Returns – CA Inter Taxation Study Material is designed strictly as per the latest syllabus and exam pattern.

Returns – CA Inter Taxation Study Material

Question 1.

What kinds of invoice details of outward supplies are required to be furnished in GSTR-1 for outward supplies? [Nov. 2018 Old Course, 5 Marks]

Answer:

The invoice details of outward supplies required to be furnished in GSTR-1 are the following:

- The name of Buyer

- GSTN of buyer

- Invoice no.

- date tg

- value

- taxable value

- rate of tax

- amount of tax

- HSN code in respect of supply of goods

- accounting code in respect of supply of services and place of supply.

The following invoice details of outward supplies are required to be fur-nished invoice wise in GSTR-1:

- intra-State supplies made to the registered persons;

- inter-State supplies made to the registered persons;

- inter-State supplies made to unregistered persons with invoice value exceeding ₹ 2,50,000.

Note: The question may be answered either on the basis of invoice details of outward supplies required to be furnished in GSTR-1 or on the basis of invoice details of outward supplies required to be furnished invoice-wise in GSTR-1.

Question 2.

A taxpayer can file GSTR-1 under CGST Act, 2017, only after the end of the current tax period. State exceptions to this. [Nov. 2018, 2 Marks]

Answer:

A taxpayer can file GSTR-1 under CGST Act, 2017, only after the end of the current tax period. However, following are the exceptions to this rule:

- Casual taxpayers, after the closure of their business

- Cancellation of GSTIN of a normal taxpayer.

![]()

Question 3.

Mr. Anand Kumar, a regular taxpayer, filed his return of outward supply (GSTR-1) for the month of August, 2019 before the due date. Later on, in February, 2020 he discovered error in the GSTR-1 return of August, 2019 already filed and wants to revise it. You are required to advise him as to the future course of action to be taken by him according to statutory provisions.

Answer:

Statutory Provisions:

- The mechanism of filing revised return for any correction of errors/ omission is not available under GST. The rectification of errors/omis-sion is allowed in the subsequent returns.

- However, as per section 37(3) of the CGST Act, 2017, no rectification of details furnished in GSTR-1 shall be allowed after:

(i) Filing of monthly return/GSTR-3 (Now: GSTR 3B) for the month of September following the end of the financial year to which such details pertain or

(ii) Filing of the relevant annual return, whichever is earlier.

In the given case:

- Mr. Anand Kumar who discovered an error in GSTR-1 for August, 2019, cannot revise it.

- However, he should rectify said error in the GSTR-1 filed for February, 2020 and should pay the tax and interest, if any, in case there is short payment, in the return to be furnished for February, 2020.

- The error can be rectified by furnishing appropriate particulars in the “Amendment Tables” contained in GSTR-1.

Question 4.

Please answer the following individual independent cases with reference to Section 37 of the CGST Act, 2017 and Rule 59 of CGST Rules, 2017 :

(1) Mr. Kolly is registered supplier in the State of Gujarat. He is filling GSTR 1 every month. During the month of February, 2018 he was out of India and so did not do any transaction during the month. He believes that as there is no transaction there is no need to file GSTR 1 for the month of February, 2018. Is he correct?

(2) Mr. Kaji is a registered dealer in Kerala. He was registered as a nor-mal tax payer for FY 2017-18. But on 15-01-2018, he converted from normal taxpayer to composition taxpayer. Is he liable to file GSTR-1 for the month of February, 2018?

(3) Mrs. Zeel a registered dealer in Rajasthan did not file GSTR-1 for the month of June, 2018 but she wants to file GSTR-1 for the month of July, 2018. Is it possible? [May 2019 Old Course, 1+2+1 Marks]

Answer:

| Statutory Provision | In the given case | |

| (1) | GSTR-1 needs to be filed even if there is no business activity in the tax period. This type of return is called as Nil Return. | Therefore, even though Mr. Kolly was out of India and thus had not done any transaction during February 2018, he is STILL REQUIRED TO FILE GSTR-1 for the said month. Thus, Mr. Kolly is not correct. |

| (2) | A person paying tax under composition scheme is not liable to furnish the details of outward supplies in GSTR-1. Further, in cases where a taxpayer has been converted from a normal taxpayer to composition taxpayer, GSTR-1 is to be filed only for the period during which the taxpayer was registered as normal taxpayer. |

Therefore, Mr. Kaji is NOT LIABLE TO FILE GSTR-1 for February, 2018 since he had already shifted to composition scheme on 15.01.2018. |

| (3) | There is no specific bar under the law on filing of GSTR-1 for current month when GSTR-1 for the previous month has not been filed. | Therefore, Mrs. Zeel CAN FILE GSTR-1 for July, 2018 even though she has not filed GSTR-1 for the preceding month, i.e., June, 2018. |

Note: The given question specifies that Mr. Kaji has converted from normal taxpayer to composition taxpayer on 15.01.2018. However, as per rule 4(1) of the CGST Rules, 2017, the option to pay tax under composition scheme shall be effective from the beginning of the financial year, where the intimation is filed by any registered person who opts to pay tax under section 10.

Further, as per rule 3(3A) of the CGST Rules, 2017, a person who has been granted certificate of registration under sub-rule (1) of rule 10 may opt to pay tax under composition scheme with effect from the first day of the month immediately succeeding the month in which he files an intimation on the common portal on or before the 31st day of March, 2018.

![]()

Question 5.

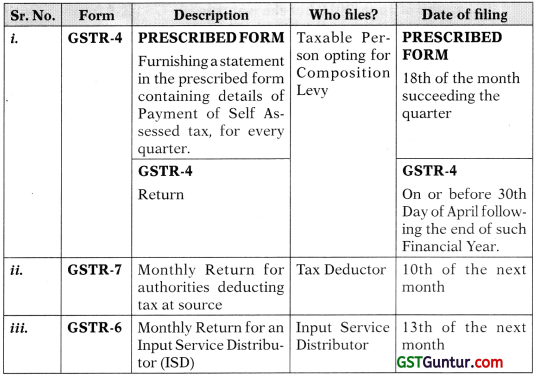

State the Form Number and the due date for its filing under CGST Act, 2017 of the return by:

(i) a composition scheme taxable person

(ii) a registered person deducting tax at source

(iii) an input service distributor.

Answer:

Question 6.

Mr. Alok, a registered supplier of taxable goods, filed GSTR 3B for the month of January 2019 on 15th April, 2019. The prescribed due date to file the said GSTR 3B was 20th February, 2019. The amount of net GST payable on supplies made by him for the said month worked out to ₹ 36,500 which was paid on the same date of filing the return.

Briefly explain the related provisions and compute the amount of interest payable under the CGST Act, 2017 by Mr. Alok. [Nov. 2019 Old Course, 4 Marks]

Answer:

Interest is payable in case of delayed payment of tax @ 18% per an-num from the date following the due date of payment to the actual date of payment of tax.

Thus, the amount of interest payable by Mr. Alok is as under:- Period of delay = From 21st February, 2019 to 15th April, 2019 = 54 days Amount of interest = ₹ 36,000 × 18% × 54/365 = ₹ 972

Question 7.

Explain First Return?

Answer:

- When a person becomes liable to registration after his turnover cross-ing the threshold limit of registration (10 lakhs/20 lakhs/40 lakhs as the case may be), he may apply for registration within 30 days of so becoming liable.

- Thus, there might be a time lag between a person becoming liable to registration and grant of registration certificate.

- During the intervening period, such person might have made the . outward supplies, i.e. after becoming liable to registration but before grant of the certificate of registration.

- Now, in order to enable such registered person to declare the taxable supplies made by him for the period between the date on which he became liable to registration till the date on which registration has been granted so that ITC can be availed by the recipient on such supplies:

- Firstly, the registered person may issue Revised Tax Invoices against the invoices already issued during said period within 1 month from the date of issuance of certificate of registration.

- Further, section 40 provides that registered person shall declare his outward supplies made during said period in the first return furnished by him after grant of registration. The format for this return is the same as that for regular return.

![]()

Question 8.

Explain the provision relating to filing of Annual Return under section 44 of CGST Act, 2017 and Rules thereunder.

[May 2018 Old Course, 5 Marks]

Answer:

| (1) | Who is required to file |

|

| (2) | Reconciliation Statement | Every registered person who is required to get his accounts audited under section 35(5) of the CGST Act, 2017 shall furnish the annual return electronically along with a copy of the audited annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement, and other prescribed particulars. |

Question 9.

Who is required to furnish Final Return under CGST Act, 2017 and what is the time limit for the same?

Discuss [May 2018, 5 Marks]

Answer:

Every registered person who is required to furnish a return u/s 39(1) of the CGST Act, 2017 and whose registration has been surrendered or cancelled shall file a Final Return electronically in the prescribed form through the common portal.

Final Return has to be filed within 3 months of the:

- date of cancellation or

- date of order of cancellation whichever is later.

Question 10.

Discuss about the nature of default and the late fee levied for delay in filing :

(i) Final Return

(ii) Annual Return [Nov. 2019 Old Course Modified, 5 Marks]

Answer:

(1) Late fee for delay in filing return:

| Nature of Default | Quantum of Late Fee |

| Any registered person who fails to furnish following by the due date:

(A) Statement of Outward Supplies [Section 37] (B) Statement of Inward Supplies [Section 38] (C) Returns [Section 39] (D) Final Return [Section 45], shall pay a late fee. |

(a)₹ 100 for every day during which such failure continues

OR |

![]()

(2) Late Fee for delay in filing ANNUAL RETURN

| Nature of Default | Quantum of Late Fees |

| Any registered person who fails to furnish the Annual Return by the due date shall be liable to pay a late fee. | (c) ₹ 100 for every day during which such failure continues

OR |

| (d) 0.25°6 of the turnover of registered person in the state/UT. Whichever is Lower |

Question 11.

Explain the consequences, if the taxable person under GST law files the GST return under section 39(1) of the CGST Act, 2017, but does not make payment of self-assessment tax. [Nov. 2019, 2 Marks]

Answer:

- If the taxable person under GST law files the GST return under section 39(1) of the CGST Act, 2017, but does not pay the self-assessment tax, the return is not considered as a valid return.

- Since the input tax credit can be availed only on the basis of a valid return, the taxable person, in the given case, will not be able to claim any input tax credit.

- He shall pay interest, penalty, fees or any other amount payable under the CGST Act, 2017 for filing return without payment of tax.

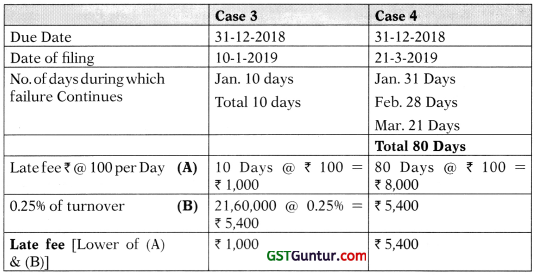

Question 12.

Vishnu, a registered person under GST has filed GSTR-1, GSTR-2 and GSTR-3 for the concerned months in related with 2017-18. The turnover was ₹ 21,60,000. Calculate the amount of late fee, if for FY 2017-18, the annual return has been filed on:

CASE 1. 25th July 2018

CASE 2. 18th Nov. 2018

CASE 3. 10th Jan. 2019

CASE 4. 21st March, 2019

Answer:

Cases 1 & 2: Calculation of late fee under section 47(2)

In respect of financial year 2017-18, the due date for filing Annual Return is 31st December, 2018. Since, the return has been filed before 31st De-cember, no late fee is payable under section 47(2).

Cases 3 & 4: Calculation of late fee under section 47(2)

![]()

Question 13.

Discuss the provisions of section 39(9) of the COST Act, 2017, relating to rectification of errors/omissions in GST returns already filed and also gj state its exceptions. State the time limit for making such rectification. [Nov. 2019, 5 Marks]

Answer:

Provisions relating to rectification of errors/omissions in GST returns:

- Omission or incorrect particulars discovered in the returns filed under section 39 can be rectified in the return to be filed for the month/ quarter during which such omission or incorrect particulars are no-ticed.

- Any tax payable as a result of such error or omission will be required to be paid along with interest.

Exception:

Section 39(9) of the CGST Act does not permit rectification of error/omis-sion discovered on account of scrutiny, audit, inspection or enforcement activities by tax authorities.

Time Limit:

The time limit for making such rectification is earlier of the following dates:

- Due date for filing return for September month of next financial year or

- Actual date of filing annual return.