Income from Other Sources – CA Inter Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Income from Other Sources – CA Inter Taxation Study Material

Gift

Question 1.

From the following particulars of Pankaj for the previous year ended 31st March, 2021 compute the Income under the head “Income from other Sources” [Nov. 2009, 6 Marks]

| Particulars | Amount (₹) |

| Directors Fee from a Company | 10000 |

| Interest on bank Deposits | 3000 |

| Income from undisclosed source | 12000 |

| Winnings from Lotteries (Net) | 33500 |

| Royalty on a book written by him | 9000 |

| Lectures in Seminars | 5000 |

| Interest on loan given to a relative | 7000 |

| Interest on Debentures of a Company (listed in a Recognized Stock Exchange) Net of Taxes | 3588 |

| Interest on Post Office Savings Bank Account | 500 |

| Interest on Deposit Certificate issued under the Gold Monetization Scheme | 9000 |

| Interest on Government Securities | 2200 |

| Interest on Monthly Income Scheme of Post office | 33000 |

| He paid ₹ 1,000 for typing the manuscript of book written by him | 1000 |

Answer:

Computation of Income from Other Sources for the Assessment Year 2021-22

| Particulars | Amount (₹) |

| Directors Fee from a Company | 10000 |

| Interest on bank Deposits | 3000 |

| Income from undisclosed source | 12000 |

| Winnings from Lotteries Gross [33500 × 100/70] = 47857 | 47857 |

| Royalty on a book written by him [9000 – 1000] | 8000 |

| Lectures in Seminars | 5000 |

| Interest on loan given to a relative | 7000 |

| Interest on Debentures of a Company (listed in a Recognized Stock Exchange) Net of Taxes received [3588 × 100/90] | 3987 |

| Interest on Post Office Savings Bank Account ₹ 500 Exempt u/s 10(15) | Exempt |

| Interest on Deposit Certificate issued under the Gold Monetization Scheme Exempt u/s 10(75) | Exempt |

| Interest on Government Securities | 2200 |

| Interest on Monthly Income Scheme of Post office | 33000 |

| Taxable Income under the head Income from Other Sources | 132044 |

![]()

Question 2.

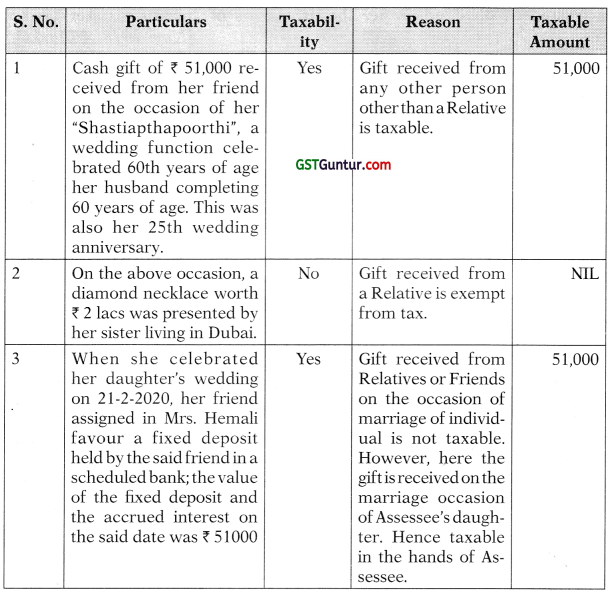

The following details have been furnished by Mrs. Hemali, pertaining to the year ended 31-3-2021 :

| S.No. | Particulars |

| 1 | Cash gift of ₹ 51,000 received from her friend on the occasion of her “Shastiapthapoorthi”, a wedding function celebrated 60th years of age her husband completing 60 years of age. This was also her 25th wedding anniversary. |

| 2 | On the above occasion, a diamond necklace worth ₹ 2 lacs was presented by her sister living in Dubai. |

| 3 | When she celebrated her daughter’s wedding on 21-2-2020, her friend assigned in Mrs. Hemali favour a fixed deposit held by the said friend in a scheduled bank; the value of the fixed deposit and the accrued interest on the said date was ₹ 51000 |

Compute the income, if any, assessable as income from other sources. [May 2011, 4 Marks]

Answer:

Computation of Income from Other Sources for the Assessment Year 2021-22

![]()

Question 3.

Discuss the taxability or otherwise in the hands of the recipients, as per the provisions of the Income-tax Act, 1961.

Mr. Kumar gifted a car to his sister’s son (Sunil) for achieving good marks in CA Final exam. The fair market value of the car is ₹ 5,00,000. [May 2016, 2 Marks]

Answer:

| Section | Explanation |

| 56(2) | Car is not asset. Hence it is not taxable. |

![]()

Question 4.

Mr. Rakesh has 15% shareholding in RSL Private Limited and has also 50% share in Rakesh & sons a partnership firm. The accumulated profit of RSL Private Limited is ₹ 20,00,000. Rakesh & sons has taken a loan of ₹ 25,00,000 from RSL Private Limited. Explain whether the above loan is treated as dividend as per the provisions of Income-tax Act 1961. [Nov. 2018, 4 Marks]

Answer:

| S. No. | Reasons |

| 1 | RSL Private Limited is a company in which public are not substantially interested. |

| 2 | This company has Accumulated Profit of ₹ 20 Lakhs. |

| 3 | Rakesh’s shareholding in RSL (P) limited > 10% |

| 4 | Rakesh’s Share in the Partnership Firm > 20% |

| 5 | Hence all conditions given in the principles above are attracted. |

| Conclusion: Of the Loan of ₹ 25 Lakh, ₹ 20 Lakh shall be treated as Deemed Dividend u/s 2(22)(e) in the hands of shareholder. | |

Note:

1. Corporate Dividend Tax is not leviable on Deemed Dividend u/s 2(22) (e) and it will be taxed in the hands of Shareholders.

![]()

Question 5.

State with reason whether the following receipt is taxable or not under the provision of Income-tax Act, 1961?

Mr. Suri received a sum of ₹ 5,00,000 as compensation from ‘Yatra Foundation’, towards the loss of property on account of “Flood Disaster” at Chennai during December 2020. [Nov. 2016, 2 Marks]

Answer:

| Section | Provision | Case Answer |

| 10(10BC) | any amount received or receivable as compensation by an individual, on account of any loss or damage caused by disaster from the Central Government, State Government or a local authority is exempt from tax | Mr. Suri has received a compensation of ₹ 5,00,000 from Yatra Foundation, and not the Central or State Government or local authority, no exemption will be available under Section 10 (10BC) |

Question 6.

Discuss the taxability of the following receipts in the hands of Mr. Sanjay Kamboj under the Income-tax Act, 1961 for A.Y. 2021-22 :

(i) ₹ 51,000 received from his sister living in US on 1-6-2020.

(ii) Received a car from his friend on payment of ₹ 2,50,000, the FMV of which was ₹ 5,50,000.

Provisions of taxability or Non-taxability must be discussed. [May 2018, 3 Marks]

Answer:

| Section | Provision | Case | Case Answer |

| 56(2) | Gift received from any other person other than a Relative is taxable. | ₹ 51,000 received from his sister living in US on 1-6-2020 | In this case Gifts are from sister and hence NOT TAXABLE. |

| 56(2)(vii) | Motor Car is not a Movable Property. | Received a car from his friend on payment of ₹ 2,50,000, the FMV of which was ₹ 5,50,000 | In this Case Received a Car from his friend on payment of ₹ 2,50,000 the FMV of which was ₹ 5,50,000. Hence NOT TAXABLE. |

![]()

Question 7.

Examine with brief- reasons, whether the following are chargeable to income-tax and the amount liable to tax with reference to the provisions of the Income-tax Act, 1961:

During the previous year 2020-21, Mrs. Aishwarya, resident, received, a sum of ₹ 8,50,000 as dividend from Indian companies and ₹ 4,00,000 as dividend from Indian equity oriented mutual fund units. [Nov. 2018, 2 Marks]

Answer:

From Assessment Year 2021-22 the dividend is taxable in the hands of Recipient.

Question 8.

State with brief reasoning whether the following receipts are chargeable to Income Tax or exempt for the assessment year 2021-22. (Computation is not required.)

- Interest on enhanced compensation received ₹ 1,02,000 in 12.02.2021 for acquisition of urban land of which 40% relates to the earlier year.

- Rent received ₹ 55,000 for letting out agricultural land for a movie shooting. [Nov. 2013, Modified]

Answer:

| S.No. | Section | Particulars | Taxability |

| 1 | 56 and57 | Interest on enhanced compensation received in 12.02.2021 for acquisition of urban land of which 40% relates to the earlier year. | Yes, ₹ 51,000 |

| 2 | 2(1 A) | Rent received for letting out agricultural land for a movie shooting. | Yes, ₹ 55,000 |

![]()

Question 9.

Mr Sajan is employed in a company with taxable salary income of ₹ 5,00,000. He received a Cash gift of ₹ 1,00,000 from Sunita Charitable Trust registered under section 12AA in the month of December for meeting his medical expenses. Is the cash gift received from the trust chargeable to tax in the hands of Mr Sajan. [May 2011, Modified]

Answer:

Computation of Gross Total Income of Mr. Sajan for the Assessment Year 2021-22

| Particulars | Amount (₹) |

| Income from Salary | 5,00,000 |

| Cash gift from Sunita Charitable Trust is Exempt u/s 56 | NIL |

| Gross Total Income | 5,00,000 |

![]()

Question 10.

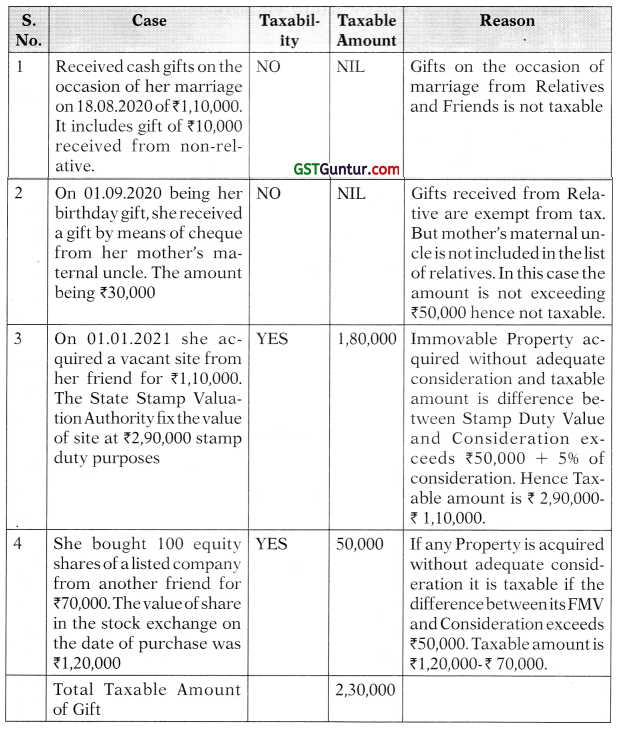

Shrimati Saraswati reports the following transactions:

- Received cash gifts on the occasion of her marriage on 18.08.2020 of ₹ 1,10,000. It includes gift of ₹ 10,000 received from non-relative.

- On 01.09.2020 being her birthday gift, she received a gift by means of cheque from her mother’s maternal uncle. The amount being ₹ 30,000.

- On 01.01.2021 she acquired a vacant site from her friend for ₹ 1,10,000. The State Stamp Valuation Authority fix the value of site at ₹ 2,90,000 stamp duty purposes.

- She bought 100 equity shares of a listed company from another friend for ₹ 70,000. The value of share in the stock exchange on the date of purchase was ₹ 1,20,000.

Determine the amount chargeable to tax in the hands of Shrimati Saraswati for the assessment year 2021-22. [Nov. 2012, Modified]

Answer:

![]()

Question 11.

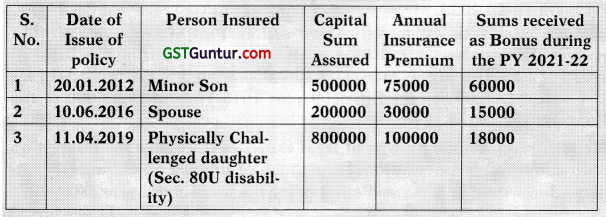

Determine the taxability of the following sums received by Mr. Pradeep Kumar from LIC on account of life insurance policies taken by him. [RTP, Modified]

Answer:

![]()

Question 12.

On 10-10-2020, Mr. Govind (a bank employee) received ₹ 5,00,000 towards interest on enhanced compensation from State Government in respect of compulsory acquisition of his land effected during the financial year 2012-13. Out of this interest, ₹ 1,50,000 related to the financial year 2014-15, ₹ 1,65,000 to the financial year 2015-16; and ₹ 1,85,000 to the financial year 2016-17.

He incurred ₹ 50,000 by way of legal expenses to receive the interest on such enhanced compensation. How much of interest on enhanced com-pensation would be chargeable to tax for the assessment year 2021-22? [Nov. 2011, 4 Marks]

Answer:

Computation of Taxable Income from Other Sources

(Assessment Year 2021-22)

| Particulars | Amount (₹) |

| Interest on enhanced compensation Section 56(2)(viii) | 5,00,000 |

| Less – Deduction at the rate of 50°o under section 57(iv) | 2,50,000 |

| Taxable interest on enhanced compensation | 2,50,000 |

Notes:

- The amount of interest on enhanced compensation is taxable under the head income from other sources in assessment year 2021-22.

- As per section 57( iv) – 50% of such taxable interest is deductible and no other expenses are allowed.

- As per section 145B which is inserted by Finance Act, 2018 and applicable with effect from assessment year 2017-18 onwards. Interest received by an assessee on compensation or on enhanced compensation [section 56(2)(viii)] is deemed to be income of the Year in which it is received and taxable under the head income from other sources.

![]()

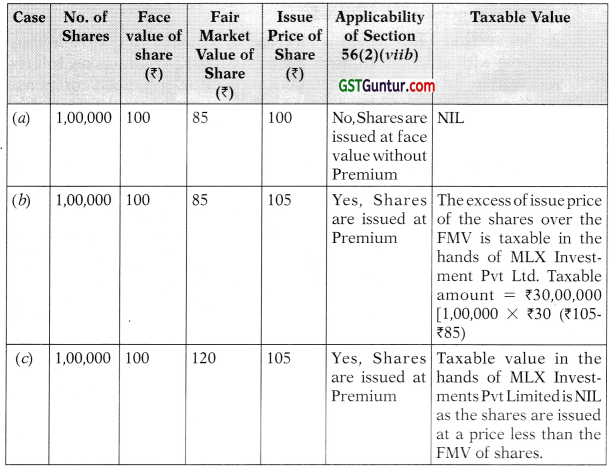

Question 13.

MLX Investments (P) Ltd. was incorporated during P.Y. 2016-17 having a paid up capital of ₹ 10 lacs. In order to increase its capital, the company further issues, 1,00,000 shares (having face value of ₹ 100 each) during the year at par as on 01-08-2018. The FMV of such share as on 01-08-2018 was ₹ 85.

a. Determine the tax implications of the above transaction in the hands of company, assuming it is the only transaction made during the year.

b. Will your answer change, if shares were issued at ₹ 105 each?

c. What will be your answer, if shares were issued at ₹ 105 and FMV of the share was ₹ 120 as on 01-08-2018? [Nov. 2019, 4 Marks]

Answer:

The provisions of section 56(2)(viib) would be attracted, where consi-deration is received from a resident person by a company, other than a company in which public are substantially interested, in excess of the face value of shares i.e., where shares are issued at a premium. In such a case, the difference between the consideration received and the fair market value would be chargeable to tax under the head “Income j from Other Sources”.

(a) In this case, since MLX Investments (P.) Ltd., a closely held company issued 1,00,000 shares (having face value of ₹ 100 each) at par i e., ₹ 100 each, though issue price is greater than FMV, no amount would be chargeable to tax as income from other sources.

(b) In this case, since shares are issued at a premium, the amount by which the issue price of ₹ 105 each exceeds the FMV of ₹ 85 each would be chargeable to tax under the head “Income from other sources”. Hence, ₹ 20 lakh, being ₹ 20 (ie., ₹105 – ₹ 85) × 1,00,000 shares, would be chargeable under section 56(2)(viib).

(c) If shares are issued at ₹ 105 each and FMV of share is ₹ 120 each, no amount would be chargeable to tax even though the shares were issued at a premium, since shares are issued at a price which is less than the fair market value.

![]()