Residence and Scope of Total Income – CA Inter Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Residence and Scope of Total Income – CA Inter Taxation Study Material

Introduction

Question 1.

State with reason whether the following statement is true or false with regard to the provisions of the Income-tax Act, 1961 for the Assessment Year 2021-22.

(a) Income to a non-resident by way of interest royalty and fee for Tech-nical Services be made to accrue or arise in India is taxable in India irrespective of Territorial Nexus. [Nov. 2008, 2 Marks]

Answer:

Statement is true

The income of a non-resident which is arises or accrued in India is taxable irrespective of Territorial Nexus

![]()

Question 2.

State with reason whether the following statement is true or false with I® regard to the provisions of the Income-tax Act, 1961 for the Assessment Year 2021-22.

Mr. X Karta of Hindu undivided family claims that the Hindu undivided family is non-resident as the business of Hindu undivided family is trans¬acted from United Kingdom and all the policy decisions are taken there. [May 2009, 2 Marks]

Answer:

Statement is true

- The residential status of Hindu undivided family depends upon the control and management and residential status of Karta.

- The control and management is in UK and Karta in his personal capacity is also non-resident. Hence Hindu undivided family is non-resident.

Question 3.

How is the residential status of a company determined for the purpose of Income-tax Act, 1961 for the assessment year 2021-22. [May 2016, 4 Marks]

Answer:

Section 6(3)

Resident:

- A company is said to be resident if it is an Indian company and place of effective management at any time in the previous year is in India.

- Place of effective management means the place where the manage¬ment and commercial decisions are taken by the management.

Non-Resident:

- A company is said to be non-resident if a company does not satisfy both the above conditions of residence.

![]()

Question 4.

Mis. Vivitha paid a sum of 5,000 USD to Mr. Kulasekhara, a management consultant practicing in Colombo, specializing in project financing. The payment was made in Colombo to Mr. Kulasekhara who is a non-resident. The Consultancy related to a project in India with possible ceylonese collaboration. Is this payment chargeable to tax in India in the hands of Mr. Kulasekhara, since the services were used in India? [May 2011, 4 Marks]

Answer:

- Remuneration or fee paid for Technical Services paid by resident or non-resident to carry business or profession in India or to earn any income from any source in India is treated as deemed to be accrued or arise in India. Hence it is taxable for resident, not ordinary resident and non-resident.

- Here the above payment to Kulasekhara is taxable in India even he is non-resident.

Question 5.

Explain with reasons whether the following transactions attract income tax in India in the hands of recipients?

(a) Salary paid to Mr. David, a citizen of India ₹ 15,00,000 by the Central Government for the services rendered in Canada.

(b) Legal charges of ₹ 7,50,000 paid to Mr. Johnson, a lawyer of London, who visited India to represent a case at the Supreme Court.

(c) Royalty paid to Rajeev, a non-resident by Mr. Mukesh, a resident for a business carried on in Sri Lanka.

(d) Interest received of ₹ 1,00,000, on money borrowed from France, by Ms. Dyana, a non-resident for the business at Bangalore. [May 2015, 4 Marks]

Answer:

(a) As salary is paid by Government of India, it is deemed as accrued and arise in India. Hence, taxable in India.

(b) Since the income is received in India against Services rendered in India, it is taxable in India.

(c) The business is carried on outside India and recipient is a non-resident. Hence royalty paid to Rajiv is not taxable in India.

(d) The interest is received in India, Hence taxable in India.

![]()

Question 6.

State with reason whether the following receipt is taxable or not under the provision of Income-tax Act, 1961?

Mr. Federer, a non-resident residing in Sweden, has received rent from Mr. Nadal, also a non-resident residing in France in respect of a property j taken on lease at Mumbai. Since this income is received outside India from a non-resident. Federer claims that his income is not chargeable to Tax in India. [Nov. 2016, 2 Marks]

Answer:

| Particulars | Relevant Provision |

| Section 9(1) |

Hence Rent is taxable in India. |

Question 6A.

State the conditions under which a non-resident is treated as resident but not ordinary resident, as inserted by Section 6(1A), applicable from Assessment year 2021-22.

Answer:

Even if an individual does not satisfy none of the two basic conditions, he is deemed to be resident but not ordinarily resident in the following cases:

(a) First exception (for Indian citizen) : An individual shall be deemed to be resident but not ordinarily resident in India, if he satisfies the following 3 conditions:

- He is an Indian Citizen

- His total income (Other than the income from foreign sources) exceeds Rs. 15,00,000 during the relevant previous year and

- He is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.

It may be noted that this exception is not applicable in case of a foreign citizen, even if he is a person of Indian origin.

![]()

(b) Second exception: An individual shall be deemed to be resident but not ordinarily resident in India if he satisfies the following 4 conditions:-

- He is an Indian Citizen or a person of Indian origin.

- His total income (Other than the income from foreign sources) exceeds Rs. 15,00,000 during the relevant previous year.

- He comes to India an a visit during the relevant previous year and

- He is in India for 120 days (or more but less than 182 days) during the relevant previous year and 365 days (or more) during 4 years immediately preceding the relevant previous year.

Calculation of Days

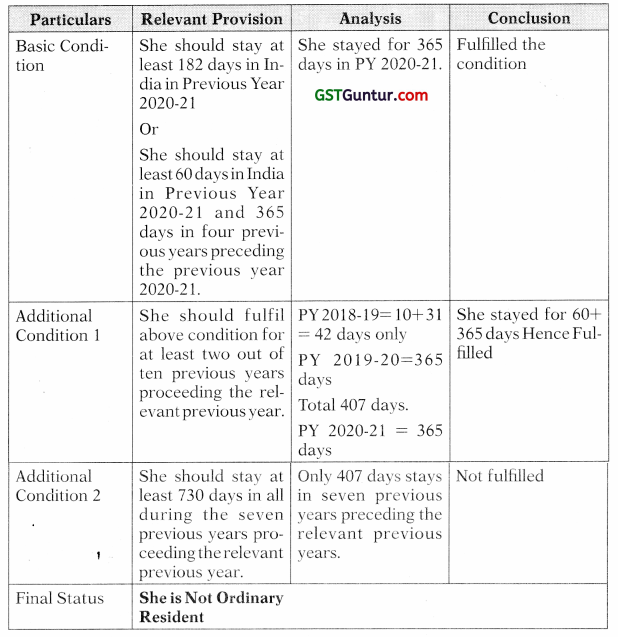

Question 7.

Ms. Bindu, a non-resident, residing in New York since 1991, came back to India on 19-02-2019 for permanent settlement in India. Explain the residential status of Ms, Bindu for the Assessment Year 2021-22.

In accordance with the various provision of Indian Income-tax Act. [May 2015, 4 Marks]

Answer:

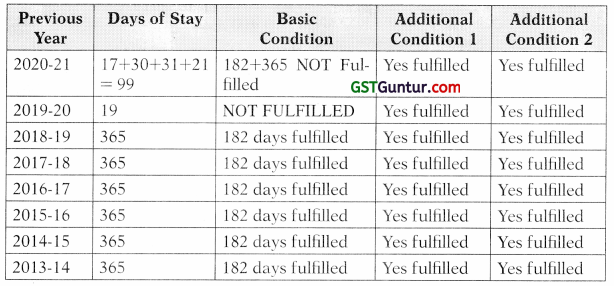

![]()

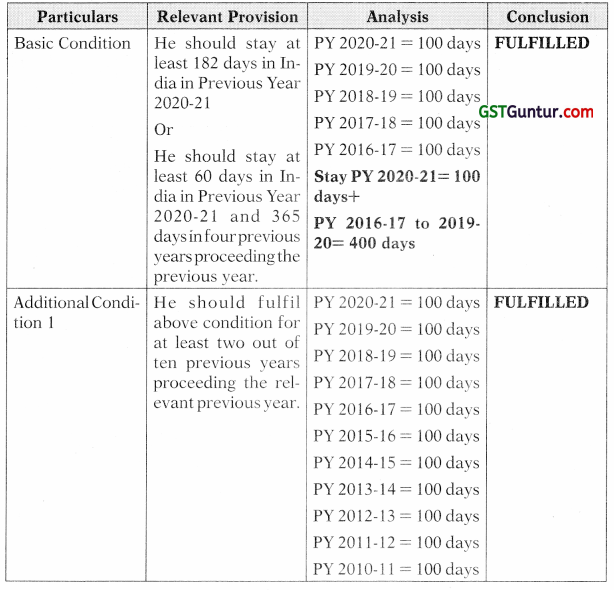

Question 8.

Brett Lee, an Australian cricket player visits India for 100 days in every financial year. This has been his practice for the financial years. Find out his residential status for the assessment year 2021-22. [Nov. 2011, 4 Marks]

Answer:

![]()

Question 9.

Mr. Soham, an Indian Citizen left India on 20-04-2019 for the first time to setup a software firm in Singapore. On 10-04-2020, he entered into an agreement with LK Limited, an Indian Company for the transfer of technical documents and designs to setup an automobile factory in Faridabad. He reached India along with his team to render the requisite services on 15-05-2020 and was able to complete his assignment on 20-08-2020. He left for Singapore on 21 08-2020. He charged ₹ 50 Lakhs for his services from LK Limited. Determine the residential status of Mr. Soham 5 for the Assessment Year 2021-2022 and explain as to ‘the taxability of the fees charged ‘ from LK Limited as per the Income-tax Act, 1961. [Nov. 2015, 8 Marks]

Answer:

On the basis of basic conditions, Mr. Soham is non-resident. But, according to amendments applicable from AY 2021 -22, anon-resident shall be deemed as not ordinary resident if he satisfies following conditions:

(a) He is an Indian Citizen

(b) His total income (Other than the income from foreign sources) exceeds Rs. 15,00,000 during the relevant previous year and

(c) He is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.

Conclusion:

In view of above, Mr. Soham is not ordinary resident for RY. 2020-21 (A.Y. 2021-22). It has been assumed that he fulfils (c) also.

TAXABILITY : Any Income arising from India is taxable in the hands of Non-Resident also.

![]()

Question 10.

During the last four years preceding the financial year 2020-21, Mr. Damodhar, a citizen of India was present in India for 430 days. ‘During the last seven previous years preceding the previous year 2020-21, he was present in India for 830 days. Mr. Damodhar is a member of crew of a Dubai bound Indian ship, carrying passengers in the international waters, which left Kochi port in Kerala, on 12th August, 2020.

Following details are made available to you for the previous year 2020-21

| Particulars | Date |

| Date entered into the Continuous Discharge Certificate in respect of Joining the Ship by Mr. Damodhar. | 12 August, 2020 |

| Date entered into the Continuous Discharge Certificate in respect of signing of the ship by Mr. Damodhar. | 21st January, 2021 |

In May, 2019 he had gone out of India to Singapore and Malaysia on a private tour for a continuous period of 29 days.

You are required to determine the residential status of Mr. Damodhar for the previous year 2020-21. [May 2017, 4 Marks]

Answer:

| Previous years 2020-21 | 30 + 31 + 30 + 31 + 12 = 134 days |

| Previous years 2016-17 to 2019-20 ’ | 430 days four previous years preceding the relevant previous year |

| Previous years 2013-14 to 2019-20 ‘ | 830 days in seven previous years preceding the relevant previous year |

| Case | He is member of crew hence he has to stay at least 182 days in PY 2020-21. But he stayed only for 134 days hence he is NON-RESIDENT |

![]()

Incidence of Tax Numerical Questions

Question 11.

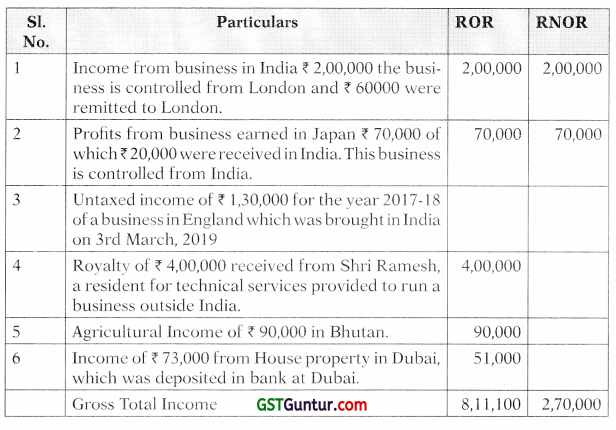

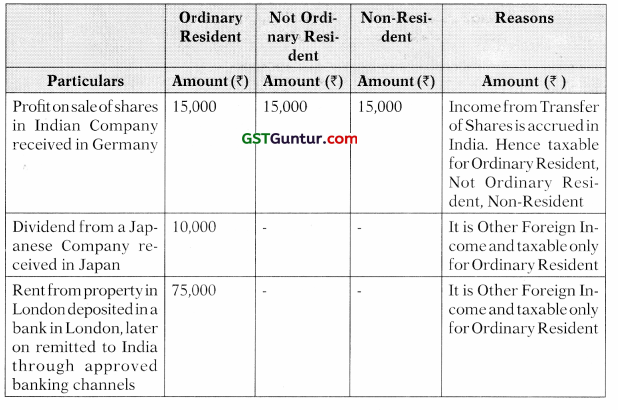

From the following particulars of Income furnished by Mr. Anirudh pertaining to the year ended 31.3.2020, compute the total income for the assessment year 2020-21, if he is

(i) Resident and ordinary resident;

(ii) Resident but not ordinarily resident;

(iii) Non-resident :

| Particulars | Amount |

| Profit on sale of shares in Indian Company received in Germany | 15,000 |

| Dividend From a Japanese Company received in Japan | 10,000 |

| Rent from property in London deposited in a bank in London, later on remitted to India through approved banking channels | 75,000 |

| Dividend from RP Ltd., an Indian Company | 6,000 |

| Agricultural income from lands in Gujarat | 25,000 |

Answer:

Computation of Total Income of Mr. Anirudh for the Assessment Year 2021-22

![]()

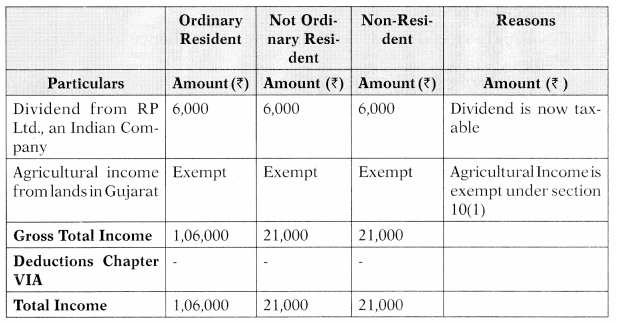

Question 12.

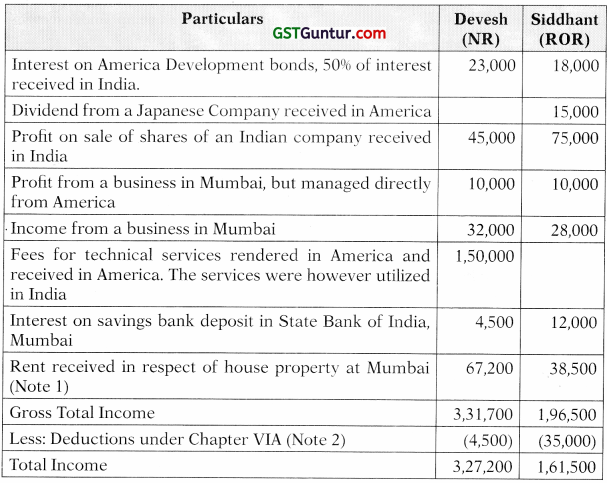

Devesh and Siddhant are brothers and they earned the following incomes during the financial year 2020-21. Devesh settled in America in the year 1986 and Siddhant settled in Mumbai. Devesh visits India for 20 days every year. Siddhant also visits America every year for a month.

Compute their total income for the Assessment year 2021-22 from the following information. [May 2013, 8 Marks]

Answer:

Residential Status:

- Devesh: He visited India for 20 days every year hence he is Non-Resident.

- Siddhant: He is staying India every year for more than 182 days hence he is Resident.

Note 1: Standard Deduction u/s 24 is allowed @3096. Devesh will be taxable 96000 × 70/100 = 67200 and Siddhant will be taxable 55000 × 70/100 = 38500.

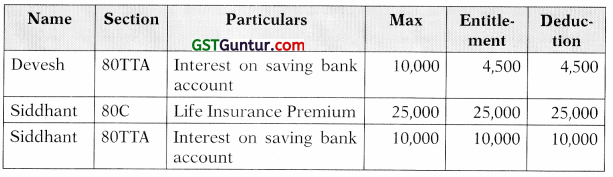

Note 2: Deductions under Chapter VIA will be:

Question 13.

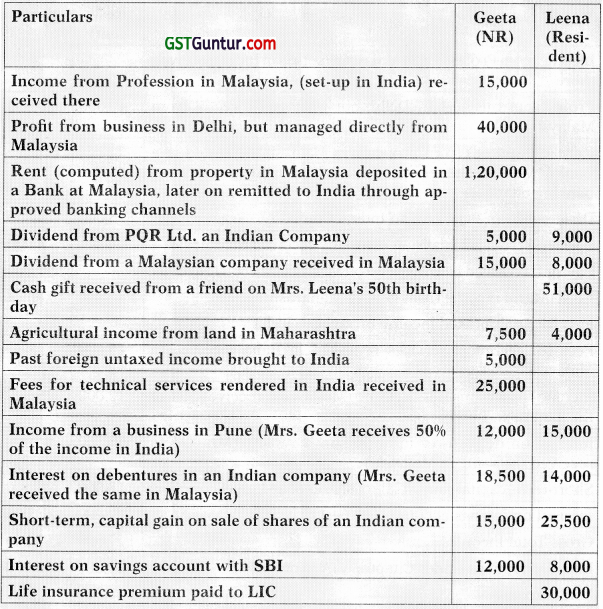

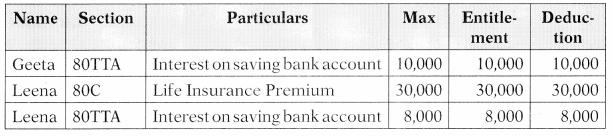

Mrs. Geeta and Mrs. Leena are sisters and they earned the following income during the Financial Year 2020-21. Mrs. Geeta is settled in Malaysia since 1985 and visits India for a month every year. Mrs. Leena is settled in Indore since her marriage in 1993. Compute the total income of Mrs. Geeta and Mrs. Leena for the assessment year 2021-22. [Nov. 2014, 8 Marks]

Answer:

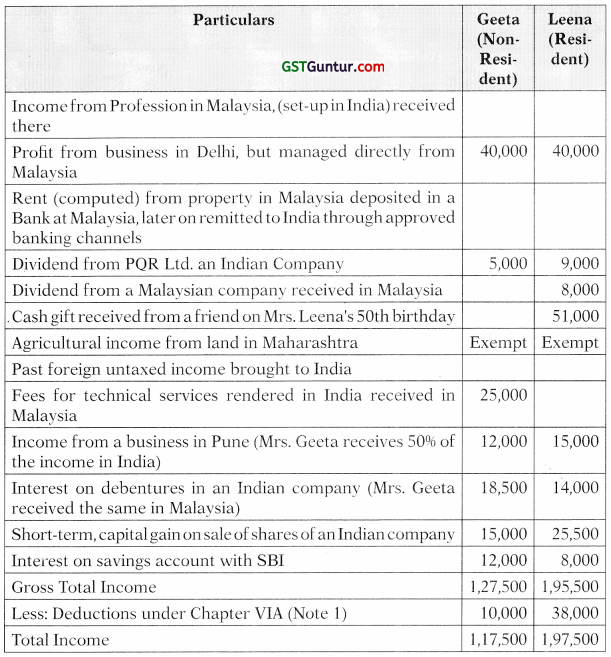

Computation of Total Income of Geeta and Leena for the Assessment Year 2021-22

Note 1: Deductions under Chapter VIA will be:

![]()

Question 14.

Mr. Rajnesh, a citizen of India, serving in the Ministry of Finance in India and transferred to High Commission of Australia on 15th March 2019. He did not come to India during the financial year 2020-21. His income during the financial year 2020-21 is given here under:

| Particulars | Amount |

| Salary from Govt, of India | 7,20,000 |

| Foreign Allowances from Govt, of India | 6,00,000 |

| Rent from a house situated at London, received in London | 3,60,000 |

| Interest accrued on National Saving Certificate during the year | 45,000 |

Compute the Gross Total Income of Mr. Rajnesh for the Assessment year 2021-22. [Nov. 2016, 4 Marks]

Answer:

Residential Status of Mr. Rajnesh will be Non-Resident. He has not satisfying the condition No. 1 of 182 days.

Computation of Gross Total Income of Mr. Rajnesh for the Assessment Year 2021-22

| Particulars | Amount | Amount |

| Income From Salary: | ||

| Salary from Govt, of India | 7,20,000 | |

| Foreign Allowances from Govt, of India | Exempt | |

| Gross Salary | 7,20,000 | |

| Less: Standard Deduction u/s 16 | 50,000 | 6,70,000 |

| Income from House Property: | ||

| Rent from a house situated at London, received in London | Not

Taxable |

NIL |

| Income From Other Sources: | ||

| Interest accrued on National Saving Certificate during the year | 45,000 | 45,000 |

| Gross Total Income | 7,15,000 |

![]()

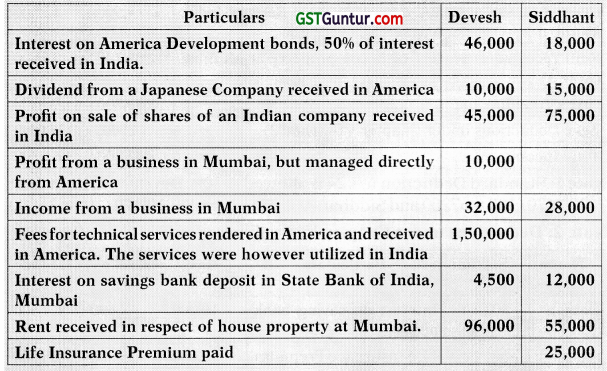

Question 15.

A Korean Company Damjung Ltd. Entered in to the following transactions during the financial year 2020-21. Explain briefly whether these receipts are taxable in India.

| Sl. No. | Particulars |

| 1 | Received ₹ 20 Lakhs from a non-resident for use of Patent for a business in India. |

| 2 | Received ₹ 15 Lakhs from a non-resident Indian for use of know-how for a business in Sri Lanka and this amount was receive in Japan. Assume that the above amount is converted/stated in Indian Rupees |

| 3 | Received ₹ 7 Lakhs from RR Co. Ltd. An Indian Company for providing technical know-how in India. |

| 4 | Received ₹ 5 Lakhs from R & Co. Mumbai for conducting the feasibility study for a new project in Nepal, and the payment was made in Nepal. |

Answer:

| S. No. | Particulars | Taxable or Not Taxable | Reason |

| 1 | Received ₹20 Lakhs from a non- resident for use of Patent for a business in India. | Taxable | Deemed to be accrue or arise in India as Patents are used in India |

| 2 | Received ₹ 15 Lakhs from a nonresident Indian for use of know-how for a business in Sri Lanka and this amount was receive in Japan. Assume that the above amount is converted/stated in Indian Rupees | Not Taxable | Other Foreign Income. Outside Income. Not arise in India. |

| 3 | Received ₹ 7 Lakhs from RR Co. Ltd. An Indian Company for providing technical know-how in India. | Taxable | Deemed to be accrue or arise in India as technical know-how are used in India |

| 4 | Received ₹X 5 Lakhs from R & Co. Mumbai for conducting the feasibility study for a new project in Nepal, and the payment was made in Nepal | Not Taxable | Other Foreign Income. Outside Income. Not arise in India. |

![]()

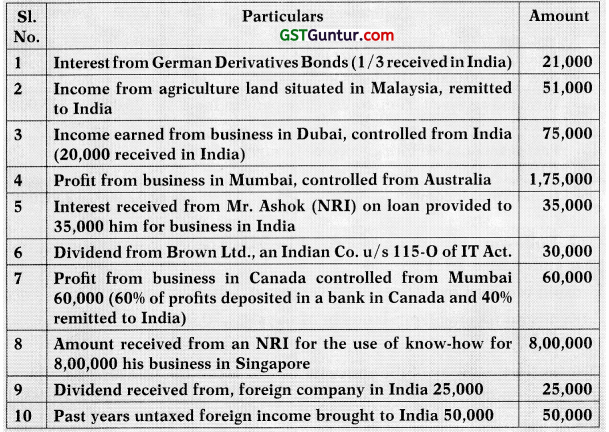

Question 16.

Compute the Gross Total Income in the hands of an individual, if he is

(a) a resident and ordinary resident; and

(b) a non-resident for the AY 2021-22. [Nov. 2018, 10 Marks]

Answer:

Computation of Gross Total Income of Mr. Individual for the Assessment Year 2021-22

![]()

Question 17.

Following incomes are derived by Mr, Krishna Kumar during the year ended 31-3-2021 :

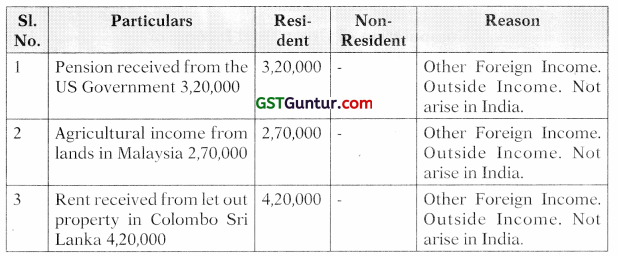

Pension received from the US Government 3,20,000

Agricultural income from lands in Malaysia 2,70,000 Kent received from let out property in Colombo Sri Lanka 4,20,000 Discuss the taxability of the above items where the assessee is (i) Resident, (ii) Non-resident. [Nov. 2018, 6 Marks]

Answer:

Taxability of the Items

![]()

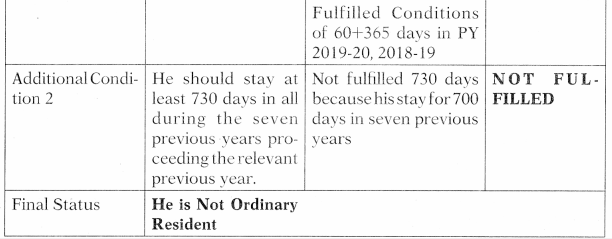

Question 18.

The following are the incomes of Shri Subhash Chandra, a Citizen of India for the previous year 2020-21.

| Sl. No. | Particulars |

| 1 | Income from business in India ₹ 2,00,000 the business is controlled from London and ? 60,000 were remitted to London. |

| 2 | Profits from business earned in Japan ₹ 70,000 of which ₹ 20,000 were received in India. This business is controlled from India. |

| 3 | Untaxed income of ₹ 1,30,000 for the year 2017-18 of a business in England which was brought in India on 3rd March, 2019 |

| 4 | Royalty of ₹ 4,00,000 received from Shri Ramesh, a resident for technical services provided to run a business outside India. |

| 5 | Agricultural Income of ₹ 90,000 in Bhutan. |

| 6 | Income of ₹ 73,000 from House property in Dubai, which was deposited in bank at Dubai. |

Answer:

Compute Gross Total Income of Shri Subhash Chandra for the Assessment year 2021-22, if he is Resident and Ordinary Resident and Resident and Not Ordinary Resident.