Capital Gains – CA Inter Taxation Study Material is designed strictly as per the latest syllabus and exam pattern.

Capital Gains – CA Inter Taxation Study Material

Question 1.

How will you calculate the period of holding in case of the following assets ?

(1) Shares held in a company in liquidation

(2) Bonus shares

(3) Flat in a co-operative society

(4) Transfer of a security by a depository (i.e. demat account) [Nov. 2010, 4 Marks]

Answer:

| Case | Period of holding | |

| 1. | Shares held in a company in liquidation |

|

| 2. | Bonus shares |

|

| 3. | Flat in a cooperative society |

|

| 4. | Transfer of a security by a depository |

|

Question 2.

Discuss the tax implication arising consequent to conversion of a Capital Asset into stock of business and its Subsequent sale. [Nov. 2010, 4 Marks]

Answer:

The followings are the provisions of Conversions of a Capital Asset into Stock in Trade of business :

| Particulars | Relevant Provisions | |

| (i) | Section 2(47) | Conversion of Capital Asset into stock in trade is governed by section 2(47)(iit). Transfer is treated as transfer in the year in which the capital asset is converted into stock in trade as per section 2(47). |

| (a) | Section 45(2) | The notional profit arising on transfer by way of conversion of Capital Asset into stock in trade. It is chargeable to tax in the year in which stock in trade is actually sold. |

| (iii) | Capital Gain | To Compute capital gain the fair market value of Capital Asset on the date of conversion is treated as deemed to be full value of consideration received or accrued. |

| (iv) | Business Profit | When actual sales arises then business profit will be, the difference between the actual sales. |

| (v) | Sold in Parts | If asset are sold in parts in different financial years then tax is chargeable in different years \CITv. Crest Hotels Limited [2001] 78 ITD 213 (Mumbai)] |

![]()

Question 3.

Mrs. X an individual resident woman wanted to know whether Income tax is attracted on sale of gold and jewellery gifted to her by her parent at the occasion of her marriage in the year 1980, which was purchased at a total cost of ₹ 2,00,000. Answer the following with regard to the provisions of the Income-tax Act, 1961. [Nov. 2008, 4 Marks]

Answer:

The followings are the provisions of Sale of gifted capital asset :

| Particulars | Relevant Provisions | ||

| (i) | Section 56 | The gifts at the time of marriage given by parent in any form like cash, stock, jewellery, automobile electronic item etc. is not taxable. But incomes generated from such gifts are subject to tax. | |

| (ii) | Tenure | In this case Mrs. X sold the jewellery in 2020. It is long term capital gain as it is acquired by him in 1980 and by her parents prior 1980 (date is not given in the question) and hence it attracts long term capital gain in the hands of Mrs. X. | |

| (iii) | Cost of Acquisition | the cost of acquisition is the cost of Gold and Jewellery to her parents or fair market value as on 1st April 2001 whichever is higher. | |

| (iv) | Capital Gain | Gross sales proceeds – brokerage – indexed cost of acquisition. | |

Note 1: In this question fair market value as on 1st April 2001 is not given.

Question 4.

On 10-10-2020, Mr. Govind (a bank employee) received ₹ 5,00,000 towards interest on enhanced compensation from State Government in respect of compulsory acquisition of his land effected during the financial year 2012-13. Out of this interest, ₹ 1,50,000 related to the financial year 2014-15, ₹ 1,65,000 to the financial year 2015-16; and ₹ 1,85,000 to the financial year 2016-17. He incurred ₹ 50,000 by way of legal expenses to receive the interest on such enhanced compensation. How much of interest on enhanced compensation would be chargeable to tax for the assessment year 2021 -22? [Nov. 2011, 4 Marks]

Answer:

Computation of Taxable Income from Other Sources (Assessment Year 2021-22)

| Particulars | Amount (₹) |

| Interest on enhanced compensation Section 56(2)(viii) | 5,00,000 |

| Less – Deduction at the rate of 50% under section 57(zv) | 2,50,000 |

| Taxable interest on enhanced compensation | 2,50,000 |

Notes:

1. The amount of interest on enhanced compensation is taxable under the head income from other sources in assessment year 2021-22.

2. As per section 57(iv) – 50% of such taxable interest is deductible and no other expenses are allowed.

3. As per section 145B which is inserted by Finance Act, 2018 and ap-plicable with effect from assessment year 2017-18 onwards. Interest received by an assessee on compensation or on enhanced compensation [section 56(2)(viii)] is deemed to be income of the Year in which it is received and taxable under the head income from other sources.

Question 5.

Anshu transfers land and building on 02-01-2021 and furnishes the following information.

- Net consideration received ₹ 14,00,000

- Value adopted by Stamp Valuation Authority ₹ 23,00,000

- Value ascertained by Valuation Officer on Reference by the Assessing Officer ₹ 24,00,000.

- This land was acquired by Anshu on 1-04-2001. Fair Market value of the land as on 01-04-2001 was ₹ 1,10,000

- A Residential building was constructed on land by Anshu at cost of ₹ 3,20,000 (construction completed on 01-12-2005 during financial year 2005-06).

- Short term capital loss incurred on sale of shares during financial Year 2014-15 b/f of ₹ 1,00,000.

Anshu seeks your advice to the amount to be invested in NHAI Bonds so as to be exempt from capital gain tax under Income-tax Act.

Cost Inflation Indices: FY 2001-02=100, FY 2005-06 = 117, FY 2019-20 £ = 289, FY 2020-21 = 301 [May 2012, 8 Marks]

Answer:

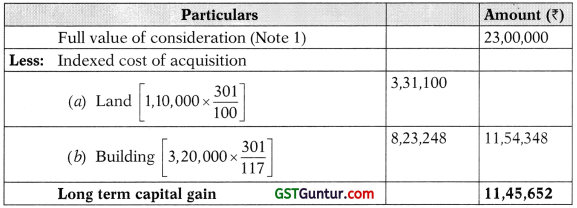

Computation of Long Term capital gain on sale of Land and Building (Assessment year 2021-22)

Computation of Income chargeable under capital gain (Assessment year 2021-22)

| Particulars | Amount (₹) |

| Long term capital gain (as calculated above) | 11,45,652 |

| Less: Set off of brought forward Short term capital loss | 1,00,000 |

| Taxable Long term capital gain | 10,45,652 |

Advice: If Mrs. Anshu invests in NHAI Bonds redeemable after 5 years, the entire amount of capital gain Rupees 10,45,652 will be exempted from capital gain tax.

Notes:

- The fair market value As on 1st April 2001 is taken as cost of acquisi-tion. In this question actual cost of acquisition for Mrs. Anshu is not given.

- In this question being long term capital asset indexed cost of acquisi-tion benefits is available.

- In this question the value adopted by Stamp Valuation Authority is more than 105% of net consideration received rupees 14,00,000. Hence 23 lakhs is considered as full value of consideration.

- As per section 50(3) – if valuation is referred by Assessing Officer to valuation officer and such valuation officer exceeds the value adopted by stamp valuation authority then value of Stamp Valuation Authority is considered as full value of consideration i.e. Rupees 23 lakhs.

- In this case section 54EC benefits are allowed if Mrs. Anshu invest in National Highway Authority of India bonds redeemable after 5 years. The entire amount of capital gain Rupees 10,45,652 should be invested for full exemption from capital gain tax.

- In this case, short term capital loss on sale of shares in financial year 2014-15 can be set off against in the current year long term capital gain on sale of land and building.

- Section 50, applies then there are two conditions on transfer of land and building or both being short term or long term capital asset or all depreciable or non-depreciable assets.

- Stamp duty value adopted by stamp valuation authority for the purpose of payment of stamp duty is deemed to be full value of consideration received or accruing on transfer if stamp duty value exceeds 110% of sale consideration received or accrued on transfer.

- Section 54EC the assessee can avail exemption on transfer of long term capital assets by investing in National Highway Authority of In-dia, Rural Electrification Corporation or any Bond notified by Central Government. The amount of exemption will be amount of Capital Gain or actual amount invested in a specified asset within 6 months, whichever is less.

- Section 74 says that long term capital loss can be set off with long term capital gain. Short term capital loss can be set off with short term capital gain and long term capital gain. If Short term capital loss could not be set off then in that case it can be carried forward for eight assessment year immediately succeeding the assessment year in which the loss was first computed.

![]()

Question 6.

Mr. Subramani sold a house plot to Mrs. Vimala for ₹ 45 lakhs on 12-5-2020. The valuation determined by the stamp valuation authority was ₹ 53 lakhs. Discuss the tax consequences of above, in the hands of each one of them, viz., Mr. Subramani & Mrs. Vimala. Mrs. Vimala has sold this plot to Ms. Padmaja on 21-3-2021 for ₹ 55 lakhs. The valuation as per stamp valuation authority remains the same at ₹ 53 lakhs.

Compute the capital gains arising on sale of the house plot by Mrs. Vimala.

Note: None of the parties viz. Mr. Subramani, Mrs. Vimala & Ms. Padmaja are related to each other; the transactions are between outsiders. [Nov. 2018, 6 Marks]

Answer:

Tax consequences in the hands of Mr. Subramani

| Particulars | Relevant Provisions |

| Section 50C | If the consideration received on transfer of capital asset being land or building or both is less than stamp duty value (as per Stamp Duty Valuation Authority), in that case the stamp duty value is treated as full value of consideration. |

| Case Ans. | In this case Mr. Subramani sold the house for ₹ 45 Lakhs which is less than ₹ 53 Lakhs (Stamp Duty Value). Hence ₹ 53 Lakhs is treated as full value of consideration for Mr. Subramani. |

Tax consequences in the hands of Mrs. Vimala

| Particulars | Relevant Provisions |

| Section 56(2)(x) clause (a) | Any Property/Money received by way of Gift without consideration the aggregate value of which exceeds ₹ 50,000/-, the whole of the aggregate value of such sum is taxable. |

| Section 56(2)(x) clause (b) |

|

| Case Ans. | Hence as per section 56(2)(x), in this case Mrs. Vimala purchased the house for ₹ 45 Lakhs which is less than ₹ 53 Lakhs being stamp duty value. Therefore difference of ₹ 8 Lacs (₹ 53 – ₹ 45) is taxable in the head Income from Other Sources. |

Computation of Taxable Capital Gain in the hands of Mrs. Vimala Assessment Year 2021-22

| Particulars | Amount (₹) |

| Gross Value of Consideration | 55,00,000 |

| Less: Cost of Acquisition | 53,00,000 |

| Taxable Short Term Capital Gain | 2,00,000 |

Question 7.

Mr. Kumar is the owner of a residential house which was purchased in September, 2003 for ₹ 7,00,000. He sold the said house on 5th August, 2020 for ₹ 30,00,000. Valuation as per Stamp Valuation Authority of the said plot of land was ₹ 44,00,000. He invested ₹ 8,00,000 in NHAI Bonds on 12th January, 2021. He purchased a residential house on 8th September, 2020 for ₹ 12,00,000. He gives other particulars as follows:

Interest on Bank Deposit ₹ 32,000 Investment in public provident fund ₹ 12,000

You are requested to calculate the taxable income for the assessment year 2021-22.

Cost inflation index for F.Ys. 2003-04 and 2020-21 are 109 and 301 re-spectively. [May 2009, 8 Marks]

Answer:

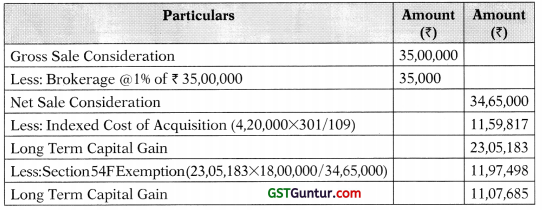

Computation of Taxable Income (Assessment year 2021-22)

| Particulars | Amount (₹) | Amount (₹) |

| Capital Gain: | ||

| Gross Sale Consideration | 44,00,000 | |

| Less: Indexed Cost of Acquisition (7,00,000X301/109) | 19,33,028 | |

| Long term Capital Gain | 24,66,972 | |

| Less: Exemption under Section 54 (Purchase of New Residential House) | 12,00,000 | |

| Less: Exemption under Section 54EC | 8,00,000 | 20,00,000 |

| Taxable Long term Capital Gain | 4,66,972 | |

| Income from Other Sources: | ||

| Interest on Bank Deposit | 32,000 | |

| Gross Total Income | 4,98,972 | |

| Less: Deduction under Section 80C | 12,000 | |

| Total Income | 4,86,972 | |

| Total Income Rounded off nearest ₹ 10 | 4,86,970 |

Note:

1. The Gross Sale Consideration is taken as per Stamp Valuation Authority of the Plot as ₹ 44,00,000 which is higher than the actual sale consideration of ₹ 30,00,000.

Question 8.

Mr. Raj Kumar sold a house to his friend Mr. Dhuruv on 1st July, 2020 for a consideration of ₹ 26,00,000. The Sub-Registrar refused to register the document for the said value, as according to him, stamp duty had to be paid on ₹ 45,00,000, which was the Government guideline value. Mr. Raj Kumar preferred an appeal to the Revenue Divisional Officer, who fixed the value of the house as ₹ 38,00,000 (₹ 24,00,000 for land and balance for building portion). The differential stamp duty was paid, accepting the said value determined. Assuming that the fair market value is ₹ 32,00,000. What are the tax implications in the hands of Mr. Raj Kumar and Mr. Dhuruv for the assessment year 2021-22? Mr. Raj Kumar had purchased the land on 1st June, 2014 for ₹ 5,19,000 and completed the Construction of house on 1st October, 2019 for ₹ 16,00,000. [May 2010, 6 Marks]

Answer:

Computation of Taxable Capital Gain in the hands of Mr. Raj Kumar Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Capital Gain: | ||

| Land: | ||

| Gross Sale Consideration | 24,00,000 | |

| Less: Indexed Cost of Acquisition (5,19,000X301 240) | 6,50,913 | |

| Long term Capital Gain | 17,49,087 | 17,49,087 |

| Building: | ||

| Gross Sale Consideration | 14,00,000 | |

| Less: Cost of Acquisition | 16,00,000 | |

| Short term Capital Loss | (2,00,000) | (2,00,000) |

| Net Taxable Long term Capital Gain | 15,49,087 |

Notes:

1. The capital gain on Land will be Long term as it was held more than 24 months. Date of Purchase is 01.06.2014 and date of sale is 01.07.2020.

2. The capital gain on Building will be short term as it was held less than 24 months. Date of construction completed is 01.10.2019 and date of sale is 01.07.2020.

3. The Gross Sale Consideration is taken as per appeal which is ₹ 3 8,00,000 (for land ₹ 2,40,000 and for Building ₹ 14,00,000).

4. As per section 70, Short Term Capital Loss can be set off against Long Term Capital Gain.

5. Taxable Long term Capital Gain of ₹ 15,49,087 is taxed @ 20%. :

Taxable Income from Other Sources in the hands of Mr. Dhuruv Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Income from Other Sources: | ||

| Valuation as per Revenue Divisional Officer | 38,00,000 | |

| Less: Consideration paid for the house | 26,00,000 | |

| Net Gain | 14,00,000 | |

| Gross Total Income | 14,00,000 | |

| Total Income | 14,00,000 |

Notes:

1. Section 50C – Mr. Dhruv paid inadequate consideration for the house and hence benefit of ₹ 14,00,000 is taxable in the hands of Mr. Dhruv under the head Income from Other Sources.

![]()

Question 9.

Mr. Selvan Acquired a residential house in December 2005 for ₹ 11,00,000 and made some improvements by way of additional construction to the house, incurring expenditure of ₹ 3,00,000 in October, 2010. He sold the house property in November, 2020 for ₹ 70,00,000. The value of property was adopted as ₹ 85,00,000 by the State Stamp Valuation Authority for registration purpose. He acquired a residential house in January, 2021 for ₹ 25.00,000. He deposited ₹ 20,00,000 in capital gains bonds issued by National Highways Authority of India (NHAI) in September, 2021.

Compute the capital gain chargeable to tax for the assessment year 2021 -22.

What would be the tax consequence and in which assessment year it would be taxable, if the house property acquired in January, 2021 is sold for ₹ 40,00,000 in March, 2022?

Cost inflation index: F.Y. 2005-2006 = 117, F.Y. 2010-2011 = 167, F.Y. 2020-2021 = 301. [Nov. 2011, 8 Marks]

Answer:

Computation of Taxable Capital Gain in the hands of Mr. Selvan Assessment Year 2021-22

| Particulars | Amount(₹) | Amount(₹) |

| Gross Sale Consideration (Being Stamp Duty Value) | 85,00,000 | |

| Less: Indexed Cost of Acquisition (11,00,000X301 /117) | 28,29,915 | |

| Less: Indexed Cost of Acquisition – Additional Construction (3,00,000X301/167) | 5,40,719 | 33,70,634 |

| Long term Capital Gain | 51,29,366 | |

| Less: Sec. 54 Purchase of New Residential House | 25,00,000 | |

| Taxable Long term Capital Gain | 15,49,087 |

Notes:

1. The Gross Sale Consideration is taken as per Stamp Valuation Au-thority of the house as ₹ 85,00,000 which is higher than the actual sale consideration of ₹ 70,00,000.

2. Section 54EC is not allowed as deduction. NHAI bonds are purchased after 6 months from the date of transfer of the house.

Question 10.

Ms. Mohini transferred a house to her friend Ms. Ragini for ₹ 35,00,000 on 01.10.2020. The Sub-Registrar valued the land at ₹ 48,00,000. Ms. Mohini contested the valuation and the matter was referred to Divisional Revenue Officer, who valued the house at ₹ 41,00,000. Accepting the said value, differential stamp duty was also paid and the transfer was completed.

The total income of Mohini and Ragini for the assessment year 2021-22, before considering the transfer of said house are ₹ 3,80,000 and ₹ 3,45,000 respectively. Ms. Mohini had purchased the house on 15th May 2013 for ₹ 25,00,000 and registration expenses were ₹ 1,50,000.

You are required to explain provisions of Income-tax Act, 1961 applicable to present case and also determine the total income of both Ms. Mohini and Ms. Ragini taking into account the above said transactions.

Cost inflation index: F.Y. 2013-2014 = 220, F.Y. 2020-2021 = 301. [May 2015, 8 Marks]

Answer:

Computation of Taxable Income of Ms. Mohini (Assessment year 2021-22)

| Particulars | Amount (₹) | Amount (₹) |

| Capital Gain: | ||

| Gross Sale Consideration (Note 1) | 41,00,000 | |

| Less: Indexed Cost of Acquisition being value as per DivisionalRevenueOfficer(Note2)(26,50,000X301 /220) | 36,25,682 | |

| Long term Capital Gain | 4,74,318 | 4,74,318 |

| Income from Other Sources: | ||

| Other Income | 3,80,000 | |

| Gross Total Income | 8,54,318 | |

| Less: Deduction under Chapter VIA | NIL | |

| Total Income | 8,54,318 | |

| Total Income Rounded off nearest ₹ 10 | 8,54,320 |

Notes:

1. The Gross Sale Consideration of the house is taken as per Divisional Revenue Officer as ₹ 41,00,000 which is higher than the actual sale consideration of ₹ 35,00,000.

2. The cost of acquisition of the house is ₹ 26,50,000 (Purchase price ₹ 25,00,000 + Registration charges ₹ 1,50,000).

Computation of Taxable Income of Ms. Ragini (Assessment year 2021-22)

| Particulars | Amount (₹) | Amount (₹) |

| Income from Other Sources: | ||

| Inadequate consideration (Note 2) | 6,00,000 | |

| Other Income | 4,45,000 | |

| Gross Total Income | 10,45,000 | |

| Less: Deduction under Chapter VIA | NIL | |

| Total Income | 10,45,000 |

Notes:

1. The Inadequate consideration is paid by Ms. Ragini to Ms. Mohini. The Difference of ₹ 6,00,000 (₹ 41,00,000 – 35,00,000).

![]()

Question 11.

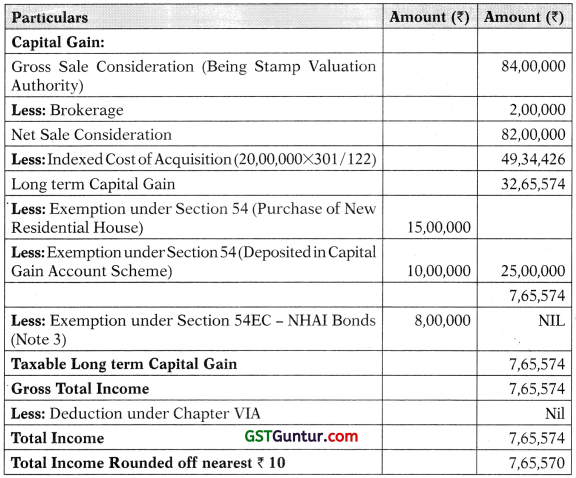

Mr. Martin sold his residential house property on 08-06-2020 for ₹ 70 lakhs which was purchased by him for 20 lakhs on 05-05-2006. He paid ₹ 2 lakhs as brokerage for the sale of said property. The stamp duty valuation assessed by sub-registrar was ₹ 84 lakhs. He bought another house property on 25-12-2020 for 15 lakhs. He deposited 10 lakhs on 10-11-2020 in the capital gain bond of National Highway Authority of India (NHAI).

He deposited another 10 lakhs on 10-07-2021 in the capital gain deposit scheme with SBI for construction of additional floor of house property. Compute income under the head “Capital Gains” for A.Y. 2021-22 as per Income-tax Act, 1961 and also Income tax payable on the assumption that he has no other income chargeable to tax.

Cost inflation index for Financial Years 2006-07 = 122 and 2020-21 = 301. [Nov. 2015, 8 Marks]

Answer:

Computation of Taxable Income of Mr. Martin (Assessment 2021-22)

Notes:

- The Gross Sale Consideration is taken as per Stamp Valuation Authority of the residential house as ₹ 84,00,000 which is higher than the actual sale consideration of ₹ 70,00,000.

- As per Section 54

- On transfer of residential house building or land appurtenant thereto, being a long-term capital asset.

- If the amount of capital gain exceeds ₹ 2 Crore – then Assessee may at his option, purchase one residential house in India within one year before or 2 years after the date of transfer or construct one residential house in India within a period of three years after the date of transfer.

- If the amount of capital gain does not exceed ₹ 2 Crore – then Assessee may at his option, purchase two residential houses in India within one year before or 2 years after the date of transfer or construct two residential houses in India within a period of three years after the date of transfer.

- If an assessee has exercised the option to purchase or construct two residential houses in India, he shall not be subsequently entitled to exercise the option for the same in any other assessment year.

- In this case NHAI Bonds are purchased after six months from the date of transfer of the house, he is not entitled for Section 54EC.

Computation of Tax Liability of Mr. Martin (Assessment Year 2021-22)

| Particulars | Amount (₹) |

| Tax on Long Term Capital Gain ₹ 5,15,574 (₹ 7,65,570 – 2,50,000) @20% | 1,03,115 |

| Add: HEC @ 4% of ₹ 1,03,115 | 4,125 |

| Tax Liability | 1,07,240 |

Question 12.

Mr. Sunil entered into an agreement with Mr Dhaval to sell his f residential house located at Navi Mumbai on 16.08.2020 for Rupees 80 lacs. The sale proceeds was to be paid in the following manner.

a. 20% through account payee bank draft on the date of agreement.

b. 60% on the date of the possession of the property.

c. Balance after the completion of the registration of the title of the property.

Mr. Dhaval was handed over the possession of the property on 15.12.2020 and the registration process was completed on 14.01.2021. He paid the sale proceed as per the sale agreement.

The value determined by the stamp duty authority on 16.08.2020 was Rupees 90 lacs. Whereas on 14.01.2021 it was ₹ 91,50,000.

Mr Sunil had acquired the property on 01.04.2001 for ₹ 10 lacs. After recovering the sale proceed from Mr. Dhaval. He purchased another residential house property for ₹ 35 lacs. Compute the income under the head capital gain for the assessment year 2021-22. Also compute tax liability. Cost inflation index for financial years 2001-02 = 100, 2002-03 = 105, 2021-22 = 301. [Nov. 2017, 5 Marks]

Answer:

Computation of Taxable Capital Gain in the hands of Mr. Sunil Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Gross Sale Consideration (Being Stamp Duty Value) | 90,00,000 | |

| Less: Indexed Cost of Acquisition (10,00,000X301 100) | 30,10,000 | |

| Long term Capital Gain | 59,90,000 | |

| Less: Sec. 54 Purchase of New Residential House | 35,00,000 | |

| Taxable Long term Capital Gain | 24,90,000 | |

| Less: Deduction under Chapter VIA | Nil | |

| Total Income | 24,90,000 |

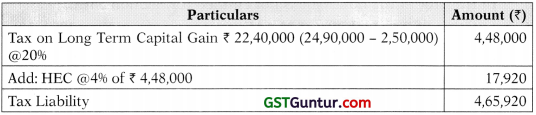

Computation of Tax Liability of Mr. Sunil (Assessment Year 2021-22)

Notes:

- As per Section 50C, If full value of consideration is claimed by an if Assessee less than Stamp Duty Value, in that case Full value of consideration is taken to be Stamp Duty Value. In this case the Gross Sale Consideration is taken as per Stamp Valuation Authority of the house as ₹ 90,00,000 which is higher than the actual sale consideration of ₹ 80,00,000.

- In this case 20% amount was given on the date of agreement through account payee bank draft hence Stamp Duty Value is taken for the date of agreement.

- If the date of agreement and date of registration are different in that case value on the agreement shall be taken into consideration provided some advance was given otherwise than in cash on or before the agreement.

Question 13.

Mr. Manish owned a land located in Chennai Bangalore highway in Tambaram Municipality Corporation Limited, which was acquired by National Highway Authority of India in the financial year 2020-21 for ₹ 10 Lacs . The land had been purchased by Mr. Manish on 02.04.2003 for ₹ 10,000. The fair market value of the land on 01.04.2001 was ₹ 19,000.

Yet another piece of urban Land located in Chennai purchased in April 2011 for ₹ 25 lacs was sold by him, in February 2021 for ₹ 38 Lacs but the sale deed thereof, was not registered till 31.03.2021. The possession was given to the buyer on 31.01.2021 and the sale deed was finally registered on 16.04.2021. The value adopted by the stamp valuation authority was ₹ 42 Lacs. Mr Manish paid 2% of the sale consideration towards brokerage. Manish deposited ₹ 10 lacs in Capital Gain Deposit Account of State Bank ; of India on 20.11.2021 in order to avail exemption under section 54F of the Income-tax Act, 1961 subsequently by constructing a residential house.

Cost inflation index 2020-21 = 301, 2011-12 = 184, 2003-04 = 109 Compute the capital gain chargeable to tax arising as a result of these transactions.

Answer:

| Section | Relevant Provisions |

| Section 2(47) | If consideration has been received and position has been given then it will be considered as transfer. |

| Section 50C | The value of stamp valuation authority will be considered as sale consideration if the stamp exceeds 110% of consideration. |

| Section 54F | If assessee transfer any capital asset other than Residential House and invest the amount of net sale consideration in New Residential House than proportionately he is entitled. |

![]()

Property 1:

| Particulars | Amount (₹) |

| Gross Sale Consideration | 10,00,000 |

| Less: Brokerage @2% | NIL |

| Net Sale Consideration | 10,00,000 |

| Less: Indexed COA (19,000X301/109 = 52,468) | 52,468 |

| Long Term Capital Gain | 9,47,532 |

Property 2:

| Particulars | Amount (₹) |

| Gross Sale Consideration | 42,00,000 |

| Less: Brokerage @2% of ₹ 38 Lacs | 76,000 |

| Net Sale Consideration | 41,24,000 |

| Less: Indexed COA (25,00,000X301/184 = 40,89,674) | 40,89,674 |

| Long Term Capital Gain | 34,326 |

Computation of Taxable Long Term Capital Gain

| Particulars | Amount (₹) |

| Property 1 | 9,47,532 |

| Property 2 | 34,326 |

| Total Long Term Capital Gain | 9,81,858 |

| Less Exemption Section 54F | NIL |

| Taxable Long Term Capital Gain | 9,81,858 |

Note: Mr. Manish is not entitled for exemption under section 54E

Question 14.

State with reason whether the following receipt is taxable or not under the provision of Income-tax Act, 1961?

Mr. Suman received an advance of ₹ 3 lakhs on 06.06.2020 to transfer his residential house property. Since the transfer was not effected during the previous year due to failure in negotiations, he deducted the advance money forfeited from the cost of acquisition of the property. [Nov. 2016, 2 Marks]

Answer:

The followings are the provisions of Sale of gifted capital asset:

| Particulars | Relevant Provisions | |

| (i) | Section 51 & Section 56(2)(tx) |

|

| (ii) | Case Ans. | In this case Rupees three lakhs was forfeited in 2020-21, hence as per section 56(2\ix) it is taxable under the head income from other sources and Mr. Suman is liable to pay tax on Rupees 3,00,000 under the head income from other sources in financial year 2020-21. |

Question 15.

Compute the net taxable capital gains of Smt. Megha on the basis of the following information :

A house was purchased on 1.05.2004 for ₹ 4,50,000 and was used as a residence by the owner. The owner had contracted to sell this property in June, 2011 for ₹ 10 lacs and had received an advance of ₹ 70,000 towards sale. The intending purchaser did not proceed with the transaction and the advance was forfeited by the owner. The property was sold in April, 2020 for ₹ 15,00,000. The owner, from out of sale proceeds, invested ₹ 3 lacs in a new residential house in January, 2021. [Nov. 2009, 6 Marks]

Answer:

Computation of Net Taxable Capital Gain in the hands of Smt. Megha Assessment Year 2021-22

| Particulars | Amount (₹) |

| Gross Sale Consideration | 15,00,000 |

| Less: Transfer Expenses | NIL |

| Net Sale Consideration | 15,00,000 |

| Less: Indexed Cost of Acquisition (3,80,000X301/111) Noted | 10,30,450 |

| Long term Capital Gain | 4,69,550 |

| Less: Exemption under Section 54 (Purchase of New Residential House) | 3,00,000 |

| Taxable Long term Capital Gain | 1,69,550 |

Notes:

- The Cost of Acquisition is reduced by ₹ 70,000. This vas forfeited in June 2011.

- As per Section 51, if advance money is forfeited during financial year 2013. 14 or earlier than it is not taxable till Capital Asset is transferred in the hands of recipient. But if capital assets transferred then advance money will be deducted from the cost of acquisition of the asset.

- He has purchased new residential house within 2 years from the date of transfer of house, hence eligible for exemption under section 54.

Question 16.

Discuss the taxability or otherwise In the hands of the recipient as per the provisions of the Income-tax Act 1961

Mr. A received and advance of ₹ 50000 on 10.09.2020 against the sale of his house. However due to non-payment of instalment in time, the contract was cancelled and the amount of ₹ 50,000 was forfeited. [Nov. 2016, 2 Marks]

Answer:

Taxable under the head income from other sources under Section 56 in the hands of Mr. A

If advance money is forfeited in financial year 2014-15 on or after then it is taxable in the hands of recipient under Section 56(2)(ix) under the head Income from other sources. It is taxable in the year in which advance money is forfeited.

![]()

Question 17.

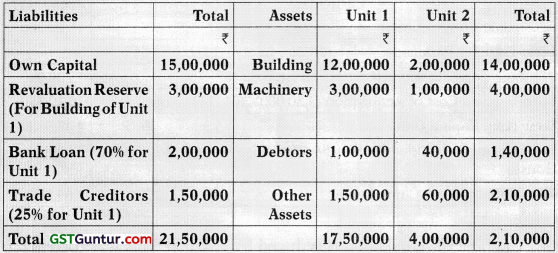

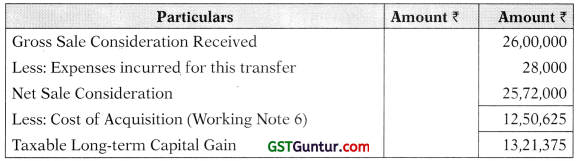

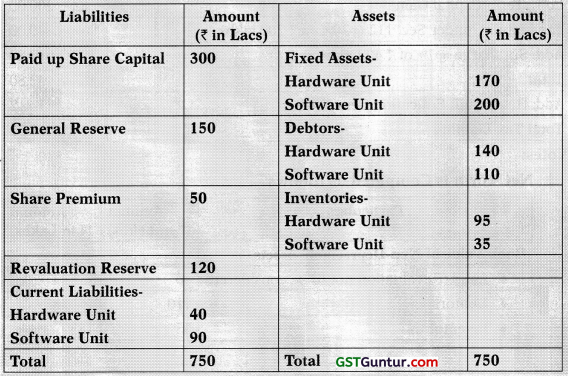

Mr. A is a proprietor of Akash Enterprises having 2 units. He transferred on 1.4.2020 his unit 1 by way of slump sale for a total consideration at ₹ 26 Lacs. The expenses incurred for this transfer were ₹ 28,000/-. His Balance Sheet as on 31.3.2020 is as under:

Other information:

- Revaluation reserve is created by revising upward the value of the building of unit 1.

- No individual value of any asset is considered in the transfer deed.

- Other assets of unit 1 include patents acquired on 1.7.2018 for ₹ 50,000/- on which no depreciation has been charged.

Compute the capital gain for the assessment year 2021-22. [Nov. 2010, 5 Marks]

Answer:

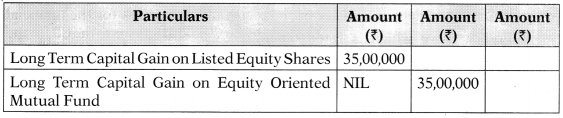

Computation of Capital Gain of Unit 1 on Slump Sale Assessment Year 2021-22

Notes:

- Indexation is not done in case of Depreciable Assets and under Slump Sale.

- Depreciation on patents is equal to 2 5 % per annum written down value method. Date of acquisition 01.07.2018. Book value as on 31.03. 2020 = ₹ 50,000 × 0.75 × 0.75 = ₹ 28,125

- Value of bank loan = ₹ 2,00,000 × 0.70 = ₹ 1,40,000

- Value of trade creditors = ₹ 1,50,000 × 0.25 = ₹ 7 37,500

- Net Worth of the Akash Enterprises unit 1 is treated as cost of acquisition.

- Total assets:

Question 18.

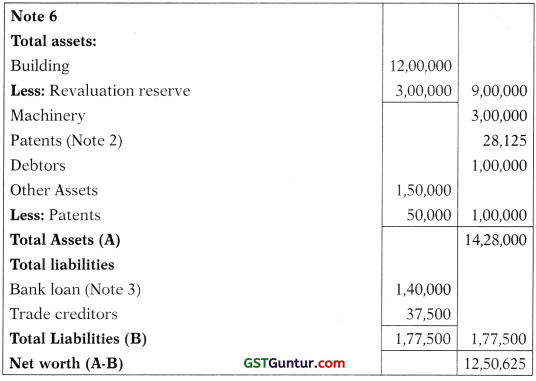

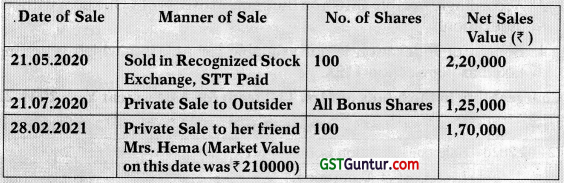

Star Enterprises has transferred its unit R to A Ltd. by way of Slump Sale on January 3,2021. The summarized Balance Sheet of Star Enterprises as on that date is given below:

Using the further information below, Compute the Capital Gains arising from slump sale of Unit R for Assessment year 2021-22.

- Slump sale consideration on transfer of Unit R was ₹ 930 lacs.

- Fixed Assets of Unit R includes land which was purchased at ₹ 110 lacs in the year 2010 and was revalued at ₹ 140 lacs.

- Other fixed assets are reflected at ₹ 460 lacs. (i.e. ₹ 600 lacs less value of land) which represents written down value of those assets as per books. The written down value of these asset is ₹ 430 lacs.

- Unit R was set up by Star Enterprises in Oct., 2009.

Note: Cost of Inflation Indices for the financial years 2009-10, 2010-11

and financial year 2020-21 is 148,167 and 301 respectively. [May 2018, 10 Marks]

Answer:

Computation of Capital Gain in Slump Sale of Unit R Assessment Year 2021-22

Notes:

- Indexation is not done in case of Slump Sale.

- Holding period for unit R is from date of commencement of unit to date of transfer. The period is October 2009 to 3rd January 2021, which is more than 36 months and hence long term capital gain arises.

- Fixed assets mean land cost + depreciable assets as per written down value

Fixed assets = ₹ 110 Lacs + ₹ 430 Lacs = 540 Lacs. - Other Assets of Unit R = ₹ 440 lacs.

- Liabilities of unit R = ₹ 140 lacs.

- Net Worth of unit R = Fixed asset + Other assets – liabilities Net Worth of unit R

= ₹ 540 + ₹ 440 – ₹ 140

= ₹ 840 lacs

Question 19.

Vatika Limited has two units 1 engaged in manufacture of computer hardware and the other involved in developing software. As a restructuring drive, the company has decided to sell its software unit as a Going Concern by way of Slump sale for ₹ 385 Lacs to a new company called Sumedha Limited, in which it holds 74% equity shares. The balance sheet of Vertical Limited as on 31st March, 2021 being the date on which software unit has been transferred, is given hereunder:

Following additional informations are furnished by the management.

- The software unit is an existence since May 2012.

- Fixed assets of software units includes land which was purchase at ₹ 40 lacs in the year 2008 and evaluate at 60 lacs as on March 31st 2021.

- Fixed assets of the software units mirror at ₹ 140 Lakhs (₹ 200 Lakhs – land value ₹ 60 lacs) is written down value of depreciable assets as per books of account. However the written down value of these assets under section 43(6) of Income-tax Act is ₹ 90 lakhs. Ascertain tax liability, which would arise from slump sale to Sumedha Limited.

Answer:

Computation of Taxable Capital Gain from Slump Sale on Software Units of Vertika Limited.

| Particulars | Amount (₹ in Lakhs) |

| Gross Sale Consideration for Slump Sale of Software Unit | 385 |

| Less: Cost of Acquisition being the Net Worth of Software Unit (Note 1) | 185 |

| Long Term Capital Gain (Note 2) | 200 |

Computation of Tax Liability from Slump Sale on Software Units of Vertika Limited.

| Particulars | Amount (₹ in Lakhs) |

| Long Term Capital Gain | 200.00 |

| Tax Liability under Sec. 112 @20% on ₹ 200 lakhs | 40.00 |

| Add: Surcharge @7% of ₹ 40 Lakhs | 2.80 |

| Total | 42.80 |

| Add: Health and Education Cess @ 4% | 1.712 |

| Total Tax Liability | 44.51 |

Notes:

1. Net worth is Computed as follows:

| Particulars | Amount (₹ in Lakhs) | Amount (₹ in Lakhs) |

| Book Value of Non-Depreciable Assets | ||

| ♦ Land (Revaluation not to be considered) | 40 | |

| ♦ Debtors | 110 | |

| ♦ Inventories | 35 | 185 |

| Particulars | Amount(₹ in Lakhs) | Amount(₹ in Lakhs) |

| Written Down Value of Depreciable Assets as per sec. 43(6) | 90 | |

| Total Aggregate value of Total Assets | 275 | |

| Less: Current Liabilities of Software Unit | 90 | |

| Net Worth of the Software Unit | 185 |

2. If the assessee having any undertaking transferred under Slump sale and having for more than 36 months, then the capital gain will be long term and indexation but indexation will benefit will not be available under as per section 50B(2).

![]()

Question 20.

Explain the concept of reverse mortgage and discuss its tax implications. [May 2009, 3 Marks]

Answer:

The followings are the provisions of reverse mortgage:

| Particulars | Relevant Provisions | |

| (i) | Section 10(43) | If an individual being senior citizen and having own residential house mortgage his residential house with lender in return of loan amount referred in section 47 is exempt. Person has to repay the loan in the form of EMI (notification no. 93/2008 dated 30 September, 2008) |

| (ii) | Section 47 Clause (xvi) | Any transfer of capital asset in a transaction of reverse mortgage under a scheme notified by Central Government shall not be regarded as transfer and hence will not attract capital gain tax. |

| (iii) | Purpose | The loan amount may be used to finance the purchase or construction of the same property or for any other purpose. The borrower can use the loan amount for medical or any purpose also. The amount cannot be used for trading or speculative. |

| (iv) | Possession | The borrower can reside the same house and can get regularly amount monthly or in Lump sum. |

| (v) | Where to Mortgage | Property can be mortgage with National housing bank or scheduled bank for housing finance company registered with National housing Bank. |

| (vi) | If not able to Pay | If borrower did not pay in its life time then lender can recover the loan amount and interest thereon from the property. But in case of death of the borrower then after the death of borrower the lender can recover the loan amount from legal Heirs of the borrowers or from the property mortgage. |

Question 21.

Mr. Abhik’s father, who is a senior citizen had pledged his residential house to a bank under a notified reverse mortgage scheme. He was getting loan from bank in monthly instalments. Mr. Abhik’s father did not repay the loan on maturity and given possession of the house to the bank to discharge his loan. How will the treatment of long-term capital gain be made on such reverse mortgage transaction? [May 2009, 3 Marks]

Answer:

- The provisions of section 10(43) and section 47 clause (xvi) applies. (Refer Q. No. 1 above)

- In this case Bank will transfer the mortgage residential house to re-cover the amount of loan and interest thereon. Such transfer will be treated as transfer and hence any capital gain arises will be taxable in the hands of Mr. Abhik’s father.

- If transfer takes place after the death of Mr. Abhik’s father then bank can recover the amount either from Mr. Abhik and if he is not able to repay then by transfer the house.

Question 22.

Discuss whether the expenditure incurred by an assessee to remove mortgage and encumbrance be claimed as a deduction under section 48 while computing the capital gain in the following cases:

1. where the mortgage was created by the assessee himself

2. where the mortgage was created by the previous owner

Answer:

1. If assessee created mortgage by himself and clearing of the Mortgage that prior to transfer of the property he is not entitled to claim de-duction under section 48. It is just application by the owner to realise profit on sale of asset towards the discharge of loan applications.

In other words we can say that the expenditure incurred by the as-sessee himself to remove and encumbrance created by himself on the Asset, acquired by him without any encumbrance, is not allowed as deduction under section 48.

Smt. Zeenath vs. ITO Madras High Court

2. If any asset is acquired by the assessee and mortgage was created by the previous owner and assessee acquired absolute interest in that asset. In that case if assessee incurred expenditure to discharge the mortgage debt, created by the previous owner, to Acquire absolute interesting that property is treated as cost of acquisition. Such amount paid is deductible as cost of acquisition from the full value of consideration.

Question 23.

State with reason, any whether the following statements is true or false with regard to the provisions of the Income-tax Act, 1961 for the Assessment year 2021-22:

(i) Capital gain of ₹ 75 lakh arising from transfer of long term capital assets will be exempt from tax if such capital gain is invested in the bonds redeemable after three years, issued by NHAI, u/s 54EC of the Act. [Nov. 2008, 2 Marks]

Answer:

The followings are the provisions of Section 54EC:

| Particulars | Relevant Provisions | |

| (i) | Section 54EC | If any assessee transfers any long-term capital asset and long-term capital gain arises then amount of capital gain is exempt if

|

| (ii) | Case Ans. | The statement is false. He can should invest maximum 50 lacs to get the exemption of X 50 lacs. |

Question 24.

What are the circumstances under which the Assessing officer can make reference to the valuation officer u/s 55A of the Income-tax Act, 1961? [Nov. 2009, 3 Marks]

Answer:

To ascertain the fair market value of a capital asset to determine capital gain, the Assessing Officer may refer the valuation of capital assets to a Valuation Officer.

- If the value of the asset as claimed by the assessee, is in accordance with estimate made by a Registered Valuer (Private Valuer). Assessing Officer is of opinion that their is variance from the fair market value. In that case he can make the reference to the Valuation Officer.

- In any other case, if assessing officer is of the opinion that the fair market value of the asset exceeds the value of the asset as claimed by the assessee by more than 15% of the value or more than ₹ 25,000 of the value claimed by the assessee.

- Where the Assessing Officer is of the opinion that nature of asset and relevant circumstances, it is necessary to refer to Valuation Officer.

Question 25.

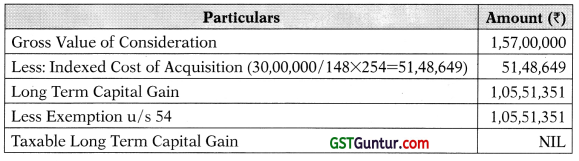

Mr. Roy residential house in Noida it was acquired on 09.09.2009 for ₹ 30,00,000. He sold it for ₹ 1,57,00,000 on 07.01.2016. Mr. Roy utilised the sale proceeds of the above property to acquire a residential house in Panchkula for ₹ 2,05,00,000 on 20.07.2017. The said house property was sold on 31.10.2019 and he purchased another residential house in Delhi for ₹ 2,57,00,000 on 02.03.2020. The property at Panchkula was sold for ₹ 3,25,00,000. Calculate capital gain chargeable to tax for assessment years 2016-17 and 2021-22. All working should be part of your answer.

Cost inflation index for various financial year are as under 2009-10=148, 2015-16 = 254, 2017-18 = 272, 2020-21 = 301. [May 2019, 6 Marks]

Answer:

Computation of Capital Gain of Mr. Roy Assessment Year 2016-17

Computation of Capital Gain of Mr. Roy Assessment Year 2021-22

![]()

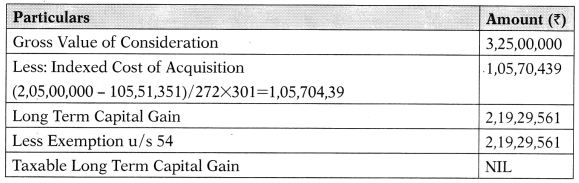

Question 26.

On 2 1.03.2020 Mr. Janak gifted to his wife Mrs. Thilagam 200 listed shares which had been bought by him on 19.04.2018 at ₹ 2000 per shares. On 01.06.2018 bonus shares were allotted in the ratio of 1:1. All the shares were sold by Mrs. Thilagam as under:

Briefly state the income tax consequences in respect of the sale of the shares by Mrs. Thilagam showing clearly the person in whose hands the same is chargeable, quantum and the head of income in respect of above transactions. Detailed computation of total income is not required.

Net sales value represents the amount credited after all taxes, levies, brokerage etc. and the same may be adopted for computing the capital gain.

Cost inflation index for the financial year 2018-19 is 280 and for the financial year 2020-21 is 301.

Answer:

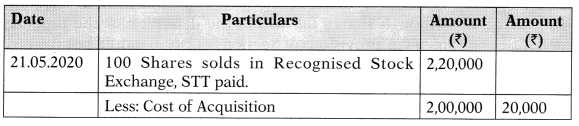

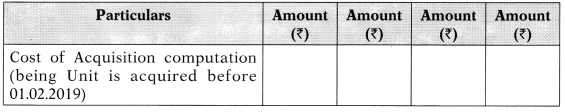

Chargeability in the hands of Mr. Janak for Assessment Year 2021-22

Notes

- If an asset is transferred by an individual to his/her spouse without adequate consideration, the income arising from the sale of said asset by the spouse will be clubbed in the hands of transferor.

- In Budget 2018 Section 10(38) is withdrawn. Finance Act, 2018 inserted a new section 112A to provide for the rate of tax on long term capital gains arising on the transfer of certain assets. The capital assets on which the provisions of Section 112A applies include Equity Shares in a Company or unit of Equity oriented fund or units of a business trust.

- Accordingly taxable @ 10% on the gains in excess of ₹ One lakh without indexation.

- Benefit of Indexation is not available for an asset which is getting taxed as per Section 112A.

Chargeability in the hands of Mrs. Thilagam for Assessment Year 2021-22

Note:

1. When there is any accretion to the assets transferred, income arising to the transferee from such accretion will not be clubbed. Therefore the profit from the sale of Bonus shares allotted to Mrs. Thilagam will not chargeable to tax in the hands of Mr. Janak.

Chargeability in the hands of Mrs. Hema under the head Income from Other Sources Assessment Year 2021-22

Mrs. Hema has received from her friend Mrs. Thilagam without adequate consideration. Although shares fall within the definition of the property under Section 56(2)(iii), provisions of Section 56(2)(vii) should be attracted but the amount does not exceed ₹ 50,000 hence Section 56(2)(vii) will not attract and amount of difference between the fair market value of shares and actual sale consideration.

Question 27.

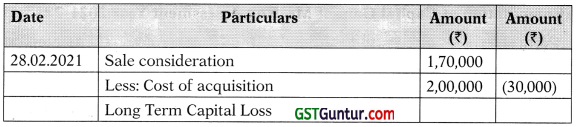

Discuss the taxability or otherwise in the hands of the recipient as 1 per the provisions of the Income-tax Act 1961

ABC Private Limited closely held Company issued 10,000 shares at ₹ 130 Per share. The face value of the share is ₹ 100 per share and the fair market value of the share is ₹ 120 per share. [May 2016, 2 Marks]

Answer:

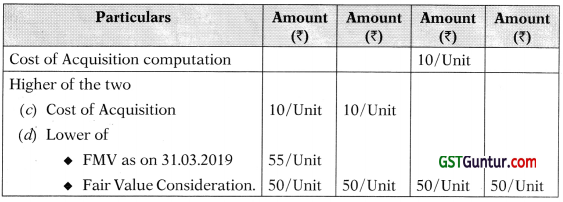

Taxability in the hands of ABC Private Limited

![]()

Question 28.

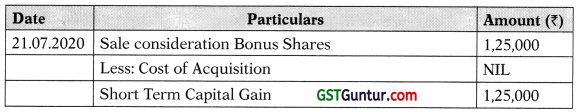

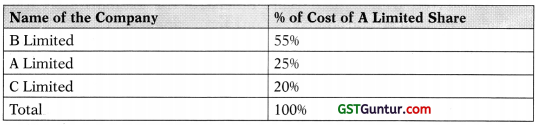

Mr. Rajan provides you the following details with regard to sale of certain securities by him. During financial year 2020-2021.

1. Sold 10,000 shares of A limited on 05.04.2020 @ 650 per share. A Limited is a listed company. These shares were acquired by Mr. Rajan on 05.04.2017 @ ₹ 100 per share. STT was paid both at the time of acquisition as well as at the time of transfer of such shares which was effected through a recognised Stock Exchange. On 31.01.2020 the shares of a limited were traded on a recognised stock exchange as under:

highest price ₹ 300 per share

average price ₹ 290 per share

lowest price ₹ 280 per share

2. Sold 100 units of B Mutual Fund on 20.04.2020 @ ₹ 50 per unit B Mutual Fund is an equity oriented fund. These units were acquired by Mr. Rajan on 15.04.2017 @ ₹ 10 per unit. STT was paid only at the time of transfer of such units. On 31.01.2020 the Net Asset Value of the units of B Mutual Fund was ₹ 55 per unit.

3. Sold 100 shares of C Limited on 25.04.2020 @ ₹ 200 per share. C Limited is an unlisted company. These shares were issued by the company as bonus shares on 30.09.1998. The Fair Market Value of these shares as on 01.04.2001 was ₹ 50 Per share. Cost Inflation Index for various financial years are as under:

FY 2001-02 = 100

FY 2016-17 = 264

FY 2017-18 = 272

FY 2018-19 = 280

FY 2019-20 = 289

FY 2020-21 = 301

Calculate the amount chargeable to Tax under the head capital gain and also calculate tax on such gains for assessment year 2021-22 assuming that the other incomes of Mr. Rajan exceeds the maximum amount not chargeable to tax. (Ignore Surcharge and Cess) [Nov. 2019, 6 Marks]

Answer:

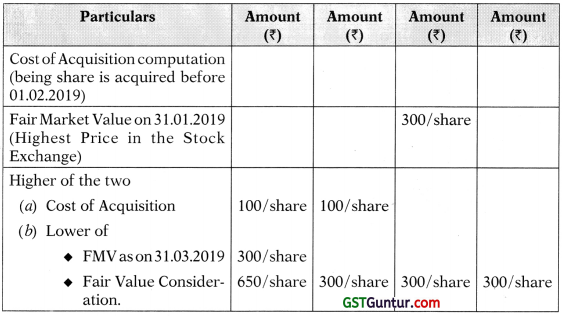

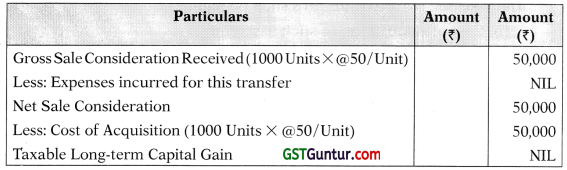

Capital Asset: Listed Equity Shares

Computation of Capital Gain of Mr. Rajan Assessment Year 2021-22

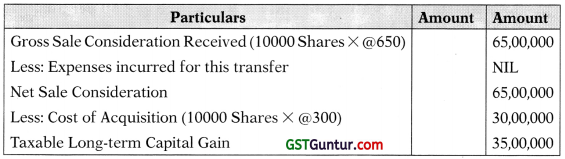

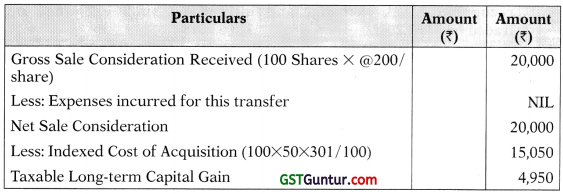

Capital Asset: Equity oriented Mutual Fund

Computation of Capital Gain of Mr. Rajan Assessment Year 2021-22

Computation of Capital Gain of Capital Asset Unlisted Equity Shares of Mr. Rajan Assessment Year 2021-22

Computation of Capital Gain Tax of Mr. Rajan Assessment Year 2021-22

Notes:

- Section 55(2)(ac) in respect of Long Term Capital Asset acquired by the assessee before 01.02.2018 shall be higher of

- Cost of Acquisition of such asset and

- Lower of

- Fair Market Value of such asset and

- Full value of consideration received or accruing as a result of the transfer of the capital asset.

- Fair Market value means:

| Nature of Capital Asset | Fair Market Value |

| Capital Asset is Listed on any recognized stock exchange and traded on 31.01.2018 | Highest Price of the capital asset quoted on such exchange on 31.08.2018 |

| Capital Asset is listed on any recognized stock exchange, but no trading in such asset on such exchange on 31.01.2018 | Highest price of such asset on such exchange on a date immediately preceding 31.01.2018, when such asset was traded on such exchange. |

| Capital Asset is a Unit and is not Listed on a recognized stock exchange on 31.01.2018 | Net Asset Value of such asset as on 31.01.2018 |

| Equity Share Not listed on recognized stock exchange as on 31.01.2018, but listed on the date of transfer or Equity share which is listed on a recognized stock exchange on the date of transfer and which became the property of the assessee in consideration of share which is not listed on such exchange as on 31.01.2018 by way of transaction not regarded as transfer u/s 47 | An amount which bears to the cost of acquisition the same proportion as cost inflation index for the financial year 2017-2018, bears to the CII for the

|

![]()

Question 29.

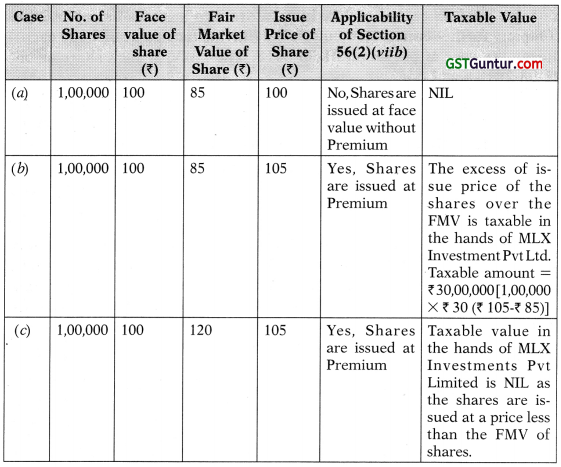

MLX Investments (P) Ltd. was incorporated during P.Y. 2016-17 having a paid up capital of ₹ 10 lacs. In order to increase its capital, the company further issues, 1,00,000 shares (having face value of ₹ 100 each) during the year at par as on 01-08-2018. The FMV of such share as on 01-08-2018 was ₹ 85.

a. Determine the tax implications of the above transaction in the hands of company, assuming it is the only transaction made during the year.

b. Will your answer change, if shares were issued at ₹ 105 each?

c. What will be your answer, if shares were issued at ₹ 105 and FMV of the share was ₹ 120 as on 01-08-2018? [Nov. 2019, 4 Marks]

Answer:

The provisions of section 56(2)(viib) would be attracted, where consideration is received from a resident person by a company, other than a company in which public are substantially interested, in excess of the face value of shares ie., where shares are issued at a premium. In such a case, the difference between the consideration received and the fair market value would be chargeable to tax under the head “Income from Other Sources”.

(a) In this case, since MLX Investments (P) Ltd., a closely held com-pany issued 1,00,000 shares (having face value of ₹ 100 each) at par Le., ₹ 100 each, though issue price is greater than FMV, no amount would be chargeable to tax as income from other sources.

(b) In this case, since shares are issued at a premium, the amount by which the issue price of ₹ 105 each exceeds the FMV of ₹ 85 each would be chargeable to tax under the head “Income from other sources”. Hence, ₹ 20 lakh, being ₹ 20 {ie., ₹ 105 – ₹ 85) × 1,00,000 shares, would be chargeable under section 56(2)(vzz’h).

(c) If shares are issued at ₹ 105 each and FMV of share is ₹ 120 each, no amount would be chargeable to tax even though the shares were issued at a premium, since shares are issued at a price which is less than the fair market value.

Answer:

Question 30.

Write short note on capital gains on buyback of shares

Answer:

Capital gains on buyback of shares section 46A

- If any company has purchase its own shares or other securities, it is known as buyback of shares.

- Any consideration received by a shareholder or a holder of any se-curities specified from any company or purchase of its own shares or other specified securities held by such holder or holder of other specified security shall be chargeable to tax.

- The amount of capital gain will be the difference between the cost of acquisition and the consideration received by the holder of the securities.

- The computation will be done according to the section 48 and such capital gain is chargeable in the year in which securities are purchased by the company for this purpose.

![]()

Question 31.

What is the cost of acquisition of sweat equity shares in the hands of the employee

Answer:

| Section | Explanations |

| Section

49AA |

If capital gain arises on transfer of specified securities or Sweat equity which has already been taxed under the head salary. In that case the cost of acquisition of such securities will be the fair market value which has been taken into consideration for the purpose of valuation of perquisites. |

Question 32.

Where and urban agricultural land owned by an individual continuously used by him for agricultural purpose for a period of 2 years prior to the date of transfer is compulsorily acquired under law and compensation is fixed by the state government is the resultant capital gain chargeable to tax.

Answer:

Section 10(37):

If any compensation received on compulsory acquisition of agricultural land situated within specified urban limit. Capital gain whether short term or long term to an individual or Hindu undivided family on transfer of such agricultural land or enhance compensation is received on or after 01.04.2004 shall be exempt.

Conditions are

- The assessee is an individual or Hindu undivided family.

- Land is urban agricultural land section 2(14)(iii)(a)(b).

- Compulsory acquisition under any law.

- Agriculture land was used for agricultural purposes during two years immediately prior to the date of transfer by such individual or parents of his or by Hindu undivided family.

- Compulsory acquisition has taken place on or after 01.04.2004.

- If compulsory acquisition has taken place before 01.04.2004 but com-pensation was received after 31.03.2004, it will be exempt.

- If part of additional compensation in such case has already been re-ceived before 01.04.2004, exemption shall not be available even though balance original compensation is received after 01.04.2004.

- Enhanced compensation received on or after 01.04.2004 against agricultural land compulsory acquisition before 01.04.2004 shall be exempt.

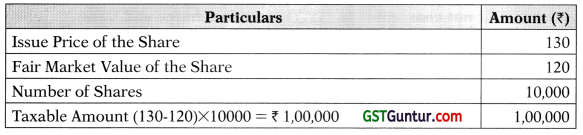

Question 33.

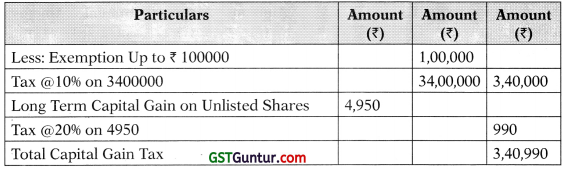

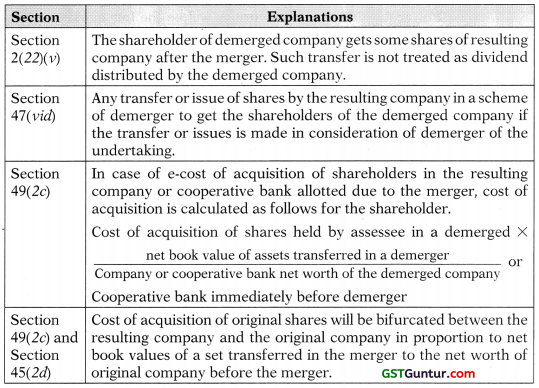

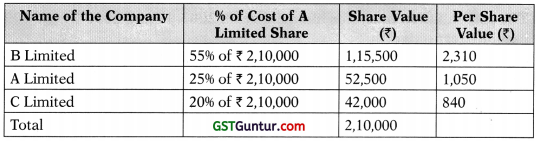

Discuss the tax issues including cost of acquisition and period of holding, determine in the hands of the shareholder after demerger covering deemed dividend and capital gains.

Answer:

Example:

| Case | A Limited has been the merged and Shareholders will receive shares in new resulting Company A Limited, B Limited, C Limited, the existing shareholders of A Limited will get one share each in resulting company for every share they held in A Limited after the merger. A Limited name will be changed to B Limited and B Limited name will be changed to A Limited due to business interchange. New resulting companies are now A Limited, B Limited, C Limited. Dr. Bansal had purchased 50 shares in A Limited @ ₹ 4200 on 06.01.2017. |

| Tax implications | 1. To find out the period of acquisition whether long term or short term the holding period of original shares of A Limited will be considered for the calculation of period of holding of new shares.

2. Indexation will start from the date of allotment of new shares and not from the date of acquisition of the originals shares of A Limited. To find out capital gain amount indexation is important if same is to be set off against capital loss. 3. Cost of acquisition of various shares after the demerger – when shares are sold and to calculate capital gain cost of acquisition is calculated on the basis of proportion of net worth of a limited and book value of the business transfer to arrive at new cost of acquisition |

Table showing the proportion in which original cost of acquisition of a limited will be apportioned to new shares

Since Dr. Bansal had purchased 50 shares in A Limited @ ₹ 4200 on 06.01.2017. Hence Cost of Acquisition is ₹ 2,10,000

Post-Merger his New Cost

![]()

Question 34.

Can Mr Ajit who has long term Capital Asset from sale of vacant site in India by a residential house outside India to claim exemption under section 54F question mark assume that he has no residential property in India?

Answer:

Mr. Ajit is not entitled to get exemption under section 54F as he has purchase the residential house outside India. Provisions of section 54F as follows:

- Transfer of any long term Capital Asset other than residential house.

- Assessee can be Individual or Hindu undivided family.

- Assessee can purchase residential house one year before or two year after or a construct residential house within a period of three years from the date of transfer.

- He does not have more than one house in his name at the time of transfer of assets.

- Exemption will be proportionately of amount invested in new resi-dential house and net consideration.

- The new residential house purchase or constructed should not be transferred within three years otherwise the examination earlier allowed shall be considered as Long term capital gain

- Amount can also be deposited in Capital Gain Account Scheme, 1988.

Question 35.

Sindia furnishes the following particulars for the previous year 2020-21.

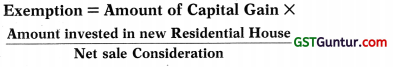

Plot of land was sold on 19.07.2020 for ₹ 35,00,000. He paid brokerage on its sales at 1%. He had purchased this plot on 20.12.2003 for ₹ 4,20,000. On 01.02.2021, he had purchased a residential house for ₹ 18,00,000. He e owns another residential house purchase on 08.07.2016.

The cost inflation index for financial years 2003-04 and 2020-21 are 109 and 301 respectively.

- Find out the amount of capital gain chargeable to Income Tax.

- Suppose Sindia sells the new residential house on 01.01.2023, what will be the taxable amount of capital gains and in which year it will be charged to tax?

- If he purchase any other residential house on 01.06.2022, what will be taxable amount of capital gain and in which year it will be charged to tax? Is the same short term or long term in nature. [CMA June 2011, 6 Marks]

Answer:

Computation of Capital Gain of Mr. Rajan Assessment Year 2021-22

| Section | Provision | Case Answer |

| Section 54F | New Residential House cannot be sold within 3 years from the date of acquisition. The time will expire on 01.02.2024. | If Mr. Sindia sells the new residential house on 01.01.2023 then capital gain exempt earlier ₹ 11,97,498 under section 54F shall be treated as Long Term Capital Gain of the previous year in which the new asset is transferred and capital gain or loss on transfer of new house which will always be short term capital gain or loss. |

| Section | Provision | Case Answer |

| Section 54F | If the assessee should not purchase, within a period of two years after the date of transfer of original asset or construct within a period of three years after the date of transfer of original asset, any other residential house other than the new asset. | Hence Mr. Sindia if purchases any new residential house within two years of sale of original house then exemption will be withdrawn and amount exempted earlier will be taxable as Long Term Capital Gain in assessment year 2023-24. |

Question 36.

State the conditions to be satisfied that when a sole proprietor concern is succeeded by a company to avail tax exemption in respect of capital gains. [CMA June 2015, 4 Marks]

Answer:

| Section | Explanations |

| Section 47 | On conversion of sole proprietorship concern or form into a company transfer of an asset is not regarded as transfer. |

| Section 49 | For the purpose of computation of capital gain the cost of acquisition of a set in the hands of the successor is taken as that of predecessor. |

| Conditions | The Capital Asset transferred is not treated as transfer for hands no question of capital gain but following conditions must be satisfied

|

![]()

Question 37.

Are the profits arising from the sale of agricultural land situated in a village 10 kilometers from Visakhapatnam Corporation limits and another situated in city limits of Visakhapatnam liable to Income Tax? [CMA June 2015, 3 Marks]

Answer:

In this case when agricultural land is situated within the city limit it is a Capital Asset and will arise capital gain which attracts capital gain tax. But in the case of an agricultural land situated beyond limit then it is not a Capital Asset Section 2(14). According to this section agricultural land in India not being land situate:

- In any area which is comprised within the jurisdiction of a municipality or buy any name or a Cantonment Board and which has a population of not less than 10,000

- In any area within the distance measured aerially:

- not being more than two kilometers from the local limits of any municipality or Cantonment Board referred in above a and which has a population of more than 10,000 but not exceeding one lakh.

- not being more than 6 kilometers from the local limits of any municipality or Cantonment Board referred in above a and which has a population of more than 1 lakh but not exceeding 10 lacs.

- not be more than 8 kilometers from the local limits of any municipality or Cantonment Board referred in above a and which has a population of more than 10 lacs.