Set-off and Carry Forward of Losses – CA Inter Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Set-off and Carry Forward of Losses – CA Inter Taxation Study Material

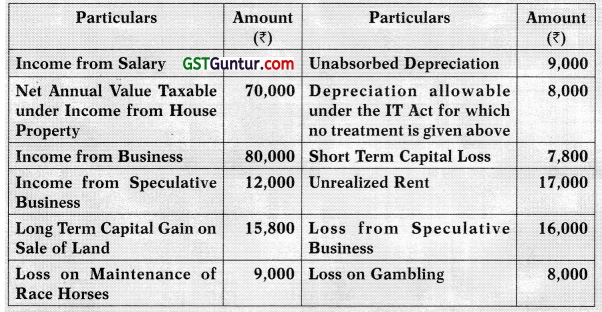

Question 1.

Mr. P a resident individual, furnishes the following particulars of his income and other details for the previous year 2020-21 :

- Income from salary ₹ 18,000

- Net annual value taxable under income from house property ₹70,000

- Income from business ₹ 80,000

- Income from speculative business ₹ 12,000

- Long term capital gain on sale of land ₹ 15,800

- Loss on maintenance of race horses ₹ 9.000

- Loss on gambling ₹ 8,000

Depreciation allowable under the Income-tax Act comes to ₹ 8,000 for which no treatment is given above.

The other details of unabsorbed depreciation and brought forward losses are:

- Unabsorbed depreciation ₹ 9,000

- Loss from speculative business ₹ 16,000

- Short term capital loss ₹ 7,800

- Unrealized rent ₹ 17,000

Compute the gross total income of Mr. P for the Assessment year 2021-22 and amount of loss that can or cannot be carried forward. [Nov. 2008, 6 Marks]

Answer:

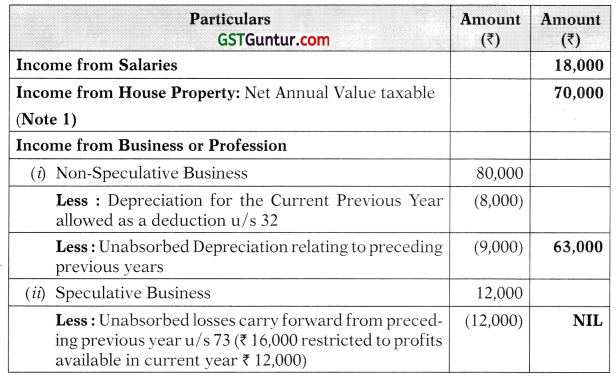

Computation of Gross Total Income of Mr. P for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Income from salary | 18,000 | |

| Income from House Property | 70,000 | |

| Income from Business or Profession | ||

| ♦ Non-Speculative Business | 80,000 | |

| Less: Depreciation for the Current Previous Year allowed as a deduction u/s 32 | (8,000) | |

| Less: Unabsorbed Depreciation relating to preceding previous years | (9,000) | 63,000 |

| ♦ Speculative Business | 12,000 | |

| Less: Unabsorbed losses carry forward from preceding previous years u/s 73 16,000 restricted to profits available in Current year ₹ 12000) | (12,000) | NIL |

| Capital Gains | ||

| Long Term Capital Gain on Sale of Land | 15,800 | |

| Less: Brought Forward Short Term Capital Loss of the preceding previous year u/s 74 | (7,800) | 8,000 |

| Gross Total Income | 1,59,000 |

Notes:

- It is given in questions Net Annual Value taxable under income from house property.

- Loss from Maintenance of Race Horses shall be carry forward for four subsequent assessment year u/s 74A and it can be set – off only against the Income from these activity.

- Loss from Gambling is not eligible for carry forward.

- First current year loss have been set off against income under the same head.

![]()

Question 2.

Mr. Rajat submits the following information for the financial year ending 3 1.03.2021. He desires that you should:

- Compute the total Income and

- Ascertain the amount of losses that can be carried forward.

(a) He has two houses:

- House No. I – Income after all statutory deductions ₹ 72,000

- House No. II – Current year loss ₹ 30,000

(b) He has three proprietary businesses:

- Textile Business:

- Discontinued from 31.10.2020 – Current year loss ₹ 40,000

- Brought forward business loss of the assessment year 2017-2018 ₹ 95,000

- Chemical Business:

- Discontinued from 01.03.2019 – hence no profit/Loss ₹ NIL

- Bad debts allowed in earlier years recovered during this year ₹ 35,000

- Brought forward business loss of the assessment year 2019-2020 ₹ 50,000

- Leather Business: Profit for the current year ₹ 1,00,000

- Share of Profit in a firm in which he is Partner since 2012 ₹ 16,550

(c)

- Short-term Capital Gain ₹ 60,000

- Long-term Capital Loss ₹ 35,000

(d) Contribution to LIC towards Premium ₹ 10,000 [Nov. 2009, 10 Marks]

Answer:

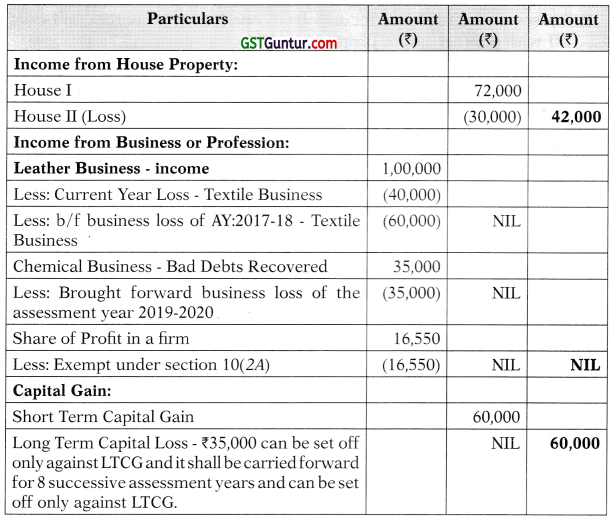

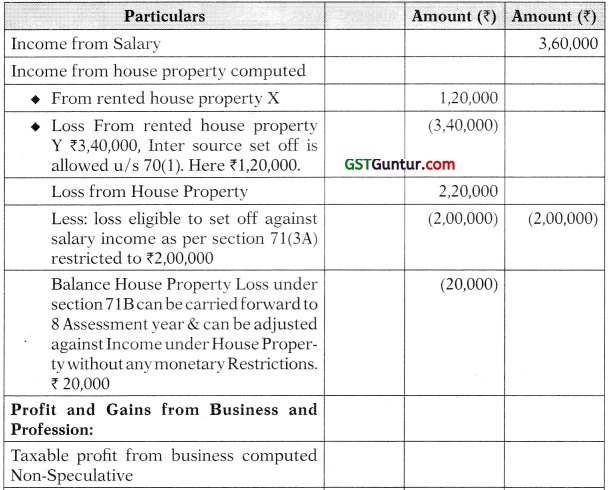

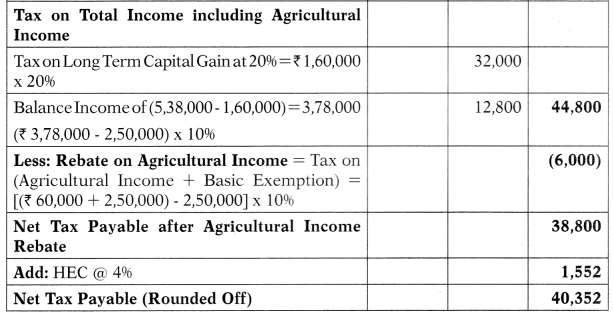

Computation of Total Income of Mr. Rajat for the Assessment Year 2021-22

![]()

Computation of Carried Forward Losses

| Particulars | Amount (₹) |

| Textile Business loss of AY 2017-18 can be C/f up to Assessment Year 2025-26 (95,000 – 60,000) | 35,000 |

| Chemical Business Loss of the assessment year 2019-2020 of ?50,000 – 35,000 can be c/f up to AY 2027-28 | 15,000 |

| Long Term Capital Losses can be c/f up to AY 2029-30 | 35,000 |

| Total of Losses | 85,000 |

Notes:

- Losses under the head Income from one house property can be set S off with another house property u/s 70.

- As per section 41(5), the unabsorbed business loss pertaining to the year in which the business was discontinued is permitted to be set off against deemed business income u/s 41.

- Long term capital loss can be set off only against Long Term Capital Gain and it can be carried forward for 8 assessment years and set off only against Long Term Capital Gain.

- Brought forward business loss can be set off only against profit and gains from business and profession head.

![]()

Question 3.

The following are the details relating to Mr. Srivatsan, a resident Indian, aged 57, relating to the year ended 31-3-2020.

| Particulars | Amount (₹) |

| Income from salaries | |

| Loss from house property | 2,10,000 |

| Loss from cloth business | 2,40,000 |

| Income from speculation business | 30,000 |

| Loss from specified business covered by section 35AD | 20,000 |

| Long-term capital gains from sale of urban land | 2,50,000 |

| Long-term capital loss from sale of listed shares in recognized stock exchange (STT paid) | 1,10,000 |

| Loss from card games | 32,000 |

| Income from betting | 45,000 |

| Life Insurance Premium paid | 1,20,000 |

Compute the total income and show the items eligible for carry forward. [May. 2011, 8 Marks]

Answer:

Computation of Gross Total Income of Mr. Srivatsan for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Income from Salaries | 2,20,000 | |

| Income from House Property | (2,00,000) | |

| Income from Business and Profession: | ||

| ♦ Speculative Business | 30,000 | |

| Less: Loss from Cloth Business set- off to the extent of profits available | (30,000) | NIL |

| Capital Gain: | ||

| ♦ LTCG on Sale of Urban Land | 2,50,000 | |

| Less: Cloth Business Loss (2,40,000 – 30,000) – 2,10,000 | 2,10,000 | 40,000 |

| Income from Other Sources: | ||

| Income from Betting | 45,000 | 45,000 |

| Gross Total Income | 1,05,000 | |

| Less: Deductions under Chapter VIA | ||

| Section 80C – LIP paid the extent of GTI (excluding LTCG) (1,15,000-40,000) = 75,000 ‘ | (75,000) | |

| Total Income | 30,000 |

Notes:

- Loss of House Property can be set off with any other head of Income subject to restricted to ₹ 2,00,000. The remaining ₹ 10,000 can be carried forward and set off in the subsequent assessment year.

- As per section 73A the loss from specified business u/s 35AD can be set off only against the similar business income and can be carried forward until it is 100°o set off.

- Gain under the head Capital Gain on sale of listed securities on which STT is paid is fully exempt. Hence any loss arising from such sale of listed securities cannot be set off.

![]()

Question 4.

Mr. Mohit submits the following information for the financial year ending 31.03.2021. He desires that you should:

(i) Compute the total Income and

(ii) Ascertain the amount of losses that can be carried forward.

He has two houses:

House No. I-Income after all statutory deductions ₹ 90,000

House No. II-Current year loss ₹ 35,000

He has three proprietary businesses:

- Textile Business: – Discontinued from 30.09.2020

a. Current year loss ₹ 45,000

b. Brought forward business loss of the assessment year 2017-2018 ₹ 1,05,000 - Chemical Business: Since Discontinued: NIL

(a) Bad debts allowed in earlier years recovered during this year ₹ 48,000

(b) Brought forward business loss of the assessment year 2019-2020 ₹ 66,000 - Leather Business: Profit for the current year ₹ 1,10,000

- Share of Profit in a firm in which he is Partner since 2007 ₹ 99,000

- Capital Gain

(a) Short-term Capital Gain ₹ 86,000

(b) Long-term Capital Loss ₹ 44,000

Contribution to LIC towards Premium ₹ 8,000 [May 2013, 8 Marks]

Answer:

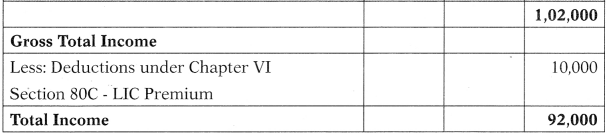

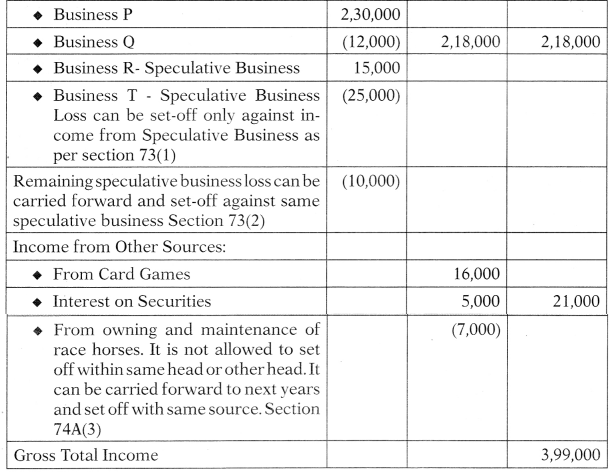

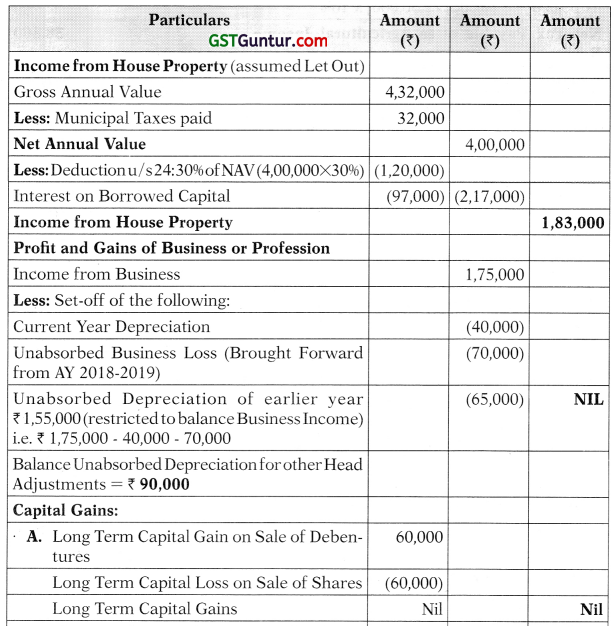

Computation of Total Income of Mr. Mohit for the Assessment Year 2021-22

Computation of Carried Forward Losses

| Particulars | Amount (₹) |

| Textile Business loss of AY 2017-18 can be c/f up to Assessment Year 2025-26 (1,05,000 – 65,000) | 40,000 |

| Chemical Business Loss of the assessment year 2019-2020 of ₹ 66,000 – 48,000 can be c/f up to AY 2027-28 | 18,000 |

| Long Term Capital Losses can be c/f up to AY 2029-30 | 44,000 |

| Total of Losses | 1,02,000 |

Notes:

- Losses under the head Income from one house property can be set off with another house property u/s 70.

- As per section 41(5), the unabsorbed business loss pertaining to the year in which the business was discontinued is permitted to be set off against deemed business income u/s 41.

- Long term capital loss can be set off only against Long Term Capital Gain and it can be carried forward for 8 assessment years and set off only against Long Term Capital Gain.

- Brought forward business loss can be set off only against profit and gains from business and profession head

![]()

Question 5.

Mr. Garg, a resident individual, furnishes the following particulars of his income and other details for the previous year 2020-21.

- Income from Salary ₹ 15,000

- Income from Business (before providing depreciation) ₹ 66,000

- Long term capital gain on sale of Land ₹ 10,800

- Loss on maintenance of Race Horses ₹ 15,000

Loss from Gambling ₹ 9,100

The other details of unabsorbed depreciation and brought forward losses pertaining to Assessment Year 2020-21 are as follows:

- Unabsorbed depreciation ₹ 11,000

- Loss from Speculative business ₹ 22,000

Short term capital loss ₹ 9,800

Compute the Gross total income of Mr. Garg for the Assessment Year 2021-22 and the amount of loss, if any, that can be carried forward or not. [May 2014, 4 Marks]

Answer:

Computation of Gross Total Income of Mr. Garg for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Income from Salaries: | 15,000 | |

| Income from Business and Profession: | ||

| ♦ Non Speculative Business Gain | 66,000 | |

| Less: Unabsorbed Depreciation relating to preceding previous year | (11,000) | 55,000 |

| Capital Gain: | ||

| ♦ Long Term Capital Gain on Sale of Land | 10,800 | |

| Less: b/f Short term Capital Loss of the previous year u/s 74 | (9,800) | 1,000 |

| Gross Total Income | 71,000 |

Statement of Carry Forward of Losses:

| S. No. | Particulars | Amount (₹) |

| 1 | Carry forward of Speculative Business loss can be adjusted only against the Speculative Income. | 22,000 |

| 2 | Carry forward of loss on maintenance of race horses | 15,000 |

Notes:

| S. No. | Particulars |

| 1 | Speculative Business loss can be carry forward up to next 4 assessment years from the assessment year in which the loss was incurred. It can be adjusted only against Income from speculative business. It cannot be carried forward if the return is not hied within the original due date. It is not necessary to continue the business at the time of set off in future years. |

| 2 | Capital Loss can be carry forward up to next 8 assessment years from the assessment year in which the loss was incurred. Long-term capital losses can be adjusted only against long-term capital gains. Short-term capital losses can be set off against long-term capital gains as well as short-term capital gains. Capital Loss cannot be carried forward if the return is not filed within the original due date. |

| 3 | Losses from owning and maintaining race-horses can be carry forward up to next 4 assessment years from the assessment year in which the loss was incurred. It cannot be carried forward if the return is not hied within the original due date. It can only be set off against income from owning and maintaining race-horses only. |

| 4 | Loss from Gambling shall not be eligible for carry forward. |

![]()

Question 6.

Mr. Shyam a resident of Chandigarh, provides the following information for the financial year 2020-21:

Particulars :

| Particulars | Amount (₹) |

| Income from Textile business | 4,60,000 |

| Income from speculation business | 25,000 |

| Loss from gambling | 12,000 |

| Loss on maintenance of racehorse | 15,000 |

| Eligible current year depreciation of textile business not adjusted in the income given above | 5,000 |

| Unabsorbed depreciation of Assessment year 2020-21 brought forward | 10,000 |

| Speculation business loss of Assessment year 2020-21 | 30,000 |

Compute the Gross Total Income of Mr. Shyam for the Assessment year 2021-22 and any other item of expense or loss eligible for carry forward. [May, 2017, 4 Marks]

Answer:

Computation of Gross Total Income of Mr. Shyam for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Income from Business and Profession: | ||

| ♦ Non-Speculative Business Gain | ||

| 1. Textile Business | 4,60,000 | |

| Less: Current year Depreciation | (5,000) | |

| 4,55,000 | ||

| Less: Unabsorbed Depreciation of AY 202021 | (10,000) | 4,45,000 |

| ♦ Speculative Business Gain | 25,000 | |

| Less: Brought Forward Speculative Loss restricted to speculative Income | (25,000) | NIL |

| Gross Total Income | 4,45,000 |

Notes:

| S. No. | Particulars |

| 1 | Speculative Business loss can be carry forward up to next 4 assessment years from the assessment year in which the loss was incurred. It can be adjusted only against Income from speculative business. It cannot be carried forward if the return is not hied within the original due date. It is not necessary to continue the business at the time of set off in future years. |

| 2 | Capital Loss can be carry forward up to next 8 assessment years from the assessment year in which the loss was incurred. Long-term capital losses can be adjusted only against long-term capital gains. Short-term capital losses can be set off against long-term capital gains as well as short-term capital gains. Capital Loss cannot be carried forward if the return is not filed within the original due date. |

| 3 | Losses from owning and maintaining race-horses can be carry forward up to next 4 assessment years from the assessment year in which the loss was incurred. It cannot be carried forward if the return is not hied within the original due date. It can only be set off against income from owning and maintaining race-horses only. |

| 4 | Loss from Gambling shall not be eligible for carry forward. |

![]()

Question 7.

Ms. Geeta is a resident individual, provides the following details of her income losses for the year ended 31.03.2021 :

- Salary received as a partner from a partnership firm ₹ 7,50,000.

- Loss on sale of shares listed in BSE ₹ 3,00,000. Shares were held for 15 months and STT paid on sale.

- Long-term capital gain on sale of land ₹ 5,00,000.

- ₹ 51,000 received in cash from friends in party.

- ₹ 5 5,000 received towards dividend on listed equity shares of domestic companies.

- Brought forward business loss of assessment year 2017-18 ₹ 12,50,000.

The return for assessment year 2017-18 was filed in time.

Compute gross total income of Ms. Geeta for the assessment year 2021-22 and ascertain the amount of loss that can be carried forward. [May 2009, 8 Marks]

Answer:

Computation of Gross Total Income of Ms. Geeta for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Income from Business and Profession: | ||

| Salary received as a partner from a Partnership firm | 7,50,000 | |

| 2. Less: brought forward business loss of assessment year 2017-18 ₹ 12,50,000 subjectto ₹ 7,50,000. Remaining ₹ 5,00,000 can be carry forward to next 8 assessment years 2025-26 | 7,50,000 | NIL |

| Capital Gain: | ||

| Long term Capital Gain on sale of land | 5,00,000 | |

| Less: Long term capital loss in excess of ₹ 1,00,000 set off (₹ 3,00,000 – 1,00,000) | 2,00,000 | 3,00,000 |

| Income from Other Sources: | ||

| Gift from friend in party in cash | 51,000 | |

| Dividend from an Indian Company | 55,000 | 1,06,000 |

| Gross Total Income | 4,06,000 |

Note: Remaining ₹ 5,00,000 brought forward business loss can be carry forward to next 8 assessment year 2025-26.

![]()

Question 8.

Mr. Sohan submits the following details of his income for the assessment year 2021-22.

Income from salary ₹ 3,00,000

Loss from let out house property ₹ 40,000

Income from sugar business ₹ 50,000

Loss from iron ore business (discontinued in 2014-15) b/f ₹ 1,20,000

Short term capital loss ₹ 60,000

Long term capital gain ₹ 40,000

Dividend ₹ 5,000

Income received from lottery winning (Gross) ₹ 50,000

Winning In card games ₹ 6,000

Agricultural income ₹ 20,000

Long term capital gain from shares (STT paid) ₹ 10,000

Short term capital loss under section lilA ₹ 10,000

Bank interest ₹ 5,000

Calculate gross total income and losses to be carried forward. [Nov. 2010, 5 Marks]

Answer:

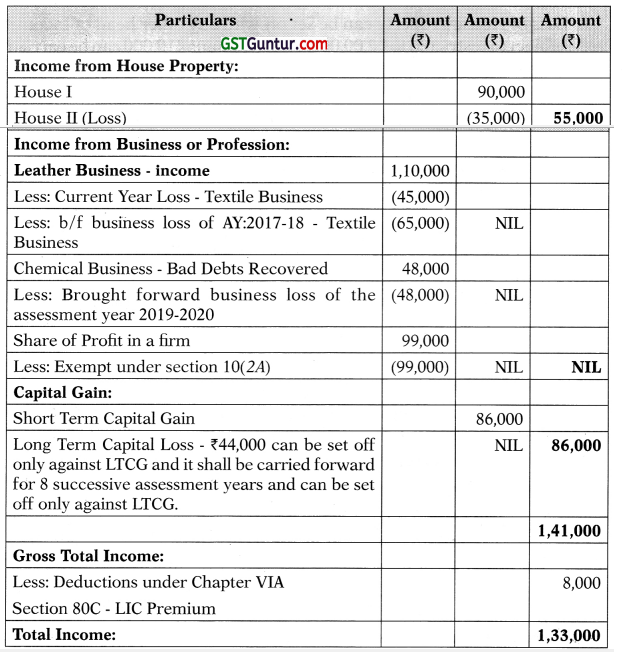

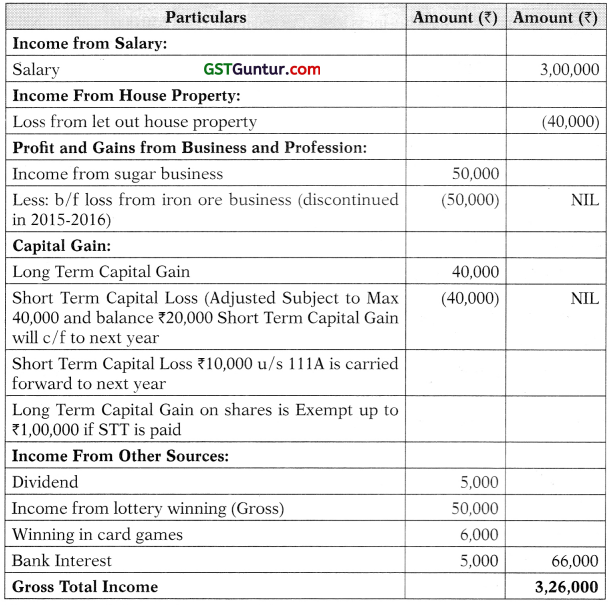

Computation of Gross Total Income of Ms. Sohan for the Assessment Year 2021-22

Statement of Carry Forward of Losses:

| S. No. | Particulars | Amount (₹) |

| 1 | b/f loss from iron ore business (discontinued in 2015-2016) remaining amount of ₹ 1,20,000 – 50,000 = 70,000 carried forward | 70,000 |

| 2 | Short term capital loss is carry forward to extent of ₹ 60,000 – ₹ 40,000 = ₹ 20,000 | 20,000 |

| 3 | Short term capital loss u/s 111 is to be carried forward ₹ 10,000 | 10,000 |

![]()

Question 9.

Mr. Aditya furnishes the following details for the year ended 31 -03-2021:

Loss from speculative business A ₹ 25.000

Income from speculative business B ₹ 5,000

Loss from specified business covered under section 35AD ₹ 20,000

Income from Salary ₹ 2,50,000

Loss from House Property ₹ 1,50,000

Income from trading business ₹ 45,000

Long-term Capital Gain from sale of urban land ₹ 2,00,000

Long-term Capital Loss on sale of shares (STT not paid) ₹ 75,000

Long-term Capital Loss on sale of listed shares in recognized stock exchange (STT Paid) ₹ 82,000

Following are the brought forward losses:

- Losses from owning and maintaining of race horses pertaining to A.Y. 2020-21 ₹ 2,000.

- Brought forward loss from trading business ₹ 5,000 relating to A.Y. 2017-18.

Compute the total income of Mr. Aditya and show the items eligible for carry forward. [May 2016, 8 Marks]

Answer:

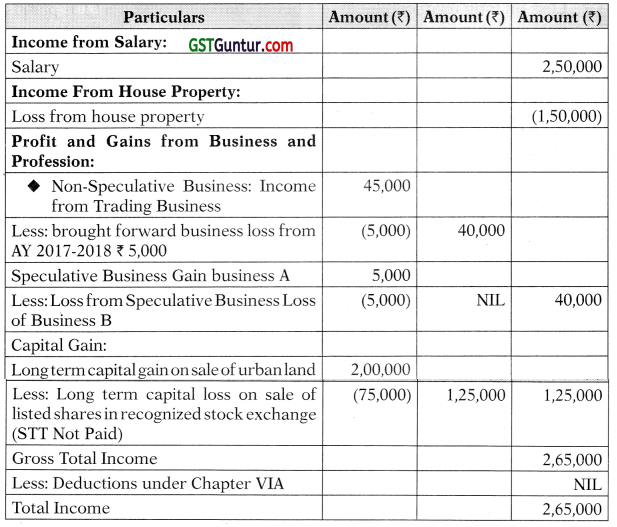

Computation of Total Income of Mr. Aditya for the Assessment Year 2021-22

Statement of Carry Forward of Losses:

| S. No. | Particulars | Amount (₹) |

| 1 | Loss from owning Race horses pertaining to AY 2020-21 can be carried forward till 2024-25 ie. maximum period of 4 assessment years. | 2,000 |

| 2 | Loss from Speculative Business B (₹25,000 – 5,000) ₹ 20,000 c/f for four assessment years and can be set off only against Income from Speculative Business | 20,000 |

| 3 | Loss from specified Business u/s 35AD can be carried forward for any number of years and can be set off against specified business income | 20,000 |

Notes:

- The loss arising from the activity of owning and maintaining from racehorses can be carried forward for a maximum period of 4 assessment years.

- Loss on long term capital assets being shares on which STT is paid is not available for set off up to ₹ 1,00,000.

![]()

Question 10.

Mr. Prakash furnishes you the following details in respect of the Financial Year 2020-21.

1. Loss from the business carried on by him as proprietor ₹ 11 ,20,000(*)

2. Deduction u/s 80-IB ₹ 5,50,000 (*)

3. Unabsorbed Depreciation ₹ 4,80,000 (*)

4. Loss from House property ₹ 2,50,000 (*)

(*) Computed as per the Income-tax Act, 1961.

The due date for filing the return for Mr. Prakash was 31st July, 2021 under section 139(1). However, he filed the return on 29.9.2021. Discuss with reference to the relevant provisions of Income-tax Act, 1961 if the losses and deductions could be carried forward/claimed by Mr. Prakash. [Nov. 2017, 5 Marks]

Answer:

| Section | Provision | Case |

| 139(1) | Filing of return within due date required. | Return filed after due date and hence it is belated return under section 139(4). Loss of₹ 11,20,000 and deduction u/s 80-IB cannot be claimed. |

| 80 read with 139(3) | Specified losses cannot be c/f to next year due to non-filing of return in time | Hence not carried forwarded specified losses. |

| 71B and 32(2) | It does not include loss from house property and unabsorbed depreciation | Hence allowed to c/f ₹ 2,50,000 and ₹ 4,80,000 |

![]()

Question 11.

Mr. Rakesh Gupta has derived the following income/loss, as com-puted below, for the previous year 2020-21:

- Loss from let out house property ₹ 2,50,000

- Loss from non-speculation business ₹3,20,000

- Income from speculation business ₹ 12,45,000

- Loss from specified business covered u/s 35AD ₹ 4,10,000

- Winnings from lotteries (Gross) ₹ 1,50,000

- Winnings from beatings ₹ 90,000

- Loss from card games ₹ 3,40,000

You are required to compute the total income of the assessee for the assessment year 2021-22 showing clearly the manner of set-off and the items eligible for carry forward the return of income has been failed on 30.07.2020. [Nov. 2018, 5 Marks]

Answer:

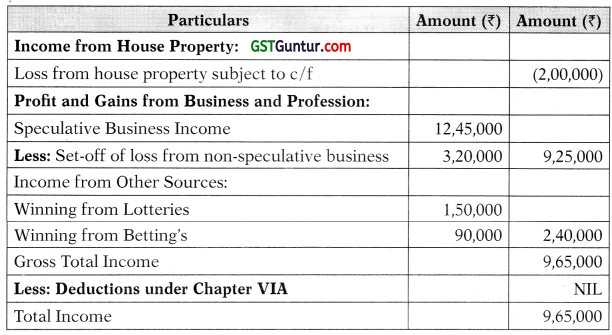

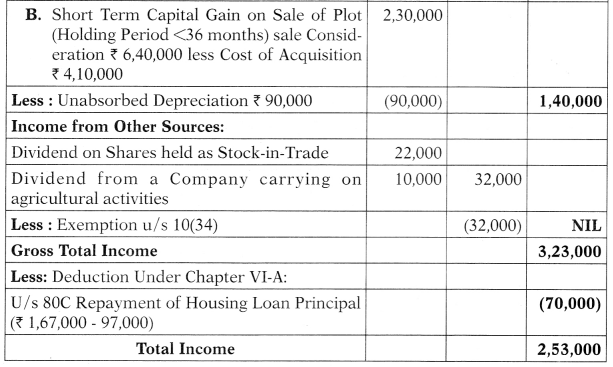

Computation of Total Income of Mr. Rakesh Gupta for the Assessment Year 2021-22

Statement of Carry Forward of Losses:

| S. No. | Particulars | Amount (₹) |

| 1 | Loss from House Property (₹ 2,50,000 – ₹ 2,00,000) = 50,000 as per Section 71(3 A), loss can be set-off subject to ₹ 2,00,000 and as per section 71 (BA), balance loss can be carried forward and set off from house property. | 50,000 |

| 2 | Loss from business specified under section 35AD cannot be set-off against any other income except income from specified business. It can be carried forward to the subsequent years and set-off against income from specified business. | 4,10,000 |

| 3 | Loss from Card Games can neither be set-off nor carried forward ₹ 3,40,000 | NIL |

![]()

Question 12.

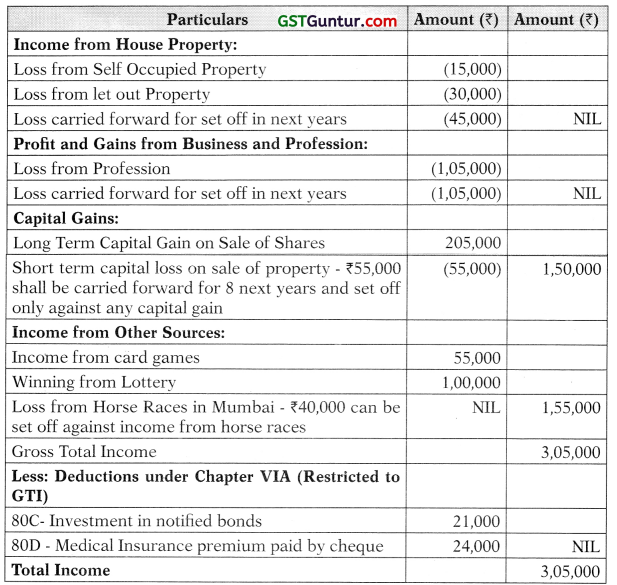

Following are the details of incomes/Losses of Mr. Rishi for the financial year 2020-21.

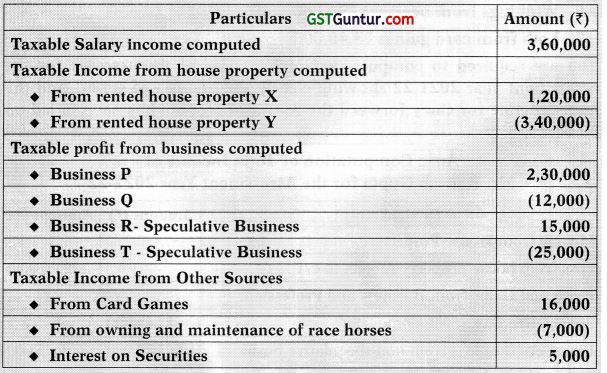

You are required to compute gross total Income of Mr. Rishi. [Nov. 2019, 2 Marks]

Answer:

Computation of Gross Total Income of Mr. Rishi for the Assessment Year 2021-22

![]()

Question 13.

Mr. Rakesh an assessee aged 61 years gives the following information for the previous year 31.03.2021.

| S. No. | Particulars | Amount (₹) |

| 1 | Loss from Profession | 1,05,000 |

| 2 | Capital Loss on the sale of Property – Short Term | 55,000 |

| 3 | Capital Gain on sale of shares – Long Term | 2,05,000 |

| 4 | Loss in respect of self-occupied property | 15,000 |

| 5 | Loss in respect of let out property | 30,000 |

| 6 | Share of loss from Firm | 1,60,000 |

| 7 | Income from Card Games | 55,000 |

| 8 | Winning from Lottery | 1,00,000 |

| 9 | Loss from Horse Races in Mumbai | 40,000 |

| 10 | Investment in notified bonds | 21,000 |

| 11 | Medical Insurance premium paid by cheque | 24,000 |

Compute the Total Income of Mr. Rakesh for the Assessment year 2021-22. [Nov. 2019, 2 Marks]

Answer:

Computation of Total Income of Mr. Rakesh for the Assessment year 2021-22.

Notes:

- Mr. Rakesh is senior citizen hence deduction u/s 80D is maximum 30,000.

- Since Total Income having only income from Card Games and Lotteries, deduction under Chapter VIA is not available due to section 58(4).

- Share from the Firm is exempt from Tax u/s 10(2A), the share of loss in relations to exempt income is not eligible for set off and carry forward.

![]()

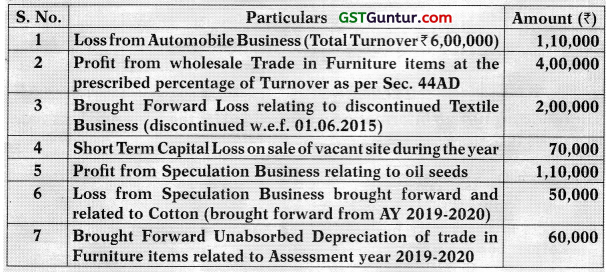

Question 14.

Sandeep engaged in various types of activities gives the following information for the year ended 31.03.2021.

Note: Aggregate Total Business Turnover of Sanjay to be assumed as below limit prescribed u/s 44AB. Compute the Total Income of Sanjay for the Assessment Year 2021-2022. [May 2012, Modified]

Answer:

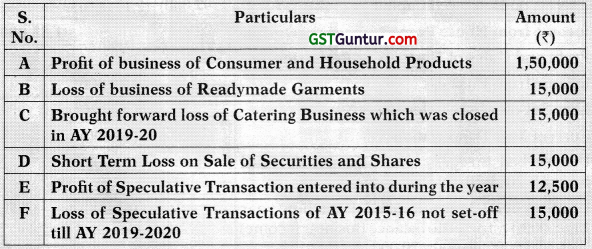

Computation of Gross Total Income of Mr. Sandeep for the assessment year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Income from Business or Profession | ||

| (i) Profit from Wholesale trade in Furniture items | 4,00,000 | |

| Less: Loss from automobile business | (1,10,000) | |

| Less: Short Term Capital Loss on Sale of Vacant Site (See Note) | NIL | |

| Less: Unabsorbed Depreciation relating to Furniture Business (AY 2019-20) | (60,000) | |

| Less : Brought Forward Loss relating to discontinued Textile Business (AY 2016-2017) | (2,00,000) | 30,000 |

| (ii) Profit from Speculative Business | 1,10,000 | |

| Less: Loss from Speculative Business (AY 2019 – 2020) | (50,000) | 60,000 |

| Gross Total Income | 90,000 |

Note:

STCL can be set-off against any Capital Gains but not against Income 1 from Business or Profession

![]()

Question 15.

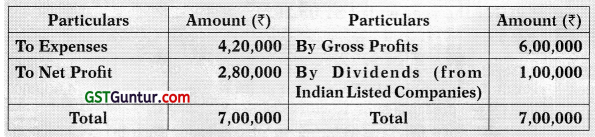

The summarized P&L Account of Sri Raj Kumar Santoshi (from his Grocery Stores) for the Previous Year ended 31.03.2021 is as under:

The following further information was provided for the same previous year:

Raj had other business (Proprietary)

(a) Cloth Trade (Loss) ₹ 42,000

(b) Speculation (Profit) ₹ 30,000

(c) Loss in Proprietary business carried on in the name of Minor Son ₹ 45,000

He had carried forward loss of ₹ 39,000 in Electrical Spares for Assessment Year 2019-2020. The business was closed down. However, the Income Tax return for Assessment Year 2019-2020 was filed in time.

Income of Smt. Raj was ₹ 55,000

Compute the income of Sri Raj Kumar Santoshi for AY 2021 -2022 charge-able under the head Profits and Gains of business.[Nov. 2002, Modified]

Answer:

Computation of Income Sri Raj Kumar Santoshi under the head “Profits and Gains of Business or Profession” for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Profit as per Profit and Loss Account – Grocery Business | 2,80,000 | |

| Less: Income to be considered under the head “Other Sources” – Dividend (Note 1) | (1,00,000) | 1,80,000 |

| Profit from Speculation Business | 30,000 | |

| Loss from Cloth Trade | (42,000) | |

| Loss from Proprietary Business of Minor Son (Note 3) | (45,000) | |

| Income from business | 1,23,000 | |

| Less: Brought forward business loss of Electrical Spares Business (Note 4) | (39,000) | |

| Income under the head Profits and Gains of Business or Profession | 84,000 |

Notes :

- Dividend from Indian/Domestic Companies exempt from tax u/s 10(34).

- Income of Mrs. Raj shall not be considered because provisions of Sec. 64 do not apply in this case.

- U/s 64( 1)(1 A), Income of the Minor Child shall be clubbed in the hands of the parent whose Total Income before such clubbing is greater. Income for the purposes of Sec. 64 includes losses also. Hence loss in business carried on in the name of Minor Son is clubbed in the hands of Mr. Raj.

- Loss of Discontinued Business shall be set-off against Current Year Business Income.

![]()

Question 16.

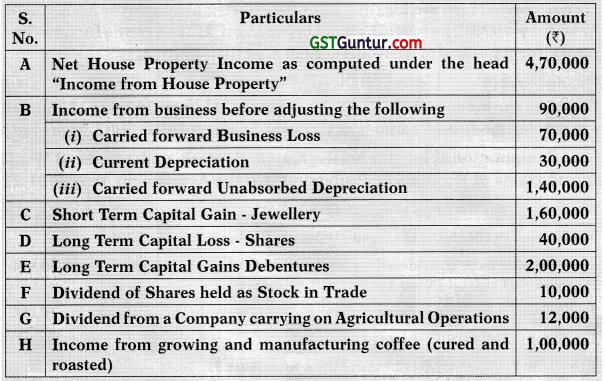

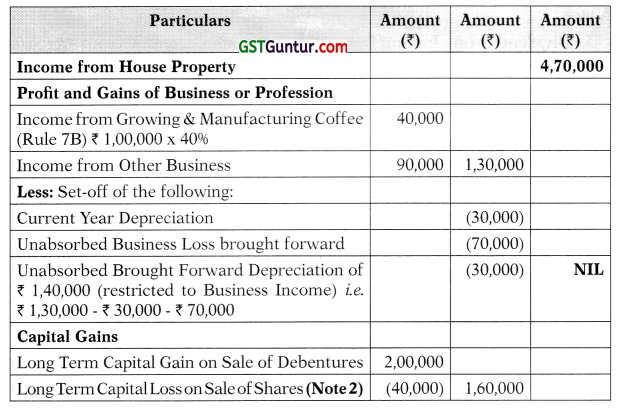

Compute the tax liability of Puneet Kumar for Assessment Year 2021-2022 from the following particulars:

During Previous Year 2020-2021, the Assessee had donated ₹ 35,000 to an approved Local Authority for promotion of Family Planning and Purchased NSC VIII issue for ₹ 50,000. [May 2003, Modified]

Answer:

Computation of Total Income of Mr. Puneet Kumar for the Assessment Year 2021-2022

Notes:

- Balance in Unabsorbed Depreciation has been claimed against Short Term Capital Gain, as it is subject to higher rate of taxation than Long Term Capital Gain and hence is more beneficial to the assessee.

- Shares: Shares are assumed as not listed and not subject to Securities Transaction Tax.

![]()

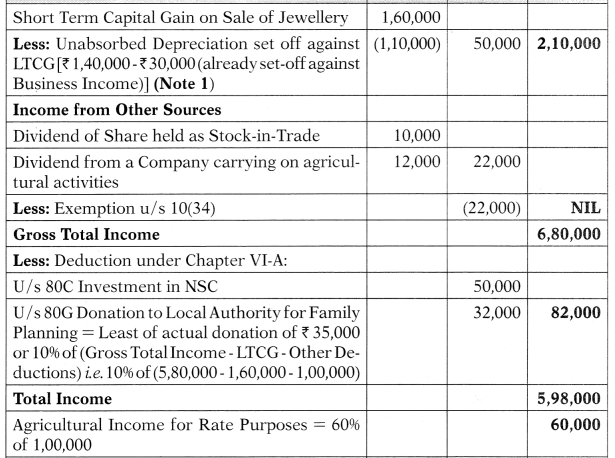

Question 17.

Compute the Total Income of Mr. Krishna for the Assessment Year 2021-2022 from the following particulars:

| Particulars | Amount (₹) |

| Income from Business before adjusting the following items | 1,75,000 |

| (a) Business Loss brought forward from Assessment Year 2018-2019 | 70,000 |

| (b) Current Depreciation | 40,000 |

| (c) Unabsorbed Depreciation of earlier year | 1,55,000 |

| Income from House Property (Gross Annual Value) | 4,32,000 |

| Municipal Taxes paid | 32,000 |

| Mr. Krishan sold a Plot at Noida on 12th September 2019 for a consideration of ₹ 6,40,000, which had been purchased by him on 20th December 2016 at a cost of ₹ 4,10,000. | |

| Long-Term Capital Loss on Sale of Shares sold through Recognized Stock Exchange (STT paid) | 75,000 |

| Long-Term Capital Gain on Sale of Debentures | 60,000 |

| Dividend on Shares held as Stock – in – Trade | 22,000 |

| Dividend from a Company carrying on agri business | 10,000 |

During the previous year 2020-2021, Mr. Krishan has repaid ₹ 1,67,000 towards Housing Loan from a Scheduled Bank. Out of ₹ 1,67,000, ₹ 97,000 was towards Payment of Interest and rest towards Principal Payments. [Nov. 2013, Modified]

Answer:

Computation of Total Income

![]()

Question 18.

Simran, engaged in various types of activities, gives the following particulars of her Income for the year ended 31.03.2021 :

Compute the Total Income of Simran for the Assessment Year 2021-22. [May. 2007, Modified]

Answer:

Computation of Total Income of Simran

| Particulars | Amount (₹) | Amount (₹) |

| Profit and Gains of Business or Profession | ||

| Profit of Consumer Household products business | 1,50,000 | |

| Less: Current year loss of Business of Readymade Garments | (10,000) | |

| 1,40,000 | ||

| Less: Brought forward loss of Catering Business | (15,000) | 1,25,000 |

| Profit on Speculative Transactions | 12,500 | |

| Gross Total Income | 1,37,500 |

Notes:

- Brought forward Loss from Speculative transaction can be carried forward for the purpose of set-off only for 4 Assessment Years and the Speculative Loss for AY 2016-17 elapsed in AY 2019-20 itself.

- Short-Term Capital Loss on Sale of Securities and Shares can be set-off only against Short-Term Capital Gain or Long-Term Capital Gain. The unabsorbed Short-Term Capital Loss can be carried forward for 8 Assessment years immediately succeeding the assessment year for which the loss was computed.

![]()

Question 19.

Ms. Pragati, a Resident Individual, furnishes the following particulars of income and other details for PY 2020-21:

Answer:

Computation of Gross Total Income