Income from House Property – CA Inter Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Income from House Property – CA Inter Taxation Study Material

Introduction

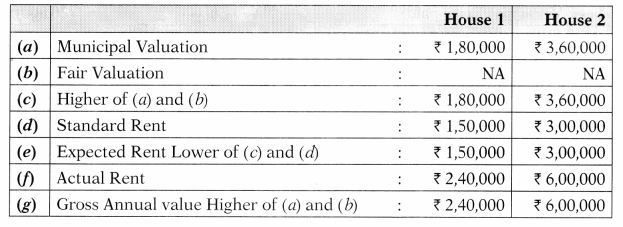

Question 1.

Explain the concept of Municipal Value, Fair Rent and Standard Rent.

Answer:

Municipal Value

It refers to the value that the Municipal Authorities deems as the value of the property for the purpose of assessment of property taxes.

Fair Rent

It is the rent fetched by a similar property, in same or similar locality, with same facilities.

Standard Rent

It is the maximum rent which a person can legally recover from his tenant under Rent Control Act.

![]()

Question 2.

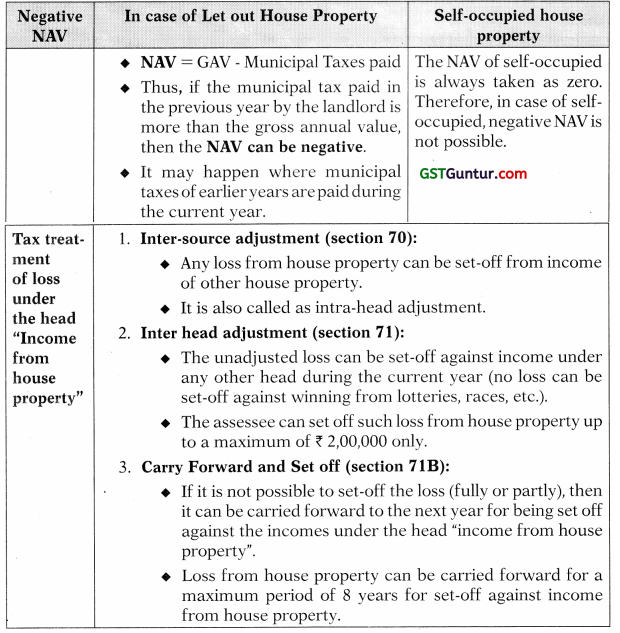

Is it possible for the net annual value of a house property to be negative? What will be tax treatment if income under the head “Income from house property” is negative? [CMA June 2009, 4 Marks]

Answer:

Question 3.

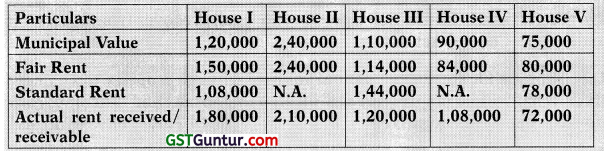

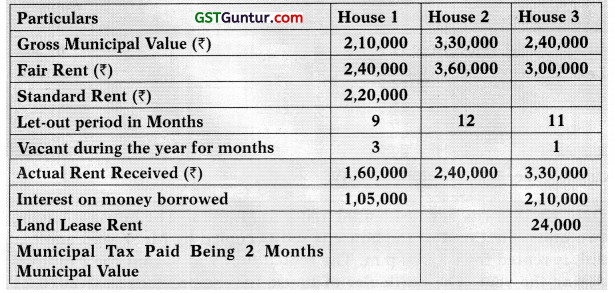

Mr. X owns live houses at Cochin. Compute the Gross Annual Value of each house from the information given below: [May 2012, 5 Marks]

Answer:

![]()

Deductions Under Section 24

Question 4.

Mr. A owns a commercial building let out @ X 40,000 per month. During the financial year 2020-21, he wants to claim expenses made | towards insurance, water, etc. from the rent received. Comment in the light of section 24(a).

Answer:

The section 24(a) allows deduction to an extent of 30% of Net Annual Value (NAV) as a standard deduction from the house property used as a let out property or deemed let out property. In the given case, Mr. A is entitled to standard deduction but no other expenditure shall be allowed as deduction towards insurance, repair, ground rent, collection charges, water charges, etc.

Question 5.

Ms. Jyoti purchased a house property costing X 49 Lakhs on 1st May, 2020. The property is used exclusively for her residential purpose. For this purpose she obtained loan from DHFL of X 35 lakhs bearing interest @ 14% p.a. on 1st April, 2020. She does not own any other house.

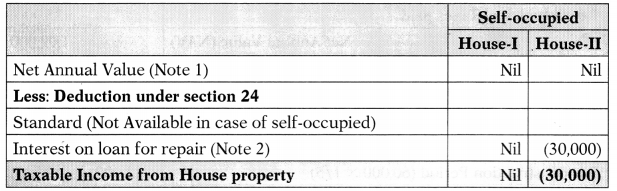

State with brief reasons the deductions that can be claimed by Ms. Jyoti in respect of interest on loan for Assessment Year 2021-22. What would -5 be the change in your answer if the loan has been taken over for repairs. [Nov. 2017 Modified, 5 Marks]

Answer:

Interest paid on housing loan = 14% of ₹ 35,00,000 = ₹ 4,90,000

Status of house property = Self-occupied

(a) Loan taken for construction or acquisition: If the capital is borrowed on or after April 1,1999 for acquiring or constructing a property which i is self-occupied, the interest on such borrowed capital is deductible up to ₹ 2,00,000.

(b) Loan taken for reconstruction, repairs or renewal: In this case, the maximum amount of deduction on account of interest is ₹ 30,000.

![]()

Question 6.

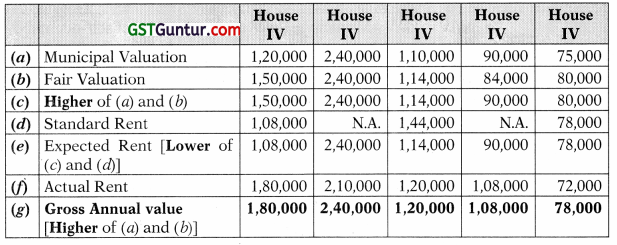

Mrs. Vimala commenced construction of house meant for residential purpose on 01.11.2018. She raised a loan of ₹ 10 lakhs @ 11% per annum from a bank. Finding that there was over run in the cost of construction, she raised a further loan of ₹ 5 lakhs from her friend at 15% rate of interest per annum on 1.10.2020. The construction was completed by February, 2021.

Compute the amount of interest allowable exemption under section 24 of the income-tax Act, 1961 in the following cases:

(i) The house was meant for self-occupation from 01.03.2021

(ii) The house was to be let out from 01.03.2021.

Is there any deduction available u/s 80C towards principal repayment in respect of above loans? [CMA June 2011, 6 Marks]

Answer:

(i) When the house was meant for self-occupation:

Computation of the amount of interest allowable exemption under section 24

As per section 24(b), the amount eligible for deduction for interest on borrowed capital (of the current year and pre-construction period) is up to ₹ 2,00,000. The actual interest (₹ 1,78,667) is deductible as it is within limit.

(ii) When the house is let out w.e.f. 1-3-2021:

If capital is borrowed for the purpose of purchase, construction, repair, renewal or reconstruction of the property, then no maximum limit has been prescribed, if the house is not self-occupied.

Therefore, the whole amount of ₹ 1,78,667 (calculated in first part) is deductible.

![]()

Question 7.

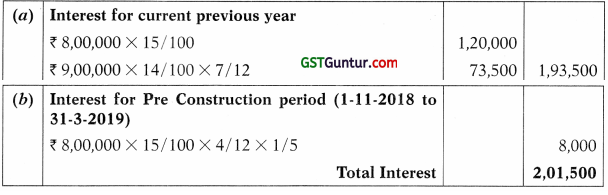

Sanjay commenced construction of a residential house intended exclusively for his residence, on 1-12-2019. He raised a loan of ₹ 8,00,000 @15% interest for the purpose of construction on 1-11 -2019. Finding that there was an over run in the cost of construction he raised a further loan of ₹ 9,00,000 at 14% p.a. on 1-9-2020. What is the interest allowable under section 24 in Assessment year 2021-22, assuming that the construction was completed on 31-3-2021? [May 2000 Modified, 5 Marks]

Answer:

Computation of the amount of interest allowable exemption under section 24

As per section 24(b), in case of self-occupied property, the amount eligible for deduction for interest on borrowed capital (of the current year and pre-construction period) is up to ₹ 2,00,000. Thus, the deduction under section 24 in respect of borrowed capital is ₹ 2,00,000.

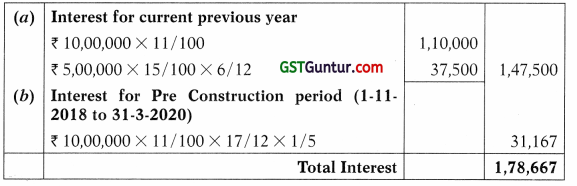

Question 8.

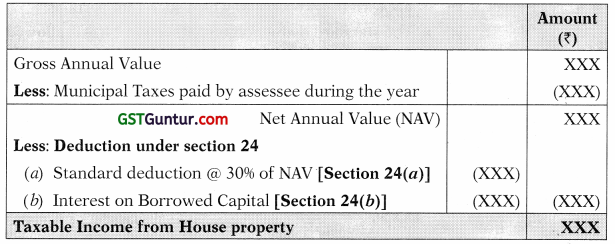

Give a tabular presentation of computation of income under the head “Income from House Property”.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

![]()

Deduction For Unrealised Rent And Subsequent Recovery [Rule 4 And Section 25a]

Question 9.

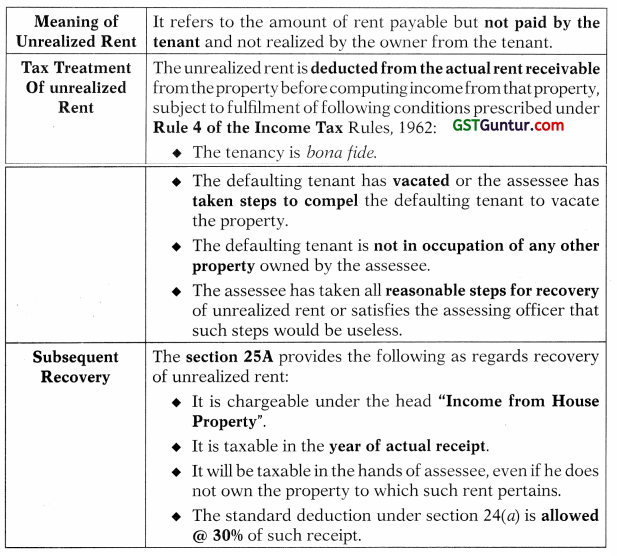

Explain the treatment of unrealized rent and its recovery in subsequent years under the provisions of Income Tax Act, 1961 [May 2012, 4Marks]

Answer:

![]()

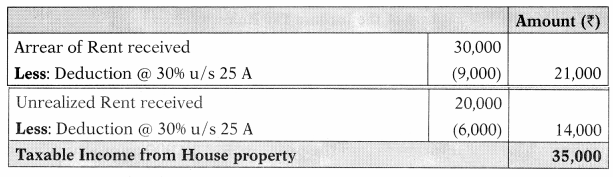

Question 10.

Mr. X owns a house property which is let out. During the previous year ending 31-3-2021, he receives the following:

(i) Arrears of Rent ₹ 30,000

(ii) Unrealized Rent ₹ 20,000 You are requested to

(a) State, how they should be dealt with as per the provisions of the Act.

(b) Compute the income chargeable under the head “Income from House Property”. ___ [May 2002, 4 Marks]

Answer:

(a) State, how they should be dealt with as per the provisions of the Act.

As per section 25A, the arrears of rent received are taxable in the year in which arrears have been received. However, deduction shall be allowed @ 30% of such arrears and only the balance amount is taxable. The taxability exists irrespective of the fact whether assessee remains the owner of the property in the year of receipt or not.

(b) Computation of Income from House Property

(Assessment Year 2021-22)

![]()

Let Out Property Throughout The Year [Without Vacancy]

Question 11.

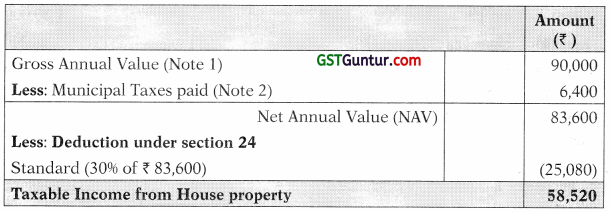

[Elementary] Amalesh owns a house property which is let-out for ₹ 6,500 per month. The fair rent of the property is ? 90,000. Municipal taxes paid during the year for each half year is ₹ 3,200. The tenant has spent ₹ 10,000 towards repairs of the property during the year. Compute the income from house property for the assessment year 2021-22.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

1. The GAV of the house property is determined as under:

Step 1: Computation of Expected Rent

(a) Municipal Valuation : NA

(b) Fair Valuation : ₹ 90,000

(c) Higher of (a) and (b) : ₹ 90,000

(d) Standard Rent : NA

Expected Rent = Lower of (c) and (d) = ₹ 90,000

Step 2: Computation of Gross Annual value

- Expected Rent (As per step 1) : ₹ 90,000

- Actual Rent Received (6,500 × 12) : ₹ 78,000

1. Gross Annual Value: The expected rent is higher than the rent received. Thus, the expected rent i.e. ₹ 90,000 shall be GAV.

2. The Municipal Taxes paid during the year for each half year is ₹ 3,200 i.e. ₹ 6,400 annual.

![]()

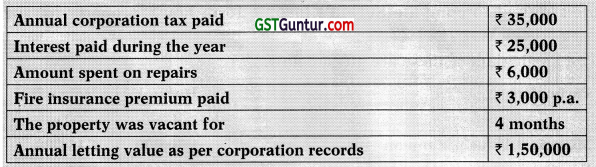

Question 12.

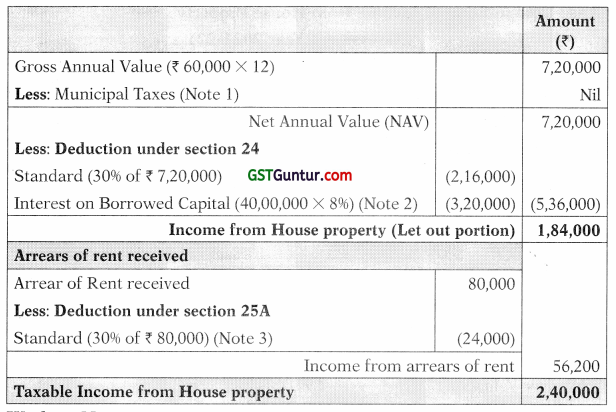

Mr. Lai is the owner of a commercial property let out at ₹ 60,000 per month. The Corporation tax on the property is ₹ 30,000 annually, 60% of which is payable by the tenant. This tax was actually paid on 15.04.2021. He had borrowed a sum of ₹ 40 lakhs from his cousin, resident in Singapore (in dollars) for the construction of the property on which interest at 8% is payable. He has also received arrears of rent of ₹ 80,000 during the year, which was not charged to tax in the earlier years. What is the property income of Mr. Lai for the assessment year 2021-22?

Answer:

Computation of Income from House Property (Assessment Year 2021-22)

Working Notes:

- Municipal taxes paid by tenant (60%) are not deductible. The balance 40%, although paid by assessee, is not deducted because it was paid in FY 2021-22 and not in 2020-21.

- It is presumed that the tax has been deducted at source on the amount of interest payable outside India.

- As per section 25A, the arrears of rent received are taxable in the year in which arrears have been received. However, deduction shall be allowed @ 30% of such arrears and only the balance amount is taxable.

![]()

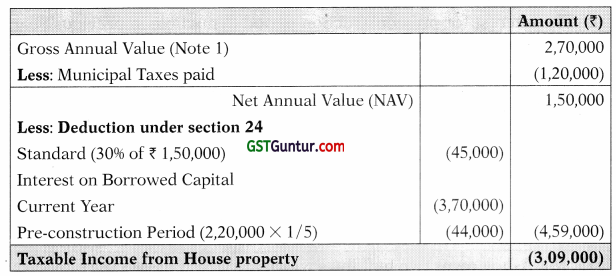

Question 13.

Tarun, employed in a private company, commenced construction of a commercial complex in July, 2019. He borrowed ₹ 50 lakhs from a bank @ 9% per annum. Interest up to 31.03.2020 was₹ 2,20,000 and for j the period from 01.04.2020 to 31.12.2020 ₹ 2,30,000; ₹ 1,40,000 towards interest for the balance three months remained unpaid.

The construction of the building was completed on 31st December, 2020. The building was let out w.e.f. 01.01.2021 for a monthly rent ₹ 90,000. Municipal tax of ₹ 1,20,000 was paid by cash on 10.01.2021. He repaid ₹ 1,90,000 towards principal during the previous year 2020-21, of which he paid ₹ 1,20,000 up to 31.12.2020. The municipal value of the property is ₹ 9,00,000.

Compute the income from house property of Tarun for the assessment year 2021-22.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

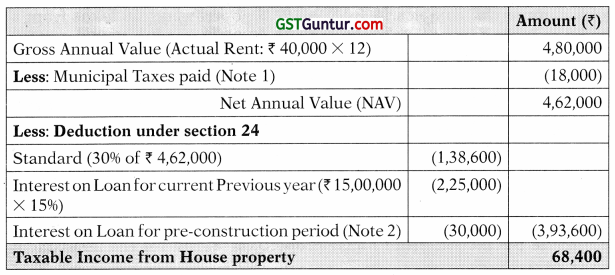

Question 14.

Mr. Ganesh owns a commercial building whose construction got completed in June 2019. He took a loan of ₹ 15 lakhs from his friend on 1-8-2018 and had been paying interest calculated at 15% per annum. He is eligible for pre-construction interest as deduction as per the provisions of the Income Tax Act.

Mr. Ganesh has let out the commercial building at a monthly rent of ₹ 40,000 during the financial year 2020-21. He paid municipal tax of ₹ 18,000 each for the financial years 2019-20 and 2020-21 on 1-5-2020 and 5-4-2021 respectively.

Compute income under the head ‘House Property’ of Mr. Ganesh for the Assessment Year 2021-22. [May 2017, 4 Marks]

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

- Municipal taxes paid on 5-4-2021 are not considered because these are not paid in financial year 2019-20.

- The interest for pre-construction period deductible in previous year is determined as under:

(a) Pre-construction period (PCP) : 1-8-2018 to 31-3-2019 i.e. 8 Months

(b) Loan amount : ₹ 15,00,000

(c) Rate of Interest : 15%

(d) Total Pre-construction Interest : 15,00,000 × 15% × 8/12 = ₹ 1,50,000

(e) PCP Interest deductible in current Pr. Yr. : ₹ 1,50,000 × l/5 = ₹ 30,000

![]()

Question 15.

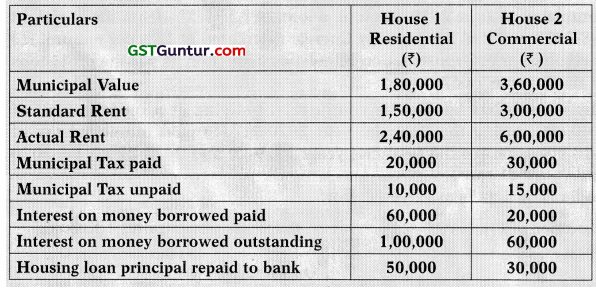

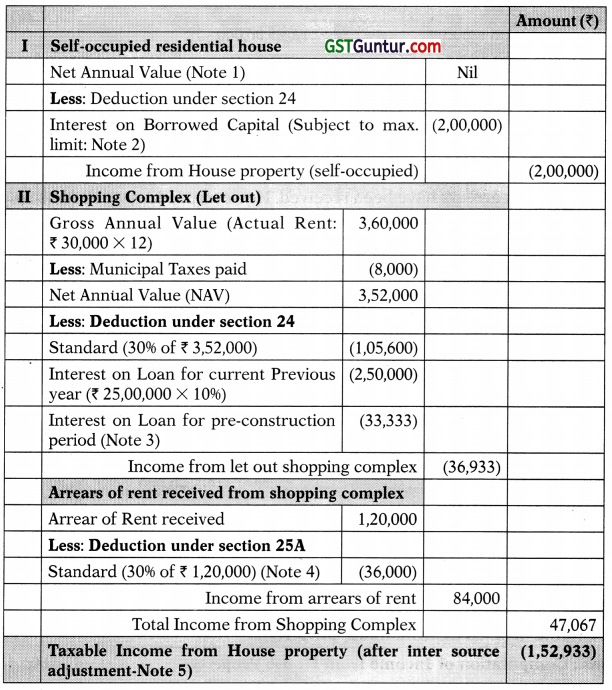

Mr. Ashok owns two buildings which are let out during the financial year 2020-21. The relevant details are as under:

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Note: Repayment of principal amount of housing loan to bank is deductible from Gross Total Income under section 80C.

Working Notes:

1. The GAV of both the houses are determined as under:

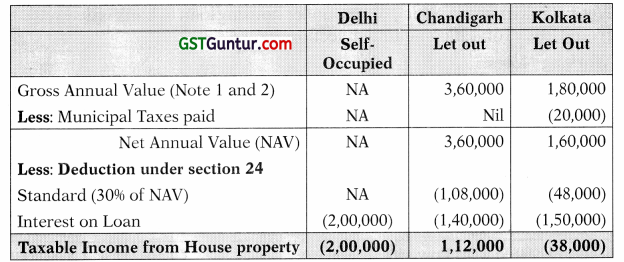

![]()

Self-Occupied Property Throughout The Year [One Self-Occupied House]

Question 16.

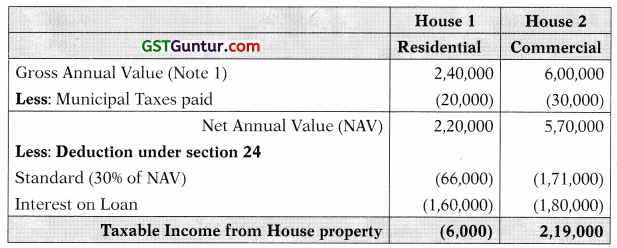

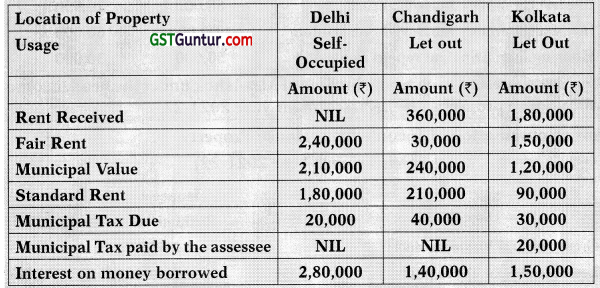

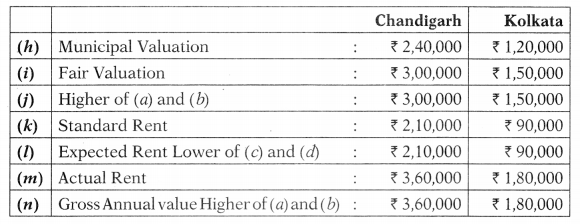

Mr. Chaturvedi, Delhi has 3 house properties in various parts of India. The details are given below:

Note: All the properties were acquired constructed after 01.04.2013.

You are required to compute the income of Mr. Chaturvedi chargeable under x the head Income form house property for the assessment year 2021-22.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Total taxable Income from House Property = (2,00,000) + 1,12,000 + (38,000) = – 1,26,000

Working Notes:

- The NAV of self-occupied property (Delhi) is always taken as nil.

- The GAV of both the houses are determined as under:

![]()

Question 17.

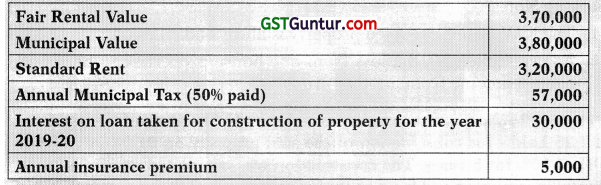

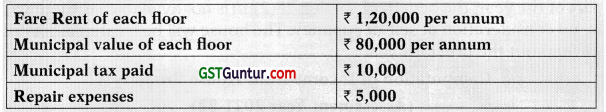

Raja is the owner of a residential house property having two independent floors of equal size in Chennai. The ground floor of the property has been let out to a tenant at rent of ₹ 15,000 per month from 1st June, 2020. The first floor of the property is occupied by Raja for his residential purpose.

Other particulars relating to the property are as follows:

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

- The NAV of self-occupied property is always taken as nil.

- As per section 70, the loss from one house property can be set-off against income from another property.

![]()

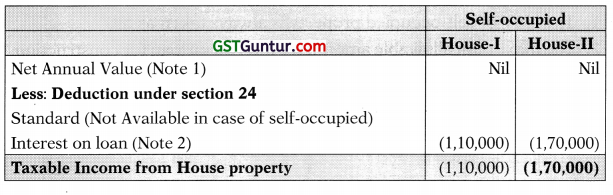

Question 18.

Mr. Raphael constructed a shopping complex. He had taken a loan of 25 Lakhs for construction of the said property on 01-08-2018 from SBI @ 10% for 5 years. The construction was completed on 30-06-2019. Rental income received from shopping complex ₹ 30,000 per month being let out for the whole year. Municipal Taxes paid for shopping complex ₹ 8,000. Arrears of rent received from shopping complex ₹ 1,20,000.

Interest paid on loan taken from SBI for purchase of house for use as own residence for the period 2020-2 1 Is ₹ 3 lakhs.

You are required to compute Income from House property of Mr. Raphael for A.Y. 2021-22 as per Income Tax Act, 1961. [Nov. 2015, 8 Marks]

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

- The NAV of self-occupied property is always taken as nil.

- The maximum allowable amount for interest on loan for construction on self-occupied is ₹ 2,00,000.

- The interest for pre-construction period deductible in previous year is determined as under:

(a) Pre-construction period (PCP) : 1-8-2018 to 31-3-2019 i.e. 8 Months

(b) Loan amount : ₹ 25,00,000

(c) Rate of Interest : 10%

(d) Total Pre-construction Interest : 25,00,000 × 10% × 8/12 = ₹ 1,66,666.67

(e) PCP Interest deductible in current Yr. : ₹ 1,66,666.67 × 1/5 = ₹ 33,333 - As per section 25A, the arrears of rent received are taxable in the year in which arrears have been received. However, deduction shall be allowed @ 30% of such arrears and only the balance amount is taxable.

- As per section 70, the loss from one house property can be set-off against income from another property.

![]()

Self-Occupied Property Throughout The Year [Two Self-Occupied Houses]

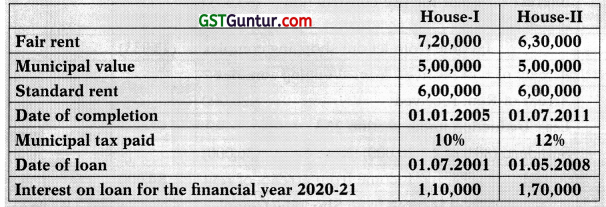

Question 19.

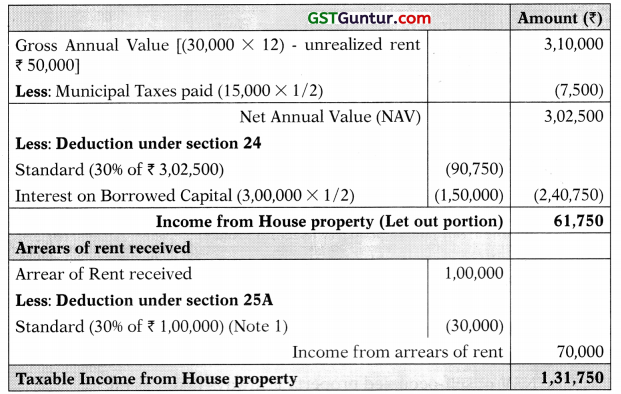

Mr. Nitin owns two houses, both of which are occupied by him for residential purpose. The details are given below:

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

The total comes to (2,80,000), but in case of self-occupied, the total interest on borrowed capital is deductible up to ₹ 2,00,000 only. Hence, total taxable income from house property = – 2,00,000

Working Notes:

1. The NAV of self-occupied property is always taken as nil.

![]()

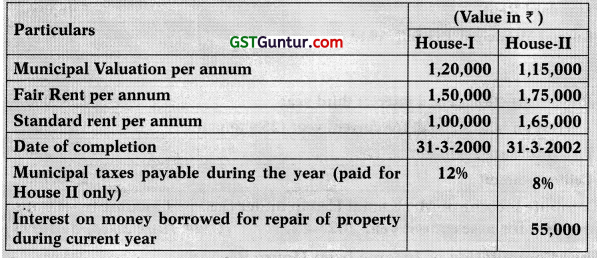

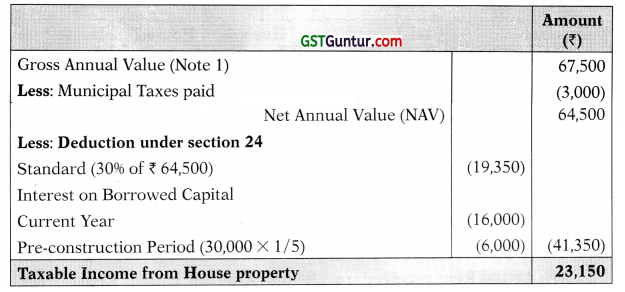

Question 20.

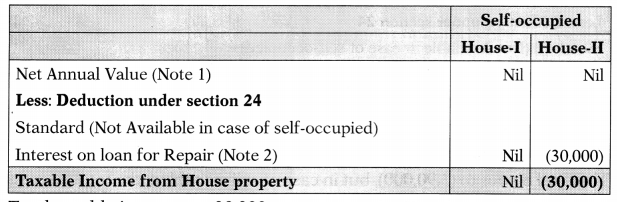

Nisha has two houses, both of which are self-occupied. The particulars of these are given below:

Compute Nisha’s income from the House Property for the Assessment Year 2021-22 and suggest which house should be opted by Nisha to be is assessed as self-occupied so that her Tax liability is minimum. [May 2014, 8 Marks]

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Total taxable income = – 30,000

Working Notes:

- The NAV of self-occupied property is always taken as nil.

- The maximum allowable amount for interest on loan for repair on self-occupied is ₹ 30,000

![]()

Question 21.

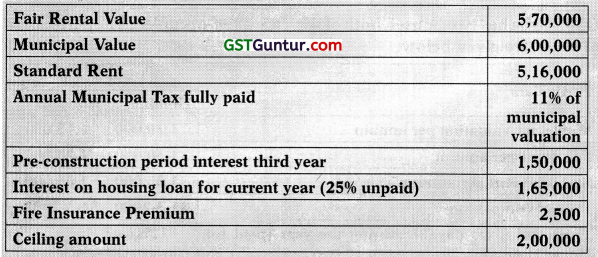

Mr. Kamal Hasan has two independent residential flats in an apartment, both of them being of identical size. First flat is self-occupied and the second flat is occupied by his daughter, from whom he does not receive any rent.

For each flat the relevant annual rent details are as under:

Compute income of Mr. Kamal Hasan under the head income from house property for assessment year 2021-22. [CMA June 2016, 8 Marks]

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

The total comes to (3,90,000), but in case of self-occupied, the total interest on borrowed capital is deductible up to ₹ 2,00,000 only. Hence, total taxable income from house property = – 2,00,000

Working Note:

1. The NAV of self-occupied property is always taken as nil.

![]()

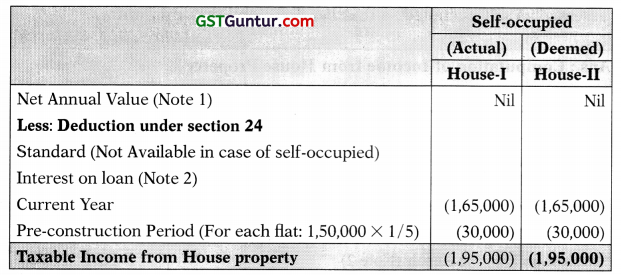

Question 22.

Surbhi has two houses, both of which are self-occupied. You are required to compute Surbhi’s income form house property for the Assessment Year 2021-22.

The Particulars of these are given below:

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Total taxable income = Nil + (30,000) = – 30,000

Working Notes:

- The NAV of self-occupied property is always taken as nil.

- The maximum deduction allowable on loan taken for repairs is ₹ 30,000.

![]()

Let Out Property Throughout The Year [Kept Vacant For Part of the Year]

Question 23.

Mr. Nitin completed construction of a residential house on 01.04.2020. Interest paid on loans borrowed for the purpose of construction during the 30 months prior to completion was ₹ 60,000.

The house was let-out on a monthly rent of ₹ 18,000.

He had also received arrears of rent of ₹ 36,000 during the year, which had not been charged to tax in the earlier year.

Compute the income under the head “Income from House Property” for the assessment year 2021-22.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

1. The NAV of the house property is determined as under:

Step 1: Computation of Expected Rent

(a) Municipal Valuation : ₹ 1,50,000

(b) Fair Valuation : NA

(c) Higher of (a) and (b) : ₹ 1,50,000

(d) Standard Rent : NA

Expected Rent = Lower of (c) and (d) = ₹ 1,50,000

Step 2: Computation of Gross Annual value

(i) Expected Rent (As per step 1) : ₹ 1,50,000

(ii) Actual Rent received/receivable (After unrealized Rent)

(a) If there is no vacancy (18,000 × 12) : ₹ 2,16,000

(b) In case of Vacancy (18,000 × 8) : ₹ 1,44,000

Gross Annual value: The rent received/receivable is lower than expected rent due to vacancy. Thus, the rent received or receivable (considering vacancy) i.e. ₹ 1,44,000 shall be GAV.

2. As per section 25A, the arrears of rent received are taxable in the year in which areas have been received. However, deduction shall be allowed @ 30% of such arrears and only the balance amount is taxable.

![]()

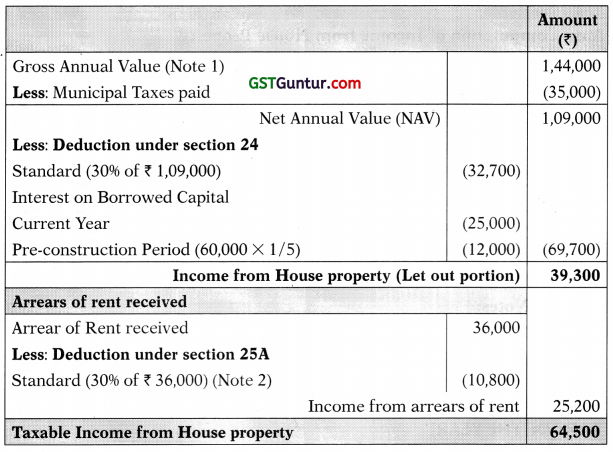

Question 24.

Mr. Singhania constructed a residential house property in Kanpur. Construction was completed on 1st April, 2020. The house was vacant from 1st April, 2020 to 30th June, 2020. The house was let out at rent of ₹ 7,500 per month from 1st July 2020. Mr. Singhania obtained loan for the purpose of construction. Interest paid on such loan during two years prior to completion of construction amounted to ₹ 30,000. Interest paid during the year 2020-21 is ₹ 16,000. Fire Insurance premium paid is ₹ 2,000. Municipal value of the property has been assessed at ₹ 40,000. Annual corporation tax paid ? 3,000.

Compute income under the Assessment year 2021-22.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

1. The NAV of the house property is determined as under:

Step 1: Computation of Expected Rent

(a) Municipal Valuation : ₹ 40,000

(b) Fair Valuation : NA

(c) Higher of (a) and (b) : ₹ 40,000

(d) Standard Rent : NA

Expected Rent = Lower of (c) and (d) = ₹ 40,000

Step 2: Computation of Gross Annual value

(i) Expected Rent (As per step 1) : ₹ 40,000

(ii) Actual Rent received/receivable (After unrealized Rent)

(a) If there is no vacancy (7,500 × 12) : ₹ 90,000

(b) In case of Vacancy (7,500 × 9) : ₹ 67,500

Gross Annual value: The rent received/receivable is higher than expected rent even if there is vacancy. Thus, in accordance with section 23(1)(c), the rent received or receivable (considering vacancy) i.e. ₹ 67,500 shall be GAY.

![]()

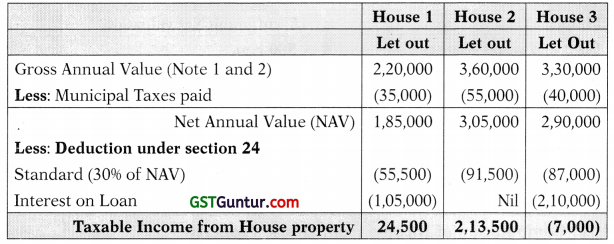

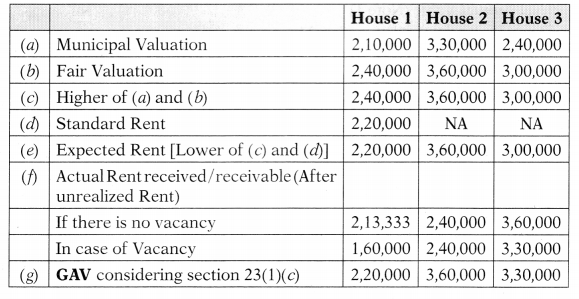

Question 25.

Mr. Arjun furnishes the following details relating to three house properties at Erode, Tamil Nadu, let out by him during the previous year 2020-21:

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Total taxable Income from House Property = 24,500 + 2,13,500 + (7,000) = 2,31,000

Working Notes:

1. The GAV of the houses have been determined as under:

Gross Annual value: The rent received/receivable is lower than expected rent due to vacancy. Thus, the rent received or receivable (considering vacancy) i.e. ₹ 80,000 shall be GAV.

![]()

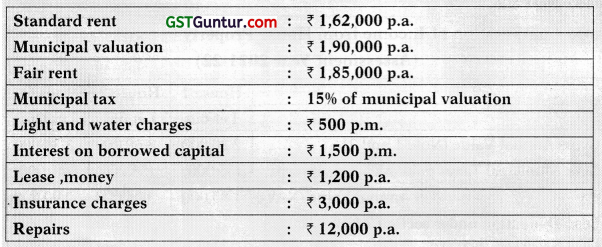

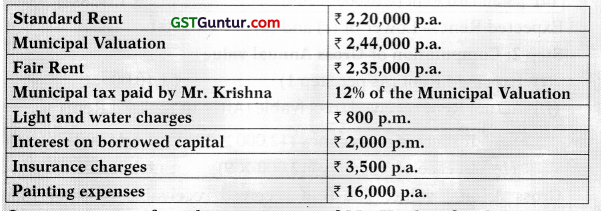

Question 26.

Mr. X owns one residential house in Mumbai. The house is having two units. First unit of the house is self-occupied by Mr. X and another unit is rented for ₹ 8,000 p.m. The rented unit was vacant for 2 months during the year. The particular of house for the previous year 2020-21 are as under:

Compute income from house property of Mr. X for the Assessment year 2021-22, [Nov. 2008, 9 Marks]

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

1. The NAV of self-occupied property is always taken as nil.

2. The GAY of 2nd unit is determined as under:

Step 1: Computation of Expected Rent

(a) Municipal Valuation (1,90,000 × 50%) : ₹ 95,000

(b) Fair Valuation (1,85,000 × 50%) : ₹ 92,500

(c) Higher of (a) and (b) : ₹ 95,000

(d) Standard Rent (1,62,000 × 50%) : ₹ 81,000

Expected Rent = Lower of (c) and (d) = ₹ 81,000

Step 2: Computation of Gross Annual value

(i) Expected Rent (As per step 1) : ₹ 81,000

(ii) Actual Rent received/receivable (After unrealized Rent)

(c) If there is no vacancy (8,000 × 12) : ₹96,000

(d) In case of Vacancy (8,000 × 10) : ₹ 80,000

3. Gross Annual value: The rent received/receivable is lower than I expected rent due to vacancy. Thus, the rent received or receivable (considering vacancy) i.e. ₹ 80,000 shall be GAV.

4. As per section 70, the loss from one house property can be set off against income from another property.

5. Light and water charges, insurance charges and painting expenses are not allowable as deduction under section 24.

![]()

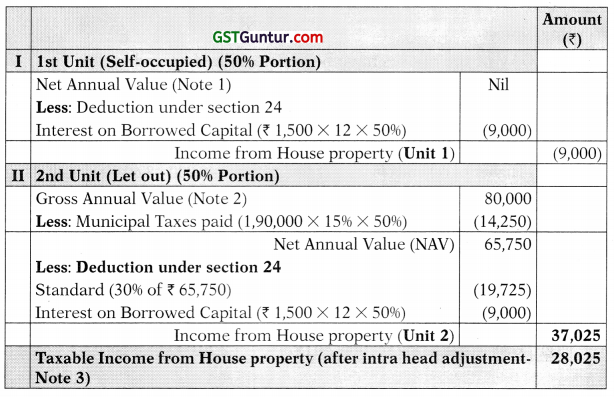

Question 27.

Mr. Krishna owns a residential house in Delhi. The house is having two identical units. First unit of the house is self-occupied by Mr. Krishna and another unit is rented for ₹ 12,000 p.m. The rented unit was vacant for three months during the year. The particulars of the house for the previous year 2020-21 are as under:

Compute income from house property of Mr. Krishna for the assessment year 2021-22. [Nov. 2013, 8 Marks]

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

1. The NAV of self-occupied property is always taken as nil.

2. The GAV of 2nd unit is determined as under:

Step 1: Computation of Expected Rent

(a) Municipal Valuation (2,44,000 × 50%) : ₹ 1,22,000

(b) Fair Valuation (2,35,000 × 50%) : ₹ 1,17,500

(c) Higher of (a) and (b) : ₹ 1,22,000

(d) Standard Rent (2,20,000 × 50%) : ₹ 1,10,000

Expected Rent = Lower of (c) and (d) = ₹ 1,10,000

Step 2: Computation of Gross Annual value

(i) Expected Rent (As per step 1) : ₹ 1,10,000

(ii) Actual Rent received/receivable (After unrealized Rent)

(a) If there is no vacancy (12,000 × 12) : ₹ 1,44,000

(b) In case of Vacancy (12,000 × 9) : ₹ 1,08,000

Gross Annual value: The rent received/receivable is lower than expected rent due to vacancy. Thus, the rent received or receivable (considering vacancy) i.e. ₹ 1,08,000 shall be GAV.

3. As per section 70, the loss from one house property can be set-off against income from another property.

4. Light and water charges, insurance charges and painting expenses are not allowable as deduction under section 24.

![]()

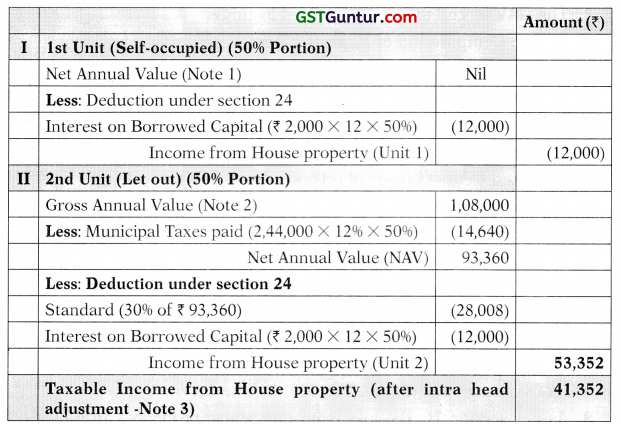

Property Self-Occupied For Part Of The Year & Let Out For The Remaining Part

Question 28.

Mrs. Disha Khanna, a resident of India, owns a house property at Bhiwani in Haryana. The Municipal, value of the property is ₹ 7,50,000, Fair Rent of the property is ₹ 6,30,000 and Standard Rent is ₹ 7,20,000 per annum.

The property was let out for ₹ 75,000 per month for the period April 2020 to December 2020. Thereafter, the tenant vacated the property and Mrs. Disha Khanna used the house for self-occupation. Rent for the months of November and December 2020 could not be realized from the tenant. The tenancy was bona fide but the defaulting tenant was in occupation of another property of the assessee, paying rent regularly.

She paid municipal taxes @ 12% during the year and paid interest of ₹ 35,000 during the year for amount borrowed towards repairs of the house property.

You are required to compute her income from “House Property” for the A.Y. 2021-22. [Nov. 2018, 7 Marks]

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

1. The GAV of the house property is determined as under:

Step 1: Computation of Expected Rent

(a) Municipal Valuation : ₹ 7,50,000

(b) Fair Valuation : ₹ 6,30,000

(c) Higher of (a) and (b) : ₹ 7,50,000

(d) Standard Rent : ₹ 7,20,000

Expected Rent = Lower of (c) and (cl) = ₹ 7,20,000

Step 2: Computation of Gross Annual value

(i) Expected Rent (As per step 1) : ₹ 7,20,000

(ii) Actual Rent Received (75,000 × 9) : ₹ 6,75,000 (Note 2)

Gross Annual value: The expected rent is higher than rent received/ receivable. Thus, the expected rent i.e. ₹ 7,20,000 shall be GAV.

2. As per one of the conditions given in Rule 4, the defaulting tenant should not be in occupation of any other property of the assessee. Hence, in the given case, unrealized rent of two months is not deductible from rent received or receivable.

![]()

Question 29.

Ramesh owns a house at Hyderabad. Its municipal valuation is ₹ 24,000. He incurred the following expenditure in respect of the house property:

(i) Municipal Tax at 20%;

(ii) Fire insurance premium ₹ 2,000; and

(iii) Land revenue ₹ 2,400

He had taken bank loan of ₹ 25,000 at 16% per annum on April 1, 2018; the whole amount is still unpaid. The house was completed on April 1, 2020.

Find the income from house property for the assessment year 2021-22 for the following situations:

(i) If the assessee uses house for self-occupation throughout the previous year, and

(ii) If the house is let out for residential purpose on monthly rent of ₹ 2,500 from April 1, 2020 to December 31, 2020 and self-occupied for the remaining period.

Answer:

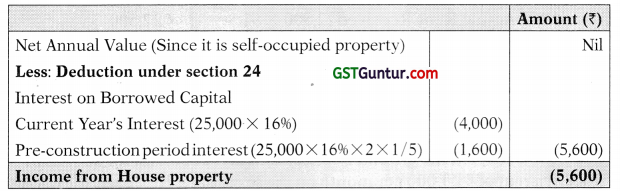

(i) When property is self-occupied throughout the previous year:

Computation of Income from House Property

(Assessment Year 2021-22)

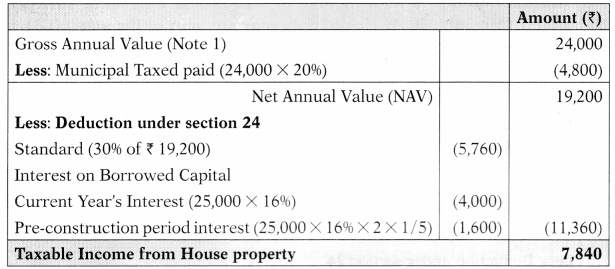

(ii) When property is let out for part of the year and self occupied for part of the year:

Where a house is self-occupied for a part of the year and let out for remaining part of the year, the benefit of section 23(2)(a) is not available i.e. there will I be no consideration of self-occupancy. The house will be treated as let out throughout the previous year.

Computation of Income from House Property (Assessment Year 2021-22)

Working Notes:

1. The NAV of the house property is determined as under:

Step 1: Computation of Expected Rent

(a) Municipal Valuation : ₹ 24,000

(b) Fair Valuation : NA

(c) Higher of (a) and (b) : ₹ 24,000

(d) Standard Rent : NA

Expected Rent = Lower of (c) and (d) = ₹ 24,000

Step 2: Computation of Gross Annual value

(i) Expected Rent (As per step 1) : ₹ 24,000

(ii) Actual Rent Received (2,500 × 9) : ₹ 22,500

(iii) Gross Annual Value (Higher) : ₹ 24,000

![]()

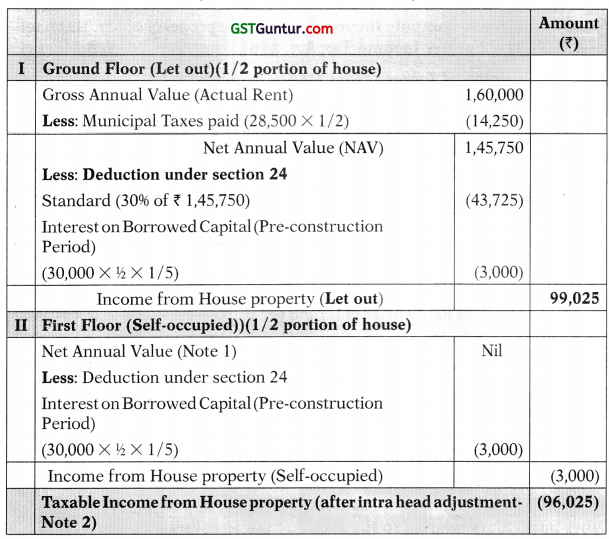

Question 30.

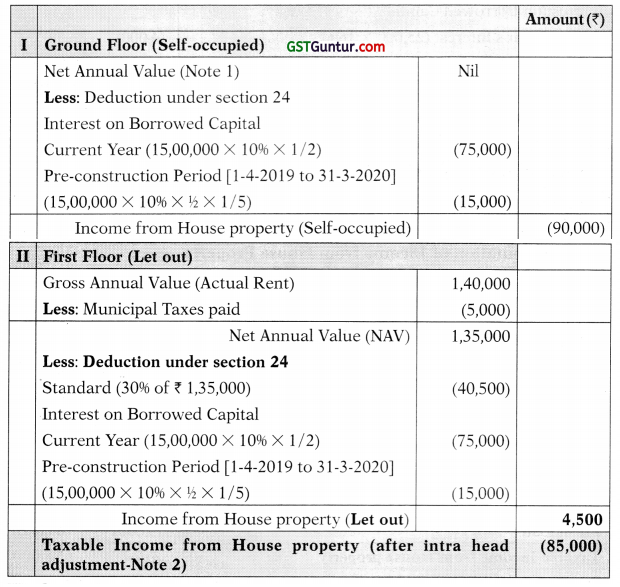

Mr. Sridhar constructed his house on a plot of land acquired by him in Kolkata. The house has two floors of equal size. He started construction of the house on 1st April, 2019 and completed construction on 30th June, 2020. He occupied the ground floor on 1st July, 2020 and let out the first floor at a rent of ₹ 20,000 per month on the same date. However, the tenant vacated the first floor on 31st January, 2021 and Mr. Sridhar occupied the entire house from 1st February, 2021 to 31st March, 2021.

Other information.

Mr. Sridhar obtained a housing loan of ₹ 15 lacs at interest of 10% per annum on 15th July, 2019. He did not repay any part of the loan till 31st March, 2021.

Compute income from house property in the hands of Mr. Sridhar for the Assessment year 2021-22.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Working Notes:

- The NAV of self-occupied property is always taken as nil.

- As per section 70, the loss from one house property can be set-off against income from another property.

![]()

Co-Ownership [Section 26]

Question 31.

Mr. Raman is a co-owner of a house property along with his brother.

The loan for the construction of this property is jointly taken and the interest charged by the bank is ₹ 25,000 out of which ₹ 21,000 have been paid. Interest on the unpaid interest is ₹ 450. To repay this loan, Raman and his brother have taken a fresh loan and interest charged on this loan is ₹ 5,000.

The Municipal Taxes of ? 5,100 have been paid by the tenant.

Compute the income from this property chargeable in the hands of Mr. Raman for AY 2021-22. [Nov. 2009, 6 Marks]

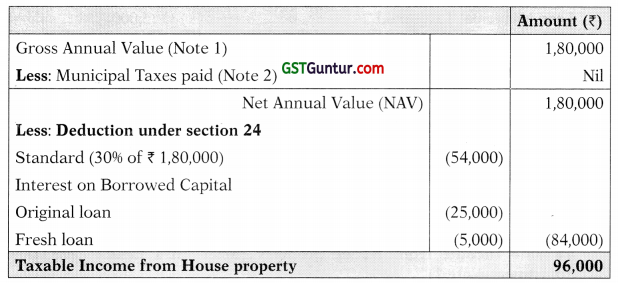

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Share of Raman in taxable income = ₹ 96,000 × 5096 = ₹ 48,000

Working Notes:

1. The GAV of the house property is determined as under:

Step 1: Computation of Expected Rent

(a) Municipal Valuation : ₹ 1,60,000

(b) Fair Valuation : ₹ 1,50,000

(c) Higher of (a) and (&) : ₹ 1,60,000

(d) Standard Rent : ₹ 1,70,000

Expected Rent = Lower of (c) and (d) = ₹ 1,60,000

Step 2: Computation of Gross Annual value

(i) Expected Rent (As per step 1) : ₹ 1,60,000

(it) Actual Rent Received (15,000 × 12) : ₹ 1,80,000

Gross Annual value: The rent received/receivable is higher than expected rent. Thus, the rent received i.e. ₹ 1,80,000 shall be GAV.

2. Since the Municipal Taxes have been paid by tenant, deduction is not allowed.

3. Interest on unpaid interest is not deductible. (Shew Kissen Bhatterv. Commissioner of Income Tax, 1973)

![]()

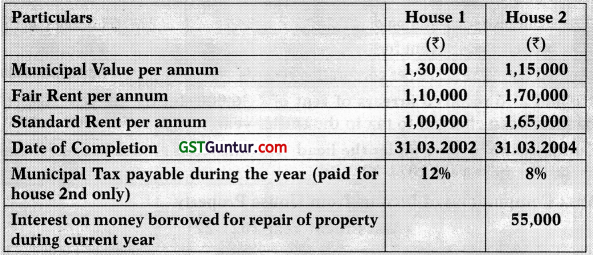

Question 32.

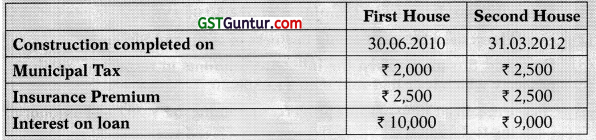

X and Y are co-owners of two houses with equal share of both the houses. While the first house is used by them for their residence, the second house is let to a tenant at a monthly rent of ₹ 2,500. The other relevant particulars of the houses for the year 2020-21 are as follows:

Compute income from house property of X and Y for the relevant assessment year.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Since Mr. X and Mr. Y are co-owners of both houses, taxable income is equally divided between them as ₹ 125 each.

Working Notes:

- The NAV of self-occupied property is always taken as nil.

- As per section 70, the loss from one house property can be set-off against income from another property.

![]()

Question 33.

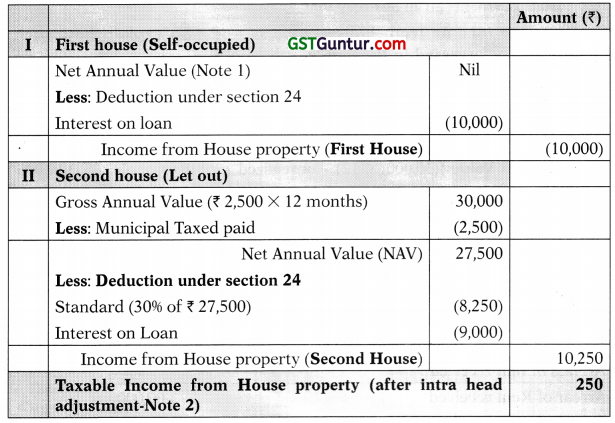

Ram and Shyam are members of a firm “R and S” and also joint owners (50% each) of a two storied house property (of equal area), the details of which’ are as follows:

(1) Ground Floor: let out at a monthly rent of ₹ 30,000

(2) First Floor: used for partnership business of Ram and Shyam.

(3) Ram and Shyam received the following amounts in respect of another property which they had sold it on 31.03.2020:

(a) Unrealized Rent of same property pertaining to FY 2020-21 amounting to ₹ 50,000

(b) Arrears of rent of sold out property pertaining to FY 2019-20 amounting to ₹ 1,00,000

(4) Municipal taxes paid for the entire house property is ₹ 15,000 p.a.

(5) Interest on borrowings for the entire house property (Joint loan taken from HDFC) is given at ₹ 3,00,000

Compute the income from house property and also explain how such income will be assessed in the hands of R and S.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Since R and S are joint owners (50% each), taxable amount in the hands of them is ₹ 65,875 each.

Working Notes:

1. As per section 25A, the arrears of rent received are taxable in the year in which arrears have been received. However, deduction shall be allowed @ 30% of such arrears and only the balance amount is taxable.

![]()

Question 34.

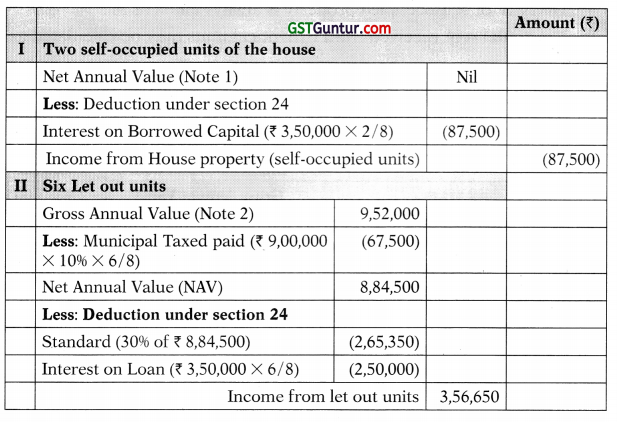

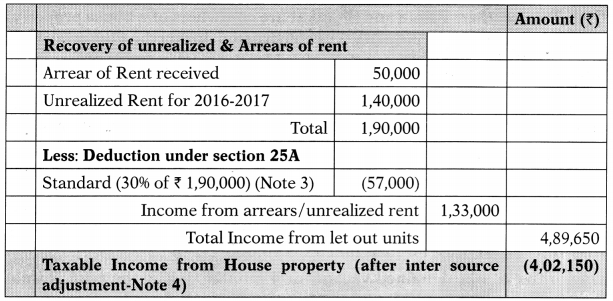

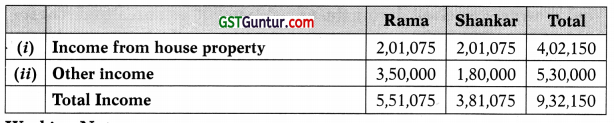

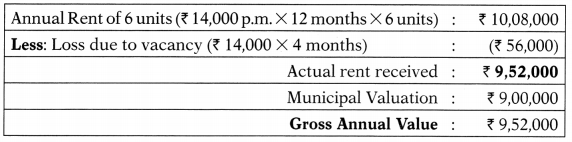

Two brothers Rama and Shankar are co-owners of a house property with equal shares. The property was constructed during the Financial year 2001-2002. The property consists of 8 identical units and is situated at Salem. During the Financial Year 2020-2021 each owner occupied 1 unit for residence and balance 6 units were let out at a rent of ₹ 14,000 per unit per month. The municipal value of property is ₹ 9,00,000 and municipal tax are 10% of municipal value, paid during the year. The other expenses are as follows:

(i) Repairs ₹ 90,000

(ii) Insurance premium paid ₹ 15,000

(iii) Interest payable on loan taken ₹ 3,50,000

One of the let out remained vacant for 4 months during the year. Rama could not occupy his unit for 6 months as he was transferred to Bangalore. He does not own any other house. The other income of Rama and Shankar are ₹ 3,50,000 and ₹ 1,80,000 respectively for the Financial Year 2020-21. The co-owners received during the year ₹ 1,40,000 as unrealized rent for 2017-2018 and ₹ 50,000 as arrears of rent. Compute the income under the head “Income from House Property” and total income of the two brothers for the Assessment Year 2021-2022.

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

Computation of Total Income of Rama and Shankar

(Assessment Year 2021-22)

Working Notes:

- The NAV of self-occupied property is always taken as nil.

- The actual rent received from 6 identical units may be calculated as under:

- As per section 25A, the arrears of rent received are taxable in the year in which arrears have been received. However, deduction shall be allowed @ 30% of such arrears and only the balance amount is taxable.

- As per section 70, the loss from one house property can be set-off against income from another property.

![]()

Deemed Ownership [Section 27]

Question 35.

Explain briefly the applicability of section 22 for chargeability of income tax for house property with disputed ownership. [Nov. 2010, 2 Marks]

Answer:

| Decision of Income Tax Department | If title of ownership of house property is under dispute in a court of law, the decision rests with the Income Tax Department. |

| Assessment | The assessment will be held even if suit has been filed. |

| Assessee | The person who is in receipt of income or person who enjoys the possession as owner is assessable to tax under section 22, though his claim is disputed. |

![]()

Question 36.

Ashok has constructed a house on a leasehold land. He has let-out the said property and has treated the rent from such property under the head “Income from other sources” and deducted expenses on repairs, security charges, insurance and collection charges, in all amounting to 35% of receipts.

In this case, state the head of income under which the relevant receipt is to be assessed, along with the reason.

Answer:

| Deemed ownership |

|

| Charging head | The receipt is assessable as “Income from House Property’’. |

| Deduction available |

|

![]()

Property Situated Outside India

Question 37.

Explain briefly the applicability of section 22 for chargeability of income tax for house property situated in foreign country. [Nov. 2010, 2 Marks]

Answer:

The following are the provisions as regards house property situated in foreign country:

| Resident Ordinarily Resident (ROR) | Taxable in India |

| Not Ordinarily Resident (NOR)

& Non-Resident (NR) |

|

| Municipal Taxes | For a property situated outside India, Municipal Taxes levied by Foreign Local Authority can be claimed as deduction. |

![]()

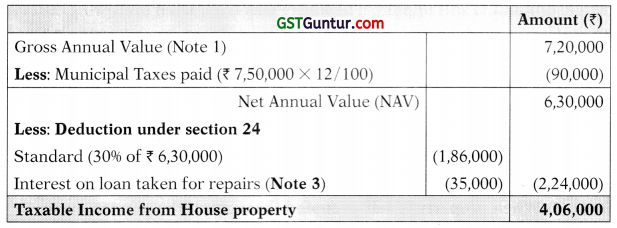

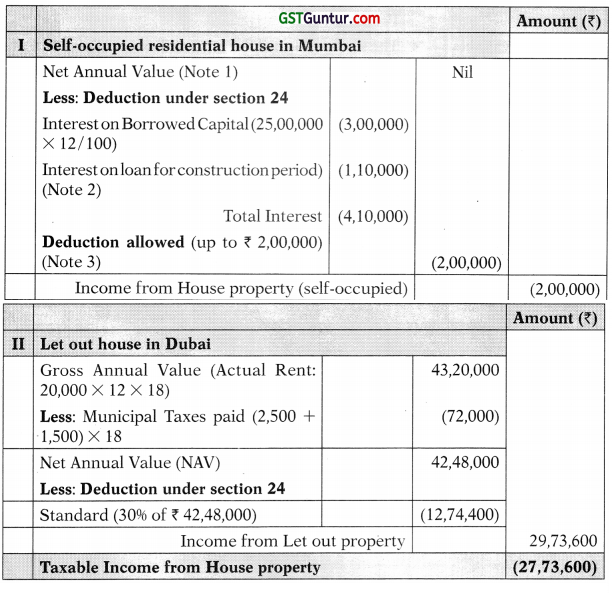

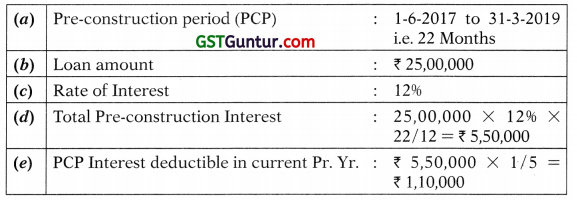

Question 38.

Mr. Aditya, a resident but not ordinarily resident in India during the Assessment Year 2021-22. He owns two houses, one in Dubai and the other in Mumbai. The house in Dubai is let out there at a rent of DHS 20,000 p.m. (1 DHS = INR 18). The entire rent is received in India. He paid Property tax of DHS 2,500 and Sewerage Tax DHS 1,500 there, for the Financial Year 2020-21. The house in Mumbai is self-occupied. He had taken a loan of ₹ 25,00.000 to construct the house on 1st June, 2017 @12%.

The construction was completed on 31st May, 2019 and he occupied the house on 1st June, 2019. The entire loan is outstanding as on 31st March, 2021. Property tax paid in respect of the second house is ₹ 2,400 for the Financial Year 2020-21. Compute the income chargeable under the head “Income from House property” in the hands of Mr. Aditya for the Assessment Year 2021-22. [Nov. 2017, 5 Marks]

Answer:

Computation of Income from House Property

(Assessment Year 2021-22)

![]()

Working Notes:

- The NAV of self-occupied property is always taken as nil.

- The interest for pre-construction period deductible in previous year is determined as under:

- The maximum allowable amount for interest on loan for construction on self-occupied is ₹ 2,00,000.

- Rental income from let out house property in a foreign country is taxable in the hands of a not-ordinarv on the basis of received in India.