CA Inter Audit Notes Download PDF: Are you pursuing a CA course? If yes, then you might be looking for the revised CA Inter syllabus. Here we are offering the CA Inter Auditing Study Notes that contain the important questions from all the chapters. So, download ICAI CA Inter Audit and Assurance Notes PDF for free of cost and improve your preparation.

A perfect preparation plan is needed for clearing the Auditing and Assurance subject. All the students are advised to give their 100% while preparing the Auditing paper and write the examination. Have a look at the CA Inter Audit Study Notes Study Material, and Chapter wise weightage in the following sections.

- Audit Notes CA Inter

- CA Inter Audit Chapter Wise Weightage

- CA Inter Auditing Syllabus

- Benefits of CA Inter Audit Notes

- FAQs on CA Inter Auditing Notes

Audit Notes CA Inter – CA Inter Audit and Assurance Notes Study Material

CA Inter Audit Revised Syllabus Notes are useful for individuals in making a preparation plan. The final exam has both objective and subjective questions. Candidates who are about to start the preparation are advised to gather the latest syllabus and download the Audit CA Inter Study Material Notes Pdf. The Audit Notes have all the concepts according to the new syllabus of ICAI’s official website.

Inter Auditing and Assurance CA Study Notes have questions about the important concepts. Read these questions to score at least 30% of the marks in the exam. We suggest students prepare all the topics of the CA Inter Audit Syllabus as we can’t know which questions can ask in the exam. Prepare well and score best marks.

Auditing and Assurance CA Inter Notes – CA Inter Audit Notes Pdf Free Download

- Nature, Objective and Scope of Audit

- Audit Strategy, Audit Planning and Audit Programme

- Audit Documentation and Audit Evidence

- Risk Assessment and Internal Control

- Fraud and Responsibilities of the Auditor in this Regard

- Audit in an Automated Environment

- Audit Sampling

- Analytical Procedures

- Audit of Items of Financial Statements

- The Company Audit

- Audit Report

- Audit of Banks

- Audit of Different Types of Entities

- Standards on Auditing

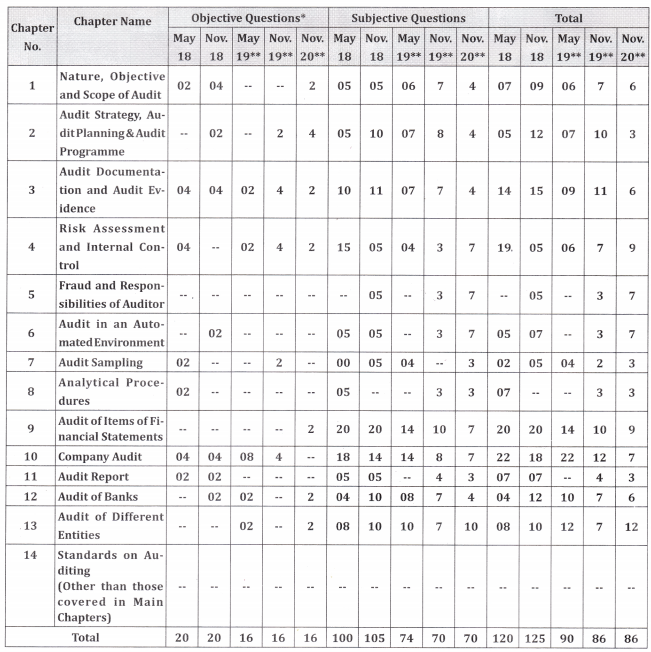

CA Inter Audit Chapter Wise Weightage

Chapter wise CA Inter Audit Marking Scheme contains the number of subjective and MCQ questions in every chapter. The weightage table gives the marking strategy of different concepts in various papers. The exam will be conducted for 3 hours for 100 marks. Observe the CA Inter Auditing and Assurance Chapter Wise Weightage carefully and make a preparation plan according to it.

CA Inter Audit Weightage – CA Inter Auditing Weightage

CA Inter Auditing Syllabus

Auditing and Assurance is the 6th paper in the CA Inter course. To clear this paper, students have to score qualifying marks. The latest CA Inter Audit Syllabus 2023 has covered the topics from all the chapters. Check out the detailed CA Inter New Syllabus for Auditing and prepare the topics.

CA Inter Audit Syllabus

PAPER 6: AUDITING AND ASSURANCE (100 MARKS)

(One paper — Three hours — 100 Marks)

Objective:

To develop an understanding of the concepts in auditing and of the generally accepted auditing procedures, techniques and skills and acquire the ability to apply the same in audit and attestation engagements.

1. Nature, Objective and Scope of Audit Auditing

Concepts: Nature, objective and scope of Audit; Relationship of auditing with other disciplines;

Standard Setting Process: Overview, Standard-setting process, Role of International Auditing and Assurance Standards Board (IAASB) & Auditing and Assurance Standards Board (AASB); Standards on Auditing, Guidance Note(s) issued by the ICAI;

Engagement Standards: Qualities of Auditor, Elements of System of Quality Control (SQC 1 Quality Control for Firms that Perform Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Engagements); Ethical requirements relating to an audit of financial statements; Inherent Limitations of an audit (SA 200 Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Standards on Auditing); Preconditions for an audit; Audit Engagement; Agreement on Audit Engagement Terms; Terms of Engagement in Recurring Audits (SA 210 Agreeing the Terms of Audit Engagements); Leadership Responsibilities for Quality on Audits; Concept of Auditor’s Independence; Threats to Independence; Acceptance and Continuance of Client Relationships and Audit Engagements (SA 220 Quality Control for an Audit of Financial Statements).

2. Audit Strategy, Audit Planning and Audit Programme: Audit Strategy; Audit planning (SA 300 Planning an Audit of Financial statements); Audit programme; Development of Audit Plan and Programme, Control of quality of audit work – Delegation and supervision of audit work; Materiality and Audit Plan; Revision of Materiality; Documenting the Materiality; Performance Materiality (SA 320 Materiality in Planning and Performing an Audit).

3. Audit Documentation and Audit Evidence: Concept of Audit Documentation; Nature & Purpose of Audit Documentation; Form, Content & Extent of Audit Documentation; Completion Memorandum; Ownership and custody of Audit Documentation (SA 230 Audit Documentation); Audit procedures for obtaining audit evidence; Sources of evidence; Relevance and Reliability of audit evidence; Sufficient appropriate audit evidence, Evaluation of Audit Evidence (SA 500 Audit Evidence); Written Representations as Audit Evidence; Objective of Auditor regarding Written Representation; Management from whom Written Representations may be requested; Written Representations about Management’s Responsibilities (SA 580 Written Representations); Obtaining evidence of existence of inventory; Audit procedure to identify litigation & claims (SA 501 Audit Evidence – Specific Considerations for Selected Items); External confirmation procedures; Management’s refusal to allow the auditor to send a confirmation request; Negative Confirmations (SA 505 External Confirmations); Audit evidence about opening balances; Accounting policies relating to opening balances; Reporting with regard to opening balances (SA 510 Initial Audit Engagements-Opening Balances); Meaning of Related Party; Nature of Related Party Relationships & Transactions; Understanding the Entity’s Related Party Relationships & Transactions (SA 550 Related Parties); Meaning of Subsequent Events; Auditor’s obligations in different situations of subsequent events (SA 560 Subsequent Events); Responsibilities of the Auditor with regard to Going Concern Assumption; Objectives of the Auditor regarding Going Concern; Events or Conditions that may cast doubt about Going Concern Assumption; Audit Procedures when events or conditions are identified (SA 570 Going Concern).

4. Risk Assessment and Internal Control: Audit Risk, Identifying and Assessing the Risk of Material Misstatement, Risk Assessment procedures; Understanding the entity and its environment; Internal control, Documenting the Risks; Evaluation of internal control system; Testing of Internal control; Internal Control and IT Environment (SA 315 Identifying and Assessing the Risks of Material Misstatement Through Understanding the Entity and Its Environment); Materiality and audit risk (SA 320 Materiality in Planning and Performing an Audit); Internal audit, Basics of Standards on Internal Audit (SIAs) issued by the ICAI; Basics of Internal Financial Control and reporting requirements; Distinction between Internal Financial Control and Internal Control over Financial Reporting.

5. Fraud and Responsibilities of the Auditor in this Regard: Responsibility for the Prevention and Detection of Fraud; Fraud Risk Factors; Risks of Material Misstatement Due to Fraud; Communication of Fraud (SA 240 The Auditor’s responsibilities Relating to Fraud in an Audit of Financial Statements); Provisions of the Companies Act 2013 relating to fraud and rules thereunder including reporting requirements under CARO.

6. Audit in an Automated Environment: Key features, Impact of IT related Risks, Impact on Controls, Internal Financial Controls as per Regulatory requirements, Types of Controls, Audit approach, Understanding and documenting Automated environment, Testing methods, data analytics for audit, assessing and reporting audit findings.

7. Audit Sampling: Meaning of Audit Sampling; Designing an audit sample; Types of sampling; Sample Size and selection of items for testing; Sample selection method (SA 530 Audit Sampling).

8. Analytical Procedures: Meaning, nature, purpose and timing of analytical procedures; Substantive analytical procedures, Designing and performing analytical procedures prior to Audit; investigating the results of analytical procedures (SA 520 Analytical Procedures).

9. Audit of Items of Financial Statements: Audit of sale of Products and Services; Audit of Interest Income, Rental Income, Dividend Income, Net gain/loss on sale of Investments etc.

Audit of Purchases, Employee benefits expenses, Depreciation, Interest expense, Expenditure on Power & Fuel, Rent, Repair to building, Repair to Machinery, Insurance, Taxes, Travelling Expenses, Miscellaneous Expenses etc.

Audit of Share Capital, Reserve & Surplus, Long Term Borrowings, Trade Payables, Provisions, Short Term Borrowings & Other Current Liabilities. Audit of Land, Buildings, Plant & Equipment, Furniture & Fixtures, Vehicles, office Equipments, Goodwill, Brand/Trademarks, Computer Software etc. Audit of Loan & Advances, Trade Receivable, Inventories, Cash & Cash Equivalent, Other Current Assets. Audit of Contingent Liabilities. (The list of items is illustrative only)

10. The Company Audit: Eligibility, Qualifications and Disqualifications of Auditors; Appointment of auditors; Removal of auditors; Remuneration of Auditors; Powers and duties of auditors; Branch audit; Joint audit; Reporting requirements under the Companies Act, 2013 including CARO; Other Important Provisions under the Companies Act, 2013 relating to Audit and Auditors and Rules made thereunder.

11. Audit Report: Forming an opinion on the Financial Statements; Auditor’s Report- basic elements (SA 700 Forming an Opinion and Reporting on Financial Statements); Types of Modified Opinion; Circumstances When a Modification to the Auditor’s Opinion is Required, Qualified, Adverse, Disclaimer of Opinion (SA 705 Modification to the Opinion in the Independent Auditor’s Report); Qualification, Disclaimer, Adverse opinion, SA 706 Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report; Nature of Comparative Information; Corresponding Figure; Comparative Financial Statements (SA 710 Comparative Information — Corresponding Figures and Comparative Financial Statements).

12. Audit of Banks: Understanding of accounting system in Banks, Audit Approach, Audit of Revenue items, Special Consideration in Bank Audit with emphasis on Advances and NPAs.

13. Audit of Different Types of Entities: Appointment of Auditor, Audit Procedure and Audit Report in respect of different Category of Entities: Government; Local bodies and Not-for-profit organizations; Partnership Firms, Audit of different type of undertakings, i.e., Educational institutions, Hotels, Clubs, Hospitals Basics of Limited Liability Partnerships (LLPS) audit and co- operative Societies Audit.

Note:

1. The specific inclusions/exclusions, in any topic covered in the syllabus, will be effected every year by way of Study Guidelines.

2. The provisions of the Companies Act, 1956 which are still in force would form part of the syllabus till the time their corresponding or new provisions of the Companies Act, 2013 are enforced.

3. If new legislations/ Standards on Auditing/Guidance Notes/Statements are enacted in place of the existing legislations, the syllabus would include the corresponding provisions of such new legislations with effect from a date notified by the Institute. The changes in this regard would also form part of the Study Guidelines.

Download CA Inter Study Material PDF by clicking on this link. You can avail the study material and new syllabus for all the subjects in one place.

Do Refer

Benefits of CA Inter Audit Notes

CA Inter Auditing Study Material Notes help you to succeed in the exam. Know the benefits of having CA Inter Study Notes and Study Material from this section.

- You can download the chapter-wise CA Inter Auditing & Assurance Notes free of cost.

- It has important CA Inter Audit MCQ and Subjective questions with answers.

- Students can get a brief explanation of all CA Inter Audit Important Questions.

- With the help of these study notes students can enhance their skills and secure good marks on the exam.

FAQs on CA Inter Auditing Notes

1. Which SA is important in Auditing for CA Inter?

The list SAs important in Auditing for the CA Inter course are Standards on Review Engagements (SREs), Standards on Related Services (SRSs), Standards on Quality Control (SQCs), Standards on Auditing (SAs), and Standards on Assurance Engagements (SAEs).

2. Can the CA Inter audit be self-studied?

Yes, CA Inter Audit can be a self-studied course. But students have to manage their tome and strict discipline for clearing the exam.

3. Which book is best for Auditing CA Inter?

Taxmann’s Auditing and Assurance by Pankaj Garg is the best book for preparing for the Audit CA Inter course.

4. How to make notes for the CA Inter audit?

Go through these steps to make CA Inter Auditing Notes.

- Write an introduction that contains a few main points about the topic.

- There is no trick or technique for self-written notes.

- Learn the art of taking effective notes.

- High-quality notes are not like self-written notes.

- Try to prepare study notes in your own style.

- Replicate the notes that capture your interest.

- Don’t prepare last-minute notes.

Final Words

We thought that the details enclosed here about CA Audit Notes are helpful for the students to clear the exam. Go through the more related articles on our site. If you have any doubts about the study notes or study material, you can leave a comment below.