Incomes Which Do Not Form Part of Total Income – CA Inter Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Incomes Which Do Not Form Part of Total Income – CA Inter Taxation Study Material

Introduction

Question 1.

State with reason, whether the following statement is true or false with regard to the provisions of the Income-tax Act, 1961 for the Assessment year 2021-22.

(a) Compensation on account of disaster received from local authority by an individual or his/her legal heir is taxable. [Nov. 2008, 2 Marks]

Answer:

The statement is False

| Section | Explanation |

| 10(10BC) |

|

![]()

Question 2.

State with reason, whether the following statement is True or False:

(a) Mr. P, a shareholder of a closely held company, holding 16% shares, received advances from that company which is to be deemed as dividend from an Indian Company, hence exempted under Section 10(34) of the Income-tax Act, 1961. [May 2009, 2 Marks]

Answer:

The statement is False

| Section | Explanation |

| 2(22) | Any payment by a closely held company bv way of advance or loan to a shareholder being a person who is the beneficial owner of shares, having at least 10% of the voting power or to any concern in which such shareholder is a member or a partner and in which he has substantial interest. |

| 2(22)(e) | Taxation of Dividend will be treated as under:

It is not govern by section 115-0. |

| Case | Statement is False. Mr. P will have to pay tax and it is chargeable. |

![]()

Question 3.

Discuss with reason, whether the following statements are true or false, as per the provisions of the Income-tax Act, 1961:

(a) Any amount received by an individual or his legal heir as compensation for natural disaster from the Government, is taxable.

(b) Dividend received (on which no Dividend Distribution Tax has been paid) by a dealer in shares or one engaged in buying/selling of shares, is chargeable under the head “Income from other sources” [May 2016, 4 Marks]

Answer:

(a) The Statement is False.

| Section | Explanation |

| 10(10BC) |

|

(b) The Statement is True

This Dividend is chargeable to tax.

| Section | Explanation |

| 2(22) | Any payment by a closely held company bv way of advance or loan to a shareholder being a person who is the beneficial owner of shares, having at least 10% of the voting power or to any concern in which such shareholder is a member or a partner and in which he has substantial interest. |

| 2(22)(e) | Taxation of Dividend will be treated as under:

It is not govern by section 115-0. |

| Case | Statement is False. Mr. P will have to pay tax and it is chargeable. |

![]()

Question 4.

Which income of Sikkimese individual is exempted from tax under Section 10(26AAA) ? [Nov. 2010, 4 Marks]

Answer:

- Income of a Sikkimese Individual which accrues or arise to him/her from any source in the State of Sikkim or Income from Dividend/ Interest on Securities from anywhere in the world is exempt.

- If Sikkimese woman who on or after April 1,2008, marries a non-Sikkimese individual then exemption is not available.

Question 5.

Briefly explain the exemption available under section 10(48) of the Income-tax Act, 1961 in respect of income received by certain foreign companies from sale of crude oil. [Nov. 2013, 4 Marks]

Answer:

- Any income received in India in Indian currency by a foreign company I on account of sale of crude Oil

- Any other goods or rendering of services as may be notified by the j Central Government in this behalf.

- To any person in India shall be exempt subject the following conditions being satisfied.

- the receipt of money in India by the foreign company is pursuant to an agreement or an arrangement which is either entered into by the central Government or approved by it.

- The foreign company and the arrangement or agreement has been notified by the Central Government in this behalf having regard to the national interest.

- the receipt of money is the only activity carried out by the foreign company in India.

![]()

AGRICULTURAL INCOME

Question 6.

Discuss with brief reasons, whether rent received for letting out ; agricultural land for a movie shooting and amounts received from sale of seedlings in a nursery adjacent to the agricultural lands owned by an assessee can be regard as agricultural income, as per the provisions of the Income-tax Act, 1961. [May 2017, 4 Marks]

Answer:

| Particulars in Qs. | Provisions | Case |

| Letting out agricultural land for a movie shooting | As per section 2(1 A)(a) any income by way of rent, which is derived from Agricultural Land providing the land for agricultural purpose, is agricultural income. | The land is used for a movie shooting hence it is not the agricultural income. |

| Amounts received from sale of seedlings inanursery adjacent to the agricultural lands ownedbyan assessee | As per section 2( 1 A) if agricultural land is used for seedling grown or saplings in nursery then it is treated as agricultural income. The land is used for nursery for seedlings and subsequently by selling it. It is created as agricultural Income. | The land is used for a nursery for seedlings and subsequently by selling it. It is created as agricultural Income. |

![]()

Question 7.

Answer the following with reference to the provisions of the Income- tax Act, 1961 for the assessment year 2020-21:

(a) Whether the income derived from saplings or seedlings grown in a nursery is taxable under the Income-tax Act, 1961? [May 2009, 2 Marks]

Answer

Section – 2(1 A)

Explanation :

It is agricultural income. Income derived from seedlings or saplings grown in nursery will be deemed to be agricultural income and exempt from tax.

Question 8.

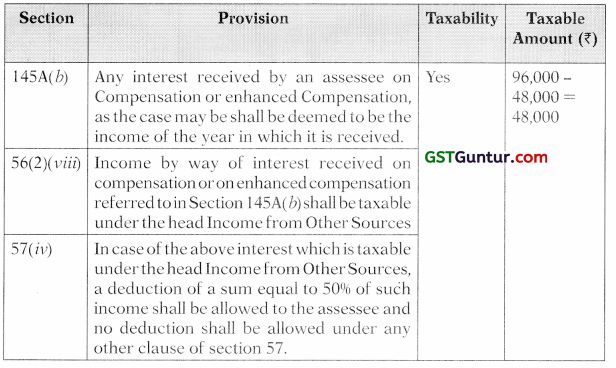

State with brief reasoning whether the following receipts are chargeable to income-tax or are exempt (if chargeable, the amount taxable is to be mentioned) for the assessment year 2021-22:

| Nature of Receipt | Amount (₹) |

| Interest on enhanced compensation received on 12-3-2021 for acquisition of urban land, of which 40% relates to the earlier year, | 96,000 |

| Rent received for letting out agricultural land for a movie shooting. | 72,000 |

Computation is not required. [Nov. 2013, 4 Marks]

Answer:

Interest on enhanced compensation received on 12-3-2021 for acquisition of urban land, of which 40% relates to the earlier year.

Rent received for letting out agricultural land for a movie shooting.

![]()

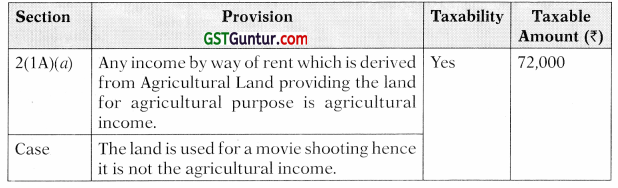

Question 9.

Mr. Tenzingh is engaged in composite business of growing and curing (further processing) Coffee in Coorg, Karnataka. The whole of coffee grown in his plantation is cured. Relevant information pertaining to the year ended 31.3.2021 are given below :

Besides being used for agricultural operations, the car is also used for personal use: disallowance for personal use may be taken at 20%. The expenses incurred for car running and maintenance are ₹ 50,000. The machines were used in coffee curing business operations.

Compute the income arising from the above activities for the assessment year 2021-22. Show the WDV of the assets as on 31.3.2021. [May 2010, 6 Marks]

Answer:

Rule – 7B

Explanation :

- Income derived from the sale of coffee grown and cured by the seller in India shall be computed as if it were income derived from business, and

- Twenty five per cent of such income shall be deemed to be income liable to tax.

- Seventy five per cent of such income shall be agricultural Income.

Computation of Income of Mr. Tenzingh for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| (A) Sale of Cured Coffee | 22,00,000 | |

| Expensed on growing the Coffee | 3,10,000 | |

| Expenditure for curing the Coffee | 3,00,000 | |

| Car Expenses 80% of ₹ 50,000 | 40,000 | |

| Depreciation of Car [3,00,000 × 15% × 80% = 36,000] | 36,000 | |

| Depreciation of Machinery [15,00,000 × 15% = 2,25,000] | 2,25,000 | |

| (B) Total Expenses for Growing and Curing the Coffee | 9,11,000 | 9,11,000 |

| (C) Net Profit (A) – (B) | 12,89,000 | |

| Business Income 25% of ₹ 12,89,000 | 3,22,250 | |

| Agricultural Income 75% of ₹ 12,89,000 | 9,66,750 |

![]()

Computation of Written Down Value of Car and Machinery on 31.03.2021

| Car: | ||

| Written Down of Car on 01.04.2020 | 3,00,000 | |

| Less: Depreciation of Car [3,00,000 × 15% × 80% = 36,000] | 36,000 | |

| Written Down of Car on 31.03.2021 | 2,64,000 | |

| Machinery: | ||

| Written Down of Car on 01.04.2020 | 15,00,000 | |

| Less: Depreciation of Machinery [15,00,000 × 15%) = 2,25,000] | 2,25,000 | |

| Written Down of Car on 31.03.2021 | 12,75,000 | |

Sez Questions

Question 10.

Nathan Aviation Ltd. is running two industrial undertakings, one in a SEZ (Unit S) and another in a normal area (Unit N). The brief summarized details for the year ended 31-3-2021 are as under:

| Particulars | S (₹ In Lacs) | N (₹ In Lacs) |

| Domestic Turnover | 10 | 100 |

| Export Turnover | 120 | NIL |

| Gross Profit | 20 | 10 |

| Less: Expenses and Depreciation | 7 | 6 |

| Profits derived from the Unit | 13 | 4 |

The brought forward business loss pertaining to Unit N is ₹ 2 lacs. Briefly compute the business income of the assessee. [Similar Type Nov. 2013, 4 Marks\ [Nov. 2015, 8 Marks]

Answer:

| Particulars | Unit S (2 In Lacs) | Unit N (2 In Lacs) |

| Profits derived from the Unit | 13 | 4 |

| Less: Exemption Under Section 10AA | 12 | ML |

| Profit from Unit S × Export Turnover of Unit S/Total Turnover of Unit S 13 × 120/130 = 12 |

||

| Taxable Profit | 1 | 4 |

| Less: brought forward losses of Unit N | NIL | 2 |

| Business Income | 1 | 2 |

| Therefore the Total Business Income of Nathan Aviation Ltd. is [ 1+2 ] | 3 | |

Note: It is assumed that the above financial year 2020-21 falls within the first five years period commencing from the year of manufacture or production of articles or provision of service by Unit S.

![]()

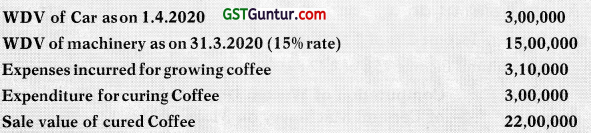

Question 11.

Rudra Ltd. has one unit at Special Economic Zone (SEZ) and other unit at Domestic Tariff Area (DTA), the company provides the following details for the previous year 2020-21.

| Particulars | Rudra Ltd. (₹) | Unit in DTA (₹) |

| Total Sales | 6,00,00,000 | 2,00,00,000 |

| Export Sales | 4,60,00,000 | 1,60,00,000 |

| Net Profit | 80,00,000 | 20,00,000 |

Calculate the eligible deduction under section 10AA of the Income-tax Act, 1961, for the Assessment Year 2021-22, in the following situations:

(a) If both the units were set-up and start manufacturing from 22-05-2015.

(b) If both the units were set-up and start manufacturing from 14-05-2019, [May 2015, 08 Marks]

Answer:

Note:

- No deduction is available for Unit in Domestic Tariff Area as it is not covered u/s 10AA.

- SEZ profits are computed as Total for Rudra Ltd. less amount for Unit in DTA.

![]()

Question 12.

Mr. Suresh has set-up an undertaking in SEZ (Unit A) and another undertaking in DTA (Unit B) in the financial year 2016-17. In the previous year 2020-21, total turnover of the unit A is ₹ 180 Lacs and total turnover of Unit B is ₹ 120 Lacs. Export turnover of Unit A for the year is ₹ 150 Lacs and the profit for the unit A is ₹ 60 Lacs.

Calculate the deduction available, if any, to Mr. Suresh under Section 10AA of the Income-tax Act, 1961, for the Assessment year 2021-22, if the manufacturing started in Unit A in the financial year 2016-17. [May 2016, 4 Marks]

Answer:

Computation of Business Income for the Assessment Year 2021-2022

| Particulars | Amount (₹ in Lacs) |

| Profits from the unit A in SEZ | 60 |

| Less: Exemption u/s 10AA = Profit of Business of the Undertaking × Export Turnover/Total Turnover = 60 × \(\frac{150 \times 50 \%}{150+30}\) |

25 |

| Business Income | 35 |

Note: Since Unit A has been set-up in Financial Year 2016-17, it falls within second 5 year period, for which exemption is 50%.

![]()

Question 13.

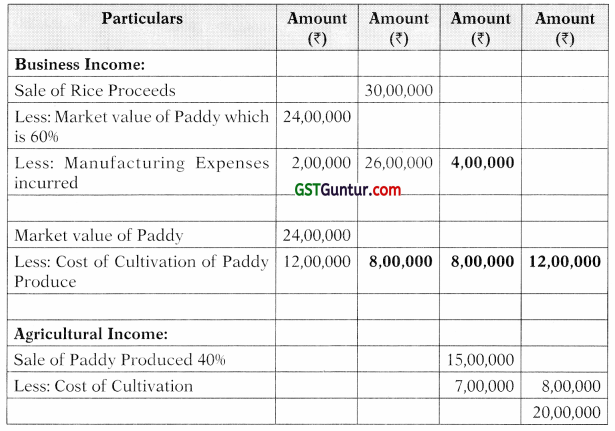

Mr. Kamal grows paddy and uses the same for the purpose of manufacturing of rice in his own Rice Mill. The cost of cultivation of 40% of paddy produce is ₹ 7,00,000 which is sold for ₹ 15,00,000; and the cost of cultivation of balance 60% of paddy is ₹ 12,00,000 and the market value of such paddy is ₹ 24,00,000. To manufacture the rice, he incurred ₹ 2,00,000 in the manufacturing process on the balance (60%) paddy. The rice was sold for ₹ 30,00,000.

Compute the Business income and Agriculture Income of Mr. Kamal. [Nov. 2016, 4 Marks]

Answer:

Computation of Business Income and Agricultural Income of Mr. Kamal

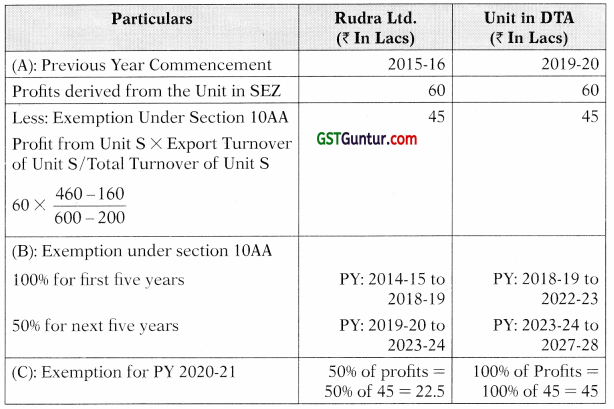

Question 14.

Mr. Avans, a resident aged 25 years, manufactures tea leaves from the tea plants grown by him in India, These are then sold in the Indian market for ₹ 40 lakhs. The cost of growing tea plants was ₹ 15 lakhs and the cost of manufacturing tea leaves was ₹ 10 lakhs.

Compute her tax liability for the Assessment Year 2021-22. [May 2018, 7 Marks]

Answer:

Computation, of Taxable Income of Mr. Avani for Assessment Year 2021-20

| Particulars | Amount (₹) | Amount (₹) |

| Sale Value of Tea | 40,00,000 | |

| Less: Cost of Growing tea Plant | 15,00,000 | |

| Less: Cost Manufacturing Tea | 10,00,000 | 25,00,000 |

| Business Income | 15,00,000 | |

| Less: Agricultural Income 60% of ₹ 15,00,000 is Exempt under Rule 8 | 9,00,000 | |

| Business Income | 6,00,000 |

![]()

Computation of Tax Liability

| Particulars | Amount (₹) | Amount (₹) |

| Agricultural income | 9,00,000 | |

| Business Income | 6,00,000 | |

| Total Income | 15,00,000 | |

| Tax on total income of ₹ 15,00,000 [A] | 2,62,500 | |

| Agricultural Income | 9,00,000 | |

| Exemption Limit | 2,50,000 | |

| Total | 11,50,000 | |

| Tax on ₹ 11,50,000 [B] | 1,57,500 | |

| Difference [A] – [B] | 1,05,000 | |

| Add: SHEC @4% of ₹ 1,05,000 | 4,200 | |

| Net Tax Liability | 1,09,200 |

![]()

Question 15.

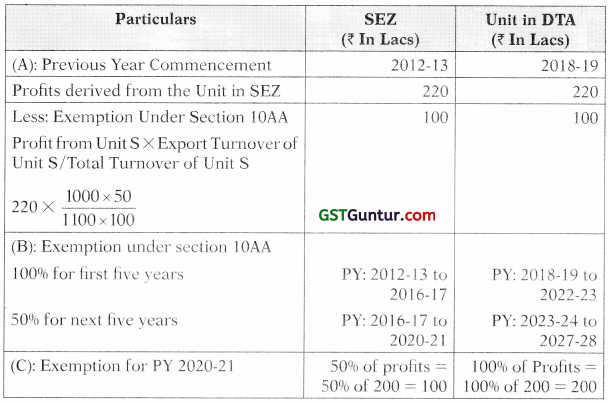

Mrs. Vibha Gupta, a resident individual, is running a SEZ unit, as well as a unit in Domestic Tariff Area (DTA), She furnishes the following details relating to the year ended 31-3-2021, pertaining to these two units ₹ in lakhs.

| Particulars | DTA Unit | SEZ Unit |

| Export Turnover | 100 | 1000 |

| Total Turnover | 400 | 1100 |

| Net Profit | 50 | 220 |

Calculate the eligible deduction under section 10AA of the Income-tax Act, 1961, for the Assessment Year 2021-22, in the following situations:

(a) If both the units were set-up and start manufacturing from 12-03-2013.

(b) If both the units were set-up and start manufacturing from 12-08- 2018. [Nov. 2018, 6 Marks]

Answer:

Note:

1. No deduction is available for Unit in Domestic Tariff Area as it is not covered u/s 10AA.