Agricultural Income – CA Inter Taxation Study Material is designed strictly as per the latest syllabus and exam pattern.

Agricultural Income – CA Inter Taxation Study Material

Question 1.

Discuss with brief reasons, whether Rent Received for letting out Agricultural Land for a Movie Shooting and Amounts Received from Sale of Seedlings in Nursery adjacent to the Agricultural Lands owned by an Assessee can be regarded as Agricultural Income, as per the provisions of the Income-tax Act, 1961. [May 2017, 4 Marks]

Answer:

| Item | Treatment |

| Rent of Movie Shooting | It is not an Agricultural Income, since it is not Income derived “through Agriculture’’. This constitutes Rental Income for “non-agricultural purposes”. |

| Sale of Seedlings in Nursery | As such, Income from Sale of Plants and Seedlings grown in Pots in a Nursery constitutes Agricultural Income as per decision in Soundarya Nursery 241 ITR 530 (Mad). However, in this case, such Income is derived not from agricultural land, but from a Nursery “adjacent” to it. Hence, it does not constitute Agricultural Income. |

Question 2.

X Limited, grows sugarcane to manufacture sugar. The data for the Previous Year 2020-21 is as follows –

| S.No. | Particulars | Amount(₹) |

| 1 | Particulars Cost of Cultivation of Sugarcane | 6,00,000 |

| 2 | Market Value of Sugarcane when transferred to Factory | 10,00,000 |

| 3 | Other Manufacturing Cost | 6,00,000 |

| 4 | Sales of Sugar | 25,00,000 |

| 5 | Salary of Managing Director who looks after all operations of the Company | 3,00,000 |

Determine the Income of the Company [Modified]

Answer:

Computation of Total Income of X limited for the Assessment Year 2021-22

| Particulars | Amount(₹) | Amount(₹) |

| 1. Profit and Gains of Business or Profession | ||

| Sale of Sugar | 25,00,000 | |

| Less: Average Market Value of Sugarcane | 10,00,000 | |

| Salary to Managing Director | 3,00,000 | |

| Manufacturing Cost | 6,00,000 | (19,00,000) |

| Business Income | 6,00,000 | |

| 2. Computation of Agricultural Income | 10,00,000 | |

| Market Value of Sugarcane | 10,00,000 | |

| Less: Cost of Cultivation | (6,00,000) | |

| Agricultural Income | 4,00,000 |

![]()

Question 3.

Mr. Avani, a resident aged 25 years, manufactures tea leaves from the tea plants grown by him in India. These are then sold in the Indian Market for ₹ 40 lakhs. The cost of growing tea plants was ₹ 15 lakhs and the cost of manufacturing tea leaves was ₹ 10 lakhs. Computer her Tax Liability the Assessment Year 2021-2022. [May 2018, 4 Marks]

Answer:

| Particulars | Amount (₹) |

| Sale Value of Tea | 40,00,000 |

| Less : Cost of growing Tea Plant | (15,00,000) |

| Less : Cost of Manufacturing Tea | (10,00,000) |

| Business Income (before Rule 8) | 15,00,000 |

| Less : Agricultural Income (60% Exempted as per Rule 8) | (9,00,000) |

| Taxable Business Income | 6,00,000 |

| Step | Particulars (Tax Liability) | Amount (₹) |

| 1 | Agricultural Income + Total Income – ₹ 9,00,000 – ₹ 6,00,000 | 15,00,000 |

| 2 | Tax on Step 1 [1,12,500 + (15,00,000-10,00,000) 30%] | 2,62,500 |

| 3 | Agricultural Income + Basic Exemption = ₹ 9,00,000 + ₹ 2,50,000 | 11,50,000 |

| 4 | Rebate for Agricultural Income = Tax on Step 3 = [₹ 1,12,500 + (11,50,000 – ₹ 10,00,000)] | 1,57,500 |

| 5 | Net Tax Payable = (Step 2 – Step 4) | 1,05,000 |

| 6 | SHEC @ 4% of ₹ 1,05,000 | 4,200 |

| 7 | Net Tax Payable | 1,09,200 |

![]()

Question 4.

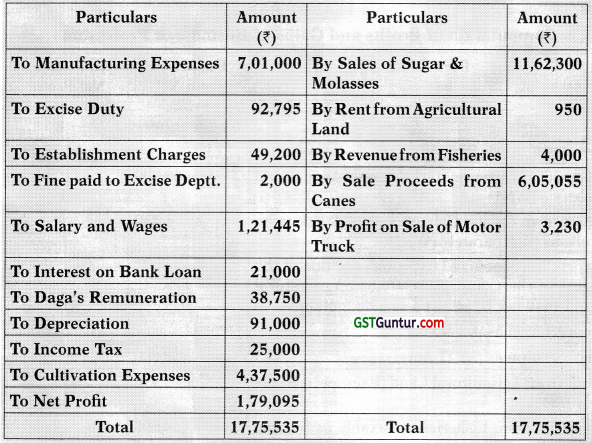

The following is the P&L for the year ended 31.03.2021 of western Sugar Mills, of which Shir Daga is the owner

Compute the Income from Business Shri Daga from the Sugar Mill for the Assessment Year 2021-2022 after taking the following information into consideration.

(a) Sale Proceeds of Cane include ₹ 5,32,000 on account of Cane pro-duced and consumed in the Factory, and debited to Manufacturing Expenses, the Average Market Price of such Cane being ₹ 6,00,000.

(b) The Motor Truck sold during the year for ₹ 7,2230 was purchased in

the past for ₹ 19,000. Depreciation claimed in respect thereof in past assessment was ₹ 15,000.)

(c) General Charge include – (a) ₹ 2,000 being the legal expenses incurred in defending a suit regarding the Company’s title to certain agricul-tural lands, and (b) ₹ 10,000 paid to Daga’s son who is an employee in the Sugar Mill, for a trip to Hawaii to study modern methods of manufacture.

(d) Depreciation in respect of all assets has been ascertained at ₹ 50,000 as per Income Tax Rules. [Nov. 1998, 14 Marks]

Answer:

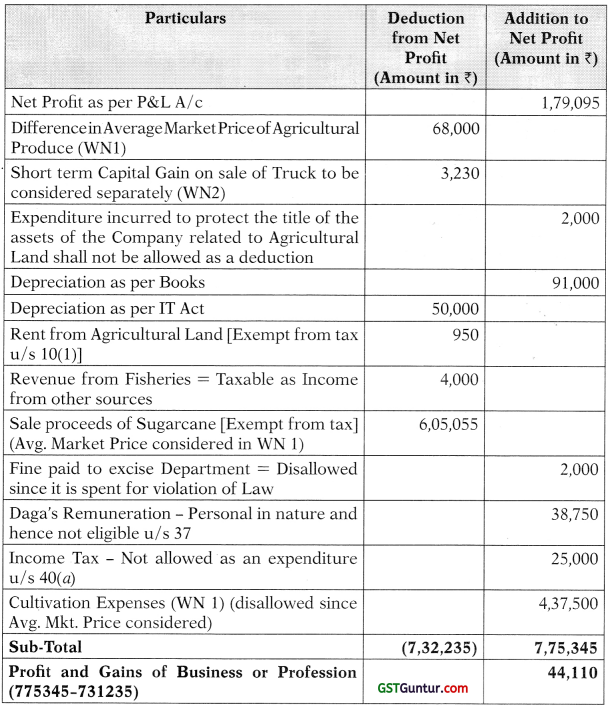

Computation of Profits and Gains of Business or Profession

![]()

Working Notes :

1. Adjustment in respect of Average Market Price: Under Rule 7, where Agricultural Produce is used as a Raw Material, the Average Market Price of the Agricultural Produce so consumed shall be debited to the Manufacturing A/c. No other expenditure relating to agricultural activity shall be considered. The adjustment for this item is as under –

| Particulars | Amount (₹) |

| Average Market Price of Agricultural Produce consumed | 6,00,000 |

| Less: Amount already debited as Manufacturing Expenses | 5,32,000 |

| Balance to be debited = Deduction from Net Profit | 68,000 |

2. Computation of Short-term Capital Gain:

| Particulars | Amount (₹) |

| Cost of Motor Truck | 19,000 |

| Less: Depreciation | 15,000 |

| Written Down Value | 4,000 |

| Less : Sale Value | 7,230 |

| Short Term Capital Gains [Sale value ₹ 7,230 – WDV ₹ 4,000] | 3,230 |

3. Expenditure relating to Mr. Dag&s son, who is an Employee, is incurred for the purpose business and no portion of the expenditure is considered to be excessive u/s 40A(2). Hence, it is fully allowed as a deduction.