Security Valuation – CA Final SFM Study Material is designed strictly as per the latest syllabus and exam pattern.

Security Valuation – CA Final SFM Study Material

Part – 1 (Theory)

Question 1.

Write a short note on Zero coupon bonds [May 2012] [4 Marks]

Answer:

Zero coupon bonds are issued by Banks, Government and Private Sec-tor companies. These bonds do not pay interest during the life of the bonds. Instead, they are issued at discounted price to their face value, which is the amount a bond will be worth when it matures or comes due. When it matures, the investor receives a lump sum amount equal to the initial investment plus interest that has been accrued on the investment made. The maturity dates on zero coupon bonds are usually long term. Bonds issued by corporate sector carry a potentially higher degree of risk, depending on the financial strength of the issuer and longer maturity period, but they also provide an opportunity to achieve a higher return.

Question 2.

Write a short note on Traditional & Walter Approach to Dividend Policy. [May 2014] [4 Marks]

Answer:

Traditional approach:

It is also known as the “The Graham and Dodd model” as it was expounded by him. According to the model, the stock market places considerably more weight on dividends than on retained earnings. This is expressed quantitatively in the following valuation model:

P = m(D + E/3)

Where, P = Market price of the share

D = Dividend per share

E = Earnings per share

m = a multiplier.

This model is based on the following assumptions:

(a) Investors are rational

(b) Under conditions of uncertainty, they turn risk averse.

Under this model, the weight attached to dividends is equal to four times the weight attached to retained earnings. The weights provided by Graham and Dodd are based on their subjective judgment and not derived from any empirical analysis.

Investors discount distant dividends at a higher rate than they discount nearby dividend. This is because nearby dividends are more certain than distant dividends.

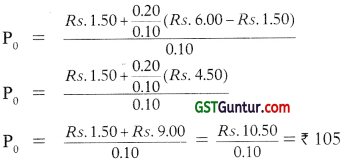

Walter approach:

The Walter’s Model propounded in 1963 by John E Walter supports the doc-trine that dividends are relevant. The investment policy of the firm cannot be separated from its dividend policy and both are interlinked. The choice of an appropriate dividend policy affects the value of any firm. It is based on the following assumptions:

(a) The firm is an all equity firm.

(b) The firm will use only retained earnings to finance its investments.

(c) The rate of return on investment is constant and so is the cost of equity. This means that with every additional investment, business risk remains unaltered.

(d) All earnings are either distributed or retained internally.

(e) The firm has a perpetual or very long life.

(f) Earnings and dividends don’t change over the life of the firm.

Walter argued that the market price of a share is the sum of the present value of the following two cash flow streams:

- Infinite stream of constant future dividends.

- Infinite stream of capital gains.

Walter model is based on the premise that there is a relationship between the return on a firm’s investment or its internal rate of return (r) and its cost of capital (ke). The firm would have an optimum dividend policy which will be determined by the relation between (r) and (ke). If r is greater than ke, the firm should retain the earnings and if r is less than ke, it must distribute the earnings.

![]()

Question 3.

Why should the duration of a coupon carrying bond always be less than the time to its maturity? [May 2009] [3 Marks]

Answer:

The concept of duration can be defined as the percentage change in price of a bond for a 100 basis point change in interest rates. However, there is another concept of duration ie. the time concept of duration according to which duration is nothing but the average time taken by an investor to collect his/her investment. It is the weighted average time to receive the present value of the bond. Therefore, if an investor receives a part of his/her investment over the time on specific intervals before maturity, the investment will offer him the duration which would be lesser than the maturity of the instrument. Higher the coupon rate, lesser would be the duration. The duration of a Zero coupon bond is always equal to its maturity period.

Question 4.

Write a note on buy-back of shares by companies and what is the impact on P/E Ratio upon buy-back of shares? [Nov. 2019 (Old Syllabus)] [4 Marks]

Answer:

Buy-Back of Shares: The buy-back of shares means the repurchase of its own shares by a company and to return money to the holders of these shares. The cash is exchanged for a reduction in the number of outstanding shares. Since this process involves outflow of cash resources, it is adopted when the company has sufficient cash resources. The buy-back is a method of financial engineering which enables the company to go back to its shareholders and offers to purchase from them the shares they hold. However, the companies have to fulfil some legal conditions for buy-back of shares.

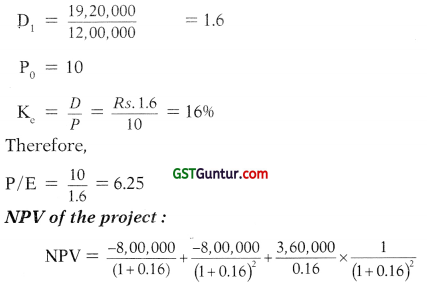

Impact of Buy-Back on P/E Ratio:

P/E Ratio is given by the following formula :

P/E = \(=\frac{\text { Market Price of the Share }}{\text { Earnings per Share }}\)

The buy back of shares by the company reduces the number of shares. In this case if the earnings remain constant, there is a rise in the Earnings Per Share ie. EPS.

After buy back, the market price of the share generally increases. Thus, there is increase in Market price of share Le. MPS.

As the numerator and denominator in the formula tend to increase, the impact on P/E will depend upon the quantum of relative increase in the two factors.

Part – 2 (Numerical Problems)

Question 1.

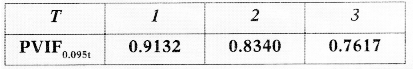

An investor is considering the purchase of the following Bond:

| Face Value | ₹ 100 |

| Coupon rate | 11% |

| Maturity | 3 years |

(i) If he wants a yield of 13%, what is the maximum price he should be ready to pay for?

(ii) If the Bond is selling for ₹ 97.60, what would be his yield? [Nov. 2009] [4 Marks]

Answer:

(i) Calculation of Maximum price

The present value of future inflows (comprising both interest as well as redemption value) discounted at 13% is the maximum price the investor would be ready to pay.

Annual Interest (I) = Rs. 100 × \(\frac{11}{100}\) = Rs. 11

Redemption Value (RV) = Rs. 100

Maturity Period (n) = 3 Years

Accordingly, Present value of future inflows can be calculated as

= ₹ 11 × PVIFA(13%, 3) + ₹ 100 PVIF(13%, 3)

= ₹ 11 × 2.361 + ₹ 100 × 0.693

= ₹ 25.97 + 69.30

= ₹ 95.27

The maximum price that the investor is ready to pay is Rs. 95.27.

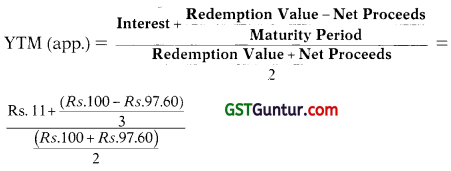

(ii) Calculation of yield

It may be noted that the price of bond and yield/return are inversely related. The fair value is Rs. 95.28 at 13% yield. It means, if the bond is selling at higher than this fair value at Rs. 97.60, the return will be less than 13%.

Let us find out approximate yield:

= 0.1194 or 11.94%

The present value of future inflows (comprising both interest as well as Value at 12%

= ₹ 11 × PVIFA(12%3) + 100 × PVIF(12% 3)

= ₹ 11 × 2.402 + ₹ 100 × 0.712

= ₹ 26.42 + ₹ 71.20

= ₹ 97.62

This value is almost equal to the price of ₹ 97.60. Therefore, the YTM of the bond would be 12%.

Question 2.

The Nominal value of 10% Bonds issued at par by M/s SK Ltd. is Rs. 100. The bonds are redeemable at Rs. 110 at the end of year 5.

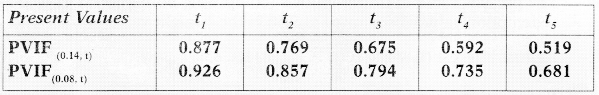

(I) Determine the value of the bond if required yield is : [Nov. 2019 Old Syllabus [5 Marks]]

(i) 8%

(ii) 9%

(iii) 10%

(iv) 11%

(II) When will the value of the bond be highest ?

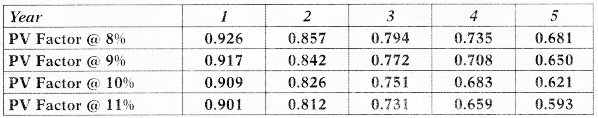

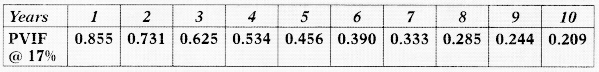

Given below are Present Value Factors :

Answer:

Given

Coupon rate 10%

Face value Rs. 100

Redemption Value Rs. 110

Life 5 yrs.

(I) Value of the bond if required yield is

(II) The price and yield are inversely related. Therefore, the highest price will be at the lowest yield. In the given case the value of the bond will be highest when yield is 8%.

![]()

Question 3.

Calculate Market Price of:

(i) 10% Government of India security currently quoted at ₹ 110, but interest rate is expected to go up by 1%.

(ii) A bond with 7.5% coupon interest, Face Value ₹ 10,000 & term to maturity of 2 years, presently yielding 6%. Interest payable half yearly. [Nov. 2010] [5 Marks]

Answer:

(i) Current yield:

= (Coupon Interest/Market Price) × 100 = (10/110) × 100 = 9.09%

When current yield go up by 1%:

Expected Yield = Current Yield + 1% = 9.09% + 1 = 10.09%

Calculation of new market price at a yield of 10.09%:

Yield =(Coupon Interest/Market Price) × 100 Or 10.09

= 10/Market Price × 100 New Market Price

= ₹ 99.11

(ii) Market Price of Bond:

The market price of the bond shall be the present value of future inflows, which comprises interest as well as redemption value.

Market Price = P. V. of Interest + P. V. of Principal

Half-yearly Interest (I) = Rs. 10,000 × \(\) = Rs. 375

Redemption Value (RV) = Rs. 10,000

Maturity Period (n) = 2 Years or 4 half Years

YTM (r) = 6% p.a. or 3% half yearly

Market Price = ₹ 375 × PVIFA(3%4) + ₹ 10,000 × PVIF(3%4)

= (₹ 375 × 3.7171) + (₹ 10,000 × .8885)

= ₹ 1,394 + ₹ 8,885

= ₹ 10,279

Tutorial Note:

Since, the coupon (7.5%) is higher than YTM (6%), therefore the bond will be selling at premium i.e. above Rs. 10,000.

Question 4.

Based on the credit rating of the bonds, A has decided to apply the following discount rates for valuing bonds:

| Credit rating | Discount rate |

| AAA | 364-day T-bill rate + 3% spread |

| AA | AAA + 2% spread |

| A | AAA + 3% spread |

He is considering to invest in a AA rated ₹ 1,000 face value bond currently selling at ₹ 1,025.86. The bond has five years to maturity and the coupon rate on the bond is 15 per cent per annum payable annually. The next inter-est payment is due one year from today and the bond is redeemable at par.

(Assume the 364-day T-bill rate to be 9 per cent).

You are required to calculate:

(i) The intrinsic value of the bond for A. Should he invest in the bond?

(ii) The Current Yield (CY) and

(iii) The Yield to Maturity (YTM) of the bond. [Nov. 2011] [8 Marks]

Answer:

(i) Calculation of Intrinsic Value of the bond:

As per table given in the question, the appropriate discount rate for valuing the AA rated bond for A is:

YTM = 996 + 396 + 2% = 1496

The other parameters are:

Annual Interest (I) = 1596 of Rs. 1,000 = Rs. 150

Redemption Value (RV) = Rs. 1,000

Maturity Period (n) = 5 Years

Accordingly, Intrinsic Value of future inflows can be calculated as = ₹ 150 × PVIFA(14%5) + ₹ 1,000 × PVIF(14%>5)

= ₹ 150 × 3.4331 + ₹ 1,000 × 0.5194

= ₹ 514.96 + ₹ 519.40 = ₹ 1,034.36

The current market value (Rs. 1,025.86) is less than the intrinsic value (Rs. 1,034.36) of the bond. Therefore, the bond is underpriced. So, Mr. A should buy the bond.

(ii) Calculation of Current Yield (CY):

Current yield = Annual Interest/Price = ₹ 150/₹ 1,025.86

= 14.6296

(iii) Calculation of Yield to Maturity (YTM):

Since, the coupon rate is 15% and bond is redeemable at par, therefore the price of the bond at 15% YTM will be Rs. 1,000.

| Yelid | Value (Rs) |

| 15% | 1,000 |

| 14% | 1,034.36 |

YTM at Rs, 1025.86 can be calculated using interpolation as per the manner given below.

By interpolation, the YTM is

= 14% + \(\frac{34.36-25.86}{34.36}\) × (15% – 14%)

= 14% + \(\frac{8.5}{34.36}\)%

= 14.24796

Question 5.

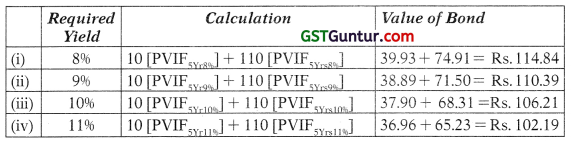

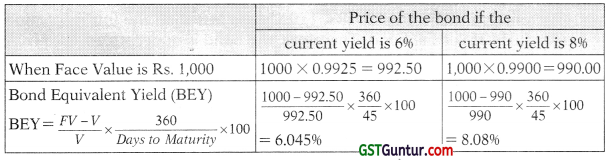

A bond is held for a period of 45 days. The current discount yield is 6 per cent per annum. It is expected that current yield will increase by 200 basis points and current market price will come down by Rs. 2.50.

Calculate

(i) Face Value of the Bond

(ii) Bond Equivalent yield. [May 2017] [4 Marks]

Answer:

(i) Let the Face value of bond be Re. 1

The difference in bond price due to 200 basis increase in interest rates is a decrease of Re. 0.0025. Therefore, by applying unitary method, if the actual difference is Rs. 2.50 the face value of the bond will be \(\frac{2.5}{0.0025}\) × 1 = Rs. 1,000

Face Value of the Bond = Rs. 1,000

(ii) Bond Equivalent yield

Question 6.

Bright Computers Limited is planning to issue a debenture series with a face value of ₹ 1,000 each for a term of 10 years with the following coupon rates:

| Years | Rates |

| 1-4 | 8% |

| 5-8 | 9% |

| 9-10 | 13% |

The current market rate on similar debenture is 15% p.a. The company proposes to price the issue in such a way that a yield of 16% compounded rate of return is received by the investors. The redeemable price of the debenture will be at 10% premium on maturity. What should be the issue price of debenture?

PV @ 16% for 1 to 10 years are: .862, .743, .641, .552, .476, .410, .354, .305, .263, .227 respectively. [May 2016] [5 Marks]

Answer:

The issue price of the debentures will be the sum of present value of interest payments during 10 years and present value of redemption of debenture.

Interest (first 4 Years) = Rs. 1,000 @ 8% = Rs. 80

Interest (Next 4 Years) = Rs. 1,000 @ 9% = Rs. 90

Interest (Next 2 Years) = Rs. 1,000 @ 13% = Rs. 130

Redemption Value (10th Year) = Rs. 1,100

Maturity = 10 Years YTM = 16%

The cash inflows of the interest part are not constant throughout the period and the present value factors are given in the question. Therefore, it would be better to solve in the following tabular form.

| Years | Cash outflow (Rs.) | PVF @ 16% | PV |

| 1 | 80 | 0.862 | 68.96 |

| 2 | 80 | 0.743 | 59.44 |

| 3 | 80 | 0.641 | 51.28 |

| 4 | 80 | 0.552 | 44.16 |

| 5 | 90 | 0.476 | 42.84 |

| 6 | 90 | 0.410 | 36.90 |

| 7 | 90 | 0.354 | 31.86 |

| 8 | 90 | 0.305 | 27.45 |

| 9 | 130 | 0.263 | 34.19 |

| 10 | 130 | 0.227 | 29.51 |

| 10 | 1,100 (RV) | 0.227 | 249.70 |

| 676.29 |

The company should issue the debentures at a price at ₹ 6/6.29.

![]()

Question 7.

Consider two bonds, one with 5 years to maturity and the other with 20 years to maturity. Both the bonds have a face value of ₹ 1,000 and coupon rate of 8% (with annual interest payments) and both are selling at par.

(i) Assume that the yields of both the bonds fall to 6%, whether the price of bond will increase or decrease?

(ii) What percentage of this increase/decrease comes from a change in the present value of bond’s principal amount and what percentage of this increase/decrease comes from a change in the present value of bond’s interest payments? [May 2009] [8 Marks]

Answer:

(i) The price of bond and yield are inversely related. Since the yield falls to 6%, the price of bonds will increase. The increase in price of the bond with higher maturity period will be higher.

If yield falls to 6%

| Price of 5 years bond | |

| = ₹ 80 × PVIFA(6% 5) + ₹ 1,000 × pvif(6% 5) = (₹ 80 × 4.2124) + (₹ 1,000 × 0.7473) = 336.99 + 747.30 = ₹ 1,084.29 |

Increase in price Rs. 84.29 |

| Price of 20 years bond | |

| = ₹ 80 × pvifa(6%20) + ₹ 1,000 × PVIF(6%20) = (₹ 80 × 11.4699) + (₹ 1,000 × 0.3118) = 917.59 + 311.80 = ₹ 1,229.39 |

Increase in price Rs. 229.39 |

(ii) Price increase in Bond:

(a) Due to change in the present value of bond’s principal amount:

| Price of 5 years bond | |

| = Principal × [PVIF(6%,5) – PVIF(8%,5)] = 1,000 × [0.7473 – 0.6806] = Rs. 66.70 |

Percentage Increase \( \frac{\text { Rs. } 66.70}{\text { Rs. } 84.29} \) × 100 = 79.13% |

| Price of 20 years bond | |

| = Principal × [PVIF(6%,5) – PVIF(8%,5)] = 1,000 × [0.3118 – 0.2145] = Rs. 97.30 |

Percentage Increase \( \frac{\text { Rs. } 97.30}{\text { Rs. } 229.39} \) × 100 = 42.42% |

(b) Due to change in the present value of bond’s Interest amount:

| Price of 5 years bond | |

| = Interest × [PVIF(6%,5) – PVIF(8%,5)] = 80 × [4.2124 – 3.9927] = Rs. 17.59 |

Percentage Increase \( \frac{\text { Rs. } 17.59}{\text { Rs. 84.29 }} \) × 100 = 20.87% |

| = Interest × [PVIF(6%,5) – PVIF(8%,5)] = 80 × [11.4699 – 9.8181] = Rs. 132.14 |

Percentage Increase \( \frac{\text { Rs. } 132.14}{\text { Rs. } 229.39} \) × 100 = 57.58% |

Tutorial Note:

The segment of increase in the price of the bond due to interest part is higher mease of bond with higher maturity.

Question 8.

Pet feed pic has outstanding, a high yield Bond with the following features:

| Face value | £10,000 |

| Coupon | 10% |

| Maturity period | 6 years |

| Special feature | Company can extend the life of Bond to 12 years. |

(a) If an investor expects that interest will be 8%, six years from now then how much he should pay for this bond now.

(b) Now suppose, on the basis of that expectation, he invests in the Bond,

but interest rate turns out to be 12%, six years from now, then what will be his potential loss/gain if company extends the life of bond another 6 years [RTP Nov. 2018]

Answer:

(a) If the current interest rate is 896, the company will not extend the duration of Bond and the maximum amount the investor would be ready to pay will be:

= £ 1,000 PVIFA (8%, 6) + £10,000 PVIF (8%,6)

= £1,000 × 4.623 + £10,000 × 0.630

= £4,623 + £ 6,300

= £10,923

(b) If the current interest rate is 1296, the companies will extend the duration of Bond. After six year the value of Bond will be =£ 1,000 PVIFA (1296,6) + £10,000 PVIF (1296,6)

= £1,000 × 4.111 + £10,000 × 0.507

= £ 4,111 + £ 5,070

= £ 9,181

Potential gain = £9,181 – £10.923 = -£1,742

Thus, potential loss will be £1,742

Question 9.

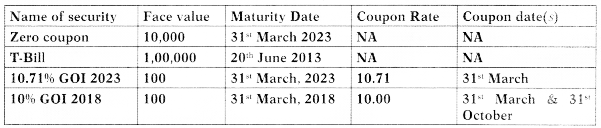

On 31st March 2013, the following information about bond is available:

i. If 10 year yield is 7.5% p.a., what price the Zero coupon Bond would fetch on 31st March 2013?

ii. What will be the annualized yield if the T-Bill is traded @ Rs. 98,500?

iii. If 10.71% GOI 2023 Bond having yield to maturity is 8% what price would it fetch on April 1, 2013 (after coupon payment on 31st March)?

iv. If 10% GOI 2018 Bond having yield to maturity is 8%, what price would it fetch on April 1, 2013 (after coupon payment on 31st March)? [May 2015][8 Marks]

Answer:

(i) Price of Zero coupon bond on 31.3.2013:

= 10,000 PVIF (7.5%, 10)

= 10,000 × 0.4852

= Rs. 4,852

(ii) Annualized yield on T-Bill = \(\frac{F-P}{P} \times \frac{365}{M}\) × 100

\(\frac{1,00,000-98,500}{98,500} \times \frac{365}{81}\) × 100 = 6.

(iii) 10.71 PVIFA (8%, 10) + 100 PVIF (8%, 10)

= 10.71 × 6.7101 + 100 × 0.4632

= 71.87 + 46.32

= Rs. 118.19

(iv) 5 PVIFA (496,10) + 100 PVIF (4%, 10)

= 5 × 8.111 + 100 × 0.6756

= 40.56 + 67.56

= Rs.108.12

![]()

Question 10.

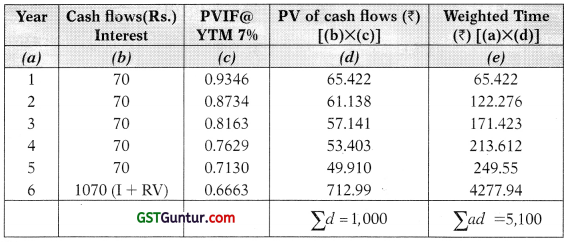

Consider a bond selling at its par value of ₹ 1,000, with 6 years to maturity and a 7% coupon rate (with annual interest payment).

(a) What is bond’s duration? [May 2009] [6 Marks]

(b) If the YTM of the bond in (a) above increases to 10%, how it affects the bond’s duration? And why? [3 Marks]

Answer:

(i) Determination of Duration of the Bond:

The following steps are to be taken:

Step 1: Calculation of YTM (Yield to maturity).

Since, the coupon rate is 7°-6 and bond is redeemable at par, and the price of the bond is Rs. 1,000 i.e. the bond is selling at par therefore the YTM ‘ will be 7%.

Step 2 : Calculation of Duration.

The duration of a bond is the weighted average of the time it takes to return the investor’s money. The present values of cash flows are to be taken as weights (w).

Year Cash flows(Rs.) PVIF@ PV of cash flows (?) Weighted Time

Duration = \(\frac{\text { Weighted Time }}{\text { Purchase Price }}=\frac{\sum a d}{\sum d}=\frac{\text { Rs. } 5,100}{\text { Rs.1,000 }}\) = 5.10 Years

Alternative Method for determination of Duration:

| Formula method | Where, |

| Duration = \( \frac{1+y}{y-}-\frac{(1+y)+\text { Period }(c-y)}{c\left[(1+y)^{\text {Period }}-1\right]+y} \)

|

y = Yield to maturity c = Coupon rate |

Duration = \(\frac{1+0.07}{0.07}-\frac{(1+0.07)+6(0.07-0.07)}{0.07\left[(1+0.07)^6-1\right]+0.07}\)

= \(\frac{1.07}{0.07}-\frac{1.07}{0.10505}\)

= 15.2857 – 10.1855 = 5.10 Years (approx.)

(ii) Effect of increase in YTM on duration of the Bond:

The calculations are similar to first part except changes in Present value factors.

Duration = \(\frac{\text { Weighted Time }}{\text { Purchase Price }}=\frac{\sum a d}{\sum d}=\frac{\text { Rs. } 4369.751}{\text { Rs. } 869.364}\) = 5.025 Years

Alternative Method for determination of Duration:

| Formula method | Where |

| Duration = \( \frac{1+y}{y}-\frac{(1+y)+\operatorname{Period}(c-y)}{c\left[(1+y)^{\text {Period }}-1\right]+y} \) | y = Yield to maturity c = Coupon rate |

Duration = \(\frac{1+0.1}{0.1}-\frac{(1+0.1)+6(0.07-0.1)}{0.07\left[(1+0.1)^6-1\right]+0.1}\)

= \(\frac{1.1}{0.1}-\frac{.92}{0.154}\)

= 11 – 5.975 = 5.025 Years (approx.)

The duration of bond decreases, reason being the receipt of slightly higher portion of one’s investment on the same intervals as the present value or purchase price is less.

Question 11.

Mr. A will need ₹ 1,00,000 after two years for which he wants to make one time necessary investment now. He has a choice of two types of bonds. Their details are as below:

| Bond X | Bond Y | |

| Face value | ₹ 1,000 | ₹ 1,000 |

| Coupon | 7% payable annually | 8% payable annually |

| Years to maturity | 1 | 4 |

| Current price | ₹ 972.73 | ₹ 936.52 |

| Current yield | 10% | 10% |

Advice Mr. A whether he should invest all his money in one type of bond or he should buy both the bonds and, if so, in which quantity?

Assume that there will not be any call risk or default risk. [Nov. 2015] [6 Marks]

Answer:

Step 1: Determination of duration of the bonds available for investment.

Duration of the bond X:

Since the year to maturity of Bond X is one year, therefore all the cash flows will be at the end of 1st year only. Hence, the duration will be 1 year.

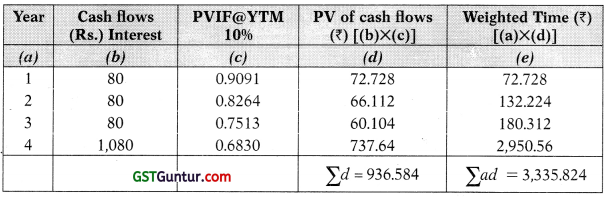

Duration of the bond Y:

Duration = \(\frac{\text { Weighted Time }}{\text { Purchase Price }}=\frac{\sum a d}{\sum d}=\frac{\text { Rs. } 3,335.824}{\text { Rs. } 936.584}\) = 3.5617 Years

Step 2 : Determination of investment to be made today to meet obligation after 2 years:

= Amount of obligation × PVIF(10% 2)

= Rs. 1,00,000 × 0.8264

= Rs. 82,640

Step 3 : Determination of proportion of investment in Bond X & Bond Y

The duration of both the bonds is different and the duration of liabilities is 2 years. Our objective is to match the duration of the liability with the duration of investment in bonds. Therefore, the weighted average of duration of bonds should be equal to 2 years.

Let x1 be the investment in Bond X and therefore investment in Bond Y shall be (1 – x1). The proportion of investment in these two bonds shall be computed as follows:

Required duration= [x1 × Duration of Bond X] + [(1 – x1) × Duration of Bond Y]

2 = x1(1) + (1 – x1) 3.5617

x1 = 0.6096 = 61% (appx.)

Therefore, 61 % investment should be made in Bond X and balance 39% in Bond Y.

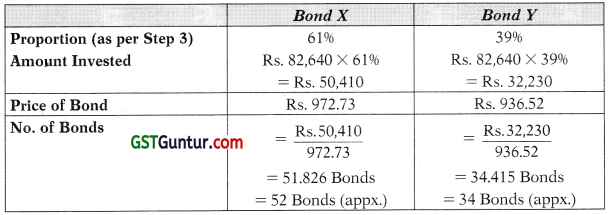

Step 4 : Investments in Bond X and Bond Y

Mr. A must invest in both the bonds in above manner and remain invested for 2 years. Since the duration of Bond X is one year, therefore he should reinvest at the end of first year.

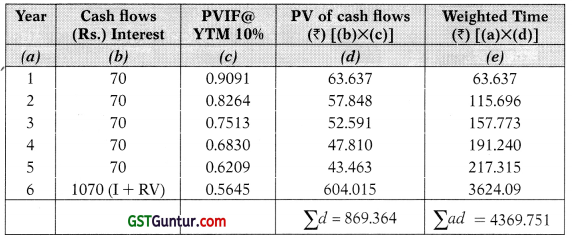

Question 12.

The following data are available for three bonds A, B and C. These bonds are used by a bond portfolio manager to fund an outflow scheduled in 6 years. Current yield is 9%. All bonds have face value of Rs. 100 each and will be redeemed at par. Interest is payable annually.

| Bond | Maturity (years) | Coupon rate |

| A | 10 | 10% |

| B | 8 | 11% |

| C | 5 | 9% |

(i) Calculate the duration of each bond.

(ii) The bond portfolio manager has been asked to keep 45% of the portfolio money in Bond A. Calculate the percentage amount to be invested in bonds B and C that need to be purchased to immunize the portfolio.

(iii) After the portfolio has been formulated, an interest rate change occurs, increasing the yield to 11%. The new duration of these bonds are: Bond A = 7.15 years, Bond B = 6.03 years and Bond C= 4.27 years.

Is the portfolio still immunized? Why or why not?

(iv) Determine the new percentage of B and C that are needed to immunize the portfolio. Bond A remaining at 45% of the portfolio.

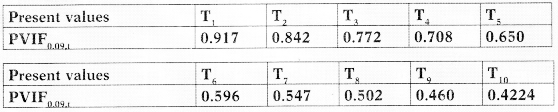

Present values be used as follows: [Nov. 2018] [12 Marks]

Answer:

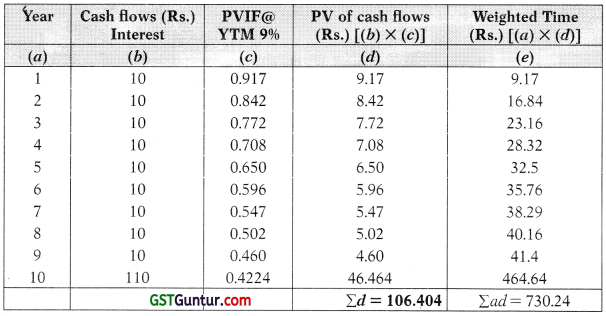

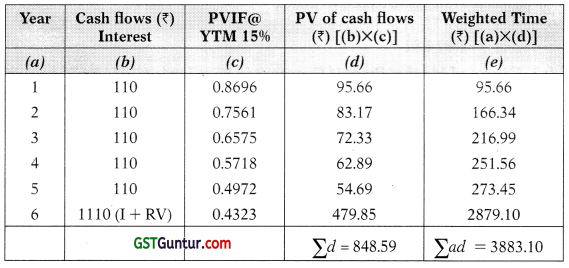

(i) Determination of duration of the bonds available for investment.

(a) Bond A:

Duration = \(\frac{\text { Weighted Time }}{\text { Purchase Price }}=\frac{\sum a d}{\sum d}=\frac{\mathbf{R s . 7 3 6 0 . 2 4}}{\text { Rs.106.404 }}\) = 6.863 Years

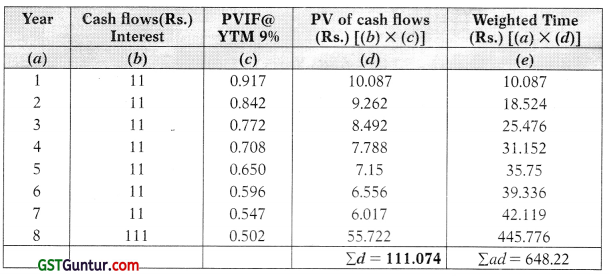

(b) Bond B:

Duration = \(\frac{\text { Weighted Time }}{\text { Purchase Price }}=\frac{\sum a d}{\sum d}=\frac{\text { Rs. } \mathbf{6 4 8 . 2 2}}{\text { Rs. } \mathbf{1 1 1 . 0 7 4}}\) = 5.8359 Years

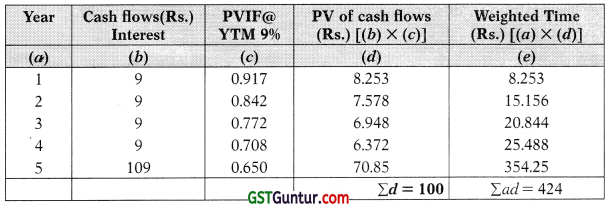

(c) Bond C:

Duration = \(\frac{\text { Weighted Time }}{\text { Purchase Price }}=\frac{\sum a d}{\sum d}=\frac{\mathrm{R s . 4 2 4}}{\mathrm{R s . 1 0 0}}\) = 4.24 Years (approx.)

| Formula method | Where |

| Duration = \( \frac{1+y}{y}-\frac{(1+y)+\text { Period }(c-y)}{c\left[(1+y)^{\text {Periad }}-1\right]+y} \) | y = Yield to maturity c = Coupon rate |

(ii) Determination of proportion of investment in Bond B & Bond C given that 45% is invested in Bond A

The duration of the bonds is different and the duration of liabilities is 6 years. Our objective is to match the duration of the liability with the duration of investment in bonds. Therefore, the weighted average of duration of bonds should be equal to 6 years.

Let x1 be the investment in Bond B and therefore investment in Bond C shall be (1 – 0.45 – x1) as 45% is invested in Bond A. The proportion of investment in these two bonds shall be computed as follows:

Required duration

= [0.45 × Duration of Bond A]+ [x1 x Duration of BondB] + [(0.55 – x1) × Duration of Bond C] = 6

0.45 × 6.863 + x1(5.8354)+ (0.55 – x1) 4.24 = 6

3.08835 + 5.8354x1 + 2.332 – 4.24x1 = 6

5.42035 + 1.5954 x1 = 6

1.5954 x1 =0.57965

x1 = 0.3633 = 36% (approx.)

Therefore, 45% investment should be made in Bond A, 36% investment should be made in Bond B and balance 19% in Bond C.

Weighted Duration = WA (DA) + WB (DB) + WC (DC)

= 0.45(6.863) + 0.36(5.8354) + 0.19(4.24)

= 6 Yrs. App.

(iii) Weighted Duration of the portfolio, if the Yield changes to 11% and the new duration of the three Bonds are given as under:

| Bond | Duration |

| A | 7.15 |

| B | 6.03 |

| C | 4.27 |

Weighted Duration = WA (DA) + WB (DB) + WC (DC )

= 0.45(7.15) + 0.36(6.03) + 0.19(4.27)

= 6.1996

The Liability is not immunized as the duration of Bond A with highest maturity and highest weight has increased thereby increasing the duration of the portfolio and since it is slightly beyond 6 years the liability is not immunized.

(iv) New percentage ofB and C: Let x1 be the investment in Bond B and there-fore investment in Bond C shall be (1- 0.45 – x1) as 45% is invested in Bond A. The proportion of investment in these two bonds shall be computed as follows:

Required duration

= [0.45x Duration of Bond A]+ [x1 × Duration of Bond B] + [(0.55 – x1) × Duration of Bond C] = 6

= 0.45 × 7.15 + x1(6.03)+ (0.55 – x1) 4.27

= 6 3.2175 + 6.03x1 + 2.3485 – 4.27x1

= 6 5.566 + 1.76x = 6 1.76x1 = 0.434

x = 0.2466 = 24.66%

Therefore, 45% investment should be made in Bond A, 24.66% investment should be made in Bond B and balance 30.34% in Bond C.

Weighted Duration = WA (DA) + WB (DB) + WC (DC)

= 0.45(7.15) + 0.2466(6.03) + 0.3034(4.27)

= 6 Yrs.

![]()

Question 13.

The following data is available for a bond:

| Face value | ₹ 1,000 |

| Coupon Rate | 11% |

| Years to Maturity | 6 |

| Redemption Value | ₹ 1,000 |

| Yield to Maturity | 15% |

(Round-off your answers to 3 decimals)

Calculate the following in respect of the bond:

(i) Current Market Price.

(ii) Duration of the Bond.

(iii) Volatility of the Bond.

(iv) Expected market price if increase in required yield is by 100 basis points,

(v) Expected market price if decrease in required yield is by 75 basis points. [Nov. 2015] [5 Marks]

Answer:

(i) Current Market Price = \(\frac{\text { Coupon Interest }}{\text { Yield } \%}\)

= \(\frac{110}{15 \%}\)

= ₹ 733.33

(ii) Determination of Duration of the Bond:

The following steps are to be taken:

Step 1 Calculation of YTM (Yield to maturity).

It is given in the question as 1596

Step 2 Calculation of Duration.

The duration of a bond is the weighted average of the time it takes to return the investor’s money. The present values of cash flows are to be taken as weights (w).

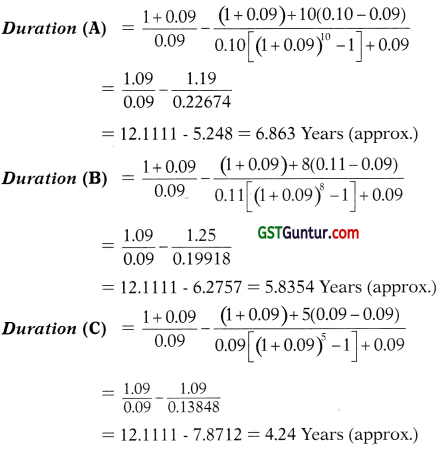

Duration = \(\frac{\text { Weighted Time }}{\text { Purchase Price }}=\frac{\sum a d}{\sum d}=\frac{\text { Rs. } 3883.10}{\text { Rs. } 848.59}\)4.576 Yrs.

Alternative Method for determination of Duration:

| Formula method | Where, |

| Duration = \( \frac{1+y}{y}=\frac{(1+y)+\text { Period }(c-y)}{c\left[(1+y)^{\text {Period }}-1\right]+y} \) | y = Yield to maturity c = Coupon rate |

Duration = \(\frac{1+0.15}{0.15}-\frac{(1+0.15)+6(0.11-0.15)}{0.11\left[(1+0.15)^6-1\right]+0.15}\)

= \(\frac{1.15}{0.15}-\frac{0.91}{02944}\)

= 7.6667 – 3.091 = 4.576 Years (approx.)

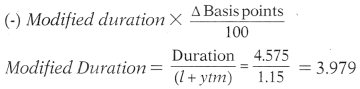

(iii) Volatility of the Bond

The negative sign indicates that the price will be inversely related to the change in interest rates and the number 3.979 indicates the magnitude of the sensitivity. This means that for every 100 basis points i.e. 1% rise in interest rates the price of the bond will fall approximately by 3.979% and vice versa.

(iv) Expected Market price if increase in requiredyield is by 100 basis points

= (-) 3.979 × \(\frac{100}{100}\) = -3.979%

848. 59 × 3.979% = ₹ 33.77

= Then Market Price will fall by Rs. 33.77 and it will be = 848.59 – 33.77

= ₹ 814.82

(v) Expected Market Price if Decrease in requiredyield is by 75 basis points

(-) 3.979 × \(\frac{100}{100}\) = 2.984%

= 848.59 × 2.984% = 25.32

= Therefore Market Price will rise by Rs. 25.32 and it will be = 848.59 + 25.32 = ? 873.91

Question 14.

XL Ispat Ltd. has made an issue of 14 per cent non-convertible debentures on January 1, 2007. These debentures have a face value of ? 100 and is currently traded in the market at a price of ₹ 90.

Interest on these NCD will be paid through post-dated cheques dated June 30 and December 31. Interest payments for the first 3 years will be paid in advance though post-dated cheques while for the last 2 years, post-dated cheques will be issued at the third year. The bond is redeemable at par on December 31, 2011 at the end of 5 years.

Required:

(i) Estimated the current yield at the YTM of the bond.

(ii) Calculate the duration of the NCD.

(iii) Assuming that intermediate coupon payments are, not available for reinvestment calculate the realized yield on the NCD. [Nov. 2008] [6 Marks]

Answer:

(i) Current yield:

= (Coupon Interest/Market Price) × 100= (14/90) × 100 = 15.55%

(ii) Determination of Duration of the Bond:

The following steps are to be taken:

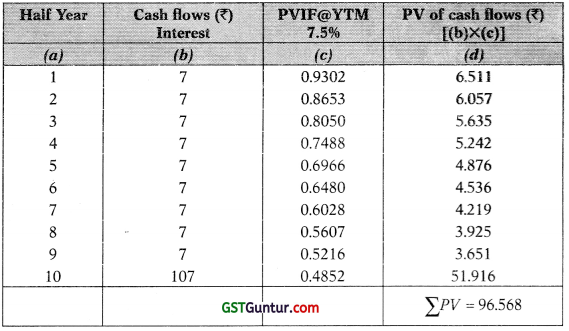

Step 1: Calculation of YTM (Yield to maturity).

YTM in this case shall be calculated by interpolation. Since, the coupon rate is 1% half yearly and bond is redeemable at par, and the price of the bond is Rs. 90 i.e. the bond is selling below par therefore the YTM will be more than 1% half yearly and as per the current yield also it is 15.55% p.a so the first trial is assumed at 7.5%.

Half yearly Interest (I) = Rs. 100 × = Rs. 7

Redemption Value (RV) = Rs. 100

Maturity Period (n)= 5 Years =10 half years

Accordingly, Present value of future inflows can be calculated as

= ₹ 7 (PVIFA(7.5%, 10)) + ₹ 100 × PVIF(7.5%,10)

= ₹ 7 × 6.8641 + ₹ 100 × 0. 4852

= ₹ 48.0487 + 48.52

= ₹ 96.568

Alternative Method

Since the present value is required to be brought down, the next trial should be at higher rate of interest. Taking 9%, the present value will be:

= ₹ 7 × PVIFA(9% 10) + ₹ 100 × PVIF(9% 10)

= ₹ 7 × 6.418 + ₹ 100 × 0.4224

= ₹ 44.93 + 42.24

= ₹ 87.17

Calculation of Yield to Maturity (YTM):

| Yield | Value (Rs.) |

| 7.5% | 96.57 |

| 9uo | 87.17 |

YTM at Rs. 90 can be calculated using interpolation as pei the manner given below

By interpolation, the YTM is

= 7.5% + \(\frac{96.57-90}{96.57-87.17}\) × (9% – 7.5%)

= 7.5% + \(\frac{6.57}{9.4}\) × (1.5%)

= 8.548% semi annual

Therefore, annualized ytm = 8.548% × 2=17.10% app.

Step 2: Calculation of Duration.

The duration of a bond is the weighted average of the time it takes to return the investor’s money. The present values of cash flows are to be taken as weights (w).

= 3.682 yrs.

Alternative Method for determination of Duration:

| Formula Method | Where, |

| Duration = \( \frac{1+y}{y}-\frac{(1+y)+\text { Period }(c-y)}{c\left[(1+y)^{\text {Period }}-1\right]+y} \) | Y = Yelid to maturity c = Coupon rate |

Duration = \(\frac{1+0.0855}{0.0855}-\frac{(1+0.0855)+10(0.07-0.0855)}{0.07\left[(1+0.0855)^{10}-1\right]+0.0855}\)

= \(\frac{1.0855}{0.0855}-\frac{0.9305}{0.1745}\)

= 12.696 – 5.332= 7.364 half Years (approx.) = \(\frac{7.364}{2}\) = 3.682 year

(i) If the interest received is not reinvested then realized yield can be calcu-lated as follows:

Half yearly Interest (I) = Rs. 100 × \(\frac{7}{100}\) = Rs. 7

(ii) Redemption Value (RV) = Rs. 100

(iii) Maturity Period (n) = 5 Years =10 half years

(iv) Total amount from interest = 7 × 10 = Rs. 70

Total realized Value = Rs. 170

Realized Yield. 170 = 90 (1 + r)5

Solving for r:

r = 13.5696

Question 15.

The Nominal value of 12% bonds issued by a company is Rs.100. The bonds are redeemable at Rs. 105 at the end of year 5. Coupons are paid annually.

Determine the duration and convexity of the bond at required annual yield rate of 10%. [Practice question]

Answer:

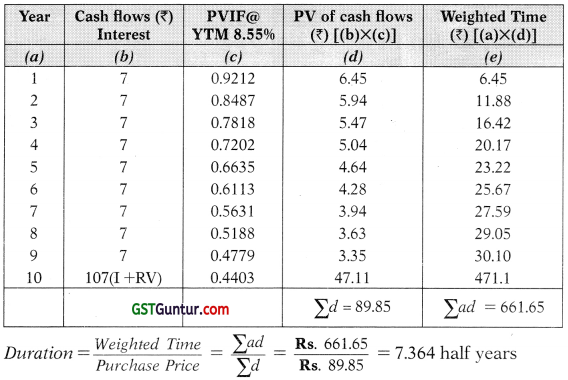

(i) Determination of duration and convexity of the bond:

![]()

Question 16.

The following is the yield structure of AAA rated debenture:

Period-Yield (%)

3 months-8.5%.

6 months-9.25

1 year-10.50

2 years-11.25

3 years and above-12.00

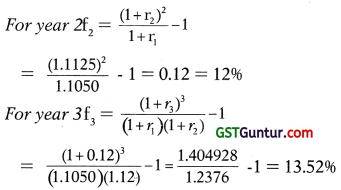

(i) Based on the expectation theory calculate the implicit one-year forward rates in year 2 and year 3.

(ii) If the interest rate increases by 50 basis points, w hat will be the percentage change in the price of the bond having a maturity of 5 years? Assume that the bond is fairly priced at the moment at ₹ 1,000. [Nov. 2008] [4 Marks]

Answer:

(i) Implicit 1 year forward rates for year 2 and year 3

(ii) If fairly priced at ₹ 1,000 and rate of interest increases to 12.596, the percentage change will be as follows:

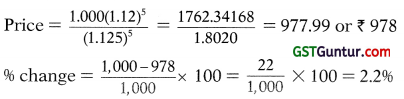

Question 17.

Consider the following data for Government Securities:

Calculate the forward interest rates. [May 2010] [8 Marks]

Answer:

To get forward interest rates,

(i) For 1 year, the one year Government Security.

₹ 91,000 = ₹ 1,00,000/(1 + r)

r = 0.099

r = 9.9%

(ii) The two years Government Security

₹ 99,000 = (₹ 10,500/1.099) + (₹ 1,10,500/(1.099) (1+r))

r = 0.124

r = 12.4%

(iii) The three years Government Security

₹ 99,500 = (11,000/1.099) + [(₹ 11,000/1.099) (1.124)] + [(₹ 1,11,000/1.099) (1.124(1 +r)]

r = 0.115

r = 11.5%

(iv) The four years Government Security

₹ 99,000 = (₹ 11,500/1.099) + [(₹ 11,500/1.099) (1.124)] + [(₹? 11,500/1.099) (1.124) (1.115)] + [(₹ 1,11,500/1.099) (1.124) (1.115) (1 + r)]

r = 0.128

r = 12.8%

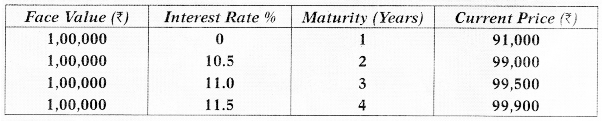

Question 18.

Sonic Ltd. issued 8% 5 year bonds of Rs. 1,000 each having a maturity of 3 year. The present rate of interest is 12% for one year tenure. It is expected that forward rate of interest for one year tenure is going to fall by 75 basis points and further by 50 basis points for next year. This bond has a beta value of 1.02 and is more popular in the market due to less credit risk.

Calculate:

(i) Intrinsic value of bond.

(ii) Expected price of bond in the market. [Nov. 2013] [Nov. 2018 old syllabus] [5 Marks]

Answer:

The following information is available :

| Face Value | 1000 |

| Coupon rate | 8% |

| Remaining Life | 3 Years |

| Present rate of Interest | 12% |

| Forward rate after one year | 11.25% (12 – 0.75) |

| Forward rate after 2 years | 10.75% (11.25 – 0.50) |

| Beta | 1.02 |

(i) Intrinsic Value of the Bond:

The intrinsic value of the Bond is Rs. 918.27

(ii) Expected Price of the Bond:

= Intrinsic value × Beta

= 918.27 × 1.02

= Rs. 936.64

Question 19.

Sabanam Ltd. has issued convertible debenture with coupon rate 11%. Each debenture has an option to convert to 16 equity shares at any time until the date of maturity. Debentures will be redeemed at Rs.100 on maturity after 5 years. An investor generally requires a rate of return of 8% p.a. on a 5 year security. As an advisor, when will you advise the investor to exercise conversion for given market prices of the equity share of (i) Rs. 5 (ii) Rs. 6 and (iii) Rs. 7.10. [May 2018 New syllabus] [8 Marks]

| Cumulative PV factor for 8% for 5 year | 3.993 |

| P.V factor for 8% for year 5 | 0.681 |

Answer:

The value of Debentures if conversion option is not exercised:

Artnual Interest (I) = Rs. 100 × \(\frac{11}{100}\) = Rs. 11

Redemption Value (RV) = Rs. 100

Maturity Period (n) = 5 Years

Accordingly, Present value of future inflows can be calculated as

= Rs. 11 PVIFA(8%5) + Rs. 100 PVIF(8% 5)

= Rs. 11 3.993 + Rs. 100 0.681

= Rs. 43.923 + 68.10

= Rs. 112.023

The value of Shares if conversion option is exercised at various prices:

| S. No. | If the price of the share is | Com ersion Value |

| (i) | R.s. 5 | Rs. 80 (5 × 16) |

| (ii) | Rs. 6 | Rs. 96 (6 × 16) |

| (iii) | Rs. 7.10 | Rs. 113.60(7.1 × 16) |

Conclusion: Conversion value is more than straight value of the bond only at the price of Rs. 7.10, therefore the conversion option is exercisable only if the share price is Rs. 7.10.

![]()

Question 20.

Pineapple Ltd. has Issued fully convertible 12 per cent debentures of ₹ 5,000 face value, convertible into 10 equity shares. The current market price of the debentures is ₹ 5,400. The present market price of equity shares is ₹ 430.

Calculate:

(i) The conversion value [3 Marks]

(ii) The conversion percentage premium [Nov. 2011] [3 Marks]

Answer:The following information is given in the question:

Face Value of the Debenture : Rs. 5,000

Coupon Rate : 12%

Conversion Ratio: 10 Equity Shares for 1 Debenture

Market Price of the Debenture Rs. 5,400

Market Price of Equity Share Rs. 430

(i) Calculation of Conversion Value per Debenture:

Conversion Value of Debenture = Value of Shares received per debenture

= Market Price per share × Conversion Ratio

= 430 × 10

= Rs. 4,300

(ii) Calculation of Conversion Percentage premium:

Market Conversion Price = \(\frac{\text { Market Price of the Debenture }}{\text { Conversion Ratio }}\)

= \(\frac{R s .5,400}{10}\) = Rs. 540

Conversion Premium per Share = Market Conversion Price – Market Price per Share

= Rs. 540 – Rs. 430

= Rs. 110

Conversion Premium per Share = \(\frac{\text { Conversion Premium per Share }}{\text { Market Price per Share }}\)

= \(\frac{R s .110}{430}\) × 100

= 25.58%

Question 21.

The data given below relates to a convertible bond:

| Face Value | ₹ 250 |

| Coupon rates | 12% |

| No. of shares per bond | 20 |

| Market price of share | ₹ 12 |

| Straight value of bond | ₹ 235 |

| Market price of convertible bond | ₹265 |

Calculate:

(i) Stock value of bond.

(ii) The percentage of downside risk.

(iii) The conversion premium

(iv) The conversion parity price of the stock. [Nov. 2008] [8 Marks]

Answer:

The following information is given in the question:

Face Value of the Bond : Rs. 250

Coupon Rate : 12%

Conversion Ratio : 20

Equity Shares for 1 Bond

Market Price of the Convertible Bond : Rs. 265

Market Price of Equity Share : Rs. 12

Straight Value of Bond : Rs. 235

(i) Calculation of Stock Value or Conversion Value of Bond:

Conversion Value of Bond = Value of Shares received per Bond

= Market Price per share × Conversion Ratio

= 12 × 20 = Rs. 240

(ii) Percentage of Down side Risk

Market Price of the Bond = \(\frac{\text { Market Price of the Bond-Straight Value of the Bond }}{\text { Straight Value of the Bond }} \) × 100

= \(\frac{R s .265-235}{235}\) × 100

= 12.77%

(iii) Calculation of Conversion Percentage premium:

Market Conversion Price = \(=\frac{\text { Market Price of the Bond }}{\text { Conversion Ratio }}\) × 100

= \(\frac{R s .265}{20}\) = Rs. 13.25

Conversion Premium per Share = Market Conversion Price – Market Price per Share

= Rs. 13.25 – Rs. 12

= Rs. 1.25

Conversion Percentage Premium = \(\frac{\text { Conversion Premium per Share }}{\text { Market Price per Share }}\)

= \(\frac{R s .1 .25}{12}\) × 100

= 10.42%

(iv) The Conversion Parity Price Or the Market Conversion Price

Market Conversion Price = \(\frac{\text { Market Price of the Bond }}{\text { Conversion Ratio }}\)

= \(\frac{R s .265}{20}\) = Rs. 13.25

![]()

Question 22.

The following is the data related to 9% fully convertible (into equity shares) debentures issued by Delta Ltd. at Rs.1000

| Market price of 9% Debenture Rs. | 1,000 |

| Conversion Ratio (No. of shares) | 25 |

| Straight value of 9% Debentures | 800 |

| Market price of Equity share on the date of conversion Rs. | 30 |

| Expected Dividend per share Rs. | 1 |

Calculate:

(а) Conversion value of Debenture;

(b) Market conversion Price;

(c) Conversion premium per share;

(d) Ratio of conversion premium;

(e) Premium over straight value of Debenture;

(f) Favourable income differential per share and

(g) Premium pay back period

Answer:

The following information is given in the question:

Face Value of the Debenture : Rs. 1,000

Market price of the debenture : Rs. 1,000

Coupon Rate : 9%

Conversion Ratio : 25 Equity Shares for 1 debenture

Expected dividend per share : Re. 1

Market Price of Equity Share : Rs. 30

Straight Value of 9% debenture : Rs. 800

(a) Calculation of Stock Value or Conversion Value of Debenture:

Market Price of one equity share × Conversion ratio = 30 × 25

= Rs. 750.

(b) Market Price of the debenture = \(\frac{\text { Market Price of the debenture }}{\text { Conversion Ratio }}\)

= \(\frac{\text { Rs. } 1000}{25}\) = Rs. 40

(c) Calculation of Conversion premium:

Conversion Premium per Share = Market Conversion Price – Market Price per Share

= Rs. 40 – Rs. 30

= Rs. 10

(d) Ratio of conversion Premium

\(\frac{\text { Premium per share }}{\text { Price of the share }} \) × 100

= \(\frac{\text { Rs. } 10}{30}\) × 100

= 33.33%

(e) Premium over straight value of debenture

Market Conversion Price of the Share- Straight Price of the share based on straight value of bond i.e. Rs. 800/25 = 32

= Rs. 8 per share

= \(\frac{\text { Rs. } 8}{32}\) × 100 = 25%

Or

\(\frac{\text { Market Price of the debenture }}{\text { Straight value of debenture }}\) – 1 = (\(\frac{R s .1000}{800}\) – 1) × 100 = 25%

(f) Favourable income differential per Share:

\(\frac{\text { Coupon interest from debenture }- \text { Conversion ratio } \times \text { Expected dividend per share }}{\text { Conversion ratio }}\) × 100

= \(\frac{90-25 \times 1}{25}\) = Rs. 2.6

(g) Premium pay back period

\(\frac{\text { Conversion premium per share }}{\text { Favourable income differential per share }}=\frac{\text { Rs.10 }}{\text { Rs.2.6 }}\) = 3.846 years

Question 23.

The following is the data related to 8.5% fully convertible (into equity shares) debentures issued by JAC Ltd. at Rs.1000

| Market price of 9% Debenture Rs. | 900 |

| Conversion Ratio (No. of shares) | 30 |

| Straight value of 9% Debentures | 700 |

| Market price of Equity share on the date of conversion Rs. | 25 |

| Expected Dividend per share Re. | 2 |

Calculated:

(a) Conversion value of Debenture;

(b) Market conversion Price;

(c) Conversion premium per share;

(d) Ratio of conversion premium;

(e) Premium over straight value of Debenture

(f) Favourable income differential per share; and

(g) Premium pay back period [Mock Test August 2018] [8 Marks]

Answer:

The following information is given in the question:

Face Value of the Debenture : Rs. 1,000

Market price of the debenture : Rs. 900

Coupon Rate Conversion Ratio : 8.5%

Expected dividend per share : 30

Equity Shares for 1 debenture : Re. 1

Market Price of Equity Share : Rs. 25

Straight Value of 9% debenture : Rs. 700

(a) Calculation of Stock Value or Conversion Value of Debenture:

Market Price of one equity share × Conversion ratio = 25 × 30 = Rs. 750.

(b) Market Conversion Price = \(\frac{\text { Market Price of the debenture }}{\text { Conversion Ratio }}\)

= \(\frac{\text { Rs. } 900}{30}\) = Rs. 30

(c) Calculation of Conversion premium:

Conversion Premium per Share = Market Conversion Price – Market Price per Share

= Rs. 30 – Rs. 25 = Rs. 5

(d) Ratio of conversion Premium

\(\frac{\text { Premium per share }}{\text { Price of the share }}\) × 100 = \(\frac{\text { Rs. } 5}{25}\) × 100 = 20%

(e) Premium over straight value of debenture

Market Conversion Price of the Share – Straight Price of the share based on straight value of bond i.e. Rs. 700/30 = 23.33

Rs. 30 – Rs. 23.33 = Rs. 6.67 per share

= \(\frac{R s .6 .67}{23.33}\) × 100 = 28.60% approx.

Or \(\frac{\text { Market Price of the debenture }}{\text { Straight value of debenture }}\) – 1 = [\(\frac{R s .900}{700}\) – 1] × 100 = 28.57%

(f) Favourable income differential per share:

\(\frac{\text { Coupon interest from debenture }- \text { Conversion ratio } \times \text { Expected dividend per share }}{\text { Conversion ratio }}\) × 100

(g) Premium pay back period

\(\frac{\text { Conversion premium per share }}{\text { Favourable income differential per share }}=\frac{\text { Rs. } 5}{\text { Rs. } 1.833}\) = 2.73 vears

![]()

Question 24.

GUI Ltd., AAA rated company has issued fully convertible bonds on the following terms, a year ago:

Face value of bond : ₹ 1,000

Coupon (interest rate) : 8.5%

Time to Maturity (remaining) : 3 years

Interest Payment : Annual at the end of year

Principal Repayment : At the end of bond maturity

Conversion ratio (No. of shares per bond) : 25

Current market price per share : ₹ 45

Market price of convertible bond : ₹ 1, 175

AAA rated company can issue plain vanilla bonds without corn ersion option at an interest rate of 9.5%.

Required:

Calculate as of today:

(i) Straight Value of bond.

(ii) Conversion Value of the bond.

(iii) Conversion Premium.

(iv) Percentage of downside risk,

(v) Conversion Parity Price.

[May 2014] [4 + 1 + 1 + 1 + 1 = 8 Marks]

Answer:

The following information is given in the question:

Face Value of the Bond : Rs. 1, 000

Coupon Rate : 85%

Conversion Ratio : 25 Equity Shares for 1 bond

Market Price of the Convertible : Rs. 1, 175

Bond Market Price of Equity Share : Rs. 45

Remaining life of Bond ie. Maturity : 3yrs

Interest payments : Anuual

Redemption at maturity : At par

This question is different from previous as the straight value of Bond is required to be calculated and therefore maturity period and redemption price is also given in the question.

(i) Calculation of Straight Value of Bond

The present value of future inflows (comprising both interest as well as redemption value) discounted at 9.5% is the straight value of the Bond.

Annual Interest (I) = Rs. 1000 × \(\frac{8.5}{100}\) = Rs. 85

Redemption Value (RV) = Rs. 1000

Maturity Period (n) = 3 Years

Accordingly, Present value of future inflows can be calculated as

= ₹ 85 × PVIFA (9.5%,3) + ₹ 1000 × PVIF (9.5%,3)

= ₹ 85 × 2.5089 + ₹ 1000 × 0.7617

= ₹ 213.26 + 761.7 = ₹ 974.96

(ii) Calculation of Stock Value or Conversion Value of Bond:

Conversion Value of Bond = Value of Shares received per Bond

= Market Price per share × Conversion Ratio

= 25 × 45

= Rs. 1125

(iii) Calculation of Conversion premium:

Market Conversion Price = \(\frac{\text { Market Price of the Bond }}{\text { Conversion Ratio }}\)

= \(\frac{\mathrm{Rs} .1175}{25}\) = Rs. 47

Conversion Premium per Share = Market Conversion Price – Market Price per Share

= Rs. 47 – Rs. 45

= Rs. 2

(iv) Percentage of Down side Risk

\(\frac{\text { Market Price of the Bond }- \text { Straight Value of the Bond }}{\text { Straight Value of the Bond }}\) × 100

= \(\frac{\text { Rs. } 1175-974.96}{974.96}\) × 100 = 20.52%

(v) The Conversion Parity Price or the Market Conversion Price

Market Conversion Price = \(\frac{\text { Market Price of the Bond }}{\text { Conversion Ratio }}\)

= \(\frac{\text { Rs. } 1175}{25}\) = Rs. 47

Question 25.

A Ltd. has issued convertible bonds, which carries a coupon rate of 14%. Each bond is convertible into 20 equity shares of the company A Ltd. The prevailing interest rate for similar credit rating bond is 8%. The convertible bond has 5 years maturity. It is redeemable at part at ? 100.

You are required to estimate:

(Calculations be made up-to 3 decimal places)

(i) current market price of the bond, assuming it being equal to its funda-mental value;

(ii) Minimum market price of equity share at which bond holder should exercise conversion option; and

(iii) duration of the bond.

Answer:

The following information is given in the question:

Face Value of the Bond : Rs. 100

Coupon Rate : 14%

Conversion Ratio : 20 Equity Shares for 1 Bond

Remaining life of Bond i.e. Maturity : 5 yrs.

Interest payments : Annual

Redemption at maturity : At Par

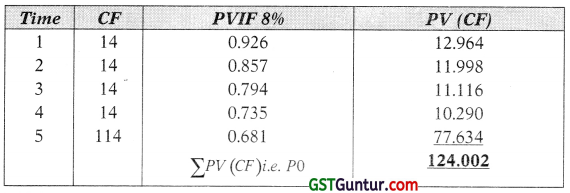

(i) Calculation of Current Market Price or the Straight Value of Bond

The present value of future inflows (comprising both interest as well as redemption value; discounted at 8% is the market price or the straight value of the Bond.

Annual Interest (I) = Rs. 100 × \(\frac{14}{100}\) = Rs. 14

Redemption Value (RV) = Rs. 100

Maturity Period (n) = 5 Years

Accordingly, Present value of future inflows can be calculated as

= ₹ 14 × PVIFA (896,5) + ₹ 1000 × PVIF (8%,5)

= ₹ 14 × 3.993 + ₹ 100 × 0.681

= ₹ 55.902 + 68.1

= ₹ 124.002 = Rs. 124 (Approx.)

Alternatively:

Current Market Price of Bond

₹ 124

(ii) Minimum Price at which Bond holder should exercise Conversion:

It should be the Market conversion price which is calculated as below:

\(\frac{\text { Market Price of the Bond }}{\text { Conversion ratio }}=\frac{124.002}{20 \text { shares }}\) = ₹ 6.20 Per Share

(iii) Duration of Bond (Formula method)

Formula method

Duration = \(\frac{1+y}{y}-\frac{(1+y)+\text { Period }(c-y)}{c\left[(1+y)^{\text {Period }}-1\right]+y}\)

Where,

y = Yield to maturity

c = Coupon rate

Duration = \(\frac{1+0.08}{0.08}-\frac{(1+0.08)+5(0.14-0.08)}{0.14\left[(1+0.08)^5-1\right]+0.08}\)

= \(\frac{1.08}{0.08}-\frac{1.38}{0.1457}\)

= 13.5 – 9.472 = 4.028 Years (approx)

![]()

Question 26.

XYZ company has current earnings of 13 per share with 5,00,000 shares outstanding. The company plans to issue 40,000, 7% convertible preference shares of ₹ 50 each at par. The preference shares are convertible into 2 shares for each preference shares held. The equity share has a current market price of ₹ 21 per share.

(i) What is preference shares’ conversion value?

(ii) What is conversion premium?

(iii) Assuming that total earnings remain the same, calculate the effect of the Issue on the basic earning per share (a) before conversion (b) after conversion.

(iv) If profits after tax increases by ₹ 1 million what will be the basic EPS

(a) before conversion and (b) on a fully diluted basis? [Nov. 2009] [8 Marks]

Answer:

The following information is given in the question:

Face Value of the Share : Rs. 50 1%

Rate of Preference Share : 7%

Conversion Ratio : 2 Equity Shares for 1 Preference Share

Market Price of the Preference Share : Rs. 50

Market Price of Equity Share : Rs. 21

No. of Equity Shares Outstanding : 5,0, 000

EPS : Rs. 3 per Share

Total number of convertible preference shares to be issued : 40,000

(i) Calculation of Conversion Value of Preference Shares:

Conversion Value of Pref. Share = Value of equity Shares received per Pref. Share

= Market Price per Equity share × Conversion Ratio

= Rs. 21 × 2 = Rs. 42

(it) Calculation of Conversion Percentage premiunv

Market Conversion Price = \(\frac{\text { Market Price of the Pref. Share }}{\text { Conversion Ratio }}\)

= \(\frac{R s .50}{2}\) = Rs. 25

Conversion Premium per Share = Market Conversion Price – Market Price per Share

= Rs. 25 – Rs. 21 = Rs. 4

Conversion Percentage Permium = \(\frac{\text { Conversion Premium per Share }}{\text { Market Price per Share }}\)

= \(\frac{R s .4}{21}\) × 100

= 19.05%

(iii) Statement of EPS before Conversion

| Particulars | Amount (₹) |

| Total earning [3 × 5,00,000] | 15,00,000 |

| (-) Preference dividend (40,000 × 50 × 1%) | (1,40,000) |

| Earnings for Equity Shareholders | 13,60,000 |

| No. of Equity Shares | 5,00,000 |

| EPS | 2.72 |

Statement of EPS After Conversion

| Particulars | Amount (₹) |

| Total earning

No. of Equity shares [5,00,000 + (40,000 × 2)] |

15,00,000 5,80,000 |

| EPS | 2.586 |

(iv) If Profits increase by 10 Lakhs

Statement of EPS before Conversion

| Particulars | Amount (₹) |

| Total earning [(3 × 5,00,000) + 10,00,000] (-) Preference dividend Earnings for Equity Shareholder No. of Equity Shares |

25,00,000

(1,40,000) |

| 23,60,000 5,00,000 |

|

| EPS | 4.72 |

Statement of EPS after Conversion

| Particulars | Amount (₹) |

| Total earning

No. of Equity Shares [5,00,000 + (40,000 × 2)] |

25,00,000

5,80,000 |

| EPS | 4.31 |

Question 27.

P Ltd. has current earnings of ₹ 6 per share with 10,00,000 shares outstanding. The company plans to issue 80,000,8% convertible preference shares of ₹ 100 each at par. The preference shares are convertible into 2 equity shares for each preference share held. The equity share has a current market price of ₹ 42 per share. Calculate:

(i) What is preference share’s conversion value?

(ii) What is conversion premium?

(iii) Assuming that total earnings remain the same, calculate the effect of the issue on the basic earnings per share (A) before conversion (B), after conversion.

(iv) If profits after tax Increases by ₹ 20 Lakhs what will be the basic EPS, (A) before conversion and (B) on a fully diluted basis? [May 2017] [8 Marks]

Answer:

The following information is given in the question:

Face Value of the Share : Rs. 100

Rate of Preference Dividend : 8%

Conversion Ratio : 2 2 Equity Shares for 1 Preference Share

Market Price of the Preference Share : Rs. 100

Market Price of Equity Share : Rs. 42

No. of Equity Shares Outstanding : 10,00,000

EPS : Rs. 6 per shares

Total number of convertible preference shares to be issued : 80,000

(i) Calculation of Conversion Value of Preference Shares:

Conversion Value of Pref. Share = Value of equity Shares received per Pref. Share

= Market Price per Equity share × Conversion Ratio

= Rs. 42 × 2 = Rs. 84

(ii) Calculation of Conversion Percentage premium:

Market Conversion Price = \(\frac{\text { Market Price of the Pref. Share }}{\text { Conversion Ratio }}\)

= \(\frac{\mathrm{Rs} \cdot 100}{2}\) = Rs. 50

Conversion Premium per Share = Market Conversion Price – Market Price per Share

= Rs. 50 – Rs. 42 = Rs. 8

Conversion Premium Premium = \(=\frac{\text { Conversion Premium per Share }}{\text { Market Price per Share }}\)

= \(\frac{\text { Rs. } 8}{42}\) = 19.05%

(iii) Statement of EPS before Conversion

| Particulars | Amount (₹) |

| Total earning [6 X 10,00,0001 (-) Preference dividend (80,000 × 100 × 8%)Earnings for Equity Shareholders No. of Equity Shares |

60,00,000 (6,40,000) |

| 53,60,000 10,00,000 |

|

| 5.36 |

Statement of EPS after Conversion

| Particulars | Amount (₹) |

| Total earning No. of Equity shares (10,00,000 + (80,000 × 2)] |

60,00,000 11,60,000 |

| EPS | 5.17 |

(iv) If Profits increase by 20 Lakhs

Statement of EPS before Conversion

| Particulars | Amount (₹) |

| Total earning [6 × 10,00,0001 + 20,00,000] (-) Preference dividend (80,000 × 100 × 8%)Earnings for Equity Shareholder No. of Equity Shares |

80,00,000 (6,40,000) |

| 73,63,000 10,00,000 |

|

| EPS | 7.36 |

Statement of EPS after Conversion

| Particulars | Amount (₹) |

| Total earning No. of Equity Shares [10,00,000 + (80,000 × 2)] |

80,00,000 11,60,000 |

| EPS | 6.90 |

![]()

Question 28.

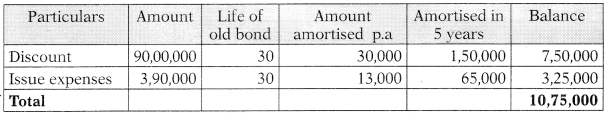

ABC Ltd. has ₹ 300 million, 12 per cent bonds outstanding with six years remaining to maturity. Since interest rates are falling, ABC Ltd. is contemplating of refunding these bonds with a ₹ 300 million issue of 6 year bonds carrying a coupon rate of 10 per cent. Issue cost of the new bonds will be ₹ 6 million and the call premium is 4 per cent. ₹ 9 million being the unamortized portion of issue cost of old bonds can be written off no sooner the old bonds are called off. Marginal tax rate of ABC Ltd. is 30 per cent. You are required to analyse the bond refunding decision. [May 2009] [6 Marks]

Answer:

1. Calculation of initial outlay:

| ₹ (million) | |

| a. Face value | 300 |

| Add: Call premium | 12 |

| Cost of calling old bonds | 312 |

| b. Gross proceed of new issue | 300 |

| Less: Issue costs | 6 |

| Net proceeds of new issue | 294 |

| c. Tax savings on call premium and unamortized cost 0.30 (12 + 9) | 6.3 |

| Initial outlay = ₹ 312 million – ₹ 294 million – ₹ 6.3 million

= ₹ 11.7 million |

6.3 |

2. Calculations of net present value of refunding the bond:

| Saving in annual interest expenses | 7 (million) |

| [300 × (0.12-0.10)]

Less: Tax saving on interest and amortization |

6.00 |

| 0.30 × [6 + (9 – 6)/6] | 1.95 |

| Annual net cash saving | 4.05 |

| PVIFA (7% 6 years) | 4.766 |

| Present value of net annual cash saving | = ₹ 19.30 million |

| Less: Initial outlay | = ₹ 11.70 million |

| Net present value of refunding the bond Decision: The bonds should be refunded. |

₹ 7.60 million |

Question 29.

M/s. Earth Limited has 11% bond worth of ₹ 2 crores outstanding with 10 years remaining to maturity.

The company is contemplating the issue of a ₹ 2 crores 10 years bond carrying the coupon rate of 9% and use the proceeds to liquidate the old bonds.

The unamortized portion of issue cost on the old bonds is ₹ 3 lakhs which can be written off no sooner the old bonds are called. The company is paying 30% tax and it’s after tax cost of debt is 7%. Should Earth Limited liquidate the old bonds?

You may assume that the issue cost of the new bonds with be ₹ 2.5 lakhs and the call premium is 5%. [May 2013] [6 Marks]

Answer:

1. Computation of initial outlay:

| (₹ lakhs) | ||

| (a) | Face value | 200.00 |

| Add: Call premium | 10.00 | |

| Cost of calling old bonds | 210.00 | |

| (b) | Gross proceed of new issue | 200.00 |

| Less: Issue costs | 2.50 | |

| Net proceeds of new issue | 197.50 | |

| (c) | Tax savings on call premium and unamortized costs 0.30 (10 + 3) | 3.90 lakhs |

| Therefore, Initial outlay = ₹ 210 lakhs – ₹ 197.50 lakhs – ₹ 3.90 lakhs |

2. Computation of net present value of refunding the bond:

| ₹ lakhs | |

| Saving in annual interest expenses[₹ 200 (0.11 – 0.09)] | 4.000 |

| Less: Tax saving on interest and amortization 0.30 [4 + (3 – 2.5)/10] | 1.215 |

| Annual net cash saving | 2.785 |

| PVIFA (7%, 10 years) | 7.024 |

| Present value of net annual cash saving | ₹ 19.56 lakhs |

| Less: Initial outlay | ₹ 8.60 lakhs |

| Net present value of refunding the bond | ₹ 10.96 lakhs |

Decision, Since the NPV of refunding the bond is favourable, the bonds should be refunded.

Question 30.

Tangent Limited is considering calling Rs. 3 crores of 30 years, Rs. 1000 bond issued 5 years ago with a coupon interest rate of 14 per cent. The bonds have a call price of Rs. 1,150 and had initially collected proceeds of Rs. 2.91 crores since a discount of Rs. 30 per bond was offered. The initial floating cost was Rs. 3,90,000. The company intends to sell Rs. 3 crores of 12 per cent coupon rate, 25 years bonds to raise funds for retiring the old bonds. It proposes to sell the new bonds at their par value of Rs. 1,000. The estimated floatation cost is Rs. 4,25,000. The company is paying 40% tax and its after tax cost of debt is 8 per cent. As the new bonds must first be sold and then their proceeds to be Used to retire the old bonds, the company expects a two months period of overlapping interest during which interest must be paid on both the old and the new bonds. You are required to evaluate the bond retiring decision. [PVIFA8%,25 = 10.675] [Nov. 2018] [8 Marks]

Answer:

1. Computation of initial outlay:

| (Rs. in lakhs) | |

| (a) Face value | 300.00 |

| Add: Call premium | 45.00 |

| Cost of calling old bonds | 345.00 |

| (b) Gross proceed of new issue | 300.00 |

| Less: Issue costs | 4.25 |

| Net proceeds of new issue | 295.75 |

| (c) Tax savings on call premium and unamortized costs 0.40 (45+10.75)(W.N.) | 22.30 |

| (d) Overlapping Interest after tax (300 × 0.14 × \(\frac{2}{12}\)) (1-0.4) | = 4.2 |

| Therefore, Initial outlay = ₹ 345 + 4.2 – (₹ 295.75 + 22.30) 31.15 |

2. Annual cash flow savings: (Rs. in Lakhs)

(a) Old bond

| (i) Interest cost after tax (300 × 0.14)(1 – 0.4) | 25.20 |

| (ii) Tax saving on amortization of discount (9,00,000/30) (0.40) | 0.12 |

| (iii) Tax saving on amortization of floatation costs (390000/30)(0.40) | 0.052 |

| Annual cost | 25.028 |

(b) New bond

| (i) Interest cost after tax (300 × 0.12)(1 – 0.4) | 21.60 |

| (ii) Tax saving on amortisation of discount | Nil |

| (iii) Tax saving on amortisation of floatation costs (425000/25 × 0.40) | 0.068 |

Annual cost

| Saving in annual expenses Annual net cash saving (25.028 – 21.532) |

3.496 |

| PVIFA (8°o, 25 years) | 10.675 |

| ∴ Present value of net annual cash saving | Rs. 37.31980 lakhs |

| Less: -Initial outlay | Rs. 31.15 lakhs |

| Net present value of refunding the bond | Rs. 6.1698 lakhs |

Decision Since the NPV of refunding the bond is favourable, the bonds should be refunded.

Working Note:

UnamortizedDiscount and issue costs:

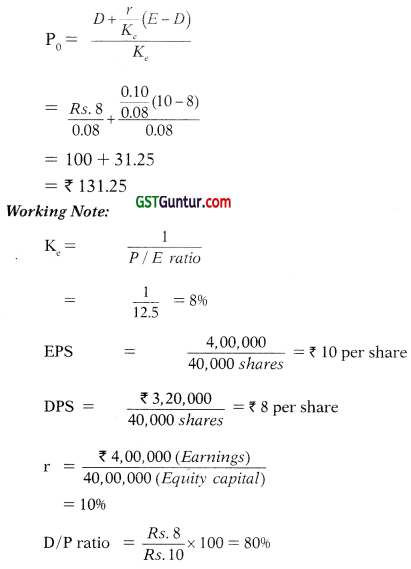

Question 51.

A firm had been paid dividend at ₹ 2 per share last year. The estimated growth of the dividends from the company is estimated to be 5% p.a. Determine the estimated market price of the equity share if the estimated growth rate of dividends (i) rises to 8%, and (ii) falls to 3%. Also find out the present market price of the share, given that the required rate of return of the equity investors is 15.5%. [Nov. 2009] [6 Marks]

Answer:

In this case the company has paid dividend of ₹ 2 per share during the last year.

The growth rate (g) is 5%. Then, the current year dividend (D1) with the expected growth rate of 5°o will be = D0( 1+g) = ₹ 2.10.

The share price is P0 = \(\frac{D_1}{K_e-g}\)

= \(\frac{\text { Rs. } 2.10}{0.155-0.05}\)

= ₹ 20

In case the growth rate rises to 8% then the dividend for the current year. (Dt) would be ₹ 2.16 and market price would be

= \(\frac{R s .2 .16}{0.155-0.08}\)

= ₹ 28.80

In case growth rate falls to 3% then the dividend for the current year (D,) would be ₹ 2.06 and market price would be –

= \(\frac{R s .2 .06}{0.155-0.03}\)

= ₹ 16.48

Conclusion:

The market price of the share is expected to vary in response to change in expected growth rate in dividends.

![]()

Question 32.

Shares of Volga Ltd. are being quoted at a price-earnings ratio of 8 times. The company retains 50% of its Earnings per Share. The company’s EPS is Rs. 10.

You are required to determine:

(1) The cost of equity to the company if the market expects a growth rate of 15% p.a.

(2) The indicative market price with the same cost of capital and if the anticipated growth rate is 16% p.a.

(3) The market price per share if the company’s cost of capital is 20% p.a. and the anticipated grow th rate is 18% p.a. [Nov. 2018] [8 Marks]

Answer:

(1) As per Dividend Discount Model approach the firm’s expected or required return on equity is computed as follows:

Kc = \(\frac{\text { Expected dividend at the end of year } 1\left(\mathbf{D}_1\right)}{\text { Current Market Price }\left(\mathbf{P}_0\right)}\) + Expected Growth Rate of Dividend

Current Market Price = P/E ratio × EPS = 8 × 10 = Rs. 80

D0= 50% of EPS and EPS is Rs. 10

Therefore, D0= Rs. 5.0

Expected Dj= Rs. 5(1.15) = Rs. 5.75

Since, Ke = \(\frac{D_1}{p}\) + g

Therefore, Ke = \(\frac{5.75}{80}\) + 15% = 0.071875 + 0.15 = 0.221875 = 22.19%

(2) When anticipated growth rate changes to 16% and Cost of capital as calcu¬lated in (i) above ie. 22.19%, the indicative market price will be as follows.

P = \(\frac{D_1}{K_e-g}=\frac{5(1.16)}{0.2219-0.16}\) = Rs. 93.70 approx

Question 33.

Shares of Voyage Ltd. are being quoted at a price-earnings ratio of 8 times. The company retains 45% of its earnings which are ₹ 5 per share.

You are required to compute

1. The cost of equity to the company if the market expects a growth rate of 15% p.a. [May 2011] [3 Marks]

2. If the anticipated growth rate is 16% per annum, calculate the indicative market price with the same cost of capital. [3 Marks]

3. If the company’s cost of capital is 20% p.a. and the anticipated growth rate is 19% p.a., calculate the market price per share. [2 Marks]

Answer:

1. Cost of Capital

Retained earnings (45%) = ₹ 5 per share

Therefore, Dividend= (100 – 45)= (55%) = ₹ 6.11 per share

EPS (100%) = ₹ 11.11 per share

P/E Ratio = 8 times

Market price EPS × PE Ratio = ₹ 11.11 × 8 = ₹ 88.88

P0 = \(\frac{D_1}{K_e-g}\)

Ke = \(\frac{R s .6 .11}{R s .88 .88}\) + 0.15 = 21.87%

2. Market Price if growth rate is 16%

P0 = \(\frac{D_1}{K_e-g}=\frac{R s .6 .11}{(21.87 \%-16 \%)}\) = 104.08 per share

3. Market Price if growth rate is 19% and cost of capital is 20%

= \(\frac{R s .6 .11}{(20-1996)}\) = ₹ 611.00 per share

Question 34.

A company has a book value per share of ₹ 137.80. Its return on equity is 15% and follows a policy of retaining 60 per cent of its annual earnings. If the opportunity cost of capital is 18 per cent, what is the price of its share? [adopt the perpetual growth model to arrive at your solution). [Nov. 2011] [5 Marks]

Answer:

The Company’s earnings and dividend per share after a year are expected to be:

EPS = ₹ 137.80 × 0.15 = ₹ 20.67

Dividend = 0.40 × 20.67 = ₹ 8.27

The growth in dividend would be: e = 0.6 × 0.15 = 0.09

Perpetual growth model Formula : P0 = \(\frac{\text { Dividend }}{K_e-g}\)

P0 = \(\frac{8.27}{0.18-0.09}\)

P0 = ₹ 91.89

Question 35.

In December, 2011 AB Co.’s share was sold for ₹ 146 per share. A long term earnings growth rate of 7.5% is anticipated. AB Co. is expected to pay dividend of 7 3.36 per share.

(i) What rate of return an investor can expect to earn assuming that dividends are expected to grow along with earnings at 7.5% per year in perpetuity?

(ii) It is expected that AB Co. will earn about 10% on book Equity and shall retain 60% of earnings. In this case, whether, there would be any change in grow th rate and cost of Equity? [May 2012] [6 Marks]

Answer:

(i) As per Dividend Discount Model approach the firm’s expected or required return on equity is computed as follows:

Ke = \(\frac{\text { Expected dividend at the end of year } 1\left(D_1\right)}{\text { Current Market Price }\left(P_0\right)}\) + Expected Growth Rate of Dividend

Therefore, Ke = \(\frac{3.36}{146}\) + 7.5%

= 0.230 + 0.075 = 0.098

Ke = 9.80%

(ii) When rate of return is 10% and retention ratio (b)is 60%, new growth rate will be as follows.

g = br

= 0.10 × 0.60 = 0.06

Thus dividend will also get changed and to calculate this, first we shall calculate previous retention ratio (b1) and then EPS assuming that rate of return on equity (r) is same.

With previous Growth Rate of 7.5% and r= 10% the retention ratio comes out to be:

0.075 = b1 × 0.10

b1 = 0.75 and payout ratio = 0.25

With 0.25 payout ratio the EPS will be as follows:

\(\frac{3.36}{0.25}\) = 13.44

With new 0.40 (1 – 0.60) payout ratio the new dividend will be

D, = 13.44 × 0.40 = 5.376

Accordingly new Ke will be

Ke = \(\frac{5.376}{146}\) + 6.0%

Ke = 9.68%

![]()

Question 36.

Given the following information :

| Current Dividend | ₹ 5.00 |

| Discount Rate | 10% |

| Growth rate | 2% |

(i) Calculate the present value of the stock.

(ii) Is the stock over valued if the price is ₹ 40, ROE = 8% and EPS = ₹ 3.00

Show your calculations under the PE Multiple approach and Earnings Growth model. [Nov. 2012] [8 Marks]

Answer:

(i) Present Value of the Stock:

P0 = \(\frac{5.00(1.02)}{0.10-0.02}\) = 63.75

(ii) Value of Stock under the PE Multiple Approach

| Particulars | ₹ |

| Actual Stock Price | 40.00 |

| Return on equity | 8% |

| EPS | 3.00 |

| PE Multiple (1/Return on Equity) =1/8% | 12.50 |

| Market Price per Share EPS × PE | 37.50 |

Since, Actual Stock Price is higher, hence it is overvalued.

(iii) Value of the Stock under the Earnings Growth Model

| Particulars | ₹ |

| Actual Stock Price | 40.00 |

| Return on equity | 8% |

| EPS | 3.00 |

| Growth Rate | 2% |

| Market Price per Share [EPS × (1+g)]/ (Ke -g) = ₹ 3.00 × 1.02/0.06 | 51.00 |

Since, Actual Stock Price is lower, hence it is undervalued.

Question 37.

X Limited, just declared a dividend of ? 14.00 per share. Mr. B is plan¬ning to purchase the share of X Limited, anticipating increase in growth rate from 8% to 9%, which will continue for three years. He also expects the market price of this share to be ? 360.00 after three years.

You are required to determine:

The maximum amount Mr. B should pay for shares, if he requires a rate of return of 13% per annum. [May 2013] [4 Marks]

(ii) The maximum price Mr. B will be willing to pay for share, if he is of the opinion that the 9% growth rate can be maintained indefinitely and require 13% rate of return per annum. [2 Marks]

(iii) The price of share at the end of three years, if 9% growth rate is achieved and assuming other conditions remaining same as in (ii) above.

Calculate rupee amount up to two decimal points.

| Year-1 | Year-2 | Year-3 | |

| FVIF @ 9% | 1.090 | 1.188 | 1.295 |

| FVIF @ 13% | 1.130 | 1.277 | 1.443 |

| PVlF @ 13% | 0.885 | 0.783 | 0.693 |

Answer:

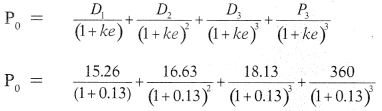

(i) Expected dividend for next 3 years.

Year 1 (D1) ₹ 14.00 (1.09) = ₹ 15.26

Year 2 (D2) ₹ 14.00 (1.09) = ₹ 16.63

Year 3 (D3) ₹ 14.00 (1.09) = ₹ 18.13

Required rate of return = 13% (Ke)

Market price of share after 3 years = (P3) = ₹ 360

The present value of share

P0 = 15.26 (0.885) + 16.63 (0.783) + 18.13 (0.693) + 360 (0.693)

P0 = 13.50 + 13.02 + 12.56 + 249.48

P0 = ₹ 288.56

(ii) When the growth rate 9% is achieved for indefinite period, then maximum price of share should Mr. A willing be to pay is

P0 = \(\frac{D_1}{(k e-g)}=\frac{R s .15 .26}{0.13-0.09}=\frac{R s .15 .26}{0.04}\) = ₹ 381.50

(iii) Assuming that conditions mentioned above remain same, the price expected after 3 years will be:

P3 = \(\frac{D_4}{k_e-g}=\frac{D_3(1.09)}{0.13-0.09}=\frac{18.13 \times 1.09}{0.04}=\frac{19.76}{0.04}\) = Rs. 494

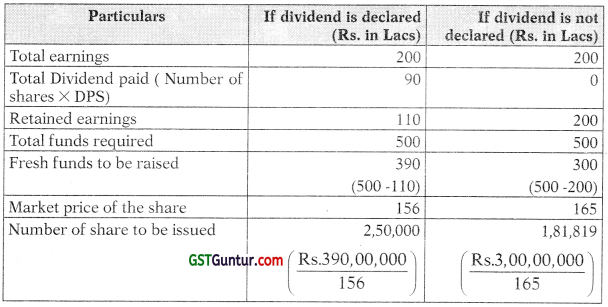

Question 38.

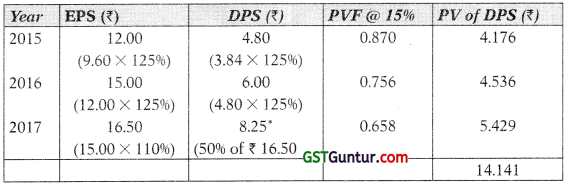

The shares of G Ltd. are currently being traded at Rs. 46. The company published its result for the year ended 31st March, 2019 and declared a dividend of Rs.5. The company made a return of 15% on its capital and expects that to be the norm in which it operates. G Ltd. also expects the dividends to grow at 10% for the first three years and thereafter at 5%.

You are required to advise whether the share of the company is being traded at a premium or discount.

PVIF @ 15% for the next 3 year is 0.870, 0.756 and 0.658 respectively. [May 2019][8 Marks]

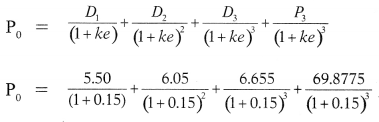

Answer:

Expected dividend for next 3 years.

Year 1 (D1) =Rs. 5.00 (1.10) = Rs. 5.50

Year 2 (D2) =Rs. 5.00 (1.10)2 = Rs. 6.05

Year 3 (D3) =Rs. 5.00 (1.10)3 = Rs, 6.655

After 3rd year, the dividends will grow at a normal rate of 5% till perpe-tuity.

Therefore, dividend in the year 4, (D4) = (D3)(1.05) = Rs. 6.655 (1.05) = Rs. 6.98775

Required rate of return = 15% (Ke)

= Rs. 69.8775

The present value of share

P0 = 5.50 (0.870) + 6.05 (0.756) + 6.655 (0.658) + 69.8775 (0.658)

P0 = 4.785 + 4.5738 + 4.3790 + 45.9794

P0 = Rs. 59.7172

The share of the company is traded at discount. The intrinsic value of the share is Rs. 59.7172 (ex-dividend), whereas, the share is being traded at a price of Rs. 46 (assuming, cum-dividend). Therefore, the share is traded at a discount.

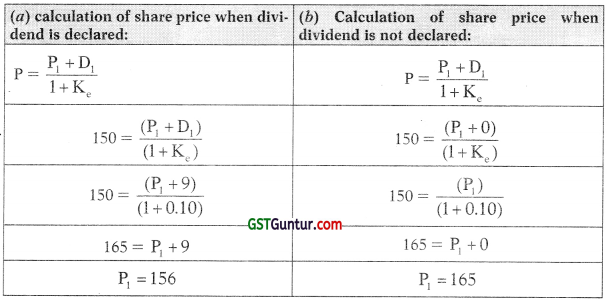

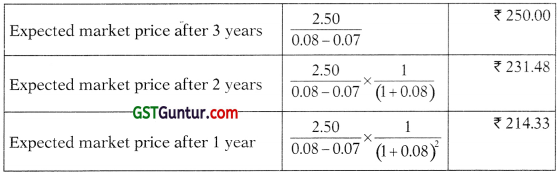

Question 39.

An investor is considering purchasing the equity shares of LX Ltd. whose current market price (CMP) is Rs. 150. The Company is proposing a dividend of Rs. 6 for the next year. LX is expected to grow @18 per cent per annum for the next four years. The growth will decline linearly to 14 per cent per annum after first four years. Thereafter, it will stabilize at 14 per cent per annum infinitely. The required rate of return is 18 per cent per annum.

You are required to determine:

(i) The intrinsic value of one share

(ii) Whether it is worth to purchase the share at this price.

Answer:

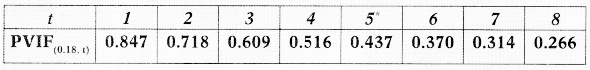

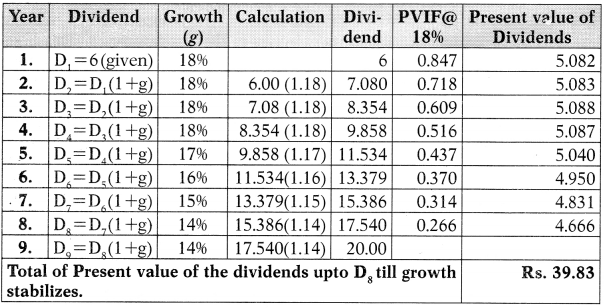

(i) Expected dividend for next 8 years.

After 9th year, the dividends will grow at a normal rate of 14% till perpetuity. Required rate of return = 18% (Ke)

Market price of share after 8 years = (Ps) = \(\frac{(\mathrm{D} 9)}{k e-g}=\frac{20}{0.18-0.14}\) = Rs. 500.00

The present value of share = Sum of dividends + Present value of price after 8 years.

P0 = \(\frac{D_1}{(1+k e)}+\frac{D_2}{(1+k e)^2}+\frac{D_3}{(1+k e)^3}+\frac{D_4}{(1+k e)^4}+\frac{D_5}{(1+k e)^5}+\frac{D_0}{(1+k e)^6}+\frac{D_7}{(1+k e)^7}+\frac{D_8}{(1+k e)^8}+\frac{P_8}{(1+k e)^8}\)

P0 = 39.83 + \(\frac{500}{(1+0.18)^8}\)

P0 = 39.83 + 500 (0.266)

P0 = 39.83 + 133 = Rs. 172.83

The intrinsic value of the share is = Rs. 172.83

(ii) The share of the company is traded at discount. The intrinsic value of the share is Rs. 172.83 whereas, the share is being traded at a price of Rs. 150. Therefore, the share is worth purchasing.

Note: There are two issues in this question:

(a) ‘The PVIF values for year 4 are given twice and are different, therefore, it y should be year 5 and not year 4 (it must be a misprint in the paper). The correction has been done.

(b) The growth rate is declining linearly from 18°o to 14%. But the question is silent as to the period over which the growth will decline, therefore, it is assumed that the 4°o decline is to occur gradually over a period of 4 years.

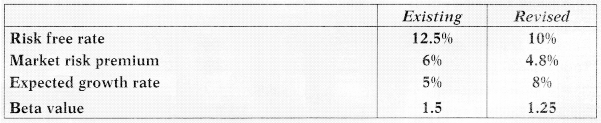

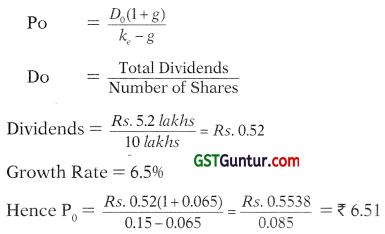

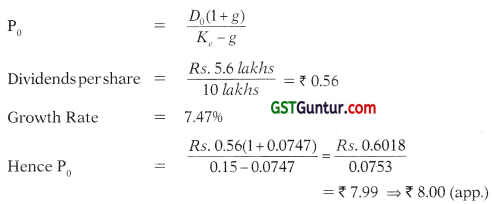

![]()

Question 40.