Income from Salaries – CA Inter Tax Study Material

Income from Salaries – CA Inter Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Income from Salaries – CA Inter Taxation Study Material

Introduction

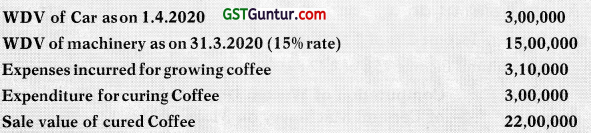

Question 1.

Mr. M is an area manager of M/s N Steels Company Limited. During the financial year 2020-21, he gets following emoluments from his employer:

Basic Salary

Up to 31.08.2020 ₹ 20,000 pm

From 01.09.2020 ₹ 25,000 pm

Transport Allowance ₹ 2,000 pm

Contribution to recognized provident fund ₹ 15% of Basic Salary and DA

Children Education Allowance ₹ 500 pm for two children

City Compensatory Allowance ₹ 300 pm

Hostel Expenses Allowance ₹ 4,560 for two children

Tiffin Allowance ₹ 5,000 pa. Actual Expenses of Tiffin ₹ 3,700

Tax paid on employment ₹ 2,500

Compute Taxable Salary of Mr. M for the Assessment year 2021-22. [Nov. 2008, 6 Marks]

Answer:

Computation of Taxable Salary of Mr. M for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Basic Salary Up to 31.08.2020 [₹ 20,000 pm × 5] | 1,00,000 | |

| Basic Salary from 01.09.2020 [₹ 25,000 pm × 7] | 1,75,000 | 2,75,000 |

| Transport Allowance [₹ 2,000 pm × 12] | 24,000 | |

| Contribution to RPF in excess of 12% of Salary [Working Note 1] ‘ | 8,250 | |

| City Compensatory Allowance [300 pm × 12] | 3,600 | |

| Children Education Allowance [₹ 500 pm × 12] | 6,000 | |

| Less: Exempt [₹ 100 × 2 × 12] | 2,400 | 3,600 |

| Hostel Expenses Allowance | 4,560 | |

| Less: Exempt [₹ 190 × 2 × 12] | 4,560 | NIL |

| Tiffin Allowance | 5,000 | |

| Tax paid on employment | 2,500 | |

| Gross Salary | 3,21,950 | |

| Less: Standard Deduction u/s 16 (ia) | 50,000 | |

| Less: Professional Tax u/s 16(iii) | 2,500 | 52,500 |

| Net Salary | 2,69,450 |

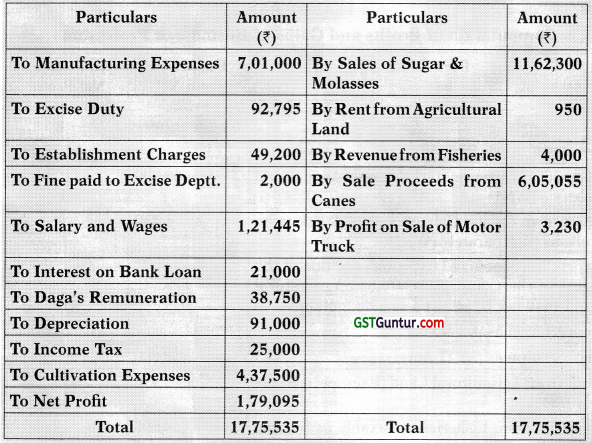

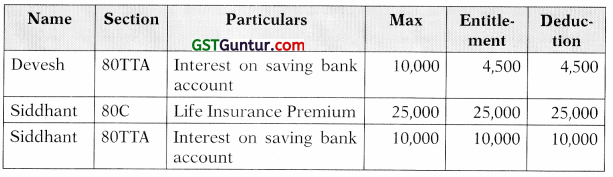

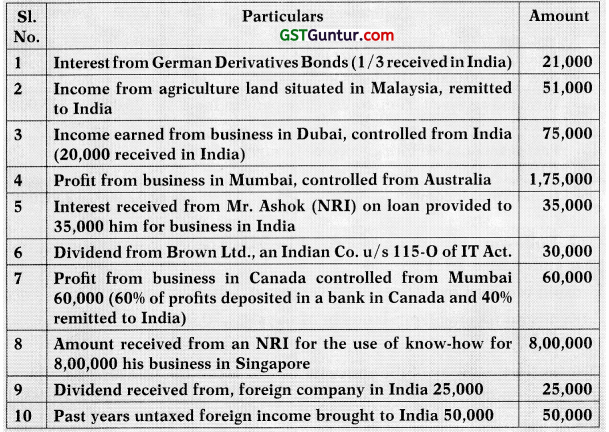

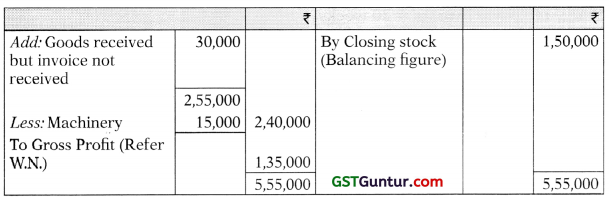

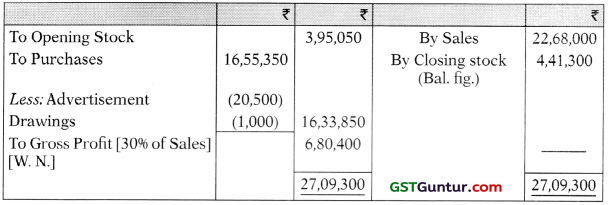

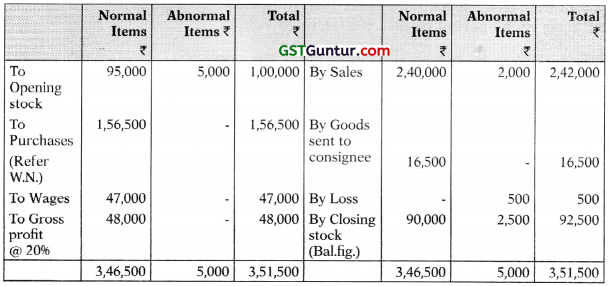

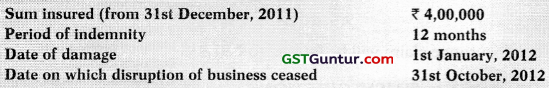

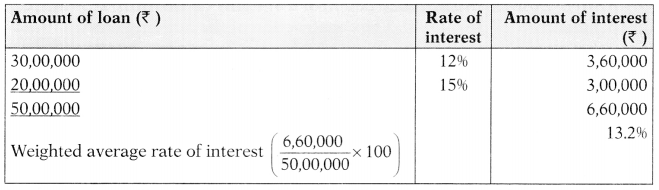

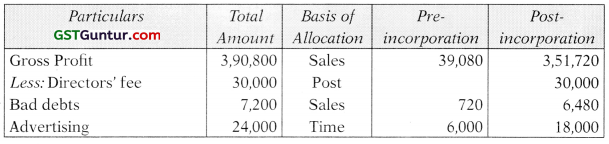

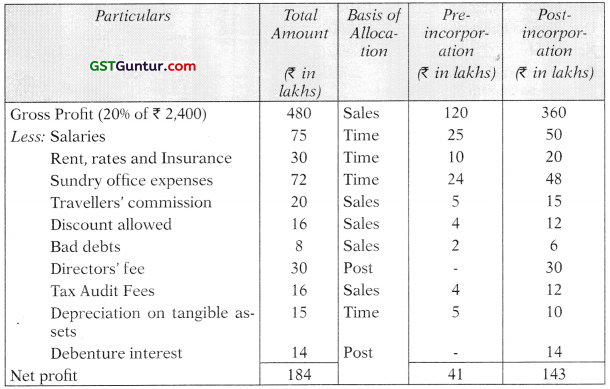

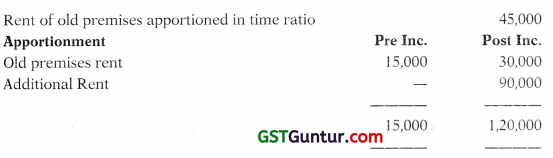

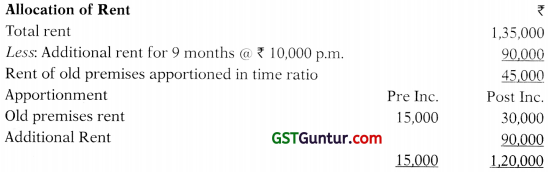

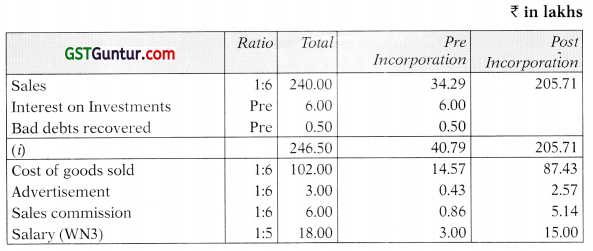

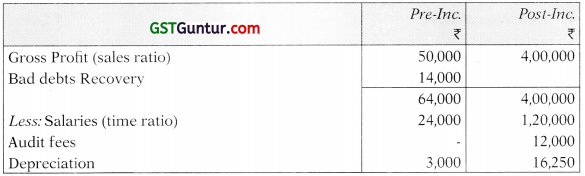

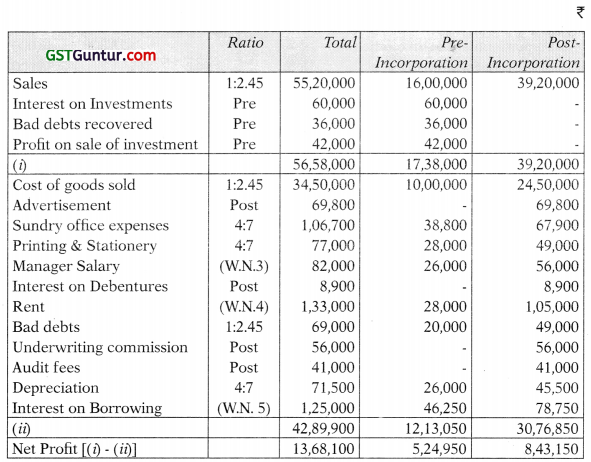

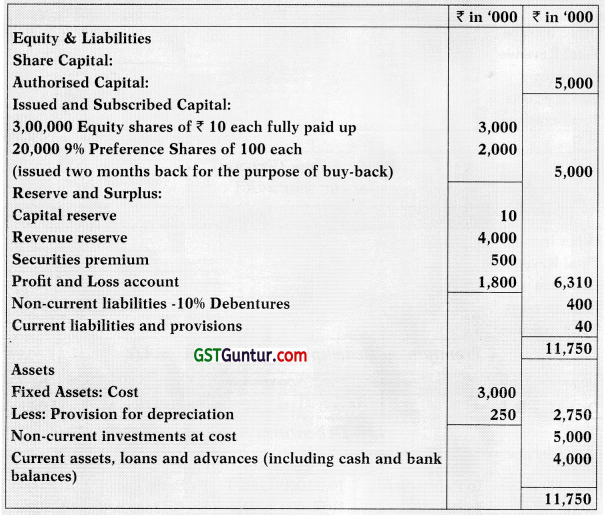

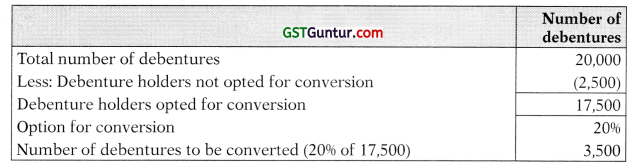

Working Notes:

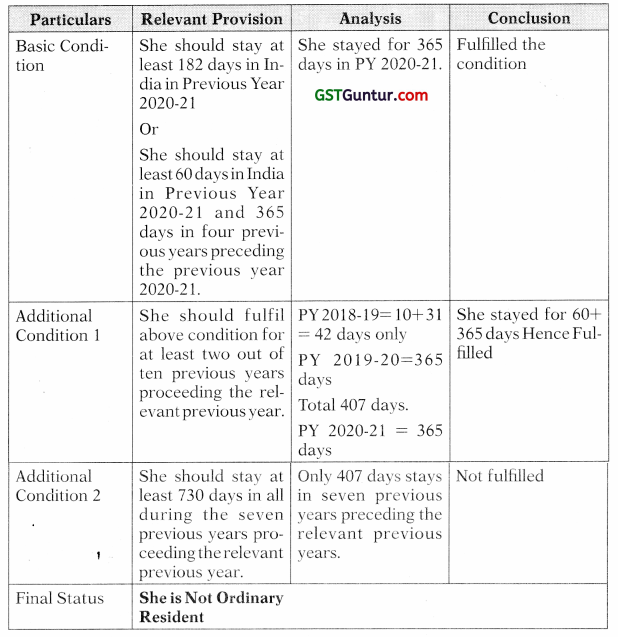

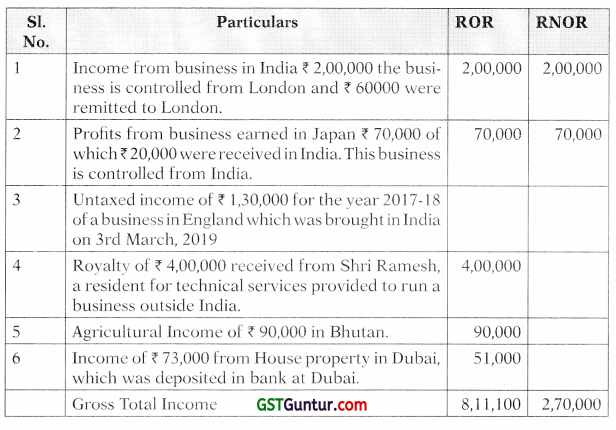

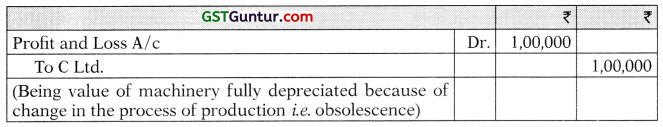

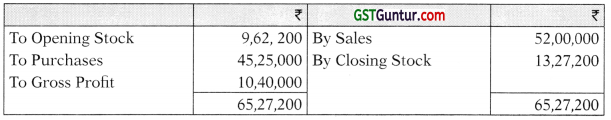

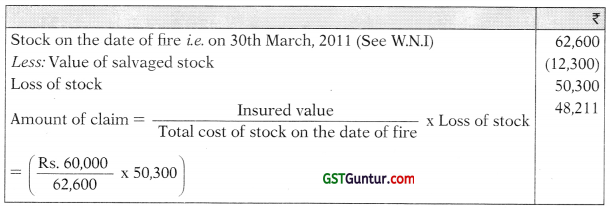

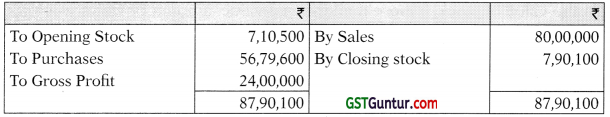

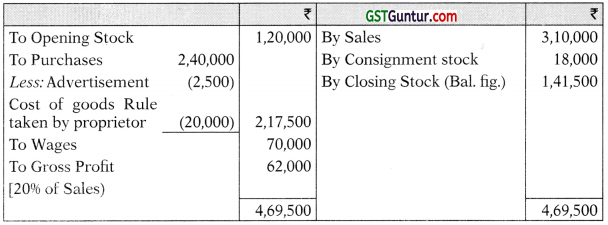

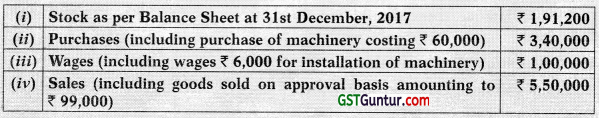

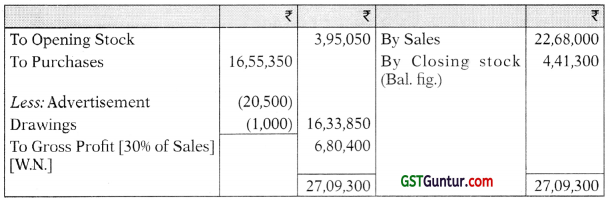

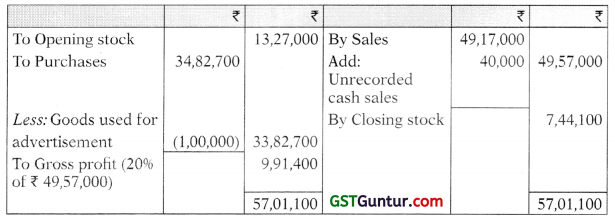

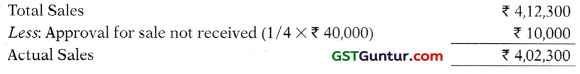

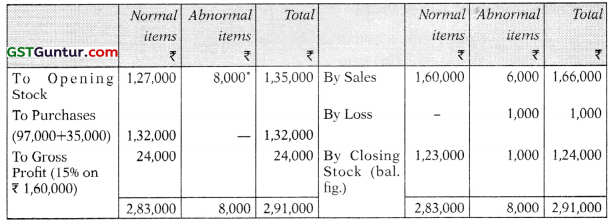

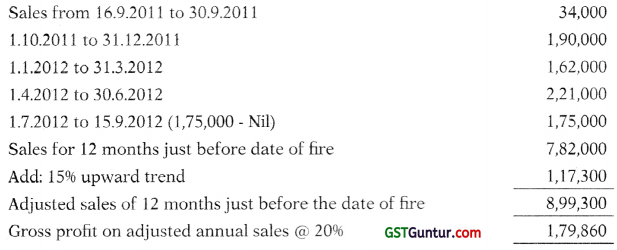

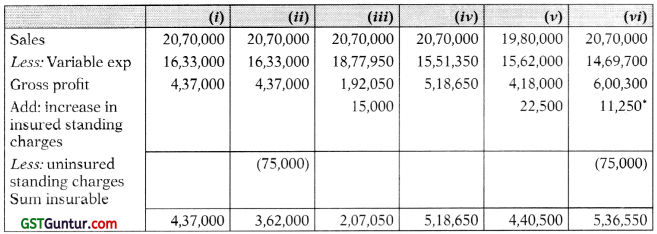

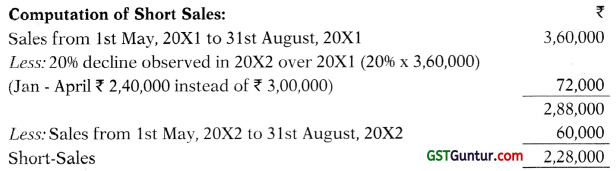

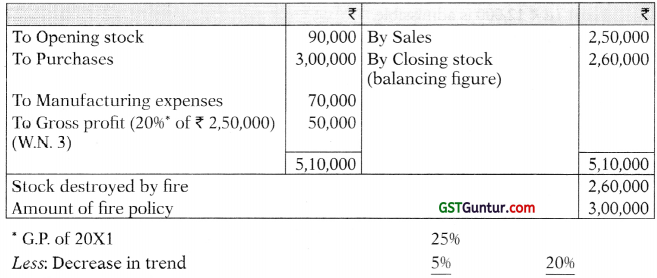

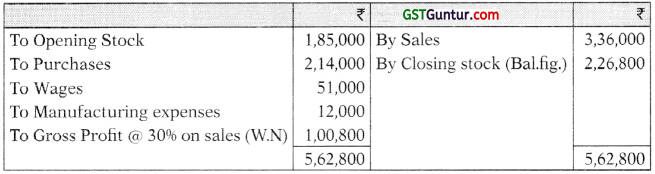

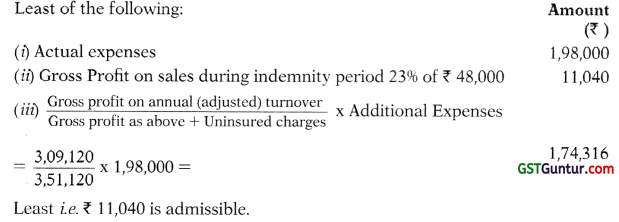

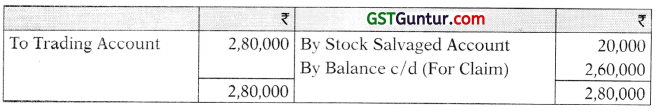

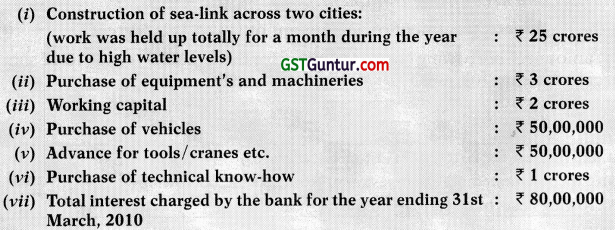

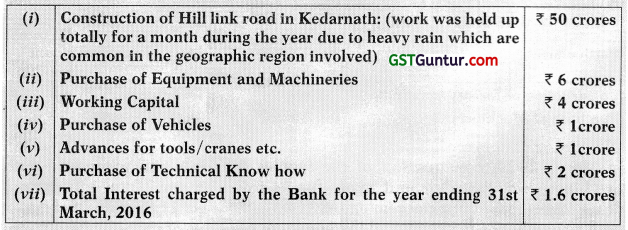

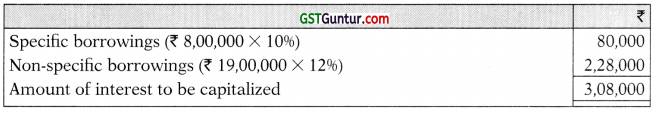

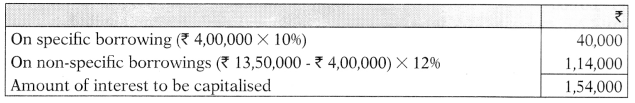

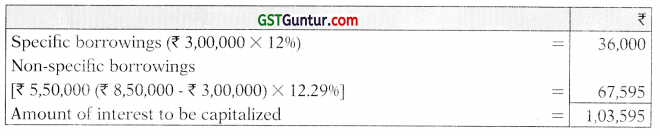

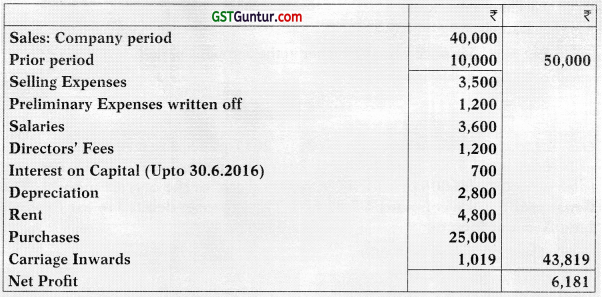

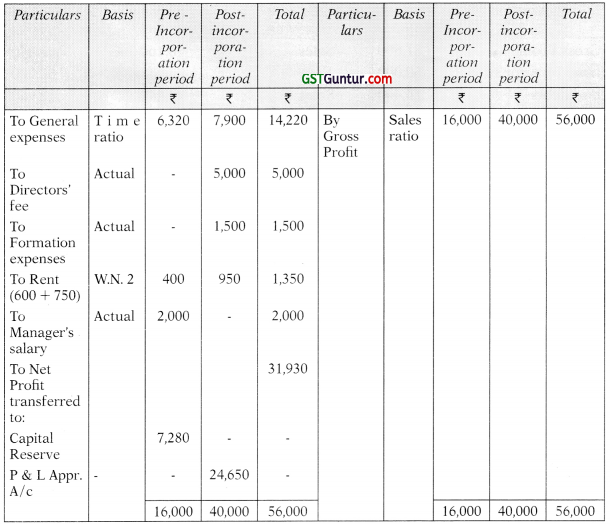

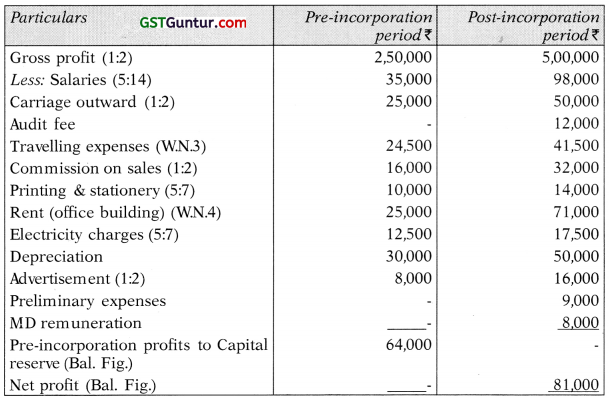

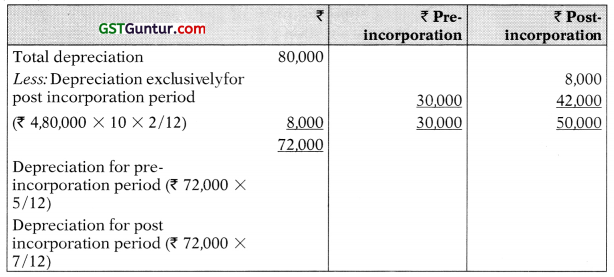

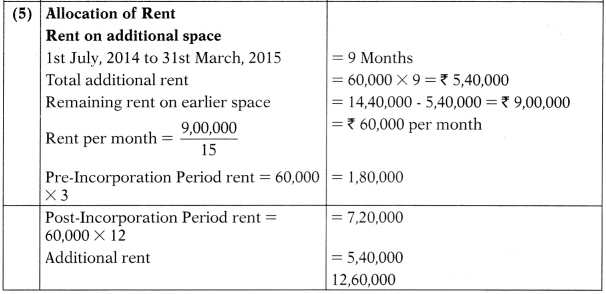

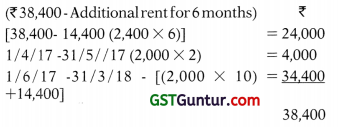

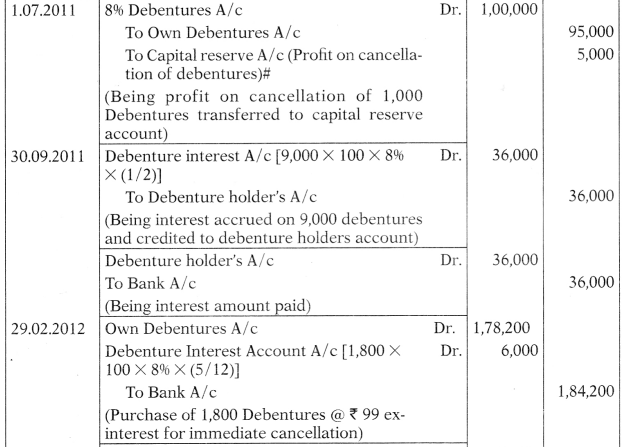

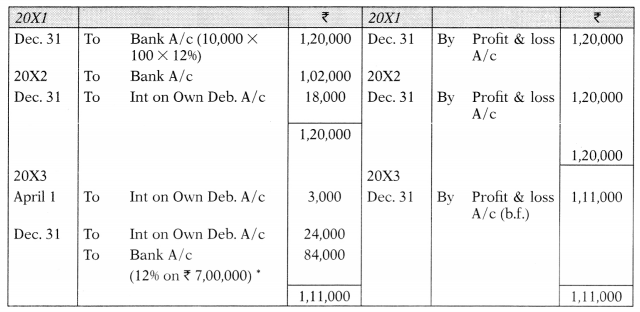

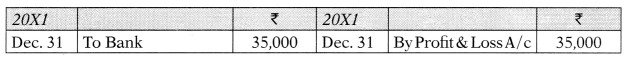

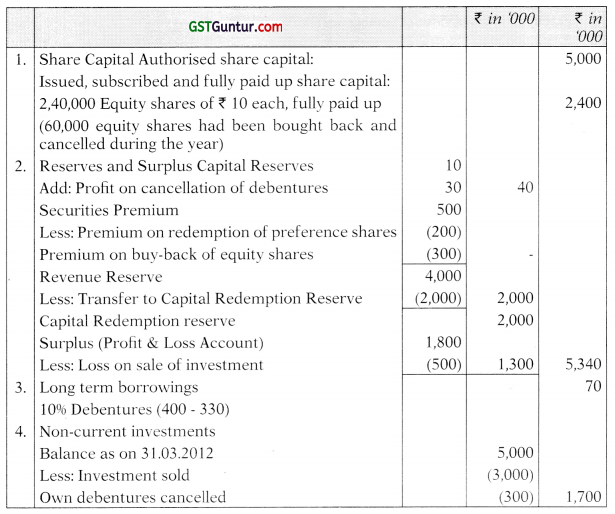

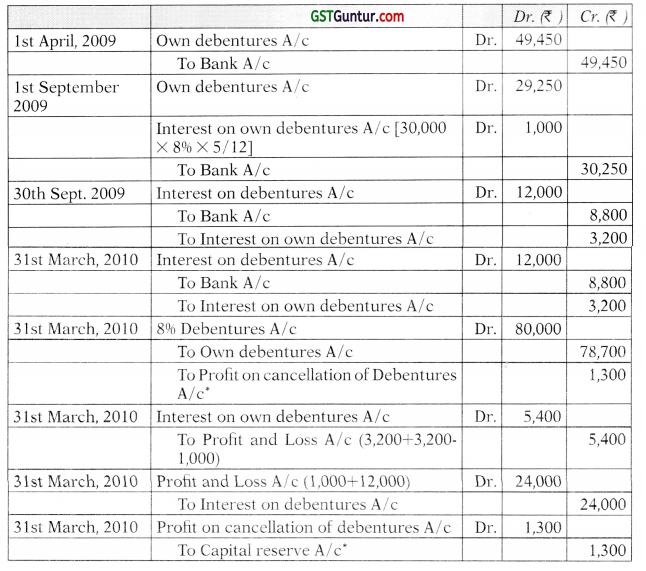

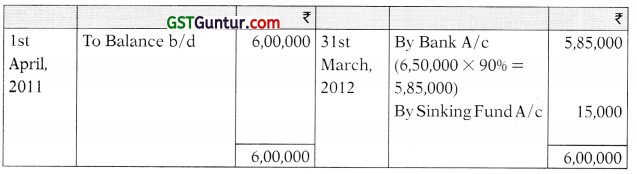

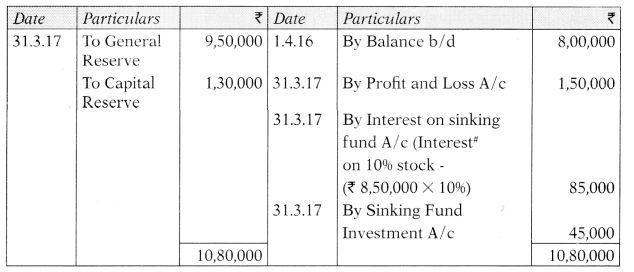

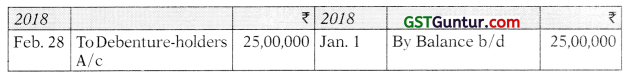

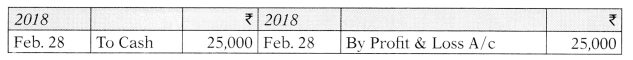

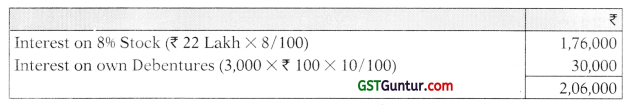

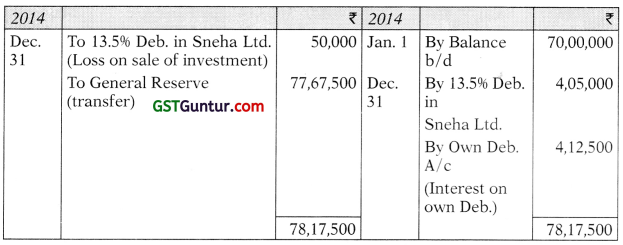

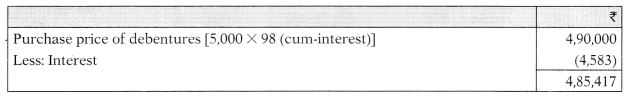

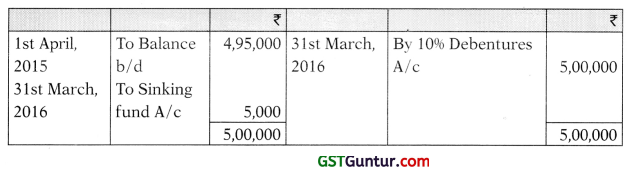

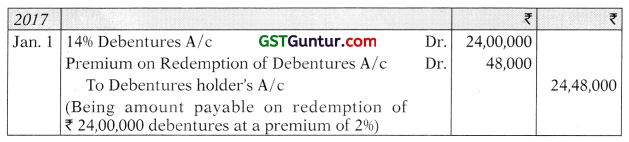

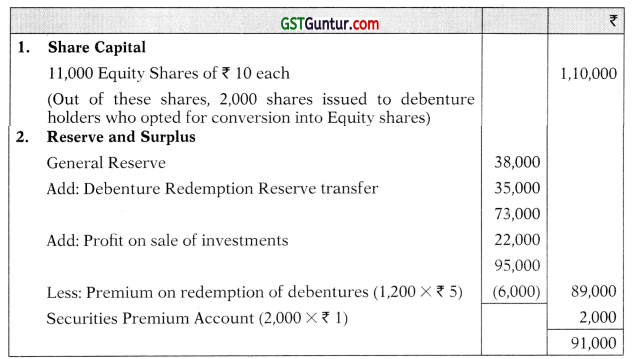

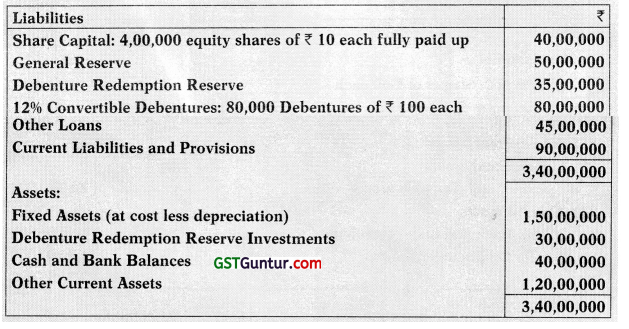

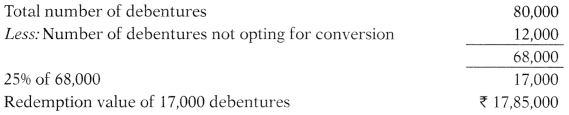

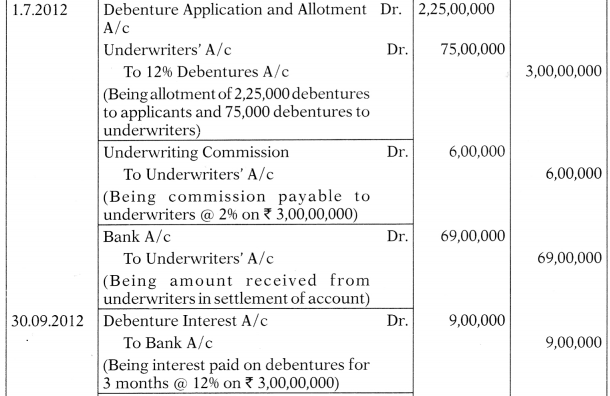

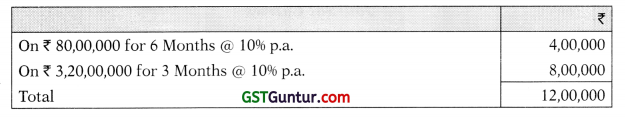

1. Employer contribution to RPF in excess of 12% of Salary.

![]()

Question 2.

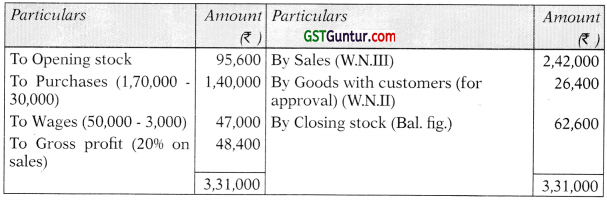

From the following details find out the salary chargeable to tax for the assessment year 2021-22

Mr. X is regular employee of Rama & Company in Gurgaon. He was appointed on 01.01.2020 in the scale of 20,000-1,000-30,000. He is paid D.A 10% of Basic Pay and Bonus equivalent to one month pay. He contributes 15% of his pay and D.A. towards his recognized provident fund and the company contributes the same amount.

He is provided Rent free housing facility which has been taken on rent by the company at ₹ 25,000 pm. He is also provided with following facilities:

- Facility of Laptop Costing ₹ 50,000

- Company reimbursed the medical treatment bill of his brother of ₹ 10,000 who is dependent on him.

- The monthly salary of ₹ 1,000 of a house keeper is reimbursed by the company.

- Gift voucher of ₹ 10,000 on the occasion of his marriage anniversary.

- Conveyance allowance of ₹ 1,000 per month is given by the company towards actual reimbursement.

- He is provided personal accident policy for which premium of ₹ 5,000 is paid by the company.

- He is getting telephone allowance @500 per month. [Nov. 2010, 8 Marks]

Answer:

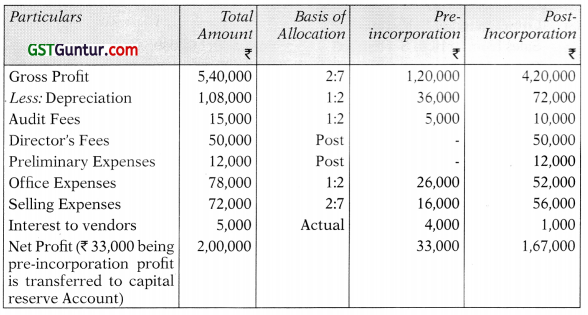

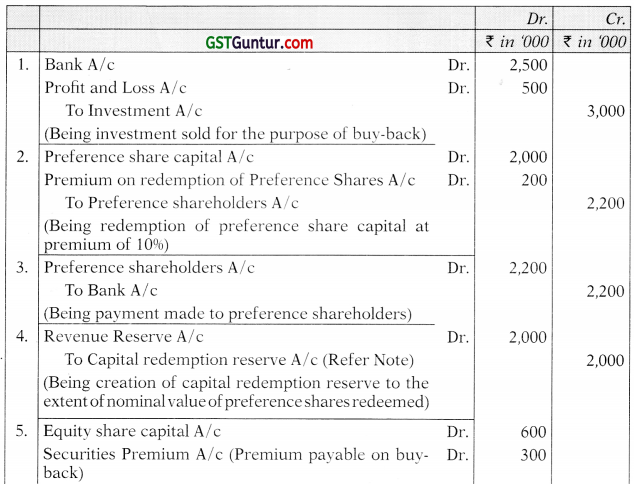

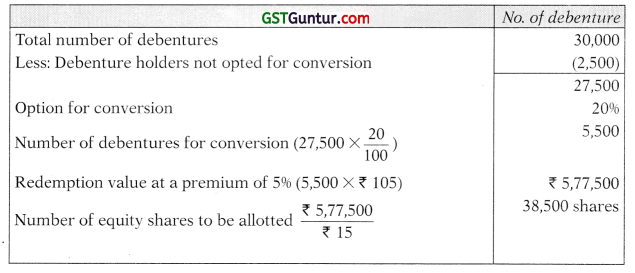

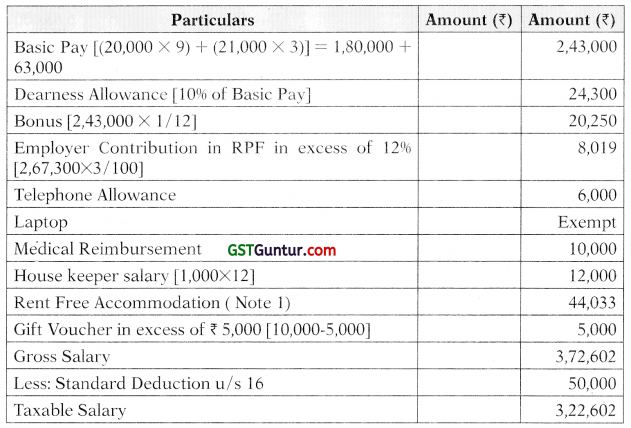

Computation of Taxable Salary of Mr. X for the Assessment Year 2021-22

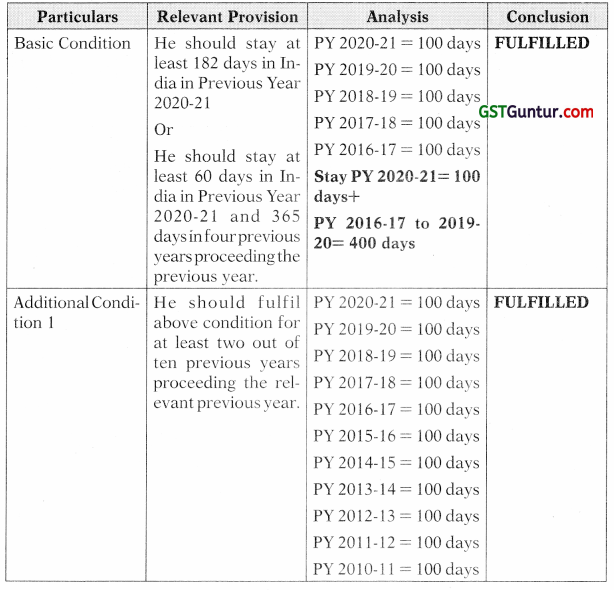

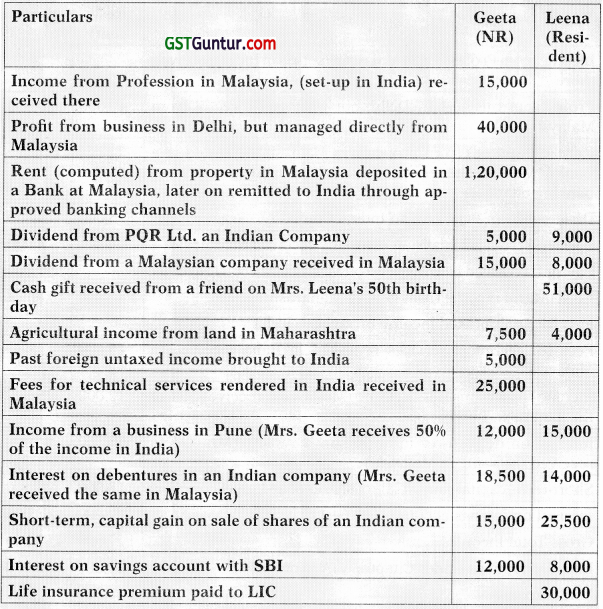

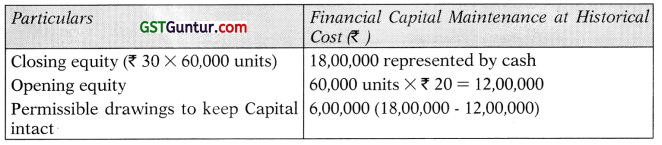

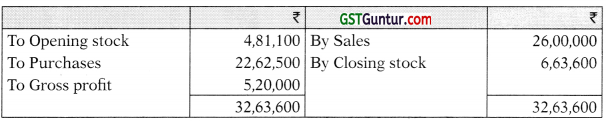

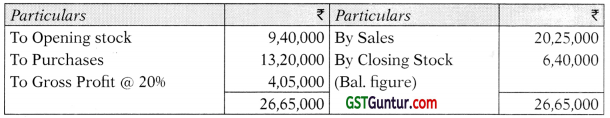

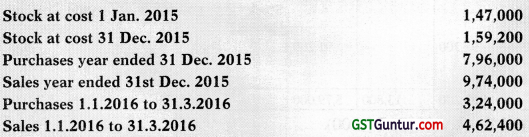

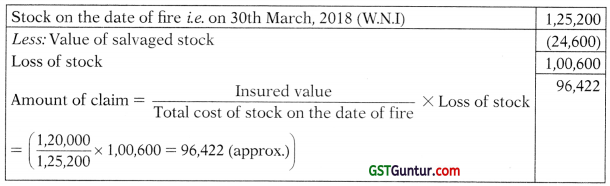

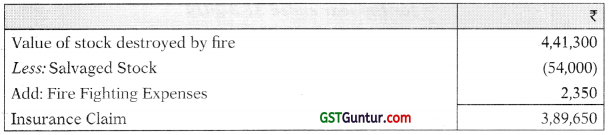

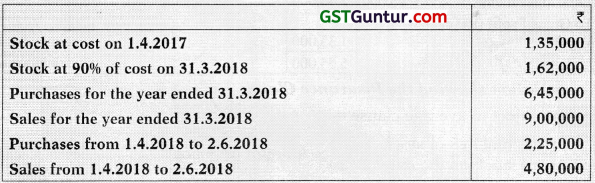

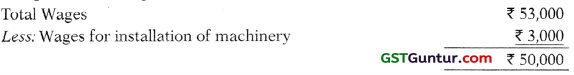

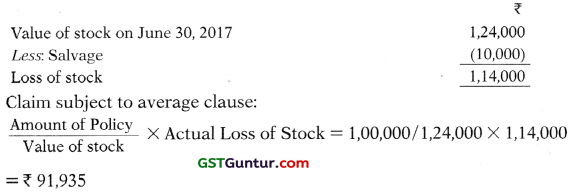

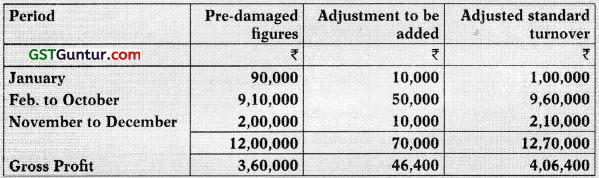

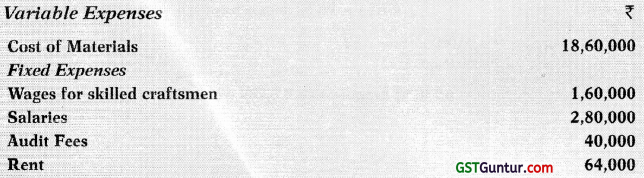

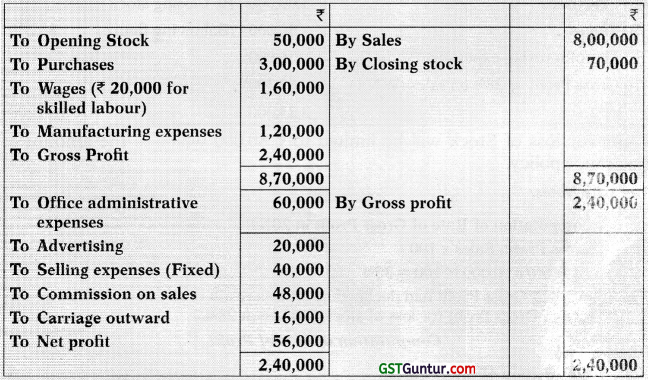

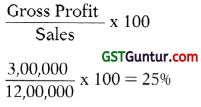

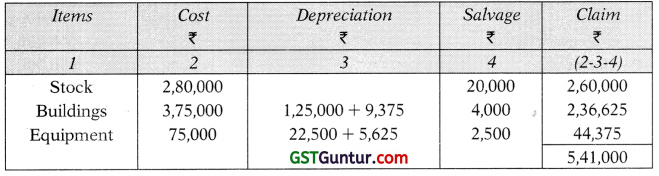

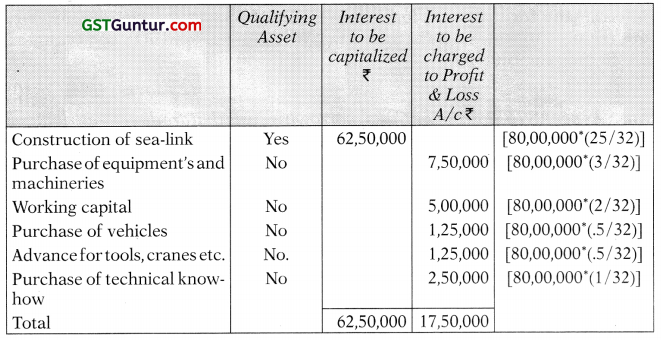

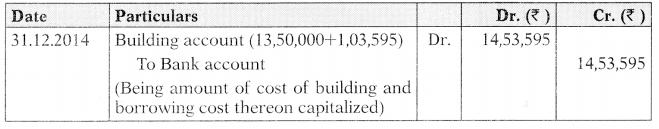

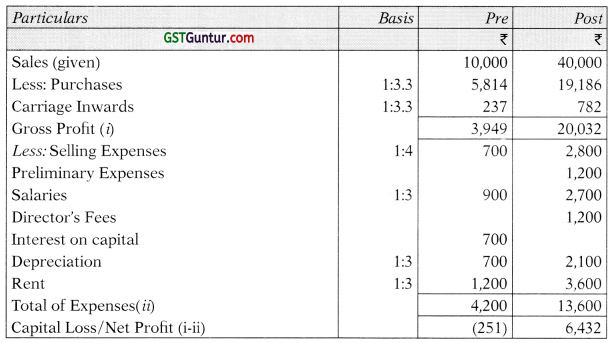

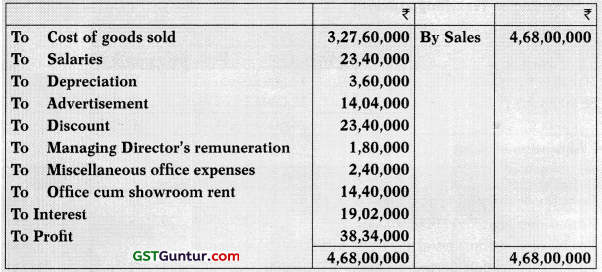

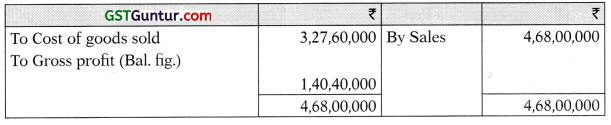

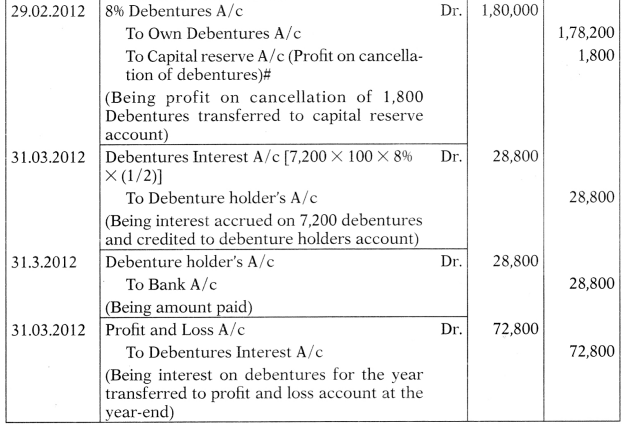

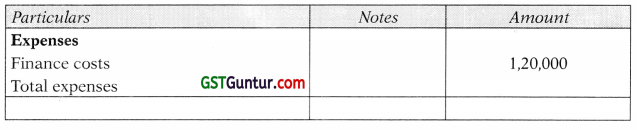

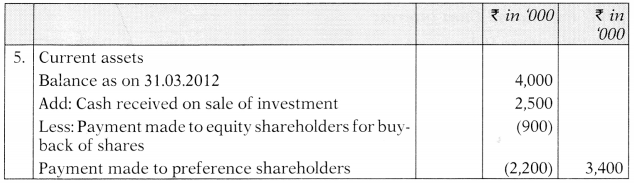

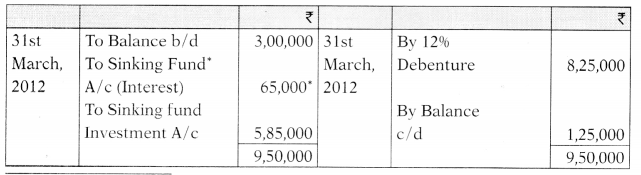

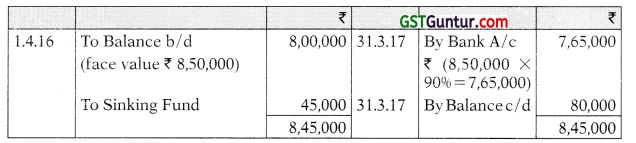

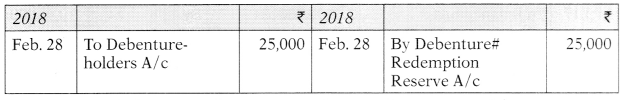

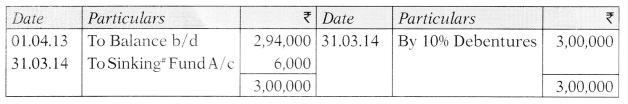

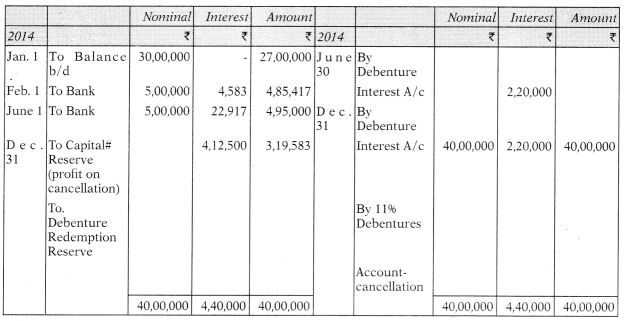

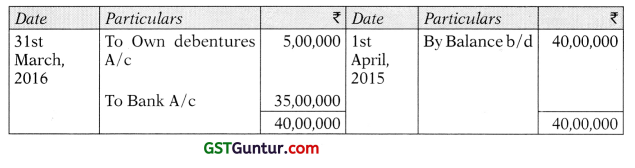

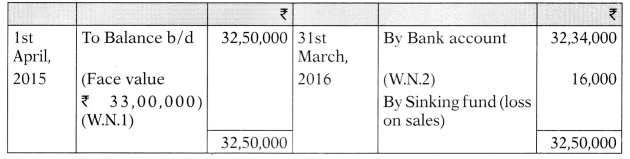

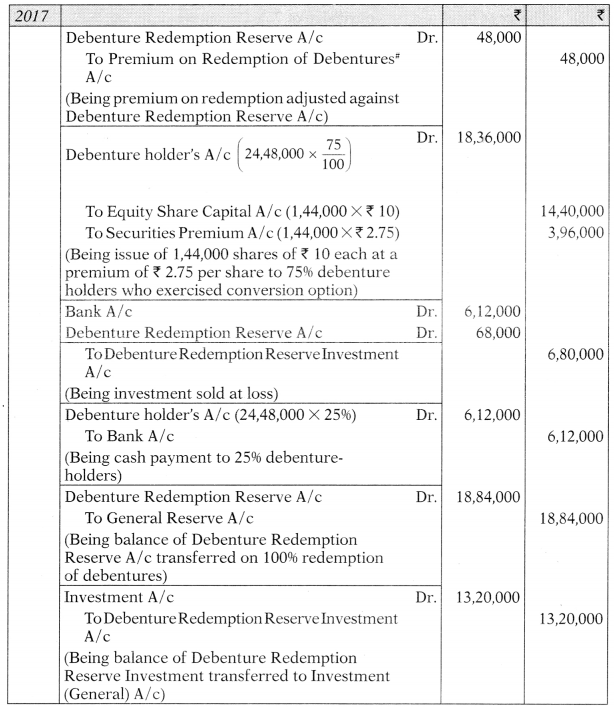

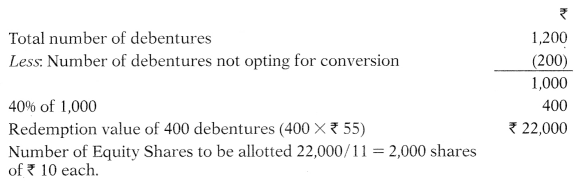

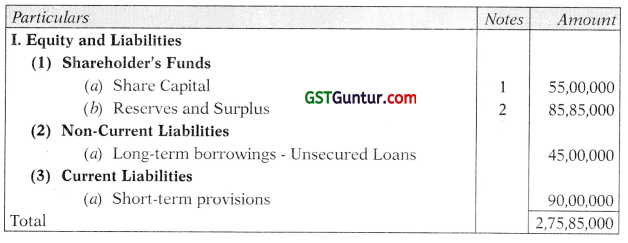

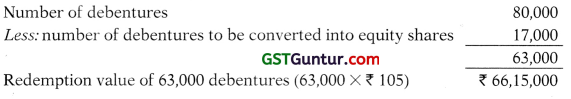

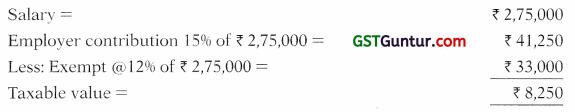

Note: Value of Rent Free House

| Particulars | Amount (₹) |

| Salary = 2,43,000 + 24,300 + 20,250 + 6,000 = 2,93,550 | ‘ 2,93,550 |

| 15% of Salary = 2,93,550 × 15 /100 = 44,033 | 44,033 |

| Rent paid by Company = 25,000 × 12 = 3,00,000 | 3,00,000 |

| 15% of salary or Rent paid whichever is Less is Value of RFH | 44,033 |

![]()

Question 3.

Mr. Shah, an Accounts Manager, has retired from JK Ltd. on 15.01.2021 after rendering services for 30 years 7 months. His salary is ₹ 25,000/ p.m. up to 30.09.2020 and ₹ 27,000 thereafter. He also gets ₹ 2,000 p.m. as dearness allowance (55% of it is a part of salary for computing retirement benefits. He is not covered by the payments of Gratuity Act, 1972. He has received ₹ 8,00,000 as gratuity from his employer company. Compute the exemption u/s 10(10) and gross income under the head Salary. [Nov. 2010, 4 Marks]

Answer:

Computation of Taxable Salary of Mr. Shah for the Assessment Year 2021 -22

| Particulars | Amount (₹) |

| Basic Salary [(25,000 × 6) + (27,000 × 3.5)] | 2,44,500 |

| Dearness Allowance [2,000 × 9.5] | 19,000 |

| Gratuity (Working Note 1) | 3,99,500 |

| Gross Salary | 6,63,000 |

| Standard Deduction | 50,000 |

| Taxable Salary | 6,13,000 |

Working Note 1:

Computation of Taxable Gratuity of Mr. Shah for the Assessment Year 2021-22

| Particulars | Amount (₹) |

| Basic Salary for 10 Months [(25,000 × 7) (27,000 × 3)] | 2,56,000 |

| Dearness Allowance [2000 × 10 × 55/100] | 11,000 |

| Total of 10 Months Salary | 2,67,000 |

| Average Salary = 2,67,000/10 = 26,700 | 26,700 |

| Gratuity Provision: | |

| Least of the following is exempt | |

| 1. Actual Amount Received | 8,00,000 |

| 2. Maximum Amount notified | 20,00,000 |

| 3. \(\frac{1}{2}\) × 26700 × 30 | 4,00,500 |

| Least Amount among above three | 4,00,500 |

| Exempt Amount | 4,00,500 |

| Received Amount | 8,00,000 |

| Taxable Amount [8,00,000 – 4,00,500] | 3,99,500 |

Formula of Gratuity for above 3:

\(\frac{1}{2}\) × Average Salary for 10 months Preceding the month of retirement × No. of years of Completed Years

![]()

Question 4.

Mr. Balaji employed as Production Manager in Beta Limited furnishes you the following information for the year ended on 31.03.2021:

- Basic Salary up to 31.10.2020 ₹ 50,000 pm

- Basic Salary From 01.11.2020 ₹ 60,000 pm (Salary is due and paid on the last day of every month)

- Dearness Allowance @ 40% of Basic Salary.

- Bonus equal to one month salary paid in October 2020 on Basic Salary plus Dearness Allowance applicable for that month.

- Contribution of employer to recognized provident fund account of the employee @16% of Basic Salary.

- Profession Tax paid ₹ 3,000 of which ₹ 2,000 was paid by the employer.

- The facility of laptop and computer was provided to Balaji for both official and personal use. Cost of laptop ₹ 45,000 and computer ₹ 35,000 was acquired by the company on 01.12.2019.

- Motor car owned by the employer cubic capacity of engine exceeds 1.60 Litre provided to the employee from 01.11.2020 Meet for both official and personal use. Repair and running expenses of ₹ 45,000 from 01.11.2020 to 31.03.2021, were fully met by the employer. The motor car was self-driven by the employee.

- Leave travel concession given to employee his wife and three children (one daughter age 7 and twin sons Age 3). cost of air tickets economic class reimbursed by the employer ₹ 30,000 for adults and ₹ 45,000 for 3 children. Balaji is eligible for availing exemption this year to the extent, it is permissible in law.

Compute the salary income chargeable to tax in the hands of Mr Balaji for the assessment year 2021-22. [May. 2013, 8 Marks]

Answer:

Computation of Taxable Salary for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Basic Salary [(50,000 × 7) + (60,000 × 5)] | 6,50,000 | |

| Dearness Allowance [40% of ₹ 6,50,000] | 2,60,000 | |

| Bonus [(50,000 + 50,000 × 40/100) = 70,000 | 70,000 | |

| Employer Contribution in RPF in excess of 12% [6,50,000 × 4/100] | 26,000 | |

| Professional Tax paid by Employer | 2,000 | |

| Facility of Laptop and Computer | Exempt | |

| Motor Car [ 2400 × 5] = 12000 | 12,000 | |

| Leave Travel Concession | NIL | |

| Gross Salary | 10,20,000 | |

| Less: Standard Deduction u/s 16 | 50,000 | |

| Less: Professional Tax u/s 16 (iii) | 3,000 | 53,000 |

| Taxable Salary | 9,67,000 |

Note:

1. Leave Travel Concession is available up to two children. Children born after 01.10.1998 out of multiple births after the first birth will be treated as one child only. Hence it is exempt here.

![]()

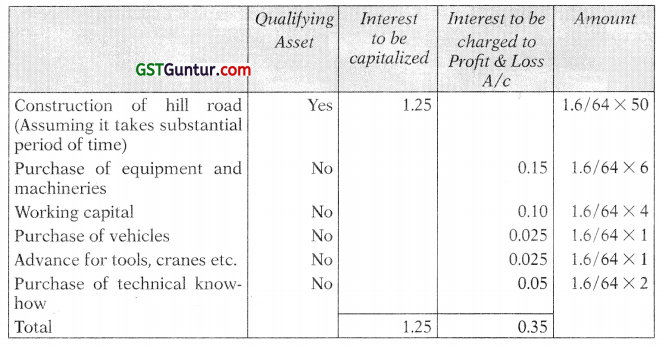

Question 5.

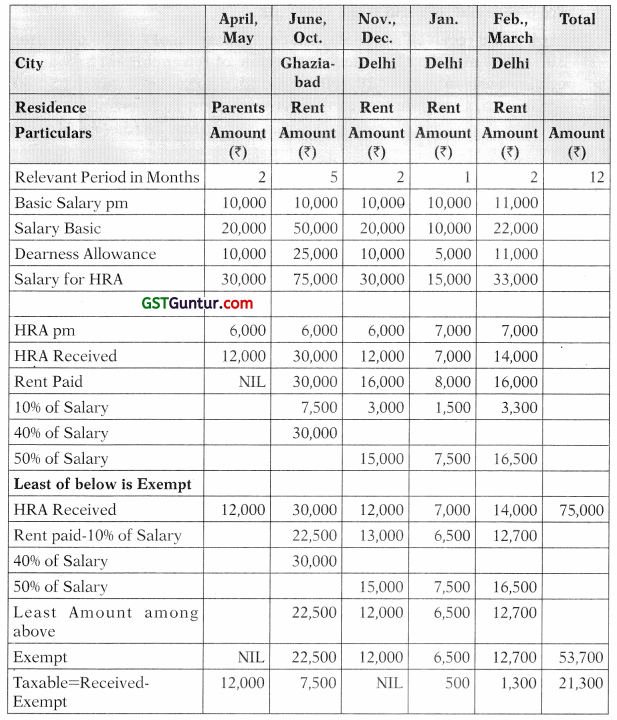

Mr Mohit is employed with XY Limited on a basic salary of ₹ 10,000 per month. He is also entitled to dearness allowance @100% of basic salary, (50% of which is included in salary as per terms of employment). The company gives him house rent allowance of ₹ 6,000 per month which was increased to ₹ 7,000 per month with effect from 01.01.2021. He also got an increment of ₹ 1,000 per month in his basic salary with effect from 01.02.2021. Rent paid by him during the previous year 2020-21 is as under:

April and May 2020 – nil as he stayed with his parents

June to October 2020 – ₹ 6,000 per month for an accommodation in Ghaziabad

November 2020 to March 2021 – ₹ 8,000 per month for an accommodation in Delhi.

Compute his gross salary for the Assessment Year 2021-22. [May. 2012, 8 Marks]

Answer:

Computation of Gross Salary of Mr. Mohit for the Assessment Year 2021 -22

| Particulars | Amount (₹) | Amount (₹) |

| Basic Salary | ||

| April 2020 to Jan 2021 [ 10,000 × 10 ] | 1,00,000 | |

| Feb 2021 to March 2021 ] 11,000 × 2] | 22,000 | 1,22,000 |

| Dearness Allowance [100% × of Basic Salary] | 1,22,000 | |

| House Rent Allowance [Working Note 1] | 21,300 | |

| Gross Salary | 2,65,300 |

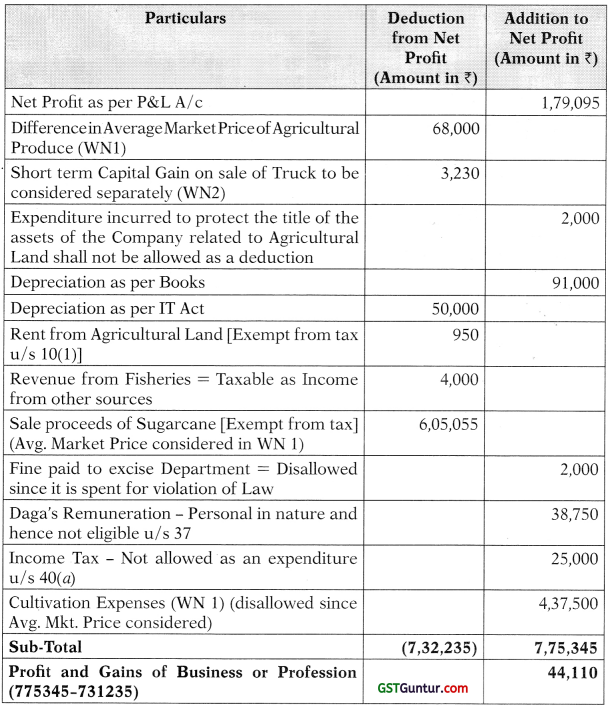

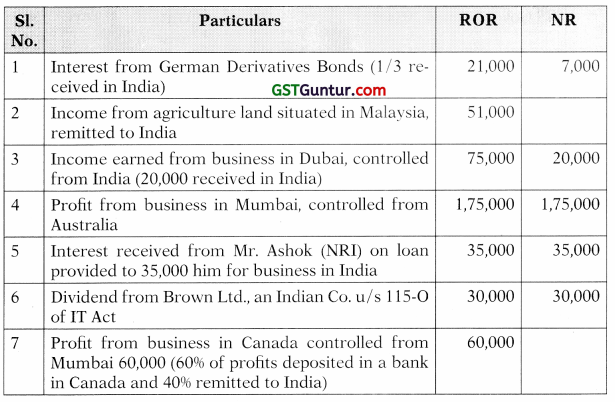

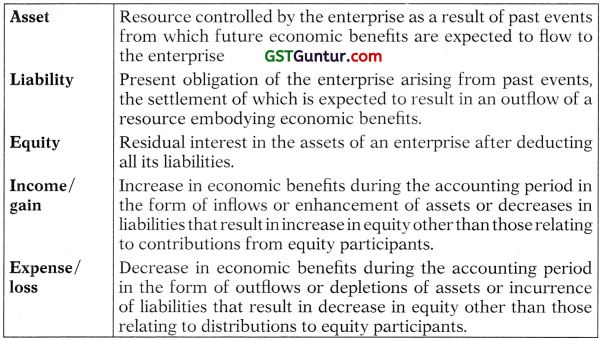

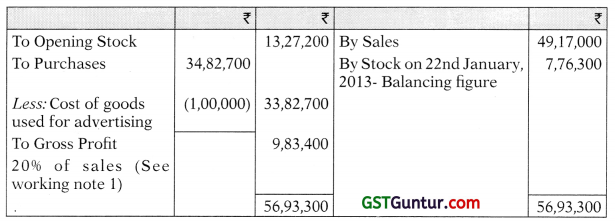

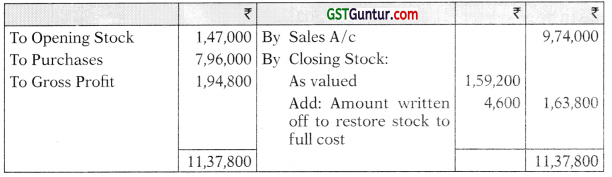

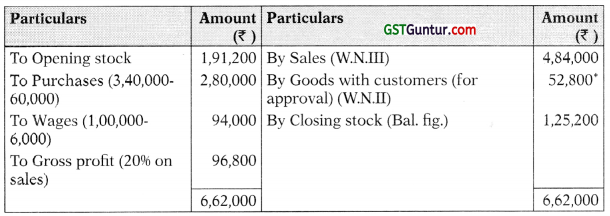

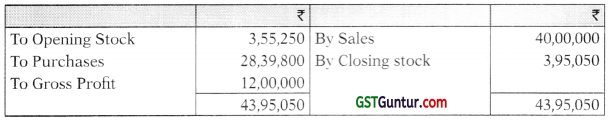

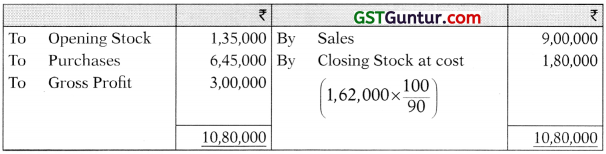

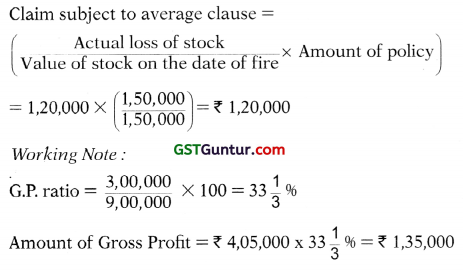

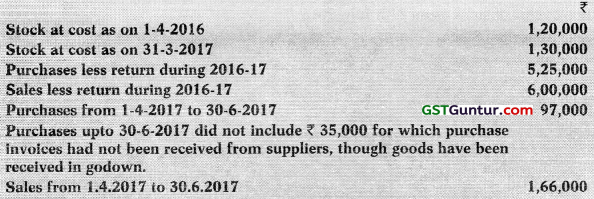

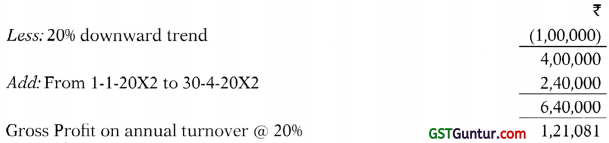

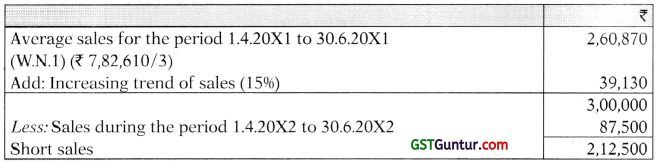

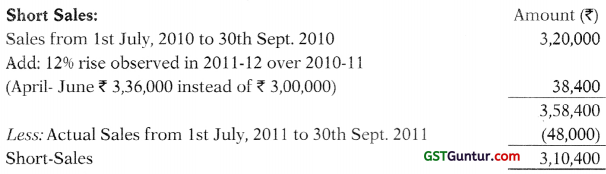

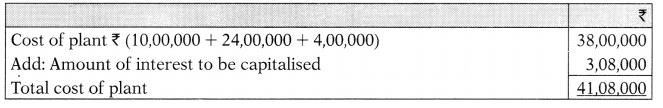

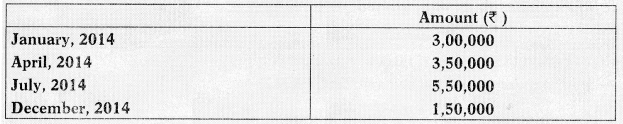

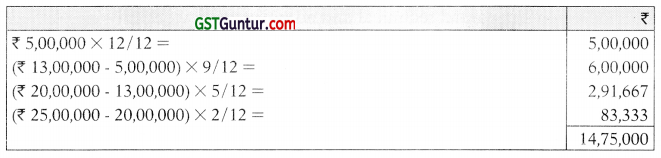

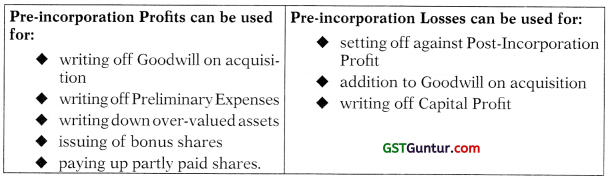

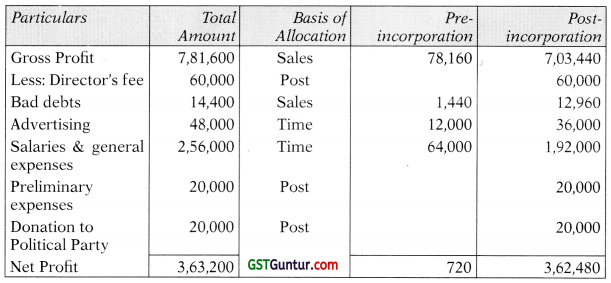

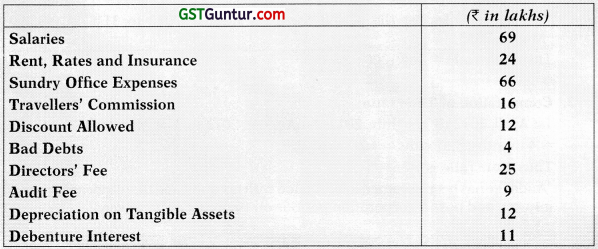

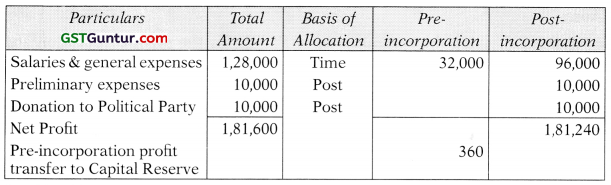

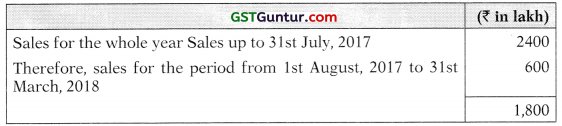

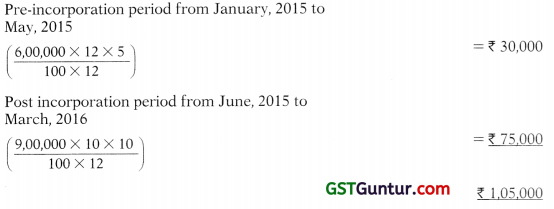

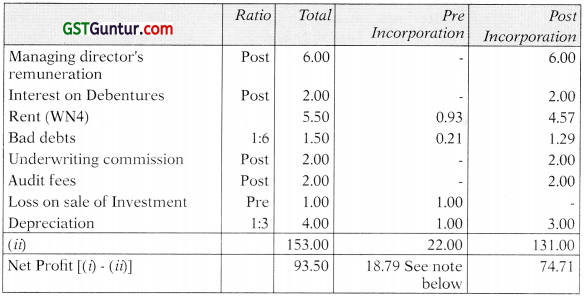

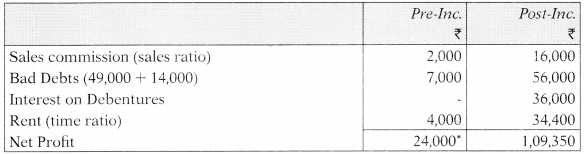

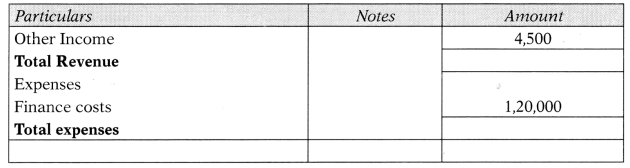

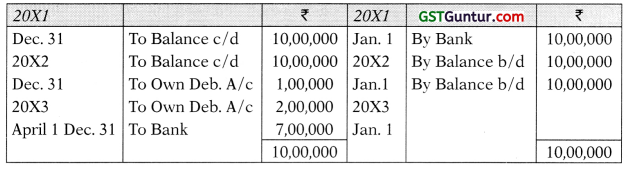

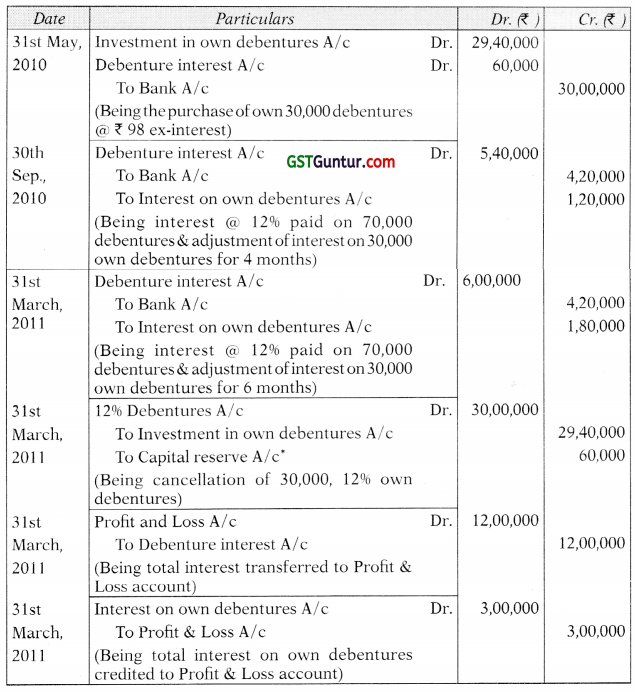

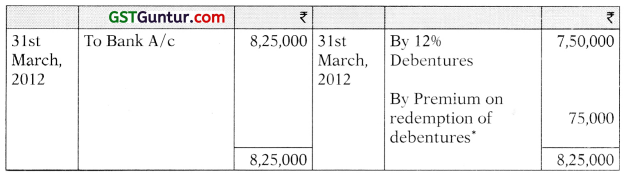

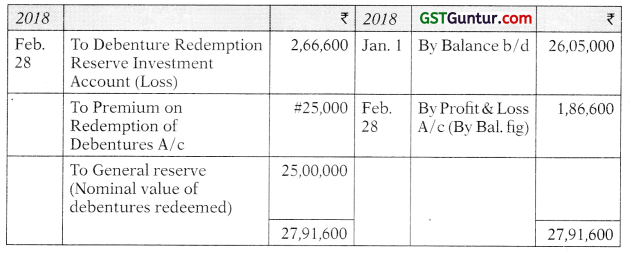

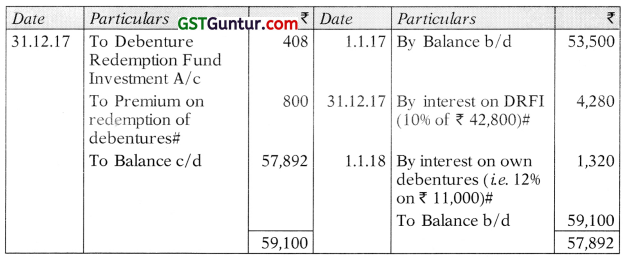

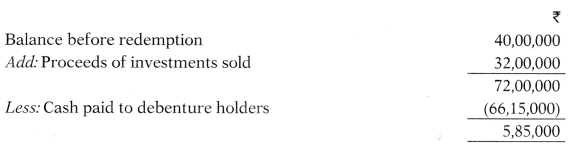

Working Note: (House Rent Allowance)

![]()

Question 6.

(a) Rajesh went to Srinagar on a holiday on 15.11.2020 with his wife and two children (one son is 6 years and twin daughters 3 years). They went by aeroplane economic class and the total cost of tickets by his employer was ₹ 58,000 (₹ 43,000 adults and ₹ 15,000 for the three minor children). Compute the amount of leave travel concession exempt.

Will the answer be any different if among his three children the twins are 6 year old and son three years old.

(b) Mr Govind received retrenchment compensation of ₹ 10,00,000 after 30 years 4 months of service. At the time of retrenchment he was receiving basic salary of ₹ 20,000 per month dearness allowance ₹ 5,000 per month. Compute his taxable retrenchment compensation. [May. 2013, 4+4 Marks]

Answer:

(a) Case 1: One Son Is 6 Years And Twin Daughters 3 Years Old

Computation of Taxable Leave Travel Concession u/s 10(5) for the Assessment Year 2020-2021

| Particulars | Amount (₹) |

| Cost of Travel in Economy Class | |

| For the Spouse and Assessee himself | 43,000 |

| For Children – First Child is Son 6 years old and Second Children are twin (Then Twins are treated as One Child and exemption is available to all) | 15,000 |

| Total Exemption | 58,000 |

Case 2: Twins Are 6 Year Old And Son Three Years Old.

Computation of Taxable Leave Travel Concession u/s 10(5) for the Assessment Year 2020-2021

| Particulars Cost of Travel in Economy Class |

Amount (₹) |

| For the Spouse and Assessee himself | 43,000 |

| For Children – First Child is twin daughter 6 years old and Second Child is Son 3 years old (Then exemption is not available to Son, as the twin daughters are considered as Two Children). Hence exemption will be ₹ 15,000 × 2/3 = 10,000 | 10,000 |

| Total Exemption | 53,000 |

![]()

Note:

1. The Exemption will be available only for two surviving children of an individual born after 01.10.1998. There is no restriction for children born before 01.10.1998 and also in case of multiple births after one child.

(b) Computation of Taxable Amount of Retrenchment Compensation of Mr. Govind for the Assessment Year 2021-2022

| Particulars | Amount (₹) |

| Basic Salary pm | 20,000 |

| Dearness Allowance pm | 5,000 |

| Salary for the purpose of Retrenchment Compensation | 25,000 |

| No. of years Service Completed Years or Part thereof in excess of 6 months | 30 |

| Maximum Limit | 5,00,000 |

| Amount of Compensation Received | 10,00,000 |

| Least of the Following is Exempt | |

| 1. Actual Amount Received | 10,00,000 |

| 2. Maximum Limit | 5,00,000 |

| 3. Amount under Industrial Dispute Act, 1947= \(\frac{15}{30}\) × 25,000 × 30 = 3,75,000 | 3,75,000 |

| Exempt | 3,75,000 |

| Received | 10,00,000 |

| Taxable | 6,25,000 |

![]()

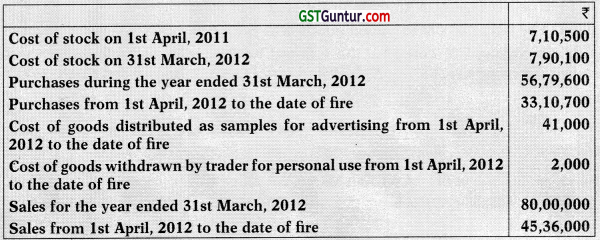

Question 7.

From the following details, Find out the salary chargeable to tax of Mr Anand for the Assessment Year 2021-22:

Mr Anand is a regular employee of Malpani Limited in Mumbai. He was appointed on 01.03.2020 in the pay scale of 25,000-2,500-35,000. He is paid dearness allowance (which forms part of salary for retirement benefits) @ 15% of basic pay and bonus equivalent to one and a half months basic pay as at the end of the year. He contributes 18% of his salary (basic pay plus dearness allowance) towards recognized provident fund and the company contributes the same amount.

He is provided with rent free housing facility which has been taken on rent by the company at ₹ 15,000 per month. He is also provided with the following facilities:

- The company reimbursed the medical treatment bill of ₹ 40,000 of his daughter who is dependent on him.

- The monthly salary of ₹ 2,000 of a housekeeper is reimbursed by the company.

- He is getting telephone allowance @ ₹ 1,000 per month

- A gift voucher of ₹ 4,700 was given on the occasion of his marriage anniversary

- The company pays medical insurance premium to effect and insurance on the health of Mr Anand ₹ 12,000.

- Motor car running and maintenance charges fully paid by employer of ₹ 36,600 (the motor car is owned and driven by Mr Anand. The engine cubic capacity is below 1.6 litre. The motor car is used for both official and personal purpose by the employee.

- Value of free lunch provided during the office hours is ₹ 2,200. [Nov. 2013, 8 Marks]

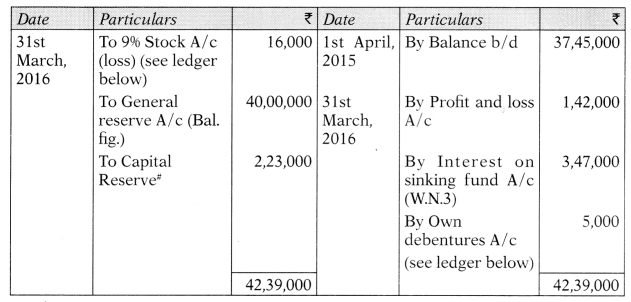

Answer:

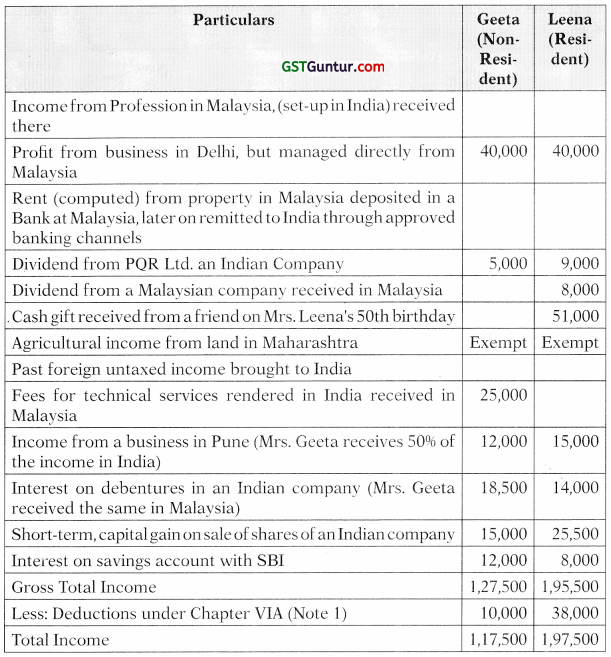

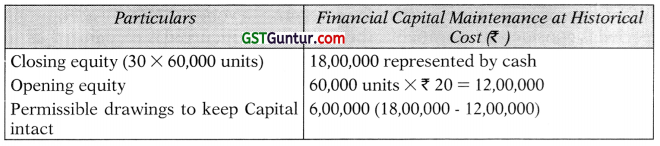

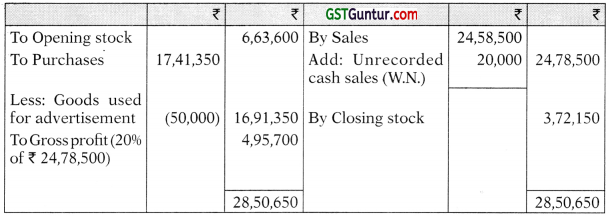

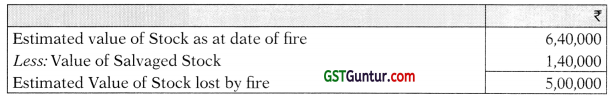

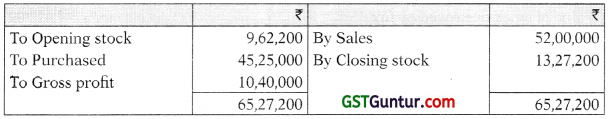

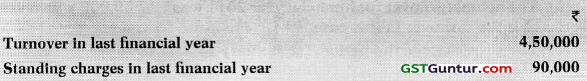

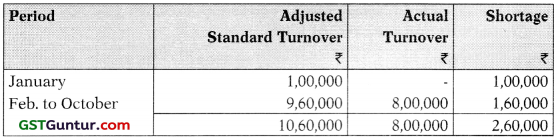

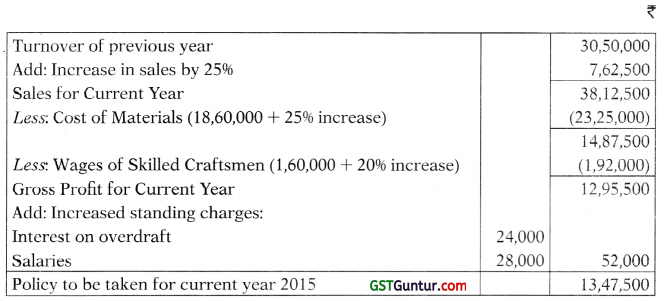

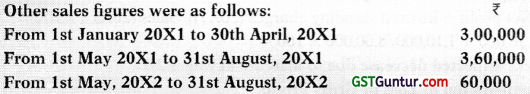

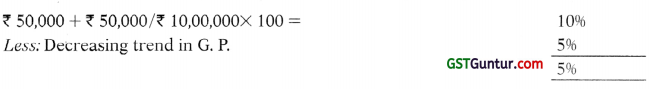

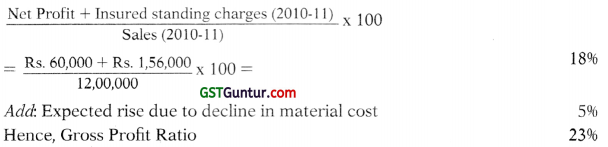

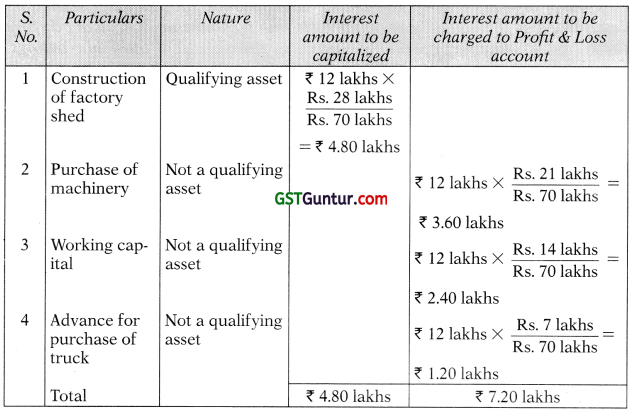

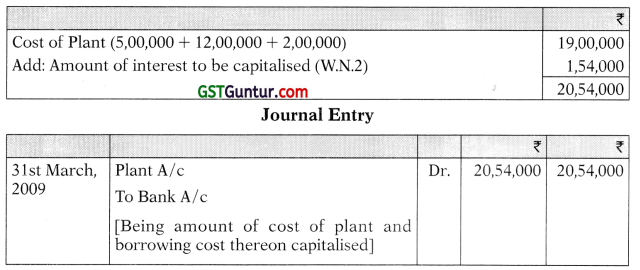

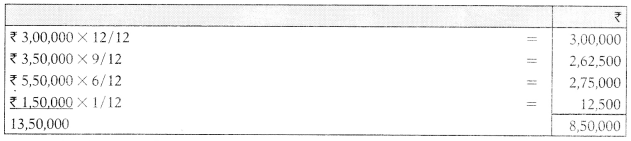

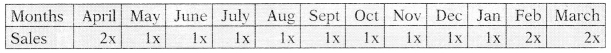

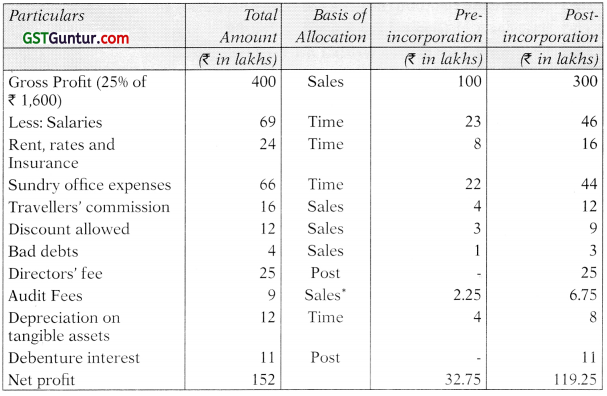

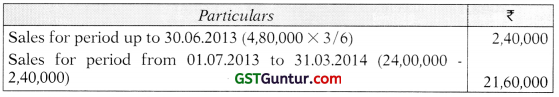

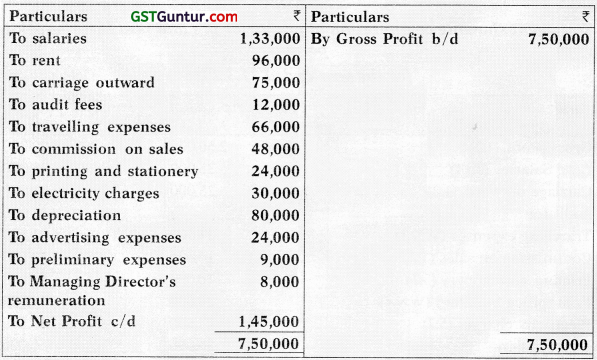

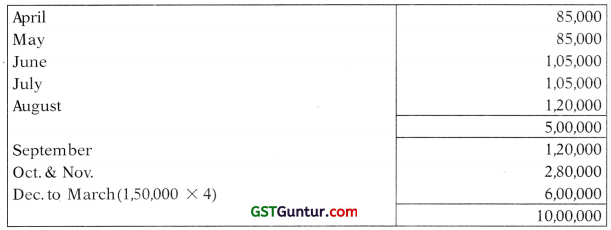

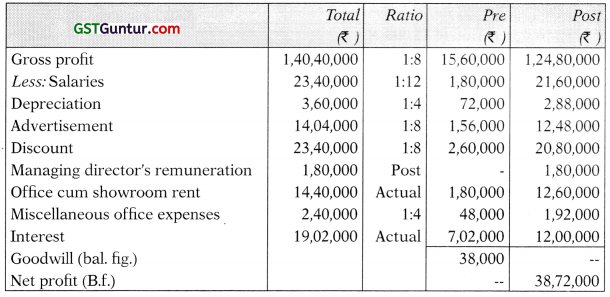

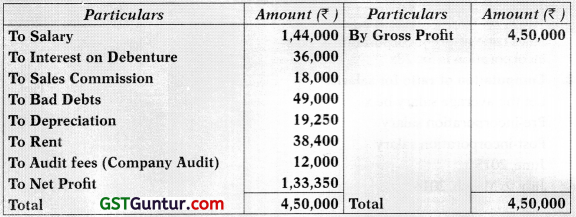

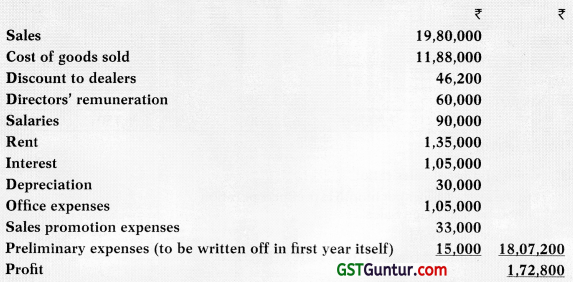

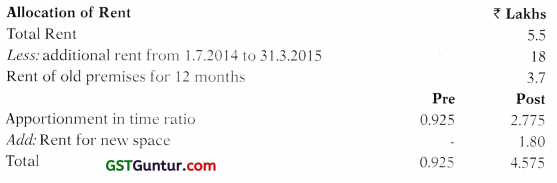

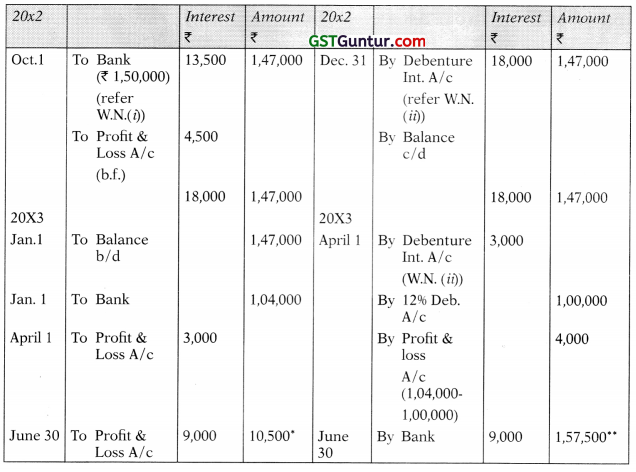

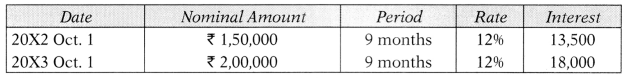

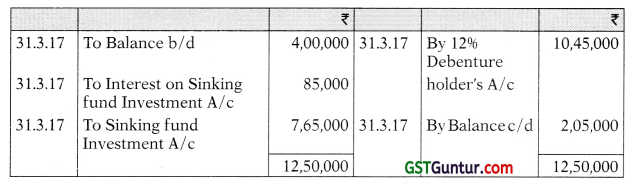

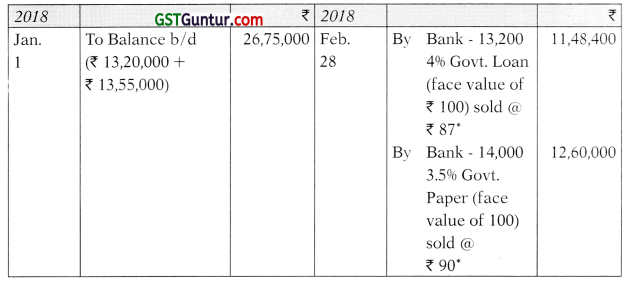

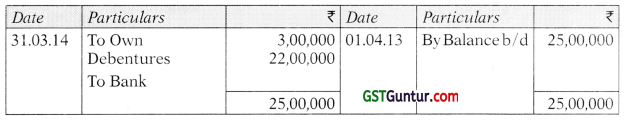

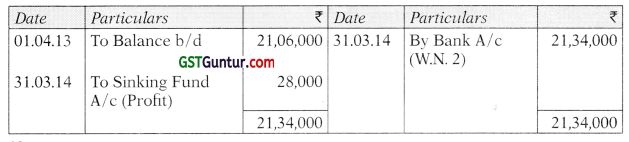

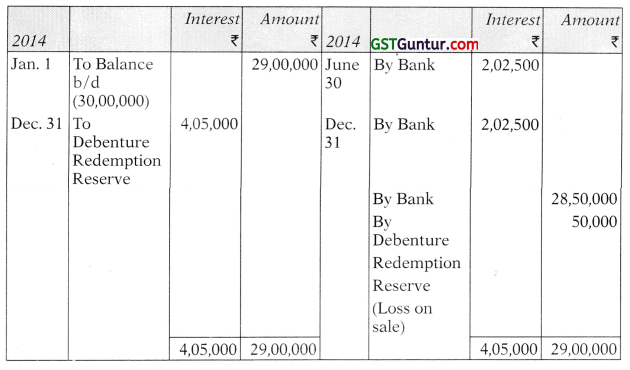

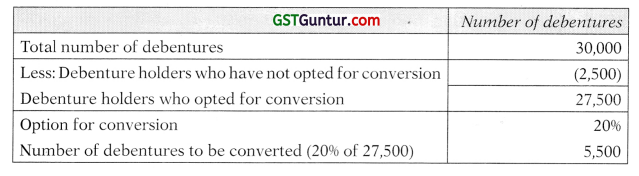

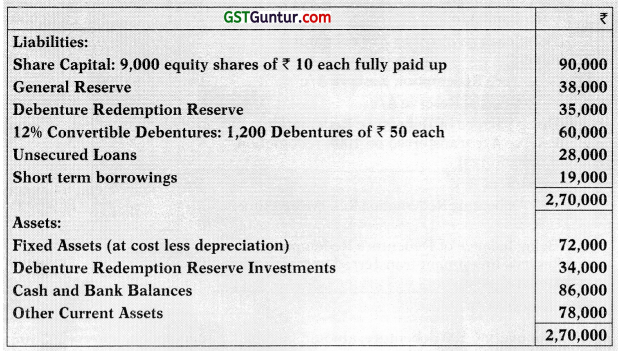

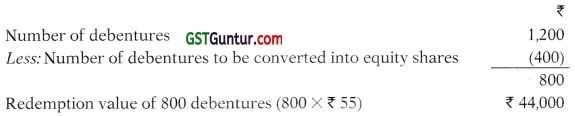

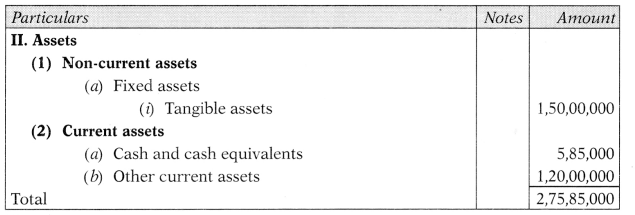

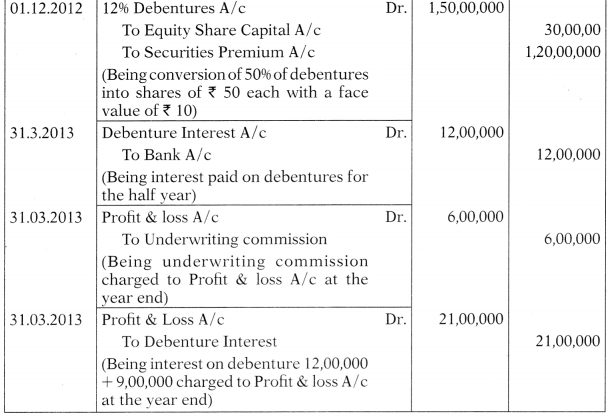

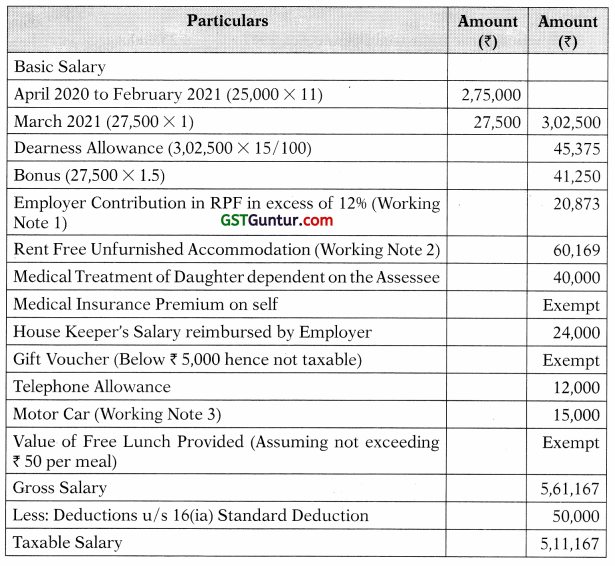

Computation of Taxable Salary of Mr Anand for the Assessment Year 2021-22

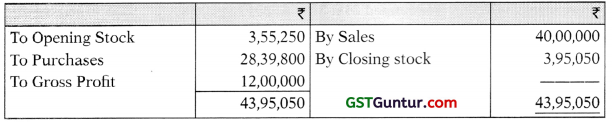

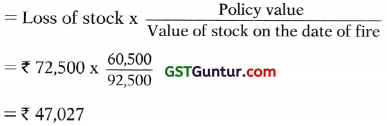

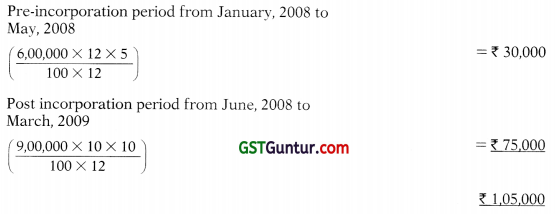

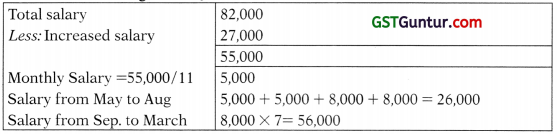

Working Notes:

1. Employer Contribution in RPF in excess of 12%:

- Salary for the purpose of Recognized Provident Fund = 3,02,500 + 45,375 = 3,47,875

- Employer Contribution in RPF = 18% of 3,47,875 = 62,618

- Exempt to the extent = 12% of 3,47,875 = 41,745

- Taxable Amount = 62,618 – 41,745 = 20,875

2. Rent Free Unfurnished Accommodation:

- Salary for the purpose of Rent Free Unfurnished Accommodation

Basic + Dearness Allowance + Bonus + Telephone Allowance

3,02,500 + 45,375 + 41,250 + 12,000 = 4,01,125 - 15% of Salary = 60,169

- Rent paid by Employer to Landlord = 1,80,000

- Valuation of RFFI = 15% of Salary or Actual Rent paid by Employer to Landlord whichever is less

- = 60,169 or 1,80,000 whichever is less

- = 60,169

3. Motor Car Valuation:

- Motor Car is owned by Employer.

- Motor Car running and maintenance expenses paid by employer.

- Actual Expenses Incurred by the Employer = 36,600

- Amount Exempt to the extent = @1,800 pm being small car.

- Valuation = 36,600 – 21,600 = 15,000

![]()

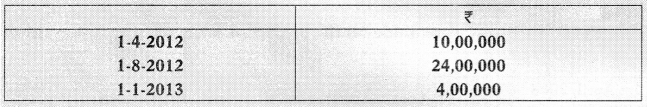

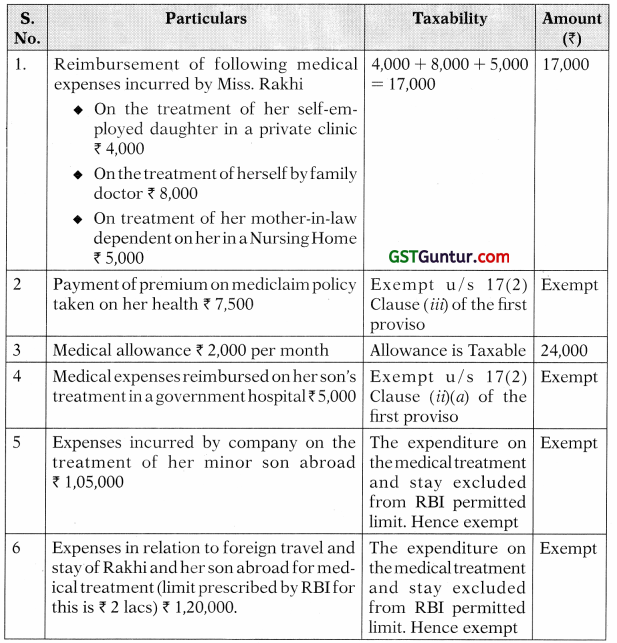

Question 8.

Ms. Rakhi is an employee in a private company. She receives the following medical benefits from the company during the previous year 2020-21:

- Reimbursement of following medical expenses incurred by Miss. Rakhi

- On the treatment of her self-employed daughter in a private clinic ₹ 4,000

- On the treatment of herself by family doctor ₹ 8,000

- On treatment of her mother-in-law dependent on her in a Nursing Home ₹ 5,000

- Payment of premium on mediclaim policy taken on her health ₹ 7,500

- Medical allowance ₹ 2,000 per month

- Medical expenses reimbursed on her son’s treatment in a government hospital ₹ 5,000

- Expenses incurred by company on the treatment of her minor son abroad ₹ 1,05,000

- Expenses in relation to foreign travel and stay of Rakhi and her son abroad for medical treatment (limit prescribed by RBI for this is ₹ 2 lacs) ₹ 1,20,000.

Discuss about the taxability of above benefits and allowance in the hands of Rakhi. [May. 2009, 2 Marks]

Answer:

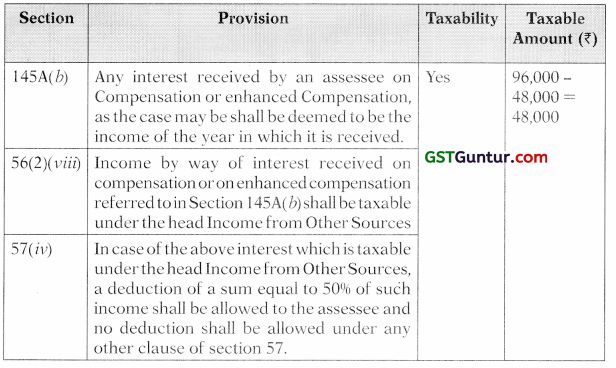

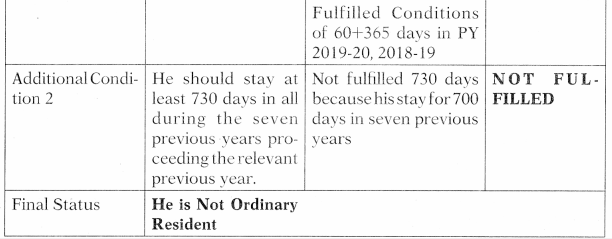

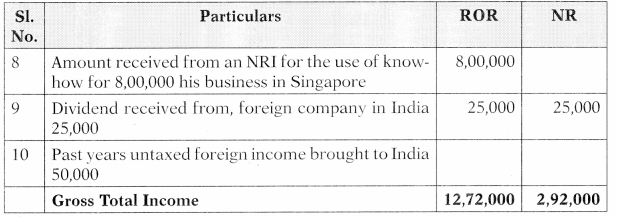

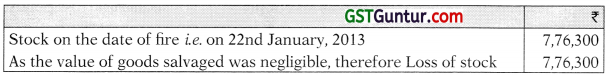

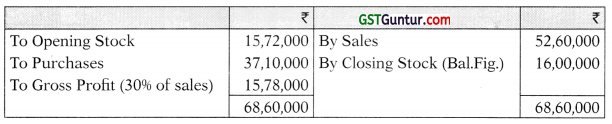

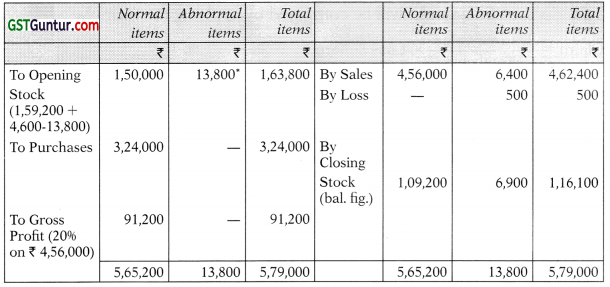

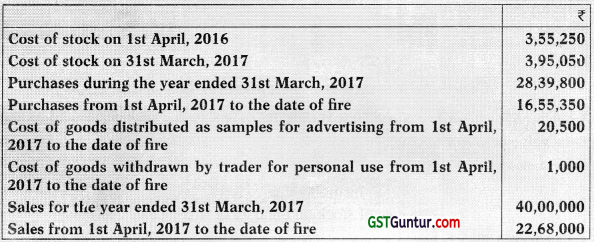

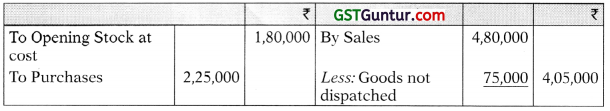

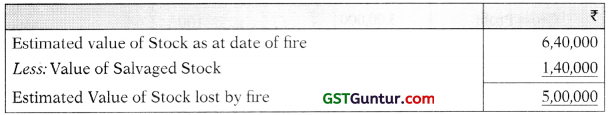

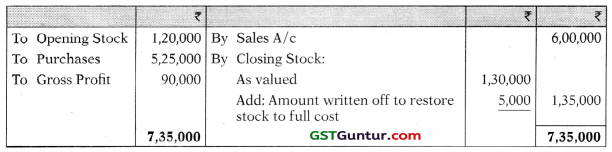

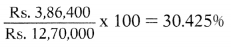

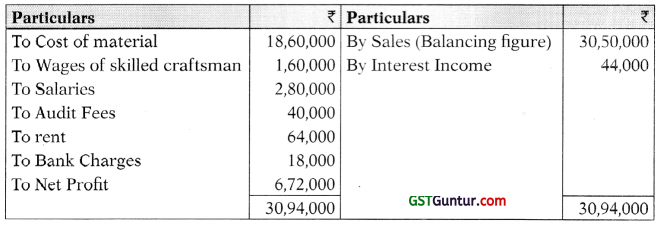

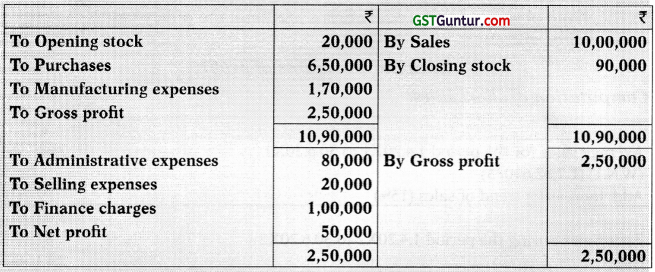

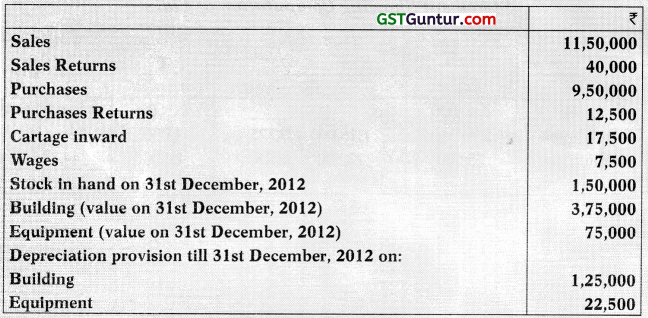

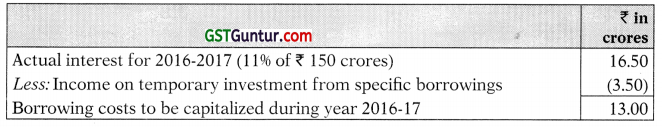

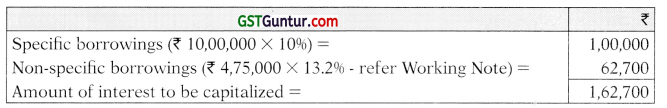

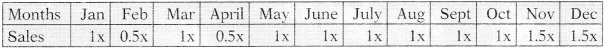

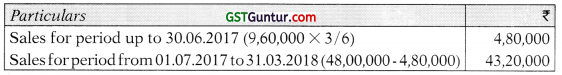

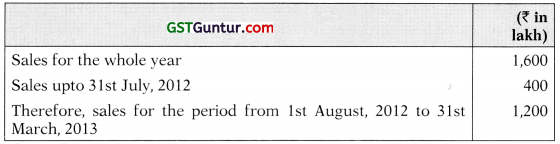

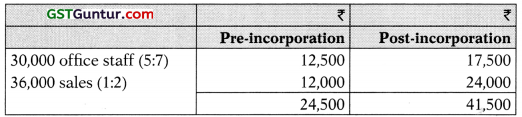

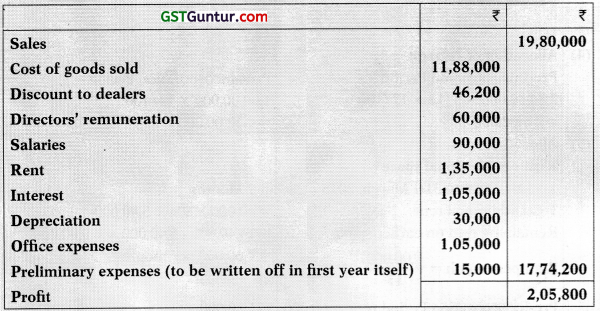

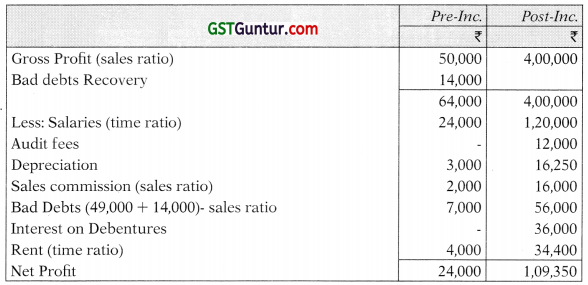

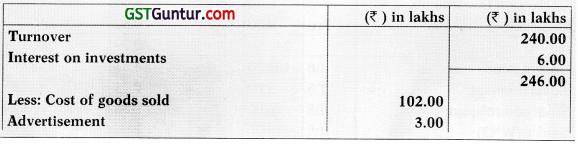

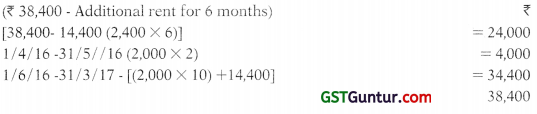

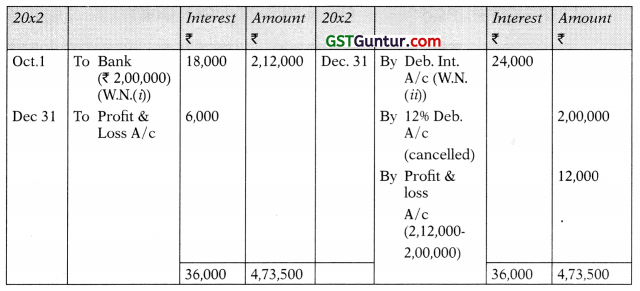

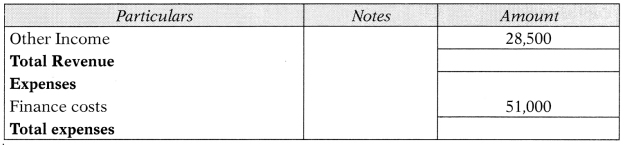

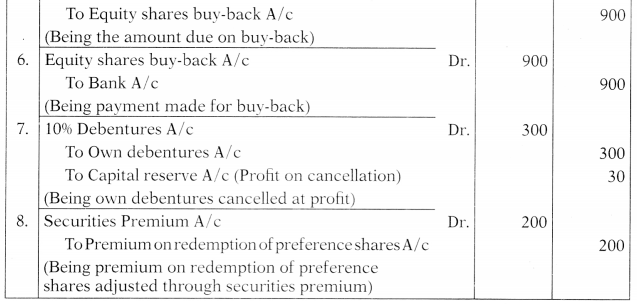

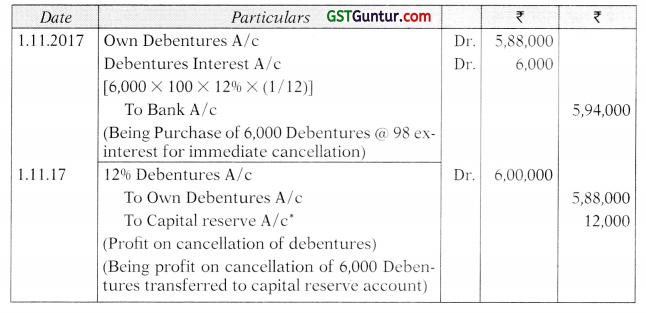

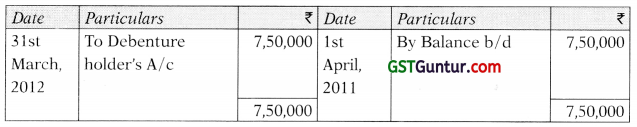

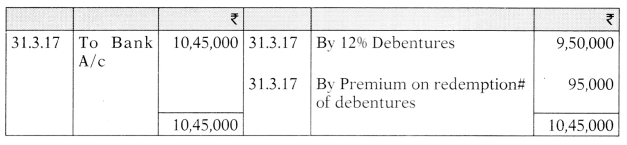

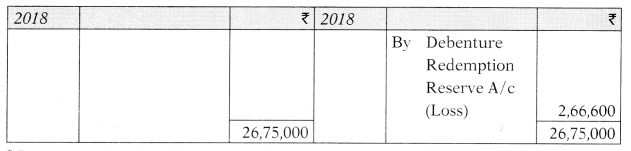

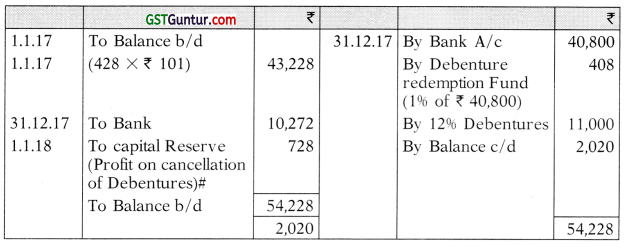

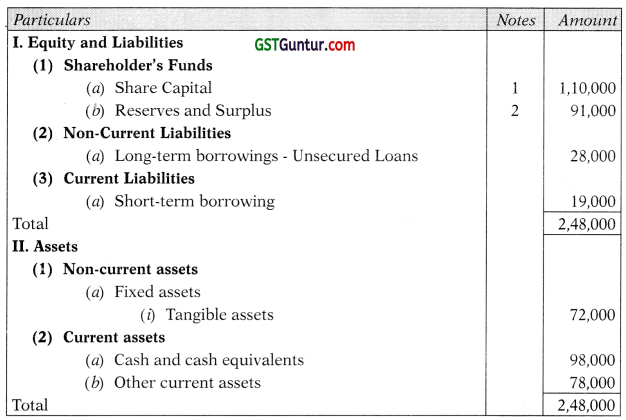

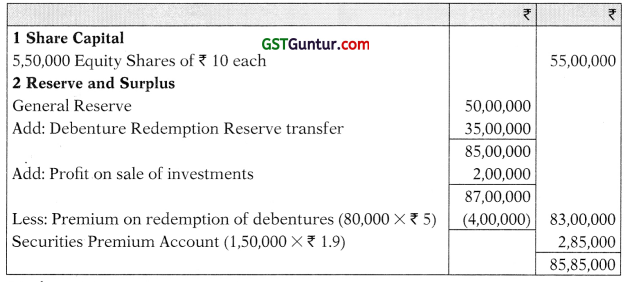

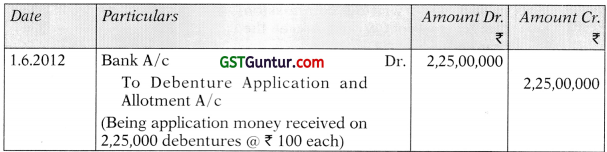

Taxability of Medical benefits and allowances in the hands of Ms. Rakhi for the Assessment Year 2021-22

![]()

Question 9.

Mr Anand is an employee of XYZ company limited at Mumbai and covered by Payment of Gratuity Act retires at the age of 64 years on 31.12.2020 after completing 33 years and 7 months of service. At the time of retirement his employer pays ₹ 20,51,640 as gratuity and ₹ 6,00,000 as accumulated balance of recognized provident fund. He is also entitled for monthly pension of ? 8,000. He gets 75% of pension commuted for ₹ 4,50,000 01.02.2021.

Determine the salary chargeable to tax for Mr Anand for the assessment year 2021-22 with the help of the following information’s:

- Basic salary (₹ 80,000 × 9) ₹ 7,20,000

- Bonus ₹ 36,000

- House rent allowance (₹ 15,000 × 9) ₹ 1,35,000

- Rent paid by Mr Anand (₹ 10,000 × 9) ₹ 1,20,000

- Employer contribution towards recognised provident fund ₹ 1,10,000

- Professional tax paid by Mr Anand ₹ 2,000

Note: salary and pension Falls due on the last day of each month. [Nov. 2014, 8 Marks]

Answer:

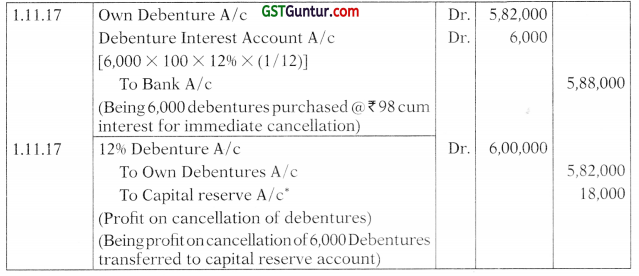

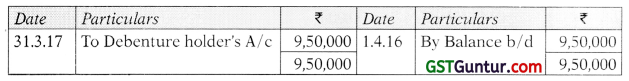

Computation of Taxable Salary of Mr Anand for the Assessment Year 2021-22

| Particulars | Amount (₹) | Amount (₹) |

| Salary (80,000 ×9) | 7,20,000 | |

| Bonus | 36,000 | |

| House Rent Allowance (Working Note 1) | 1,17,000 | |

| Employer Contribution in RPF in excess of 12% (Working- Note 2) | 23,600 | |

| Pension | 12,000 | |

| Gratuity (Working Note 3) | 4,82,409 | |

| Commuted Value of Pension (Working Note 4) | 2,50,000 | |

| Accumulated Balance of Recognized Provident Fund | Exempt | |

| Gross Salary | 16,41,009 | |

| Less: Deductions u/s 16(ia) Standard Deduction | 50,000 | |

| Less: Deductions u/s 16(iii) Professional Tax | 2,000 | 52,000 |

| Taxable Salary | 15,89,009 | |

![]()

Working Notes:

1. House Rent Allowance (Only for nine months)

-

- Salary for the purpose of HRA = 7,20,000

- HRA received = 15,000 × 9 = 1,35,000

- Rent paid in Mumbai = 10,000 × 9 = 90,000

- 10% of Salary = 72,000

- 50% of Salary (Being in Mumbai) = 3,60,000

- Least of the following is exempt:

(1) Actual HRA received = 1,35,000

(2) Rent paid – 10% of Salary = 90,000 – 72,000 = 18,000

(3) 50% of Salary (Being in Mumbai) = 3,60,000- Exempt = 18,000

- Taxable = Received – Exempt = 1,35,000 – 18,000 = 1,17,000

- Least of the following is exempt:

2. Employer Contribution in RPF in excess of 12%

- Salary for the purpose of Recognized Provident Fund = 7,20,000

- Employer Contribution in RPF = 1,10,000

- Exempt to the extent = 12% of 7,20,000 = 86,400

- Taxable Amount = 1,10,000 – 86,400 = 23,600

3. Gratuity

- Salary for the purpose of Gratuity (Covered by Payment of Gratuity Act)

= Basic + Dearness Allowance = 80,000 + 0

= Last Salary drawn = 80,000 - Actual Amount of Gratuity received = 20,51,640

- No. of completed years of Services or part thereof = 34 years

- Notified amount = 20,00,000

- Least of the following is exempt

(1) Actual Amount of Gratuity received = 20,51,640

(2) Notified Amount = 20,00,000 15

(3) \(\frac{15}{26}\) × 80,000 × 34 = 15,69,231

Exempt = 15,69,231

Taxable = Received – Exempt = 20,51,640 – 15,69,231 = 4,82,409

4. Commuted Value of Pension

- Actual Amount of Commuted Pension receive = 4,50,000

- 75% received = 4,50,000

- Full Value = 450000 × \(\frac{100}{75}\) = 6,00,000

- Exempt u/s 10(10A) = 1 /3rd of Full value of Pension

600000 × \(\frac{1}{3}\) = 2,00,000 - Taxable = Receive – Exempt = 4,50,000 – 2,00,000 = 2,50,000

![]()

Question 10.

Compute the amount of LTC exemption in the following cases with the reference to the provision under Income Tax Act 1961

(a) Mr Suresh went on a holiday on 09.09.2020 to Mysore with his wife and three children- one daughter born on 02.02.2011 and twin sons born on 05.05.2013. The total cost of travel was ₹ 80,000. The ticket cost for Mr Suresh and his wife w as ₹ 50,000 and for all three children was ₹ 30,000. The employer reimburse total ticket cost ? 80,000.

(b) In the above case (a) if among his three children the Twin sons born on 02.02.2011 and the daughter was born on 05.05.2013, what shall b be the exemption ? [May 2009, 2 Marks]

Answer:

Case 1: First Child is daughter born on 02.02.2011 and Second Children ; are twin born on 05.05.2013

Computation of Taxable Leave Travel Concession u/s 10(5) for the Assessment Year 2020-21

| Particulars | Amount (₹) |

| Cost of Travel | |

| For the Spouse and Assessee himself | 50,000 |

| For Children – First Child is daughter born on 02.02.2011 and Second Children are twin born on 05.05.2013 (Then Twins are treated as One Child and exemption is available to all) | 30,000 |

| Total Exemption | 80,000 |

Case 2: Twins Are 6 Year Old And Son Three Years Old.

Computation of Taxable Leave Travel Concession u/s 10(5) for the Assessment Year 2020-21

| Particulars | Amount (₹) |

| Cost of Travel | |

| For the Spouse and Assessee himself | 50,000 |

| For Children – First Child is twin sons and Second Child is daughter (Then exemption is not available to daughter, as the twin sons are considered as Two Children). Hence exemption will be ₹ 30,000 × 2/3 = 20,000 | 20,000 |

| Total Exemption | 70,000 |

Note:

1. The Exemption will be available only for two surviving children of an individual born after 01.10.1998. There is no restriction for children born before 01.10.1998 and also in case of multiple births after one child.

![]()

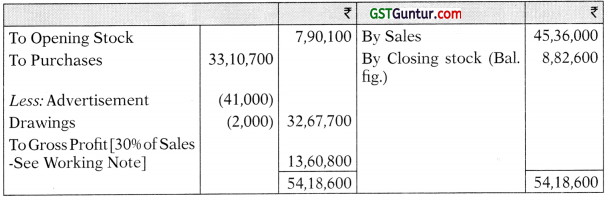

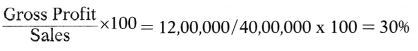

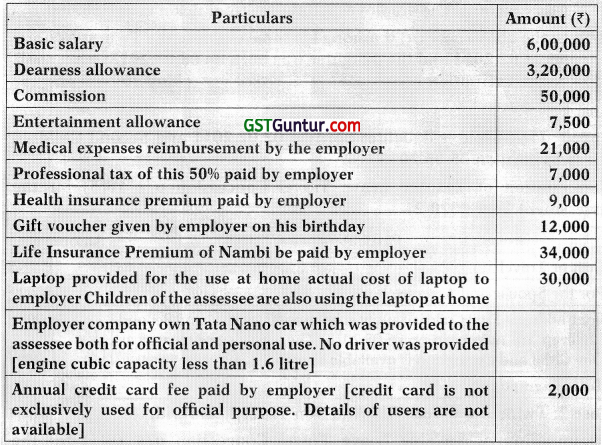

Question 11.

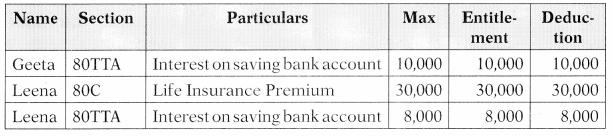

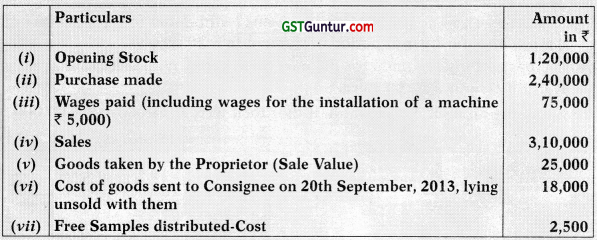

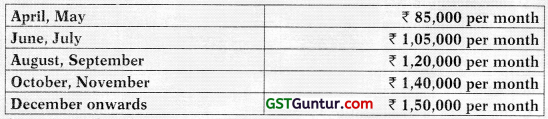

Mr. Nambi, salaried employee furnishes the following details for the financial year 2020-21:

You are required to compute the income chargeable under the head salaries for the assessment year 2021-22 [May 2017, 8 Marks]

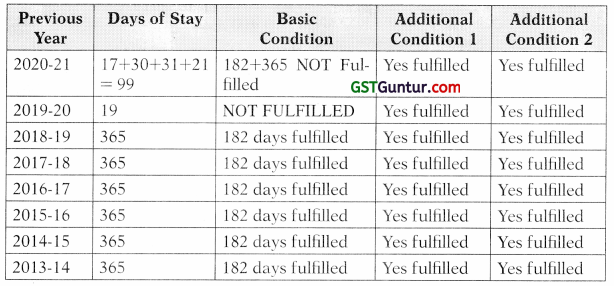

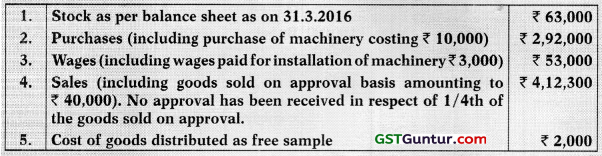

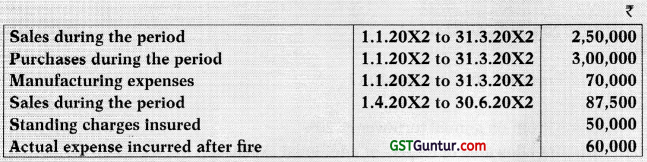

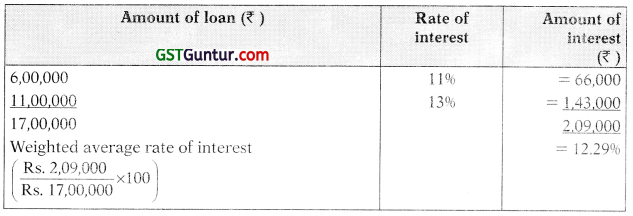

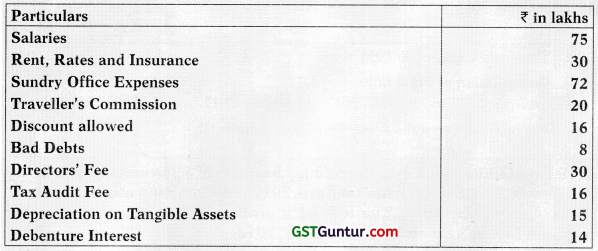

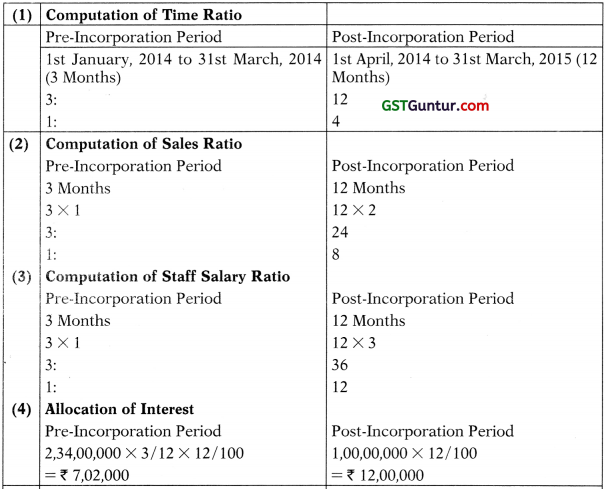

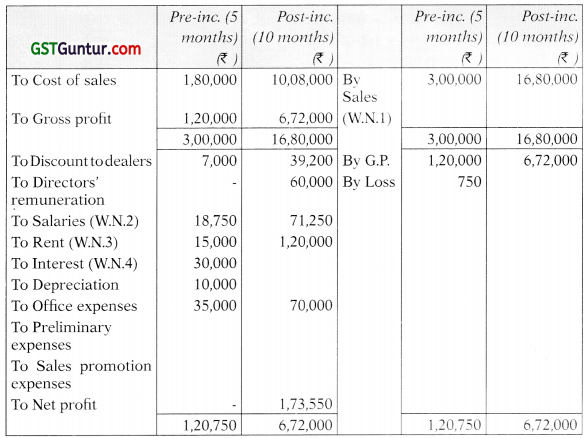

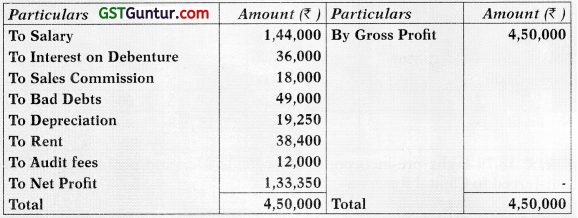

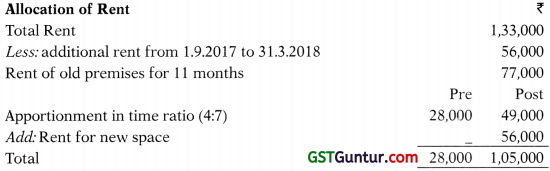

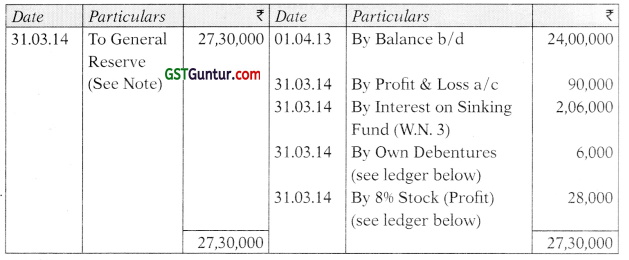

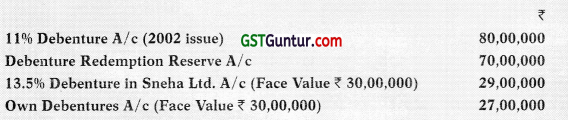

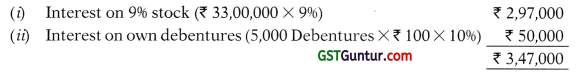

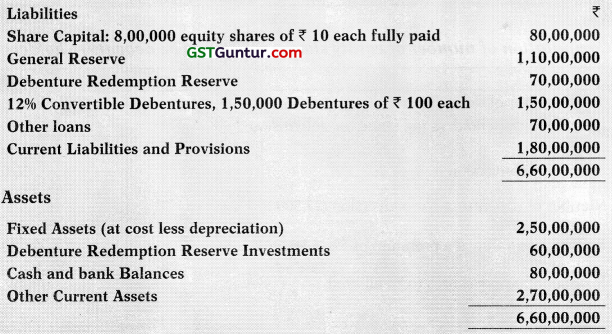

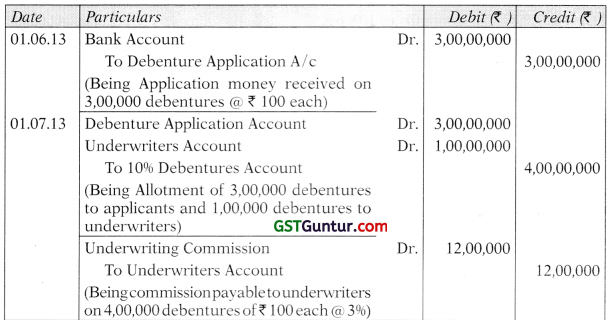

Answer:

Computation of Income chargeable under the head salaries of Mr. Nambi for the assessment year 2021-22

Note:

1. All payments paid by employer like Professional Tax paid by employer, Life Insurance Premium Paid by Employer, Credit card Fee, is obligation of employee paid by employer hence taxable (Except Health Insurance Premium paid by Employer )

![]()

Question 12.

Ms. Jaya is the marketing manager in XYZ Limited. She gives you the following particulars basic salary ₹ 65,000 pm

Dearness allowance ₹ 22,000 pm (30% is for retirement benefits)

Bonus ₹ 17,000 pm

Her employer has provided her with an accommodation on 1st April 2020 at a concessional rent. The house was taken on lease by XYZ Limited for ₹ 12,000 per month Ms. Jaya occupied the house from 1st November 2020. Company recovered ₹4,800 per month from the salary of Ms. Jaya.

The employer gave her a gift voucher of ₹ 8,000 on her birthday. She contributes 18% her salary (basic pay plus dearness allowance) towards recognised provident fund and the company contributes the same amount.

The company pays medical insurance premium to effect insurance on the health of Ms. Jaya ₹ 18,000.

Motor car owned by the employer (cubic capacity of engine exceeds 1.6 litre) provided to Ms. Jaya from 1st November 2020 which is used for both official and personal purposes. The motor car repair and running expenses of ₹ 50,000 were fully met by the company. The motor car was self-driven by the employee.

Compute the income chargeable to Tax under the head salaries in the hands of Ms. Jaya for the assessment year 2021-22

[Nov. 2017, 10 Marks]

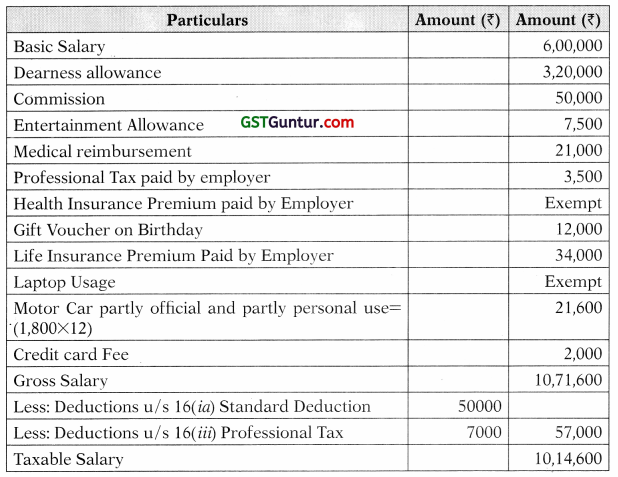

Answer:

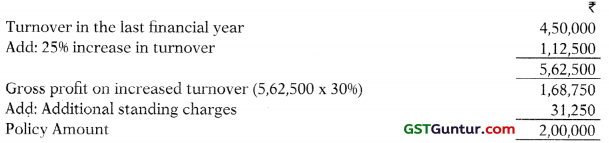

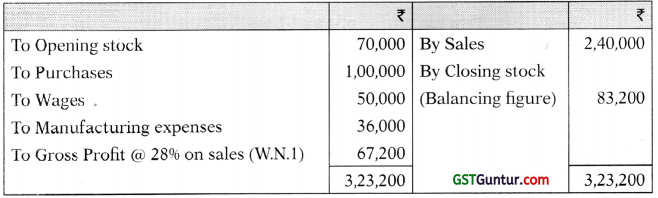

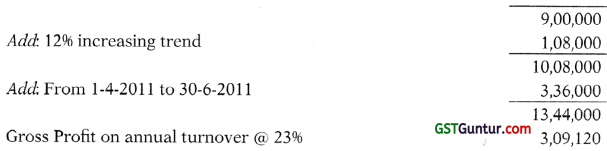

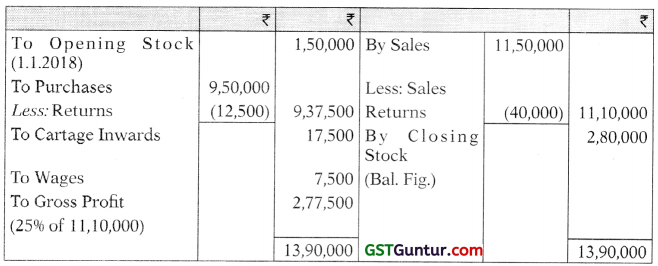

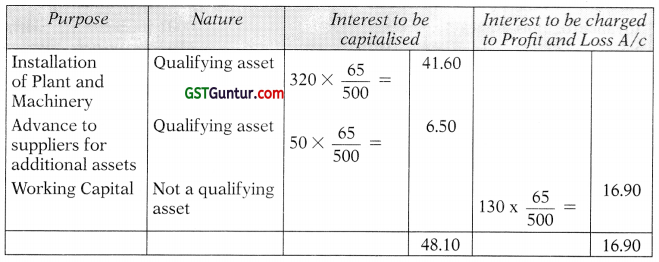

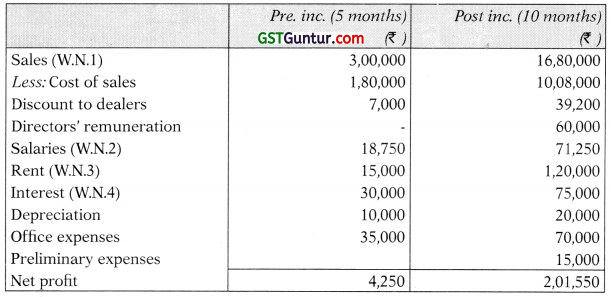

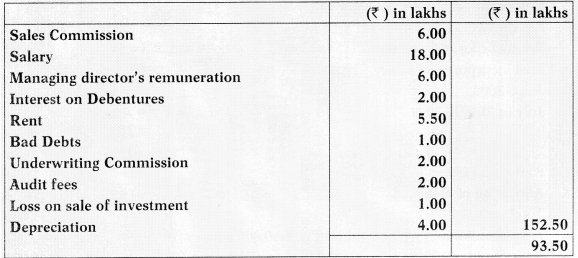

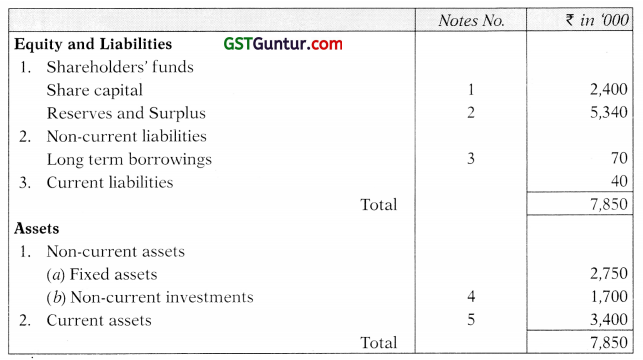

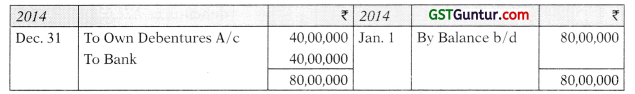

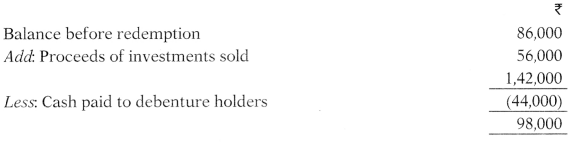

Computation of Income chargeable under the head salaries of Ms. Jaya 1 For the Assessment Year 2021-22

| Particulars | Amount (₹) |

| Basic Salary [65000 × 12] | 7,80,000 |

| Dearness Allowance [22,000 × 12] | 2,64,000 |

| Bonus [17,000 × 12] | 2,04,000 |

| Value of Concessional Rent Accommodation (Working Note 1) | 36,000 |

| Gift Voucher on Birthday | 8,000 |

| Employer Contribution in Recognized Provident Fund (Working- Note 2) | 51,552 |

| Medical Insurance premium paid by Employer [Exempt u/s 17(2)] | Exempt |

| Motor Car (Working Note 3) | 12,000 |

| Gross Salary | 13,55,552 |

| Standard Deduction | 50,000 |

| Taxable Salary | 13,05,552 |

![]()

Working Notes:

1. Value of Concessional Rent Accommodation (from 01.11.2020 to 31.03.2021)

- Salary for the purpose of Rent Free Unfurnished Accommodation

Basic + Dearness Allowance + Bonus

(65000 × 5) + (22000 × 5 × 30/100) + (17000 × 5) = 443000 - 15% of Salary = 66450

- Rent paid by Employer to Landlord = 12000 × 5 = 60000

- Rent Recovered from Ms. Jaya = 4800 × 5 = 24000

- Valuation of RFH = [15% of Salary or Actual Rent paid by Employer to Landlord whichever is less] – Rent Recovered from Ms. Jaya

= [66450 or 60,000 whichever is less] – Rent Recovered from Ms. Jaya

= 60,000 – 24000

= 36000

2. Employer Contribution in Recognized Provident Fund

- Salary for the purpose of Recognized Provident Fund = 7,80,000 + 79,200 = 8,59,200

- Employer Contribution in RPF = 18% of 8,59,200 = 1,54,656

- Exempt to the extent = 12% of 8,59,200 = 1,03,104

- Taxable Amount = 1,54,656 – 1,03,104 = 51,552

3. Motor Car Valuation: (from 01.11.2020 to 31.03.2021)

- Motor Car is owned by Employer and Cubic Capacity is more than 1.6 Litre.

- Motor Car is used for both Official and Personal Purposes.

- Car is self-driven.

- Motor Car running and maintenance expenses paid by employer.

- Actual Expenses Incurred by the Employer = 50,000 (not relevant)

- Amount Taxable = @ 2,400 pm × 5 = 12,000

![]()

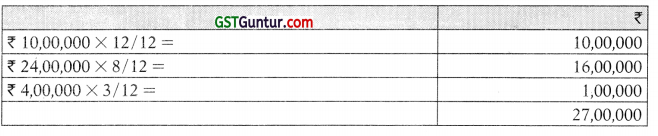

Question 13.

Mr Honey is working with a domestic company having a production unit in the USA for last 15 years. He has been regularly visiting India for export promotion of company’s product. He has been staying in India for at least 184 days every year.

He submits the following information:

Salary received outside India (for 6 months) ₹ 50,000 per month Salary received in India for 6 months ₹ 50,000 per month He has been given rent free accommodation in USA for which company pays ₹ 15,000 per month as Rent but when he comes to India, he stays in the guest house of the company. During this period he is given free lunch facility. During the previous year company incurred and expenditure of ₹ 48,000 on this facility.

He has been provided a car of 2000 cc capacity in USA which is used by him for both official and private purposes. The actual cost of the car is ₹ 8,00,000. But when he is in India the car is used by him and the members of his family only for personal purpose. The monthly expenditure of the car is ₹ 5,000 his elder son is studying in India for which his employee spends ₹ 12000 pa where as his younger son is studying in USA and stays in hostel for which Mr Honey get ₹ 3,000 per month as combined allowance. The company has taken an accident insurance policy and life insurance policy. During the previous year company paid premium of ₹ 5,000 and ₹ 10,000 respectively.

Compute Mr. Honeys taxable income from salary for the assessment year 2021-22. [Nov. 2013, 4 Marks]

Answer:

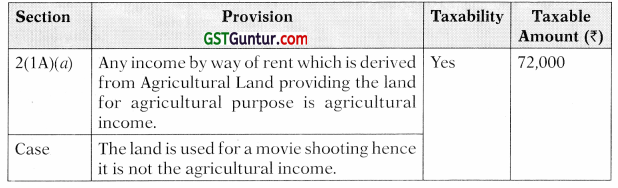

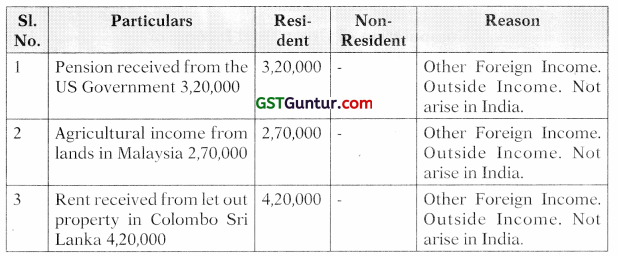

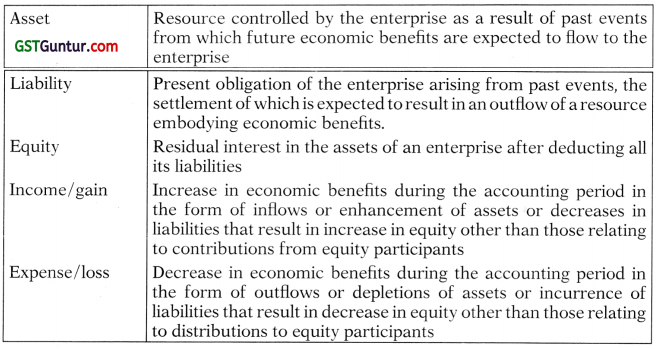

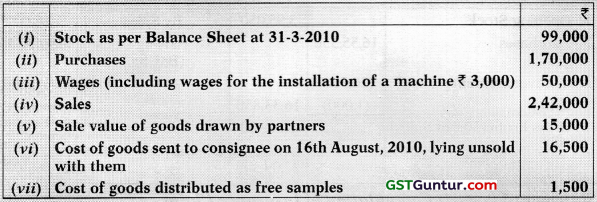

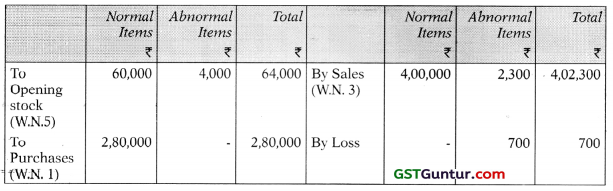

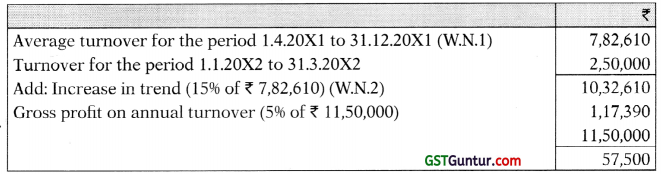

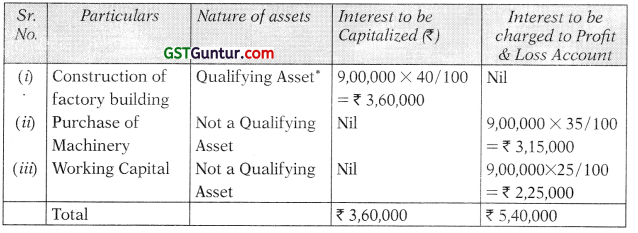

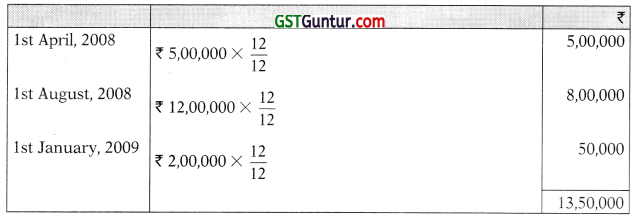

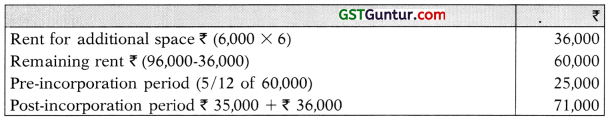

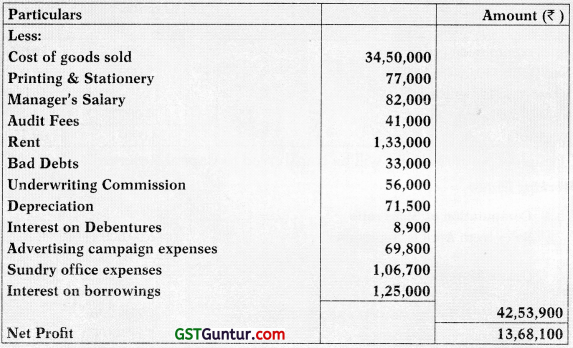

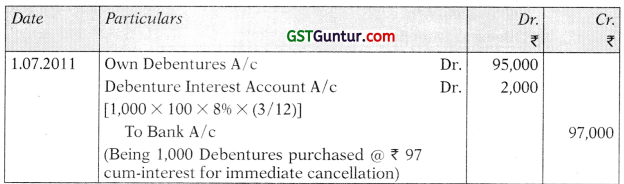

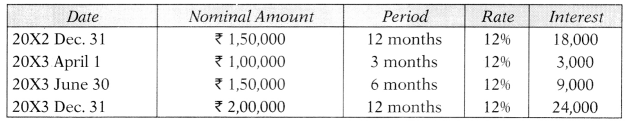

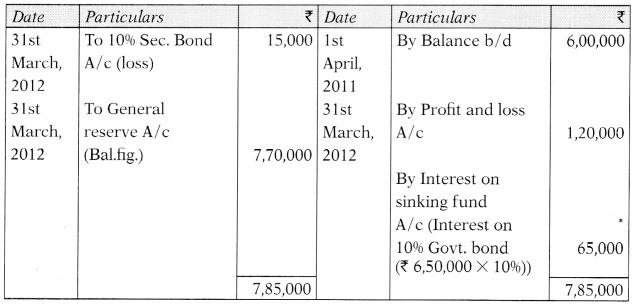

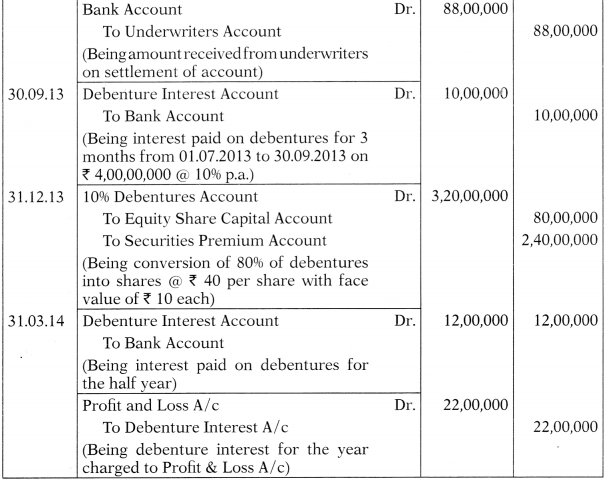

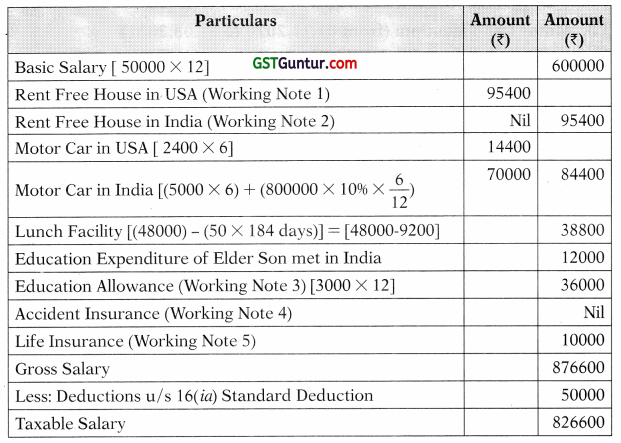

Computation of income chargeable under the head salaries of Mr. Honey for the assessment year 2021-22

Working Notes:

- Rent Free House in USA:

Salary for the purpose of RFH 600000 + 36000 = 636000

Valuation of RFH = 15% of Salary or Actual Rent paid by Employer to Landlord whichever is less

= 636000 × 15/100 or 15000 × 12

= 95400 or 180000

= 95400 - Rent Free House in India:

This accommodation is available for official purpose only hence not taxable. - Education Allowance:

Educational facility of Education and Hostel to children outside India is fully taxable. - Accident Insurance – It is Exempt

- Life Insurance – It is obligation of employee paid by employer and hence fully taxable.

![]()

Question 14.

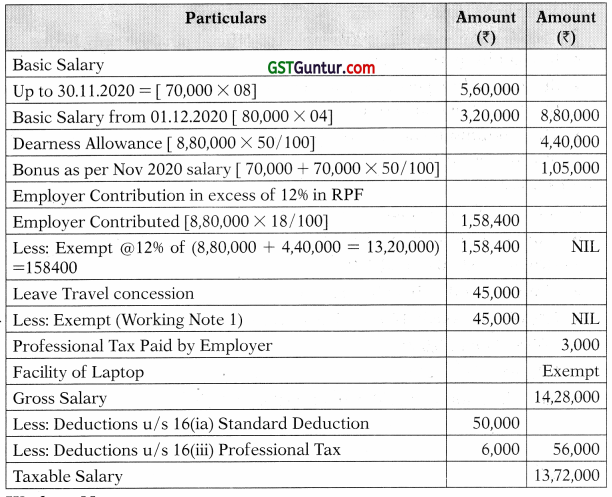

Mr Janak Raj employed as General Manager in Rajus refractories Private Limited furnishes you the under mentioned information for the year ended 31.03.2021:

- Basic salary up to 30.11.2020 70,000 per month

- Basic salary from 01.12.2020 80,000 per month

- Salary is due and paid on last day of every month

- Dearness allowance @ 50% of basic salary (not forming part of salary for retirement benefits)

- Bonus equal to one month salary (this was paid In November 2019 on basic salary plus dearness allowance applicable for that month)

- Contribution of employer to recognized provident fund account of the employee @18% of basic salary. Employee also contributing and equal amount.

- Professional tax paid ₹ 6,000 of which ₹ 3,000 was paid by employer.

- Facility of laptop was provided to Mr. Janak Raj for both official and personal use. Cost of laptop ₹ 65,000 and was purchased by the company on 11.10.2020.

- Leave travel concession given to Janak Raj, his wife and three children (one daughter age 6 and twin sons Age 4). Cost of air tickets economy class reimbursed by the employer ₹ 20,000 for adults and lump sum of ₹ 25,000 for 3 children)

- Mr. Janak Raj is eligible for availing exemption this year to the extent, it is permissible under the Income Tax Act 1961.

Compute the taxable salary of Mr Janak Raj. [Nov. 2018,6 Marks]

Answer:

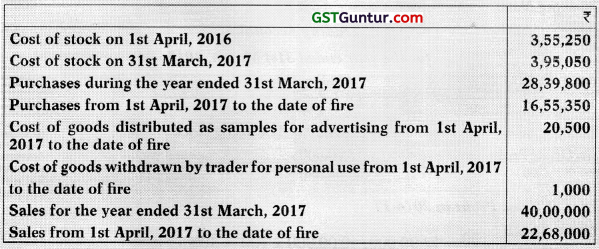

Computation of income chargeable under the head salaries of Mr. Honey for the assessment year 2021-22

Working Note:

1. The Exemption will be available only for two surviving children of an individual born after 01.10.1998. There is no restriction for children born before 01.10.1998 and also in case of multiple births after one child.

![]()

Question 15.

Examine with brief reasons whether the following are chargeable to Income tax and the amount liable to tax with reference to the provisions of the Income Tax Act 1961. Allowances received by an employee Mr Ram working in a transport system at ₹ 12,000 per month which has been granted to meet his personal expenditure while on duty. He is not in receipt of any daily allowance from his employer. [Nov. 2018, 2 Marks]

Answer:

Provision:

- If any fixed amount of allowance is given by the employer to the employee

- who is working in any transport system,

- to meet his personal expenditure

- during his duty performed in the course of running of such transport from one place to another place.

- Then the amount of exemption will be 70% of the allowance or @ 10000 pm whichever is less.

In this Case:

- Amount of Allowance = 12,000 pm

- Annual amount of allowance = 12,000 × 12 = 1,44,000

- 7096 of 1,44,000 = 1,00,800

- Limit amount = 10,000 × 12 = 1,20,000

- 7096 of 1,44,000 or 120000 whichever is less is exempt

1,00,800 or 1,20,000

1,00,800 - Taxable amount = 1,44,000 – 1,00,800 = 43,200