CA Inter FM ECO Paper July 2021 – CA Inter FM ECO Study Material is designed strictly as per the latest syllabus and exam pattern.

CA Inter FM ECO Question Paper July 2021 Solution

Question 1.

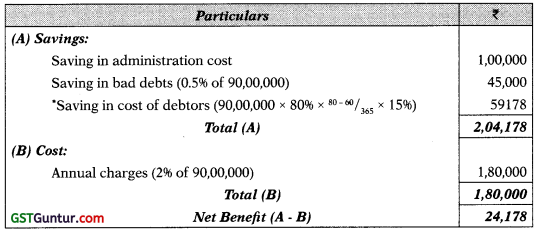

(a) Current annual sales of SKD Ltd. ₹ 360 Lakhs. It’s directors are of the opinion that company’s current expenditure on receivables management is too high and with a view to reduce the expenditure they are considering following two new alternate credit policies:

Selling price per unit of product is ₹ 150. Total cost per unit is ₹ 120. Current credit terms are 2 months and percentage of default is 3%. Current annual collection expenditure is ₹ 8 Lakhs. Required rate of return on investment of SKD Ltd. is 20%.

Determine which credit policy SKD Ltd. should follow. (5 Marks)

Answer:

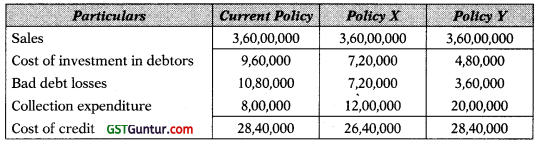

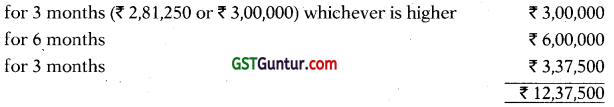

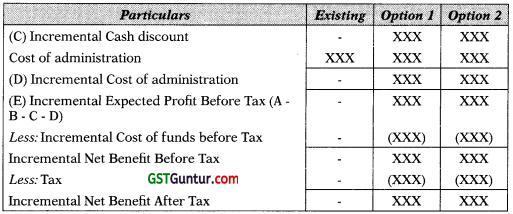

Statement of Evaluation of Credit Policies

SKD Ltd. should follow Policy X having lowest cost of credit.

Working Notes:

Calculation of cost of investment in debtors:

Current policy = 3,60,00,000 × 8096 × 2/12 × 20% = 9,60,000

Policy X = 3,60,00,000 × 8096 × 15/12 × 20% = 7,20,000

Policy Y = 3,60,00,000 × 8096 × 1/12 × 20% = 4,80,000

Percentage of cost of sales = 120/150 × 100 = 80%

(b) The details about two companies R Ltd. and S Ltd. having same operating risk are given below:

| Particulars |

R Ltd. |

S Ltd. |

| Profit before interest and tax |

₹ 10 Lakhs |

₹ 10 Lakhs |

| Equity share capital ₹ 10 each |

₹ 17 Lakhs |

₹ 50 Lakhs |

| Long term borrowings @ 10% |

₹ 33 Lakhs |

– |

| Cost of Equity (K.) |

18% |

15% |

(1) Calculate the value of equity of both the companies on the basis of M.M. Approach without tax.

(2) Calculate the total value of both the companies on the basis of M.M. Approach without tax. (5 Marks)

Answer:

(1) Value of Equity = \(\frac{\text { EBIT }-\mathrm{I}}{\mathrm{Ke}}\)

R Ltd. = \(\frac{\mathrm{EBIT}-\mathrm{I}}{\mathrm{Ke}}\) = \(\frac{10,00,000-10 \% \text { of } 33,00,000}{18 \%}\) = 37,22,222

S. Ltd. = \(\frac{\mathrm{EBIT}-\mathrm{I}}{\mathrm{Ke}}\) = \(\frac{10,00,000-0}{15 \%}\) = 66,66,667

(2) Value of Companies:

Value of S Ltd. (VUL) = EBIT ÷ K0 = 10,00,000 ÷ 15% = 66,66,667

Value of R Ltd. (VL) = Value of S Ltd. (VUL) = 66,66,667

Note: Alternatively Value of R Ltd. can be calculated as: V = S + D (V = 37,22,222 + 33,00,000 = 70,22,222).

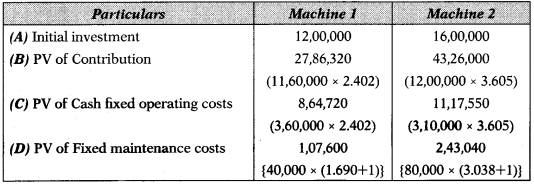

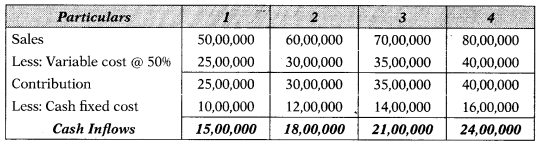

(c) K. P. Ltd. is investing ₹ 50,00,000 in a project. The life of the project is 4 years. Risk free rate of return is 6% and risk premium is 6%, other information is as under:

Sales of 1st year : ₹ 50,00,000

Sales of 2nd year : ₹ 60,00,000

Sales of 3rd year : ₹ 70,00,000

Sales of 4th year : ₹ 80,00,000

P/V Ratio (same in all the years) : 50%

Fixed Cost (excluding Depreciation) of 1st year : ₹ 10,00,000

Fixed Cost (excluding Depreciation) of 2nd year ₹ 12,00,000

Fixed Cost (excluding Depreciation) of 3rd year : ₹ 14,00,000

Fixed Cost (excluding Depreciation) of 4th year : ₹ 16,00,000

Ignore interest and taxes, You are required to calculate NPV of given project on the basis of Risk Adjusted Discount Rate.

Discount factor @ 6% and 12% are as under:

| Years |

1 |

2 |

3 |

4 |

| Discount Factor @ 6% |

0.943 |

0.890 |

0.840 |

0.792 |

| Discount Factor @ 12% |

0.893 |

0.797 |

0.712 |

0.636 |

(5 Marks)

Answer:

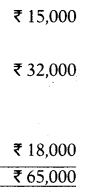

Net Present Value Using Risk Adjusted Discount Rate

| Year |

Particulars |

₹ |

DF @ 12% |

PV |

| 0 |

Initial outflows |

(50,00,000) |

1.000 |

(50,00,000) |

| 1 |

Cash Inflows |

15,00,000 |

0.893 |

13,39,500 |

| 2 |

Cash Inflows |

18,00,000 |

0.797 |

14,34,600 |

| 3 |

Cash Inflows |

21,00,000 |

0.712 |

14,95,200 |

| 4 |

Cash Inflows |

24,00,000 |

0.636 |

15,26,400 |

| NPV |

7,95,700 |

Yes, accept the proposal having positive NPV.

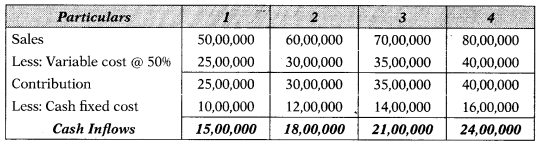

Working Notes: Statement Showing Cash Inflows

(d) The following information relates to LMN Ltd.

| Earnings of the Company |

₹ 30,00,000 |

| Dividend Payout ratio |

60% |

| No. of shares outstanding |

5,00,000 |

| Rate of return on investment |

15% |

| Equity capitalized rate |

13% |

Required:

1. Determine what would be the market value per share as per Walter’s model?

2. Compute optimum dividend payout ratio according to Walter’s model and the market value of company’s share at that payout ratio? (5 Marks)

Answer:

1. Calculation of market value per share as per, Walter’s model:

P = \(\frac{\mathrm{D}+(\mathrm{E}-\mathrm{D}) \times \frac{\mathrm{r}}{\mathrm{K}_{\mathrm{e}}}}{\mathrm{K}_{\mathrm{e}}}\) = \(\frac{3.60+(6-3.60) \times \frac{0.15}{0.13}}{0.13}\) = ₹ 6

DPS = EPS × Dividend payout ratio = ₹ 6 × 60% = 13.60

2. According to Walter’s model when the return on investment is more than the cost of equity capital, the price per share increases as the dividend payout ratio decreases. Hence, the optimum dividend payout ratio in this case is nil.

P(at 0 Payout) = \(\frac{\mathrm{D}+(\mathrm{E}-\mathrm{D}) \times \frac{\mathrm{r}}{\mathrm{K}_e}}{\mathrm{~K}_{\mathrm{e}}}\) = \(\frac{0+(6-0) \times \frac{0.15}{0.13}}{0.13}\) = ₹ 53.25

Question 2.

Following are the information of TT Ltd.:

| Particulars |

|

| Earnings per share |

₹ 10 |

| Dividend per share |

₹ 6 |

| Expected growth rate in dividend |

6% |

| Current market price per share |

₹ 120 |

| Tax rate |

30% |

| Requirement of additional finance |

₹ 30,00,000 |

| Debt Equity ratio (for additional finance) |

2 : 1 |

Cost of Debt:

0 – 5,00,000 |

10% |

| 5,00,001 – 10,00,000 |

9% |

| Above 10,00,000 |

8% |

Assuming that there is no Reserve and Surplus available in TT Ltd.

You are required to:

(a) Find the pattern of finance for additional requirement.

(b) Calculate post tax average cost of additional debt.

(c) Calculate cost of equity.

(d) Calculate overall weighted average after tax cost of additional finance. (10 Marks)

Answer:

(a) Pattern for additional requirement:

Total requirement of additional fund is ₹ 30,00,000. With a Debt Equity ratio of 2 : 1. It means ₹ 20,00,000 is to be raised through debt and ₹ 10,00,000 through equity. Out of ₹ 20,00,000 debt, first 5,00,000 @10%, next 5,00,000 @10% and remaining 10,00,000 @8%. Entire equity finance of ₹ 10,00,000 through issuing equity shares.

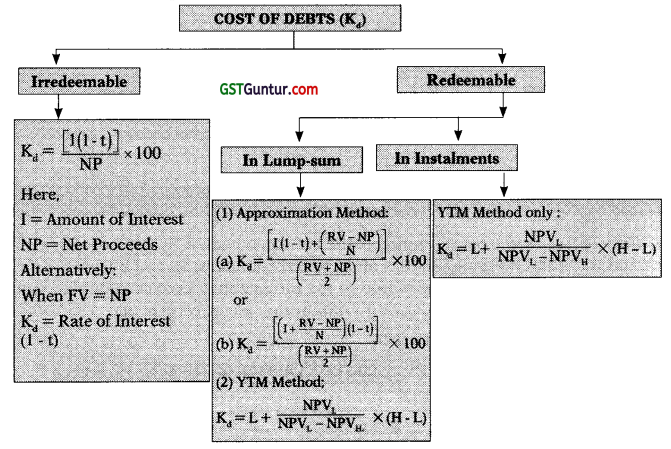

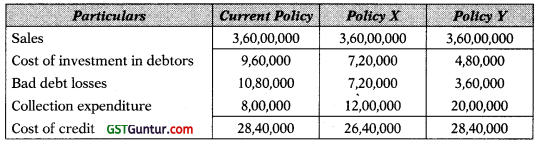

(b) Post tax average cost of additional debt:

Kd1 = I (1 – t) – 10% (1 – 0.30) = 7%

Kd2 = I (1 – t) = 9% (1 – 0.30) = 6.30%

Kd3 = I (1 – t) = 8% (1 – 0.30) = 5.60%

Average Kd = Kd1Wd1 + Kd2Wd2 + Kd3Wd3

= 7% × 5/20 + 6.3096 × 5/20 + 5.6096 × 10/20

= 6.125%

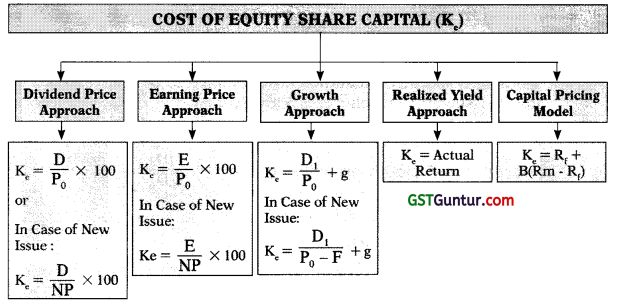

(c) Cost of Equity:

Ke = \(\frac{D_1}{P_0}\) + g = \(\frac{6(1+0.06)}{120}\) + 0.06 = 11.30%

(d) Overall WACC after tax of additional finance:

K0 = KeWe + KdWd

= 11.30% × \(\frac{10}{30}\) + 6.12596 × \(\frac{20}{30}\) = 7.85%

Assumption: DPS is treated at Do.

Question 3.

Masco Limited has furnished the following ratios and information relating to the year ended 31st March, 2021.

Sales : ₹ 75,00,000

Return on Net Worth : 25%

Rate of Income Tax : 50%

Share Capital to Reserve : 6 : 4

Current Ratio : 2.5

Net Profit to Sales (after tax) : 6.50%

Inventory Turnover (Based on cost of goods sold) : 12

Cost of Goods Sold : ₹ 22,50,000

Interest on Debenture : ₹ 75,000

Receivables (includes Debtors ₹ 1,25,000) : ₹ 2,00,000

Payables : ₹ 2,50,000

Bank Overdraft : ₹ 1,50,000

You are required to:

(a) Calculate the operating expenses for the year ended 31st March, 2021.

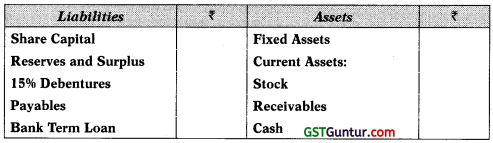

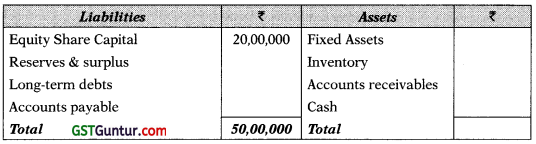

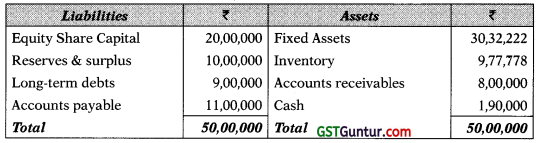

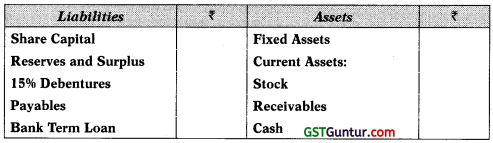

(b) Prepare Balance Sheet as on 31st March in the following format:

(10 Marks)

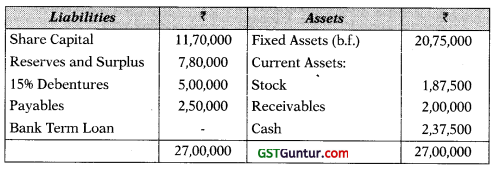

Answer:

(a) Operating Expenses = Gross Profit (Sales – COGS) – EBIT

= ₹ 52,50,000 (75,00,000 – 22,50,000) – ₹ 10,50,000

= ₹ 42,00,000

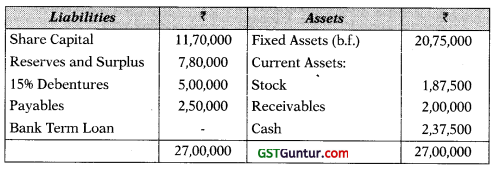

(b) Balance Sheet

Working notes:

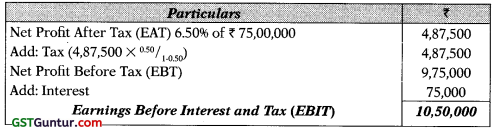

1. Calculation of EBIT

2. Return on Net Worth \(=\frac{\text { PAT }}{\text { Net Worth }}\) × 100 = 25%

Net Worth = 4,87,500 ÷ 25% = 19,50,000

Net Worth = Share Capital + Reserve = 19,50,000

Share capital to Reserve = 6 : 4

Share capital = 19,50,000 × 6/10 = 11,70,000

Reserve = 19,50,000 × 4/10 = 7,80,000

3. Debentures \(=\frac{\text { Interest }}{\text { Rate of Interest }}\)

= 75,000 ÷ 15% = 5,00,000

4. Inventory \(=\frac{\text { COGS }}{\text { Closing Stock }}\)

Closing stock \(=\frac{\text { COGS }}{\text { Inventory Turnover }}\)

= \(\frac{22,50,000}{12}\) = 1,87,500

5. Current Ratio = \(=\frac{C A}{C L}\)

2.5 times \(=\frac{\text { Receivables }+ \text { Closing Stock }+ \text { Cash }}{\text { Payables }}\)

Cash = 2,50,000 × 2.5 – 2,00,000 – 1,87,500

= 2,37,500

Notes: Payables include bank overdraft and there is no Bank term loan.

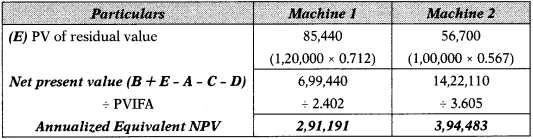

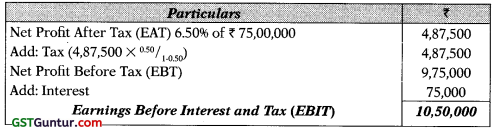

Question 4.

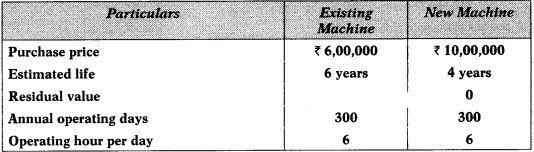

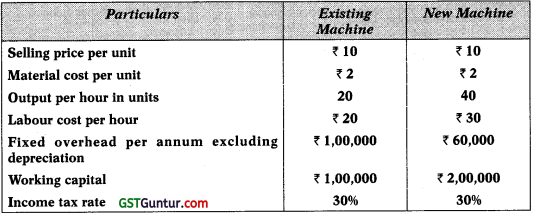

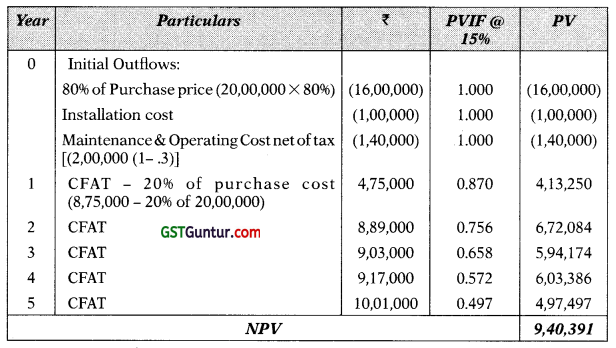

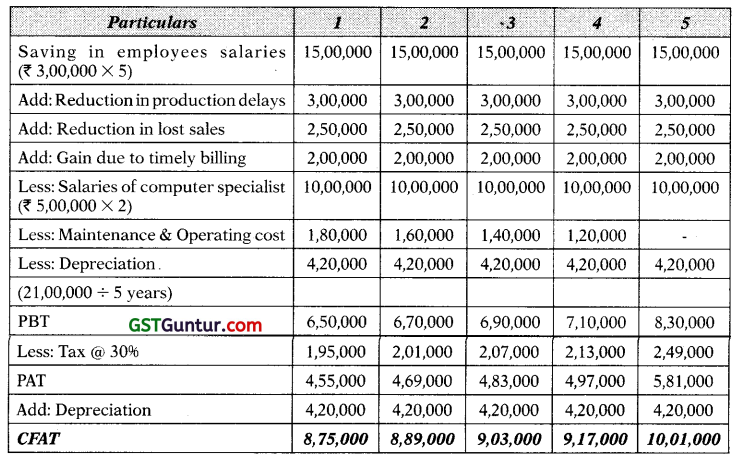

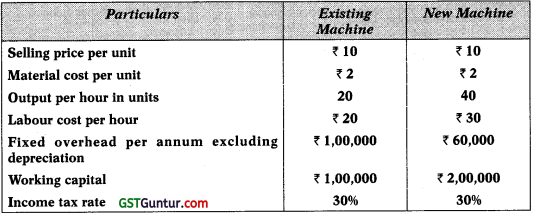

An existing company has a machine in operation for two years, its estimated life is 4 years with no residual value in the end. Its current market value is ₹ 3 lakhs. The management is considering a proposal to purchase an improved model of a machine which gives increase output. The details are as under:

Assuming that cost of capital is 10% and the company uses written down value of depreciation @ 20% and it has several machines In 20% block.

Advice the management on the replacement of machine as per NPV method.

The discounting factor table given below:

| Dicount Factors |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

| 10% |

0.909 |

0.826 |

0.751 |

0.683 |

(10 Marks)

Answer:

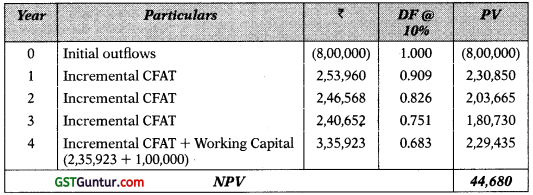

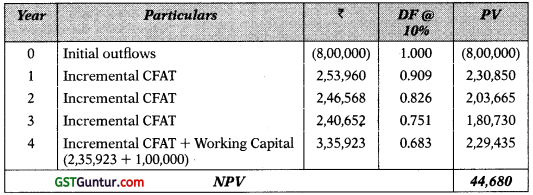

Statement of NPV

Advise: The company should go ahead with replacement of machine, since it has positive NPV.

Working Notes:

1. Calculation of initial outflow:

Cost of new machine ₹ 10,00,000

Less: Sales value of old machine (₹ 3,00,000)

Add: Increase in Working Capital ₹ 1,00,000

Initial outflow ₹ 8,00,000

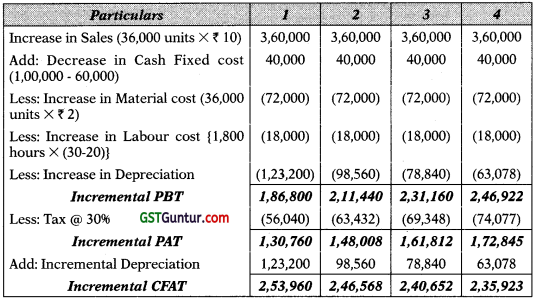

2. Total operating hours = 300 days × 6 hours = 1,800 hours

3. Increase in output = 1,800 hours × (40 – 20) = 36,000 units

4. Incremental Depreciation:

Year 1 = {10,00,000 – (6,00,000 × 8096 × 8096)} × 2096 = 1,23,200

Year 2 = 1,23,200 × 8096 = 98,560

Year 3 = 98,560 × 8096 = 78,840

Year 4 = 78,840 × 8096 = 63,078

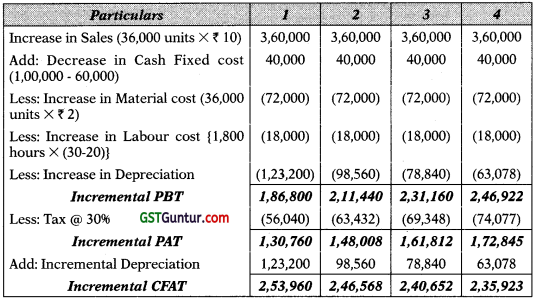

5. Calculation of incremental CFAT:

Notes: Since company has several machines in 20% block of assets, there is no tax benefit on loss on sale of machine.

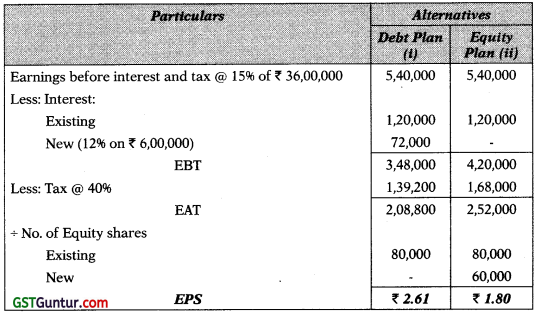

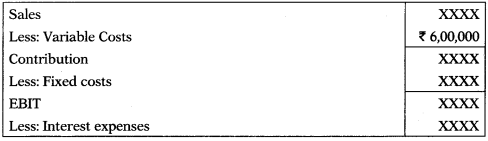

Question 5.

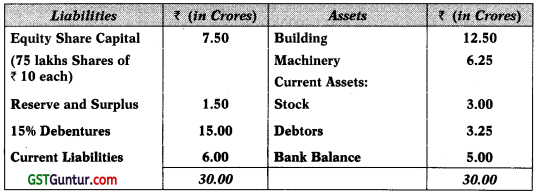

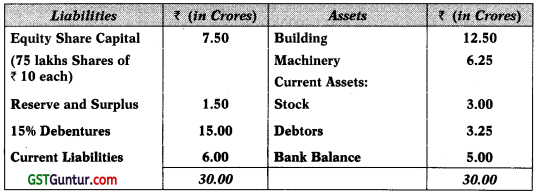

A Company had the following Balance Sheet as on 31st March 31, 2021:

The additional information given is as under:

Fixed costs per annum (excluding interest) : ₹ 6 Crores

Variable operating costs ratio : 60% of sales

Total assets turnover ratio : 2.5 times

Income tax rate : 40%

Calculate the following and comment:

(a) Earnings per share

(b) Operating Leverage

(c) Financial Leverage

(d) Combined Leverage (10 Marks)

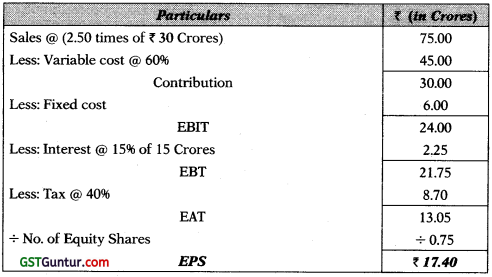

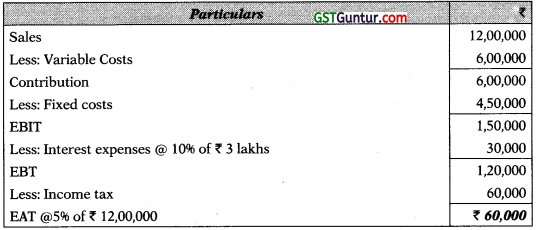

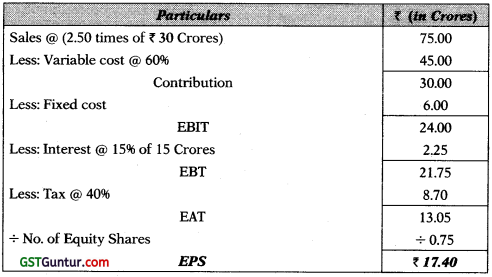

Answer:

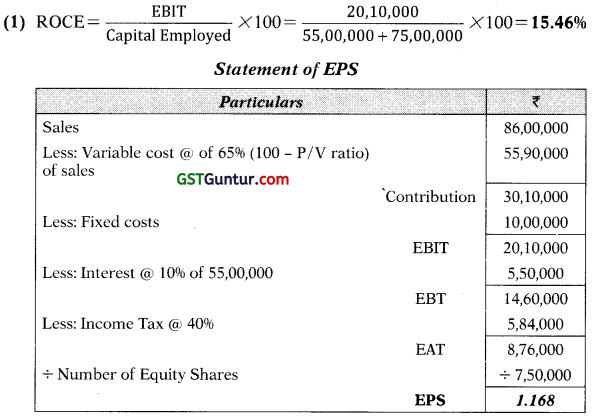

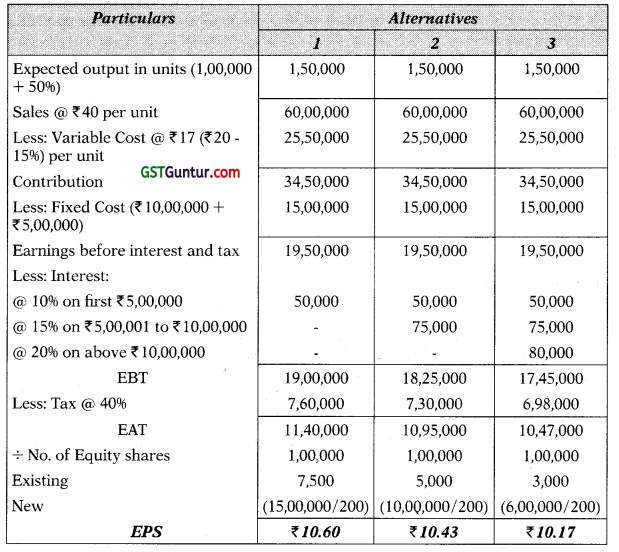

(a) Statement of EPS

(b) Operating Leverage = \(\frac{\text { Contribution }}{\text { EBIT }}\) = \(\frac{30 \text { Crores }}{24 \text { Crores }}\) = 1.25 times

It indicates fixed cost in cost structure. It indicates sensitivity of earnings before interest and tax (EBIT) to change in sales at a particular level.

(c) Financial Leverage = \(\frac{\mathrm{EBIT}}{\mathrm{EBT}}\) = \(\frac{24 \text { Crores }}{21.75 \text { Crores }}\) = 1.10 times

The financial leverage is very comfortable since the debt service obligation is small vis-a-vis EBIT.

(d) Combined Leverage = OL × FL = 1.25 × 1.10 = 1.38 times

The combined leverage studies the choice of fixed cost in cost structure and choice of debt in capital structure. It studies how sensitive the change in EPS is vis-a-vis change in sales.

The leverages – operating, financial and combined are measures of risk.

Question 6.

(a) Explain in brief the forms of Post Shipment Finance. (4 Marks)

Answer:

Followings are the forms of Post Shipment Finance:

(a) Purchase /discounting of documentary export bills: Finance is provided to exporters by purchasing export bills drawn payable at sight or by discounting usance export bills covering confirmed sales and backed by documents including documents of the title of goods such as bill of lading, post parcel receipts, or air consignment notes.

(b) E.C.G.C. Guarantee: Post-shipment finance, given to an exporter by a bank through purchase, negotiation or discount of an export bill against an order, qualifies for post-shipment export credit guarantee. It is necessary, however, that exporters should obtain a shipment or contracts risk policy of E.C.G.C.

Banks insist on the exporters to take a contracts shipments (comprehensive risks) policy covering both political and commercial risks. The Corporation, on acceptance of the policy, will fix credit limits for individual exporters and the Corporation’s liability will be limited to the extent of the limit so fixed for the exporter concerned irrespective of the amount of the policy.

(c) Advance against export bills sent for collection: Finance is provided by banks to exporters by way of advance against export bills forwarded through them for collection, taking into account the creditworthiness of the party, nature of goods exported, usance, standing of drawee, etc.

(d) Advance against duty draw backs, cash subsidy, etc.: To finance export losses sustained by exporters, bank advance against duty draw-back, cash subsidy, etc., receivable by them against export performance. Such advances are of clean nature; hence necessary precaution should be exercised.

Question 6.

(b) Describe the salient features of FORFEITING. (4 Marks)

Answer:

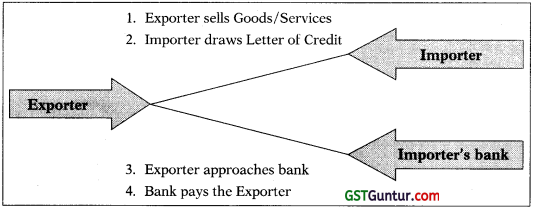

‘Forfait’ is a French term which means “relinquish a right”. Forfaiting is an arrangement of bill discounting in which a financial institution or bank buys the trade bills (invoices) or trade receivables from exporters of goods or services, where the exporter relinquish his right to receive payment from importer. Financial Institutions or banks provides immediate finance to export er ‘without recourse’ basis in which risk and rewards related with the bills/ receivables transferred to the financial institutions/banks. It is a unique credit facility arrangement where an overseas buyer (importer) can open a “letter of credit” (or other negotiable instruments) in favour of the exporter and can import goods and services on deferred payment terms.

Features of Forfaiting

(a) It motivates exporters to explore new geographies as payment is assured.

(b) An overseas buyer (importer) can import goods and services on deferred payment terms.

(c) The exporter enjoys reduced transaction costs and complexities of international trade transactions.

(d) The exporter gets to compete in the international market and can continue to put his working capital to good use to scale up operations.

(e) While importers avail of forfaiting facility from international financial institutions in order to finance their imports at competitive rates.

Question 6.

(c) List out the steps to be followed by the manager to measure and max-imize the Shareholder’s wealth. (2 Marks)

Or

Explain the limitations of Average Rate of Return. (2 Marks)

Answer:

We will first like to define what is Wealth/Value Maximization Model. Shareholders wealth are the result of cost benefit analysis adjusted with their timing and risk i.e. time value of money.

So,

Wealth = Present value of benefits – Present Value of Costs

It is important that benefits measured by the finance manager are in terms of cash flow. Finance manager should emphasison Cash flow for investment or financing decisions not on accounting profit. The shareholder value maximization model holds that the primary goal of the firm is to maximize its market value and implies that business decisions should seek to increase the net present value of the economic profits of the firm. So for measuring and maximising shareholders wealth finance manager should follow:

- Cash Flow approach not Accounting Profit

- Cost benefit analysis

- Application of time value of money.

Or

Answer:

Following are the limitations of ARR:

(a) The accounting rate of return technique, like the payback period technique, ignores the time value of money and considers the value of all cash flows to be equal.

(b) The technique uses accounting numbers that are dependent on the or-ganization’s choice of accounting procedures, and different accounting procedures, e.g., depreciation methods, can lead to substantially different amounts for an investment’s net income and book values.

(c) The method uses net income rather than cash flows; while net income is a useful measure of profitability, the net cash flow is a better measure of an investment’s performance.

(d) Furthermore, inclusion of only the book value of the invested asset ignores the fact that a project can require commitments of working capital and other outlays that are not included in the book value of the project.

Question 7.

(a) Explain the measurement of Net Domestic Product at market price. (2 Marks)

Answer:

Net domestic product at market prices (NDPMP) is a measure of the market value of all final economic goods and services, produced within the domestic territory of a country by its normal residents and non-residents during an accounting year less depreciation. The portion of the capital stock used up in the process of production or depreciation must be subtracted from final sales because depreciation represents capital consumption and therefore a cost of production.

NDPMP = GDPMP – Depreciation

NDPMP = NNPMP – Net Factor Income from Abroad

The basis of distinction between ‘gross’ and ‘net’ is depreciation or consumption of fixed capital.

Gross = Net + Depreciation or Net = Gross – Depreciation

(b) In the context of India, measure money supply (In crores of) (M3) as per guidelines published by Reserve Bank of India.

- Currency notes and coins with the public : 24,637.20

- Demand deposits of Banks : 2,01,589.60

- Net time deposits with post office saving accounts : 28,116.40

- Other deposits with Reserve Bank : 420.10

- Saving deposits with post office saving banks : 415.25 (3 Marks)

Answer:

M1 = Currency with public + Demand Deposits with Banking System + Other Deposits with the RBI

= 24,637.20 + 2,01,589.60 + 420.10 = 2,26,646.90 Crores

M3 = Ml + net time deposits with the banking system

= 2,26,646.90 + Nil

= 2,26,646.90 Crores

(c) Justify the role of public debt as an instrument of Fiscal Policy. (2 Marks)

Answer:

A rational policy of public borrowing and debt repayment is a potent weapon to fight inflation and deflation. Public debt may be internal or external; when the government borrows from its own people in the country, it is called internal debt. On the other hand, when the government borrows from outside sources, the debt is called external debt. Public debt takes two forms namely, market loans and small savings.

In the case of market loans, the government issues treasury bills and government securities of varying denominations and duration which are traded in debt markets. For financing capital projects, long-term capital bonds are floated and for meeting short-term government expenditure, treasury bills are issued.

The small savings represent public borrowings, which are not negotiable and are not bought and sold in the market. In India, various types of schemes are introduced for mobilising small savings e.g., National Savings Certificates, National Development Certificates, etc.

Borrowing from the public through the sale of bonds and securities curtails the aggregate demand in the economy. Repayments of debt by governments increase the availability of money in the economy and increase aggregate demand.

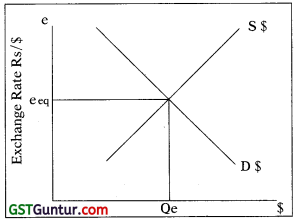

(d) Compare and contrast between devaluation and depreciation in the context of exchange rate. (2 Marks)

Answer:

Devaluation is a deliberate downward adjustment in the value of a country’s currency relative to another currency, group of currencies or standard. It is a monetary policy tool used by countries that have a fixed exchange rate or nearly fixed exchange rate regime and involves a discrete official reduction in the otherwise fixed par value of a currency.

The monetary authority formally sets a new fixed rate with respect to a foreign reference currency or currency basket. In contrast, depreciation is a decrease in a currency’s value (relative to other major currency benchmarks) due to market forces under a floating exchange rate and not due to any government or centred bank policy actions.

Question 8.

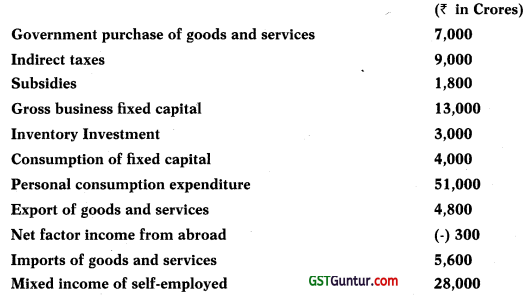

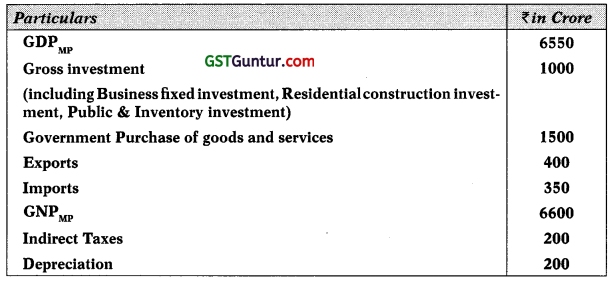

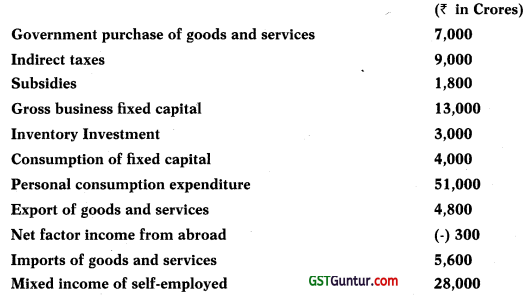

(a) Calculate the national income using income and expenditure method from the data given below:

(3 + 2 = 5 Marks)

Answer:

Income Method:

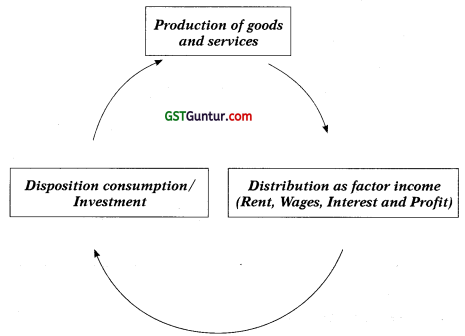

GDPMP = Compensation of employees + profits + rent + interest + mixed income of self employed + depreciation+net indirect taxes (Indirect taxes – subsidies)

GDPMP = 24,000 + 10,000 + 28,000 + 4,000 + 7,200 (9,000 – 1,800)

GNPMP = GDPMP + NFIA = 73,200 + (-) 300

NNPMP = GNPMP – Depreciation = 72,900 – 4,000 = 68,900

NNPFC (NI) = NNPMP – Net indirect taxes

= 68,900 – 7,200 = 61,700

Expenditure Method:

GDPMP(Y) = C + I + G + (X – M)

= 51,000 + 16,000 (13,000 + 3,000) + 7,000 + (4,800 – 5,600)

= 73,200

GNPMP = GDPMP + NFIA = 73,200 + (-) 300 = 72,900

NNPMP = GNPMP – Depreciation = 72,900 – 4,000 = 68,900

NNPFC (NI) = NNPMP – Net indirect taxes = 68,900 – 7,200 = 61,700

(b)

(i) Describe various types of externalities which cause market failure. (3 Marks)

Answer:

Sometimes, the actions of either consumers or producers result in costs or benefits that do not reflect as part of the market price. Such costs or benefits which are not accounted for by the market price are called externalities be cause they are “external” to the market. In other words, there is an externality when a consumption or production activity has an indirect effect on other’s consumption or production activities and such effects are not reflected directly in market prices.

The four possible types of externalities are:

1. Negative Production Externalities:

“A negative externality initiated in production which imposes an external cost on others may be received by another in consumption or in production.”

As an example, a negative production externality occurs when a factory which produces aluminium discharges untreated waste water into a nearby river and pollutes the water causing health hazards for people who use the water for drinking and bathing. Pollution of river also affects fish output as there will be less catch for fishermen due to loss of fish resources.

The former is a case where a negative production externality is received in consumption and the latter presents a case of a negative production externality received in production. The firm, however, has no incentive to account for the external costs that it imposes on consumers of river water or fishermen when making its production decision. Additionally, there is no market in which these external costs can be reflected in the price of aluminium.

2. Positive production externalities:

“A positive production externality initiated in production that confers external benefits on others may be received in production or in consumption.”

Compared to negative production externalities, positive production externalities are less common. As an example of positive production externality received in production, we can cite the case of a firm which offers training to its employees for increasing their skills. The firm generates positive benefits on other firms when they hire such workers as they change their jobs.

A positive production externality is received in consumption when an individual raises an attractive, garden and the persons walking by enjoy the garden. These external effects were not in fact taken into account when the production decisions were made.

3. Negative consumption externalities:

“Negative consumption externalities are extensively experienced by us in our day to day life. Such negative consumption externalities initiated in consumption which produce external costs on others may be received in consumption or in production.”

Examples to cite where they affect consumption of others are smoking cigarettes in public place causing passive smoking by others, creating litter and diminishing the aesthetic value of the room and playing the radio loudly obstructing one from enjoying a concert.

The act of undisciplined students talking and creating disturbance in a class preventing teachers from making effective instruction and the case of excessive consumption of alcohol causing impairment in efficiency for work and production are instances of negative consumption externalities affecting production.

4. Positive consumption externalities:

“A positive consumption externality initiated in consumption that confers external benefits on others may be received in consumption or in production.”

For example, if people get immunized against contagious diseases, they would confer a social benefit to others as well by preventing others from getting infected. Consumption of the services of a health club by the employees of a firm would result in an external benefit to the firm in the form of increased efficiency and productivity.

(b)

(ii) Mention any four sectors in which foreign direct investment is prohibited. (2 Marks)

Answer:

In India, foreign investment is prohibited in the following sectors:

- Lottery business including Government /private lottery, online lotteries, etc.

- Gambling and betting including casinos etc.

- Chit funds.

- Nidhi company.

- Trading in Transferable Development Rights (TDRs).

- Real Estate Business or Construction of Farm Houses.

- Manufacturing of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes.

- Activities/sectors not open to private sector investment e.g. atomic energy and railway operations (other than permitted activities).

(Student can mention any four)

Question 9.

(a)

(i) Justify the following statements in the light of holding cash balance.

(1) For investment in interest bearing assets

(2) In the prevailing scenario, usually all transactions are made through online or E-banking.

(3) Money is a unique store of value (3 Marks)

Answer:

(1) People either can hold cash balance or can invest it in interest bearing assets. If rate of interest is high then people invest higher portion in interest bearing assets and maintain less cash balance, inversely if rate of interest is low then people choose to hold high cash balance.

(2) In today’s world, usually all transactions are made through online or E-banking. Therefore, people hold less cash balance.

(3) Money also functions as a unique store of value. There are many other assets such as government bonds, deposits and other securities, land, houses etc. which also store value. Despite having the advantages of potential income yield and appreciation in value over time, these other assets are subject to limitations such as storage costs, lack of liquidity and possibility of depreciation in value. Money is the only asset which has perfect liquidity. Therefore, people hold cash balance.

(a)

(ii) Briefly describe any two advantages of fixed exchange rate regime in the context of open economy. (2 Marks)

Answer:

In an open economy, the main advantages of a fixed rate regime are:

- A fixed exchange rate avoids currency fluctuations and eliminates exchange rate risks and transaction costs that can impede international flow of trade and investments. A fixed exchange rate can thus greatly enhance international trade and investment.

- A fixed exchange rate system imposes discipline on a country’s monetary authority and therefore is more likely to generate lower levels of inflation.

- The government can encourage greater trade and investment as stability encourages investment.

- Exchange rate peg can also enhance the credibility of the country’s monetary policy.

- The central bank is required to stand ready to intervene in the foreign exchange market and, also to maintain an adequate amount of foreign exchange reserves for this purpose.

(Student can mention any two)

(b)

(i) Define Common Access Resources. Why they are over-used? Explain.

(2 Marks)

Answer:

Common access resources or common pool resources are a special class of impure public goods which are non-excludable as people cannot be excluded from using them. These are rival in nature and their consumption lessens the benefits available for others. This rival nature of common resources is what distinguishes them from pure public goods, which exhibit both non-excludability and non-rivalry in consumption. They are generally available free of charge. Some important natural resources fall into this category.

Since price mechanism does not apply to common resources, producers and consumers do not pay for these resources and therefore, they overuse them and cause their depletion and degradation. This creates threat to the sustainability of these resources and, therefore, the availability of common access resources for future generations.

Economists use the term ‘tragedy of the commons’ to describe the problem which occurs when rivalrous but non excludable goods are overused, to the disadvantage of the entire world.

(b)

(ii) Explain in brief any four effects of tariffs on importing and exporting countries. (3 Marks)

Answer:

- Tariff barriers create obstacles to trade, decrease the volume of imports and exports and therefore of international trade.

- By making imported goods more expensive, tariffs discourage domestic consumers from consuming imported foreign goods. Domestic consumers suffer a loss because they must now pay a higher price for the good and consume lesser quantity of the good.

- Tariffs encourage consumption and production of the domestically produced import substitutes and thus protect domestic industries.

- Producers in the importing country experience an increase in well-being as a result of imposition of tariff. The price increase of their product in the domestic market increases producer surplus in the industry. They can also charge higher prices than would be possible in the case of free trade because foreign competition has reduced.

- The price increase also induces an increase in the output of the existing firms and possibly addition of new firms due to entry into the industry to take advantage of the new high profits and consequently an increase in employment in the industry.

- Tariffs create trade distortions by disregarding comparative advantage and prevent countries from enjoying gains from trade arising from comparative advantage. Thus, tariffs discourage efficient production in the rest of the world and encourage inefficient production in the home

country.

- Tariffs increase government revenues of the importing country by the value of the total tariff it charges.

(Student can mention any four)

Question 10.

(a)

(i) Fisher’s equation of exchange is: MV = PT. If velocity (V) = 25, Price (P) 110.5 and volume of transaction (T) = 200 billion.

Calculate:

(1) Total money supply (m)

(2) Effect on M when velocity (V) increases to 75

(3) Velocity (V) when the volume of transactions increases to 325 billion.

Answer:

(1) MV =PT

M × 25 = 110.5 × 200

M = 22,100 ÷ 25 884 billion

(2) MV = PT

M × 75 = 110.5 × 200

M = 22,100 ÷ 75 = 294.67billion

M decreases by 589.33 billion

(3) MV = PT

884 × V = 110.5 × 325

V = 35,912.5 ÷ 884 = 40.625

(a)

(ii) Briefly explain the advantages of two key concepts of New Trade Theories to countries when importing goods to compete with products from the home country. (2 Marks)

Answer:

According to NTT, two key concepts give advantages to countries that import goods to compete with products from the home country:

(1) Economies of Scale: As a firm produces more of a product its cost per unit keeps going down. So if the firm serves domestic as well as foreign market instead of just one, it can reap the benefit of large scale of production consequently the profits are likely to be higher.

(2) Network effects: are the way one person’s value of a good or service is affected by the value of that good or service to others. The value of the product or service is enhanced as the number of individuals using it increases. This is also referred to as the ‘bandwagon effect’. Consumers like more choices, but they also want products and services with high utility, and the network effect offers increased utility from these products over others. A good example will be Mobile App such as Whats App and software like Microsoft Windows.

(b)

(i) Mention any three key objectives of World Trade Organisation. (3 Marks)

Answer:

The WTO has six key objectives:

- to set and enforce rules for international trade,

- to provide a forum for negotiating and monitoring further trade liberalization,

- to resolve trade disputes,

- to increase the transparency of decision-making processes,

- to cooperate with other major international economic institutions involved in global economic management, and

- to help developing countries benefit fully from the global trading system.

(Student can mention any three)

(b)

(ii) Describe the differences between Liquidity Adjustment facility (LAF) and Marginal Standing Facility (MSF). (2 Marks)

Answer:

The Liquidity Adjustment Facility (LAF): is a facility extended by the Reserve Bank of India to the scheduled commercial banks (excluding RRBs) and primary dealers to avail of liquidity in case of requirement (or park excess funds with the RBI in case of excess liquidity) on an overnight basis against the collateral of government securities including state government securities.

The Marginal Standing Facility (MSF): The Marginal Standing Facility (MSF) announced by the Reserve Bank of India (RBI) in its Monetary Policy, 2011-12 refers to the facility under which scheduled commercial banks can borrow additional amount of overnight money from the central bank over and above what is available to them through the LAF window by dipping into their Statutory Liquidity Ratio (SLR) portfolio up to a limit (a fixed percent of their net demand and time liabilities deposits (NDTL) liable to change every year) at a penal rate of interest. This provides a safety valve against unexpected liquidity shocks to the banking system.

Question 11.

(a)

(i) The equation of ‘consumption function’ of an economy is as: C = 450 + 0.70Y.

You are required to compute the following:

(1) Consumption when disposable income (Y) is ₹ 3,500, and ₹ 5,800.

(2) Saving when disposable income (Y) is ₹ 3,500, and ₹ 5,500.

(3) Amount induced when disposable income is ₹ 3,200. (3 Marks)

Answer:

(1) Consumption (C) = 450 + 0.70Y

When Y = ₹ 3,500

C = ₹ 450 + 0.70 (₹ 3,500)

= ₹ 450 + ₹ 2,450 = ₹ 2,900

When Y = ₹ 5,800

C = ₹ 450 + 0.70 (₹ 5,800)

= ₹ 450 + ₹ 4,060 = ₹ 4,510

(2) Saving (S) = Y – C

When Y = ₹ 3,500

C = ₹ 3,500 – ₹ 2,900 = ₹ 600

When Y = ₹ 5,500

C = ₹ 5,500 – {450 + 0.70 (₹ 5,500)} = ₹ 1,200

(3) Amount induced = Y

When Y = ₹ 3,200

Amount induced = 0.70 (₹ 3200) = ₹ 2,240

(a)

(ii) Distinguish between horizontal, vertical and conglomerate type of foreign Investments. (2 Marks)

Answer:

FDI may be categorized as horizontal, vertical or conglomerate:

1. A horizontal direct investment: is said to take place when the investor establishes the same type of business operation in a foreign country as it operates in its home country, for example, a cell phone service provider based in the United States moving to India to provide the same service.

2. A vertical investment: is one under which the investor establishes or acquires a business activity in a foreign country which is different from the investor’s main business activity yet in some way supplements its major activity. For example; an automobile manufacturing company may acquire an interest in a foreign company that supplies parts or raw materials required for the company.

3. A conglomerate type of foreign direct investment: is one where an investor makes a foreign investment in a business that is unrelated to its existing business in its home country. This is often in the form of a joint venture with a foreign firm already operating in the industry as the investor has no previous experience.

(b)

(i) Explain the concept of ‘Voluntary Export Restraints’. Under which ‘ circumstances exporters commit to voluntary export restraint? Discuss. (3 Marks)

Answer:

Voluntary Export Restraints (VERs) refer to a type of informal quota administered by an exporting country voluntarily restraining the quantity of goods that can be exported out of that country during a specified period of time. Such restraints originate primarily from political considerations and are imposed based on negotiations of the importer with the exporter.

The inducement for the exporter to agree to a VER is mostly to appease the importing country and to avoid the effects of possible retaliatory trade restraints that may be imposed by the importer. VERs may arise when the import-competing industries seek protection from a surge of imports from particular exporting countries. VERs cause, as do tariffs and quotas, domestic prices to rise and cause loss of domestic consumer surplus.

(b)

(ii) Mention any four arguments made in favour of Foreign Direct Investment to developing economy like India. (2 Marks)

Or

Explain the concept of real Exchange Rate. (2 Marks)

Answer:

Following are the arguments made in favour of Foreign Direct Investment to developing economy like India:

1. Entry of foreign enterprises usually fosters competition and generates a competitive environment in the host country. This results in positive outcomes in the form of cost-reducing and quality-improving innovations, higher efficiency and increasing variety of better products and services at lower prices ensuring wider choice and welfare for consumers.

2. International capital allows countries to finance more investment than can be supported by domestic savings and can enhance the total output (as well as output per unit of input) flowing from the factors of production.

3. From the perspective of emerging and developing countries, FDI can accelerate growth and foster economic development by providing the much needed capital, technological know-how, management skills and marketing methods and critical human capital skills in the form of managers and technicians. The spill-over effects of the new technol ogies usually spread beyond the foreign corporations. In addition, the new technology can clearly enhance the recipient country’s production possibilities.

4. Competition for FDI among national governments also has helped to promote political reforms important to attract foreign investors, including legal systems and macroeconomic policies.

5. Since FDI involves setting up of production base (in terms of factories, power plants, etc.) it generates direct employment in the recipient coun try.

6. FDI not only creates direct employment opportunities but also, through backward and forward linkages, generate indirect employment opportunities.

7. Foreign direct investments also promote relatively higher wages for skilled jobs. More indirect employment will be generated to persons in the lower-end services sector occupations thereby catering to an extent even to the less educated and unskilled persons engaged in those units.

8. Foreign corporations provide better access to foreign markets. Unlike portfolio investments, FDI generally entails people-to-people relations and is usually considered as a promoter of bilateral and international relations. Greater openness to foreign capital leads to higher national dependence on international investors, making the cost of discords higher.

9. There is also greater possibility for the promotion of ancillary units resulting in job creation and skill development for workers.

10. Foreign enterprises possessing marketing information with their global network of marketing are in a unique position to utilize these strengths to promote the exports of developing countries. If the foreign capital produces goods with export potential, the host country is in a position to secure scarce foreign exchange which can be used to import needed capital equipments or materials to assist the country’s development plans or to ease its external debt servicing.

11. The foreign investment projects also would act as a source of new tax revenue which can be used for development projects.

12. It is likely that foreign investments enter into industries in which scale economies can be realized so that consumer prices might be lowered. Domestic firms might not always be able to generate the necessary capital to achieve the cost reductions associated with large-scale production.

13. Increased competition resulting from the inflow of foreign direct investments facilitates weakening of the market power of domestic monopolies resulting in a possible increase in output and fall in prices.

14. Since FDI has a distinct advantage over the external borrowings, it is considered to have a favourable impact on the host country’s balance of payment position, and

15. Better work culture and higher productivity standards brought in by foreign firms may possibly induce productivity related awareness and may also contribute to overall human resources development.

(Student can mention any four)

Answer:

When prices of goods and services change in either or both countries, it would be difficult to know the change in relative prices of foreign goods and services. Therefore, Real Exchange Rate (RER) which incorporates changes in prices is a better measure. The ‘real exchange rate’ describes ‘how many’ of a good or service in one country can be traded for ‘one’ of that good or service in a foreign country. It is calculated as:

Real exchange rate = Nominal exchange rate \(\frac{\text { Domestic Price Index }}{\text { Foreign Price Index }}\)

![]()

![]()

![]()

![]()

![]()

![]()

![]()