Management of Working Capital – CA Inter FM Study Material

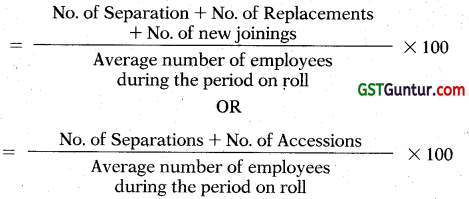

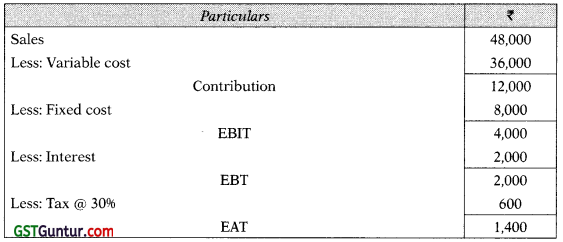

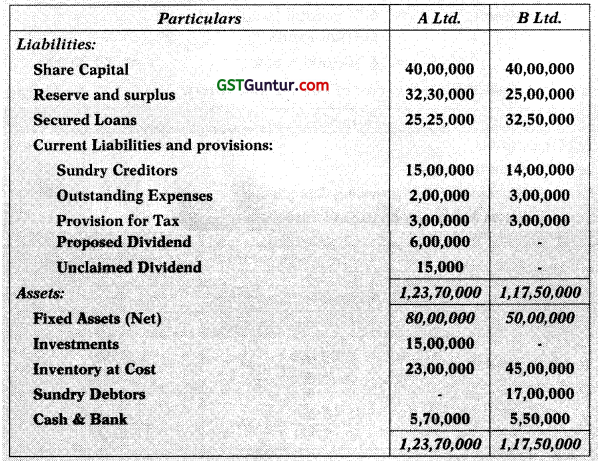

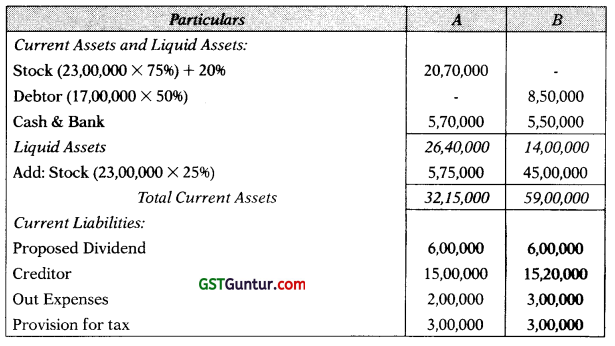

Management of Working Capital – CA Inter FM Study Material is designed strictly as per the latest syllabus and exam pattern.

Management of Working Capital – CA Inter FM Study Material

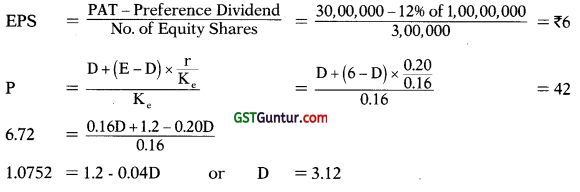

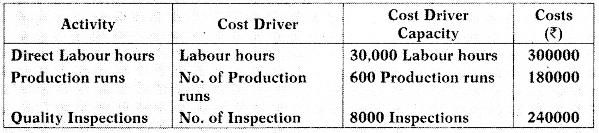

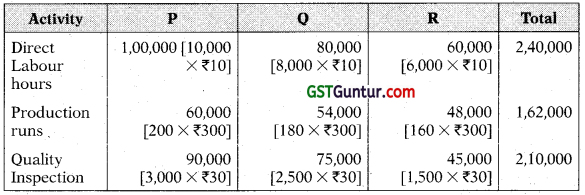

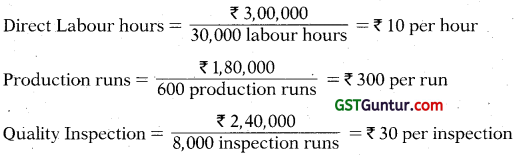

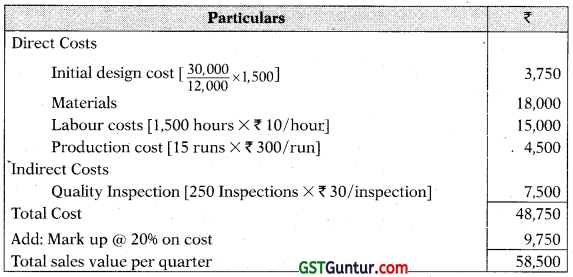

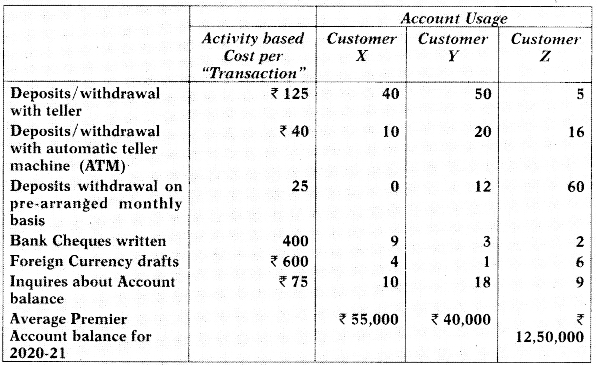

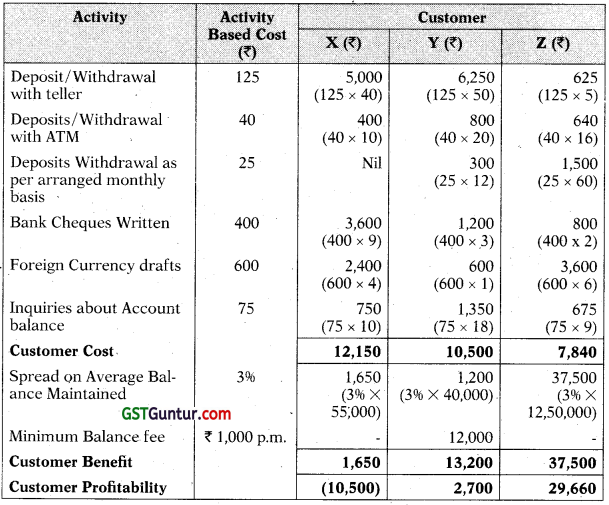

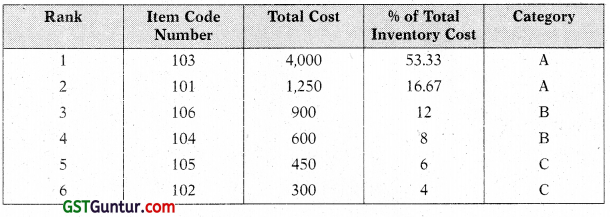

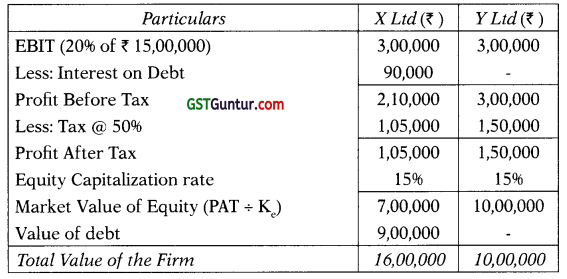

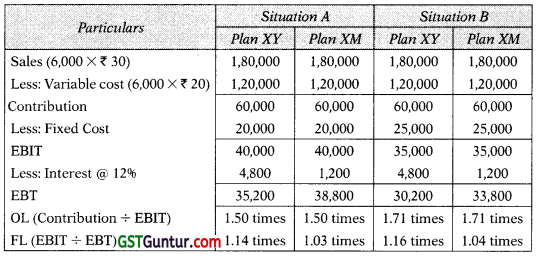

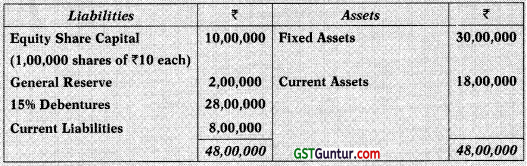

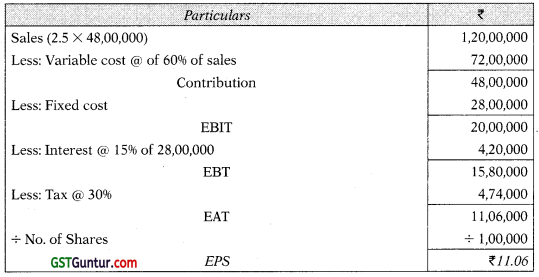

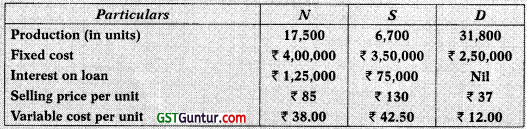

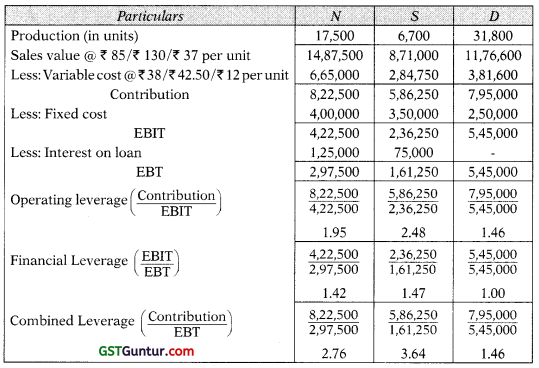

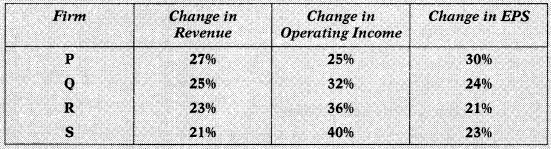

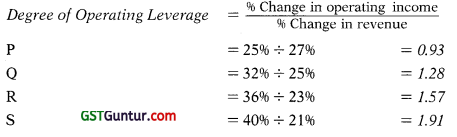

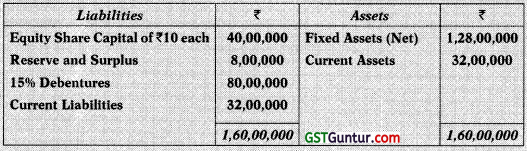

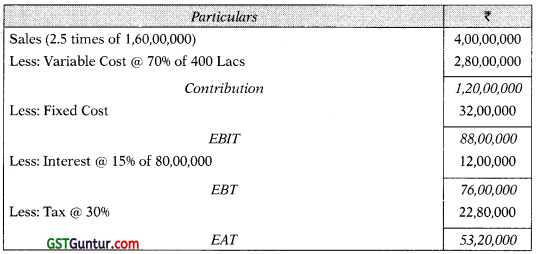

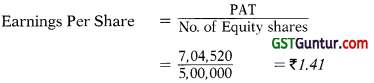

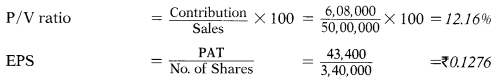

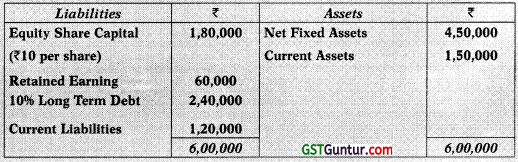

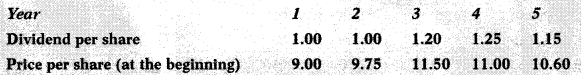

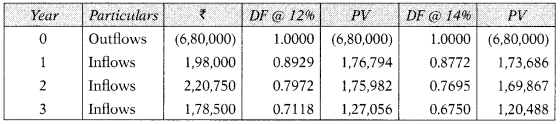

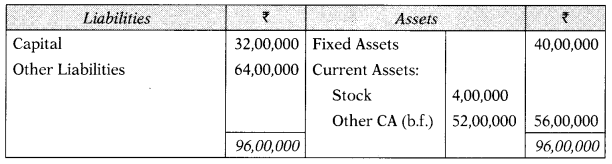

Question 1.

What is factoring? Enumerate the main advantages of factoring. (5 Marks May 2011, 4 Marks May 2017)

Answer:

Factoring: Factoring is an agreement between factor and business firm. Factor provides various services to business firm as per the factoring agreement. Generally factoring services consists to credit investigation, sales led ger management, purchase and collection of debts, credit protection and risk bearing. In advance factoring factor purchase account receivables and provide advance to businessman after withholding factor reserve, factor charges commission and interest and bears the credit risks associated with the accounts receivables purchased by it.

Advantages of Factoring:

- Firm receives advance against accounts receivables.

- Advance is received easily comparative to traditional bank loan.

- Bad debt losses are suffered by factor.

- Firm receives cash in definite pattern.

- There is no need of the credit department.

Question 2.

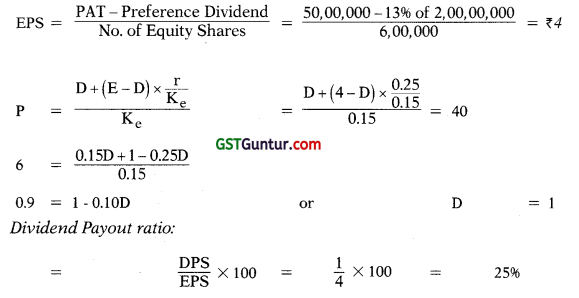

Write short note on William J, Baumol Vs. Miller-Orr cash management model. (4 Marks May 2011)

Answer:

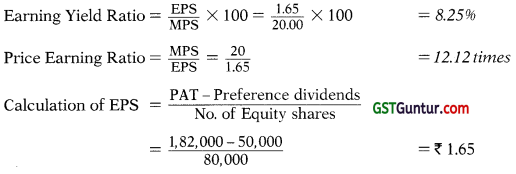

William J. Baumol Model (1952): William J. Baumol developed a model for optimum cash balance which is normally used in inventory management. This model is also known as EOQ model. As per this model optimum cash bal ance is the balancing between cost of holding cash and the transaction cost. Optimum cash balance refers to the level of cash at which total holding cost is equal to the total transaction cost.

Formula of optimum cash balance is:

Optimum Cash Balance = \(\sqrt{\frac{2 \mathrm{AT}}{\mathrm{H}}}\)

Where,

A = Annual Cash disbursements

T = Transaction cost (Fixed cost) per transaction

H = Opportunity cost one rupee per annum (Holding cost)

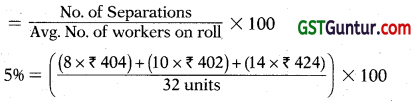

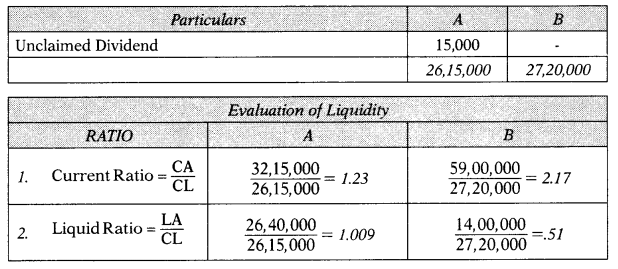

Miller-Orr Cash Management Model (1966): According to this model the net cash flow is completely stochastic. In this model control limits are set for cash balances. These limits may consist of h as upper limit, z as the return point; and zero as the lower limit

- When the cash balance reaches the upper limit, the transfer of cash equal to h – z is invested in marketable securities account.

- When it touches the lower limit, a transfer from marketable securities account to cash account is made.

- During the period when cash balance stays between (h, z) and (z, 0) i. e. high and low limits no transactions between cash and marketable securities account is made.

![]()

Question 3.

What are the forms of bank credit? (4 Marks Nov. 2012)

Answer:

The bank credit will generally be in the following forms:

- Cash Credit: Under this facility banker sanctions a specific limit for borrower. The borrower doesn’t need holding a credit balance in an account. The borrower cannot withdraw more than the limits sanctioned by the bank.

- Bank Overdraft: Overdraft is a short-term borrowing facility made avail able to the business firms. Banker set overdraft limit of business firm and firm can use this limit as per the requirement. This loan is quickly repayable. Banker has right to call for return of overdraft amount at short notice.

- Bills Discounting: When a company sells its goods on credit, it draws a bill on the buyer and after acceptance of bill company has an option to discount it with bank and receive discounted money.

- Bilb Acceptance: is a unique type of bank credit, under this arrangement a company draws a bill of exchange on bank. The bank accepts the bill thereby promising to pay out the amount of the bill at some specified future date.

- Line of Credit: Under this arrangement Bank commits to lend a certain amount of funds on demand specifying the maximum amount.

- Letter of Credit: On the instructions of a customer, bank issues letter of credit and undertakes to pay against prescribed documents.

- Bank Guarantees: It is given by the banks on behalf of their customer. Bank guarantee is in favour of third parties who will be the beneficiaries of the guarantee.

Question 4.

Distinguish between factoring and bill-discounting. (4 Marks May 2013, 2015, 2017)

Answer:

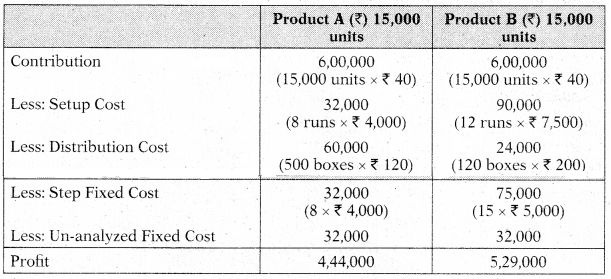

Differentiation between Factoring and Bills Discounting

| S.N | Factoring | Bills Discounting |

| 1 | It is also known as invoice factoring. | It is also known as invoice discounting. |

| 2 | There are three parties involved in factoring viz. client, factor and debtor. | There are three parties involved in bill discounting viz. drawer, drawee and payee. |

| 3 | Factor collects amount from debtor on behalf of supplier and charge commission. | Drawer receives discounted amount today and Bank collect amount from drawee on due date. |

| 4 | Bad debt is suffered by factor. | In case of dishonour of bill, Bank collects amount of bill from the party who discounted bill. |

| 5 | For factoring there is no specific Act. | Negotiable Instruments Act is applicable on bills discounting. |

Question 5.

State the advantage of Electronic Cash Management System. (4 Marks May 2013)

Answer:

Advantages of Electronic Cash Management System

- Significant saving in time.

- Decrease in interest costs.

- Less paper work.

- Greater accounting accuracy.

- More control over time and funds.

- Supports electronic payments.

- Faster transfer of funds from one location to another, where required.

- Speedy conversion of various instruments into cash.

- Making available funds wherever required, whenever required.

- Reduction in the amount of ‘idle float’ to the maximum possible extent.

- Ensures no idle funds are placed at any place in the organization.

- It makes inter-bank balancing of funds much easier.

- It is a true form of centralised ‘Cash Management’.

- Produces faster electronic reconciliation.

- Allows for detection of book-keeping errors.

- Reduces the number of cheques issued.

- Earns interest income or reduce interest expense.

(Student can mention any four)

Question 6.

What is Virtual Banking? State Its advantages. (4 Marks Nov. 2013)

Answer:

Virtual Banking: Virtual banking or Net-banking or E-banking refers to the online banking services like: NEFT, RTGS, IMPS, online DD, and online bank statement etc.

Advantages of virtual banking services are as follows:

- It reduces handling cost of transaction.

- Speedy response to customer and execution of requirements.

- It reduces branch operating cost.

- Reduction in banking staff.

- Increase in accuracy and convenience.

![]()

Question 7.

‘Management of marketable securities is an integral part of investment of cash.’ Comment. (4 Marks Nov. 2013)

Answer:

Management of Marketable Securities is an Integral Part of Investment of Cash: In case of surplus cash balance finance manager purchases marketable securities and earn profit on these securities. Finance manager sells these securities when firm needs liquidity. Thus Management of marketable secu rities is an integral part of investment of cash.

Firm needs cash for its day to day operations, in season firm face excess cash balance situation and in off season deficit cash balance situation. Efficient management of marketable securities provides solution of surplus and deficit cash balance situations. Selection of marketable securities should be done with consideration of three principles namely safety, maturity and marketability.

Question 8.

Explain the following:

(1) Concentration Banking

(2) Lock Box System (4 Marks May 2014, Nov. 2017)

Answer:

(1) Concentration Banking: Concentration banking refers to the process of creating number of strategic collection centers in various regions instead of a single collection center at the head office to reduce size of float. This system is used to reduce period between the events a customer mails in his remittances and when the funds deposited in company’s account. First collection centres receive payment from customers after that such payments are deposited with their respective local bank and at last all local banks transfer all surplus funds to the concentration bank of head office.

(2) Lock Box System: Under lock box system, company rents the local post office box, Company’s bank has authorization to collect remittances in the boxes. Authorize bank collects remittance several times a day and deposits the cheques in the company’s account. Customers are billed with instructions to mail their remittances to the lock boxes. This system increases the flow of funds. Company selects lock boxes on regional basis according to its billing patterns.

Question 9.

Explain four kinds of float with reference to management of cash. (4 Marks Nov. 2014)

Answer:

Float: Float refers to the time consumed in collection process. There are four types of floats as:

- Billing Float: Time gap between sale and mailing of the invoice to the buyer is known as billing float.

- Mail Float: Time consumed in processing of a cheque by post office, messenger service, courier service or other means of delivery when buyer sends cheque to the company.

- Cheque processing float: Time consumed by the company in depositing cheque into the bank.

- Bank processing float: Time consumed from the deposit of the cheque to the crediting of funds in the seller’s account.

Question 10.

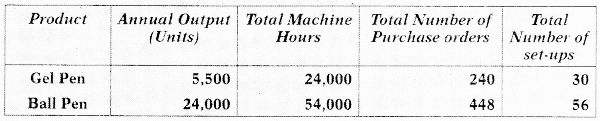

Explain Miller-Orr Cash Management Model. (4 Marks May 2015)

Answer:

Miller – Orr Cash Management Model (1966): According to this model the net cash flow is completely stochastic. In this model control limits are set for cash balances. These limits may consist of h as upper limit, z as the return point; and zero as the lower limit.

- When the cash balance reaches the upper limit, the transfer of cash equal to h – z is invested in marketable securities account.

- When it touches the lower limit, a transfer from marketable securities account to cash account is made.

- During the period when cash balance stays between (h, z) and (z, 0) i. e. high and low limits no transactions between cash and marketable securities account is made.

Question 11.

Discuss the risk-return considerations in financing current assets. (4 Marks Nov. 2015)

Answer:

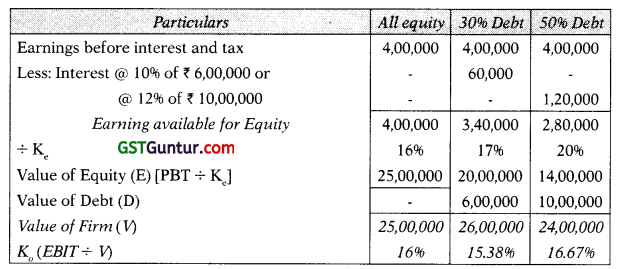

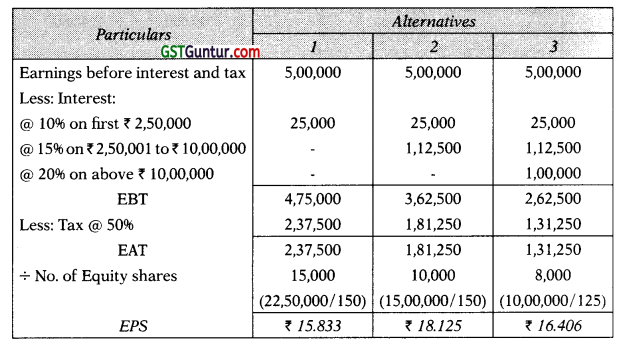

There are three approaches to finance current assets:

Conservative approach: As per this approach permanent current assets and portion of temporary current assets are financed through long term funds involved higher cost and lower risk of non-liquidity.

Matching approach: As per this approach permanent current assets are financed through long term funds and temporary current assets through short term funds.

Aggressive approach: As per this approach temporary current assets and portion of permanent current assets are financed through short term funds involved lower cost and higher risk of liquidity.

Finance manager should maintain balancing between risk and return to select appropriate approach. It is advised to follow matching approach to finance current assets.

Question 12.

Evaluate the role of cash budget in effective cash management system. (4 Marks Nov. 2015)

Answer:

Finance manager prepares cash budget to plan and control receipts and payments. The various roles of cash budgets in effective cash management system are:

- Cash budget indicates future expected surplus and deficit cash balance situations;

- It helps to arrange funds in future to fulfil expected shortage on favourable term.

- It helps to evaluate and select future short term investment in case of expected surplus.

- It helps to avoid future liquidity issues and therefore goodwill of company will not damage.

![]()

Question 13.

Describe the three principles relating to selection of marketable securities. (4 Marks May 2016)

Answer:

The three principles relating to selection of marketable securities are:

- Safety: Objective of investment in marketable securities is ensuring liquidity, minimum risk is the criterion of selection.

- Maturity: Maturity date of marketable securities should be matched with the date of future needs of cash.

- Marketability: Marketable securities should be converted into cash in convenient and speedy way with less transaction cost.

Question 14.

Explain briefly the functions of Treasury Department. (4 Marks Nov. 2016)

Answer:

The functions of treasury department are:

- Cash Management: The efficient collection and payment of cash both inside and outside the organization is the function of treasury department. Treasury normally manages surplus funds in an investment portfolio.

- Currency Management The treasury department manages the foreign currency risk exposure of the company. It advises on the currency to be used when invoicing overseas sales. It also manages any net exchange exposures in accordance with the company policy.

- Fund Management: Treasury department is responsible for planning and sourcing the company’s short, medium and long-term cash needs. It also participates in the decision on capital structure and forecasts future interest and foreign currency rates.

- Banking: Since short-term finance can come in the form of bank loans or through the sale of commercial paper in the money market, therefore, treasury department carries out negotiations with bankers and acts as the initial point of contact with them.

- Corporate Finance: Treasury department is involved with both acquisition and disinvestment activities within the group. In addition, it is often responsible for investor relations.

Question 15.

What are the sources of short term financial requirement of the com-pany? (4 Marks May 2018)

Answer:

Following are the sources of short term finance:

- Short term loans

- Overdraft

- Clean overdrafts

- Cash credits

- Advances against goods

- Bills discounting

- Advance against documents of title to goods

- Advance against supply of bills

- Factoring etc.

Question 16.

Explain Electronic Cash Management System. (4 Marks Jan. 21)

Answer:

Today’s world is known as digital world. Today we are using digital cash management system. Data and funds are transferred digitally. Various el ements in the process of cash management are linked through a satellite. Various places that are interlinked may be the place where the instrument is collected, the place where cash is to be transferred in company’s ,account, the place where the payment is to be transferred etc.

Certain networked cash management system may also provide a very limited access to third parties like parties having very regular dealings of receipts and payments with the company etc. A finance company accepting deposits from public through sub-brokers may give a limited access to sub-brokers to verify the collections made through him for determination of his commission among other things.

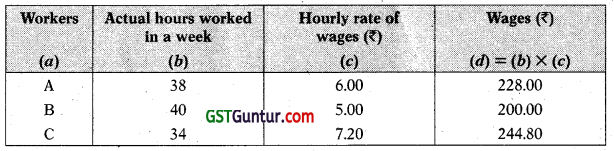

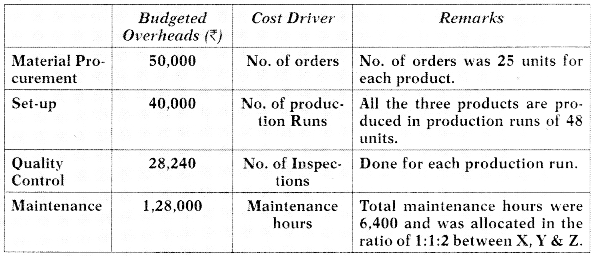

Practical Problems

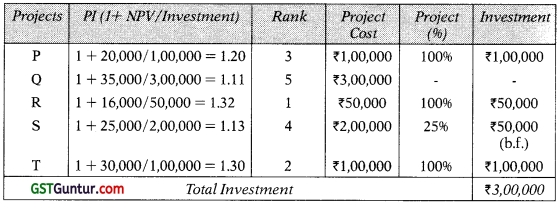

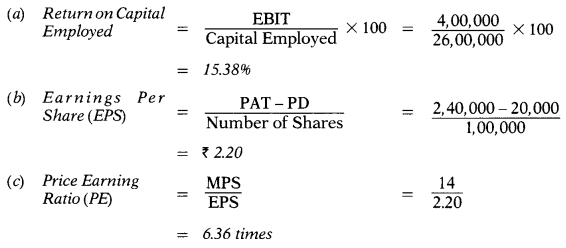

Cash Budget

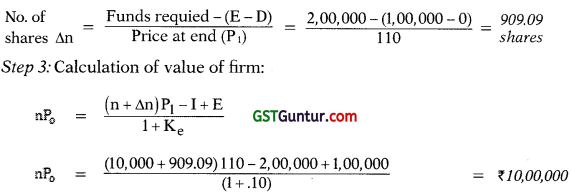

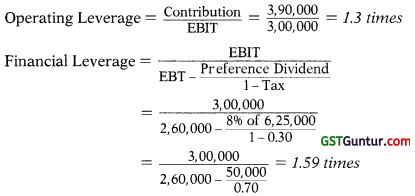

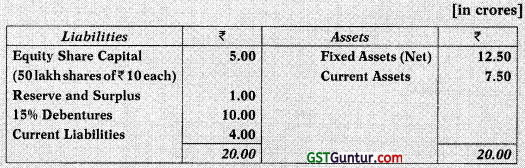

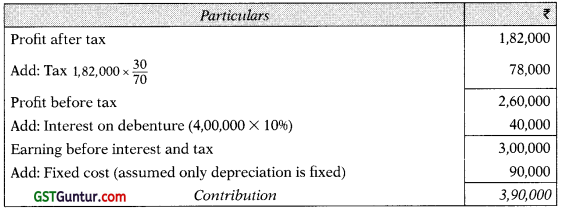

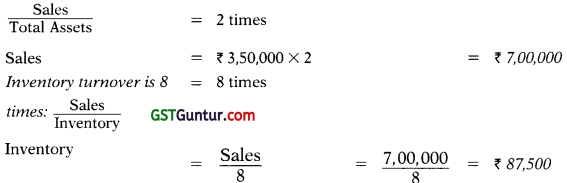

Question 1.

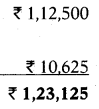

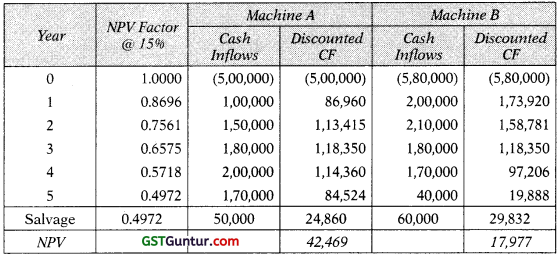

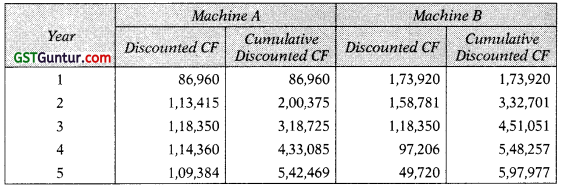

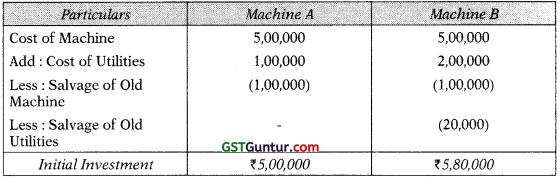

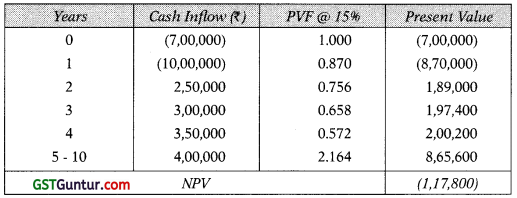

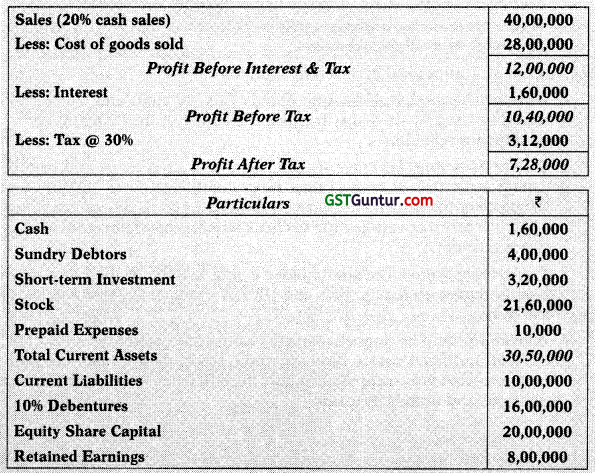

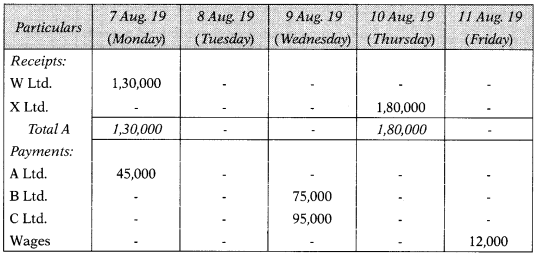

Following information relates to ABC company for the year 2016:

(a) Projected sales (₹ in lakhs)

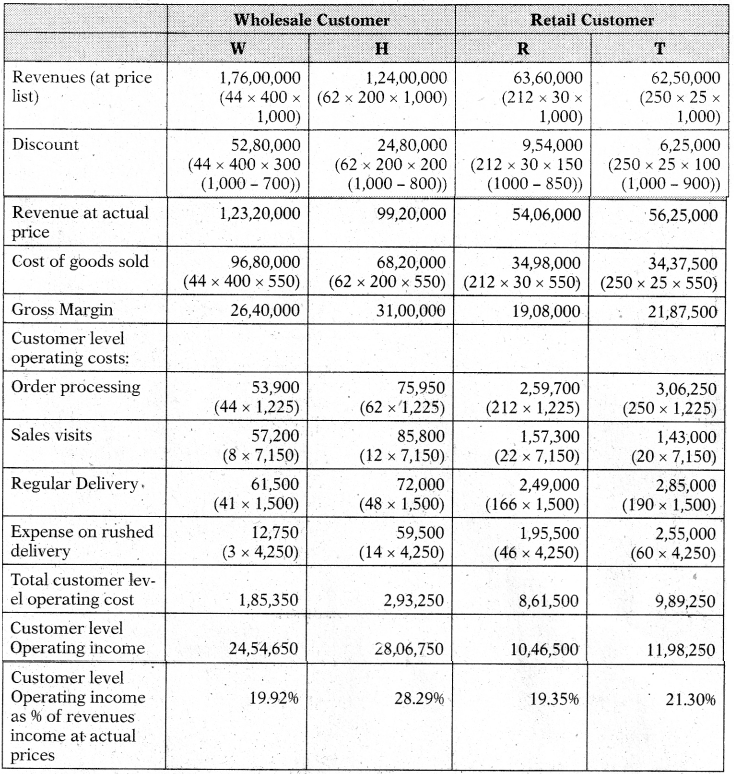

| August | September | October | November | December |

| 35 | 40 | 40 | 45 | 46 |

(b) Gross profit margin will be 20% on sale.

(c) 10% of projected sale will be cash sale. Out of credit sale of each month, 50% will be collected in the next month and the balance will be collected during the second month following the month of sale.

(d) Creditors will be paid in the first month following credit purchase. There will be credit purchase only.

(e) Wages and salaries will be paid on the first day of the next month. The amount will be ₹ 3 lakhs each month.

(f) Interim dividend of ₹ 2 lakhs will be paid in December 2016.

(g) Machinery costing ₹ 10 lakhs will be purchased in September 2016. Repayment by instalment of ₹ 50,000 p.m. will start from October 2016.

(h) Administrative expenses of ₹ 1,00,000 per month will be paid in the month of their incurrence.

(i) Assume no minimum cash balance is required. Opening cash balance as on 1-10-2016 is estimated at ₹ 10 lakhs.

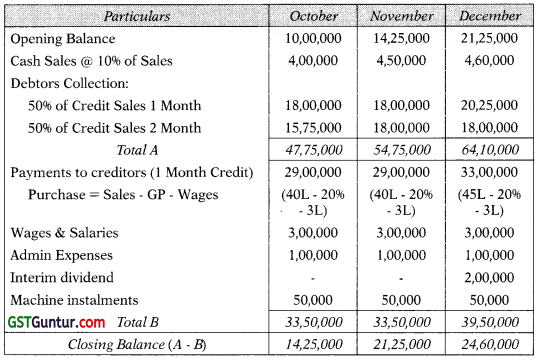

You are required to prepare the monthly cash budget for the 3-month period (October 2016 to December 2016). (8 Marks Nov. 2016)

Answer:

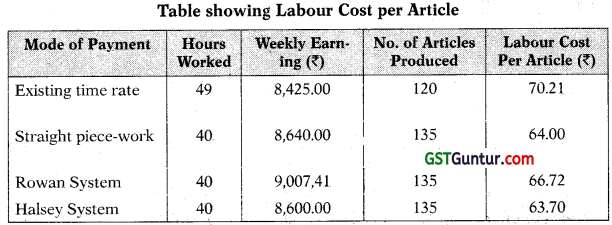

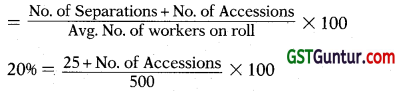

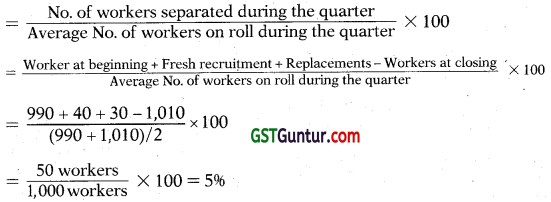

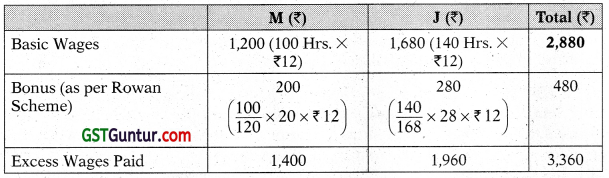

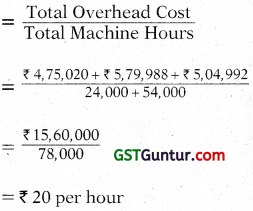

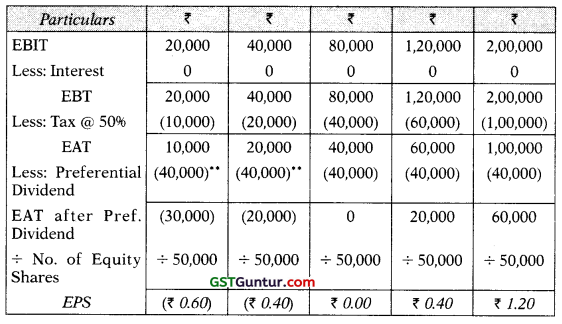

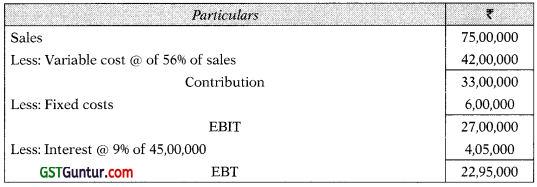

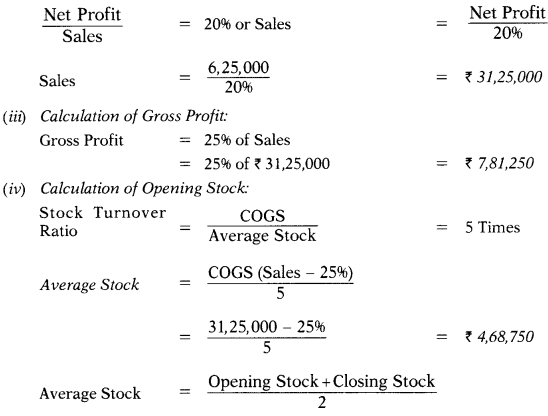

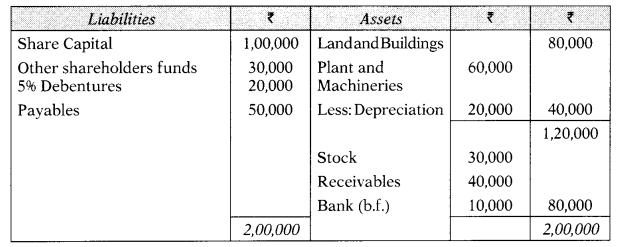

Cash Budget

(From Oct 2016 to December 2016)

![]()

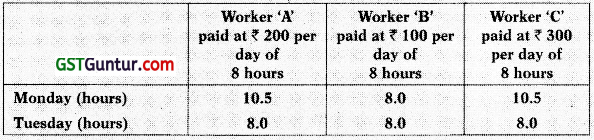

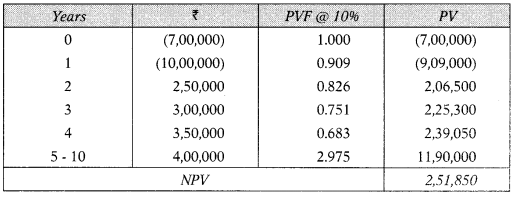

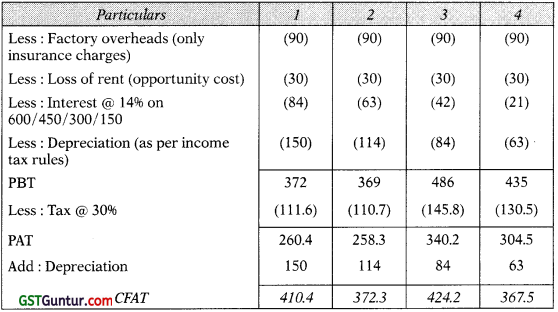

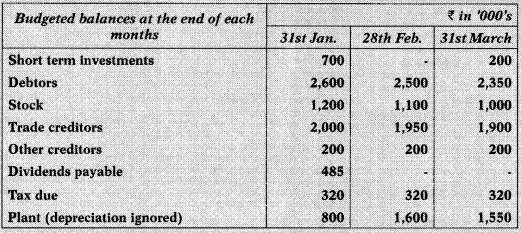

Question 2.

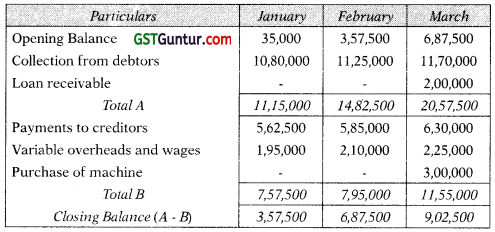

Slide Ltd is preparing a cash flow forecast for the three months period from January to the end of March. The following sales volumes have been forecasted:

| December | January | February | March | April | |

| Sales (units) | 1,800 | 1,875 | 1,950 | 2,100 | 2,250 |

Selling price per unit is ₹ 600. Sales are all on one month credit. Production of goods for sales takes place one month before sales. Each unit produced requires two units of raw material costing ₹ 150 per unit. No raw material inventory is held. Raw materials purchases are on one month credit.

Variable overheads and wages equal to ₹ 100 per unit are incurred during pro duction and paid in the month of production. The opening cash balance on 1st January is expected to be ₹ 35,000. A long term loan of ₹ 2,00,000 is excepted to be received in the month of March. A machine costing ₹ 3,00,000 will be purchased in March.

(a) Prepare a cash budget for the months of January, February and March and calculate the cash balance at the end of each month in the three month period.

(b) Calculate the forecast current ratio at the end of the three months period. (10 Marks Nov. 2019)

Answer:

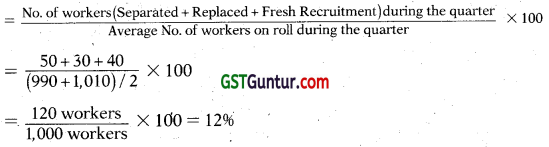

(a) Cash Budget

(for three months period January to March)

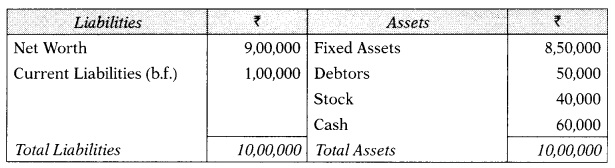

(b) Forecast Current Ratio at the end of three month period:

Forecast Current Ratio \(=\frac{\text { Expected Current Assets at the end of March }}{\text { Expected Current Liabilities at the end of March }}\)

= \(\frac{9,02,500+12,60,000+9,00,000}{6,75,000}\)

= 4.537 times

Current Assets = Cash and bank balance + Sundry debtors + Finished goods stock

Current Liabilities = Sundry creditors

Working note:

(a) Calculation of Collection from debtors, payment for Purchases, Variable overheads and Wages:

(b) Valuation of Finished goods stock at the end of March:

Valuation of Stock = Production cost of 2,250 units

= 2,250 units × (2 units of raw material × ₹ 150 + ₹ 100 Variable OH and wages)

= 9,00,000

Optimum Cash Transaction

Question 3.

VK Co. Ltd. has total cash disbursement amounting ₹ 22,50,000 in the year 2017 and maintains a separate account for cash disbursements. Company has an administrative and transaction cost on transferring cash to disbursement account 15 per transfer. The yield rate on marketable securities

is 12% per annum.

Determine the optimum cash balance according to William J Baumol model. (5 Marks May 2017)

Answer:

Optimal transfer size = \(\sqrt{\frac{2 \mathrm{UP}}{\mathrm{S}}}\) = \(\sqrt{\frac{2 \times 22,50,000 \times 15}{0.12}}\) = 23,717

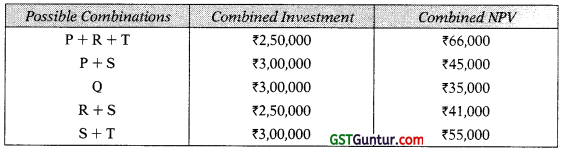

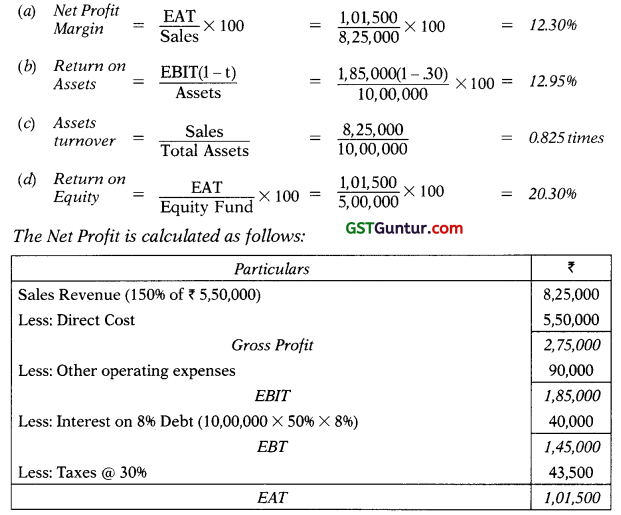

Evaluation Of Credit Policies

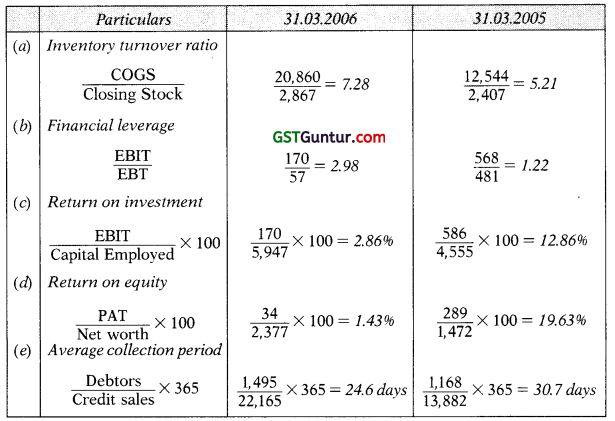

Question 4.

The marketing manager of XY Ltd. is giving a proposal to the board of directors of the company that an increase in credit period allowed to customers front the present one month to two months will bring a 25% increase in sales volume in the next year.

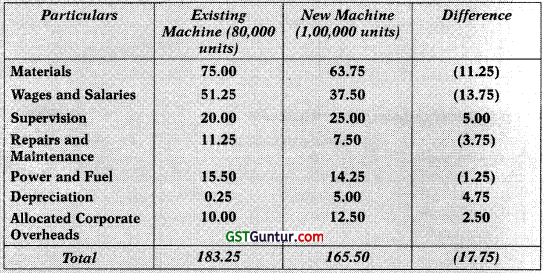

The following operational data of the company for the current year are taken from the records of the company:

Selling price : ₹ 21 per unit

Variable cost : ₹ 14 per unit

Total cost : ₹ 18 per unit

Sales value : ₹ 18,90,000

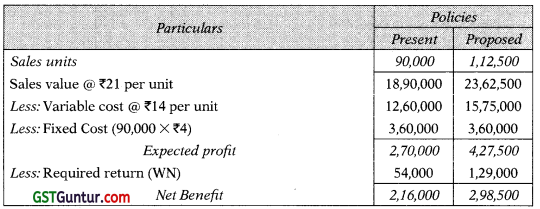

The board, by forwarding the above proposal and data requests you to give your expert opinion on the adoption of the new credit policy in next year subject to a condition that the company’s required rate of return on investments is 40%. (8 Marks May 2011)

Answer:

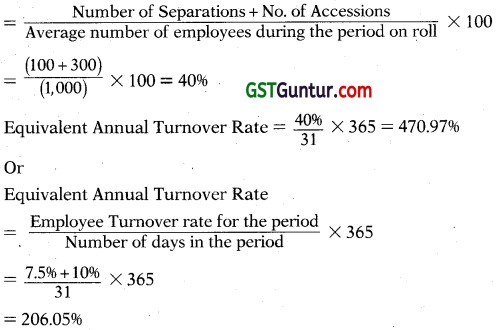

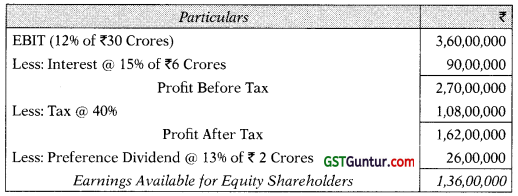

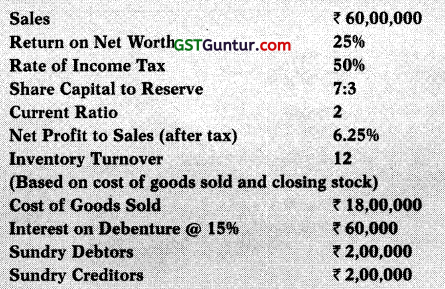

Statement of Evaluation

Analysis: The proposal for a more liberal extension of credit by increasing the average collection period from one month to two months is suggested to adopt.

Working notes:

Calculation of required return on investment in cost of debtors:

Existing = (12,60,000 + 3,60,000) × 1/12 × 40% = 54,000

Proposed = (15,75,000 + 3,60,000) × 2/12 × 40% = 1,29,000

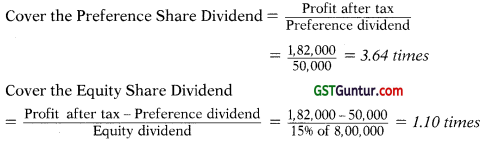

![]()

Question 5.

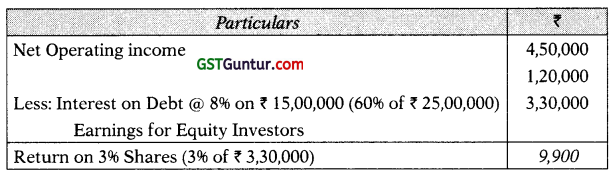

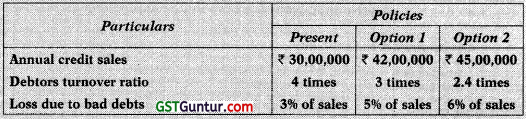

PTX Limited is considering a change in its present credit policy. Currently it is evaluating two policies. The company is required to give a return of 20% on the investment in new receivables. The company’s variable costs are 70% of selling price.

Information regarding present and proposed policies are as follows:

Note: Return on investment in new account receivable is based on cost of investment in debtors.

Which option would you recommend? (8 Marks Nov. 13)

Answer:

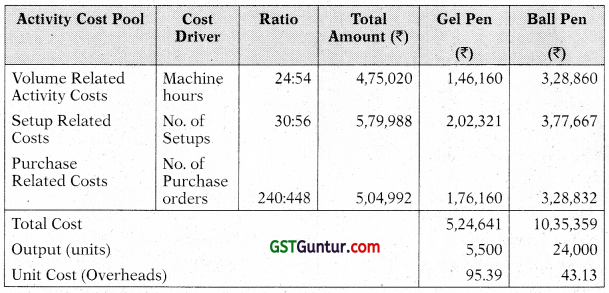

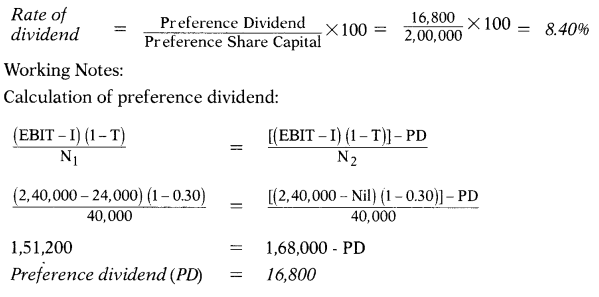

Statement of Evaluation

Note: In the above solution, investment in accounts receivable is based on total cost of goods sold on credit. Since fixed costs are not given in the problem, therefore, it is assumed that there are no fixed costs and investment in receivables is determined with reference to variable costs only. The above solution may alternatively be worked out on the basis of incremental approach. However, the recommendation would remain the same.

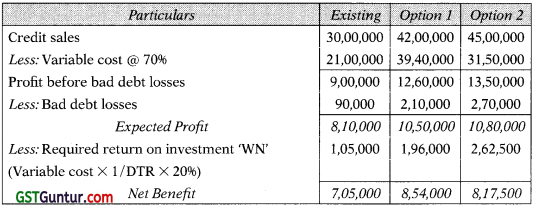

Question 6.

A trader whose current sales are ₹ 4,20,000 per annum and an average collection period of 30 days, wants to pursue a more liberal policy to improve sales. A study made by a management consultant reveals the following information:

Credit Policy Increase in Collection Period Increase in Sales Present default anticipated

| Credit Policy | Increase in Collection Period | Increase in Sales | Present default anticipated |

| I | 10 days | ₹ 21,000 | 1.5% |

| II | 30 days | ₹ 52,500 | 3% |

| III | 45 days | ₹ 63,000 | 4% |

The selling price per unit is ₹ 3. Average cost per unit is ₹ 2.25 and variable cost per unit is ₹ 2. The current bad-debts loss is 1%. Required return on additional investment is 20%. Assume a 360 days year.

Which of the above policies would you recommend for adoption ? (8 Marks May 2016)

Answer:

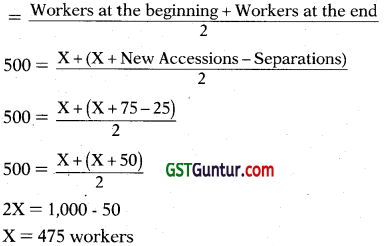

Statement of Evaluation of Credit Policies

Working notes:

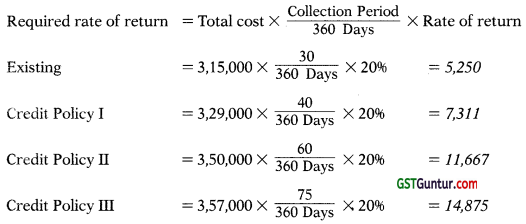

Calculation of cost required rate of return:

Recommendation: Proposed Policy I (i.e. increase in collection period by 10 days or total 40 days) should be adopted since the net benefits under this policy are higher as compared to other policies.

![]()

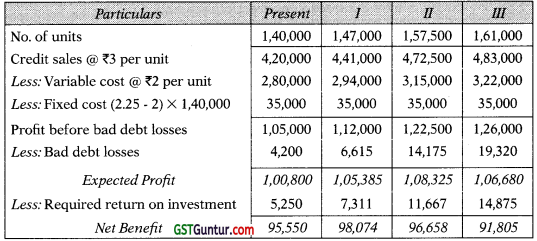

Question 7.

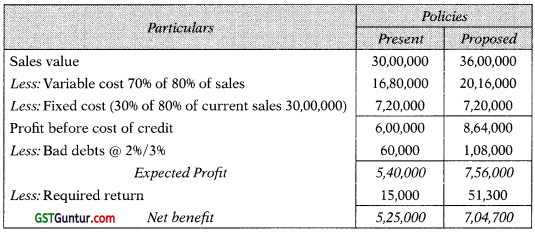

MN Ltd has a current turnover of ₹ 30,00,000 p.a. Cost of sale is 80% of turnover and bad debts are 2% of turnover. Cost of sales includes 70% Variable cost and 30% Fixed cost, while company’s required rate of return is 15%. MN Ltd. currently allows 15 days credit to its customer, but it is considering increase this to 45 days credit in order to increase turnover.

It has been estimated that this change in policy will increase turnover by 20%, while bad debts will increase by 1%. It is not expected that the policy change will result in an increase in fixed cost and creditors and stock will be unchanged.

Should MN Ltd introduce the proposed policy? (Assume 360 days year) (10 Marks Nov. 2018)

Answer:

Statement of Evaluation

Yes, the firm should change its credit period

Working Notes:

Calculation of required return in debtors:

Existing = (16,80,000 + 7,20,000) × 15/360 × 15% = 15,000

Proposed = (20,16,000 + 7,20,000) × 45/360 × 15% = 51,300

Evaluation Of New Customers

Question 8.

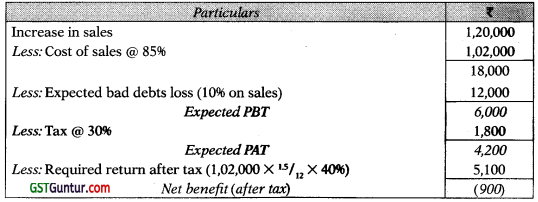

A new customer with 10% risk of non-payment desires to establish business connection with you. He would require 1.5 month of credit and is likely to increase you sales by ₹ 1,20,000 p.a. Cost of sales amounted to 85% of sales. The tax rate is 30%. Required rate of return is 40% (after tax). Should you accept the offer? (4 Marks Nov. 2011)

Answer:

Statement of Evaluation

Conclusion: Since company has negative benefit after tax, offer should be rejected.

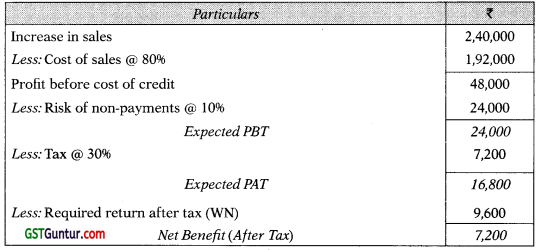

Question 9.

A new customer has approached a firm to establish new business connection. The customer require 1.5 month of credit. If the proposal is accepted, the sales of the firm will go up by ₹ 2,40,000 per annum. The new customer is being considered as a member of 10% risk of non-payment group. The cost of sales amounted to 80% of sales. The tax rate is 30% and required rate of return is 40% (after tax).

Should the firm accept the offer? Give your opinion on the basis of calculations. (5 Marks May 2015)

Answer:

Statement of Evaluation

Conclusion: Since company has positive benefit after fulfil of required return from investment in debtors, offer should be accepted.

Working notes: –

Calculation of cost of investment in debtors:

Existing = 1,92,000 × 15/12 × 4096 = 9,600

![]()

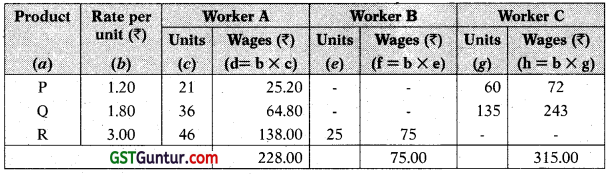

Evaluation Of Cash Discount Policies

Question 10.

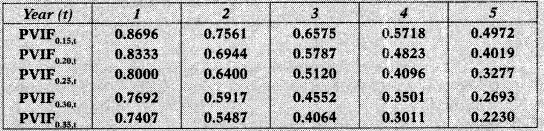

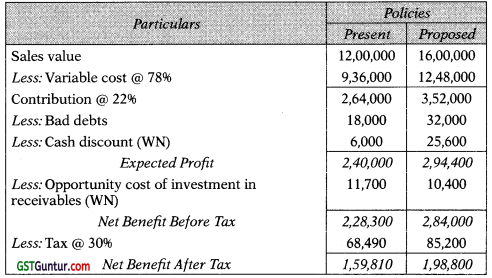

A company is presently having credit sales of ₹ 12,00,000. The existing credit terms are 1/10 net 45 days and average collection period is 30 days. The current bad debts loss is 1.5%. In order to accelerate the collection process further as also to increase sales, the company is contemplating liberalization of its existing credit terms to 2/10 net 45 days.

It is expected that sales are likely to increase 1/3 of existing sales, bad debts increase to 2% of sales and average collection period to decline to 20 days. The contribution to sales ratio of the company is 22% and opportunity cost of investment in receivables is 15 per cent (pre tax). 50 per cent and 80 per cent of customers in term of sales revenue are expected to avail cash discount under existing and liberalisation scheme respectively. The tax rate is 30%.

Should the company change its credit terms? (Assume 360 days in a year). (5 Marks May 2012)

Answer:

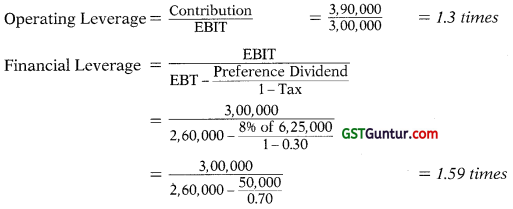

Statement of Evaluation

Advise: Company should change its credit terms having higher net benefit.

Working notes:

(1) Calculation of opportunity cost of investment in receivables:

Existing = 9,36,000 × 15% × 30/360 = 11,700

Proposed = 12,48,000 × 15% × 20/360 = 10,400

(2) Calculation of cash discount:

Existing = 12,00,000 × 50% × 1% = 6,000

Proposed = 16,00,000 × 80% × 2% = 25,600

Question 11.

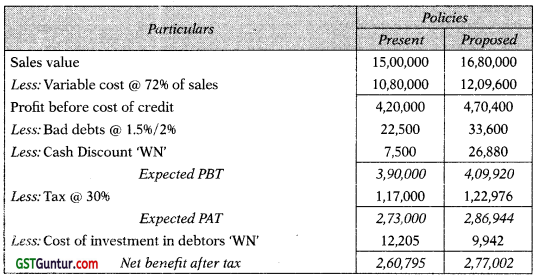

A current credit sales of a firm is ₹ 15,00,000 and the firm still has an unutilized capacity. In order to boost its sales, the firm is willing to relax its credit policy. The firm proposes a new credit policy of 2/10 net 60 days as against the present policy of 1 /10 net 45 days. The firm expects an increase in the sales by 12%.

However, it is also expected that bad debts will go upto 2% of sales from 1.5%. The contribution to sales ratio of the firm is 28%. The firm’s tax rate is 30% and firm requires an after tax return of 15% on its investment. 50 per cent and 80 percent of customers in term of sales revenue are expected to avail cash discount under existing and liberalization scheme respectively.

Should the firm change its credit period? (8 Marks Nov. 2017)

Answer:

Statement of Evaluation

Yes, the firm should change its credit period Working notes:

Working notes:

1. Calculation of opportunity cost of investment in receivables:

Existing = 10,80,000 × 15% × 27.5 (.5 × 10 + .5 × 45)/365 = 12,205

Proposed = 12,09,600 × 15% × 20 (.8 × 10 + .2 × 60)/365 = 9,942

2. Calculation of cash discount:

Existing = 15,00,000 × 50% × 1% = 7,500

Proposed = 16,80,000 × 80% × 2% = 26,880

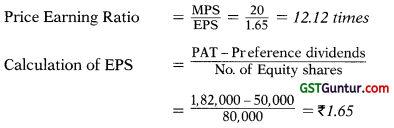

![]()

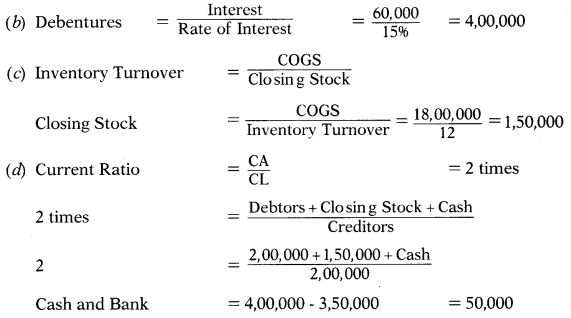

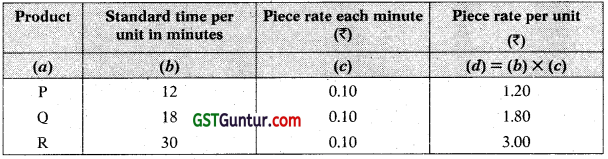

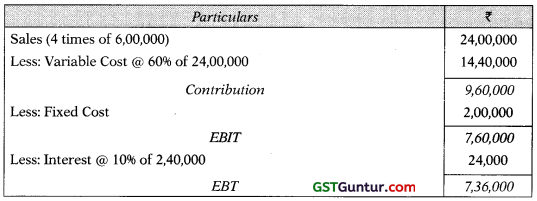

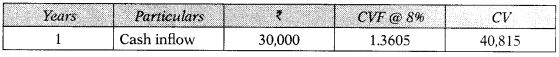

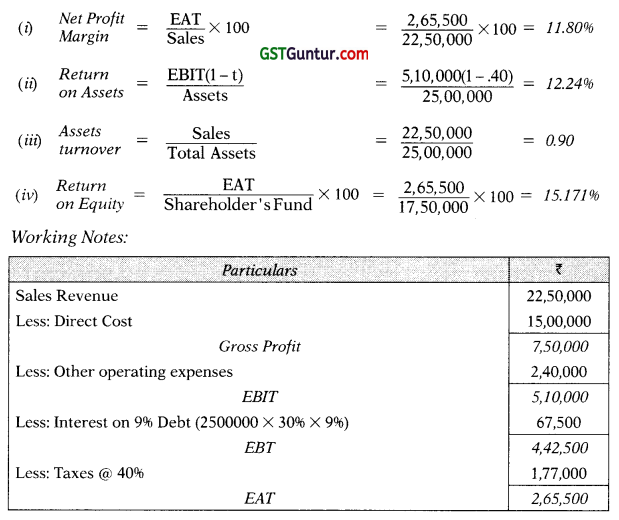

Evaluation Of Collection Policies

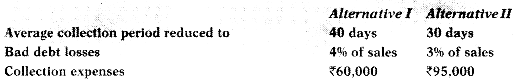

Question 12.

PQR Ltd. having annual sales of ₹ 30,00,000, is reconsidering its pres ent collection policy. At present the average collection period is 50 days, bad debt losses are 5% of sales. The company is incurring an expenditure of ₹ 30,000 on account of collection of receivables. Cost of funds is 10 per cent.

The alternative policies are:

Evaluate the alternatives on the basis of incremental approach and state which alternative is more beneficial. (8 Marks Nov. 2014)

Answer:

Statement of Evaluation

Analysis: Since incremental benefit over present policy is higher in case of alternative II, select Alternative II. It is suggested to reduce the collection period from existing 50 days to 30 days.

Working Notes:

Calculation of cost of investment in debtors:

Existing = 30,00,000 × 50/365 × 10% = 41,096

Alternative I = 30,00,000 × 40/365 × 10% = 32,877

Alternative II = 30,00,000 × 30/365 × 10% = 24,658

![]()

Factoring

Question 13.

A firm has total sales as ₹ 200 lakhs of which 80% is on credit. It is offering credit term of 2/40, net 120. Of the total, 50% of customers avail of discount and the balance pay in 120 days. Past experience indicates that bad debt losses are around 1% of credit sales. The firm spends about ₹ 2,40,000 per annum to administer its credit sales. These are avoidable as a factor is prepared to buy the firm’s receivables.

He will charge 2% commission. He will pay advance against receivables to the firm at an interest rate of 18% after withholding 10% as reserve,

(i) What is the effective cost of factoring? Consider year as 360 days.

(ii) If bank finance for working capital is available at 14% interest, should the firm avail of factoring service? (8 Marks Nov. 2015)

Answer:

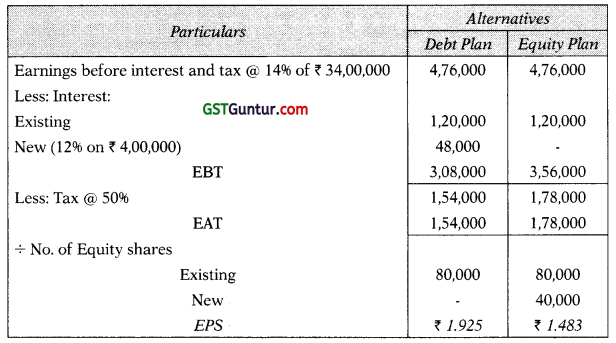

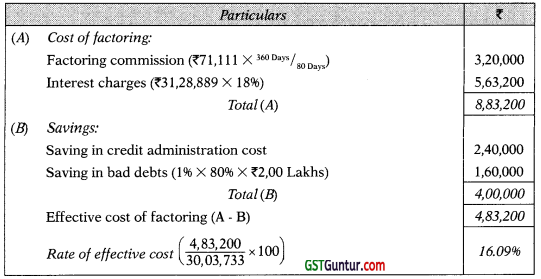

(i) Statement of Effective Cost of Factoring to the Firm

Alternatively:

If cost of factoring is calculated on the basis of total amount available for advance, then, it will be

Rate of effective cost = (\(\frac{4,83,200}{31,28,889}\) × 100) = 15.44%

(ii) If bank finance for working capital is available at 14%, firm will not avail factoring services as 14% is less than 16.08% (or 15.44%).

Working Notes:

(1) Calculation of advance:

(2) Average collection period = 40 Days × 1/2 + 120 Days × 1/2 = 80 Days

Assumptions:

- Factoring commission will be paid in advance.

- Factor will bear bad debt losses (Non recourse factoring).

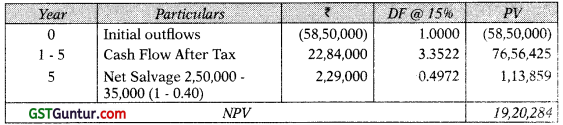

Question 14.

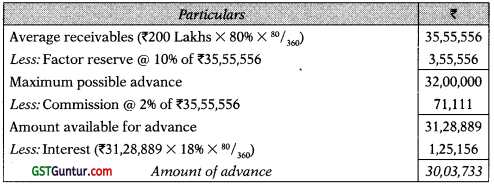

A company is considering to engage a factor. The following information is available:

- The current average collection period for the company’s debtors is 90 days and l’2% of debtors default. The factor has agreed to pay money due after 60 days, and will take the responsibility of any loss on account of bad debts.

- The annual charge for the factoring is 2% of turnover. Administration cost saving is likely to be ₹ 1,00,000 per annum.

- Annual credit sales are ₹ 1,20,00,000. Variable costs is 80% of sales price. The company’s cost of borrowings is 15% per annum. Assume 360 days in a year.

Should the company enter into a factoring agreement? (8 Marks May 2018)

Answer:

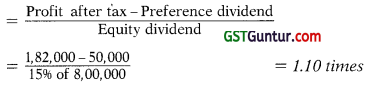

Statement of Evaluation

* Presently, the debtors of the company pay after 90 days. However, the factor has agreed to pay after 60 days only. So, the investment in Debtors will be reduced by 30 days.

Conclusion: Yes, company should enter into factoring agreement.

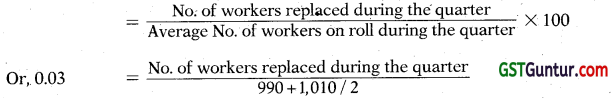

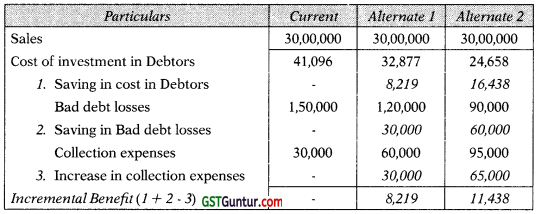

![]()

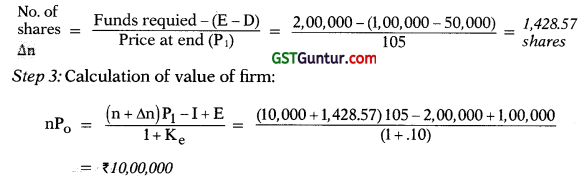

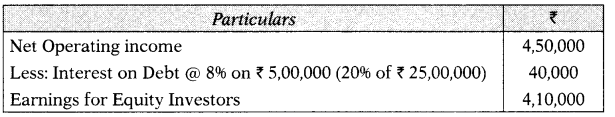

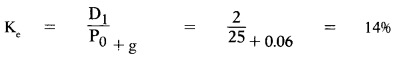

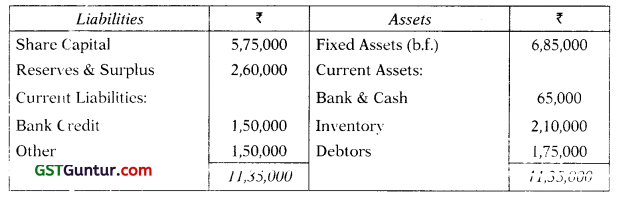

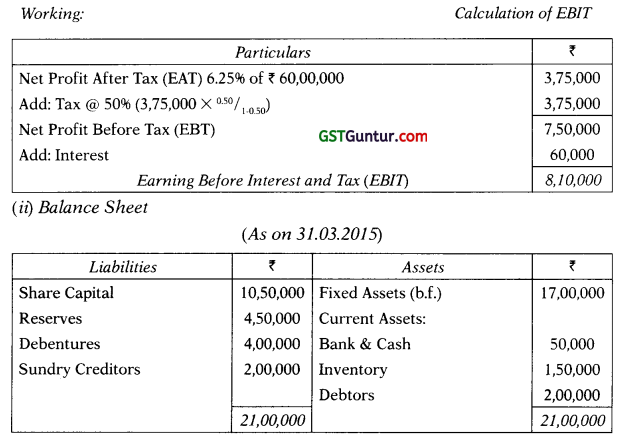

Operating Cycle Method

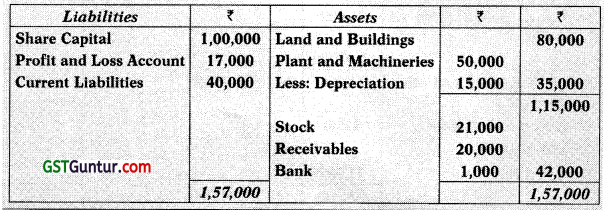

Question 15.

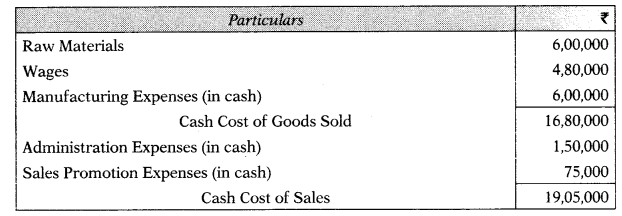

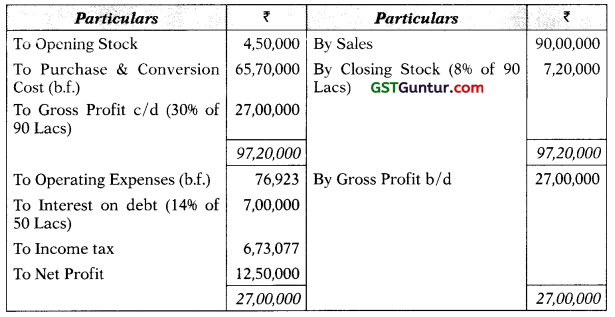

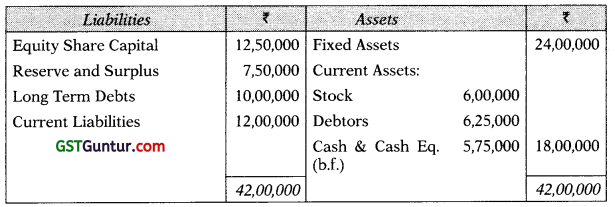

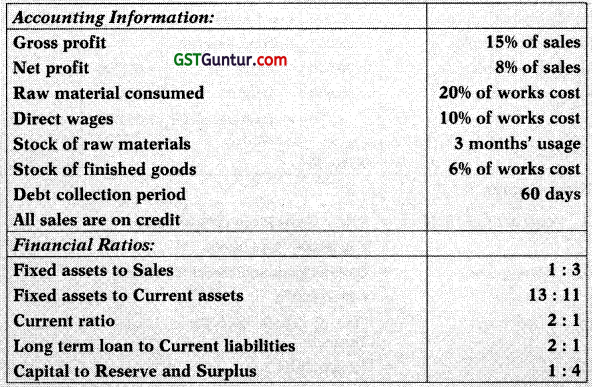

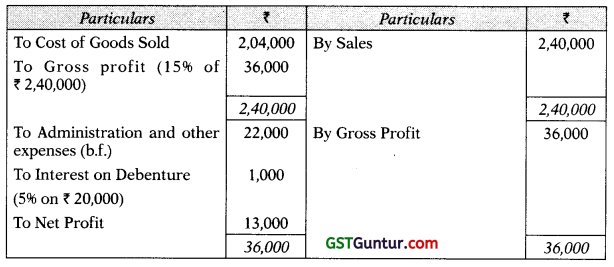

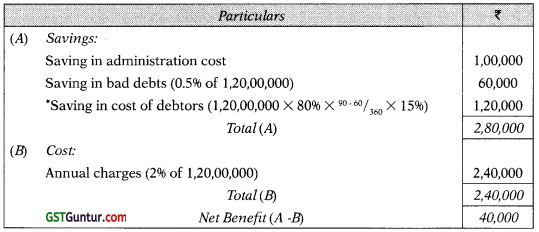

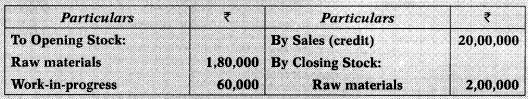

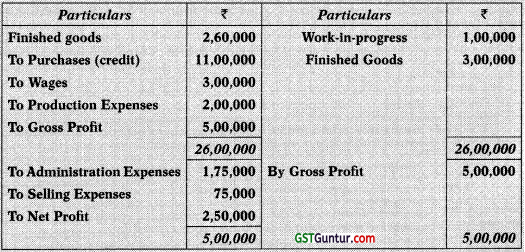

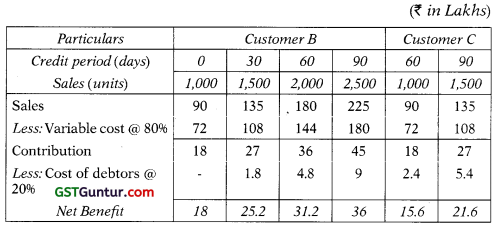

The Trading and Profit and Loss Account of Beta Ltd. for the year ended 31st March, 2011 is given below:

Particulars Particulars

The opening and closing balances of debtors were ₹ 1,50,000 and ₹ 2,00,000 respectively whereas opening and closing creditors were ₹ 2,00,000 and ₹ 2,40,000 respectively.

You are required io ascertain the working capital requirement by operat ing cycle method. (8 Marks Nov. 2011)

Answer:

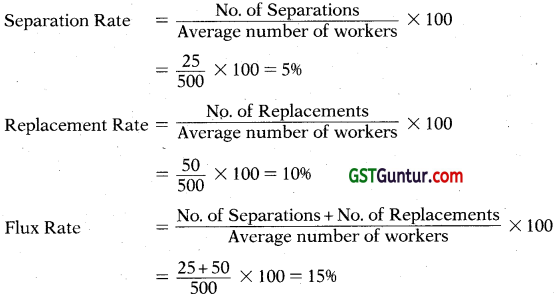

![]()

= (₹ 20,00,000 – ₹2,50,000) × \(\frac{110.24}{365}\) = ₹ 5,28,548

Operating cycle =R + W + F + D – C

= 64.21 + 18.96 + 68.13 + 31.94 – 73 = 110.24 Days

Calculations:

Raw materials storage period

\(=\frac{\text { Average stock of raw materials }}{\text { Average cost of raw materials consumption per day }}\)

= \(\frac{1,90,000}{10,80,000 \div 365}\) = 64.21 days

Raw materials consumed = Opening RM + Purchases – Closing RM

= 1,80,000 + 11,00,000 – 2,00,000 = 10,80,000

WIP holding period \(=\frac{\text { Average stock of WIP }}{\text { Average cost of production per day }}\)

= \(\frac{80,000}{15,40,000 \div 365}\) = 18.96 days

Cost of Production = RMC + Wages + Production expenses + Op. WIP – Closing WIP

= 10,80,000 + 3,00,000 + 2,00,000 + 60,000 – 1,00,000

= 15,40,000

Finished Goods storage period \(=\frac{\text { Average stock of FG }}{\text { Average cost of goods sold per day }}\)

= \(\frac{2,80,000}{15,00,000 \div 365}\) = 68.13 days

Cost of goods sold = COP + Opening FG – Closing FG

= 15,40,000 + 2,60,000 – 3,00,000

= 15,00,000

Debtors collection period \(=\frac{\text { Average debtors }}{\text { Average credit sales per day }}\)

= \(\frac{1,75,000}{20,00,000 \div 365}\) = 31.94 days

Credit period availed \(=\frac{\text { Average trade creditors }}{\text { Average credit purchases per day }}\)

= \(\frac{2,20,000}{11,00,000 \div 365}\) = 73 days

Calculation of averages:

Average stock of raw materials = (1,80,000 + 2,00,000) ÷ 2 = 1,90,000

Average stock of WIP = (60,000 + 1,00,000) ÷ 2 = 80,000

Average stock of FG = (2,60,000 + 3,00,000) ÷ 2 = 2,80,000

Average debtors = (150,000 + 2,00,000) ÷ 2 = 1,75,000

Average trade creditors = (2,00,000 + 2,40,000) ÷ 2 = 2,20,000

![]()

Question 16.

The following information is provided by the DPS Limited for the year ending 31st March, 2013

Raw material storage period : 55 days

Work-in progress conversion period : 18 days

Finished Goods storage period : 22 days

Debt collection period : 45 days

Creditor’s payment period : 60 days

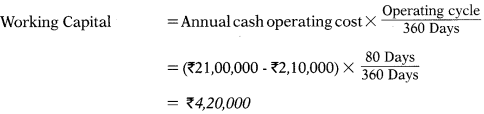

Annual Operating cost (including depreciation of ₹ 2,10,000) : ₹ 21,00,000

1 year : 360 days

You are required to calculate:

I. Operating Cycle period.

II. Number of Operating Cycle in a year.

III. Amount of working capital required of the company on a cash cost

IV. The company is a market leader in its product, there is virtually no competitor in the market. Based on a market research it is planning to discontinue sales on credit and deliver products based on pre-payment. Thereby, it can reduce its working capital requirement substantially. What would be the reduction in working capital requirement due to such decision? (8 Marks May 2013, 2015)

Answer:

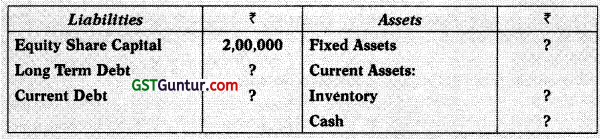

I. Operating cycle = R + W + F + D- C

= 55 + 18 + 22 + 45 – 60 = 80 Days

II. No. of operating cycle = \(\frac{360}{80}\) = 4.5 times

III.

IV. In case of cash sales operating cycle period will reduce by 45 Days (Debt collection period).

Revised operating cycle period = 55 + 18 + 22 – 60 = 35 Days

Revised working capital = (₹ 21,00,000 – ₹ 2,10,000) × \(\frac{35 \text { Days }}{360 \text { Days }}\)

= ₹ 1,83,750

Reduction in working capital = ₹ 4,20,000 – ₹ 1,83,750 = ₹ 2,36,250

Or

Reduction in working capital = (₹ 21,00,000 – ₹ 2,10,000) × \(\frac{80 \text { Days }-35 \text { Days }}{360 \text { Days }}\)

= ₹2,36,250

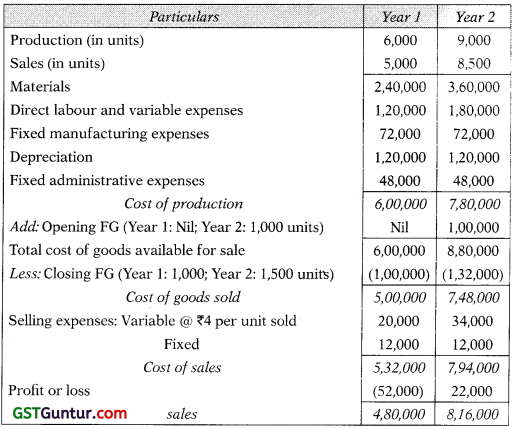

Question 17.

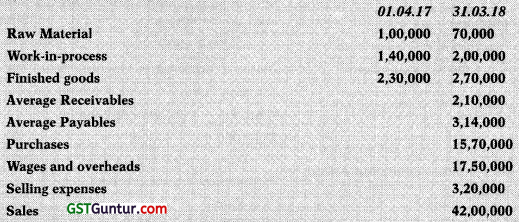

Following information has been extracted from the books of ABS Limited:

All purchases and sales are on credit basis. Company is willing to know:

(1) Net operating cycle period.

(2) Amount of working capital requirement (Assume 360 days in a year). (8 Marks Nov, 2018)

Answer:

(1) Operating cycle = R + W + F + D – C

= 19 + 19 + 28 + 18 – 72 = 12 Days

Calculations:

Raw materials storage period (R)

\(=\frac{\text { Average stock of raw materials }}{\text { Average cost of raw materials consumption per day }}\)

= \(\frac{(1,00,000+70,000) \div 2}{16,00,000 \div 360}\) = 19 days

= Opening RM + Purchases – Closing RM

= 1,00,000 + 15,70,000 – 70,000 = 16,00,000

WIP holding period \(=\frac{\text { Average stock of WIP }}{\text { Average cost of production per day }}\)

= \(\frac{(1,40,000+2,00,000) \div 2}{32,90,000 \div 360}\) = 19 days

Cost of Production = RM consumed + Wages and OH + Opening WIP – Closing WIP

= 16,00,000 + 17,50,000 + 1,40,000 – 2,00,000

= 32,90,000

Finished Goods storage period

\(=\frac{\text { Average stock of } \mathrm{FG}}{\text { Average cost of goods sold per day }}\)

= \(\frac{(2,30,000+2,70,000) \div 2}{32,50,000 \div 360}\) = 28 days

Cost of Goods Sold = Cost of Production + Opening FG – Closing FG

= 32,90,000 + 2,30,000 – 2,70,000

= 32,50,000

Debtors collection period \(=\frac{\text { Average book debts }}{\text { Average credit sales per day }}\)

= \(\frac{2,10,000}{42,00,000 \div 360}\) = 18 days

Credit period availed \(=\frac{\text { Average trade creditors }}{\text { Average credit purchases per day }}\)

= \(\frac{3,14,000}{15,70,000 \div 360}\) = 72 days

(2) Amount of working capital required

Working Capital \(=\frac{\text { Annual Cost of Sales }}{360}\) × Operating Cycle Period

= \(\frac{35,70,000}{360}\) × 12 = ₹ 1,19,000

Cost of Sales = Cost of Goods Sold + Selling expenses

= 32,50,000 + 3,20,000 = 35,70,000

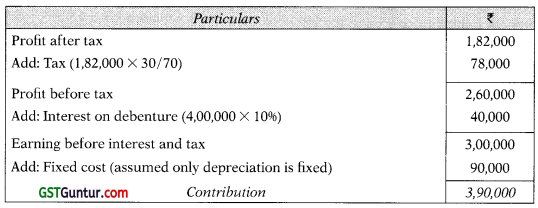

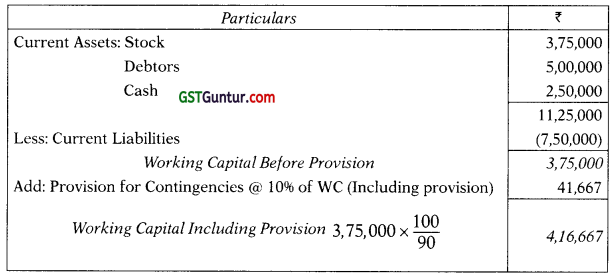

![]()

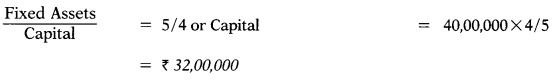

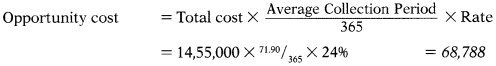

Question 18.

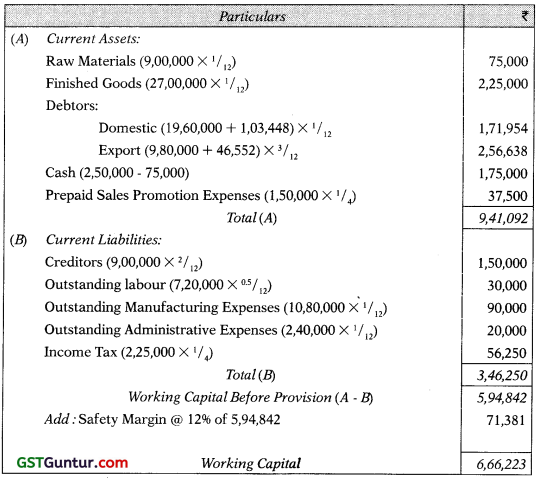

The following information is provided by MNP Ltd. for the year end ing 31st March, 2020:

Raw material storage period : 45 days

Work-in progress conversion period : 20 days

Finished Goods storage period : 25 days

Debt collection period : 30 days

Creditor’s payment period : 60 days

Annual Operating cost (including depreciation of ₹ 2,50,000) : ₹ 25,00,000

Assume 360 days in a year.

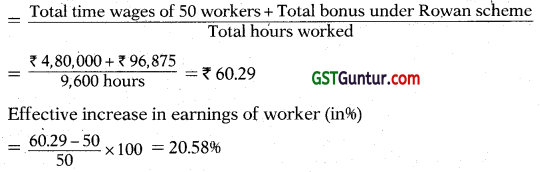

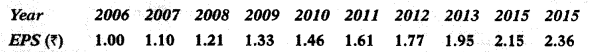

You are required to calculate:

I. Operating Cycle period.

II. Number of Operating Cycle in a year.

III. Amount of working capital required of the company on a cash cost basis.

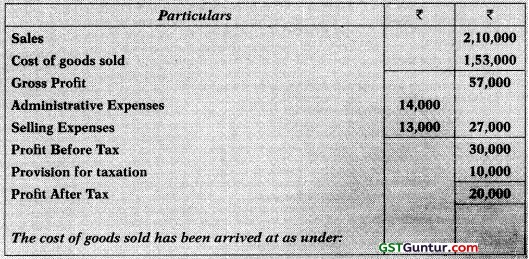

IV. The company is a market leader in its product, there is virtually no competitor in the market. Based on a market survey it is planning to discontinue sales on credit and deliver products based on pre-payment in order to reduce its working capital requirement substantially. You are required to compute the reduction in w’orking capital requirement in such a scenario. (5 Murks Jan. 2021)

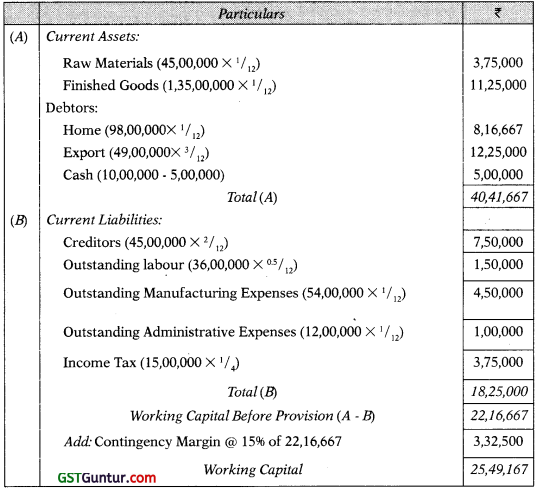

Answer:

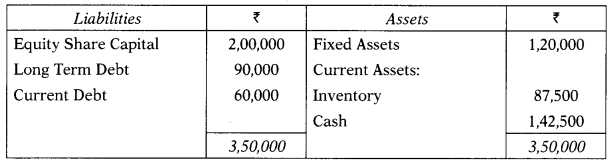

I. Operatingcycle = R + W + F + D – C

= 45 + 20 + 25 + 30 – 60 Days

II. No. of operating cycle = \(\frac{360}{60}\) = 6 times

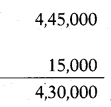

III.

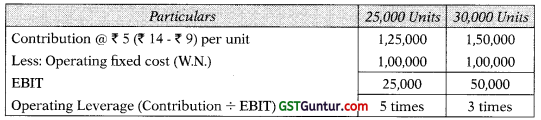

![]()

= (₹ 25,00,000 – ₹ 2,50,000) × \(\frac{60 \text { Days }}{360 \text { Days }}\)

= ₹ 3,75,000

IV. Reduction in working capital

= (₹ 25,00,000 – ₹ 2,50,000) × 30 days/360 days = ₹ 1,87,500

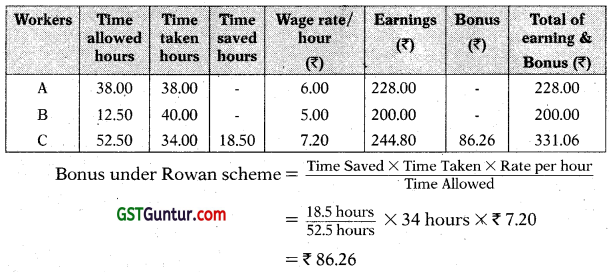

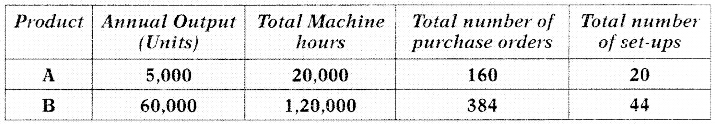

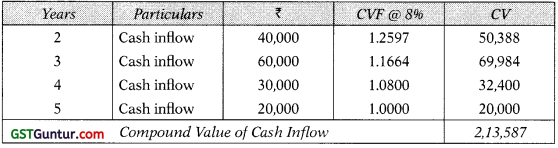

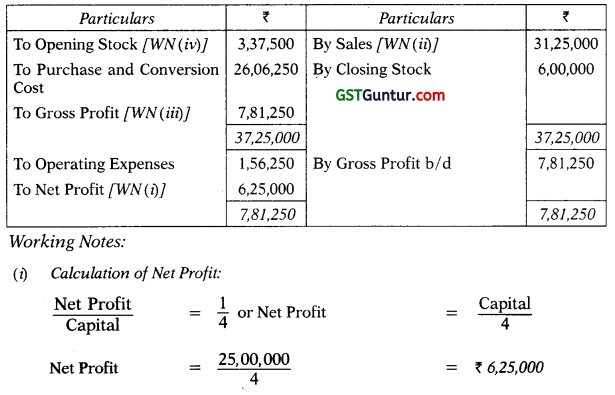

Components Wise Estimation Method (Cash Cost App-Roach)

Question 19.

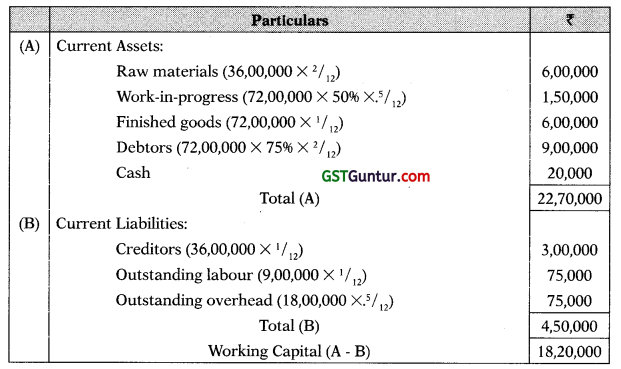

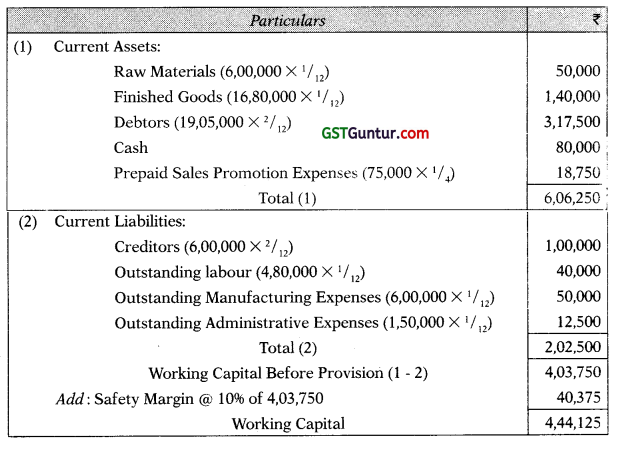

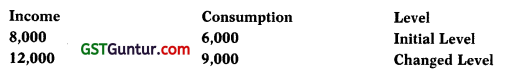

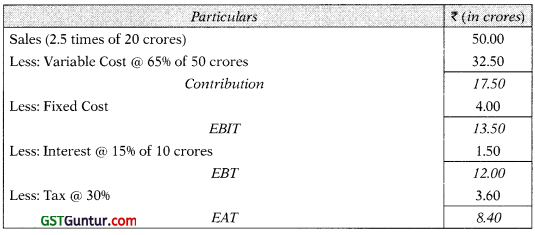

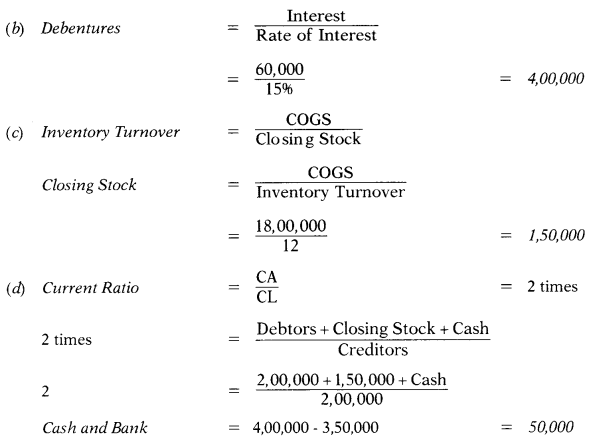

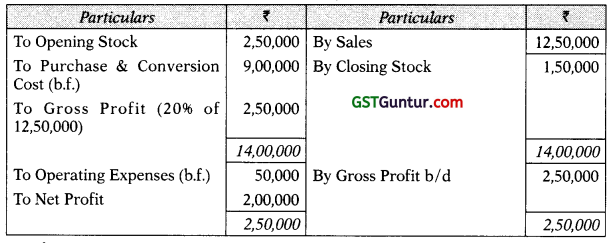

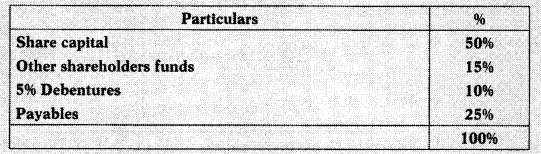

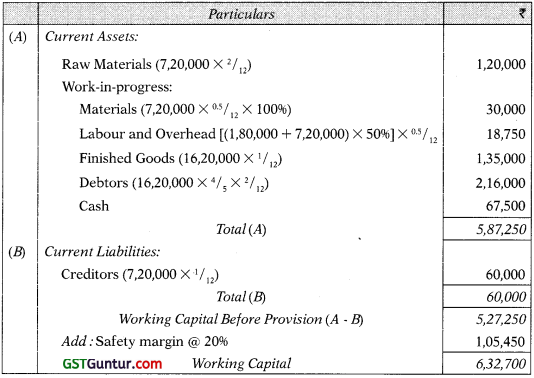

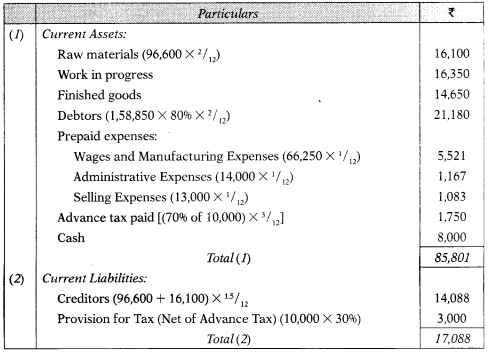

The management of MNP Company Ltd. is planning to expand its business and consult you to prepare an estimated working capital statement.

The records of the company revealed the following annual information:

Sales:

Domestic at one month’s credit : ₹ 24,00,000

Export at three month’s credit : ₹ 10,80,000

(Sales price 10% below Domestic price)

Material used (suppliers extend two months credit) : ₹ 9,00,000

Lag in payment of wages – 1/2 month: ₹ 7,20,000

Lag in payment of manufacturing expenses (cash) – 1 month: ₹ 10,80,000

Lag in payment of administrative expenses – 1 month : ₹ 2,40,000

Sales promotion expenses payable quarterly in advance : ₹ 1,50,000

Income tax payable in four instalments (of which one falls in the next financial year) : ₹ 2,25,000

Rate of gross profit is 20%. Ignore work-in-progress and depreciation. The company keeps one month’s stock of raw materials and finished goods (each) and believes in keeping ₹ 2,50,000 available to it including the over draft limit of ₹ 75,000 not yet utilized by the company. The management is also of the opinion to make 12% margin for contingencies on computed figure.

You are required to prepare the estimated working capital statement for next year. (16 Marks May 2011)

Answer:

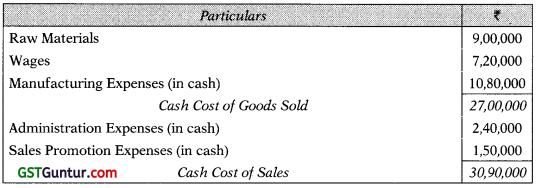

Statement of Working Capital Requirement (Cash Cost Basis)

Working Notes:

1. Projected Income Statement

2. Calculation of Cash cost of Debtors:

Export sales (10% below domestic sales price) = 10,80,000

Export sales equivalent to domestic sales = 10,80,000 × \(\frac{100}{90}\)

= 12,00,000

Total equivalent domestic sales = 24,00,000 + 12,00,000

= 36,00,000

Apportionment of cash cost of sales except sales promotion expenses in proportion of equivalent domestic sales between Domestic and Foreign Sales:

Domestic sales = 29,40,000 × \(\frac{24,00,000}{36,00,000}\) = 19,60,000

Foreign sales = 29,40,000 × \(\frac{12,00,000}{36,00,000}\) = 9,80,000

Apportionment of sales promotion expenses between Domestic and Foreign Sales in sales ratio:

Domestic sales = 1,50,000 × \(\frac{24,00,000}{34,80,000}\) = 1,03,448

Foreign sales = 1,50,000 × \(\frac{10,80,000}{34,80,000}\) = 46,552

![]()

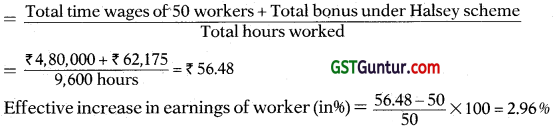

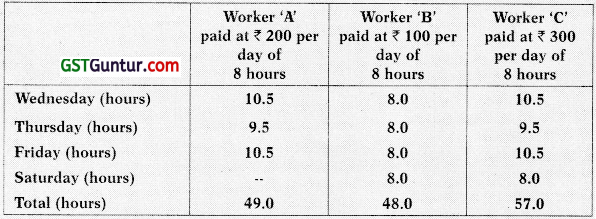

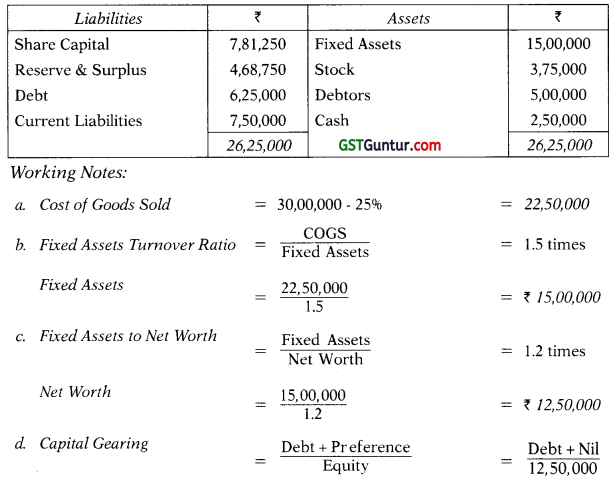

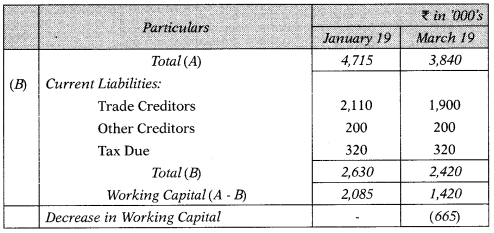

Question 20.

STN Ltd. is a readymade garment manufacturing company. Its production cycle indicates that materials are introduced in the beginning of the production phase; wages and overhead accrue evenly throughout the period of cycle.

The following figures for the 12 months ending 31st December 2011 are given:

Production of shirts : 54,000 units

Selling price per unit : ₹ 200

Duration of the production cycle : 1 month

Raw material Inventory held : 2 month’s consumption

Finished goods stock held for : 1 month

Credit allowed to debtors : 1.5 months

Credit allowed by creditors : 1 month

Wages are paid in (lie next month following the month of accrual. In the work in progress 50% of wages and overheads are supposed to be conversion costs. The ratios of cost to sales price are raw materials 60%, direct wages 10% and overheads 20%. Cash is to be held to the extent of 40% of current liabilities and safety margin of 15% will be maintained.

Calculate amount of working capital required for the company on a cash cost basis. (8 Marks May 12)

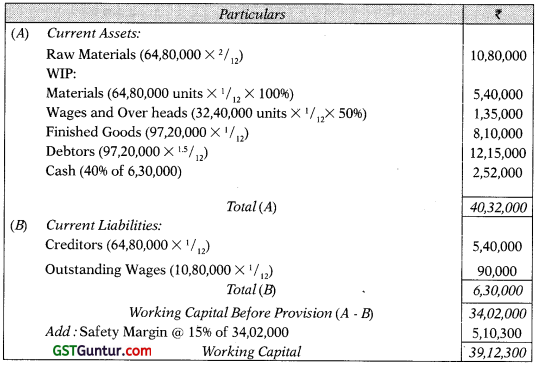

Answer:

Statement of Working Capital Requirement (Cash Cost Basis)

Working Notes:

Projected Income Statement

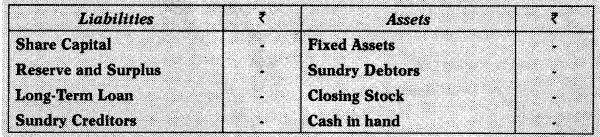

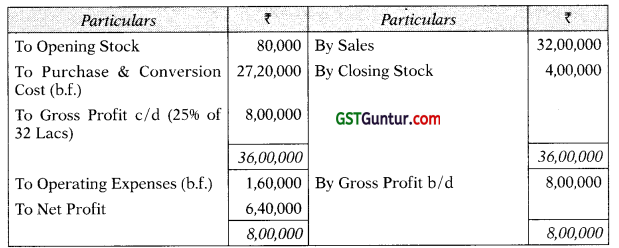

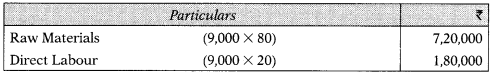

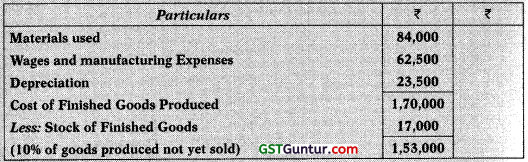

Question 21.

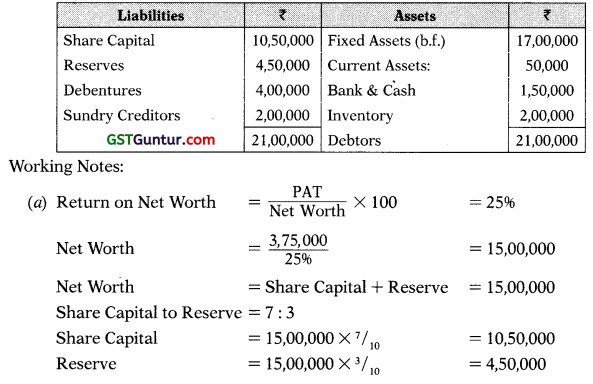

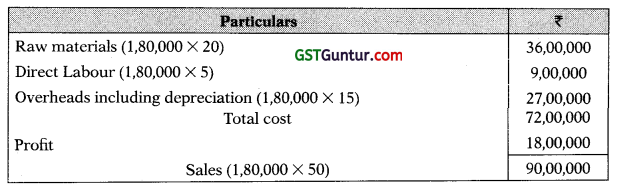

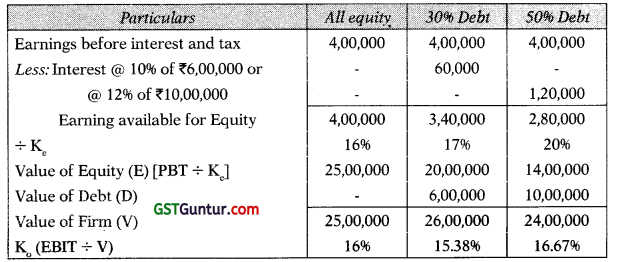

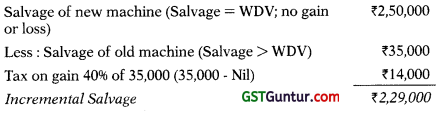

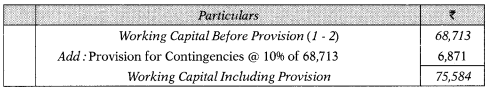

Black Limited has furnished the following cost sheet:

Factory overheads includes depreciation of ₹ 15 per unit at budgeted level of activity

Additional Information:

- Average raw material in stock : 3 weeks

- Average work-in-progress : 2 weeks

(% of completion with respect to Materials 75% and Labour and Overhead 70%) - Finished goods in stock : 4 weeks

- Credit allowed to debtors : 2.5 weeks

- Credit allowed by creditors : 3.5 weeks

- Time lag in payment of labour : 2 weeks

- Time lag in payment of factory overheads : 1.5 weeks

- Company sells, 25% of the output against cash

- Cash in hand and bank is desired to be maintained ₹ 2,25,000

- Provision for contingencies is required @ 4% of working capital requirement including that provision.

You may assume that production is carried on evenly throughout the year and labour and factory overheads accrue similarly.

You are required to prepare a statement showing estimate of working capital needed to finance a budgeted activity level of 1,04,000 units of production. Finished stock, debtors and overheads are taken at cash cost. (8 Marks May 2014)

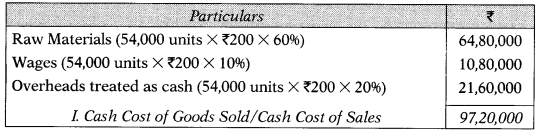

Answer:

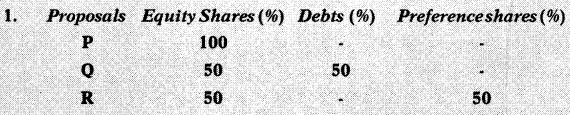

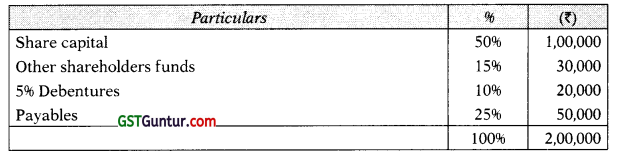

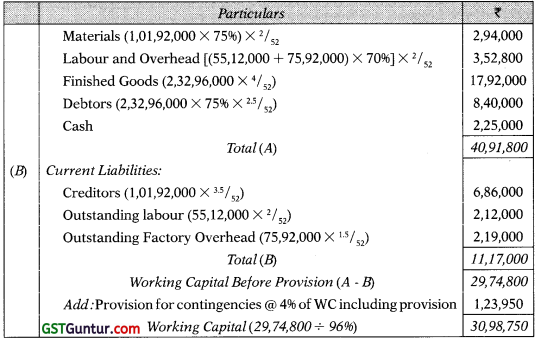

Statement of Working Capital Requirement (Cash Cost Basis)

Working Notes:

Projected Income Statement (Production of 1,04,000 units)

![]()

Question 22.

PQ Limited wants to expand its business and has applied for a loan from a commercial bank for its growing financial requirements. The re cords of the company reveals that the company sells goods in the domestic market at a gross profit of 25% not counting depreciation as part of the cost of goods sold.

The following additional information is also available for you:

Home at one month’s credit : ₹ 1,20,00,000

Export at three month’s credit : ₹ 54,00,000

(Sales price 10% below’ Home price)

Material used (suppliers extend two months’ credit) : ₹ 45,00,000

Wages paid month in arrear : ₹ 36,00,000

Manufacturing expenses (cash) paid (1 month in arrear) : ₹ 54,00,000

Administrative expenses paid 1 month in arrear : ₹ 12,00,000

Income tax payable in four instalments (of which one falls in the next financial year) : ₹ 15,00,000

The company keeps one month’s stock of raw materials and finished goods (each) and believes in keeping ₹ 10,00,000 available to it including the over draft limit of ₹ 5,00,000 not yet utilized by the company. Assume a 15% margin for contingencies.

You are required to ascertain the requirement of the working capital of the company. (8 Marks May 2017)

Answer:

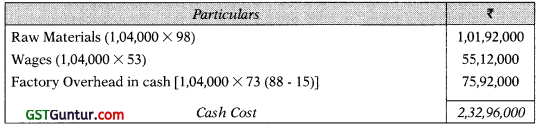

Statement of Working Capital Requirement (Cash Cost Basis)

Working Notes:

(A) Calculation of Cash cost of Debtors:

Export sales (10% below home sales price) = 54,00,000

Export sales equivalent to home sales = 54,00,000 × \(\frac{100}{90}\)

= 60,00,000

Total equivalent home sales = 1,20,00,000 + 60,00,000

= 1,80,00,000

Apportionment of cash cost of COGS and administrative expenses in proportion of equivalent home sales between Home and Foreign Sales:

Home sales = 1,47,00,000 × \(\frac{1,20,00,000}{1,80,00,000}\) = 98,00,000

Foreign sales = 1,47,00,000 × \(\frac{60,00,000}{1,80,00,000}\) = 49,00,000

(B) Projected Income Statement

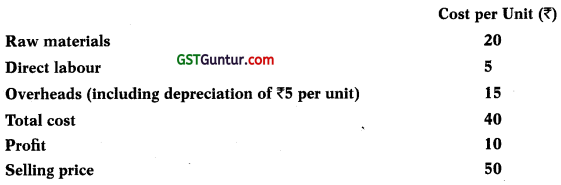

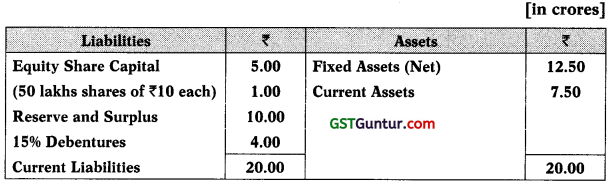

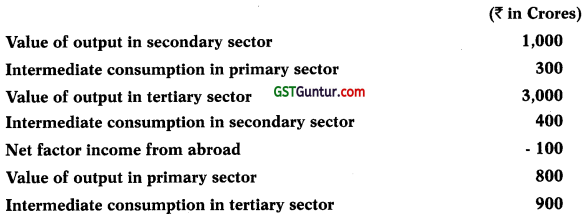

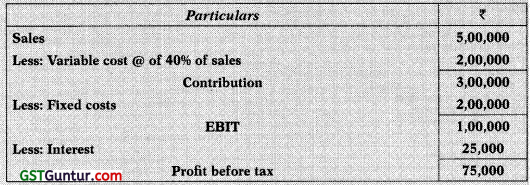

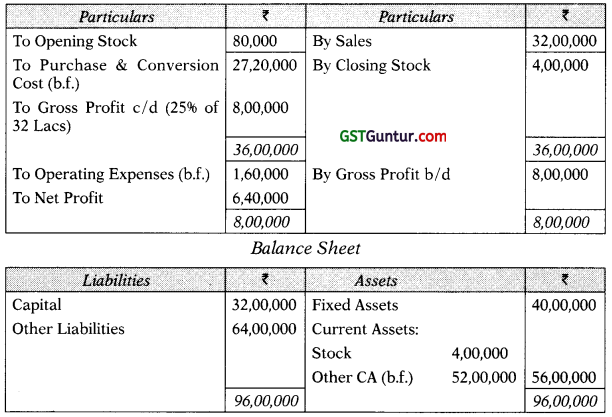

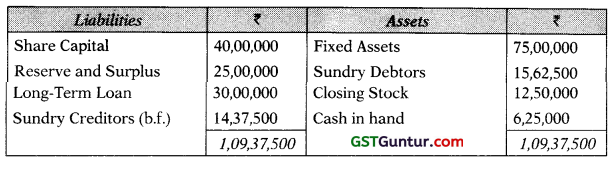

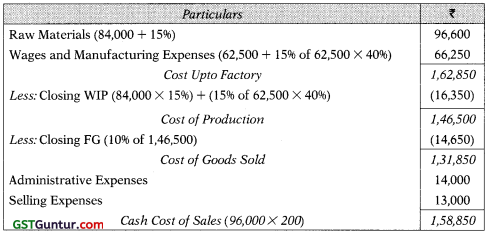

Question 23.

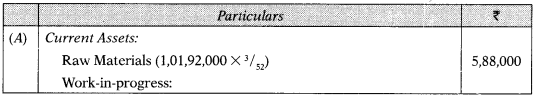

Day Ltd., a newly formed company has applied to the Private bank for the first time for financing its working capital requirements.

The following information is available about the projection for the current year:

Estimated level of activity : Completed units of production 31,200 units Plus units of WIP 12,000

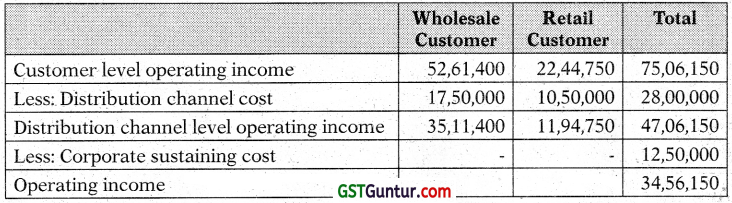

Raw material cost : ₹ 40 per unit

Direct wages cost : ₹ 15 per unit

Overhead : ₹ 40 per unit

(Inclusive Depreciation ₹ 10 per unit)

Selling Price : ₹ 130

Raw material in stock : Average 30 days consumption

work in progress stock : Material 100% and conversion cost 50%

Finished goods stock : 24,000 units

Credit allowed by suppliers : 30 days

Credit allowed to purchasers : 60 days

Direct wages (lag in payment) : 15 days

Expected cash balance : ₹ 2,00,000

Assume that production is carried on evenly throughout the year (360 days) and w’ages and overhead accrue similarly. All sales are on credit basis.

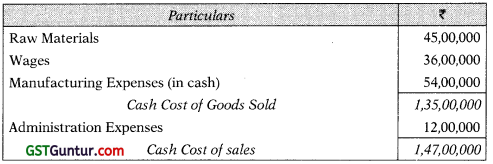

You are required to calculate the Net Working Capital requirement on Cash Cost Basis. (10 Marks May 2018)

Answer:

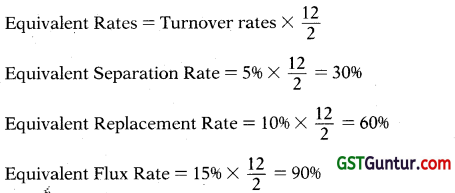

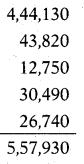

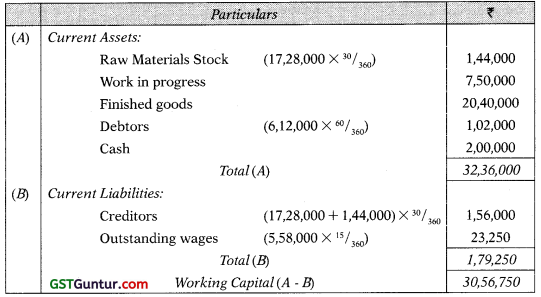

Statement of Working Capital Requirement

Projected Cost of Goods Sold

![]()

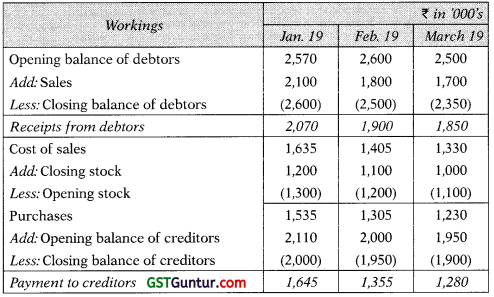

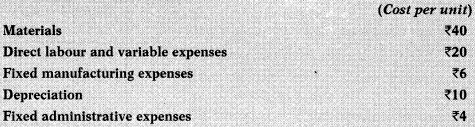

Question 24.

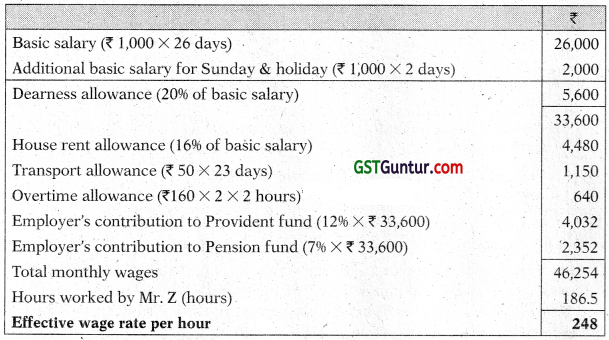

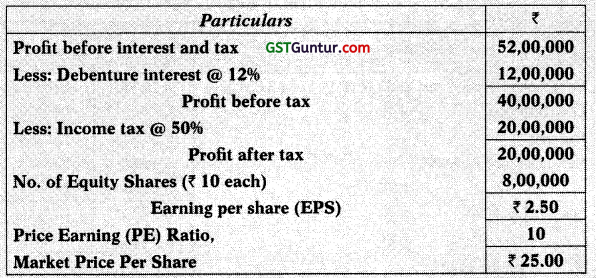

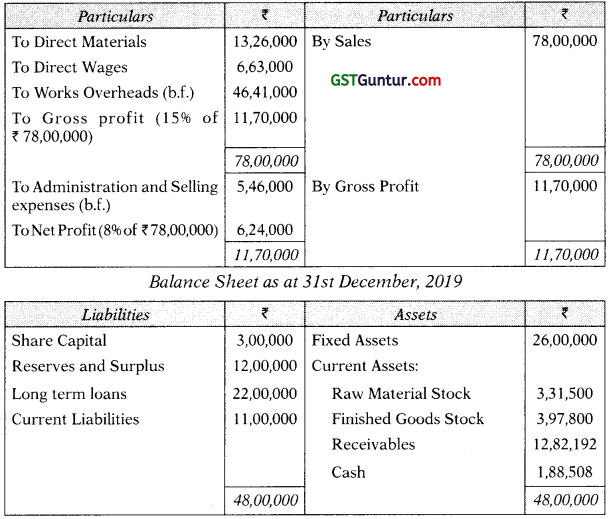

PK Ltd. a manufacturing company, provides the following information:

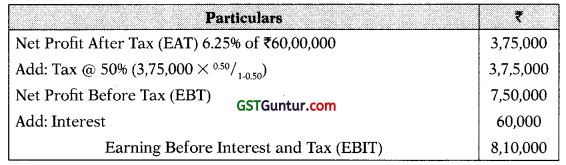

| Particulars | ₹ |

| Sales | 1,08,00,000 |

| Raw material consumed | 27,00,000 |

| Labour paid | 21.60.000 |

| Manufacturing overhead (including depreciation for the year ₹ 3,60.000) |

32,40,000 |

| Administrative and Selling overheads | 10,80,000 |

Additional information:

(a) Receivables are allowed 3 months’ credit.

(b) Raw material supplier extends 3 months’ credit.

(c) Lag in payment of labour is 1 month.

(d) Manufacturing overheads are paid one month in arrear.

(e) Administrative and Selling overhead is paid 1 month advance.

(f) Inventory holding period of raw material and finished goods are of 3 months.

(g) Work-in-progress is Nil.

(h) PK Ltd. sells goods at cost plus 33 1/3%.

(i) Cash balance ₹ 3,00,000.

(j) Safely margin 10%.

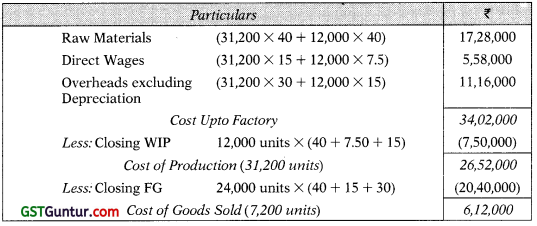

You are required to compute the working capital requirements of PK Ltd. on cash cost basis. (10 Marks Nov. 2020)

Answer:

Statement of Working Capital Requirement (Cash Cost Basis)

Working Notes:

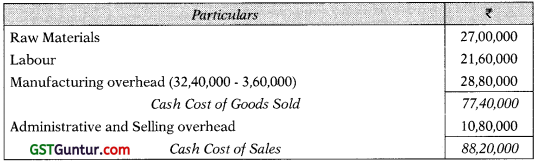

Projected Income Statement (Cash Cost Basis)

Components Wise Estimation Method (Total Approach)

Question 25.

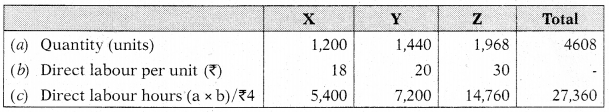

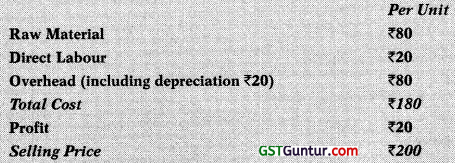

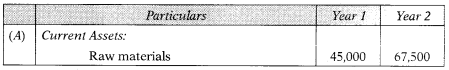

Bita Limited manufactures a product used in the steel industry. The following information regarding the company is given for your consideration:

- The cost structure for Bita Limited’s product is as follows:

- Expected level of production 9,000 units per annum.

- Raw materials are expected to remain in stores for an average of two months before issue to production.

- Work-in-progress (50% complete as to conversion cost) will approxi-mately to 1/2 month’s production.

- Finished goods remain in warehouse on an average for one month.

- Credit allowed by supplier is one month.

- Two month’s credit is normally allowed to debtors.

- A minimum cash balance of ₹ 67,500 is expected to be maintained.

- Cash sales are 75% less than the credit sales.

- Safety margin of 20% to cover unforeseen contingencies.

- The production pattern is assumed to be even during the year.

You are required to estimate the working capital requirement of Bita Limited. (10 Marks May 2019)

Answer:

Statement of Working Capital Requirement

Working Notes:

1. Projected Income Statement (Production of 9,000 units)

2. Proportion between cash and credit sales:

Let Credit sales be x then cash sales will be 0.25 × (x – 75%)

Cash Sales : Credit Sales = x :.25x = 1 :.25 = 4:1

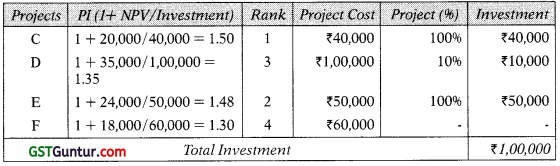

Important Questions

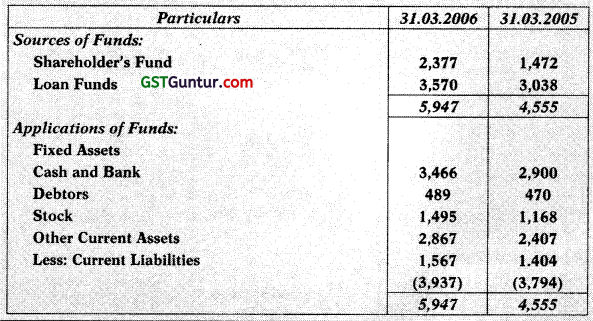

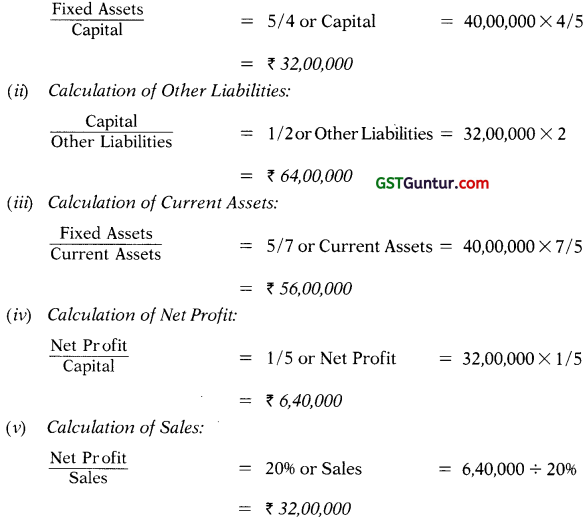

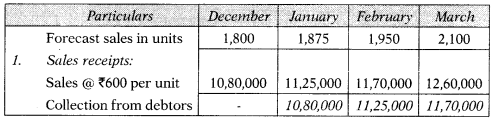

Question 1.

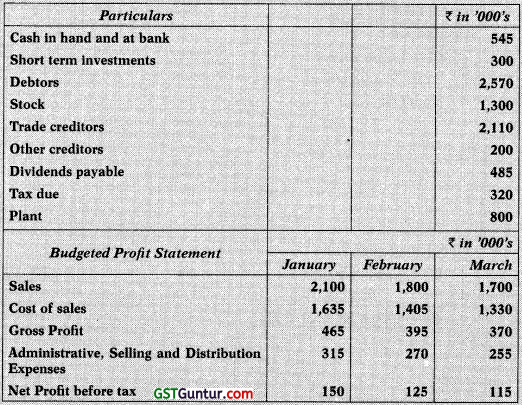

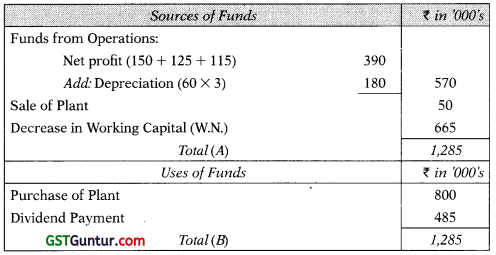

From the following information relating to a departmental store, you are required to prepare for the three months ending 31st March, 2019:

(a) Month-wise cash budget on receipts and payments basis; and

(b) Statement of Sources and uses of funds for the three months period.

It is anticipated that the working capital at 1st January, 2019 will be as follows:

Depreciation amount to ₹ 60,000 is included in the budgeted expenditure for each month.

Answer:

(a) Cash Budget

(3 months ending 31st March, 2019)

Calculation of receipts from debtors and payment to creditors:

(b) Statement of Sources and uses of Funds (3 months ending 31st March, 2019)

Statement of Changes in Working Capital

![]()

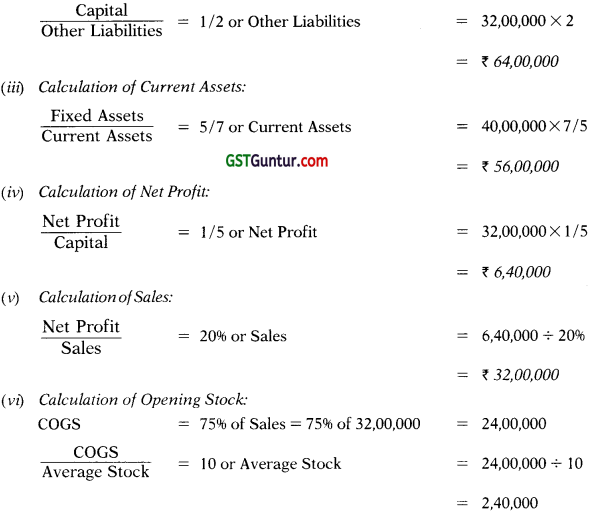

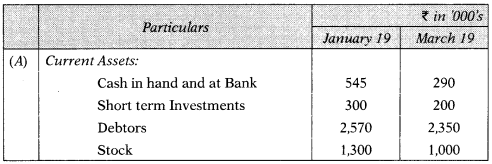

Question 2.

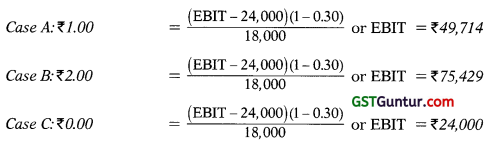

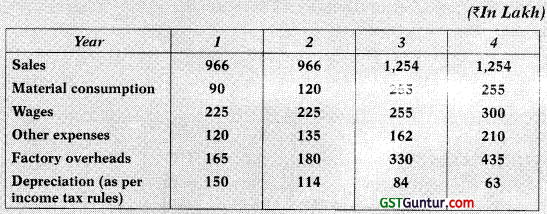

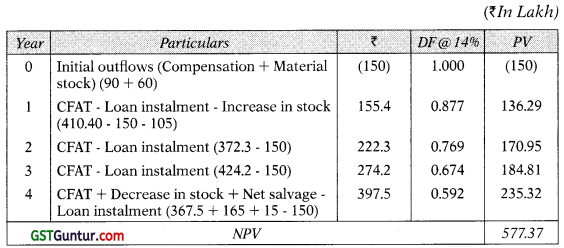

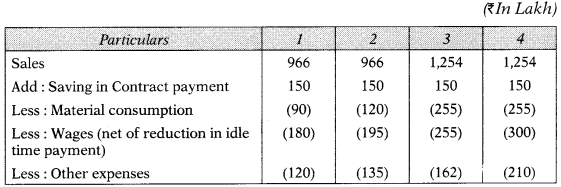

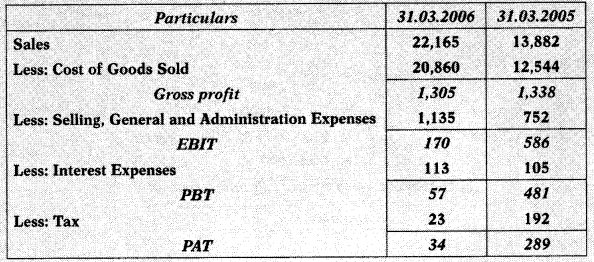

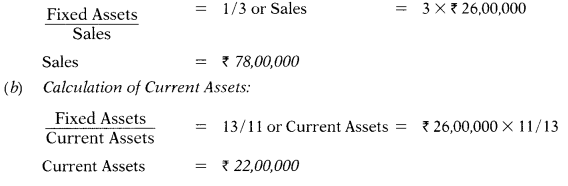

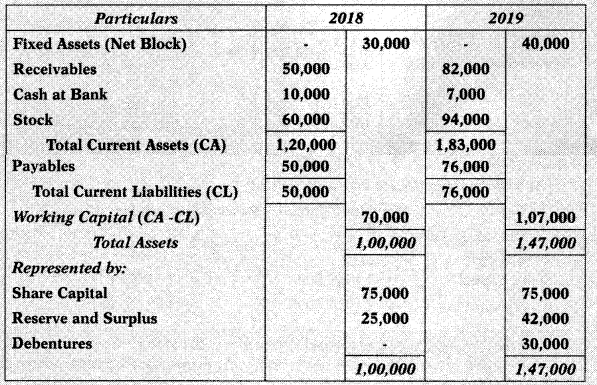

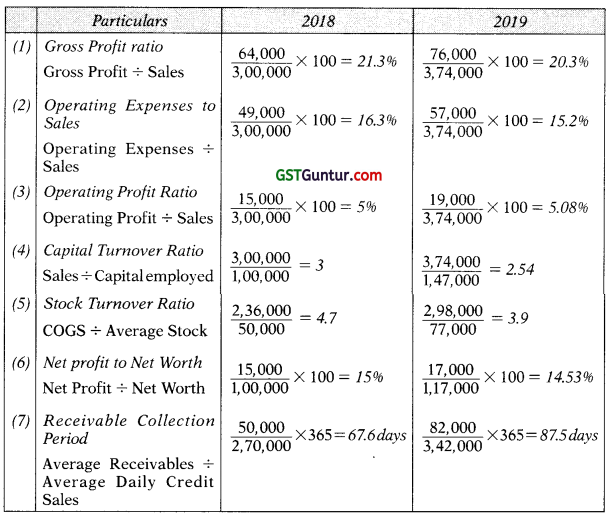

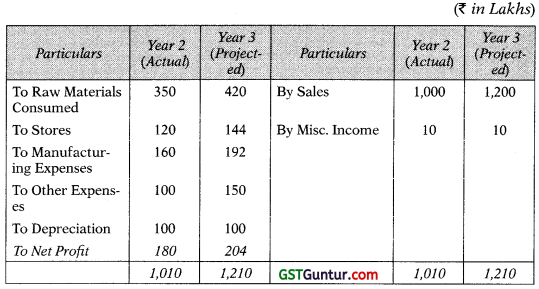

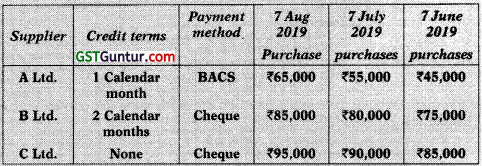

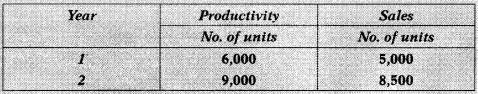

You are given below the Profit & Loss Accounts for two years for a company:

Sales are expected to be ₹ 12,00,00,000 in year 3.

As a result, other expenses will increase by ₹ 50,00,000 besides other charges. Only raw materials are in stock. Assume sales and purchases are in cash terms and the closing stock is expected to go up by the same amount as between years 1 and 2. You may assume that no dividend is being paid. The Company can use 75% of the cash generated to service a loan.

Compute how much cash from operations will be available in year 3 for the purpose? Ignore income tax.

Answer:

Projected Profit and Loss Account for the year 3 (₹ in Lakhs)

Cash Flow:

Available for servicing the loan: 75% of ₹ 2,54,00,000 or ₹ 1,90,50,000

Working Notes:

(a) Material consumed in year 2 = ₹ 350 Lakhs ÷ ₹ 1,000 lakhs

= 35% of sales

Likely consumption in year 3 = ₹ 1,200 Lakhs × 35%

= ₹ 420 Lakhs

(b) Stores are 12% of sales, as in year 2

(c) Manufacturing expenses are 16% of sales

Note: The above also shows how a projected profit and loss account is prepared

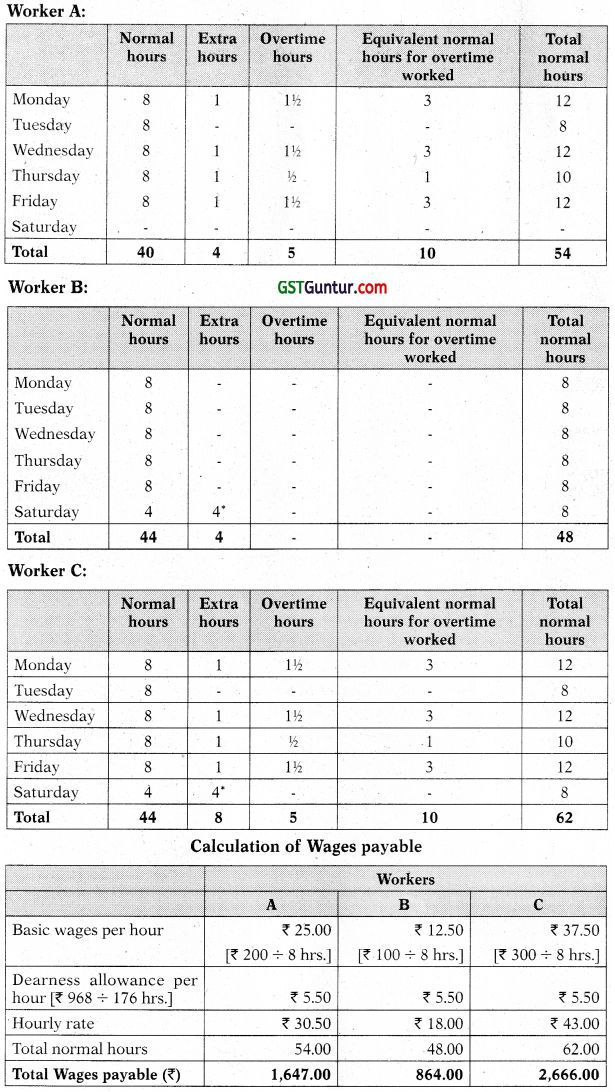

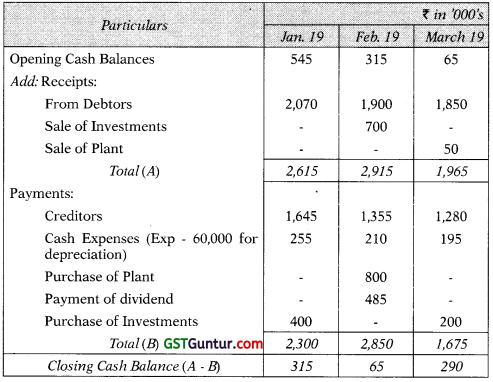

Question 3.

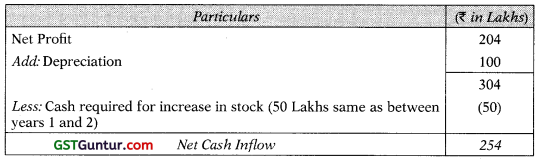

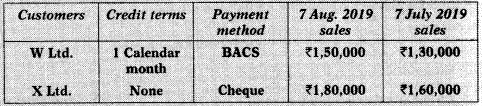

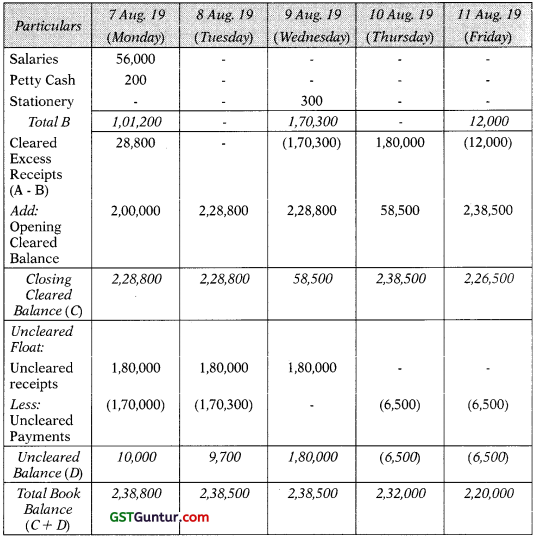

Prachi Ltd. is a manufacturing company producing and selling a range of cleaning products to wholesale customers. It has three suppliers and two customers. Prachi Ltd. relies on its cleared funds forecast to manage its cash.

You are an accounting technician for the company and have been asked to prepare a cleared funds forecast for the period Monday 7 August to Friday 11 August 2019 inclusive. You have been provided with the following infor-mation:

(1) Receipts from customers

(а) Receipt of money by BAGS (Bankers’ Automated Clearing Services) is instantaneous.

(b) X Ltd.’s cheque will be paid into Prachi Ltd’s bank account on the same day as the sale is made and will clear on the third day following this (excluding day of payment).

(2) Payments to suppliers

(a) Prachi Ltd. has set up a standing order for ₹ 45,000 a month to pay for supplies from A Ltd. This will leave Prachi’s bank account on 7 August.

Every few months, an adjustment is made to reflect the actual cost of supplies purchased (you do not need to make this adjustment).

(b) Prachi Ltd will send out, by post, cheques to B Ltd. and C Ltd. on 7 August. The amounts will leave its bank account on the second day following this (excluding the day of posting).

(3) Wages and salaries

| July 2019 | August 2019 | |

| Weekly wages

Monthly salaries |

₹ 12,000

₹56,000 |

₹ 13,000

₹59,000 |

(a) Factory workers are paid cash wages (weekly). They will be paid one week’s wages, on 11 August, for the last week’s work done in July (i.e. they work a week in hand).

(b) All the office w’orkers are paid salaries (monthly) by BACS. Salaries for July will be paid on 7 August.

(4) Other miscellaneous payments

(a) Every Monday morning, the petty cashier withdraws ₹ 200 from the company bank account for the petty cash. The money leaves Prachi’s bank account straight away.

(b) The room cleaner is paid ₹ 30 from petty cash every Wednesday morning.

(c) Office stationery will be ordered by telephone on Tuesday 8 August to the value of ₹ 300. This is paid for by company debit card. Such payments are generally seen to leave the company account on the next working day.

(d) Five new softwares will be ordered over the Internet on 10 August at a total cost of ₹ 6,500. A cheque will be sent out on the same day. The amount will leave Prachi Ltd’s bank account on the second day following this (excluding the day of posting).

(5) Other informatian

The balance on Prachi’s bank account will be ₹ 200,000 on 7 August 2019. This represents both the book balance and the cleared funds.

Prepare a cleared funds forecast for the period Monday 7 August to Friday 11 August 2019 inclusive using the information provided. Show clearly the uncleared funds float each day.

Answer:

Clear Fund Forecast

Note : ₹ 1,70,000 Cheque to B Ltd. for ₹ 75,000 ánd Cheque to C Ltd. for ₹ 95,000.

![]()

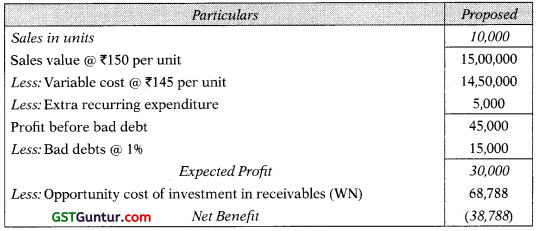

Question 4.

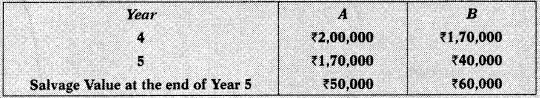

Slow Payers are regular customer of Goods Dealers Ltd., Calcutta and have approached the sellers of extension of a credit facility for enabling them to purchase goods from Goods Dealer Ltd. On an analysis of past per-formance and on the basis of information supplied, the following pattern of payment schedule is regard to Slow Payers:

Slow Payers want to enter Into a firm commitment for purchase of goods of ₹ 15 Lacs in 2017, deliveries to be made in equal quantities on the first day of each quarter in the calendar year.

The price per unit of commodity is ₹ 150 on which a profit of ₹ 5 per unit is expected to be made. It is anticipated by Goods Dealers Ltd. that taking up of this contract would mean an extra recurring expenditure of ₹ 5,000 per annum.

If the opportunity cost of funds in the hands of Goods dealers is 24% per annum, would you as the finance manager of the seller recommend the grant of credit to Slow Payers? Workings should form part of your answer. Assume year of 365 days,

Answer:

Statement of Evaluation of Credit Policy

Recommendation: The proposed policy should not be adopted since the net benefit under this policy is negative.

Working notes:

Calculation of Average collection period’:

Average collection period = 30 days × 15% + 60 days × 34% + 90 days × 30% + 100 days × 20% = 71.90 Days

Question 5.

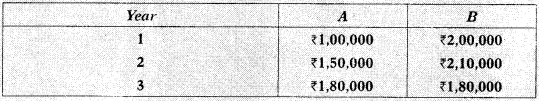

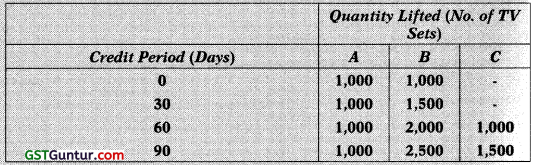

Star Limited manufacturer of color TV seta, are considering the liberalization of existing credit terms to three of their large customers A B and C. The credit period and likely quantity of TV sets that will be lifted by the customers are as follows:

The selling price per TV set is ₹ 9,000. The expected contribution is 20% of the selling price. The cost of carrying debtors averages 20% per annum.

You are required:

(a) Determine the credit period to be allowed to each customer. (Assume 360 days in a year for calculation purposes).

(b) What other problems the company might face in allowing the credit period as determined in (a) above?

Answer:

(a) Determination of credit period to be allowed to customers A, B and C. In case of customer A there will be constant sales irrespective of the credit period allowed. Hence, it is suggested not to extend any credit period to customer A. The only analysis to be made about the profitability of extending different credit periods with different sales levels.

Analysis:

(a) It is suggested to allow credit period upto 90 days to both customers B and C.

(b) By giving credit period of 90 days to customers B and C and no credit allowed to customer A may cause to stop purchase T. V. sets from the company by customer A.

Question 6.

The Dolce Company purchases raw materials on terms of 2/10, net 30. A review of the company’s records by the owner, Mr. Gautam, revealed that payments are usually made 15 days after purchases are made. When asked why the firm did not take advantage of its discounts, the accountant, Mr. Rohit, replied that it cost only 2 percent for these funds, whereas a bank loan would cost the company 12 percent.

(a) Analyse, what mistake is Rohit making?

(b) If the firm could not borrow from the bank and was forced to resort to the use of trade credit funds, what suggestion might be made to Rohit that would reduce the annual interest cost? Identify.

Answer:

(a) Rohit is confusing the percentage cost of using funds for 5 days with the cost of using funds for a year. These costs are clearly not comparable. One must be converted to the time scale of the other.

Real cost of not taking advantage of discount is = \(\frac{2}{98}\) × \(\frac{365}{5}\) × 100 = 148.98%

(b) Assuming that the firm has made the decision not to take the cash discount, it makes no sense to pay before the due date. In this case payment should be made after 30 days rather than 15 days and it would reduce the annual interest cost to 37.24 percent

= \(\frac{2}{98}\) × \(\frac{365}{5}\) × 100 = 37.24%

Question 7.

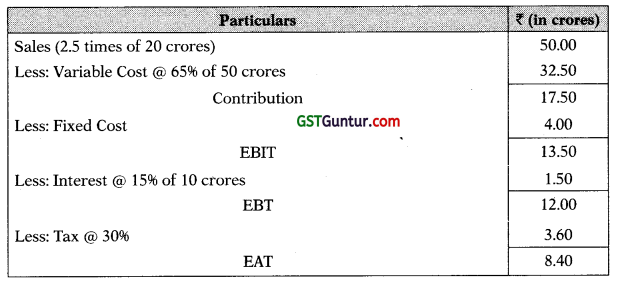

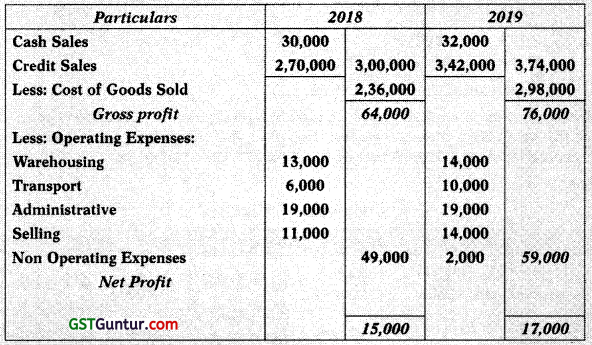

PQ Ltd. a company newly commencing business in 2020 has the under-mentioned projected P & L Account:

The figure given above relate only to finished goods and not to work-in-progress. Goods equal to 15% of the year’s production (in terms of physical units) will be in process on the average requiring full materials but only 40% of the other expenses. The company believes in keeping materials equal to two months consumption in stock.

All expenses will be paid one month in advance. Suppliers of materials will extend 1-1/2 months credit. Sales will be 20% for cash and rest at two months credit. 70% of the income tax will be paid in advance in quarterly instal-ments, The company wishes to keep ₹ 8,000 in cash. 10% has to be added to the estimated figure for unforeseen contingencies.

Prepare an estimate of working capital an cash cost basis.

Answer:

Statement of Working Capital Requirement

Working Notes:

Projected Income Statement

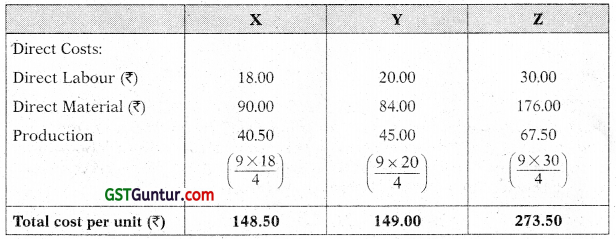

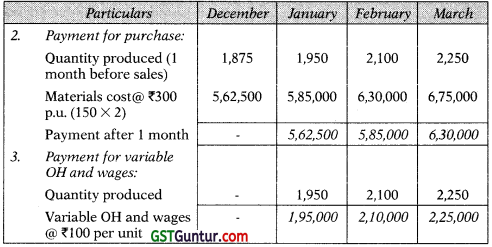

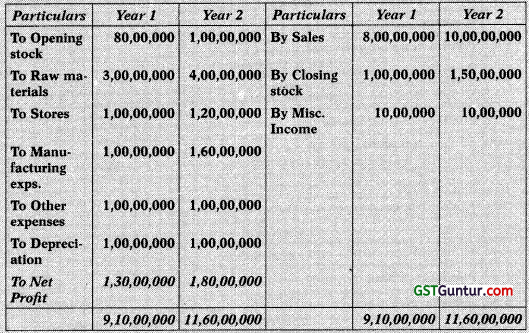

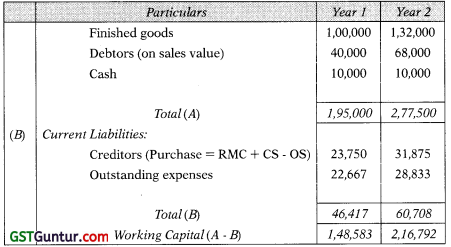

Question 8.

M.A. Limited is commencing a new project of a plastic component. The following cost information has been ascertained for annual production of 12,000 units which is the full capacity.

The selling price per unit is expected to be ₹ 96 and the selling expenses ₹ 5 per unit 80% of which is variable. In the first two years of operation, produc tivity and sales are expected to be as follows:

To assess the working capital requirement, the following additional information is available:

(a) Stock of Materials : 2.25 months average

(6) Work-in-Progress : Nil

(c) Debtors : 1 month’s average sales

(d) Cash balance : ₹ 10,000

(e) Creditors for supply of materials : 1 month’s average purchase

(f) Creditors for expenses : 1 month average of all expenses

You may make any relevant assumption. Prepare for two years:

(I) Projected Statement of Profit and Loss (ignoring taxation) and

(II) Projected Statement of working capital requirements.

Answer:

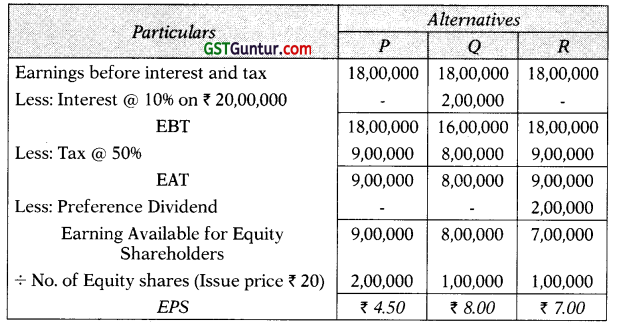

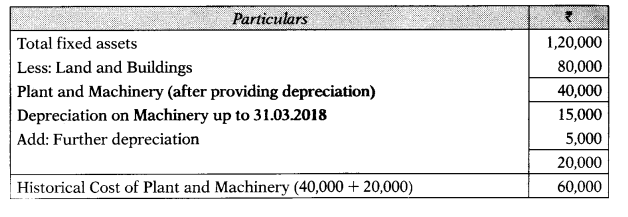

(I) PS Limited

Projected Statement of Profit and Loss

(II) Projected Statement of Working Capital Requirement

![]()

Question 9.

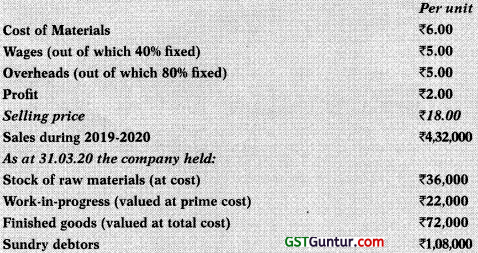

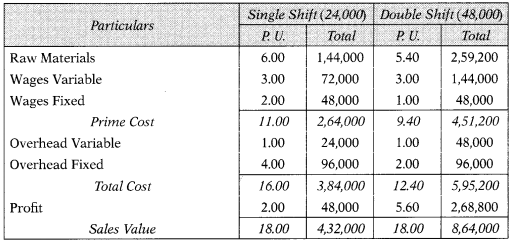

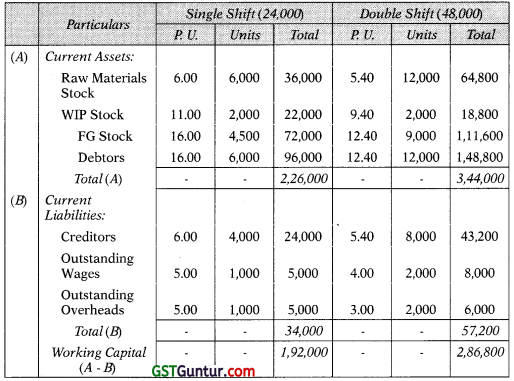

Samreen Enterprises has been operating its manufacturing facilities till 31.03.2020 on a single shift working with the following cost structure:

In view of increased market demand, it is proposed to double production by working an extra shift. It is expected that a 10% discount will be available from suppliers of raw materials in view of increased volume of business. Selling price will remain the same.

The credit period allowed to customers will remain unaltered. Credit availed of from suppliers will continue to remain at the present level i.e. 2 months. Lag in payment of wages and expenses will continue to remain half a month.

You are required to assess the additional working capital requirement, if the policy to increase output is implemented.

Answer:

Statement of Cost at Single Shift and Double Shift Working

Statement of Working Capital for Single Shift and Double Shift Working

Increase in working capital requirement is ₹94,800 (₹2,86,800 – ₹1,92,000).

Notes:

- The quantity of material in process will not change due to double shift working since work started in the first shift will be completed in the second shift.

- It is given in the question that the WIP is valued at prime cost hence, it is assumed that the WIP is 100 complete in respect of material and labour.

- In absence of any information on proportion of credit sales to total sales, debtors quantity has been doubled for double shift.

- It is assumed that all purchases are on credit.

- The valuation of work-in-progress based on prime cost as per the policy of the company.