Unit and Batch Costing – CA Inter Cost and Management Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Unit and Batch Costing – CA Inter Costing Study Material

Unit Costing: It is used where the output produced is identical and each unit of output require identical cost.

Cost per unit = \(\frac{\text { Total Production Cost }}{\text { No. of units produced }}\)

Batch Costing: It is a type of specific order costing where articles are manufactured in pre-determined lots, known as batch.

Economic Batch quantity: It is the size of a batch where total cost of set-up and holding costs are at minimum.

Theory Questions

Question 1.

Explain ‘Job Costing’ and ‘Batch Costing’. [CA Inter May 2Q01, May 2018, 5 Maris]

Answer:

Job costing: Job costing is the category’ of basic costing methods which is applicable where the work consists of separate contracts, jobs or batches, each of which is authorised by specific order or contract. According to this method, costs are collected and accumulated according to jobs, contracts, products or work orders. Each job or unit of production is treated as a separate entity for the purpose of costing. Job costing is carried out for the purpose of ascertaining cost of each job and takes into account the cost of materials, employees and overhead etc.

Batch Costing: Batch Costing is a type of specific order costing where articles are manufactured in predetermined lots, known as batch. Under this costing method, the cost object for cost determination is a batch for production rather output as seen in unit costing method. A batch consists of certain number of units which are processed simultaneously to be for manufacturing operation. Under this method of manufacturing, the inputs are accumulated in the assembly line till it reaches minimum batch size. Soon after a batch size is reached, all inputs in a batch is processed for further operations.

![]()

Question 2.

Discuss the concept of Economic Batch Quantity (EBQ). [CA Inter May 2000, 2 Marks]

Answer:

Economic batch quantity is the size of a batch where total cost of set-up and holding costs are at minimum.

Since, the product is produced in batches or lots, the lot size chosen will be critical in achieving least cost of operation. If the lot size is higher, the set up cost may decline due to lesser number of set ups required; but units in inventory will go up leading to higher holding costs. If the lot size is lower, lower inventory holding costs are accomplished but only with higher set up costs.

The objective of Economic Batch Quantity (EBQ) is to determine the production lot (Batch size) that optimizes on both set up and inventory holding costs.

Question 3.

In Batch Costing, how is Economic Batch Quantity determined? [CA Inter May 2001, 3 Marks]

Answer:

The Economic Batch Quantity may be determined by calculating the total cost for a series of possible batch sizes and checking which batch size gives the minimum cost.

The mathematical formula usually used for its determination is as follows:

EBQ = \(\sqrt{\frac{2 \mathrm{DS}}{\mathrm{C}}}\)

Where,

D = Annual demand for the product .

S = Setting up cost per batch

C = Carrying cost per unit of production

The objective here being to determine the production lot (Batch size) that optimizes on both set up and inventory holding cots formula.

Question 4.

Differentiate between Job costing and hatch costing. Name three such industries where these are used. [CA Inter May 20f 9, May 2006, Nov. 2004 4 Marks]

Answer:

According to job costing, costs are collected and accumulated according to job. Each job or unit of production is treated as a separate entity for the purpose of costing. Job costing may be employed when jobs are executed for different customers according to their specification.

Industries where job costing is used are printing, furniture, hardware, ship building, heavy machinery, interior decoration, repairs similar other work.

On the other hand, batch costing is a form of job costing, a lot of similar units which comprises the batch may be used as a cost unit for ascertaining cost.

Such a method of costing is used in case of pharmaceutical industry, readymade garments, industries manufacturing parts of TV, radio sets, etc.

Question 5.

Describe unit costing and batch costing giving examples of industries where these are used. [ICAI Module]

Answer:

Unit Costing: It is the method of costing where the output produced is identical and each unit of output requires identical cost. It is also known as single or output costing, but these are sub-division of unit costing method. This method of costing is followed by industries which produce single output or few variants of a single output.

Under this method costs, are collected and analysed element wise and then total cost per unit is ascertained by dividing the total cost with the number of units produced.

Examples of industries: Paper, cement, steel works, mining, breweries etc.

Batch Costing: It is a type of specific order costing where articles are manufactured in predetermined lots, known as batch. Under this method, the cost object for cost determination is a batch for production rather output as seen in unit costing method. A batch consists of certain number of units which are processed simultaneously to be for manufacturing operation.

Examples of industries: Biscuit manufacture, toy making, spare parts manufacture, ready-made garments, etc.

![]()

Practical Questions

Economic Batch Quantity (EBQ)

Question 1.

A Ltd. manufactures mother boards used in smart phones. A smart phone requires one mother board. As per the study conducted by the Indian Cellular Association, there will be a demand of 180 million smart phones in the coming year. A Ltd. is expected to have a market share of 5.5% of the total market demand of the mother boards in the coming year. It is estimated that it costs ₹ 6.25 as inventory holding cost per board per month and that the set-up cost per run of board manufacture is ₹ 33,500.

(i) COMPUTE the optimum run size for board manufacturing?

(ii) Assuming that the company has a policy of manufacturing 80,000 boards per run, CALCULATE how much extra costs the company would be incurring as compared to the optimum run suggested in (1) above? [CA Inter Nov. 2020, RTP]

Answer:

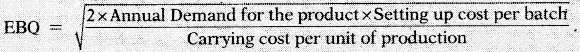

(i) Computation of optimum run size

D = Annual demand i.e. 5.5% of 18,00,00,000 = 99,00,000 units

S = Set-up cost per run = ₹ 33,500

C = Inventory holding cost per unit per annum = ₹ 6.25 × 12 months = ₹ 75

Optimum run size or Economic Batch Quantity (EBQ) = \(\sqrt{\frac{2 \mathrm{DS}}{\mathrm{C}}}\)

EBQ = \(\sqrt{\frac{2 \times 99,00,000 \times ₹ 33,500}{₹ 75}}\) = 99,0425 units or 99,043 units

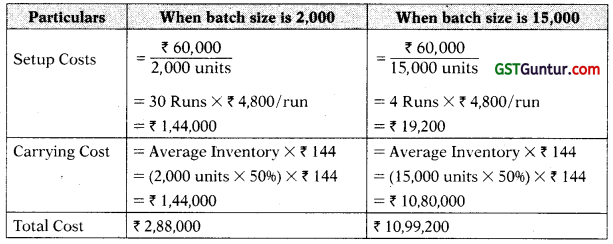

(ii) Calculation of Total Cost of set-up and inventory holding

Question 2.

XYZ Ltd. has obtained an order to supply 48,000 bearings per year from a concern. On a steady basis, it is estimated that it costs ₹ 0.20 as inventory holding cost per bearing per month and the set-up cost per run of bearing manufacture is ₹ 384.

You are required to:

(i) Compute the optimum run size and number of runs for bearing manufacture.

(ii) Compute the interval between two consecutive runs.

(iii) Find out the extra costs to be incurred, if company adopts a policy to manufacture 8,000 bearings per run as compared to optimum run size.

(iv) Give your opinion regarding run size of bearing manufacture.

Assume 365 days in a year. [CA Inter Nov. 2018,10 Marks]

Answer:

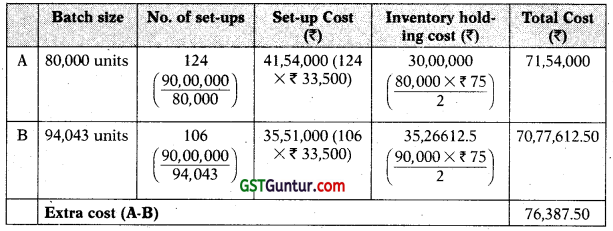

D = Annual demand = 48,000 units

S = Set-up cost per run = ₹ 384

C = Inventory holding cost per unit per annum = ₹ 0.2 × 12 months ₹ 2.40

(i) Calculation of Optimum batch size or Economic Batch Quantity (EBQ):

Number of optimum runs = 48,000 ÷ 3919 = 12.245 runs or 13 run

(ii) Interval between 2 runs (in days) = 365 days ÷ 13 = 28 days Or, 365 days ÷ 12.245 = 29.80 days

(iii) Extra Costs to be incurred if company manufactures 8,000 bearings as compared to optimum run size

| When run size is 3,920 bearings | When run size is 8,600 bearings | |

| Annual Requirement | 48,000 | 48,000 |

| Run Size | 3,920 | 8,000 |

| No. of runs | 12.245 (48,000 + 3,920) | 6 (48,000 ÷ 8,000) |

| Set up cost per run | ₹ 384 | ₹ 384 |

| Total set up cost | ₹ 4,702 (₹ 384 × 12.245) | ₹ 2,304 (₹ 384 × 6) |

| Average inventory | 1,960 | 4,000 |

| Inventory holding cost per unit p.a. | ₹ 2.4 | ₹ 2.4 |

| Total inventory holding cost | ₹ 4,704 (1,960 × ₹ 2:4) | ₹ 9,600 (4,000 × ₹ 2.4) |

| Total Cost | ₹ 9,406 | ₹ 11,904 |

Extra cost = ₹ 11,904 – ₹ 9,406 = ₹ 2,498

(iv) The company should run at optimum batch size i.e. 3,920 bearings, since it saves them cost of ₹ 2,498. Run size should match with the economic production run of bearing manufacture. In making decision relating to the number of units to be produced in each production run, the cost of setting up and inventory holding costs should be considered.

![]()

Question 3.

GHI Ltd. manufactures ‘Stent’ that is used by hospitals in heart surgery. As per the estimates provided by Pharmaceutical Industry Bureau, there will he a demand of 40 Million ‘Stents’ in the coming year. GHI Ltd. is expected have a market share of 2.5% of the total market demand of the Stents in the coming year. It is estimated that it costs ₹ 1.50 as inventory holding cost per stent per month and that the set-up cost per ran of stent manufacture is ₹ 225.

Required:

(i) What would be the optimum run size for Stent manufacture?

(ii) What is the minimum inventory holding cost?

(iii) Assuming that the company has a policy of manufacturing 4,000 stents per run, how much extra costs the company would be incurring as compared to the optimum run suggested in (i) above? [CA Inter Jan. 2021, 5 Marks]

Answer:

D = Annual demand = 4,00,00,000 units ₹ 2.596 = 10,00,000 units .

S = Set-up cost per run = ₹ 225

C = Inventory holding cost per unit per annum

= ₹ 1.50 × 12 months = ₹ 18

(i) Calculation of Optimum Run size of ‘Stents’ or Economic Batch Quantity (EBQ):

EBQ = \(\sqrt{\frac{\text { 2DS }}{\mathrm{C}}}\)

= \(\sqrt{\frac{2 \times 10,00,000 \times ₹ 225}{₹ 18}}\) = 5,000 units

(ii) Minimum inventory holding cost

Minimum Inventory Cost = Average Inventory × Inventory Carrying

Cost per unit = (5,000 ÷ 2) × ₹ 18 = ₹ 45,000

(iii) Calculation of the extra cost due to manufacturing policy

| When run size is 4,000 units | When run size is 5,000 units i.e. at EBQ | |

| Total set up cost | ₹ 56,250 (\(\frac{10,00,000}{4,000}\) × ₹ 225) | ₹ 45,000 (\(\frac{10,00,000}{5,000}\) × ₹ 225) |

| Total Carrying cost | ₹ 36,000 (½ × 4,000 × ₹ 18) | ₹ 45,000 (½ × 5,000 × ₹ 18) |

| Total Cost | ₹ 92,250 | ₹ 90,000 |

Extra cost = ₹ 92,250 – ₹ 90,000 = ₹ 2,250

Question 4.

BTL LLP. manufactures glass bottles for HDL Ltd., a pharmaceutical company, which is in ayurvedic medicines business.

BTL can produce 2,00,000 bottles in a month. Set-up cost of each production run is ₹ 5,200 and the cost of holding one bottle for a year is ₹ 1.50.

As per an estimate HDL Ltd. can order as much as 19,00,000 bottles in a year spreading evenly throughout the year.

At present the BTL manufactures 1,60,000 bottles in a batch.

Required:

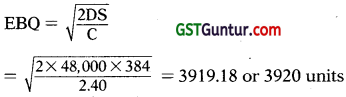

(i) Compute the Economic Batch Quantity for bottle production.

(ii) Compute the annual cost saving to BTL by adopting the EBQ of a production. [CA Inter Nov. 2019, RTP]

Answer:

Economic Batch Quantity (EBQ) = \(\sqrt{\frac{2 \times \mathrm{D} \times \mathrm{S}}{\mathrm{C}}}\)

Where, D = Annual demand for the product

S = Setting up cost per batch

C = Carrying cost per unit of production

(i) Computation of EBQ:

= \(\sqrt{\frac{2 \times ₹ 19,00,000 \times 5,200}{₹ 1.5}}\)

= 1,14,775 bottles

(ii) Computation of savings in cost by adopting EBQ:

![]()

Question 5.

AUX Ltd. has an Annual demand from a single customer for 60,000 COVID-19 vaccines. The customer prefers to order in the lot of 15,000 vaccines per order. The productions run of COVID-19 vaccine. The production cost of vaccine is ₹ 5,000 per vaccine. The set-up cost per production run of COVID-19 vaccines is ₹ 4,808. The carrying cost is ₹ 12 per vaccine per month.

You are required to;

(i) Find the most Economical Production Run.

(ii) Calculate the extra cost that Company incurs due to production of 15,000 vaccines in a batch. [CA Inter July 2021, S Marks]

Answer:

(i) Economical Production Run = \(\sqrt{\frac{2 \mathrm{DS}}{\mathrm{C}}}\)

= \(\sqrt{\frac{2 \times 60,000 \text { units } \times ₹ 4,800}{₹ 12 \times 12 \text { months }}}\)

= 2,000 units/Run

(ii)

Extra Cost incurred = ₹ 10,99,200 – ₹ 2,88,000

= ₹ 8,11,200

Batch Costing

Question 6.

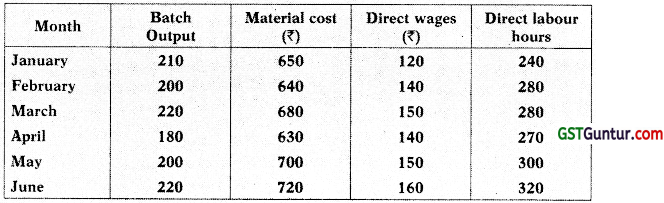

A jobbing factory has undertaken to supply 200 pieces of a component per month for the ensuing six months. Every month a batch order is opened against which materials and labour hours are booked at actual. Overheads are levied at a rate equal to per labour hour. The selling price contracted for is ₹ 8 per piece. From the following data calculate the cost and profit per piece of each batch order and overall position of the order for 1,200 pieces.

The other details are:

| Month | Overheads(₹) | Direct labour hours |

| January | 12,000 | 4,800 |

| February | 10,560 | 4,400 |

| March | 12,009 | 5,000 |

| April | 10,580 | 4,600 |

| May | 13,000 | 5,000 |

| June | 12,000 | 4,800 |

Answer:

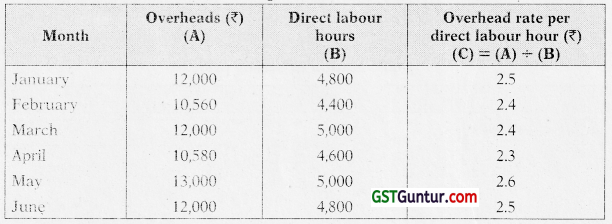

Calculation of overhead rate per direct labour hour for every month:

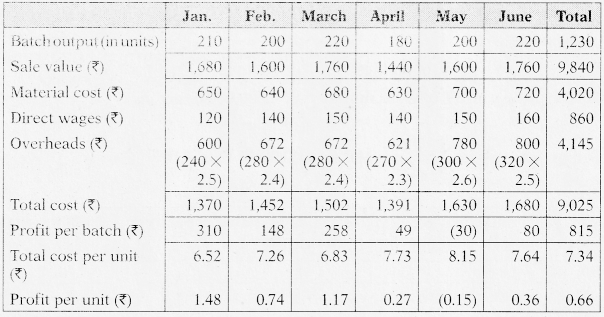

Calculation of cost and profit per piece of each batch:

Overall position of the order for 1,200 units

Sales value [1,200 units × ₹ 8 per unit] ₹ 9,600

Total cost [1,200 units × ₹ 7.34 per unit] ₹ 8,808

Profit ₹ 792

![]()

Calculating Unit Cost

Question 7.

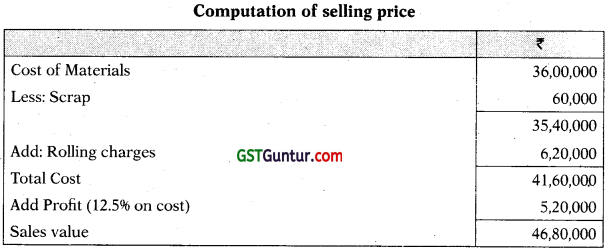

A re-roller produced 400 metric tons of M.S. bars spending ₹ 36,00,000 towards materials and ₹ 6,20,000 towards rolling charges. 10% of the output was found to be defective, which had to be sold at 10% less than the price for good production. If the sales realization should give the firm an Overall profit of 12.5% on cost, find the selling price per metric ton of both the categories of bare. The scrap arising during the rolling process fetched a realization of ₹ 60,000. [CA Inter Nov. 2005, 6 Marks]

Answer:

Computation of selling price

Output (effective) = 360 tonnes + 9/10 × 40 tons = 396 tons

Selling price per MT of good output = ₹ 48,00,000/396 tons

= ₹ 11,818.18

Selling price of defective per MT = 0.9 × ₹ 11,818.18

= ₹ 10,636.36

Question 8.

A Manufacturing Company has an installed capacity of 1,50,000 units per annum. Its cost structure is given below:

| ₹ | |

| (i) Variable cost per unit | |

| Materials | 10 |

| Labour (Subject to a minimum of ₹ 1,00,000 per month) | 10 |

| Overheads | 4 |

| (ii) Fixed overheads per annum | 1,92,300 |

| (iii) Semi-variable overheads per annum at 75% capacity | |

| (It will increase by ₹ 4,000 per annum for increase of every 5% of the capacity utilisation or any part thereof) | 60,000 |

The capacity utilisation for the next year Is budgeted at 75% for first three months, 80% for the next six months and 90% for the remaining three months.

Required: If the company is planning to have a profit of 20% on the selling price, calculate the selling price per unit for the next year. [CA Inter Nov. 2006, 10 Marks]

Answer:

Installed capacity 1,50,000 units per annum.

Per month capacity 1,50,000 ÷ 12 = 12,500 units

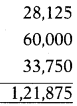

75% for 3 months (12,500 × 3 × 75%) = 28,125

80% for 6 months (12,500 × 6 × 80%) = 60,000

90% for 3 months (12,500 × 3 × 90%) = 33,750

Total production = 1,21,875

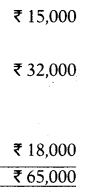

Labour cost:

Semi-variable costs:

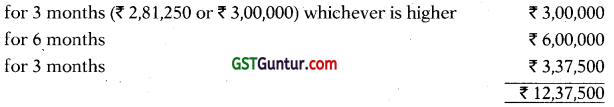

₹ 60,000 Per annum at 75% capacity utilisation i.e. ₹ 5,000 per month.

for first 3 months = ₹ 15,000

for next 6 months [₹ 5,000 × 6 + ₹ 2,000 (₹ 4,000 ÷ 12 × 6 months)] = ₹ 32,000

for next 3 months

[(₹ 5,000 × 3) + ₹ 3,000 (₹ 12,000 {i.e. ₹ 4,000 × 3} ÷ 12 × 3 months)] = ₹ 18,000

Calculation of selling price:

| ₹ | |

| Material (1,21,875 × ₹ 10) | 12,18,750.00 |

| Labour | 12,37,500.00 |

| Variable Overhead (1,21,875 × ₹ 4) | 4,87,500.00 |

| Fixed overhead | 1,92,300.00 |

| Semi- Variable overhead | 65,000.00 |

| 32,01,050.00 | |

| Add: Profit (20% on S.P.) (i.e. 25% on cost price) | 8,00,262.50 |

| Sales value | 40,01,312.50 |

Selling price per unit = ₹ 40,01,312.5/1,21,875 units = ₹ 32.83 per unit.