CS Professional Advanced Tax Laws Notes Study Material Important Questions

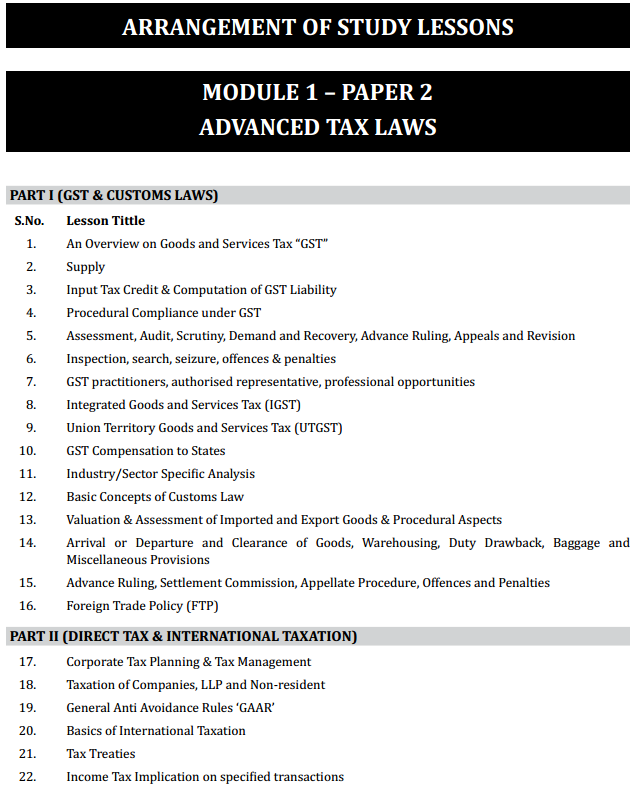

- Chapter 1 An Overview on GST

- Chapter 2 Supply

- Chapter 3 Input Tax Credit & Computation of GST Liability

- Chapter 4 Procedural Compliance under GST

- Chapter 5 Demand and Recovery, Advance Ruling, Appeals and Revision

- Chapter 6 Inspection, Search, Seizure, Offences & Penalties

- Chapter 7 GST Practitioners, Authorised Representative, Professional Opportunities

- Chapter 8 Integrated Goods and Services Tax (IGST)

- Chapter 9 Union Territory Goods and Services Tax (UTGST)

- Chapter 10 GST Compensation to States

- Chapter 11 Industry/Sector Specific Analysis

- Chapter 12 Basic Concepts of Customs Law

- Chapter 13 Valuation & Assessment of Imported and Export Goods & Procedural Aspects

- Chapter 14 Arrival or Departure and Clearance of Goods, Warehousing, Duty Drawback, Baggage and Miscellaneous Provisions

- Chapter 15 Advance Ruling, Settlement Commission, Appellate Procedure, Offences and Penalties

- Chapter 16 Foreign Trade Policy (FTP)

- Chapter 17 Corporate Tax Planning & Tax Management

- Chapter 18 Taxation of Companies, LLP and Non-resident

- Chapter 19 General Anti Avoidance Rules ‘GAAR’

- Chapter 20 Basics of International Taxation

- Chapter 21 Tax Treaties

- Chapter 22 Income Tax Implication on Specified Transactions

CS Professional Advanced Tax Laws Syllabus

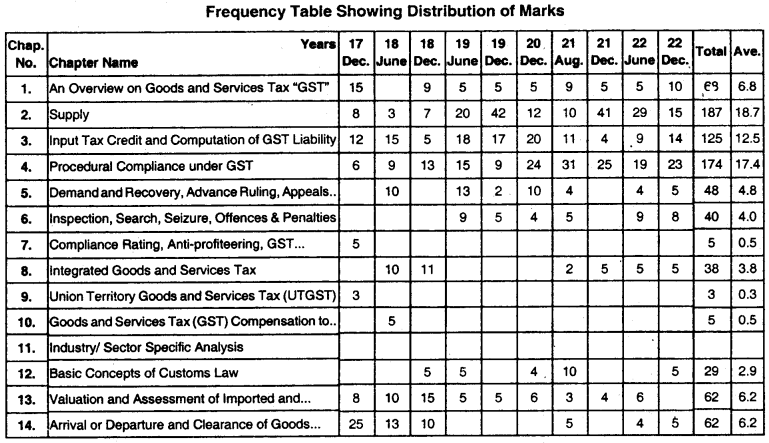

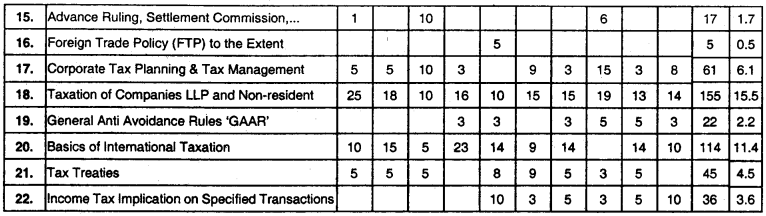

CS Professional Advanced Tax Laws Chapter Wise Weightage

Professional Programme Module 1 Paper 2

Advanced Tax Laws (Max Marks 100)

Syllabus

Objective:

Part I: To acquire expert subject knowledge, interpretational skills, and practical application of Customs and GST Laws.

Part II: To acquire expert knowledge on the practical application of Corporate taxation including International Taxation.

Detailed Contents

Indirect Taxes (70 Marks)

Part I: GST and Customs Laws

Goods and Services Tax ‘GST’ (60 Marks)

1. An Overview on Goods and Services Tax “GST”: Introduction; Constitutional Aspects & Administration; GST models; Levy and collection of CGST and IGST; Composition scheme & Reverse Charge, Exemptions.

2. Supply: Meaning & scope, types of supply (composite/mixed inter/intra); Time, Place and Value of Taxable Supply; Import and Export of Goods or Services under GST, Classification of Goods and Services; Job work provisions, agency contracts, e-commerce & TCS.

3. Input Tax Credit & Computation of GST liability: Input tax credit; Computation of GST liability.

4. Procedural Compliance under GST: Registration; Tax Invoice, Debit & Credit Note, Account and Record, Electronic Way Bill, Payment of Tax, TDS, Returns & Refund, Valuation, Audit & Scrutiny; Assessment.

5. Assessment, Audit, Scrutiny, Demand and Recovery, Advance Ruling, Appeals and Revision.

6. Inspection, search, seizure, offences & penalties.

7. GST practitioners, authorised representatives, and professional opportunities.

8. Integrated Goods and Services Tax (IGST).

9. Union Territory Goods and Services Tax (UTGST).

10. GST Compensation to States.

11. Industry/Sector Specific Analysis.

Customs Law (10 Marks)

12. Basic Concepts of Customs law: Introduction; Levy and collection of customs duties; Taxable Events; Custom duties.

13. Valuation & Assessment of Imported and export Goods & Procedural Aspects: Classification and Valuation of Import and Export Goods; Assessment; Abatement and Remission of Duty; Exemptions;

Refund and recovery.

14. Arrival or Departure and Clearance of Goods, Warehousing, Duty Drawback, Baggage and Miscellaneous Provisions: Arrival and departure of goods; Clearance of Import and Export Goods & Goods in Transit; Transportation and Warehousing provisions; Duty Drawback provisions, Baggage Rules & provision related to prohibited goods, notified goods, specified goods, illegal importation/exportation of goods.

15. Advance Ruling, Settlement Commission, Appellate Procedure, Offences and Penalties: Advance Ruling; Appeal and Revision; Offences and Penalties; Prosecution; Settlement of Cases.

16. Foreign Trade Policy (FTP): Export promotion scheme under FTP; Salient features, administration & Other miscellaneous provisions.

Case laws, Case Studies & Practical Aspects.

Part II: Direct Tax & International Taxation (30 Marks)

17. Corporate Tax Planning & Tax Management: Tax Planning, Tax Management; Tax Avoidance v/s Tax Evasion; Areas of Corporate Tax Planning; Tax Planning Management Cell.

18. Taxation of Companies, LLP and Non-resident: Tax incidence on Companies including foreign company; Minimum Alternate Tax ‘MAT ’; Dividend Distribution Tax; Alternate Minimum Tax ‘AMT’; Tax incidence on LLP; Taxation of Non-resident Entities.

19. General Anti Avoidance Rules ‘GAAR’: Basic concept of GAAR; Impermissible avoidance arrangement; Arrangement to lack commercial substance; Application of GAAR Rule; GAAR v/s SAAR.

20. Basics of International Taxation

(i) Transfer Pricing: Introduction & Concept of Arm’s Length Price; International and Specified Domestic Transaction; Transfer Pricing Methods; Advance Pricing Agreement & Roll Back Provision; Documentation and Return. (ii) Place of Effective Management (POeM): Concept of POEM; Guidelines of determining POEM.

21. Tax Treaties.

22. Income Tax Implication on specified transactions: Slump Sale; Restructuring; Buy Back of shares; Redemption of Preference shares; Issue of shares at Premium; Transfer of shares; Reduction of share Capital; Gifts, cash credits, unexplained money, investments, etc.

Case laws, Case Studies & Practical Aspects.