Chapter 17 Corporate Tax Planning & Tax Management – CS Professional Advance Tax Law Notes is designed strictly as per the latest syllabus and exam pattern.

Corporate Tax Planning & Tax Management – CS Professional Advance Tax Law Study Material

Question 1.

Distinguish between tax planning’ and tax evasion’. (June 2016, 5 marks)

Answer:

The differences between tax planning and tax evasion are summarised as under:

| Basis | Tax planning | Tax evasion |

| Meaning | It is to avail maximum benefit of deductions, exemptions, rebates etc. for minimizing tax liability. | It refers to reducing tax liability by dishonest means. |

| Legality | It is fully within the framework of law and it makes use of the beneficial provisions in law. | It is clearly violation of law and unethical in nature. It includes an element of deceit. |

| Acceptance | This concept is very well accepted by the Judiciary in India. | This is clearly prohibited, as it is fully illegal. |

| Penalties and Prosecution | It does not result in levy of penalty and prosecution as it is within the language and spirit of law. | It results in stringent penalties and prosecution against the person engaged in it. |

| Time period | It is futuristic in nature i.e. it aims to minimize the tax liability of the future years. | It aims at evading the payment of tax after the liability to tax has arisen. |

Question 2

Distinguish between ‘tax planning’ and ‘tax avoidance’. (Dec 2016, 5 marks)

Answer:

Difference between Tax Planning and Tax Avoidance

| Tax Planning | Tax Avoidance |

| (1) Tax planning is an act within the permissible range of the Act conducted to achieve social and economic benefits. | Tax avoidance means planning for minimisation of tax according to legal requirement but it defeats the basic intention of the legislature. |

| (2) Tax planning is a legal right which enables the tax payer to achieve social and economic objective. | Tax avoidance takes into accounts various lacunas of law. |

| (3) Tax planning accelerates development of the economy of a country by generating funds for investment in desired sectors. | Tax avoidance is lawful but involves the element of malafide intention. |

| (4)Tax planning promotes professionalism and Strengthens economic and political situation of the country. | Tax avoidance is planning before the actual liability for tax comes into existence. |

![]()

Question 3.

Distinguish and differentiate between:

(a) Tax Planning and Tax Avoidance

(b) Diversion of Income and Application of Income. (June 2017, 5 marks)

Answer:

(b)

| Diversion of income | Application of Income |

| 1. In case of diversion of income, Income never reaches to the assessee as his own income. By virtue of an obligation, the income is diverted at source before it reaches the assessee. | In case of application of income, income reaches to the assessee as his own income and is subsequently applied to discharge an obligation. |

| 2. In case of diversion of income, the obligation is on the source of income. | In case of application of income, the obligation is on the receipt of income i.e. after income reaches to the assessee. |

| 3. There is an overriding title by virtue of which diversion of income takes place. | There is no over riding title in this case. |

| 4. In case of diversion of income, the income is not included in the income of the assessee. | In case of application of income, income is included in the income of assessee. |

Question 4.

Enumerate the conditions prescribed in the proviso to Section 47 (xiiib) in order to avail of total exemption from capital gains tax upon transfer of capital assets by a private company or an unlisted public company to a limited liability partnership (LLP). (Dec 2012, 6 marks)

Answer:

Transfer of capital asset or intangible asset by a private limited company or a non-listed company to LLP shall not be regarded as a transfer. Correspondently, any transfer of a share or shares held in a company by a shareholder shall also not be treated as a transfer on conversion of the above company to a LLP [Section 47 (xiiib)].

The Act has inserted Clause (xiiib) to Section 47 to provide that:

(a) the transfer of a capital asset or intangible asset by a private limited company or a unlisted company, or

(b) any transfer of a share or shares held in the company by a shareholders. On conversion of a private limited company or an unlisted company to LLP in accordance with Section 56 and Section 57 of the LLP Act, 2008 shall not be regarded as a transfer for the purposes of capital gains tax under section 45, subject to certain conditions.

These conditions are as follows:

(a) All the assets and liabilities of the company immediately before the conversion become the assets and liabilities of the LLP.

(b) All the shareholders of the company immediately before the conversion becomes the partners of the LLP and their capital contribution and profit sharing ratio in the LLP are in the same proportion as their shareholding in the company on the date of conversion.

(c) The shareholders of the company do not receive any consideration or benefits, directly or indirectly, in any form or manner, other than by way of share in profits and capital contribution in the LLP..

(d) The aggregate of the profit sharing ratio of the shareholders of the company in the LLP shall not be less than 50% at any time during the period of 5 years from the date of conversion.

(e) The total sales, turnover or gross receipts in business of the company in any of the three previous years preceding the previous year in which the conversion takes place does not exceed ₹ 60,00,000; and

(f) No amount is paid, either directly or indirectly, to any partner out of balance of accumulated profit standing in the accounts of the company on the date of conversion for a period of 3 years from the date of conversion.

Question 5.

Does the Income-tax Appellate Tribunal has the following powers:

(i) Power to recall its order in entirety under section 254(2); (Dec 2012, 3 marks)

(ii) Power to grant indefinite stay in any proceeding relating to an appeal under section 254(2A)? (Dec 2012, 3 marks)

Answer:

(b) (i) As per Section 254 (2), the Appellate Tribunal may, at any time within 4 years from the date of the order, with a view to rectify any mistake apparent from record, amend any order passed by it under section 254 (1), and shall make such amendment if the mistake is brought to its notice by the assessee or Assessing Officer. Thus, above said Tribunal has the power to recall its order in entirety as per Section 254 (2).

(ii) The Tribunal can pass an order of stay only for a period not exceeding 180 days from the date of such order subject to the condition that the assessee deposits not less than twenty percent of the amount of tax, interest, fee, penalty, or any other sum payable under the provisions of this Act, or furnishes security of equal amount in respect thereof.

“Provided further that no extension of stay shall be granted by the Appellate Tribunal, where such appeal is not so disposed of within the said period of stay as specified in the order of stay, unless the assessee makes an application and has complied with the condition referred to in the first proviso and the Appellate Tribunal is satisfied that the delay in disposing of the appeal is not attributable to the assessee, so however, that the aggregate of the period of stay originally allowed and the period of stay so extended shall not exceed three hundred and sixty-five days and the Appellate Tribunal shall dispose of the appeal within the period or periods of stay so extended or allowed.” Section 254 (2A).

Thus, the Tribunal cannot grant indefinite stay in any proceeding relating to an appeal.

![]()

Question 6.

An assessee, who is aggrieved from all or any of the following orders is desirous to know the available remedial recourse and the time-limit against each under the Income-tax Act, 1961:

(i) An order passed by an Assessing Officer under section 153C in pursuance of the directions of the dispute resolution panel.

(ii) An order passed by the Director General of Income-tax under section 272A.

(iii) An order passed by the Income-tax Appellate Tribunal (ITAT) under section 254. (Dec 2013, 2 marks each)

Answer:

(i) Time-limit against an order passed by an Assessing Officer under section 153C in pursuance of the directions of the dispute resolution panel is within 60 days from the above said order to file an appeal before Appellate Tribunal.

(ii) Time limit against an order passed by the Director General of Income Tax under section 272A is within 60 days from the above said order, to file an appeal before Appellate Tribunal.

(iii) Time limit against an order passed by the Income-Tax Appellate Tribunal (ITAT) under section 254 is within 120 days from the above said order to file an appeal before High Court.

Question 7.

Discuss the mode of determination of fair market value of Employees Stock Option, if shares are:

(i) Listed in a recognised stock exchange in India

(ii) Not listed in any recognised stock exchange in India. (Dec 2014, 4 marks)

(d) What are the objectives of tax planning? (Dec 2014, 3 marks)

Answer:

(c) (i) Determination of Fair Market Value (FMV) of ESOPs on the date of exercise of option:

(a) Where shares in the company are listed on a single stock exchange: FMV will be average of opening and closing prices of shares on the date of exercise of option.

If on the date of exercise of option there is ho trading in shares, the FMV shall be the closing price of the share on any recognised stock exchange on a date closest to the date of exercise of option and immediately preceding such date of exercise of option.

(b) Where shares in the company are listed on more than one recognised stock exchange: FMV will be average of opening and closing price of shares on the date of exercise of option on a recognised stock exchange which records the highest volume of trading in the shares.

If on the date of exercise of option there is no trading in shares, the FMV shall be the closing price of the share on a recognised stock exchange which records the highest volume of trading on a date closest to the date of exercise of option and immediately preceding such date of exercise of option.

(ii) Where shares in the company are not listed on a recognised stock exchange: FMV will be value on a “specified date” as determined by a Category I merchant banker registered with SEBI. Specified date means the date of exercise of option or any date earlier than the date of exercise of option, not being a date which is more than 180 days earlier than the date of exercise of option.

Answer:

(d) Objectives of Tax Planning

- Reduction of tax liability

- Minimisation of litigation

- Productive Investment

- Healthy growth of economy

- Economic stability.

- Smooth flow of Taxes

Question 8.

Make an analysis between the purchase and taking on lease of an asset for the purpose of business by the assessee considering the Income Tax provisions and the benefits available. Which option is considered to be better as per tax provisions and other benefits? (June 2017, 5 marks)

Answer:

Analysis between Purchase of an assets and taking the assets on Lease for the purpose of business.

(i) In case of purchase, depreciation is allowed under section 32. On the other hand, depreciation will not be allowed u/s 32 in case of assets taken on lease. This principle has also been upheld by the Hon’ble Supreme Court in case of ICDS Ltd. V/s CIT(2013) 350ITR 527.

(ii) In case of lease, lease rent paid will be allowed as deduction u/s 37(1) as revenue expenditure. Repairs are also allowable under section 31.

(iii) In case of purchase, insurance premium, current repairs are allowed as deduction u/s 31 and interest on borrowed funds is deductible u/s 36 as revenue expenditure.

(iv) Purchase of machinery would create tangible assets which can also be mortgage in case of finance needs whereas in case of assets taken on lease, it is not possible.

(v) In case of purchase option, residual value at the end of useful life belongs to owner. Capital gains tax liability or savings should also be taken into consideration.

The benefits available as to tax payments are to be worked out separately under both the situations and be analyzed to find out which option is better. However, taking of an assets by investing own funds be always found to be better because of the available benefits under the tax laws and having of the tangible assets in the business.

![]()

Question 9.

Specify the tax incentives for start-ups as amendments effective from 1st April, 2019 and accordingly apply in relation to the assessment year 2020-21 and subsequent assessment years. (Dec 2017, 5 marks)

Answer:

Tax Incentives for Start-Ups

With a view to providing an impetus to start-ups and facilitate their growth in the initial phase of their business, it is provided that a deduction of one hundred percent of the profits and gains derived by an eligible start-up from a business involving innovation development, deployment or commercialization of new products, processes or services driven by technology or intellectual property.

The benefit of 100% deductions of the profits derived from such business shall be available to an eligible start-up which is setup before 01.04.2020. Keeping this objective in view, a new section 54EE has been inserted that provide exemption from capital gains tax if the long term capital gains proceeds are invested by an assessee in units of such specified fund, as may be notified by the Central Government in this behalf, subject to the condition that the amount remains invested for three years failing which the exemption shall be withdrawn. The investment in the units of the specified fund shall be allowed up to ₹ 50 lakh.

The existing provisions of section 54GB provide exemption from tax on long term capital gains in respect of the gains arising on account of transfer of a residential property, if such capital gains are invested in subscription of shares of a company which qualifies to be a small or medium enterprise under the Micro, Small and Medium Enterprises Act, 2006 subject to other conditions specified therein.

With an objective to provide relief to an individual or HUF willing to setup a start-up company by selling a residential property to invest in the shares of such company, an amendment has been made in section 54GB so as to provide that long term capital gains arising on account of transfer of a residential property shall not be charged to tax if such capital gains are invested in subscription of shares of a company which qualifies to be an eligible start-up subject to the condition that the individual or HUF holds more than fifty per cent shares of the company and such company utilises the amount invested in shares to purchase new asset before due date of filing of return by the investor.

The existing provision of section 54GB requires that the company should invest the proceeds in the purchase of new asset being new plant and machinery but does not include, inter-alia, computers or computer software. With a view to avoid the incidence of the aforesaid condition on start-ups where computers or computer software form the core asset base owing to nature of business activity, it is provided that the expression “new asset” includes computers or computer software in case of technology driven start-ups so certified by the Inter-Ministerial Board of Certification notified by the Central Government in the Official Gazette.

These amendments effective from 1st April, 2017 and, accordingly, apply in relation to the assessment year 2018-19 and subsequent assessment years.

Question 10.

State with brief reason, whether the following relate to tax planning, tax avoidance or tax evasion:

(i) Setting up of a liaison office in India by a foreign company, instead of a full fledged establishment to run its business activities in India.

(ii) Investment in bonds approved for purposes of section 54EC.

(iii) Businessman daiming depreciation on a refrigerator purchased for residential use.

(iv) Visiting a foreign country for certain number of days to reduce the number of days of stay in India.

(v) Assessee has two residential houses. He wants to sell a vacant site purchased 6 years back. To avail exemption under section 54F, he gifts a residential house to his major son. (June 2018, 1 mark each = 5 marks)

Answer:

- Setting up of a liaison office in India by a foreign company, instead of a full fledged establishment to run its business activities in India is to reap the benefit of the DTAA instead of coming under the provisions of Section 9 of the Income, Tax Act, and thus is an act of Tax Planning.

- Investment in Bonds approved u/s 54EC will reduce tax liability relating to Capital Gains. It is an act of Tax Planning.

- Businessman claiming depreciation on a refrigerator purchased for residential use is an act of Tax Evasion because of wrongly claiming depreciation on personal assets by showing as business assets.

- Visiting a foreign country to reduce the number of days of stay in India is a measure of Tax avoidance with regard to residential status, which may have impact on the taxability total income.

- Gifting a house property to major son with a view to come within the eligibility norms of an exemption Section is though legally permissible but is an act of Tax Avoidance.

Question 11.

Examine in brief the doctrine of “form and substance” in the context of tax planning under the Income Tax Act, 1961. Support your answer with the decided court cases explaining the principle of form and substance which will prevail in Income Tax matters. (Dec 2020, 5 marks)

Answer:

The following are certain principles enunciated by the Courts on the question as to whether it is the form or substance of a transaction, which will prevail in Income-tax matters.

(i) It is well settled that when a transaction is arranged in one form known to law, it will attract tax liability whereas, if it is entered into in another form which is equally lawful, it may not. In considering whether a transaction attracts tax or not, the form of the transaction put through is to be considered and not the substance. However, this rule applies only to genuine transactions. [Motor and General Stores (P) Ltd. vs. CIT (1967) 66ITR 692 (AP)].

(ii) True legal relation is the crucial element for taxability. The true legal relation arising from a transaction alone determines the taxability of a receipt arising from the transaction.

It is open for the authorities to pierce the corporate veil and look behind the legal facade at the reality of the transaction. The taxing authority is entitled as well as bound to determine the true legal relation resulting from a transaction.

(iii) Substance is relevant and not the form:

(a) In the case of an expenditure, the mere fact that the payment is made under an agreement does not preclude the department from enquiring into the actual nature of the payment [Swadeshi Cotton Mills Co. Ltd. vs. CIT (1967) 63 ITR 57 (SC)].

(b) In order to determine whether a particular item of expenditure is of revenue or capital nature, the substance and not merely the form should be looked into. [Assam Bengal Cement Co Ltd. vs. CIT (1955) 27 ITR 34 (SC)].

![]()

Question 12.

Narrate any three evil consequences of tax avoidance. (Aug 2021, 3 marks)

Answer:

The evil consequences of Tax Avoidance may be listed as under:

- Substantial loss of much needed public revenue particularly in welfare state like India.

- Serious disturbance caused to the economy of the country by piling up of black money directly causing inflation.

- Large hidden loss to the community by perpetual engagement of best brains in litigation.

- Sense of injustice and inequality which tax avoidance arouses in the breasts of those unwilling or unable to profit by it.

- Ethics or unethical behaviour causing burden of tax liability to good, taxpaying citizens.

Question 13.

Specify all those documents which are required to be submitted for making an appeal to the Appellate Tribunal as per provisions of Income Tax Act, 1961. (Dec 2021, 5 marks)

Answer:

The following documents are required to be submitted for making an appeal to the ITAT:

- The memorandum of appeal in Form No. 36 with the grounds of appeal.

- Copy of the order of the Commissioner (Appeals).

- Copy of the grounds of appeal and statement of facts filed before the Commissioner (Appeals).

- Copy of the order of the Assessing Officer.

- Challan for payment of requisite fee.

All those documents are required to be submitted in duplicate except the memorandum of appeal in Form No. 36 which is to be filed in triplicate.

Question 14.

With reference to Income Tax Act, 1961, compare the benefits available, where the asset is acquired on lease and assets purchase from own fund. (Dec 2022, 3 marks)

Question 15.

Comment in brief on the allowability of depreciation under section 32—

(i) Both the stipulated conditions under section 32 have been complied with but assessee company has not claimed the depreciation.

(ii) A Ltd. and B Ltd. jointly owned plants in the proportion of 80% and 20% respectively and put to use by both the companies during the previous year 2020-21.

(iii) X Ltd. acquired following assets during the previous year 2021 -22, but could not use them:

(a) High powered inverter costing ₹ 2,50,000; and

(b) Fire extinguisher costing ₹ 75,000. (Dec 2012, 2 marks each)

Answer:

(i) As per Explanation 5 of Section 32(1) of the Income Tax Act, 1961, depreciation will be allowed, if due, by the Assessing Officer, even when it was not claimed by the assessee and compute the total income accordingly.

(ii) Both the basic conditions regarding allowability of depreciation under section 32 (1) are satisfied namely about ownership and its use, therefore, both the companies are eligible to claim depreciation in the same fractional value of assets i.e., in the proportion 80% & 20%.

(iii) X Ltd. will be eligible for depreciation allowance under section 32 (1), inspite of non-fulfillment of condition of its use. In case of assets acquired for the business and kept, ‘stand by’ tantamount ‘passive’ use and hence entitled for eligible depreciation.

Question 16.

The Assessing Officer issued a notice under section 142(1) on the assessee on 18th December, 2020 calling him upon to file return of income for the assessment year 2021-22. In response to the said notice, the assessee furnished a return of loss arid claimed carry forward of business loss and unabsorbed depreciation. State whether the assessee would be entitled to carry forward as claimed in the return. (Dec 2012, 9 marks)

Answer:

According to Section 139 (3) read with Section 80, if a. person has sustained a loss under the head” Profit and gains of business or profession” or under the head “Capital Gains” and claims that such” loss or any part thereof should be carried forward under section 72 or section 73 or section 74 or section 74A then he may furnish a return Of loss within the time prescribed under section 139 (1) and all the provisions of this Act shall apply as if it were a return under section 139 (1).

It is not mandatory to file a return of a loss (except in case of a company or a firm) as there is no taxable income. However, under section 80, losses under the head business or profession and capital gain can not be carried forward unless the return of loss is submitted on or before the due date mentioned under section 139 (1)and it is duly assessed. If the return of loss is not submitted or is submitted after the due date, such losses cannot be carried forward.

Thus, in the given case, it is clear that the assessee has not filed the return of loss voluntarily within the time allowed under section 139 (1). Therefore, the assessee will not be in a position to carry forward the business loss by virtue of the specific provisions of Section 80.

However, the assessee will be in a position to carry forward the unabsorbed depreciation as per Section 32 (2).

Question 17.

Specify with reason whether following acts can be considered as tax planning or tax management or tax evasion or tax avoidance:

(i) Deposit of ₹ 60,000 in public provident fund account to reduce total tax liability.

(ii) A company installed an air conditioner at the residence of its director and treated it as business asset for depreciation.

(iii) X Ltd. issued a credit note for ₹ 40,000 as commission payable to Y who is son of X, managing director of the company. The sole purpose was to transfer the income of the company as income of Y.

(iv) Y, a non-resident Indian citizen visits India every year only for 181 days to remain non-resident.

(v) Z Ltd. deducts tax at source but fails to deposit the same in government treasury.

(vi) B transferred 1,000 debentures of a company to his son C before the due date of interest to reduce his tax liability. (June 2013, 1 mark each)

Answer:

(i) It is tax planning because depositing money of ₹ 60,000 in PPF and taking deduction under Section 80C is as per the provisions of law.

(ii) It is tax evasion, if such installation is not as per the term of employment.

(iii) The issue of credit note for ₹ 40,000 as commission to reduce the tax liability of company is tax evasion.

(iv) It is tax planning because residing in India for less than 182 days will reduce his tax liability and it is in accordance with the provisions of tax laws.

(v) It is tax evasion because fails to deposit the collected TDS shows that undue benefit is taken by not complying tax provisions.

(vi) It is tax avoidance because as per Section 60 of the Act, transfer of debenture to C and income thereon for reducing the tax liability shall not to be clubbed in the hands of B as the asset is also transferred along with the income.

Question 18.

State, with reasons in brief, whether income-tax return is to be filed in the following cases for the assessment year 2023-24:

(i) Anthony, an individual aged 82 years has a gross total income of ₹ 6,20,000 and he is eligible for deduction of ₹ 1,40,000 under Chapter VI-A.

(ii) Robert, an employee of X Ltd., draws a salary of ₹ 19,00,000 and has income from fixed deposit with bank of ₹ 10,000.

(iii) An infrastructure debt fund referred to in Section 10(47) has gross total income of ₹ 2,10,000 and it is eligible for exemption under section 10(47) of ₹ 2,10,000 and is exempt from tax, as it is a notified infrastructure debt fund. (June 2013, 2 marks each)

Answer:

(i) In this case, the gross total income of Mr. Anthony aged 82 years before deduction under section 80C is ₹ 6,20,000, which exceeds the basic exemption limit of ₹ 5,00,000. Therefore Mr. Anthony has to furnish his return of income for the A.Y. 2023-24.

(ii) As per Notification No. 9/2012, dated 11.02.2013, the individual is exempted from filing return of income whose total income does not exceed ₹ 5,00,000, provided the total income consists only of salary and/or interest from savings bank account (not exceeding ₹ 10,000), subject to fulfillment of certain conditions. Thus, in this case, Mr. Robert has earned interest on fixed deposits and his total income exceeds ₹ 5,00,000.

Consequently, he will have to submit his return of income.

(iii) A notified infrastructure debt fund is exempt from tax under section 10 (47) but it is required to file a return of income under section 139 (4C) as the income without giving exemption under section 10 (47) exceeds the exemption limit, i.e., ₹ 2,50,000 for the Assessment Year 2023-24.

![]()

Question 19.

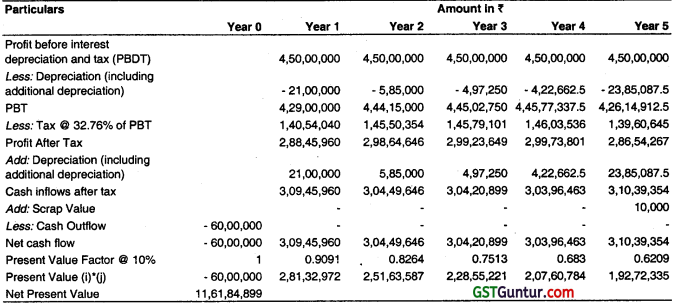

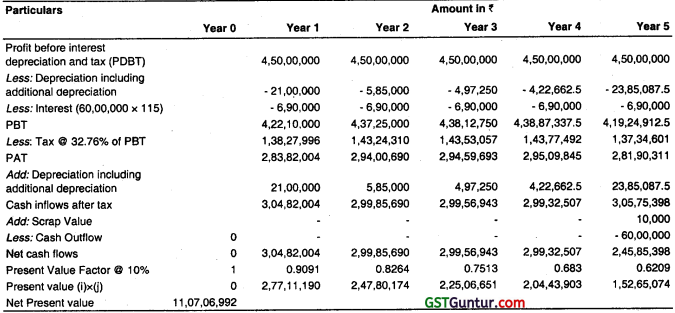

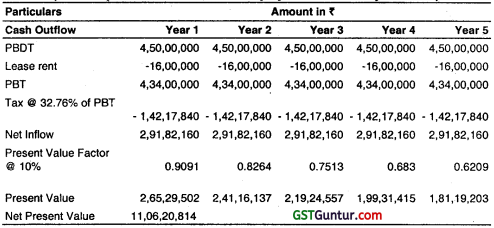

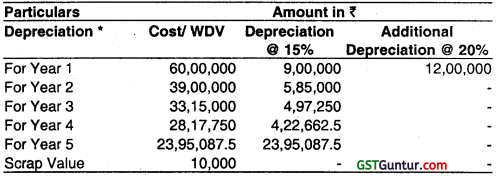

A Ltd. wants to acquire a machine on 1st April, 2020. It will cost ₹ 60 lakh. It is expected to have a useful life of 5 years. Scrap value will be ₹ 10,000. If the machine is purchased through borrowed funds, rate of interest is 11.5% per annum. Loan is repayable at the end of 5 years. If machine is acquired through lease, lease rent would be ₹ 16 lakh per annum. Profit before depreciation and tax is expected to be ₹ 4.50 crore every year. Depreciation is charged @ 15% on written down value. Besides, additional depreciation is available in the first year. Investment allowance is, however, not available. Average rate of tax may be taken at 32.76%.

A Ltd. seeks your advice whether it should –

(i) Acquire the machine through own funds or borrowed funds; or

(ii) Take it on lease.

Present value factor shall be taken @ 10%. At this rate present values of rupee one are- year 1 : 0.9091; year 2 : 0.8264; year 3 : 0.7513; year 4 : 0. 6830; and year 5 : 0.6209. (June 2014, 5 marks)

Answer:

Purchasing Machine out of own Fund

Purchasing Machine out of borrowed fund

Take Machine on lease

(Assumption: Lease rental is payable at each year end)

Advice:

From purely financial perspective, A Ltd. should purchase the machine out of borrowed funds as the Net Present Value in that case is highest. However, company should consider non-financial factors also while taking the final decision.

Working Noté: Calculation of Depreciation and Additional Depreciation

- Additional Depreciation is available as per provisions of Income Tax.

- Assuming this is the only asset in the block.

Question 20.

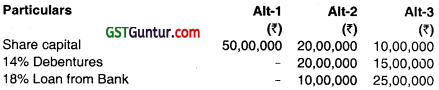

Virat Ltd. is a widely held company. It is currently considering a major expansion of its production facilities and the following alternatives are available:

Expected rate of return before tax is 30%. Rate of dividend of the company since 1995 has not been less than 22% and date of dividend declaration is 30th June every year. Which alternative should the company opt with reference to tax planning? (Dec 2014, 5 marks)

Answer:

Analysis of Financing Options for expansion of Virat Ltd.

Analysis of Financing Options for X Ltd.

Since, Alternative 3 offers the maximum rate of return, with reference to tax planning company should opt it.

Question 21.

Vijay is employed with Sunder Ltd., at a monthly salary of ₹ 45,000. He also receives ₹ 15,000 per month as house rent allowance. He deposited ₹ 40,000 in the PPF account. He also pays ₹ 30,000 as tuition fees of his two children.

Vijay’s wife, Isha is employed with Chander Ltd., at a monthly salary of ₹ 25,000, where Vijay holds 21% of the shares of the company. Isha is not adequately qualified for the post held by her in Chander Ltd.

Isha owns a house used as self occupied house by the family. Municipal value of the house is ₹ 3,60,000. It was constructed with borrowed funds in 2020-21. Interest on loan is ₹ 1,80,000 p.a. Isha insured the house and paid insurance premium of ₹ 8,000 to United India Insurance Company. She also paid ₹ 20,000 as municipal taxes.

Suggest a scheme of tax planning for both Vijay and Isha to minimise their tax liability during the financial year 2022-23. (June 2015, 5 marks)

Answer:

Some of the Tax planning measures for Vijay and Isha could be:

(i) Vijay holds substantial interest (21 %) in Chander Ltd. where Isha holds a post for which she is not adequately qualified. Thus, the remuneration received by Isha would be clubbed in the income of Vijay. To avoid this, Vijay may reduce his shareholding in Chander Ltd. to 19%.

(ii) Vijay and Isha may request to their respective employers to restructure their salaries, as follows:

(a) Restructure salaries to break up the monthly salary into basic pay, conveyance allowance/car facility, leave travel facility, medical reimbursement and telephone reimbursement etc. This will reduce the amount of taxable salary.

(b) There are several employees’ welfare schemes such as recognised provident fund, approved superannuation fund, gratuity fund. Payments made towards such schemes are eligible for deductions. So, Vijay and Isha may request their employer to include these welfare schemes and make contribution towards same.

(iii) Currently Isha is treating the house as self occupied by the family; she may rent out this to Vijay against a rent receipt. This will enable Vijay in claiming deduction for House Rent Allowance.

(iv) Isha may claim the deduction for the principal amount and the interest amount paid for the funds borrowed for construction of house. For principal amount, deduction, could be claimed for upto ₹ 1,50,000 and for interest amount deduction could be claimed upto ₹ 2,00,000.

Question 22.

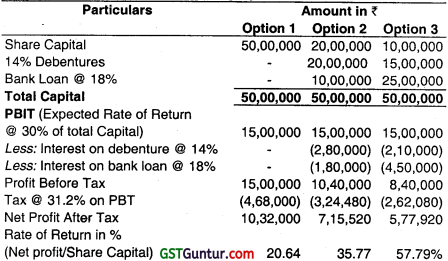

From the following information, advice as to which shall be a better option, i.e., repair or replacement of machin

- The cost of repair is ₹ 90,000 and the machine will work for 4 years.

- An expenditure of ₹ 18,00,000 shall be incurred on the purchase of new machine and the scrap value of machine after 10 years would be ₹ 72,000.

- On purchase of new machine the production will increase and the profit of the organisation will increase from ₹ 9,00,000 to ₹ 15,00,000 per year.

- Rate of interest is 15% (on purchase).

- The old machine can be sold at present for ₹ 1,50,000 and after 4 years it would be sold for ₹ 30,000.

- The rate of income-tax is 30% and no surqharge is payable. Health and Education cess is applicable as per rules. (Dec 2015, 5 marks)

Answer:

Working Note:

1. Annual Repairing expenses = ₹ 90,000/4 = ₹ 22,500

2. Depreciation on new machinery = (Cost – Scrap value)/Life of asset

= ₹ (18,00,000-72,000)/10

= ₹ 1,72,800

3. Depreciation on old machinery = (Present value – Sale value)/Balance life

= ₹ (1,50,000-30,000)/4

= ₹ 30,000

Comparative Statement Showing After Tax Profit From Different Alternatives

It is better to replace old machinery wih a new one.

Question 23.

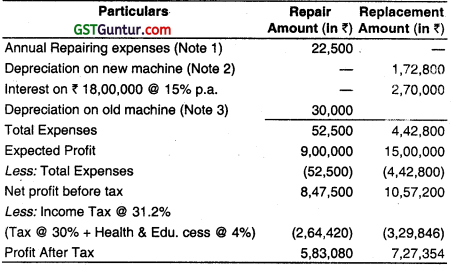

Ravi Glass Ltd., a widely held company is considering for a major expansion of its activities for which an additional investment of ₹ 3 Crores is required. The company has following three options/alternatives for the financing of proposed additional investment of ₹ 3 crores:

(i) By issue of Equity shares and raise the equity share capital only.

(ii) ₹ 2 crores from issue of Equity shares and ₹ 1 crore by issue of 15% debentures.

(iii) ₹ 1 crore from issue of Equity shares, ₹ 1 crore from issue of 15% debentures and remaining 1 crore by taking a bank loan on interest payable at 15% p.a.

The expected rate of return on the new investment has been worked out at 30%. The corporate rate of tax for the time being on the income is 31.2%. Company has proposed to declare the total net profits as dividend.

You are required to suggest the company which is the best alternative to be undertaken for the purpose of proposed investment. Assume that no other taxes are being payable/to be charged on the distributed profits. (June 2017, 5 marks)

Answer:

Conclusion: The company is paying its entire net profits as dividend and the rate of return on equity is highest in the case of third alternative. Therefore, the company should opt for the third alternative.

Question 24.

Specify whether the following acts can be considered as

(i) Tax planning; or

(ii) Tax management; or

(iii) Tax evasion.

(i) P deposits ₹ 1,00,000 in Public Provident Fund (PPF) account so as to reduce his total income from ₹ 3,40,000 to ₹ 2,40,000.

(ii) SQL Ltd. maintains register of tax deduction at source affected by it to enable timely compliance.

(iii) An individual tax payer making tax saver fixed deposit of ₹ 1,00,000 in a nationalized bank.

(iv) A bank obtaining declaration from depositors in Form No. 15G/15H and forwarding the same to income-tax authorities.

(v) Z debits his household expenses as business expenses in the books. (Dec 2018, 1 mark each)

Answer:

(i) Depositing an amount to the Public Provident Fund “PPF” in order to reduce the total income and tax liability is an act of Tax Planning. Therefore, deposit of ₹ 1,00,000 in “PPF” by P to reduce his total income from ₹ 3,40,000 to ₹ 2,40,000 is an act of Tax Planning.

(ii) Maintenance of Register of Tax Deduction at Source to enable timely compliance is an act of Tax Management. Therefore, the maintenance of TDS register by SQL Ltd. to enable timely compliance is an act of Tax Management.

(iii) Investment in tax saver fixed deposits is allowed as deduction u/s 80C of the Income Tax Act, 1961 and is an act of Tax Planning. Therefore, depositing ₹ 1,00,000 in tax saver fixed deposit by an individual tax payer is an act of Tax Planning.

(iv) Obtaining declaration from depositors by a bank in Form 15G/15H and forwarding the same to the Income Tax Authorities is an act of Tax Management.

(v) Claiming the household expenses as business expenses in the books of account is not allowed as deduction u/s 37 of the Income Tax Act, 1961 and is an act of Tax Evasion. Therefore, the act of Z debiting his household expenses as business expenses is an act of Tax Evasion.

Question 25.

Advise Rashmi suitably to minimise her fax liability based on the facts given below.

Rashmi, an Indian citizen, joined University of Toranto as a professor in Canada, on a monthly salary of Canadian $ 10,000 on 1st April, 2019. She wants to come to India in the year 2021 and to stay continuously for a period of 11 months to complete her house construction in Delhi. She wants to know whether she can avoid payment of income tax legally on her foreign income earned. She can come to India at any time in 2021 for this purpose. (Dec 2018, 2 marks)

Answer:

The period of 11 months may be staggered over 2 previous years, in such a way that the basic condition for residence is not satisfied i.e. Rashmi may be treated non-resident in India if her stay in India is less than 182 days during relevant previous year.

Therefore, Rashmi can stay in India upto 362 days at a stretch spread over two financial years (181 days in 2019-20 and 181 days in 2020-21) without becoming residents in India in any of the previous year.

Question 26.

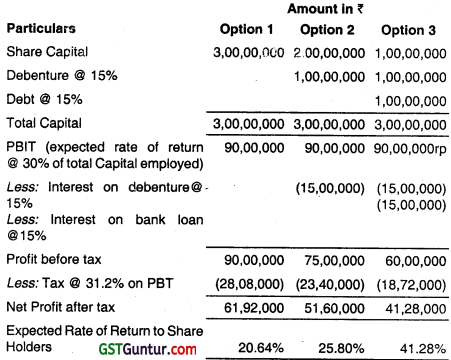

A is employed with XYZ Ltd. His salary is ₹ 1,00,000 per month. He is also paid house rent allowance of ₹ 20,000 per month. His wife B is also employed at a salary of ₹ 40,000 per month with ABC Ltd. where A holds 20% shares. B does not hold adequate qualification for the post which she is holding. B is the owner of a house which is self- occupied by the family. The house was constructed in the year 2018-19 with borrowed funds. Suggest a scheme for tax planning to minimise the tax liability for the financial year 2022-23 (assessment year 2023-24).

(Dec 2018, 3 marks)

Answer:

A is advised to reduce his share holdings with, XYZ Ltd. from 20% to 19% to avoid clubbing of salary income of B (A’s wife) u/s 64(1)(iv).

B should not treat the house as self occupied. She should let it out to A and issue a rent receipt of an amount say ₹ 40,000 per month. On the basis of rent receipt, A is entitled to claim the exemption in respect of House Rent Allowance ‘HRA’ to reduce his tax liability. Besides, B can claim the exemption in respect of interest payable on housing loan.

![]()

Question 27.

Specify with brief reason, whether the following acts can be considered as an act of

(i) Tax management; or

(ii) Tax planning; or

(iii) Tax evasion : or

(iv) Tax avoidance:

(i) To reduce tax payable, Sunil Varma an individual, paid ₹ 55,000 as life insurance premium on the policy of his minor son.

(ii) A foreign company has an Indian subsidiary which is selling its product to the parent company at a price of ₹ 100 per unit while the same product is sold to another foreign company at ₹ 200 per unit.

(iii) Company claiming depreciation on the motor car which is being used by director for personal purposes. (June 2019, 3 marks)

Answer:

(i) Premium paid on life insurance policy of minor son is allowed as deduction under Section 80C of the Income tax Act, 1961. Therefore, ₹ 55,000 paid, by Mr. Sunil Varma, as premium on life insurance policy of his minor son is an act of Tax Planning.

(ii) The transaction which is not at Arm’s Length Price ‘ALP’ is an act of Tax Avoidance. In this case, an Indian subsidiary, while selling its. products, charging less amount from its foreign parent company and shifting profits to outside India in order to avoid tax liability in India and therefore is an act of Tax Avoidance as the transaction is not at arm’s length price.

(iii) Claiming depreciation on motor car being used for personal purpose is not allowed under Section 32 of the Income Tax Act, 1961. Therefore, the depreciation claimed by the company on the motor car which is being used by the director for personal purpose is an act of Tax Evasion.

Question 28.

XYZ Ltd took over the running business of a sole-proprietor by a sale deed. As per terms of the sale deed, XYZ Ltd required to pay overriding charges of ₹ 75,000 p.a. to the wife of the sole-proprietor for ten years in addition to the sale consideration.

The sale deed also specifically mentioned that the amount of ₹ 75,000 is a charge on the net profits of XYZ Ltd. who had accepted the obligation as a condition of purchase of the business as a going concern. Is the payment of overriding charges by XYZ Ltd, to the wife of the sole-proprietor in the nature of diversion of income or application of income? Discuss and explain as per provisions of Income – Tax Act, 1961. (Dec 2020, 4 marks)

Answer:

This issue came up for consideration before the Allahabad High Court in the case of Jit & Pal X-Rays (P) Ltd. vs. CIT (2004) 267ITR 370. The Allahabad High Court observed that the overriding charge which had been created in favour of the wife of the sole-proprietor was an integral part of the sale deed by which the going concern was transferred to the assessee.

The obligation, therefore, was attached to the very source of income i.e., the going concern transferred to the assessee by the sale deed. The sale deed also specifically mentioned that the amount in question was charged on the net profits of the assessee company and the assessee company had accepted that obligation as a condition of purchase of the going concern. Hence, it is clearly a case of diversion of income by an overriding charge and not a mere application of income.

Question 29.

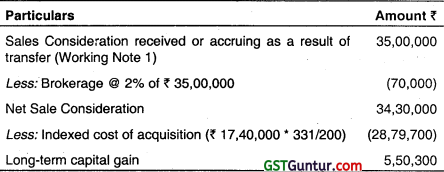

Kanishk had purchased a House Property in Delhi on 12.01.2013 for ₹ 17,40,000. He sold this house to his friend Suresh on 21.03.2023 for a consideration of ₹ 35,00,000. He paid brokerage @ 2% on the sale price.

On the date of registration stamp duty value of the said property is ₹ 39,50,000. However, on the date of agreement stamp duty value of the said property was ₹ 37,25,000.

Suresh had paid advance 20% of the value of the property by way of A/c payee cheque at the time of agreement. Compute the Capital Gain taxable in the hands of Kanishk for Assessment year 2023-24? What are the tax implications in the hands of Suresh for the same Assessment year? Cost Inflation Index : F.Y. 2012-13-200; F.Y. 2022-23-331. (Dec 2021, 5 marks)

Answer:

Computation of Capital Gain in the hands of the Kanishkfor AY 2022-23

Tax Treatment in the hands of the buyer Suresh: As per section 56(2)(x) of the Income tax Act, 1961, where any person receives from a non-relative, any immovable property for a consideration which is less than the stamp duty value on the date of agreement or date of registration as the case may be, and the difference between actual consideration and stamp duty value so considered is more than the higher of 50,000 or 10% (amendment by Finance Act, 2020) of the consideration so received, then the difference between such value and actual consideration of such property is chargeable to tax as income from other sources.

Since the difference of ₹ 2,25,000 (37,25,000 – 35,00,000) is not more than ₹ 3,50,000 being higher of ₹ 50,000 or ₹ 3,50,000 (10% of 35,00,000), no income would be chargeable to tax as income from other sources in the hands of Suresh.

Working Note 1:

Where the date of registration and date of agreement are not the same and part or whole of the consideration is paid by way of A/c payee cheque or A/c payee bank draft or by use of ECS on or before the date of agreement, then stamp duty value on the date of agreement may be taken for the purpose of determining income taxable under the head “Income from other sources”.

In the present case, Suresh has paid 20% of the consideration by way of A/c payee cheque, the stamp duty value on the date of agreement has to be taken.

Working Note 2:

As per section 50C of the Income tax Act, 1961, where the consideration received or accruing as a result of transfer of land or building or both, is less than the value adopted or assessed or assessable by the stamp valuation authority, the value adopted or assessed or assessable by the stamp valuation authority shall be deemed to be the full value of consideration received or accruing as a result of transfer.

Further, where the stamp duty value on the date of agreement or registration, as the case may be, does not exceed 110% (amendment by FA 2020) of the amount of actual consideration received or receivable then the consideration so received would be deemed to be the full value of the consideration. In the present case, since Kanishk has received 20% of the consideration by way of A/c payee cheque on the date of agreement, the stamp duty value of ₹ 37,25,000 on the date of agreement would be taken for the purpose of computing full value of consideration.

Further, since the stamp duty of House Property is ₹ 37,25,000 does not exceed ₹ 38,50,000 i.e., 110% of 35,00,000, the consideration received i.e., Hence Actual consideration 35,00,000 in respect of House Property would be deemed to be the full value of consideration.

Question 30.

Mr. Rajiv is a salaried individual working with a MNC in Jaipur, Rajasthan. He is staying in his ancestral house which was built by his grandfather in 1975. During the P.Y. 2022-23, he decided to reconstruct his house for which he gave an all-inclusive contract to Mr. P. The overall contract price was ₹ 47,50,000. The contract was entered into Oct., 2022 and Mr. P handed over the reconstructed house back to Mr. Rajiv on 01.02.2023. Due to poor condition of house prior to reconstruction, Rajiv decided to shift temporarily in a rented furnished apartment from 01.04.2022 onwards at a monthly rent of ₹ 60,000 per month. The landlord of Mr. Rajiv and Mr. P. (Contractor) does not have PAN.

(a) State whether any Tax is required to be deducted by Rajiv on payment of rent made to his landlord and the amount of such TDS. if applicable. (Dec 2021, 3 marks)

(b) State whether Tax is to be deducted by Rajiv from payment made to Mr. P. (Contractor). If yes, determine the amount of tax to be deducted by Rajiv during the P.Y. 2022-23. (2 marks)

Answer:

(a) As per provision of section 194-IB of the Income tax Act, 1961, Mr.

Rajiv is required to deduct TDS on payment of rent made to his landlord @ 5% (The period 14.05.2022 to 31.03.2023, the rate is 3.75% instead of 5%) if the rent paid exceeds ₹ 50,000 per month or part thereof. However, Section 206AA of the Income Tax Act, 1961 requires providing of PAN of deductee, failing which tax shall be deducted at a higher rate i.e. 20%.

Further, As per provision of Section 194IB of the Income tax Act, 1961, where the tax is required to be deducted as per the provisions of section 206AA, such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

Therefore, In this case, Tax to be deducted by Mr. Rajiv from the payment made to landlord will be (₹ 60000*10*20%) i.e. ₹ 1,20,000 but restricted to rent of last month = ₹ 60000 [Section 194 IB(4)] as landlord does not have PAN.

(b) As per provision of section 194M of the Income tax Act, 1961, any person, being an individual or a Hindu undivided family, is required to deduct TDS on payment made to a resident Contractor @ 5% of the amount paid to such contractor.

However, tax u/s 194M has to be deducted only if aggregate amount of sum paid to a resident during the P.Y. exceed ₹ 50,00,000. Since, the amount paid by Mr. Rajiv to Mr. P is less than ₹ 50,00,000 i.e., 47,50,000 only. Thus, no tax has to be deducted by Mr. Rajiv.

![]()

Question 31.

Examine with reasons, the allowability of the following expenses incurred by Anand, a wholesale dealer of commodities, under the Income Tax Act, 1961 while computing profit and gains from business or profession for the Assessment Year 2023-24.

(i) Construction of school building in compliance with CSR activities amounting to ₹ 5,70,000.

(ii) Commodities transaction tax paid ₹ 20,000 on sale of bullion.

(iii) Purchase of oil seeds of ₹ 50,000 in cash from a farmer on a banking day. (June 2022, 3 marks)

Answer:

Allowability of the expenses incurred by Mr. Anand, a wholesale dealer in commodities, while computing profits and gains from business or profession for AY 2023-24 are as under:

(i) Construction of school building in compliance with CSR activities amounting to ₹ 5,70,000 : As per provision of section 37(1) of the Income tax Act, 1961, expenditure not being in the nature of capital expenditure or personal expenses of an assesses and not covered under sections 30 to 36 of the income tax Act, 1961, and incurred wholly and exclusively for the purposes of the business is allowed as deduction while computing business income.

However, any expenditure incurred by an assessee on the activities relating to corporate social responsibility referred to in section 135 of the Companies Act, 2013 shall not be deemed to have been incurred for the purpose of business and, hence, shall not be allowed as deduction under section 37 of the Income tax Act, 1961.

Accordingly, the amount of ₹ 5,70,000 incurred by Mr. Anand towards construction of school building in compliance with CSR activities shall not be allowed as deduction.

(ii) Commodities transaction tax of ₹ 20,000 paid on sale of bullion : As per provision of section 36(1)(xvi) along with section 43B of the Income tax Act, 1961, Commodities transaction tax paid in respect of taxable commodities transactions entered into in the course of business during the previous year is allowable as deduction, provided the income arising from such taxable commodities transactions is included in the income computed under the head “Profit and gains from business or profession”.

Assuming that the income from these commodities transactions is included while computing the business income of Mr. Anand, the commodity transaction tax of ₹ 20,000 paid is allowable as deduction under section 36 (1) (xvi) of the Income tax Act, 1961.

(iii) Purchase of oil seeds of ₹ 50,000 in cash from a farmer on a banking day : As per rule 6DD (e) of the Income tax Rules, 1962, in case, the payment is made for purchase of agriculture produce directly to the cultivator, grower or producer of such agriculture produce, no disallowance under section 40A(3) of the Income tax Act, 1961 is attracted even though the cash payment for the expense exceeds ₹ 10,000 in a single day.

Therefore, in the given case, cash payment of ₹ 50,000 made to a farmer is allowable expenditure because disallowance under section 40A(3) is not attracted since cash payment for purchase of oil seeds is made directly to the farmer.

Question 32.

With reference to the Income Tax Act, 1961, discuss whether the following acts can be considered as tax evasion, tax avoidance, tax planning, tax management or otherwise for the assessment year 2023-24:

(i) J Ltd. issued a credit note for ₹ 85,000 for brokerage payable to Amar who is son of Q, managing director of the company. The purpose is to increase total income of Amar from ₹ 1,60,000 to ₹ 2,45,000 and reduce Company’s income correspondingly.

(ii) Sunil is using a Car for his personal purposes, but charged car related expenses as business expenditure.

(iii) ABC industries Ltd. installed an air-conditioner costing ₹ 65,000 at the residence of a director as per terms of his appointment but treats it as fitted in quality control section in the factory. This is with the objective to treat it as plant for the purpose of computing depreciation.

(iv) A bank obtaining declaration from depositors in Form No. 15G/15H and forwarding the same to income-tax authorities.

(v) Mahesh deposited ₹ 50,000 in PPF account with the Post Office to avail tax deduction under section 80C. (Assume he has not opted for section 115BAC of the Income Tax Act, -1961). (Dec 2022, 5 marks)

|

Repeatedly Asked Questions |

||

| No. | Question | Frequency |

| 1. | Distinguish and differentiate between: Tax Planning and Tax Avoidance 16 – Dec [2] (b), 17 – June [2A] (Or) (i) |

2 Times |

Corporate Tax Planning & Tax Management Notes

Tax Planning

It is to avail maximum benefit of deductions, exemptions, rebates etc. for minimizing tax liability.

Tax Avoidance

It refers to reducing the tax liability by finding out loopholes in the law.

Tax Evasion

It refers to reducing tax liability by dishonest means.

Objectives of Tax Planning

- Reduction of tax liability

- Minimisation of litigation

- Productive Investment

- Healthy growth of economy

- Economic stability

Permissive tax planning

It involves making plans which are permissible under different provisions of tax laws. Tax laws of our country offer many exemptions and incentives. Planning to take advantage different tax concessions and incentives and deductions etc.