Chapter 3 Input Tax Credit & Computation of GST Liability – CS Professional Advance Tax Law Notes is designed strictly as per the latest syllabus and exam pattern.

Input Tax Credit & Computation of GST Liability – CS Professional Advance Tax Law Study Material

Question 1.

State with reasons, whether the following statements are true or false under GST law:

(iii) While doing repair of furniture of a company. GST was paid on wood, board, mica, paint etc.; the amounts so paid are eligible for input tax credit.

(v) Expenditure incurred on construction of factory building is ₹ 18,40,000 including GST of ₹ 2,80,000. The GST amount is not eligible for Input tax credit (Dec 2019, 1 mark each)

Answer:

(iii) True. As per Section 16 of the CGST Act, the tax charged in respect of goods which are used or Intended to be used in the course or furtherance of his business shall be eligible for Input tax credit, Thus. materials purchased for repairs of existing furniture is eligible for ITC.

(v) True. As per clause (C) and (d) of Section 17(5) of the CGST Act, tax charged on works contract service or goods or services used for construction of immovable property on its own account shall not be eligible for Input tax credit

Question 2.

State with reasons whether the following statement is true or false under GST Law:

(i) CGST Balance of one state can be adjusted to set oft CGST Liability of another state. (Aug 2021, 1 mark)

![]()

Question 3.

Explain the following terms used under the Central Goods and Services Tax Act, 2017:

(ii) Input Service Distributor (Dec 2017, 2 marks)

Answer:

“Input Service Distributor” means an office of the supplier of goods or services or both which receives tax invoices issued under Section 31 towards the receipt of input services and issues a prescribed document for the purposes of distributing the credit of Central tax, State tax, Integrated tax or Union tèrrltory tax paid on the said services to a supplier of taxable goods or services or both having the same Permanent Account Number as that of the said office [Section 2(61)]

Question 4.

Explain the mechanism under the CGST Act, 2017 for claiming Input Tax Credit while making payment of Taxes. (Dec 2017, 5 marks)

Answer:

Eligibility and Conditions for taking Input Tax Credit

1. Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

2. Notwithstanding anything contained in this section, no registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to hm unless,-

(a) he is in possession of a tax invoioe or debit note issued by a supplier registered under this Act, Or such other tax paying documents as may be prescribed;

(aa) the details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37;

(b) he has received the goods or services or both.

Explanation: For the purposes of this clause, It shall be deemed that the registered person has received the goods or, as the case may be, services

(i) where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

(ii) where the services are provided by the supplier to any person on the direction of and on account of such registered person;]

(c) subject to the provisions of section 41 or section 43A, the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilisation of Input tax credit admissible in respect of the said supply; and

(d) he has furnished the return under section 39:

However, where the goods against an invoice are received in lots or instalments, the registered person shall be entitled to take credit upon receipt of the last lot or instalment. Further, where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon, in such manner as may be prescribed:

Also, the recipient shall be entitled to avail of the credit of input tax on payment made by him of the amount towards the value of supply of goods or services or both along with tax payable thereon.

3. Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income tax Act, 1961 (43 of 1961), the input tax credit on the said tax component shaft not be allowed.

4. A registered person shall not be entitled to take Input tax credit in respect of any invoice or debit note for supply of goods or services or both after the due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or debit note pertains or furnishing of the relevant annual return, whichever is earlier.

However, the registered person shall be entitled to take input tax credit after the due date of furnishing of the return under section 39 for the month of September, 2018 till the due date of furnishing of the return under the said section for the month of March, 2019 in respect of any invoice or invoice relating to such debit note for supply of goods or services or both made during the financial year 2017-18, the details of which have been uploaded by the supplier under sub-section (1) of section 37 till the due date for furnishing the details under sub-section (1) of said section for the month of March, 2019.

![]()

Question 5.

Explain the consequences according to provisions of GST law, if a recipient of goods or services or both does not make payment for the supply within 180 days. (Dec 2018, 2 marks)

Answer:

Where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the Input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon.

Question 6.

Explain the concept of “Zero rated and Exempt transaction” for the purpose of availment of input tax credit In GST law. (Dec 2018, 3 marks)

Answer:

Exempt supply” means supply of goods or services which attracts Nil rate of tax or which are wholly exempt from tax and includes non-taxable supply.

“Zero rated supply” means export of goods or services or supplies made to Special Economic Zone (SEZ) developer or SEZ unit.

As per Section 17(2) of CGST Act, 2017 where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies and partly for effecting exempt supplies, the

amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies ‘including zero-rated supplies.

Question 7.

Goyal Manufactures, a registered person, instructs its one of the suppliers to send the input directly to Sumit Enterprises, who is a job worker, outside its factory premises for carrying out certain operations on the goods. The goods were sent by the supplier on 15th July, 2020 and were received by the job worker on 17th July, 2020. Whether Goyal Manufacturers are eligible to take Input Tax Credit (ITC) on the input goods directly received

by the job worker from the supplier. Discuss, what action under the GST law is required to be taken by Goyal Manufacturers. (June 2019, 4 marks)

Answer:

As per Section 19(2) of the CGST Act, 2017, the principal is entitled to take input tax credit of inputs sent for job work even if the said goods are directly sent to a job worker.

Section 19(3) of the CGST Act. 2017 further stipulates that where the inputs are sent directly to ajob worker but are not received back by the principal within a period of 1 year of the date of receipt of inputs by the job worker, it shall be deemed that such input had been supplied by the principal to the job worker on the day when the said inputs were received by the job worker.

In view of aforementioned provisions, Goyal Manufacturers are eligible to take the input tax credit on the input goods directly received by the job worker from the suppliers.

However, if the inputs are not returned by Sumit Enterprises within 1 year from 17.07.2020 (date of receipt of input goods by job worker), it shall be deemed that such input had been supplied by Goyal Manufactures to Sumit Enterprises on 17.07.2020 and Goyal Manufactures shall be liable to pay the tax along applicable interest.

Question 8.

Briefly explain about apportionment of credit and blocked credits under section 17 of the CGST Act. (Dec 2019, 5 marks)

Answer:

Apportionment of credit and blocked credits:

Section 17 of the CGST Act deals with apportionment of credit and blocked credits.

Where the goods or services or both are used by the registered person partly for the purpose of business and partly for other purposes the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business.

Where the goods or services or both are used by the registered person partly for taxable supplies including zero rated supplies and partly for exempt supplies, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero rated supplies.

The value of exempt supply shall be such amount as may be prescribed and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and subject to clause (b) of paragraph 5 of Schedule II, sale of building.

A banking company or financial institution engaged in supplying services by way of accepting the deposits, extending loans or advances shall have the option to either comply with the provisions of section 17(2) viz. proportionate input tax credit or avail of every month 50% of the eligible input tax credit on inputs, capital goods and input services in that month and the rest shall lapse.

Provided that once the option is exercised by a banking company or financial institution, it shall not be withdrawn during the remaining part of the financial year. This restriction of 50% also shall not apply to the tax paid on supplies made by one registered person to another registered person having the same PAN.

![]()

Question 9.

Nargis Agro Traders located at Jaipur and engaged in the business as retail traders provides the following details of its purchases and sales made during the month of July, 2022:

The rate of tax under GST on the items are 5%, 12%, 12% and 18% respectively. You are required to calculate the amount of GST payable and the date by which the due tax is to be paid by the trader for the month of July, 22 after availing the Input Credit. (Dec 2017, 5 marks)

Answer:

Note: Since GST Acts require that GST is to be charged separately, hence, all prices are taken as ‘value’ before taxes. Due credit may be given if a candidate has assumed that prices are inclusive of GST.

1. Calculation of Tax Payable by Nargis Agro Traders on the sales during July, 2022.

| Item | Value in ₹ | Rate | Tax in ₹ |

| Sugar Candies | 1,20,000 | 5% | 6,000 |

| Chocolates Bars | 1,00,000 | 12% | 12,000 |

| Wafers Packets | 60,000 | 12% | 7,200 |

| Biscuits | 50,000 | 18% | 9,000 |

| 34,200 |

2. Calculation of Tax paid on Purchase as Input Tax

| Item | Value in ₹ | Rate | Tax in ₹ |

| Sugar Candies | 1,00,000 | 5% | 5,000 |

| Chocolates Bars | 80,000 | 12% | 9,600 |

| Wafers Packets | 75,000 | 12% | 9,000 |

| Biscuits | 50,000 | 18% | 9,000 |

| Total Input Tax Credit | 32,600 |

Amount of Tax Payable

Tax to be paid:

- 34,200 – 32,600 = ₹ 1,600/- as CGST of ₹ 800/- and SGST of ₹ 800/-

- by 20/08/2017.

Question 10.

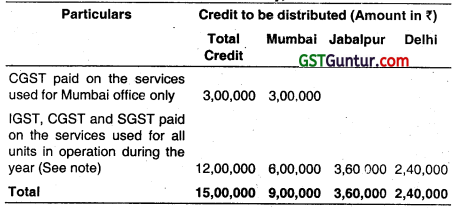

XYZ Ltd. having its head office at Mumbai, is registered as Input Service Distributor (ISD). It has three units in different cities situated in “Mumbai’. ‘Jabalpur’ and ‘Delhi’ which are operational in the current year. XYZ Ltd. furnishes the following information for the month of July 2022:

- CGST paid on services used only for Mumbai Unit: ₹ 3,00,000

- IGST, CGST & SGST paid on services used for all units: ₹ 12,00,000

- Total turnover of the units for the previous financial year is as follows:

Unit : Turnover (₹)

Total Turnover of three units : ₹ 10,00,00,000

Turnover of Mumbai unit : ₹ 5,00,00,000

Turnover of Jabalpur unit : ₹ 3,00,00,000

Determine the credit to be distributed by XYZ Ltd. to each of its three units. (June 2018, 5 marks)

Answer:

Input Tax Credit to be distributed by XYZ Ltd. a registered ISD on different Units for July, 2022

Note : The input-tax credit has been distributed on all the units on the pro-rata basis of the turnover of each of the Units in the ratio of 5 : 3 : 2.

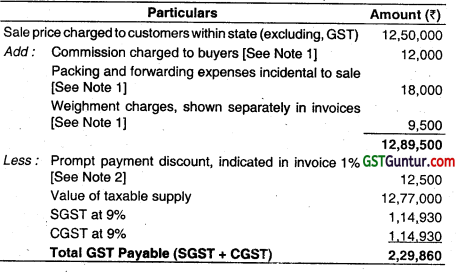

Question 11.

From the following details pertaining to Ashwathama, a registered dealer engaged in purchase and sale of goods, ascertain the GST liability (SGST/CGST/IGST) for the month of November, 2022:

Particulars : Amount (₹)

Sale price charged to customers within State

(excluding GST) : 12,50,000

Commission charged to buyers : 12,000

Packing and forwarding expenses incidental to sale : 18,000

Weighment charges, shown separately in invoices : 9,500

Prompt payment discount, indicated In invoice 1%, if payment made within 1 month. All buyers of goods have availed the discount.

The rates of taxes for the goods supplied are as under

Particulars : Amount (₹)

CGST : 9%

SGST : 9%

IGST : 18% (June 2018, 5 marks)

Answer:

Determination of GST Liability of Ashwathama for the month of November, 2022

Notes:

- As per Section 15 of the CGST Act, 2017, all incidental expenses like commission, packing and forwarding, weighment charges will form part of the taxable supply.

- Prompt payment discount is deductible, since it is known at the time of supply.

![]()

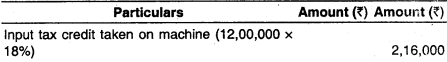

Question 12.

Jayakumar TextiLes Ltd., purchased a machinery on 12th August, 2021 for ₹ 12 lakhs (excluding GST). The company put the machinery to use after the purchase and avaed input tax credit for the

eligible amount.

The machinery was sold as second hand machinery on 14th May, 2021 for ₹ 9 lakhs. During purchase as well as sale of the machinery, the GST rate applicable was 18%. Assuming that there war no change in legal position after November, 2021, discuss the steps which Jayakumar Textiles Ltd., is required to take at the time of sale of the second hand machine. Briefly state the statutory provisions involved. (June 2018, 5 marks)

Question 13.

Parthiv Chemicals Pvt. Ltd. is a manufacturing company registered under GST in the State of Maharashtra. It manufactures two taxable products Sun” and Moon, and one exempt product “Jupiter”. On 1st October, 2021. product Moon got exempted through an exemption notification and the exemption available on product Jupiter” got withdrawn on the same date (1st October, 2021) under the same notification.

The above registered supplier has furnished the following details (amounts are excluding GST) chargeable at 18% GST;

| Particulars | Price (₹) |

| (a) Machinery “L” purchased on 22-10-2021 for being used in manufacturing product “Sun” and “Jupiter” | 1,20,000 |

| (b) Machinery ‘M’ purchased on 1st October, 2018 used till 30-09-2021 exclusively in manufacturing product “Jupiter”. However, from 1-10-2021, such machinery will also be used for manufacturing product “Moon” besides “Jupiter” | 5,00,000 |

| (c) Raw material used for manufacturing “Sun” purchased on 9-10-2021 | 2,20,000 |

| (d) Raw material used for manufacturing “Moon” purchased on 10-10-2021 | 4,00,000 |

| (e) Raw material used for manufacturing “Jupiter” purchased on 16-10-2021 | 1,00,000 |

All purchases are from outside the State from registered suppliers.

Compute the amount of input tax credit (ITC) to be credited to Electronic Credit Ledger for the Month of October, 2021. (June 2019, 5 marks)

Answer:

Computation of Amouñt of Input tax credit (ITC) credited to Electronic Credit Ledger for the month of October’ 2021:

| Particulars | Amount of ITC to be credited (₹) |

| (a) Machinery “L” [Note 1] | 21,600 |

| (b) Machinery “M” [Note 2] | 36,000 |

| (c) Raw Material used for manufacturing “Sun” [Note 3] | 39,600 |

| (d) Raw Material used for manufacturing “Moon” [Note 3] | Nil |

| (e) Raw Material used for manufacturing “Jupiter” [Note 3] | 18,000 |

| Total ITC credited to Electronic Credit Ledger | 1,15,200 |

Notes:

1. ITC in respect of capital goods used or intended to be used exclusively for effecting supplies other than exempted supplies but including zero rated supplies shall be credited to the electronic credit ledger [Rule 43(1)(b) of the CGST Rules, 2017].

2. Where any capital goods earlier used exclusively for effecting exempt supplies is subsequently also used for effecting taxable supplies, the value of capital goods being machinery shall be arrived at by reducing the ITC at the rate of 5% for every quarter or part thereof and the amount so arrived at shall be credited to the electronic credit ledger (Proviso to Rule 43(1)(c) of the CGST Rules, 2017].

Thus, ITC on M” shall be computed as under:

= ₹ 90,000 – 54,000 (90,000 × 5% × 12 quarters)

= ₹ 36,000

3. ITC in respect of inputs used for effecting taxable supplies will be credited in electronic credit ledger. ITC in respect of inputs used for effecting exempt supplies will not be credited in electronic credit ledger [Rule 42 of CGST Rules, 2017].

Question 14.

Determine the amount of Input Tax Credit (ITC) admissible to JKL Ltd.. in the month of September, 2021 In respect of various Inward supplies during the month from the following information.

Assume that all the conditions necessary for availing the Input tax credit have been fulfilled by JKL Ltd:

| Items | GST Paid (₹) |

| • Health Insurance of permanent factory employees, as per policy of company | 60,000 |

| • Raw materials for which invoice received and GST paid for full amount but only 90% of material received during the month and remaining 10% will be received in next month (October, 2021) | 1,13,000 |

| • Work contractor’s service used for installation of plant and machinery | 1,18,000 |

| • Goods purchased against valid invoice from PQR Ltd., Although GST has been deposited by PQR Ltd. but JKL Ltd. has made payment to PQR Ltd. for such purchases in the month of November, 2021. | 50,000 |

| • Purchase of car used by director for the business meetings only | 25,000 |

(June 2019, 5 marks)

Answer:

Calculation of Input Tax Credit (ITC) available to JKL Ltd. for the month of September, 2021

| Particulars of items with Amount of GST | Amount (₹) |

| Health Insurance of factory employees of ₹ 60,000

Note: As per Section 17(5)(b)(iii) ITC is not available until and unless it is as per compulsory Government policy. Here it is only as per Company policy, therefore. ITC is not available. |

Nil |

| Raw materials for which invoice received and GST paid for full amount but only 90% of material received during the month and remaining 10% will be received in next month ₹ 1,13,000

Note: As per proviso to Section 16(2), it will be available when last lot will be received, hence entire ITC be available in October, 2021 |

Nil |

| Work contractor’s service used for installation of plant and machinery of ₹ 1,18,000

Note: As per Section 17(5)(c) ITC will not be available for works contract services when supplied for construction of an immovable property other than plant and machinery. |

1,18,000 |

| Goods purchased against valid invoice from PQR Ltd. | ₹ 50,000 |

| Note: ITC shall be admissible in Month of September, 2021 even if payment is made by JKL Ltd. in the Month of November, 2021 as payment is made within 180 days’ period. Purchase of car used by director for the business meetings only of ₹ 25,000

Note: As per Section 17(5)(a) input tax credit shall not be available in respect of Motor Vehicle (Car) for director even for business use only. |

Nil |

| Total input tax credit available | 1,68,000 |

![]()

Question 15.

Saraswathi Polymers Pvt. Ltd., has two units, one in Coimbatore, Tamil Nadu and another in Thrissur, Kerala. In the Coimbatore unit, it manufactures customised products only. Each lot consists of 100 units and is valued at ₹ 5 lakhs. These products require further processing before delivery to the customers. The further processing is done by the Kerala Unit, which enjoys a unique market position as there being no competitor providing similar services in Kerala.

The Kerala Unit, besides processing the products of the Tamil Nadu Unit, undertakes processing work of outsiders also and collects charges from them. Other manufacturers in Kerala, who deliver products to this unit for further processing, value at ₹ 3.5 lakhs per 100 units.

You are required to determine the value of 100 units supplied by the Tamil Nadu Unit of the registered supplier to its Kerala unit as per provisions of the CGST Act, 2017. (June 2019, 4 marks)

Answer:

As per Section 25(4) of the CGST Act, 2017, a person who has obtained or is required to obtain more than one registration, whether in one State or Union Territory or more than one State or Union Territory shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act. Therefore, units of Saraswathi Polymers Pvt. Ltd. in Kerala and in Coimbatore are two distinct person.

As per Rule 28 of CGST Rules 2017, the value of the supply of goods between distinct persons as specified in sub-sections (4) and (5) of Section 25 of the CGST Act, 2017 or where the supplier and recipient are related, other than where the supply is made through an agent, shall,—

(a) be the open market value of such supply;

(b) if the open market value is not available, be the value of supply of goods or services of like kind and quality;

(c) if the value is not determinable under Cause (a) or (b), then the cost of supply plus 10% mark up or be determined by other reasonable means, in that sequence.

Provided that where the goods are intended for further supply as such by the recipient, the value shall, at the option of the supplier, be an amount equivalent to ninety percent of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person:

In the given case, open market value of the 100 units being supplied to Kerala unit is not available since the supplier manufactures customized products. Therefore the value of 100 units supplied by Tamil Nadu unit of Saraswathi polymers Pvt. Ltd. to Kerala unit will be the value of the goods of similar kind and quality supplied to Kerala unit by other customers which is being ₹ 3.5 lakhs per 100 units.

Since goods are not supplied as such by the Kerala unit, goods cannot be valued @ 90% of the price charged for the supply of like goods by the Tamil Nadu unit to its unrelated customers in terms of first proviso to Rule 28 of CGST Rules, 2017, Hence, value be taken at ₹ 3.5 lakhs for the 100 units supplied by Tamil Nadu Unit to its Kerala Unit for the purpose of processing.

Question 16.

Parikh is a practising Company Secretary at Mumbai. His gross fee receipts for the financial year 2021-22 was ₹ 28 lakhs. He estimated his gross receipts at ₹ 32 lakhs for the financial year 2022-23. He wants to avail composition scheme for the financial year 2023-24. Briefly narrate whether he can avail composition scheme for the financial year 2023-24 with attendant conditions. Will he be eligible to avail input tax credit? Can he issue tax invoice? (Dec 2019, 5 marks)

Answer:

Applicability of Composition Scheme:

Tfie new composition scheme, introduced vide Notification No.2/2020 dated 7.03.2020, provides for concessional rate of tax particularly to the suppliers of services. It is applicable to suppliers of services who have to pay tax at a rate of 6% (3% CGST and 3% SGST / 6% IGST). The basic condition for its applicability is that the annual turnover of the person in preceding financial year must not have exceeded ₹ 50 lakhs. In the present case, since Mr. Parikh has estimated turnover of ₹ 32 lakhs in the year 2022-23 which is below the minimum threshold of ₹ 50 lakhs, he can avail the new composition scheme for supply of service in the F.Y. 2023-24.

The registered person opting for new composition scheme is not eligible to avail input tax credit nor shall he be eligible to charge output tax from its recipients of supply.

The registered person shall issue bill of supply instead of tax invoice.

Question 17.

Bharat Ltd., a registered supplier under the regular scheme, is engaged in manufacture of electronic items. The following details for the month of March, 2022 are available:

Item : GST Paid (₹)

Machines acquired for manufacture (capital goods) : 10,00,000

Electronic items utilized in manufacture : 25,00,000

Trucks used for transporting materials : 1,00,000

Food and beverages consumed within the factory : 25,000

Advise the ITC eligibility for the company. (Dec 2019, 5 marks)

Answer:

Computation of ITC available:

| Amount(₹) | |

| (i) Machineries acquired for manufacture of electronic items is eligible for ITC. However, depreciation has to be claimed on the net value excluding the GST. It is assumed that the GST amount has not been considered for the purpose of depreciation under section 32 of the Income-tax Act. 1961. | 10,00,000 |

| (ii) Electronic items utilized In manufacture. The ITC would be fully available as these are used in the course of business/ furtherance of business. [Section 16 CGST Act] | 25,00,000 |

| (iii) Trucks used foc transporting materials. ITC on motor vehicles for transportation of goods has not been blocked under Section 17(5) of the CGST Act. Hence, it is eligible for input tax credit. | 1,00,000 |

| (iv) Under Section 17(5) of the CGST Act, ITC on food and beverages is a blocked credit unless they are consumed to make outward taxable supplies in the same category or as part of mixed supply or composite supply or it is obligatory on the part of the employer to provide such service to its employees under any law. However, in the present case, food and beverage have been consumed within the factory. Hence, not eligible. |

Nil |

| (v) Total ITC available | 36,00,000 |

Question 18.

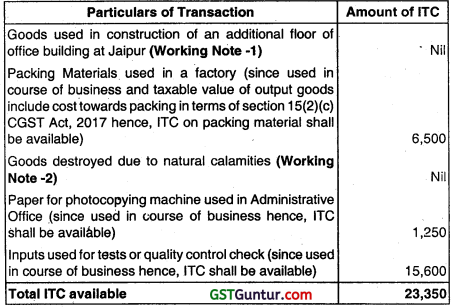

Determine the amount of Input Tax Credit (ITC) admissible under the provisions of CGST Act, 2017 to PQR Ltd. in respect of the following transactions which have taken place in the month of January, 2023. Take note that

(i) all the conditions necessary for availing the ITC have been complied with and fulfilled; and

(ii) the registered person PQR Ltd. is not eligible for any threshold exemption.

Support your answer by giving brief reasons.

Particulars : Amount of GST (₹)

(i) Goods used in constructing an additional floor of office building at Jaipur. : 24,750

(ii) Packing materials used in the factory : 6,500

(iii) Goods destroyed in flood waters due to natural calamities : 4,750

(iv) Paper purchased for computers printing and for photocopying machine used in Administrative Office : 1,250

(v) Inputs used for tests or for quality control check : 15,600 (Dec 2020, 5 marks)

Answer:

Computation of Input Tax Credit for the month of January, 2023

Working Notes:

1. As per Section 17(5)(d) of CGST Act, 2017, Input Tax Credit shall not be available in respect of goods or services Or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course of furtherance of business. Hence, input tax credit shall not be available in respect of goods used in construction of an additional floor of office building.

2. Section 17(5)(h) of CGST Act, 2017, Input Tax Credit shall not be available in respect of goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples. Hence, no ITC shall be available in respect of goods destroyed due to natural calamities.

![]()

Question 19.

Romeo Small Finance Bank Ltd is engaged In providing financial related services and of various types of loan facilities to its constituents, furnishes the following information relating to various services provided and the gross amount received during the month of December, 2022.

Particulars of service Amount : (₹ In lacs)

(1) Commission received for debt collection service : 10

(2) Discount earned on bills discounted : 3

(3) Penal interest recovered from the customers for the delay in payment of loan. EMIs/Dues : 2

(4) Commissioner received for service rendered to Government for the collection of taxes : 5

(5) Interest earned on reverse repo transaction : 10

(6) Service to merchants accepting credit/debit card payments using point of sale (POS) machine of Bank. (In 30% cases, the amount per transaction was up to ₹ 1,800 while in the other cases the amount was exceeding ₹ 2,000) : 20

Compute the value of taxable supply and of the amount of GST payable for the month of December, 2021 of Romeo Small Finance Bank Ltd. Gross amount does not indude the amount of GST. Take the Rate of GST as 18%.

(Dec 2020, 5 marks)

Answer:

Romeo Small Finance Bank Ltd. Computation of Value of Taxable Supply and of GST payable for the month of December, 2022

| Particulars | Amount (₹) |

| Commission received on debt collection | 10,00,000 |

| Discount earned on Bills Discounted [Exempt Entry 27 of Notification No. 12/2017-CT (Rate)] | Exempt |

| Penal interest charged for delay in repayment [Includible in value as per Section 15(2)(d) of the CGST Act] | 2,00,000 |

| Commission received for services rendered to Government for collection of taxes. [Since an activity carried out for consideration and there is no exemption in force, liable to GST] | 5,00,000 |

| Interest earned on Reverse Repo transaction [Reverse Repo are ‘securities’-Not covered in goods as well as in services. Additionally, interest earned on securities is exempt vide Entry 27 of Notification No. 12/2017-CT (Rate), hence not taxable] | Exempt |

| Service to merchants accepting credit/debit card payments using Point of Sale machine(POS) of Bank [in 30% cases, the amount per transaction was up to ₹ 1800 hence exempt vide Entry 34 of Notification No. 12/2017-CT(R); while in other cases, the amount was exceeding ₹ 2000 hence liable to GST] (70% of 20,00,000) | 14,00,000 |

| Value of Taxable Supply | 31,00,000 |

| Total GST payable @18% on ₹ 31,00,000 | 5,58,000 |

Question 20.

2020 – Dec [2] (a) PQR Travels Ltd. engaged in providing diversified services of transportation of passengers by various modes provides the details of the various services so provided to the passengers and of the amount collected there against for the month of March, 2022. Service of Transportation of Passengers:

(1) by National Waterways : ₹ 40,00,000

(2) by Air conditioned State carriages : ₹ 30,00,000

(3) by contract carriages for tourism purposes : ₹ 25,00,000

(4) from Mumbai to Chennai port in a vessel and such service is not for tourism purpose : ₹ 12,00,000

(5) in Metered Cab : ₹ 32,50,000

(6) in Radio Taxis : ₹ 25,00,000

(7) in Air conditioned contract carriages : ₹ 25,00,000

Compute the value of the taxable supply of the services and of the amount of GST liability payable thereon by PQR Travels Ltd for March, 2023 by taking the applicable rate of GST at 5%. (Dec 2020, 5 marks)

Answer:

Computation of Taxable Value of Supply and of GST liability PQR Travels Ltd. for March, 2023

| Particulars | Amount (₹) |

| 1. Transportation of passengers by National Waterways [Exempt vide Entry 17 of Notification No. 12/2017-CT (Rate)] | Nil |

| 2. Transportation of passengers by Air conditioned State carriages | 30,00,000 |

| 3. Transportation of passengers by contract carriage for tourism | 25,00,000 |

| 4. Transportation of passengers from Mumbai to Chennai port in a vessel [being in a public transport vessel sailing in India not for tourism – is exempt vide Entry-17 of Notification No. 12/2017-CT (Rate)] | Nil |

| 5. Transportation of passengers in Metered Cab [Exempt vide entry 17 Notification No. 12/2017-CT (Rate)] | Nil |

| 6. Transportation of passengers in Radio Taxis | 25,00,000 |

| 7. Transportation of passengers in air-conditioned contract carriages | 25,00,000 |

Question 21.

Destiny Advertising Agency, Ahemdabad supplying services to different customers for making booking of advertisements in different media, provides the following details and of the amounts charged there against for the month of January, 2023.

Particulars : Amount (₹ Lakh)

(1) Aerial advertising : 15

(2) Sale of time slot for advertisement to be broadcast on television : 12

(3) Advertisement via banner at public places : 7

(4) Sale of time slot for advertisement on FM Radio/98 Radio Mirchi : 13

(5) Advertisements in Dainik Bhaskar newspaper : 9

(6) Advertisement on cover and back pages of books : 1

Compute the taxable value of the services and of the amount of GST payable. Take the rate of GST in print’ media of 5% and in other cases of 18%. All amounts given are exclusive of GST. Ignore the threshold limit. (Dec 2020, 5 marks)

Answer:

Destiny Advertising Agency, Ahemdabad Computation of Taxable Value of Supply and of GST payable of January, 2023

| Particulars | Amount (₹) |

| 1. Aerial advertising | 15,00,000 |

| 2. Sale of time slot for advertisement in TV Serial | 12,00,000 |

| 3. Advertisement via banners at public places | 7,00,000 |

| 4. Sale of time slot for advertisement on FM radio and 98 Radio Mirchi | 13,00,000 |

| 5. Advertisement in Dainik Bhaskar news paper(Print media hence GST applicable @5%) | 9,00,000 |

| 6. Advertisement on cover and back pages of books (Books are covered in Print media – hence GST applicable @ 5%) | 1,00,000 |

| Total Value of Taxable Supply | 57,00,000 |

| Value of supply Taxable @ 5% (9,00,000+1,00,000) | 10,00,000 |

| Value of supply Taxable @ 18% (15,00,000+12,00,000+7,00,000+13,00,000) | 47,00,000 |

| GST Payable (10,00,000 × 5 %) + (47,00,000 × 18%) = 50,000 + 8,46,000 | 8,96,900 |

Question 22.

M/s Basuridhara Properties is a registered person under GST. Its main business is renting of various Immovable properties owned by them. The following collections are made in the course of its business during the month of March, 2023:

(i) Building let to a theatre : ₹ 50,000

(ii) Premises let to a charitable trust : ₹ 45,000

(iii) Land let for use by Asian Circus : ₹ 90,000

(iv) Houses let to individuals for residential purposes : ₹ 30,000

(v) Vacant land let used for agriculture purposes : ₹ 40,000

(vi) Land given on lease to Titu Ltd. for construction of a commercial complex : ₹ 60,000

(vii) Building let to a coaching centre : ₹ 45,000

(viii) Building let to a hotel : ₹ 50,000

You are required to calculate the GST payable by M/s Basundhara Properties (GST rate applicable is 18%). (Aug 2021, 5 marks)

Answer:

Computation of GST Payable for the month of March, 2023 :

| Particulars | Amount (₹) |

| i. Building let to a theater | 50,000 |

| ii. Premises let to a Charitable Trust | 45,000 |

| iii. Land let for use by Asian Circus | 90,000 |

| iv. Houses let to individuals for residential purpose | Nil |

| v. Vacant land let used for Agriculture Purposes | Nil |

| vi. Land given on lease to Titu Ltd. for construction of a commercial complex | 60,000 |

| vii. Building let to a coaching centre | 45,000 |

| viii. Building let to a Hotel | 50,000 |

| Total Taxable Supply | 3,40,000 |

| GST payable on 3,40,000 @ 18% | 61,200 |

Note:

I. As per Entry No. 12 of Notification no. 12/2017 Central Tax (Rate) dated June 28, 2017 Services by way of renting of immovable properties for use as residence are exempt.

II. As per Entry No. 54 of Notification no. 1212017 Central Tax (Rate) Services by way of renting or leasing of agro machinery or vacant and with or without a structure incidental to its use relating to cultivation of plants and rearing of all the form of animals, except the rearing of horses, for food, fibre, fuel, raw material or other similar products or agricultural produce are exempt.

III. GST is on reverse charge for Long term lease of land (30 years or more) by any person against consideration in the form of an upfront amount (called as premium, salami, cost, price, development charges, or by any other name) and/or periodic rent for construction of a project by a promoter. [Notification 05/2019 Central Tax (Rate)

it is assuried that in Point (vi), it is not long term lease and hence torward charge is applicable.

![]()

Question 23.

Jinia is a Garments manufacturer registered under GST. It received a Government order for making Garments for Defence Personnel (exempted from GST under a special notification by the Government of India) for which it procured fabric separately. To execute the work Jifia also procured buttons, threads, collars and lining materials which are also used for the production of other goods in the factory.

ITC (Input Tax Credit) available in respect of thread. buttons and collars for the month of January, 2022 was ₹ 25,000, ₹ 45,000 and ₹ 50,000 respectively and the taxable and exempted supplies during the month were ₹ 10 lakh and ₹ 2 lakh respectively. Calculate the eligible ITC that can be availed by Jinia for the month of January 2023 in respect of thread, buttons and collars. (Aug 2021, 5 marks)

Answer:

As per Section 17 of the Central Goods and Services Tax Act, 2017 read with Rule 42 of CGST Rules law if goods or services or both are used by the registered person partly for effecting taxable supplies including Zero rated supplies under this Act or under the IGST Act and partly for effecting exempt supplies under the said Act, the amount of credit shall be restricted to so much of the input tax as is attributable to taxable supplies including Zero rated supplies.

In the given case Thread, Buttons and Collars are used for both taxable as well as exempt supplies.

As per the manner of apportionment prescribed in CGST Act

![]()

In the given case

Common ITC credit (₹ 25,000 + 45,000 + 50,000) = ₹1,20,000

Exempt Turnover = ₹ 2,00,000

Total Turnover (₹ 10,00,000 + 2,00,000) = ₹ 12,00,000

Therefore,

Credit attributable to Exempt supplies \(=\frac{1,20,000 \times 2,00,000}{12,00,000}\) = ₹ 20,000

Hence, Jinia would have to reverse ITC of Rupees 20,000 in its GSTR – 3B in the month of January 2022 and only ₹ 1,00,000 (₹ 1,20,000 – ₹ 20000) can be availed by June as ITC in respect of Thread, Buttons and Collars.

Question 24.

Calculate the value of taxable supply and GST liability of GG Freight and Goods carries engaged in the business of transport of goods by road for the month of March, 2023 from the given particulars.

Give reasons for taxability or exemption of each item. Suitable assumptions may be made wherever required. GG freight and goods carriers avails ITC.

Take the rate of GST chargeable at 12% . Total freight charges received for the month of March, 2023 of ₹ 20,00,000 and following charges included in 20 lakhs.

Particulars : Amount (₹)

(i) Freight charges received from Government Departments registered only for the purpose of tax deduction at

source : 4,00,000

(ii) Freight charges received from unregistered persons for transportation of their household goods : 1,00,000

(iii) Freight collected for transporting goods in small vehicles for persons who paid less than ₹ 1,500 per trip : 3,00,000 (Dec 2021, 4 marks)

Answer:

Computation of Value of taxable supply and GST for March, 2023

CG Freight and Good Carriers

| Particulars | Amount (₹) |

| Total freight received | 20,00,000 |

| Less: Freight Charges received from Government department registered only for the purpose of tax deduction at source.[Exempt vide Entry 21B of Notification No.12 2017 CT (Rate)] | 4,00,000 |

| Less: Freight charges received from unregistered persons for transportation of their household goods (Exempt vide Entry 21 A of Notification No. 12/201 7-CT (Rate)] | 1,00,000 |

| Less: Freight collected for transporting goods in small vehicles for persons who paid less than 1500 per trip (Exempt, since the freight on all consignments transported into a goods carnage doesnt exceed 1 500)[Exempt vide Entry 21 of Notification No. 1212017-CT(Rate) | 3,00,000 |

| Total value of taxable supply | 12,00,000 |

| GST payable @ 12% on ₹ 12,00,00 | 1,44,000 |

Question 25.

Kajri Pvt. Ltd., a registered supplier, is engaged in the manufacture of taxable goods. The company provides the following information pertaining to purchase made/services availed by it during the month of August, 2022:

| Particulars | GST (₹) |

| (i) Raw spices purchased for personal use of directors | 3,50,000 |

| (ii) Electric machinery purchased for being used in the manufacturing process | 2,25,000 |

| (iii) Club membership fees for employees working in the factory | 1,55,000 |

| (iv) Motor vehicle used for transportation of employee (seating capacity 12 persons) | 2,70,000 |

| (v) Payment made to contractor for construction of staff quarter | 80,000 |

Determine the amount of Input Tax Credit (ITC) available with Kajri Pvt. Ltd. for the month of August, 2022 in the context of provision of CGST Act, 2017 by giving the necessary explanation for treatment of various items. Subject to the information given above, all the other conditions necessary for availing ITC have been fulfilled. (June 2022, 5 marks)

Answer:

Computation of Input Tax Credit (ITC) available with Kajrl Pvt. Ltd. for the month of August, 2022:

| Particulars | Amount (₹) |

| (i) Raw spices purchase for personal use of directors [ITC is not available on goods used for personal consumption as credit blocked under Section 17(5) of Central Goods and Services Tax Act, 2017.] |

Nil |

| (ii) Electric machinery purchased for being used in the manufacturing process | 2,25,000 |

| (iii) Club Membership fees for employees working in the factory [Covered under Blocked credit in terms of Section 17(5) of Central Goods and Services Tax Act, 2017] |

Nil |

| (iv) Motor vehicle used for transportation of employee[ITC on motor vehicles for transportation of persons with seating capacity ≤ 13 persons (including the driver) is blocked except when the same are used for (i) making further taxable supply of such motor vehicles (ii) making taxable supply of transportation of passengers (iii) making taxable supply of imparting training on driving such motor vehicles.In the given case, motor vehicle used for transportation of the employee is covered under blocked credit in term of Section 17(5) of Central Goods and Services Tax Act, 2017] |

Nil |

| (v) Payment made to contractor for construction of staff quarter. [ITC is not available on goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.] |

Nil |

| Total available ITC | 2,25,000 |

![]()

Question 26.

Piyush Manufactures, a registered person, instructs its supplier to send the capital goods directly, to Vijay Enterprises, who is a job-worker, outside its factory premises for carrying out certain operations on the goods. The goods were sent by the supplier on 10th April and were received by the job-worker on 15th April.

Vijay Enterprises carried out the job-work, but did not return the capital goods to their principal – Piyush Manufactures. Discuss whether Piyush Manufactures are eligible to retain the input tax credit availed by them on the capital goods. What action under the GST Act is required to be taken by Piyush Manufactures ?

What would be your answer if in place of capital goods, jigs and fixtures are supplied to the job worker and the same has not been returned to the principal? (June 2022, 4 marks)

Answer:

As per section 19(5) of the Central Goods and Services Tax Act, 2017: Notwithstanding anything contained in 16(2)(b), the principal shall be entitled to take credit of input tax on capital goods even if the capital goods are directly sent to a job worker for job work without being first brought to his place of business.

Further, section 19(6) of the Central Goods and Services Tax Act, 2017 stipulates that where the capital goods sent directly to a job worker are not received back by the principal within a period of 3 years of the date of receipt of capital goods by the job worker, it shall be deemed that such capital goods had been supplied by the principal to the job worker on the day when the said capital goods were received by the job worker.

In view of aforementioned provisions, Piyush Manufactures are eligible to retain the input tax credit availed by them on the capital goods.

However, if the capital goods are not returned by Vijay Enterprises within 3 years from 15th April and Piyush Manufactures shall be liable to pay the tax along with applicable interest.

There is no time limit for return of moulds and dies, jigs and fixtures or tools sent out to a job worker for job work [section 19(7) of Central Goods and Services Tax Act, 2017].

However, if Vijay Enterprises does not return the jigs and fixtures to Piyush Manufactures, it shall not be considered as a supply of jigs and fixtures to Vijay Enterprises by Piyush Manufactures. In this case also, Vijay Manufactures will be eligible to retain the input tax credit availed by them.

Question 27.

Sukesh Private Ltd., registered in Uttar Pradesh, is engaged in supplying of services, its turnover was ₹ 30 lakh in the financial year 2021 -22. It has provided the following information of outward supply for the month of May, 2023 :

| Particulars | Amount (₹) |

| (i) Fee for the coaching provided to students for competitive exams. The coaching centre is run by Sukesh Private Ltd. in Uttar Pradesh | 6,00,000 |

| (ii) Receipts for services provided in relation to conduct of examination in Saransh University, Delhi (Providing education recognized by Indian Laws) | 20,000 |

| (iii) Amount received from Kama Public School a higher secondary school at Noida (Uttar Pradesh) for transportation of students from their residence and back. | 50,000 |

| (iv) Amount received for providing the security and housekeeping services in VT Public School-a pre-school at Delhi | 30,000 |

Note: Rate of CGST, SGST ar.d IGST and 9%, 9% and 18% respectively. All the amounts given above are exclusive of taxes.

Compute the total GST Liability of Sukesh Private Ltd. for the month of May, 2023. (Dec 2022, 5 marks)

Question 28.

Aditi Company Ltd. is engaged in the manufacturing of heavy machinery. It procured the following items during the month of April, 2023:

| Items | GST Paid (₹) |

| (i) Electrical transformers to be used in the manufacturing process | 5,00,000 |

| (ii) Trucks used for the transport of raw material | 1,20,000 |

| (iii) Goods purchased from R traders (Invoice of R Traders is received in the month of April, 2023 and debited in the books of account in the April, 2023, but goods were received in the month of May, 2023 | 1,50,000 |

| (iv) Confectionery items for consumption of employees working’ in the factory | 20,000 |

Determine the amount of Input Tax Credit (ITC) available with Aditi Company Ltd., in the month of April, 2023 by giving necessary explanations for treatment of various items. Assume that:

- All the conditions necessary for availing the ITC have been fulfilled.

- Aditi Company Ltd. is not eligible for any threshold exemption. (Dec 2022, 5 marks)

Question 29.

Ghumte Raho Ltd. a tour operator, availed input tax credit (ITC) in respect of certain transactions where no such supplier was existent or from a person not doing any business from the registered place of business.

Jurisdictional Deputy Commissioner of GST wants to restrict the utilization of the credit by Ghumte Raho Ltd. You have been approached by Ghumte Raho Ltd. to give your advice on the following questions raised by it:

(i) Is it possible for the Department to restrict the utilization of credit which is already availed?

(ii) If yes, under what circumstances this can be done by the Department? (Dec 2022, 4 marks)

Question 30.

What is Input Service Distributor (ISD)?

Answer:

ISD means an office of the supplier of goods or services or both which receives tax invoices towards receipt of input services and issues a prescribed document for the purposes of distributing the credit of central tax (CGST), State tax (SGST)/ Union territory tax (UTGST) or integrated tax (IGST) paid on the said services to a supplier of taxable goods or services or both having same PAN as that of the ISD.

Question 31.

What is Input Tax credit?

Answer:

Input tax credit means the credit of central tax, state/ union territory tax and integrated tax available to a registered person on the inward supply of goods or services or both, made to him excluding the tax paid on supplies liable to composite tax. It further includes the integrated tax applicable on import of goods or services and the tax payable under reverse charge mechanism.

Question 32.

Whether Input tax credit availed on refractory bricks, moulds and dies, jigs and fixtures is to be reversed in case of supply of such goods?

Answer:

Yes. In terms of proviso to Section 18(6) of CGST Act, in case of supply of such goods as scrap, the registered person is required to pay the tax on the transaction value of such goods. Thus, in this case, unlike section 18(6), no comparison is required to be made between ITC taken on the capital goods/plant and machinery reduced by the specified percentage points and the tax on the transaction value of such goods.

Question 33.

Can the ISD distribute the credit as a consolidated amount to a recipient?

Answer:

No, in terms of Rule 39(1) (b) of the CGST Rules, 2017, the ISD is required to distribute the eligible and in-eligible credit separately to a recipient. Further, the integrated tax, central tax and state tax should also be distributed separately.

![]()

Question 34.

Can a company have multiple ISD?

Answer:

Yes, different offices like marketing division, security division etc. may apply for separate ISD.

Question 35.

Can GST paid on reverse charge basis be considered as input tax?

Answer:

Yes. The definition of input tax includes the tax payable under the reverse charge.

Question 36.

What are the conditions necessary for obtaining ITC?

Answer:

Following four conditions are to be satisfied by the registered taxable person for obtaining ITC:

(a) he is in possession of tax invoice or debit note or such other tax paying documents as may be prescribed;

(b) he has received the goods or services or both;

(c) the supplier has actually paid the tax charged in respect of the supply to the government; and

(d) he has furnished the return under section 39.

Question 37.

What is the time limit for taking ITC and reasons thereof?

Answer:

A registered person cannot take ITC in respect of any invoice or debit note for supply of goods or services after the due date for furnishing the return under section 39 for the month of September following the end of financial year to which such invoice/invoice relating to debit note pertains or furnishing of the relevant annual return, whichever is earlier. So, the upper time limit for taking ITC is 20th October of the next FY or the date of filing of annual return whichever is earlier.

The underlying reasoning for this restriction is that no change in return is permitted after September of next FY. If annual return is filed before the month of September, then no change can be made after filing of annual return.

Question 38.

What is the time limit within which the recipient of supply is liable to pay the value of supply with taxes to the supplier of services/goods to avail in the input tax credit?

Answer:

In terms of second proviso to Section 16(2) of the CGST Act, the time limit prescribed is one hundred and eighty days (180 days) from the date of issue of invoice by the supplier of services/goods. If the recipient fails to pay the value of supply (with tax) within 180 days, such input tax credit would be payable by the recipient along with applicable interest.

The above time limit is not applicable to supplies that are liable to tax under reverse charge mechanism.

Question 39.

A person becomes liable to pay tax on 1st August, 2021 and has obtained registration on 15th August, 2020. Such person is eligible for input tax credit on inputs held in stock as on:

(a) 1st August, 2021

(b) 31st July, 2021

(c) 15th August, 2021

(d) He cannot take credit for the past period

Answer:

(b) 31st July, 2021.

Question 40.

Which of the following is included for computation of taxable supplies for the purpose of availing credit?

(a) Zero-rated supplies

(b) Exempt supplies

(c) Both

Answer:

(a) Zero rated supplies.

Question 41.

Mr. A, a registered person was paying tax under composition scheme up to 30th July, 2021. However, w.e.f 31st July, 2021, Mr. A becomes liable to pay tax under regular scheme. Is he eligible for ITC?

Answer:

Mr. A is eligible for input tax credit on inputs held in stock and inputs contained in semi-finished or finished goods held in stock and capital goods (reduced by such percentage points as may be prescribed) as on 30th July, 2021.

![]()

Question 42.

Mr. B applies for voluntary registration on 5th June, 2020 and obtained registration on 22nd June, 2021. Mr. B is eligible for input tax credit on inputs in stock as on ………

Answer:

Mr. B is eligible for input tax credit on inputs held in stock and inputs contained in semi-finished or finished goods held in stock as on 21st June, 2021. Mr. B cannot take input tax credit in respect of capital goods.

Question 43.

Whether the registered person can avail the benefits of input tax credit and depreciation on the tax component of capital goods and plant and machinery?

Answer:

No, Section 16(3) provides that input tax credit will not be allowed on the tax component of cost of capital goods/ plant and machinery, if the depreciation on the said tax component is claimed under the provision of Income Tax Act, 1961 by the taxable person. Therefore, the registered person has an option to either claim depreciation (under the Income Tax Act, 1961) or claim credit under the GST law, on the said tax component.

For example:

Cost of Asset = ₹ 1,000/

Tax = ₹ 100/

Total = ₹ 1,100/

If depreciation is charged on ₹ 1,000/-, then credit will be available under the GST law and if depreciation is charged on ₹ 1,100/- then credit will not be available.

Question 44.

What are the requirements for registration as ISD?

Answer:

An ISD is required to obtain a separate registration even though it may be separately registered. The threshold limit of registration is not applicable to ISD. The registration of ISD under the existing regime (i.e. under Service Tax) would hot be migrated in GST regime. All the existing ISDs will be required to obtain fresh registration under new regime in case they want to operate as an ISD.

Question 45.

What does the turnover used for ISD cover?

Answer:

The turnover for the purpose of ISD does not include any duty or tax levied under entry 84 of List I and entry 51 and 54 of List II of the Seventh Schedule to the Constitution.

Question 46.

Is the ISD required to file return?

Answer:

Yes, ISD is required to file monthly return by 13th of the following month.

Question 47.

The ISD may distribute the CGST and IGST credit to recipient outside the State as

(a) IGST

(b) CGST

(c) SGST

Answer:

(a) IGST.

Question 48.

The ISD may distribute the CGST credit within the State as _____

(a) IGST

(b) CGST

(c) SGST

Answer:

(a) IGST

Question 49.

The lSD may distribute the CGST credit within the State as____

(a) IGST

(b) CGST

(C) SGST

(d) Any of the above.

Answer:

(b) CGST.

Question 50.

The credit of tax paid on input service used by more than one supplier is _______

(a) Distributed among the suppliers who used such input service on pro rata basis of turnover in such State.

(b) Distributed equally among all the suppliers.

(c) Distributed only to one supplier.

(d) Cannot be distributed.

Answer:

(a) Distributed among the suppliers who used such input service on pro rata basis of turnover in such State.

![]()

Question 51.

Is a job worker required to take registration?

Answer:

Yes, as job work is a service, the job worker would be required to obtain registration if his aggregate turnover exceeds the prescribed threshold.

Input Tax Credit & Computation of GST Liability Notes

Input Tax”

Section 2(62) “input tax” in relation to a registered person, means the Central tax, State tax, Integrated tax or Union Territory tax charged on any supply of goods or services or both made to him and includes –

- the integrated goods and services tax charged on import of goods;

- the tax payable under the provisions of sub-sections (3) and (4) of Section 9;

- the tax payable under the provisions of sub-sections (3) and (4) of Section 5 of the Integrated Goods and Services Tax Act;

- the tax payable under the provisions of sub-sections (3) and (4) of Section 9 of the respective State Goods and Services Tax Act; or

- the tax payable under the provisions of sub-sections (3) and (4) of Section 7 of the Union Territory Goods and Services Tax Act, but does not include the tax paid under the composition levy.

“Input Tax Credit”

Section 2(63) “input tax credit” means the credit of input tax;

Input Tax Credit (ITC) is considered as a cornerstone of GST. In the previous tax regime, there was non- availability of credit at various points in supply chain, leading to a cascading effect of tax i.e., tax on tax and therefore increasing the cost of goods and services. This flaw has been removed under GST and a seamless flow of credit throughout the value chain is therefore available consequently doing away with the cascading effect of taxes.

To avail the benefit of ITC, it is required that the person availing such benefit is registered under GST. An unregistered person is not eligible to take the benefit of ITC. Section 155, of the CGST Act, 2017 states that where any person claims that he is eligible for input tax credit under this Act, the burden of proving such claim shall lie on such person.

Eligibility for taking ITC [Section 16(1)]

Only a registered person will be allowed to take input tax credit. If a person is liable to register but did not register himself under the GST law, input tax credit will not be allowed to such person.

ITC will be available on goods and/ or services which are used or intended to be used in the course or furtherance of business. Thus, tax paid on goods and/ or services which are used or intended to be used for non-business purposes cannot be availed as credit. ITC will be credited to the Electronic Credit Ledger.

“Job Work”

Section 2(68): “Job Work” means any treatment or process undertaken by a person on goods belonging to another registered person and the expression “job worker” shall be construed accordingly.

“Input Service Distributor”

“Input Service Distributor” means an office of the supplier of goods or services or both which receives tax invoices issued under section 31 towards the receipt of input services and issues a prescribed document for the purposes of distributing the credit of central tax, State tax, integrated tax or Union territory tax paid on the said services to a supplier of taxable goods or services or both having the same Permanent Account Number as that of the said office.

Various Forms used under ITC

1. Form GST ITC – 01 [See rule – 40(1)]

Declaration for claim of input tax credit under sub-section (1) of Section 18.

2. Form GST ITC-02 [See rule-41(1)]

Declaration for transfer of ITC in case of sale, merger, demerger, amalgamation, lease or transfer of a business under sub-section (3) of Section 18.

3. Form GST ITC -03 [See rule – 44(4)]

Declaration for intimation of ITC reversal/payment of tax on inputs held in stock, inputs contained in semi-finished and finished goods held in stock and capital goods under sub-section (4) of Section 18.

4. Form GST ITC-04 [See rule-45(3)]

Details of goods/capital goods sent to job worker and received back