Chapter 13 Valuation & Assessment of Imported and Export Goods & Procedural Aspects – CS Professional Advance Tax Law Notes is designed strictly as per the latest syllabus and exam pattern.

Valuation & Assessment of Imported and Export Goods & Procedural Aspects – CS Professional Advance Tax Law Study Material

Question 1.

Distinguish between the following:

‘Transit of goods’ and ‘transhipment of good’ under the Customs Act,

1962. (Dec 2013, 3 marks)

Answer:

Distinctions Between Transit and Transhipment Goods

| Transit Goods | Transhipment of Goods |

| 1. Goods are lying in the ship at an intermediate port. | Goods are transferred at the intermediate port. |

| 2. Only arrival manifest or import manifest has to be submitted for entry. | Bill of transhipment/declaration is also required for transhipment. |

| 3. Transit is allowed in every port normally. | Transhipment is allowed in specified ports only. |

| 4. No supervision is required for transit goods. | Transhipment takes place under the supervision of the proper officer. |

| 5. No additional conditions or formalities are required. | Specific conditions are imposed if the goods are deliverable at Indian port. |

| 6. Only one conveyance is involved in transit of goods and the same carries the goods to the port of clearance. | At least two conveyances are involved in transhipment and the transferee ship reaches the destination port. |

Question 2.

Mention the ‘relevant date’ for the purpose of issuing show cause notice for demanding customs duty under section 28 of the Customs Act, 1962 in the following cases:

(a) Where duty has been erroneously refunded;

(b) Where duty is provisionally assessed; and

(c) Where duty is not levied at the time of importation of goods. (Dec 2012, 3 marks)

Answer:

As per Explanation 1 to Section 28 (10) of Customs Act (as substituted w.e.f. 08-04-2011), ‘relevant date’ is:-

(a) If duty or interest was erroneously refunded -date of refund

(b) If duty is provisionally assessed the date when it is adjusted after final assessment or re-assessment.

(c) If duty was not levied at the time of importation of goods the date on which the proper officer makes an order for clearance of goods.

![]()

Question 3.

Can a request for provisional assessment of duty be made by an importer/exporter? If yes, what is the amount of bond and duty to be deposited? Is there any penalty attracted on contravention of these regulations? (June 2013, 5 marks)

Answer:

As per Regulation 2 (1)(a) of the Customs (Provisional Duty Assessment) Regulations, 2011, if an importer or an exporter, as the case may be, is unable to make self-assessment under sub-sec. (1) of Sec. 17 of the Customs Act, 1962 and makes a request in writing to the proper officer for assessment.

As per Regulation (2) of Customs (Provisional Duty Assessment) Regulations, 2011, if the importer or the exporter, as the case may be, executes a bond in an amount equal to the difference between the duty that may be finally assessed or re-assessed and the provisional duty and deposits with the proper officer such sum not exceeding 20% of the provisional duty, as the proper officer may direct, the proper officer may assess the duty on the goods provisionally at an amount equal to the provisional duty. Any contravention of these regulations would attract penalty which may extend to ₹ 50,000.

Question 4.

Mention the expenses which are to be included in the assessable value of imported goods as per Rule 10(2) of the Customs Valuation (Determination of Price of Imported Goods) Rules, 2007. (Dec 2014, 3 marks)

Answer:

The value of the imported goods shall be the value of such goods, for delivery at the time and place of importation and shall include:

(a) the cost of transport of ‘He imported goods to the place of importation;

(b) loading, unloading and handling charges associated with the delivery of the imported goods at the place of importation; and

(c) the cost of insurance actually incurred

The following points shall also be considered while determining the assessable value:

(i) Where the cost of transport is not ascertainable, such cost shall be 20% of the free on board value of the goods. In the case of goods imported by air, even where the cost of transportation is ascertainable, such cost shall not exceed 20% of free on board value of the goods;

(ii) where the cost of insurance is not ascertainable, such cost shall be 1.125% of free on board (FOB) value of the goods;

(iii) loading, unloading and handling charges shall be 1% of the free on board (FOB) value of the goods + the cost of transport + cost of insurance i.e. CIF Value.

Computation where FOB value and Cost of Insurance & Transport not ascertainable:

Where the free on board value of the goods is not ascertainable, then

- Costs of transportation shall be 20% of the FOB value of the goods + cost of insurance and

- Cost of insurance shall be 1.125% of the free on board value of the goods + cost of transport.

Question 5.

Is the transaction value under the Customs Valuation (Determination of Value of Imported Goods) Rules, 2007, acceptable even if goods are sold to related persons? Give reasons. (June 2015, 3 marks)

Answer:

As per Rule 3(3) of Customs Valuation (Determination of Value of Imported Goods) Rules, 2007, transaction value can be accepted even if buyer and seller are related if

(a) examination of circumstances show that the relationship has not affected the selling price or

(b) buyer demonstrates that the price is similar to identified or similar goods sold to unrelated buyers in India, or deductive value or computed value of identical or similar goods. Burden of Proof is on the importer.

Question 6.

With reference to Section 9AA of the Customs Tariff Act, 1975, state briefly the provisions of refund of anti-dumping duty with reference to relevant case law. (Dec 2015, 5 marks)

Answer:

According to the provisions of Section 9AA of the Customs Tariff Act, 1975, where an importer proves to the satisfaction of the Central Government that he has paid any anti-dumping duty imposed on any article, in excess of the actual margin of dumping in relation to such article, he shall be entitled to refund of such excess duty.

However, the importer will not be entitled for refund of provisional anti-dumping duty under Section 9AA as the same is refundable under Section 9A(2) of the said Act. Refund of excess anti-dumping duty paid is subject to provisions of unjust enrichment – Automotive Tyre Manufacturers Association vs. Designated Authority 2011 (263) ELT481 (SC).

![]()

Question 7.

Refund of import duty is available to an importer under section 26A of the Customs Act, 1962, if the goods are found to be defective and an application for refund of duty is made before the expiry of six months from the relevant date. What does the term ‘relevant date’ mean for the purposes of Section 26A of the Customs Act, 1962? (June 2016, 3 marks)

Answer:

“Relevant date” means:

(a) in cases where the goods are exported out of India, the date on which the proper officer makes an order permitting clearance and loading of goods for exportation under section 51;

(b) in cases where the title to the goods is relinquished, the date of such relinquishment;

(c) in cases where the goods are destroyed or rendered commercially valueless, the date of such destruction or rendering of goods commercially valueless.

Question 8.

State the relevant dates for determination of the rate of duty and tariff value for imports. (Dec 2016, 3 marks)

Answer:

Under section 15(1), the rate of duty and tariff valuation, if any, applicable to any imported goods, shall be the rate and valuation in force,

(a) In the case of goods entered for home consumption under section 46: The date on which a bill of entry is presented [Section 15(1)(a)]

(b) In the case of goods cleared from a warehouse under section 68: The date on which a bill of entry for home consumption is presented [Section 15(1 )(b)].

(c) In the case of any other goods: The date of payment of duty [Section 15(1 )(c)].

However, if a bill of entry has been presented before the date of entry inwards of the vessel or the arrival of the aircraft or the vehicle by which the goods are imported, the bill of entry shall be deemed to have been presented on the date of such entry inwards or the arrival, as the case may be [Proviso to Section 15(1)].

The provisions of this section shall not apply to baggage and goods imported by post (Section 15(2)).

Question 9.

Briefly explain the following with reference to the Customs (Determination of Value of Imported Goods) Rules, 2007:

(i) Goods of the same class or kind

(ii) Place of Importation

(iii) Computed Value. (June 2022, 6 marks)

Answer:

(i) Goods of the same class or kind : As per rule 2(1) (C) of Customs Valuation (Determination of value of imported goods) Rules, 2007, goods of the same class or kind, means imported goods that are within a group or range of imported goods produced by a particular industry or industrial sector and includes identical goods or similar goods.

(ii) Place of Importation: As per rule 2(1) (da) of Customs Valuation (Determination of value of imported goods) Rules, 2007, “place of importation” means the customs station, where the goods are brought for being cleared for home consumption or for being removed for deposit in a warehouse.

(iii) Computed Value : As per rule 2(1)(a) of the said rules, computed value means the value of imported goods determined in accordance with rule 8. The value of imported goods is taken as computed value when valuation is not possible as per any of rules earlier than rule 8 and cost is ascertainable. As per rule 8, subject to the provisions of rule 3, the value of imported goods shall be based on a computed value, which shall consist of the sum of-

(a) The cost or value of materials and fabrication or other processing employed in producing the imported goods

(b) An amount for profit and general expenses equal to that usually reflected in sales of goods of the same class or kind as the goods being valued which are made by producers in the country of exportation for export to India

(c) The cost or value of all other expenses under sub-rule (2) of rule 10.

Question 10.

Briefly explain the following with reference to the Customs (Determination of Value of Imported Goods) Rules, 2007 :

(i) Goods of the same class or kind

(ii) Place of Importation

(iii) Computed Value. (June 2022, 6 marks)

Answer:

(i) Goods of the same class or kind : As per rule 2(1) (c) of Customs Valuation (Determination of value of imported goods) Rules, 2007, goods of the same class or kind, means imported goods that are within a group or range of Imported goods produced by a particular industry or industrial sector and includes identical goods or similar goods.

(ii) Place of Importation: As per rule 2(1) (da) of Customs Valuation (Determination of value of imported goods) Rules, 2007, place of importation” means the customs station, where the goods are brought for being cleared for home consumption or for being removed for deposit in a warehouse.

(iii) Computed Value : As per rule 2(1)(a) of the said rules, computed value means the value of imported goods determined in accordance with rule 8. The value of imported goods is taken äs computed value when valuation is not possible as per any of rules earlier than rule 8 and cost is ascertainable. As per rule 8, subject to the provisions of rule 3. the value of imported goods shall be based on a computed value, which shall consist of the sum of-

(a) The cost or value of materials and fabrication or other processing employed in producing the imported goods

(b) An amount for profit and general expenses equal to that usually reflected in sales of goods of the same class or kind as the goods being valued which are made by producers in the country of exportation for export to India

(c) The cost or value of all other expenses under sub-rule (2) of rule 10.

Question 11.

Sun Power Ltd. is registered under ‘Project Import Regulations, 1986′ for import of power equipments at concessional rate to implement a project for setting-up of a power plant. It imported a gas turbine and generator under the Project Import Regulations, 1986, but before these could reach the project site, these were lost/ destroyed in the sea within India.

The department denied project import concession under the heading 9801 and demanded full duty, as the goods were not used in the project. Discuss in the light of decided case law, whether the demand made by the department is tenable in law. (Dec 2012, 5 marks)

Answer:

No, the demand made by the Department is not tenable in law. The facts of the present case are similar to the case of CCEx v. Lanco Kondapalli Power Pvt. Ltd.(2011). The Court held that the goods were irretrievably lost and were not available for the purpose for which they were imported. Merely because the goods were not destroyed in the presence of the customs officers, that would not disentitle the goods from the project import rate of duty under heading 9801 of the Customs Tariff. Hence Sun Power Ltd. is entitled to pay duty at concessional rate under the Project Import Regulations.

Question 12.

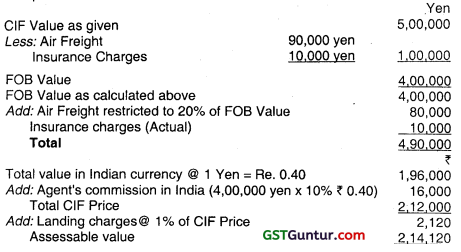

Bhaskar Ltd. has imported certain equipments from Japan at CIF value of 5,00,000 Yen. Other details are as under

(i) Air freight : 90,000 Yen

(ii) Insurance charges : 10,000 Yen

(iii) Freight from airport to factory in India : ₹ 20,000

(iv) Date of presentation of bill of entry : 28th April, 2020

(Exchange rate notified by CBIC 1 Yen = ₹ 0.40)

(v) Date of arrival of goods in India

(Exchange rate notified by CBIC 1 Yen = ₹ 0.42) : 10% of FOB cost

(vi) Commission payable to the agent in India : 10% of FOB cost in Indian rupees

(Not included in CIF value of 5,00,000 Yen)

Arrive at the assessable value for the purposes of customs duty providing brief notes wherever required with appropriate assumptions. (Dec 2012, 5 marks)

Answer:

Computation of Assessable Value

Computation of FOB Value

Notes:

(a) As per Rule 10 (2) (a) of the Customs Valuation (Determination of value of imported Goods) Rules, 2007. Cost of transport of the imported goods upto the place of importation is only includible. Hence, freight from airport to factory is not includible.

(b) Exchange rate as applicable on date of presentation of bill of entry is to be considered.

(c) Agent’s commission does not represent buying commission, hence, it is includible.

(d) Landing charges are considered as per clause (ii) of the proviso to Rule 10(2) of the Customs Valuation Rules.

![]()

Question 13.

Honest importers imported a machine with accessories from USA. Compute the assessable value and customs duty payable thereon form the following data:

- CIF value of machine (inclusive of accessories) : US$1,50,000

- CIF value of accessories compulsorily supplied along with the machine (not shown separately) US : $30,000

- Rate of basic customs duty on machine : 10%

- Rate of basic customs duty on accessories : 20%

- SWS : 10%

- Exchange rate : 1 US $ = ₹ 50 (June 2015, 5 marks)

Answer:

Computation of Assessable Value & Customs Duty

| Value (₹) | Duties (₹) | |

| CIF value of machine inclusive of assessories | US $ 1,50,000 | |

| CIF value in Indian Currency $ 1,50,000 × ₹ 50 | 75,00,000 | |

| Assessable Value (AV) | 75,00,000 | |

| Add: Basic Customs Duty (BCD) @ 10% on AV | 7,50,000 | 7,50,000 |

| Add: SWS @ 10% on BCD | 75,000 | 75,000 |

| Total (AV +BCD+ SWS) | 83,25,000 | |

| Add: IGST @ of 18% of 83,25,000 | 14,98,500 | 14,98,500 |

| Total | 98,23,500 | 23,23,500 |

Question 14.

Compute export duty from the following data:

(i) FOB price of goods to be exported: ₹ 50,00,000.

(ii) Rate of export duty : 10% on 1st March, 2021 and 8% on 4th March, 2021.

(iii) A notification was issued exempting the export item from customs duty on 7th March, 2021.

(iv) Proper Officer passed order permitting clearance and loading of goods for export on 1st March, 2021.

(v) Loading of goods on ship commenced on 4th March, 2021.

(vi) But goods crossed India only on 8th March, 2021. (Dec 2013, 5 marks)

Answer:

As per Section 16(1) of the Customs Act, 1962, taxable event arises only when Proper Officer makes an order permitting clearance (i.e. entry outwards) granted [Esajee Tayabally Kapasi (1995) (SC)] and loading of the goods for exportation took place under section 51 of the Customs Act, 1962. In the case of any other goods, on the date of payment of duty.

Therefore, export duty rate prevailing as on the date of entry outwards granted to the vessel by the Customs Officer is relevant.

In the given case, Proper Officer passed order permitting clearance and loading of goods for export on 1st March, 2021. Hence, the rate prevalent as on the date of entry outwards granted to the vessel is relevant for determination of rate of duty. Therefore, assessee is liable to pay export duty @ 10%

FOB = ₹ 50,00,000

Rate of export duty = 10%

Thus, Duty is payable @ 10% of ₹ 50,00,000 i.e. ₹ 5,00,000.

[Note: Export duties do not carry any cess].

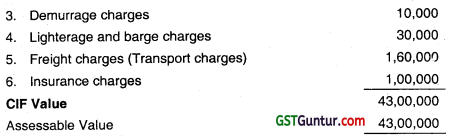

Question 15.

SM Ltd. imported a machine at FOB value of ₹ 34,00,000. This sum includes ₹ 4,00,000 attributable to post-importation activities to be called by the seller. SM Ltd. had supplied raw materials worth ₹ 10,00,000 to the seller for the manufacture of the said machine. The goods were imported by vessel and actual cost of transport is ₹ 1,60,000. The importer has also paid demurrage charges of ₹ 10,000 and lighterage and barge charges ₹ 30,000 in addition to said ₹ 1,60,000. SM Ltd. also paid ₹ 50,000 for transportation of goods from port of entry to Inland container.

The actual cost of insurance is ₹ 1,00,000.

Compute the assessable value based on Rule 3 read with Rule 10 of the Customs Valuation (Determination of Value of Imported Goods) Rules, 2007, assuming amount attributable to post-importation activities is not payable as a condition of the sale of imported goods. (June 2014, 5 marks)

Answer:

Question 16.

A consignment of 800 metric tonnes of edible oil of Malaysian origin was imported in January, 2021 by a charitable organisation in India for free distribution to below poverty line citizens in a backward area under the scheme designed by the Food and Agriculture Organisation.

Only a nominal price of US $10 per metric tonne was charged for the consignment to cover the freight and insurance charges. The customs house found out that at or about the time of importation of this gift consignment, the following imports of edible oil of Malaysian origin were also made:

The rate of exchange on the relevant date was US $1 = ₹ 60 and the rate of basic customs duty was 10% ad valorem SWS. There is no countervailing duty or special additional duty.

Calculate the amount of duty leviable on the consignment under the Customs Act, 1962 with appropriate assumptions and explanations, where required. (Dec 2014, 5 marks)

Answer:

Calculation of amount of duty payable:

Exchange rate of $ 1 = ₹ 60

Question 17.

Chandu Industries Ltd. imported some goods from USA. The details of the transactions are as under:

CIF value of goods : US $ 1,44,000

Rate of basic duty : 10%

SWS : 10%

You are required to calculate the assessable value and total duty payable thereon as per provisions of customs law.

Note : Rate of exchange is as follows:

As per CBIC : 1 US $ = ₹ 63

As per RBI : 1 US $ = ₹ 60 (June 2015, 5 marks)

Answer:

| (in ₹) | |

| CIF Value | 90,72,000 |

| Assessable Value | 90,72,000 |

| Add: Basic Customs Duty (BCD) (10% of assessable value) [A] | 9,07,200 |

| Add: SWS @ 10% on BCD | 90,720 |

| Total (AV + BCD + SWS) | 1,00,69,920 |

| Add: IGST @ of 18% of 1,00,69,920 | 18,12,585 |

| Total duty round off | 28,10,505 |

Question 18.

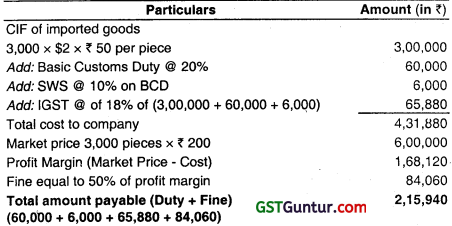

Shyam Ltd. makes an unauthorised import of 3,000 pieces of a product CIF priced at $2 per piece by air from USA. The consignment is liable to be confiscated. The import is adjudicated. Assistant Commissioner gives to the company an option to pay a fine in lieu of confiscation. It is proposed to impose fine equal to 50% of margin of profit.

The market price is ₹ 200 per piece. The rates of duty are as under:

Basic customs duty : 20%

Additional customs duty under section 3(5) : Nil

Exchange rate is ₹ 50 per U.S. Dollar.

Compute-

(i) the amount of fine; and

(ii) total amount payable by the company to clear the consignment. (Calculations should be made to the nearest rupee) (Dec 2015, 5 marks)

Answer:

Computation of Amount Payable to Clear the Consignment

Question 19.

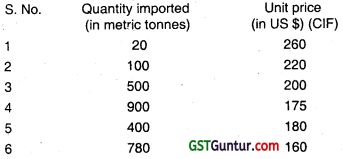

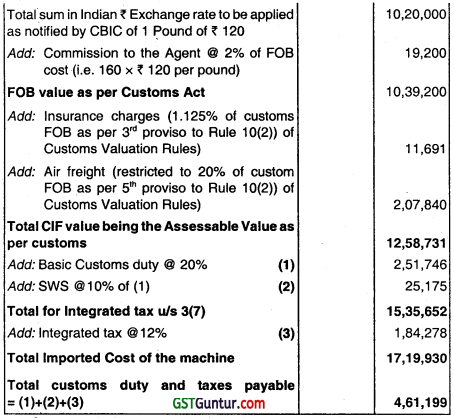

A material was imported by air at CIF price of US $5,000. Freight paid was US $ 1,500 and insurance cost was US $500. The banker realised the payment from importer at the exchange rate of 65 per US dollar. Central Board of Excise and Customs notified the exchange rate at ₹ 63 per US $. Find the value of material for the purpose of levying customs duty. (June 2016, 5 marks)

Answer:

Computation of Assessable value of Imported Goods

| Particular | Amount (US $) |

| A. CIF value of the material | 5,000 |

| Less: Air Freight | (1,500) |

| Less: Insurance | (500) |

| B. FOB value (CIF value – Airfreight – Insurance) | 3,000 |

| Add: Air Freight (20% of FOB value) | 600 |

| Add: Insurance actual | 500 |

| C. CIF value as calculated (FOB + Air Freight + Insurance) | 4,100 |

| D. Assessable value in INR (4,100 × 63) | ₹ 2,58,300 |

Notes:

1. If the goods are imported by air, the freight cannot exceed 20% of FOB price.

![]()

Question 20.

Zuhi Ltd. has imported a machine to be used for providing a taxable service. The assessable value of imported machine as approved by customs in ₹ 5,00,000. Customs duty @ 10% is payable. SWS and applicable. You are required to —

(i) Calculate the total customs duty payable on such machinery; and

(ii) Examine whether Zuhi Ltd. can avail CENVAT credit and if yes, how much CENVAT credit can be availed. (Dec 2016, 5 marks)

Answer:

Statements showing assessable value and customs duties:

| Particulars | Value in (₹) | Workings |

| Assessable value | 5,00,000 | |

| Add: Basic Customs Duty | 50,000 | 5,00,000 × 10% |

| Add: SWS @ 10% on BCD | 5,000 | 50,000 × 10% |

| Sub total | 5,55,000 | |

| Add: IGST @ 18% | 99,900 | 5,55,000 × 18% |

| Subtotal | 6,54,900 | |

| Value of imported goods | 6,54,900 |

Question 21.

Mr. Kapoor is a CS and Indian resident. He brought the following items with him while returning to India from USA :

(a) Personal Effects of ₹ 50,000

(b) Jewellery valued at ₹ 25,000

(c) One Camera costing ₹ 50,000

(d) Professional equipment ₹ 40,000

(e) Laptop worth of ₹ 30,000

(f) Household goods of ₹ 30,000.

Compute the amount of Custom Duty payable by Mr. Kapoor on his baggage, by assuming the Rate of duty @ 38.05%. (June 2017, 5 marks)

Answer:

Computation of Customs Duty payable by Mr. Kapoor

| Particulars | Amount (INR) | Amount (INR) |

| Personal effects (Exempt) | – | |

| Jewellery | 25,000 | |

| One Camera | 50,000 | |

| Professional equipment | 40,000 | |

| Laptop (Exempt) | ||

| Household goods | 30,000 | |

| Total Value | 1,45,000 | |

| Less: G.F.A | (50,000) | |

| Assessable value for duty | 95,000 | |

| Customs duty (@ 38.05% of ₹ 95,000) | 36,147 |

Note:

- Period of stay abroad by Mr. Kapoor has not been specified in the question. Hence it has been taken as a short trip. Hence no additional allowance was allowed to households, professional equipment and jewellery.

- GFA has been increased to 50,000 under New Baggage Rules, 2016.

Question 22.

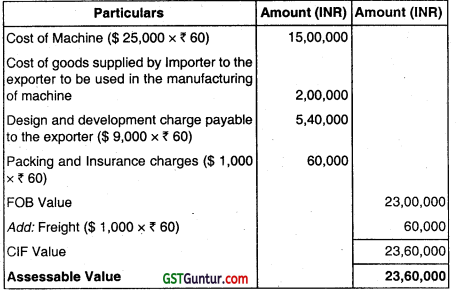

Determine the assessable value for computation of Customs Duty from the following information relating to a machine imported from U.S.A. by an Indian Company:

(i) Cost of machine ($) 25,000

(ii) Cost of goods supplied by the importer to the exporter to be used in manufacturing of machine (₹) 2,00,000

(iii) Design and development charge payable to the exporter ($) 9,000

(iv) Installation charges of machine (₹) 1,00,000

(v) Packing and Insurance charges ($) 1,000

(vi) Freight ($) 1,000

(vii) Transportation charges of machine from port to the place of installation (₹) 50,000

Note: Exchange rate declared by RBI was ₹ 61 per dollar while the rate declared by the Board was ₹ 60 per dollar. (June 2017, 5 marks)

Answer:

Note: The exchange rate for the purpose of working of the assessable value shall be the rate declared by the board and not by the RBI. Hence, the value of $ is taken at 60/$.

Question 23.

Lalit Export House exported some goods to Germany. The invoice value of the goods exported of ₹ 45,00,000 was assessed by the customs appraiser at ₹ 50,00,000. The shipping bill was presented electronically on 20.3.2021. However, the proper officer passed order permitting clearance and loading of goods for export on 9.4.2021. Compute the export duty payable by Lalit Export House. if the rate of export duty was 9% on 20.3.2021 and 10% on 9.4.2021. (June 2017, 3 marks)

Answer:

For purpose of determining rate of export duty, the relevant date is date on which clearance is permitted by customs officer i.e. on 09.04.2021, which was 10%.

Therefore:

FOB Value of goods ₹ 50,00,000

(as assessed by the custom appraiser)

Export duty @ 10% ₹ 5,00,000

Hence, export duty payable by Lalit Export House is ₹ 5,00,000.

![]()

Question 24.

A person makes an unauthorised import of goods liable to confiscation. After adjudication, Assistant Commissioner provides an M option to the importer to pay fine in lieu of confiscation. It is proposed to impose fine (in lieu of confiscation) equal to 50% of margin of profit.

The following particulars are made available:

- Assessable value: ₹ 15,00,000

- Total duty payable: ₹ 6,00,000

- Market value: ₹ 25,00,000

You are required to narrate the provision and calculate amount of fine and total payment to be made by importer to clear the consignment. (Dec 2017, 5 marks)

Answer:

In the given case, Assistant Commissioner intends to impose redemption fine equal to 50% of margin of profit.

Total cost to importer = ₹ 15,00,000 + ₹ 6,00,000 = ₹ 21,00,000

Margin of profit:

Market value – Total cost to importer = ₹ 25,00,000 – ₹ 21,00,000 = ₹ 4,00,000

Hence, redemption fine will be ₹ 2,00,000 [(@) 50% of ₹ 4,00,000]. In addition, duty of ₹ 6,00,000 is payable. Thus, importer will have to pay totally ₹ 8,00,000 to clear the goods from customs.

Question 25.

Bholaram imported certain goods in November, 2020 and an ‘into bond’ bill of entry was presented on 28 November, 2020. Assessable value was US $ 1,00,000. Order permitting the deposit of goods in warehouse for 3 months was issued on 2nd Dec. 2020. Bholaram neither obtained extension of warehousing period nor cleared the goods within the permitted warehousing period of 1st March, 2021. Only after a notice was issued under section 72 of the Customs Act, 1962 demanding duty and other charges, Bholaram removed the goods on 15th April, 2021.

Compute the amount of duty payable by Bholararn while removing the goods from warehouse, assuming that no additional duty or special additional duty is payable. You are supplied with the following information:

| 28.11.2020 | 01.03.2021 | 15.04.2021 | |

| Rate of exchange per USD | ‘56 | ‘55 | ’54 |

| Hate of basic customs duty | 15% | 10% | 5% |

Answer:

| Rate of duty applicable | 10% |

| Exchange rate | ₹ 56 |

| Assessable value 1,00,000 USD @ ₹ 56 | ₹ 56,00,000 |

| Basic Customs duty @10% × 56,00,000 | ₹ 5,60,000 |

| SWS @ 10% on BCD | ₹ 56,000 |

| Total (AV + BCD + SWS) | 62,16,000 |

| IGST @ 18% of 62,16,000 | 11,18,880 |

| Total duty payable | 17,34,880 |

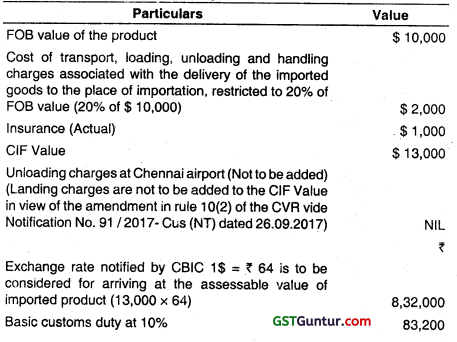

Question 26.

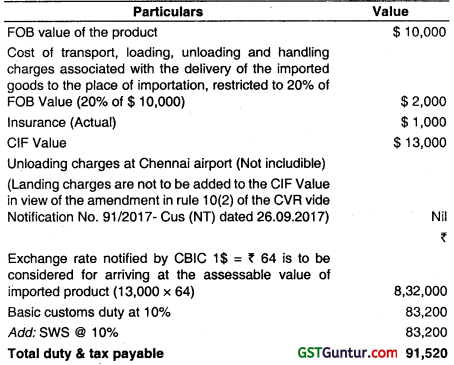

Particulars relating to import of product Z by Mr. Prahalad on 23-12-21 from Antwerp, Belgium to the Chennai airport, are given hereunder:

FOB value of the Product : $ 10,000

Cost of transport, loading, unloading and handling charges associated with the delivery of the Imported goods to the place of importation : $ 2,500

Insurance : $ 1,000

Unloading charges át Chennal airport : $ 34,000

Exchange rate notified by CBIC on 23-12-21 : 1$ = ₹ 64

Exchange rate notified by RBI on 23-12-21 : 1$ = 64.50

Basic customs duty : 10%

Ascertain the assessable value and the amount of duty payable by Mr. Prahalad. (June 2018, 5 marks)

Answer:

Computation of assessable value and total tax and duty payable by Mr. Prahalad in respect of Import of product Z

Alternate:

Computation of assessable value and total tax & duty payable by Mr. Prahalad in respect of Import of product Z

Question 27.

Compute the assessable value of an imported product (as on 11-12-2021), in the following independent situations:

Case 1

| Particulars | Figure (Euro €) |

| FOB value

Freight, loading, unloading and handling charges associated with the delivery of the imported goods to the place of importation |

2,000

Not known |

| Insurance charges | 20 |

Case 2

| Particulars | Figure (Euro €) |

| FOB value

Sea freight, loading, unloading and handling charges associated with the delivery of the imported goods to the place of importation |

2,000

100 |

| Insurance charges | Not known |

Answer:

Case 1

| Particulars | Euro € |

| FOB Value | 2,000 |

| Add: Cost of transport, loading unloading and handling charges associated with the delivery of the imported goods to the place of importation [20% of FOB value in terms of first proviso to rule 10(2) of CVR] | 400 |

| Cost of Insurance | 20 |

| Assessable value [CIF value] | 2,420 |

Case 2

| Particulars | Euro € |

| FOB Value | 2,000 |

| Add: Cost of sea transport, loading, unloading and handling charges associated with the delivery of the imported goods to the place of importation [includible in terms of rule 10(2) (a) of CVR] | 100 |

| Insurance [1.125% of sum of FOB value of the goods in terms of third proviso to rule 10(2) of CVR] | 22.50 |

| Assessable value [CIF value] | 2,122.50 |

| Assessable Value rounded off | 2,123 |

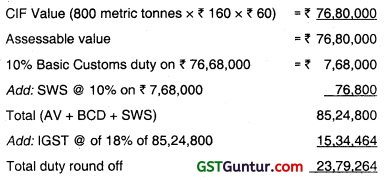

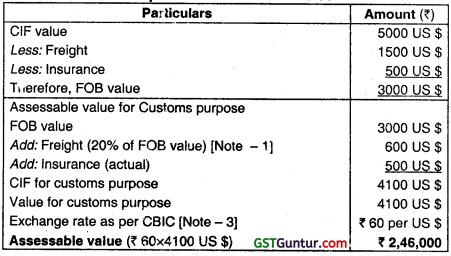

Question 28.

Calculate FOB Value, Cost of Insurance, Cost of Freight and Assessable Value where only the CIF value is given as US $ 5,000. Exchange rate notified by RBI and CBIC are ₹ 50 and ₹ 48 respectively for one US $. (Dec 2018, 5 marks)

Answer:

As per rule 10(2) provision 3 ol Customs Valuation (Determination of Value of Imported Goods) Rule, 2007 where FOB value of goods, cost of insurance, and freight are riot ascertainable, then cost of insurance and cost of freight shall be computed as follows:

CIF value — US$ 5,000 × ₹ 48 = ₹ 2,40,000

Freight and Insurance — ₹ 2,40,000 × 21.125/121.125 = ₹ 41,858

FOB Value — ₹ 2,40,000 — ₹ 41,858 = ₹ 1,98,142

Exchange rate notified by CBEC/CBIC has to be taken ie. ₹ 48/US$

As per Rule 10 of Valuation Rules, freight and insurance when not available has to be taken as 20% and 1.125% of FOB value respectively

![]()

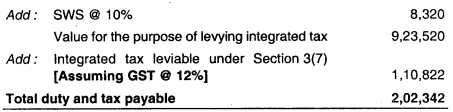

Question 29.

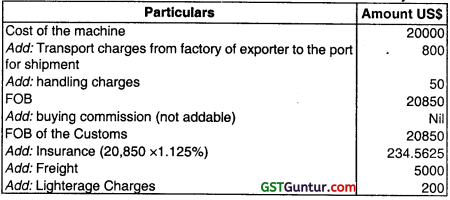

Compute the assessable value and total customs duty payable under the Customs Act. 1962 for an imported machine, based on the following information:

Particulars : Amount (US $)

- Cost of the machine at the factory of the exporter : 20,000

- Transport charges from the factory of the exporter, to the port for shipment : 800

- Handling charges paid for loading the machine in the šhip : 50

- Buying commission paid by the importer : 100

- Lighterage charges paid by the importer : 200

- Freight Incurred from port of entry to Inland Container depot : 1,000

- Ship demurrage charges : 400

- Freight charges from exporting country to India : 5,000

Date of bill of entry 20-02-2021

(Rate of BCD 20%: Exchange rate as notified by CBIC ₹ 60 per US $)

Date of entry Inward 25-01-2021

(Rate of BCD 12%; Exchange rate as notified by CBIC ₹ 65 PER US $)

Rate of IGST 12%. (Dec 2018, 5 marks)

Answer:

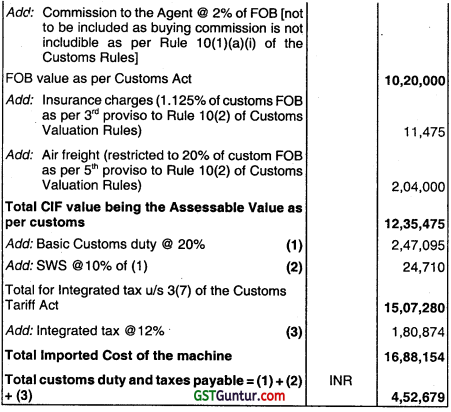

Computation of assessable value and total customs duty

Question 30.

St. Thomas Hospital and Research Centre imported a machine from Long Life Scientific Ltd., USA for in-house research. The price of the machine was settled at US $ 8,000. The machine was shipped on 10th March, 2021. Meanwhile, the hospital authorities negotiated for a reduction in the price.

As a result Long Life Scientific Ltd. agreed to reduce the price by $ 500 and communicated the revised price of $ 7,500 by sending a fax message dated 14th March, 2021. The machine arrived in India on 17th March, 2021. The Commissioner of customs has decided to take the original price as the transaction value of the goods on the ground that the price is reduced only after the goods have been shipped.

Do you agree with the step taken by the commissioner? Give reasons in support of your answer. (Dec 2018, 5 marks)

Answer:

No, the commissioner’s approach is not correct in the law.

As per Section 14 of the Customs Act, 1962, the transaction value is the price actually paid or payable for the goods when sold for export to India for delivery at the time and place of importation.

Further, Supreme Court in the case “Garden Silk Mills vs UOI” has held that importation get complete only when the goods become part of mass of goods within the country.

In the given case, the price of the goods was reduced while the goods were in transit, it could not be contended that the price was revised after importation took place. Hence, the goods should be valued as per the reduced price, which was the price actually paid at the time of importation.

Question 31.

ABC Ltd. imported a machine from UK in November, 2019. The details in this regard are as under:

(i) FOB value of the machine : 12,000 UK Pound

(ii) Freight (Air): 4000 UK Pound

(iii) Licence fee, the buyer was required to pay in UK : 500 UK Pound

(iv) Buying commission paid in India ₹ 20,000

(v) Designing charges paid to consultancy firm in New Delhi, which was necessary for such machine ₹ 1,00,000

(vi) Actual landing charges paid at the place of importation ₹ 25,000

(vii) Insurance premium details were not available

(viii) For this purpose you may consider followings:

(a) Rate of exchange ₹ 98.00 per one pound

(b) Rate of Basic Customs Duty (BCD) at 10%

(c) Integrated tax under Section 3(7) of Customs Tariff Act at 12%

(d) Social Welfare surcharge as applicable

(e) Ignore GST Compensation Cess.

You are required to compute the total customs duty and integrated tax payable on the imported machine. You may make suitable assumptions wherever found necessary. (June 2019, 5 marks)

Answer:

Computation of Assessable value and total customs duty and integrated tax payable

| Particulars | Amount (UK Pound) |

| FOB Value | 12,000 |

| Add: License fee required to be paid in UK payable by the buyer as a condition of sale, are all includible in the assessable value – Rule 10(1)(c) | 500 |

| Customs FOB Value | 12,500 |

| Value in rupees (Exchange rate is ₹ 98 per UK Pound × 12,500) | 12,25,000 |

| Add: Air freight (restricted to 20% of ₹ 12,25,000) | |

| Note: In case of goods imported by air, freight cannot exceed 20% of Customs FOB value | 2,45,000 |

| Insurance @ 1.125% of ₹ 12,25,000 | |

| Insurance charges, when not ascertainable, have to be included @ 1.125% of FOB value of goods [Third proviso to Rule 10(2) of the Customs Valuation Rules]. | 13,781.25 |

| Buying commission is not includible in the assessable value | NIL |

| Designing charges paid for work done in India have not been included for the purpose of arriving at assessable value. Rule 10(1 )(b)(iv) | NIL |

| No landing charges are to be added to the CIF value in view of the amendment in Rule 10(2) | NIL |

| CIF Value | 14,83,781.25 |

| Assessable Value | 14,83,781.25 |

| Add: Basic customs duty @ 10% (₹ 14,83,781 × 10%) [rounded off] (A) | 1,48,378 |

| Add: Social Welfare Surcharge (10% of ₹ 1,48,378) [rounded off] (B) | 14,838 |

| Value for integrated tax under Section 3(7) of the Customs Tariff Act, 1975 | 16,46,997 |

| Add: Integrated tax under Section 3(7) @ 12% [rounded off] (C) | 1,97,640 |

| Total customs duty and integrated tax payable [(A)+(B)+(C)] | 3,60,856 |

Question 32.

Ms.’Poorvisha has exported some goods to Sydney, Australia. She provides the following details to you :

(i) CIF value of the goods = AUD 210,000.

(ii) FOB price of goods : (Australian $) AUD 200,000.

(iii) Shipping bill presented electronically on 29th April, 2021.

(iv) Proper officer passed an order permitting clearance and loading of goods for export (Let Export Order) on 2nd May, 2021.

(v) During the interval between presentation of the shipping bill and clearance of goods, there were changes in the rate of export duty as well as rate of exchange.

Rate of export duty and rate of exchange details are as follows:

| Date | Rate of exchange | Rate of Export duty |

| 29-04-2021

43865 |

1 AUD = ₹ 70

1 AUD = ₹ 70.50 |

11%

10% |

You are required to calculate the export duty payable by the exporter. (Dec 2019, 5 marks)

Answer:

Computation of export Duty Payable

| Particulars | Amount |

| FOB price of goods [Note 1] AUD

Value in Indian currency (AUD 200,000 × ₹ 70) [Note 2] Export duty @ 10% [Note 3] |

200,000

₹ 1,40,00,000 ₹ 14,00,000 |

Notes:

1. As per section 14(1) of the Customs Act, 1962, assessable value of the export goods is the transaction value of such goods which is the price actually paid or payable for the goods when sold for export from India for delivery at the time and place of exportation.

2. As per third proviso to section 14(1) of the Customs Act, 1962, assessable value has to be calculated with reference to the rate of exchange notified by the CBIC on the date of presentation of shipping bill of export.

3. As per section 16(1)(a) of the Customs Act, 1962, in case of goods entered for export, the rate of duty prevalent on the date on which the proper officer makes an order permitting clearance and loading of the goods for exportation, is considered.

![]()

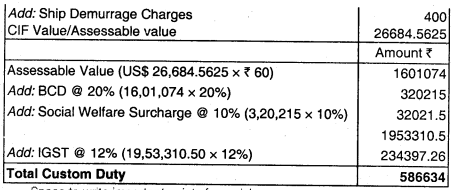

Question 33.

Ram Ratan who has imported a machine from UK in India provides the following information and details relating to such machine and requests you to compute the assessable value and of the total amount of payable Custom duty and other taxes to be levied :

(i) FOB value of machine – 8,000 UK Pounds

(ii) Air Freight paid – 2500 UK Pounds

(iii) Design and development charges paid in UK – 500 UK Pounds

(iv) Commission payable to local agent @ 2% of FOB in INR

(v) Date of bill of entry – 24.10.2021 (Rate BCD 20%, Exchange rate as notified by CBIC ₹ 120 per UK Pound)

(vi) Date of entry inward – 20.10.2021 (Rate BCD 18%, Exchange rate as notified by CBIC ₹ 115 per UK Pound)

(vii) Integrated tax payable @ 12%

(viii) GST Compensation Cess – Nil

(ix) Insurance charges actually paid but details not available. (Dec 2020, 6 marks)

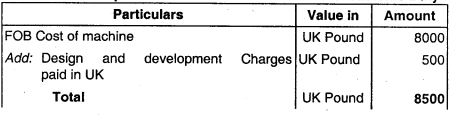

Answer:

If Commission paid to local agent is treated as buying commission Computation of Assessable value and of customs Duty

Alternate Answer:

If Commission paid to local agent is treated as other than buying commission Computation of Assessable value and of customs Duty

Question 34.

The assessable value of a commodity inclusive f of landing charges is ₹ 50,000 IGST @ 28%. Basic Customs Duty @ 10%, countervailing Duty @ 12%, Social Security Cess (SCC) @ 10% and Compensation Cess 10% are leviable on the imported goods. Calculate all ‘ duties and taxes in this case. (Aug 2021, 3 marks)

Answer:

Calculations of duties and Taxes:

Assessable value = ₹ 50,000 Basic Customs Duty 10% = ₹ 5,000

Countervailing Duty = 12% of (Assessable Value + Basic Duty)

= 12% of (₹ 50,000 + ₹. 5,000)

= 12% of ₹. 55,000

= ₹6,000

Social Security Cess (SSC) = 10% of (Basic Customs Duty + Countervailing Duty)

= 10% of (5,000+6,600)

= 10% of 11,600

= ₹ 1160

Integrated Goods and Services Tax (IGST) = 28% of [Assessable Value + Basic Customs Duty + Countervailing Duty + Countervailing Duty+SSC]

= 28% of (₹50,000+5,000+6,600+1,160)

= 28% of ₹62,760

= ₹ 17,672.80

Compensation Cess = 10% of [Assessable Value+Customs Duty + Countervailing Duty + SSC

= 10% of (50,000 + 5,000 + 6,600 + 1,160)

= 10% of 62,760

= ₹ 6,276

Question 35.

Decent Laminates and Plywood Pvt. Ltd. imported resin impregnated paper and plywood for the purpose of manufacture of furniture. The goods so imported were warehoused at Mumbai Port from the date of their import in the month of June, 2022. Decent Laminates and Plywood Pvt. Ltd. sought an extension of the warehousing of goods till November, 2022 which was granted.

However, even after the expiry of extended period, it did not remove the goods from the warehouse. Subsequently, Decent Laminates and Plywood Pvt. Ltd. applied for remission of duty under section 23 of the Customs Act, 1962 on the ground that the imported goods had become unfit for use on account of non-availability of orders for clearance and had lost their shell life also.

Explain, in the context of provisions of Customs Act, 1962 with the help of a decided case law, if any, whether the application for remission of duty filed by Decent Laminates and Plywood Pvt. Ltd. is valid in law. (Dec 2021, 4 marks)

Answer:

Remission can be granted under Section 23 only when the imported goods have been lost or destroyed at any time before clearance for home consumption. The expression “at any time before clearance for home consumption” as provided in section 23 means the time period originally fixed and extended period available for warehousing and not after the lapse of such periods.

The said expression (at any time before clearance for home consumption) cannot be extended to a period after the lapse of the extended period merely because the goods were no: cleared within the stipulated time. It would be a case of goods improperly removed from the warehouse.

The facts of the given case are similar to the case of CCEx. vs. Decorative Laminates (I) Pvt. Ltd. [2010] 257 ELT 61 (Ker.). The High Court held that the circumstances made out under section 23 were not applicable in the instant case as the destruction/ loss of the goods had not occurred before the clearance for home consumption.

Hence, the application for remission of duty filed by Decent Laminates and Plywood Pvt. Ltd is not valid in law.

Question 36.

Explain briefly the following with reference to the provisions of the Customs Act, 1962:

(i) Meaning of Assessment

Answer:

“Assessment” means determination of the durability of any goods and the amount of duty, tax, cess or any other sum so payable, if any, under this Act or under the Customs Tariff Act, 1975 (hereinafter referred to as the Customs Tariff Act) or under any other law for the time being in force, with reference to—

(a) the tariff classification of such goods as determined in accordance with the provisions of the Customs Tariff Act;

(b) the value of such goods as determined in accordance with the provisions of this Act and the Customs Tariff Act;

(c) exemption or concession of duty, tax, cess or any other sum, consequent upon any notification issued therefor under this Act or under the Customs Tariff Act or under any other law for the time being in force;

(d) the quantity, weight, volume, measurement or other specifics where such duty, tax, cess or any other sum is leviable on the basis of the quantity, weight, volume, measurement or other specifics of such goods;

(e) the origin of such goods determined in accordance with the provisions of the Customs Tariff Act or the rules made thereunder, if the amount of duty, tax, cess or any other sum is affected by the origin of such goods;

(f) any other specific factor which affects the duty, tax, cess or any other sum payable on such goods, and includes provisional assessment, self-assessment, re-assessmfent and any assessment in which the duty assessed is nil.

![]()

Question 37.

Mr. Krishna Bhansali, has imported some garments from Paris. He is unable to make self-assessment under section 17(1) of the Customs Act, 1962 and hence has made a request in writing to the proper officer for provisional assessment. Can he apply for provisional assessment? Discuss.

Answer:

Yes, Mr. Krishna Bhansali can apply for provisional assessment under section 18 of the Customs Act, 1962. Section 18(1), provides that provisional assessment can be resorted to, inter alia, where the importer or exporter is unable to make self-assessment under sub-section (1) of Section 17 and makes a request in writing to the proper officer for assessment.

In such a circumstance, the proper officer may order for provisional assessment of duty if the irnporter/exporter, furnishes such security as the proper officer deems fit for the payment of the deficiency, if any, between the final re-assessed duty the provisionally assessed duty. After the finalization of assessment, if the importer/exporter is entitled to refund of duty, such refund shall be subject to doctrine of unjust enrichment.

Question 38.

A material was imported by air at CIF price of 5,000 US$. Freight paid was 1,500 US$ and insurance cost was 500 US$. The banker realized the payment from Importer at the exchange rate of ₹ 61 per dollar.

Central Board of Excise and Customs notified the exchange rate as ₹ 60 per USS. Find the value of the material for the purpose of levying duty.

Answer:

Computation of a assessable

Notes:

1. If the goods are imported by air, the freight cannot exceed 20% of FOB price [Second proviso to Rule 10(2) of the Customs (Determination of Value of Imported Goods) Rules, 2007].

2. Rate of exchange determined by CBIC is considered [Clause (a) of the explanation to Section 14 of the Customs Act, 1962].

Valuation & Assessment of Imported and Export Goods & Procedural Aspects Notes

Customs Station

“customs station” means any customs port, customs airport, international courier terminal, foreign post office or land customs station

Prohibited Goods

“prohibited goods” means any goods the import or export of which is subject to any prohibition under this Act or any other law for the time being in force but does not include any such goods in respect of which the conditions subject to which the goods are permitted to be imported or exported have been complied with;

Warehouse

“warehouse” means a public warehouse licensed under section 57 or a private warehouse licensed under section 58 or a special warehouse licensed under section 58A

Person in Charge

“person-in-charge” means, –

- in relation to a vessel, the master of the vessel;

- in relation to an aircraft, the commander or pilot-in-charge of the aircraft;

- in relation to a railway train, the conductor, guard or other person having the chief direction of the train;

- in relation to any other conveyance, the driver or other person-in-charge of the conveyance

“Arrival Manifest or Import Manifest”

“arrival manifest or import manifest”]or “import report” means the manifest or report required to be delivered under section 30

FOB ‘

This is also known as “Free on Board” or “Freight on Board”. It signifies the cost of delivering the goods to the nearest port and thereafter the Buyer is responsible to ship from there to the buyer’s address.

CIF

This is known as “Cost, Insurance & Freight” Value. This would add on the Insurance and Freight to the FOB Values, as explained below.

Power of Customs Officers

- Declare warehousing stations

- Allow setting up warehouses (Public / Private)

- Power to search any vessel / conveyance / person

- Power of Seizure of Goods

- Power to Arrest

Public Bonded Warehouse

- These are owned and managed by Government / Governmental Bodies / Agencies

- Only dutiable goods can be warehoused therein

- Availability of space certificate from the warehouse keeper would be required

- A double duty bond would also be required to be furnished for deposit of goods

- Also, the person seeking warehousing would need to pay rental /warehousing charges to the warehouse keeper ’

Private Bonded Warehouse

- These are owned and managed by private entities

- These aren’t generally allowed where the public bonded warehouses are available

- Only dutiable goods can be warehoused therein

- Availability of space certificate from the warehouse keeper would not be required in this case

- Double bond duty would still be required but, customs officers would need to be posted at the expense of the warehouse keeper