The Labour Laws Act, 1988 – CS Professional Study Material

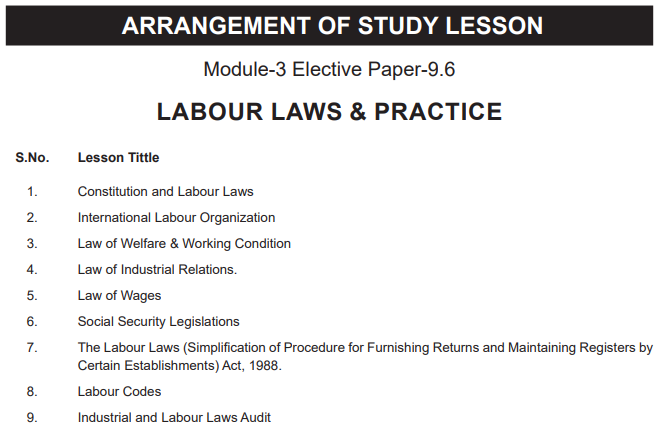

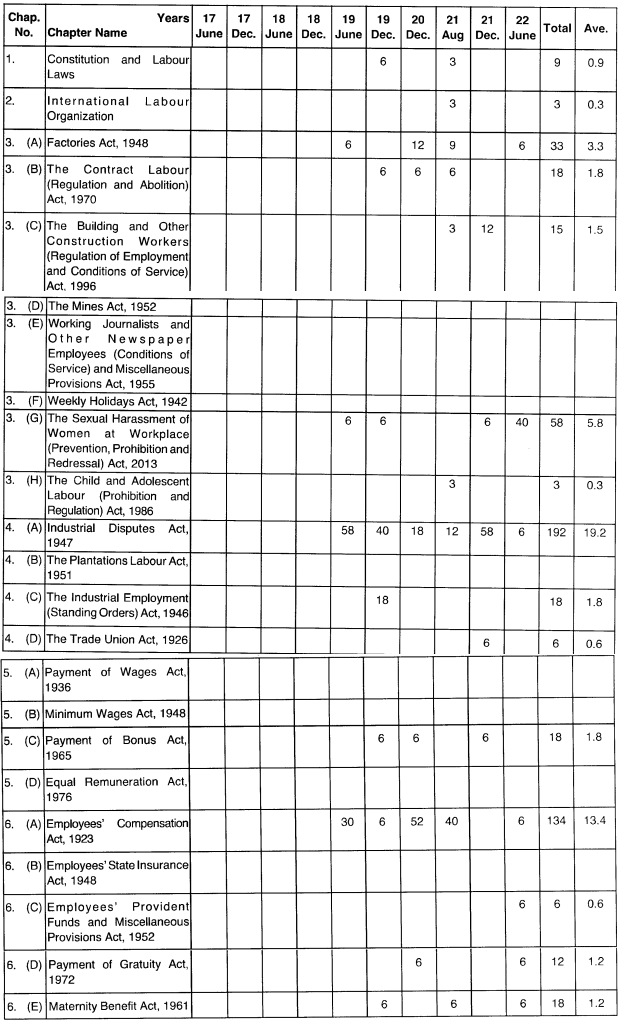

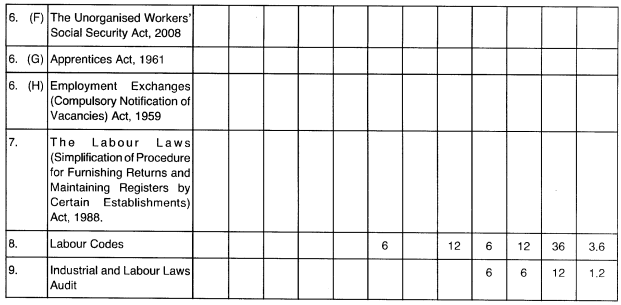

Chapter 7 The Labour Laws Act, 1988 – CS Professional Labour Laws and Practice Notes is designed strictly as per the latest syllabus and exam pattern.

The Labour Laws Act, 1988 – CS Professional Labour Laws and Practice Study Material

Question 1.

What is Establishment.

Answer:

Establishment has the meaning assigned to it in a Scheduled Act, and includes

- Industrial or other establishment as defined in Payment of Wages Act, 1936

- Factory as defined in Factories Act, 1948

- Factory, workshop or place where employees are employed or work is given out to workers, in any scheduled employment to which the Minimum Wages Act, 1948

- Plantation as defined in Plantations Labour Act, 1951

- Newspaper establishment as defined in Working Journalists and other Newspaper Employees (conditions of Service) and Miscellaneous Provisions Act, 1955

![]()

Question 2.

What is Small Establishment.

Answer:

Small establishment means an establishment in which not less than ten and not more than forty persons are employed or were employed on any day of the preceding twelve months

Question 3.

What is Very Small Establishment.

Answer:

Very small establishment means an establishment in which not more than 9 persons are employed or were employed on any day of the preceding twelve months

![]()

Question 4.

What are the Scheduled Acts?

Answer:

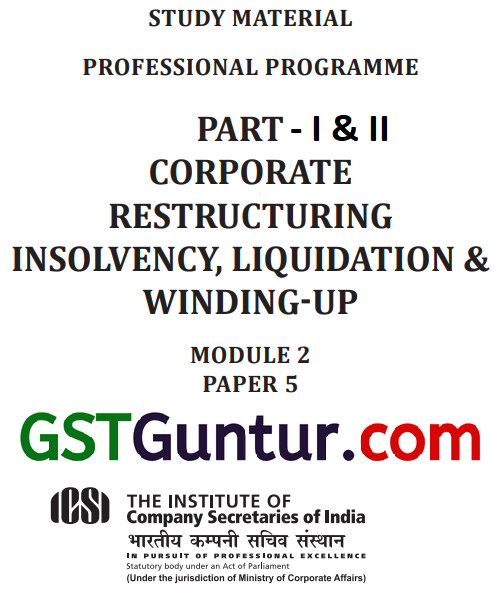

Following 16 Acts are termed as Scheduled Acts to which Labour Laws (Simplification of Procedure for Furnishing Returns and Maintaining Registers by Certain Establishments) Act, 1988 applies:

- The Payment of Wages Act, 1936

- The Weekly Holidays Act, 1942

- The Minimum Wages Act, 1948

- The Factories Act, 1948

- The Plantations Labour Act, 1951

- The Working Journalists and other Newspaper Employees (Conditions of Service) and Miscellaneous Provisions Act, 1955

- The Motor Transport Workers Act, 1961

- The Payment of Bonus Act, 1965

- The Beedi and Cigar Workers (Conditions of Employment) Act, 1966

- The Contract Labour (Regulation and Abolition) Act, 1970

- The Sales Promotion Employees (Conditions of Service) Act, 1976

- The Equal Remuneration Act, 1976

- The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979

- The Dock Workers (Safety, Health and Welfare) Act, 1986

- The Child Labour (Prohibition and Regulation) Amendment Act, 2016

- The Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996

![]()

Question 5.

Who is exempted from furnishing or maintaining of returns and registers required under certain labour laws and how?

Answer:

- Section 4(1) of Labour Laws (Exemption from Furnishing Returns and Maintaining Registers by certain Establishments) Amendment Act, 2014, provides exemption to an employer of small establishment or very small establishment to which a Scheduled Act applies, to furnish the returns or to maintain the registers required to be furnished or maintained under that Scheduled Act.

- Following forms are only required to be furnished by such exempted employer:

- Form I -Annual Return (To be furnished to the Inspector or the authority before the 30th April of the following year)

- Form 11 -Register of persons employed-cum-employment card (Small establishment)

- Form III- Muster roll-cum-wage register

![]()

Question 6.

What are the penalty provisions of Labour Laws (Exemption from Furnishing Returns and Maintaining Registers by certain Establishments) Act?

Answer:

Penalty provisions:

- First conviction: Upto INR 5,000

- Second or subsequent conviction: INR 10,000 to INR 25,000+ Imprisonment 1 to 6 months or both

![]()

The Labour Laws Act, 1988 Notes

Labour Laws (Exemption from Furnishing Returns and Maintaining Registers by certain Establishments) Act, 1988 is renamed as Labour Laws (Simplification of Procedure for Furnishing Returns and Maintaining Registers by Certain Establishments) Act, 1988.

The Act was passed by the Rajya Sabha on November 26, 2014, by Lok Sabha on November 28, 2014 and received the assent of the President on December 9, 2014.

To coverage of Principal Act has been expanded from the establishments employing upto 19 workers to 40 workers while very small establishment means an establishment in which not more than nine persons are employed.

As per the provisions of the Act, it shall not be necessary for an employer in relation to any small establishment or very small establishment to which a Scheduled Act applies, to furnish the returns or to maintain the registers required.

Such establishments are required to file forms have been prescribed in the Second Schedule.

![]()

Following forms are specified:

- Form I -Annual Return (To be furnished to the Inspector or the authority before the 30th April of the following year)

- Form II -Register of persons employed-cum-employment card (Small establishment)

- Form III- Muster roll-cum-wage register

The Act also gives an option to maintain the registers electronically and to file the returns electronically which leads to ease of compliance as well as better enforcement of the labour laws.

The Amendment Act now includes a total of 16 labour laws by adding 7 more Labour Acts under the purview of the Principal Act. The Acts being:

- The Payment of Wages Act, 1936

- The Weekly Holidays Act, 1942

- The Minimum Wages Act, 1948

- The Factories Act, 1948

- The Plantations Labour Act, 1951

- The Working Journalists and other Newspaper Employees(Conditions of Service) and Miscellaneous Provisions Act, 1955

- The Motor Transport Workers Act, 1961

- The Payment of Bonus Act, 1965

- The Beedi and Cigar Workers (Conditions of Employment) Act, 1966

- The Contract Labour (Regulation and Abolition) Act, 1970

- The Sales Promotion Employees (Conditions of Service) Act, 1976

- The Equal Remuneration Act, 1976

- The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979

- The Dock Workers (Safety, Health and Welfare) Act, 1986

- The Child Labour (Prohibition and Regulation) Amendment Act, 2016

- The Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996

![]()

Penalty provisions remains the same as previous being the case of first conviction, with fine which may extend to rupees five thousand; and in the case of any second or subsequent conviction, with imprisonment 1 to 6 months or with fine ranging from INR 10,000 to INR 25,000 or both.