CS Professional Corporate Restructuring Insolvency Liquidation & Winding Up Notes Study Material Important Questions

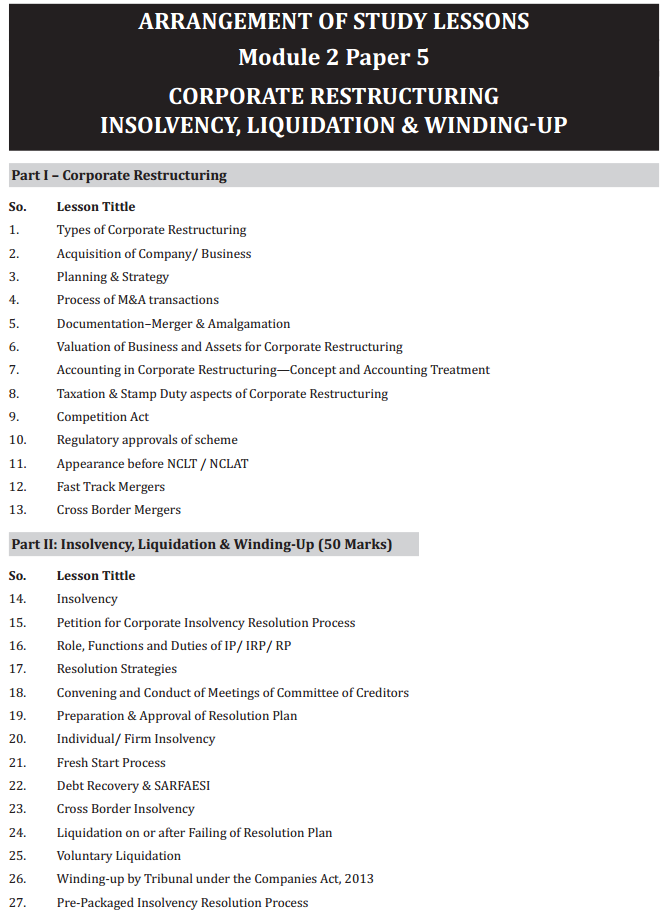

Part I – Corporate Restructuring

- Chapter 1 Types of Corporate Restructuring

- Chapter 2 Acquisition of Company/Business

- Chapter 3 Planning and Strategy

- Chapter 4 Process of M&A Transactions

- Chapter 5 Documentation-Merger & Amalgamation

- Chapter 6 Valuation of Business and Assets for Corporate Restructuring

- Chapter 7 Accounting in Corporate Restructuring

- Chapter 8 Taxation & Stamp Duty Aspects of Corporate Restructuring

- Chapter 9 Competition Act

- Chapter 10 Regulatory Approvals of Scheme

- Chapter 11 Appearance before NCLT/NCLAT

- Chapter 12 Fast Track Mergers

- Chapter 13 Cross Border Mergers

Part II: Insolvency, Liquidation & Winding-Up (50 Marks)

- Chapter 14 Insolvency

- Chapter 15 Petition for Corporate Insolvency Resolution Process

- Chapter 16 Role, Functions and Duties of IP/IRP/RP

- Chapter 17 Resolution Strategies

- Chapter 18 Convening and Conduct of Meetings of Committee of Creditors

- Chapter 19 Preparation & Approval of Resolution Plan

- Chapter 20 Individual/Firm Insolvency

- Chapter 21 Fresh Start Process

- Chapter 22 Debt Recovery & SARFAESI

- Chapter 23 Cross Border Insolvency

- Chapter 24 Liquidation on or after Failing of Resolution Plan

- Chapter 25 Voluntary Liquidation

- Chapter 26 Winding-up by Tribunal under the Companies Act, 2013

- Chapter 27 Pre-Packaged Insolvency Resolution Process

CS Professional Corporate Restructuring, Insolvency, Liquidation & Winding-up Syllabus

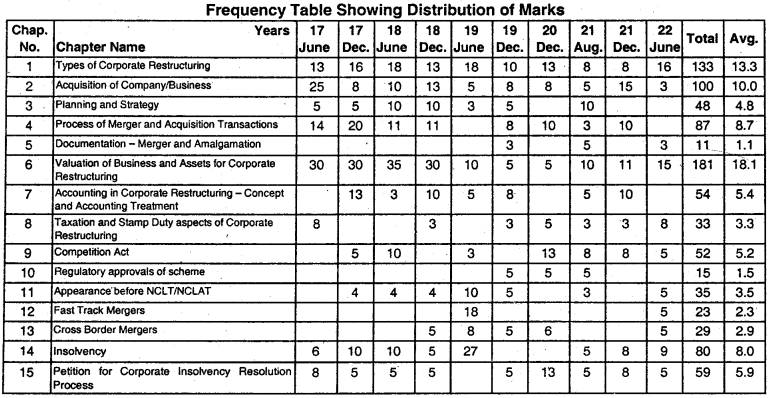

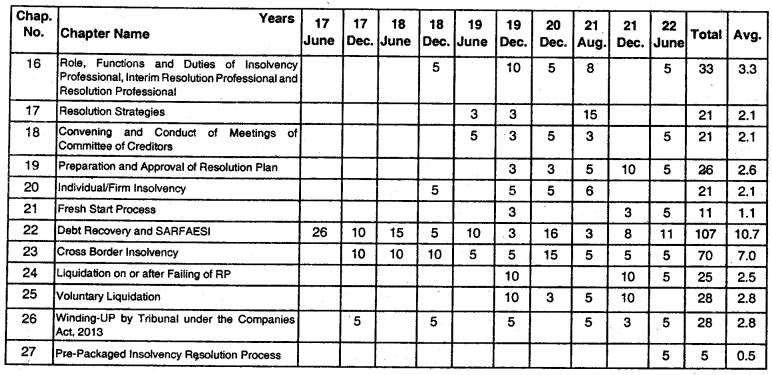

CS Professional Corporate Restructuring Insolvency Liquidation & Winding Up Chapter Wise Weightage

Professional Programme Module 2 Paper 5

Corporate Restructuring, Insolvency Liquidation & Winding-Up (Max Marks 100)

Syllabus

Objective

Part I: To provide expert knowledge of legal, procedural and practical aspects of Corporate Restructuring, Merger & Acquisitions, Insolvency, Liquidation & Winding-up.

Part II: To acquire knowledge of the legal, procedural and practical aspects of Insolvency and its resolution.

Detailed Contents

Part I – Corporate Restructuring (50 Marks)

1. Types of Corporate Restructuring: Key definitions, Compromises, Arrangements, Mergers & Amalgamations; Demergers & Slump Sale, Business Sale; Joint Venture, Strategic Alliance, Reverse Merger Disinvestment; Financial Restructuring (Buy-back, Alteration & Reduction).

2. Acquisition of Company/Business: Acquisition of Company; Takeover of Listed Companies (i) Legal

Framework (ii) Process & Compliances; Cross Borders Takeovers – Procedure.

3. Planning & Strategy: Case Studies pertaining to Merger, Amalgamation, Restructuring; Funding for M&A, Studies of Judicial pronouncements; Planning relating to acquisitions & takeovers; Protection of minority interest; Succession Planning; Managing Family Holdings through Trust.

4. Process of M&A transactions: Key Concepts of M&A; Law & Procedure; M&A Due Diligence; M&A Valuation; M&A Structure finalization; Post transaction integration.

5. Documentation – Merger & Amalgamation: Drafting of Scheme; Drafting of Notice and Explanatory

Statement; Drafting of application & Petition.

6. valuation of Business and Assets for Corporate Restructuring: Type of Valuations; Valuation Principles & Techniques for Merger, Amalgamation, Slump Sale, Demerger; Principles & Techniques of Reporting; Relative Valuation and Swap Ratio.

7. Accounting in Corporate Restructuring: Concept and Accounting Treatment: Methods of Accounting for Amalgamations – AS-14/IndAS 103; Treatment of Reserves, Goodwill; Pre-Acquisition & Post-Acquisition Profit; Accounting in Books of Transferor and Transferee; Merger and De-Merger; Acquisition of Business and Internal Reconstruction.

8. Taxation & Stamp Duty aspects of Corporate Restructuring: Capital Gain; Set-off and carry forward under section 2(14) of Income Tax Act; Deemed Dividend; Payment of Stamp Duty on the scheme, payment of stamp duty on movable and immovable properties.

9. Competition Act: Regulation of combinations under the Competition Act, Kinds of combinations, Exempted combinations, Concept of relevant market and its importance, Determination of combinations and any appreciable adverse effect, Role of CCI.

10. Regulatory approvals of the scheme: From CCI, Income Tax, Stock Exchange, SEBI, RBI, RD, ROC, OL, and Sector Regulators such as IRDA, TRAI, etc.

11. Appearance before NCLT/NCLAT.

12. Fast Track Mergers: Small companies, Holding and wholly owned companies

13. Cross Border Mergers

Case Laws/Case Studies/Practical Aspects

Part II: Insolvency, Liquidation & Winding-Up (50 Marks)

14. Insolvency: Historical Background; Pillars of IBC, 2016 [IBBI, IPA, IP, AA, Information utility]; Key Definitions and Concepts; Insolvency Initiation/Resolution under sections 7, 8, and 10.

15. Petition for Corporate Insolvency Resolution Process: Legal Provisions; Procedure, Documentation;

Appearance, Approval; Case Laws.

16. Role, Functions and Duties of IP/IRP/RP: Public announcement, Management of affairs and operations of the company as a going concern, Raising of Interim Finance, Preparation of Information Memorandum.

17. Resolution Strategies: Restructuring of Equity & Debt; Compromise & Arrangement; Acquisition, Takeover & Change of Management; Sale of Assets; Valuation.

18. Convening and Conduct of Meetings of Committee of Creditors: Constitution of Committee of Creditors; Procedural aspects for the meeting of creditors.

19. Preparation & Approval of Resolution Plan: Contents of the resolution plan; Submission of the resolution plan; Approval of resolution plan.

20. Individual/ Firm Insolvency: Application for insolvency resolution process; Report of resolution professional; Repayment plan; Discharge Order.

21. Fresh Start Process: Person eligible to apply for a fresh start; Application for fresh start order; Procedure after receipt of application; Discharge order.

22. Debt Recovery & SARFAESI: Non-Performing Assets; Asset Reconstruction Company; Security Interest (Enforcement) Rules, 2002; Evaluation of various options available to bank viz. SARFASEI, DRT, Insolvency Proceedings; Application to the Tribunal/Appellate Tribunal.

23. Cross Border Insolvency: International Perspective and Global Developments; UNCITRAL Legislative Guide on Insolvency Laws; US Bankruptcy Code, Chapter 11 reorganization; Enabling provisions for cross border transactions under IBC.

24. Liquidation on or after failing of Resolution Plan: Initiation of Liquidation; Distribution of assets; Dissolution of the corporate debtor.

25. Voluntary Liquidation: Procedure for Voluntary Liquidation; Powers and Duties of the Liquidator; Completion of Liquidation.

26. Winding-up by Tribunal under the Companies Act, 2013: Procedure of Winding-up by Tribunal; Powers and duties of the Company Liquidator; Fraudulent preferences.

Case Laws, Case Studies, and Practical aspects.