Chapter 20 Basics of International Taxation – CS Professional Advance Tax Law Notes is designed strictly as per the latest syllabus and exam pattern.

Basics of International Taxation – CS Professional Advance Tax Law Study Material

Question 1.

Write a note on unilateral relief under Section 91. (Dec 2012, 4 marks)

Answer:

Unilateral Relief under Section 91: If any person who is resident In India in any previous year proves that, in respect of his Income which accrued or arose during that previous year outside India (and which is not deemed to accrue or arise in India), he has paid in any country with which there is no agreement under section 90 for the relief or avoidance of double taxation income-tax by, deduction or otherwise under the law in force in that country, he shall be entitled to the deduction from the Indian income tax payable by him of a sum calculated on such doubly taxed income at the Indian rate of tax or the rate of tax of the said country whichever is lower, or at the Indian rate of tax if the both the rates are equal.

Example:

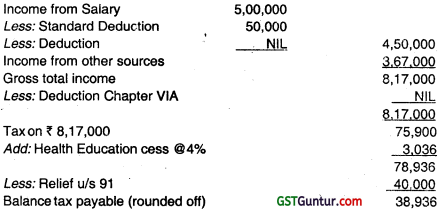

Mr. X, an individual resident and citizen of India earned remuneration in foreign currency from a University in foreign country during his stay in that Country in the previous year 2021-22. There is no DTAA with that country. The remuneration was ₹ 5,00,000 and ₹ 40,000 was deducted at source by the University. Income from other sources of Mr. X in India, was ₹ 3,67,000. Compute the relief available to him under section 91 assuming that Mr. X brings ₹ 4,00,000 in India in convertible foreign exchange by 30.09.2022.

Answer:

Computation of Taxable Income of Mr. X for assessment year 2023-24:

(i) Average rate of tax i.e. \(\frac{\text { Tax on Total Income }}{\text { Total Income }} \times 100\)

= \(\frac{78,936}{8,17,000}\) × 100 = 9.70%

(i) Average rate of foreign tax \(\frac{40,000}{5,00,000} \times 100\) = 8.00%

Hence, relief available shall be @ 9.70% or 8.00% of foreign income whichever is less

₹ 5,00,000 × ₹ 8.00% = ₹ 40,000

Question 2.

Attempt the following:

(i) “The Finance Act, 2011 has expanded the scope of powers of the Transfer Pricing Officer (TPO) under section 92CA.” Discuss. (Dec 2012, 4 marks)

(ii) When can an advance ruling become void? Explain. (Dec 2012, 4 marks)

Answer:

(i) The Finance Act, 2011 has expanded the powers of the Transfer Pricing Officer (TPO) under section 92CA to empower him to:

- Determine arm’s length price of other international transactions of the assessee even though not covered under the reference made to him [Section 92CA (2A)]

- Conduct survey under section 133A.

(ii) Advance Ruling to be void in certain circumstances (section 245T)

1. Where the Authority finds, on a representation made to it by the Principal Commissioner or Commissioner or otherwise) that an advance ruling pronounced under sub-section (6) of section 245R has been obtained by the applicant by fraud or misrepresentation of facts, it may, by order, declare such ruling to be void ab initio and thereupon all the provisions of this Act shall apply (after excluding the period beginning with the date of such advance ruling and ending with the date of order under this sub-section) to the applicant as if such advance ruling had never been made.

2. A copy of the order made under sub-section (1) shall be sent to the applicant and the Principal Commissioner or Commissioner.

3. With effect from such date as the Central Government may, by notification in the Official Gazette, appoint, the provisions of this section shall have effect as if for the word “Authority”, the words “Board for Advance Rulings” had been substituted.

![]()

Question 3.

Attempt the following:

(ii) Discuss the meaning of the term ‘associated enterprise’ as defined under section 92A(1).

(iii) Discuss the procedure for filing application for advance ruling. Also indicate the parties affected by the advance ruling. (June 2018, 5 marks each)

Answer:

(ii) Associated Enterprise [Section 92A(1)]: ‘Associated Enterprise’ in relation to another enterprise, means an enterprise –

(a) which participates, directly or indirectly, or through one or more intermediaries, in the:

- Management; or

- Control, or

- Capital of the other enterprise; or

(b) In respect of which one or more persons who participate, directly or indirectly, or through one or more intermediaries, in its management or control or capital, are the same persons who participate, directly or indirectly, or through one or more intermediaries in the management or control or capital of the other enterprise.

Thus Section 92A(1)(a) provides that if an enterprise participates in the management, capital or control of another enterprise, then, the other enterprise is to be regarded as associated enterprise of the participating enterprise, Such participation may, however, be direct, indirect or through one or more intermediaries.

Section 92A(1)(b) provides that if one or more persons participates in the management, capital or control of one enterprise and the same person also participates in the management capital or control of another enterprises, then both these enterprises are associated enterprises. In this case also participation may be direct, indirect or through one or more intermediaries.

(iii) Application for obtaining an advance ruling [Section 245Q]:

1. An applicant desirous of obtaining an advance ruling under this Chapter or under Chapter V of the Customs Act, 1962 (52 of 1962) or under Chapter III A of the Central Excise Act, 1944 (1 of 1944) or under Chapter VA of the Finance Act, 1994 (32 of 1994)] may make an application in such form and in such manner as may be prescribed, stating the question on which the advance ruling is sought.

2. The application shall be made in quadruplicate and be accompanied by a fee of ten thousand rupees or such fee as may be prescribed in this behalf, whichever is higher.

3. An applicant may withdraw an application within thirty days from the date of the application.

4. Where an application for advance ruling under this Chapter is made before such date as the Central Government may, by notification in the Official Gazette appoint, and in respect of which no order under sub-section (2) of section 245R has been passed or no advance ruling under sub-section (4) of section 245R has been pronounced before such date, such application along with all the relevant records, documents or material, by whatever name called, on the file of the Authority shall be transferred to the Board for Advance Rulings and shall be deemed to be the records before the Board for Advance Rulings for all purposes.

Parties affected by Advance Ruling:

Advance ruling is binding on the following persons, therefore these are the persons which are affected by Advance Ruling:

(a) The applicant who had sought it and only in respect of the transaction in relation to which the ruling had been sought;

(b) on the Commissioner and the income tax authorities sub-ordinate to him, in respect of the applicant and the said transaction. For other persons, advance ruling carries only persuasive value.

Question 4.

Attempt the following:

(ii) The Finance Act, 2012 has extended the applicability of transfer pricing provisions to ‘specified domestic transactions’. What are the transactions covered by Section 92BA as ‘specified domestic transactions’? (Dec 2013, 5 marks)

(iv) Explain in brief the procedure for making an application for advance ruling to Authority for Advance Rulings. (Dec 2013, 5 marks)

(v) What do you mean by ‘foreign tax credit’? (Dec 2013, 5 marks)

Answer:

(ii) “Specified domestic transaction” in case of an assessee means any of the following transactions, not being an international transaction, namely:

- Any expenditure in respect of which payment has been made or is to be made to a person referred to in clause (b) of sub-section (2) of Section 40A;

- Any transaction referred to in Section 80A;

- Any transfer of goods or services referred to in sub – section (8) of Section 80 – IA;

- Any business transacted between the assessee and other person as referred to in sub-section (10) of Section 80 – IA;

- Any transaction, referred to in any other Section under Chapter VI – A or Section 10AA, to which provisions of sub-section (8) or sub – section (10) of Section 80 -IA are applicable; or

- Any other transaction as may be prescribed and where the aggregate of such transactions entered into by the assessee in the previous year exceeds a sum of rupees twenty crore.

(iv) Application for obtaining an advance ruling [Section 245Q]:

1. An applicant desirous of obtaining an advance ruling under this Chapter or under Chapter V of the Customs Act, 1962 (52 of 1962) or under Chapter IIIA of the Central Excise Act, 1944 (1 of 1944) or under Chapter VA of the Finance Act, 1994 (32 of 1994)] may make an application in such form and in such manner as may be prescribed, stating the question on which the advance ruling is sought.

2. The application shall be made in quadruplicate and be accompanied by a fee of ten thousand rupees or such fee as may be prescribed in this behalf, whichever is higher.

3. An applicant may withdraw an application within thirty days from the date of the application.

4. Where an application for advance ruling under this Chapter is made before such date as the Central Government may, by notification in the Official Gazette appoint, and in respect of which no order under sub-section (2).of section 245R has been passed or no advance ruling under sub-section (4) of section 245R has been pronounced before such date, such application along with all the relevant records, documents or material, by whatever name called, on the file of the Authority shall be transferred to the Board for Advance Rulings and shall be deemed to be the records before the Board for Advance Rulings for all purposes.

(v) Foreign Tax Credit: Tax credit in India is generally governed by the provisions of a bilateral Double Taxation Avoidance Agreement (‘DTAA’ or The treaty’) concluded between India and the other contracting state. Further, where there is no DTAA, Section 91 of the Indian Income – Tax Act, 1961 (‘The Act”) grants unilateral relief in respect of income which has suffered tax both in India and in a country with which no DTAA exists (i.e. doubly taxed income).

![]()

Question 5.

In relation to the Authority for Advance Ruling (AAR), state in brief, covering the vital points in the following questions:

(i) What is meant by advance ruling?

(ii) What is the composition of AAR?

(iii) Who is an applicant? (June 2014, 10 marks)

Answer:

(i) Advance Ruling [Section 245N(a)]:

“Advance Ruling” means:

(i) a determination by the Authority in relation to a transaction which has been undertaken or is proposed to be undertaken by a non-resident applicant;

(ii) a determination by the Authority in relation to the tax liability of a non-resident arising out of a transaction which has been undertaken or is proposed to be undertaken by a resident applicant with such non-resident;

(iia) a determination by the Authority in relation to the tax liability of a resident applicant, arising out of a transaction which has been undertaken or is proposed to be undertaken by such applicant; and such determination shall include the determination of any question of law or of fact specified in the application;

(iii) a determination or decision by the Authority in respect of an issue relating to computation of total income which is pending before any income-tax authority or the Appellate Tribunal and such determination or decision shall include the determination or decision of any question of law or of fact relating to such computation of total income specified in the application;

(iv) a determination or decision by the Authority whether an arrangement, which is proposed to be undertaken by any person being a resident or a non-resident, is an impermissible avoidance arrangement as referred to in Chapter X-A or not:

However, where an advance ruling has been pronounced, before the date on which the Finance Act, 2003 receives the assent of the President, by the Authority in respect of an application by a resident applicant referred to in sub-clause (ii) of this clause as it stood immediately before such date, such ruling shall be binding on the persons specified in section 245S.

(ii) Authority for Advance Ruling [Section 245-O]:

1. The Central Government shall constitute an Authority for giving advance rulings, to be known as “Authority for Advance Rulings”:

1 A. On and from the date of appointment of the Customs Authority for Advance Rulings referred to in the proviso to sub-section (1), the Authority shall act as an Appellate Authority.

2. The Authority shall consist of a Chairman and such number of Vice-chairmen, revenue Members and law Members as the Central Government may, by notification, appoint.

3. A person shall be qualified for appointment as—

(a) Chairman, who has been a Judge of the Supreme Court or the Chief Justice of a High Court or for at least seven years a Judge of a High Court;

(b) Vice-chairman, who has been Judge of a High Court;

(c) a revenue Member— ’

- from the Indian Revenue Service, who is, or is qualified to be, a Member of the Board; or

- from the Indian Customs and Central Excise Service, who is, or is qualified to be, a Member of the Central Board of Excise and Customs, on the date of occurrence of vacancy;

(d) a law Member from the Indian Legal Service, who is, or is qualified to be, an Additional Secretary to the Government of India on the date of occurrence of vacancy.

(iii) “Applicant” [Section 245N (b)] means—

(A) any person who—

(I) is a non-resident referred to in sub-clause (i) of clause (a); or

(II) is a resident referred to in sub-clause (ii) of clause (a); or

(III) is a resident referred to in sub-clause (iia) of clause (a) falling within any such class or category of persons as the Central Government may, by notification in the Official Gazette, specify; or ‘

(IV) is a resident falling within any such class or category of persons as the Central Government may, by notification in the Official Gazette, specify in this behalf; or

(v) is referred to in sub-clause (iv) of clause (a), and makes an application under sub-section (1) of section 245Q;

Question 6.

Explain how the arm’s length price in relation to an international transaction is computed under ‘resale price method’ as per rule 10B(1)(b) of the Income-tax Rules, 1962. (Dec 2014, 4 marks)

Answer:

(a) Rule 10B (1) (b) of Income Tax Rules, 1962 prescribes Resale Price Method by which:

(i) The price at which property purchased or services obtained by the enterprise from an associated enterprise is resold or are provided to an unrelated enterprise is identified;

(ii) Such resale price is reduced by the amount of a normal gross profit margin accruing to the enterprise or to an unrelated enterprise from the purchase and resale of the same or similar property or from obtaining and providing the same or similar services, in a comparable uncontrolled transaction or a number of such transactions;

(iii) The price so arrived at is further reduced by the expenses incurred by the enterprise in connection with the purchase of property or obtaining of services;

(iv) The price so arrived at is adjusted to take into account the functional and other differences, including differences in accounting practices, if any, between the international transaction and the comparable uncontrolled transactions or between the enterprises entering into such transactions, which could materially affect the amount of gross profit margin in the open market;

(v) The adjusted price arrived at under sub-clause (iv) is taken to be an arms length price in respect of the purchase of the property or obtaining of the services by the enterprise from the associated enterprise.

Question 7.

What are the ‘specified domestic transactions’ which are subject to transfer pricing provisions? (June 2015, 5 marks)

Answer:

“Specified Domestic Transaction” in case of an assessee means any of the following transactions, not being an international transaction, namely:

- Any expenditure in respect of which payment has been made or is to be made to a person referred to in clause (b) of sub-section (2) of Section 40A;

- Any transaction referred to in Section 80A;

- Any transfer of goods or services referred to in sub-section (8) of Section 80-IA;

- Any business transacted between the assessee and other person as referred to in sub-section (10) of Section 80-IA;

- Any transaction, referred to in any other Section under Chapter VI-A or Section 10AA, to which provisions of sub-section (8) or sub-section (10) of Section 80-IA are applicable; or

- Any other transaction as may be prescribed, and where the aggregate of such transactions entered into by the assessee in the previous year exceeds a sum of twenty crore rupees.

Question 8.

In the context of transfer pricing provisions in relation to international transactions, what are the factors to be considered while selecting the most appropriate method? (June 2015, 5 marks)

Answer:

In selecting a most appropriate method, the following factors shall be taken into account namely,

(a) The nature and class of the international transaction.

(b) The class or classes of Associated Enterprises entering into the transaction and the functions performed by them taking into account assets employed or to be employed and risks assumed by such enterprises.

(c) The availability, coverage and reliability of data necessary for application of the method.

(d) The degree of comparability existing between the international transaction and the uncontrolled transaction and between the enterprises entering into such transactions.

(e) The extent to which reliable and accurate adjustments can be made to account for differences, if any, between the international transaction and the comparable uncontrolled transactions or between the enterprises entering into such transactions.

(f) The nature, extent and reliability of assumptions required to be made in the application of a method.

Question 9.

(ii) What do you mean by ‘transfer pricing’? Explain its importance and benefits. (Dec 2015, 5 marks)

(iii) Under what circumstances an application for advance ruling will not be allowed? Is advance ruling binding on the income-tax department? When does an advance ruling become void? (Dec 2015, 5 marks)

Answer:

(ii) Transfer Pricing:

Transfer Pricing is the setting of price for goods and services sold between controlled (or related) legal entities within an enterprise for example if a subsidiary company sells goods to parent company. The cost of these goods paid by the parent to the subsidiary is the transfer price. Legal entities considered under the control of a single corporation include branches and companies that are wholly or majority owned ultimately by the parent corporation.

Importance and benefits:

Transfer pricing can be used as profit allocation method to attribute a multinational corporation’s net profit (or loss) before tax to countries where it does business. Transfer pricing results in the setting of prices among divisions within an enterprise.

In principal, a transfer price should match either what the seller would charge an independent, arm’s length customer, or what the buyer would pay an independent arm’s length supplier. While unrealistic transfer prices do not affect the overall enterprise directly, they become a concern for taxing authorities when transfer pricing is used to lower profits in a division of an enterprise located in a country that levies high income taxes and raises profit in a country that is a tax heaven that levies no (or low) income taxes.

(iii) No income-tax authority or the Appellate Tribunal shall proceed to decide any issue in respect to which an application has been made by an applicant, being a resident, under sub-section (1) of section 245Q. Is Advance Ruling binding on the Income Tax Department: Advance ruling in other words calls binding ruling. Therefore, it is binding on the Income Tax Department.

Advance Ruling to be void in certain circumstances (Section 245T)

1. Where the Authority finds, on a representation made to it by the Principal Commissioner or Commissioner or otherwise, that an advance ruling pronounced under sub-section (6) of section 245R has been obtained by the applicant by fraud or misrepresentation of facts, it may, by order, declare such ruling to be void ab initio and thereupon all the provisions of this Act shall apply (after excluding the period beginning with the date of such advance ruling and ending with the date of order under this sub-section) to the applicant as if such advance ruling had never been made.

2. A copy of the order made under sub-section (1) shall be sent to the applicant and the Principal Commissioner or Commissioner.

3. With effect from such date as the Central Government may, by notification in the Official Gazette, appoint, the provisions of this section shall have effect as if for the word “Authority”, the words “Board for Advance Rulings” had been substituted.

![]()

Question 10.

What is ‘advance ruling’? State the procedure to obtain advance ruling. (June 2016, 5 marks)

Answer:

Advance Ruling (Section 245 N(a)]:

“Advance Ruling” means:

(i) a determination by the Authority in relation to a transaction which has been undertaken or is proposed to be undertaken by a non-resident applicant;

(ii) a determination by the Authority in relation to the tax liability of a non-resident arising out of a transaction which has been undertaken or is proposed to be undertaken by a resident applicant with such non-resident;

(iia) a determination by the Authority in relation to the tax liability of a resident applicant, arising out of a tiansaction which has been undertaken or is proposed to be undertaken by such applicant; and such determination shall include the determination of any question of law or of fact specified in the application;

(iii) a determination or decision by the Authority in respect of an issue relating to computation of total income which is pending before any income-tax authority or the Appellate Tribunal and such determination or decision shall include the determination or decision of any question of law or of fact relating to such computation of total income specified in the application;

(iv) a determination or decision by the Authority whether an arrangement, which is proposed to be undertaken by any person being a resident or a non-resident, is an impermissible avoidance arrangement as referred to in Chapter X-A or not:

However, where an advance ruling has been pronounced, before the date on which the Finance Act, 2003 receives the assent of the President, by the Authority in respect of an application by a resident applicant referred to in sub-clause (ii) of this clause as it stood immediately before such date, such ruling shall be binding on the persons specified in section 245S.

Procedure to Obtain Advance Ruling (Section 245 R):

1. On receipt of an application, the Authority shall cause a copy thereof to be forwarded to the Principal Commissioner or Commissioner and, if necessary, call upon him to furnish the relevant records ; However, where any records have been called for by the Authority in any case, such records shall, as soon as possible, be returned to the Principal Commissioner or Commissioner.

2. The Authority may, after examining the application and the records called for, by order, either allow or reject the application :

However, the Authority shall not allow the application where the question raised in the application,—

- is already pending before any income-tax authority or Appellate Tribunal [except in the case of a resident applicant falling in sub-clause (iii) of clause (b) of section 245N] or any court;

- involves determination of fair market value of any property;

- relates to a transaction or issue which is designed prima facie for the avoidance of income-tax [except in the case of a resident applicant falling in sub-clause (iii) of clause (b) of section 245N or in the case of an applicant falling in sub-clause (iiia) of clause (b) of section 245N:

No application shall be rejected under this sub-section unless an opportunity has been given to the applicant of being heard: Where the application is rejected, reasons for such rejection shall be given in the order.

3. A copy of every order made under sub-section (2) shall be sent to the applicant and to the Principal Commissioner or Commissioner.

4. Where an application is allowed under sub-section (2), the Authority shall, after examining such further material as may be placed before it by the applicant or obtained by the Authority, pronounce its advance ruling on the question specified in the application.

5. On a request received from the applicant, the Authority shall, before pronouncing its advance ruling, provide an opportunity to the applicant of being heard, either in person or through a duly authorised representative.

Explanation—For the purposes of this sub-section, “authorised representative” shall have the meaning assigned to it in sub-section (2) of section 288, as if the applicant were an assesses.

6. The Authority shall pronounce its advance ruling in writing within six months of the receipt of application.

7. A copy of the advance ruling pronounced by the Authority, duly signed by the Members and certified in the prescribed manner shall be sent to the applicant and to the Principal Commissioner or Commissioner, as soon as may be, after such pronouncement.

8. On and from such date as the Central Government may, by notification in the Official Gazette, appoint, the provisions of this section shall have effect as if for the word “Authority”, the words “Board for Advance Rulings” had been substituted and the provisions of this section shall apply mutatis mutandis to the Board for Advance Rulings as they apply to the Authority.

9. The Central Government may, by notification in the Official Gazette, make a scheme for the purposes of giving advance rulings under this Chapter by the Board for Advance Rulings, so as to impart greater efficiency, transparency and accountability by—

(a) eliminating the interface between the Board for Advance Rulings and the applicant in the course of proceedings to the extent technologically feasible;

(b) optimising utilisation of the resources through economies of scale and functional specialisation;

(c) introducing a system with dynamic jurisdiction.

10. The Central Government may, for the purposes of giving effect to the scheme made under sub-section (9), by notification in the Official Gazette, direct that any of the provisions of this Act shall not apply or shall apply with such exceptions, modifications and adaptations as may be specified in the said notification: Provided that no such direction shall be issued after the 31 st day of March, 2023.

11. Every notification issued under sub-section (9) and sub-section (10) shall, as soon as may be after the notification is issued, be laid before each House of Parliament.

Question 11.

What is advance pricing agreement? State the validity period of the agreement. Also, specify the binding force of the agreement. (June 2016, 4 marks)

Answer:

Advance Pricing Agreement (APA) is an agreement between a taxpayer and a taxing authority (Board) on an appropriate transfer pricing methodology for fixing the arm’s length price for a set of transactions over a fixed period of time in future.

Validity of advance pricing agreement:

The Advance Pricing Agreement shall be valid for a period as specified in the Advance Pricing Agreement. However, this period will not be more than 5 consecutive years.

Bindingrvess of advance pricing agreement:

Advance Pricing Agreement shall be binding on:

(a) the person in whose case, and in respect of the transaction in relation to which, the agreement has been entered into; and

(b) on the Principal Commissioner or Commissioner, and the income-tax authorities subordinate to him, in respect of the said person and the said transaction. However, the advance pricing agreement shall not be binding if there is a change in law or facts having bearing on the agreement so entered.

Question 12.

When can uncontrolled transactions be taken as comparable to international transactions? Which data can be used for the comparability of an uncontrolled transaction with an international transaction? (Dec 2016, 5 marks)

Answer:

As per Rule 10B (3), uncontrolled transaction can be taken as comparable to international transaction only if:

(a) none of the differences, if any, between the transactions being compared, or between the enterprises entering into such transactions are likely to materially affect the price or cost charged or paid in, or the profit arising from, such transactions in the open market; or

(b) Reasonably accurate adjustments can be made to eliminate the material effects of such difference.

If the differences are material and the adjustments cannot be made, the transaction cannot be taken as comparable transaction, then such transaction shall be ignored. Further, as far as possible the internal comparable (i.e. transactions entered into by the associated enterprise with unrelated party) should be selected as these will provide more reliable and accurate data as compared to external comparable data i.e. (transaction with third parties).

As per Rule 10B(4), the data to be used in analyzing the comparability of an uncontrolled transaction with an international transaction shall be the data relating to the financial year in which the international transaction has been entered into.

However, data relating to a period not being more than 2 years prior to such financial year may also be considered if such data reveals facts which could have an influence on the determination of transfer prices in relation to the transactions being compared.

Question 13.

State the powers exercised by the Authority for Advance Ruling under the Income Tax Act, 1961. (Dec 2017, 5 marks)

Answer:

Section 245U deals with the Powers of the Authority. Sub-section (1) provides that for the purpose of exercising its powers, the Authority shall have all the powers of a Civil Court under the Code of Civil Procedure, 1908 as are referred to in Section 131 of the Income-tax Act, when trying a suit in respect of the following matters, namely:

(a) Discovery and inspection;

(b) Enforcing the attendance of any person, including any officer of a banking company and examining him on oath;

(c) Compelling the production of books of account and other documents; and

(d) Issuing commissions.

Under sub-section (2) the Authority shall be deemed to be a Civil Court for the purposes of Section 195 of the Code of Criminal Procedure. Section 195 deals with ‘Prosecution for contempt of lawful authority of public servants, for offences against public justice and for offences relating to documents given in evidence’. But it would not be deemed to be a Court for the purposes of Chapter XXVI of the Code of Criminal Procedure which deals with ‘Provisions as to offences affecting the administration of justice’. Further, every proceeding before the authority shall be deemed to be a judicial proceeding within the meaning of Sections 193 and 228, and for the purpose of Section 196 of the Indian Penal Code.

Question 14.

Explain in the context of provisions contained under the Income-Tax Act, 1961, the Income test and the Assets test with reference to passive foreign investment company? (June 2018, 5 marks)

Answer:

Income Test

Under the Income test, a foreign corporation is considered a Passive Foreign Investment Company ‘PFIC’ if 75% or more of the foreign corporation’s gross Income for the taxable year consist of passive income.

Passive income includes dividends, interest, royalties, rents, annuities, net gains from certain commodities transactions, net foreign currency gains, income equivalent to interest, payment in lieu of dividends, income from notional contracts and income from certain personal service contracts.

Assets Test

Under the Assets test, a foreign corporation is considered a PFIC if 50% or more of the foreign corporation’s assets produce or are held to produce passive income. In applying the Assets Test, the fair market value of the assets is generally used worked out on FMV method.

The general exception is a foreign corporation that is not publically traded and is a controlled foreign corporation, which must use the adjusted basis (the basis method) of its assets in applying the Assets Test. A tax payer may also elect to utilize the basis method, but, once this is done, may not change back to the FMV method without IRS content.

Question 15.

Answer the following questions in the context of provisions contained under the Income-Tax Act, 1961 by taking each an independent case of Advance Ruling:

(i) Applicability of advance ruling and to whom the same is binding. (June 2018, 2 marks)

(ii) When can the advance ruling be void? (June 2018, 1 mark)

(iii) Fees to be paid and form to be filed for obtaining the advance ruling. (June 2018, 2 marks)

Answer:

(i) Applicability of advance ruling (Section 245S)

1. The advance ruling pronounced by the Authority under section 245R shall be binding only—

(a) on the applicant who had sought it;

(b) in respect of the transaction in relation to which the ruling had been sought; and

(c) on the Principal Commissioner or Commissioner,’ and the income-tax authorities subordinate to him, in respect of the applicant and the said transaction.

(ii) Advance ruling to be void in certain circumstances (Section 245T)

1. Where the Authority finds, on a representation made to it by the Principal Commissioner or Commissioner or otherwise, that an advance ruling pronounced under sub-section (6) of section 245R has been obtained by the applicant by fraud or misrepresentation of facts, it may, by order, declare such ruling to be void ab initio and thereupon all the provisions of this Act shall apply (after excluding the period beginning with the date of such advance ruling and ending with the date of order under this sub-section) to the applicant as if such advance ruling had never been made.

2. A copy of the order made under sub-section (1) shall be sent to the applicant and the Principal Commissioner or Commissioner.

3. With effect from such date as the Central Government may, by notification in the Official Gazette, appoint, the provisions of this section shall have effect as if for the word “Authority”, the words “Board for Advance Rulings” had been substituted.

(iii) Application for obtaining an advance ruling [Section 245Q]:

1. An applicant desirous of obtaining an advance ruling under this Chapter or under Chapter V of the Customs Act, 1962 (52 of 1962) or under Chapter IIIA of the Central Excise Act, 1944 (1 of 1944) or under Chapter VA of the Finance Act, 1994 (32 of 1994)] may make an application in such form and in such manner as may be prescribed, stating the question on which the advance ruling is sought.

2. The application shall be made in quadruplicate and be accompanied by a fee of ten thousand rupees or such fee as may be prescribed in this behalf, whichever is higher.

3. An applicant may withdraw an application within thirty days from the date of the application.

4. Where an application for advance ruling under this Chapter is made before such date as the Central Government may, by notification in the Official Gazette appoint, and in respect of which no order under sub-section (2) of section 245R has been passed or no advance ruling under sub-section (4) of section 245R has been pronounced before such date, such application along with all the relevant records, documents or material, by whatever name called, on the file of the Authority shall be transferred to the Board for Advance Rulings and shall be deemed to be the records before the Board for Advance Rulings for all purposes.

![]()

Question 16.

What is Advance Pricing Agreement (APA) under section 92CC of the Income-Tax Act, 1961 ? Discuss and explain the validity and the binding nature of APA. (June 2018, 5 marks)

Answer:

Advance Pricing Agreement (APA) as per Section 92CC is an agreement entered into between a taxpayer and a taxing authority (Board) on an appropriate transfer pricing methodology for fixing the arm’s length price ‘ALP’ for a set of transactions over a fixed period of time in future.

The Advance Pricing Agreement shall be valid for a period as specified in the Advance Pricing Agreement. However, this period will not be more than 5 consecutive previous years.

Advance Pricing Agreement shall be binding on:

(a) the person in whose case, and in respect of the transaction in relation to which, the agreement has been entered into; and

(b) on the Principal Commissioner or Commissioner, and the income – tax authorities subordinate to him, in respect of the said person and the said transaction.

However the advance pricing agreement shall not be binding if there is a change in law or facts having bearing on the agreement so entered into.

Question 17.

“Transfer pricing adjustments must be made while computing book profit for levy of Minimum Alternate Tax (MAT)”.

In the context of provisions contained in the Income-tax Act, 1961, examine the correctness of the above statement. (June 2019, 3 marks)

Answer:

For the purpose of computing book profit for levy of minimum alternate tax, the net profit shown in the Statement of Profit and Loss account prepared in accordance with the Companies Act, 2013 must be increased/decreased only by the additions and deductions specified in Explanation 1 to section 115JB of the Income Tax Act, 1961.

The Explanation 1 to Section 115JB of the Income Tax Act, 1961 does not provide for adjustments for Transfer Pricing and therefore, transfer pricing adjustments cannot be made while computing book profit for levy of Minimum Alternate Tax.

Hence, the statement that Transfer pricing adjustment must be made while computing book profit for levy of Minimum Alternate Tax (MAT) is incorrect.

Question 18.

Explain the consequences that would follow if the Assessing Officer makes adjustment to Arm’s Length Price (ALP) in international transactions of the assessee resulting in increase in total income. What are the remedies available to an assessee to dispute such adjustment made by the AO ? (June 2019, 5 marks)

Answer:

In case the Assessing Officer makes adjustment to Arm’s Length Price ‘ALP’ in an international transaction which result into an increase in taxable income of the assessee, the following consequences shall follow:

1. No deduction under Section 10AA or Chapter Vl-A of Income Tax Act, 1961 shall be allowed from the income so increased.

2. No corresponding adjustment would be made to the total income of the other associated enterprise (in respect of payment made by the assessee from whom tax has been deducted or is deductible at source) on account of increase in the total income of the assessee on the basis of the arm’s length price so recomputed.

The remedies available to the assessee to dispute such an adjustment are:

1. In case the assessee is an eligible assessee under Section 144C of Income Tax Act, 1961, he can file his objections to the variation made in the income within 30 days [of the receipt of draft order by him] to the Dispute Resolution Panel and Assessing Officer. Appeal against the order of the Dispute Resolution Panel can be made to the Income-tax Appellate Tribunal.

2. In any other case, he can file an appeal under Section 246A of Income Tax Act, 1961 to the commissioner (Appeals) against the order of the Assessing Officer within 30 days of the date of service of notice of demand.

3. The assessee can opt to file an application to the Commissioner of Income-tax for revision under Section 264 of Income Tax Act, 1961 of the order of the Assessing Officer.

Question 19.

Discuss in brief a few benefits derived from the Safe Harbour Rules, relating to the transfer pricing regulations. (Dec 2019, 3 marks)

Answer:

Benefits derived from Safe Harbour Rules are as under:

1. Compliance Simplicity: Safe Harbour Rules tends to substitute requirements in place of existing regulations, thereby reducing compliance burden and associated costs for eligible taxpayers, who would otherwise be obligated to dedicate resources and time to collect, analyze and maintain extensive data to support their inter-company transactions.

2. Certainty and Reduce litigation: Electing Safe Harbours may grant a greater sense of assurance to taxpayers regarding acceptability of their transfer price by the authorities without onerous audits. This conserves administrative and monetary resources for both the taxpayer and tax administration.

3. Administrative Simplicity: Since Tax administration would be required to carry out only a minimal examination in respect of taxpayers opting for safe harbours, they can channelize their efforts to examine more complex and high – risk transactions and high- risk transactions and taxpayers.

Question 20.

Discuss the factors to be considered by the Assessing Officer while selecting the appropriate transfer pricing method. (Dec 2019, 3 marks)

Answer:

Factors to be considered by the Assessing Officer while selecting an appropriate transfer pricing method are as under:

- The nature and class of the International or Specified Domestic Transaction.

- The class or classes of Associated Enterprises entering into the transactions and the functions performed by them taking into account assets employed or to be employed and risk assumed by each enterprises.

- The availability, coverage and reliability of data necessary for application of the method.

- The degree of comparability existing between the International transaction or Specified Domestic Transaction and the uncontrolled transaction, and between the enterprises entering into such transaction

- The extent to which reliable and accurate adjustments can be made to account for differences, if any, between the International or Specified Domestic Transaction and the comparable uncontrolled transactions or between the enterprises entering into such transactions.

- The nature, extent and reliability of assumptions required to be made in the application of the method.

Question 21.

How and when a unilateral Advance Pricing Agreement (APA) entered into can be converted into a bilateral APA ? (Dec 2020, 3 marks)

Answer:

A unilateral Advance Pricing Agreement ‘APA’ can be converted into a bilateral APA before the mutually agreed draft agreement is forwarded by the DGIT (International Taxation) to the Board. While converting a unilateral APA application to a bilateral APA application, the applicant or its Associated Enterprise needs to make a similar request with the competent authority of the other country.

The bilateral request of the applicant shall be forwarded by the DGIT to the competent authority in India. The competent authority of India shall decide whether the bilateral request is allowable based on the existence of appropriate provision on lines of OECD Model Article 9(2) in the tax treaty between India and other country and also on the existence of an APA program in that other country.

If the request is allowed, then the application would be processed as a bilateral APA application.

Question 22.

What is the legislative intent/objective of bringing into existence the provisions relating to transfer pricing in relation to international transactions? Explain the statement in the context of Income Tax Act, 1961.

(Dec 2022, 3 marks)

Answer:

The presence of multinational enterprises in India and their ability to allocate profits among the enterprises within the group in different jurisdictions by controlling prices in intra-group transactions in such a way that there may be either no profit or negligible profit in the jurisdiction which taxes such profits and substantial profit will be in the jurisdiction which is a tax heaven or where the tax liability on such profits is minimum.

This may adversely affect a country’s share of due revenue. The profits derived by such enterprises carrying on business in India can be controlled by the multinational group, by manipulating the prices charged and paid in such intra-group transactions, which may lead to erosion of tax revenue.

Therefore, transfer pricing provisions have been brought in by the Finance Act, 2001 with a view to provide a statutory framework which can lead to computation of reasonable, fair and equitable profits and tax in India, in the case of such multinational enterprises.

Question 23.

The Assessing Officer can complete the assessment of income from international transactions in disregard of the order passed by the Transfer Pricing Officer (TPO) by accepting the contention of the assessee. Explain. (Dec 2020, 3 marks)

Answer:

Section 92CA(4) of the Income Tax Act, 1961, provides that the order of the Transfer Pricing Officer determining the arm’s length price (ALP) of an International Transaction is binding on the Assessing Officer. The Assessing Officer shall proceed to compute the total income from the International Transactions in conformity with the arm’s length price (ALP) as determined by the Transfer Pricing Officer.

Therefore, the Assessing Officer cannot completer the assessment of income from international transactions in disregard of the order of Transfer Pricing Officer and on the basis of contention raised by the Assessee.

Question 24.

What are the practical difficulties in applying Arm’s length price? (Aug 2021, 3 marks)

Answer:

The practical difficulties involved in application of Arm’s length price are as follows:

- True comparison difficult in certain cases.

- Availability of data and reliability of available data.

- Absence of market price.

- Absence of comparable market price for “intangible” transactions.

- Administrative burden.

- Time lag.

Question 25.

A person fails to furnish audit report under section 92E of the income Tax Act, 1961. The Incpme Tax Officer imposes penalty on the assessee. Assessee challenges the penalty stating that there was reasonable cause for not furnishing the report. Can the assessee escape the penalty if the cause was genuine. (Aug 2021, 3 marks)

Answer:

As per section 271 BA of the Income-tax Act, 1961 The Act”, if any person fails to furnish audit report as required under section 92E of the Act, then the assessing officer may direct that such person shall pay, by way of penalty, a sum of ₹ 1 lakh.

However, as per section 273B of the Act, penalty shall not be levied if the assessee proves that there was reasonable cause for such failure. In this case, as the assessee is able to proves genuine reasonable cause of failure to furnish report u/s 92E, the assessing officer is not justified in imposing the penalty.

Question 26.

The concept of Permanent Establishment is one of the most important concepts in determining the tax implications of cross border transactions. Examine the significance thereof, when such transactions are governed by Double Taxation Avoidance Agreements (DTAA). (June 2022, 3 marks)

Answer:

Double Taxation Avoidance Agreements (DTAAs) generally contain an article providing that business income is taxable in the country of residence, unless the enterprise has a permanent establishment ‘PE’ in the country of source, and such income can be attributed to the permanent establishment.

As per section 92F(iiia) of the Income Tax Act, 1961, the term “Permanent Establishment” includes a fixed place of business through which the business of an enterprise is wholly or partly carried on.

As per this definition, to constitute a permanent establishment, there must be a place of business which is fixed and the business of the enterprise must be carried out wholly or partly through this place.

Section 9(1)(i) of the Income Tax Act, 1961, requires existence of business connection for deeming business income to accrue or arise in India.

DTAAs, however, provide that business income is taxable only if there is a permanent establishment in India. As per section 92(2) of the Income Tax Act, 1961, the DTAA or the provisions of the Income-tax Act, 1961, whichever is more beneficial, shall apply. The PE concept is narrower than the business connection concept. Therefore, in a case where the Indian Government has entered into DTAA with a country, unless and until the PE test is satisfied, the business income would not be taxable in the source country. However, in cases not covered by DTAAs, business income attributable to business connection is taxable.

Question 27.

Assessing Officer can complete the assessment of income from international transaction in disregard of the order passed by the Transfer Pricing Officer by accepting the contention of assessee. Discuss the Correctness or otherwise with reference to the provisions of Income-Tax Act, 1961. (June 2022, 3 marks)

Answer:

The statement is not correct.

Section 92CA(4) of the Income Tax Act, 1961, provides that on receipt of the order of the Transfer Pricing Officer determining the arm’s length price of an international transaction, the Assessing Officer shall proceed to compute the total income in conformity with the arm’s length price determined by the Transfer Pricing Officer. The order of the Transfer Pricing Officer is binding on the Assessing Officer.

Therefore, the Assessing Officer cannot complete the assessment of income from international transactions is disregard of the order of Transfer Pricing Officer by accepting the contention raised by the assessee.

![]()

Question 28.

Briefly explain the following subjects in the context of International Taxes:

(i) Tax Havens

(ii) Exchange Controls. (June 2022, 3 marks)

Answer:

(i) Tax Havens:

Tax havens are jurisdiction which tends to have nil tax or low tax rate. Tax havens may also be jurisdiction which has other benefits like financial secrecy, minimum reporting requirements, ring fencing, discretionary tax privileges, allowing ownership to be held in trust, no registry of companies and partnership, no taxes on dividends and interest payments to non-residents, etc.

Several countries have SAARs i.e. Specific Anti Avoidance Rules to limit the deductions of tax expense or tax benefits to entities located in tax havens. For e.g. india has enacted section 94A, where on being notified, there is restriction on allowability of payment to entity in such jurisdictions, higher withholding taxes, applicability of Transfer Pricing provisions etc.

(ii) Exchange Controls:

Exchange control and tax clearances may be used by countries as anti-avoidance measures on cross-border transactions. These transactions are subject either to prior government approvals or post transaction reporting thereof. Many countries (mostly developing countries) have a partial or full exchange control. E.g. in India all capital account transactions under FEMA are not freely allowed unless provided otherwise and all revenue account transactions are freely allowed, unless provided otherwise.

Question 29.

The Assessing Officer have to consider some factors while selecting the appropriate transfer pricing method. Discuss those factors in brief. (Dec 2022, 5 marks)

Question 30.

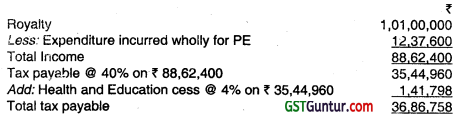

A non-resident foreign company has a permanent establishment (PE) in India, in respect of which royalty ₹ 101 lakh was earned from an Indian company in pursuance of an agreement dated 10th June, 2021 (expenditure incurred on PE in India ₹ 12,37,600). Compute the gross tax liability of foreign company ignoring TDS/ advance tax for the assessment year 2023-24, assuming that there is no other income of the company for the year. (Dec 2012, 4 marks)

Answer:

Computation of Tax Liability of Foreign Company for the Assessment Year 2023-24.

Question 31.

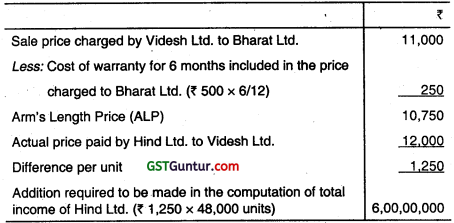

Videsh Ltd., a US company has a subsidiary, Hind Ltd. in India. Videsh Ltd. sells mobile phones to Hind Ltd. for resale in India, Videsh Ltd. also sells mobile phones to Bharat Ltd., another mobile phone reseller. It sold 48,000 mobile phones to Hind Ltd. at ₹ 12,000 per unit. The price fixed for Bharat Ltd. is ₹ 11,000 per unit.

The warranty in case of sale of mobile phones by Hind Ltd. is handled by itself, whereas, for sale of mobile phones by Bharat Ltd., Videsh Ltd. is responsible for warranty for 6 months. Both Videsh Ltd. and Hind Ltd. extended warranty at a standard rate of ₹ 500 per annum.

On the above facts, how is the assessment of Hind Ltd. going to be affected? Show your calculations also. (Dec 2013, 5 marks)

Answer:

Since Hind Ltd. is a subsidiary company of Videsh Ltd., Hind Ltd. and Videsh Ltd. are associated enterprises and the computation of Arm’s Length Price (ALP) by Comparable Uncontrolled Price Method and additions required

to be made in total income of Hind Ltd. shall be computed as under:

Note:

Exemption u/s 10AA and deduction under chapter VI-A will not be available in respect of increased income of ₹ 6 crore.

Question 32.

Ms. Alicia is a German national working in Sinsang Ltd., in Turkey. Sinsang Ltd., neither has any office in India nor done any business in India. The company deputed Ms. Alicia to India on 31st January, 2022 for conducting market survey. She went back to Turkey on 30th March, 2022. Salary of US $ 50,000 for the period of her stay in India was credited in an account maintained by her in India.

Examine the taxability of the salary income received by her in India. Would your answer be different, if Sinsang Ltd. is maintaining its office in Delhi? (Dec 2012, 5 marks)

Answer:

Section 10(6)(vi) of Income Tax Act, 1961 states that remuneration received by a foreign national as an employee of a foreign enterprise for services rendered during his/her stay in India is exempt from tax provided:

- Foreign enterprise is not engaged in any business or trade in India.

- Stay of employee does not exceed 90 days in such Previous Year; and

- Such remuneration is not liable to be deducted from the income of employer chargeable under the Income Tax Act.

In the given case:

Ms. Alicia stayed in India for a period of (1+28+30) 59 days inclusive of the days of coming to and going from India. Since, Ms. Alicia satisfies all the above condition, she is not required to pay tax on US $ 50,000 received by her in India during January to March, 2022.

Yes, if Sinsang Ltd. had its Office in Delhi, it would have mean that foreign enterprise was engaged in business in India and accordingly exemption under section 10(6)(vi) would not have been available to Ms. Alicia.

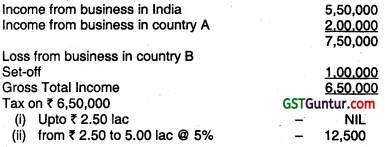

Question 33.

Compute the amount of tax relief under section 91 (1) and of the tax payable by the assesses, an Indian resident, aged 50 years having following incomes during the previous year 2022-23:

(i) Business income in India ₹ 5,50,000.

(ii) Business income in country A of ₹ 2,00,000 on which tax was deducted in the foreign country by the Government of ₹ 50,000.

(iii) Loss from business in country B of ₹ 1,00,000.

(Note: Government of India does not have any Double Tax Avoidance Agreement with either country A or with country B). (June 2017, 5 marks)

Answer:

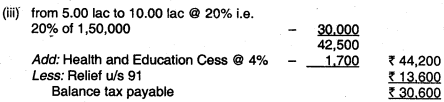

Computation of taxable income of a assessee for assessment year 2023-24.

Working Note:

Calculation of relief under section 91

(i) Average rate of tax i.e. \(=\frac{\text { Tax on total income }}{\text { Total income }}\) × 100

= \(\frac{44,200}{6,50,000}\) × 100 = 6.8%

(ii) Average rate of foreign tax = \(\frac{50,000}{2,00,000}\) × 100 = 25%

Hence, relief available shall be @ 6.8% or 25% of foreign income whichever is less.

₹ 2,00,000 × 6.8% = ₹ 13,600

Hence, the amount of tax relief u/s 91 (1) is ₹ 13,600 and tax payable by the assessee is ₹ 30,600.

Question 34.

Nadal, a professional tennis player and a non- Indian citizen during the Financial Year 2021-22 participated in India in a Tennis Tournament and won the prize money of ₹ 25 lacs. Ha contributed articles on the tournament in a local newspaper for which he was paid ₹ 3 lakh. He was also paid ₹ 7,50,000 by a Soft Drink Company for appearance in a TV advertisement. All his expenses in India were though met by the sponsors, but he had incurred ₹ 5,00,000 towards his travel cost to India. He was a non resident for tax purposes in India during the financial year 2021-22.

What would be his tax liability in India for A. Y. 2023-24? Is he required to file his return of Income? (Dec 2017, 5 marks)

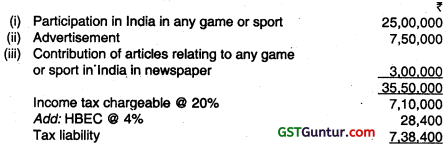

Answer:

Taxable income in India for the A.Y. 2023-24

Question 35.

A Ltd., a US company has a subsidiary B Ltd. in India. A Ltd. sells Laptops to B Ltd. for resale in India. A Ltd. also sells laptops to C Ltd., another reseller. It sells 40,000 Laptops to B Ltd. at ₹ 10,000 per unit. The price fixed for C Ltd. is ₹ 9,000 per unit. The warranty in case of sale of laptops by B Ltd. is provided by B Ltd. However, for laptops sold by C Ltd., A Ltd. is responsible for providing service warranty for 3 months. Both A Ltd. and B Ltd. offer extended warranty at a standard rate of ₹ 1,000 per annum.

On the basis of these facts explain the method which can be applicable for determination of arm’s length price. Also determine the effect on the net profit/income of B Ltd. (Assuming that C Ltd. has not entered into an advance pricing agreement) in the scenario discussed above. Determine the arm’s length price also. (Dec 2018, 5 marks)

Answer:

A Ltd., the foreign company, and B Ltd., the Indian company, are associated enterprises since A Ltd. is the holding company of B Ltd. A Ltd. sells laptops to B Ltd. for resale in India. A Ltd. also sells identical laptops to C Ltd. which is not an associated enterprise. The price charged by A Ltd. for a similar product transferred in comparable uncontrolled transaction is available. Therefore, Comparable Uncontrolled Price ‘CUP’ method for determining arm’s length price can be applied.

For sale of laptops by C Ltd. A Ltd. is responsible for warranty of 3 months. The price charged by A Ltd. to C Ltd. includes the charge for warranty for 3 months. Hence arm’s length price for laptops being sold by A Ltd. to B Ltd. would be:

| Particulars | Amount (₹) |

| Sale Price per laptops charged by A Ltd. from C Ltd. | 9,000 |

| Less: Cost of warranty included in the price charged to C Ltd. (₹ 1,000 × 3/12) | (250) |

| Arm’s Length Price | 8,750 |

| Actual Price paid by B Ltd. to A Ltd. | 10,000 |

| Difference per unit | 1,250 |

No. of units supplied by A Ltd. to B Ltd. = 40,000

Addition of Income required to be made in the computation of total income of B Ltd. = ₹ 1,250 × 40,000 = ₹ 5,00,00,000

Note: No deduction under chapter Vl-A would be allowable in respect of the enhanced income of ₹ 5 crores.

Question 36.

Zonik Inc of Canada holds 35% Shares of Gama India Ltd. Gama India Ltd. imports 2000 unit of product X from Zonik Inc Canada at a price of ₹ 1,500 per unit and these are sold to Sunil Regency Ltd. at a price of ₹ 1,700 per unit. Gama India Ltd. has bought similar products from Ronak India Ltd. and sold to Vijay Ltd. at a gross profit of 14% on sales. Zonik Inc Canada offers a quantity discount of ₹ 15 per unit whereas Ronak India Ltd. does not offer such quantity discount. Gama India Ltd. incurred freight of ₹ 10 per unit and customs duty of ₹ 30 per unit in case of purchases made from Zonik Inc Canada.

On the basis of these facts explain the method which would be applicable for determination of Arm’s Length Price (ALP) under Income Tax Act, 1961. Determine the Arm’s Length Price on the basis of the method as found to be applicable and also determine the effect on the net Profit/Income of Gama India Ltd. (assuming that there is no advance pricing agreement) in the scenario discussed above. (June 2019, 5 marks)

Answer:

Arm’s Length Price is determined on the basis of Resale Price Method:

| Particular | Amounts (₹) |

| Resale price of goods purchased from Zonik Inc Canada (per unit) | 1,700 |

| Less: Normal Gross Profit Margin @ 14% on ₹ 1,700 (per unit) | (238) |

| Less: Expenses connected with purchases (fright and customs duty i.e. ₹ 10 + ₹ 30) | (40) |

| Less: Quantity discount allowed by Zonik Inc Canada | (15) |

| Arm’s Length Price (per unit) | 1,407 |

| Price paid to Zonik Inc Canada (per unit) | 1,500 |

| Excess price paid per unit (₹ 1500 – ₹ 1407) | 93 |

| Increase in Income of Gama Limited (₹ 93 × 2000 units) | 1,86,000 |

![]()

Question 37.

Jim Grow Tex. Inc. is a company incorporated in London (England). 60% of its shares are held by Sampat Pvt. Ltd. a domestic company. Jim Crow Tex. Inc. has its presence in India also. The data relating to Jim Crow Tex. Inc. 1o financial year 2022-23 are as under:

| Particulars | India | England |

| Fixed assets at depreciated values for tax purposes (₹ in crores) | 60 | 90 |

| Intangible assets (₹ in crores) | 80 | 190 |

| Other assets (₹ in crores) | 20 | 60 |

| Income from trading operations (₹ in crores) | 16 | 37 |

| Income from investments (₹ in crores) | 29 | 18 |

| Number of employees (Residents in respective countries) | 70 | 30 |

State for the purpose of Place of Effective Management (POEM) whether the Jim Crow Tex. Inc. shall be said to be engaged in Active Business Outside Indida’ (ABOI) under Income Tax Act, 1961 on the basis of:

(a) Income criteria

(b) Assets criteria

(c) Number of employees criteria. (June 2019, 5 marks)

Answer:

(a) Income Criteria: The passive income should not be more than 50% of its total income.

Total Income during the previous year 2020-21 is ₹ 100 crores [(16 crores + 29 crores) + (37 crores + 18 crores)]

Passive Income is ₹ 47 crores being income from investment (29 crores in India and 18 crores in England).

% of passive income to total income=47 crores/100 crores × 100 = 47%

Since passive income is 47% i.e. not more than 50% of its total income, the income condition for Active Business Outside India ‘ABOI’ test is satisfied.

(b) Assets Criteria: Should have less than 50% of its total assets situated in India Value of Total Assets during the previous year 2022-23 is ₹ 500 crores [160 crores in India + 340 crores in England].

Value of total Assets in India during the previous year 2021 -22 is ₹ 160 crores.

% of assets situated in India to total assets = 160 crores/500 crores × 100 = 32%

Since the value of assets situated in India is less than 50% of its total assets i.e. 32%, the assets condition for Active Business Outside India ‘ABOI’ test is satisfied.

(c) Employee Criteria: Less than 50% of the total number of employees should be situated in India or should be resident in India.

Number of employees situated in India or resident in India is 70.

Total number of employees is 100 (70 + 30).

% of employees situated in India or are resident in India to total number of employees is 70/100 × 100 = 70%

Since employees situated in India or are resident in India are more than 50% of its total employees i.e. 70%, the employee condition for Active Business Outside India ‘ABOI’ test is not satisfied.

Question 38.

State with reasons, whether Jackson LLC., (incorporated in Japan) and Vijayshree Ltd. a domestic company, are/can be deemed to be associated enterprises for the transfer pricing regulations in the following independent situations:

(a) Jackson LLC. has advanced a loan of ₹ 55 crores to Vijayshree Ltd. on 12th January, 2022. The total book value of assets of Vijayshree Ltd. is ₹ 100 crores. The market value of the assets, however, is ₹ 140 crores. Vijayshree Ltd. repaid ₹ 10 crores before 31st March, 2022. (June 2019, 2 marks)

(b) Total value of raw materials and consumables of Vijayshree Ltd. is, ₹ 800 crores. Of this, Jackson LLC supplies to the tune of ₹ 740 crores, at prices mutually agreed upon once in six months and depending upon the market conditions. (June 2019, 3 marks)

Answer:

(a) Jackson LLC (a foreign company, has advanced loan of ₹ 55 crores to Vijayshree Ltd., a domestic company, which amounts to 55% of book value of assets of Vijayshree Ltd. Since the loan advanced by Jackson LLC is not less than 51 % of the book value of assets of Vijayshree Ltd., Jackson LLC and Vijayshree Ltd. are deemed to be associated enterprises for the purpose of transfer pricing regulations. The deeming provision would be attracted even if there is a repayment of loan during the same previous year which brings down its percentage below 51 % .

(b) The Jackson LLC supplies 92.50% (₹ 740 crore/₹ 800 crores × 100) of the raw material and consumables required by Vijayshree Ltd. which is more than the specified threshold limit of 90%, however, Jackson LLC and Vijayshree Limited are not deemed to be associated enterprises since the price of supply is not influenced by Jackson LLC but is mutually agreed upon once in six months depending upon prevailing market conditions.

Question 39.

XYZ Ltd., a foreign company, has its head office at USA. The Board of Directors (BOD) meetings are held in USA. However, the Board of Directors has delegated major powers to a committee in Kolkata and the members of this committee are based in Kolkata. The Board of Directors ratified the decisions of the said committee. In the light of above,

1. Discuss the place of effective management (POEM) of XYZ Ltd.

2. Discuss the guiding factors of POEM for Board of Directors delegating authorities to Committee. (Dec 2019, 3 marks)

Answer:

The location where company’s Board of Directors (BOD) regularly meets and makes decisions may be the company’s Place of Effective Management (POEM) provided the Board:

- Retain and exercises its authority to govern the company: and

- Does, in substance, make the key management and commercial decisions necessary for the conduct of the company’s business as a whole.

In given case the board meetings are held in USA, but the same formalise the decisions taken by the committee at Kolkata. Hence Place of Board meeting held at USA cannot be POEM, as power is delegated to committee which is based at Kolkata.

Guiding factors when Board Delegating Authorities to Committee are as under:

If Board of Director had delegated some or all of its major authorities to one or more committees consisting senior management, then POEM shall be at the place where:

- Members of executive committee are based and

- Where committee develops and formulate key decisions for formal approval by Board. Hence in given case, POEM of XYZ Ltd. will be Kolkata, as discussed above.

Question 40.

ABC Ltd. is a foreign subsidiary company of XYZ Ltd. XYZ Ltd. sells refrigerators to ABC Ltd. at a price of ₹ 10,000 each for sale to its dealers in Singapore. In other States, XYZ Ltd. is directly selling to their dealers at ₹ 12,000 with a warranty of one year (₹ 500 for each fridge). ABC Ltd, does not offer such warranty.

Quantity sold to ABC Ltd. is 8000 units and to dealers of XYZ Ltd. is 3000 units. Discuss the method to be applied to arrive at the arm’s length price and compute the ALP.

How is the assessment of XYZ Ltd. going to be affected? (Dec 2019, 5 marks)

Answer:

ABC Ltd. and XYZ Ltd. are associated enterprise as ABC Ltd is subsidiary of XYZ Ltd. Comparable product (fridge) is sold to dealers (Uncontrolled transactions). Hence in given circumstances Comparable Uncontrolled Price CUP) Method for determining arm’s length price can be applied.

Particulars : Amount

Sale price charged to Dealers of XYZ Ltd. : 12,000

Less: cost of warranty included in price : (500)

Arm length price : 11,500

Actual price paid by ABC Ltd. To XYZ Ltd. : 10,000

Difference per unit : 1,500

Addition required to be made in the computations of the total Income of XYZ Ltd. (1500 × 8000 units) : 12,00,000

No deduction under chapter Vl-A would be available in respect of the enhanced Income.

Question 41.

Discuss the relevant provisions of Income Tax Act, 1961 in respect of the following transaction:

Mr. Joy has entered into International transactions aggregating to ₹ 75 lakhs and specified domestic transactions aggregating to ₹ 5 crores. He did not mention any document /information relating to transfer pricing nor has filed any report/ certificate/document/information with the tax authorities. Discuss Penal consequences, if any. (Aug 2021, 3 marks)

Answer:

Mr. Joy is not required to maintain information and documents since neither the aggregated value of international transactions exceed ₹ 1 crore, nor the aggregated value of specified domestic transactions exceed ₹ 20 Crore.

Therefore, no penalty shall be levied for non-maintenance of information and documents.

However, Mr. Joy is required to obtain and furnish the audit report u/s 92E even if the aggregated value of international transactions does not exceed ₹ 1 crore or specified domestic transaction does not exceed ₹ 20

crore. Hence, Mr. Joy was required to obtain and furnish audit report u/s 92E in respect of international transactions aggregating to ₹ 75 lakh and specified domestic transaction aggregating to ₹ 5 crore. He shall be liable to penalty u/s 271 BA of ₹ 1,00,000 for such default.

Question 42.

Comment on the following independent situations, whether X Ltd. and Y Ltd. constitute associated enterprises under the provisions of Section 92A:

(a) Book value of total assets of X Ltd. is Rupees 100 crores, Y Ltd. has advanced a loan of Rupees 80 crores to its wholly subsidiary A Ltd., A Ltd., in term advanced a loan of Rupees 80 crore to X Ltd.

(b) Y Ltd. is engaged in trading of furniture. During the previous year 2020-21 it purchases furniture of Rupees 50 lakh from X Ltd. Total purchases of Y Ltd. during the year Rupees 55 lakh.

(c) X Ltd. has two units, Unit A and Unit B. Unit A manufacturers industrial equipment using the manufacturing process exclusively owned by Y Ltd. Unit B is engaged in buying and selling of toys.

(d) X Ltd. holds whole of equity share capital of C Ltd. C Ltd. holds 30% equity shares of Y Ltd. X Ltd. also holds 60% of preference share capital of Y Ltd.

(e) Y Ltd. has the right to appoint one of the executive director of X Ltd.

However Y Ltd. does not exercise its right and therefore it did not appoint any executive director of X Ltd. (Aug 2021, 5 marks)

Answer:

(a) X Ltd. and Y Ltd. are not Associated Enterprise

As per section 92A of the Income-tax Act, 1961, two enterprises are deemed to be associated enterprise if loan advanced by one enterprise to another enterprise constitutes not less than 51 % of book value of the total asset of the other enterprise. Under this clause, direct loans are covered and loan advanced indirectly is not covered. In this case, Y Ltd. has not directly given loan to X Ltd. and hence they do not qualify as Associated Enterprises.

(b) X Ltd. and Y Ltd. are not Associated Enterprise

As per section 92A of the Income-tax Act, 1961, two enterprises are deemed to be associated enterprises if 90% or more of the raw material required for the manufacture or processing of goods carried out by one enterprise, are supplied by the other enterprise. This clause is applicable only if the purchasing enterprise is engaged in manufacturing or processing of goods. In this case, Y Ltd. is not engaged in manufacturing or processing of goods and hence, X Ltd. and Y Ltd. do not qualify as Associated Enterprises.

(c) X Ltd. and Y Ltd. are not associated enterprises

As per section 92A of the Income-tax Act, 1961, two enterprises are deemed to be associated enterprises if the business carried on by one enterprise is ‘wholly’ dependent upon the intangible owned by the other enterprise. In this case, X Ltd. is engaged in two businesses, out of which only one business is dependent on Y Ltd. Thus, X Ltd.’s business is not wholly dependent upon Y Ltd. and therefore they do not qualify As associated Enterprises.

(d) X Ltd. and Y Ltd. are Associated Enterprises.

As per section 92A of the Income-tax Act, 1961, two enterprises are deemed to be associated enterprises if one enterprise holds, directly or indirectly, shares carrying not less than 26% of voting power in other enterprise.

In this case, X Ltd. indirectly (through C Ltd.) holds more than 26% equity shares (i.e. 30%) in Y Ltd. and thus they qualify as associated enterprises.

(e) X Ltd. and Y Ltd. are not associated enterprises.

As per section 92A of the Income-tax Act, 1961, two or more enterprises are deemed as associated enterprises if one or more executive director of one enterprise is appointed by other enterprise. In this case, Y Ltd. has actually not appointed any executive director of X Ltd. Merely having a right to appoint is not sufficient. Hence, X Ltd. and Y Ltd. do not qualify as associated enterprises.

![]()

Question 43.

Comment on the following independent situations, whether P.C. Ltd. (domestic company) and R.D. Ltd. (incorporated in UK) constitute “associated enterprises” under the provisions pf section 92A of Income Tax Act, 1961 :

(i) Book value of total assets of P.C. Ltd. is ₹ 100 crore. R.D. Ltd. has advanced a loan of ₹ 80 crore to its wholly owned subsidiary company A Ltd., A Ltd. has in turn advanced a loan of ₹ 80 crore to P.C. Ltd.

(ii) P.C. Ltd. is engaged in trading of furniture. During the previous year 2022-23, it purchases furniture of ₹ 50 lakh from R.D. Ltd. Total purchases of P.C. Ltd. during the previous year 2022-23 is ₹ 55 lakh.

(iii) P.C. Ltd. has two units. Unit A and Unit B. Unit A manufactures industrial equipment using the manufacturing process exclusively owned by R.D. Ltd. Unit B is engaged in buying and selling of toys independently.

(iv) Total value of raw materials and consumables purchase of P.C. Ltd. is ₹ 700 crore. Of this. R.D. Ltd. supplies to the tune of ₹ 650 crore, at prices mutually agreed upon once in six months and depending upon the market conditions.

(v) Gulgulia Ltd. holds 40% of shareholding in P.C. Ltd. and 30% shareholding in R.D. Ltd., where neither P.C. Ltd. has any holding in R.D. Ltd. nor R.D. Ltd. has any holding in R.C. Ltd. (June 2022, 5 marks)

Answer:

(i) P.C. Ltd and R.D. Ltd. are not associated enterprises: Under section 92A of the Income tax Act, 1961, two enterprises are deemed to be associated enterprise if loan advanced by one enterprise to another enterprise constitutes not less than 51 % of book value of total assets.

Here R.D. Ltd and A Ltd. as well as A Ltd. and PC Ltd. are associated enterprises, but P.C. Ltd and R.D. Ltd are not associated enterprises because under this clause, R.D. Ltd has not directly given loan to P.C. Ltd. Hence, they do not qualify as associated enterprises.

(ii) P.C. Ltd and R.D. Ltd. are not associated enterprises: Under section 92A of the income tax Act, 1961, two enterprises are deemed to be associated enterprises if 90% or more of the raw material required for the manufacture or processing of goods carried out by one enterprises, are supplied by the other enterprise. This clause is applicable only if the purchasing enterprise is engaged in manufacturing or processing of goods. In this case, P.C. Ltd. is not engaged in manufacturing or processing of goods and hence. P.C. Ltd and R. D. Ltd. do not qualify as associated enterprises.

(iii) P.C. Ltd and R.D. Ltd. are not associated enterprises : Under section 92A of the Income tax Act, 1961, two enterprises are deemed to be associated enterprises if the business carried on by one enterprise is wholly dependent upon the intangible owned by the other enterprise not only unit wise. Here, condition of 92A for associate enterprises does not apply. Hence P.C. Ltd and R.D. Ltd. do not qualify as associated enterprises.

(iv) P.C. Ltd and R.D. Ltd. are not associated enterprises : Even though R.D. Ltd. supplies more than 90% of the raw materials and consumables required by P.C. Ltd, they are not qualify as associated enterprises because the price of supply is not influenced by R.D. Ltd. but is mutually agreed upon once in six months depending upon prevailing market conditions.

(v) P.C. Ltd and R.D. Ltd. are associated enterprises : Under section 92A of the Income tax Act, 1961, two enterprises are deemed to be associated enterprises if any person or enterprise holds, directly or indirectly, share carrying not less than 26% of the voting power in each of such enterprises. In this situation, since Gulgulia Ltd. directly holds 40% shareholding in P.C Ltd. and 30% shareholding in RD Ltd., hence P.C. Ltd and R.D. Ltd. are associated enterprises.

Question 44.

State with brief reasons, which method of determination of Arm’s Length Price (ALP) will be most appropriate in the following cases:

(a) AY Ltd., Bangalore Provided identical call center services to both related and unrelated parties.

(b) B Co. Ltd., Murnbai is engaged In manufacture of garments. It manufactured and supplied as per the variation and customization in finishing of products to its associated enterprises Xylo Inc. UK as compared to the goods regularly sold to third parties.

(c) JEF Co. Ltd., ‘s engaged in manufacture of medicines. It manufactured semi-finished drugs in bulk and sold to related parties located in India and outside India. It adds gross profit mark up on direct and indirect costs of production. (Aug 2021, 5 marks)