Chapter 8 Integrated Goods and Services Tax (IGST) – CS Professional Advance Tax Law Notes is designed strictly as per the latest syllabus and exam pattern.

Integrated Goods and Services Tax (IGST) – CS Professional Advance Tax Law Study Material

Question 1.

Siddarth Transports Ltd., is running a regular tourist bus service, carrying passengers and goods from Coimbatore, Tamil Nadu to Trivandrum, Kerala, with effect from 1st August, 2017. Discuss whether such inter-state movement of various modes of conveyance carrying goods or passengers or both, between distinct persons as specified in section 25(4) of the CGST Act, 2017 [except in cases where such movement is for further supply of the same conveyance), is leviable to IGST. (June 2018, 5 marks)

Answer:

The legal provisions in GST laws are as under:

(a) As per Section 24(1) of the CGST Act, persons making any inter-State taxable supply shall be required to be registered under this Act.

(b) As per Section 25(4) of the said Act a person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purpose of this Act.

(c) Schedule I of the said Act specifies situations where activities are to be treated as supply even if made without consideration which also includes supply of goods or services or both between related persons or between distinct persons as specified in Section 25, when made in the course or furtherance of business.

(d) Section 7(2) of the CGST Act envisages that activities or transactions undertaken by the Cer s al Government, a State Government or any local authority in which they are engaged as public authorities, as may be notified by the Government on the recommendation of the Council, shall be treated neither as a supply of goods nor a supply of services.

The issue of inter – state movement of goods like movement of various modes of conveyance, between distinct persons as specified in Section 25(4) of the said Act, not involving further supply of such conveyance, including trucks, buses, etc.,

(a) carrying goods or passengers or both; or

(b) for repairs and maintenance, [except in cases where such movement is for further supply of the same conveyance] was discussed in GST Council’s meeting held on 11th June, 2017 and the Council recommended that such inter – state movement shall be treated ‘neither as a supply of goods or supply of service’ and therefore not be leviable to IGST.

In view of above, the inter – state movement of goods like movement of various modes of conveyance, between distinct persons as specified in Section 25(4) of the CGST Act including TRUCKS, BUSES, TRAINS, TANKERS, TRAILERS, VESSELS, AIRCRAFT ETC., may not be treated as ) supply and consequently IGST will not be payable on such supply.

(Reference in this regard may be made to Circular No. 1 /1/2017 IGST dated 07.07.2017)

Question 2.

Briefly explain the following features of GST law in India:

(ii) Integrated Goods and Services Tax. (Dec 2018, 3 marks)

Answer:

Integrated Goods and Services Tax (IGST) is charged on inter-state supply of goods or services or both and collected by Central Government under IGST Act, 2017.

IGST rate is equal to CGST and SGST rates. Revenue from IGST apportions among Union and State Governments on the basis of recommendations of GST council.

![]()

Question 3.

B, a supplier registered in Chennai (Tamil Nadu) procures goods from China and directly supplies the same to a customer in UAE without bringing to India. With reference to the provisions of GST law examine whether the supply of goods by B to customer in UAE is an inter state supply and is it either import or export in terms of Customs Act, 1962? (Dec 2018, 3 marks)

Answer:

The transaction undertaken by Mr. B is neither import nor export of goods in terms of Customs Act, 1962. However, it is an inter-state supply in terms of provision of Section 7(5)(a) of IGST Act, 2017, which provides that when the supplier is located in India and the place of supply is outside India, supply of goods or services or both shall be treated to be a supply of goods or services or both in the course of inter state trade.

Question 4.

Balram, a registered supplier, furnishes the following details pertaining to the month of October, 2022 (first month of starting of business):

Particulars : Amount (₹)

Purchases of goods within the State : 8,00,000

Purchases of goods from outside the State : 10,00,000

Inter State Sales : 6,00,000

Intra State Sales : 12,50,000

The rates of taxes for the goods supplied are as under:

Particulars : Rate

CGST : 6%

SGST : 6%

IGST 12%

Compute the GST payable by the supplier Bairam for the month of October, 2022. (June 2018, 5 marks)

Answer:

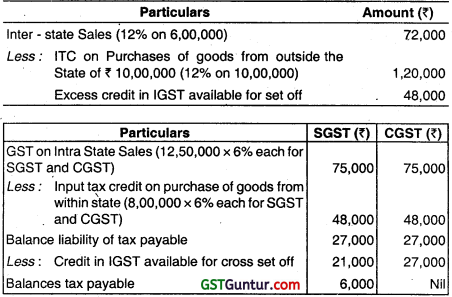

Computation of GST Liability of Bairam for October 2022

Question 5.

Determine the place of supply according to the provisions of Integrated Goods and Services Tax Act, 2017 in the following cases:

(i) K of Kerala places an order to H of Gurgaon (Haryana) to supply motor parts and instructs him to deliver the spare parts to U of Kanpur (U.P.) directly to save transportation cost.

(ii) P Ltd. registered in Punjab sold its pre-installed transformer tower of electricity located at Himachal Pradesh to Bharat Ltd. registered in Delhi.

(iii) M from Mumbai enters into contract with the Indian Railways controlling office situated in U.P. for sale of food items in the trains from Mumbai to Delhi.

(iv) D of Delhi has a savings bank account with HDFC Bank in Delhi. When he was in Mumbai for official tour, he gets a DD (Demand Draft) from HDFC Bank in Mumbai.

(v) K of Kerala avails architect services for his property located in Chennai (Tamil Nadu) from an architect H of Hyderabad in Telangana State. (Dec 2018, 1 mark each)

Answer:

(i) Goods are delivered to U (Kanpur, U.P.) the recipient of goods on the direction of K of Kerala. As per Section 10(1)(b) of IGST Act, 2017, where the goods are delivered by the supplier to a recipient or any other person on the direction of a third person it shall be deemed that the said third person has received the goods and the place of supply of such goods shall be the principal place of business of such person, therefore in the given case, place of supply shall be the location of principal place of K i.e. Kerala.

(ii) As per Section 10(1)(c) of IGST Act, 2017, where supply does not involve movement of goods, place of supply shall be the location of goods at the time of delivery to the recipient. In the given case, the location of pre-installed tower is in Himachal Pradesh, therefore, place of supply is Himachal Pradesh.

(iii) As per Section 10(1)(e) of IGST Act, 2017, where the goods are supplied on board a conveyance, the place of supply shall be the location at which such goods are taken on board. In the given case, M from Mumbai supplying food items in the train from Mumbai to Delhi, assuming that food items are taken on board at Mumbai, therefore, place of supply shall be Mumbai.

(iv) Assuming that D is unregistered person and on record address in Delhi as per the records with HDFC Bank, place of supply shall be Delhi.

(v) As per Section 13(4) of IGST Act, 2017, place of supply of services of architects in relation to immovable property, shall be the location where immovable property is located. Therefore, in the given case place of supply shall be Chennai (Tamil Nadu).

![]()

Question 6.

The assessable value of a commodity imported into India is ₹ 10,000, Basic Customs Duty is 10%. Social welfare cess @ 10% of Customs Duty and the IGST is leviable @ 18%. Calculate the IGST and the total duty chargeable on imports. (Aug 2021, 2 marks)

Answer:

Computation of IGST and total duty chargeable on imports

| Particulars | Amount (₹) |

| 1. Assessable Value | 10,000 |

| 2. Add : Basic Customs Duty @ 10% | 1,000 |

| 3. Add : Social Welfare cess @ 10% of Custom Duty | 100 |

| 4. Sub total | 11,100 |

| 5. integrated Tax @ 18% of f 11,100 | 1,998 |

| 6. Total Duty and integrated tax payable (2+3+5) | 3,098 |

Question 7.

Sanjay of New Delhi made a request for a Motor cab to “Destiny Rides” for travelling from New Delhi to Jaipur (Rajasthan). Sanjay , after paying the cab charges using his debit card, gets details of the driver

Joga Singh and the cab’s registration number.

“Destiny Rides” is a mobile application owned and managed by “D.T. Ltd”, located in India. The application “Destiny Rides” facilities a potential customer to connect with the persons providing cab service under the brand name of “Destiny Rides”.

D.T. Ltd. claims that cab service is provided by Joga Singh and hence, he is liable to pay GST under the provisions of Goods and Service tax laws and Act. You are required in the context of IGST Act, 2017 to determine who is liable to pay GST in this ease. Would your answer be different, if D.T. Ltd. is located in New York (USA). (Dec 2021, 5 marks)

Answer:

As per Section 5(5) of the Integrated Goods and Services Tax Act, 2017, the Government may, on the recommendations of the Council, by notification, specify categories of services, the tax on inter-state supplies which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services.

As per Section 2(45) of the Central Goods and Services Tax Act, 2017, “Electronic commerce operator” (ECO) means any person who owns, operates or manages digital or electronic facility or platform for electronic commerce.

The Central Government has notified services by way of transportation of passengers by a radio-taxi, motorcab, taxicab and motor cycle and the tax on inter-state supplies which shall be paid by the electronic commerce operator. Thus, in the above case D.T. Ltd., is liable to pay GST in respect of supply of the said service. Thus, the contention of D.T. Ltd. that Joga Singh should pay GST on the same as he is provider of service is not correct.

Further, proviso to Section 5(5) of the Integrated Goods and Services Tax Act, 2017, provides that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax.

Where an electronic commerce operator does not have a physical presence in the taxable territory and also he does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax.

Thus, even if D.T. Ltd, is located in New York (USA) a non-taxable territory its liability to pay GST will not be extinguished. The representative of D.T. Ltd or the person appointed by D.T. Ltd will be required to discharge the GST liability on behalf of D.T. Ltd.

Question 8.

Mahaveer International entered into a transaction for import of goods from a vendor located in Germany. Due to financial issues Mahaveer International was not in a situation to clear the goods upon payment of import duty. Mahaveer International sold the goods to Sairam Export House by endorsement of title to the goods, while the goods were in high seas. The agreement further provided that Mahaveer International shall purchase back the goods in future from Sairam Export House. Determine the taxability of transaction(s) involved, under the GST law. (June 2022, 5 marks)

Answer:

As per Section 7(2) of the Central Goods and Services Tax Act, 2017 along with Schedule III, high seas sale transaction i.e, supply of goods by the consignee to any other person, by endorsement of documents of title to the goods, after the goods have been dispatched from the port of origin located outside India, but before clearance for home consumption shall not be considered as supply under GST. Thus, the sale of goods by Mahaveer International to Sairam Export House in high seas shall not be liable to GST.

Further, the import duty including IGST shall be payable by Sairam Export House at the time of clearance of goods at port of import. In case the goods are sold back by Sairam Export House to Mahaveer International at a subsequent point of time, the same shall be treated as normal domestic sale transaction; and GST shall be applicable on the same subject to other conditions prescribed under GST Law.

![]()

Question 9.

Determine the place of supply according to IGST Act, 2017 in the following independent cases :

(i) Suresh (New Delhi) boards the New Delhi-Udaipur train at New Delhi. Suresh sells the goods taken on board by him (at New Delhi) in the train, at Chittorgarh (Rajasthan) during the journey.

(ii) Ajay Spinners Ltd. imports electric food processors from USA for its Kitchen Store in Bhilwara (Rajasthan). Ajay Spinners Ltd. is registered in Rajasthan.

(iii) Amit, a manager in a bank is transferred from Bareilly, Uttar Pradesh to Bhopal, Madhya Pradesh. Amit’s family is stationed in Kanpur, Uttar Pradesh. He hires Hari Carriers of Lucknow, Uttar Pradesh (registered in Uttar Pradesh), to transport his household goods from Kanpur to Bhopal.

(iv) Baldev, a resident of Jaipur, opens his saving account in Jaipur branch of a nationalized Bank after undergoing the KYC process. He goes to Amritsar (Punjab) for some official work and withdraws money from Bank’s ATM in Amritsar thereby crossing his limit of free ATM withdrawals.

(v) Chandrasekhar, an architect (New Delhi), enters into a contract with John of New York to provide professional services in respect of his immovable properties located in Pune and New York. (Dec 2022, 5 marks)

Question 10.

How will the Inter-State supplies of Goods and Services be taxed under GST?

Answer:

IGST shall be levied and collected by Centre on inter-state supplies. IGST would be broadly CGST plus SGST and shall be levied on all inter-State taxable supplies of goods and services. The inter-State seller will pay IGST on value addition after adjusting available credit of IGST, CGST, and SGST on his purchases. The Exporting State will transfer to the Centre the credit of SGST used in payment of IGST.

The Importing dealer will claim credit of IGST while discharging his output tax liability in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. The relevant information is also submitted to the Central Agency which will act as a clearing house mechanism, verify the claims and inform the respective governments to transfer the funds.

Question 11.

What are the salient features of the draft IGST Law?

Answer:

The draft IGST law contains 25 sections divided into 9 Chapters. The law, inter alia, sets out the rules for determination of the place of supply of goods. Where the supply involves movement of goods, the place of supply shall be the location of goods at the time at which the movement of goods terminates for delivery to the recipient. Where the supply does not involve movement of goods, the place of supply shall be the location of such goods at the time of delivery to the recipient. In the case of goods assembled or installed at site, the place of supply shall be the place of such installation or assembly.

Finally, where the goods are supplied on board a conveyance, the place of supply shall be the location at which such goods are taken on board. The law also provides for determination of place of supply of service where both supplier and recipient are located in India (domestic supplies) or where supplier or recipient is located outside India (international supplies).

It also provides for certain other specific provisions like payment of tax by online information and database access service provider located outside I India to an unregistered person in India, upon taking registration in India,

/ under the IGST Act, following a simplified provision (section 14 of the IGST Act),

Question 12.

What are the advantages of IGST Model?

Answer:

The major advantages of IGST Model are:

(a) Maintenance of uninterrupted ITC chain on inter-State transactions;

(b) No upfront payment of tax or substantial blockage of funds for the inter-State seller or buyer;

(c) No refund claim in exporting State, as ITC is used up while paying the tax;

(d) Self-monitoring model;

(e) Ensures tax neutrality while keeping the tax regime simple;

(f) Simple accounting with no additional compliance burden on the taxpayer;

(g) Would facilitate in ensuring high level of compliance and thus higher collection efficiency.

Model can handle ‘Business to Business’ as well as ‘Business to Consumer’ transactions.

Question 13.

What is the need for the Place of Supply of Goods and Services under GST?

Answer:

The basic principle of GST is that it should effectively tax the consumption of such supplies at the destination thereof or as the case may at the point of consumption. So place of supply provision determines the place i.e. taxable jurisdiction where the tax should reach. The place of supply determines whether a transaction is intra-state or inter-state. In other words, the place of Supply of Goods or services is required to determine whether a supply is subject to SGST plus CGST in a given State or union territory or else would attract IGST if it is an inter-state supply.

![]()

Question 14.

How to ascertain the taxable value for levy of IGST?

Answer:

In terms of Section 5(1) the IGST Act shall be levied on the value of goods ascertained in terms of Section 15 of the CGST Act, 2017. It is specified that the value of supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.

Further Section 15 provides for certain inclusions which will form part of the value viz., incidental expenses, commission, interest, penalty etc. In case where the supplier and recipient are related persons, the draft Central Goods and Services Tax rules published contains the provisions and method for ascertaining the value of supplies.

Question 15.

____________ Supply shall attract IGST?

(a) Intra-State

(b) Inter-State

(C) Both

Answer:

(b) Interstate

Question 16.

Is there any celhng Išmt prescribed on the rate under IGST?

(a) 14%

(b) 40%

(C) 26%

(d) 30%

Answer:

(b) 40%

Integrated Goods and Services Tax (IGST) Notes

“Continuous Journey”

“Continuous Journey” Means a journey for which a single or more than one ticket or invoice is issued at the same time, either by a single supplier of , service or through an agent acting on behalf of more than one supplier of service, and which involves no stopover between any of the legs of the journey for which one or more separate tickets or invoices are issued.

“Customs Frontiers of India”

“Customs frontiers of India” means the limits of a customs area as defined in section 2 of the Customs Act, 1962;

“Export of Services”

“Export of services” means the supply of any service when,-

- the supplier of service is located in India;

- the recipient of service is located outside India;

- the place of supply of service is outside India;

- the payment for such service has been received by the supplier of service in convertible foreign exchange; and

- the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in Section 8.

“Fixed Establishment”

“Fixed establishment” means a place (other than the registered place of business) which is characterised by a sufficient degree of permanence and suitable structure in terms of human and technical resources to supply services or to receive and use services for its own needs

“Import of Services”

Import of services” means the supply of any service, where-

- the supplier of service is located outside India;

- the recipient of service is located in India; and

- the place of supply of service is in India;

![]()

“Integrated Tax”

“Integrated tax” means the integrated goods and services tax levied under this Act;

“Location of the recipient of services”

“Location of the recipient of services” means,-

- where a supply is received at a place of business for which the registration has been obtained, the location of such place of business;

- where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

- where a supply is received at more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the receipt of the supply; and

- in absence of such places, the location of the usual place of residence of the recipient;

“Location of the supplier of services means, —

- where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

- where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

- where a supply is made from more than one establishment, whether the place of business of fixed establishment, the location of the establishment most directly concerned with the provision of the supply; and

- in absence of such places, the location of the usual place of residence of the supplier

![]()

“Non-taxable online recipient”

Non-taxabIe online recipient” means any Government, local authority, governmental authórity, an individual or any other person not registered and receiving online information and database access or retrieval services in relation to any purpose other than commerce, industry or any other business or profession, located in taxable territory.

“Online information and database access or retrieval services” (OIDAR)

“Online information and database access or retrieval services” (OIDAR) means services whose delivery is mediated by information technology over the internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention and impossible to ensure in the absence of information technology and includes electronic services such as,

- advertising on the internet;

- providing cloud services;

- provision of e-books, movie, music, software and other intangibles through telecommunication networks or internet;

- providing data or information, retrievable or otherwise, to any person in electronic form through a computer network;

- online supplies of digital content (movies, television shows, music and the like);

- digital data storage; and

- online gaming

Zero Rated Supply”

“Zero rated supply” means any of the following supplies of goods or services or both, namely: –

- export of goods or services or both; or

- supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.