Chapter 22 Income Tax Implication on Specified Transactions – CS Professional Advance Tax Law Notes is designed strictly as per the latest syllabus and exam pattern.

Income Tax Implication on Specified Transactions – CS Professional Advance Tax Law Study Material

Question 1.

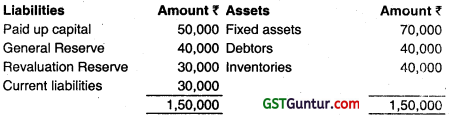

ABC Ltd. proposes to sell one unit XYZ which was set up in 2012 (out of 10 units) and is not related to company’s main line or business. Total consideration for sale of XYZ unit as a going concern by way of slump sale is ₹ 3,50,000. The summarized financial position of XYZ unit as

Additional information as under:

Fixed assets includes Land purchased at ₹ 5,000 in May, 2014 revalued at ₹ 50,000. For the remaining fixed assets, their written down value as per the Income-tax Act, 1961 is ₹ 10,000.

Cost inflation indices are as under:

FY 2015-16-254, FY 2022-23-331.

Compute the capital gain arising on sale of XYZ unit of ABC Ltd. (Dec 2019, 5 marks)

Answer:

Computation of long term capital gain on slump sale of XYZ Unit of ABC Ltd.

Note:

- In slump sale, benefit of indexation is not available.

- Revaluation Reserve is not to be considered.

Question 2.

ABC Ltd. is a public limited company but shares are not listed in any stock exchange in India as on 31 Dec., 2022. On 1 Jan., 2023, the company issued 10 lakh shares of face value of ₹ 10 per share, the fair market value of which is ₹ 130, at issue price of ₹ 150 per share.

Discuss the applicability of section 56 of the Income-tax Act, 1961 where shares are issued to:

(a) Resident Indians;

(b) Non-resident Indians;

(c) Venture Capital Undertakings. (Dec 2019, 5 marks)

Answer:

Issue of shares at excessive share premium:

Since, the Shares of AC Ltd. are not listed in any recognized stock exchange in India, it is a Company in which public are not substantially interested.

When such company issues shares at a price In excess of the Fair Market Value, share premium so charged excess, will be taxable under Section 56 of the Income Tax Act, 1961.

Excess premium is (₹ 150 – ₹ 130) ₹ 20 per share. Hence where 10 lakh shares are issued, excess share premium charged is ₹ 200 lakhs.

Such liability will arise only when shares are issued to residents. ₹ 200 lakhs will be treated as Income from other sources.

Where the shares are issued to non-residents or Venture Capital undertakings, there is no applicability of section 56 of the Income Tax Act, 1961 ad hence there will be no tax effect.

![]()

Question 3.

Chetan Lal had borrowed on Hundi a sum of ₹ 25,000 by way of a bearer cheque on 11.09.2022 and repaid the same with interest in total amounting to ₹ 30,000 by account payee cheque on 12.12.2022.

The Assessing Officer (AO) had issued a show cause notice to treat the amount borrowed by Chetan Lai on Hundi as income chargeable to tax during the previous year ended on 31-03-2023. Chetan Lal seeks your opinion as to the correctness of the action of the AO. (Dec 2020, 3 marks)

Answer:

Section 69D of the income Tax Act, 1961. provides that where any amount is borrowed on a hundi from, or any amount due thereon is repaid to any person otherwise than through an account payee cheque drawn on a bank, the amount so borrowed or repaid shall be deemed to be the income of the person borrowing or repaying the amount aforesaid for the previous year in which the amount was so borrowed or repaid. For the purposes of this section, the amount repaid shall include the amount of interest paid on the amount borrowed.

In this case. Mr. Chetan Lal has borrowed ₹ 25,000 on Hundi by way of bearer cheque. Therefore, it shall be deemed to be the income of Mr. Chetan Lal for the previous year 2022-23.

However, the repayment of the same along with interest was made by way of account payee cheque, the same would not be hit by the provisions of section 69D of the Income tax Act, 1961. Therefore, the action of Assessing Officer is not valid in law to the extent of treating the amount repaid by account payee cheque as income during the previous year 2022-23.

Question 4.

In the books of a sole proprietor carrying on business the block of fixed assets stood at 01.04.2022 as 4,00,000. If the rate of depreciation is 15% and another machinery was purchased on 15.10.2021 worth ₹ 1,00,000 of the same block of fixed assets and the proprietary business is succeeded by a company on 01.11.2022. determine the depreciation allowable to both the proprietary concern and the company before or after the merger for Assessment Year 2023-24. (Aug 2021, 5 marks)

Answer:

Computation of Depreciation for AY 2023-2024

| Particulars | Amount |

| Opening WDV of the Block of Assets | 4,00,000 |

| Add: Purchase of Assests in same Block on 15.10.2021 | 1,00,000 |

| Total | 5,00,000 |

| Depreciation Allowable (4,00,000 x15% + 1,00,000 x 7.5%) | 67,500 |

This depreciation will be appointed on the basis of number of days of use

| Particulars | Sole proprietary concern | Company |

| No. of Days opening block used by the Concern | 214 days | 151 days |

| A. Proportionate Depreciation on opening Block (Note 1) | ₹ 35,178 | ₹ 24,822 |

| No. of Days New Block used by the Concern | 17 Days | 151 Days |

| B. Proportionate Depreciation on New Block (Note2) | ₹ 759 | ₹ 6741 |

| Total Depreciation (A+B) | ₹ 35,937 | ₹ 31,563 |

Note: 1

Sole Proprietary Concern 60,000 × 214/365 = 35.178

Company = ₹ 60,000 × 151/365 = 24,822

Note: 2

Sole Proprietary Concern = ₹ 7,500 × 17/168 = 759

Company = ₹ 7,500 × 151/168 = ₹ 6741

Question 5.

Mr. Kamlesh borrowed on hundi, a sum of ₹ 3,75,000 during May, 2021 by way of a bearer cheque. He partly repaid ₹ 1,50,000 on 01.12.2021 by way of bearer cheque. Examine the consequences of said transactions. (Dec 2021, 3 marks)

Answer:

It has been provided u/s 69D of the Income tax Act, 1961, that if any amount is borrowed on a hundi or any amount due thereon is repaid other than through an account payee cheque, then the amount so borowed or repaid shall be deemed to be the Income of the person for the P.Y. In which the amount was borrowed or repaid, as the case may be.

It has been further stated u/s 69D of the Income tax Act, 1961, that if any amount borrowed on hundi has been deemed to be the income of any person, he will again not be liable to be assessed In respect of such amount on repayment of such amount.

Thus, it ₹ 3,75,000 were borrowed by Mr. Kamlesh through a bearer cheque, the same would be taxable as his income u/s 69D during the PY 2022-23 and repayment made subsequently of ₹ 1,50,000 will not have any effect.

Income u/s 69D will be taxable @ 60% + 25% Surcharge + 4% HEC.

Question 6.

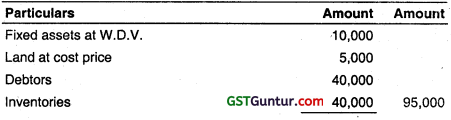

On January 20, 2023 TPS Ltd. a domestic company purchases its own shares (face value ₹ 10 per share, amount offered to shareholders: ₹ 90 per share). Total amount distributed by TPS Ltd. on buy back of ₹ 30,000 share is ₹ 27,00,000.

These shares were issued by TPS Ltd. in 2015-16 at a premium of ₹ 15 per share. Mr. X who is one of the Shareholder purchased 1200 shares of TPS Ltd. at the price of ₹ 75 per share on January 25, 2022 and applied all its share to company for buy back option. The TPS Ltd. will pay him ₹ 1,08,000 for purchase its own share held by Mr. X.

Considering the above transaction, you are requiring to compute the income tax liability of Mr. X and TPS Ltd. for assessment year 2023-24. (June 2022, 5 marks)

Answer:

(i) Income Tax Liability in the hand of Mr. X for Assessment year 2023-24:

The income arising to the shareholders in respect of such búy back of shares by the domestic company would be exempt under section 10(34A) of the Income tax Act, 1961, where the company is liable to pay the additional income-tax on the buy-back of share. Hence, Mr. X is not chargeable to Income tax in this transaction. Capital gain arising to him under the buy-back Scheme is exempt u/s 10(34A) of the Income tax Act, 1961.

(ii) Income tax liability on TPS Ltd in the buy-back scheme for Assessment Year 2023-24:

TPS Ltd. will have to pay additional income tax @ 23.296% (20% tax plus surcharge @ 12% plus health and education cess @ 4%) on buy-back of its share on distributed income u/s 115QA of the Income tax Act, 1961.

Computation of additional income tax liability of TPS Ltd. for Assessment Year 2023-24

![]()

Question 7.

Sanjay, a resident of India received gifts during the financial year 2022-23 as follows:

(a) ₹ 40,000 from his elder brother residing in Jaipur,

(b) ₹ 1,99,000 from his friend residing in USA

(C) ₹ 49,000 from his friend residing wi New Delhi (received on the occasion of birthday of Sanjay)

(d) Shares received from his father, the fair market value (i.e. value as per stock exchange) of the shares on the date of gift was ₹ 3,00,000

(e) ₹ 60,000 from his friend residing in Mumbai (received on the occasion of marriage of Sanjay).

You need to advice Sanjay with regard to tax treatment of each of the above item and calculate the total taxable value of the gifts in the hands of Sanjay for the assessment year 202324. (Dec 2022, 5 marks)

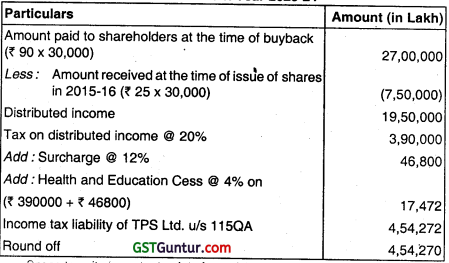

Question 8.

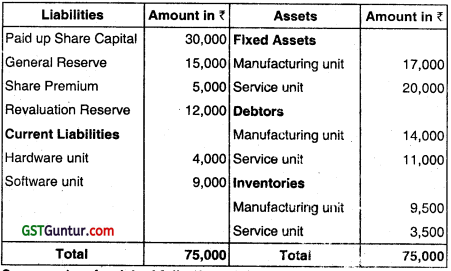

K Ltd., a public company incorporated under the Companies Act. 2013 has two units-one engaged in manufacture and the other involved in service. As the company is planning for restructuring of the company, it has decided to sell its Manufacturing unit as a going concern by way of slump sale for ₹ 50,000 to a new company called M Ltd., in which it holds 73% equity shares.

The balance sheet of K limited as on 31st March, 2023, being the date on which Manufacturing unit has been transferred, is given hereunder:

Balance Sheet as on 31.03.2023

Company has furnished following additional information:

(i) The Manufacturing unit is in existence since June, 2016.

(ii) Fixed Assets of Manufacturing unit includes land which was purchased at ₹ 6,000 in the month of July 2016 and revalued at ₹ 8,000 as on March 31, 2023.

(iii) Fixed assets of Manufacturing unit is at ₹ 17,000(₹ 25,000 minus land value ₹ 8,000)is written down value of depreciable assets under section 43(6) of the Income Tax Act, 1961 is ₹ 11,000.

For the assessment year 2023-24, Ascertain the tax liability, which would arise to K Limited from slump sale. Cost inflation index for the financial year 2016-17 was 264 and for 2022-23 it was 331. (Dec 2022, 5 marks)

Question 9.

Write a short note on balance-sheer for purpose of rule 11U.

Answer:

Balance-Sheet” in relation to any company means the balance-sheet of such company (including the notes annexed thereto and forming part of the accounts) as drawn up on the valuation date which has been audited by the auditor of the company appointed under Companies Act and where the balance-sheet on the valuation date is not drawn up, the balance-sheet (including the notes annexed thereto and forming part of the accounts) drawn up as on a date immediately preceding the valuation date which has been approved and adopted in the annual general meeting of the shareholders of the company.

Question 10.

Write a short note on “telegraphic transfer selling rate”.

Answer:

“Telegraphic Transfer Selling Rate”, in relation to a foreign currency, means the rate of exchange adopted by the State Bank of India constituted under the State Bank of India Act, 1955, for selling such currency where such currency is made available by that bank through telegraphic transfer.

Question 11.

Write a short on “Unexplained Money [Section 69A]”.

Answer:

Where in any financial year the assessee is found to be the owner of any money, bullion, jewellery or other valuable article and such money, bullion, jewellery or valuable article is not recorded in the books of account, if any, maintained by him for any source of income, and the assessee offers no explanation about the nature and source of acquisition of the money, bullion, jewellery or other valuable article, or the explanation offered by him is not, in the opinion of the Assessing Officer, satisfactory, the money and the value of the bullion, jewellery or other valuable article may be deemed to be the income of the assessee for such financial year.

In order to satisfy the condition for Cash Credit following conditions must be satisfied –

- The assessee must be found to be the owner of any money, bullion, jewellery or other valuable article,

- Such money, bullion, jewellery or valuable article is/are not recorded in the books of account, if any, maintained by him for any source of income,

- The assessee offers no explanation about the nature and source of acquisition of the money, bullion, jewellery or other valuable article,

- In case the assessee provides explanation, the same offered by him is not, in the opinion of the Assessing Officer, satisfactory, the money and the value of the bullion, jewellery or other valuable article may be deemed to be the income of the assessee for such financial year. From above we can understand that in order to attract Section 69A above conditions must be satisfied.

Question 12.

What are the tax implications on Buy Back of shares?

Answer:

Tax implication in case of buy back by –

a. Listed Companies,

b. Unlisted Companies

a. Listed Companies –

- In case of listed company buyback tax is not triggered, buy back option can be considered as best way for distribution of surplus funds by these entities,

- The shareholders are liable to pay capital gain tax in case they receive amount from the company in process of buy back. Capital gain tax payable can be long term or short term capital gain tax depending upon duration the shares are held, this is covered under Section 10 (38) of the Income Tax Act, 1961,

- Capital gain is payable by both resident as well as non – resident shareholders

b. Unlisted Companies

- An unlisted domestic company is liable to pay income tax on buy back at rate of 20 percent,

- Buy Back Tax rules provide the methodology for determination of the amount received by the company so that the liability can be determined,

- A shareholder participating in such a buyback scheme enjoys tax exemption under Section 10 (34A)

![]()

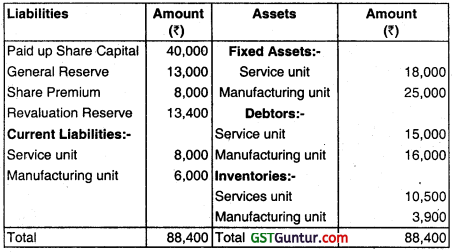

Question 13.

ABC Limited, a public company incorporated under the Companies Act, has two units – one engaged in manufacture and the other involved in service. As the company is planning restructuring of the company, it has decided to sell its service unit as a going concern by way of slump sale for ₹ 38,500 to a new company called XYZ Limited, in which it holds 74% equity shares.

The balance sheet of ABC limited as on 31st March 2022, being the date on which service unit has been transferred, is given here under –

Balance sheet as on 31.03.2023:

Company has furnished following additional information:

1. The Service unit is in existence since May, 2016.

2. Fixed assets of Service unit includes land which was purchased at ₹ 4,000 in the year 2013 and revalued at ₹ 6,000 as on March 31,2022.

3. Fixed assets of Service unit is at ₹ 14,000 (₹ 20,000 minus land value ₹ 6,000) is written down value of depreciable assets as per books of account. However, the written down value of these assets under section 43(6) of the Income -tax Act is ₹ 9,000.

Ascertain the tax liability, which would arise from slump sale to ABC Limited.

Answer:

- Capital Gains = “ Slump sale consideration” minus “Net worth of the Undertaking or division”

- “Net worth” = Aggregate value of total assets of the undertaking or division transferred minus Value of Liabilities of the undertaking or division transferred as appearing in its books of account.

- For computing the “net worth”, non-depreciable assets are to be taken -at their book values.

- For computing the “ net worth”, in case of depreciable assets, the written down value of such assets shall be computed as per section 43(6)(c)(i)(c). In the present case, the capital gains are long term since period of holding of software unit shall be from May 2016 to March 2023.

Computation of net worth of service unit-

| Amount in ₹ | |

| Depreciable assets (W.D.V. as per Income Tax Act) | 4,000 |

| Land | 11,000 |

| Debtors | 3,500 |

| Inventory | |

| Total assets | 27,500 |

| Less: Current liability | 9,000 |

| Net worth | 18500 |

| Computation of capital gain on transfer of service unit –

Full value of sale consideration Less: Net worth of service unit |

38,500 18,500 |

| Long – term capital gain | 20,000 |

Question 14.

ABC Private Limited is a closely held company, its board of directors decided to issue 500 shares face value of which is ₹ 100 per share, fair market value of which is ₹ 150 per share at a premium of ₹ 200 per share. Please advice whether section 56 will be attracted and tax payable, in following circumstances –

In case the investor/subscribers to the shares of above named company are

(a) Resident Indian,

(b) Non resident Indian,

(c) Venture Capital undertaking.

Further, what will be your answer, if the shares are issued at fair market value.

Answer:

In case the investors/subscribers are Resident Indian than tax liability will be issue price ₹ 300 (i.e ₹ 100 face value plus ₹ 200 share premium) minus ₹ 150 (fair market price) = ₹ 150 per share. Total tax needs to be paid on ₹ 75,000/-.

In case the investors/subscribers are non – resident Indian and venture capital undertaking than no tax liability has they are exempted under Section 56 of the Act.

In case the shares were issued at fair market value instead at face value or at premium than no tax liability would had occurred.

Question 15.

A held 2000 shares in a company ABC Ltd. ABC Ltd amalgamated with another company during the previous year ended 31.03.2023. Under the scheme of amalgamation, A was allotted 1000 shares in the new company. The market value of shares allotted is higher by ₹ 50000 than the value of holding in ABC Ltd.

The assessing officer proposes to treat the transaction as an exchange and to tax ₹ 50000 as capital gains. Is he justified?

Answer:

Assuming that the amalgamated company is an Indian company, the transaction is covered by the exemption under section 47 and the proposal of the assessing officer to treat the transaction as an exchange is not justified.

Question 16.

A held 2000 shares in a company ABC Ltd. ABC Ltd amalgamated with another company during the previous year ended 31.03.2021. Under the scheme of amalgamation, A was allotted 1000 shares in the new company.

The market value of Shares allotted is higher by ₹ 50000 than the value of holding in ABC Ltd.

The assessing officer proposes to treat the transaction as an exchange and to tax ₹ 50000 as capital gains. Is he justified?

Answer:

Assuming that the amalgamated company is an Indian company, the transaction is covered by the exemption under section 47 and the proposal of the assessing officer to treat the transaction as an exchange is not justified.

![]()

Question 17.

Company A, which has an accumulated business loss of ₹ 5,00,000 and unabsorbed depreciation of ₹ 3,00,000 wants to reorganize its business by amalgamating with a rival company B, which is engaged in the same line of production but with a smaller capital but has an efficient management set-up and more modern machinery. Company B is agreeable to the amalgamation. What are the alternative courses available to the companies for effecting the merger and how would you advise them as to the best course of action?

Answer:

The alternative of merger that are available to company A and B are

- Merger of A into B, whereby A goes out of existence

- Merger of B into A whereby B goes out of existence.

- Merger of A and B into a new company, whereby a new company say C, is formed and both A and B go out of existence.

All the three mergers can take place under one of the following situations.

- If merger is not amalgamation within the meaning of section 2(1B) or

- If merger is an amalgamation within the meaning of section/ 2/(1B) but ii does not fulfill the conditions of section 72A or

- If merger satisfy conditions of section 2(1 B) as well as 72A

Under the aforesaid situations, the position regarding the set off of unabsorbed loss of ₹ 5,00,000 and unabsorbed depreciation of ₹ 3,00,000 will be as under:

| Whether set off the unabsorbed loss/ depreciation is possible | Situation (a) |

Situation (b) |

Situation (c) |

| Merger of A into B, whereby A goes out of existence | No | No | Yes |

| Merger of B into A whereby B gobs out of existence | Yes | Yes | Yes |

| Merger of A and B into a new company, whereby a new company say C, is formed and both A and B go out of existence. | No | No | Yes |

To conclude, it can be said that the conditions of section 72A are satisfied, any of the three alternatives for mergers can be adopted as in all the cases the loss can be set off by the amalgamated company. However, if conditions of section 72A are not satisfied, alternative (ii) should be adopted as in this case, company A would be able to carry forward and set off of business loss and depreciation even if the merger does not satisfy the requirement of section 2(1B). This kind of/merger is also known as reverse merger.

Income Tax Implication on Specified Transactions Notes

“Slump Sale’

Slump sale” means the transfer of one or more undertaking, by any means, for a lump sum consideration without values being assigned to the individual assets and ‘labilities in such sales.

“Unquoted Shares and Securities”

“unquoted shares and securities” means shares and securities which is not a quoted shares or securities;

“Indexed Cost of Acquisition”

indexed cost of acquisition” means an amount which bears to the cost of acquisition the same proportion as Cost Inflation Index for the year in which the asset is transferred bears to the Cost Inflation Index for the first

year in which the asset was held by the assessee or for the year beginning on the 1st day of April, 2001, whichever is later;

“Amalgamation”

“amalgamation”, in relation to companies, means the merger of one or more companies with another company or the merger of two or more companies to form one company. The company or companies which so merge being referred to as the amalgamating company or companies and the company with which they merge or which is formed as a result of the merger, as the amalgamated company.

“Demerger”

“Demerger”, In relation to companies, means the transfer, pursuant to a scheme of arrangement under sections 391 to 394 of the Companies Act, 2013 by a demerged company of its one or more undertakings to any resulting company.