Chapter 21 Tax Treaties – CS Professional Advance Tax Law Notes is designed strictly as per the latest syllabus and exam pattern.

Tax Treaties – CS Professional Advance Tax Law Study Material

Question 1.

Discuss in brief the provisions regarding double taxation relief. (June 2018, 5 marks)

Answer:

Double Taxation Relief:

Double taxation means taxation of same income of a person in more than one country. This results due to countries following different rules for income taxation. There are two main rules of income taxation i.e.

(a) Source of income rule and

(b) Residence rule.

To mitigate the double taxation of income the provisions for double taxation relief were make. Following are the provision in India regarding double taxation relief.

1. Bilateral Relief [Sec. 90]:

India has entered into agreement with many countries regarding avoidance of double taxation. Section 90 of the Income Tax Act deals with relief to be granted to the assessee who is involved in paying taxes in India as well as in a foreign country. Where the Government has entered into an agreement with the Government of any country for granting relief of tax or avoidance of double taxation, then the provision of Income Tax Act, 1962 shall apply to the assessee to the extent they are more beneficial to him.

2. Unilateral Relief [Sec. 91]:

If any person who is resident in India in any previous year proves that, in respect of his income which accrued or arose during that previous year outside India (and which is not deemed to accrue arise in India), he has paid in any country with which there is no agreement under Sec. 90 for the relief or avoidance of double taxation income tax by, deduction or otherwise under the law in force in that country, he shall be entitled to the deduction from the Indian income tax payable by him of a sum calculated on such doubly taxed income at the Indian rate of tax or the rate of tax of the said country whichever is lower, or at the Indian rate of tax if the both the rates are equal.

Question 2.

As per the double taxation avoidance agreements, permanent establishment includes a wide variety of arrangements. Specify all these instances of permanent establishment. (Dec 2013, 5 marks)

Answer:

As per the Double Taxation Avoidance Agreements, PE includes, a wide variety of arrangements i.e. a place of management, a branch, an office, a factory, a workshop or a warehouse, a mine, a quarry, an oilfield etc. Imposition of tax on a foreign enterprise is done only if it has a PE (Permanent Establishment) in the contracting state. Tax is computed by treating the PE as a distinct and independent enterprise.

Some salient aspects concerning a PE could be discussed as under:

- PE is defined with reference to place and persons;

- PE could be a fixed place, a construction site, service, PE agency, PE branch etc.

- PE denotes non-resident’s business preserves. The degree of preserve which could constitute PE has been illustrated by ‘inclusions and exclusions’.

- An enterprise is liable to tax on its profits in a foreign country, if it conducts its subsidiary in that country through PE.

![]()

Question 3.

Under what circumstances can Unilateral Relief be granted to avoid Double Taxation under section 91 of Income Tax Act 1961 ? (Dec 2019, 3 marks)

Answer:

Under the following circumstances, the Indian Government can grant Unilateral Relief from double taxation u/s 91 of the Income Tax Act, 1961, if:

- The person or company has been resident of India in the previous year.

- The Income must have accrued to and received by the tax payer outside India in the previous year.

- The Income should have been taxed in India and in another country with which there is no tax treaty.

- The person or company had paid tax under the laws of the foreign country in question.

On a similar note, the unilateral relief can be granted to

any person who is resident in India in any previous year

proves that in respect of his income which accrued or arose to him during that previous year in Pakistan he has paid in that country, by deduction or otherwise, tax payable to the Government under any law for the time being in force in that country relating to taxation of agricultural income.

Similarly unilateral relief can be granted to

any non-resident person is assessed on his share in the income of a registered firm assessed as resident in India in any previous year and such share includes any income accruing or arising outside India during that previous year (and which is not deemed to accrue or arise in India) in a country with which there is no agreement under section 90 for the relief or avoidance of double taxation and he proves that he has paid income-tax by deduction or otherwise under the law in force in that country in respect of the income so included.

Question 4.

Define Tax Treaty. Discuss the principal objectives of Indian Tax Treaties. (Dec 2019, 5 marks)

Answer:

Tax Treaty: A Tax treaty is a bilateral agreement made by two countries to resolve issues involving double taxation of passive as well as active income Tax treaties generally determine the amount of tax that a country can levy on a taxpayer’s income/capital. It is also called a Double Taxation Avoidance Agreement.

Principal objective of India Tax Treaties are as under:

(a) For the granting of relief in respect of:

(iii) income on which have been paid both income tax under this act and Income tax in any specified territory outside India; or

(iv) income tax chargeable under this Act and under the corresponding law in force in that specified territory outside India to promote mutual economic relations, trade and investment, or

(b) For the avoidance of double taxation of Income under this Act and under the corresponding law in force in that specified territory outside India without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance (including through treaty-shopping arrangements aimed at obtaining reliefs provided in the said agreement for the indirect benefit to residents of any other country or territory), or

(c) For exchange of information for the prevention of evasion or avoidance of income tax chargeable under this Act or under the corresponding law in force in that specified territory outside India, or investigation of cases of such evasion or avoidance, or

(d) For recovery of income-tax under this Act and under the corresponding law in force in that specified territory outside India, or

(e) When provisions have been made / modified as above, then in relation to the assessee to whom such agreement applies, the provisions of this Act shall apply to the extent they are more beneficial to the assessee.

Question 5.

The concept of Permanent Establishment is important in determining the tax implications of cross border transactions. Examine the significance thereof (PE), when such transactions are governed by Double Taxation Avoidance Agreements (DTAA). (Dec 2020, 3 marks)

Answer:

Double Taxation Avoidance Agreements (DTAA) generally contain an Article providing that business income is taxable in the country of residence, unless the enterprise has a permanent establishment in the country of source, and such income can be attributed to the permanent establishment.

As per section 92F(iiia) of the Income tax Act, 1961, the term “Permanent Establishment” includes a fixed place of business through which the business of an enterprise is wholly or partly carried on. This means, to constitute a permanent establishment, there must be a place of business which is fixed and the business of the enterprise must be carried out wholly or partly through that place.

Section 9(1 )(i) of the Income tax Act, 1961 requires existence of business connection for deeming business income to accrue or arise in India. DTAAs however provide that business income is taxable, if there is a permanent establishment in India.

![]()

Question 6.

What do you understand by the term double taxation? Discuss the connecting factors which lead to double taxation of an income. (Dec 2020, 6 marks)

Answer:

Double taxation occurs when an assessee is required to pay two or more taxes for the same income, asset, or financial transaction in different countries. Double taxation occurs mainly due to overlapping tax laws and regulations of the countries where an assessee operates his business. Double taxation Agreement is the systematic imposition of two or more taxes on the same income. The double tax liability is often mitigated by tax agreements, known as treaties, between countries.

The taxability of a Foreign Entity in any country depends upon two ‘ distinct factors, namely, whether it is doing business with that country or in that country. Internationally, the term used to determine the jurisdiction for taxation is “connecting factors”.

There are two types of connecting factors, namely, “Residence” and “Source”. It means a company can be subject to tax either on its residence link or its source link with a country.

Broadly, if a company is doing business with another country (i.e., host/ source country), then it would be subject to tax in its home country alone, based on its residence link. However, if a company is doing business in a host/ source country, then, besides being taxed in the home country on the basis of its residence link, it will also be taxed in the host country on the basis of its source link.

Jurisdictional Double Taxation: Accordingly, when source rules overlap, double taxation may arise i.e. tax is imposed by two or more countries as per their domestic tax laws in respect of the same transaction; income arises or is deemed to arise in their respective jurisdictions. This is known as “jurisdictional double taxation”.

In order to avoid such double taxation, a company can invoke provisions of Double Taxation Avoidance Agreements (DTAAs) (also known as Tax Treaty or Double Tax Convention – DTC) with the host/ source country, or in the absence of such an agreement, as Indian company can invoke provisions of section 91 of the Income-tax Act, 1961, providing unilateral relief in the event of double taxation.

Economic Double Taxation: Economic Double Taxation happens when the same transaction, item of income or capital is taxed in two or more states but in hands of different person (because of lack of subject identity).

Question 7.

What is the role of the Double Taxation Avoidance Agreement in deciding the Income of a resident earned outside India? (Dec 2021, 3 marks)

Answer:

In the case of a resident, if an income earned outside India is charged to tax in that country then the application of sections 90,90A and 91 in respect of double taxation relief has to be looked into.

If a double taxation avoidance agreement has been entered into between Government of India and the Government of that country (in which he has earned income) then the agreement will be looked into for deciding the taxability of such incomes accruing or arising outside India.

If an agreement with a foreign country does not exist, then in respect of income earned outside India, the tax paid on such income in the foreign country (ascertaining the average rate of tax and applying such rate on the said income) or the Indian rate of tax, whichever is lower, is deductible from the total tax payable by the assessed on his total income including such foreign income.

Question 8.

State briefly the objectives and the factors of a tax treaty made between two contracting States. (June 2022, 5 marks)

Answer:

Objective of a Tax treaty:

As per OECD Model Conventions:

Principle objective of double taxation conventions is to promote, by eliminating international double taxation, exchange of goods and services, movement of capital and person. Also to prevent tax avoidance and evasion. As per UN Model Conventions:

The principal objectives of UN Model Conventions are as follows:

- To Protect tax payer from double taxation

- To encourage free flow of international trade and investment

- To encourage transfer of technology

- To prevent discrimination between taxpayer

- To provide a reasonable element of legal and fiscal certainty to investors and traders

- To arrive at an acceptable basis to share tax revenues between two states

- To improve the co-operation between taxing authorities in carrying out their duties.

In order to advance the object of avoiding/reducing the hardship caused by double taxation, the following factors are considered in tax treaties:

- Scope of the treaty, taxes covered, entities covered.

- Determination of residential status of a person for the purpose of tax credit and also to determine whether a person is entitled to treaty benefits (limitation of benefits).

- Provision for reduced rate of tax in the country / state of Source.

- Exchange of information.

- Provision for procedural frame work for enforcement, availing credit of taxes paid, collection of taxes and dispute resolution etc.

Question 9.

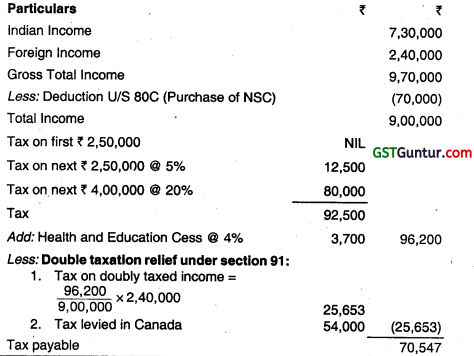

Nitin, a re&dent of India has the following incomes during the previous year 2022-23:

Income from textiles business in India : ₹ 7,30,000

Income from garment business in Canada (with which India does not have double tax avoidance agreement) : ₹ 2,40,000

Tax levied in Canada on the above said income : ₹ 54,000

Purchase of NSC VIII Issue : ₹ 0,000

Compute the tax liability of Nitin. (Dec 2015, 5 marks)

Answer:

Computation of tax liability of Mr. Nitin for the Previous year 2022-23:

Note:

Calculation of Tax levied In Canada:

Tax levied in Canada = 54,000

₹ 25,653 vs ₹ 54,000 whichever is less = ₹ 25,653

Therefore ₹ 96,200 – ₹ 25,653 = ₹ 70,547.

![]()

Question 10.

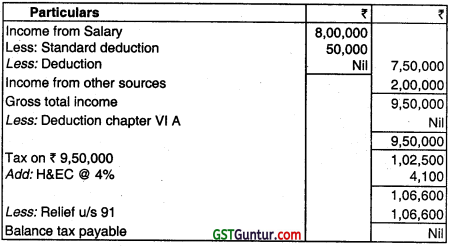

Mrs. Kareena, an individual resident and citizen of India, earned remuneration in foreign currency from an enterprise in foreign country during her stay in that country In the previous year 2022-23. There is no DTAA with that country. The remuneration was ₹ 8,00,000 and ₹ 1,60,000 was deducted at source by the enterprise. Income from other sources of Mrs. Kareena in India was ₹ 2,00,000.

Compute the relief available to her under section 91 assuming that Mrs. Kareena brings ₹ 3,00,000 in India in convertible foreign exchange by 30 September, 2019. Also, compute the taxable income and tax liability of

Mrs. Kareena for the assessment year 2023-24. (June 2016, 5 marks)

Answer:

Computation of taxable Income of Mrs. Karsna for assessment year 2023-24:

Note:

- Average rate of tax \(=\frac{\text { Tax on total income }}{\text { Total income }}\) × 100

= \(\frac{1,06,600}{9,50,000}\) × 100 = 11.22% - Average rate of foreign tax \(=\frac{1,60,000}{8,00,000}\) × 100 = 20%

Hence, relief available shall be @ 11.22% or 20% of foreign income whichever Is less. ie, ₹ 1,06,600.

Question 11.

GX Ltd. is a foreign company having business operations in India. The company has made prescribed arrangements for declaration and payment of dividends within India and paid preference share divided of ₹ 880 lakh for financial year 2022-23. Is dividend distribution tax payable by the foreign company? Is there any time limit for payment of DOT?

Can GX Ltd. avail deduction in respect of DOT paid? (June 2017, 5 marks)

Answer:

1. Dividend from specified foreign company to be taxed at the specified rate of 15%. [Sec. 115BBD(1)]

Where the total income of assessee, being an Indian Company, includes any Income by way dividends declared distributed or paid by a specified foreign company. The income-tax payable shall be the aggregate of:

(a) The amount of income-tax calculated on the income by way of such dividends @ 15% plus cess; and

(b) The amount of income-tax with which the assessee would have been chargeable had its total income been reduced by the aforesaid income by way of dividends.

2. No deduction is allowed from dividend received from specified foreign company. [Sec. 115BBD(2)]:

Notwithstanding anything contained in this Act, no deduction in respect of any expenditure or allowance shall be allowed to the assessee under provision of this Act in computing its Income by way of dividend received from specified foreign company.

3. The tax has to be paid within 14 days of declaration, distribution or payment of any dividend whichever is the earliest.

Question 12.

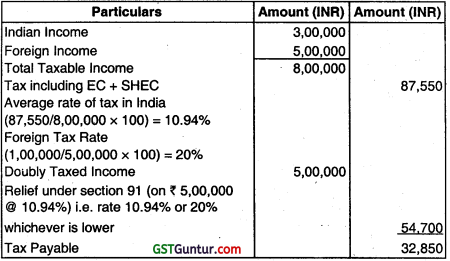

Mr. Beeta, aged 30 years, resident in India and a musician derived income of ₹ 5,00,000 from concerts performed outside India. Tax of ₹ 1,00,000 was deducted at source in the country where the concerts were given by Mr. Beeta. India does not have any agreement with that country for avoidance of double taxation. Indian income of Mr. Beeta during the year was of ₹ 3,00,000. Work out of the amount of tax payable and relief due to

him under section 91 for the Assessment Year 2023-2024. (Dec 2017, 5 marks)

Answer:

Computation of Total Income and Tax UabiIlty of Mr. Beeta for the AY 2023-24:

Question 13.

Bharani Exports Ltd. (BEL), has a SEZ unit in 8th year of its operation. 90% of its export sales are to Lovely LLC of USA. which has guaranteed the loan of ₹ 100 crore taken by BEL. Export sales turnover or the year is ₹ 300 crore. There is no DTA sales. The Assessing officer, after examination of the records, conduded that the assessee BEL had failed to mantain proper records of the international transactions, computed the ALP and made an addition of ₹ 32 lakhs to the income returned. He also proposes to levy penalty. The assessee seeks your advice on the proposed action of the AO. Advise suitably.

Can the assessee claim deduction under section 10AA in respect of the addition of ₹ 32 lakhs made on account of transfer pricing adjustments? BEL has not entered into any Advance Pricing Agreement (APA). (June 2018, 5 marks)

Answer:

The action of the assessing officer in making addition to the declared income and issuing show cause notice for levy of various penalties is correct since BEL had committed various defaults, as briefed hereunder, in respect of

which penalty, is impossible.

(i) Failure to report any International transaction or any transaction, deemed to be an international transaction or any specified domestic transaction, to which the provision of Chapter – X applies would attract penalty @ 200% of the amount of tax payable, since It is a case of misreporting of Income referred under Section 270A(9) read with

Section 270A(8).

(ii) Failure to maintain requisite records as required under Section 920 in relation to international transaction shall be subject to penalty u/s 271 AA @ 2% of the value of each international transaction.

(iii) Failure to furnish report from an accountant as required under Section 92E makes it liable for penalty under Section 271 BA of ₹ 1 lakh. The assessing officer shall give an opportunity of being heard to the assessee with a notice as to why the arm’s length price should not be determined on the basis of material or Information or documents in the possession of the Assessing Officer.

The assessee cannot claim deduction u/s 10AA in respect of the additions of ₹ 32 Lakhs made the AO on account of transfer pricing adjustments.

![]()

Question 14.

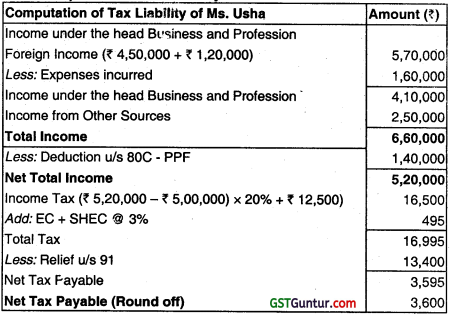

Usha, aged 50 years, a resident in India for the previous year 2021-22 receives professional fee of ₹ 4,50,000 for rendering services outside India. Tax of ₹ 1,20,000 was deducted at source In the country with which India does not have any double taxation avoidance agreement. She incurred ₹ 1,60,000 as expenditure for earning this tee. She has income from other sources in India amounting to ₹ 2,50,000 and she deposited ₹ 1,40,000 towards Public Provident Fund. Compute the tax liability and relief under section 91 of the Income Tax Act, 1961. (Dec 2018, 5 marks)

Answer:

Computation of Tax Liability of Ms. Usha for A.Y. 2023-24:

Computation of Relief u/s 91

| Particulars | Amount (₹) |

| Doubly Taxed Income | 4,10,000 |

| Total Income in India | 5,20,000 |

| Tax on total income in India | 17,160 |

| Tax paid in foreign country | 1,20,000 |

| Total income assessed in foreign country | 5,70,000 |

| (a) Tax on such doubly taxed income in India | |

| (17,160 × 4,10,000)/5,20,000 | 13,530 |

| (b) Tax on such doubly taxed income in Foreign Country | |

| (1,20,000 × 4,10,000)/ 5,70,000 | 86,316 |

| Relief u/s 91 will be lower of (a) or (b) above | 13,530 |

Question 15.

XYZ Inc., a company incorporated in U.S. is engaged in management consultancy. It has set up a branch office in India which qualifies to be a permanent establishment in terms of india-U.S. Tax treaty. During the previous year 2022-23, it has earned the following incomes from India:

(i) Fee for Technical Services of ₹ 75,00,000 taxable @ 10% under section 115A of the Act. Tax rate provided on such income under India-U.S. tax treaty is 10%.

(ii) Dividend of ₹ 17,00,000 received from Indian companies. Tax rate provided on such income under India-U.S. tax treaty is 25%.

(iii) XYZ Inc. incurred expenses of ₹ 3,00,000 and ₹ 75,000 respectively in earning income from fee for technical services and dividend. Compute the tax payable by XYZ Inc. in India after considering the provisions of Section 115B (MAT), if applicable. (Aug 2021, 5 marks)

Answer:

Computation of Tax Payable under the normal Provisions of the income-tax Act, 1961

| Particulars | Amount (₹) |

| Fee for Technical Services | 75,00,000 |

| Dividend Income from India Company | 17,00,000 |

| Total Income | 92,00,000 |

| Income Tax @ 10% on fee for technical services (as per India-us tax treaty) | 7,50,000 |

| Income Tax @ 20% on Dividend Income | 3,40,000 |

| Total tax | 10,90,000 |

| Add: Health and Education Cess @ 4% (Only in respect of dividend income) (4% of ₹ 3,40,000) | 13,600 |

| Tax Payable | 11,03,600 |

Computation of Tax Payable u/s 115JB

| Particulars | Amount(₹) | Amount(₹) |

| Fee for technical services | Nil | |

| Dividend income from Indian Company | 17,00,000 | |

| Less: Expenses incurred | 7,500 | 16,25,000 |

| Book Profit | ||

| Tax payable u/s 115JB @ 15.60% (15%=4%) | 2,53,500 | |

| Tax payable by assessee (Higher of (i) tax payable under the normal provisions; and (ii) tax payable under MAT) |

11,03,600 |

Notes:

1. Under section 115A, fee for technical services and dividend income are taxable on gross basis without allowing deduction for any expenses. Hence, ₹ 3,00,000 and ₹ 75,000 incurred for earning the above income are not allowed as deduction.

2. Income tax is payable at the rate provided under the Act or treaty, whichever is beneficial to assesses. Fees for technical services is taxable @ 10% + cess (4%) under the Act. However, treaty provides tax rate of 10% on such income. Cess rate is not added to rates prescribed under the treaty. Hence, in this case, fees for technical service shall be taxable @ 10% without including cess of 4%.

Similarly, dividend income is taxable @ 20% + Cess (4%) under the Act. The treaty provides tax rate of 25% on such income. Hence, dividend income shall be taxable @ 20.80%.

3. MAT provisions u/s 115JB are applicable to foreign company having a permanent establishment in India in terms of provisions of relevant double taxation avoidance agreement. In this case, provisions of section 115JB shall be applicable to XYZ Inc. since it has a permanent establishment in India.

4. Under section 115JB, fee for technical services which is taxable at a rate lower than 15% is to be reduced while calculating book profits. In this case, fees for technical services is taxable @ 10%, hence’, the same is to be reduced in computing book profits.

5. XYZ Inc. Is liable to pay tax as per normal provisions of the Act, the same being higher than the MAT.

Tax Treaties Notes

Specified Association”

“Specified Association” means any institution, association or body whether incorporated or not, functioning under any law for the time being in force India or the laws of specified territory outside India and which may be notified as such by the Central Government.

“Specified Territory”

“Specified Territory” means any area outside India which may be notified as such by the Central Government for the purpose of section 90A.

![]()

Economic double taxation

Economic double taxation refers to the taxation of two different taxpayers with respect to the same income (or capital). Economic double taxation occurs, for example, when income earned by a corporation is taxed both to the corporation and to its shareholders when distributed as a dividend.

Unilateral Relief from Double Taxation

Under Section 91, the Indian government can relieve an individual from double taxation irrespective of whether there is a DTAA between India and the other country concerned. Unilateral relief may be offered to a tax payer if:

- The person or company has been a resident of India in the previous year.

- The same income must be accrued to and received by the tax payer outside India in the previous year.

- The income should have been taxed in India and in another country with which there is no tax treaty.

- The person or company has paid tax under the laws of the foreign country in question.

Treaty’

Article 2 of Vienna Convention on law and Treaties, 1969 defines Treaty as:

‘treaty’ means an international agreement concluded between States in written form and governed by international law, whether embodied in a single instrument or in two or more related instruments and whatever its particular designation.

DTAAs can be two types

- Comprehensive DTAA: Comprehensive DTAAs are those which cover almost all types of incomes covered by any model convention. Many a time a treaty covers wealth tax, gift tax, surtax etc. too.

- Limited DTAA: Limited DTAAs are those which are limited to certain types of incomes only, e.g. DTAA between India and Pakistan is limited to shipping and aircraft profits only.