CMA Inter Financial Accounting MCQs – CMA Inter Financial Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

CMA Inter Financial Accounting MCQs

Question 1.

From the four alternative answers given against each of the following cases, indicate the correct answer:

(i) Realisation account is opened at the time of

(A) Admission of a new partner

(B) Retirement of a partner

(C) Dissolution of the Firm

(D) In all the above situations

Answer:

(C) Dissolution of the Firm

Dissolution of the firm: At the time of Admission/ Retirement of a partner, revaluation account is opened but at the time of dissolution of a firm, realization a/c is opened.

Question 2.

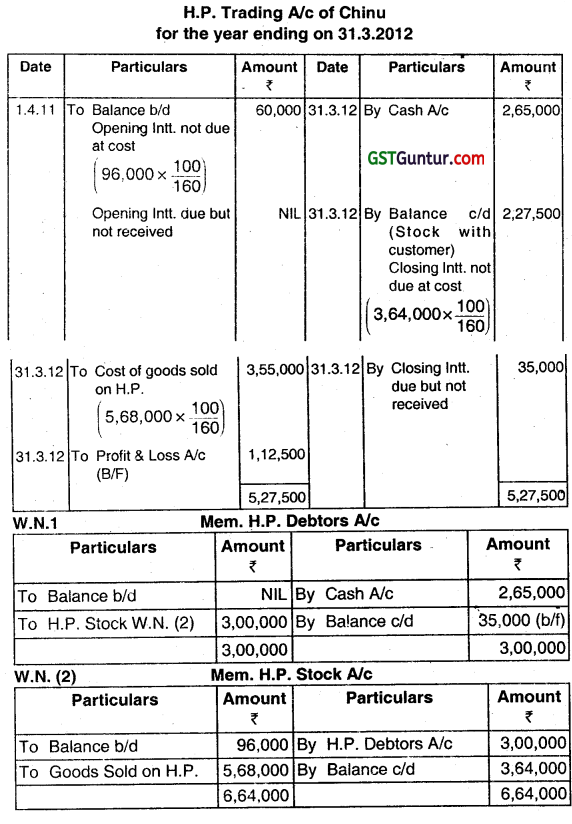

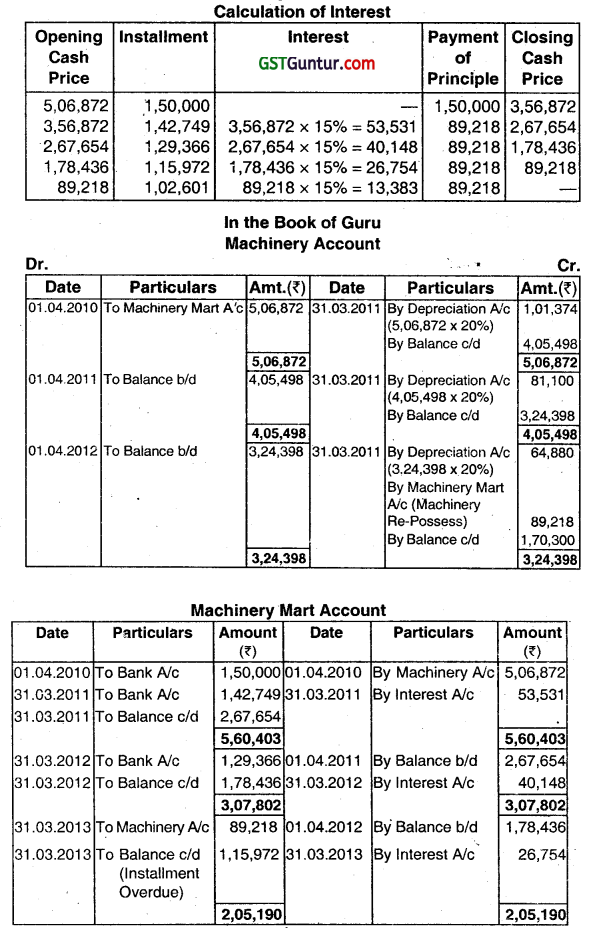

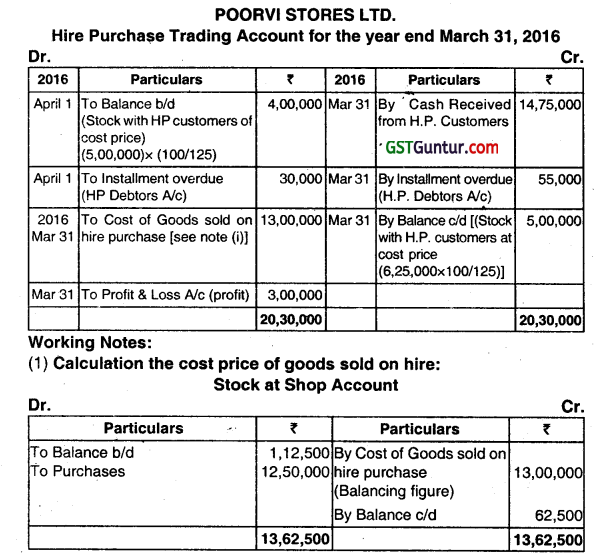

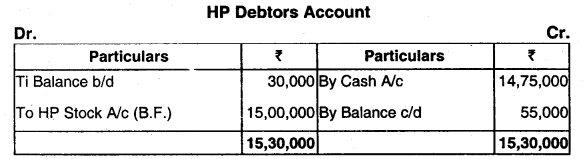

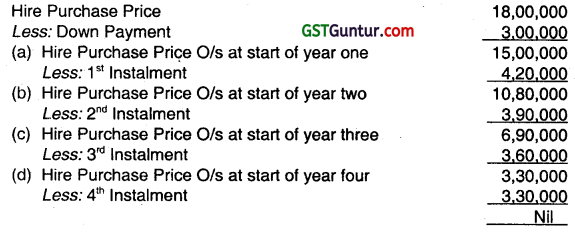

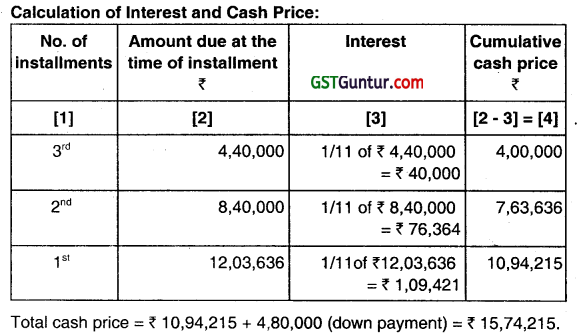

(ii) In the hire purchase system interest charged by vendor is calculated on the basis of

(A) Outstanding Cash Price

(B) Hire Purchase Price

(C) Instalment amount

(D) None of the above

Answer:

(A) Outstanding cash price: In the hire purchase system H.P. price = Cash Price + Interest. In this system, ¡hterest will be calculated every time on outstanding principle amount i.e. cash price. Therefore option (B) is not correct. Option (C) is also not correct because installment amount includes both Principle and Interest.

Question 3.

(iii) Bad debts are apportioned among departments in the proportion of

(A) Sales of each department

(B) Number of units sold by each department

(C) Cost of sales of each department

(D) None of the above

Answer:

(A) Sales of each department: Bad debt is treated as selling and distribution expenses, therefore it will be apportioned on the basis of sales of each department. It is related to value only therefore option (B) and (C) is not correct.

Question 4.

(iv) The following account has a credit balance

(A) Plant and Equipment A/c

(B) Purchase Returns A/c

(C) Purchase A/c

(D) None of the above

Answer:

(B) Purchase returns A/c: At the time of purchase return, following journal entry is passed- creditors A/c ………… Dr.

To purchase return A/c

Therefore option (B) is Correct. Options (A) and (C) are incorrect since these accounts will be debited not credited.

Question 5.

(v) The amortisation of amount of software commences from the date when it is

(A) Available for use

(B) Put to use

(C) Developed up to 75%

(D) None of the above

Answer:

(A) Available for use: As per AS 26 “Intangible Assets amortisation of softwares should start when the asset is available for use and not put to use.

Question 6.

(vi) When prior period expenditure is paid subsequently and for which no provision was made earlier, the accounting entry would be

(A) Debit expenditure

(B) Debit prior period expenditure

(C) Debit deferred revenue expenditure

(D) None of the above.

Answer:

(B) Debit prior period expenditure: Example Rent paid in April 2013 ₹ 1,100,000 includes 60,000 for the month of March 2013. The Journal entry will be:

Rent A/c Dr. 40,000

Prior period expenses (Rent) A/c Dr. 60,000

To cash Bank A/c 1,00,000

Therefore option (B) is correct

Question 7.

(vii) In the case of non-profit organisation donations received by the organisation are reflected in

(A) Income and Expenditure Account

(B) Capital Account

(C) Receipts and Payments Account :

(D) None of the above (Dec 2012,1 x 7 = 7 marks)

Answer:

(C) Receipts and Payments A/c: In case of receipt of donation, the following entry will be passed

Cash/Bank A/c Dr.

To capital fund A/c

Therefore option (C) is correct.

Question 8.

(b) State whether the following statement is TRUE (T) or FALSE (F):

(v) Liquid assets plus stock in trade is called current assets. (1 mark)

Answer:

(b) (v) True: Current assets = Liquid assets + stock in trade

Liquid assets Cash in hand + Bank balance + Debtors + B/R.

Question 9.

(c) Fill up the blanks in the following sentences using appropriate word from the alternatives indicated:

(iii) Errors in principle ……………………. affect, tallying Balance Sheet (does/does not).

Answer:

(iii) Does not

(iv) In case of instalment sale ownership passes at the time of …………………… (sale/payment of last installment). (Dec 2012, 1 x 2 = 2 marks)

Answer:

(iv) Sale

Question 10.

(a) From the four alternatives given against each of the following cases, indicate the correct answer: (just state a, b, c, or d)

(i) At the year-end, an amount outstanding for electricity consumed during that year will be dealt in the Accounts for the year by following the accounting concept of

(a) Realisation

(b) Accrual

(c) Conservatism

(d) None of the above

Answer:

(b) Accrual

(i) When business procures goods or services with the agreement that the payment will be made at a future date. An obligation to pay for goods or services is created upon the procurement thereof.

Question 11.

(ii) Contingent Liability would appear

(a) On the liability side

(b) On the asset side

(c) As a note in Balance Sheet

(d) None of the above

Answer:

(c) As a note in Balance Sheet

Question 12.

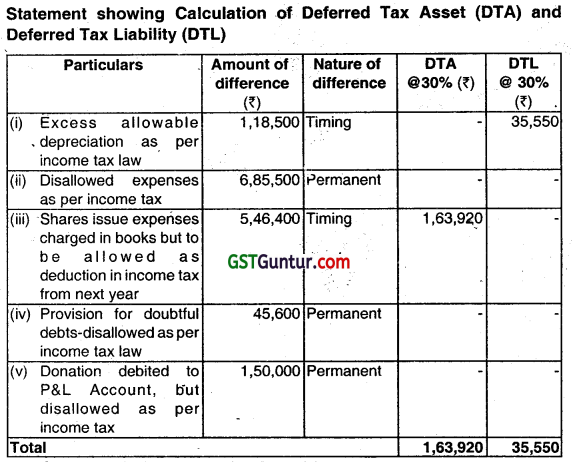

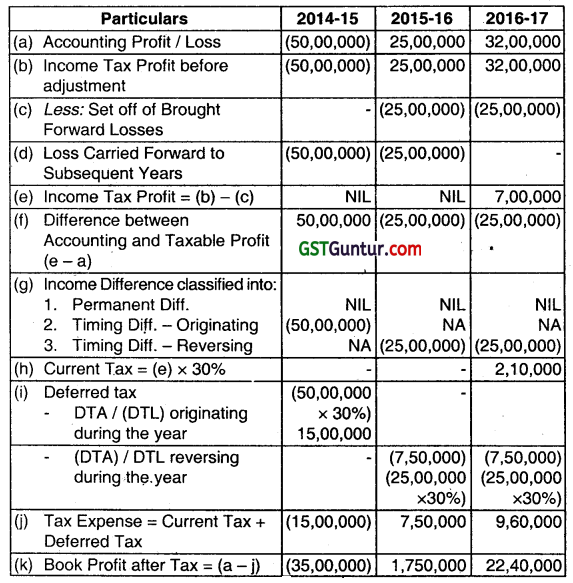

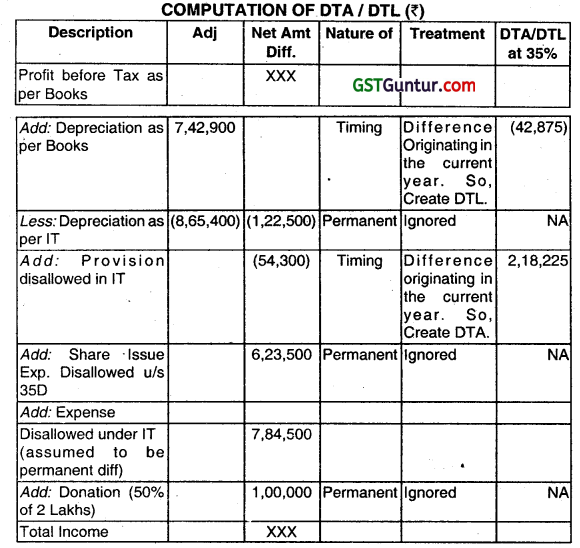

(iii) The effect of timing difference is called as

(a) Current Tax

(b) Deferred Tax

(c) Minimum Tax

(d) None of the above (June 2013, 1 x3=3marks)

Answer:

(b) Deferred Tax

Current tax is the amount of income tax determined to be payable or recoverable in respect of the taxable income (tax

loss) for a period. According to Section 115JB of Income Tax Act. 1961, the payable on the total income as computed under

the Income Tax Act in respect of any previous year cannot be less than 18.5% of the Book Profit. Deferred tax is the timing

difference between accounting income & taxable income.

State whether the following statements are TRUE (T) or FALSE (F):

i. Sinking fund method of depreciation takes into account the cost of an asset as well as interest also thereon at given rate.

(ii) Purchase of a technical know-how is revenue expenditure.

(iii) Transactions are recorded on accrual basis in the ‘Income and Expenditure Account’.

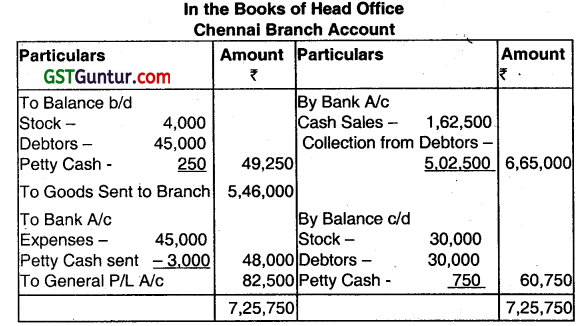

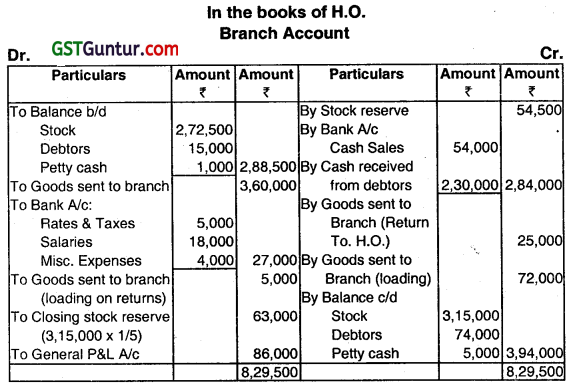

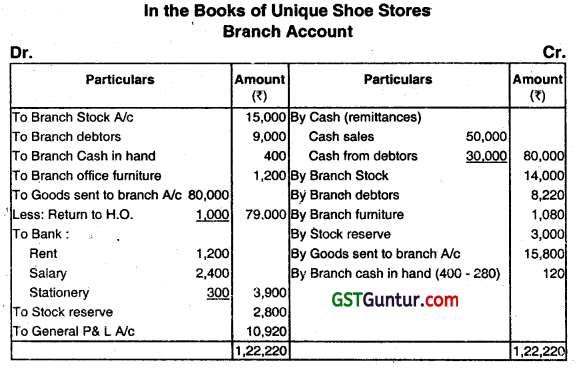

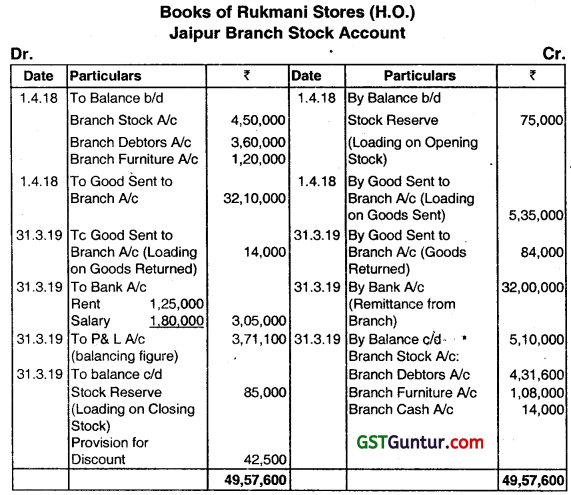

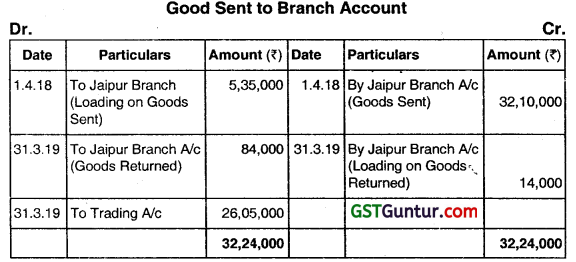

(iv) When the goods are returned by Branch, goods sent to Branch account will be debited in the books of Head Office.

(June 2013, 1 x4=4 marks)

Answer:

(i) True

(ii) False If technical knowhow is one time investment then it is assets. On the other hand, pay for technical know-how in the nature of payment for consultancy it is purely an expense.

(iii) True

(iv) True

Fill up the blanks in the following sentences using appropriate word from the alternatives indicated:

ii. Revenue nature receipts and payments which relates to a particular accounting period are shown in the ……………..

account (Receipts and Payments/Income and Expenditure). (2 marks)

Answer:

Income & Expenditure

(e) In the following cases, one out of four answers is correct. lndicatate the correct answer (=1 mark) and give brief workings in support or your answer (=1 mark):

iii. A and B are partners sharing profit/loss in the ratio of 3: 2. They admit C into partnership for 1/6 share in the profit which he acquired equally from the old partners. The new profit-sharing ratio will be

(a) 3: 2: 1

(b) 1: 1: 1

(c) 31: 19: 10

(d) 14: 6: 4 (June 2013, 2 marks)

Answer:

(c) 31:19:10; A’s new share = \(\frac{3}{5}-\frac{1}{6} \times \frac{1}{2}=\frac{3}{5}-\frac{1}{2}=\frac{36-5}{60}=\frac{31}{60} \)

B’s new share = \(\frac{2}{5}-\frac{1}{6} \times \frac{1}{2}=\frac{2}{5}-\frac{1}{2}=\frac{24-5}{60}=\frac{19}{60}\)

C’s new share = \(\frac{1}{6} \text { or } \frac{10}{60} \)

Hence, new ratio = 31: 19: 10

Question 13.

Answer the following questions:

(a) Choose the most appropriate one from the stated options and write it down (only indicate (A) or (B) or (C) or (D) as you think correct.)

(i) Expenditures in respect of certain types of assets whose usefulness does not expires in the year of their occurrence but generally expires in the near future are called

(A) Revenue Expenditure

(B) Capital Expenditure

(C) Deferred Revenue Expenditure

(D) None of the above

Answer:

(C) Deferred Revenue Expenditure

Question 14.

(ii) The main objective of average clause contained in a fire insurance policy is to

(A) Encourage full Insurance

(B) Discourage full Insurance

(C) Encourage under Insurance

(D) Encourage full Insurance and Discourage under Insurance

Answer:

(D) Encourage full Insurance and Discourage under Insurance

Question 15.

(iii) AS-10 is applicable to which one of the following assets?

(A) Goodwill

(B) Live Stock

(C) Plantation

(D) Property, Plant and Equipment (June 2016, 1 x 3 = 3 marks)

Answer:

(D) Property, Plant and Equipment

State whether the following statements given below are TRUE or FALSE:

i. Income and Expenditure Account is prepared by adopting accrual principle of Accounting.

Answer:

True

ii. As per concept of conservatism, the Accountant should provide for all possible losses but should not anticipate profit.

Answer:

True

iii. The cost of developing software for a company engaged in software business is revenue expenditure. (June 2016, 1 x 3 = 3 marks)

Answer:

False

Question 16.

Answer the following questions:

(a) Choose the most appropriate one from the stated options and write it down (only indicate (A) or (B) or (C) or (D) as you think correct.):

(i) Any change in the accounting policy relating to inventories which has a material effect in the current or later periods should be disclosed. This is in accordance with the accounting principle of:

(A) Going Concern

(B) Conservatism

(C) Consistency

(D) Disclosure

Answer:

(C) Consistency

Question 17.

(ii) Depreciation is a process of

(A) Apportionment

(B) Valuation

(C) Allocation

(D) None of the above

Answer:

(C) Allocation

Question 18.

(iii) An amount spent in connection with obtaining a License for starting the factory is

(A) Revenue Expenditure

(B) Capital Expenditure

(C) Pre-paid Expenditure

(D) None of the above (Dec 2016, 1 x 3 = 3 marks)

Answer:

(A) Revenue Expenditure

State whether the following statements given below are TRUE or FALSE:

(i) In the case of consignment sales, revenue is to be recognised on sale of goods to a third party.

Answer:

True

(ii) Retiring a bill under rebate means payment of the bill before due date. (1 x 2 = 2 marks)

Answer:

True

Question 19.

Answer the following questions:

(a) Choose the most appropriate one from given four alternatives:

(i) Receipts and Payments account is a

(a) Nominal Account

(b) Real Account

(c) Personal Account

(d) Artificial Personal Account

Answer:

(b) Real Account

Question 20.

(ii) A resource owned by the business with purpose of using it for generating tuture profit, is known as

(a) Capital

(b) Asset

(c) Liability

(d) Surplus

Answer:

(b) Asset

Question 21.

(iii) Outward Invoice issued is a source document of

(a) Purchase Book

(b) Sales Book

(c) Return Inward Book

(d) Return Outward Book

Answer:

(b) Sales Book

Question 22.

(iv) Which of the following is of capital nature?

(a) Commission on purchases

(b) Cost of repairs

(c) Rent of factory

(d) Wages paid for installation of machinery

Answer:

(d) Wages paid for installation of machinery

Question 23.

(vi) If any stock is taken by a co-venturer, it will be treated as

(a) an income of the joint venture.

(b) an expense of the joint venture.

(c) to be ignored from joint venture.

(d) it will be treated in the personal books of the co-venturer.

Answer:

(a) an income of the joint venture.

Question 24.

(vii) Contingent liability would appear

(a) on the liability side of the Balance Sheet.

(b) on the assets side of the Balance Sheet.

(c) do not shown in the books of accounts.

(d) as a note in Balance Sheet.

Answer:

(d) as a note in Balance Sheet.

Question 25.

(viii) Income statement of a Charitable Institution is known as

(a) Statement of profit and loss

(b) Receipts and Payments Account

(c) Income and Expenditure Account

(d) Profit and Loss Account

Answer:

(c) Income and Expenditure Account

Question 26.

(ix) Which of the following accounts is mainly prepared at the time of dissolution of the firm

(a) Revaluation A/c

(b) Goodwill A/c.

(c) Realization A/c

(d) Memorandum Revaluation A/c

Answer:

(c) Realization A/c

Question 27.

(x) Advertisement expenses are apportioned among departments in the proportion of

(a) sales of each department

(b) purchases of each department

(c) no. of units sold by each department

(d) cost of sales of each department (June 2017, 1 x 9 = 9 marks)

Answer:

(a) sales of each department

State whether the following statements given below are true or false:

(i) One of the objectives achieved by providing depreciation is saving cash resources for future replacement of assets.

Answer:

True

(ii) Expenses incurred by branch out of petty cash balance are debited – to branch account by the head office.

Answer:

False

(iii) In absence of partnership deed the profit or loss should be distributed among partners in their capital ratio. (1 x 3 = 3 marks)

Answer:

False.

Fill in the blanks:

(i) The ………………………. discount is never entered in the books of accounts.

Answer:

trade

(ii) A bill of exchange drown on 12’ April 2017 for four months, the date of maturity will be ……………………. .

Answer:

14.08.2017

(iii) The parties of joint venture is called …………………….. .

Answer:

co-venturers

(iv) Outstanding subscription is shown in the ………………… side of Balance Sheet. (1 x 4 = 4 marks)

Answer:

assets

Question 28.

Answer the Following Questions:

(a) Choose the most appropriate one from given four alternatives:

(i) If an employee of the business files a legal suit on business, it is considered in the books as a

(a) Legal Expense

(b) Liability

(c) Contingent Asset

(d) Contingent Liability

Answer:

(d) Contingent Liability

Question 29.

(ii) At the end of the accounting year the capital expenditures are shown in the

(a) assets side ot the Balance Sheet.

(b) liabilities side of the Balance Sheet.

(c) debit side of the Profit and Loss A/c.

(d) credit side of the Profit and Loss A/c.

Answer:

(a) assets side ot the Balance Sheet.

Question 30.

(iii) Which of the following is not a method of charging depreciation?

(a) Sinking Fund Method

(b) Sum of years Digit Method

(c) Working hours Method

(d) Asset’s Life-cycle Method

Answer:

(d) Asset’s Life-cycle Method

Question 31.

(iv) If average inventory is ₹ 1,25,000 and closing inventory is ₹ 10,000 less than opening inventory then the value of closing inventory will be

(a) ₹ 1,35,000

(b) ₹ 1,15,000

(c) ₹ 1,30,000

(d) ₹ 1,20,000

Answer:

(d) ₹ 1,20,000

Question 32.

(v) The Accommodation bill is drawn

(a) to finance actual purchase or sale of goods.

(b) to facilitate trade transmission.

(c) when both parties are in need of funds.

(d) None of the above.

Answer:

(c) when both parties are in need of funds.

Question 33.

(viii) Accounting standards in India are issued by

(a) Government of India

(b) Reserve Bank of India

(c) The Institute of Chartered Accountants of India

(d) The Institute of Accounting Standard of India.

Answer:

(c) The Institute of Chartered Accountants of India

Question 34.

(ix) As on 31 March, 2017 debtors; and additional bad debts are ₹ 8,00,000 and ₹ 10,000 respectively. If the provision for bad debts is made at 5% on debtors then amount of such provision will be

(a) ₹ 40,000

(b) ₹ 50,000

(c) ₹ 39,500

(d) ₹ 40,500

Answer:

(c) ₹ 39,500

Question 35.

(x) Income and Expenditure Account is a

(a) Nominal Account

(b) Real Account

(c) Personal Account

(d) Artificial Personal Account (Dec 2017, 1 x 8 = 8 marks)

Answer:

(a) Nominal Account

State whether the following statements given below are ‘True’ or ‘False’:

i. Memorandum joint venture account ¡s prepared to find out amount due from co-venture.

Answer:

False

ii. Receipts and Payments Account is prepared by adopting cash principle of accounting.

Answer:

True

iii. Bad debts recovered is credited to debtor’s personal account.

Answer:

False

iv. New partners pays premium for goodwill, which will be shared by old partners in their new profit-sharing ratio. (Dec 2017, 1 x 4 = marks)

Answer:

False

(d) Fill in the blanks:

(i) The ……………………… discount is not recorded in the books of accounts.

Answer:

Trade

(ii) Profit or Loss on revaluation is shared among the partners in ………………… Ratio.

Answer:

Old profit sharing

(iii) At the time of goods sent to consignee, the proforma invoice is prepared by …………………. .

Answer:

Consignor

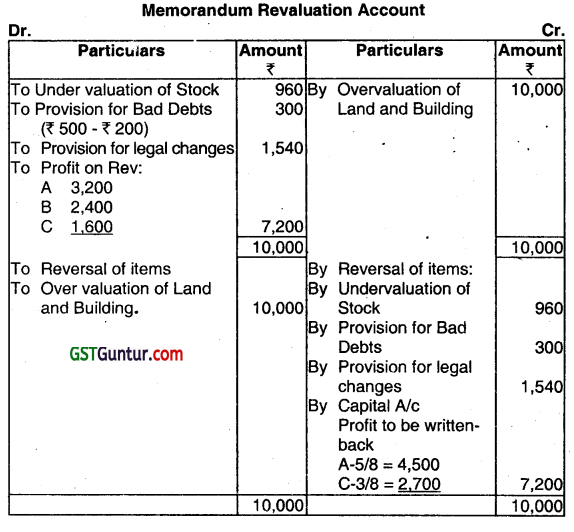

(iv) Memorandum revaluation account is prepared when the ………………………. of assets and liabilities are not altered.

Answer:

Book value

(v) Realisation account is opened at the time of ……………………… of firm. (Dec 2017, 1 x 5 = 5’marks)

Answer:

Dissolution of the firm

Question 36.

Answer the Following Questions:

(a) Choose the most appropriate one from the given following alternatives:

(i) Which of the following is not a Qualitative Characteristics of Financial Statement?

(a) Cost Principle

(b) Understandability

(c) Relevance

(d) Reliability

Answer:

(a) Cost Principle

Question 37.

(ii) Name the book in which, entries are recorded on the basis of credit notes issued.

(a) Sales Book

(b) Purchase Book

(c) Sales Return Book

(d) Purchase Return Book

Answer:

(c) Sales Return Book

Question 38.

(iii) Exception to consistency principle is

(a) Cost Principle

(b) Going Concern Principle

(c) Matching Principle

(d) Prudence Principle

Answer:

(d) Prudence Principle

Question 39.

(iv) Interest charged by vendor in Hire Purchase System, is calculated on the basis of

(a) Outstanding hire purchase price

(b) Outstanding cash price

(c) Instalment amount

(d) Cost price of the asset

Answer:

(b) Outstanding cash price

Question 40.

(v) The balance in consignment account shows

(a) Amount receivable from consignee

(b) Amount payable to consignee

(c) Profit/loss on consignment

(d) Closing stock with consignee.

Answer:

(c) Profit/loss on consignment

Question 41.

(vi) Provision for bad debts is

(a) Real Account

(b) Nominate account’

(c) Personal account

(d) None of the above

Answer:

(c) Personal account

Question 42.

(vii) The business is treated as distinct and separate from its owners on the basis of the

(a) Going concern concept

(b) Conservatism concept

(c) Matching concept

(d) Business entity concept

Answer:

(d) Business entity concept

Question 43.

(viii) Due to retrospective effect on revision of salary of employees, the arrears of salary relating to past years, payable in current year is

(a) Prior-period item

(b) Extra-ordinary item

(c) Ordinary item requiring separate disclosure

(d) Contingent item

Answer:

(c) Ordinary item requiring separate disclosure

Question 44.

(ix) Discount given in the Sales – Invoice itself is

(a) Cash discount

(b) Trade discount

(c) Rebate

(d) Allowance

Answer:

(b) Trade discount

Question 45.

(x) Canteen expenses are apportioned among departments in the proportion of

(a) Departmental floor space

(b) Departmental direct wages

(c) Departmental sales

(d) Departmental No. of employees (June 2018, 1 x 10 = 10 marks)

Answer:

(d) Departmental No. of employees

State whether the following statements given below are True or False:

i. Receipt & Payment Account only records the revenue nature of receipts and expenses.

Answer:

False

ii. Sales Book records both cash and credit sales.

Answer:

False

iii. Normal loss of goods sent on consignment is shown in Consignment Account.

Answer:

False

iv. In case of trading concern, cost of good sold and cost of sales are same.

Answer:

False

(v) In Proprietorship business, Income-tax payable is shown as a liability in Balance Sheet. (June 2018, 1 x 5 =5 marks)

Answer:

False

(d) Fill in the blanks:

(i) The Bank A/c is a ……………………. Account.

Answer:

Personal

(ii) Assets are classified as non-current asset and current assets as per ……………………… Principle.

Answer:

Going – Concern

(iii) ……………………….. Amount is the higher of asset’s net selling price and its value in use. (June 2018, 1 x 3 = 3 marks)

Answer:

Recoverable/Fair Value

Question 46.

Answer the following questions:

(a) Choose the most appropriate one from the given following alternatives:

(i) Both cash and credit transactions are recorded, on the basis of

(a) Accounting Period Concept

(b) Going Concern Concept

(c) Business Entity Concept

(d) Accrual Concept

Answer:

(d) Accrual Concept

Question 47.

(ii) Which of the following book is both a journal and a ledger?

(a) Cash Book

(b) Sales Day Book

(c) Bills Receivable Book

(d) Journal Proper

Answer:

(a) Cash Book

Question 48.

(iii) Interest received in advance account is a

(a) Nominal Account

(b) Real Account

(c) Artificial Personal Account

(d) Representative Personal Account

Answer:

(d) Representative Personal Account

Question 49.

(iv) Shiva draws a bill on Sanat on 25 October, 2018 for 90 days, the maturity date of the bill will be

(a) 27th January, 2019

(b) 26th January, 2019

(c) 25th January, 2019

(d) 28th January, 2019

Answer:

(c) 25th January, 2019

Question 50.

(v) Peeru and Simu are entered in the business of buy and sale of food grain for a period of one year and sharing the profit in the ratio of 3:2, this agreement is a

(a) Partnership

(b) Consignment

(c) Joint-venture

(d) Lease

Answer:

(c) Joint-venture

Question 51.

(vi) At the end of the year 201 7-18, Prepaid Insurance Premium ₹ 7,500 was appeared in the Trial Balance, it will be shown

(a) only in Profit & Loss Account.

(b) only in Balance Sheet.

(c) both in Profit & Loss Account and in Balance Sheet.

(d) not in both in Profit & Loss Account and in Balance Sheet.

Answer:

(b) only in Balance Sheet.

Question 52.

(vii) Contingent Liability would appear

(a) on the liabilities side of the Balance Sheet.

(b) on the assets side of the Balance Sheet.

(c) as a note in the Balance Sheet.

(d) None of the above.

Answer:

(c) as a note in the Balance Sheet.

Question 53.

(ix) Generally sacrifice ratio is concerned with the situation of

(a) Admission of a new partner

(b) Retirement of a partner

(c) Dissolution of firm

(d) Conversion of firm into company.

Answer:

(a) Admission of a new partner

Question 54.

(x) KCS purchased a machine from JPS on hire purchase system, whose cash price was ₹ 8,64,000. ₹ 2,16,000 being paid on delivery and balance in three annual instalments of ₹ 2,88,000 each. The amount of interest included in first instalment would be

(a) ₹ 72,000

(b) ₹ 57,600

(c) ₹ 1,08,000

(d) ₹ 36,000 (Dec 2018, 1 x 9 = 9 marks)

Answer:

(c) ₹ 1,08,000

Fill in the blanks:

(i) While posting an opening entry in the ledger, in case of an Account having debit balance, in ‘Particulars’ column the words ………………. are written on debit side.

Answer:

To Balance b/f

(ii) Depreciation Accounting is the process of ………………….. and not …………………. .

Answer:

Allocation Valuation

(iii) Finished goods are normally valued at cost or ………………… whichever is lower.

Answer:

Net Realisable Value

(iv) The relation between Consignee and Consignor is that of …………………… .

Answer:

Agent and Principal

(v) The relationship between Co-venturers is that of …………………… . (Dec 2018, 1 x 5 = 5 Marks)

Answer:

Co-owners

State with reason whether the following statements are true or false (No marks shall be awarded without valid reason):

i. Deferred revenue expenditure is current year’s revenue expenditure to be paid in the later years.

Answer:

False

ii. Reducing balance method for depreciation is followed to have a uniform charge for depreciation and repairs and maintenance together.

Answer:

True

(iii) Reserve for Discount on Creditors has a credit balance.

Answer:

False

(iv) A promissory note can be made payable to the bearer. (1 x 4 =4 marks)

Answer:

False

Question 55.

Answer the following questions:

(a) Choose the most appropriate one from the given following alternatives:

(i) Which of the following is a resource owned by the business with the purpose of using it for generating future profits?

(a) Loan from Bank

(b) Owner’s Capital

(c) Trade Mark

(d) All of the above

Answer:

(c) Trade Mark

Question 56.

(ii) Chandu & Co.’s Account is a

(a) Real Account

(b) Nominal Account

(c) Representative.Personal Account

(d) Artificial Personal Accounts

Answer:

(d) Artificial Personal Accounts

Question 57.

(iii) Purchase of a laptop for office use wrongly debited to Purchase Account. It is an error of

(a) Omission

(b) Commission

(c) Principle

(d) Misposting

Answer:

(c) Principle

Question 58.

(iv) Which of the following term is most suitable for writing off Patent?

(a) Depletion

(b) Amortization

(c) Depreciation

(d) All of the above

Answer:

(b) Amortization

Question 59.

(v) Memorandum Joint Venture Account ¡s prepared when

(a) the separate set of books is maintained for Joint Venture.

(b) the Each co-venturer keeps records of all transactions.

(c) the Each co-venturer keeps records of their own transactions only.

(d) All of the above cases

Answer:

(c) the Each co-venturer keeps records of their own transactions only.

Question 60.

(vi) Which of the following commission is allowed by the consignor to the consignee to encourage the consignee for putting-up hard work in introducing new product in the market?

(a) Del-credere Commission

(b) Over-riding Commission

(c) Hard Work Commission

(d) Ordinary Commission

Answer:

(b) Over-riding Commission

Question 61.

(vii) If Ram’s acceptance which was endorsed by us ¡n favour of Saleem is dishonoured, then the amount will be debited in our books to

(a) Saleem

(b) Ram

(c) Bills Receivable Account

(d) None of the above

Answer:

(b) Ram

Question 62.

(viii) In case of a Club, the excess of expenditure over income is called as

(a) Surplus

(b) Deficit

(c) Capital Fund

(d) Investment in Fixed Assets

Answer:

(b) Deficit

Question 63.

(ix) A Charitable Institution has 250 members with a annual subscription of ₹ 5,000 each. The subscriptions received during 2018-19 were ₹ 11,25,000. which include ₹ 65,000 and ₹ 25,000 for the years of 2017-18 and 2019-20 respectively. Amount of outstanding subscriptions for the 2018-19 will be

(a) ₹ 90,000

(b) ₹1,25,000

(c) ₹ 2,15,000

(d) ₹ 1,90,000

Answer:

(c) ₹ 2,15,000

Question 64.

(x) The following are details of dosing stock items in Aarvi Limited:

| Items |

Historical Cost (₹ In Lakh) |

Net Realisable Value (₹ in Lakh) |

| A |

30 |

27 |

| B |

15 |

18 |

| C |

35 |

35 |

| D |

40 |

45 |

The value of Closing Stock will be

(a) ₹ 120 Lakh

(b) ₹ 125 Lakh

(c) ₹ 117 Lakh

(d) ₹ 128 Lakh (June 2019, 1 x 10 = 10 marks)

Answer:

(c) ₹ 117 Lakh

(b) Match the following in Column I with the appropriate in Column II:

| Column-I |

Column-II |

| (1) Highest Relative Capital Method |

(A) Departmental Accounts |

| (2) Basis of Apportionment of Expenses |

(B) Insurance Claim |

| (3) Partial Repossession |

(C) Piecemeal Distribution |

| (4) Indemnity Period |

(D) Hire Purchase |

(June 2019, 1 x 4 = 4 marks)

Answer:

| Column-I |

Column-II |

| (i) Highest Relative Capital Method |

(C) Piecemeal Distribution |

| (ii) Basis of Apportionment of Expenses |

(A) Departmental Accounts |

| (iii) Partial Repossession |

(D) Hire Purchase |

| (iv) Indemnity Period |

(B) Insurance Claim |

State whether the following statements are True or False.

i. All these items of revenue nature which received during the period of accounts, are only shown in the Income and Expenditure Account.

Answer:

False

ii. When the capitalization of profits method is used then the value of goodwill on the basis of future maintainable profits is more than that of on the basis of super profits.

Answer:

False

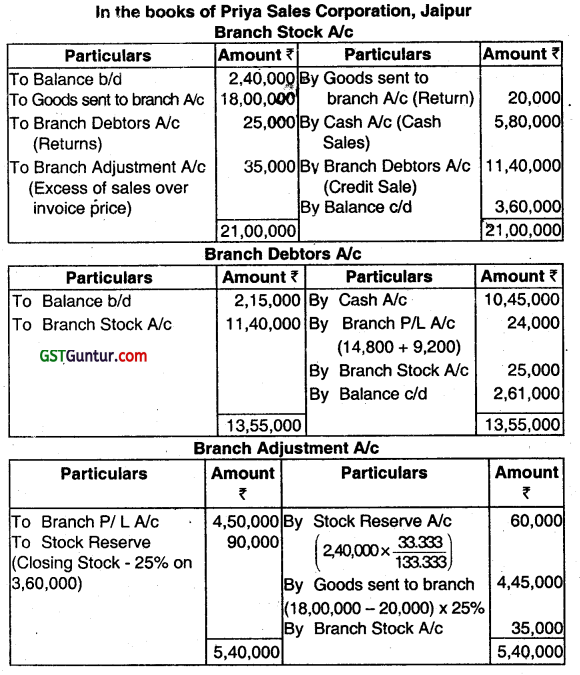

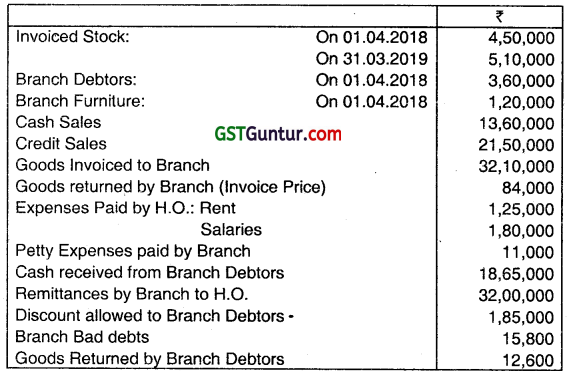

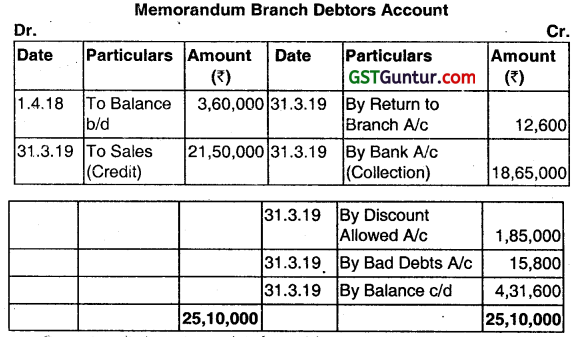

iii. In the Stock and Debtors Method of accounting, balance of Branch Stock Account shows either Gross Profit or Gross Loss. (June 2019, 1 x 3 = 3 marks)

Answer:

False.

(d) Fill in the blanks:

(i) Net Worth is excess of ………………….. over.

Answer:

Total assets, total liabilities

(ii) The Sates ₹ 180 Lakh, Purchases ₹ 129 Lakh and Opening Stock ₹ 33 Lakh. If the rate of Gross Profit is 50% on cost, then the value of closing stock will be …………………. .

Answer:

₹ 42 Lakh

(iii) In case of Loss of Profit Policy, Gross Profit is the sum of Net Profit plus ………………….. Standing Charges.

Answer:

Insured

(iv) Interest to be allowed @ 0.75 percent per month on Partners Capital of ₹ 60 Lakh; Manager’s Commission @ 5 percent of Net Profit before charging such commission. If the Net Profit before charging interest on capital and manager’s commission amounted to ₹ 14.85 Lakh, then manager’s commission will be ………………….. .

Answer:

₹ 47,250

(v) A machinery was purchased on Hire Purchase System. Its cash price was ₹ 5,20,000 which was payable in annual instalments of ₹ 1,80,000 each including interest @ 15 per cent per annum. The amount of interest included in 2nd instalment would be …………………. . (June 2019, 1 x5 = 5 marks)

Answer:

₹ 62,700.

Question 65.

Answer the following questions:

(a) Choose the most appropriate one from the given following alternatives:

(i) When stock is valued at cost ¡n one accounting period and at lower of cost and Net realizable va’ue in another accounting period

(a) Prudence Principle conflicts with Consistency Principle.

(b) Matching Principle conflicts with Consistency Principle.

(c) Consistency Principle conflicts with Accounting Period Assumption.

(d) None of the above

Answer:

(a) Prudence Principle conflicts with Consistency Principle.

Question 66.

(ii) Materiality Principle is an exception to the

(a) Consistency Principle

(b) Full Disclosure Principle

(c) Accounting Period Assumption

(d) Prudence Principle

Answer:

(b) Full Disclosure Principle

Question 67.

(iii) In a Cash Book Debit balance of ₹ 112 brought forward as credit balance of ₹ 121, while preparing a Bank Reconciliation Statement taking the balance as per Cash Book as the starting point:

(a) ₹ 112 to be added

(b) ₹ 121 to be added

(c) ₹ 233 to be added

(d) ₹ 112 to be subtracted

Answer:

(c) ₹ 233 to be added

Question 68.

(iv) represents a potential obligation that could be created depending on the outcome of an event.

(a) Internal Liability

(b) Current Liability

(c) Contingent Liability

(d) Non-current Liability

Answer:

(c) Contingent Liability

Question 69.

(v) Opening Debtors, Collection Iron, Debtors, and Discount Allowed were ₹ 3,1 5,000; ₹ 18,30,000 and ₹ 35,000 respectively. If the closing debtors were 20% of credit sales of the period then closing debtors and credit sales would be

(a) ₹ 3,51,667 and ₹ 17,58,333

(b) ₹ 3,63,333 and ₹ 18,16,667

(c) ₹ 3,87,500 and ₹ 19,37500

(d) ₹ 3,10,000 and ₹ 15,50,000

Answer:

(c) ₹ 3,87,500 and ₹ 19,37500

Question 70.

(vi) Following information is given:

|

₹ |

| Opening Stock |

2,13000 |

| Purchases |

16,55,000 |

| Sales |

21,32,000 |

| Carriage Inwards |

32,500 |

| Carriage Outwards |

38,600 |

| Return Inwards |

38,000 |

If the rate of gross profit is 25% on cost then value of closing stock will be

(a) ₹ 2,57,800

(b) ₹ 1,94,900

(c) ₹ 2,25,300

(d) ₹ 3,30,000

Answer:

(c) ₹ 2,25,300

Question 71.

(vii) Provision for Doubtful Debt on 1st April 2018 was ₹ 21 ,500. During the year 2018-19, the Bad-debt and Recovery of Bad-debt were ₹ 10,500 and ₹ 2,100 respectively. The Sundry Debtors on 31st March, 2019 were ₹ 2,25,000. Provision is to be made @ 5% on Debtors. If on 31st March 2019, there was additional bad debt of ₹ 2,500 then Provision for doubtful debt will be

(a) debited to Profit & Loss Account by ₹ 11,250.

(b) debited to Profit & Loss Account by ₹ 2,625.

(c) debited to Profit & Loss Account by ₹ 3,000.

(d) debited to Profit & Loss Account by ₹ 900.

Answer:

(b) debited to Profit & Loss Account by ₹ 2,625.

Question 72.

(viii) A and B enter a joint venture sharing profit and losses in the ratio of 3:2. A purchased goods costing 2,00,000.

B sold 95% goods for ₹ 2,50,000. A is entitled to get 1% commission on purchases and B is entitled to get 5% commission on sales. A drew a bill on B for an amount equivalent to 80% of original cost of goods. A got it discounted at ₹ 1,50,000. What is A’s share of profit?

(a) ₹ 15,300

(b) ₹ 21,300

(c) ₹ 18,900

(d) None of the above

Answer:

(b) ₹ 21,300

Question 73.

(ix) Subscription of ₹ 6,25,000 had been shown in the Income and Expenditure Account prepared for the year ending 31st March 2019. Additional information is as below:

|

On 31st March, 2018 (₹) |

On 31st March, 2019 (₹’) |

| Subscription Outstanding |

55,000 |

72,000 |

| Subscription Received in Advance |

31,000 |

37,000 |

The amount of subscriptions received during the year 2018-19 would be

(a) ₹ 6,36,000

(b) ₹ 6,02,000

(c) ₹ 6,14,000

(d) ₹ 6,48,000

Answer:

(c) ₹ 6,14,000

Question 74.

(x) X and Y are partners with the capital of ₹’50,000 and ₹ 30,000 respectively. Interest Payable on Capital Is 10% p.a. If the profits earned by the firm is ₹’ 4,800, what will be the Interest on Capital for X and Y?

(a) ₹ 5,000 and ₹’3,000

(b) ₹ 3,000 and ₹ 1,800

(c) No interest will be paid to the partners

(d) None of the above (Dec 2019, 1 x 10=10 marks)

Answer:

(b) ₹ 3,000 and ₹ 1,800

Match the following:

| Column A |

Column B |

| (i) Endorsement |

(A) AS 10 |

| (ii) Amortisation |

(B) Depreciation |

| (iii) Average Clause |

(C) Bills Receivable |

| (iv) Recoverable Amount |

(D) Insurance Claim |

(1 x 4 = 4 marks)

Answer:

| Column-A |

Column-B |

| (i) Endorsement |

(C) Bills Receivable |

| (ii) Amortisation |

(B) Depreciation |

| (iii) Insurance Claim |

(D) Average Clause |

| (iv) Recoverable Amount |

(A) AS 10 |

State with reason whether the following statements are ‘True’ or ‘False’ (No Marks shall be awarded without valid reason):

i. Prudence is a concept to recognize all losses and not profits.

Answer:

False: Prudence is a concept to recognize all unrealized losses and not profits.

ii. Revenues are matched with expenses in accordance with the matching principle.

Answer:

False: Expenses are matched with revenùes in accordance with the matching principle. The concept of matching requires accrual and periodicity concepts as accrued reyenues are matched with accrued expenses of a definite accounting period.

iii. Depreciation is non-cash and non-operating expense which is to be provided for if there are profits.

Answer:

False: Depreciation is a non-cash, operating expense which is to be provided for whether there are profits or losses.

iv. Net Profit is reflected in higher cash balances and net loss is reflected in lower net worth.

Answer:

False: Net profit may not be reflected in higher cash balance because of credit transactions. On the other hand, cash may increase due to fresh loan or fresh capital. Net Worth may also be reduced by withdrawal by the proprietor/partners. So lower net worth may not necessarily reflect net loss.

v. If Partnership Deed is silent, Rate of Interest on loan by firm to a Partner shall be 6% p.a. (1×5 = 5 marks)

Answer:

False: The Partnership Act 1932, has not prescribed any Rate of Interest on Loan by firm to Partner.

Fill in the blanks:

(i) …………………. method for depreciation is followed to have a uniform charge for depreciation and repairs and maintenance together.

Answer:

Reducing balance

(ii) Reserve for Discount on Creditors has a …………………… balance.

Answer:

Debit

(iii) …………………….. can be made payable to the bearer.

Answer:

Bills Receivable

(iv) The gain from sale of capital assets need not be added to revenue to ascertain the ……………………… of a business.

Answer:

Operating Profit or Loss

(v) property may be the subject matter of consignment. (Dec 2019, 1 x 5 = 5 marks)

Answer:

Movable

Question 75.

In hire purchase system, cash price plus interest is known as …………………. .

(1) Hire purchase charges.

(2) Capital value of asset.

(3) Hire purchase price of assets.

(4) Book value of asset.

Answer:

(3) Hire purchase price of assets.

Question 76.

Depreciation is calculated from the date of-

(1) Assets put to use.

(2) Purchase of assets.

(3) Assets installed.

(4) Receipts of assets at business practices.

Answer:

Answer:

(1) Assets put to use.

Question 77.

Debit balance in the cash book is equivalent to:

(1) Overdraft as per cash book.

(2) None of these.

(3) Credit balance as per Passbook.

(4) Overdraft as per Passbook.

Answer:

(3) Credit balance as per Passbook.

Question 78.

Main elements of the accounting equation are:

(1) Cash, stock, and debtors.

(2) Bank balance, Investments, and bills receivable.

(3) Assets, liabilities, and capital.

(4) Capital, creditors, and bills payable.

Answer:

(3) Assets, liabilities, and capital.

Question 79.

A Bill of Exchange cannot be:

(1) Endorsed.

(2) Crossed.

(3) None of these.

(4) Accepted.

Answer:

(2) Crossed.

Question 80.

Spent amount on unsuccessful promotion policy is:

(1) Capital expenditure.

(2) Expenses.

(3) Revenue expenditure.

(4) Deferred revenue expenditure.

Answer:

(1) Capital expenditure.

Question 81.

Convention of Conservatism takes into account:

(1) All tutu re profits and not losses.

(2) Neither profits nor losses of the future.

(3) All future losses and not profits.

(4) All future profits and losses.

Answer:

(3) All future losses and not profits.

Question 82.

Balance Sheet is prepared with the balances of which of the following?

(1) All balances in the Ledger.

(2) Balances of real accounts.

(3) Balances of personal accounts.

(4) Balances of personal and real accounts.

Answer:

(4) Balances of personal and real accounts.

Question 83.

Which of these terms/concepts are not relevant to a joint venture?

(1) Co venturers.

(2) Temporary partnership.

(3) Principal and agent relationship.

(4) Sharing profit and loss of joint ventures.

Answer:

(3) Principal and agent relationship.

Question 84.

Sold goods worth list price of 8,000 at 10% trade discount and 2% cash discount. 25% received at the time of transaction only. The amount posted to the discount account will be:

(1) ₹ 144 on credit side.

(2) ₹ 36 on debit side.

(3) ₹ 144 oh debit side.

(4) ₹ 40 on credit side.

Answer:

(2) ₹ 36 on debit side

Question 85.

Bills payable honoured during the year, will be debited to.

(1) None of these.

(2) Creditors amount.

(3) Bills payable account.

(4) Cash account.

Answer:

(3) Bills payable account.

Question 86.

Which of the following is not an essential feature of a partnership firm?

(1) Mutual agency.

(2) Existence of business.

(3) Association of two or more people.

(4) Compulsory registration. ‘

Answer:

(4) Compulsory registration.

Question 87.

Sacrificing ratio is:

(1) New Profit sharing ratio – old profit sharing ratio.

(2) Equal to old profit-sharing ratio.

(3) Equal.

(4) Old profit sharing ratio- new profit sharing ratio.

Answer:

(4) Old profit sharing ratio – new profit sharing ratio.

Question 88.

Which of the following statements is not correct?

(1) Bad debts can be less than the amount of provision for doubtful debts.

(2) Bad debts can be more than the amount of provision for doubtful debts.

(3) Provision for doubtful debts account is the amount payable to debtors.

(4) . Provision for doubtful debts is shown in the balance sheet.

Answer:

(3) Provision for doubtful debts account is the amount payable to debtors.

Question 89.

Errors are:

(1) Frauds.

(2) Undetected mistake.

(3) Intentional mistake.

(4) Unintentional mistake.

Answer:

(4) Unintentional mistake.

Question 90.

Choose the correct statement.

(1) Financial statements need not take into consideration any statutory requirement.

(2) Only credit transactions are recorded in books of accounts.

(3) Financial statements prepared by two different accountants will always show identical results.

(4) Financial accounts, of an enterprise, are treated as evidence in the Court of Law.

Answer:

(4) Financial accounts, of an enterprise, are treated as evidence in the Court of Law.

Question 91.

Which of these is/are one of the methods of stocktaking?

(1) Periodic inventory

(2) Perpetua inventory.

(3) Both.

(4) None

Answer:

(3) Both. (Dec 2021,1 x 17 = 17 marks)