Profits and Gains of Business or Profession – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Profits and Gains of Business or Profession – CMA Inter Direct Tax Study Material

Short Notes

Question 1.

Write short note on Tax audit requirements in the case of notified professions. (Dec 2021, 3 marks)

Answer:

In the case of persons carrying on notified profession, the provisions of tax audit contained in section 44AB would be attracted when the gross receipt exceeds ₹ 50 lakhs in the previous year. However, where the gross receipt does not exceed ₹ 50 lakhs. the assessee must admit income @ 50% or more of the gross receipt in order to be eligible for exemption from tax audit.

Thus, by default the provisions of section 44ADA would apply. Where the assessee has gross receipt below 50 Iakhs and does not want to admit income of 50% or more of the gross receipts, then the books of account have to be maintained under section 44AA and have to be audited under section 44AB. In such case, the presumptive provision contained in section 44ADA would not be applicable.

Descriptive Question

Question 2.

Name any four specified businesses covered under section 35AD and state the fiscal incentives available to such businesses.

(Dec 2012, 5 marks)

Answer:

Specified businesses covered by Section 35AD are:

- Setting up and operating cold chain facilities for specified products.

- Setting up and operating warehousing facilities for storing agricultural produce.

- Laying and operating cross-country natural gas or crude or petroleum oil pipeline network for distribution, including storage facilities being as integral part of such network.

- Building and operating, anywhere in India, a hotel of two-star or above category as classified by CG.

- Building and operating, anywhere in India, a hospital with at least one hundred beds for patients.

- Developing and building a housing project under a scheme for slum redevelopment or rehabilitation framed by the Central Government or State Government, as the case may be, and notified by the CBDT in this behalf in accordance with the guidelines as may be prescribed.

- Developing and building a housing project under a scheme for affordable housing framed by the Central Government or State Government, as the case may be, and notified by the CBDT in this behalf in accordance with the guidelines as may be prescribed.

- Production of fertilizer in India in new plant or in a newly installed capacity in an existing plant. (w.e.f. 1-4-2012)

Availability of Fiscal Incentives:

100% of the capital expenditure incurred, wholly and exclusively, for the purpose of any specified business carried on by the assessee shall be allowed as deduction during the previous year in which such expenditure is incurred by him. However, expenditure towards acquisition of land, goodwill or financial instrument would not be eligible for deduction.

The loss of an assessee on account of a “specified business” claiming deduction u/s 35 would be allowed to be set off against the profits of any other specified business under section 73A, whether or not the latter is eligible for deduction u/s 35 AD.

Question 3.

Discuss whether it is required on the part of an assessee desiring to claim deduction of bad debt written off,to prove that the debt written off in the books as irrecoverable or bad debt, is incapable of recovery or that the said debt had really turned bad. (Dec 2012, 4 marks)

Answer:

Write-off of bad debt

Bad debts to be allowed as deduction only in the year in which they become irrecoverable on the basis of recently notified income computation and disclosure standards without recording the same In the accounts [Section 36(1)(vU)] [W.e.f. A.Y. 2016-17]

Where the amount of debt or part thereof which has been taken into account in computing the income of the assessee of the previous year in which the amount of such debt or part thereof becomes irrecoverable or of an earlier previous year on the basis of income computation and disclosure standards notified under section 145(2) without recording the same in the accounts, then, such debt or part thereof shall be allowed in the previous year in which such debt or part thereof becomes irrecoverable and it shall be deemed that such debt or part thereof has been written of as irrecoverable ¡n the accounts for the purposes of this clause.

Question 4.

Please state the deductibility of the following expenses:

(i) Litigation expenses for restraining another company from using assessee’s trademark.

(ii) Brokerage paid for raising loan to finance assessee-company’s business.

(iii) Compensation paid to cancel purchase order of a machine due to abnormal rise in its price. Assessee claims it as a trading loss. (Dec 2012, 6 marks)

Answer:

(i) Litigation expenses for restraining another company from using assessee’s trade mark, is one expended out of commercial

expediency, wholly and exclusively for the purchase of the business; being revenue expenditure, the same is an allowable expenditure u/s 37.

(ii) As per Section 37 deduction of expenditure ¡s allowed if it is done to expend wholly and exclusively for the purpose of such business or profession. In this case brokerage paid for raising loan to finance business is a deductible expenditure u/s 37 as it is incurred wholly and exclusively for the purpose of the business. If any tax is deductible at source u/s 194-H, the same has to be done; the provisions of Section 40(a)(ia) should not be contravened.

(iii) As per Section 37 deduction of expenditure is not allowed if it’s nature of capital expenditure. In this case compensation paid to cancel purchase order of a machine, ¡s a capital expenditure. It cannot be deducted u/s 37. As there is no ‘transfer’ of any capital asset, compensation paid cannot be claimed as a Capital loss also.

Question 5.

State who are the persons not eligible to avail any benefit u/s 44 AD. (June 2013, 2 marks)

An assessee owned a light commercial vehicle for 8 months and 3 days, a medium goods vehicle for 11 months, and another medium goods vehicle for 12 months during the previous year. Compute his profits from the three trucks In terms of Section 44 AE. (June 2013, 2 marks)

Answer:

Sec. 44AD: Special provision for computing profit and gains of business of civil construction.

(i) The following persons are not eligible u/s 44AD.

- Person carrying on profession as referred to in Section 44AA(1)

- A person earning income in the nature of commission or brokerage;

- A person carrying on any agency business; or

- A person who is in the business of plying, hiring or leasing goods carriages.

- Note: Section 44AA – maintenance of books of accounts by certain person cam/in g on profession or business.

(ii) Provision of Section 44AE for transporters:

A taxpayer who own not more than 10 goods carriage and is engaged in the business of plying, hiring, and leasing of goods carriage, his income would be deemed to be ₹ 7,500 per goods carriage per month. So, profit and gain of the assessee u/s 44AE would be:

(7,500 x 9) + (7,500 x 11) + (7,500 x 12) = ₹ 2,40,000

Amendment to [Section-44AE]

Section 44AE(2) has been substituted (with effect from the assessment year 2019-20) so as to provide that for a heavy goods vehicle, the profits and gains shall be an amount equal to ₹ 1,000 per ton of gross vehicle weight (or unladen weight) for every month (or part of a month) during which the heavy goods vehicle is owned by the assessee in the previous year or an amount claimed to have been actually earned from such vehicle, whichever is higher.

In the case of a goods carriage other than heavy vehicle, the profits and gains shall be an amount equal to ₹ 7,500 for every month (or part of a month) during which the goods carriage is owned by the assessee in the previous year or an amount claimed to have been actually earned from such goods carriage, whichever is higher. For this purpose, “heavy goods vehicle” means any goods carriage the gross vehicle weight of which exceeds 12,000 kilograms.

Question 6.

State the deductibility of the following expenses while computing the business income:

(i) Anticipated hedging loss under a contract to purchase raw material;

(ii) Consultation fees paid to tax advisor;

(iii) Advertisement expenses incurred outside India in foreign currency. RBI permission has not been obtained;

(iv) 500 VIP briefcases costing 2,000 each presented to customers;

(v) Travelling expenses incurred to explore the feasibility of new line of business;

(vi) The assessee claims the setoff of unabsorbed depreciation of a discontinued business against the profits of another business. (June 2013, 6 x 1= 6 marks)

Answer:

The deductibility of the following expenses while computing the business income:

(i) Anticipated hedging loss under a forward contract is not allowed to be deducted

(ii) Consultation fees paid to tax advisor is allowed under section 37(1).

(iii) Advertisement expenses incurred in India or outside India is allowed to be deducted under section 37(1), provided it is not of a capital nature and it is incurred wholly and exclusively for the purpose of business. Permission of RBI is not relevant.

(iv) Presentation of VIP bags to customers is allowed as expenditure on advertisement under section 37(1). There is no ceiling limit for gift articles.

(v) Travelling expenditure for exploring new line of business is a capital expenditure. It is not allowed under sec. 37(1). It may be capitalized for the purposes of Sec. 35D.

(vi) Unabsorbed depreciation of a discounted business now can be set off against the profits of any other business and thereafter against income of any other head.

Question 7.

State the conditions to be fulfilled for deduction in respect of write-off of bad debt. (Dec 2013, 3 marks)

Answer:

Write-off of bad debt

Bad debts to be allowed as deduction only in the year in which they become irrecoverable on the basis of recently notified income computation and disclosure standards without recording the same In the accounts [Section 36(1)(vU)] [W.e.f. A.Y. 2016-17]

Where the amount of debt or part thereof which has been taken into account in computing the income of the assessee of the previous year in which the amount of such debt or part thereof becomes irrecoverable or of an earlier previous year on the basis of income computation and disclosure standards notified under section 145(2) without recording the same in the accounts, then, such debt or part thereof shall be allowed in the previous year in which such debt or part thereof becomes irrecoverable and it shall be deemed that such debt or part thereof has been written of as irrecoverable ¡n the accounts for the purposes of this clause.

Question 8.

Briefly explain the deduction allowable u/s 37 of the Income Tax Act, 1961 in respect of income from business or profession.

(June 2014, 4 marks)

Answer:

General Deduction [Section 37(1)]

Section 37(1) is a residuary section. In order to claim deduction under this Section, the following conditions should be satisfied:

- The expenditure should not be of the nature described under sections 30 to 36.

- It should not be in the nature of capital expenditure.

- It should not be personal expenditure of the assessee.

- It should have been incurred in the previous year.

- It should be in respect of business carried on by the assessee.

- It should not have been incurred for any purpose which s an offence or is prohibited by any law. Thus, penalty paid under any law is not deductible.

Question 9.

Attempt the question below:

What is the rate of tax applicable to income of a non-resident sportsman who is a foreign national by way of participation in any sport in India? (June 2015, 1 mark)

Answer:

20%.

Question 10.

Name any tour businesses which are eligible for deduction under section 35AD of the Income-tax Act, 1961. (June 2015, 4 marks)

Answer:

Section 35AD: Deduction in respect of expenditure on specified business.

Eligible businesses u/s 35AD:

The following businesses are specified business as per Section 35AD(8):

- Setting up and operating a cold chain facility

- Setting up and operating a warehouse facility for storage of agricultural produce.

- Laying and operating a cross-country natural gas or crude or petroleum oil pipeline network for distribution, including storage facilities being an integral part of such network.

- Building and operating, anywhere in India. a hotel of two star or above category as classified by the Central Government.

- Building and operating, anywhere in India, a hospital with at least one hundred beds for patients.

- Developing and building a housing project under a scheme for slum redevelopment or rehabilitation framed by the Central Government or State Government, as the case may be and notified in this behalf.

- Developing and building a housing project under a scheme for affordable housing framed by the Central Government or State Government, as the case may be and notified in this behalf.

- Production of fertilizers in India.

- Setting up and operating an inland container depot or a container freight station notified or approved under the Customs Act, 1962. Bee-keeping and production of honey and beeswax.

- Setting up and operating a warehouse facility for storage of sugar.

- Laying and operating a slurry pipeline for the transportation of iron ore; Setting and operating a semiconductor wafer fabrication manufacturing unit notified by the Board in accordance with such guidelines as may be prescribed.

Question 11.

When are the books of account of a person engaged in notified profession liable for audit under section 44A6? What is the penalty is leviable for failure to get the accounts audited? (June 2015, 2 marks)

Answer:

Every person carrying on profession shall, if his gross receipts in profession exceed ₹ 50 lakhs in any previous year must get his accounts audited under section 44AB. For failure to get the accounts audited the penalty leviable is 0.5% of the gross receipt or ₹ 1,50,000 – whichever is less (Section 271 B).

Question 12.

Answer the following question with brief reason/working:

Are profits on transfer of shares and securities held by a Foreign Institutional Investor chargeable to tax under the head “profits and gains of business or profession” or “capital gains”? (Dec 2015, 2 marks)

Answer:

Profit/gain on transfer of share and securities held by a foreign institutional investor shall be chargeable to tax under the head ‘capital gain’.

Practical Questions

Question 13.

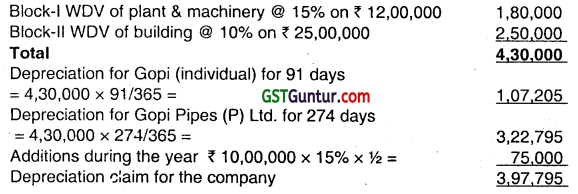

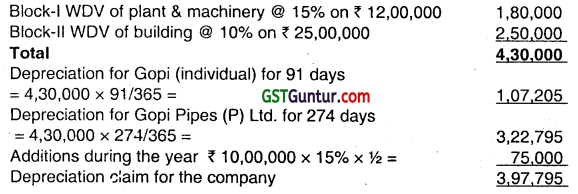

Mr. Gopi carrying on business as proprietor converted the same into a limited company by name Gopi Pipes (P) Ltd. from 01.07.2022. The details of the assets are given below:

Block – I WDV of plant & machinery (rate of depreciation @15%) ₹ 12,00,000

Block – II WDV of building (rate of depreciation @10%) ₹ 25,00,000

The company Gop Pipes (P) Ltd. acquired plant and machinery in December 2022 for ₹ 10,00,000. It has been doing the business from 01.07.2023. Compute the quantum of depreciation to be claimed by Mr. Gopi and successor Gopi Pipes (P) Ltd. for the assessment year 2023-24.

Note: Ignore additional depreciation. (Dec 2012, 5 marks)

Answer:

Computation of depreciation for the Assessment Year 2023-24 u/s 32

The asset acquired during the year is used for less than 180 days, hence 50% of the depreciation will be allowed.

Question 14.

‘A’ Ltd. owns two plants: Plant X and Plant Y, as on April 1, 2022 (rate of depreciation: 15% depreciated value on 01.04.2022:

₹ 2,37,000).

The company purchased Plant Z on May 31, 2022 for ₹ 20,000.

It sells Plant X (on April 10, 2022) and Plant Y (on December 11, 2022), and Plant Z (on March 1, 2023) for ₹ 40,000; ₹ 36,000 and ₹ 24,000 respectively. Find out the WDV of the block of assets on 31.03.2023. Explain the treatment relating to depreciation and allied issues relating to the above. What is the opening WDV of the block as on 01.04.2023? (Dec 2012, 5 marks)

Answer:

Written down value of the block of assets will be determined as below:

| Amount |

₹ |

| Opening WDV of the block consisting of Plants X & Y |

2,37,000 |

| Add: Cost of Plant Z (Because Put to use> 180 days) |

20,000 |

| Total |

2,57,000 |

| Less: Sale of Plants X, Y, and Z |

1,00,000 |

| Short-Term Capital Loss |

1,57,000 |

Note:

- No depreciation is allowable as the block of assets ceases to exist on the last day of the previous year, since all plants are sold.

- As per Section 50(2) ₹‘ 1,5 7,000 will be treated as short-term capital loss on sale of the assets,

- On 1st of April, 2022 the WDV will be taken as ‘NIL’.

Question 15.

Please advise regarding admissibility of the following items of expenditure:

(i) Pa,ment of interest of ₹ 40,000 on monies borrowed from bank for payment of dividends to shareholders.

(ii) ₹ 12000 has been expended for shifting of business from the original site to another place which is more advantageously located.

(iii) Lump sum paid to acquire a licence regarding technical information to reduce production cost.

(iv) Expenses for registration of trademarks.

(v) Theft of stock-in-trade assuming

(a) it is insured

(b) it was uninsured (June 2013, 10 marks)

Answer:

(i) Loan utilized for payment of dividend. This is allowable u/s. 36(1)(iii).

(ii) Shifting expenses of business premises results in an expenditure of enduring benefit. It is a capital expenditure and hence it is not allowable.

(iii) Payment made to acquire license regarding technical information is a capital expenditure. Only depreciation is allowed on such cost u/s 32.

(iv) Expenditure incurred for registration of a trademark is a revenue expenditure. It is allowable u)s 38(1).

(v) Loss of stock in trade due to theft is allowed as incidental to business. However, if it is insured, insurance compensation received will be a trading receipt.

Question 16.

Answer the following sub-divisions briefly in the light of the provisions of the Income-tax Act, 1961:

(i) Interest on bank term loan paid during financial year 2022-23 was ₹ 1,21,000. Outstanding as on 31.03.2023 was ₹ 28,000. The assessee paid ₹ 15,000 before the “due date” for tiling the return of income under section 139(1). Is the amount paid after the end of the year be eligible for deduction?

(ii) A nationalized bank gave interest reduction of ₹ 1,70,000 in a cash credit account of a trader relating to earlier years. Is the interest reduction chargeable to income tax? Said interest had not been paid to the bank.

(iii) A windmill was installed in June, 2022 for ₹ 200 lakhs. What is the rate of normal depreciation applicable on such windmill?

(vi) A company-owned chain of star hotels in India. It has been availing deduction under section 35AD. In December, 2022, it transferred the operation of hotels (all above two-star category) to another group company. Is it eligible to avail the benefit of Section 35AD even after the transfer of operating the hotels? (Dec 2013, 1 x 4 = 4 marks)

Answer:

(i) The amount of interest paid before the due date for filing the return is eligible for deduction under section 43B. Thus the amount paid after the end of the account year but before the due date for filing the return of income is deductible.

(ii) Since the interest payment would not have been allowed earlier in view of Section 43B, the waiver is also not chargeable to tax by invoking Section 41(1) of the Act.

(iii) CBDT has amended the Income Tax Rules to restrict the depreciation allowed on windmills installed on or after 1 April 2012 to 15%. (Notification No 15/2012).

(iv) As per Section 35AD (6A) transfer of operation of hotels will not deny the assessee from availing or continuing to avail the benefits of Section 35AD.

Question 17.

State, with reasons, the deductibility or taxability of the following items in computation of income under the head “Profits and gains of business or profession”:

(i) Profit of ₹ 10 lacs on sale of import entitlement.

(ii) A sum of ₹ 15 lacs was spent for acquiring one equipment used for in house scientific research project which was approved by the prescribed authority.

(iii) Share of profit of ₹ 12 lacs as partner of a partnership firm.

(iv) Expenditure on purchase of raw materials amounting to ₹ 5 lacs from a concern owned by son of the Managing Director of the assessee company.

(v) Interest of ₹ 10 lacs on loan taken from a bank for acquiring a machine in connection with expansion project of the assessee. Loan was taken on 1st April, 2022 and the machine was put to use on July, 2022. (Dec 2013, 8 marks)

Answer:

(i) Profit on sale of import entitlement is chargeable to tax under the head “Profits or gains from business or profession” as per charging Section 28.

(ii) The assessee is entitled to claim a deduction at 100% of the amount of capital expenditure on in-house scientific research programme approved by the prescribed authority [Section 35 (2AB)]: Amount of Deduction = 15 lacs.

(iii) Partner’s share in profits of firm is specifically exempted under section 10 (2A) in the hands of the partner.

(iv) Such expenditure is allowed unless it is found that the payment is excessive or unreasonable having regard to the fair market value of raw materials received. In such case the excess amount, if any, shall be disallowed under section 40A (2).

(v) Interest on loan for the period from 1 April 2022 to 1st July 2022 i.e. ₹2.50 lacs ( 10 lacs × 3/12) shall not be allowed under section 36 (1) (iii). The balance interest i.e. 7.50 lacs can be claimed under section 36 (1) (iii). Interest to the extent of ₹ 2.50 lacs shall be added to the cost of machine and depreciation can be claimed.

Question 18.

Zoom Ltd. acquired a machinery from Japan on 17.08.2021 for $ 2,50,000. The eligible rate of depreciation is 15% and ¡t ¡s used regularly from 10.09.2021. The exchange rate at the time of acquisition was ₹ 50 per dollar and the company paid $ 1,50000. The balance payment to the supplier i.e. $ 1,00,000 was paid in September, 2022 when the exchange rate was ₹ 54 per dollar. Compute depreciation for the assessment year 2023-24. Ignore additional depreciation. (Dec 2013, 4 marks)

Answer:

Answer:

Exchange fluctuation and depreciation

| Particulars |

₹ |

| 17.08.2021: Cost of acquisition $ 2,50,000 x ₹ 50 |

1,25,00,000 |

| Less: Depreciation for the financial year 2021 – 22 @ 15% |

18,75,000 |

| WDV as on 01-04-2022 |

1,06,25,000 |

| Add: Exchange fluctuation in September 2022 |

|

| $ 1,00,000 x ₹ 4 each |

4,00,000 |

| Block value |

1,10,25,000 |

| Depreciation @ 15% for the financial year 2022-23 |

16,53,750 |

Question 19.

State, with brief reason, whether disallowance attracted under any provision of the Income Tax Act, 1961 in the following cases, while computing income under the head ‘Profits and gains of business or profession’:

(i) Salary of ₹ 3,00,000 to each working partner by a firm without deduction of tax at source.

(ii) Interest to a nationalized bank on term loan ₹ 72,000 of which the amount actually paid during the year was ₹ 40,000 and ₹ 15,000 was paid before the ‘due date’ for filing the return of income.

(iii) Demerger expenses of ₹ 7,00,000 wholly debited to profit and loss account.

(iv) Expenditure incurred towards issue of bonus shares ₹ 2,00,000. (Dec 2014, 4 marks)

Answer:

(i) Salary paid to each working partner by a firm ₹ 3,00,000 without deduction of tax at source will not attract disallowance under section 40a(ia). However, based on book profit of the firm and subject to the limits in Section 40(b), disallowance may apply.

(ii) Interest paid to a nationalized bank on term loan during the year ₹ 40,000 and the amount paid before the ‘due date’ for filing the return ₹ 15,000 are eligible for deduction as there will be no disallowance u/s 43B. The balance of ₹ 17,000 will be disallowed under section 43B.

(iii) Demerger expenses applicable for companies contained in Section 35DD of ₹ 7,00,000 is deductible in five equal annual installments. Therefore, ₹ 1,40,000 is allowable and ₹ 5,60,000 would be disallowed.

(iv) Expenditure incurred towards issue of bonus shares ₹ 2,00,000 is deductible and would not attract any disallowance. Issue of bonus shares would not bring any fresh inflow of funds or increase in capital employed, hence, the expenditure is fully deductible. CIT vs. General Insurance Corporation (2006) 286 ITR 232 (SC).

Question 20.

Sarath Ltd., engaged in manufacturing activity, acquired new plant for ₹ 30 crores in August 2022 which was put to use from

15.09.2022 Compute depreciation, additional depreciation under section 32(1 )(iia) and investment allowance under section 32AC of the Income-tax Act, 1961 for the plant. Quantify the written-down value of asset as it would be on 31.03.2023. (June 2015, 4 marks)

Vivitha Pipes Ltd. set up a new unit for extension of its manufacturing activity. It incurred 45 Iakhs towards preliminary expenses. The cost of the project is ₹ 600 lakhs and the amount of capital employed is ₹ 700 lakhs. Determine the amount eligible for amortization under section 35D and the period of amortization. (June 2015, 6 marks)

Answer:

(a)

| Particulars |

|

₹ in lakhs |

| Normal depreciation at 15% on ₹ 30 crores |

A |

450 |

| Additional depreciation at 20% on ₹ 30 crores |

B |

600 |

| Investment allowance under section 32AC at 15% on ₹ 30 crores |

C |

450 |

| Closing WDV = ₹ 30 crores – Depreciation – Additional depreciation [i.e. ₹ 30 crores – A – B] = ₹ (30 crores – 4.50 crores – 6 crores) |

|

1950 |

Note: Investment allowance under section 32A C will not reduce the block value of assets.

Answer:

(b) Amortization of preliminary expenses:

Preliminary expenses are eligible for amortization in 5 equal annual installments.

In the case of company, 5% of the cost of the project or the capital employed shall be considered for computing the amount eligible for amortization.

5% of the cost of the project =₹ 600 lakhs × 5% = ₹ 30 lakhs

5% of the capital employed = ₹ 700 lakhs × 5% = ₹ 35 lakhs

Actual preliminary expenditure incurred = ₹ 45 lakhs.

The assessee hence is eligible to amortise ₹ 35 lakhs under section 35D.

Amount eligible for amortization for 5 years = ₹ 7 lakhs for each year.

Question 21.

Vimala Pharma Ltd. informs that it has net profit of ₹ 60 lakhs for the year ended 31 March, 2023. II gives you the following further information:

(i) Depreciation as per books ₹ 3,50,000.

(ii) Bad debts written off in the books ₹ 5,00,000, which includes ₹ 1 lakh due from one customer who has disputed the liability to pay but continues to have business relationship with the company.

(iii) Proposed dividend debited to Profit and Loss Account ₹ 6 lakhs.

(iv) One machinery which has become useless has been written off in the P & L Account, the amount debited being ₹ 90,000.

(v) Provident Fund collections from employees for the year ₹ 1,50,000 and company’s own contribution of ₹ 1,10,000 for the year have not been remitted. These amounts are shown as Sundry Liability in the books. Assume it will be remitted after 31st December, 2023.

(vi) Income from agricultural lands surrounding the factory ₹ 50,000 credited to Profit and Loss Account.

(vii) Bank term loan for purchase of machinery waived ₹ 2 lakhs is credited to capital reserve account.

(viii) The opening WDV of plant and machinery was ₹ 15,90,000. One machinery for ₹ 4,10,000 was acquired on 01.06.2021 and was put to use immediately.

(ix) Provisions for taxation debited in the Profit and Loss Account amounts to ₹ 15 lakhs.

You are requested to compute the income of the company under the head ‘Profits and gains of business or profession’ for the assessment year 2023- 24. (June 2015, 9 marks)

Answer:

Question 22.

Answer the following questions with brief reasons/workings:

The Statement of Profit and Loss of KCL Limited is debited by an amount of ₹ 1,20,000 in respect of an advertisement of company’s product in a newspaper owned by a political party. Is such expense allowable in computation of income from business? (Dec 2015, 2 marks)

The Statement of Profit and Loss of a company includes interest of ₹ 5,00,000 on a loan taken for financing its expansion scheme. The machineries purchased with the borrowed amount were in transit at the end of the year. Is such interest allowable as deduction in computation of the company’s business income? (Dec 2015, 2 marks)

Answer:

Advertisement expenses is allowed to be deducted u/s 37(1); provided it is not of a capital nature and it is incurred wholly and exclusively for the purpose of business. Hence, the amount of ₹ 1,20,000 is allowable as deduction u/s 37(1).

Section 36(1 )(ii) provided that any amount of the interest paid in respect of an asset for extension of existing business or profession (whether capitalized in the books of accounts or not) for arty period beginning from the date on which the capital was borrowed for acquisition of the asset till the date on which such asset was first put to use, shall not be allowed as deduction. So, the amount of interest of ₹ 5,00,000 is not allowed as deduction because it is the interest on borrowing of machines for expansion schemes.

Question 23.

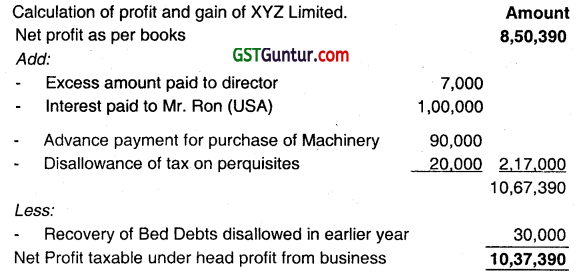

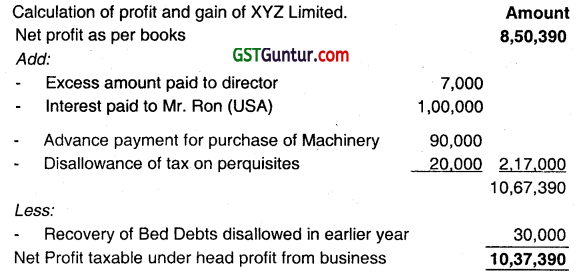

The Statement of Profit and Loss of XYZ Limited for the previous year 2022-23 shows a net profit of ₹ 8,50,390 after

debiting/crediting the following ¡tems:

(i) Purchase of goods for ₹ 42,000 (market value ₹ 35,000) from one of the directors of the company.

(ii) Interest of ₹ 1,00,000 paid on loan taken from Mr. Ron of USA without deducting tax at source.

(iii) Advance of ₹ 90,000 paid in earlier year for purchase of machinery written off.

(iv) Income tax on perquisites of employees paid by the company ₹ 20,000.

(v) Recovery of bad debt of ₹ 30,000 which was disallowed in previous assessment of the company. Compute income of XYZ Limited under the head “profits and gains of business or profession” for Assessment Year 2023-24 indicating reasons for treatment of each item. (Dec 2015, 6 marks)

Answer:

Notes:

(i) If the payment to director is excessive or unreasonable having regard to the fair market value of the material. In such case the excess amount shall be disallowed under section 40(a)(2).

(ii) In the case of interest paid to non-resident, there is a obligation to deduct tax at source u/s 195, hence non-deduction of tax at source will attract disallowance u/s 40(a)(i).

(iii) Advance paid for purchase of machine is a capita! expenditure. Hence, it’s not allowed as deduction.

(iv) Income tax on perquisites is allowable expense.

(v) As per Section 41(4), bad debts, earlier claimed as deduction 8 disallowed, ¡f recovered subsequently, then such recover1’ shall not be taxable as business gain/income.

Question 24.

Mr. Sivasankar carrying on trading business could not recover ₹ 1,00,000 due from a customer. He deems that the amount is not recoverable and hence has to be written off as bad debt. State the conditions that are to be satisfied for allowance of bad debt claim. (June 2016, 3 marks)

Mr. Ghosh established an undertaking in a notified backward area in the State of West Bengal. He invested ₹ 150 lakhs in June, 2022 towards acquisition of plant and machinery and was engaged in manufacturing activity. The regular rate of depreciation on such machineries is 15%.

Advise the maximum amount of deduction that Mr. Ghosh could avail by way of depreciation, additional depreciation, and deduction under section 32AD of the Income-tax Act, 1961. State the closing WDV of the plant and machinery after such claim. (June 2016, 4 marks)

Answer:

(a) Bad debt write-off is eligible for deduction in computing income under the head “Profits and Gains of business or profession” if the stipulated conditions are satisfied:

- The debt should be incidental to the business.

- The debt should have been taken into account in computing the income of the assessee or it should represent money lent in the ordinary course of banking or money lending business; and

- It should be written off in the books of account. If the assess is able to satisfy all the three conditions given above, he can claim the same as bad debt.

(b) Depreciation, additional depreciation, and WDV (₹ In Lacs)

| Particulars |

₹ |

| Normal depreciation u/s 32 at 15% of the actual cost of plant and machinery (15% of ₹ 150 lakhs). (Assumed that the new machinery has been put of use for more than 180 days) |

22.5 |

| Additional depreciation under section 32 (iia) (20% of ₹ 150 lakhs) |

30 |

| Closing WDV of the plant and machinery (150-52.5) |

97.5 |

Besides depreciation and additional depreciation, the assessee can claim 15% deduction under section 32AD for the investment in new plant and machinery in setting up an undertaking in notified backward area in the State of West Bengal. Thus he can claim 15% of the actual cost of plant and machinery being ₹ 22.50 lakhs. This is not deductible while computing the WDV. However, this amount will not go to reduce the written-down value of the assets.

Question 25.

State, with reasons, whether the following items are allowable as deduction in computation of income of Tyagi Aluminium Limited under the head ‘profits and gains from business or profession’ or otherwise:

(i) Contribution of ₹ 1,20,000 to political party on the occasion of its silver jubilee.

(ii) Interest of ₹ 80,000 paid to bank on loan taken and utilized for payment of dividend.

(iii) Fees of ₹ 75,000 paid to independent directors for attending board meetings without deduction of tax at source under Section 194J.

(iv) Interest of ₹ 40,000 on bank overdraft utilised for payment of dividend.

(v) Few customers are irregular in payment of dues against sale proceeds, for which provision for bad and doubtful debts has been created by debiting Statement of Profit & Loss. (Dec 2016, 1 x 5 = 5 marks)

Answer:

(i) U/s 80 GGB: Deduçtion in respect of contributions given by companies to Political Parties is allowed as deduction if paid by Account Payee Cheque. It is assumed that contributions made by Company to Political Party by Cheque. Therefore, deduction U/s 80 GGB will be allowed.

(ii) Interest of ₹ 80,000 paid to Bank on loan taken and utilised for payment of dividend will be allowed u/s 36 (1) (iii).

(iii) 30% of ₹ 75,000 i.e. ₹ 22500 will be disallowed due to non deduction of TDS u/s 194 J (ba) @ 10%.

(iv) Interest of ₹ 40,000 on Bank Overdraft utilised for payment of dividend will be allowed u/s 37.

(v) Provision for Bad and doubtful Debts will not be allowed as deduction.

Question 26.

Under Section 43B of the Income-tax Act, certain items are allowed only on actual payment basis, regardless of the method of accounting followed by the assessee. Name four such items and the due date by which they can be paid to claim deduction in the current year itself. (Dec 2016, 5 marks)

Answer:

Expenses allowed on actual payment basis u/s 43 B:

- Bonus & commission.

- Interest on loan or advances taken from Schedule Banks.

- Any sum payable by the assessee to the Indian Railways for the use of Railway Assets.

- Any sum payable by the assessee by way of tax, duty, less or fee whatever name called, under any law for time being in force.

- Any Interest on any loan or borrowings from public financial institutions or state financial corporations.

- Any sum payable by an employer in lieu of any leave at the credit to his employee.

- Due date for payment is on or before the due date for furnishing of Return of Income u/s 139(1).

Question 27.

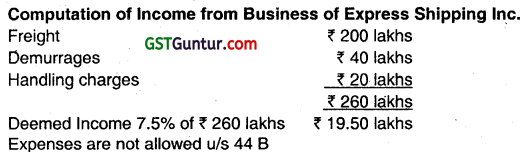

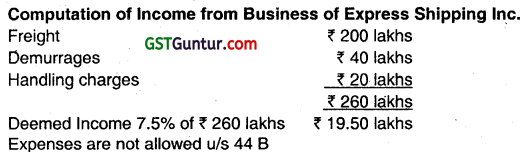

Express Shipping Inc., a foreign company operating its ships in Indian ports during the previous year 2022-23 had collected the revenue as follows:

| Freight (including ₹ 40 lakhs collected in US dollar for the cargo booked for Pradeep Port from UK) |

₹ 200 lakhs |

| Demurrages |

₹ 40 lakhs |

| Handling charges |

₹ 20 lakhs |

The expenses of operating its fleet during the year for the Indian ports were ₹ 110 lakhs which includes an expense of ₹ 0.40 lakhs paid in cash to an agency. Compute income of the company under the head ‘Profits and Gains from business or profession’ for Assessment Year 2023-24. (Dec 2016, 5 marks)

Answer:

Question 28.

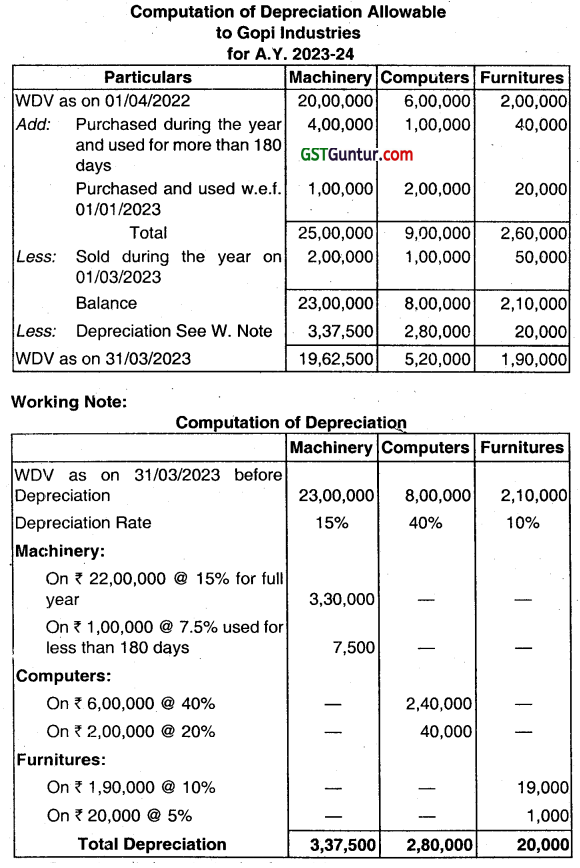

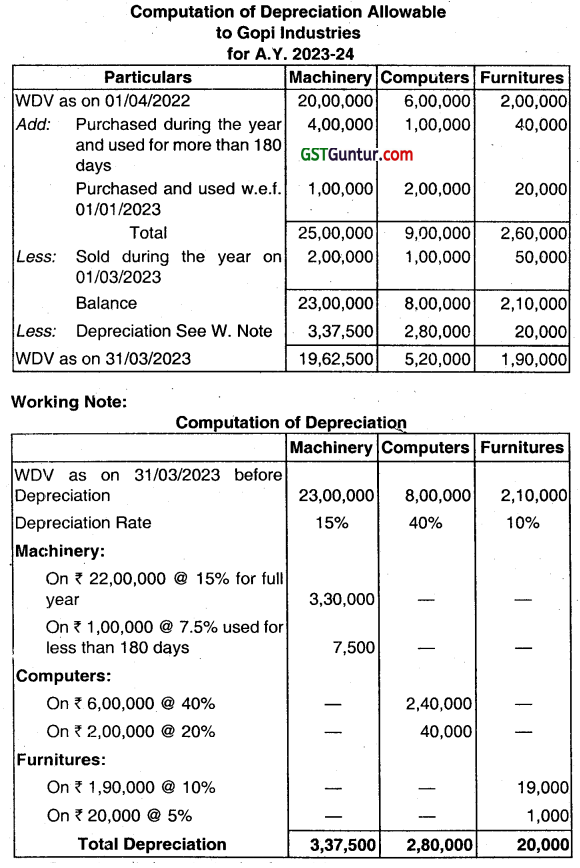

Gopi Industries furnishes you the following details:

| Particulars |

Machinery |

Computers |

Furnitures |

| WDV as on 01.04.2022 |

20,00,000 |

6,00,000 |

2,00,000 |

| Purchased during the year and used for more than 180 days |

4,00,000 |

1,00,000 |

40,000 |

| Purchased and used w.e.f. 01.01.2023 |

1,00,000 |

2,00,000 |

20,000 |

| Sold a group of assets on 01.03.2023 |

2,00,000 |

1,00,000 |

50,000 |

Compute depreciation allowable for the assessment year 2023-24. Ignore additional depreciation.’ (June 2017, 6 marks)

Answer:

Question 29.

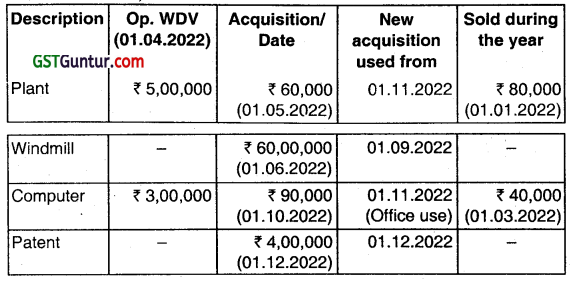

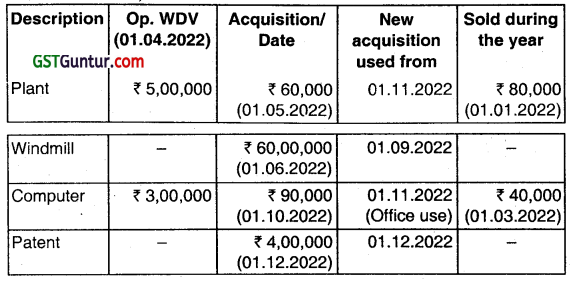

Ahuja Industries Ltd. engaged in manufacturing activity and generation of power, gives you the following information for the year ended 31st March, 2023:

Compute the depreciation and additional depreciation for the assessment year 2023-24. The computation must be such that the same is most beneficial to the assessee. (June 2018, 9 marks)

Answer:

Assessee in the business of generation or generation and distribution of power, have the option to claim depreciation on:

(i) Straight line method on each assets or

(ii) Written down value method or block of assets.

Computation of depreciation allowance under section 32 and 32(1) (IIA) for the Assessment Year 2023-24

Where any assets is acquired by the assessee during the previous year and is put to use for the purpose of business for a period of less than 180 days in that previous year, the depreciation allowance in respect of such asset shall be restricted to 50% of the amount calculated at the prescribed percentage.

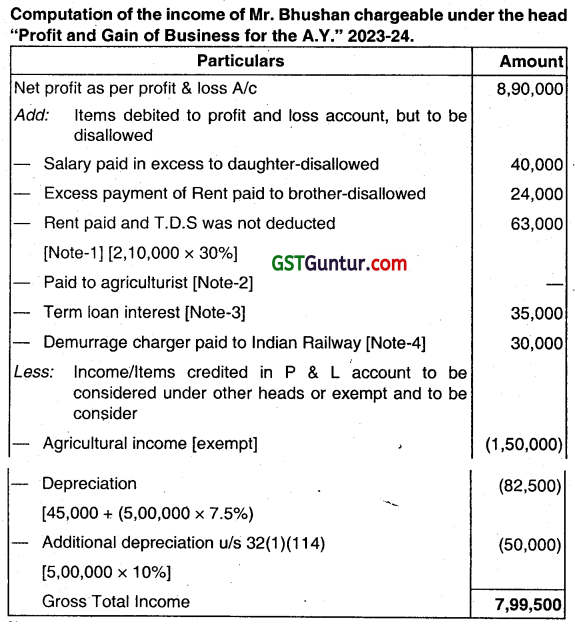

Question 30.

Mr. Rhushan, engaged in manufacture of chemicals, furnishes his Manufacturing, Trading, and Profit & Loss Account for the year ended 31st March, 2023 as under

| Particulars |

₹ |

Particulars |

₹ |

| To Opening stock |

3,40,000 |

By Sales |

1,14,00,000 |

| To Purchases |

1,00,20,000 |

By Closing stock |

19,00,000 |

| To Manufacturing Expenses |

10,40,000 |

|

|

| To Gross Profit |

19,00,000 |

|

|

|

1,33,00,000 |

|

1,33,00,000 |

| To Salary |

4,30,000 |

By Gross Profit |

19,00,000 |

| To Bonus |

80,000 |

By Discount |

25,000 |

| To Bank term loan interest |

90,000 |

By Agricultural Income |

1,50,000 |

| To Factory rent |

1,20,000 |

By Dividend from Indian Companies |

75,000 |

| To Office rent |

2,10,000 |

|

|

| To Administration Expenses |

3,30,000 |

|

|

| To Net Profit |

8,90,000 |

|

|

|

21,50,000 |

|

21,50,000 |

Additional information:

(i) The total turnover of Mr. Bhushan for the Financial Year 2021-22 was ₹ 132 lakhs.

(ii) Salary includes ₹ 1,80,000 paid to his daughter. The excess payment considering her qualifications and experience is ascertained as ₹ 40,000.

(iii) Factory rent was paid to his brother. Similar portions are let out to others by him for a rent of ₹ 96,000 per annum.

(iv) No tax was deducted at source from the office rent paid during the year.

(v) Purchases include ₹ 70,000 paid by cash to an agriculturist for purchase of grains (being raw material).

(vi) Depreciation allowable under section 32 of the Income-tax Act, 1961

amounts to ₹ 45,000 for assets held as on 01.04.2022. During the year, a machinery costing ₹ 5,00,000 was acquired on 01.07.2022 and was put to use from 15.10.2022.

(vii) Administration expenses include commission paid to a purchase agent of ₹ 12,000 for which no tax was deducted at source.

(viii) The following expenses debited above were not paid till 31.03.2023 and up to the ‘due date’ for filling the return specified in section 139(1)

(i) Term loan interest of ₹ 35,000;

(ii) Demurrages to Indian Railways for using their clearing yard beyond stipulated hours (disputed by the assessee) forming part of manufacturing expenses ₹ 30,000.

Compute the income of Mr. Bhushan chargeable under the head “Profits and gains of business or profession” for the Assessment Year 2023-24: (Dec 2018, 10 marks)

Answer:

Note:

1. According to Sec. 40(a)(ia), non-compliance of provision of T.D.S where payment is made to a resident 30% of any sum payable to a resident is to be disallowed.

2. As per section where the assessee incurs any expenditure in respect of which a payment or aggregate of payment made to a person in a day, otherwise than by an account payee cheque drawn on a bank or use of electronic clearing system through a bank account, exceed ₹ 10,000, no deduction ‘shall be allowed in respect of such expenditure. Cash payment made to agriculturist for purchase of grains covered under Rule 6DD.

3. According to Sec. 438, any tax, duty, cess, or, mt. fee is allowed as deduction if they are paid up to the date of return of income u/s 139(1).

4. According to Sec. 43B, demurrages charge paid to Indian Railway allowed as deduction only if it is paid up to the due date of filing return of income u/s 139(1).

Question 31.

Explain with brief reasons, the allowability or taxability of the following expenditure/income in computation of income under the head “Profits and gains of business or profession”:

(i) Compensation of ₹ 30 lakhs received by Mr. Jam, a businessman, under an agreement for not carrying on business of software development.

(ii) Vikram Ltd., engaged in growing and manufacturing tea in India, deposits 10 lakhs in NABAR D. Profit before considering such deposit is ₹ 15 lakhs.

(iii) Construction of toilets in a rural area by Sigma Ltd. for ₹ 10 lakhs in compliance with Corporate Social Responsibility (CSR) under the Companies Act, 2013.

(iv) Plot purchased for ₹ 20 lakhs and construction of a building for ₹ 82 lakhs by Mr. Madhusucian for storing sugar, in the course of business of warehousing of sugar. Expenditure has been capitalized in the books.

(v) Depreciation on a machine acquired for business purpose by Mr. Anand for ₹ 2,50,000, out of which an amount of ₹ 50,000 was paid in cash. (June 2019, 2 x 5 = 10 marks)

Answer:

Particulars

(i) As per section 28, any sum whether received or receivable, under an agreement for not carrying out any activity in relation to any business or profession is chargeable to tax under the head “Profits and gains from business or profession”. Therefore, compensation of ₹ 30 lakhs received by Mr. Jam under an agreement for not carrying out software development business

is taxable as business income.

(ii) As per section 33AB, in case of assessee engaged in growing and manufacturing tea in India, deduction allowed in respect of deposit in NABARO is lower of the amount of such deposit or 40% of profit of such business computed under the head “Profits and gains of business or profession” (before this deduction and before adjusting brought forward business loss). Therefore, ₹ 6 lakhs, being 40% of profit (lower than actual deposit) is allowable as deduction.

(iii) Under section 37(1), any expenditure incurred by an assessee on the activities relating to corporate social responsibility referred to in section 135 of the Companies Act, 2043 shall not be deemed to have been incurred for the purpose of business and hence, shalt not be allowed as deduction. In view of above, expenditure of ₹ 10 lakhs on construction of toilets in rural area shall not be allowed as deduction.

(iv) Business of warehousing of sugar is a specified business under section 35AD. As per section 35AD, in case of specified business capital expenditure incurred for construction of building for storage of sugar is allowable as deduction, provided such expenditure is capitalized in the books. Land cost is not allowable as deduction. Therefore, the whole amount of 82 lakhs spent on building shall be allowed as deduction.

(v) As per section 43(1), any payment exceeding ₹ 10,000 on a single day otherwise by account payee cheque or draft or by electronic mode towards acquisition of asset shall not form part of the actual cost. Therefore, depreciation shall be allowed on ₹ 2,00,000 (i.e. ₹ 2,50,000 – ₹ 50,000)

Question 32.

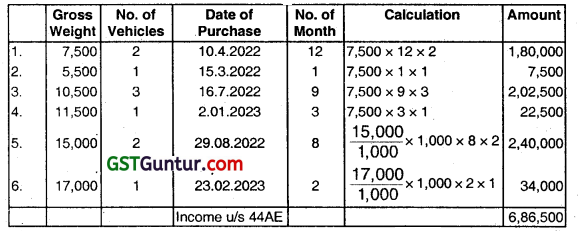

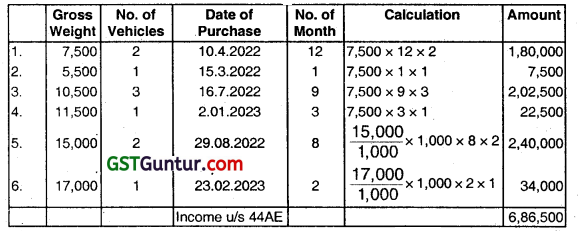

Mr. Sarath commenced business of operating goods vehicles on 01.04.2022. He purchased the following vehicles during the P.Y. 2022-23.

|

Gross Vehicle Weight (in kilograms) |

Number of vehicles |

Date of purchase |

| 1 |

7,500 |

2 |

10.04.2022 |

| 2 |

5500 |

1 |

15.03.2023 |

| 3 |

10,500 |

3 |

16.07.2022 |

| 4 |

11,500 |

1 |

02.01.2023 |

| 5 |

15,000 |

2 |

29.08.2022 |

| 6 |

17,000 |

1 |

23.02.2023 |

Compute his income under section 44AE.

Would your answer change, if the goods vehicles purchased in April, 2022 were put to use only in September, 2022? (Dec 2019, 7 marks)

Answer:

As per Section 44AE, If assessee engaged in the business of playing, hiring leasing, such goods carriage then PGBP will be:

For Heavy goods Vehicles: ₹ 1,000/ ton of gross vehicle weight or unladen weight as the case may be for every month or part of a month.

For Other Vehicles: ₹ 7,500 for every month or part of a month.

Note: Heavy goods Vehicle means any goods carriage, the gross Vehicle weight of which exceeds 12,000 Kilograms.

There will be no change in answer, if the goods vehicles purchased in April, 2022 were put to use only in September 2022.

Question 33.

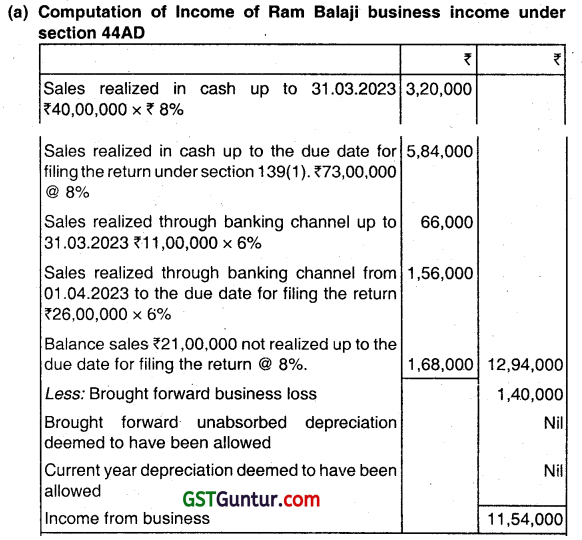

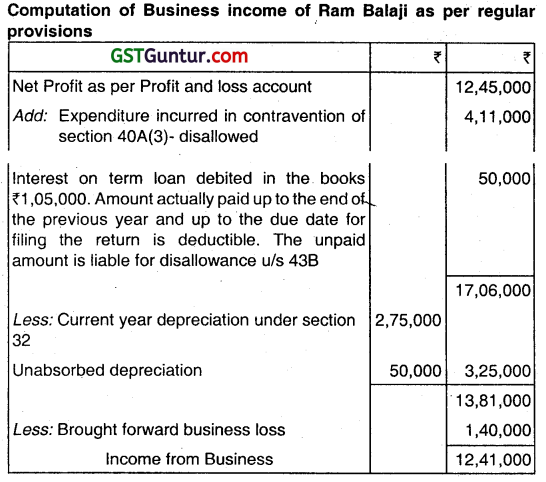

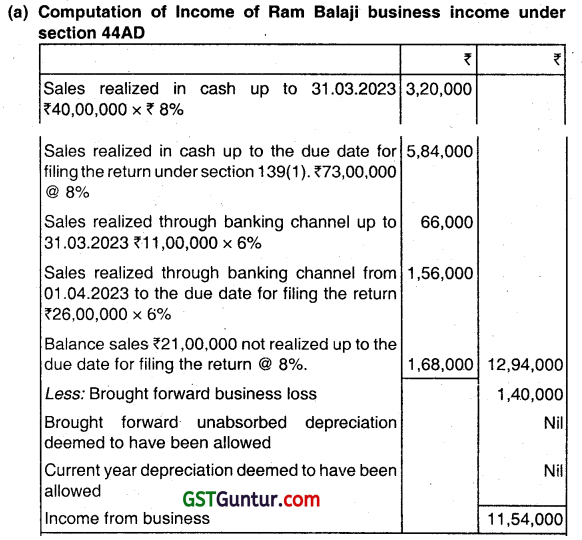

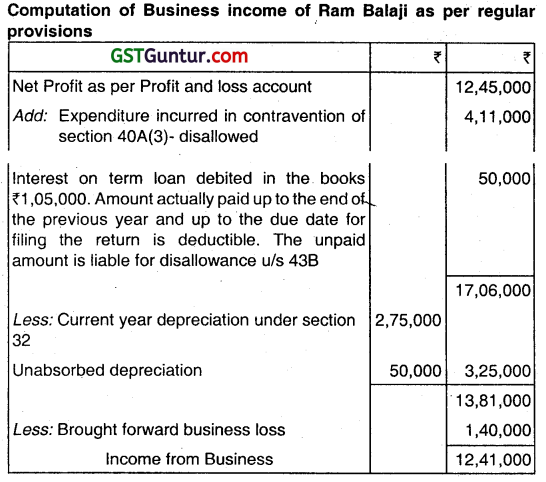

Ram Balaji is engaged in manufacture of electronic spares which are used in computers. His aggregate turnover for the year ended 31.03.2023 was ₹ 1,71,00,000. His profit as per profit and loss account extracted from the books is ₹ 12,45,000. His sale proceeds were realized as under.

|

Up to the end of the previous year |

From 01.04.2023 and up to the ‘due date’ for filing return under section 139(1) |

| Sales realized in cash |

40,00,000 |

73,00,000 |

| Sale realized through banking channel |

11,00,000 |

26,00,000 |

(i) Current year depreciation under section 32 allowable ₹ 2,75,000.

(ii) Cash payment made exceeding ₹ 10,000 per day and the aggregate payment for the year in such manner ₹ 4,1 1,000.

(iii) Interest on term loan debited in profit and loss account of the assessee for the year ended 31.03.2023 ₹ 1,05,000. Amount actually up to 31.03.2023 ₹ 15,000 and amount paid from 01.04.2023 and up to the ‘due date’ for filing the return under section 139(1) ₹ 40,000.

(iv) He has brought forward business loss of the assessment year 201 9-20 of ₹ 1,40,000 and unabsorbed depreciation of ₹ 50,000 of the assessment year 2022-23.

Compute his income from business for the assessment year 2023-24 under section 44AD and as per regular provisions. (Dec 2019, 10 marks)

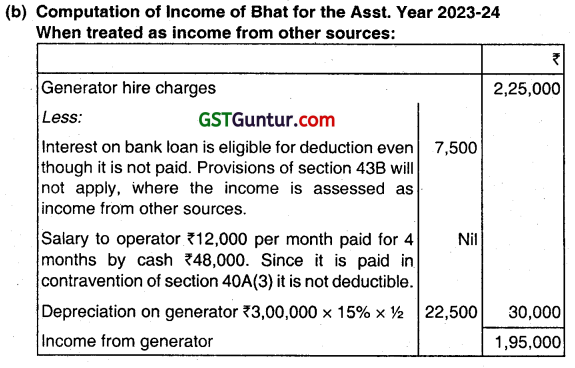

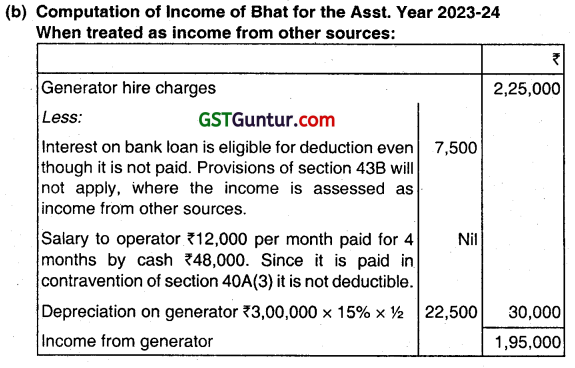

(b) Mr. Bhat acquired a generator for ₹ 3 lakhs on 30.11.2022 by taking a bank loan of ₹ 2 lakhs. Interest on bank loan payable for the year ₹ 7,500 and it was not paid up to the ‘due date’ for filing the return specified in section 139(1). He paid salary to operator @ ₹ 12,000 per month in cash for 4 months. Hire charges received up to 31.03.2023 was ₹ 2,25,000. Compute income of Mr. Bhat from the generator for the year ended 31.03.2023. (Dec 2019, 5 marks)

Answer:

Note:

Expenditure incurred in contravention of section 40A(3), is not liable for disallowance while computing the income under section 44AD. Also, interest on term loan deductible under section 43B on actual payment basis will not impact computation of income under section 44AD.

When assessed as business income:

The answer will change. When assessed as business income, section 43B will come into play ₹ 7,500 being interest on bank loan remaining unpaid will be disallowed.

Hence the income will be ₹ 1,95,000 + ₹ 7500 = ₹ 2,02,500.

Question 34.

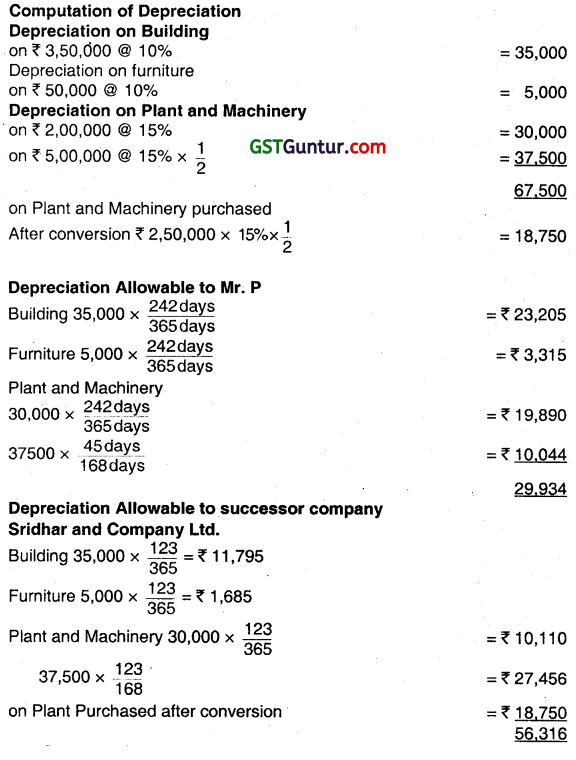

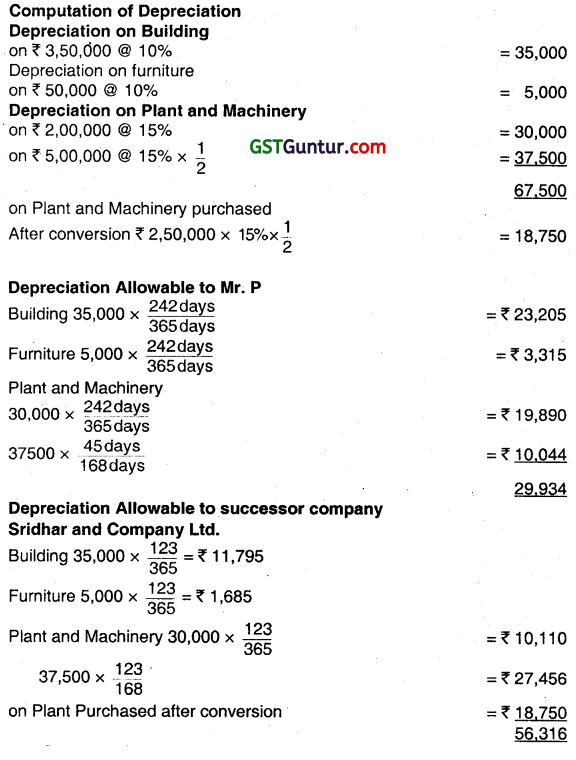

M/s. Sridhar & Co., a sole proprietary concern (owned by Mr. P) is converted into a company, Sridhar Co. Ltd. w.e.f. November 29, 2022. The written down value of assets as on April 1st, 2022 are as follows:

| Items |

Rate of Depreciation |

WDV as on 1 April, 2022 |

| Building |

10% |

₹ 3,50,000 |

| Furniture |

10% |

₹ 50,000 |

| Plant & machinery |

15% |

₹ 2,00,000 |

Further, on 15.10.2022, M/s. Sridhar & Co, purchased a plant for ₹ 5,00,000 (rate of depreciation 15%). After conversion, the company added another plant worth ₹ 2,50,000 (rate of depreciation 15%). The payments in all cases were through account payee cheques. Compute the depreciation available to (i) Mr. P and (ii) Sridhar & Co. Ltd. for the AY. 2023-24 Assume that the assessee’s are not eligible for additional depreciation. (Dec 2021, 8 marks)

Answer:

Question 35.1

State the income-tax consequence of the following transactions:

Mr. A wrote off ₹ 3 lakhs due from a customer G as bad debt in the previous year 2019-20. He died on 23 June, 2020. His son, doing some other business, received ₹ 1, 40,000 as final settlement from G in March, 2023 in the capacity of being the only legal heir of late Mr. A. (Dec 2021, 3 marks)

Answer:

Recovery against any deduction [section 41(1)]:

- Where an allowance or deduction is allowed in any assessment year in respect of loss, expenditure or trading liabîty incurred by the assessee.

- Subsequently during any previous year such assessee has obtained, whether in cash or in any other manner any amount in respect of such loss, expenditure, or any benefit in respect of such trading liability by way or remission or cessation thereof.

- Treatment: The amount obtained or benefit accrued shall be deemed to be the income from profits and gains of business or profession and chargeable to tax.

- The amount received by the son of late Mr. A is chargeable to tax under section 41(1) under the head “Profits and gains of business or profession”.

Question 36.

State the income-tax consequence of the following transactions:

Charlie & Co is a partnership firm consisting of 4 equal partners. The firm took Keyman Insurance Policy and paid premium of ₹ 1, 50,000 annually. Upon the death of one partner in January, 2023, the firm received ₹ 50 lakhs from the insurance company in respect of Keyman Insurance Policy. (Dec 2021, 3 marks)

Answer:

Keyman Insurance Policy:

As per section 10(1 OD), any sum received under a Keyman Insurance Policy would not be exempt from tax. In other words, it is chargeable to tax as income.

The firm while paying premium on Keyman Insurance Policy would have claimed the same as expenditure under section 37.

When the amount is received from the policy, the amount so received becomes chargeable to tax as income of the firm. Therefore, the sum of ₹ 50 lakhs received upon the death of one partner of the firm is chargeable to tax.

Question 37.

Abhijit & Co. is a partnership firm engaged in manufacturing activity. The firm furnishes you the following details:

| Particulars |

Plant & Machinery (₹) |

Furniture & Fitting (₹) |

Building (₹) |

| WDV as on 01.04.2022 |

20,00,000 |

1,40,000 |

9,90,000 |

| Acquired (new) |

10,00,000 (10.01.2023) |

60,000 (30.09.2022) |

20,00,000 (includes land ₹ 5,00,000) acquired on 20.07.2022 |

| Acquired (old) |

5,00,000 (25.08.2022) |

|

|

Note: Plant & Machinery as on 01.04.2022 includes a new machine whose cost was ₹ 8,00,000 and which was acquired on 22.01.2022 but put to use from 01.02.2022. Compute the eligible amount of depreciation under section 32 of the Act. (Dec 2022, 7 marks)

Question 38.

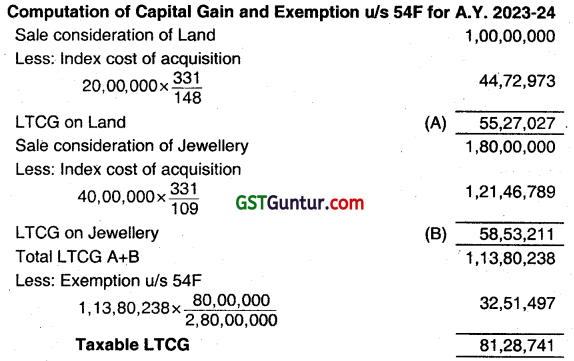

Laxman engaged in textile trade reports a turnover of ₹ 170 lakhs for the year ended 31.03.2023. It includes ₹ 60 lakhs received by way of cash and ₹ 40 lakhs received through banking channel up to 31st March, 2023. 01 the balance of turnover, ₹ 30 lakhs was realized by cheque up to the due date for filing the return specified in section 139(1). On 25.05.2022, he acquired two heavy goods vehicles with each vehicle having capacity to carry goods up to 12000 kilos. Vehicles were operated for carrying goods of customers on hire. Vehicles were acquired through bank loan for which interest due for the year amounts to ₹ 3,70,000. He wants to admit both the business incomes as referred above as per applicable

presumptive provisions. Compute total income of Laxman for the assessment year 2023-24. (Dec 2022, 8 marks)

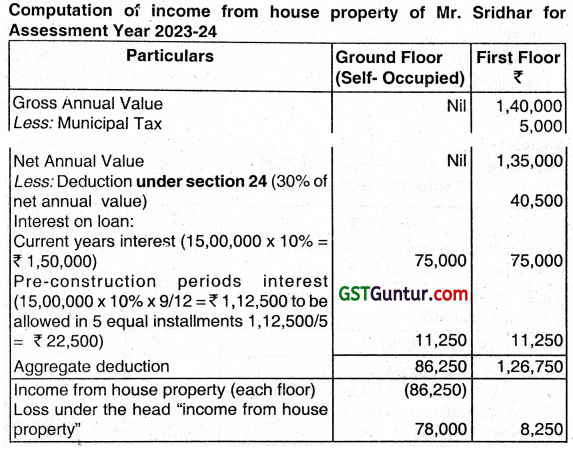

![]()

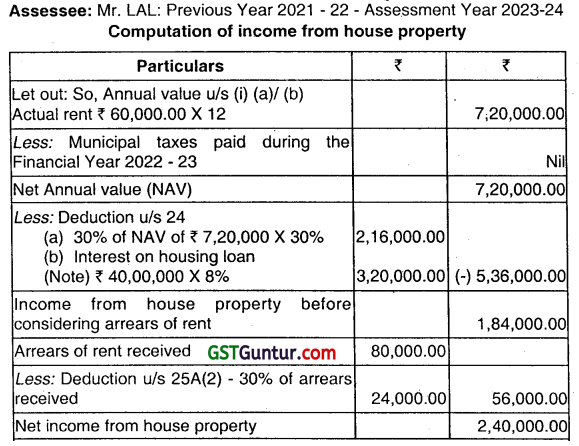

![]()

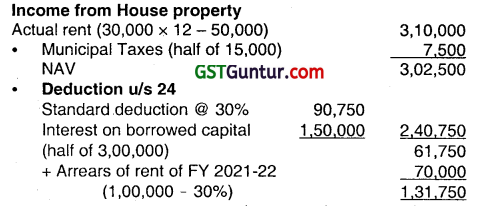

![]()

![]()