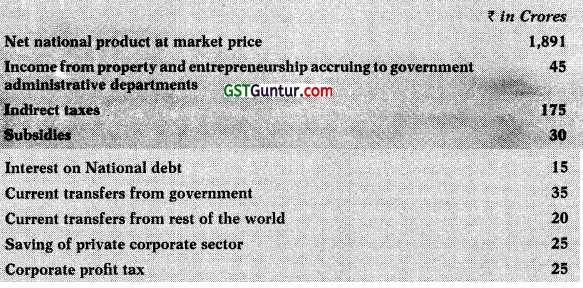

CA Final FR Question Paper Nov 2020

CA Final FR Question Paper Nov 2020 – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

CA Final Financial Reporting Question Paper Nov 2020

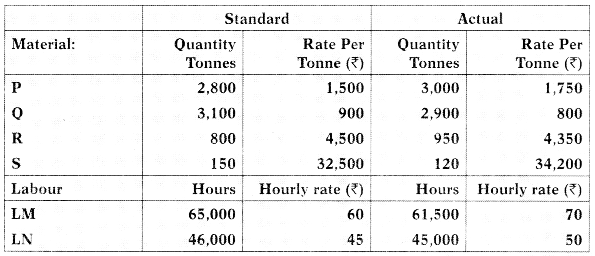

Question 1.

(a) On April 1st, 2020, Star Limited has advanced a housing loan of ₹ 15 lakhs to one of its employee at an interest rate of 6% per annum which is repayable in 5 equal annual instalments along with interest at each year end. Employee is not required to give any specific performance against this benefit. The market rate of similar loan for housing finance by banks is 10% per annum. (Marks 12)

The accountant of the company has recognized the staff loan in the balance sheet equivalent to the amount of housing loan disbursed i.e. ₹ 15 lakhs. The interest income for the year is recognized at the contracted rate in the Statement of Profit and Loss by the company i.e. ₹ 90,000 (6% of ₹ 15 lakhs).

Analyze whether the above accounting treatment made by the accountant is in compliance with the relevant Ind AS’s. If not, advise the correct treatment of housing loan, interest and other expenses in the financial statements of Star Limited for the year 2020-21 along with workings and applicable Ind AS’s.

You are required to explain how the housing loan should be reflected in the Ind AS complaint Balance sheet of Star Limited on March 31st, 2021.

Answer:

[Based on Ind AS 109]

The housing loan advanced by Star Limited is a financial asset for the company which is to measured at fair value at initial recognition.

Subsequently, the financial asset is to be measured at amortised cost using EIR.

Therefore, the accounting treatment made by the company’s accountant is not in accordance with Ind AS 109.

Let us see the correct accounting treatment in the given case.

![]()

Measurement at initial recognition:

= Fair value

= Present value of cash inflows i.e. (interest and principal repayment by the employee over the period of the loan)

Therefore,

Fair value = 13,54,602

Working Note:

| Year | Particulars | Cash Flows | PVIF @ 10% | Present value |

| 1 | Interest + Principal | 90,000 + 3,00,000 | 0.909 | 3,54,510 |

| 2 | Interest + Principal | 72,000 + 3,00,000 | 0.826 | 3,07,272 |

| 3 | Interest + Principal | 54,000 + 3,00,000 | 0.751 | 2,65,854 |

| 4 | Interest + Principal | 36,000 + 3,00,000 | 0.683 | 2,29,488 |

| 5

Total |

Interest + Principal | 18,000 + 3,00,000 | 0.621 | 1,97,478

13,54,602 |

Journal entry at the time of initial recognition:

| Particulars | Dr. | Cr. |

| Staff Loan (FA)

Prepaid Staff cost # To Bank |

13,54,602

1,45,398 |

15,00,000

15,00,000 |

# This amount will be written off over a period of 5 years on SLM i.e. 29,079.60 each year.

![]()

Subsequent measurement (of Staff Loan):

Staff Loan A/c [For the year 2020-21 only]

| Particulars | Amount | Particulars | Amount |

| To Bank

To Interest (13,54,602 × 10%) |

13,54,602

1,35,460 |

By Bank (90,000 + 3,00,000)

By Balance c/d (Balancing figure) |

3,90,000

11,00,062 |

| 14,90,062 | 14,90,062 |

Financial Statements [For the year 2020-21]

Income Statement for the year ending 31st March, 2021 (Extract)

| Particulars | Amount |

| Interest Expense | 1,35,460 |

| Other Expenses | 29,079.60 |

Balance Sheet as on 31st March, 2021 (Extract)

| Particulars | Amount |

| Staff Loan | 11,00,062 |

| Prepaid Staff cost | 1,16,318.40 |

![]()

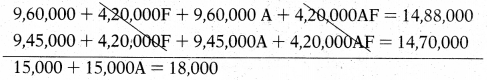

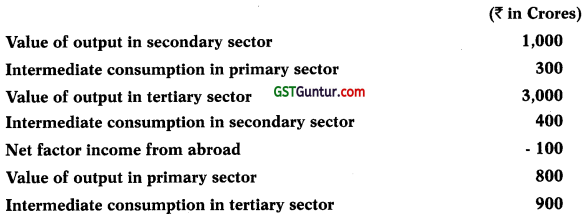

(b) The following information is available relating to Space India Limited for the Financial Year 2019-20. (Marks 8)

| Net profit attributable to equity shareholders | ₹ 90,000 |

| No. of equity shares outstanding | 16,000 |

| Average fair value of one equity share during the year | ₹ 90 |

Potential Ordinary Shares:

| Options | 900 options with exercise price of ₹ 75 |

| Convertible Preference Shares | 7,500 shares entitled to a cumulative dividend of ₹ 9 per share. Each preference share is convertible into 2 equity shares. |

| Applicable corporate dividend tax | 8% |

| 10% Convertible Debentures of ₹ 100 each | ₹ 10,00,000 and each debenture is convertible into 4 equity shares |

| Tax rate | 25% |

You are required to compute Basic and Diluted EPS of the company for the Financial Year 2019-20.

Answer:

[Based on Ind AS 33]

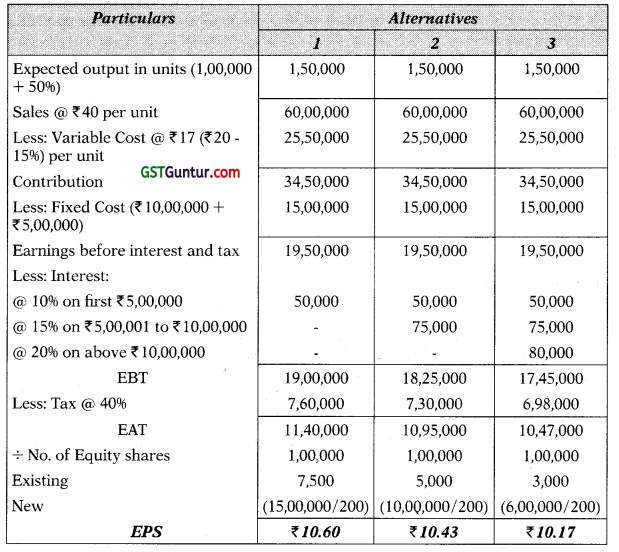

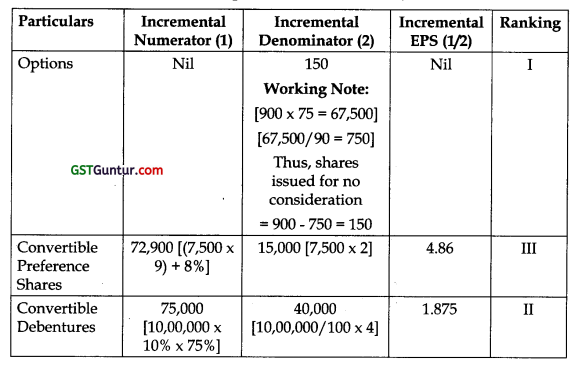

Statement Showing Ranking of Potential Ordinary Shares

(for computation of Diluted EPS)

Statement Showing Computation of Diluted EPS

(Based on Ranking)

| Particulars | Numerator (1) | Denominator (2) | EPS (1/2) | Remarks |

| Basic EPS | 90,000 | 16,000 | 5.625 | |

| Impact of options | Nil | 150 | ||

| Adjusted figures | 90,000 | 16,150 | 5.573 | Dilutive |

| Impact of Convertible Debentures | 75,000 | 40,000 | ||

| Adjusted figures | 1,65,000 | 56,150 | 2.939 | Dilutive |

| Impact of Convertible Preference Shares | 72,900 | 15,000 | ||

| Adjusted figures | 2,37,900 | 71,150 | 3.344 | Anti-Dilutive |

Thus,

Diluted EPS = 2.939

![]()

Question 2.

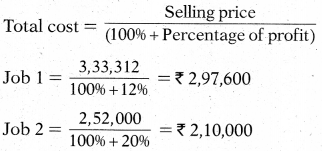

(a) ABC Limited supplies plastic buckets to wholesaler customers. As per the contract entered into between ABC Limited and a customer for the financial year 2019-20, the price per plastic bucket will decrease retrospectively as sales volume increases within the stipulated time of one year. (Marks 14)

The price applicable for the entire sale will be based on sales volume bracket during the year.

| Price per unit (INR) | Sales volume |

| 90 | 0 – 10,000 units |

| 80 | 10,001 – 35,000 units |

| 70 | 35,001 – units & above |

All transactions are made in cash.

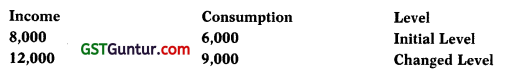

(i) Suggest how revenue is to be recognised in the books of account of ABC Limited as per expected value method, considering a probability of 15%, 75% and 10% of sales volumes of 9,000 units, 28,000 units and 36,000 units respectively. For workings, assume that ABC Limited achieved the same number of units of sales to the customer during the year as initially estimated under expected value method for the financial year 2019-20.

(ii) In case ABC Limited decides to measure revenue, based on most likely method instead of expected value method, how will be the revenue recognised in the books of account of ABC Limited based on above available information? For workings, assume ABC Limited achieved the same number of units of sales to the customer during the year as initially estimated under most likely value method for the financial year 2019-20.

(iii) You are required to pass Journal entries in the books of ABC Limited if the revenue is accounted for as per expected value method for financial year 2019-20.

Answer:

[Based on Ind AS 115]

Part (i)

Computation of expected sales (in units)

Thus,

Revenue will be recognised based on ₹ 80 per unit.

Part (ii)

Based on most likely method, revenue will still be recognised based on ₹ 80 per unit.

![]()

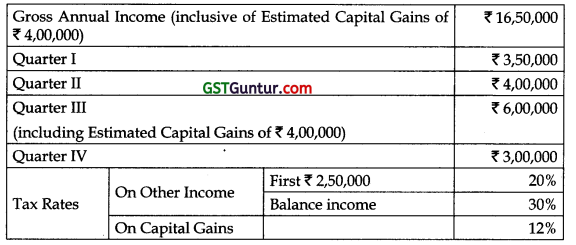

(b) Lai Ltd. provides you the following information for financial year 2019-20: (Marks 6)

Estimated Income for the year ended March 31st, 2020 :

Calculate the tax expense for each quarter, assuming that there is no difference between the estimated taxable income and the estimated accounting income.

Answer:

[Based on Ind AS 34]

Step 1:

Computation of Effective Tax Rate:

| Quarter | Income (Excluding Capital Gains) |

| I | 3,50,000 |

| II | 4,00,000 |

| III | 2,00,000 |

| IV | 3,00,000 . |

| Total | 12,50,000 |

Tax on Annual Income = 2,50,000 × 20% + 10,00,000 × 30% = 3,50,000

Therefore,

Effective Tax Rate = 3,50,000/12,50,000 × 100 = 28%.

Step 2:

Computation of Tax expense for each quarter:

| Quarter | Income (Excluding Capital Gains) | Capital Gains | Tax expense |

| I | 3,50,000 | Nil | 3,50,000 × 28% = 98,000 |

| II | 4,00,000 | Nil | 4,00,000 × 28% = 1,12,000 |

| III | 2,00,000 | 4,00,000 | 2,00,000 × 28% + 4,00,000 × 12% = 1,04,000 ‘ |

| IV | 3,00,000 | Nil | 3,00,000 × 28% = 84,000 |

![]()

Question 3.

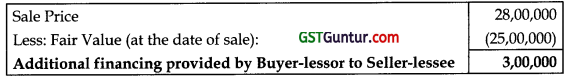

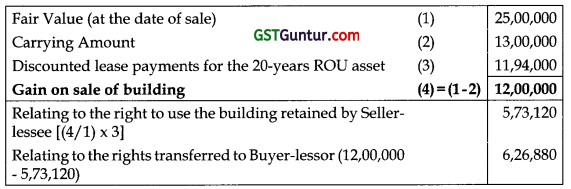

(a) Venus Ltd. (Seller-lessee) sells a building to Mars Ltd. (Buyer-lessor) for cash of ₹ 28,00,000. Immediately before the transaction, the building is carried at a cost of ₹ 13,00,000. At the same time, Seller-lessee enters into a contract with Buyer-lessor for the right to use the building for 20 years, with an annual payments of ₹ 2,00,000 payable at the end of each year. (Marks 8)

The terms and conditions of the transaction are such that the transfer of the building by Seller-lessee satisfies the requirements for determining when a performance obligation is satisfied in accordance with Ind AS 115 “Revenue from Contracts with Customers”.

The fair value of the building at the date of sale is ₹ 25,00,000. Initial direct costs, if any, are to be ignored. The interest rate implicit in the lease is 12% p.a., which is readily determinable by Seller-lessee. Present Value (PV) of annual payments (20 payments of ₹ 2,00,000 each discounted @ 12%) is ₹ 14,94,000.

Buyer-lessor classifies the lease of the building as an operating lease. How should the said transaction be accounted by Venus Ltd. ?

Answer:

[Based on Ind AS 116]

Analysis:

Based on the facts of the case, Seller-lessee and buyer-lessor account for the transaction as a sale and leaseback.

Accounting:

Step 1:

Application of Para No. 101(b):

The consideration for the sale of the building is not at fair value.

Thus,

Seller-lessee and Buyer-lessor need to make adjustments to measure the sale proceeds at fair value.

Therefore, the amount of the excess sale price of ₹ 3,00,000 (see below) is recognised as additional financing provided by Buyer-lessor to Seller-lessee.

Step 2:

Splitting the components of Annual Lease payments:

Accounting in the Books of Seller-Lessee:

Step A:

At the commencement date, Seller-lessee measures the ROU asset arising from the leaseback of the building at the proportion of the previous carrying amount of the building that relates to the right-of-use retained by Seller-lessee, calculated as follows:

Step B:

Seller-lessee recognises only the amount of the gain that relates to the rights transferred to Buyer- lessor, calculated as follows:

Step C:

Journal Entry:

At the commencement date, Seller-lessee accounts for the transaction, as follows:

Accounting in the Books of Buyer-Lessor:

Journal Entry:

At the commencement date, Buyer-lessor accounts for the transaction, as follows:

After the commencement date:

Buyer-lessor accounts for the lease by treating ₹ 1,59,840 of the annual payments of ₹ 2,00,000 as lease payments. The remaining ₹ 40,160 of annual payments received from Seller-lessee are accounted for as payments received to settle the financial asset of ₹ 3,00,000; and interest revenue.

![]()

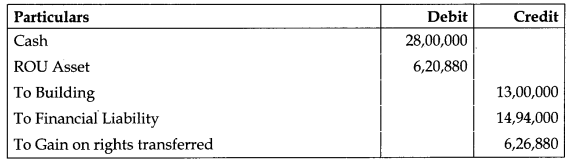

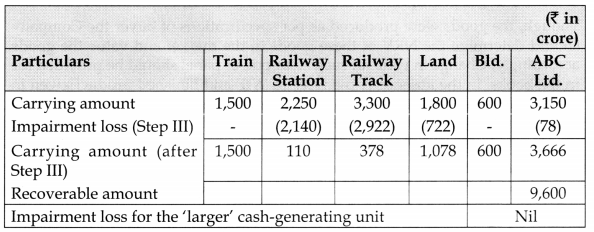

(b) Pacific Ocean Railway Ltd. has three Cash Generating units namely Train, Railway station and Railway tracks, the carrying amounts of which as on March 31st, 2020 are as follows : (Marks 8)

| Cash Generating units | Carrying amount (₹ in crore) | Remaining useful life |

| Train | 1,500 | 10 |

| Railway station | 2,250 | 20 |

| Railway tracks | 3,300 | 20 |

Pacific Ocean Railway Ltd. also has two Corporate Assets having a remaining useful life of 20 years

| (₹ in crore) | ||

| Corporate Assets | Carrying amount | Remarks |

| Land | 1,800 | The carrying amount of Land can be allocated on a reasonable basis (i.e., pro-rata basis) to the individual cash-generating units. |

| Buildings | 600 | The carrying amount of Buildings cannot be allocated on a reasonable basis to the individual cash-generating units. |

Recoverable amount as on March 31st, 2020 is as follows :

| Cash Generating units | Recoverable amount (₹ in crore) |

| Train | 1,800 |

| Railway station | 2,700 |

| Railway tracks | 4,200 |

| Company as a whole | 9,600 |

Calculate the impairment loss, if any. Ignore decimals.

Answer:

[Based on Ind AS 36]

Step – I:

Allocation of Corporate Assets:

The carrying amount of X is allocated to the carrying amount of each individual cash-generating unit.

A weighted allocation basis is used because the estimated remaining useful life of Train cash-generating unit is 10 years, whereas the estimated remaining useful lives of Railway Station and Railway Track cash-generating units are 20 years

Step – II:

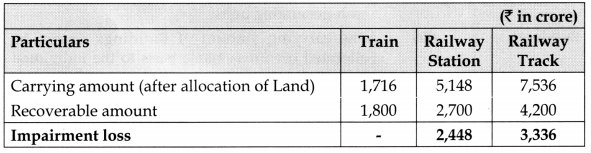

Computation of Impairment Loss:

[Application of Para No. 102(a)] – Bottom up Test:

Step – III:

Allocation of the Impairment Loss:

[Application of Para No. 104(b)]

Step – IV:

Impairment losses for the larger cash-generating unit, i.e.,

POR Ltd. as a whole:

[Application of Para Nos. 102(b) and 104] – Top down Test:

![]()

(c) Sophia Ltd. has fabricated special equipment (Inverter panel) during the financial year 2018-19 as per drawing and design supplied by the customer. However, due to a liquidity crunch, the customer has requested the company for postponement in delivery schedule and requested the company to withhold the delivery of finished products and discontinue the production of balance items. (Marks 4)

As a result of the above, the details of customer balance and the goods held by the company as work-in-progress and finished goods as on March 31st, 2020 are as follows:

Inverter panel (WIP) – ₹ 255 lakhs

Inverter panel (finished goods) – ₹ 165 lakhs

Sundry Debtor (Inverter panel) – ₹ 195 lakhs

The petition for winding up against the customer has been filed during the financial year 2019-20 by Sophia Ltd.

You are required to Comment with explanation on provision to be made for ₹ 615 lakh included in Sundry Debtors, Finished goods and Work-in-Progress in the financial statement for the Financial year 2019-20.

Answer:

[Based on Ind AS 2]

Analysis and Conclusion:

From the fact given in the question it is obvious that Sophia Ltd. is a manufacturer of solar power panel.

Therefore, solar power panel held in its stock will be considered as its inventory. Further, as per the standard, inventory at the end of the year are to be valued at lower of cost or NRV.

As the customer has postponed the delivery schedule due to liquidity crunch the entire cost incurred for solar power panel which were to be supplied has been shown in Inventory. The solar power panel are in the possession of the Company which can be sold in the market. Hence company should value such inventory as per principle laid down in Ind AS 2 i.e. lower of Cost or NRV.

Though, the goods were produced as per specifications of buyer the Company should determine the NRV of these goods in the market and value the goods accordingly. Change in value of such solar power panel should be provided for in the books. In the absence of the NRV of WIP and Finished product given in the question, assuming that cost is lower, the company shall value its inventory as per Ind AS 2 for ₹ 420 lakhs [i.e. solar power panel (WIP) ₹ 255 lakhs + solar power panel (finished products) ₹ 165 lakhs].

Alternatively, if it is assumed that there is no buyer for such fabricated solar power panel, then the NRV will be Nil. In such a case, full value of finished goods and WIP will be provided for in the books.

As regards Sundry Debtors balance, since the Company has filed a petition for winding up against the customer in 2018-19, it is probable that amount is not recoverable from the party. Hence, the provision for doubtful debts for ₹ 195 lakhs shall be made in the books against the debtor’s amount.

![]()

Question 4.

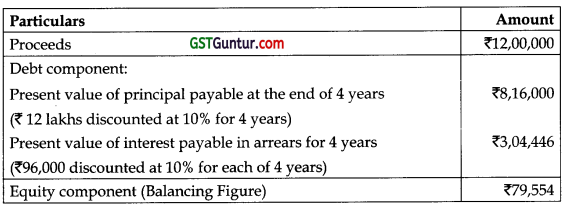

(a) On April 1st, 2019, a 8% convertible loan with a nominal value of ₹ 12,00,000 was issued at par by Cargo Ltd. It is redeemable on March 31st, 2023 also at par. Alternatively, it may be converted into equity shares on the basis of 100 new shares for each ₹ 200 worth of loan. (Marks 6)

An equivalent loan without the conversion option would have carried interest at 10%. Interest of ₹ 96,000 has already been paid and included as a finance cost.

Present Value (PV) rates are as follows :

| Year End | @8% | @ 10% |

| 1 | 0.93 | 0.91 |

| 2 | 0.86 | 0.83 |

| 3 | 0.79 | 0.75 |

| 4 | 0.73 | 0.68 |

How will the Company present the above loan notes in the financial statements for the year ended March 31st, 2020 ?

Answer:

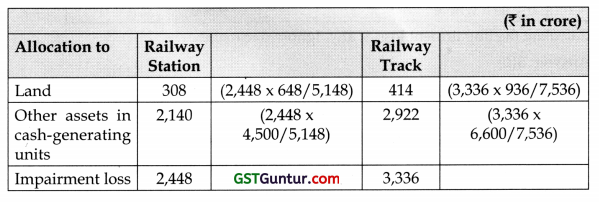

[Based on Ind AS 32]

Analysis of the Instrument:

There is an ‘option’ to convert the loans into equity i.e. the loan note holders do not have to accept equity shares; they could demand repayment in the form of cash.

In the above question we have both – ‘equity’ and ‘debt’ features in the instrument. There is an obligation to pay cash – i.e. interest at 8% per annum and a redemption amount – this is ‘financial liability’ or ‘debt component’. The ‘equity’ part of the transaction is the option to convert.

Therefore, it is a compound financial instrument.

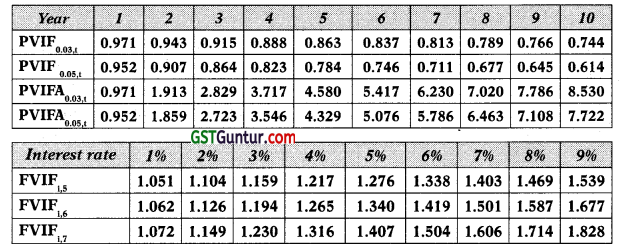

Computation of liability and equity components:

Debt Component (Ledger A/c – Year 1)

| Particulars | Amount | Particulars | Amount |

| To Bank (12,00,000 × 8%)

To Balance c/d (Balancing figure) |

96,000

11,36,490 |

By Bank (8,16,000 + 3,04,446)

By Interest/Finance cost (11,20,446 × 10%) |

11,20,446

1,12,044 |

| 11,72,490 | 11,72,490 |

![]()

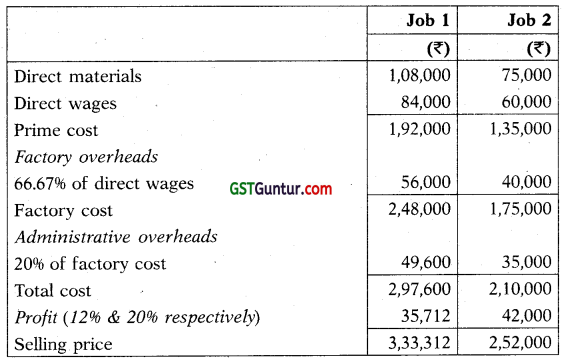

(b) John Limited has identified four segments for which revenue data is given as per below: (Marks 6)

| External Sale (₹) | Internal Sale (₹) | Total (₹) | |

| Segment A | 4,00,000 | Nil | 4,00,000 |

| Segment B | 80,000 | Nil | 80,000 |

| Segment C | 90,000 | 20,000 | 1,10,000 |

| Segment D | 70,000 | 6,20,000 | 6,90,000 |

| Total sales | 6,40,000 | 6,40,000 | 12,80,000 |

The following additional information is available with respect to John Limited:

Segment C is a high growing business and management expects that this segment to make a significant contribution to external revenue in coming years.

Discuss, which of the segments would be reportable under the threshold criteria identified in Ind AS 108 and why ?

Answer:

[Based on Ind AS 108]

Application of Para No. 13:

Threshold amount is ₹ 1,28,000 (₹ 12,80,000 × 10%).

Segment A exceeds the quantitative threshold (₹ 4,00,000 > ₹ 1,28,000) and hence reportable segment.

Segment D exceeds the quantitative threshold (₹ 6,90,000 > ₹ 1,28,000) and hence reportable segment.

Segments B & C do not meet the quantitative threshold amount and may not be classified as reportable segment.

Application of Para No. 15:

However, the total external revenue generated by these two segments A & D represent only 73.44% (₹ 4,70,000/6,40,000 × 100) of the entity’s total external revenue. If the total external revenue reported by operating segments constitutes less than 75% of the entity total external revenue, additional operating segments should be identified as reportable segments until at least 75% of the revenue is included in reportable segments.

In case of John Ltd., it is given that Segment C is a new business unit and management expect this segment to make a significant contribution to external revenue in coming years.

In accordance with the requirement of Ind AS 108, John Ltd. designates this startup segment C as a reportable segment, making the total external revenue attributable to reportable segments 87.5% (₹ 5,60,000/6,40,000 × 100) of total entity revenues.

![]()

(c) P Limited and S Limited are in business of manufacturing garments. P Limited holds 30% of equity shares of S Limited for last several years P Limited obtains control of S Limited when it acquires further 65% stake of S Limited’s shares, thereby resulting in a total holding of 95% on December 31st, 2019. The acquisition had the following features. (Marks 8)

(i) P Limited transfers cash of ₹ 50,00,000 and issues 90,000 shares on December 31st, 2019. The market price of P Limited’s shares on the date of issue was × 10 per share. The equity shares issued as per this transaction will comprise 5% of the post-acquisition capital of P Limited.

(ii) P Limited agrees to pay additional consideration of ₹ 4,00,000, if the cumulative profits of S Limited exceeds ₹ 40,00,000 over the next two years. At the acquisition date, it is not considered probable that extra consideration will be paid. The fair value of contingent consideration is determined to be ₹ 2,00,000 at the acquisition date.

(iii) P Limited spent acquisition-related costs of ₹ 2,00,000.

(iv) The fair value of the NCI is determined to be ₹ 5,00,000 at the acquisition date based on market price. P Limited decided to measure non-controlling interest at fair value for this transaction.

(v) P Limited has owned 30% of the shares in S Limited for several years At December 31st, 2019, the investment is included in P Limited’s consolidated balance sheet at ₹ 8,00,000. The fair value of previous holdings, accounted for using the equity method is arrived at ₹ 18,00,000.

The fair value of S Limited’s net identifiable assets at December 31st, 2019 is ₹ 45,00,000, determined in accordance with Ind AS 103.

Analyze the transaction and determine the accounting under acquisition method ; for the business combination by P Limited.

Answer:

[Based on Ind AS 103]

Step I:

Identify the Acquirer:

In this case, Company P has paid cash consideration to shareholders of Company S.

Further, the shares issued to Company S pursuant to the acquisition will comprise 5% of the post- acquisition capital of Company P.

Therefore, Company P is the acquirer and Company S is the acquiree.

Step II:

Determine the Acquisition date:

As the control over the business of Company S is transferred to Company P on 31st December, 2019, that date is considered as the acquisition date.

Step III:

Computation of Net Assets of Acquiree:

Fair value of Company S’s net identifiable assets at 1st November is ₹ 45,00,000, determined in accordance with Ind AS 103.

Step IV:

Computation of Consideration Transferred:

The consideration transferred will comprise the following:

| Particulars | Amount |

| Cash consideration

Equity shares issued (90,000 × 10 i.e., at fair value) Contingent consideration (at fair value) Fair value of previously held interest (Working Note -1) |

₹50,00,000

₹ 9,00,000 ₹ 2,00,000 ₹ 18,00,000 |

| ₹ 79,00,000 |

Note:

Acquisition cost incurred by and on behalf of the Company P for acquisition of Company S should be recognized in the Statement of profit and loss.

![]()

Working Note -1:

Re-measurement of previously held interests:

In this case, the control has been acquired in stages i.e., before acquisition to control, the Company P exercised significant influence over Company S. As such, the previously held interest should be measured at fair value and the difference between the fair value and the carrying amount as at the acquisition date should be recognized in Statement of Profit and Loss.

Thus, an amount of ₹ 10,00,000 (i.e., 18,00,000 less 8,00,000) will be recognized in Statement of profit and loss.

Step V:

Measurement of NCI:

The management has decided to recognize the NCI at its fair value.

NCI will be recognized at ₹ 5,00,000.

Step VI:

Computation of goodwill or gain on bargain purchase:

Goodwill will be calculated as under:

| Particulars | (₹) |

| Consideration Transferred ‘

Non-controlling interest Less: Fair value of Net identifiable assets Goodwill |

79,00,000

5,00,000 (45,00,000) |

| 39,00,000 |

![]()

Question 5.

(a) Diamond Pvt. Ltd. has a headcount of around 1,000 employees in the organisation in financial year 2019-20. As per the company’s policy, the employees are given 35 days of privilege leave (PL), 15 days of sick leave (SL) and 10 days of casual leave. Out of the total PL and sick leave, 10 PL leave and 5 sick leave can be carried forward to next year. On the basis of past trends, it has been noted that 200 employees will take 5 days of PL’ and 2 days of SL and 800 employees will avail 10 days of PL and 5 days of SL. (Marks 6)

Also the company has been earning profits since 2010. It has decided in financial year 2019-20 to distribute profits to its employees @ 4% during the year. However, due to the employee turnover in the organisation, the expected pay-out of the Diamond Pvt. Ltd. is expected to be around 3.5%. The profits earned during the financial year 2019-20 are ₹ 4,000 crores.

Diamond Pvt. Ltd. has a post-employment benefit plan which is in the nature of defined contribution plan where contribution to the fund amounts to ₹ 200 crores which will fall due within 12 months from the end of accounting period.

The company has paid ₹ 40 crores to this plan in financial year 2019-20.

What would be the treatment of the short-term compensating absences, profit-sharing plan and the defined contribution plan in the books of Diamond Pvt. Ltd.?

Answer:

[Based on Ind AS 19]

Analysis and Conclusion:

Short term compensating expenses:

Diamond Pvt. Ltd. will recognize a liability in its books to the extent of 5 days of PL for 200 employees and 10 days of PL for remaining 800 employees and 2 days of SL for 200 employees and 5 days of SL for remaining 800 employees in its books as an unused entitlement that has accumulated in 2019-2020.

Profit sharing plan:

Diamond Pvt. Ltd. will recognize ₹ 140 crores (4,000 crores × 3.5%) as a liability and expense it in books of account.

Defined contribution plan:

When an employee has rendered service to an entity during a period, the entity shall recognize the contribution payable to a defined contribution plan in exchange for that service:

Under Ind AS 19, the amount of ₹ 160 crores (200 – 40) may be recognized as a liability (accrued expense), after deducting contribution already paid. However, if the contribution already paid would have exceeded the contribution due for service before the end of the reporting period, an entity shall recognize that excess as an asset (prepaid expense); and

Also, ₹ 160 crores will be recognized as an expense which will be disclosed as an expense in the statement of profit and loss.

![]()

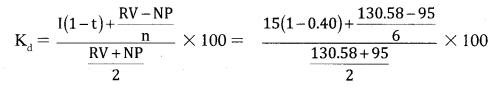

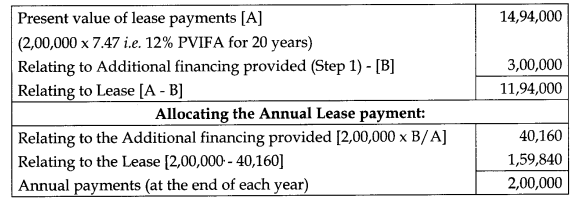

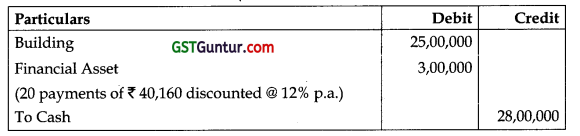

(b) Entity A acquired a subsidiary, Entity B, during the year ended March 31st, 2020. Summarised information from the Consolidated Statement of Profit and Loss and Balance Sheet is provided, together with some supplementary information. (Marks 8)

| Consolidated Statement of Profit and Loss for the year ended March 31st, 2020. | Amount (₹) |

| Revenue | 1,90,000 |

| Cost of sales | (1,10,000) |

| Gross profit | 80,000 |

| Depreciation | (15,000) |

| Other operating expenses | (28,000) |

| Interest cost | (2,000) |

| Profit before taxation | 35,000 |

| Taxation | (7,500) |

| Profit after taxation | 27,500 |

| Consolidated balance sheet | March 31st 2020 | March 31st 2019 |

| Assets | Amount (₹) | Amount (₹) |

| Cash and cash equivalents | 4,000 | 2,500 |

| Trade receivables | 27,000 | 25,000 |

| Inventories | 15,000 | 17,500 |

| Property, plant and equipment | 80,000 | 40,000 |

| Goodwill | 9,000 | – |

| Total assets | 1,35,000 | 85,000 |

| Liabilities | ||

| Trade payables | 34,000 | 30,000 |

| Income tax payable | 6,000 | 5,500 |

| Long term debt | 50,000 | 32,000 |

| Total outside liabilities | 90,000 | 67,500 |

| Shareholders’ equity | 45,000 | 17,500 |

| Total liabilities & shareholders’ equity | 1,35,000 | 85,000 |

![]()

Other information:

All of the shares of entity B were acquired for ₹ 37,000 in cash. The fair values of assets acquired and liabilities assumed were :

| Particulars | Amount (₹) |

| Inventories | 2,000 |

| Trade receivables | 4,000 |

| Cash | 1,000 |

| Property, plant and equipment | 55,000 |

| Trade payables | (16,000) |

| Long term debt | (18,000) |

| Goodwill | 9,000 |

| Cash consideration paid | 37,000 |

You are required to prepare the Consolidated Statement of Cash Flows for the financial year ended March 31st, 2020 in accordance with Ind AS 7.

Answer:

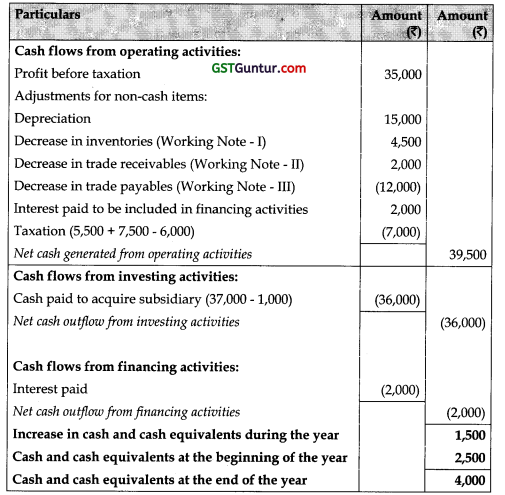

[Based on Ind AS 7]

Statement of Cash Flows for the year ended 2020 (extract)

Working Notes:

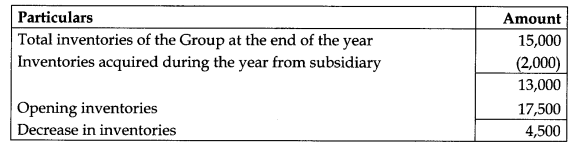

Working Note -1:

Computation of Change in Inventory during the year:

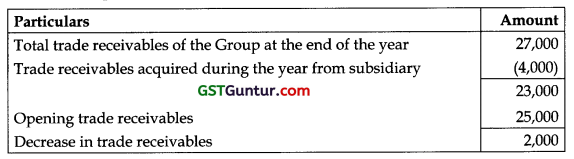

Working Note – II:

Computation of change in Trade Receivables during the year:

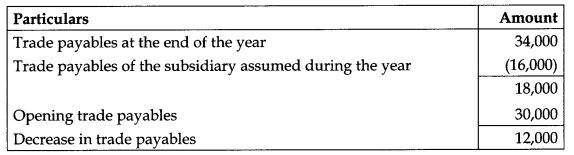

Working Note – III:

Computation of change in Trade Payables during the year:

![]()

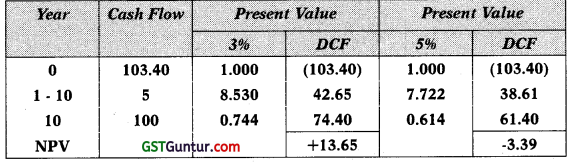

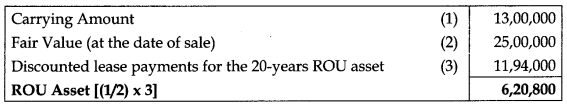

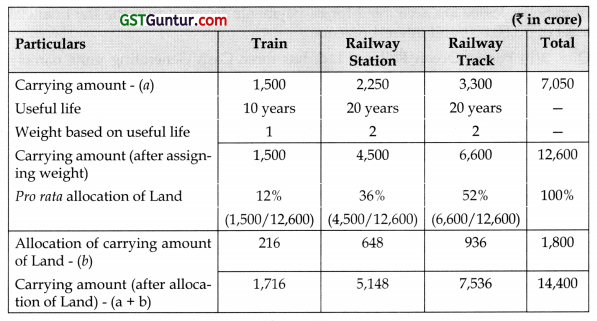

(c) Entity H holds a 20% equity interest in Entity S (an associate) that in turn has a 100% equity interest in Entity T, Entity S recognised net assets relating to Entity T of ₹ 10,000 in its consolidated financial statements. Entity S sells 20% of its interest in Entity T to a third party (a non-controlling shareholder) for ₹ 3,000 and recognises this transaction as an equity transaction in accordance with the provisions of Ind AS 110, resulting in a credit in Entity S’s equity of ₹ 1,000. (Marks 6)

The financial statements of Entity H and Entity S are summarised as follows before and after the transaction :

| Before | |||

| H’s consolidated financial statements | |||

| Assets | (₹) | Liabilities | (₹) |

| Investment in S | 2,000 | Equity | 2,000 |

| Total | 2,000 | Total | 2,000 |

| S’s consolidated financial statements | |||

| Assets | (₹) | Liabilities | (₹) |

| Assets (from.T) | 10,000 | Equity | 10,000 |

| Total | 10,000 | Total | 10,000 |

| The financial statements of S after the transaction are summarised below : | ||||

| After | ||||

| S’s consolidated financial statements | ||||

| Assets | (₹) | Liabilities | (₹) | |

| Assets (from T) | 10,000 | Equity | 10,000 | |

| Cash | 3,000 | Equity transaction Impact with non-controlling interest | 1,000 | |

| Equity attributable to owners | 11,000 | |||

| Non-controlling interest | 2,000 | |||

| Total | 13,000 | Total | 13,000 | |

![]()

Although Entity H did not participate in the transaction, Entity H’s share of net assets in Entity S increased as a result of the sale of S’s 20% interest in T. Effectively, H’s share in S’s net assets is now ₹ 2,200 (20% of ₹ 11,000) i.e., ₹ 200 in addition to its previous share.

How this equity transaction that is recognised in the financial statements of Entity S reflected in the consolidated financial statements of Entity H that uses the equity method to account for its investment in Entity S ?

Answer:

[Based on Ind AS 28]

Interpretation:

The change of interest in the net assets/equity of the associate as a result of the investee’s equity transaction is reflected in the investor’s financial statements as ‘share of other changes in equity of investee’ (in the statement of changes in equity) instead of gain in Statement of profit and loss, since it reflects the post-acquisition change in the net assets of the investee as per paragraph 3 of Ind AS 28 and also faithfully reflects the investor’s share of the associate’s transaction as presented in the associate’s consolidated financial statements.

Conclusion:

Thus, in the given case, Entity H recognises ₹ 20 as change in other equity instead of in statement of profit and loss and maintains the same classification as of its associate, Entity T, i.e., a direct credit to equity as in its consolidated financial statements.

![]()

Question 6.

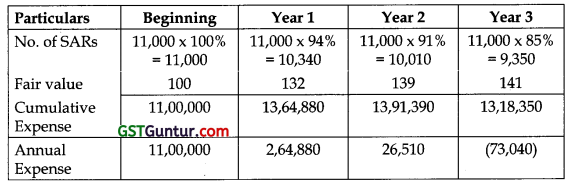

(a) Nest Ltd. issued 10,000 Share Appreciation Rights (SARs) that vest immediately to its employees on April 1st, 2017. The SARs will be settled in cash. Using an option pricing model, at that date it is estimated that the fair value of a SAR is ₹ 100. SAR can be exercised any time until March 31st 2020. It is expected that out of the total employees, 94% at the end of period on March 31st, 2018, 91% at the end of next year will exercise the option.

Finally, when these were vested i.e. at the end of the 3rd year, only 85% of the total employees exercised the option. (Marks 5)

| Fair value of SAR | ₹ |

| March 31st, 2018 | 132 |

| March 31st, 2019 | 139 |

| March 31st, 2020 | 141 |

You are required to pass the Journal entries to show the effect of the above transaction.

Answer:

[Based on Ind AS 102]

Computation of Annual Expense:

Journal Entries:

| 1st April, 2017 | Debit (₹) | Credit (₹) |

| Employee benefits expenses

To Share based payment liability (Being Fair value of the SAR recognized) |

11,00,000 | 11,00,000 |

| 31st March, 2018 | ||

| Employee benefits expenses .

To Share based payment liability (Being Fair value of the SAR re-measured) |

2,64,880 |

2,64,880 |

| 31st March, 2019 | ||

| Employee benefits expenses

To Share based payment liability (Being Fair value of the SAR re-measured) |

26,510 |

26,510 |

| 31st March, 2020 | Debit (₹) | Credit (₹) |

| Share based payment liability

To Employee benefits expenses (Being Fair value of the SAR reversed) |

73,040 |

73,040 |

| Share based payment liability

To Cash (Being Settlement of SAR) |

13,18,350 |

13,18,350 |

![]()

(b) Parent Limited, prepares consolidated financial statements of the group on 31st March every year. During the year ended March 31st, 2020, the following events affected the tax position of the group : (Marks 6)

(i) S Limited, a wholly owned subsidiary of Parent Limited, incurred a loss of ₹ 20,00,000 which is adjustable from future taxable profits of the company for tax purposes. S Limited is unable to utilize this loss against previous tax liabilities. Income-tax Act does not allow S Limited to transfer the tax loss to other group companies. However, it allows S Limited to carry forward the loss and utilize it against company’s future taxable profits. The directors of Parent Limited estimate that S Limited will not make any taxable profits in the foreseeable future.

(ii) On April 1st, 2019, Parent Limited borrowed ₹ 50,00,000. The cost incurred by Parent Limited for arranging the borrowing was ₹ 1,00,000 on the said date and this expenditure is qualified for deduction under the Income-tax Act for the accounting year 2019-20. The loan was given for a three-years period. As per agreement, no principal or interest was payable on the loan during the tenure of loan but the amount repayable on March 31st, 2022 will be by way of a bullet payment of ₹ 65,21,900. As per Parent Limited, this equates to an effective annual interest rate of 10% on loan. As per the Income-tax Act, a further expense of ?₹ 15,21,900 will be claimable from taxable income till the loan is repaid on March 31st, 2022.

The rate of corporate income tax to be assumed @ 20%.

Explain and show how each of.these events would affect the deferred tax assets/ liabilities in the consolidated balance sheet of Parent Limited as at March 31st, 2020 as per applicable Ind AS.

You are also required to examine whether the effective rate of interest arrived at by Parent Limited for the loan of ₹ 50,00,000 is in accordance with applicable Ind AS or not ?

Answer:

[Based on Ind AS 12]

Computation for Part (i):

Computation of Deferred Tax:

| Particulars | Amount |

| Carrying value | Nil |

| Tax Base | ₹ 20,00,000 |

| Deductible T.D. | ₹ 20,00,000 |

| DTA | See below |

Conclusion:

No deferred tax asset can be recognized because there is no prospect of being able to reduce tax liabilities in the foreseeable future as no taxable profits are anticipated.

![]()

Computation for Part (ii):

Computation of Deferred Tax:

| Particulars | Amount |

| Carrying value [₹ 50,00,000 – ₹ 1,00,000 + (₹ 49,00,000 × 10%)] | ₹ 53,90,000 |

| Tax Base (tax deduction has already been claimed) | ₹ 50,00,000 |

| Deductible T.D. | ₹ 3,90,000 |

| DTA | See below |

Conclusion:

This creates a potential deferred tax asset of ₹ 78,000 (₹ 3,90,000 × 20%).

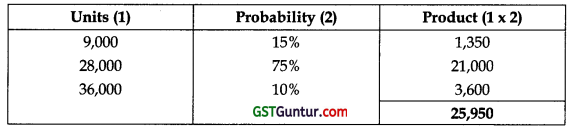

(c) Royal Ltd. is a company which has a net worth of ₹ 200 crore engaged in the manufacturing of rubber products. The sales of the company are badly affected due to pandemic during the Financial year 2019-20. Relevant financial details of the following financial years are as follows: (Marks 5)

(₹ in crore)

| Particulars | March 31st, 2020 (Current year) estimated | March 31st, 2019 | March 31st, 2018 | March 31st, 2017 |

| Net Profit | 3.00 | 8.50 | 4.00 | 3.00 |

| Sales (turnover) | 850 | 950 | 900 | 800 |

During the pandemic period (till March 31st, 2020) various commercial activities were undertaken with considerable concessions/discounts, along the related affected areas. The management intends to highlight the expenditure incurred on such activities as expenditure incurred, on activities undertaken to discharge corporate social responsibility, while publishing its financial statements for the year 2019-20.

You are requested to advise CFO of Royal Ltd. on the below points along with reasons for your advise :

(i) Whether the Company has an obligation to form a CSR committee since the applicability criteria are not satisfied in the current financial year ?

(ii) The accounting of expenditure during the pandemic period is to be treated as expenditure on CSR in the financial statement according to the view of the accountant of the company.

Answer:

[Based on CSR]

A company which meets the net worth, turnover or net profits criteria in the immediately preceding financial year will need to constitute a CSR Committee and comply with provisions of section 135(2) to (5) read with the CSR Rules.

Evaluation Chart:

| s. No. | Criteria | Remarks |

| 1. | Net worth greater than or equal to ₹ 500 Crores | Not met |

| 2. | Sales greater than or equal to ₹ 1000 Crores | Not met |

| 3. | Net Profit greater than or equal to ₹ 5 Crores | This criterion is satisfied in financial year ended March 31, 2019 i.e. immediately preceding financial year. |

Conclusion:

Hence, the Company will be required to form a CSR committee.

![]()

(d) Entity K is owned by three institutional investors – M Limited, N Limited and C Limited – holding 40%, 40% and 20% equity interest respectively. A I contractual arrangement between M Limited and N Limited gives them joint control over the relevant activities of Entity K. It is determined that Entity K is a joint operation (and not a joint venture). C Limited is not a party to the arrangement ! between M Limited and N Limited. However, like M Limited and N Limited, C Limited also has rights to the assets, and obligations for the liabilities, relating to the joint operation in proportion of its equity interest in Entity K. (Marks 4)

Would the manner of accounting to be followed by M Limited and N Limited on the one hand and C Limited on the other in respect of their respective interests in Entity K be the same or different ?

You are required to explain in light of the relevant provisions in the relevant standard in this regard.

Answer:

[Based on Ind AS 111]

Analysis:

In the given case, all three investors (M Limited, N Limited and C Limited) share in the assets and liabilities of the joint operation in proportion of their respective equity interest.

Conclusion:

Accordingly, both M Limited and N Limited (which have joint control) and C Limited (which does not have joint control) shall apply paragraphs 20-22 in accounting for their respective interests in Entity K in their respective separate financial statements as well as consolidated financial statements.

![]()

OR

(d) An entity negotiates with major airlines to purchase tickets at reduced rates compared with the price of tickets sold directly by the airlines to the public. The entity agrees to buy a specific number of tickets and will pay for those tickets even if it is not able to resell them. The reduced rate paid by the entity for each ticket purchased is negotiated and agreed in advance. The entity determines the prices at which the airline tickets will be sold to its customers. The entity sells the tickets and collects the consideration from customers when the tickets are sold; therefore, there is no credit risk to the entity.

The entity also assists the customers in resolving complaints with the service provided by airlines.

However, each airline is responsible for fulfilling obligations associated with the ticket, including remedies to a customer for dissatisfaction with the service.

Determine whether the entity is a principal or an agent with suitable explanation in light with the provisions given in the relevant standard.

Answer:

[Based on Ind AS 115]

Analysis:

To determine whether the entity’s performance obligation is to provide the specified goods or services itself (i.e. the entity is a principal) or to arrange for another party to provide those goods or services (i.e. the entity is an agent), the entity considers the nature of its promise.

The entity determines that its promise is to provide the customer with a ticket, which provides the right to fly on the specified flight or another flight if the specified flight is changed or cancelled. The entity considers the following indicators for assessment as principal or agent under the contract with the customers:

| S. No. | Para No. | Indicators |

| 1. | B37(a) | The entity is primarily responsible for fulfilling the contract, which is providing the right to fly. However, the entity is not responsible for providing the flight itself, which will be provided by the airline. |

| 2. | B37(b) | The entity has inventory risk for the tickets because they are purchased before, they are sold to the entity’s customers and the entity is exposed to any loss as a result of not being able to sell the tickets for more than the entity’s cost. |

| 3. | B37(c) | The entity has discretion in setting the sales prices for tickets to its customer |

![]()

Conclusion

The entity concludes that its promise is to provide a ticket (i.e. a right to fly) to the customer. On the basis of the indicators, the entity concludes that it controls the ticket before it is transferred to the customer.

Thus, the entity concludes that it is a principal in the transaction and recognizes revenue in the gross amount of consideration to which it is entitled in exchange for the tickets transferred.