CA Inter Costing Question Paper May 2022 – CA Inter Costing Study Material is designed strictly as per the latest syllabus and exam pattern.

CA Inter May 2022 Costing Question Paper Solution

Question 1.

Answer the following :

(a) A Limited a toy company purchases its requirement of raw material from S Limited at ₹ 120 per kg. The company incurs a handling cost of ₹ 400 plus freight of ₹ 350 per order. The incremental carrying cost of inventory of raw material is ₹ 0.25 per kg. per month. In addition the cost of working capital finance on the investment in inventory of raw material is ₹ 15 per kg. per annum. The annual production of the toys is 60,000 units and 5 units of toys are obtained from one kg. of raw material.

Required:

(i) Calculate the Economic Order Quantity (EOQ) of raw materials.

(ii) Advise, how frequently company should order to minimize its procurement cost. Assume 360 days in a year.

(iii) Calculate the total ordering cost and total inventory carrying cost per annum as per EOQ.

(b) PQR Limited has replaced 72 workers during the quarter ended 31st March 2022. The labour rates for the quarter are as follows :

| Flux method | 16% |

| Replacement method | 8% |

| Separation method | 5% |

You are required to ascertain:

(i) Average number of workers on roll (for the quarter),

(ii) Number of workers left and discharged during the quarter,

(iii) Number of workers recruited and joined during the quarter,

(iv) Equivalent employee turnover rates for the year.

(c) Top-tech a manufacturing company is presently evaluating two possible machines for the manufacture of superior Pen-drives. The following information is available :

| Particulars | Machine A | Machine B |

| Selling price per unit | ₹ 400.00 | ₹ 400.00 |

| Variable cost per unit | ₹ 240.00 | ₹ 260.00 |

| Total fixed costs per year | ₹ 350 lakhs | ₹ 200 lakhs |

| Capacity (in units) | 8,00,000 | 10,00,000 |

(i) Recommend which machine should be chosen?

(ii) Would you change your answer, if you were informed that in near future demand will be unlimited and the capacities of the two machines are as follows?

Machine A – 12,00,000 units

Machine B – 12,00,000 units Why?

(d) Coal is transported from two mines X & Y and unloaded at plots in a railway station. X is at distance of 15 kms and Y is at a distance of 20 kms from the rail head plots. A fleet of lorries having carrying capacity of 4 tonnes is used to transport coal from the mines. Records reveal that average speed of the lorries is 40 kms per hour when running and regularly take 15 minutes to unload at the rail head.

At Mine X average loading time is 30 minutes per load, while at mine Y average loading time is 25 minutes per load.

Additional Information:

Drivers’ wages, depreciation, insurance and taxes, etc. 12 per hour Operated Fuel, oil tyres, repairs and maintenance, etc. ₹ 1.60 per km.

You are required to prepare a statement showing the cost per tonne kilometre of carrying coal from each mine ‘X’ and ‘Y’. (Marks 4 × 5 = 20)

Answer:

Answer the following:

(a) Ordering Cost (O) = 400 + 350 = ₹ 750

Price per kg. = ₹ 120

Carrying cost (C) = 0.25 × 12 + 15 = ₹ 18

Annual requirement (A) = \(\frac{60,000}{5}\) = 12,000

(i) EOQ = \(\sqrt{\frac{2 \mathrm{AO}}{\mathrm{C}}}\)

= \(\sqrt{\frac{2 \mathrm{AO}}{\mathrm{C}}}\)

= 1000 units

(ii) Frequency = 360 × \(\frac{\mathrm{EOQ}}{\mathrm{A}}\)

= 360 × \(\frac{1000}{12000}\)

= 30 days

∴ Company should order every 30 days to minimize its procure¬ment cost.

(iii) Total Ordering Cost = \(\frac{\mathrm{A}}{\mathrm{EOQ}}\) × O

= \(\frac{12000}{1000}\) × 750 = ₹ 9000

Total Inventory Carrying Cost = \(\frac{\mathrm{EOQ}}{\mathrm{A}}\) × C

= \(\frac{1000}{2}\) × 18 = ₹ 9000

(b) (i) Employee Turnover rate using Replacement Method

= \(\frac{\text { No. of Replacements }}{\text { Average No. of workers on roll }}\) × 100

\(\frac{8}{100}=\frac{72}{\text { Average No. of workers on roll }}\)

Average No. of workers on roll = 900

(ii) Employee turnover Rate (Separation Method)

= \(\frac{\text { No. of Separations(S) }}{\text { Average No. of workers on roll }}\) × 100

\(\frac{5}{100}=\frac{S}{900}\)

or S = 45

Hence, No. of workers left and discharged comes to 45.

(iii) Employee Turnover Rate (Flux Method)

= \(\frac{\text { No. of Separations }(\mathrm{S})+\text { No. of Accession(A) }}{\text { Average No. of workers on roll }}\)

\(\frac{16}{100}=\frac{45+A}{900}\)

A = 99

No. of workers joined and recruited is 99

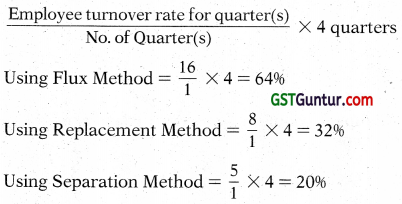

(iv) Calculation of equivalent employee turnover ratio:

(c) (i) Statement of profit from Machine A and Machine B

| Machine A | Machine B | |

| Capacity | 8,00,000 | 10,00,000 |

| Selling price p.u. (₹) | 400 | 400 |

| Less: Variable Lost p.u. (₹) | 240 | 260 |

| Contribution p.u. (₹) | 160 | 140 |

| Total Contribution (₹) | 12,80,00,000 | 14,00,00,000 |

| Less: Fixed cost (₹) | (3,50,00,000) | (2,00,00,000) |

| Profit (₹) | 9,30,00,000 | 12,00,00,000 |

As the profit in Machine B is higher, Machine B should be selected.

(ii) Now, if the capacity for both the machine are similar, the profit under both the machine will be as under:

| Machine A | Machine B | |

| Total Contribution (₹) | 19,20,00,000 (12,00,000 × ₹ 160p.u.) |

16,80,00,000 (12,00,000 × ₹ 140p.u.) |

| Less: Fixed cost (₹) | (3,50,00,000) | (2,00,00,000) |

| Profit (₹) | 15,70,00,000 | 14,80,00,000 |

Therefore, as the profit under Machine A is higher, machine A will be recommended.

The profit under machine A is higher because the contribution per unit under machine A is greater as compared to machine B and the higher fixed cost in Machine A is offset by the higher contribution per unit in machine A.

(d) Calculate of cost per tonne km

| MineX | Mine Y | |

| Driver’s wages, dep, evs, & taxes [WN-1] | ₹ 18 | ₹ 20 |

| Fuel, Oil, R&M [WN-2] | ₹ 48 | ₹ 64 |

| Total cost | ₹ 66 | ₹ 84 |

| Total Tonne – km | 60 tonne – km | 80 tonne – km |

| Cost per tonne km | ₹ 1.1 | ₹ 1.05 |

Working Notes:

1.

| Mine X | Mine Y | |

| Loading at mines | 30 min | 25 min |

| From mine to Rail Station | 22.50 min | 30 min |

| Unloading at Rail Station | 15 min | 15 min |

| Rail Station to mine | 22.50 min | 30 min |

| 90 min or | 100 min or | |

| ₹ 1.5 Hr | ₹ 1.67 Hr. | |

| Cost per Hour | ₹ 12/Hr | ₹ 12/Hr. |

| Total | ₹ 18 | ₹20 |

2.

| Mine X | Mine Y | |

| Total distance travelled | 30 km (15 km × 2) |

40 km (20 km × 2) |

| Cost per km | ₹ 1.60 | ₹ 1.60 |

| Total cost | ₹ 48 | ₹ 64 |

![]()

Question 2.

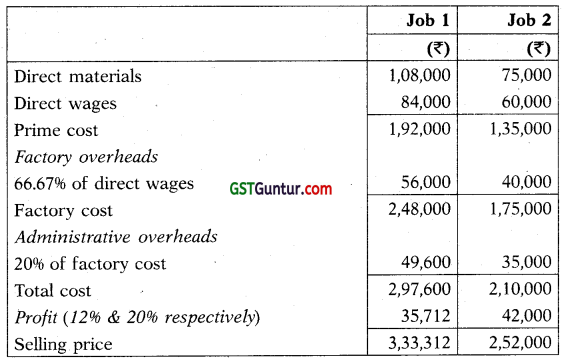

(a) In a manufacturing company, the overhead is recovered as follows:

Factory Overheads: a fixed percentage basis on direct wages and Administrative overheads: a fixed percentage basis on factory cost.

The company has furnished the following data relating to two jobs undertaken by it in a period.

| Job 1 (₹) | Job 2 (₹) | |

| Direct materials | 1,08,000 | 75,000 |

| Direct wages | 84,000 | 60,000 |

| Selling price | 3,33,312 | 2,52,000 |

| Profit percentage on total cost | 12% | 20% |

You are required to :

(i) Compute the percentage recovery rates of factory overheads and administrative overheads.

(ii) Calculate the amount of factory overheads, administrative overheads and profit for each of the two jobs.

(iii) Using the above recovery rates, determine the selling price to be quoted for Job 3. Additional data pertaining to Job 3 is as follows : (10 Marks)

| Direct materials | ₹ 68,750 |

| Direct wages | ₹ 22,500 |

| Profit percentage on selling price | 15% |

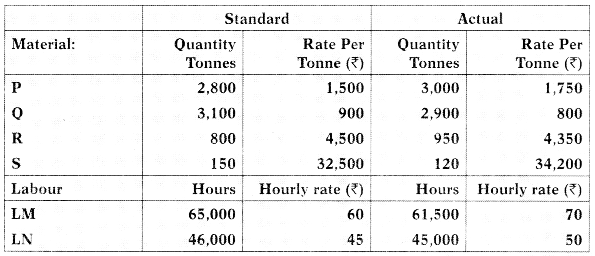

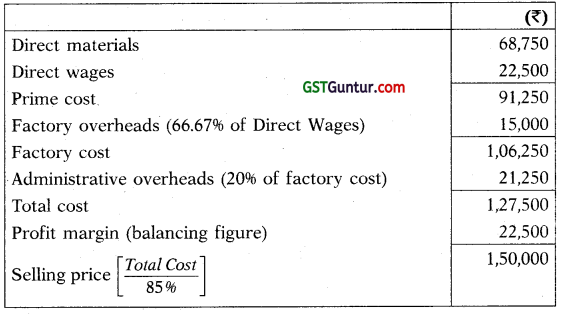

(b) Paramount Constructions Limited is engaged in construction and erection of bridges under long term contracts. It has entered into a big contract at an agreed price of ₹ 250 Lakhs subject to an escalation clause for material and labour as spelt out in the contract and corresponding actual are as follows :

Required:

(i) Prepare a statement showing admissible additional claim of material and labour due to escalation clause.

(ii) Determine the final price payable after admissible escalation claim. (5 Marks)

(c) Distinguish between Job costing and Process Costing. (Any five points of differences) (5 Marks)

Answer:

(a)

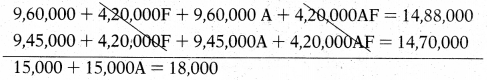

(i) Let the factory overhead recovery rate as percentage of direct wages be ‘F’ and Administrative overhead recovery rate as percentage of factory cost be ‘A’

Factory cost of jobs:

Direct materials + Direct wages + Factory overhead

For Job 101 = ₹ 1,08,000 + ₹ 84,000 + ₹ 84,000 F

For Job 102 = ₹ 75,000 + ₹ 60,000 + ₹ 60,000F

Total Cost of Jobs: Factory cost + Administrative overhead

For Job 1 = (₹ 1,92,000 + ₹ 84,000F) + (₹ 1,92,000 + ₹ 84,000F) A

= ₹ 2,97,600 [WN-1]

For Job-2 = (₹ 1,35,000 + ₹ 60,000F) + (₹ 1,35,000 + ₹ 60,000F) A

= ₹ 2,10,000 [WN-2]

The value of F & A can be found using following equations

1.92.0 + 84,000F + 1,92,000A + 84,000AF = 2,97,600 …eqn (i)

1.35.0 + 60,000F + l,35,OOOA + 60,000AF = 2,10,000 …eqn (ii)

Multiplying Equation (i) by 5 and Equation (ii) by 7

15.000A = 3,000

A = 0.2

Now put the value of ‘A’ in equation (z) to find the value of ‘F’

1,92,0 + 84000F + 1,92,000(0.2)+ 16,800F = 2,97,600

F = 0.6667

On solving the above relations: F = 0.6667 and A = 0.20

Hence, percentage recovery rates of:

Factory overheads = 66.67% of wages and Administrative overheads = 20% of factory cost.

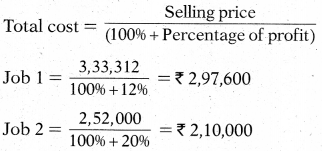

Working note:

(ii) Statement of jobs, showing amount of factory overheads, administrative overheads and profit:

(iii) Selling price of Job 3

(b) Statement Showing Final Claim

Final Claim = (A) + (B) = 5,25,000 + 8,80,000 = ₹ 14,05,000

Statement Showing Final Price Payable

| ₹ (in lakhs) | |

| Agreed Price | 250.00 |

| Agreed Escalation | |

| Material Cost | 5.25 |

| Labour Cost | 8.80 |

| 264.05 |

(c)

| Job Costing | Process Costing |

| A Job is carried out or a product is produced by specific orders. | The process of producing the product has a continuous flow and the product produced is homogeneous. |

| Costs are determined for each job. | Costs are compiled on time basis ie., for production of a given accounting period for each process or department. |

| Each job is separate and independent of other jobs. | Products lose their individual identity as they are manufactured in a continuous flow. |

| Each job or order has a number and costs are collected against the same job number. | The unit cost of process is an average cost for the period. |

| Costs are computed when a job is completed. The cost of a job may be determined by adding all costs against the job. | Costs are calculated at the end of the cost period. The unit cost of a process may be computed by dividing the total cost for the period by the output of the process during that period. |

| As production is not continuous and each job may be different, so more managerial attention is required for effective control. | Process of production is usually standardized and is therefore, quite stable. Hence control here is comparatively easier. |

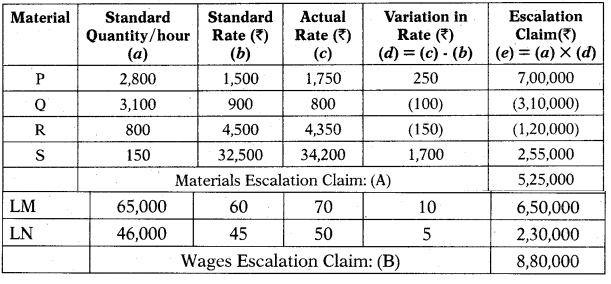

Question 3.

(a) SR Ltd. is a manufacturer of Garments. For the first three months of financial year 2022-23 commencing on 1st April 2022, production will he constrained by direct labour. It is estimated that only 12,000 hours of direct labour hours w ill be available in each month.

For market reasons, production of either of the two garments must be at least 25% of the production of the other. Estimated cost and revenue per garment are as follows :

| Shirt (₹) | Short(₹) | |

| Sales price | 60 | 44 |

| Raw Materials | ||

| Fabric @12 per metre | 24 | 12 |

| Dyes and cotton | 6 | 4 |

| Direct labour @ 8 per hour | 8 | 4 |

| Fixed Overhead @4 per hour | 4 | 2 |

| Profit | 18 | 22 |

From the month of July, 2022 direct labour will no longer be a constraint. The company expects to be able to sell 15,000 shirts and 20,000 shorts in July 2022. There wrill be no opening stock at the beginning of July 2022.

Sales volumes are expected to grow at 10% per month cumulatively thereafter throughout the year. Following additional information is available:

- The company intends to carry stock of finished garments sufficient to meet 40% of the next month’s sale from July 2022 onwards.

- The estimated selling price will be same as above.

Required:

I. Calculate the number of shirts and shorts to be produced per month in the first quarter of financial year 2022-23 to maximize company’s profit.

II. Prepare the following budgets on a monthly basis for July, August and September 2022:

(i) Sales budget showing sales units and sales revenue for each product.

(ii) Production budget (in units) for each product. (10 Marks)

(b) The following data are available from the books and records of A Ltd. for the month of April 2022 :

| Particulars | Amount (₹) |

| Stock of raw materials on 1st April 2022 | 10,000 |

| Raw materials purchased | 2,80,000 |

| Manufacturing wages | 70,000 |

| Depreciation on plant | 15,000 |

| Expenses paid for quality control check activities | 1000 |

| Lease Rent of Production Assets | 10,000 |

| Administrative Overheads (Production) | 15,000 |

| Expenses paid for pollution control and engineering & maintenance | 1000 |

| Stock of raw materials on 30th April 2022 | 40,000 |

| Primary packing cost | 8,000 |

| Research & development cost (Process related) | 5.000 |

| Packing cost for redistribution of finished goods | 1,500 |

| Advertisement expenses | 1,300 |

Stock of finished goods as on 1st April 2022 was 200 units having a total cost of ₹ 28,000. The entire opening stock of finished goods has been sold during the month. Production during the month of April, 2022 was 3,000 units. Closing stock of finished goods as on 30th April, 2022 was 400 units.

You are required to :

I. Prepare a Cost Sheet for the above period showing the:

(i) Cost of Raw Material consumed

(ii) Prime Cost

(iii) Factory Cost

(iv) Cost of Production

(v) Cost of goods sold

(vi) Cost of Sales

II. Calculate selling price per unit, if sale is made at a profit of 20% on sales. (10 Marks)

Answer:

(a)

| Particulars | Shirt (₹) | Short (₹) |

| Profit p.u (Given) | 18 | 22 |

| Direct Labour @18 per hour | 8 | 4 |

| Actual Labour hours required [i.e. Actual Cost/Cost per hour] | 1 hour | 0.5 hour |

| Profit per Labour Hour [re. Profit p.u/Actual Labour Hours] | ₹ 18/hour | ₹ 44/hour |

| Ranking | II | I |

Given That Production of one garment must be 25% of the production of other

So, let the No. of units production of shorts be x

the production of shirts will be 0.25x.

→ The labour hours of shorts + labour hours of shirts must be 12,000

Now, 0.5 hours (x) + 1 hour (0.25x) = 12,000 hours

0.5x + 0.25x = 12,000

0.75x = 12,000

x = 16,000

∴ Production of Shorts will be 16,000 units and Production of Shirts will be 4,000 units.

The Profit for the first quarter will be:

16,000 units × ₹ 22 + 4,000 units × ₹ 18

= ₹ 4,24,000

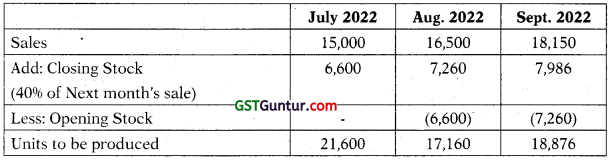

(II)

(i) Sales Budget

(ii) Production Budget (Shirts)

Production Budget (Shorts)

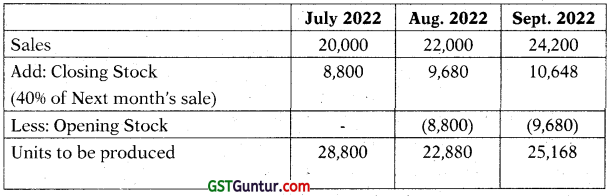

(I) Cost Sheet: (Amount in ₹)

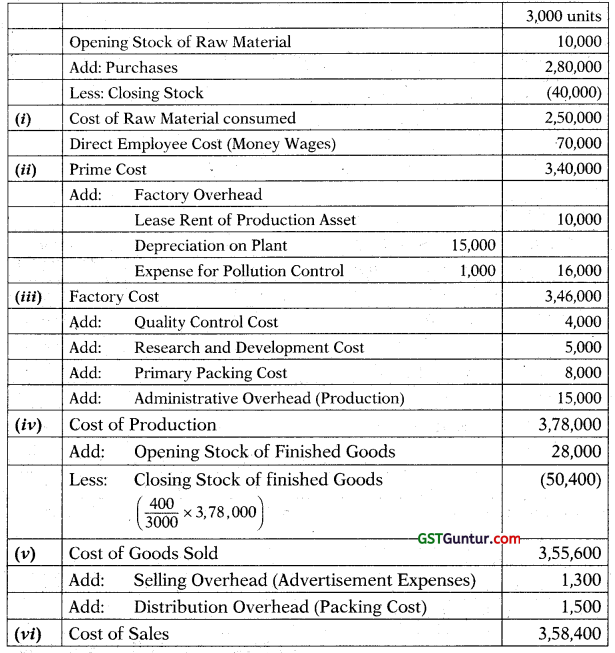

(II) Total no. of Units sold

= Opening + Production – Closing

= 200 + 3000 – 400

= 2800 Units

Total Selling Price

![]()

Question 4.

(a) STG Limited is a manufacturer of Chemical ‘GK’ which is required for industrial use. The complete production operation requires two processes.

The raw material first passes through Process I, where Chemical ‘G’ is produced. Following data is furnished for the month April 2022 ;

| Particulars | (in kgs.) |

| Opening work-in-progress quantity (Material 100% and conversion 50% complete) |

9.500 |

| Material input quantity | 1,05,000 |

| Work Completed quantity | 83,000 |

| Closing work-in-progress quantity

(Material 100% and conversion 60% complete) |

16,500 |

You are further provided that:

| Particulars | (in ₹) |

| Opening work-in-progress cost | |

| Material cost | 29,500 |

| Processing cost | 14,750 |

| Material input cost | 3,34,500 |

| Processing cost | 2,53,100 |

Normal process loss may be estimated to be 10% of material input. It has no realizable value. Any loss over and above normal loss is considered to be 100% complete in material and processing.

The Company transfers 60,000 kgs. of output (Chemical G) from Process I to Process II for producing Chemical ‘GK’ Further materials are added in Process II which yield 1.20 kg. of Chemical ‘GK’ for every kg. of Chemical ‘G’ introduced. The chemicals transferred to Process II for further processing are then sold as Chemical ‘GK’ for ₹ 10 per kg. Any quantity of output completed in Process I, are sold as Chemical ‘G’ @ ₹ 9 per kg.

The monthly costs incurred in Process II (other than the cost of Chemical ‘G’ are :

Input 60,000 kg. of Chemical ‘G’

Materials Cost ₹ 5,000

Processing Costs ₹ 50,000

You are required:

(i) Prepare Statement of Equivalent production and determine the cost per kg. of Chemical ‘G’ in Process I using the weighted average cost method.

(ii) Prepare a statement showing cost of Chemical ‘G’ transferred to Pro-cess II, cost of abnormal loss and cost of closing work-in-progress.

(iii) STG is considering the option to sell 60,000 kg. of Chemical ‘G’ of Process I without processing it further in Process-II. Will it be beneficial for the company over the current pattern of processing 60,000 kg. in process II ?

(Note : You are not required to prepare Process Accounts) (10 Marks)

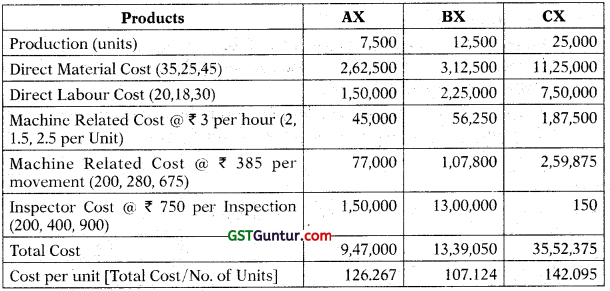

(b) UV Limited started a manufacturing unit from 1st October, 2021. It produces designer lamps and sells its lamps at ₹ 450 per unit.

During the quarter ending on 31st December, 2021, it produced and sold

12,0 units and suffered a loss of ₹ 35 per unit.

During the quarter ending on 31st March, 2022, it produced and sold 30,000 units and earned a profit of ₹ 40 per unit.

You are required to calculate :

(i) Total fixed cost incurred by UV Ltd. per quarter.

(ii) Break Even sales value (in rupees)

(iii) Calculate Profit, if the sale volume reaches 50,000 units in the next quarter (i.e., quarter ending on 30th June, 2022). (5Marks)

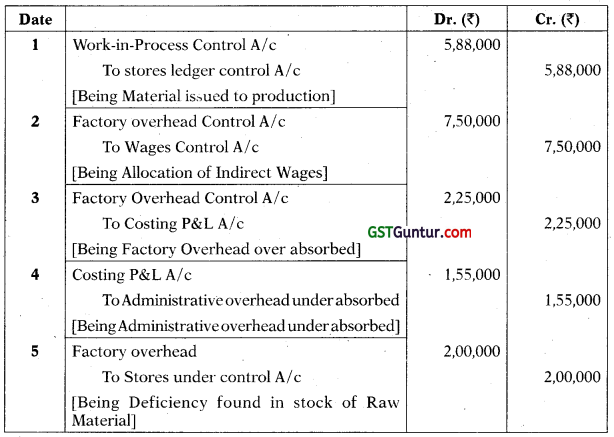

(c) Journalize the following transactions assuming the cost and financial accounts are integrated: (5 Marks)

| Particulars | Amount (₹) |

| Direct Materials issued to production | ₹ 5,88,000 |

| Allocation of Wages(Indirect) | ₹ 7,50,000 |

| Factory Overheads (Over absorbed) | ₹ 2,25,000 |

| Administrative Overheads (Under absorbed) | ₹ 1,55,000 |

| Deficiency found in stock of Raw material (Normal) | ₹ 2,00,000 |

Answer:

(a)

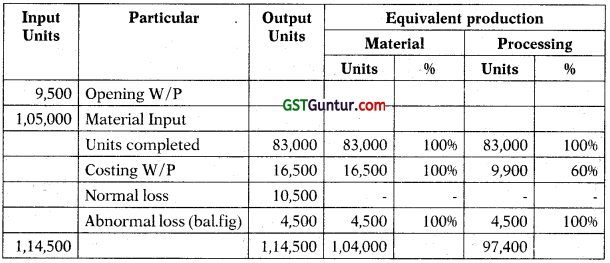

(i) Statement of equivalent production

(ii) Calculation of cost per unit

Material Cost = 1 04 000 “ = ₹ 3.5/kg.

2,53,100 + 14,750 ‘

Conversion Cost = Q7 = ₹ 2.75/kg.

Cost of chemical & transferred to process II

Material cost = ₹ 3.5/kg × 60,000 kg = 2,10,000

Conversion cost = ₹ 2.75/kg × 60,000 kg = 1,65,000

= 3,75,000

Cost of abnormal loss

Material cost = ₹ 3.5/kg × 4,500 kg

Conversion cost = ₹ 2.75/kg × 4,500 kg

Cost of Closing W-I-P

Material cost = ₹ 3.5/kg × 16,500 kg

Conversion cost = ₹ 2.75/kg × 9,900 kg

(iii) If chemical G is further processed in process II Total Sales value 7,20,000

(60,000 kg × 1.2 × ₹ 10/kg)

| Less: Chemical G | 3,75,000 |

| Material cost | 85,000 |

| Processing cost | 50,000 |

| 2,10,000 |

If chemical G is not further processed

| Sales value (60,000 kg × ₹ 9) | 5,40,000 |

| Less: Material cost | (2,10,000) |

| Conversion cost | (1,65,000) |

| 1,65,000 |

Therefore, further processing of Chemical G will give incremental revenue of ₹ 45,000 ie. (2,10,000 – 1,65,000).

(b) Contribution p.u. = \(\frac{\text { Change in Contribution }}{\text { Change in No. of Units }}\)

Change in Contribution = (12,000 × ₹ 35) + (30,000 × ₹ 40)

= ₹ 16,20,000

Change in No. of Units = 30,000 – 12,000

= 18,000 Units

Contribution p.u. = \(\frac{₹ 16,20,000}{18,000 \text { units }}\)

= ₹ 90 p.u.

∴ P/V Ratio = \(=\frac{₹ 90}{₹ 450}\) × 100 = 20%

(i) Fixed Cost = Total Contribution + Loss

= (12,000 × ₹ 90) + (12,000 × ₹ 35)

= ₹ 10,80,000 + ₹ 4,20,000

= ₹ 15,00,000

(ii) Break Even Sales Value (in ?)

= \(\frac{\text { Fixed Cost }}{P / V \text { Ratio }}\)

= \(\frac{15,00,000}{20 \%}\)

= ₹ 75,00,000

(iii) Total Profit = Total Contribution – Fixed Cost

= (50,000 × ₹ 90) – ₹ 15,00,000

= ₹ 45,00,000 – ₹ 15,00,000

= ₹ 30,00,000

(c)

Journal Entries

Question 5.

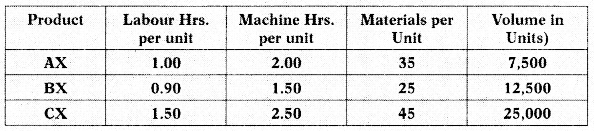

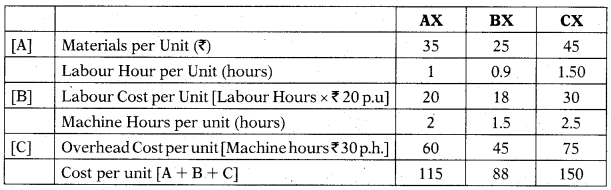

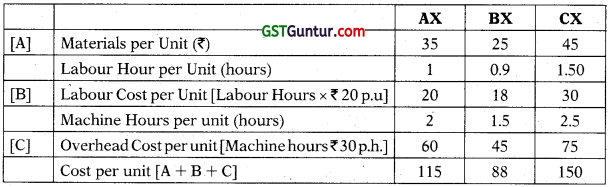

(a) StaT Limited manufacture three products using the same production methods. A conventional product costing system is being used currently. Details of the three products for a typical period are :

Direct Labour costs ₹ 20 per hour and production overheads are absorbed on a machine hour basis. The overhead absorption rate for the period is ₹ 30 per machine hour.

Management is considering using Activity Based Costing system to ascertain the cost of the products. Further analysis shows that the total production overheads can be divided as follows :

| Particulars | % |

| Cost relating to set ups | 40 |

| Cost relating to machinery | 10 |

| Cost relating to material handling | 30 |

| Costs relating to inspection | 20 |

| Total production overhead | 100 |

The following activity volumes are associated with the product line for the period as a whole. Total activities for the period :

Required:

(i) Calculate the cost per unit for each product using the conventional method.

(ii) Calculate the cost per unit for each product using activity based costing method. (10 Marks)

(b) A manufacturing department of a company has employed 120 workers. The standard output of product “NPX” is 20 units per hour and the standard wage rate is ₹ 25 per labour hour.

In a 48 hours week, the department produced 1,000 units of ‘NPX’ despite 5% of the time paid being lost due to an abnormal reason. The hourly wages actually paid were ₹ 25.70 per hour.

Calculate:

(i) Labour Cost Variance

(ii) Labour Rate Variance

(iii) Labour Efficiency Variance

(iv) Labour Idle time Variance (5 Marks)

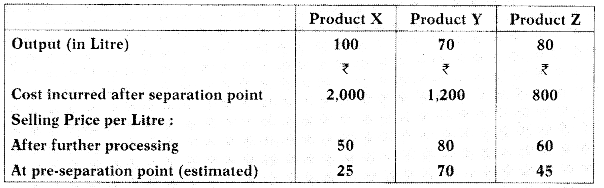

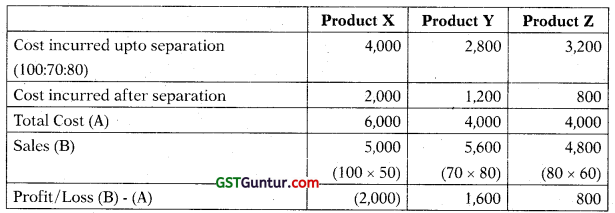

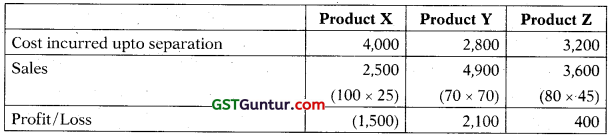

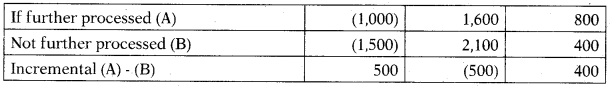

(c) RST Limited produces three joint products X, Y and Z. The products are processed further. Pre-separation costs are apportioned on the basis of weight of output of each joint product. The following data are provided for the month of April, 2022.

Cost incurred up to separation point: ₹ 10,000

You are required to :

(i) Prepare a statement showing profit or loss made by each product after further processing using the presently adopted method of apportionment of pre-separation cost.

(ii) Advise the management whether, on purely financial consideration, the three products are to be processed further or not.

Answer:

(a)

(i) Statement Showing Cost (Conventional Method)

Total Overhead = Σ Overhead Cost per unit × No. of Units

= (7,500 × ₹ 60) + (12,500 × ₹ 45) + (25,000 × ₹ 75)

= 28,87,500

Cost driver Rates

(ii) Calculate the cost per unit for each product using activity based costing method.

(b) Standard output per hour = 20 units

Standard rate (SR) = ₹ 25/Hr

Actual output = ₹ 1,000 units

Actual Hrs. (AH) = 48 Hrs – idle time (48 × 5%)

= 45.60 Hr

Standard has required for actual output (SH) = \(\frac{1,000 \text { units }}{20 \text { units } / \mathrm{hr}}\) = 50 hrs

Actual Rate (AR) = ₹ 25.70 Hr.

Idle time = ₹ 48 Hrs × 5% = 2.4 Hrs.

(i) Labour Cost Variance = SH × SR – AH × AR

= 50 × ₹ 25/Hr – 48 Hr × ₹ 25.70/Hr

= ₹ 16.40 (F).

(ii) Labour Rate Variance = AH (SR – AR)

= 48 Hrs (25 – 25.70) 1 Hr .

= ₹ 33.60 (A).

(iii) Labour Efficiency Variance = SR (SH – AH)

= 25 (50 – 45.60)

= 110(F)

(iv) Labour IDLE TIME variance = Idle time × Std. Rate (SR)

= 2.4 Hrs × 25 = 60 (A).

(c)

(i) Statement showing profit and loss of each product if products are processed further:

(ii) Statement showing profit/loss if products are not processed further

Therefore,

As clearly visible that further processing of Products X & Z to be incremental benefit, so it should be processed further.

However, Product Y should not be processed further as it leads to loss, so it should be sold at separation point.

![]()

Question 6.

Answer any four of the following :

(a) Briefly explain the essential features of a good Cost Accounting System.

(b) Write down the treatment of following items associated with purchase of materials.

(i) Cash discount

(ii) IGST

(iii) Demurrage

(iv) Shortage

(v) Basic Custom Duty

(c) Explain the treatment of Overtime Premium in following situations:

(i) SV & Co. wants to grab some special orders, and overtime is required to meet the same.

(ii) Dept. X has to work overtime to make up a shortfall in produc¬tion due to some fault of management in dept. Y.

(iii) S Ltd. has to work overtime regularly throughout the year as a policy due to the workers’ shortage.

(iv) Due to flood in Odisha, RS Ltd. has to work overtime to com¬plete the job.

(v) A customer requested the company MN Ltd. to expedite the job because of his urgency of work.

(d) Discuss briefly some of the criticism which may be levelled against the Standard Costing System.

(e) Identify the methods of costing from the following statements:

(i) Costs are directly charged to a group of products.

(ii) Nature of the product is complex and method cannot be ascertained.

(iii) Cost is ascertained for a single product.

(iv) All costs are directly charged to a specific job.

(v) Costs are charged to operations and averaged over units pro-

Answer:

(a) The essential features, which a good cost accounting system should possess, are as follows:

- Informative and simple: Cost accounting system should be tailor-made, practical, simple and capable of meeting the requirements of a business concern. The system of costing should not sacrifice the utility by introducing inaccurate and unnecessary details.

- Accurate and authentic: The data to be used by the cost accounting system should be accurate and authenticated; otherwise it may distort the output of the system and a wrong decision may be taken.

- Uniformity and consistency: There should be uniformity and consistency in classification, treatment and reporting of cost data and related information. This is required for benchmarking and comparability of the results of the system for both horizontal and vertical analysis.

- Integrated and inclusive: The cost accounting system should be integrated with other systems like financial accounting, taxation, statistics and operational r esearch etc. to have a complete overview and clarity in results.

- Flexible and adaptive: The cost accounting system should be flexible enough to make necessary amendment and modifications in the system to incorporate changes in technological, reporting, regulatory and cither requirements.

- Trust on the system: Management should have trust on the system and its output. For this, an active role of management is required for the development of such a system that reflects a strong conviction in using information for decision making.

(b) (i) Cash discount will be treated as an income and will be credited to P/I. A/c

(ii) Amount of IGST will have no effect on the value of purchase. It shall be excluded from the value of Materials, if already included.

(iii) Demurrage

(iv) The value of shortage will be excluded from the value of materials and be charged to P/L A/c

(v) Basic Custom Duty will be added to the purchase amount.

(c)

(i) Overtime premium will be including in the cost of order

(it) Since the overtime was required due to the fault of management in Department Y, such overtime premium will be charged to overheads of Department Y.

(iii) Overtime premium will be added to the cost of contract

(iv) Overtime premium will be charged to costing P/L A/c

(v) Overtime premium will be including in the cost of order

(d) The following are some of the criticism which may be levelled against the standard costing system. The arguments have been suitably answered as stated against each by advocates of the standard costing and hence they do not invalidate the usefulness of the system to business enterprises.

- Variation in price: One of the chief problems faced in the operation of the standard costing system is the precise estimation of likely prices or rate to be paid. The variability of prices is so great that even actual prices are not necessarily adequately representative of cost. But the use of sophisticated forecasting techniques should be able to cover the price fluctuation to some extent. Besides this, the system provides for isolating uncontrollable variances arising from variations to be dealt with separately.

- Varying levels of output: If the standard level of output set for pre-determination of standard costs is not achieved, the standard costs are said to be not realised. However, the statement that the capacity utilisation cannot be precisely estimated for absorption of overheads may be true only in some industries of jobbing type. In vast majority of industries, use of forecasting techniques, market research, etc., help to estimate the output with reasonable accuracy and thus the variation is unlikely to be very large. Prime cost will not be affected by such variation and, moreover, variance analysis helps to measure the effects of idle time.

- Changing standard of technology: In case of industries that have frequent technological changes affecting the conditions of pro¬duction, standard costing may not be suitable. This criticism does not affect the system of standard costing. Cost reduction and cost control is a cardinal feature of standard costing because standards once set do not always remain stable. They have to be revised.

- Attitude of technical people: Technical people are accustomed to think of standards as physical standards and, therefore, they will be misled by standard costs. Since technical people can be educated to adopt themselves to the system through orientation courses, it is not an insurmountable difficulty.

- Mix of products: Standard costing presupposes a pre-determined combination of products both in variety and quantity. The mix¬ture of materials used to manufacture the products may vary in the long run but since standard costs are set normally for a short period, such changes can be taken care of by revision of standards.

- Level of Performance: Standards may be either too strict or too liberal because they may be based on (a) theoretical maximum efficiency, (b) attainable good performance or (c) average past performance. To overcome this difficulty, the management should give thought to the selection of a suitable type of standard. The type of standard most effective in the control of costs is one which represents an attainable level of good performance.

- Standard costs cannot possibly reflect the true value in exchange:

If previous historical costs are amended roughly to arrive at estimates for ad /zocpurposes, they are not standard costs in the strict sense of the term and hence they cannot also reflect true value in exchange. In arriving at standard costs, however, the economic and technical factors, internal and external, are brought together and analysed to arrive at quantities and prices which reflect opti¬mum operations. The resulting costs, therefore, become realistic measures of the sacrifices involved. - Fixation of standards may be costly: It may require high order of skill and competency. Small concerns, therefore, feel difficulty in the operation of such system.

(e) (i) Batch Costing

(ii) Standard Costing

(iii) Unit Costing

(iv) Job Costing

(v) Process Costing