Go through this Depreciation Accounting – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Depreciation Accounting – CS Foundation Fundamentals of Accounting Notes

Depreciation:

- Depreciation means a fall in the value of asset due to usage, efflux of time or due to obsolescence.

- It is a permanent, continuous or gradual shrinkage in the book value of a fixed asset.

- The annual loss in the value of the asset is taken as the expenditure of the business.

- Depreciation is a process of allocating the cost of a fixed asset over its estimated useful life in a rational and systematic manner.

- “Depreciation is a process of allocation of expired cost and not of valuation of fixed asset”.

Depreciation Accounting:

Definition: “A measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortization of assets whose useful life is predetermined.”

Institute of Charted Accountants of India (ICAI):

“A system of accounting which aims to distribute the cost or other basic value of tangible capital assets less salvage (if any) over the estimated useful life of the unit (which may be a group of assets) in a systematic and rational manner. It is a process of allocation and not of valuation.”

American Institute of Certified Public Accountants (AICPA):

Characteristics of Depreciation –

- Depreciation is the reduction in the book value of an asset.

- Depreciation reduces the book value of an asset and not the market value.

- Depreciation is a charge against profit.

- Depreciation is a process of allocation of cost of an asset over the period of its life.

- The term depreciation is used for tangible fixed assets. For wasting assets (Like mines) it is called depletion and for fictitious assets such as goodwill it is called amortization.

- The amount of depreciation can never be calculated exactly, it can only be estimated.

- Depreciation is must, i.e. it always takes place whether the asset is carefully handled or neglected.

- If market value of fixed asset is fluctuating, the same does not affect the amount of depreciation so made on respective assets.

- Total depreciation cannot exceed its depreciable value or original cost where the scrap value is nil.

The fundamental objectives of depreciation are:

- To maintain the nominal capital invested in fixed assets.

- To allocate the expired cost of fixed assets over a number of accounting years.

Causes of Depreciation:

- Physical wear and tear due to continuous use.

- Efflux (passage of time)

- Physical deterioration

- Obsolescence (asset becoming redundant due to technological changes

- Accidents (fire etc.)

- Depletion

Objectives of providing Depreciation:

- To ascertain correct profit/loss

- To show a true and fair view of financial statements

- To show assets at their proper value

- To make provision for replacement of assets.

- Compliance of legal provisions

- To get tax benefit

Note : Replacement of asset.

Depreciation is a non cash expenditure, hence the amount debited in the profit and loss account are retained In the business. These are available for the replacement of the asset (buying a new asset), when replacement is required.

Factors in Measurement of Depreciation –

Cost of Asset:

Cost of the asset refers to the cost at which the asset is purchased. It includes all expenses incurred upto the point the asset is ready for use. Original cost = Purchase price + freight + installation cost

Useful Life of the Asset:

Useful life of the asset means the period for which an asset can be used productively without incurring extraordinary repairs and maintenance expense.

Determination of useful life is a matter of estimation.

Scrap (Residual value):

Residual value is the estimated sale value of the asset at the end of the economic life. Difference between the cost and the residual value is the depreciable amount which is to be written off over the useful life.

Other factors:

The following are the other factors affecting the measurement of depreciation.

- Obsolescence i.e. chance of going out of fashion of the asset.

- Working hours of the asset.

- Repairs and Renewals.

- Skills of the operator handling the asset.

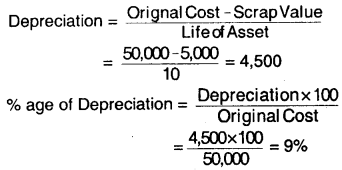

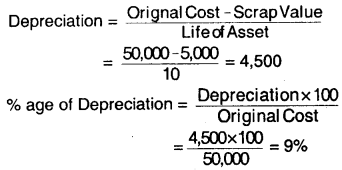

- Legal provisions relating to the asset.

- The addition if any made during the year.

Depreciation Accounting:

Depreciation Accounting is the process of allocating the cost of depreciable asset less its salvage value over its serviceable useful life.

Note:

Depreciable assets are the assets which:

- Are expected to be used for more than one accounting period

- Have a limited useful life

- Are held by the organisation for use in the production or supply of goods and services.

- Depreciation is not a process of valuation but it is an allocation.

- There are two methods of recording depreciation:

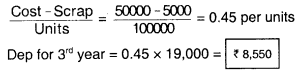

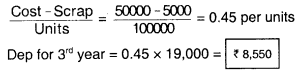

- When depreciation is charged to asset account

- When provision of depreciation/ accumulated depreciation account is created.

(i) When Depreciation is Charged to Asset A/c:

- Depreciation is charged from the asset directly.

- At the year end, depreciation A/c is closed by transferring it to the Profit & Loss Account.

- In Balance Sheet, asset is shown at the written down value (cost less depreciation).

- Depreciation is to be charged whether the business incurs profit or loss.

- Depreciation provides funds for replacing the asset when its useful life ends

Journal Entries:

1. Charging Depreciation from Asset:

Depreciation A/c Dr. (With amount of depreciation)

To Asset A/c

(Being depreciation on asset charged)

2. Transferring Depreciation A/c to P/L A/c :

Profit & Loss A/c Dr. (With amount of depreciation)

To Depreciation A/c (Being depreciation transferred to P/L)

(ii) When Provision for Depreciation A/c is Made:

- Current year’s depreciation will be transferred to Profit/Loss A/c each year.

- In the Balance Sheet, asset will continue to appear at its original cost and total amount of depreciation charged till date will be shown in provision for depreciation or accumulated depreciation A/c.

- The balance is calculated by deducting provision for depreciation from original cost of asset.

Journal Entries:

1. Charging Depreciation:

Depreciation A/c Dr. (With amount of depreciation)

To Provision for depreciation A/c

(Being the depreciation on asset charged)

2. Transfer of Depreciation to P/L A/c at the year end:

Profit/Loss A/c Dr. (With amount of current year depreciation)

To Depreciation A/c

(Being depreciation transferred to P/L Account)

3. When asset is sold/discarded/exchanged accumulated depreciation for that asset in provision for Dep. A/c is transferred to asset account Provision for Dep. A/c Dr.

To Relevant Asset A/c

Notes :

1. Accumulated depreciation means total depreciation provided on an asset till date.

2. If the words “p.a.” i.e. per annum are attached to the rate of depreciation, then depreciation must be calculated only for that period when asset was held. Whereas if the words “p.a.” is not attached then depreciation is to be charged for the full year.

Component Method of Depreciation:

It may be noted that Accounting Standards as well as the Companies Act, 2013 allow depreciation to be charged on a component basis. Each part of an item of Property, Plant and Equipment with a cost that is significant in relation to the total cost of the item should be depreciated separately, eg.: It may be appropriate to depreciate separately the airframe and engines of an aircraft.

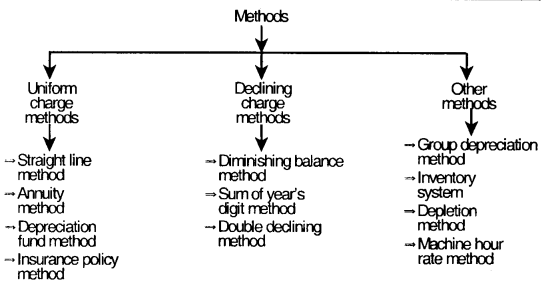

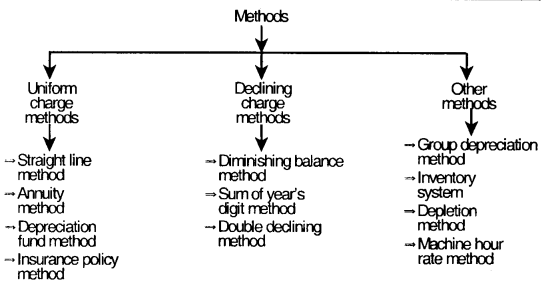

Methods of Providing Depreciation:

Uniform Charge Method:

(i) Straight Line Method (Fixed Installment Method):

1. Under this method, a percentage of original cost of the asset is written off every year so that asset account may be reduced to its residual value at end of its estimated economic life.

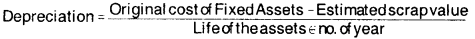

2. If the percentage of depreciation is not given, then the amount of depreciation to be charged every year shall be calculated as follows:

Amount of Depreciation = \(\frac { Cost-Estimated scrao value }{ Expected life }\)

Percentage of Depreciation = \(\frac { Deprecation × 100 }{ Ongnal cost of assete }\)

Example:

A firm bought an asset for ₹ 2,00,000 on 1st January, 2012. ₹ 10,000 are spent on installation. The life of the asset is estimated to be 5 years. Its scrap value at the end of the period is ₹ 10,000. Find the amount of annual depreciation.

Solution:

Amount of depreciation = \(\frac{\text { Cost – scrapvalue }}{\text { Estimatedlife }}\)

Here;

Cost of asset Original cost + expenses upto installation

= 2,00,000 + 10,000

= ₹ 2,10,000

Scrap value = ₹ 10,000 (given)

Estimated life = 5 years (given)

Applying the above Formula :

Amount of depreciation = \(\frac{\text { Cost – scrapvalue }}{\text { Estimatedlife }}\)

= \(\frac{2,10,000-10,000}{5}\)

= ₹ 40,000.

Therefore, ₹ 40,000 will be charged annually as depreciation.

Note : Calculating rate of depreciation

[Taking figures of above example]

Rate of depreciation = \(\frac{\text { Amount of Annual Depreciation }}{\text { Cost of Asset }}\)

= \(\frac{40,000}{2,10,000} \times 100\)

= 19% (approx)

- The amount of depreciation under this method will remain same every year.

- If the asset is purchased in between the year, depreciation will be charged only for that part of the year when the asset was held by the company.

- If the date on which asset is purchased is not given, depreciation will be charged for half year (assuming that the asset was purchased in the mid of the year).

- Value of asset each year in Balance Sheet is reasonably fair.

Merits of this Method:

- Simple to calculate

- Asset can be completely written off

- Amount and rate of depreciation remains same throughout the useful life.

- Best suited when asset is depreciating due to efflux of time (passage of time).

- The value of the asset each year in the Balance Sheet is reasonably fair.

Demerits of this Method:

- It assumes that the asset should be used equally throughout its life. This is not realistic.

- Charge on asset will not be uniform because in the later years apart from depreciation, repair expenses to the asset will also be incurred.

- It does not take into account the effective utilization of the asset.

Declining Charge Method – Diminishing Balance Method:

- This method is also known as written down value method.

- Under this method, depreciation is charged at a fixed rate on the reducing balance.

- Reducing Balance or Written Down Value = Cost of Asset – Depreciation

- The depreciation charge under this method goes on decreasing gradually.

Hence in the earlier years when there are negligible repairs, depreciation is high and in the later years when repairs are high, depreciation charge is low.

Annuity Method:

-

- Under this method, depreciation takes into account element of interest on capital outlay.

- Here, along with the value of asset, the interest lost over the life of the asset is also written off.

- The amount of Interest is calculated on Book value of the asset in the beginning of each year.

- Since the amount of interest lost cannot be computed easily, hence we make use of annuity tables for calculating the amount of depreciation.

- Here, the amount written off annually is constant.

- This method is best suited for writing off amount paid for long leases which involve a heavy capital outlay.

Note:

What is the element of interest on capital outlay?

When an amount is invested to purchase a capital asset, it is assumed that if that amount was invested elsewhere, it would have earned interest. This notional income is considered as a cost of the asset. It is a type of opportunity cost.

Journal Entries:

(i) On Purchase of Asset:

Asset A/c Dr.

To Bank A/c

(ii) For Charging Interest on Asset:

Asset A/c Dr.

To Interest A/c

(iii) For Charging Depreciation:

Depreciation A/c Dr.

To Asset A/c

(iv) For Transfer of Interest A/c to P/L A/c:

Interest A/c Dr.

To P/L A/c

(v) For Transfer of Depreciation A/c to P/L:

Profit & Loss A/c Dr.

To Depreciation A/c

Depreciation Fund Method (Sinking Fund Method):

- Under this method, the amount of depreciation is not charged from the assets and remain same year after year.

- Here, the amount annually provided for depreciation is placed to the credit of a special account named as “Sinking Fund A/c”.

- The amount so accumulated in the sinking fund account shall be invested in government securities bearing interest at specified rate.

- When the asset is due for replacement, the securities are sold and the new asset is purchased with the proceeds of their sale.

- The book value of old asset is transferred to the Sinking Fund A/c.

- Any amount realised from sale of old asset as well as Profit/Loss on sale of securities is transferred to Sinking Fund A/c.

- Sinking Fund A/c is closed by transferring the balance to Asset A/c.

Journal Entries:

(a) At the end of First Year:

(i) For setting aside amount of depreciation :

Depreciation A/c Dr.

To Depreciation Fund A/c

(ii) For investing the amount of depreciation :

Depreciation Fund Investment A/c Dr. (with the amount in dep. fund) To Bank

(b) In the Second and Subsequent Years :

(i) For interest received on investment:

Bank A/c Dr.

To Interest on Dep. Fund Investment A/c

(ii) For transferring interest to depreciation fund A/c :

Interest on depreciation fund

Investment A/c Dr.

To Depreciation Fund

(iii) For annual installment of depreciation :

Depreciation A/c Dr.

To Depreciation Fund A/c

(iv) For investing the amount of depreciation and interest received on investment:

Depreciation Fund Investment A/c Dr.

To Bank

At the end of Last Year:

First three entries will be same as in second year.

In the last year, the amount will not be invested because the old asset is replaced by new one for which investments will need to be sold.

(i) For Sale of Investment:

Bank A/c Dr.

To Depreciation Fund Investment A/c

(ii) For Transfer of Profit or Loss on sale of Investment:

| In case of Profit |

In case of Loss |

Depreciation Fund Investment A/c Dr.

To Depreciation Fund A/c

(with the amount of net profit on sale of investment) |

Depreciation Fund A/c Dr.

To Depreciation Fund

Investment A/c

(with net loss on sale of investment) |

(iii) For Sale of Old Asset:

Bank A/c Dr. (with net amount

To Old Asset A/c

(iv) Transferring Depreciation Fund A/c to Old Asset A/c:

Depreciation Fund A/c Dr.

To Old Asset A/c (with the balance of depreciation fund A/c) The Balance in Old Asset A/c represents Profit or Loss. It will be transferred to P/L A/c.

(v) For Purchases of New Asset

New Asset A/c Dr. (with cash realised on sale of old asset)

To Bank

Insurance Policy Method:

- Under this method, the company takes an insurance policy for replacement of the asset.

- At the beginning of every year, a fixed amount of premium is paid.

- At the end of the term, the agreed sum is received from the insurance company which is used for the replacement of asset.

- Amount will be paid in the beginning of year.

Journal Entries:

(a) First year and Subsequent years:

(i) Insurance premium paid at the beginning of the year:

Depreciation Insurance Policy A/c Dr.

To Bank A/c

(ii) At year end:

P/L A/c Dr.

To Depreciation Reserve A/c

(b) At the end of Last year:

(i) Amount realised from insurance company:

Bank A/c Dr.

To Depreciation Insurance Policy A/c

(ii) For transfer of profit on insurance policy:

Depreciation Insurance Policy A/c Dr.

To Depreciation Reserve A/c

(iii) For transfer of accumulated depreciation to asset A/c:

Depreciation Reserve A/c Dr.

To Asset A/c

(iv) On purchase of new asset:

New Asset A/c Dr.

To Bank A/c

Note:

Sinking Fund Method and Insurance Policy Method:

Under sinking fund, the amount in the reserve is used for buying government securities whereas in insurance policy method an insurance policy is taken for this purpose.

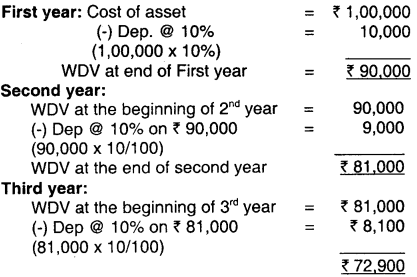

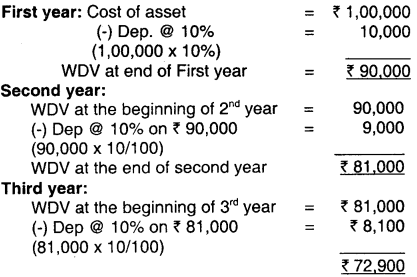

Example : Cost of asset is ₹ 1,00,000 Rate of depreciation to be written off each year is 10% on the reducing balance. Calculate the depreciation charge for the first 3 years.

Solution:

Depreciation under this method can also be determined using the following formula:

Rate of Depreciation = 1 – n\(\sqrt{\frac{N e t \text { Residual Value(Salvage Value) }}{\text { Costof Acquisition }}}\)

Where n = life of the asset

Merits of this Method:

- Uniform weight of charge to P/L A/c for depreciation and repairs

- This method is recognized by the Income Tax Act

- Easier to compute

- Any additions to the asset are depreciated at the same rate.

Demerits of this Method:

- Value of asset can never be reduced to zero.

- Computation of rate of depreciation is a bit complex.

- Depreciation is neither based on use of asset nor a uniform charge is made.

Difference between Straight Line Method and Written Down Value Method:

| Basic |

Straight Line Method |

Written Down Value Method |

| 1. Depreciation Charge |

Depreciation is calculated on the original cost of a fixed asset: |

Depreciation is calculated on the diminishing balance or written down value of a fixed asset. |

| 2. Amount of Depreciation |

The amount of depreciation remains the same for all years. |

The amount of depreciation reduces year after year. |

| 3. Zero Balance |

At the expiry of the working life of the asset, the balance in the asset account reduces to zero. |

The balance in the asset account will not reduce to zero. |

| 4. Cost of Depreciation and Repairs |

The combined cost on account of depreciation and repairs is lower in the initial years and higher in the later years. |

The combined cost on account of depreciation and repairs are more or less, equal throughout the period. |

| 5. Suitability |

This method is more suitable for assets which get depreciated on account of expiry of working life of the asset. |

This method is suitable for such assets which require more and more repairs in the later years of their working life. |

| 6. Calculation Easy or Difficult |

It is easy to calculate the rate of depreciation. |

It is difficult to calculate the rate of depreciation. |

Sum of Years Digit Method:

- This method is a slight variation of reducing balance method.

- Under this method, the charge for depreciation for an accounting period is calculated in proportion of the remaining life of the asset at the beginning of every accounting year.

- Depreciation = \(\frac { Remaining life of asset including current year × Cost of asset }{ Sum of digits of life of the asset }\)

In the above Formula :

Remaining life of assets Individual digits used in life of asset taken in reverse order

Sum of digits representing life of asset = n\(\frac { (n+1) }{ 2 }\)

Example

Suppose the estimated life of an asset is 10 years and cost of asset is ₹ 1,00,000.

Depreciation for the First year:

\(\frac { Remaining life including C.Y × Cost of asset }{ Sum of digits of life of asset }\)

→ Remaining life including C.Y. =10

→ Sum of digits n\(\frac { (n+1) }{ 2 }\) = \(\frac { 10×11 }{ 2 }\) = 55

Depreciation = \(\frac { 10 }{ 55 }\) x 1,00,000 = ₹ 18,181.

Depreciation for Second Year = \(\frac { 9 }{ 55 }\) x 1,00,000 = ₹ 16,363

Note : The depreciation is reducing year by year.

Depreciation Accounting MCQ Questions

1. Depreciation is:

(a) a fall in the original cost of an asset

(b) a fall in the book value of an asset

(c) a fall in the market value of asset

(d) a fall in the real value of an asset

Answer:

(b) a fall in the book value of an asset

2. Depreciation is:

(a) a process of valuation of fixed asset

(b) a process of allocation of the cost of fixed asset

(c) a method of providing funds for replacement

(d) a process of writing off losses

Answer:

(b) a process of allocation of the cost of fixed asset

3. The amount of depreciation remains constant year after year under:

(a) Written Down Value Method

(b) Straight Line Method

(c) Sinking Fund Method

(d) Annuity Method

Answer:

(b) Straight Line Method

4. Any Profit of Loss on the sale of Sinking (depreciation)fund investment is transferred to:

(a) Profit and loss account

(b) Asset account

(c) Sinking fund account (depreciation fund account)

(d) Depreciation A/c

Answer:

(c) Sinking fund account (depreciation fund account)

5. Under annuity method, the amount of depreciation is:

(a) Increasing every year

(b) Decreasing every year

(c) Fixed for all the years

(d) Revalued every year

Answer:

(c) Fixed for all the years

6. The number of production units expected to be obtained from the use of an asset by an enterprise is called as:

(a) Unit life

(b) Useful life

(c) Production life

(d) Expected life

Answer:

(b) Useful life

7. In which of the following methods, the cost of the asset is not spread over in equal proportion during its useful economic life?

(1) Straight Line Method

(2) Written Down Value Method

(3) Units of Production Method

(4) All of the above

(a) 2 and 3

(b) 1 and 2

(c) 3 and 4

(d) 1 and 4

Answer:

(a) 2 and 3

8. For charging depreciation, on which of the following assets, the depletion method is adopted?

(a) Plant & machinery

(b) Land & building

(c) Goodwill

(d) Wasting assets like mines and quarries

Answer:

(d) Wasting assets like mines and quarries

9. If a concern proposes to discontinue its business from March 31,2006 and decided to dispose off all its assets within a period of 4 months, the Balance Sheet as on March 31,2006 should show the assets at their:

(a) Historical cost

(b) Net realizable value

(c) Cost less depreciation

(d) Cost price or market value, whichever is lower.

Answer:

(b) Net realizable value

10. Obsolescence of a depreciable asset may be caused by:

I. Technological Changes

II. Improvement in Production Method

III. Change in Market Demand for the Product or Service Output

IV. Legal or Other Restrictions

(a) Only (I) above

(b) Both (I) and (II) above

(c) All (I), (II),(III) and (IV) above

(d) only (IV) above.

Answer:

(c) All (I), (II),(III) and (IV) above

11. Using the equal instalment method for depreciation the relevant formula is:

(a) Annual charge against profit = \(\frac { Originalcost-Residual value }{ Number of year of active life }\)

(b) Annual charge against profits = \(\frac { Number of year of active life }{ Originalcost-Residualvalue }\)

(c) Annual charge against profits = \(\frac { Originalcost-Residual value }{ Estimated number of year remaining }\)

(d) Annual charge against profits = \(\frac { Estimated number of year remaining }{ Originalcost-Residual value }\)

Answer:

(a) Annual charge against profit = \(\frac { Originalcost-Residual value }{ Number of year of active life }\)

12. A Second hand machinery was purchased for ₹ 1,00,000 five years ago and was overhauled by carrying out some repairs at a cost of ₹ 10,000. It has also an accumulated depreciation of ₹ 50,000. It has been disposed off in the beginning of the sixth year for ₹ 60,000.Profit /loss on such disposal shall be:

(a) Profit of ₹ 10,000

(b) Loss of ₹ 50,000

(c) Loss of ₹ 40,000

(d) No Profit, no loss

Answer:

(d) No Profit, no loss

13. An asset was purchased for ₹ 12,500 and under the reducing balance method 20 percent of the reducing value of the asset is written off each year. What is the value of the asset at the end of three years?

(a) ₹ 8,000

(b) ₹ 7,500

(c) ₹ 6,400

(d) ₹ 5,000

Answer:

(c) ₹ 6,400

14. A machine is purchased for ₹ 200. To achieve a residual value of ₹ 128 at the end of the second year (assuming that depreciation is calculated at the end of each year) the percentage depreciation using the reducing balance method must be:

(a) 72%

(b) 36%

(c) 20%

(d) 12%

Answer:

(c) 20%

15. The main objective of providing depreciation is to:

(a) Create secret reserves

(b) Reduce the book value of assets

(c) Value the assets property

(d) Allocate cost of the assets

Answer:

(d) Allocate cost of the assets

16. Charging a period for the proportionate cost of an intangible asset is termed as:

(a) depreciation

(b) diminution

(c) amortisation

(d) expiration

Answer:

(c) amortisation

17. In the books of D Ltd. machinery account shows a debit balance of ₹ 60,000 as on April 1,2003. The machinery was sold on September 30,2004 for 7 20,000. The Company charges depreciation @ 20% P.a. on diminishing balance method Profit / Loss on sale will be:

(a) ₹ 23,200 Profit

(b) ₹ 23,200 loss

(c) ₹ 7,800 Profit

(d) ₹ 7,800 loss

Answer:

(b) ₹ 23,200 loss

18. A new machine costing ₹ 1,10,000 was purchased by a company to manufacture a special product. Its useful life is estimated to be 5 years and scrap value of 7 20,000. The production plan for the next 5 years using the above machine is as follows:

Year 1-10,000 units: Year 2-20,000 units: Year 3-24,000 units: Year4- 40,000 units : year 5- 50,000 units.

The depreciation for the 1sl year under units-of-production method will be

(a) ₹ 6,250

(b) ₹ 12,500

(c) ₹ 15,000

(d) ₹ 25,000

Answer:

(a) ₹ 6,250

19. A Co. purchased a machine on Jan, 1,03 for ₹ 2,20,000. Installation expenses were ₹ 40,000. Residual value after 5 years ₹ 5,000 on 01.07.2003, expenses for repairs were incurred to the extent of ₹ 2,000. Depreciation is provided @ 10% p.a. underwritten down value method. Depreciation for the 4th year will be:

(a) ₹ 52,000

(b) ₹ 26,000

(c) ₹ 21,060

(d) ₹ 18,954

Answer:

(d) ₹ 18,954

20. Original Cost = ₹ 1,30,000: Salvage Value = 4,000. Useful Life = 6 years.

Depreciation for the first year under sum of years digits method will be:

(a) ₹ 6,000

(b) ₹ 12,000

(c) ₹ 18,000

(d) ₹ 36,000

Answer:

(d) ₹ 36,000

21. A Co. purchased a machine on Jan 1,2003 for ₹ 1,20,000. Installation expenses were ₹ 10,000. Residual value after 5 years ₹ 5,000. On July 1, 2003 expenses for repairs were incurred to the extent of ₹ 2,000. Depreciation is provided under straight line method. Annual Depreciation will be:

(a) ₹ 13,000

(b) ₹ 24,000

(c) ₹ 21,000

(d) ₹ 25,000

Answer:

(d) ₹ 25,000

22. Original Cost of a machine was ₹ 1,26,000; Salvage Value was nil, Useful Life was 6 years. Depreciation for the fourth year under sum of years digits method will be:

(a) ₹ 6,000

(b) ₹ 12,000

(c) ₹ 18,000

(d) ₹ 24,000

Answer:

(c) ₹ 18,000

23. Which of the following statements is / are True?

I. The term ‘depreciation’,’depletion’ and ‘amortization’ convey the same meaning.

II. Provision for depreciation a/c is created.

III. The main purpose of charging the Profit and Loss a/c with the amount of depreciation is to spread the cost of an asset over its useful life for the purpose of income determination.

(a) Only (I) above

(b) Only (II) above

(c) Only (III) above

(d) All (I), (II) and (III) above.

Answer:

(d) All (I), (II) and (III) above.

24. Which of the following expenses is not included in the acquisition cost of a Plant and Equipment?

(a) Cost of site preparation

(b) Delivery and handling Charges

(c) Installation costs

(d) Financing costs incurred subsequent to the period after plant and equipment is put to use.

Answer:

(d) Financing costs incurred subsequent to the period after plant and equipment is put to use.

25. The portion of the acquisition cost of the asset, yet to be allocated is known as:

(a) Written down value

(b) Accumulated value

(c) Realizable value

(d) Salvage value

Answer:

(a) Written down value

26. Depreciation is charged because of:

(i) Wear & tear

(ii) Deterioration

(iii) Depletion

(iv) Passage of time

(a) Only (i)

(b) Both (i) & (iii)

(c) Only (ii)

(d) All (i), (ii), (iii) & (iv)

Answer:

(d) All (i), (ii), (iii) & (iv)

27. Objectives of charging depreciation are:

(i) Ascertaining correct profits

(ii) Ascertaining the cost of the product

(iii) To gain tax benefits

(iv) To meet the legal requirements

(a) Both (i) & (ii)

(b) (iii) only

(c) Both (ii) & (iv)

(d) All (i), (ii), (iii) & (iv)

Answer:

(d) All (i), (ii), (iii) & (iv)

28. If an asset is purchased for ₹ 5,00,000 and installation charges are ₹ 50,000. The estimated scrap value is ₹ 1,00,000 and the useful life of the asset is 5 years, then the amount of depreciation to be charged as per SLM method is:

(a) ₹ 90,000

(b) ₹ 80,000

(c) ₹ 1,11,111

(d) ₹ 1,20,000

Answer:

(a) ₹ 90,000

29. Scrap value of an asset refers to the amount that it can fetch at the:

(a) Beginning of its life

(b) End of its life

(c) Middle of its life

(d) None of the above

Answer:

(b) End of its life

30. Obsolescence of a depreciable asset Is caused by:

(a) Change in technology

(b) Innovation

(c) Improvement in the method of production

(d) All of the above

Answer:

(d) All of the above

31. Depreciation is a process of:

(a) Verification of asset

(b) Degradation of asset

(c) Allocation of cost of asset to the period of its life

(d) All of the above

Answer:

(c) Allocation of cost of asset to the period of its life

32. Annuity method of depreciation is suitable for:

(a) Tangible assets

(b) Intangible assets

(c) Leasehold assets

(d) None of the above

Answer:

(c) Leasehold assets

33. A gold mine was taken on lease for ₹ 50,00,00,000. The total production capacity of the mine is 10,000 tonnes. The total production in the year 2010 was 2,000 tonnes. The depreciation for the year 2010 is:

(a) ₹ 10,00,00,000

(b) ₹ 5,00,00,000

(c) ₹ 20,00,00,000

(d) None of the above

Answer:

(a) ₹ 10,00,00,000

34. Depletion method is normally applied in case of:

(a) Wasting Assets

(b) Intangible Asset

(c) Tangible Asset

(d) None of these

Answer:

(a) Wasting Assets

35. In the sinking fund method of charging depreciation, the amount debited to P&L A/c is:

(a) More in the initial years

(b) More in the ending year

(c) Remains the same every year

(d) None of the above

Answer:

(c) Remains the same every year

36. If diminishing value method is used then the amount of depreciation charged to P&L A/c is:

(a) Equal in all years

(b) Decreases year after year

(c) Increases year after year

(d) None of these

Answer:

(b) Decreases year after year

37. In sinking fund investments method, the profit on sale of investments is transferred to:

(a) Asset A/c

(b) Bank A/c

(c) Depreciation Fund A/c

(d) Depreciation Fund Investment A/c

Answer:

(c) Depreciation Fund A/c

38. Under the insurance policy method, the fixed premium is paid:

(a) To the beginning of the year

(b) Middle of the year

(c) End of the year

(d) None of the above

Answer:

(a) To the beginning of the year

39. In group depreciation method:

(a) Assets having similar average life is grouped together

(b) Depreciation is charged on the entire group and not on individual assets

(c) Both (a) and (b)

(d) Neither (a) nor (b)

Answer:

(c) Both (a) and (b)

40. The effect of change in the method of depreciation is to be taken:

(a) Retrospectively

(b) Prospectively

(c) Both (a) and (b)

(d) Neither (a) nor (b)

Answer:

(a) Retrospectively

41. Depreciation is charged on the:

(a) Historical cost

(b) Replacement cost

(c) Realisable cost

(d) None of these

Answer:

(a) Historical cost

42. During inflationary period, which method of depreciation is the most suitable:

(a) Charging depreciation on historical cost

(b) Charging depreciation on realisable value

(c) Charging depreciation on replacement cost

(d) None of the above

Answer:

(c) Charging depreciation on replacement cost

43. A machine was purchased for ₹ 10,000 on Jan, 2008. Depreciation is to be charged @ 25% on WDV method. It was sold for ₹ 6,000 at the end of the third year. Calculate the profit / loss:

(a) Profit ₹ 1,781

(b) Profit ₹ 2,300

(c) Loss ₹ 3,219

(d) Loss ₹ 3,299

Answer:

(a) Profit ₹ 1,781

44. Which of the following is depleted?

(a) Land

(b) Goodwill

(c) Machinery

(d) Quarries

Answer:

(d) Quarries

45. Which method is allowed as per Income Tax Act?

(a) Reducing balance method

(b) Sinking fund method

(c) Annuity method

(d) Straight line method

Answer:

(a) Reducing balance method

46. Under the annuity method, the asset account is debited by:

(a) Depreciation fund A/c

(b) Interest A/c

(c) Sinking fund A/c

(d) None of these

Answer:

(b) Interest A/c

47. Which method of depreciation considers the element of interest on capital outlay?

(a) WDV method

(b) Sinking fund method

(c) Annuity method

(d) SLM method

Answer:

(c) Annuity method

48. The value of an asset is ₹ 50,000. Its working life is 10 years. Firm uses sum of years digits method for providing depreciation. What will be the amount of depreciation for second year?

(a) ₹ 5,000

(b) ₹ 9,091

(c) ₹ 4,500

(d) ₹ 8,181

Answer:

(d) ₹ 8,181

Sum of year digits = 10 + 9 + 8 + 7 + 6 + 5 + 4 + 3 + 2 + 1 = 55

Depreciation for the second year will be:

= 50,000 x \(\frac { 9 }{ 55 }\)

= ₹ 8,181

49. Decrease in value of a fixed asset due to normal wear and tear is known as:

(a) Depreciation

(b) Obsolescence

(c) Appropriation

(d) Spoilage.

Answer:

(a) Depreciation

Depreciation means a fall in the value of asset due to usage, efflux of time or due to obsolescence. In other words we can say, that decrease in value of a fixed assets due to normal wear and tear is known as Depreciation.

50. Dinesh Garments purchased a machine for ₹ 50,000 and spent ₹ 6,000 on its erection. On the date of purchase, it was estimated that effective life of the machine will be ten years and after ten years its scrap value will be ₹ 6,000. The amount of depreciation for second year on straight line basis

is:

(a) ₹ 5,000

(b) ₹ 5,600

(c) ₹ 6,000

(d) ₹ 6,200

Answer:

(a) ₹ 5,000

Cost of Machine = 50,000 + 6,000 = ₹ 56,000

Depreciation as per Straight line basis = \(\frac { Cost of Machine-Scrap value }{ Estimated Life of year }\)

= \(\frac{56,000-6,000}{10}\)

= ₹ 5 000

Depreciation for each year will be ₹ 5,000

Thus, Second year Depreciation = ₹ 5,000

51. A firm charges depreciation on straight line method. The rate of depreciation is reduced from 25% to 10%. What will be the impact of this change on profits?

(a) Decrease in profits

(b) Increase in profits

(c) Decrease in assets

(d) Increase in expenses.

Answer:

(b) Increase in profits

Depreciation is transferred to debit side of profit & loss A/c. If depreciation rate is reduced from 25% to 10%, depreciation amount will be less than other past years. The less amount of depreciation will be transferred to profit & loss A/c while will result in increase in profits.

52. Under straight line method, depreciation is calculated on:

(a) Written Down Value

(b) Salvage Value

(c) Original Cost

(d) Market Value

Answer:

(c) Original Cost

Under straight line method, a fixed proportion of the original cost of the asset is written off each year so that asset account may be reduced to its residual value at the end of its estimated economic useful life. Thus, it can be said that under this method, depreciation is calculated on Original Cost.

53. Which of the following assets are shown at written down value in Balance Sheet?

(a) Current Assets

(b) Liquid Assets

(c) Floating Assets

(d) Fixed Assets

Answer:

(d) Fixed Assets

Depreciation is charged only on fixed assets and depreciation is a permanent, continuous and gradual shrinkage in the book value of fixed assets. So, it can be said that Fixed Assets are shown at written down value in Balance Sheet.

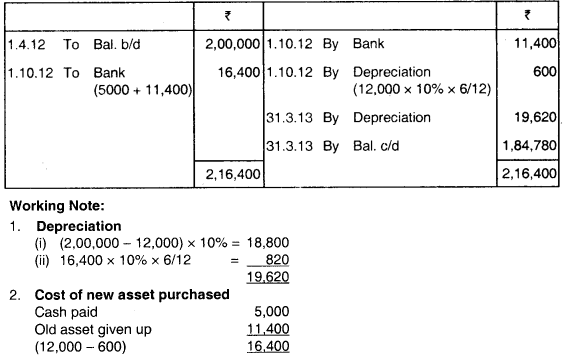

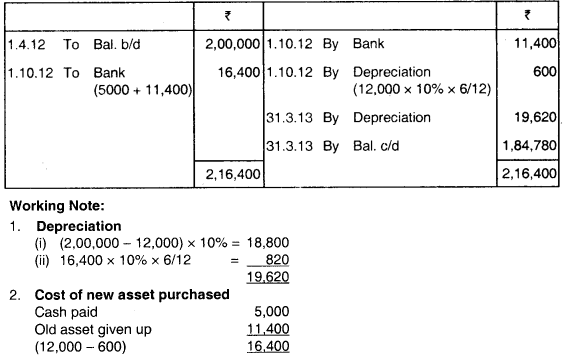

54. On 1st April, 2012 in Sethi’s Ledger, furniture account showed a balance of ₹ 2,00,000. On 1st October, 2012 Sethi purchased new furniture by paying ₹ 5,000 and giving old furniture whose book value on 1st April, 2012 was ₹ 12,000 to the seller. Sethi provides depreciation on furniture @ 10% per annum on diminishing balance method. The net value of furniture in Sethi’s books as on 31st March, 2013 would be:

(a) ₹ 1,85,080

(b) ₹ 1,83,960

(c) ₹ 1,84,780

(d) ₹ 2,04,400.

Answer:

(c) ₹ 1,84,780

In Books of Sethi

Furniture Account

55. The written down value of machine on 31st March, 2013 is ₹ 72,900. The machine was purchased on 1st April, 2010. Depreciation is being charged @ 10% p.a. by diminishing balance method. The cost price of the machine would be:

(a) ₹ 1,00,000

(b) ₹ 90,000

(c) ₹ 81,000

(d) ₹ 72,900.

Answer:

(a) ₹ 1,00,000

Cost price of machine = \(\frac{72,900}{90 \% \times 90 \% \times 90 \%}\)

= ₹ 1,00,000

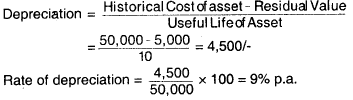

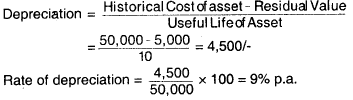

56. A company purchased plant for ₹ 50,000. The useful life of the plant is 10 years and the residual value is ₹ 5,000. The management wants to depreciate it by straight line method. Rate of depreciation will be:

(a) 8%

(b) 9%

(c) 10%

(d) None of the above.

Answer:

(b) 9%

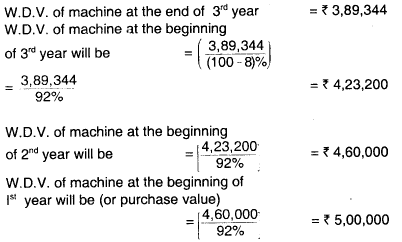

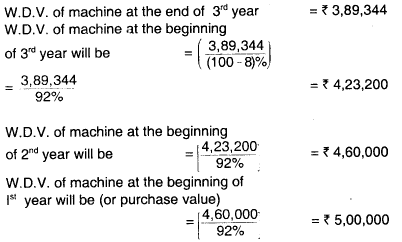

57. Madhur and Company purchases a machine for a certain sum. The company has a policy of charging 8% depreciation on written down value. The depreciated value of the machine after three years in the books of Madhur and Company is ₹ 3,89,344. What was the purchase value of machine.

(a) ₹ 5,00,000

(b) ₹ 4,60,000

(c) ₹ 4,23,000

(d) ₹ 5,52,000.

Answer:

(a) ₹ 5,00,000

58. The value of a fixed asset after deducting depreciation is known as its __________.

(a) Book value

(b) Market Value

(c) Face Value

(d) Realisable value.

Answer:

(a) Book value

The value of a fixed asset after deducting depreciation is known as written down value or book value.

59. Dinesh Garments purchased a machine for ₹ 50,000 and spent ₹ 6,000 on its creation. On the date of purchase it was estimated that the effective life of the machine will be ten years and after ten years its scrap value will be ₹ 6,000. The amount of depreciation for each year on straight line basis is __________.

(a) ₹ 5,000

(b) ₹ 5,600

(c) ₹ 6,000

(d) None of the above.

Answer:

(a) ₹ 5,000

Total cost of machinery will be = 50,000 + 6,000 = ₹ 56,000

Scrap value after 10 years will be = ₹ 6,000

Dep. on the basis of straight line

= \(\frac { Cost of machinery – Scrap Value }{ Life of machinery }\)

= \(\frac{56,000-6,000}{10}\)

= ₹ 5,000

Thus, Option (a) is right.

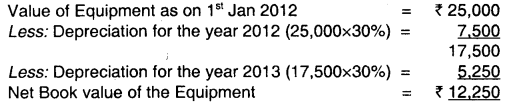

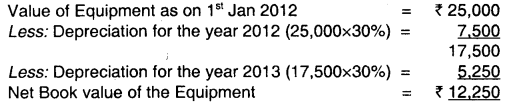

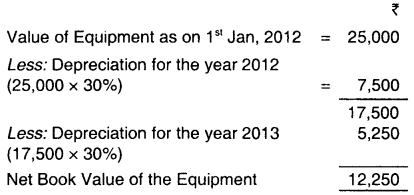

60. An equipment was purchased on 1st January, 2012 for ₹ 25,000 and is to be depreciated at 30% based on reducing balance method. If the company closes its books of account on 31st December every year, what would be the net book value of the equipment as at 31st December, 2013 __________.

(a) ₹ 12,250

(b) ₹ 10,000

(c) ₹ 17,750

(d) ₹ 12,545.

Answer:

(a) ₹ 12,250

Calculation of Net Book Value of the Equipment

61. Coal mine is which type of asset __________.

(a) Fixed Asset

(b) Current Asset

(c) Wasting Asset

(d) Fictitious Asset.

Answer:

(c) Wasting Asset

Coal mines are wasting assets as their value loses because they get exhausted on account of continuous extractions.

62. If the original and current price of machinery is given, it will be recorded at which value?

(a) Historical value

(b) Market value

(c) Realisable value

(d) Original cost.

Answer:

(d) Original cost.

Due to the cost concept, we record the fixed assets at cost price and not at market price.

63. An equipment was purchased on 1st January, 2012 for ₹ 25,000 & is to be depreciated at 30% based on WDV method. If the company closes its books of account on 31st March every year. What would be the net book value of the equipment as at 31st December 2013:

(a) ₹ 12,250

(b) ₹ 10,000

(c) ₹ 17,750

(d) ₹ 12,545

Answer:

(a) ₹ 12,250

Calculation of Net Book Value of the Equipment

64. Which of the following are amortised :

(a) Patent

(b) Copyright

(c) Goodwill

(d) All of these

Answer:

(d) All of these

Amortization is nothing but the name given to the depreciation charged on intangible assets such as goodwill, patents, copyright, trademark, etc.

Hence, all of the above are amortized.

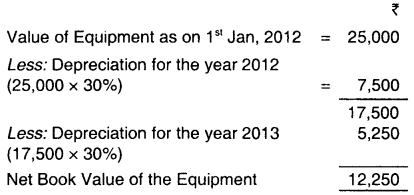

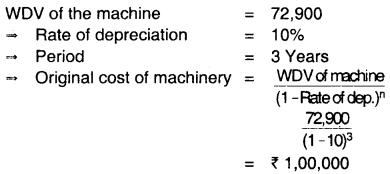

65. The WDV of machine is ₹ 72,900, rate of depreciation @ 10%, period 3 years. Calculate the original cost of machinery.

(a) ₹ 72,900

(b) ₹ 80,000

(c) ₹ 1,20,000

(d) ₹ 1,00,000.

Answer:

(d) ₹ 1,00,000.

66. Valueless assets are treated as:

(a) Tangible Asset

(b) Intangible Asset

(c) Fictitious Asset

(d) Current Asset.

Answer:

(c) Fictitious Asset

Fictitious assets are those assets which have no value but are recognised as an asset. Thus, the valueless assets are treated as fictitious assets.

67. A company purchased a mine of ₹ 50,000. Its scrap value is ₹ 5,000 and expected working life is 9 years. 1,00,000 units were expected to be produced during its working life. Units produced in first 3 years are 7,000, 15,000 and 19,000 respectively. Calculate the amount of depreciation for the third year by using depletion method.

(a) ₹ 3,150

(b) ₹ 8,550

(c) ₹ 3,000

(d) ₹ 6,750

Answer:

(b) ₹ 8,550

Rate of depreciation = \(\frac { Total cost of mine }{ Total Units }\)

= \(\frac{50,000-5,000}{1,00,000}\)

= 45

= 45%

Depreciation = Quantity extracted during the year x Rate of depreciation

= 19000 x 45%

= ₹ 8,550 is the depreciation for third year.

Hence option (b) is correct.

68. The value of a fixed asset after deducting depreciation is known as its __________.

(a) Face Value

(b) Market Value

(c) Realisable Value

(d) Book Value

Answer:

(d) Book Value

Depreciation is a process of allocating the cost of a fixed asset over its estimated useful life in a rational and systematic manner. The value of a fixed asset after deduction of depreciation is said as book value of the respective asset.

69. Samar purchased a machinery worth ₹ 1,00,000 and spent ₹ 20,000 on its repairs and ₹ 15,000 on its carriage. He decided to sell the machinery at 25% margin on selling price. What will be the expected sale value of machinery?

(a) ₹ 1,25,000

(b) ₹ 1,53,000

(c) ₹ 1,80,000

(d) ₹ 1,33,000

Answer:

(c) ₹ 1,80,000

Cost of machinery = ₹ 1,00,000 + 20,000 + 15,000

= ₹ 1,35,000.

25% on selling price = \(\frac { 25 }{ 100-25 }\) on cost.

\(\frac { 25 }{ 75 }\) x ₹ 1,35,000 = ₹ 45,000

₹ 1.35,000 + ₹ 45,000 = ₹ 1,80,000

70. A decrease in value of fixed asset due to age, wear and tear:

(a) Appreciation

(b) Written down value

(c) Depreciation

(d) Accumulated depreciation.

Answer:

(c) Depreciation

Depreciation is decrease in value of fixed asset due to physical wear and tear, obsolescence, passage of time.

71. Depletion is charged on:

(a) Fixed Assets

(b) Wasting Assets

(c) Current Assets

(d) All of the above

Answer:

(b) Wasting Assets

Depletion method is applicable in case of wasting assets, example – mines, quarries, oil well etc. from which a certain quantity of output is expected to be obtained.

72. An asset becomes useless because of technical changes this is because of:

(a) Obsolescence

(b) Physical Deterioration

(c) Depletion

(d) Passage of time

Answer:

(a) Obsolescence

Sometimes an asset becomes useless because of technical changes within the industry, technical progress in other industry, change in supply etc., this is known as Obsolescence.

73. Which of the following is not considered while calculating depreciation under straight line method?

(a) Salvage value of asset

(b) Annual repair cost of the asset

(c) Life of the asset

(d) Cost of the asset.

Answer:

(b) Annual repair cost of the asset

Under straight line method, a fixed proportion of the original cost of the asset is written off each year, so that asset account may be reduced to its residual value at the end of its estimated economic useful life. It ignores annual repair cost of the asset.

The formula is:

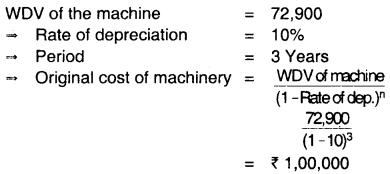

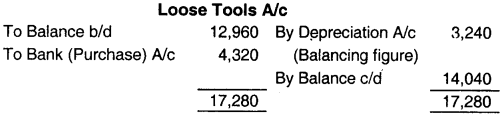

74. On 14th April, 2014 tools account showed a balance of ₹ 12,960. On 31st March, 2015 closing balance of tools was ₹ 14,040. The tools purchased during the year were for ₹ 4,320. Depreciation on loose tools for the year would be:

(a) ₹ 3,240

(b) ₹ 1,080

(c) ₹ 3,600

(d) ₹ 3,000

Answer:

(a) ₹ 3,240

75. As per Income Tax Act, which method of providing depreciation is recognised?

(a) Replacement method

(b) Depletion method

(c) Diminishing balance method

(d) Sum of the year digit method.

Answer:

(c) Diminishing balance method

Diminishing Balance Method is recognised by the income tax authorities. Under this depreciation is calculated at a certain percentage each year on the balance of the assets which is brought forward in the previous year. Thus, amount of depreciation becomes higher in the earlier periods and becomes gradually lower in subsequent periods, while repairs and maintenance charges increase gradually.

76. A company purchased plant for ₹ 50,000. The useful life of the plant is 10 years and the residual value is ₹ 5,000. The management wants to depreciate it by straight line method. Rate of depreciation will be:

(a) 9%

(b) 8%

(c) 10%

(d) 7%

Answer:

(a) 9%

77. On April 1,2013 the debit balance of the Machinery A/c of A Ltd. was ₹ 7,29,000. The machine was purchased on April 1,2010. The company charged depreciation @ 10% p.a, under diminishing balance method. The value of machinery on April 1,2012 was:-

(a) ₹ 10,00,000

(b) ₹ 9,00,000

(c) ₹ 8,10,000

(d) ₹ 12,00,000

Answer:

Let the Original Cost be 100 Dep. @ 10% under WDV

Cost after 1 year = 100 – 10 = 90

Cost after 2 year = 90 – 9 = 81

Cost after 3 year = 81 – 8.1 = 72.9

Original Cost = \(\frac { 100 }{ 72.9 }\) x 7,29,000 = 10,00,000

Cost on 1 April, 2010 = ₹ 10,00,000

Cost on 1 April, 2011= ₹ 9,00,000

Cost on 1 April, 2012 = ₹ 8,10,000

78. The amount of depreciation charged on machinery will be debited to __________.

(a) Machinery A/c

(b) Depreciation A/c

(c) Cash A/c

(d) Repair A/c.

Answer:

(b) Depreciation A/c

The amount of depreciation charged on machinery will be debited to depreciation account. Hence, option (b) is correct.

79. A company purchased a mine of ₹ 50,000. Its scrap value is ₹ 5,000 and expected working life is 9 years. 1,00,000 units were expected to be produced during its working life. Units produced in first 3 years are ₹ 7,000, ₹ 15,000 and ₹ 19,000 respectively. Calculate the amount of depreciation for the third year by using depletion method.

(a) ₹ 3,150

(b) ₹ 8,550

(c) ₹ 3,000

(d) ₹ 6,750

Answer:

(b) ₹ 8,550

80. The written down value of machine on 31st March 2013 is ₹ 72,900. The machine was purchased on 1st April, 2010. Depreciation is being charged @ 10% p.a. by diminishing balance method. The cost price of the machine would be:

(a) ₹ 1,00,000

(b) ₹ 90,000

(c) ₹ 81,000

(d) ₹ 72,900

Answer:

(a) ₹ 1,00,000

Cost price of Machine would be ₹ 1,00,000 on 1st April, 2010.

Written down Value of Machine on 1st April, 2011 is ₹ 90,000 (1,00,000 – 1,00,000 x 10%).

Written down Value of Machine on 1st April, 2012 is (90,000 – 90.0 x 10%) = ₹ 81,000.

Written down Value of Machine on 31st March, 2013 is (81,000 – 81.0 x 10%) = ₹ 72,900.

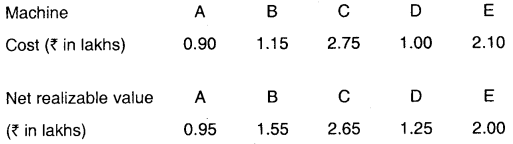

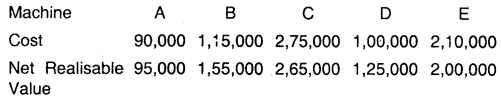

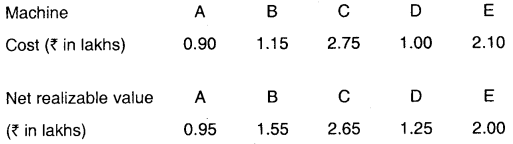

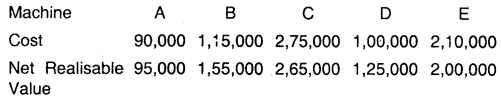

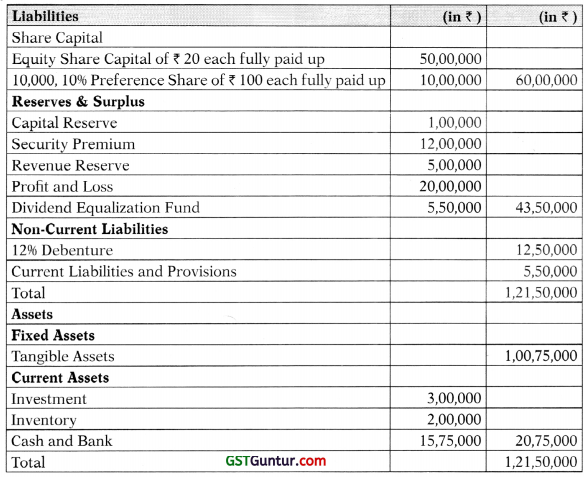

81. E Ltd. a dealer in second-hand machinery has the following five machines of different models and makes in their stock, at the end of the financial year 2012-13?

The value of stock included in the Balance Sheet of the company as on 31st March, 2013 was:

(a) ₹ 7,62,500

(b) ₹ 7,70,000

(c) ₹ 7,90,000

(d) ₹ 8,70,000

Answer:

(b) ₹ 7,70,000

So, Closing Stock included in Balance Sheet by following Golden Rule ‘Cost or NRV whichever is lower’.

Machine cost or NRV whichever is less taken

A – 90,000, C – 2,65,000, E – 2,00,000

B – 1,15,000, D-1,00,000

Total Stock included in Balance Sheet is

90,000 + 1,15,000 + 2,65,000 + 1,00,000 + 2,00,000 = ₹ 7,70,000

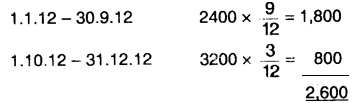

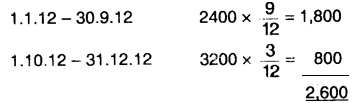

82. Fire Insurance premium paid on 1st October, 2011 for the year ended on 30th September, 2012 was ₹ 2,400 and Fire Insurance Premium paid on 1st October, 2012 for the year ending on 30th September, 2013 was ₹ 3,200. Fire Insurance Premium paid as shown in the profit and loss account for the accounting year ended 31st December, 2012 would be:

(a) ₹ 2,400

(b) ₹ 2,600

(c) ₹ 2,800

(d) ₹ 3,000

Answer:

(b) ₹ 2,600

Premium paid as follows:

1.10.11 – 30.9.12 2,400

1.10.12 – 30.9.13 3,200

Premium to be shown in P/L A/c for the year ending on 31.12.12 would be:

83. A company purchased plant for ₹ 50,000. The useful life of the plant is 10 years and the residual value is ₹ 5,000. The management wants to depreciate it by straight line method. Rate of depreciation will be:

(a) 8%

(b) 9%

(c) 10%

(d) None of the above

Answer:

(b) 9%

Plant purchased for ₹ 50,000 Residual Value = ₹ 5,000

So, Plant Cost after Residual Value is ₹ 45,000 (50,000 – 5,000)

Useful life = 10 years.

Rate of Depreciation = ?

Amount of Depreciation = \(\frac{50,000-5,000}{10}\)

= \(\frac{45,000}{10}\)

= 4,500

Amount of depreciation = Original Cost x \(\frac{Rate of Deprecation}{100}\)

4,500 = 50,000 x \(\frac{Rate of Deprecation}{100}\)

Rate of Depreciation = \(\frac{4,500 \times 100}{50,000}\) = 9%

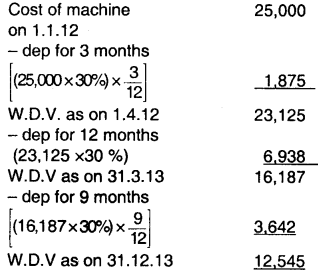

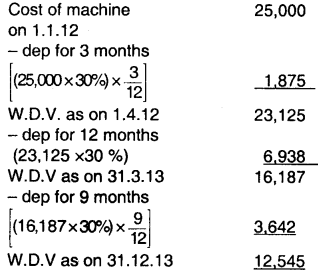

84. An equipment was purchased on 1st January, 2012 for ₹ 25,000 and is to be depreciated @ 30% based on written down value method. If the company closes its books of accounts on 31st March every year. What would be the net book value of the instrument /equipment as at on 31st December, 2013.

(a) ₹ 12,250

(b) ₹ 10,000

(c) ₹ 17,750

(d) ₹ 12,545

Answer:

(d) ₹ 12,545

Purchase Price of Asset: ₹ 25,000 (Jan. 2012)

Depreciation = \(\frac{Price of on Asset }{100 }\) x Rate of Depreciation

Jan 2012 – March 2012 = \(\frac{25,000}{100} \times 30 \times \frac{9}{12}\) = ₹ 1,875

Value of an asset on 1st April, 2012 = 25,000 – 1,875 = ₹ 23,125

Dep. for 1st April, 2012 to 31st March, 2013 = 23,125 x \(\frac{ 30 }{100}\) = ₹ 6,938

Value of an asset on 1st April, 2013 = 23,125 – 6,938 = ₹ 16,187

Dep. for 1st April, 2013 to 31st Dec. 2013 = 16,187 x \(\frac{ 30 }{100}\) x \(\frac{9}{12}\) = ₹ 3,642

Book Value of An Asset = Purchase Price of Asset – Sum of all depreciation.

Purchase Price : ₹ 25,000

Sum of All depreciation = 1,875 + 6,938 + 3,642 = 12,455

= 25,000 – 12,455 = ₹ 12,545, hence, option (d) is correct.

85. Dinesh Garments purchased a machine for ₹ 50,000 and spent ₹ 6,000 on its erection. On the date of purchase it was estimated that the effective life of the machine will be ten years and after ten years its scrap value will be ₹ 6,000. The amount of depreciation for each year on straight line basis is:

(a) ₹ 5,000

(b) ₹ 5,600

(c) ₹ 6,000

(d) None of the above

Answer:

(a) ₹ 5,000

Depreciation = \(\frac{Cost-Scrap Value}{Estimated useful life}\)

= \(\frac{56,000-6,000}{10}\)

= ₹ 5,000 p.a.

86. An equipment was purchased on 1st January, 2012 for ₹ 25,000 and is to be depreciated at 30% based on reducing balance method. If the company closes its book of accounts on 31st March every year, what would be the net book value of the equipment as at 31st December, 2013:

(a) ₹ 12,250

(b) ₹ 10,000

(c) ₹ 17,750

(d) ₹ 12,545

Answer:

(d) ₹ 12,545

87. Madhur and company purchases a machine for a certain sum. The company has a policy of charging 8% depreciation on written down value. The depreciated value of the machine after three years in the books of Madhur and company is ₹ 3,89,344 what was the purchase value of machine:

(a) ₹ 5,00,000

(b) ₹ 4,60,000

(c) ₹ 4,23,000

(d) ₹ 5,52,000

Answer:

(a) ₹ 5,00,000

Cost of Machine = \(\frac{3,89,344}{92 \% \times 92 \% \times 92 \%}\)

= ₹ 5,00,000.

88. The value of a fixed asset after deducting depreciation is known as its:

(a) Book value

(b) Market value

(c) Face value

(d) Realisable value

Answer:

(a) Book value

Value of an asset, less its depreciation is known as its book value or written down value.

89. Under which method of depreciation value can be zero __________.

(a) SLM

(b) WDV

(c) Both ‘a’ and ‘b’

(d) None of the above

Answer:

(a) SLM

As the book value reduces every years, it is also known as the Reducing Balance Method or written down value reduces every year, hence the amount of depreciation also reduces every year. Under this method, the value of asset never reduces to zero.

90. Depreciation is provided under which AS?

(a) AS-1

(b) AS-6

(c) AS-10

(d) AS-4

Answer:

(c) AS-10

Deprecation under AS 10 Property, Plant and Equipment Depreciable amount of any asset should be allocated on a methodical basis over the useful life of asset. Every part of property or P&E (Plant and Equipment) whose cost is substantial with respect to the overall cost of the item must be depreciated separately

91. Among which of the following is changed in depreciation?

(a) SLM or WDV

(b) WDV or SLM

(c) Both

(d) None

Answer:

(c) Both

Method of Deprecation are:

- WDV

- SLM

- Depletion method

- Double dealing method

- Annuity method

- Machine hours method etc.

92. Which of the following is common method of charging depreciation

(a) SLM

(b) WDV

(c) Annuity

(d) None

Answer:

(a) SLM

The most commonly used method for calculating depreciation under generally accepted accounting principles, or GAAP, is the straight line method. This method is the simplest to calculated results in fewer errors, stays the most consistent and transitions well from company prepared statements to tax returns.

![]()

![]()

![]()

![]()

![]()