How To Check Member IDs Or PF Accounts Linked To UAN

How To Check Member IDs Or PF Accounts Linked To UAN: There are two ways to determine how many Member Ids or PF accounts are connected to your UAN. EPFO issues a Member Id, also known as a Member Identification Number, or an Employee Provident Fund (EPF) account number, to enable employers to send EPF and EPS contributions on behalf of their employees. When you change jobs, your EPF contributions are transferred to a new PF account number, also known as a Member Id. These various Member Ids should be linked to UAN starting in 2014. The distinction between a UAN and a Member Id is explained in this article. It shows how many Member Ids are connected to UAN in detail with photos. The two methods for determining how many of Member Ids are possible are as follows:

- At Member Home, log in to the UAN Portal and choose View-> History of Service.

- Go to the EPFO website and pick Know Your Claim Status under Our Services->Employees. Hit Enter after entering your UAN and Captcha. You can see a list of PF Accounts that are linked to a particular UAN.

Any missing PF numbers must be connected to UAN using the One Employee One PF connection.

What is the Difference Between a Member Id and a User Account Number (UAN)?

The employer pays the EPF (Employee Provident Fund) to the EPFO (Employee Provident Fund Office) on behalf of the employee. This covers both employee and employer contributions, as well as the Employee Pension Scheme. EPFO issues a Member Id, also known as a Member Identification Number or a PF Account Number, to enable employers to send EPF and EPS contributions on behalf of their employees. It’s as though the employer establishes an EPF account for its employee and contributes to it monthly.

The format of the Member ID or PF Account Number is as follows. It’s possible that your PF Account Number doesn’t have an Extension code. For example, the code for someone working in Bangalore may be BG/BNG/012345/789.

Office code of EPFO/ Establishment code which is maximum seven digits/ extension which is maximum three digits/ Account number which is maximum seven digits

BG/BNG/012345/0001789 is an example.

The Universal Account Number (UAN) is a unique identifier for each person. A 12-digit number is assigned to an employee who contributes to the EPF. A single UAN (Universal Account Number) should be assigned to each employee. Your UAN will be connected to all of your Provident Funds or Member Ids. It will keep track of all of your Member IDs. It’s like having multiple savings accounts, but they’re all linked to your single Permanent Account Number or PAN. So, if you change jobs and your new employer contributes to EPF, you’ll get a new Member ID. Your UAN number must be connected to this new Member ID.

How to Use the UAN Member Website to Check the Number of PF Accounts Connected to Your UAN

Log in to the UAN Member Website and select View->Service History from the drop-down menu.

You’ll see a list of the different companies where you worked, along with the dates that you started and left. The following details will be shown.

- Your PF account Number or the member id

- Your name, as mentioned on the EPF records of the organizations.

- Company name for which you worked

- DOJ EPF (Date of joining Employee Provident Fund) – The date of starting your EPF contribution. It must also be the date of joining.

- DOE EPF (Date of Exit of Employee Provident Fund) – the date when the employer stops the contribution in your EPF account. It must be your resignation date.

- DOJ EPS (Date of joining of Employee Pension Scheme) – This date is mentioned the same as DOJ EPF.

- DOE EPF (Date of Exit of Employee Pension Scheme) – This dame is the same as the DOE EPF.

- DOJ FPS – FPS means Family Pension Scheme of 1971, and it is not more than the operation. Employee Pension Scheme (EPS) replaced the FPS in 1995, and FPS is now called the Ceased Pension Scheme. This is not available for the employees with a joining date after 1995.

- DOE FPS (Date of Exit of Family Pension Scheme) – This date is unavailable for the employees with a joining date after 1995.

More information is available by selecting Detailed View from the top right-hand corner.

How to Determine the Number of PF Accounts Connected to Your UAN Using Member Claim Status

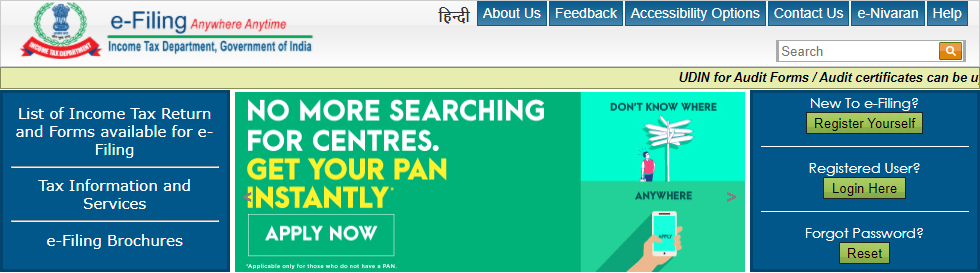

Go to the EPFO website and pick Know Your Claim Status under Our Services->Employees.

Hit Enter after entering your UAN and Captcha. You can see a list of PF Accounts that are linked to a particular UAN.

You can see your transfer information by clicking on the connection from where you transferred the account, in our case, BGB002000000000003.

The message “No record is available for member id ABCD00000000” appears for accounts for which no move has occurred or for which no claim has been filed.