Basics Of Employee Provident Fund: Employee Provident Fund (EPF) is the retirement benefit available only to salaried employees of private organisations. Government Employees do not have any contribution to EPF but NPS from 2004.

It is a fund to which both the employer and employee contribute 12% of the basic salary each month. In this article, you will learn about EPF, what is EPS, what is EPF Private Trust, how much pension will one get under EPS, VPF.

What is Employee Provident Fund (EPF)?

A provident fund is created for providing financial security and stability to older adults. Generally, an individual contributes to these funds when they start as an employee. The contributions are made regularly (monthly in most cases).

Its purpose is to help the employees save a fraction of their salary each month to be used if they are temporarily or no longer fit for working or retirement. The investments made by several people/employees are pooled together and invested by a trust. Typically, the 12% of the Basic, DA, and cash value of food allowances must be contributed to the EPF account. When one says EPF, it implies:

- Employee Provident Fund (EPF): The Employee’s contribution is matched with the Employer’s contribution (till 12%). The contribution of the employer is exempt from tax, and the employee’s contribution is taxable but eligible for deduction under section 80C of the Income-tax Act. EPF amount earns interest as was declared by the Government.

- Employees’ Pension Scheme (EPS) from 1995 offers pension on disablement, pension for nominees and widow pension.

- Employees Deposit Linked Insurance Scheme (EDLIS) provides a lump sum payment to the insured’s nominated inheritor in the event of death due to illness, natural causes or accident, while still in the job.

The parliament enacted the EPF & MP Act of 1952 and came into force with effect from 4th March 1952. A number of legislative interventions were made in this direction, including the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952. Presently, the three following schemes are in operation under the Acts:

The Employees’ Provident Fund Scheme (EPS) of 1952

- The Employees’ Deposit Linked Insurance Scheme (EDILS) of 1976

- The Employees’ Pension Scheme, 1995 (replacing the Employees’ Family Pension Scheme, 1971) (EPS)

Basics of Employee Provident Fund

The Employee Provident Fund (EPF) was implemented by the Employees Provident Fund Organisation (EPFO) of India. EPFO is one of the most prominent social security organisations across the globe in terms of members and the volume of financial transactions they undertake.

An establishment having 20 or more workers that work in any one of the 180+ industries must register with EPFO. It is a statutory body of the Indian Government under the Labour and Employment Ministry.

| Scheme Name |

Contribution of the Employee |

Contribution of the Employer |

| Employee Provident Fund |

12% |

3.76% |

| Employees’ Pension Scheme |

0 |

8.33% |

| Employees Deposit linked Insurance |

0 |

0.5% (capped at a maximum of Rs. 15,000) |

| EPF Administrative Charges |

0 |

0.85% (from January of 2015) |

| PF Admin Count |

1.1% |

|

| EDLIS Administrative Charge |

0 |

0.01% |

The above table showcases the rates of EPS, EDLI, EPF admin charges in India.

How Does One Join EPF Under EPFO?

Employees working in the private sector, drawing basic salary up to Rs 15000 (From September 1st, 2014 salary limit has been increased to Rs 15,000 before it was Rs 6500) have to compulsory contribute to the Provident fund and employees drawing above Rs 6501 have an option to become a member of this Provident Fund.

It is helpful for employees who draw salary above Rs 15001(Before September 1st, 2014, the minimum was Rs 6501) to become a Provident Fund member. It is deducted from one’s salary before deposited on the bank or given; hence compulsorily saving happens.

Those who started their job after September 1st 2014, and earning more than 15,000 Rs in basic and DA will not be contributing to the EPS or Pension scheme.

From Feb 10 2016, one is not allowed to withdraw the Employer share of EPF contribution, and the retirement age has been changed to 58 years.

Every employee must submit a declaration, Form 11, when they take up a new employment in an organisation which is registered under the EPF Scheme of 1952.

EPF Form 11 contains basic information on the employee, and an employee must fill it upon joining an organisation. EPF Form 11 is a self-declaration by the new joinee regarding his status, whether he was a member or non-member of EPF / EPS in earlier employments and opt-out of EPF.

In order to be a member of the Employee Provident Fund, one has to fill Form 11 and Nomination Form.

Difference between EPF Private Trust and EPF?

There are three different ways for an employer to contribute to the Provident Fund of his Employees if several employees are more than 20. Exempted means free from duty, obligation, or liability to which others are subjected.

One is to save in an un-exempted fund like the EPF under the EPFO. Un-exempted firms are those firms who maintain the PF accounts of the workers working under them with EPFO. There exists over five crore active subscribers whose accounts the EPFO is managing.

- Save in an EPF Private Trust, a company-run exempted fund that is recognised by the EPFO pays at least the same interest as EPF. The EPF Trust has to do the responsibilities and duties just like EPFO. The EPF Private trusts are formed by firms that manage the money and accounts of their workers and have an exemption from filing for the PF returns.

- Members of such trusts enjoy income tax and various other benefits along with the EPFO subscribers. Such establishments that seek exemptions and create EPF Private Trusts are known as the exempted establishment. However, the pension is payable only by EPFO. Companies such as Accenture, TCS have their Private PF Trust.

- Put money in a company-run excluded fund that is not regulated by EPFO but is set up with approval from the resident income tax commissioner. This type of fund looks after all the investments and fund managements itself and is self-regulated.

Government Employees Don’T Contribute to EPF but NPS from the year 2004

Government employees don’t contribute to EPF. Contributing to Tier-I is mandatory for all the Government servants joining Government service on or after 1st January 2004 (except the armed forces in the first stage). In contrast, Tier-II will be optional and the discretion of Government servants.

In Tier-I, a Government employee has to contribute 10% of their basic pay plus DA, that will be deducted from their salary bill every month by PAO concerned. The Government will be making an equally matching contribution. However, the Government will not be making any contribution regarding individuals who are not Government employees.

How is UAN Related to EPF?

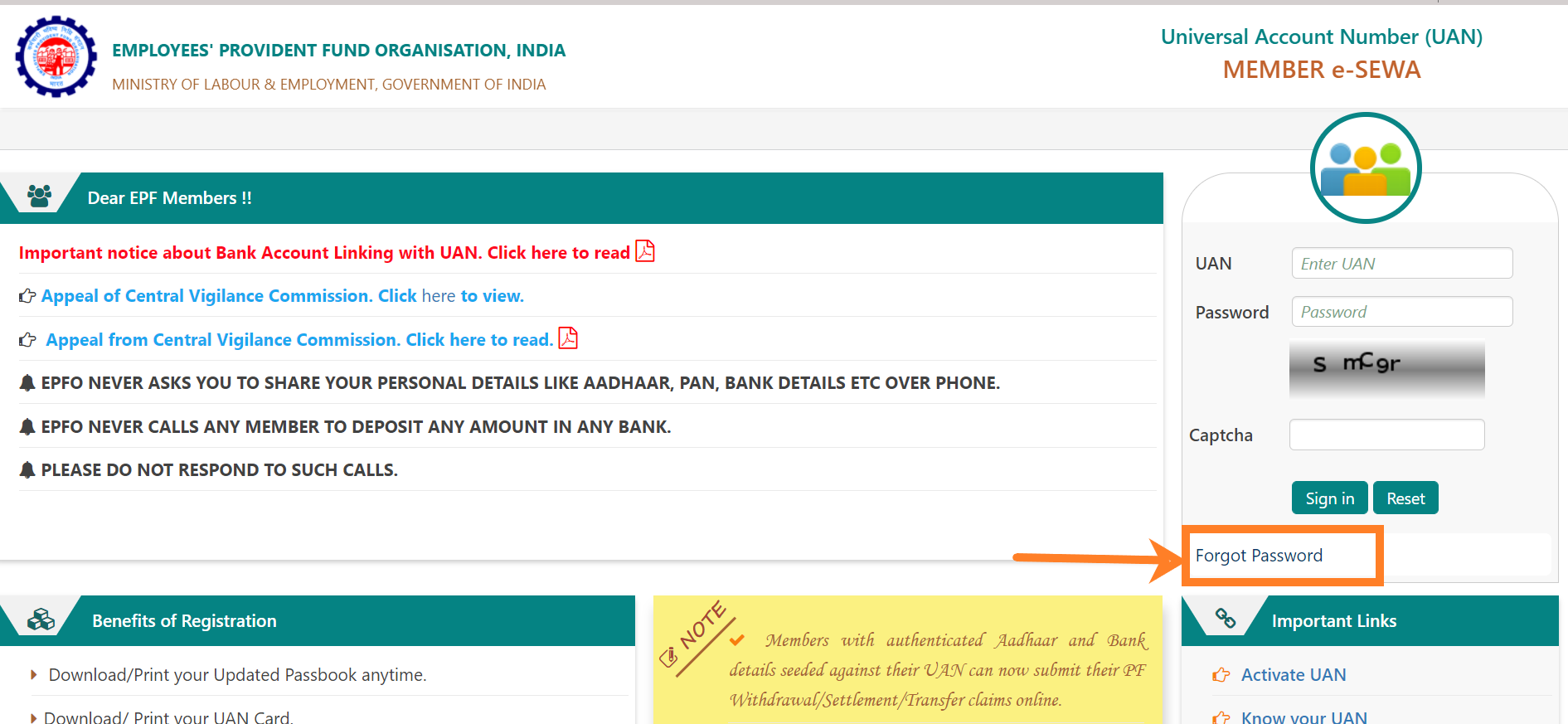

UAN (Universal Account Number) a 12-digit number that is allotted to each employee who is contributing to EPF. The universal number is a giant leap shifting EPF services towards the online platform, making it more user-friendly.

Please keep in mind that the universal account number stays the same throughout an employee’s lifetime. It does not change when one changes their jobs. No one has a UAN number, and PF number also called Member Id.

An employee will have to be given one UAN or Universal Account Number, which will remain the same as the name implies. It will maintain all the Member Ids. It’s like one can have multiple Saving Bank account, but all these accounts are tied to their one Permanent Account Number or PAN.

Hence, when one changes their job, and the new employer is contributing to EPF, it gives them a unique Member ID. The new Member ID has to be linked to the UAN number.

Members must activate their registration for availing various facilities such as UAN card download, updating of KYC information, member passbook download, listing all his member ids to UAN, file and view transfer claims.

Interest on EPF

What is the interest in PF accumulations?

As declared by Central Govt. compound interest is paid on the amount standing to an employee’s credit as of 1st April every year.

The central government decides the EPF interest rate of India with the Central Board of Trustees’ consultation. In the past few decades, the interest rate has ranged between 8-12 % of the balances that are maintained in the fund.

EPF interest rate notifications are available on the EPF India official website on an annual basis. The same is communicated by major dailies in all cities. To see the Interest rate over the years from 1952, please click the image to enlarge. The following table shows the Interest rate of EPF for the last few years.

| Financial Year |

Interest Rate |

| 2012 – 2013 |

8.5% |

| 2013 – 2014 |

8.75% |

| 2014 – 2015 |

8.75% |

| 2015 – 2016 |

8.8% |

| 2016 – 2017 |

8.65% |

EPF Vs NPS Returns

The annual interest rate announced by the government determines the PF returns. The return on NPS, on the other hand, is based on the NAV of the underline scripts, which might climb or fall. As a result, while PF provides security and guaranteed returns, NPS provides both high risk and high returns.

How does EPFO Manage To Pay The Interest?

EPFO ‘declares’ the annual interest that is paid out to the subscribers every year. In the previous four years, the returns have become around 8.75% a year. The interest is decided on the basis of the surplus of its income over expenses.

The fund earns revenue from government deposits, corporate bonds, gilts, and the other securities that are held in its portfolio. It incurs costs on the subscriber expenses and payouts. In 2015-16, EPFO had invested 5% of the incremental corpus, or slightly more than Rs.6,000 crore, in stocks.

The labour ministry officials in 2016-17 estimated that the amount will rise to as much as Rs.10,000 crore.

How is EPF Total Amount And Interest Calculated?

At the beginning of every year, there would be an opening balance, the amount which was accumulated till then. Contributions are made every month. However, the interest is calculated yearly.

One gets interested in opening balance and monthly contribution. Hence for next year, the new opening balance is going to be: old opening balance + contribution throughout the year + interest on the (old opening balance + contribution)

How Much Would One Save On Investing in EPF?

Let’s say Radhika starts with a basic salary of Rs. 20,000. Every year, on average, she gets a 5% increment. She started at 25 years and worked till 60 years, so her working life is 35 years. She contributes 12% of her basic salary towards PF, that is matched equally by one’s company (EPF contribution is 3.67%, EPS 8.67%).

In such a case, over the course of 35 years of her working life, her total contribution is Rs. 26.01 Lakhs. Of course, her company contributes Rs. 7.955 Lakhs, hence a total contribution of amount Rs 33.967 lakh. And this amount grows into – Rs. 1.38 Crores during the time of her retirement!

Can One Voluntarily Contribute More Than The Statutory Limit To EPF?

One can contribute an additional amount (over and above 12%) to Provident Fund by depositing VPF (Voluntary Provident Fund). However, the employer is not bound to make a matching contribution.

The employer is allowed to contribute only on 6500/15000, whatever being the basic salary. This is known as a voluntary contribution. A Joint Declaration Form has to be filled up where the employer and the employee both need to give a declaration according to the rate at which PF will be deducted.

How to Check the EPF Balance?

EPFO has been using technology for turning into a more professional and nimbler organisation. To help individuals, the officials have introduced an EPF Balance Check on Mobile option. So that people can now check their EPF balance through SMS. See your passbook. It has introduced an online facility for transferring the balance to any new account.

Going forward, all members are going to have a Universal Account Number (UAN) that will be portable across employers and cities. Active contributors of the EPF have already been allotted UANs.

Annual Statement: EPFO used to send a yearly statement through the employer to the employee, giving details about the PF accumulations. It is a wide slip of paper. The statement contains details like the Opening balance and the amount contributed made during the year, withdrawal made during the year, interest earned, and closing balance in the PF account.

Check EPF Balance by SMS

From July 2011 onwards, one can check their EPF account balance online.

Step 1: Go to http://epfindia.com/site_en/KYEPFB.php www.epfindia.com/MembBal.html. Now select EPFO Office.

Step 2: Enter the PF Account Number in the format: EPFO Office Code/Establishment Code (Maximum 7 Digits)/Extension (Maximum 3 digits)/Account Number (Maximum 7 digit) (PF Account Number might not have Extension code, in such case, leave it blank).

Step 3: Enter your Mobile and Name, Accept the Terms and conditions and Submit.

Step 4: You will get an SMS alert from EPFO: EE amount: Rs XXXXX and ER amount Rs: XXXXX as on < Today’s Date> (Account updated up to Date).

Step 5: You will be receiving an SMS alert from the EPFO: EE amount: Rs XXXXX and the ER amount Rs: XXXXX as on < Today’s Date> (Account updated up to Date).

- EE implies Employee Contribution, and ER implies Employer Contribution on the date (shown in Account updated date) mentioned in your SMS. It does not showcase the current balance of the PF Account as of Today.

- EPF Passbook: EPFO launched on 30th November 2012 as an e-passbook facility. The online EPF or EPF passbook is an online version of the employee’s provident fund account. It would be best if one gets the passbook.

Note it takes time to register and to become active. You will receive an SMS when you will be allowed to download the passbook. It shows information in detail about opening balance, contribution every month from employee and employer, how the employer’s contribution is split into PF and EPS. Also, withdrawals, if any, have been made from the EPF account.

EPF Passbook with UAN

As stated earlier, the UAN (Univeral Account Number) is a 12-digit number. It is allotted to each Employee Provident Fund member by the EPFO. It controls one’s EPF account and minimises the employer’s role. UAN number activation started in Oct 2014. One can download their EPF passbook if they have activated their UAN number.

Withdrawal and Transfer of EPF

At the time of the change of Job, what happens to the EPF? Is one allowed to withdraw the whole amount?

Yes, legally, it is compulsory to transfer an EPF account during the time of a job change. However, people generally don’t do it. Instead, they withdraw the amount. From 10 Feb 2016, one cannot withdraw Employer contribution to EPF before 58 years.

In the case of EPS, suppose the service period is less than 10 years. One has the option to either withdraw their corpus or get it transferred by getting a ‘Scheme Certificate’. If the service period crosses the 10 years mark, the withdrawal option ceases.

Is There Any Tax Implication If I Withdraw The Epf Balance Before 5 Years?

If you are a member of a recognised provident fund, it depends on whether your contribution is over 5 years or not, including transfers from different companies. Suppose you withdraw before completing 5 years.

In that case, all your previous year’s income gets recomputed as if the fund was unrecognised from the very beginning (i.e., the tax benefits one received on their own contribution u/s 80C/88 in the earlier years is going to be forfeited). Further, the employer’s contribution and interest received are going to be added to the current income subject to relief under section 89.

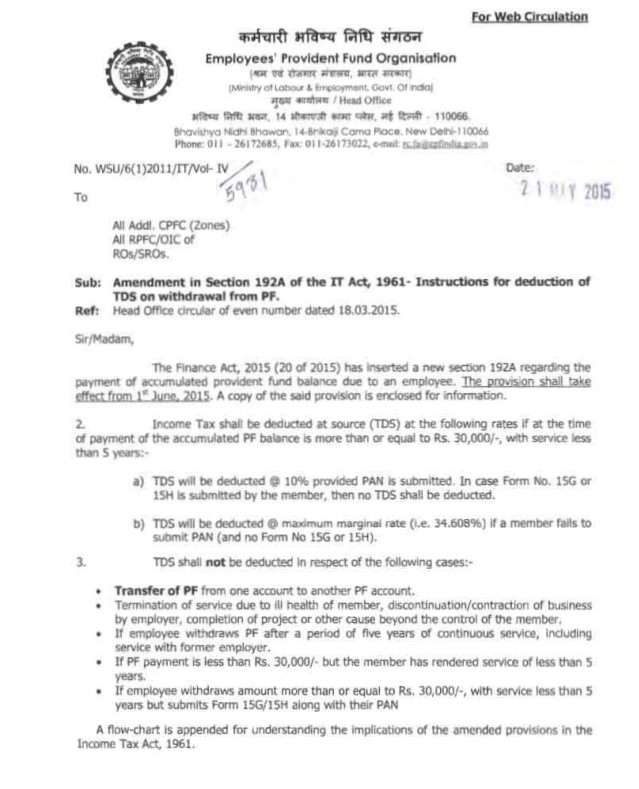

What is TDS on EPF Withdrawal? What is Form 15G?

Before five years of completion of service, Provident fund withdrawal attracts tax deducted at source at 10% from June 1st 2015.

TDS is going to be deducted at 34% if one doesn’t submit PAN.

Exemption from the TDS has been given to subscribers with no taxable income, provided they submit a 15G/15H form. In order to avoid the charge of TDS, 15H (for senior citizens) or Form No. 15G (other than senior citizens) could be submitted, provided the payable provident fund amount is up to the basic exemption limit, which for AY 2016-17 is 2,50,000 and Rs 3,00,000 for senior citizens, respectively.

Are There Going To Be Any Tax Implications If I Choose To Withdraw The Epf Balance After 5 Years?

No, if you withdraw after 5 years of total contribution to EPF (including multiple jobs), then your EPF withdrawal becomes tax-free. Show it as exempt income in an Income tax return.

How Can EPF be Transferred?

Ideally, one should initiate the process of transferring their EPF balance as soon as they join their new organisation and are allotted a unique PF account number. From Oct 2014, most of the employees have been allotted a Universal account number or UAN, a 12-digit number by the Employee Provident Fund Organization (EPFO), which controls his EPF account and minimises the role the employer.

Universal Account Number (UAN) Member Portal (www.can members.e-services.in) was launched in September 2014. This portal offers a lot of facilities to the employees or EPF members. However, EPF Online Transfer Claim is still not available. For the time being, you have to submit online EPF Transfer claims through

http://epfindia.com/Employee_OTCP.html or click on the Online Transfer Claim link is the EPF website http://memberclaims.epfoservices.in/.

Can one Withdraw from EPF while Still Working?

EPF scheme allows partial withdrawals for higher education/illness/marriage/house construction etc.

Employee Pension Scheme (EPS)

As mentioned later, the Employees’ Pension Scheme (EPS) from 1995 offers pension on disablement, pension for the nominees and widow pension. EPS program took over the Family Pension Scheme (FPS). It is financed by diverting 8.33 percent of the employer’s monthly contribution from EPF (restricted to 8.33% of 6500 or Rs 541.

From September 1st, 2014 salary limit has been increased up to Rs 15,000 so Rs 1250 per month), and the government’s contribution of 1.17% of the worker’s monthly wages.

The purpose behind the scheme is to provide for

- Retiring Pension: members who have rendered eligible service of 20 years and retire or otherwise ceases to be in employment before attaining the age of 58 years.

- Superannuation Pension: Members who have rendered eligible service of 20 years and retires on attaining the age of 58 years.

- Short service Pension: Members have to render eligible service of 10 years and more but less than 20 years.

- Permanent Total Disablement Pension

When Is An Employee Eligible For Receiving A Pension?

An employee can start receiving their pension under EPS only if they have worked for a minimum of 10 years and attain an age of 58/50 years. However, no pension is payable before reaching the age of 50 years, and early pension is payable after 50 years.

However, before the age of 58 years is subject to a discounting factor of 4% (w.e.f. 26.09.2008) for every year falling short of 58 years. In cases of disablement or death, the above restrictions do not apply.

What is the Formula to Calculate the Monthly Pension?

Under the Employees’ Pension Scheme, the monthly retiring pension is decided based on ‘Pensionable Service’ and ‘Pensionable Salary’ and is calculated as:

Monthly pension = (Pensionable salary*Pensionable service)/70

The pensionable Salary is arrived at by considering the average contributing salary immediately preceding 12 months from the date of exit from the scheme. Typically, this would be limited to Rs. 6,500 per month unless the employer makes enhanced contributions with permission.

The service in years rendered by members is the pensionable salary. These contributions have been received maximum cannot exceed more than 35 years.

How Much Money Is The Maximum Amount Of Pension Available Under Eps?

The Indian government has also fixed monthly pension benefits at Rs 1,000 from 2014-15. Those who started their job after 1st September 2014 and earning more than Rs. 15,000 in basic and DA are not going to be contributing to the Pension scheme.

Before September 1st 2014, it was on the basis of a maximum employment period of 35 years and a maximum contribution of Rs 6500. The maximum amount of pension according to the Pension formula = 6500 * 35)/70 = Rs 3,250 per month or Rs. 39,000(3250 * 12) per year.

- The maximum Pension one can get Rs 7,500 per month.

- The minimum Pension one can get Rs 1,000 per month.

- Is the Monthly Pension paid under EPS?

The amount of pension is meagre. If one had invested Rs 541 in a recurring deposit at the rate of 8% for 35 years, one would get 12,49,263 as maturity amount.

Suppose the maturity amount is put in purchasing the Pension plan, such as LIC’s Jeevan Akshay VI and put the amount mentioned above Rs 12,49,263 in the premium calculator of LIC with the option as Annuity payable for life. In that case, one will get a monthly pension of Rs 10,150, which is much more than Rs 3250.

Employees Deposit Linked Insurance Scheme (EDLI)

The Employees Deposit Linked Insurance Scheme, also known as EDLI, is an insurance cover offered by the Employees Provident Fund Organisation (EPFO) for private sector salaried employees.

The nominee who is registered receives payment on the event of the death of the person who is insured during the period of the service. EDLI applies to all the organisations registered under the Employees Provident Fund and Miscellaneous Provisions Act of 1952.

All these organisations have to subscribe to this scheme and offer life insurance benefits to their employees. This scheme works in combination with EPS and EPF. The extent of the benefits are decided according to the last drawn salary of the employee.

Significant Characteristics of Employees Deposit Linked Insurance Scheme (EDLI)

Here are the essential features of EDLI, applied uniformly to all inheritors under the policy:

- EDLI applies to all employees with a salary under Rs. 15,000/- each month. If the basic salary goes beyond Rs. 15,000 per month, maximum benefit is then capped at Rs. 6,00,000/-

- The employees need not contribute to EDLI. Their contribution is required only for the EPF.

- There is a bonus amount of Rs. 1,50,000/- available in the EDLI.

- If any organisation has more than 20 employees, they need to register for EPF. Hence, any employee having an EPF account automatically is eligible for the EDLI scheme.

- There is no exception to the insurance coverage provided by EDLI. It protects the person who is insured round the clock, all across the world.

- An employer is allowed to choose another group insurance scheme. However, the benefits offered has to be equal to or more than those provided under EDLI.

- As per the provisions of the EDLI, an employer’s contribution has to be 0.5% of the basic salary or a maximum of Rs. 75 per employee each month. If there are no other group insurance schemes, the maximum contribution is rounded off at Rs. 15,000/- per month.

- For all calculations under EDLI, the dearness allowance has to be added to the basic salary.

Calculating EDLI Charge

The registered nominee will receive a payout in the event of the death of the insured individual. If no nominee or inheritor is registered, then the amount will be paid to the legal heir. The pay-out awarded is going to be calculated as:

{Average Monthly Salary of Employee for last 12 months (capped at 15,000/- p.m.) x 30 } + Bonus Amount (Rs. 1,50,000/-)

Hence, the maximum payout under EDLI is capped at Rs. 6,00,000/-.

How To Claim The Benefits Under the EDLI?

The process to be followed by the claimant or nominee for receiving the amount under EDLI is stated below:

- The nominee specified by the insured person can claim the benefits. If no nominee has been registered, then the family members or legal heirs are eligible to apply.

- The deceased person must have been an active contributor to the EPF scheme during his/her death.

- EDLI Form 5 IF needs to be duly completed and submitted by the nominee.

- The claim form must be signed and certified by the employer.

- In case there are no employers, or somehow the signature of the employer cannot be obtained, the form has to be attested by any of the following:

- The claimant must submit all the required documents and the completed form along with the regional EPF Commissioner’s Office for processing of the claim.

- The claimant could also submit Form 20 (for EPF withdrawal claim) along with Form 10C/D for claiming all the benefits under the three schemes of EPF, EPS and EDLI.

- Additional documents needed must be furnished at the earliest for processing the claim.

- Once all the documents have been provided and the claim has been accepted, the EPF commissioner needs to settle the claim within 30 days from the receipt of the claim. Otherwise, the claimant is entitled to an interest of 12% p.a. Till the date of actual disbursal.