How to Change Password of UAN if Mobile Number is not Changed?

How to Change Password of UAN if Mobile Number is not Changed?: UAN is a 12-digit Universal Account Number allotted by Employee Provided Fund Organization to each member of the EPF. The number minimises the role of the employer and gives an employee control over Employee Provident Fund. UAN serves as a crucial part to merge multiple EPF numbers allotted to an individual by more than one employer. It links various member IDs of a person to a single Universal Account Number.

Every EPF member has information regarding their UAN number and their password to log in at EPFO online website. However, sometimes, an individual may forget or lost their password due to which they search here and there to know how to change it. It is a trouble-free task to reset the UAN password if the mobile number is not changed once the member registered into the UAN Member Portal. The entire procedure can be completed online within a short time when an individual falls under Forgot UAN Password situation.

When Does Employee Want to Change their UAN Member Password?

India has a special work unification, which helps employees to save for retirement. UAN is a legal number issued to all the contributors of EPF and it cannot be changed. This number helps employees access their saving and EPF services online without visiting the employer or HR. Whether forgotten or changed the job, whatever be the circumstance, once UAN gets issued, it cannot be changed. However, workers can reset their UAN password if they change their mobile number or forgot the old password.

There are three different scenarios under which the employee wants to change their UAN password. First, if they have changed or lost the registered mobile number. Second, if they have forgotten their UAN password but the mobile number is not changed. Third, they have forgotten the previous UAN password and also changed their phone number registered with the UAN member portal.

In any circumstance, an individual can change their password online by following few simple steps. Readout below to know how one can regain access to their UAN member portal credentials.

Steps to Change UAN Password with Registered Mobile Number

In case, if an individual forgot his/her UAN password, it is vital that they remember their Universal Account Number. Following are the steps to change the password of UAN:

- Go to the official website of Employees Provident Fund Organization

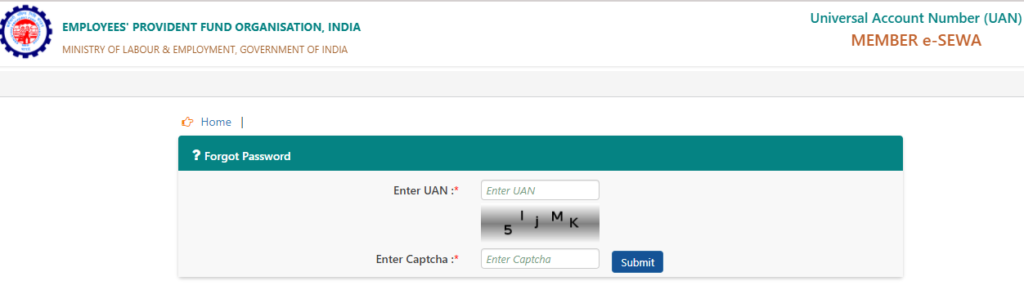

- Click on the below tab ‘Forgot Password’

- Enter UAN Number

- Enter Captcha in the given box and submit

- Click on the option ‘Verify’

- It will display the mobile number linked to UAN. A message will display which asks if one wants to get OTP on the above-mentioned mobile number and two options will be there ‘Yes’ or ‘No’. If anyone does not want to change their mobile number, they can click on option No.

- Click on the tab ‘Get Authorised Pin’

- When OTP is successfully sent, the message ‘OTP is successfully sent’ will appear on the screen. However, a message ‘Failed to send OTP. Please Try Again Later’ will display if the website is unable to send the OTP.

- Enter the PIN corresponding to the OTP ID sent on the mobile number registered with UAN to set a new password.

- Now, the employee can enter the new password.

It is vital to note that the password should contain a minimum of 4 alphabets, 7 characters, 2 digits, 1 special character, and a maximum of 20 characters. The special characters refer to #, %, !, @, &, and so on. At least one character in the password should be capital and one should be small.

- Click on the option ‘Confirm Password’ and then submit

- A message will get display on the screen, which says password changed successfully.

- Login with Universal Account Number and new password to the EPF link UAN website.

Change UAN Password After Log in to UAN Portal

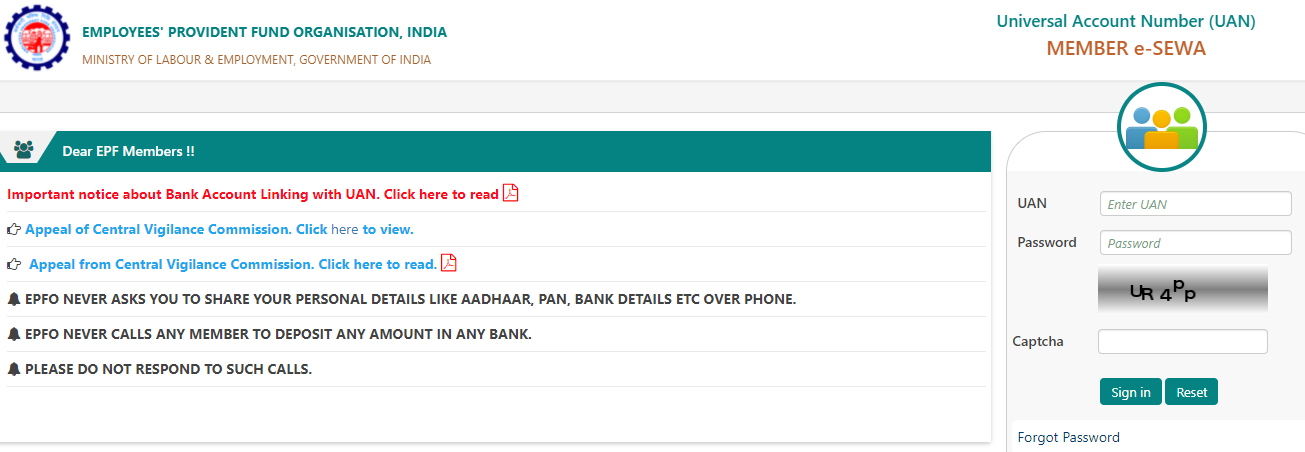

- Go to the official UAN member portal site

- Enter login credentials appearing on the right side of the screen. It involves a UAN number, password, and CAPTCHA code, and then click on the login tab. If any of the employees forgot their UAN, then they have to first get it from their employer and then continue further.

- Click on the section ‘Menu’ and then go to the Accounts showing on the upper side of the site.

- Hit on the ‘Change UAN Password’ from the drop-down menu.

- Now, three sections will appear on the screen. In the first section, an individual can type their old UAN password.

- The next two sections are for entering the new password and then re-enter it for confirmation.

- After setting the new password, hit on the ‘update’ option.

- The new password has been sent successfully and a pop-up message displaying ‘Password Updated Successfully’ will appear.

How to Change UAN Password if the Mobile Number Gets Lost?

In case, if the mobile number registered with UAN gets lost, then an individual has to first change their mobile number. After that, they can proceed further to change the password. To change the mobile number in UAN it is essential that UAN should have updated with KYC information. This information involves details of the Aadhaar card and PAN card. In case, if UAN is not updated with all these details and an employee should go to an employer and update their UAN and then follow the further process:

- Open the EPFO official website and enter the UAN number

- Click on the option ‘No’ appearing below

- Now, the employee has to fill in all personal details such as name, gender, date of birth

- After entering all these details, click on the option ‘verify’

- Once successfully verified, an individual would be asked to validate against the PAN number of the Aadhaar number. One can fill either of them and then tick on verify

- When all the given details are verified, it will ask to enter a new mobile number. An individual should enter the new mobile number and then tick on the ‘Get OTP’ tab.

- Enter the OTP sent to the phone number registered. In case, if anyone does not receive the OTP, they can click on the option ‘Resend OTP’ and then verify to continue further.

- After verifying the One Time Password successfully, the site will ask to enter New Password. As per desire, one can enter the new password and then again enter it in the Confirm Password box.

How to Get EPF Universal Account Number for a New EPFO Member?

New employees have to first register themselves in the Employee Provident Fund and then start saving for the future. The EPFO produces a UAN number and grants it to the employer, who then connects to the employee. This number holds the essential details of the contributor.

- Once, the employee receives the UAN number they should visit the official website of UAN.

- On the homepage, they have to click on the registration tab and then proceed to activate UAN.

- Now, enter the official details such as name, mobile number, date of birth, and email id. Enter the captcha code appearing in the box provided.

It is effortless to acquire a UAN number. Remembering it can be a daunting task for some employees. Some might change their mobile number after some time and can face issues while login to the PF accounts. In such a case, they can follow any of the methods mentioned above to reset their forgotten password.

Conclusion on How to Change Password of UAN if Mobile Number is not Changed?

Universal Account Number holds various benefits for an employee. It lets them attach all their PF from the last years. Whenever workers get new employment, they can open different EPF account and can link all those accounts with UAN. By registering on UAN official website, employees can access their contribution, passbook, and balance effortlessly. The best part is that one can change or reset their UAN member passwords if forgotten but the mobile number is not changed.