Overheads: Absorption Costing Method – CA Inter Costing Study Material

Overheads: Absorption Costing Method – CA Inter Costing Study Material is designed strictly as per the latest syllabus and exam pattern.

Overheads: Absorption Costing Method – CA Inter Costing Study Material

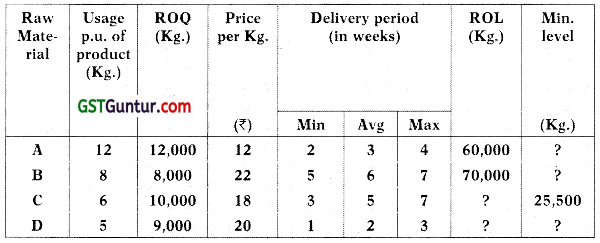

1. Meaning of certain terms:

Overheads: Overheads represent expenses that have been incurred in providing certain ancillary facilities or services which facilitate or make possible the carrying out of the production process; by themselves these services are not of, any use.

- Cost allocation: It refers to assignment or allotment of an entire item of cost to a particular cost center or cost unit.

- Cost apportionment: It implies the allotment of proportions of items of cost to cost centres or departments.

- Re-apportionment: It is the process of assigning sendee department overheads to production departments.

- Absorption: It is the process of recovering overheads of a department or any other cost center from its output.

![]()

2. Methods of Re-apportionment:

- Direct Re-distribution Method: Costs are apportioned over the produc¬tion departments only, ignoring the services rendered by one service department to the other.

- Step Method or Non-reciprocal Method: It considers service rendered by one service department to another and the sequence of apportionment begins with the department that renders maximum number of services to the other service department(s).

- Reciprocal Service Method: The inter-departmental services are to be given due weight.

Methods for dealing with reciprocal services:

- Simultaneous equation method.

- Trial and error method.

- Repeated distribution method.

3. Types of overheads rate:

Normal Rate: It is also known as actual rate.

= \(\frac{\text { Actual overheads }}{\text { Actual base }}\)

Pre-determined Overhead Rate: It is determined in advance by estimating overhead for the period in which it is to be used.

= \(\frac{\text { Budgeted overheads }}{\text { Budgeted base }}\)

Departmental Overhead Rate: It refers to the computation of one j single overhead rate for a particular production unit or department.

= \(\frac{\text { Overheads of department or cost centre }}{\text { Corresponding base }}\)

Blanket Overhead Rate: It refers to the computation of one single overhead rate for the whole factory. It is different from departmental overhead rate where separate rate is used for each individual cost centre or department.

= \frac{\text { Total factory overheads }}{\text { Total No. of units of base for the factory }}

4. Capacity Related Concept:

- Installed /Rated capacity: Maximum capacity of producing goods or providing services. Also known as theoretical capacity.

- Practical capacity: Actually utilised capacity of a plant. Also known as operating capacity or net capacity or available capacity. It considers loss of time due to repairs, maintenance, minor breakdown, idle time etc.

- Normal capacity: Volume of production or services achieved or achievable on an average over a period under normal circumstances considering reduction in capacity resulting from planned maintenance.

- Actual capacity: Capacity actually achieved during a given period.

- Idle capacity: Part of capacity of a plant, machine or equipment which cannot be effectively utilised in production.

Theory Questions

Question 1.

Distinguish between Fixed overheads and Variable overheads. [CA Inter May 2010, 2 Marks]

Answer:

Fixed Overheads Vs. Variable Overheads

Fixed overheads are the costs which are incurred for a period, and which, within certain output and turnover limits, tend to be unaffected by fluctuations in the levels of activity (output or turnover). They do not tend to increase or decrease with the changes in output. Eg. Salary paid to permanent employees, Depreciation of building, Interest on capital, Insurance, etc.

Whereas, variable overheads are the costs that tend to vary with the volume of activity. Any increase or decrease in the activity results in an increase or decrease in the variable cost. Eg. materials, power and fuel, lubricants, etc.

Question 2.

Distinguish between allocation and apportionment of cost. [CA Inter May 2008, May 2014, 4 Marks]

Answer:

Cost Allocation:

The term ‘allocation’ refers to the direct assignment of cost to a cost object which can be traced directly. It implies relating overheads directly to the various departments. The estimated amount of various items of manufacturing overheads should be allocated to various cost centres or departments. For example – if a separate power meter has been installed for a department, the entire power cost ascertained from the meter is allocated to that department.

Cost Apportionment:

There are some items of estimated overheads (like the salary of the works manager) which cannot be directly allocated to the various departments and cost centres. Such unallocable expenses are to be spread over the various departments or cost centres on an appropriate basis. This is called apportionment. Thus, apportionment implies “the allotment of proportions of items of cost to cost centres or departments”.

![]()

Question 3.

State the bases of apportionment of following overhead costs: [CA Inter Nov. 2018, 5 Marks]

(i) Air-conditioning

(ii) Time keeping

(iii) Depreciation of plant and machinery

(iv) Power/steam consumption

(v) Electric power (Machine operation)

Answer:

Basis for apportionment of overhead costs:

| Overhead costs | Basis for Apportionment |

| (i) Air-conditioning | Floor area or volume of department |

| (ii) Time-keeping | Number of workers |

| (iii) Depreciation of plant and machinery | Capital \aloes |

| (iv) Power/steam consumption | Technical estimates |

| (v) Electric power (machine operation) | Horse power of machines, number of machine hour, value of machines or units consumed. |

Question 4.

What are the methods of re-apportionment of service department ex-penses over the production departments? Discuss. [CA Inter Nov. 2010, 4 Marks]

Answer:

The re-apportionment of service department expenses over the production departments may be carried out by using any one of the following methods:

(i) Direct Re-distribution Method: Service department costs under this method are apportioned over the production departments only, ignoring the services rendered by one service department to the other. The basis of apportionment could be No. of workers, H.P of machines, etc.

(ii) Step Method or Non-reciprocal method: This method gives cognizance to the services rendered by service department to another service de-partment. Therefore, as compared to previous method, this method is more complicated because a sequence of apportionments has to be se-lected here. The sequence here begins with the department that renders maximum number of services to the other service departments.

(iii) Reciprocal Service Method: This method recognises the fact that where there are two or more service departments they may render services to each other and, therefore, these inter-departmental services are to be given due weight while re-distributing the expenses of the service departments.

The methods available for dealing with reciprocal services are:

- Simultaneous equation method;

- Trial and error method;

- Repeated distribution method.

Question 5.

Discuss the step method and reciprocal service method of secondary distribution of overheads. [CA Inter Nov. 2004, 4 Marks]

Answer:

Step Method:

Step method gives cognizance to the services rendered by service department to another service department. The cost of the service department that serves the largest number of services to the other service department(s) and production department(s) is distributed first. After this, the cost of service department serving the next largest number of departments is apportioned. This process continues till the cost of last service department is apportioned. The cost of last service department is apportioned among production departments only.

Reciprocal Service Method:

Reciprocal service method recognises the fact that where there are two or more service departments that may render services to each other and, therefore, these inter-departmental services are to be given due weight while re-distributing the expenses of the service departments.

The methods available for dealing with reciprocal services are:

(a) Simultaneous equation method: Firstly, the costs of service departments are ascertained and thereafter re-distributed to production departments on the basis of given percentages.

(b) Trial and Error Method: The cost of one service cost centre is apportioned to another service cost centre. The cost of another service centre plus the share received from the first cost centre is again apportioned to the first cost centre. This process is repeated till the amount to be apportioned becomes negligible, that means repeated distribution method is followed to the extent of service departments only.

(c) Repeated Distribution Method: Service departments’ costs are distributed to other service and production departments on agreed percentages and this process continues to be repeated, till the figures of service departments are either exhausted or reduced to too small a figure.

![]()

Question 6.

Explain Blanket Overhead Rate. [CA Inter Nov. 2007, 2 Marks]

Answer:

Blanket overhead rate refers to the computation of one single overhead rate for the whole factory. The use of blanket rate may be proper in factories producing only one major product in a continuous process or where the work performed in every department is fairly uniform or standardised.

Blanket Rate = \(\frac{\text { Total overheads for the factory }}{\text { Total No. of units of base for the factory }}\)

Question 7.

Explain Blanket Overhead Rate and Departmental Overhead Rate. How they are calculated? State the conditions required for the application of Blanket Overhead Rate. [CA Inter Jan. 2021, 5 Marks]

Answer:

Blanket Overhead Rate: Blanket overhead rate refers to the computation of one single overhead rate for the whole factory.

This overhead rate is computed as follows:

Blanket Rate = \(\frac{\text { Total overheads for the factory }}{\text { Total No. of units of base for the factory }}\)

Departmental Overhead Rate: It refers to the computation of one single overhead rate for a particular production unit or department.

This overhead rate is determined by the following formula:

Departmental overhead Rate = \(\frac{\text { Overheads of department or cost centre }}{\text { Corresponding base }}\)

Conditions required for the Application of Blanket Overhead:

A blanket rate should be applied in the following cases:

(1) Where only one major product is being produced.

(2) Where several products are produced, but

(a) All products pass through all departments; and

(b) All products are processed for the same length of time in each department.

Question 8.

Discuss the treatment of Under-absorbed and Over-absorbed overheads in Cost Accounting. [CA Inter May 2006, 6 Marks]

Answer:

Overhead expenses are usually applied to production on the basis of pre-determined rates.

Pre-determined overhead rate = \(\frac{\text { Estimated/normal overheads for the period }}{\text { Budgeted number of units during the period }}\)

The under/over absorption may take place due to variation in actual overhead rate due to any of the following:

(i) The actual level of production may be different from budgeted level during the period.

(ii) The actual overheads incurred during the period may be different from the budgeted overheads.

(iii) Both the overheads and level of activity may be different from budgeted levels during the period.

If the amount of under/over absorption is insignificant/small, it may be transferred to Costing Profit and Loss Account.

- Where the difference is large due to wrong estimation, it would be desirable to adjust the cost of products manufactured as otherwise the cost figures would convey a misleading impression.

- However, over or under recovery of overheads due to abnormal reasons, such as abnormal over or under capacity utilisation should be transferred to Costing Profit and Loss Account.

Question 9.

Explain briefly the conditions when supplementary rates are used. [CA Inter May 2007, 2 Marks]

Answer:

When the amount of under absorbed and over absorbed overhead is signifi-cant or large, because of differences due to wrong estimation, then the cost of product needs to be adjusted by using supplementary rates (under and over absorption/actual overhead) to avoid misleading impression.

Question 10.

Discuss the accounting of Selling and Distribution overheads. [CA Inter May 2006, 4 Marks]

Answer:

Accounting of Selling and Distribution Overheads:

It is difficult to determine an entirely satisfactory basis for computing the overhead rate for absorbing selling and distribution overheads.

The basis usually adopted is:

- Sales value of goods

- Cost of goods sold

- Gross profit on sales

- Number of orders or units sold

| Expenses | Basis for allocation |

| Salaries in Sales Department. | Estimated time devoted to the sale of various products. |

| Advertisements | Actual amount incurred for each product |

| Showroom expenses | Average space occupied by each product |

| Rent of finished goods, godowns and expenses on own delivery vans. | Average quantities delivered during a period |

![]()

Question 11.

Explain the following concepts related to capacity.

(i) Installed/Rated capacity

(ii) Practical capacity

(iii) Normal capacity

(iv) Actual capacity

(v) Idle capacity [ICM Module]

Answer:

(i) Installed /Rated capacity: It is the maximum capacity of producing goods or providing services which is determined either on the basis of technical specification or through technical evaluation.

(ii) Practical capacity: It is defined as actually utilised capacity of a plant. It is also known as operating capacity. It takes into account loss of time due to repairs, maintenance, minor breakdown, idle time, set up time, normal delays, Sundays and holidays, stock taking etc.

(iii) Normal capacity: Normal capacity is the volume of production or services achieved or achievable on an average over a period under normal circumstances taking into account the reduction in capacity resulting from planned maintenance.

(iv) Actual capacity: It is the capacity actually achieved during a given period. It is presented as a percentage of installed capacity.

(v) Idle capacity: It is that part of the capacity of a plant, machine or equipment which cannot be effectively utilised in production.

(a) Normal Idle Capacity: It is the difference between Installed capacity and Normal capacity.

(b) Abnormal Idle Capacity: It is the difference between Normal capacity and Actual capacity utilization where the actual capacity is lower than the normal capacity.

The idle capacity may arise due to lack of product demand, non-availability of raw material, shortage of skilled labour, absenteeism, shortage of power fuel or supplies, seasonal nature of product etc.

Question 12.

How do you deal with the following in cost accounts?

(i) Packing Expenses

(ii) Fringe benefits. [CA Inter May 2011, 4 Marks]

Answer:

(i) Packing expenses: Cost of primary packing necessary for protecting the product or for convenient handling, should become a part of the production cost. The cost of packing to facilitate the transportation of the product from the factory to the customer should become a part of the distribution cost. If the cost of special packing is at the request of the customer, the same should be charged to the specific work order or the job. The cost of fancy packing necessary to attract customers is an advertising expenditure which shall be treated as a selling overhead.

(ii) Fringe benefits: These are the additional payments or facilities provided to the workers apart from their salary and direct cost-allowances like house rent and city compensatory allowances. If the amount of fringe benefit is considerably large, it may be recovered as direct charge by means of a supplementary wage or labour rate; otherwise these may be collected as part of production overheads.

Question 13.

Explain:

(i) Research and Development Expenses

(ii) Training Expenses. [CA Inter Nov. 2000, 4 Marks]

Answer:

(i) Research and Development Expenses: Research expenses are the expenses of searching for new or improved products, new application of materials, or new or improved methods. Development expenses are the expenses of the process which begins with the implementation of the decision to produce a new or improved product.

If research is conducted in the methods of production, the research expenses should be charged to the production overhead. If the research relates to administration, the expenditure becomes a part of the administration overhead and similarly, market research expenses are charged to the selling and distribution overhead.

Development costs incurred in connection with a particular product should be charged directly to that product. General research expenses of a routine nature incurred on new or improved methods of manufacture or the improvement of the existing products should be charged to the general overhead.

(ii) Training Expenses: Training is an essential input for industrial workers. Training expenses includes wages of workers, costs incurred in running training department, loss arising from the initial lower production, extra spoilage etc. Training expenses of factory workers are treated as part of the cost of production. The training expenses of office; sales or distribution workers should be treated as office; sales or distribution overhead as the case may be. These expenses can be spread over various departments of the concern on the basis of the number of workers on roll.

![]()

Question 14.

Explain the cost accounting treatment of unsuccessful Research and Development cost. [CA Inter Nov. 2007, 2 Marks]

Answer:

Cost of unsuccessful research and development should be excluded from costs and charged to the costing Profit and Loss Account.

Question 15.

How you deal with the following in cost accounts?

1. Interest and financing charges

2. Expenses on removal and re-erection of machines

3. Canteen expenses

4. Carriage and cartage expenses .

5. Expenses for welfare activities

6. Night shift allowance [JCAJ Module]

Answer:

1. Interest and financing charges: It includes any payment in nature of interest for use of non-equity funds and incidental cost that an entity incurs in arranging those funds. Examples are interest on borrowings, financing charges in respect of finance leases, cash discount allowed to customers.

2. Expenses on removal and re-erection of machines: Such expenses may be incurred due to factors like change in the method of production; an addition or alteration in the factory building, change in the flow of production, etc. All such expenses are treated as production overheads.

3. Canteen expenses: It will be treated as production overhead. If the canteen is meant only for factory workers, it will be apportioned on the basis of the number of workers. If office workers also take advantage of canteen facility, a suitable share should be treated as office overhead.

4. Carriage and cartage expenses: It includes the expenses incurred on the movement (inward and outwards) and transportation of materials and goods. Transportation expenses related to direct material may be included in the cost of direct material and those relating to indirect material (stores) may be treated as factory overheads. Expenses related to the transportation of finished goods may be treated as distribution overhead.

5. Expenses for welfare activities: All expenses incurred on the welfare activities of employees in a company are part of general overheads. Such expenses should be apportioned between factory, office, selling and distribution overheads on the basis of number of persons involved.

6. Night shift allowance: Workers in the factories, which operate during night time are paid some extra amount known as ‘night shift allowance’.

- Incurred due to the general pressure of work beyond normal capacity level: Treated as production overhead and recovered as such.

- Incurred to meet some specific customer order: Charged directly to the order concerned.

- Night shifts are run due to abnormal circumstances: Charged to the costing profit and loss account.

Question 16.

Distinguish between Cost Allocation and Cost Absorption. [CA Inter May 2013, 4 Marks]

Answer:

Cost Allocation refers to the direct assignment of cost to a cost object which can be traced directly. It implies relating overheads directly to the various departments. Example, if a separate power meter has been installed for a department, the entire power cost ascertained from the meter is allocated to that department.

Cost Absorption is the process of recovering overheads of a department or any other cost center from its output. The overhead expenses can be absorbed by estimating the overhead and then working out an absorption rate.

![]()

Question 17.

Explain the treatment of over and under absorption of overheads in cost accounts. [CA In ter May 2010, Nov. 2010, Nov. 2014,

Answer:

Treatment of over and under absorption of overheads are:

(i) Writing off to costing P&L A/c: Small difference between the actual and absorbed amount should simply be transferred to costing P&L A/c, if difference is large then investigate the causes and after that abnormal loss/gain shall be transferred to costing P&L A/c.

(ii) Use of supplementary Rate: Under this method the balance of under and over absorbed overheads may be charged to cost of W.I.P., finished stock and cost of sales proportionately with the help of supplementary rate of overhead.

(iii) Carry Forward to Subsequent Year: Difference should be carried for-ward in the expectation that next year the position will be automatically corrected.

Question 18.

How would you account for idle capacity cost in Cost Accounting? [CA Inter Nov., 2015, Nov. 2001, 4 Marks]

Answer:

Idle capacity costs are treated in the following ways in Cost Accounts:

(i) If the idle capacity cost is due to unavoidable reasons such as repairs, maintenance, changeover of job etc. a supplementary overhead rate may be used to recover the idle capacity cost. In this case, the costs are charged to the production capacity utilised.

(ii) If the idle capacity cost is due to avoidable reasons such as faulty planning, power failure, etc. the cost should be charged to Costing Profit and Loss Account.

(iii) If the idle capacity cost is due to seasonal factors, then the cost should be charged to cost of production by inflating overhead rates.

Practical Questions

Methods Of Re-Appropriation

Question 1.

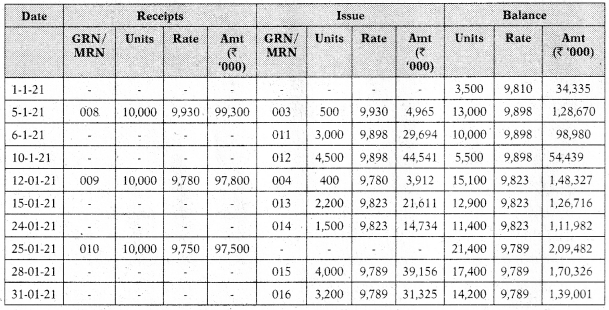

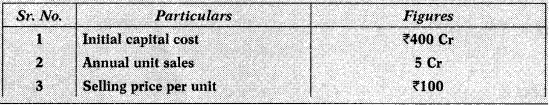

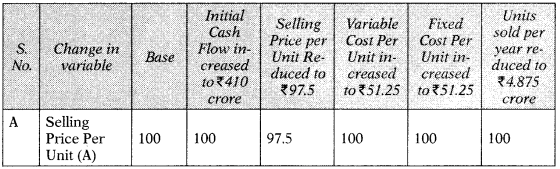

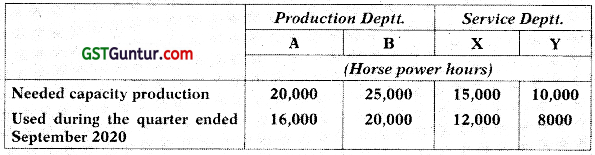

M/s. NOP Limited has its own power plant and generates its own power. Information regarding power requirements and power used are as follows:

During the quarter ended September 2020, costs for generating power amounted to ₹ 12.60 lakhs out of which ₹ 4.20 lakhs was considered as fixed cost.

Service department X renders services to departments. A, B and Y in the ratio of 6:4:2 whereas department Y renders services to department A and B in the ratio of 4:1. The direct labour hours of department A and B are 67,500 hours and 48,750 hours respectively.

Required:

(i) Prepare overheads distribution sheet.

(ii) Calculate factory overhead per labour hour for the deptt. A and deptt. B. • [CA Inter Nov, 2018, 5 MarksJ

Answer:

(i) Overhead Distribution Sheet

![]()

(ii) Calculation of the Factory Overhead per Labour hour:

| Item | Production Departments | |

| A(₹) | B(₹) | |

| Total Overhead | 6,75,000 | 5,85,000 |

| Direct labour hours | 67,500 | 48,750 |

| Factory overhead per hour | 10 | 12 |

Question 2.

RST Ltd. has two production departments Machining and Finishing.

There are three service departments Human Resource (HR), Maintenance and Design. The budgeted costs in these service departments are as follows:

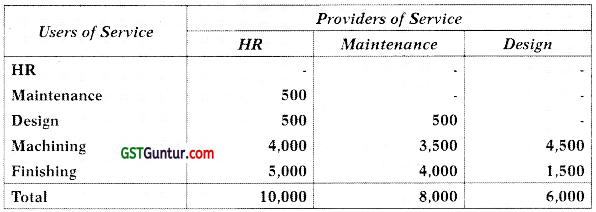

The usage of these Service Departments’ output during the year just completed is as follows:

Provision of Service Output (in hours of service)

Required:

(i) Use the direct method to re-apportion RST Ltd.’s service department cost to its production departments.

(ii) Determine the proper sequence to use in re-apportioning the firm’s service department cost by step-down method.

(iii) Use the step-down method to reapportion the firm’s service department cost. [CA Inter Nov. 2006, 7 Marks]

Answer:

(i) Re-apportion of service departments cost to its production department by using direct method:

(ii) Sequence of re-apportionment:

Since, H.R. department serves large number of departments so its cost should be first re-apportioned then overhead of maintenance department should be re-apportioned and lastly overhead of design department should be re-apportioned.

(iii) Use of step down method for re-apportioning overhead of service department:

![]()

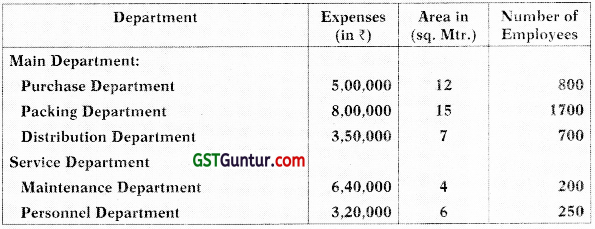

Question 3.

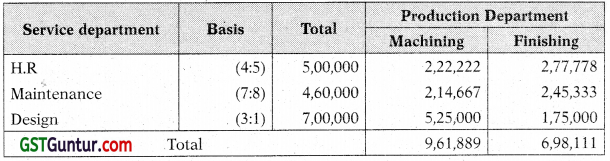

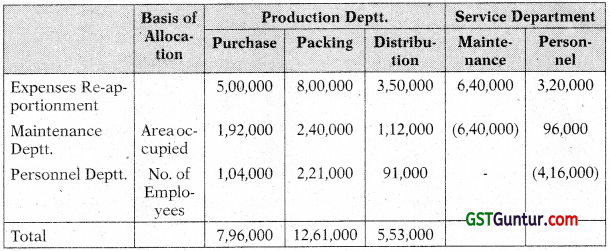

SNS Trading Company has three Main Departments and Service Departments. The date for each department below:

The Cost of Maintenance Department and Personnel Department is Distributed on the basis of ‘Area in Square Metres’ and ‘Number of Employees’ respectively.

You are required to:

(i) Prepare a Statement showing the distribution of expenses of service Departments to the Main departments using the “Step Ladder method” of Overhead Distribution.

(ii) Compute the Rate per hour of each Main Department, given that the Purchase Department, Packing Department and Distribution Department works for 12 hours a day. 24 hours a day and 8 hours a day respectively. Assume that are 365 days in years and there are no holidays. [CA Inter July 2021, 5 Marks]

Answer:

Statement showing distribution of expenses of service departments

Calculation showing rate per hour:

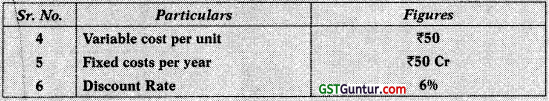

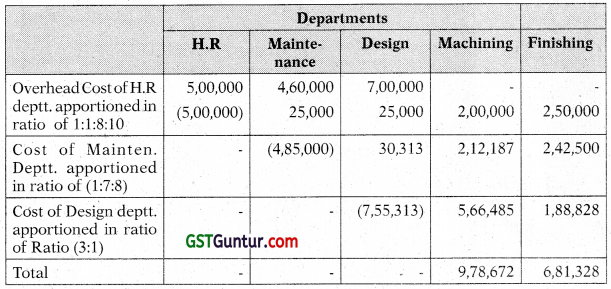

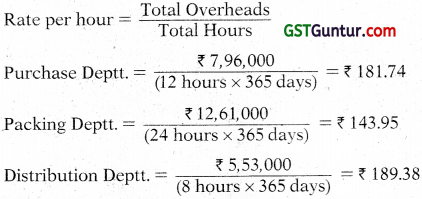

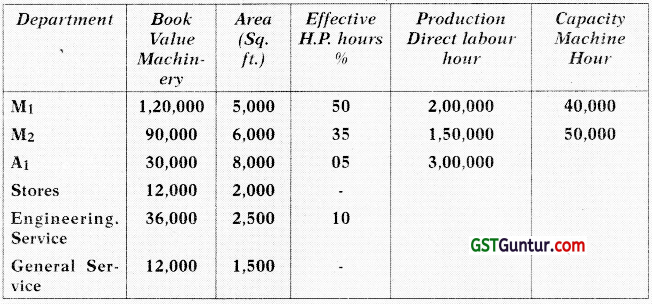

Question 4.

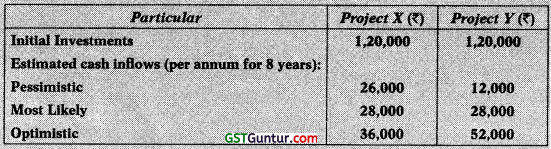

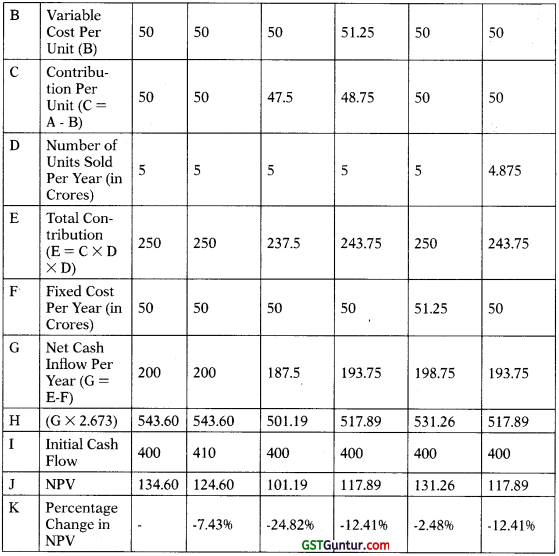

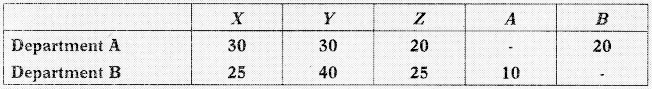

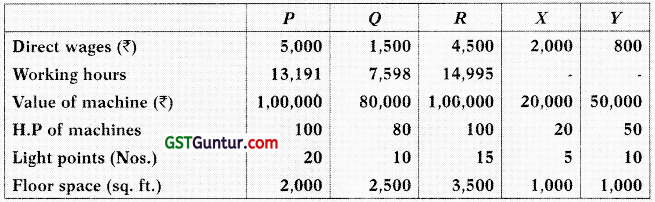

The following account balances and distribution of indirect charges are taken from the accounts of a manufacturing concern for the year ending on 31st March, 2021:

The following departmental data are also available:

Expenses charged to the service departments are to be distributed to other departments by the following percentages:

Prepare an overhead distribution statement to show the total overheads of production departments after re-apportioning service departments overhead by using simultaneous equation method. Show all the calculations to the nearest rupee. [CA Inter Nov. 2012, 8 Marks]

Answer:

Primary distribution of overhead:

Re-distribution of Overheads of Service Department A and B:

Total overheads of service departments may be distributed using simultaneous equation method.

Let, the total overheads of service department A be ‘a’ and the total overheads of service department B be ‘b’.

a = 1,57,250 + 0.10 b (i)

or, 10a – b = 15,72,500 [(i) × 10]

b = 90,250 + 0.20 a (ii)

or, – 0.20a + b = 90,250

10a – b = 15,72,500

-0.2a + b = 90,250

9.8a = 16,62,750

a = 1,69,668

Putting the value of a in equation (ii),we get

b = 90,250 + 0.20 × 1,69,668

b = 1,24,184

Secondary Distribution of Overheads:

![]()

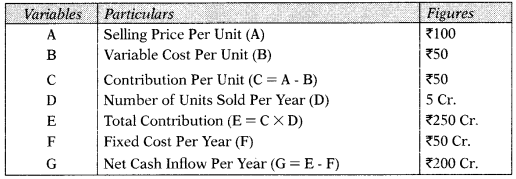

Question 5.

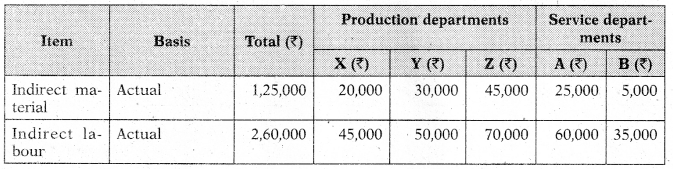

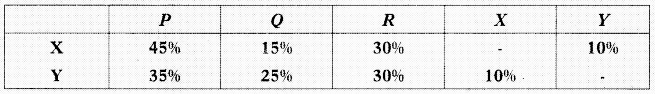

TEE Ltd. is a manufacturing company having three production departments ‘P’, ‘0’ and ‘R’ and two service departments ‘X’ and ‘Y’ detail pertaining to which are as under:

The expenses are as follows:

| ₹ | |

| Rent and rates | 10,000 |

| General lighting | 600 |

| Indirect wages | 3,450 |

| Power | 3,500 |

| Depreciation on machines | 70,000 |

| Sundries (apportionment on the basis of direct wages) | 13,800 |

The expenses of service departments are allocated as under:

Product ‘A’ is processed for manufacture in Departments P, 0 and R for 6, 5 and 2 hours respectively.

Direct Costs of Product A are:

Direct material cost is 65 per unit and Direct labour cost is ₹ 40 per unit.

You are required to:

(i) Prepare a statement showing distribution of overheads production and service departments.

(it) Calculate recovery rate per hour of each production department after redistributing the service department costs.

(iii) Find out the Total Cost of a ‘Product A’. [CA Inter Nov. 2020, 10 Marks]

Answer:

(i) Statement showing distribution of Overheads Primary Distribution Summary

Secondary Distribution using simultaneous equation method:

Overheads of service cost centres

Let, X be the overhead of service cost centre X

Y be the overhead of service cost centre Y

X = 9,750 + 0.10 Y

Y = 13,400 + 0.10 X

Substituting the value of Y in X we get

X = 9,750 + 0.10 (13,400 + 0.10 X)

X-9,750+ 1,340 + 0.01 X

0. 99 X = 11,090

X = ₹ 11,202

Y = 13,400 + 0.10 × 11,202

= ₹ 14,520

Secondary Distribution Summary

![]()

(ii) Calculation of Overhead recovery rate per hour

| P(₹) | Q(₹) | R (₹) | |

| Total overheads cost , | 39,573 | 26,585 | 37,992 |

| Working hours | 13,191 | 7,598 | 14,995 |

| Rate per hour (₹) | 3 | 3.50 | 2.53 |

(iii) Cost of Product A

| ₹ | |

| Direct material | 65.00 |

| Direct labour | 40.00 |

| Prime cost | 105.00 |

| Production overheads :

P 6 hours × ₹ 3.00 = ₹ 18.00 Q 5 hours × ₹ 3.50 = ₹ 17.50 R 2 hours × ₹ 2.53 = ₹ 5.06 |

|

| 40.56 | |

| Total cost | 145.56 |

Question 6.

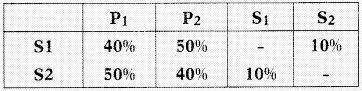

Delta Ltd. is a manufacturing concern having two production departments – P1 and P2 and two service departments S1 and S2. After making a primary distribution of factory overheads, the total overheads of all departments are as under:

| Department | ₹ |

| P1 | 4,02,000 |

| P2 | 2,93,000 |

| S1 | 3,52,000 |

| S2 | 33,000 |

Overheads of service departments are reapportioned as below:

A product ‘Z’ passes through all the two production departments – P1 and P2 and each unit of product remain there in process for 2 and 3 hours respectively. The material and labour cost of one unit of product ‘Z’ is ₹ 500 and ₹ 350 respectively.

The company run for all the 365 days of the year and 16 hours per day.

You are required:

(i) To make secondary distribution of overheads of service departments by applying Simultaneous Equation method and

(ii) Determine the total cost of one unit of product Z. [CA Inter May 2018, 8 Marks]

Answer:

(i) Secondary distribution using Simultaneous Equation method:

Overheads of service cost centres

Let S1 be the overhead of service cost centre S1 and

S2 be the overhead of service cost centre S2.

S1 = 3,52,000 + 0.10 S2

S2 = 33,000 + 0.10 S1

Substituting the value of S2 in S1 we get

S1 = 3,52,000 + 0.10 (33,000 + 0.10 S1)

S1 = 3,52,000 + 3,300 + 0.01 S1

0.99 S1 = 3,55,300

S1 = ₹ 3,58,889

S2 = 33,000 + 0.10 × 3,58,889 = ₹ 68,889

Secondary Distribution Summary

![]()

(ii) Working for Overhead rate per hour

| P1 | P2 | |

| Total overheads cost (₹) Production hours worked Rate per hour (₹) |

5,80,001

5,840 99.32 |

5,00,001

5,840 85.62 |

Calculation of per unit Total Cost of Product Z

| (₹) | |

| Direct material | 500.00 |

| Direct labour | 350.00 |

| Prime cost | 850.00 |

| Production on overheads | |

| P1 2 hours × ₹ 99.32 = 198.64 | |

| P2 3 hours × ₹ 85.62 = 256.86 . | 455.50 |

| Total cost | 1,305.50 |

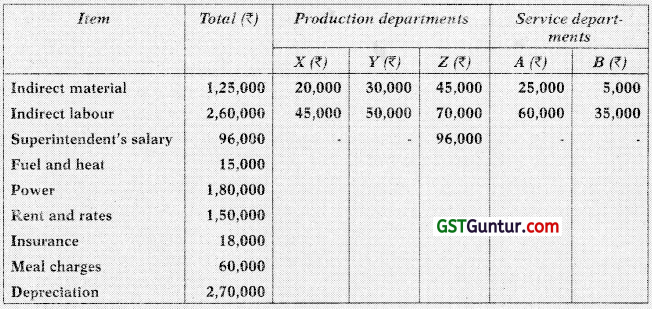

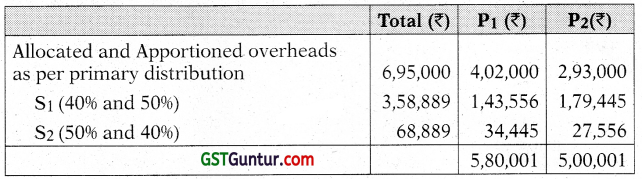

Question 7.

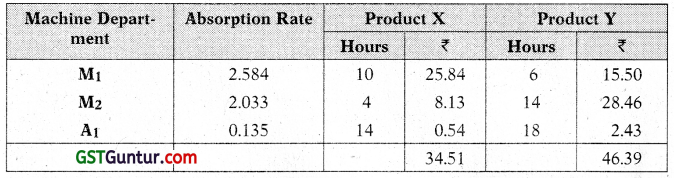

A company has three production departments (M1, M2, and A1,) and three service department, one of which Engineering service department, servicing the M1 and M2, only. The relevant information are as follows:

| Product X | Product Y | |

| M1 | 10 Machine hours | 6 Machine hours |

| M2 | 14 Machine hours | 14 Machine hours |

| A1 | 14 Direct Labour hours | 18 Direct Labour hours |

The annual budgeted overhead cost for the year is:

| Indirect Wages (₹) | Consumable Supplies (₹) | |

| M1 | 46,520 | 12,600 |

| M2 | 41,340 | 18,200 |

| A1 | 16,220 | 4,200 |

| Stores | 18,200 | 2,800 |

| Engineering Service | 5,340 | 4,200 |

| Genera! Service | 7,520 | 3,200 |

| ₹ | |

| Depreciation on Machinery | 39,600 |

| Insurance of Machinery | 7,200 |

| Insurance of Building | 3,240 (Total building insurance cost for Mi, is one third of annual premium) |

| Power | 6,480 |

| Light | 5,400 |

| Rent | 12,675 (The general service deptt is located in a building owned by the company. It is valued at ₹ 6,000 and is charged into cost at notional value of 8% per annum. This cost is additional to the rent shown above) |

The value of issues of materials to the production departments are in the same proportion as shown above for the Consumable supplies.

The following data are also available:

Required:

(i) Prepare a overhead analysis sheet, showing the bases of apportionment of overhead to departments.

(ii) Allocate service department overheads to production department ignoring the apportionment of service department costs among service departments.

(iii) Calculate suitable overhead absorption rate for the production departments.

(iv) Calculate the overheads to be absorbed by two products X & Y. [CA Inter May 2007, 15 Marks]

Answer:

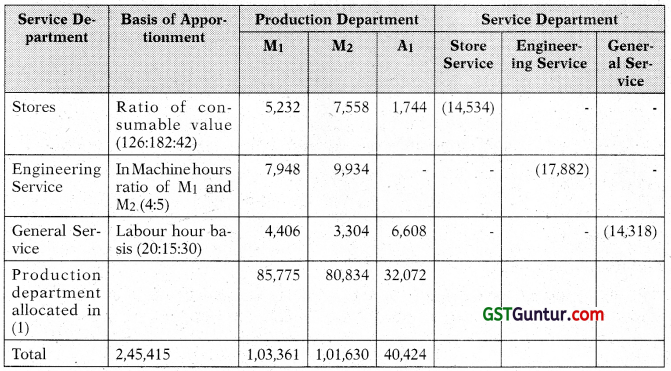

(i) Summary of Appointment of Overheads

(ii) Allocation of service departments overheads

(iii) Overhead absorption rate

| M1 | M2 | A1 | |

| Total overhead allocated | 1,03,361 | 1,01,630 | 40,424 |

| Machine hours | 40,000 | 50,000 | – |

| Labour hours | – | – | 3,00,000 |

| Rate per machine hours | 2.584 | 2.033 | – |

| Rate per direct labour | – | – | 0.135 |

(iv) Statement showing overhead absorption for Products X and Y

![]()

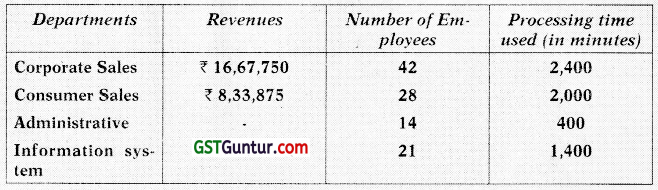

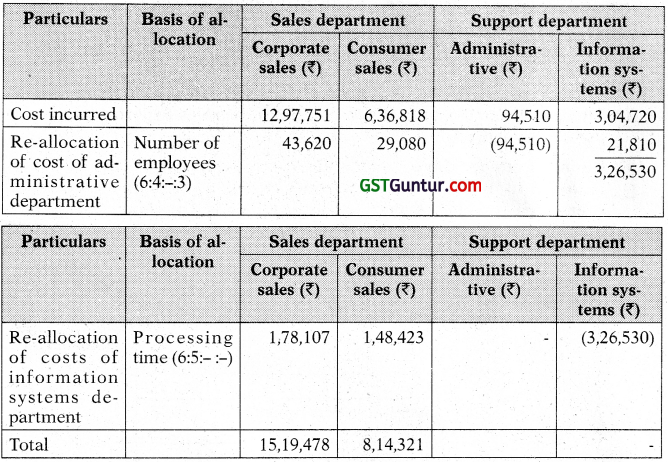

Question 8.

E-books is an online book retailer. The Company has four departments. The two sales departments are Corporate Sales and Consumer Sales. The two support – departments are Administrative (Human Resources Accounting) and Information Systems each of the sales departments conducts merchandising and marketing operations independently.

The following data are available for October, 2020:

Cost incurred in each of four departments for October, 2020 are as follow:

| Corporate Sales | ₹ 12,97,751 |

| Consumer Sales | ₹ 6,36,818 |

| Administrative | ₹ 94,510 |

| Information systems | ₹ 3,04,720 |

The company uses number of employees as a basis to allocate Administrative costs and processing time as a basis to allocate Information systems costs.

Required:

(i) Allocate the support department costs to the sales departments using the direct method.

(ii) Rank the support departments based on percentage of their services rendered to other support departments. Use this ranking to allocate support costs based on the step-down allocation method.

(iii) How could you have ranked the support departments differently?

(iv) Allocate the support department costs to two sales departments using the reciprocal allocation method. [CA Inter Nov. 2003, 10 Marks]

Answer:

(i) Statement showing the allocation of support department costs to the sales departments (using the Direct Method)

(ii) Ranking of support departments based on percentage of their services rendered to other support departments

Administration support department provides 23.077% (21 × 100/42 + 28 + 21) of its services to information systems support department Thus 23.077% of ₹ 94,510 = ₹ 21,810.

Information system support department provides 8.33% (400/2,400 + 2,000 + 400 × 100) of its services to Administration support department. Thus 8.33% of ₹ 3,04,720 = ₹ 25,383.

(iii) An alternative ranking is based on the rupee amount of services rendered to other service departments, using the rupee figures obtained under requirement (ii). This approach would use the following sequence of ranking.

- Allocation of information systems overheads as first (₹ 25,383 provided to administrative).

- Allocated administrative overheads as second (₹ 21,810 provided to information systems).

![]()

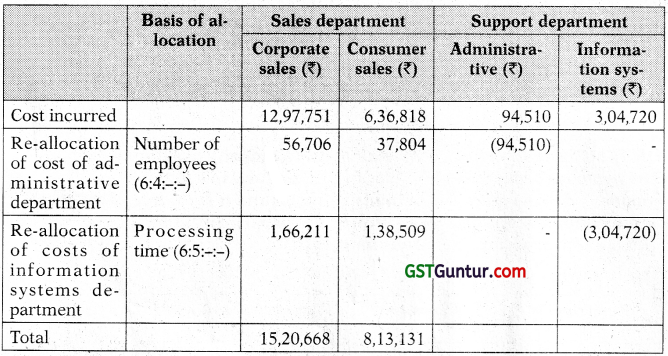

(iv) Working notes:

1. Percentage of services provided by each service department to other service department and sales departments.

2. Total cost of the support department: (By using simultaneous equation method).

Let AD and IS be the total costs of support departments Administrative and Information systems respectively. These costs can be determined by using the following simultaneous equations:

AD = 94,510 + 0.0833

IS = 3,04,720 + 0.2308

Or, AD = 94,510 + 0.0833 {3,04,720 + 0.2308 AD}

Or, AD = 94,510 + 25,383 + 0.01922 AD

Or, 0.90877 AD = 1,19,893

Or, AD = ₹ 1,22,243

and IS = ₹ 3,32,934

Statement showing the allocation of support department costs to sales departments

(Using reciprocal allocation method)

| Sales department | ||

| Corporate Sales (₹) | Consumer sales (₹) | |

| Costs incurred | 12,97,751 | 6,36,818 |

| Re-allocation of cost administrative department (46.16% and 30.77% of ₹ 1,22,243) | 56,427 | 37,614 |

| Re-allocation of costs of information systems department (50% and 41.67% of ?3,32,934) | 1,66,467 | 1,38,734 |

| Total | 15,20,645 | 8,13,166 |

Comprehensive Machine Hour Rate

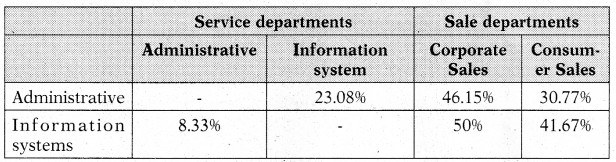

Question 9.

A machine costing ₹ 10 lakhs was purchased on 1.4.2021. The expected life of the machine is 10 years. At the end of this period its scrap value is likely to be ₹ 10,000. The total cost of all the machines including new one was ₹ 90 lakhs.

The other information is given as follows:

(i) Working hours of the machine for the year was 4,200 including 200 non-productive hours.

(ii) Repairs and maintenance for the new machine during the year was ₹ 5,000.

(iii) Insurance Premium was paid for all the machine ₹ 9,000.

(iv) New machine consumes 8 units of electricity per hour, the rate per unit being ₹ 3.75.

(v) The new machine occupies \(\frac{1}{10}\)th area of the department. Rent of the department is ₹ 2,400 per month.

(vi) Depreciation is charged on straight line basis.

Compute machine hour rate for the new machine. [CA Inter May 2012, 5 Marks]

Answer:

Computation of Machine Hour Rate of New Machine

Working Note:

Computation of productive Machine hour rate

![]()

Question 10.

M/s. Zaina Private Limited has purchased a machine costing ₹ 29,14,800 and it is expected to have a salvage value of ₹ 1,50,000 at the end of its effective life of 15 years. Ordinarily the machine is expected to run for 4,500 hours per annum but it is estimated that 300 hours per annum will be lost for normal repair & maintenance. The other details in respect of the machine are as follows:

(i) Repair & Maintenance during the whole fife of the machine are expected to be ₹ 5,40,000.

(ii) Insurance premium (per annum) 2% of the cost of the machine.

(iii) Oil and Lubricants required for operating the machine (per annum) ? 87,384.

(iv) Power consumptions: 10 units per hour @ ₹ 7 per unit. No power consumption during repair and maintenance.

(v) Salary to operator per month ₹ 24,000. The operator devotes one third of his time to the machine.

You are required to calculate comprehensive machine hour rate. [CA Inter May 2019, 5 Marks]

Answer:

Effective Machine hours = 4,500 hours – 300 hours = 4,200 hours.

Calculation of Comprehensive Machine hour rate:

| Standing Charges | |

| (i) Insurance Premium (₹ 29,14,800 × 2%) | ₹ 58,296 |

| (ii) Salary to operator (₹ 24,000 × 12 × 1/3) | ₹ 96,000 |

| Machine Expenses: | |

| (i) Repairs & Maintenance (₹ 5,40,000 ÷ 15 years) | ₹ 36,000 |

| (ii) Depreciation \( \left(\frac{₹ 29,14,800-₹ 1,50,000}{15 \text { years }}\right) \) | ₹ 1,84,320 |

| (iii) Oil and Lubricants | ₹ 87,384 |

| (iv) Power (4,200 hrs × 10 units × ₹ 7) | ₹ 2,94,000 |

| Total Cost | ₹ 7,56,000 |

| Effective Machine Hours | 4,200 hours |

| Machine hour rate | ₹ 180 |

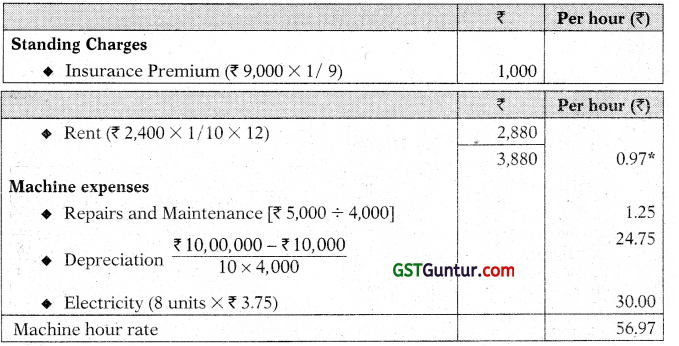

Question 11.

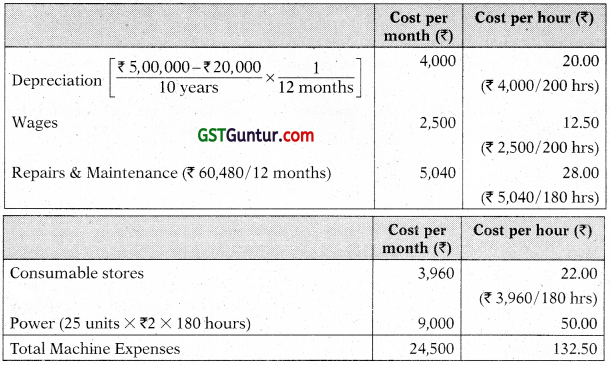

The following particulars refers to process used in the treatment of material subsequently, incorporated in a component forming part of an electrical appliance:

(i) The original cost of the machine used (Purchased in June 2012) was ₹ 10,000. Its estimated life is 10 years, the estimated scrap value at the end of its life is ₹ 1,000, and the estimated working time per year (50 weeks of 44 hours) is 2,200 hours of which machine maintenance etc., is estimated to take up 200 hours. No other loss of working time expected, setting up time, estimated at 100 hours, is regarded as productive time. (Holiday to be ignored.)

(ii) Electricity used by the machine during production is 16 units per hour at cost of a 9 paisa per unit. No current is taken during maintenance or setting up.

(iii) The machine required a chemical solution which is replaced at the end of week at a cost of ₹ 20 each time.

(iv) The estimated cost of maintenance per year is ₹ 1,200.

(v) Two attendants control the operation of machine together with five other identical machines. Their combined weekly wages, insurance and the employer’s contribution to holiday pay amount ₹ 120.

(vi) Departmental and general works overhead allocated to this machine for the current year amount to ₹ 2,000.

You are required to calculate the machine hour rate of operating the machine. [CA Inter May 2016, 5 Marks]

Answer:

Total Productive hours = Estimated Working hours – Machine Maintenance hours

= 2,200 hours – 200 hours = 2,000 hours

Computation of Machine Hour Rate:

![]()

Question 12.

A machine shop has 8 identical machines manned by 6 operators. The machine cannot work without an operator wholly engaged on it. The original cost of all the 8 machines works out to ₹ 32,00,000. The following particulars are furnished for a six months period:

| Normal available hours per month per operator | 208 |

| Absenteeism (without pay) hours per operator | 18 |

| Leave (with pay) hours per operator | 20 |

| Normal unavoidable idle time- hours per operator | 10 |

| Average rate of wages per day of 8 hours per operator | ₹ 100 |

| Production bonus estimated | 10% on wages |

| Power consumed | ₹ 40,250 |

| Supervision and Indirect Labour | ₹ 16,500 |

| Lighting and Electricity | ₹ 6,000 |

| The following particulars are given for a year: | |

| Insurance | ₹ 3,60,000 |

| Sundry work Expenses | ₹ 50,000 |

| Management Expenses allocated | ₹ 5,00,000 |

| Depreciation | 10% on the original cost |

| Repairs and Maintenance (including consumables) | 5% of the value of all the machines. |

Prepare a statement showing the comprehensive machine hour rate for the machine shop. [CA Inter Jan. 2021, 5 Marks]

Answer:

Calculation of effective working hours:

| Hours | |

| Normal available hours per month (208 × 6 months × 6 operators)

Less: Absenteeism hours (18 × 6 operators) |

7,488

(108) |

| Paid hours

Less: Leave hours (20 × 6 operators) Less: Normal idle time (10 × 6 operators) |

7,380

(120) (60) |

| Effective working hours | 7,200 |

Computation of Comprehensive Machine Hour Rate:

| ₹ | |

| Operators wages (7,380/8 × 100) | 92,250 |

| Production bonus (10% on wages) | 9,225 |

| Power consumed | 40,250 |

| Supervision and indirect labour | 16,500 |

| Lighting and Electricity | 6,000 |

| Repair and maintenance [(5% × ₹ 32,00,000)/2] | 80,000 |

| Insurance (₹ 3,60,000/2) | 1,80,000 |

| Depreciation [(₹ 32,00,000 × 10%)/2] | 1,60,000 |

| Sundry Work expenses (₹ 50,000/2) | 25,000 |

| Management expenses (₹ 5,00,000/2) | 2,50,000 |

| Total | 8,59,225 |

| Comprehensive xMachine Hour Rate = ₹ 8,59,225/7,200 hours | ₹ 119.33 |

![]()

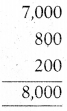

Question 13.

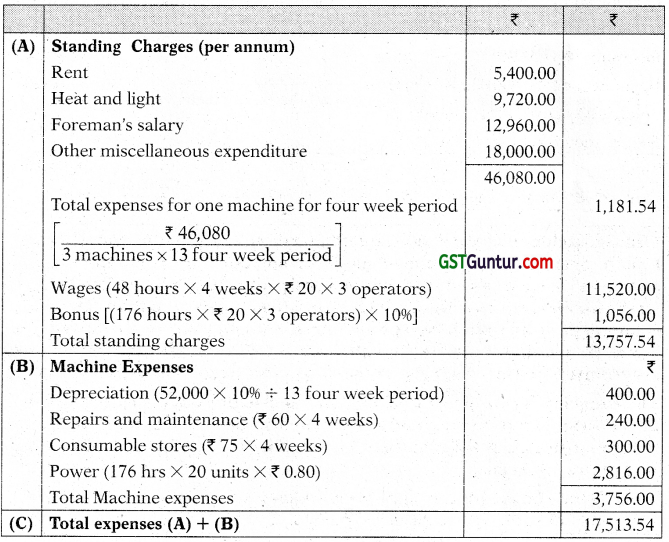

A machine shop cost centre contains three machines of equal capacities. To operate these three machines nine operators are required i.e, three operators on each machine. Operators are paid ₹ 20 per hour. The factory works for 48 hours in a week which includes 4 hours set up time. The work is jointly done by operators. The operators are paid fully for the forty eight hours. In additions they are paid a bonus of 10% of productive time. Costs are reported for this company on the basis of thirteen four-weekly period.

The company for the purpose of computing machine hour rate includes the direct wages of the operator and also recoups the factory overheads allocated to the machines. The following details of factory overheads applicable to the cost centre are available:

- Depreciation 10% per annum on original cost of the machine. Original cost of the each machine is ₹ 52,000.

- Maintenance and repairs per week per machine is ₹ 60.

- Consumable stores per week per machine are ₹ 75.

- Power: 20 units per hour per machine at the rate of ₹ 80 paise per unit.

- Apportionment to the cost centre: Rent per annum ₹ 5,400, Heat and Light per annum ₹ 9,720, foreman’s salary per annum ₹7 12,960 and other miscellaneous expenditure per annum ₹ 18,000.

Required:

(i) Calculate the cost of running one machine for a four week period.

(ii) Calculate machine hour rate. [CA Inter Nov. 2007, May 2015, 8 Marks]

Answer:

Effective Machine hour for four-week period

= Total working hours – unproductive set-up time

= {(48 hours × 4 weeks) – {(4 hours × 4 weeks)} .

= (192 – 16 hours) = 176 hours.

(i) Computation of cost of running one machine for a four week period

(ii) Machine hour rate = ₹ 17,513.54/176 hrs = ₹ 99.51

![]()

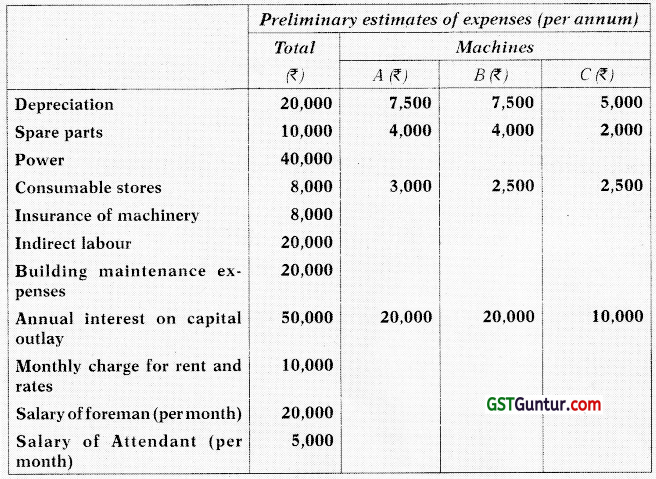

Question 14.

You are given the following information of the three machines of a manufacturing department of X Ltd.

(The foreman and the attendant control all the three machines and spend equal time on them.)

The following additional information is also available:

| Machines | |||

| A | B | c | |

| Estimated Direct Labour Hours | 1,00,000 | 1,50,000 | 1,50,000 |

| Ratio of K.W. Rating | 3 | 2 | 3 |

| Floor space (sq. ft.) | 40,000 | 40,000 | 20,000 |

There are 12 holidays besides Sundays in the year, of which two were on Saturdays. The manufacturing department works 8 hours in a day but Saturdays are half days. All machines work at 90% capacity throughout the year and 2% is reasonable for breakdown.

You are required to:

Calculate predetermined machine hour rates for the above machines after taking into consideration the following factors:

- An increase of 15% in the price of spare parts.

- An increase of 25% in the consumption of spare parts for machines B’ & ‘C’ only.

- 20% general increase in wages rates. [CA Inter May 2011, 8 Marks]

Answer:

Computation of Machine Hour Rate

Working Notes:

1. Calculation of effective working hours:

No. of holidays 52 (Sundays) + 12 (other holidays) = 64

Saturday (52 – 2) = 50

No. of days (Work full time) = 365 – 64 – 50 = 251

| Hours | |

| Full days work (251 × 8) | = 2,008 |

| Half days work (50 × 4) | = 200 |

| 2,208 | |

| Hours | |

| Effective capacity 90% of 2,208 | 1,987 (Rounded off) |

| Less: Normal loss of time (Breakdown) 2% | 40 (Rounded off) |

| Effective running hour | 1,947 |

![]()

2. Amount of spare parts:

3. Amount of Indirect labour:

| ₹ | |

| Preliminary estimates | 20,000 |

| Add: Increase in wages @ 20% | 4,000 |

| 24,000 |

4. Interest on capital outlay is a financial matter and therefore it has been excluded from the cost accounts;

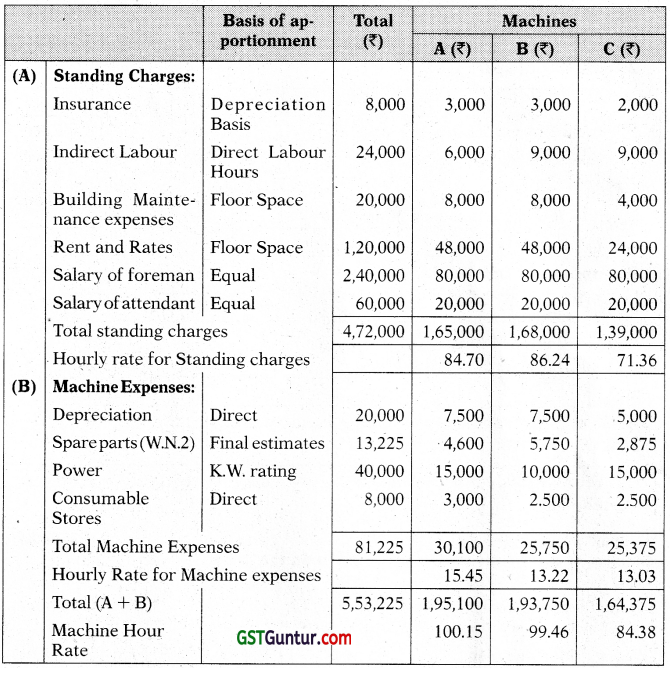

Question 15.

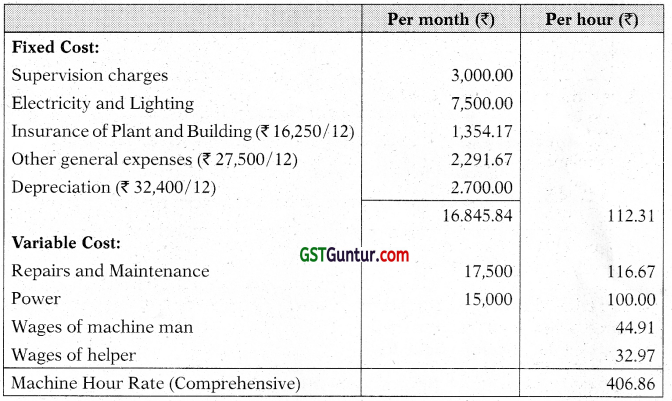

From the details furnished below you are required to compute comprehensive machine hour rate:

| Original purchase price of the machine | ₹ 3,24,000 |

| (subject to depreciation at 10% per annum on original cost) | |

| Normal working hours for the month | 200 hours |

| (The machine works to only 75% of capacity) | |

| Wages of Machine man | 125 per day (of 8 hours) |

| Wages for a Helper (Machine attendant) | 75 per day (of 8 hours) |

| Power cost for the month for the time worked | ₹ 15,000 |

| Supervision charges apportioned for the machine centre for the month | ₹ 3,000 |

| Electricity and Lighting for the month | ₹ 7,500 |

| Repairs and maintenance (machine) including consumable stores per month | ₹ 17,500 |

| Insurance of Plant and Building (apportioned) for the year | ₹ 16,250 |

| Other general expenses per annum | ₹ 27,500 |

The workers are paid a fixed dearness allowance of 1,575 per month. Production bonus payable to workers in terms of an award is equal to 33.33% of basic wages and dearness allowance. Add 10% of the basic wage and dearness allowance against leave wages and holidays with pay to arrive at a comprehensive labour wage for debit to production. [CA Inter Nov. 2005, 14 Marks]

Answer:

Effective machine working hours p.m. = 200 hrs. × 75% = 150 hours

Computation of Comprehensive Machine Hour Rate:

Wages per machine hour:

| Machine Man (₹) | Helper (₹) | |

| Wages for 200 hours: | ||

| Machine Man (₹ 125 × 25) | 3,125 | – |

| Helper (₹ 75 × 25) | – | 1,875 |

| Dearness allowance (DA) | 1,575 | 1,575 |

| 4,700 | 3,450 | |

| Production bonus (1 /3rd of Basic DA) | 1,567 | 1,150 |

| 6,267

470 |

4,600

345 |

|

| Leave Wages (10% of Basic and DA) | ||

| 6,737 | 4,945 | |

| Effective wage rate per machine hour | 44.91 | 32.97 |

![]()

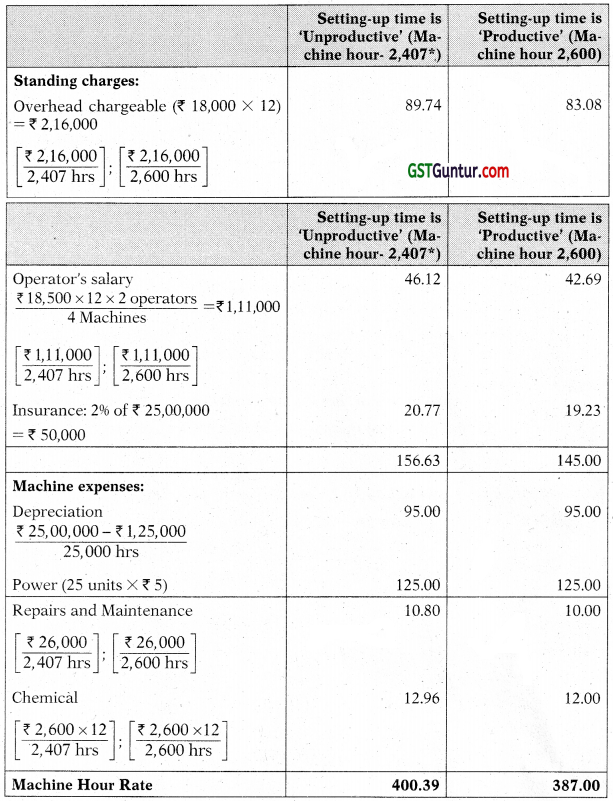

Question 16.

Calculate Machine Hour Rate from the following particulars:

| Cost of Machine | ₹ 25,00,000 |

| Salvage Value | ₹ 1,25,000 |

| Estimated life of the machine | 25,000 Hours |

| Working Hours (per annum) | 3,000 Hours |

| Hours required for maintenance | 400 Hours |

| Setting-up time required | 8% of actual working hours |

Additional Information:

(i) Power 25 units @ ₹ 5 per unit per hour.

(ii) Cost of repairs and maintenance ₹ 26,000 per annum.

(iii) Chemicals required for operating the machine ₹ 2,600 per month.

(iv) Overheads chargeable to the machine ₹ 18,000 per month.

(v) Insurance Premium (per annum) 2% of the cost of machine.

(vi) No. of operators – 02 (looking after three other machines also).

(vii) Salary per operator per month ₹ 18,500. [CA Inter Nov 2013, 8 Marks]

Answer:

Computation of Machine hour Rate

![]()

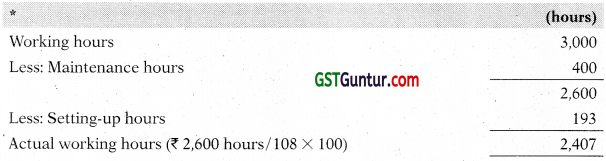

Question 17.

A manufacturing company has added a new machine to its fleet of 11 existing machines. New machine is purchased for ₹ 12,70,000 with installation cost of ₹ 40,000.

The machine has an estimated life of 10 years and is expected to realise ₹ 90,000 as scrap at the end of its useful life. Other relevant data are as follows:

(i) Budgeted annual working hours are 2,400 based on 8 hours per day for 300 days. This includes 180 hours for plant maintenance and 120 hours of productive set-up time.

(ii) Electricity used by the new machine is 12 units per hour at a cost of ₹ 6.50 per unit. No current is drawn during maintenance and setup.

(iii) Three operators control the operations of all the twelve machines and average rate of wages per operator per day is ₹ 600 and production bonus is 10% of wages.

(iv) Annual insurance premium for the new machine is ₹ 12,600.

(v) Annual maintenance cost of new machine including consumable stores is ₹ 32,500.

(vi) Rent of the factory is ₹ 24,000 per month. Area occupied by new machine 200 sq ft. and area occupied by other machines is 2800 sq ft.

Required: Compute the comprehensive machine hour rate. [CA Inter May 2019, 5 Marks]

Answer:

Computation of Comprehensive Machine hour Rate

Working Notes:

1. Effective machine hour:

= Budgeted working hours – maintenance time

= (2,400 – 180) hours = 2,220 hours.

2. Electricity consumption hours:

= Budgeted working hours – Maintenance time – Set-up time

= (2,400 – 180 – 120) hours = 2,100 hours.

3. Operators’ wages per annum

Basic wages (3 operators × ₹ 600 × 300 days) = ₹ 5,40,000

Add: Production bonus (10% of ₹ 5,40,000) ₹ 54,000

4. Depreciation per annum

\(\frac{₹(12,70,000+40,000)-₹ 90,000}{10 \text { years }}\) = ₹ 1,22,000

5. Apportioned cost for factory rent:

\(\frac{₹ 24,000 \times 12}{3,000 \mathrm{sq} . \mathrm{ft}}\) × 200 sq.ft. = ₹ 19,200

Question 18.

In a factory, a machine is considered to work for 208 hours in a month. It includes maintenance time of 8 hours and set up time of 20 hours.

Cost of the machine is 5,00,000. Life 10 years. Estimated scrap value at the end of life is 20,000.

The expense data relating to the machine are as under:

| ₹ | |

| Repairs and maintenance per annum | 60,480 |

| Consumable stores per annum | 47,520 |

| Rent of building per annum (The machine under reference occupies 1 /6 of the area) | 72,000 |

| Supervisor’s saiary per month (Common to three machines) | 6,000 |

| Wages of operator per month per machine | 2,500 |

| General lighting charges per month allocated to the machine | 1,000 |

| Power 25 units per hour at 2 per unit. |

Power is required for productive purposes only. Set up time, though productive, does not require power. The Supervisor and Operator are permanent. Repairs and maintenance and consumable stores vary with the running of the Machine.

Required: Calculate a two-tier machine hour rate for (a) set up time and (b) running time. [CA Inter May 2002, 8 Marks]

Answer:

Computation of Two-tier machine hour rate:

| Set up time rate per machine hour (₹) | Running time rate per machine hour (₹) | |

| Standing Charges | 20.00 | 20.00 |

| Machine expenses: | ||

| Depreciation

Repair and maintenance Consumable stores Power |

20.00

– – – |

20.00

28.00 22.00 50.00 |

| Machine hour rate of overheads

Wages |

40.00

12.50 |

140.00

12.50 |

| Comprehensive machine hour rate | 52.50 | 152.50 |

Working Notes:

(i) Standing Charges per hour

Effective hours for standing charges (208 hours – 8 hours) = 200 hours

| Cost per hour (₹) | Cost per hour (₹) (Cost per month ÷ 200 hours) |

|

| Supervisor’s salary (₹ 6,000 3 machines) | 2,000 | 10.00 |

| Rent of building (₹ 72,000/12 months × 1/6) | 1,000 | 5.00 |

| General lighting | 1,000 | 5.00 |

| Total Standing Charges | 4,000 | 20.00 |

![]()

(ii) Machine running expenses per hour

Effective hours for variable costs (208 hours – 28 hours) = 180 hours

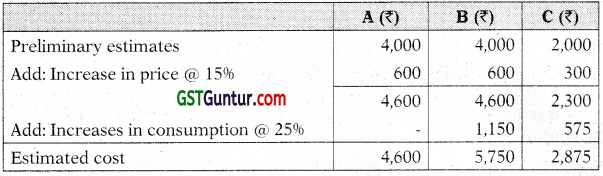

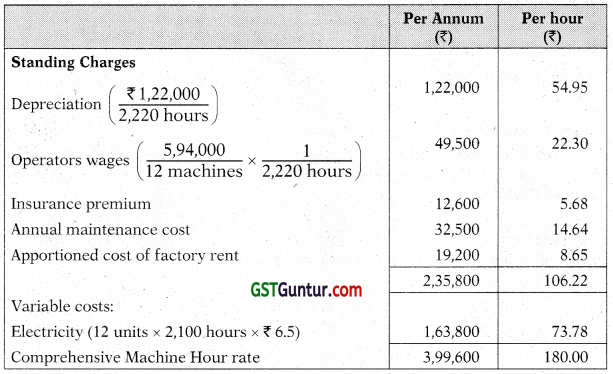

Question 19.

A manufacturing unit has purchased and installed a new machine of ₹ 12,70,000 to its fleet of 7 existing machines. The new machine has an estimated life of 12 years and is expected to realise 70,000 as scrap at the end of its working life. Other relevant data are as follows:

(i) Budgeted working hours are 2,592 based on 8 hours per day for 324 days. This includes 300 hours for plant maintenance and 92 hours for setting up of plant.

(ii) Estimated cost of maintenance of the machine is 25,000 (p.a.).

(iii) The machine requires a special chemical solution, which is replaced at the end of each week (6 days in a week) at a cost of 400 each time.

(iv) Four operators control operation of 8 machines and the average wages per person amounts to 420 per week plus 15% fringe benefits.

(v) Electricity used by the machine during the production is 16 units per hour at a cost of 3 per unit. No current is taken during maintenance and setting up.

(vi) Departmental, and general works overhead allocated to the operation during last year was 50,000. During the current year it is estimated to increase 10% of this amount.

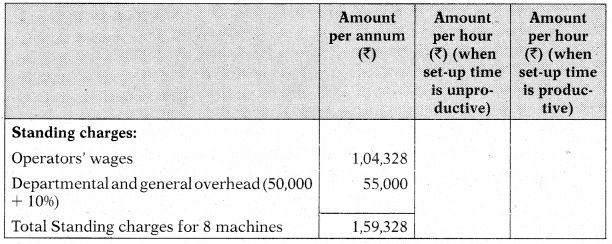

Calculate machine hour rate, if (a) setting up time is unproductive; (b) setting up time is productive. [CA Inter May 2005, 5 Marks]

Answer:

Computation of Machine hour Rate

Note: It is assumed that while setting up the plant, there is no consumption of electricity by the manufacturing unit.

Working Note:

(i) Effective machine hour when set-up time is unproductive:

= Budgeted working hours – (Maintenance time + Setting-up time)

= [2,592 – (300 + 92)] hours = 2,200 hours

(ii) Effective machine hour when set-up time is productive:

= Budgeted working hours – Maintenance time

= (2,592 – 300) hours = 2,292 hours

(iii) Operators’ wages per annum

Basic wages (4 operators × ₹ 420 × 54 weeks)

Add: Fringe benefits (15% of ₹ 90720)

(iv) Depreciation per annum

\(\frac{₹ 12,70,000 – ₹ 70,000}{12 \text { years }}\) = ₹ 1,00,000

(v) Cost of special chemical solution

324 days ÷ 6 days × ₹ 400 = ₹ 21,600

![]()

Treatment of Under/Over Absorbed Overheads

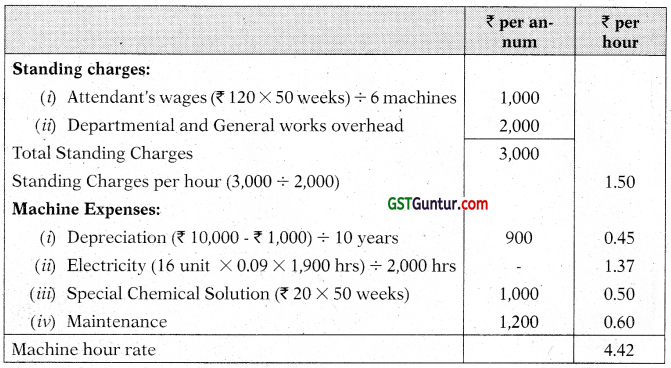

Question 20.

The total overhead expenses of a factory are ₹ 4,46,380. Taking into account the normal working of the factory, overhead was recovered in production at ₹ 1.25 per hour. The actual hours worked were 2,93,104. How would you proceed to close the books of account, assuming that besides 7,800 units produced of which 7,000 were sold, there were 200 equivalent units in work-in-progress?

On investigation, it was found that 50% of the unabsorbed overhead was on account of increase in the cost of indirect materials and indirect labour and the remaining 50% was due to factory inefficiency. Also give the profit implication of the method suggested. [CA Inter Nov. 2000, 6 Marks]

Answer:

Calculation of Unabsorbed Overheads:

| ₹ | |

| Actual overheads incurred

Less: Overheads Absorbed (₹ 1.25 × 2,93,104 Hrs.) |

4,46.380

3,36,380 |

| Unabsorbed Overheads | 80,000 |

| Unabsorbed Overheads due to increase in cost of Indirect materials and labour (₹ 80,000 × 50%)

Unabsorbed Overheads due to factory inefficiency (₹ 80,000 × 50%) |

40,000

40,000 |

Treatment of Unabsorbed Overhead and its Implication on Profit:

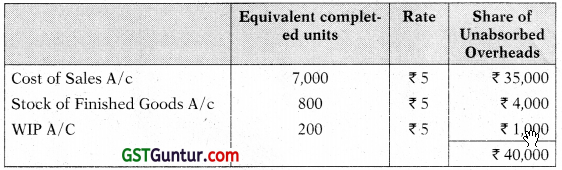

(i) The unabsorbed Overhead on account of increase in cost of indirect material and labour of ₹ 40,000 should be adjusted by applying Positive Supplementary Rates.

Supplementary rate = \(\frac{\text { Unabsorbed Overhead }}{\text { Equivalent completed units of Production }}\)

Calculation of Equivalent completed units:

Unit sold = 7,000

Units in closing stock of Finished Goods (7,800 – 7,000) = 800

Equivalent WIP units = 200

Total Equivalent Completed Units = 8,000

Supplementary Rate = ₹ 40,000/8,000 Units

= ₹ 5 per equivalent completed units

The unabsorbed O/H of ₹ 40,000 should be applied by using supplementary rate of ₹ 5 per equivalent completed unit as under:

This will reduce the Profit by ₹ 35,000, since the cost of sales has been increased. Moreover, the value of stock of Finished Goods and WIP will increase by ₹ 4,000 and ₹ 1,000 respectively.

(ii) The unabsorbed Overhead of ₹ 40,000 due to factory inefficiency being in the nature of abnormal loss should be charged to costing P&L A/c and thereby the profit would be reduced by ₹ 40,000.

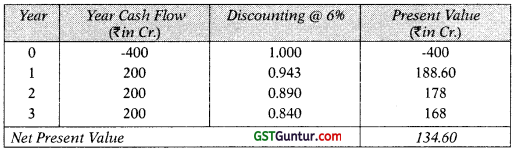

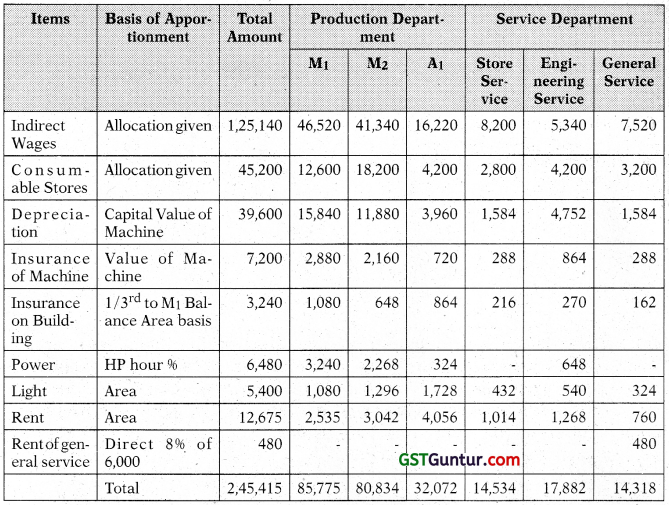

Question 21.

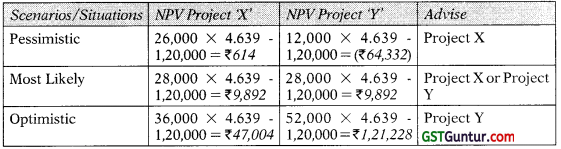

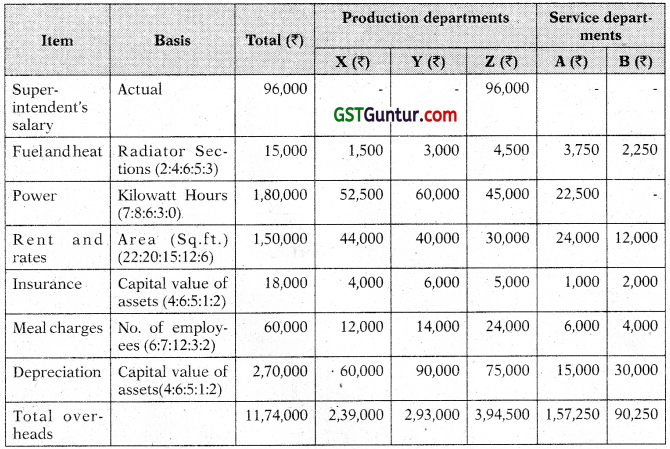

XYZ Ltd. manufactures a single product. It recovers factory overheads at a pre-determined rate of ₹ 20 per man-day.

During the year 2020-21, the total factory overheads incurred and the man- days actually worked were ₹ 35.50 lakhs and ₹ 1.50 lakh days respectively. Out of the amount of ₹ 35.50 lakhs, ₹ 2.00 lakhs were in respect of wages for stick period and ₹ 1.00 lakh was in respect of expenses of previous year booked in this current year. During the period, 50,000 units were sold. At the end of the period, 12,000 completed units were held in stock but there was no opening stock of finished goods. Similarly, there was no stock of uncompleted units at the beginning of the period but at the end of the period there were 20,000 uncompleted units which may be treated as 65% complete in all respects.

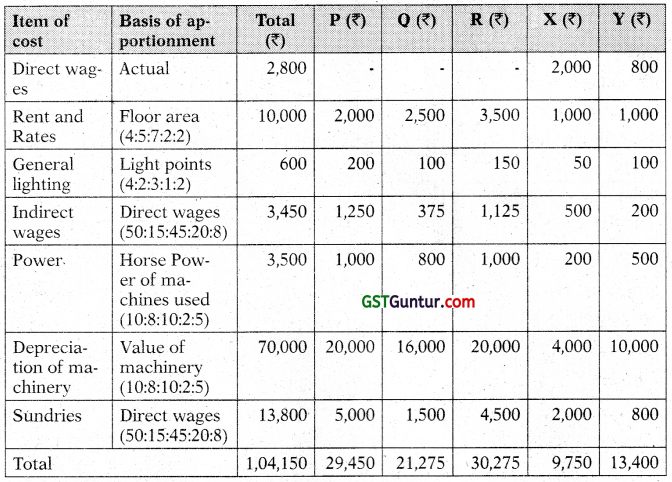

On investigation, it was found that 40% of the unabsorbed overheads were due to factory inefficiency and the rest were attributable to increase in the cost of indirect materials and indirect labour. You are required to:

(i) Calculate the amount of unabsorbed overheads during the year 2020-21.

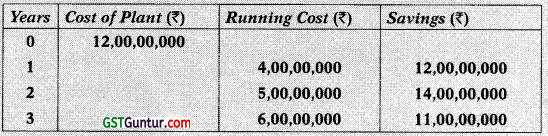

(ii) Show the accounting treatment of unabsorbed overheads in cost accounts and pass journal entry. [CA Inter Dec. 2021, Nov. 2017, Nov. 2011, 10 Marks]

Answer:

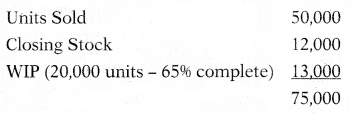

(i) Calculation of unabsorbed overheads during the year 2020-21

| ₹ | |

| Total factory overheads Incurred | 35,50,000 |

| Less: Strike | 2,00,000 |

| Less: Cost of previous year | 1,00,000 |

| Net factory overheads actually incurred | 32,50,000 |

| Overheads actually absorbed (₹ 20 per man day × 1,50,000 man days) | 30,00,000 |

| Unabsorbed overheads | 2,50,000 |

![]()

(ii) Accounting treatment of unabsorbed overheads in cost accounts:

Unabsorbed overheads of 4096 (ie. ₹ 1,00,000) due to factory inefficiency will be debited costing profit and loss account.

Unabsorbed overheads of balance 60% (ie. ₹ 1,50,000) attributable to increase in the cost of indirect materials and indirect labour should be distributed over work-in-progress, finished goods and cost of sales by using supplementary rate.

Total Units for absorption of overheads:

Supplementary overhead absorption rate = 1,50,000 ÷ 75,000 = ₹ 2/unit

Journal Entry

Question 22.

ABS Enterprises produces a product and adopts the policy to recover factory overheads applying blanket rale based on machine hours. The cost records of the concern reveal following information:

| Budgeted production overheads | ₹ 10,35,000 |

| Budgeted machine hours | 90,000 |

| Actual machine hours worked | 45,000 |

| Actual production overheads | ₹ 8,80,000 |

| Production overheads (actual) include | |

| Paid to worker as per court’s award | ₹ 50,000 |

| Wages paid for strike period | ₹ 38,000 |

| Stores written off | ₹ 22,000 |

| Expenses of previous year booked in current year | ₹ 18,500 |

| Production | |

| Finished goods | 30,000 units |

| Sale of finished goods | 27,000 units |

The analysis of cost information reveals that 1/3rd of the under absorption of overheads was due to defective production planning and the balance was attributable to increase in costs.

You are required:

(i) To find out the amount of under absorbed production overheads.

(ii) To give the ways of treating it in Cost Accounts.

(iii) To apportion the under absorbed overheads over the items. [CA Inter Nov. 2019, 10 Marks]

Answer:

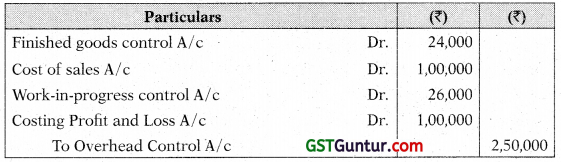

(i) Amount of under absorption of production overheads:

Budgeted Machine hour rate (Blanket rate) = ₹ 10,35,000/90,000 = ₹ 11.50 per hour.

(ii) Accounting treatment of under absorbed production overheads:

(a) As, 1 /3rd of the under absorbed overheads were due to defective production policies, this being abnormal, hence should be debited to Costing Profit and Loss Account.

Amount to be debited to Costing Profit and Loss Account = 2,34,000 × 1/3 = 78,000

(b) Balance of under absorbed production overheads should be distributed over work-in-progress, finished goods and cost of sales by applying supplementary rate.

Amount to be distributed = ₹ 2,34,000 × 2/3 = ₹ 1,56,000

Supplementary rate = ₹ 1,56,000/30,000 units = ₹ 5.20 per unit.

![]()

(iii) Apportionment of under absorbed production overheads over Finished goods and Cost of sales:

| Units | ₹ | |

| Finished goods (3000 units × ₹ 5.20) | 3,000 | 15.600 |

| Cost of Sales (27,000 units × ₹ 5.20) | 27,000 | 1,40,400 |

| Total | 30,000 | 1,56,000 |

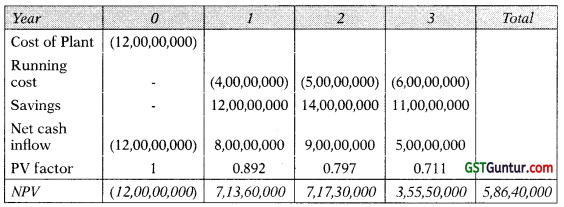

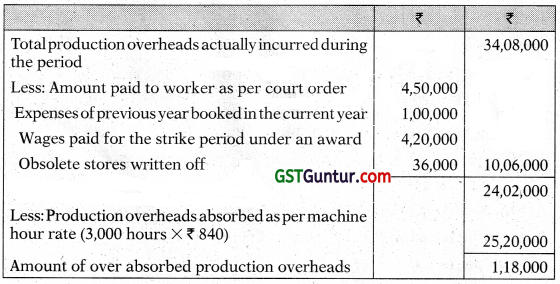

Question 23.

PLR Ltd. manufactures a single product and recovers the overheads by adopting a single blanket rate based on machine hours. The budgeted production overheads of the factory for the FY 2020-21 are ₹ 50,40,000 and budgeted machine hours are 6,000,

For a period of first six months of the financial year 2020-21, following information were extracted from the books:

| Actual production overheads | ₹ 34,08,000 |

| Amount included in the production overheads: | |

| Paid as per court’s order | ₹ 4,50,000 |

| Expenses of previous year booked in current year | ₹ 1,00,000 |

| Paid to workers for strike period under an award | ₹ 4,20,000 |

| Obsolete stores written off | ₹ 36,000 |

Production and sales data of the concern for the first six months are as under:

Production:

Finished goods 1,10,000

Work-in-progress

(50% complete in every respect) 80,000 units

Sale:

Finished goods 90,000 units

The actual machine hours worked during the period were 3,000 hours. It is revealed from the analysis of information that 40% of the over/under-absorption was due to defective production policies and the balance was attributable to increase in costs.

You are required

(i) To determine the amount of over/under absorption of production overheads for the period.

(ii) To show’ the accounting treatment of over/under-absorption of production overheads, and

(iii) To apportion the over, under-absorbed overheads over the items. [CA Inter Nov\ 2019 RTP]

Answer:

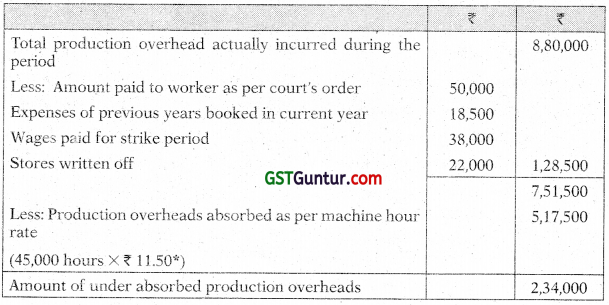

(i) Amount of over/under absorption of production overheads during the period of first six months of the year 2020-21:

Budgeted Machine hour rate (Blanket rate) = \(\frac{₹ 50,40,000}{₹ 840}\) = 6,000 hours

(ii) Accounting treatment of over absorbed production overheads: As, 40% of the over absorbed overheads were due to defective production policies, this being abnormal, hence should be credited to Costing Profit and Loss Account.

Amount to be credited to Costing Profit and Loss Account

= ₹ 1,18,000 × 40% = ₹ 47,200.

Balance of over absorbed production overheads should be distributed over Work-in-progress, Finished goods and Cost of sales by applying supplementary rate.

Amount to be distributed = ₹ 1,18,000 × 60% = ₹ 70,800

Supplementary rate = \(\frac{₹ 70,800}{1,50,000 \text { units }}\) = ₹ 0.472 per unit

![]()

(iii) Apportionment of over absorbed production overheads over WIP, Finished goods and Cost of sales:

| Equivalent completed units | ₹ | |

| Work-in-Progress (80,000 units × 50% × 0.472) | 40,000 | 18,880 |

| Finished goods (20,000 units × 0.472) | 20,000 | 9,440 |

| Cost of sales (90,000 units × 0.472) | 90,000 | 42,480 |

| Total | 1,50,000 | 70,800 |

Capacity Related Concept

Question 24.

A machine was purchased from a manufacturer who claimed that ma chine could produce 36.5 tonnes In a year consisting of 365 days. Holidays, break-down, etc., were normally allowed In the factory for 65 days. Sales were expected to be 25 tonnes during the year and the plant actually produced 25.2 tonnes during the year. You are required to state the following figures:

(i) Rated capacity

(ii) Practical capacity

(iii) Normal capacity

(iv) Actual capacity [CA Inter Nov. 2008, 2 Marks]

Answer:

(i) Rated Capacity

It is the maximum capacity of producing goods or providing services. 36.5 tonnes

(ii) Practical Capacity [(36.5 tonnes/365 days) × (365 days – 65 days)]

It is the available capacity after considering loss of 30 tonnes time due to repairs, maintenance, minor breakdown, idle time, set-up time, normal delays, sundays and holidays, stock taking, etc.

(iii) Normal Capacity

It is the volume of production or services achieved 25 tonnes or achievable on an average over a period under normal circumstances considering the reduction in capacity resulting from planned maintenance.

(iv) Actual Capacity

It is the capacity actually achieved during a given period. 25.2 tonnes

Miscellaneous

Question 25.

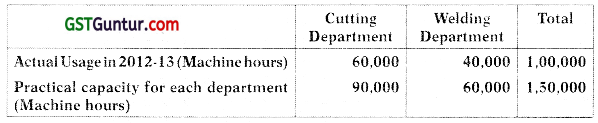

PQR Ltd. has its own power plant, which has two users, Cutting Department and Welding Department. When the plans were prepared for the power plant, top management decided that its practical capacity should be 1,50.000 machine hours. Annual budgeted practical capacity fixed costs are ₹ 9,00,000 and budgeted variable costs are ₹ 4 per machine-hour. The following data are available:

Required.:

(i) Allocate the power plant’s cost to the cutting and the welding department using a single rate method in which the budgeted rate is calculated using practical capacity and costs are allocated based on actual usage.

(ii) Allocate the power plant’s cost to the cutting and welding departments, using the dual – rate method in which fixed costs are allocated based on practical capacity and variable costs are allocated based on actual usage.

(iii) Allocate the power plant’s cost to the cutting and welding departments using the dual rate method in which the fixed-cost rate is calculated using practical capacity, but fixed costs are allocated to the cutting and welding department based on actual usage. Variable costs are allocated based on actual usage.

(iv) Comment on your results in requirements (i), (ii) and (iii). [CA inter May 2003 8 Marks]

Answer:

Working Notes:

(1) Fixed practical capacity cost per machine hour:

Practical capacity (machine hours) 1,50,000

Practical capacity fixed costs ₹ 9,00,000

Fixed practical capacity cost per machine hour

(₹ 9,00,000 ÷ 1,50,000 hours) ₹ 6

(2) Budgeted rate per machine hour (using practical capacity):

= Fixed practical capacity cost per machine hour + Budgeted variable cost per machine hour

= ₹ 6 + ₹ 4 = ₹ 10

(i) Statement showing Power Plant’s cost allocation to the Cutting & Welding departments by using single rate method on actual usage of machine hours.

| Cutting Department (₹) | Welding Department (₹) | Total (₹) | |

| Power plants cost allocation by using actual usage (machine hours) (Refer to Working Note 2) |

6,00,000 (60,000 hours × ₹ 10) | 4,00.000 (40,000 hours × ₹ 10) | 10,00,000 |

![]()

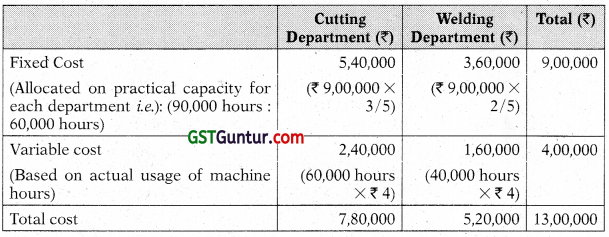

(ii) Statement showing Power Plant’s cost allocation to the Cutting & Welding departments by using dual rate method.

(iii) Statement showing Power Plant’s cost allocation to the Cutting & Welding Departments using dual rate method

(iv) Comments:

Under dual rate method, under (iii) and single rate method under (i), the allocation of fixed cost of practical capacity of plant over each department are based on single rate. The major advantage of this approach is that the user departments are allocated fixed capacity costs only for the capacity used. The unused capacity cost ₹ 3,00,000 (₹ 9,00,000 – ₹ 6,00,000) will not be allocated to the user departments. This highlights the cost of unused capacity.

Under (ii) fixed cost of capacity are allocated to operating departments on the basis of practical capacity, so all fixed costs are allocated and there is no unused capacity identified with the power plant.

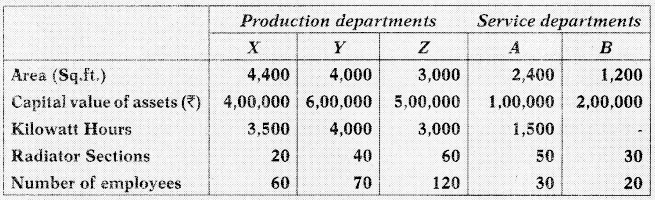

Question 26.

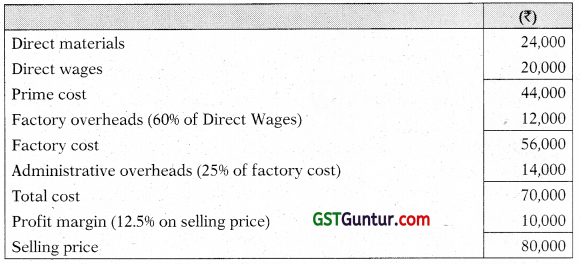

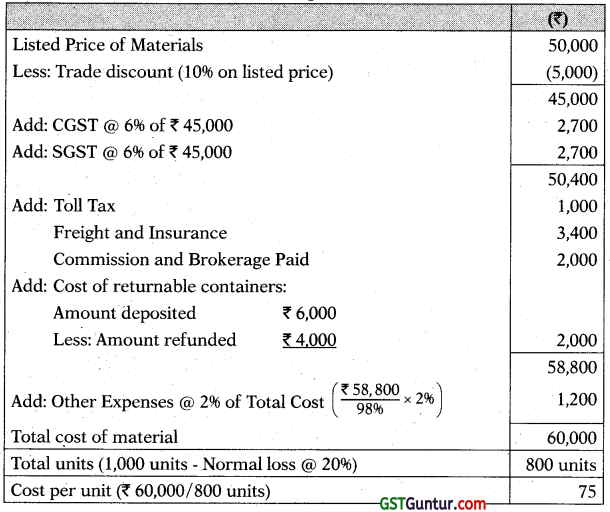

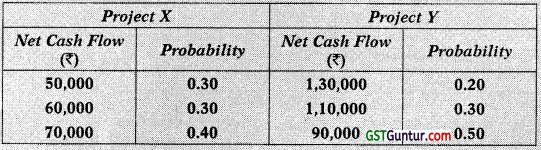

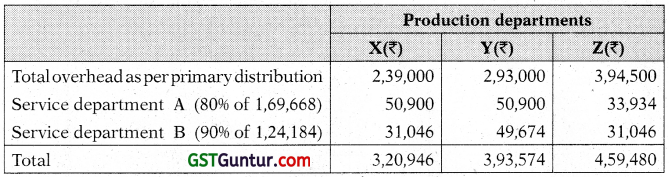

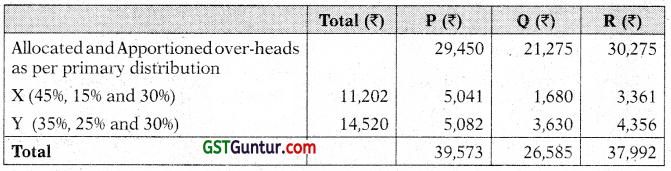

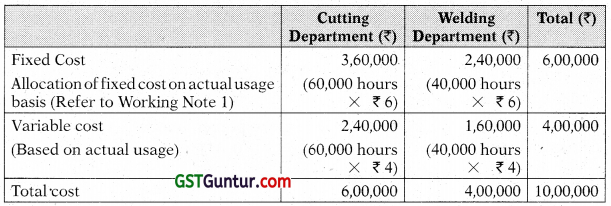

In an engineering company, the factory overheads are recovered on a fixed percentage basis on direct wages and the administrative overheads are absorbed on a fixed percentage basis on factory cost.

The company has furnished the following data relating to two jobs under-taken by it in a period:

| Job 101 | Job 102 | |

| (₹) | (₹) | |

| Direct materials | 54,000 | 37,500 |

| Direct wages | 42,000 | 30,000 | |

| Selling price | 1,66,650 | 1,28,250 |

| Profit percentage on Total Cost | 10% | 20% |

Required:

(i) Computation of percentage recovery rates of factory overheads and administrative overheads.

(ii) Calculation of the amount of factory overheads, administrative overheads and profit for each of the two jobs.

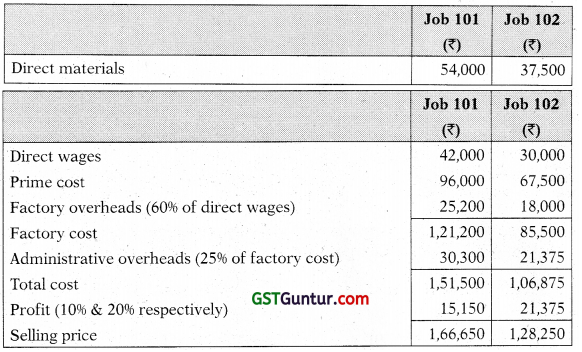

(iii) Using the above recovery rates determine the selling price of job 103. The additional data being:

Direct materials ₹ 24,000

Direct wages ₹ 20,000

Profit percentage on selling price 12.5% [ICAI Module]

Answer:

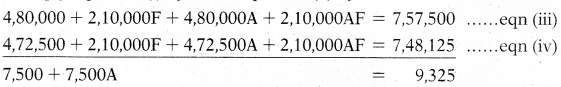

(i) Computation of percentage recovery rates of factory overheads and administrative overheads.

Let the factory overhead recovery rate as percentage of direct wages be F and administrative overheads recovery rate as percentage of factory cost be A.

Factory Cost = Direct materials + Direct wages + Factory overhead

For Job 101 = ₹ 54,000 + ₹ 42,000 + ₹ 42,000F = ₹ 96,000 + ₹ 42,000F

For Job 102 = ₹ 37,500 + ₹ 30,000 + ₹ 30,000F = ₹ 67,500 + ₹ 30.000F

Total Cost = Factory cost + Administrative overhead For Job 101:

= ₹ 96,000 + ₹ 42,000F + (₹ 96,000 + ₹ 42.000F) A = ₹ 1,51,500

= ₹ 96,000 + ₹ 42,000F + ₹ 96.000A + ₹ 42.000AF = ₹ 1,51,500 eqn (i)

For Job 102:

= ₹ 67,500 + ₹ 30,000F + (₹ 67,500 + ₹ 30,000F) A = ₹ 1,06,875

= ₹ 67,500 + ₹ 30,000F + ₹ 67,500A + ₹ 30,000AF = ₹ 1,06,875 eqn (ii)

Multiply equation (i) by 5 and equation (ii) by 7

7,500 A = 9,325 – 7,500

A = 0.25

96.000 + 42.000F + 24,000 + 10,500F = 1,51,500

52,500F = 1,51,500 – 1,20,000

F = 0.6

Percentage recovery rates:

Factory overheads = 60% of wages

Administrative overheads = 25% of factory cost.

Working note:

![]()

(ii) Statement of jobs, showing amount of factory overheads, administrative overheads and profit.

(iii) Selling price of Job 103.