CA Inter Law Case Studies – CA Inter Law MCQ is designed strictly as per the latest syllabus and exam pattern.

CA Inter Law Case Studies

Integrated Case Study – 1

Vishal Crockery Limited was incorporated on 24th September, 2014 under the jurisdiction of Registrar of Companies, Rajasthan with its registered office located in Jaipur and its manufacturing units spread out in Mumbai, Kanpur, Delhi and Ludhiana. Under the dynamic leadership of Hans Rajpal, the Chairman and Managing Director (CMD) of the company, it could easily be ascertained that the company had reached the new heights of success. The directors of the company numbered 8 including CMD of which 2 were the independent directors.

The turnover of the company for the Financial Year 2021-22 was ₹ 750 crores – a whopping rise of more than 20% from the previous year and net profit stood at a prestigious figure of ₹ 6.60 crores – also increased by ₹ 1.80 crores as compared to the net profit of previous year. The company had a net worth of f 250 crores; and it was noticed that the net worth had also registered a northern trend by more than 15%. The authorised and paid-up share capital of the company was ₹ 8 crores. Keeping in view the applicability of forming a CSR Committee for the current financial year 2022-23, a CSR Committee was formed with 4 directors as members of which one was the independent member. The Committee was, among others, given the responsibility to formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the company as specified in Schedule VII.

The company plans to diversify its business by adding another segment to manufacture steel utensils and therefore, is desirous to shift its registered office to Mumbai from the present one at Jaipur which will help the company in easing out the new business. Another strategically important segment which the company tapped earlier and now wishes to engage itself on a large scale relates to manufacturing of stationery items.

The company hopes that with the shifting of registered office to Mumbai, it shall be able to target international markets to export its quality products. As on date, the export turnover of the company is not that much significant The directors, Janardan Mittal (Finance) and Ratish Jain (Marketing), however, have in-depth knowledge of export markets, particularly those existing in UK and Singapore, where they can place their products successfully and achieve laurels for the company in terms of wealth maximisation.

During the current Financial Year 2022-23, the company under the CSR activities provided ample support for improvement of infrastructure in schools established at Mumbai, Kanpur, Delhi and Ludhiana. Not only this, the company contributed towards establishment of Digital Smart Classroom, Libraries and computer labs in these cities. The company also deployed mobile medical units equipped with medical facilities and qualified doctors. In addition to this, a large number of public health and sanitation activities had been initiated under Swachh Bharat Abhiyan. The total amount spent on these activities was, till date, almost equal to the minimum amount prescribed and it is hoped that as the current Financial Year 2022-23 approaches its end, the total spending on CSR activities will certainly exceed the budgeted figure.

Vishal Crockery Limited had decided to engage an external Section 8 company for undertaking its CSR activities and such charitable company is not established by Vishal nor it is established by the Central/State Government or by any entity established under an Act of Parliament or a State Legislature. [MTP-May 20]

Question 1.

Which of the following factors would have prompted Vishal Crockery Limited to mandatorily form a Corporate Social Responsibility (CSR) Committee for the current financial year?

(a) The net profit had increased to ₹ 6.60 crores during FY 2021-22 and it was more by ₹ 1.80 crores in comparison to previous year’s net profit.

(b) The turnover was ₹ 750 crores during FY 2021-22 which was an increase of more than 20% as compared to the previous year.

(c) The net worth was ₹ 250 crores during FY 2021-22 which when compared to the previous year had registered an increase by more than 15%.

(d) The paid-up share capital was ₹ 8 crores during FY 2021-22.

Answers:

(a) The net profit had increased to ₹ 6.60 crores during FY 2021-22 and it was more by ₹ 1.80 crores in comparison to previous year’s net profit.

Question 2.

What is the time period within which, the Central Government shall dispose of the application filed by the company for shifting of its registered office to Mumbai in Maharashtra?

(a) Within 30 days.

(b) Within 45 days.

(c) Within 60 days.

(d) Within 90 days.

Answer:

(c) Within 60 days.

Question 3.

What is the minimum amount (in percentage form) that Vishal Crockery Limited is required to spend during the Financial Year 2022-23 on the CSR activities?

(a) 2% of the average net profits made during the 2 immediately preceding financial years.

(b) 2% of the average net profits made during the 3 immediately preceding financial years.

(c) 2.5% of the average net profits made during the 2 immediately preceding financial years.

(d) 2.5% of the average net profits made during the 3 immediately preceding financial years.

Answer:

(b) 2% of the average net profits made during the 3 immediately preceding financial years.

Question 4.

What should be the established track, Section 8 company should have in undertaking similar programs or projects which Vishal Crockery Limited wants it to accomplish?

(a) Track record of minimum 1 year.

(b) Track record of minimum 2 years.

(c) Track record of minimum 3 years.

(d) Track record of minimum 4 years.

Answer:

(c) Track record of minimum 3 years.

Integrated Case Study – 2

Vivek Shah is the Chief Finance Officer (CFO) and Sachin Bhatt is the Company Secretary of Jitendra Iron Works Private Ltd (JIWPL), in Manipal, Karnataka. J1WPL is an integrated set up of foundries and machine shops that add value by machining more than 75% of the castings manufactured to fully finished condition. JIWPL is one of the largest jobbing foundries producing grey iron castings required for automobile, farm equipment sector and diesel engines industry. JIWPL serves customers globally. The turnover of JIWPL is about ₹ 600 crores, including export turnover of about ₹ 250 crores.

During the year 2019, JIWPL planned expansion to enhance its production capacity to meet the increasing demand from its customers, by importing fully automatic plant and equipment from Germany for the unit at Manipal. The means of finance of the expansion project:-

(a) JIWPL received an amount of ₹ 25 crores from Malini Shetty, wife of one of the promoter director of JIWPL, Mahesh Shetty. Mahesh Shetty wanted to know from Sachin Bhatt any compliance needed from the perspective of acceptance of Deposits.

(b) The Board and the CFO also approached the main banker of the company viz., Bank of Baroda. The Bank after proper credit analysis, sanctioned an amount of ₹ 50 crores for meeting the working capital needs of the expansion project, which included interchangeable limits of cash credit, foreign and inland bills for negotiation and acceptance. The security cover was floating charge on the book debts, inventory and other current assets of the expansion project in Manipal of JIWPL.

The CFO and the CS together coordinated with the legal department of the Bank on procedures relating to creation of security and registration of charges.

The registered office of JIWPL is located in Manipal. Out of the company’s 180 members, 20 members, who are entered in the Register of Members reside in Mangaluru, a nearby city, requested the company for some reasons to maintain the Register of Members in the company’s liaison office in Mangaluru, instead of Manipal henceforth. [MTP-May 20]

Question 1.

JIWPL received an amount of ₹ 25 crores from Malini Shetty, wife of one of the promoter directors Mahesh Shetty of JIWPL. Mahesh Shetty wanted to know from Sachin Bhatt any compliance needed from the perspective of acceptance of deposits. The CS has to ensure:

(a) That the particulars of amount received are immediately entered in the register of deposits maintained in such manner and in such format as prescribed.

(b) To issue immediately a circular to the members of the company with a statement of deposits accepted as on date with the names of each depositor, amount(s) received as on date, the due date(s) and the liability(ies) on the due date(s) in respect of each depositor.

(c) That a declaration is to be obtained to the effect that the amount given is not sourced from borrowed funds or accepting loans or deposits from others and disclose the details in the Board’s Report.

(d) To file the particulars of deposits received within 30 days from the date of its receipt with the Registrar.

Answer:

(c) That a declaration is to be obtained to the effect that the amount given is not sourced from borrowed funds or accepting loans or deposits from others and disclose the details in the Board’s Report.

Question 2.

JIWPL was also sanctioned an additional amount of ₹ 50 crores for meeting the working capital needs of the expansion project., which included interchangeable limits of cash credit, foreign and Inland bills for negotiation and acceptance. The security cover was floating charge on the book debts, Inventory and other current assets of the expansion project of JIWPL. A floating charge, in general is created by way of:

(a) Passing a board resolution.

(b) Signing and acknowledging the Credit Sanction letter.

(c) Mortgage.

(d) Hypothecation or lien.

Answer:

(d) Hypothecation or lien.

Question 3.

The registered office of JIWPL is located in Manipal. Out of the company’s 180 Members, 20 members, who are entered in the Register of Members (RoM) reside in Mangaluru, a nearby city. These members requested the company for some reasons to maintain the Register of Members (ROM) in the company’s liaison office in Mangaluru, instead of Manipal henceforth.

(a) The RoM shall be maintained only at the registered office in Manipal and maintaining in a place other than the registered office is not permitted under the Companies Act, 2013 and the relevant Rules thereunder.

(b) By passing a Special Resolution in a General Meeting, the RoM can be maintained in Mangaluru.

(c) The Board of Directors by passing a Board Resolution in one of its meetings, may direct the Company Secretary to maintain the RoM in Mangaluru.

(d) If more than 1/3rd of the members, whose names are entered in the RoM request for the change, then only the RoM can be maintained at Mangaluru after passing a Special Resolution in a General Meeting.

Answer:

(b) By passing a Special Resolution in a General Meeting, the RoM can be maintained in Mangaluru.

Integrated Case Study – 3

A private company by the name of Neha Pvt. Limited was incorporated in the year 2002. The registered office of the company Neha Pvt. Limited was situated in City K of State Y.

During the financial year beginning on 01.04.2020 and ending on 31.03.2021 the turnover of the company Neha Pvt. Limited was ₹ 1,010 crore. The net profit of the company Neha Pvt. Limited for the financial year 2020-21 was ₹ 4 crore.

The Board of Directors of Neha Pvt. Limited consisted of only two directors namely Mr. M and Mr. N. Mr. M and Mr. N were the only directors of company Neha Pvt. Limited since its incorporation in the year 2002.

Mr. M one of the two directors of Neha Pvt. Limited was of the opinion that no Corporate Social Responsibility Committee of the Board was required to be formed as for the financial year 2021-22 due to the reason that net profit of the company Neha Pvt. Limited for financial year 2020-21 was ₹ 4 crore which was less than ₹ 5 crore.

Mr. N the other director of Neha Pvt. Limited was not having the same opinion as Mr. M. He was of the opinion that Corporate Social Responsibility Committee of the Board must be formed for the company Neha Pvt. Limited.

The net profit of the company Neha Pvt. Limited for the financial year 2017-18, 2018-19 and 2019-20 were ₹ 1 crore, ₹ 2 crore and ₹ 3 crore respectively.

Keeping the basic provisions of Companies Act, 2013 in mind answer the following multiple choice questions: [RTP-May 20]

Question 1.

Mr. M one of the director of Neha Pvt. Limited was of the opinion that no Corporate Social Responsibility Committee of Board was required to be formed for financial year 2021-22 but Mr. N other director was of opinion that it was required to be formed.

According to your understanding which one of the two director is right and why:

(a) Mr. M because net profit of Neha Pvt. Limited for financial year 2020-21 was less than ₹ 5 crore.

(b) Mr. N because turnover of Neha Pvt. Limited for financial year 2020-21 was more than ₹ 1,000 crore.

(c) Mr. N because net profit of Neha Pvt. Limited for financial year 2020-21 was more than ₹ 2 crore.

(d) Mr. M because turnover of Neha Pvt. Limited for financial year 2020-21 was less than ₹ 1,500 crore.

Answer:

(b) Mr. N because turnover of Neha Pvt. Limited for financial year 2020-21 was more than ₹ 1,000 crore.

Question 2.

The company Neha Pvt. Limited must give preference to spend the amount of contribution towards Corporate Social Responsibility in area of:

(a) City O of State Y.

(b) City A of State Z.

(c) City G of State Z.

(d) City K of State Y.

Answer:

(d) City K of State Y.

Question 3.

According to law Corporate Social Responsibility Committee shall consist of 3 or more directors, so for company Neha Pvt. Limited the Corporate Social Responsibility Committee will:

(a) not be formed as it has only 2 directors namely Mr. M and Mr. N.

(b) be formed only after appointing 1 more director apart from Mr. M and Mr. N.

(c) be formed with 2 directors only namely Mr. M and Mr. N.

(d) be formed only after appointing 2 more directors apart from Mr. M and Mr. N.

Answer:

(c) be formed with 2 directors only namely Mr. M and Mr. N.

Question 4.

The company Neha Pvt. Limited shall spend during financial year 2020-21 on Corporate Social Responsibility an amount of atleast:

(a) ₹ 0.04 crore

(b) ₹ 0.12 crore

(c) ₹ 0.18 crore

(d) ₹ 0.06 crore

Answer:

(a) ₹ 0.04 crore

Integrated Case Study – 4

GHWX Private Limited was incorporated in the year 2011. The registered office of the company GHWX Private Limited was situated in city T of state V. The Board of Directors of GHWX Private Limited comprised of 5 directors namely Mr. K, Mr. N, Mr. R, Mr. U and Mr. W. During the financial year beginning on 01.04.2020 and ending on 31.03.2021 the second meeting of Board of Directors of GHWX Private Limited was held on 7 September, 2020.

Out of 5 directors, Mr. K, Mr. N, Mr. R and Mr. W were present for the said meeting. During the meeting of Board of Directors a resolution on one of the important matters was passed. While 3 directors namely Mr. K, Mr. N and Mr. R agreed with the resolution and voted in favour of resolution, however, Mr. W did not agree with the resolution and voted against the resolution.

The minutes of the second meeting of Board of Directors of GHWX Private Limited held on 7 September, 2020 were prepared and they were entered in Minutes Book of meeting of Board of Directors of GHWX Private Limited. One of the director Mr. K was of the opinion that minutes of second meeting of Board of Directors of GHWX Private Limited must be prepared and entered in Minute Book of meeting of Board of Directors of GHWX Private Limited by end of October, 2020. The remaining 4 directors namely Mr. N, Mr. R, Mr. U and Mr. W did not agree with the opinion of Mr. K because they thought that it was not within the time limit as prescribed by the law.

One of the directors, Mr. N. opined that minute books of meetings of Board of Directors of GHWX Private Limited for the years starting with 2011 to 2017 should be shredded to ruins as these papers were taking a lot of space. He further added that since the Companies Act, 2013 is silent as to maintaining the minute book of meetings of Board of Directors, it is not necessary to maintain such minute books.

The Board of Directors of GHWX Private Limited did not decide any place where minute book of meetings of Board of Directors of GHWX Private Limited will be kept.

Keeping the provisions of the Companies Act, 2013 in mind answer the following multiple choice questions: [RTP-May 20]

Question 1.

The second meeting of Board of Directors of GHWX Private Limited was held on 7 September, 2018 for the financial year 2020-21. The minutes of second meeting of Board of Directors of GHWX Private Limited for financial year 2020-21 must contain:

(a) Name of director Mr. U who was absent from the meeting of Board of Directors held on 7 September, 2020.

(b) Names of all the directors Mr. K, Mr. N, Mr. R, Mr. U and Mr. W comprising Board of Directors of GHWX Private Limited.

(c) Name of one director Mr. U who was absent and atleast one director who was present in the meeting of Board of Directors held on 7 September, 2020.

(d) Names of directors Mr. K, Mr. N, Mr. R and Mr. W who were present in the meeting of Board of Directors held on 7 September, 2020.

Answer:

(d) Names of directors Mr. K, Mr. N, Mr. R and Mr. W who were present in the meeting of Board of Directors held on 7 September, 2020.

Question 2.

In case of the resolution talked in the case study, the minutes of second meeting of Board of Directors of GHWX Private Limited for financial year 2020-21 held on 7 September, 2020 must contain:

(a) Name of any 2 directors who were present in meeting and voted in the resolution.

(b) Name of director Mr. W who voted against the resolution.

(c) Name of directors Mr. K, Mr. N and Mr. R who voted in favour of the resolution.

(d) Names of all the directors Mr. K, Mr. N, Mr. R, Mr. U and Mr. W who all had the right to attend the meeting and vote in the resolution.

Answer:

(b) Name of director Mr. W who voted against the resolution.

Question 3.

The opinion of one of the director, Mr. K was that minutes of second meeting of Board of Directors of GHWX Private Limited for financial year 2020-21 must be prepared and entered in minutes book of meeting of Board of Directors of GHWX Private Limited by the end of October, 2020 is incorrect. The opinion of Mr. K is incorrect because:

(a) Minutes of second meeting of Board of Directors of GHWX Private Limited for financial year 2020-21 must be entered in minute book of meeting of Board of Directors within thirty days of the conclusion of meeting on 7 September, 2020.

(b) Minutes of second meeting of Board of Directors of GHWX Private Limited for the financial year 2020-21 must be entered in minute book of meeting of Board of Directors within sixty days of the conclusion of meeting on 7 September, 2020.

(c) Minutes of second meeting of Board of Directors of GHWX Private Limited for the financial year 2020-21 must be entered in minute book of meeting of Board of Directors within ninety days of the conclusion of meeting on 7 September, 2020.

(d) Minutes of second meeting of Board of Directors of GHWX Private Limited for financial year 2020-21 must be entered in minute book of meeting of Board of Directors within one twenty days of the conclusion of meeting on 7 September, 2020.

Answer:

(a) Minutes of second meeting of Board of Directors of GHWX Private Limited for financial year 2020-21 must be entered in minute book of meeting of Board of Directors within thirty days of the conclusion of meeting on 7 September, 2020.

Integrated Case Study – 5

Mr. Abhinav Gyan is a tech expert and one among the promoter of Doon Technology Limited (DTL). He did his engineering from one of the prestigious HT in CSE and then persued masters in management from IIM. He started DTL fifteen years back. DTL is famous for advance technologies such as artificial intelligence, block-chain solutions and many others. The company went public a decade ago but not listed.

Since DTL is expanding its operations in wake of opportunities arises out of industrial revolution, hence willing to retain the profit for growth of the company, but shareholders are seeking dividend; because for shareholders larger the bottom line means larger the dividend. The outbreak of COVID-19 is another reason which forced the directors to retain the earnings. After the closure of books of account for the year, directors proposed the dividend of 10% against the expectation of 20% by shareholders.

However, considering the extended lock-down which causes a delay in delivering the projects (results in deferment of revenue and additional cost), directors are of the opinion to revoke the dividend. Shareholders seeks appointment of internal auditor for audit on a concurrent basis, whereas management of DTL states it does not require to appoint an internal auditor under the law and it will cause an unnecessary financial burden on the company. The excerpts from financial statements of the preceding financial year are as under:

| Particulars |

Amount in Crores |

| Paid-up share capital |

45 |

| Turnover |

495 |

| Outstanding loans or borrowings* |

105 |

| Outstanding deposits |

22# |

* includes inter-corporate loan of ₹ 25 crores.

#Up till 31st January, the outstanding deposit was ₹ 30 crores.

Mr. Gyan bought 40,000 shares of Time Consultancy Services Ltd. (TCS) of face value – ₹ 10 each, out of his savings. On such shares, the final call of 2 is due but unpaid by Mr. Gyan. In the meantime, TCS declared the dividend at a rate of 15%. Out of total dividend of ₹ 8.4 crores declared on 31st August, 2022, ₹ 0.42 crores remain unpaid as on 30th September, 2022. Out of such ₹ 0.42 crores, ₹ 12 lakhs are on account of the operation of law and ₹ 3 lakhs on account of legal disputes of right to receive dividend. The unpaid dividend was finally paid on 12th December, 2022 in full.

Mr. Gyan came from humble background, hence as part of his ethical commitment to uplift the society by promoting education to children of the economically weak section, he decided to form a Sec. 8 company around 2 years back with the support of fellow professional, who later become a member of such a company. Receipts are excess of expenditure hence it was decided that Gyan foundation will declare some dividend to its members.

On the basis of above facts, answer the following MCQs. [MTP-Oct. 20]

Question 1.

Regarding unpaid call money by Mr. Gyan, in light of dividend due to him from TCS, state which of following statements hold truth?

(a) Dividend can’t be adjusted against the unpaid call money.

(b) The dividend of ₹ 48,000 can be adjusted against unpaid call money.

(c) The dividend of ₹ 48,000 can be adjusted against unpaid call money, if consent is given by Mr. Gyan.

(d) The dividend of ₹ 48,000 can be adjusted against unpaid call money, even if consent is not given by Mr. Gyan.

Answer:

(b) The dividend of ₹ 48,000 can be adjusted against unpaid call money.

Question 2.

Does DTL is required to appoint Internal Auditor u/s 138 of Companies Act, 2013?

(a) No, because DTL is unlisted company.

(b) No, because paid-up share capital is less than ₹ 50 crores.

(c) Yes, because turnover is more than ₹ 200 crores.

(d) Yes, because outstanding loan is above ₹ 100 crores.

Answer:

(c) Yes, because turnover is more than ₹ 200 crores.

Question 3.

With reference to the declaration of dividend by Gyan Foundation, state which of following statements hold truth?

(a) Gyan Foundation can declare dividend out of the capital as well.

(b) Gyan Foundation can declare dividend either out of current years or previous years’ profit, but need to transfer a certain % to reserve.

(c) Gyan Foundation can’t declare the dividend because three years has not been elapsed since its incorporation.

(d) Gyan Foundation can’t declare the dividend in any case.

Answer:

(d) Gyan Foundation can’t declare the dividend in any case.

Question 4.

What will be the amount of penalty which TCS needs to pay u/s 127 of the Companies Act, 2013?

(a) Up to 1,000 per day till the default continues.

(b) ₹ 64,800

(c) ₹ 97,200

(d) ₹ 1,08,000

Answer:

(c) ₹ 97,200

Integrated Case Study – 6

Mr. Mohit Aggarwai is the director of Superior Carbonates and Chemicals Limited (SCCL). SCCL was incorporated by Mr. S. K. Aggarwai (father of Mr. Mohit) on 5th July, 1995 as a public company. SCCL accepts a loan from Mr. Mohit of ₹ 1.5 crores for short -term purpose and expected to repay after 24 months. SCCL in its books of account, records such receipt as loan and borrowing under non-current liabilities. At the time of advancing loan, Mr. Mohit affirms in writing that such amount is not being given out of funds acquired by him by borrowing or accepting loans or deposits from others and complete details of such loan transactions are furnished in the board report.

SCCL has its registered office in Paonta-sahib (Himachal Pradesh) and corporate office is situated in Dehradun (Uttarakhand) but around 15% of members whose name is entered in members’ register are residents of Nainital (Uttarakhand). At Nainital, SCCL has Liaison Office. Management of the company is willing to place, register of members at Nainital Liaison Office.

SCCL convene its 7th AGM on 10th September, 2021 at the registered office of the company. Notice for same was served on 21st August, 2021. More than 78% of members gave consent to convening AGM at shorter notice due to ambiguity and possibility of another lockdown starting from 11th September, 2021 on account of the second wave of COVID-19.

On the basis of above facts, answer the following MCQs. [MTP-Oct. 20]

Question 1.

With reference to the loan advanced by Mr. Mohit to SCCL, apprise whether same is classified as deposit or not?

(a) Deposit, because any sum advanced by the director whether loan or otherwise is always classified as a deposit.

(b) Deposit, because the length of the loan is for a period; more than six months.

(c) Not a deposit, because such amount is recorded as loan in books of account of SCCL.

(d) Not a deposit, because the written declaration is provided by Mr. Mohit that said sum of loan is not being given out of funds acquired by him by borrowing or accepting loans or deposits from others.

Answer:

(d) Not a deposit, because the written declaration is provided by Mr. Mohit that said sum of loan is not being given out of funds acquired by him by borrowing or accepting loans or deposits from others.

Question 2.

Pick the right statement regarding SCCL’s willingness to keep and maintain the register of members at the Nainital liaison office.

(a) Register of members shall be kept at either registered office or within the same city that too after passing the resolution, hence SCCL can’t place it at Nainital liaison office.

(b) Register of members can’t be kept at any other place by SCCL, without passing an ordinary resolution.

(c) Register of members can be kept at Nainital liaison office, after passing a special resolution, because more than 1/10th of the total members entered in the register of members reside there.

(d) Register of members can’t be kept at Nainital liaison office, even after passing a special resolution, because less than 1/5th of the total members entered in the register of members reside there.

Answer:

(c) Register of members can be kept at Nainital liaison office, after passing a special resolution, because more than 1/10th of the total members entered in the register of members reside there.

Question 3.

Considering the provision dealt with length of Notice of AGM, pick the right option depicting the validity of notice served by SCCL.

(a) Notice served by SCCL is not valid, because shorter length needs to be consented by all the members entitled to vote at AGM.

(b) Notice served by SCCL is not valid, because shorter length needs to be consented by at-least 95% of members entitled to vote thereat.

(c) Notice served by SCCL is valid because the shorter length is consented by 75% of members entitled to vote thereat.

(d) Notice served by SCCL is not valid, because shorter length need to be consented by at-least 50% of the members entitled to vote at AGM that too in writing.

Answer:

(b) Notice served by SCCL is not valid, because shorter length needs to be consented by at-least 95% of members entitled to vote thereat.

Integrated Case Study – 7

Mr. B R Mohanty, around two-decade back; along with two of his elder brothers and few friends, who are pharma and chemical engineers by profession promoted two companies; first being Well-Mount Limited (WML) dealing in wellness products and pharmaceuticals; whereas other is Tex-Mount Limited (TML) dealing in textile products. During these two decades, both WML and TML has grown magnificently as both the sectors expanded beyond imagination. Both companies went public and stock of same listed on leading stock exchanges of countries.

TML did well in the past and emerged as a major export unit but in recent years the textile sector witness stiff competition due to new entrants. The increased cost of the workforce and other input materials is also made sector unprofitable and recent lockdown hit the sector further adversely. TML’s bottom line for the current financial year is red.

TML was declaring dividends since the very first year of operation and willing to continue the tradition considering dividend as signalling effect to an investor for valuation purpose. Rate of dividend for the recent five years was 9%, 10%, 8%, 5% and 2% (9% being five years ago and 2% being the previous year) respectively. The management at TML decided to declare dividends out of the profit of previous years.

TML deals in export hence came under the scanner of enforcement authority, who seek financial statements and books of account of TML for scrutiny for the last 10 preceding financial years. In response to notice, TML furnish financial statements and books of account for last 8 immediately preceding financial years only, stating as per its Article of Association; TML is required to maintain and keep the books of account for 8 immediately preceding financial years only and that too without any record of vouchers pertaining to such accounts.

WML is doing well, it seizes outbreak of COVID-19 as a business opportunity and registers significant growth in both top and bottom line. For the past many years, WML declare a dividend at a constant rate of 20%. During the financial year 2020-21, WML earns a profit of 580 crores. Board of directors of WML declares 25% dividend without transferring any % to reserve on 15th June, 2021. On 14th July, 2021 some of the amount remaining unpaid, due to operation of law; has been transferred to unpaid dividend account on 20th July, 2021. CA. Dev was appointed as auditor u/s 139 of Companies Act, 2013 of WML in individual capacity during 17th AGM for against the financial year 2020-21. [RTP-Nov. 20]

Question 1.

In case of TML, which of the following statements are correct regarding the declaration of dividend?

(a) TML can’t declare the dividend because it earns a loss in the current financial year.

(b) TML can declare the dividend but only up to 9%.

(c) TML can declare the dividend but only up to 5%.

(d) TML can declare the dividend but only up to 6.8%.

Answer:

(c) TML can declare the dividend but only up to 5%.

Question 2.

CA. Dev, who is the auditor of WML have to vacate the office of the auditor in and can be reappointed again only in.

(a) 22nd AGM and 27th AGM

(b) 27th AGM and 32nd AGM

(c) 22nd AGM and 23rd AGM

(d) 22nd AGM and can’t be reappointed again.

Answer:

(a) 22nd AGM and 27th AGM

Question 3.

In case of WML, which of the following statement is correct regarding the declaration of dividend?

(a) WML can’t declare the dividend at a rate more than 20%.

(b) WML can declare the dividend out of current year’s profit but it needs to transfer sum equal to 20% to reserve first.

(c) WML can declare the dividend out of currentyear’s profit but it needs to transfer sum equal to 10% of paid up share capital to reserve first.

(d) WML can declare the dividend out of current years’ profit without transferring any % to reserve.

Answer:

(d) WML can declare the dividend out of current years’ profit without transferring any % to reserve.

Question 4.

In case of TML, regarding maintenance and keeping the books of account; which of the following statement hold truth?

(a) TML needs to maintain and keep the books of account for 10 preceding financial years, hence TML violate the law.

(b) TML doesn’t violate the provision of law because it keeps the books of account for 8 immediate preceding financial years.

(c) TML violate the provision of law because it keeps the books of account for 8 immediately preceding financial years without keeping relevant vouchers in the record pertaining to such books of account.

(d) TML doesn’t violate the provision of law because it is complying to its Article of Association.

Answer:

(c) TML violate the provision of law because it keeps the books of account for 8 immediately preceding financial years without keeping relevant vouchers in the record pertaining to such books of account.

Question 5.

Regarding declaration and distribution of dividend by WML, which of the following statement is correct from the view of the timeline?

(a) WML violates the law, because some of the dividend remain unpaid; irrespective of reason for non-payment.

(b) WML violates the law, because unpaid dividend need to transfer to unpaid dividend account by 19th July 2021.

(c) WML doesn’t violate the law, because an unpaid dividend transferred to unpaid dividend account prior to 21st July, 2021.

(d) WML doesn’t violate the law, because an unpaid dividend can be transferred to unpaid dividend account at any time within 90 days from the date of declaration.

Answer:

(c) WML doesn’t violate the law, because an unpaid dividend transferred to unpaid dividend account prior to 21st July, 2021.

Integrated Case Study – 8

Mr. Purshottam Prasad, a business graduate from leading B School, running the chain of restaurants; as sole proprietor concern; based in Chennai. Mr. Prasad being dynamic businessman, in order to develop the business; decided to give corporate form to his business; but concerned with dilution of die control over business decisions.

Mr. Prasad, during some Journey met Mr. Chinmay Dass; who is school days friend of Mr. Prasad and presendy working in one of leading corporate advisory firm. Mr. Prasad seeks advice from Mr. Dass, regarding conversion of sole proprietorship concern to company and also explain his intention to keep the entire control in his hand. Mr. Dass told about new type of company; which can be formed under Companies Act, 2013; One Person Company (OPC). Mr. Dass quoted Sec. 2(62), which define ‘one person company’, a company which has only one person as a member.

Mr. Prasad, felt OPC is correct form of business for him, hence promotes an OPC ‘Casa Hangout Private Limited’ (One Person Company) on 14th September, 2021, to which he sold his sole proprietor business and himself became sole member. Mr. Prasad, appointed his younger son Mr. Vijay, who was 21 year old then; as Nominee to OPC. Mr. Anand who is old friend of Mr. Prasad was appointed as director of OPC, Mr. Prasad himself also become director of company.

Mr. Vijay is professional photographer, and for some certification course went to abroad on 23rd October, 2021. He came back on 1st of March, 2022. He established photo-studio in form of OPC ‘Best Click (OPC) Private Limited’ on 20th March, 2022, in which Mr. Prasad is nominee and he became sole member. In mean time, Mr. Vijay also gave his consent as nominee to another OPC in Which his elder brother Mr. Shankar is sole member.

Mr. Prasad met an accident on 25th March, 2022, in which he lost his life. Nomination clause invoked, resultantly Mr. Vijay has to take charge over ‘Casa Hangout (OPC) Private Limited’ (One Person Company) as member with immediate effect. On 30th March, 2022 Mr. Shankar was appointed as new nominee to ‘Casa Hangout (OPC) Private Limited’, who gave written consent on 31st March 2022. Mr, Shankar who is investment banker by profession, is of opinion that ‘Casa Hangout (OPC) Private Limited’ need to amend its object clause and add ‘carry out investment in securities of body corporate’ as one of object.

Financial Period closed on 31st March, 2022. Financial statements of‘Casa Hangout (OPC) Private Limited’, which is not containing cash flow statement; signed by Mr. Anand (who left as only director after death of Mr. Prasad). [RTP-Nov. 20]

Question 1.

With reference to appointment of Mr. Vijay and Mr. Shankar as nominee to ‘Casa Hangout (OPC) Private Limited’, out of followings, who is eligible to be nominee of OPC?

(a) Any natural person excluding minor.

(b) Any legal person excluding minor.

(c) Any natural person, who is resident of India, but excluding minor.

(d) Any natural person, who is resident in India or otherwise as well as citizen of India, but excluding minor.

Answer:

(d) Any natural person, who is resident in India or otherwise as well as citizen of India, but excluding minor.

Question 2.

Mr. Shankar if wish to withdraw his consent as nominee, can do so; by giving written notice to:

(a) Director of OPC and to sole member of company.

(b) Director of OPC and to Registrar of companies.

(c) Sole member of company and to OPC.

(d) Sole member of company and to Registrar of companies.

Answer:

(c) Sole member of company and to OPC.

Question 3.

With reference to legal position of Mr. Vijay as member/s and nominee/s to various OPCs, which of the following statement is correct in reference to ceiling limit in relation to membership and being nominee to OPC? A Derson. other than minor at sneciflc noint of time ___________.

(a) Can be member in any number of OPCs but nominee in one OPC.

(b) Can be member in one OPC and nominee in any number of OPCs.

(c) Can be member in one OPC and nominee in another one OPCs.

(d) Can be member and nominee both in any number of OPCs.

Answer:

(c) Can be member in one OPC and nominee in another one OPCs.

Question 4.

Which of following statement is correct, in reference to requirement for financial Statements of ‘Casa Hangout (OPC) Private Limited’.

(a) Must be signed by one director.

(b) Must be signed by at least by 2 directors.

(c) Must contain cash flow statement as part of financial statements.

(d) None of the above.

Answer:

(a) Must be signed by one director.

Question 5.

With reference to opinion of Mr. Shankar to add ‘carry out investment in securities of body corporate’ object, choose the correct option.

(a) OPC can’t carry out non-banking financial investment activities & investment in securities of body corporate.

(b) OPC can’t carry out non-banking financial investment, but can invest in securities of body corporate.

(c) OPC can carry out non-banking financial investment & invest in securities of body corporate.

(d) None of the above.

Answer:

(a) OPC can’t carry out non-banking financial investment activities & investment in securities of body corporate.

Integrated Case Study – 9

Kaisha Packers and Movers Limited, a reliable and well-established company, was incorporated on 20th September, 2014 with an aim to provide convenient and innovative ways of moving customers’ household items, relocation of businesses and offices, shifting of vehicles, etc. in the northern region. Their services have been professionally designed to ensure maximum customers satisfaction.

The company had been formed by the directors Kashi Sharma, Pranav Chaturvedi, Abhinav Mehra, Anoop Bhargava and Vikash Kumar whose friendship had developed during their college days. Due to hard work and their business acumen, the promoters had successfully created a niche for themselves amid cut-throat competition.

The company has a fleet of over 500 vehicles, 55 branches, professionals and technical and non-technical employees. Over a period of time, Kaisha Packers and Movers has become a trusted brand and prospective customers prefer to engage it whenever they want to relocate their offices or homes since services are provided in a convenient and cost-effective manner.

The authorised capital of the company is ₹ 150 lakhs divided into 15,00,000 equity shares of ₹ 10 each. At the time of incorporation, its paid-up capital was ₹ 1,00,00,000 and there were 50 shareholders. The registered office of the company is situated in Hyden Park, Bangalore.

With a view to provide world-class relocation and moving solutions throughout the country, the directors decided to enlarge the capital base of the company. During the mid of the current financial year, it offered remaining 5,00,000 shares to another 120 persons at a premium of ₹ 10 per share on private placement basis. Among others, Ruchi, a freelance software consultant and her younger sister Rumi, a management consultant in Info Solutions Limited which is well-known company for its high export turnover, were also identified as the prospective subscribers.

However, they requested the company to offer them only the minimum number of shares. Similar requests were also received from another twelve persons. Their requests were given due consideration by the directors. All the identified persons who were offered shares paid the required amount (including premium) as per the terms of the offer. The allotment of the shares was made much before the statutory period.

Immediately after the aforesaid allotment of shares, the company rolled out its expansion plan as envisaged earlier and utilised the funds so obtained for the requisite purpose. However, the company is desirous of tapping more prospective investors by offering them equity shares on private placement basis during the remaining part of the current financial year. For this purpose, it is proposed to increase the authorised capital from the present ₹ 150 lakhs to ₹ 300 lakhs.

In addition to the further allotment of shares on private placement basis, the company is also contemplating to raise deposits from the members. However, Kashi Sharma and Anoop Bhargava are of the opinion that the company should consider raising of deposits only in the next financial year since the funds already raised need to be properly utilized. [MTP-March 21]

Question 1.

According to the case scenario, the company is desirous of raising deposits from its members to augment the funding requirements. In case, the company also contemplates to raise deposits from public in addition to its members, which of the following option is applicable:

(a) In order to raise deposits from public besides members, the company should have net worth of minimum ₹ 100 crores and a turnover of minimum ₹ 500 crores.

(b) In order to raise deposits from public besides members, the company should have net worth of minimum ₹ 150 crores and a turnover of minimum ₹ 250 crores.

(c) In order to raise deposits from public besides members, the company should have net worth of minimum ₹ 150 crores or a turnover of minimum ₹ 750 crores.

(d) In order to raise deposits from public besides members, the company should have net worth of minimum ₹ 100 crores or a turnover of minimum ₹ 500 crores.

Answer:

(d) In order to raise deposits from public besides members, the company should have net worth of minimum ₹ 100 crores or a turnover of minimum ₹ 500 crores.

Question 2.

According to the case scenario, during the mid of the current financial year, the company offered 5,00,000 shares to 120 persons at a premium of ₹ 10 per share on private placement basis. During the remaining part of the current financial year, the company is desirous of tapping more prospective investors by offering them equity shares on private placement basis. How many more such prospective shareholders can be invited by the company for investment in the capital of the company.

(a) The company can offer equity shares maximum up to the 30 prospective shareholders in the remaining part of the current financial year.

(b) The company can offer equity shares maximum up to the 55 prospective shareholders in the remaining part of the current financial year.

(c) The company can offer equity shares maximum up to the 80 prospective shareholders in the remaining part of the current financial year.

(d) The company can offer equity shares maximum up to the 130 prospective shareholders in the remaining part of the current financial year.

Answer:

(c) The company can offer equity shares maximum up to the 80 prospective shareholders in the remaining part of the current financial year.

Question 3.

In the given case scenario, suppose the company has failed to allot the shares within the statutorily allowed period. In such a case, the only remedy available with the company is to refund the application money. State the time period within which the company is required to refund the application money to the subscribers if it has failed to allot the shares within the statutorily allowed period,

(a) The application money must be refunded within 60 days from the expiry of statutorily period allowed within which the allotment of shares ought to have been made.

(b) The application money must be refunded within 45 days from the expiry of statutorily period allowed within which the allotment of shares ought to have been made.

(c) The application money must be refunded within 30 days from the expiry of statutorily period allowed within which the allotment of shares ought to have been made.

(d) The application money must be refunded within 15 days from the expiry of statutorily allowed period within which the allotment of shares ought to have been made.

Answer:

(d) The application money must be refunded within 15 days from the expiry of statutorily allowed period within which the allotment of shares ought to have been made.

Integrated Case Study – 10

Krishnakant Limited was incorporated on 24th September, 2010 under the jurisdiction of Registrar of Companies, Rajasthan with its registered office located in Jaipur and its manufacturing units spread out in Mumbai, Kanpur, Delhi and Ludhiana. Under the dynamic leadership of Hans Rajpal, the Chairman and Managing Director (CMD) of the company, the company had reached new heights of success. The directors of the company numbered 8 including CMD out of which 2 were the independent directors.

The turnover of the company for the Financial Year 2020-21 was ₹ 750 crores – a whopping rise of more than 20% from the previous year and the net profit stood at an impressive figure of ₹ 6.60 crores – an increase of ₹ 1.80 crores as compared to the net profit of the previous year. The company had a net worth of ₹ 250 crores; and it was noticed that the net worth had also registered a northern-western trend by more than 15%.

The authorised and paid-up share capital of the company was ₹ 8 crores. Keeping in view the applicability of forming a CSR Committee for the current financial year 2021-22, a CSR Committee was formed with 4 directors as members of which one was an independent director. The Committee was, among other objectives, given the responsibility of formulating and recommending to the Board, a Corporate Social Responsibility Policy which would indicate the activities to be undertaken by the company within the framework specified in Schedule VII.

As the company has huge profits it has proposed a dividend @ 10% for the year 2020-21 out of the profits of current year.

The company plans to diversify its business by adding another segment to manufacture steel utensils and therefore, is desirous of shifting its registered office to Mumbai from Jaipur which will help the company in carrying on the new business for effectively. Another strategically important segment which the company tapped earlier and now wishes to engage itself in on a large scale relates to manufacturing of stationery items.

During the current Financial Year 2021-22, the company provided ample support for improvement of infrastructure in schools established at Mumbai, Kanpur, Delhi and Ludhiana as part of its CSR activities. In addition, the company contributed towards establishment of Digital Smart Classroom, Libraries and computer labs in these cities.

The company also deployed mobile medical units equipped with medical facilities and qualified doctors. In addition to this a large number of public health and sanitation activities had been initiated under Swachh Bharat Abhiyan. The total amount spent on these activities was, till date, almost equal to the minimum amount prescribed and it is hoped that as the current Financial Year 2021-22 approaches its end, the total spending on CSR activities will certainly exceed the budgeted figure. [MTP-March 21]

Question 1.

Which of the following factors would have prompted Krishnakant Limited to mandatorily form a Corporate Social Responsibility (CSR) Committee for the current financial year?

(a) The net profit had increased to ₹ 6.60 crores and it was more by ₹ 1.80 crores in comparison to previous year’s net profit.

(b) The turnover was ₹ 750 crores which was an increase of more than 20% as compared to the previous year.

(c) The net worth was ₹ 250 crores which when compared to the previous year had registered an increase by more than 15%.

(d) The paid-up share capital was ₹ 8 crores.

Answer:

(a) The net profit had increased to ₹ 6.60 crores and it was more by ₹ 1.80 crores in comparison to previous year’s net profit.

Question 2.

What is the minimum amount (in percentage) that Krishnakant Limited is required to spend during the Financial Year 2021-22 on the CSR activities?

(a) 2% of the average net profits made during the 2 immediately preceding financial years.

(b) 2% of the average net profits made during the 3 immediately preceding financial years.

(c) 2.5% of the average net profits made during the 2 immediately preceding financial years.

(d) 2.5% of the average net profits made during the 3 immediately preceding financial years.

Answer:

(b) 2% of the average net profits made during the 3 immediately preceding financial years.

Question 3.

In the given case scenario, Krishnakant Limited decided to undertake CSR activities on its own. In case, it had decided to engage an external Sec. 8 company for undertaking its CSR activities and such charitable company is not established by Krishnakant Limited nor it is established by the Central/State Government or by any entity established under an Act of Parliament or a State Legislature, then what should be the established track which this Sec. 8 company should have in undertaking similar programs or projects which Krishnakant Limited wants it to accomplish?

(a) Track record of minimum 1 year.

(b) Track record of minimum 2 years.

(c) Track record of minimum 3 years.

(d) Track record of minimum 4 years.

Answer:

(c) Track record of minimum 3 years.

Integrated Case Study – 11

Sehzad Colour Limited (SCL) was incorporated on 12th August, 2021 with its registered office situated in Dehradun and branch offices at Delhi and Jaipur. The company was engaged in the business of manufacturing herbal products used as cosmetics. The company had prepared its “books of account” and other relevant books and records and financial statements for the year ending on 31st March, 2022.

The company maintains its books of account on a double entry system of accounting on an accrual basis and keeps the books of account and other relevant books and papers and financialstatements in the city of Jaipur in Rajasthan, which happens to be its major branch office.

Gradually, the activities of the company grew and it opened its first branch office outside India in Colombo, Sri Lanka. The business started developing well and necessary records and documents including the books of account of the branch were maintained. One of the Directors, Mr. Mac, felt it necessary to inspect the books of account and other relevant documents maintained at Colombo branch. However, due to his busy schedule, he could not personally inspect the records and accordingly sought necessary financial information through his attorney holder.

The board of directors of the company had entrusted Ms. Anjali, the General Manager of the Company to fulfil all (he duty with regard to the complying with the provisions of the company law in relation to maintaining the books of account; place of keeping the books of account, time period for preservation of books and all relevant papers and sucb things as prescribed under the Companies Act, 2013 in this regard.

In view of the aforesaid scenario relating to “books of account” of SCL, answer the following questions: [MTP-April 21]

Question 1.

As observed in the case scenario above, Mr. Mac (a director) has sought financial information maintained outside the country (i.e. financial information relating to books of account maintained in Colombo). Can a director do so under the provisions of the Companies Act, 2013?

(a) A director can inspect and seek information from any Branch of the Company located within the country only.

(b) The director can seek the information through his attorney holder with respect to financial information maintained outside the country also.

(c) The director can seek the information only individually and not through his attorney holder with respect to financial information maintained outside the country.

(d) The director can seek the information through his representative with respect to financial information maintained outside the country.

Answer:

(c) The director can seek the information only individually and not through his attorney holder with respect to financial information maintained outside the country.

Question 2.

With regard to preservation of the books of SCL, the books of account for the FY 2021-22 needs to be kept in good order until at least which of the following years?

(a) FY 2028-29

(b) FY 2029-30

(c) FY 2030-31

(d) FY 2031-32

Answer:

(b) FY 2029-30

Question 3.

The board of directors of the company had entrusted Ms. Anjali, the General Manager of the Company to fulfil all the duly with regard to complying with the provisions of the company law in relation to maintaining the books of account Which of the statement is correct with respect to entrusting Ms. Anjali for maintaining the books?

(a) Only the Managing Director can be entrusted to take all reasonable steps to secure compliance by the company with the requirement of maintenance of books of account, etc.

(b) Only the Managing Director or any Whole time director can be entrusted to take all reasonable steps to secure compliance by the company with the requirement of maintenance of books of account etc.

(c) Only Whole time director (in charge of finance) or Chief Financial Officer can be entrusted to take all reasonable steps to secure compliance by the company with the requirement of maintenance of books of account etc.

(d) Only the Managing Director or the Whole time director (in charge of finance) or Chief Financial Officer or any other person of a company charged by the Board with the duty can be entrusted to take all reasonable steps to secure compliance by the company with the requirement of maintenance of books of account etc.

Answer:

(d) Only the Managing Director or the Whole time director (in charge of finance) or Chief Financial Officer or any other person of a company charged by the Board with the duty can be entrusted to take all reasonable steps to secure compliance by the company with the requirement of maintenance of books of account etc.

Integrated Case Study -12

Mr. Anay, a business graduate from a leading B-School, has been running a chain of restaurants as a sole proprietor concern. The business is based in Chennai. Mr. Anay, in order to develop the business decided to corporatize his business but he is concerned with dilution of his control over business decisions.

Mr. Anay, during a journey met Mr. D’souza, one of his old school friends. Mr. D’souza is presently working in one of leading corporate advisory firms. Mr. Anay seeks advice horn Mr. D’souza, regarding conversion of sole proprietorship concern to company and also explain his intention to keep the entire control in his hand. Mr. D’souza informed Mr. Anay, about a new type of company, called One Person Company (OPC), which can be formed under Companies Act, 2013. Mr. Dsouza quoted Sec 2(62), which defines ‘one person company’ as a company which has only one person as a member.

Mr. Anay felt OPC is correct form of business for him, hence he promoted an OPC ‘Casa Hangout Private Limited’ (One Person Company) on 14th September, 2021, to which he sold his sole proprietory business and became the sole member. Mr. Anay, appointed his younger son Mr. Amar, who was 21 year old then, as Nominee to OPC. Mr. Anand who is a famous food blogger and old friend of Mr. Anay was appointed as director of OPC, Mr. Anay himself also become director of company.

Mr. Amar is a professional photographer, and went abroad for a certification course on 23rd October, 2021. He came back on 1st of March, 2022. He established a photo-studio as an OPC called ‘Best Click Private Limited’ (One Person Company) on 20th March, 2022, in which Mr. Anay is nominee and he became sole member. In the mean time, Mr. Amar also gave his consent as nominee to another OPC in which his elder brother Mr. Shankar is sole member.

Mr. Anay met with an accident on 25th March, 2022, in which he lost his life. Nomination clause was invoked, as a result Mr. Amar has to take charge over ‘Casa Hangout Private Limited’ (One Person Company) as member with immediate effect. On 30th March, 2022 Mr. Shankar was appointed as a new nominee to ‘Casa Hangout Private Limited’ (One Person Company), who gave written consent on 31st March, 2022. Mr. Shankar who is an investment banker by profession, is of the opinion that ‘Casa Hangout Private Limited’ (One Person Company) needs to amend its object clause and add ‘carry out investment in securities of body corporate’ as one of the objects.

The Financial year closed on 31st March, 2022. Financial statements of’Casa Hangout Private Limited’ (One Person Company), which is not containing cash flow statements were signed by Mr. Anand who left as only director after death of Mr. Anay. [MTP-April 21]

Question 1.

With reference to appointment of Mr. Amar and Mr. Shankar as nominee to ‘Casa Hangout Private Limited (One Person Company)’, out of followings, who is eligible to be nominee of OPC?

(a) Any natural person excluding minor.

(b) Any legal person excluding minor.

(c) Any natural person, who is resident of India, but excluding minor.

(d) Any natural person, who is resident in India or otherwise as well as citizen of India, but excluding minor.

Answer:

(d) Any natural person, who is resident in India or otherwise as well as citizen of India, but excluding minor.

Question 2.

Mr. Shankar if he wishes to withdraw his consent as nominee, can do so by giving written notice to ___________.

(a) Director of 0PC and to sole member of company.

(b) Director of OPC and to Registrar of companies.

(c) Sole member of company and to OPC.

(d) Sole member of company and to Registrar of companies.

Answer:

(c) Sole member of company and to OPC.

Question 3.

With reference to legal position of Mr. Amar as member/s and nominee/s to various OPCs, which of the following statement is correct with reference to ceiling limit in relation to membership and being nominee to OPC? A person, other than minor at specific point of time ________.

(a) can be member in any number of OPCs but nominee in one OPC.

(b) can be member in one OPC and nominee in any number of OPCs.

(c) can be member in one OPC and nominee in another one OPC.

(d) can be member and nominee both in any number of OPCs.

Answer:

(c) can be member in one OPC and nominee in another one OPC.

Integrated Case Study – 13

Mr, Ajay is a renowned finance professional with wide experience in banking operations. Due to his experience, he has been appointed as director on the Board of various companies. He is working as the Executive Director – Finance of Doon Carbonates Limited (DCL) for Hie past 4-5 years and heading the finance department there.

As per the object clause of the Memorandum of Association of DCL, it can raise funds by way of loans for the advancement of its business. Articles of Association of DCL authorizes the directors to borrow up to 50 lakhs on behalf of the company after passing a valid board resolution and any loans for amounts exceeding the above limit can be raised only after approval at a general meeting.

Board of Directors of DCL raised f 80 lakhs from Srikant Finance Services after passing a board resolution and out of this amount, ₹ 60 lakhs was used to pay a legitimate liability of DCL by the directors. DCL is a widely held company with around 5,600 members as per the members register. The 21st AGM of DCL is convened on 1st September, 2021. A total of 34 members attended the meeting out of which 7 members attended through proxy. 6 of such members are represented by single proxy, Mr, Das. The articles of DCL is silent about the quorum.

Mr. Ajay is also director of Padmani Silk Limited (PSL). PSL was established around 25 years back as a private company operating as a micro business with 10 employees in a three room building. During these years, the company grew exceptionally and went public and was also listed on SME exchange. PSL declares the interim dividend out of Die previous year’s undistributed profit on 31st August, 2021 on the occasion of the 25th anniversary of the company. PSL deposited the amount of said dividend in a separate bank account with a NBFC on 4th of September, 2021.

Mr. Ajay hails from a farming family and carries on the business of cultivation and milling of paddy. He is also the sole member of New-Deal Limited (NDL), a one person company. NDL is operated as rice shelter and also deals in trading of high quality basmati rice. Mr. Ajay’s father is operating as a nominee for the purposes of this OPC.

The accounts department of NDL prepared and published only Profit and Loss Account and Balance Sheet as a financial statement and did not prepare cash flow statements and explanatory notes to accounts. A statement of changes in equity is not required in the case of NDL. [RTP-May 21]

Question 1.

Regarding compliance for declaration and distribution of Interim dividend by PSL, which of the following statement is correct?

(a) There is a violation of the provisions because interim dividend can only be declared out of current year’s profits.

(b) There is no violation at all, and all the provisions prescribed by law have been complied with.

(c) There is a violation because the bank account shall be designated and shall be one of existing banks account of company.

(d) There is a violation because the bank account shall be opened with scheduled banks only.

Answer:

(d) There is a violation because the bank account shall be opened with scheduled banks only.

Question 2.

Which of the following statement is correct, with reference to the requirement for financial Statements of’New Deal limited’ (One Person Company}?

(a) NDL fails to meet the requirement because its financial statement do not include explanatory notes to accounts.

(b) NDL fails to meet the requirement because its financial statements do not include cash flow statement.

(c) NDL fails to meet the requirement because its financial statements do not include explanatory notes to account and cash flow statement.

(d) NDL has complied with the requirements related to financial statements.

Answer:

(a) NDL fails to meet the requirement because its financial statement do not include explanatory notes to accounts.

Question 3.

The borrowing of the sum of ₹ 80 lakhs bv the directors of DCL is ___________.

(a) Void ab initio

(b) Void

(c) Voidable

(d) Valid

Answer:

(c) Voidable

Question 4.

Regarding the validity of the 21st Annual General Meeting of DCL, which of the following statement is correct?

(a) The meeting doesn’t have a quorum, because 30 members need to be present in person at the meeting.

(b) The meeting is valid and has a quorum because 30 members are present at meeting either personally or through a proxy.

(c) The meeting is valid and has a quorum, because only 5 members are required to be present, either personally or through a proxy, if the number of members as on the date of the meeting is more than 5,000 but not more than 10,000.

(d) The meeting is valid and has a quorum, because only 15 members are required to be present, either personally or through a proxy, if the number of members as on the date of the meeting is more than 5,000 but not more than 10,000.

Answer:

(a) The meeting doesn’t have a quorum, because 30 members need to be present in person at the meeting.

Integrated Case Study – 14

Mr. M. Mishra is a director of Superior Carbonates and Chemicals Limited [SCCL}, SCCL was incorporated by Mr. S. K. Mishra (father of Mr. M. Mishra) on 5th July, 1995 as a public company. SCCL accepts a loan of ₹ 1.5 crores from Mr. M. Mishra for short-term purpose and the loan is expected to be repaid after 24 months.

SCCL in its books of account, records the receipt as a loan under non-current liabilities. At the time of advancing loan, Mr. M. Mishra affirms in writing that such amount is not being given out of funds acquired by him by borrowing or accepting loans or deposits from others and complete details of his loan transactions are furnished in the boards’ report.

DBSL which is an unlisted public company, also accept the deposits from the public as on 1st November, 2019, which is due for repayment on 30th September, 2024. DBSL also accepts a LAP (Loan against property) for a term of 10 years from a financial institution on 18th June, 2021. Charge was created on that day, but DBSL has neglected to register the charge with the registrar. Finally, the application for registration of charge is furnished on 18th August, 2021.

SCCL has registered office in Paonta-sahib (Himachal Pradesh) and corporate office is situated in Dehradun (Uttarakhand) but around 15% of members whose name is entered in members register are residents of Nainital (Uttarakhand). SCCL has a liaison Office at Nainital. Management of the company is willing to place the Register of Members at the Nainital Liaison Office.

DBSL convene its 7th AGM on 10th September, 2021 at the registered office of the company. Notice for same was served on 21st August, 2021. 78% of members gave consent to convening AGM at shorter notice due to ambiguity and possibility of another lockdown starting from 11th September, 2021 on account of COVID-19. [RTP-May 21]

Question 1.

Pick the right statement regarding SCCL’s willingness to keep and maintain the register of members at the Nainital liaison office.

(a) Register of members shall be kept at either registered office or within the same city that too after passing the resolution, hence SCCL is not correct in placing it at the Nainital liaison office.

(b) Register of members cannot be kept at any other place by SCCL, without passing an ordinary resolution.

(c) Register of members can be kept at Nainital liaison office, after passing a special resolution, because more than 1/10th of the total members entered in the register of members reside there.

(d) Register of members cannot be kept at Nainital liaison office, even after passing a special resolution, because less than 1/5th of the total members entered in the register of members reside there.

Answer:

(c) Register of members can be kept at Nainital liaison office, after passing a special resolution, because more than 1/10th of the total members entered in the register of members reside there.

Question 2.

With reference to deposit accepted by DBSL and its duration, you are required to identify which of the following statement is correct:

(a) There is no requirement relating to the duration of deposit, DBSL can accept a deposit for any duration.

(b) Since DBSL is an unlisted company, provision relating to the duration of the deposit is not applicable.

(c) There is a provision of a minimum duration of six months, but no upper cap to length is provided. Hence deposit accepted by DBSL is in compliance to provisions of Law.

(d) Acceptance of deposits by DBSL is in violation of provision of law, because the maximum period of acceptance of deposit cannot exceed 36 months.

Answer:

(d) Acceptance of deposits by DBSL is in violation of provision of law, because the maximum period of acceptance of deposit cannot exceed 36 months.

Question 3.

With reference to application to the registrar for registration of charge by DBSL, which of the following statement is correct?

(a) The charge cannot be registered now, even if the Registrar permits the same.

(b) The charge can be registered, if registrar permits with payment of ad valorem fee.

(c) The charge can be registered, if registrar permits but with payment of an additional fee.

(d) The charge can be registered, with payment of a standard fee.

Answer:

(b) The charge can be registered, if registrar permits with payment of ad valorem fee.

Question 4.

With reference to the loan advanced by Mr. M. Mishra to SCCL, state whether the same is to be classified as a deposit or not?

(a) Deposit, because any sum advanced by the director whether loan or otherwise is always classified as a deposit.

(b) Deposit, because the tenor of the loan is for a period of more than six months.

(c) Not a deposit, because such amount is recorded as loan in books of account of SCCL.

(d) Not a deposit, because the written declaration is provided by Mr. M. Mishra, who was a director when the loan was advanced that the loan is not being given out of funds acquired by him by borrowing or accepting loans or deposits from others.

Answer:

(d) Not a deposit, because the written declaration is provided by Mr. M. Mishra, who was a director when the loan was advanced that the loan is not being given out of funds acquired by him by borrowing or accepting loans or deposits from others.

Question 5.

Considering the provision relating to length of Notice for AGM, pick out the right option:

(a) Notice served by DBSL is not valid, because notice given within a shorter duration has to be consented to by all the members entitled to vote at AGM.

(b) Notice served by DBSL is not valid, because notice given within a shorter duration has to be consented to by at-least 95% of members entitled to vote thereat.

(c) Notice served by DBSL is valid because the shorter length has been consented to by 75% of members entitled to vote thereat.

(d) Notice served by DBSL is not valid, because notice given within a shorter length duration needs has to by at-least 50% of the members entitled to vote at AGM that too in writing.

Answer:

(b) Notice served by DBSL is not valid, because notice given within a shorter duration has to be consented to by at-least 95% of members entitled to vote thereat.

Integrated Case Study – 15

Ramesh started a new venture of on-line business of supply of grocery items at the doorstep of consumers. Initially it was having the area of operations of Jaipur City only. He employed some young boys having their own bikes and allocated the areas which they were accustomed of it, for making delivery of the grocery items as per their orders.

He also got developed a website and Mobile App to receive the orders on-line. His friend Sudhanshu who is a Chartered Accountant, suggested him to corporatize this business form, from proprietorship business to a One Person Company (OPC). Ramesh agreed and a OPC was incorporated in the name of “Ask Ramesh 4 Online Grocery (OPC) Pvt Ltd.” (for short OPC-1). In this OPC Ramesh became the member and director and Sudha (the mother of Ramesh) was made as nominee.

After a year Ramesh got married with Rachna. Since the business of on-line supply of grocery was on rising trend, day by day, he thought to start a new business of supply of Milk and Milk Products and another OPC in the name of “Rachna Milk Products (OPC) Pvt Ltd.” (for short OPC-2) was incorporated with the help of his professional friend Sudhanshu. In this OPC-2, Rachna (his wife) became the member and director and Ramesh was named as Nominee. To summarise the position, the information is tabulated as under:

| Name of OPC |

Ask Ramesh 4 Online Groceiy (OPC) Pvl. I.td. [OPC-1] |

Rachna Milk Products (OPC) Pvt Ltd. [OPC-2] |

| Member and Director |

Ramesh |

Rachna |

| Nominee |

Sudha (Mother of Ramesh) |

Ramesh (Husband of Rachna) |

After some time, Sudha (the mother of Ramesh) passed away. However, before the death, Sudha had made a WILL, in which she mentioned that after her demise, her another son Suresh be made nominee in the OPC-1. When Suresh came to know this fact, he argued with Ramesh to fulfil the wish of Sudha as per her WILL (Mother of Ramesh and Suresh), but Ramesh denied this and appointed Rachna (his wife) as nominee.

Aggrieved from the decision of Ramesh for not nominating him (Suresh), Suresh threatened Ramesh to take appropriate legal action against him for not honouring the WILL of mother Sudha and consulted his lawyer. Meanwhile due to continuous threatening and hot talks between Suresh and Ramesh, Rachna became mentally upset and became insane, as certified by the medical doctor, so lost her capacity to contract, in this situation, Ramesh being the nominee in OPC-2 became member and director of this OPC-2.

One of the friends of Ramesh advised him to do some charitable work of providing free education to the girl children of his native village near by Jaipur. Ramesh thought about this proposal and asked his professional friend Sudhanshu to convert this OPC-2 into Sec. 8 company.

Based on the above facts, answer the following MCQs: [RTP-Nov. 21]

Question 1.

Since Rachna, being insane, lost the capacity to contract, Ramesh (who was nominee) became the member of OPC-2. Now who will make nomination for this OPC:

(a) Ramesh in the capacity of husband of Rachna can nominate any person as Nominee of OPC-2.

(b) Ramesh (who was nominee) of OPC-2 has now become member of this OPC and now as a member of this OPC he can nominate any person as per his choice as Nominee for this OPC.

(c) When no person is nominated, the Central Govt, will make nomination of such OPC-2.

(d) When no person is nominated the Registrar shall order the company to be wound-up.

Answer:

(b) Ramesh (who was nominee) of OPC-2 has now become member of this OPC and now as a member of this OPC he can nominate any person as per his choice as Nominee for this OPC.

Question 2.

Whether conversion of OPC-2 into a company governed by Sec. 8 is permissible?

(a) Yes, OPC can be converted into Sec. 8 company.

(b) No, OPC cannot be converted into Sec. 8 company.

(c) This OPC-2 can be converted into Sec. 8 company, provided the Central Govt, give license.

(d) Providing of free education to girl child do not come under the specified objects mentioned for eligibility incorporation of Sec. 8 company.

Answer:

(b) No, OPC cannot be converted into Sec. 8 company.

Question 3.

Ramesh is a member in OPC-1 and became a member in another OPC-2 (on 2nd April, 2021) by virtue of his being a nominee in that OPC-2, Ramesh shall, by whac date, meet the eligibility criteria that an individual can be a member in only one OPC:

(a) 17th May 2021.

(b) 25th August 2021.

(c) 26th August 2021.

(d) 29th September 2021.

Answer:

(d) 29th September 2021.

Question 4.

After the demise of Sudha (the mother of Ramesh), Rachna was nominated by Ramesh for OPC-1 as Nominee. But now Rachna has become insane, so what recourse you will suggest to Ramesh.

(a) Ramesh is required to nominate another person as nominee.

(b) Ramesh should wait till Rachna becomes good of her health and able to have the capacity to contract.

(c) Although Rachna has become insane, but if she is able to sign, her nomination in OPC-1 may continue.

(d) Sudhanshu (the Chartered Accountant) who helped in incorporation of OPC-1, may act as legal consultant on behalf of Rachna.

Answer:

(a) Ramesh is required to nominate another person as nominee.

Integrated Case Study – 16

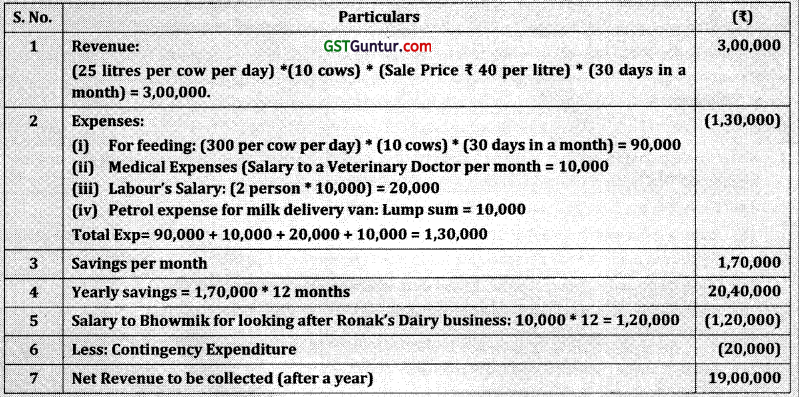

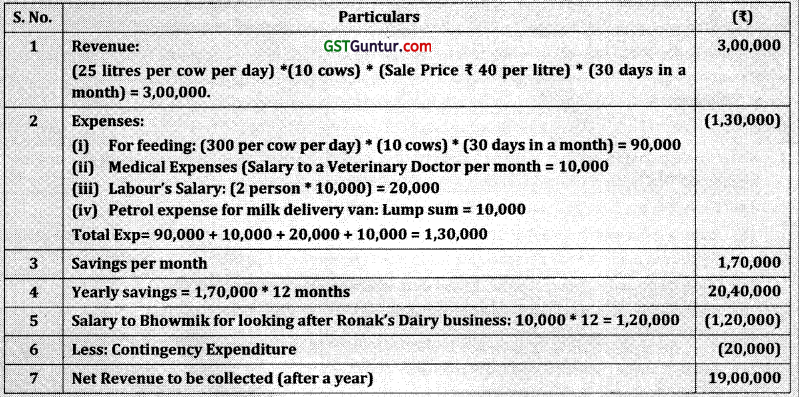

Ronak and Bhowmik are brothers and they are engaged in the business of dairy. Ronak is having 10 cows. The monthly revenue and expenses of the cows is tabulated as under: