Amalgamation of Companies – Advanced Accounts CA Inter Study Material

Amalgamation of Companies – CA Inter Advanced Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Amalgamation of Companies – CA Inter Advanced Accounting Study Material

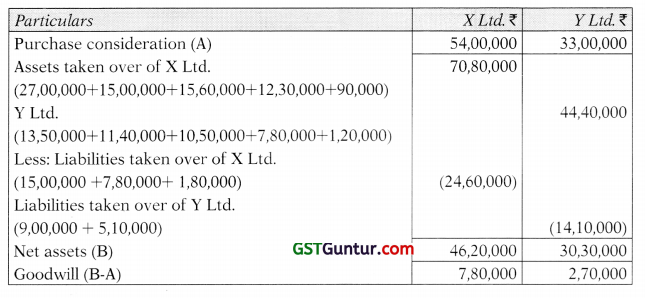

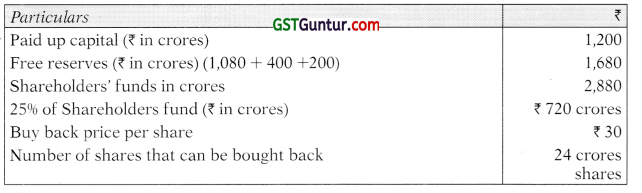

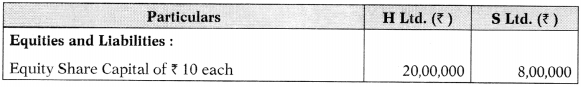

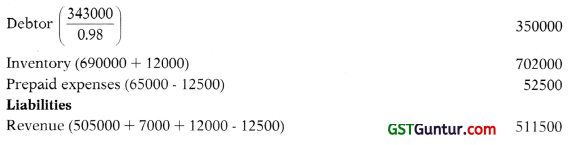

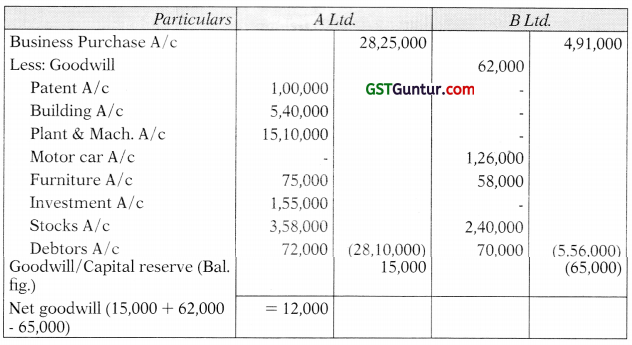

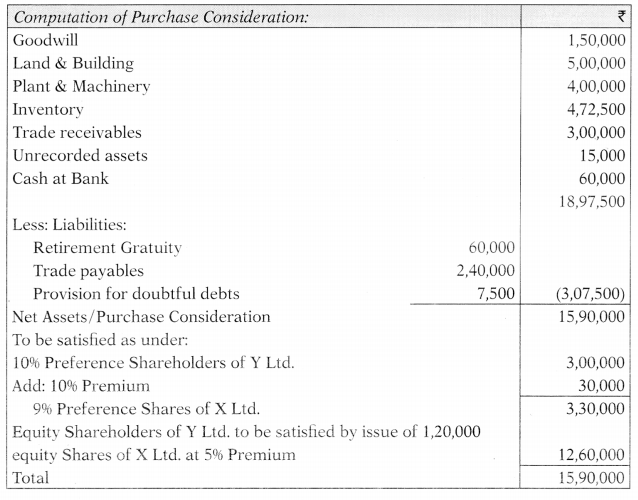

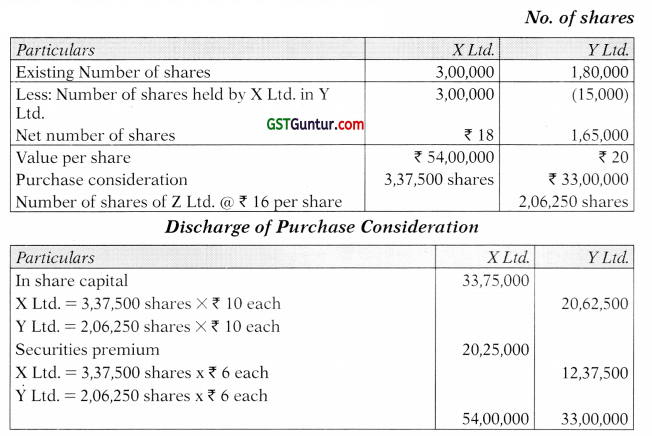

Computation of Purchase Consideration

Question 1.

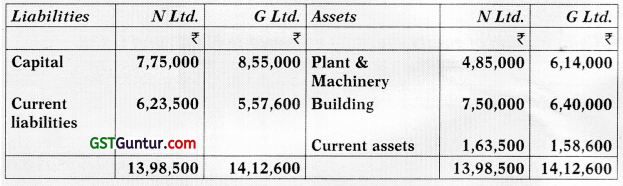

N Ltd. and G Ltd. amalgamated to form a new company on 1.04.20X1 Following is the Draft Balance Sheet of N Ltd. and G Ltd. as at 31.3.20X1:

Following are the additional information:

- The authorised capital of the new company will be ₹ 25,00,000 divided into 1,00,000 equity shares of ₹ 25 each.

- Liabilities of N Ltd. includes ₹ 50,000 due to G Ltd. for the purchases made. G Ltd. made a profit of 20% on sale to N Ltd.

- N Ltd. had purchased goods costing ₹ 10,000 from G Ltd. All these goods are included in the current asset of N Ltd. as at 31st March, 20X1.

- The assets of N Ltd. and G Ltd. are to be revalued as under:

- The purchase consideration is to be discharged as under:

(a) Issue 24,000 equity shares of ₹ 25 each fully paid up in the pro-portion of their profitability in the preceding 2 years.

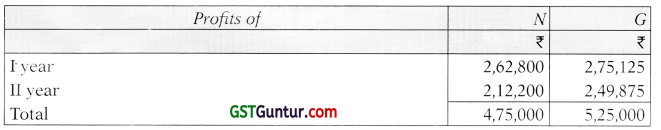

(b) Profits for the preceding 2 years are given below:

(c) Issue 12% preference shares of ₹ 10 each fully paid up at par to provide income equivalent to 8% return on net assets in the business as on 31.3.20X1 after revaluation of assets of N Ltd. and G Ltd. respectively.

You are required to compute the

-

- equity and preference shares issued to N Ltd. and G Ltd.

- Purchase consideration.

Answer:

(i) Computation of equity shares to he issued to NLtd. and G Ltd.

No. of shares to be issued = 24,000 equity shares in the proportion of the preceding 2 years’ profitability

Computation of 12% Preference shares to be issued to NLtd. and G Ltd.

(ii) Computation of Purchase Consideration

Working Note:

Calculation of Net assets as on 31.3.20X1

![]()

Question 2.

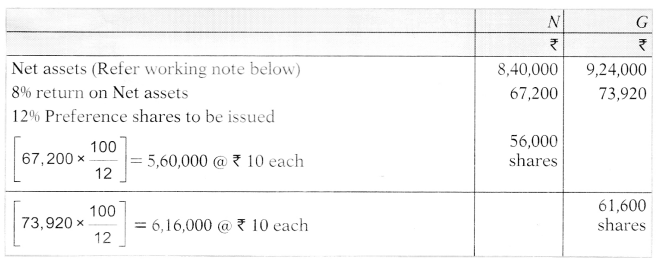

A Ltd. is absorbed by S Ltd.; the consideration being the takeover of liabilities, the payment of cost of absorption not exceeding ₹ 10,000 (actual cost ₹ 9,000); the payment of the 9% debentures of ₹ 50,000 at a premium of 20% in form of 8% debentures issued at a premium of 25% at face value and the payment of ₹ 15 per share in cash and allotment of three 11% preference share of ₹ 10 each at a discount of 10% and four equity share of ₹ 10 each at a premium of 20% fully paid for every five shares in A Ltd. The number of shares of the vendor company are 1,50,000 of ₹ 10 each fully paid.

Calculate purchase consideration as per Accounting Standard 14.

Answer:

Computation of Purchase Consideration

Question 3.

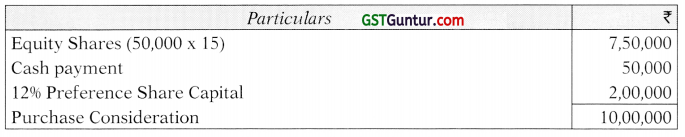

On 1st April, 2018, Tina Lid. takeover the business of Rina Ltd. and discharged purchase consideration as follows:

- Issued 50,000 fully paid Equity shares of ₹ 10 each at a premium of ₹ 5 per share to the equity shareholders of Rina Ltd.

- Cash payment of ₹ 50,000 was made to equity shareholders of Rina Ltd.

- Issued 2,000 fully paid 12% Preference shares of ₹ 100 each at par to discharge the preference shareholders of Rina Ltd.

- Debentures of Rina Ltd. 20,000 will he converted into equal number and amount of 10% debentures of Tina Ltd.

Calculate the amount of Purchase consideration as per AS-14 and pass Journal Entry relating to discharge of purchase consideration in the books of Tina Ltd. (November 2018 – New Course) (5 Marks)

Answer:

Computation of Purchase Consideration

Journal Etitry (in the books of Tina Ltd.)

![]()

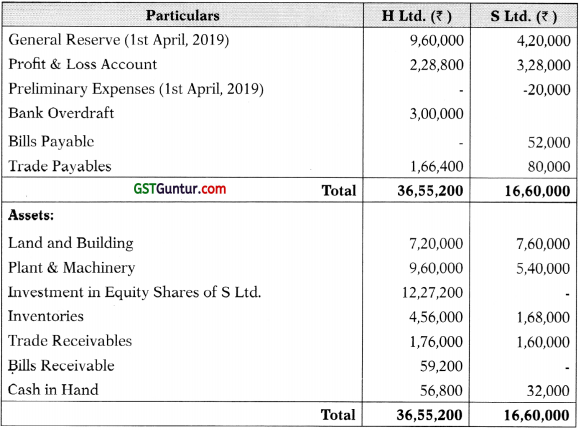

Simple Problems – Merger

Question 4.

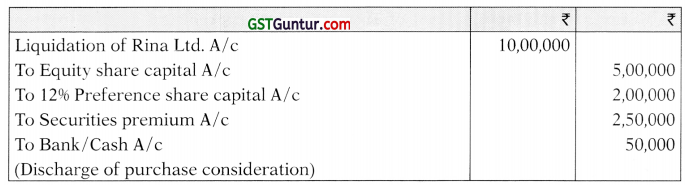

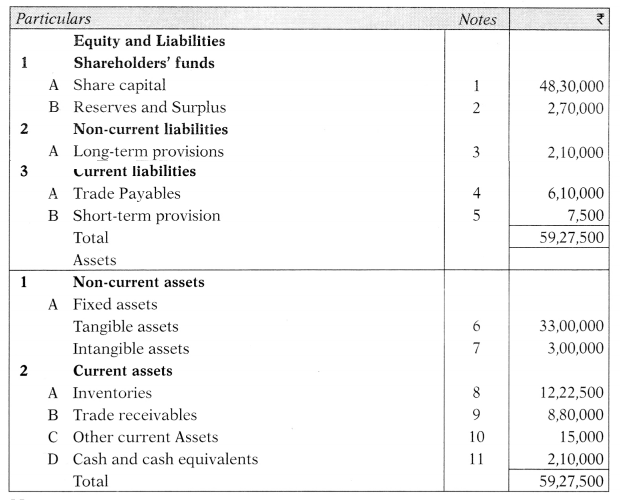

Super Express Ltd. and Fast Express Ltd. were in competing business. They decided to form a new company named Super Fast Express Ltd. The summarized balance sheets of both the companies were as under:

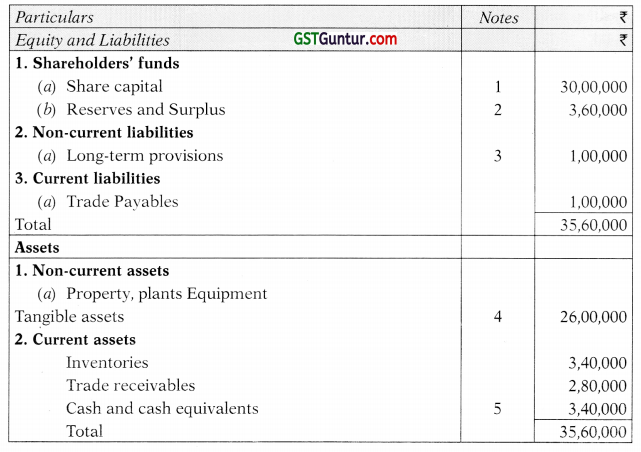

Super Express Ltd. Balance Sheet as at 31st December, 20X1

Fast Express Ltd.

Balance Sheet as at 31st December, 20X1

The assets and liabilities of both the companies were taken over by the new company at their book values. The companies were allotted equity shares of ₹ 100 each in lieu of purchase consideration amounting to ₹ 30,000 (20,000 for Super Fast Express Ltd. and 10,000 for Fast Express Ltd.).

Prepare opening balance sheet of Super Fast Express Ltd. considering pooling method.

Answer:

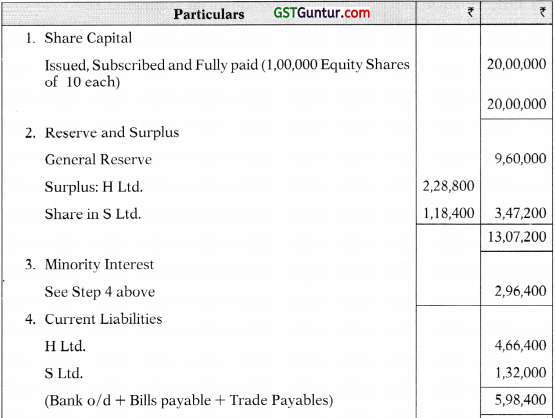

Balance Sheet of Super Fast Express Ltd.

as at 1st Jan., 20X2

Notes to accounts

![]()

Question 5.

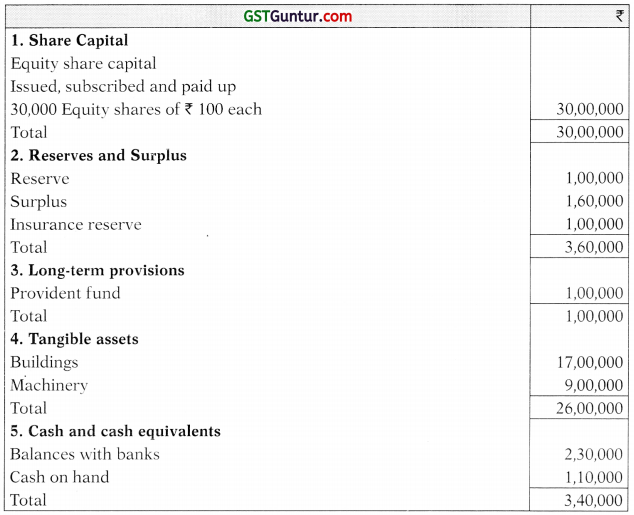

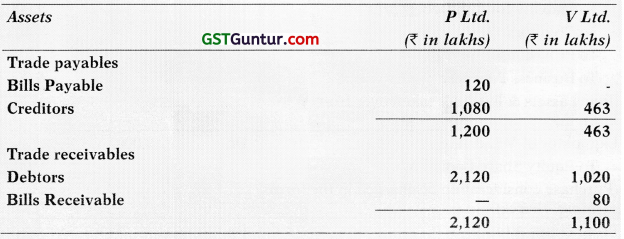

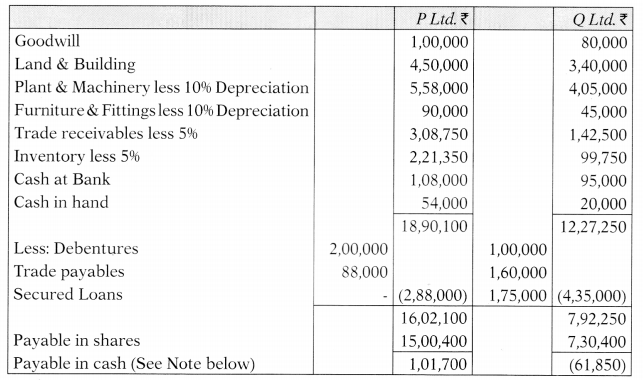

The following were the summarized Balance Sheets of P Ltd. and V Ltd. as at 31-3-20X1:

All the bills receivable held by V Ltd. were P Ltd.’s acceptances.

On 1st April 20X1, P Ltd. took over V Ltd. in an amalgamation in the nature of merger. It was agreed that in discharge of consideration for the business P Ltd. would allot three fully paid equity shares of ₹ 10 each at par for every two shares held in V Ltd. It was also agreed that 12% debentures in V Ltd. would be converted into 13% debentures in P Ltd. of the same amount and denomination.

Details of trade receivables and trade payables as under:

Expenses of amalgamation amounting to ₹ 1 lakh were borne by P Ltd. You are required to:

(i) Pass journal entries in the books of P Ltd. and

(ii) Prepare P Ltd.’s Balance Sheet ini mediately after the merger considering that the cost of issue of dehentures shown in the balance sheet of the V Ltd. company is 1101 transferred to the P Ltd. company.

Answer:

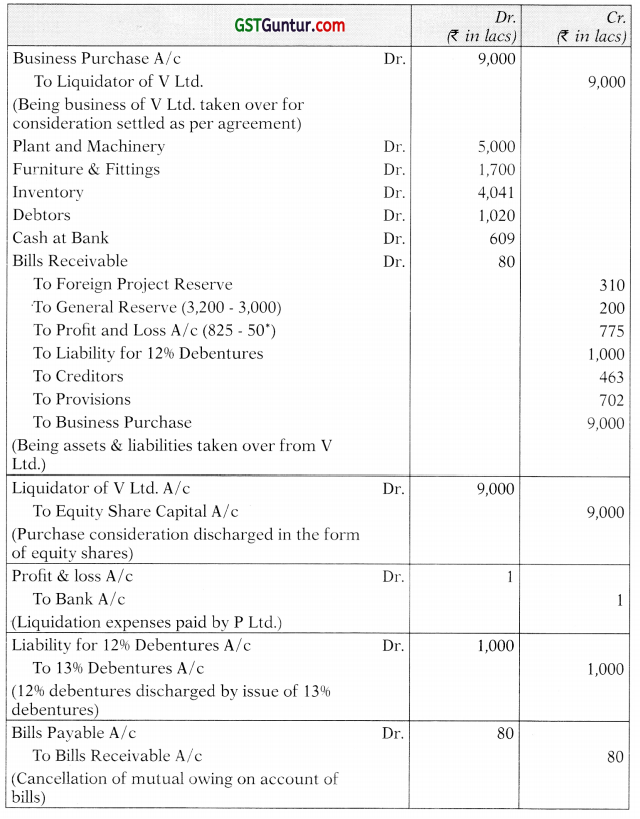

Books of P Ltd. Journal Entries

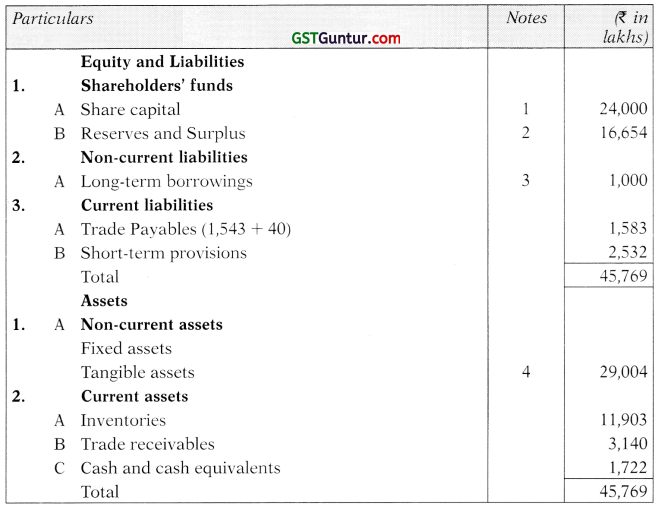

Balance Sheet of P Ltd. as at 1st April, 20X1 (after merger)

Notes to accounts

Computation of purchase consideration :

The purchase consideration was discharged in the form of three equity shares of P Ltd. for every two equity shares held in V Ltd.

Purchase consideration = ₹ 6,000 lacs × \(\frac{3}{2}\) = ₹ 9,000 lacs.

* Cost of issue of debenture adjusted against P & L Account of V Ltd.

![]()

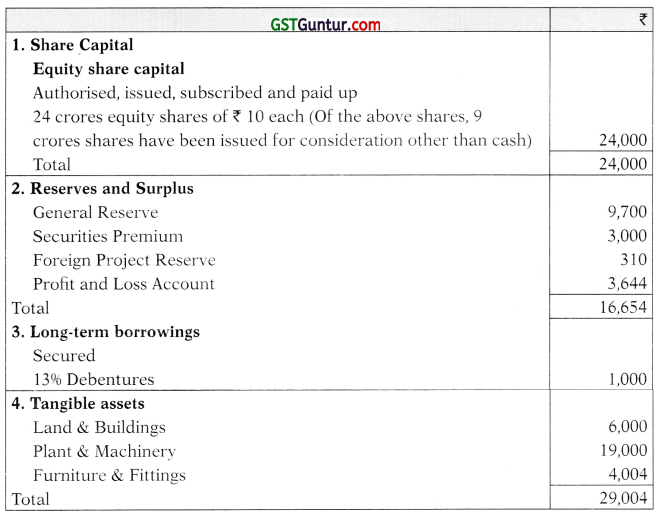

Advanced Problems – Merger

Question 6.

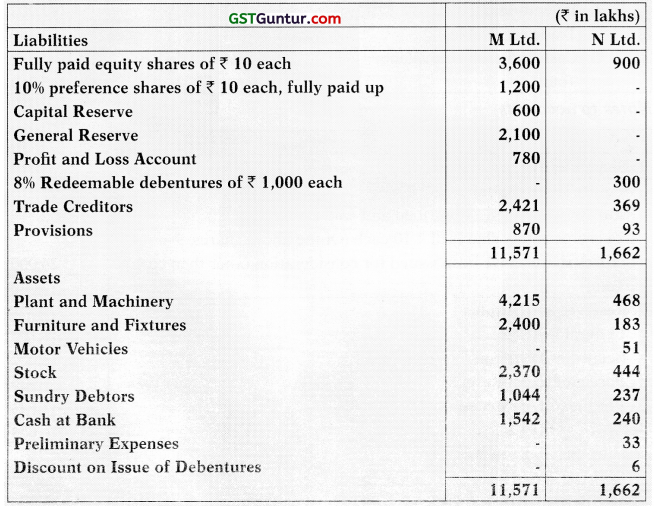

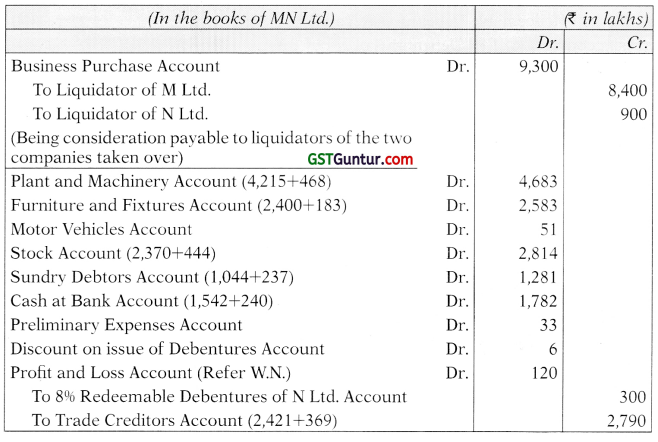

The following are the Balance Sheets of M Ltd. and N Ltd. as at 31st March, 2009:

A new Company MN Ltd. was incorporated with an authorised capital of ₹ 15,000 lakhs divided into shares of ₹ 10 each. For the purpose of amalgamation in the nature of merger, M Ltd. and N Ltd. were merged into MN Ltd. on the following terms:

- Purchase consideration for M Ltd.’s business is to be discharged by issue of 120 lakhs fully paid 11% preference shares and 720 lakhs fully paid equity shares of MN Ltd. to the preference and equity shareholders of M Ltd. in full satisfaction of their claims.

- To discharge purchase consideration for N Ltd.’s business, MN Ltd. to allot 90 lakhs fully paid up equity shares to shareholders of N Ltd. in full satisfaction of their claims.

- Expenses on the liquidation of M Ltd. and N Ltd. amounting to ₹ 6 lakhs are to be borne by MN Ltd.

- 8% redeemable debentures of N Ltd. to be converted into 8.5% redeemable debentures of MN Ltd.

- Expenses on incorporation of MN Ltd. were ₹ 15 lakhs. You are requested to:

Pass necessary Journal Entries in the books of MN Ltd. to record above transactions, and (Adapted Nov 2009) (16 Marks)

Answer:

Journal Entries

![]()

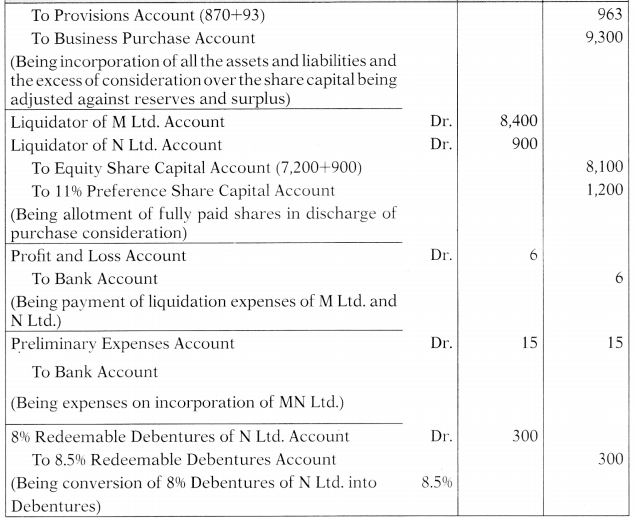

Question 7.

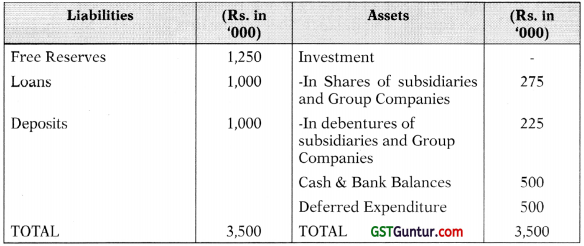

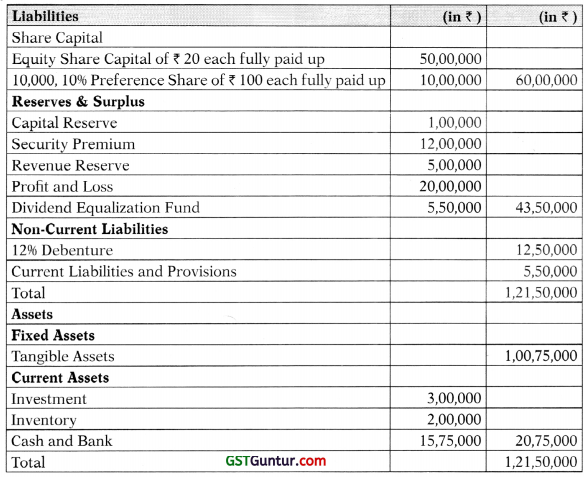

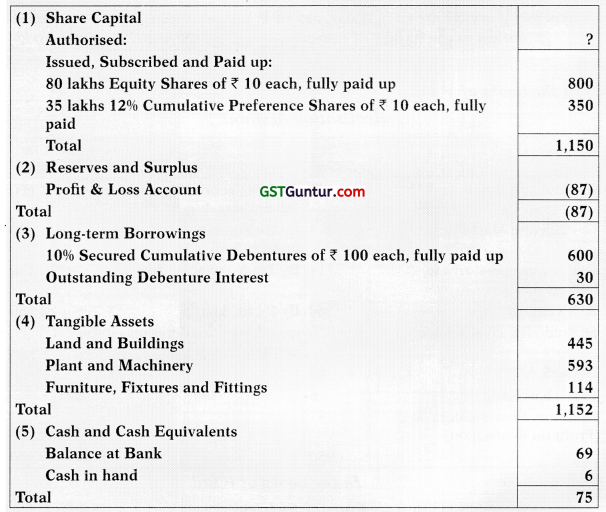

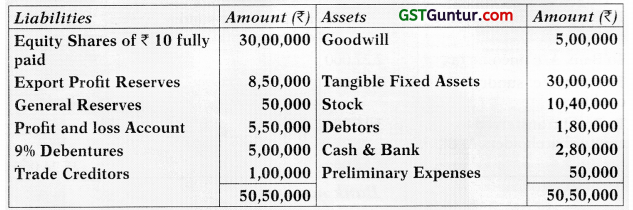

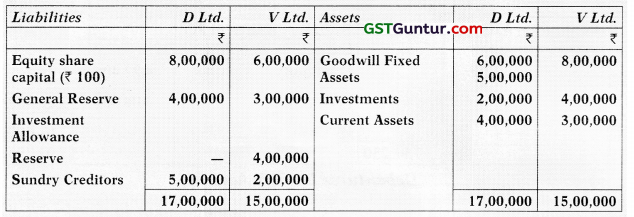

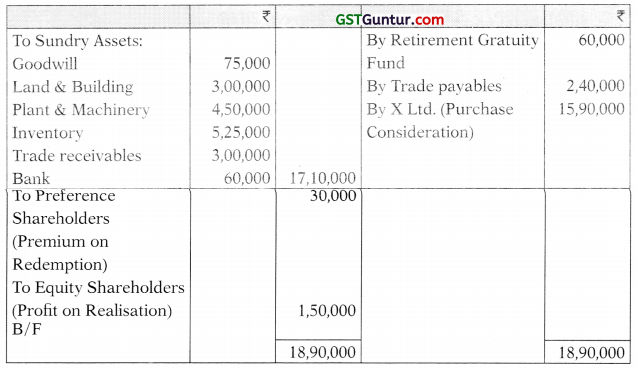

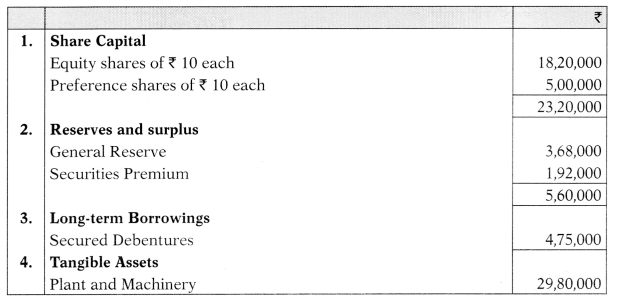

The following was the Balance Sheet of V Ltd. as on 31 st March, 2012:

Notes:

On 1st April, 2012, P Ltd. took over the entire business of V Ltd. on the following terms:

V Ltd.’s equity shareholders would receive 4 fully paid equity shares of P Ltd. of ₹ 10 each issued at a premium of ₹ 2.50 each for every five shares held by them in V Ltd.

Preference shareholders of V Ltd. would get 35 lakh 13% Cumulative Preference Shares of ₹ 10 each fully paid up in P Ltd., in lieu of their present holding.

All the debentures of V Ltd. would be converted into equal number of 10.5% Secured Cumulative Debentures of ₹ 100 each, fully paid up after the takeover by P Ltd., which would also pay outstanding debenture interest in cash.

Expenses of amalgamation would be borne by P Ltd. Expenses came to be ₹ 2 lakhs. P Ltd. discovered that its creditors included ₹ 7 lakhs due to V Ltd. for goods purchased.

Also P Ltd.’s stock included goods of the invoice price of ₹ 5 lakhs earlier purchased from V Ltd., which had charged profit @ 20% of the invoice price.

You are required to:

(i) Prepare Realisation A/c in the books of V Ltd.

(ii) Pass journal entries in the books of P Ltd. assuming it to be an amal-gamation in the nature of merger. (Nov 2012) – (16 Marks)

Answer:

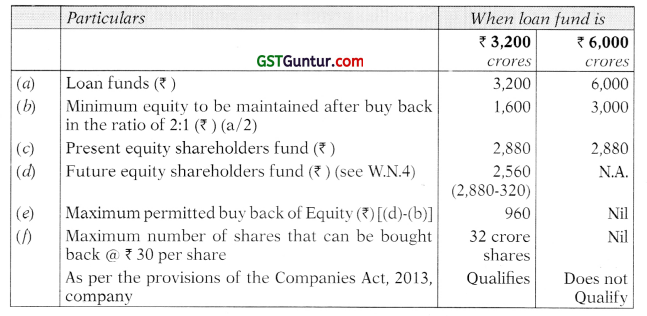

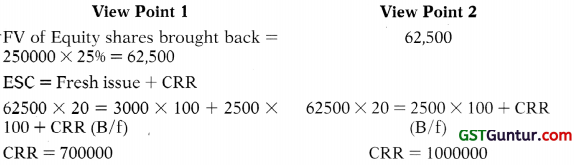

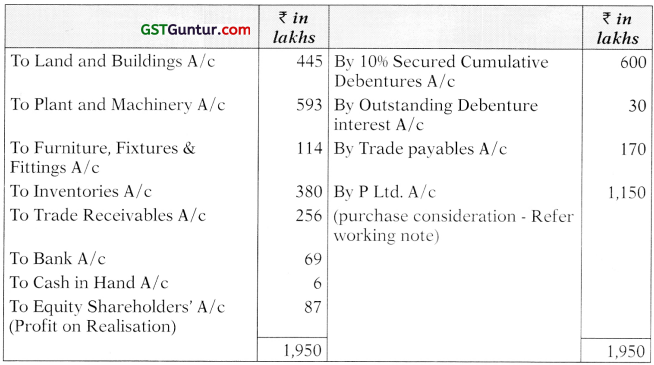

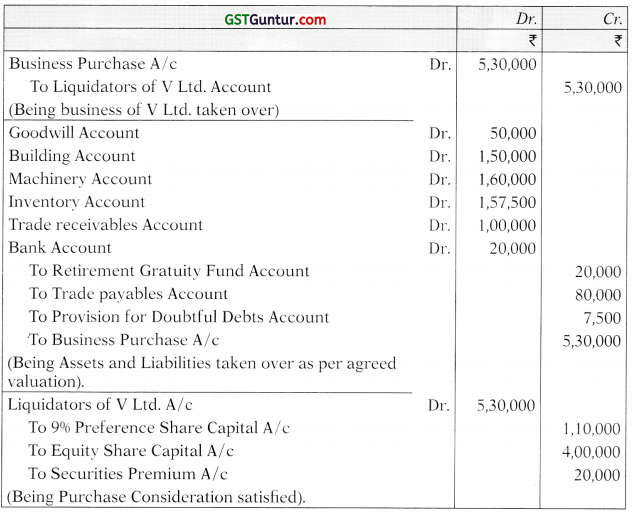

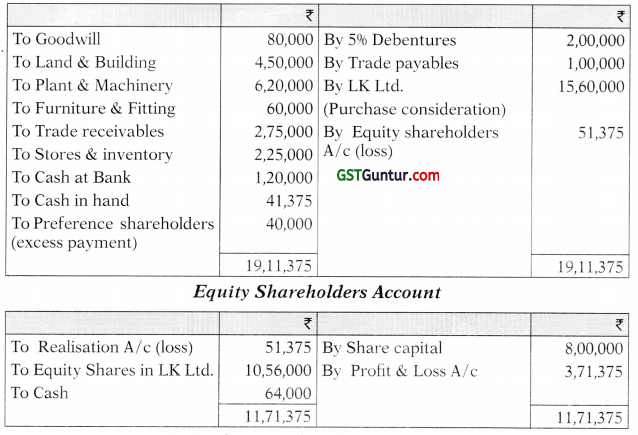

(i) In the books of V Ltd.

Realisation Account

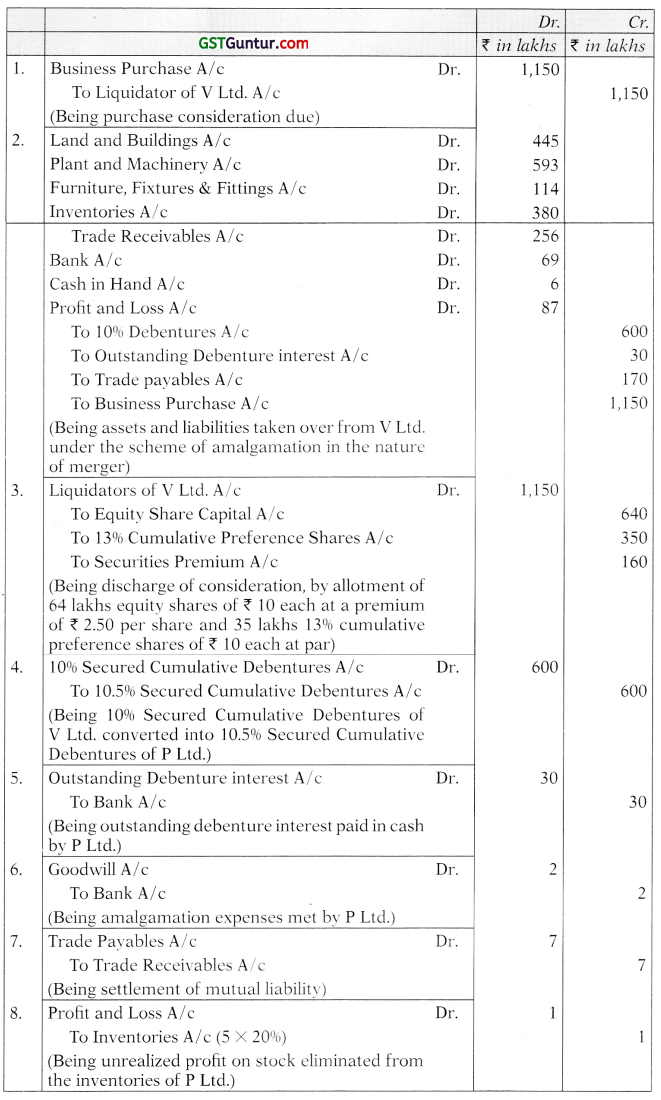

(ii)

In the books of P Ltd.

Journal Entries

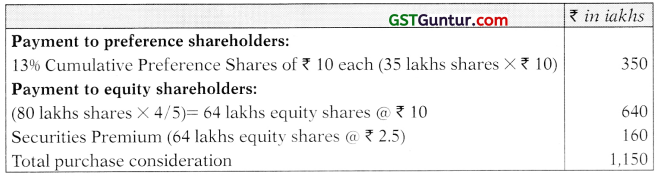

Working Note:

Calculation of Purchase Consideration payable by P Ltd.

![]()

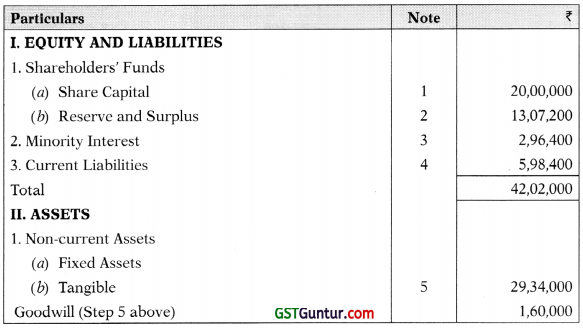

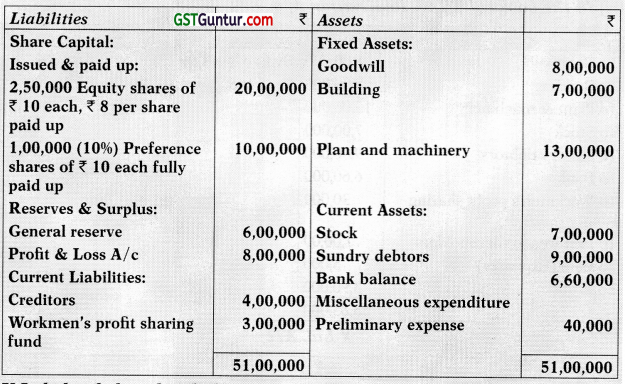

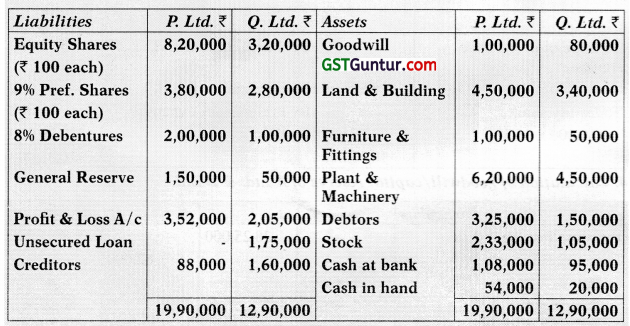

Simple Problems – Purchase

Question 8.

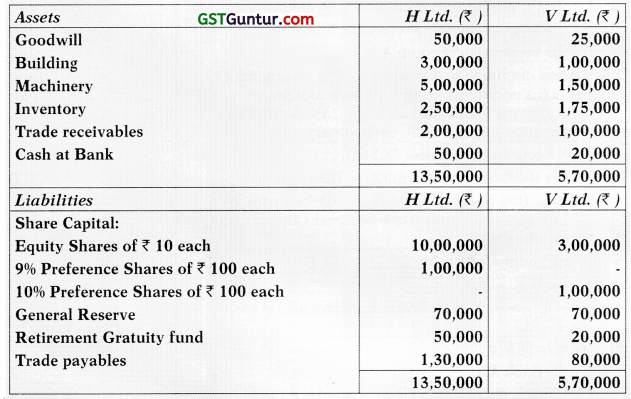

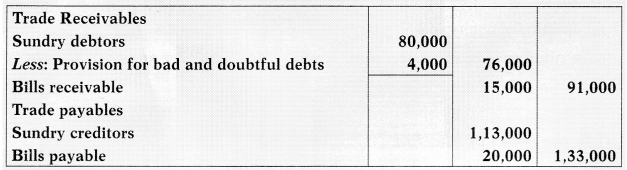

The financial position of two companies Hari Ltd. and Vayu Ltd. as on 31st March, 20X1 was as under:

H Ltd. absorbs V Ltd. on the following terms:

(a) 10% Preference Shareholders are to be paid at 10% premium by issue of 9% Preference Shares of H Ltd.

(b) Goodwill of V Ltd. is valued at ₹ 50,000, Buildings are valued at ₹ 1,50,000 and the Machinery at ₹ 1,60,000.

(c) Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created @ 7.5%.

(d) Equity Shareholders of V Ltd. will be issued Equity Shares @ 5% premium.

Prepare necessary Ledger Accounts to close the books of V Ltd. and show the acquisition entries in the books of H Ltd. Also draft the Balance Sheet after absorption as at 31st March, 20X1.

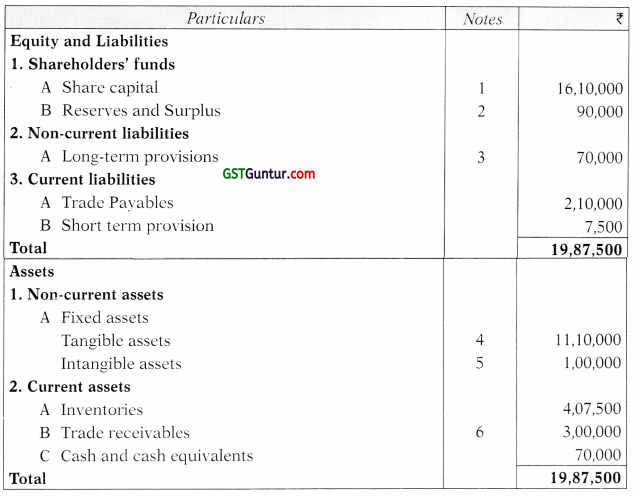

Answer:

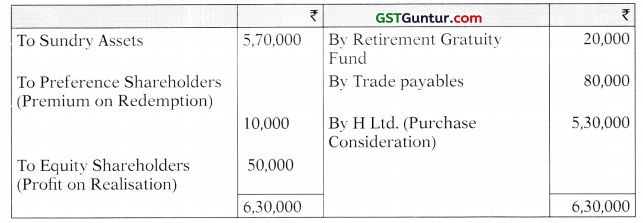

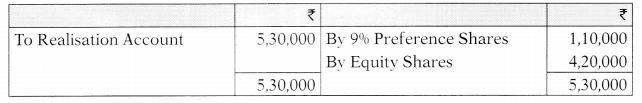

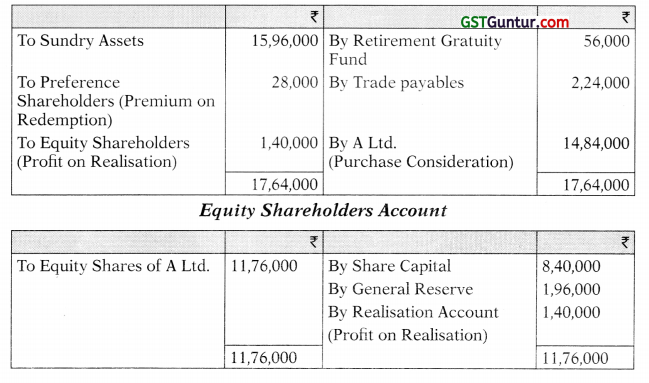

In the Books of VLtd. Realisation Account

Equity Shareholders Account

Prefetettce Shareholders Account

Hari Ltd. Account

In the Books of H Ltd.

Journal Entries

Balance Sheet of H Ltd. (after absorption) as at 31st March, 20X1

Notes to accounts

Working Notes:

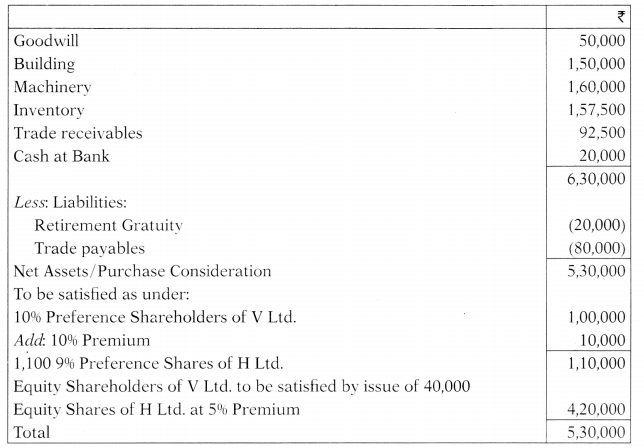

Computation of Purchase Consideration:

![]()

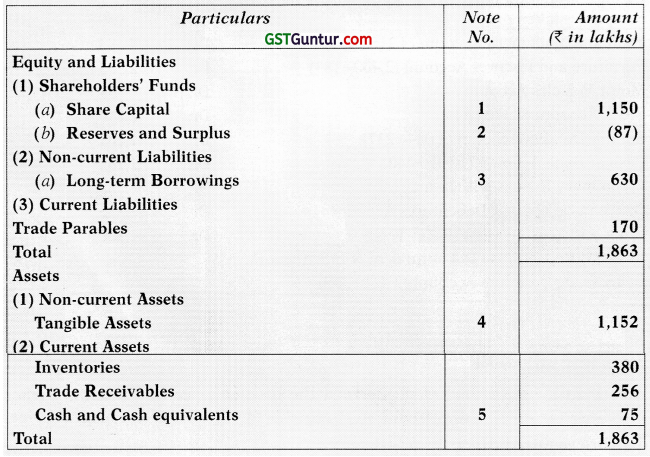

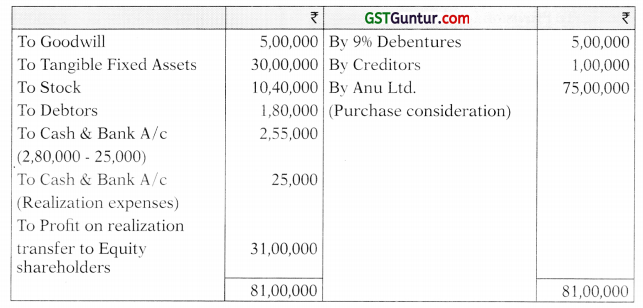

Question 9.

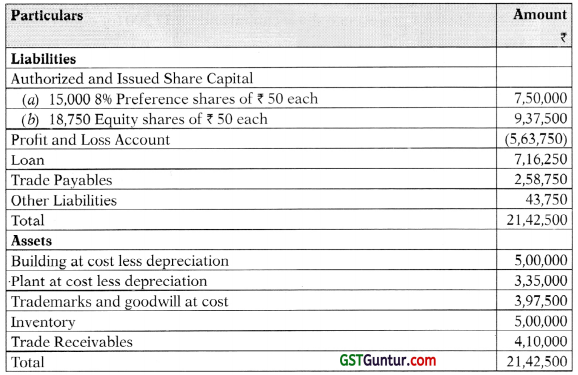

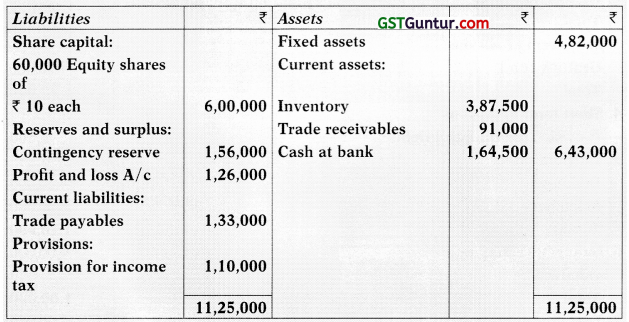

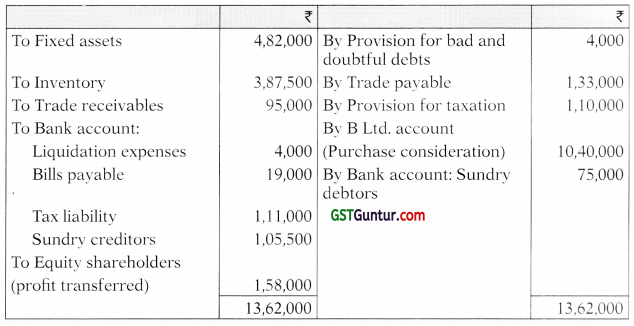

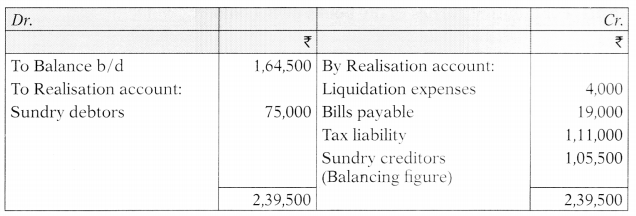

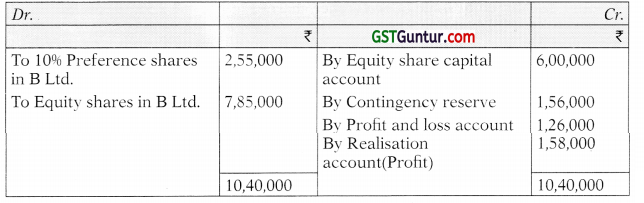

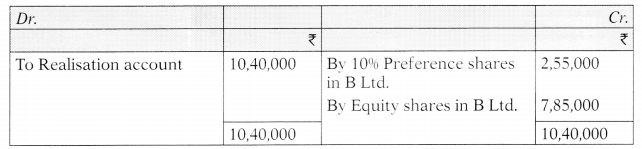

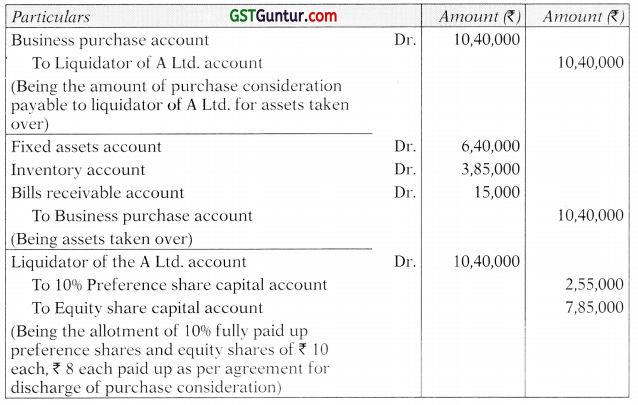

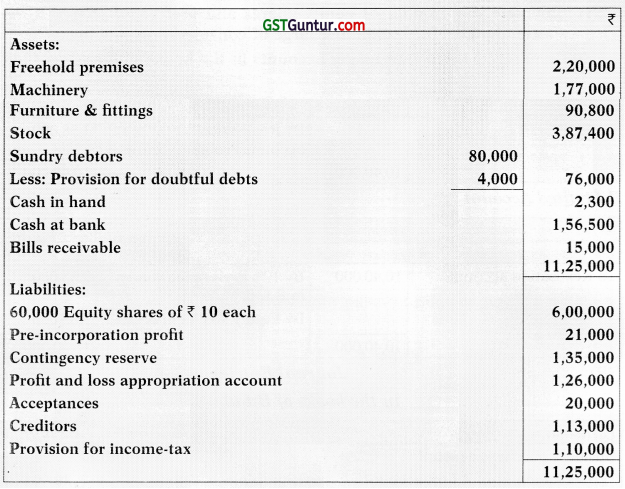

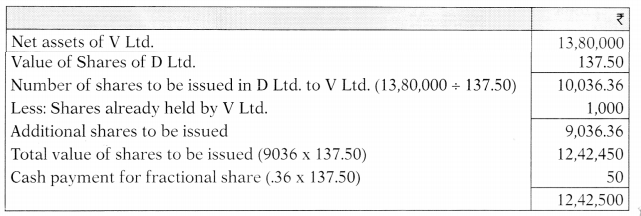

A Limited was wound up on 31.3.2014 and its draft Balance Sheet as on that date was given below:

Balance Sheet of A Limited as on 31.3.2014

Details of Trade receivables and Trade payables:

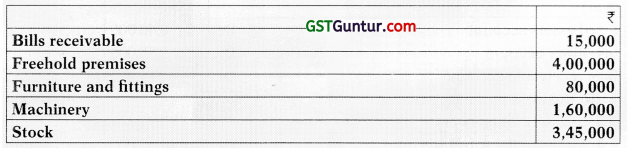

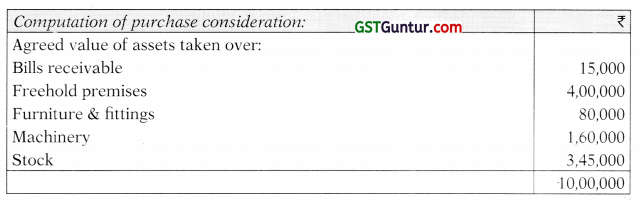

B Limied took over the following assets at values shown as under:

Fixed assets ₹ 6,40,000, Inventory ₹ 3,85,000 and Bills Receivable ₹ 15,000.

Purchase consideration was settled by B Limited: ₹ 2,55,000 of the consideration was satisfied by the allotment of fully paid 10% Preference shares of ₹ 100 each. The balance was settled by issuing equity shares of ₹ 10 each at ₹ 8 per share paid up.

Sundry debtors realised ₹ 75,000. Bills payable was settled for ₹ 19,000. Income tax authorities fixed the taxation liability at ₹ 1,11,000.

Creditors were finally settled with the cash remaining after meeting liquidation expenses amounting to ₹ 4,000.

You are required to:

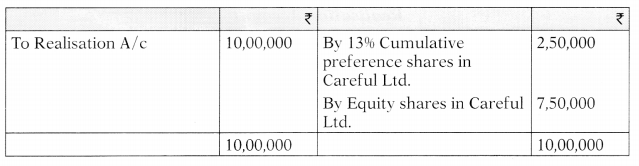

- Calculate the number of equity shares and preference shares to be allotted by B Limited in discharge of purchase consideration.

- Prepare the Realisation account, Cash/Bank account, Equity share-holders account and B Limited account in the books of A Limited.

- Pass journal entries in the books of B Limited.

Answer:

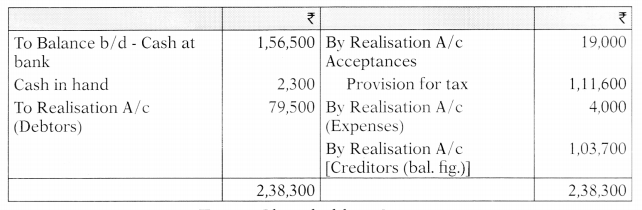

(i) Computation of purchase consideration

Discharge of purchase consideration

Amount discharged by issue of preference shares = ₹ 2,55,000 = 2,550 shares

No. of preference shares to be allotted = \(\frac{2,55,000}{100}\)

Amount discharged by allotment of equity shares = ₹ 10,40,000 – ₹ 2,o5,000

= ₹ 7,85,000

Paid up value of equity share = ₹ 8

Hence, number of equity shares to be issued = \(\frac{7,85,000}{8}\)

= 98,125 shares

(ii) In the books of Alia Ltd.

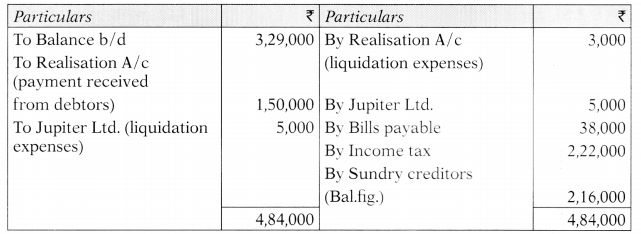

Realisation Account

Cash/Bank Account

Equity Shareholders Account

B Limited Account

(iii) Journal Entries in the books of B Ltd.

![]()

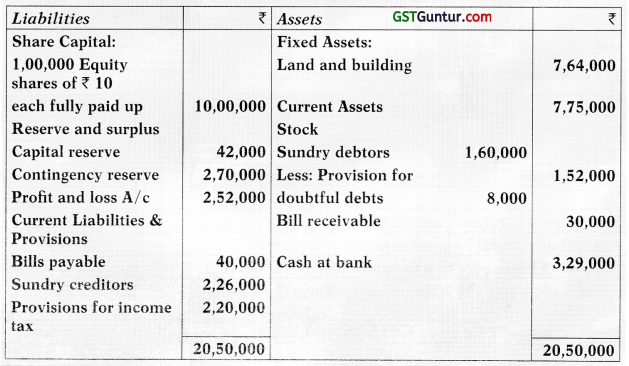

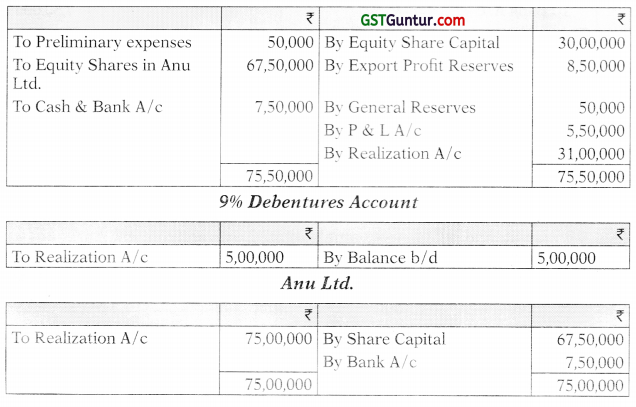

Question 10.

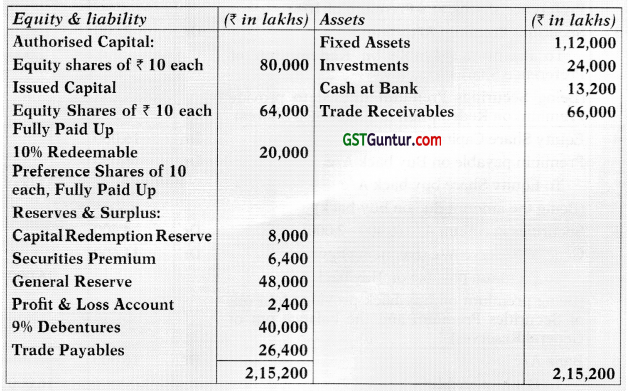

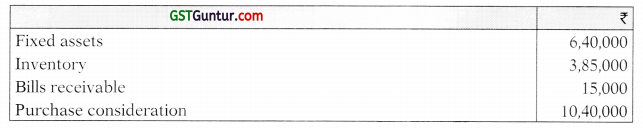

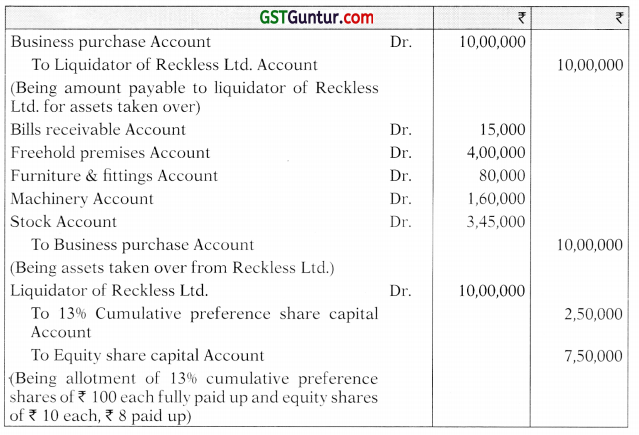

The Balance Sheet of Reckless Ltd. as on 31st March, 2008 is as follows:

Careful Ltd. decided to takeover Reckless Ltd. from 31st March, 2008 with the following assets at value noted against them:

1/4 of the consideration was satisfied by the allotment of fully paid preference shares of ₹ 100 each at par which carried 13% dividend on cumulative basis. The balance was paid in the form of Careful Ltd.’s equity shares of ₹ 10 each, ₹ 8 paid up.

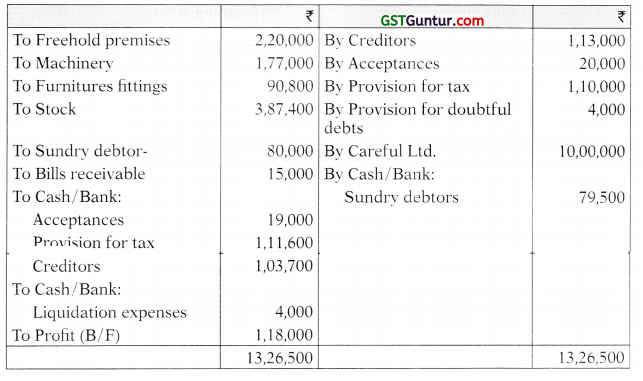

Sundry Debtors realised ₹ 79,500. Acceptances were settled for ₹ 19,000. Income-tax authorities fixed the taxation liability at ₹ 1,11,600. Creditors were finally settled with the cash remaining after meeting liquidation expenses amounting to ? 4,000.

You are required to:

- Calculate the number of equity shares and preference shares to be allotted by Careful Ltd. in discharge of consideration.

- Prepare the important ledger accounts in the books of Reckless Ltd.; and

- Pass journal entries in the books of Careful Ltd. with narration. (May 2010)

Answer:

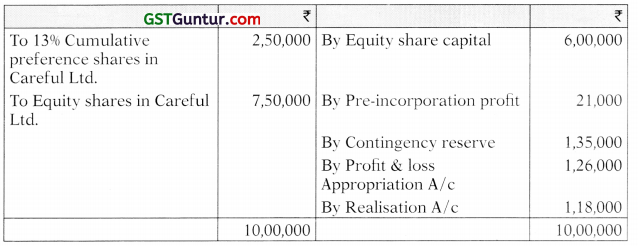

Discharge of purchase consideration:

1. Amount paid by allotment of 13% preference shares

= ₹ 10,00,000 × \(\frac{1}{4}\)

= ₹ 2,50,000

Number of 13% preference shares of ₹ 100 each

= ₹ \(\frac{2,50,000}{100}\)

= 2,500 preference shares

2. Amount paid by allotment of equity shares

= ₹ 10,00,000 – ₹ 2,50,000 = ₹ 7,50,000

Paid up value of one equity share = ₹ 8 each

Hence, the number of equity shares allotted

= ₹ \(\frac{7,50,000}{100}\)

= 93,750 equity shares

(ii) Ledger accounts in the books of Reckless Ltd.

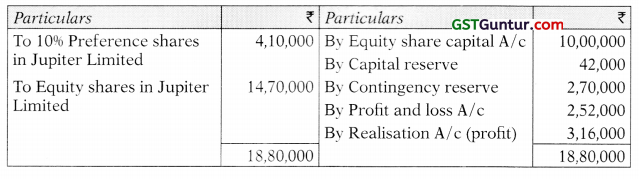

Realisation Account

Cash and Bank Account

Equity Shareholders Account

Careful Ltd. Account

(iii) Journal Entries in the books of Careful Ltd.

![]()

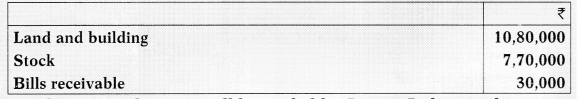

Question 11.

The Balance Sheet of Mars Limited as on 31st March, 2011 was as follow:

On 1st April, 2011, Jupiter Limited agreed to absorb Mars Limited on the following terms and conditions:

- Jupiter Limited will takeover the assets at the following values:

- Purchase consideration will be settled by Jupiter Ltd. as under:

4,100 fully paid 10% preference shares of ₹ 100 will be issued and the balance will be settled by issuing equity shares of ₹ 10 each at ₹ 8 paid up. - Liquidation expenses are to be reimbursed by Jupiter Ltd. to the extent of ₹ 5,000.

- Sundry debtors realized ₹ 1,50,000. Bills payable were settled for ₹ 38,000. Income tax authorities fixed the taxation liability at ₹ 2,22,000 and the same was paid.

- Creditors were finally settled with cash remaining after meeting liquidation expenses amounting to ₹ 8,000

You are required to:

- Calculate the number of equity shares and preference shares to be allotted by Jupiter Limited in discharge of purchase consideration.

- Prepare the Realisation account, Bank account. Equity shareholders account and Jupiter Limited’s account in the books of Mars Ltd. (May 2011) (16 Marks)

Answer:

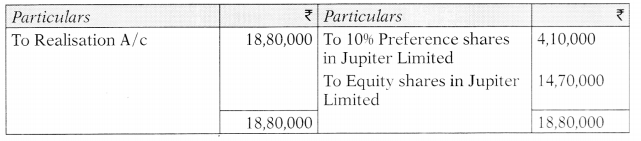

(i) Computation of purchase consideration

(ii) Ledger Accounts in the books of Mars Limited

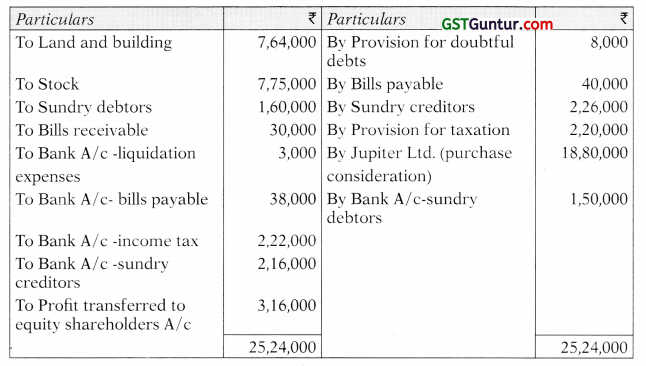

Realization Account

Bank Account

Equity Shareholders Account

Jupiter Limited Account

![]()

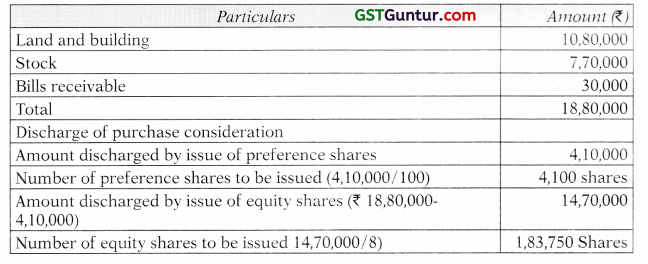

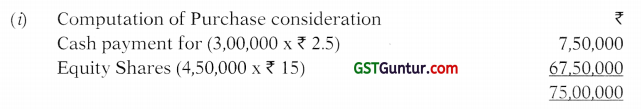

Question 12.

The summarized Balance Sheet of Srishti Ltd. as on 31st March, 2014 was as follows:

ANU Ltd. agreed to absorb the business of SRISHTI Ltd. with effect from 1st April, 2014.

(a) The purchase consideration settled by ANU Ltd. as agreed:

(i) 4,50,000 equity Shares of ₹ 10 each issued by ANU Ltd. by valuing its share @ ₹ 15 per share.

(ii) Cash payment equivalent to ₹ 2.50 for every share in SRISHTI Ltd.

(b) The issue of such an amount of fully paid 8% Debentures in ANU Ltd. at 96% as is sufficient to discharge 9% Debentures in SRISHTI Ltd, at a premium of 20%.

(c) ANU Ltd. will takeover the Tangible Fixed Assets at 100% more than the book value, Stock at ₹ 7,10,000 and Debtors at their face value subject to a provision of 5% for doubtful Debts.

(d) The actual cost of liquidation of SRISHTI Ltd. was ₹ 75,000. Liquidation cost of SRISHTI Ltd. is to be reimbursed by ANU Ltd. to the extent of ₹ 50,000.

(e) Statutory Reserves are to be maintained for 1 more year. You are required to:

(i) Close the books of SRISHTI Ltd. by preparing Realisation Account, ANU Ltd. Account, Shareholders Account and Debenture Account, and

(ii) Pass Journal Entries in the books of ANU Ltd. regarding acquisition of business. (May 2014) – (16 Marks)

Answer:

In the books of Srishti Ltd. REALISATION ACCOUNT

Equity Shareholders A/c

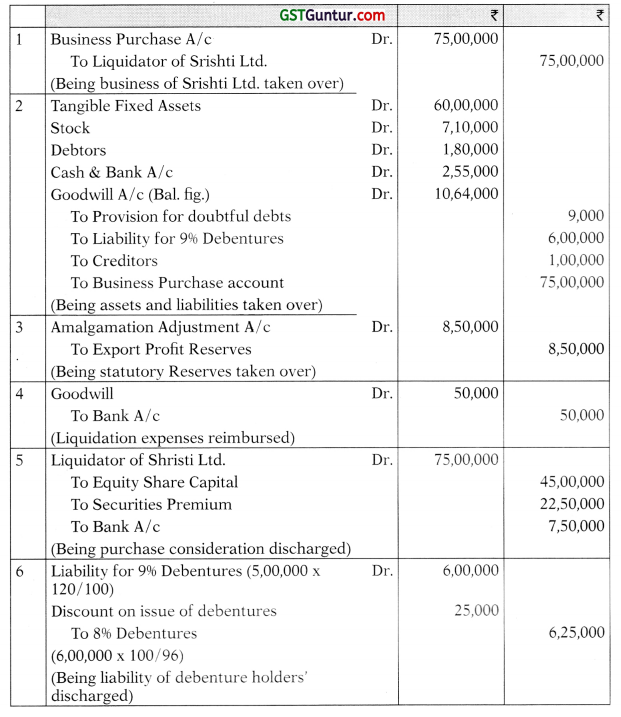

(ii) Journal Entries in the books of Anu Ltd.

![]()

Question 13.

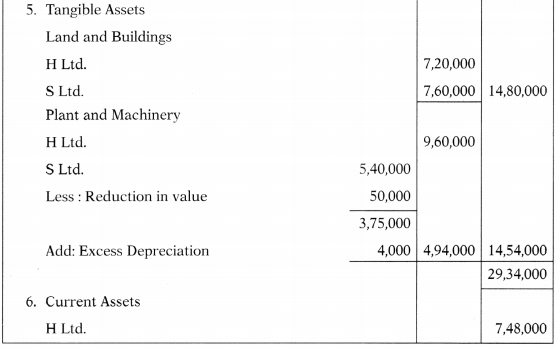

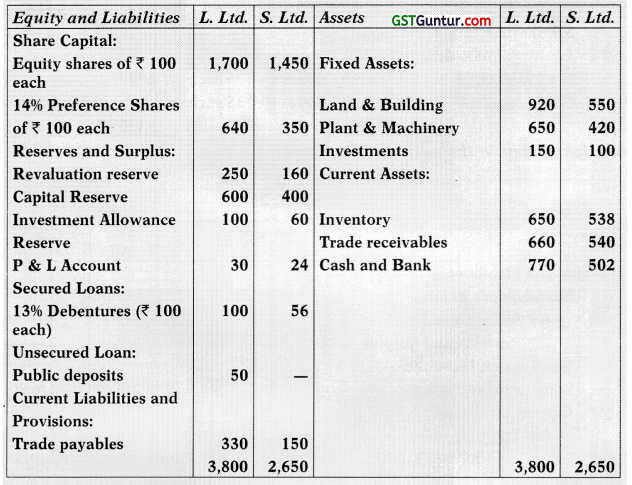

L Ltd. and S Ltd. were amalgamated on and from 1st April, 2014. A new company M Ltd. was formed to takeover the businesses of the existing companies. The summarized balance sheets of L Ltd. and S Ltd. as on 31st March, 2014 are given below: (₹ in lakhs)

Other information

- 13% Debenture holders of L Ltd. and S Ltd. are discharged by M Ltd. by issuing such number of its 15% Debentures of ₹ 100 each so as to maintain the same amount of interest.

- Preference Shareholders of the two companies are issued equivalent number of 15% preference shares of M Ltd. at a price of ₹ 125 per share (face value ? 100)

- M Ltd. will issue 4 equity shares for each equity share of L Ltd. and 3 equity shares for each equity share of S Ltd. The shares are to be issued @ ₹ 35 each, having a face value of ₹ 10 per share.

- Investment allowance reserve is to be maintained for two more years.

Prepare the balance sheet of M Ltd. as on 1 st April, 2014 after the amalgamation has been carried out if amalgamation is in the nature of purchase.

Answer:

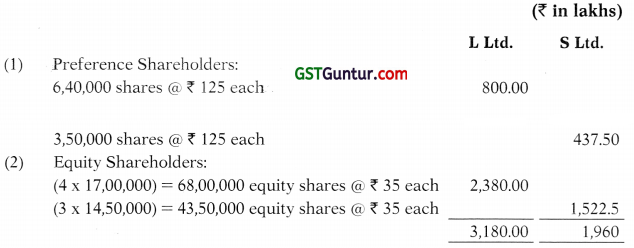

Computation of Purchase consideration (Payment Net Method)

Amalgamation in the nature of Purchase:

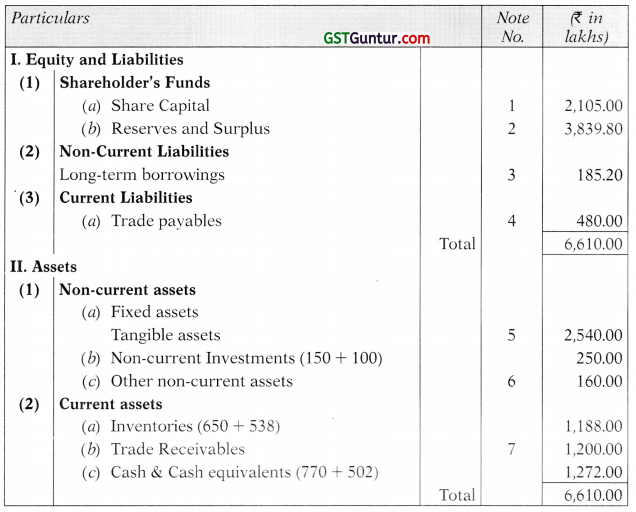

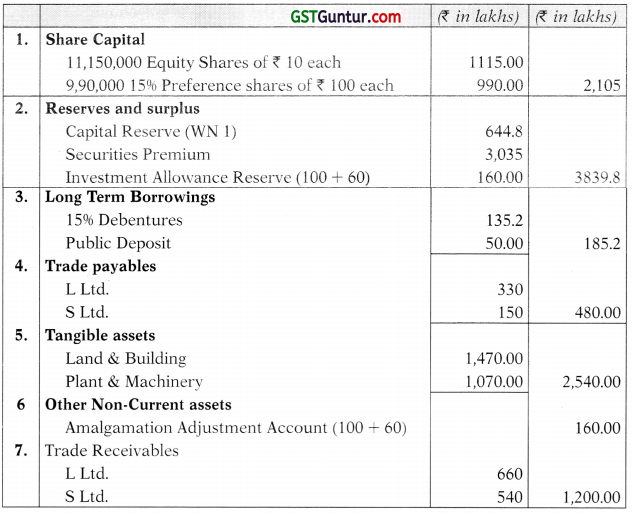

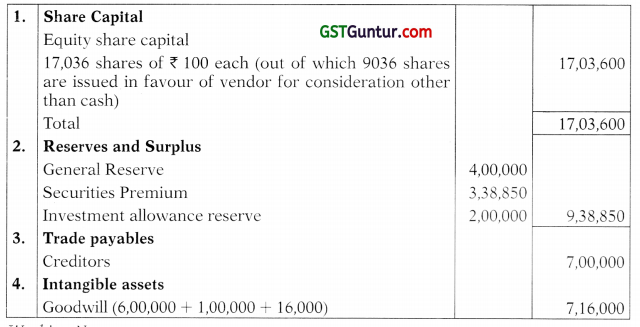

Balance Sheet of M Ltd. As on 1st April, 2014

Notes to Accounts

Working Note 1:

![]()

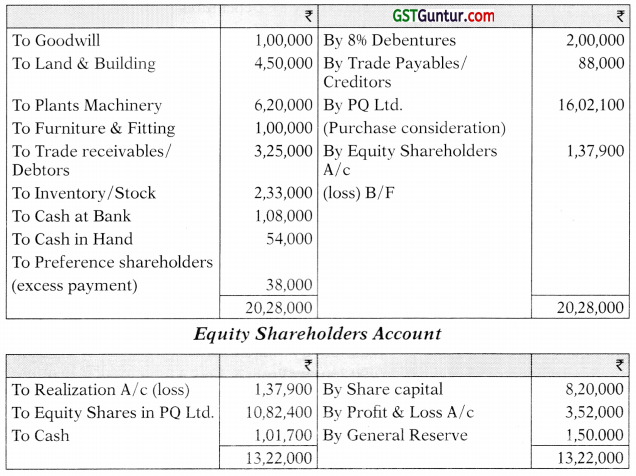

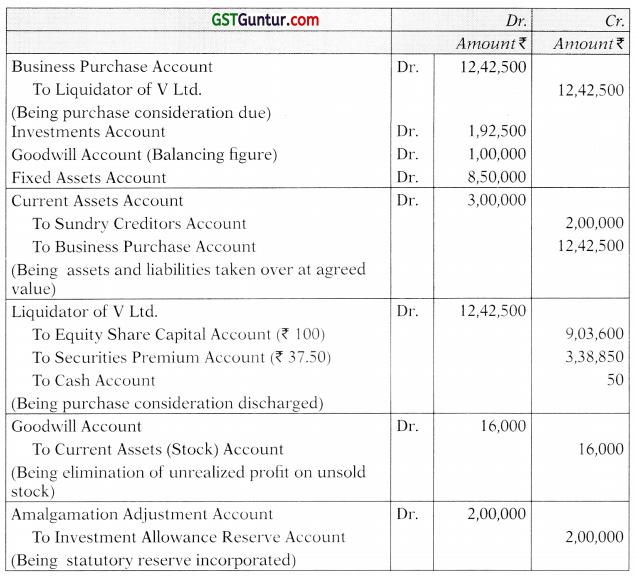

Question 14.

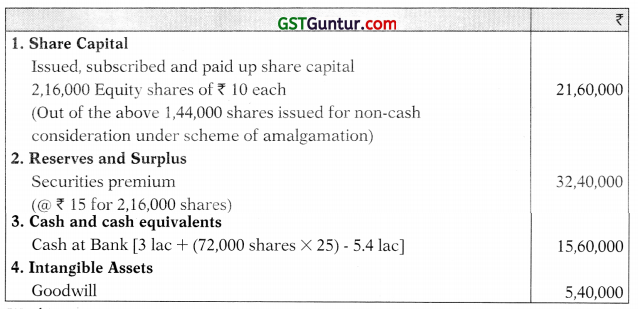

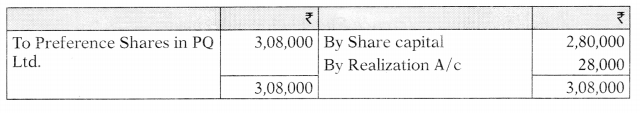

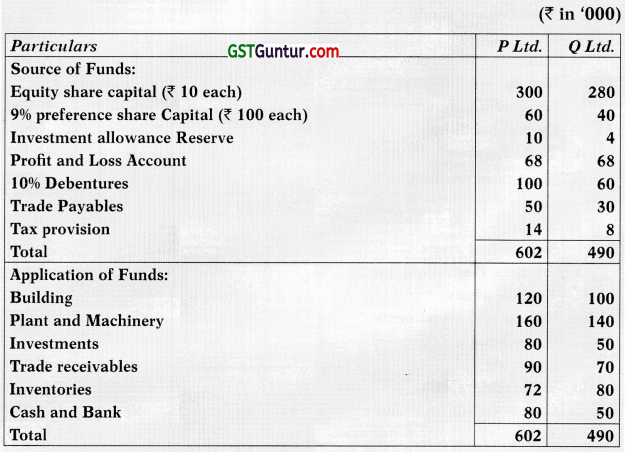

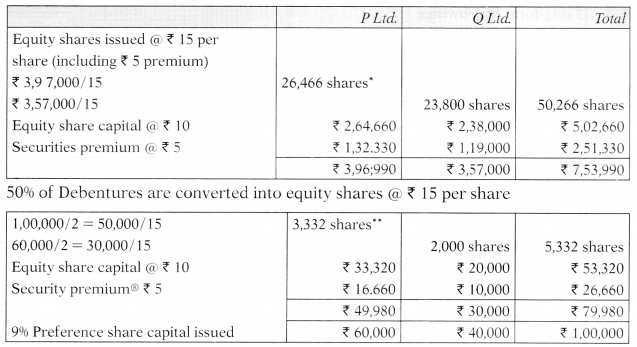

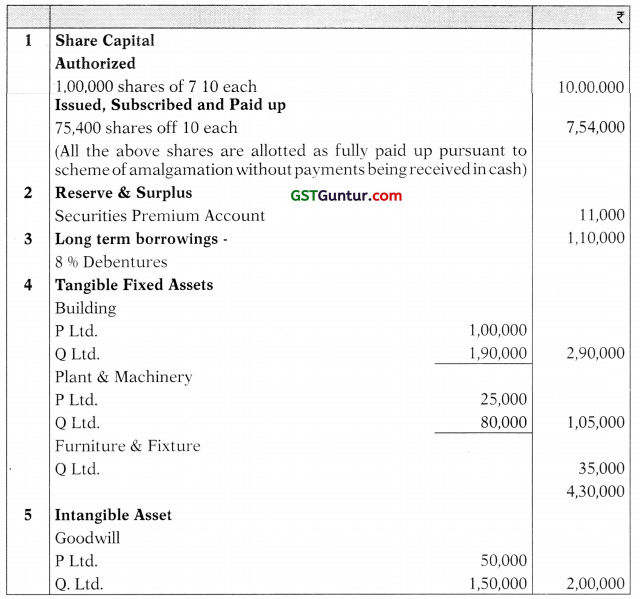

P Ltd. and Q Ltd. agreed to amalgamate their business. The scheme envisaged a share capital, equal to the combined capital of P Ltd. and Q Ltd. for the purpose of acquiring the assets, liabilities and undertakings of the two companies in exchange for share in PQ Ltd.

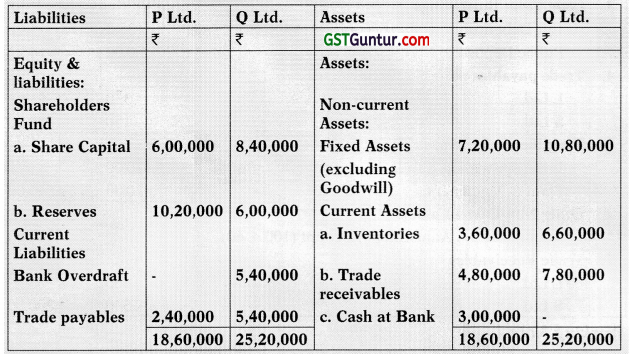

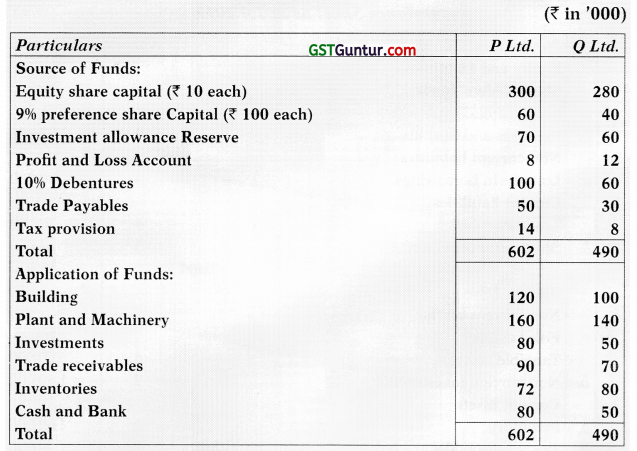

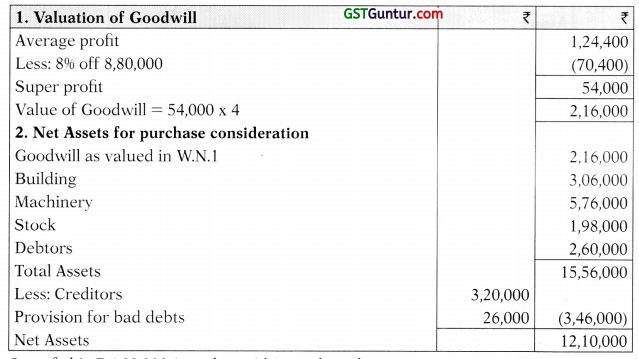

The Summarized Balance Sheets of P Ltd. and 0 Ltd. as on 31st March, 2017 (the date of amalgamation) are given below:

Summarized balance sheets as at 31-3-2017

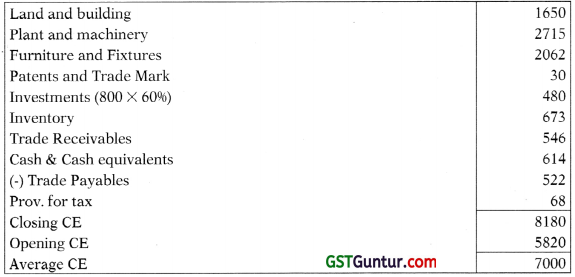

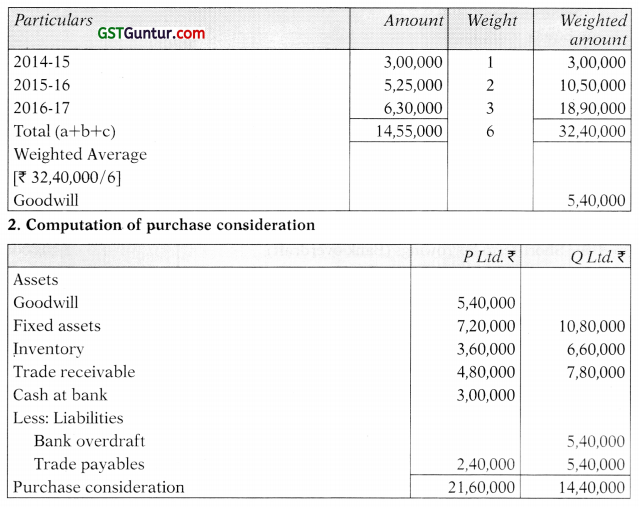

The consideration was to be based on the net assets of the companies as shown in the above Balance Sheets, but subject to an additional payment to P Ltd. for its goodwill to be calculated as its weighted average of net profits for the three years ended 31st March, 2017. The weights for this purpose for the years 2014-15, 2015-16 and 2016-17 were agreed as 1, 2 and 3 respectively.

The profit had been:

2014-15 ₹ 3,00,000; 2015-16 ₹ 5,25,000 and 2016-17 ₹ 6,30,000.

The shares of PQ Ltd. were to be issued to P Ltd. and 0 Ltd. at a premium and in proportion to the agreed net assets value of these companies.

In order to raise working capital, PQ Ltd. proceeded to issue 72,000 shares of ₹ 10 each at the same rate of premium as issued for discharging purchase consideration to P Ltd. and Q. Ltd.

You are required to:

- Calculate the number of shares issued to P Ltd. and 0 Ltd; and

- Give required journal entries in the books of PQ Ltd.; and

- Prepare the Balance Sheet of PQ Ltd. as per Schedule III after recording the necessary journal entries.

Answer:

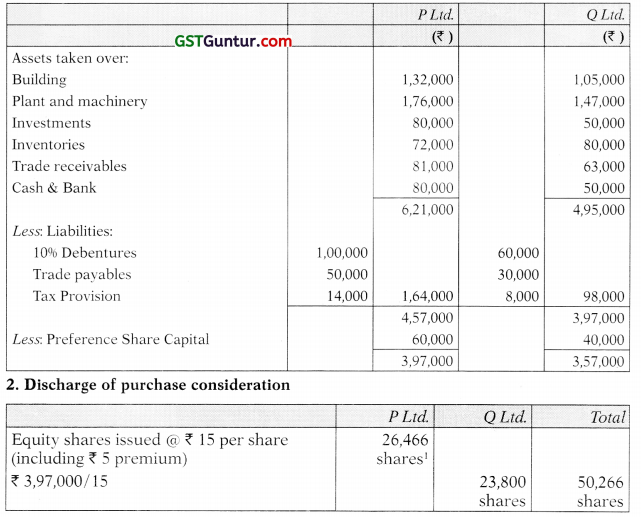

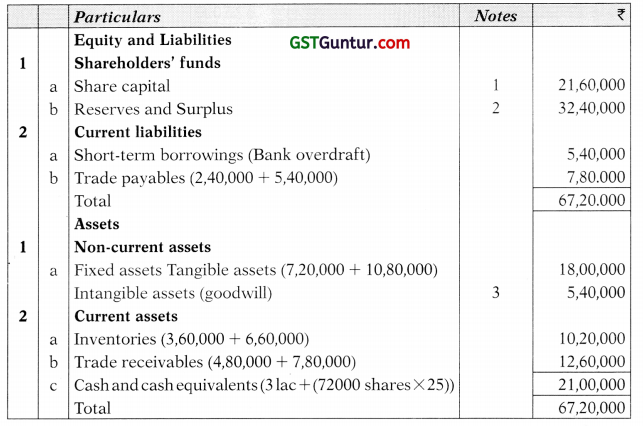

(i) Calculation of number of shares issued to P Ltd. and Q Ltd.:

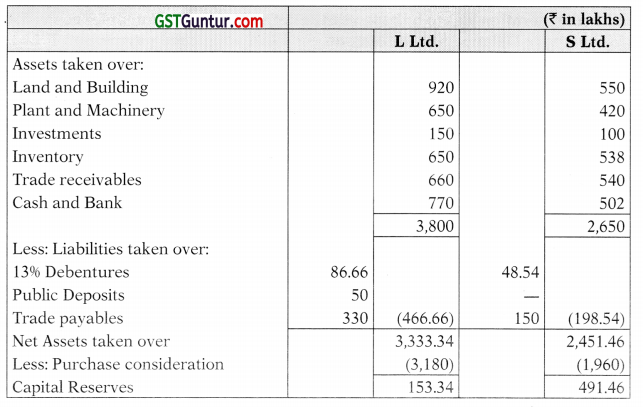

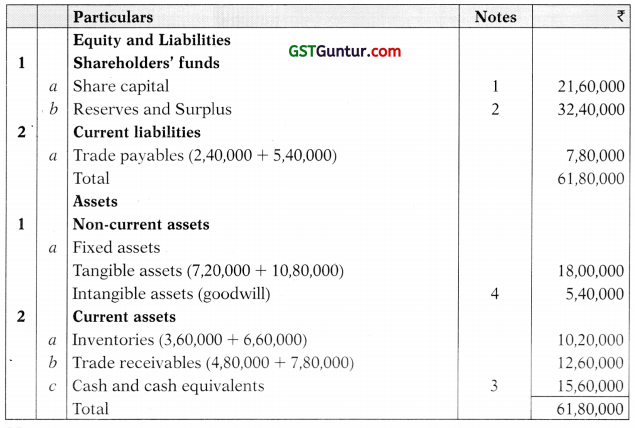

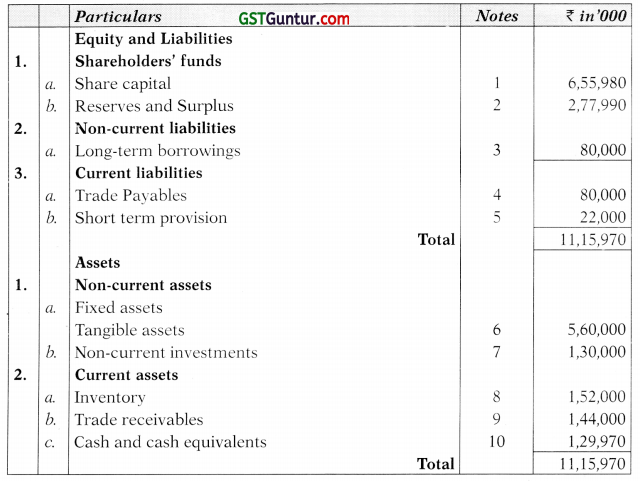

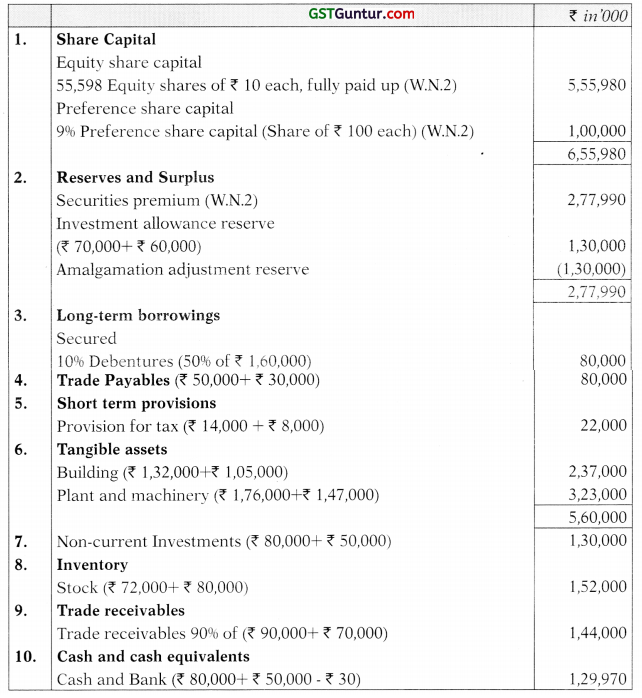

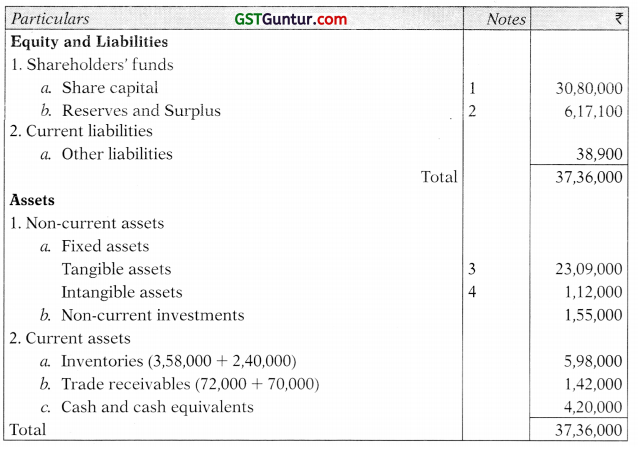

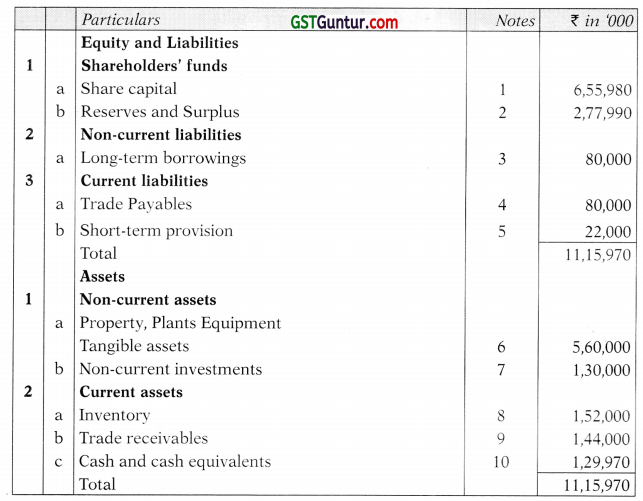

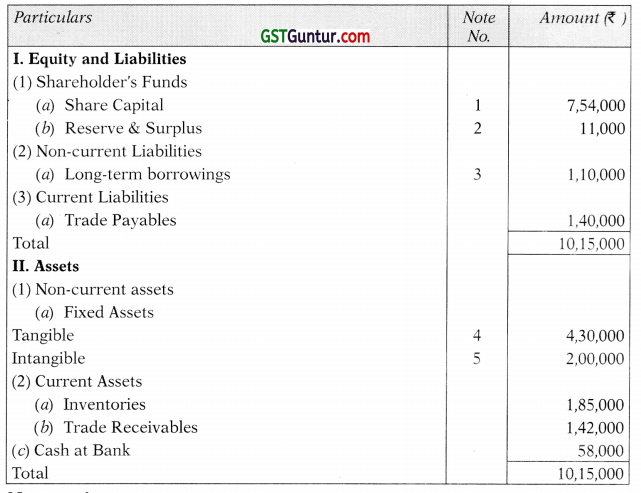

(iii) Balance Sheet of PQ Ltd. on 31st March, 2017 after amalgamation

Notes to accounts

Working Notes:

1. Calculation of goodwill of P Ltd.

![]()

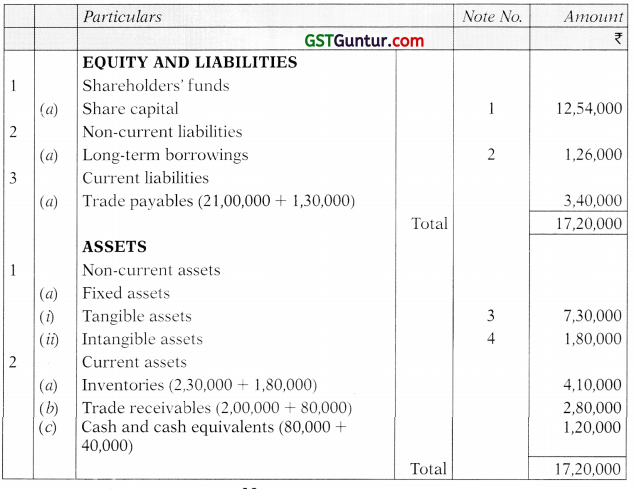

Question 15.

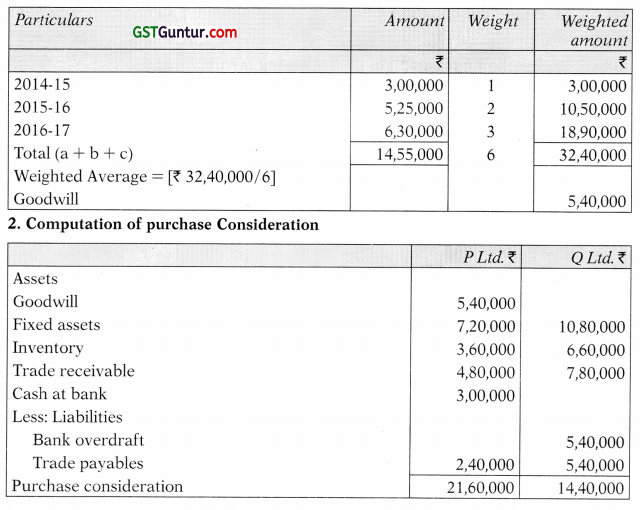

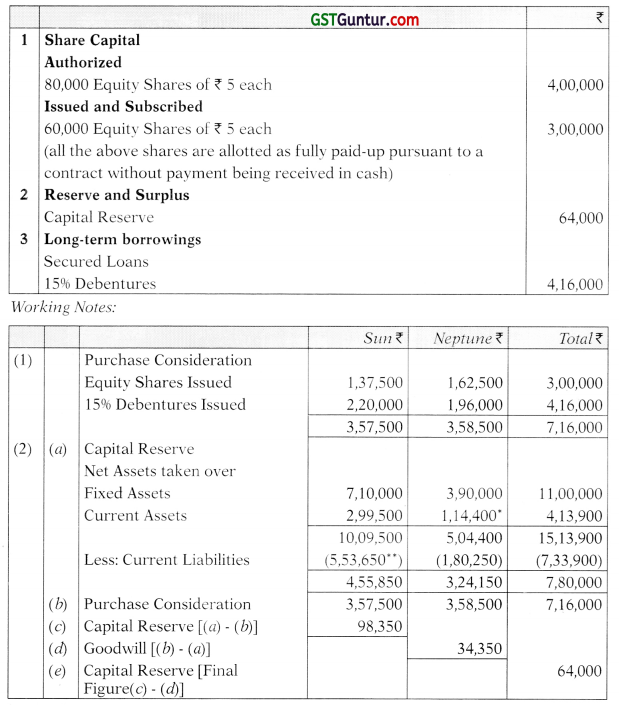

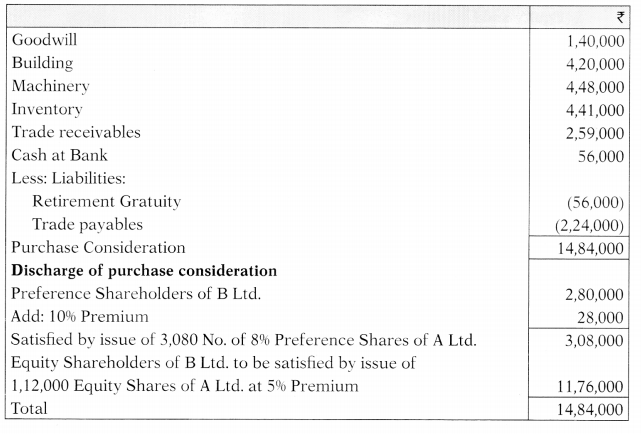

The financial position of two companies A Ltd. and B Ltd. as on 31st March, 2017 was as under:

B Ltd. is absorbed by A Ltd. on the following terms:

(a) 10% Preference Shareholders are to be paid at 10% premium by issue of 8% Preference Shares of A Ltd.

(b) Goodwill of B Ltd. is valued at ₹ 1,40,000, Buildings are valued at ₹ 4,20,000 and the Machinery at ₹ 4,48,000.

(c) Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created @ 7.5%.

(d) Equity Shareholders of B Ltd. will be issued Equity Shares of A Ltd. @ 5% premium.

You are required to:

(a) Prepare necessary Ledger Accounts to close the books of B Ltd.

(b) Show the acquisition entries in the books of A Ltd.

(c) Also draft the Balance Sheet after absorption as at 31st March, 2017.

Answer:

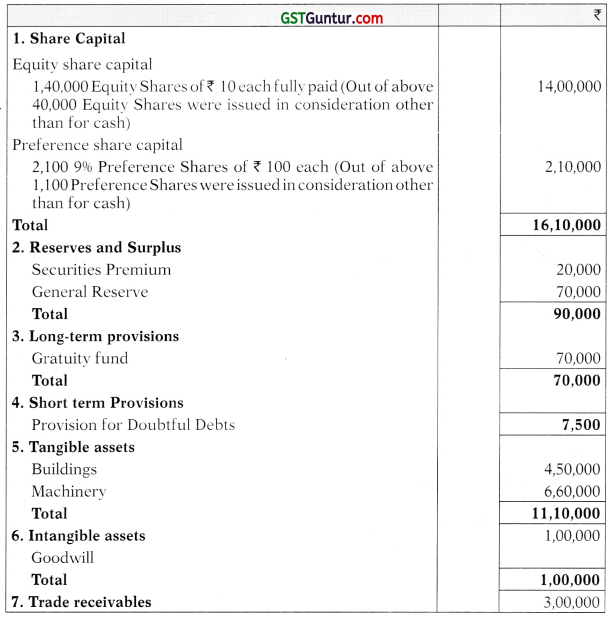

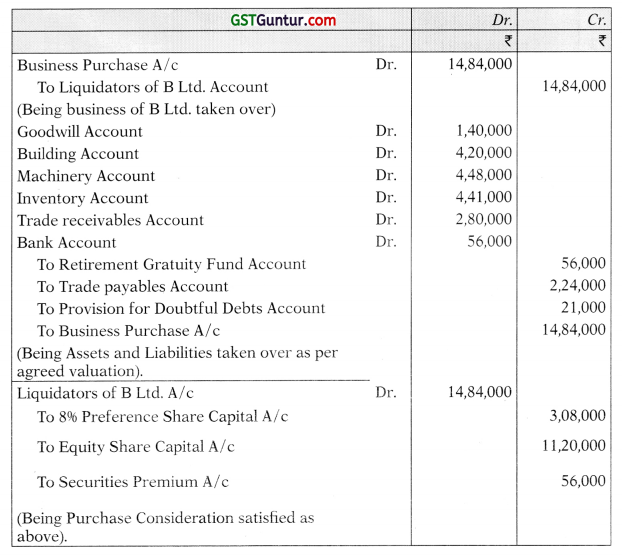

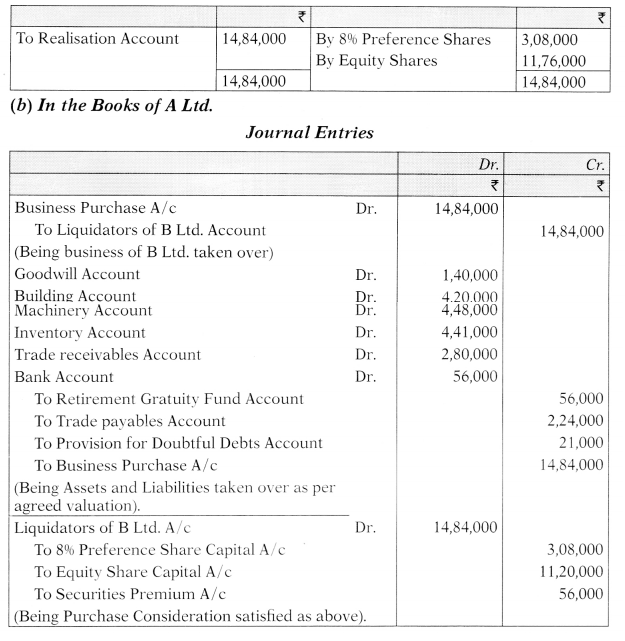

(a) In the Books of B Ltd.

Realisation Account

Preference Shareholders Account

(b) In the Books of A Ltd.

Journal Entries

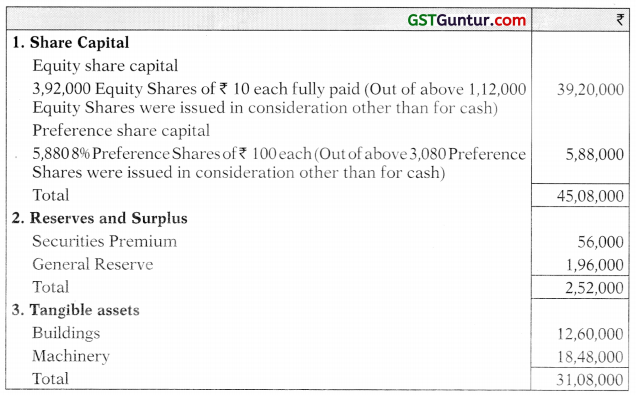

(c) Balance Sheet of A Ltd. (after absorption) as at 31st March, 2017

Notes to accounts

Working Notes:

![]()

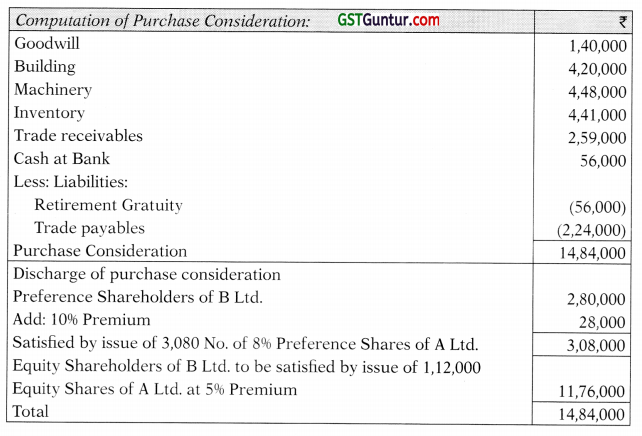

Question 16.

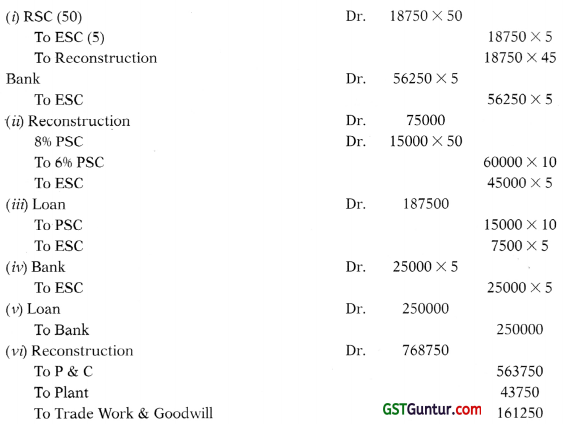

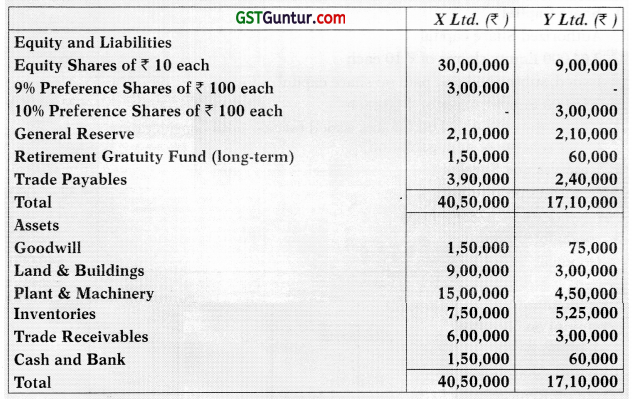

Following is the Balance Sheet of Y Ltd., as at 31st March, 2010:

X Ltd. decided to absorb the business of Y Ltd., at the respective book value of assets and trade liabilities except building which was valued at ₹ 12,00,000 and plant & machinery at ₹ 1,00,000.

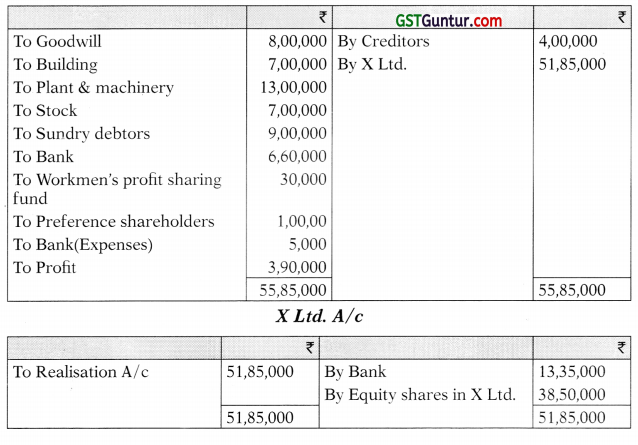

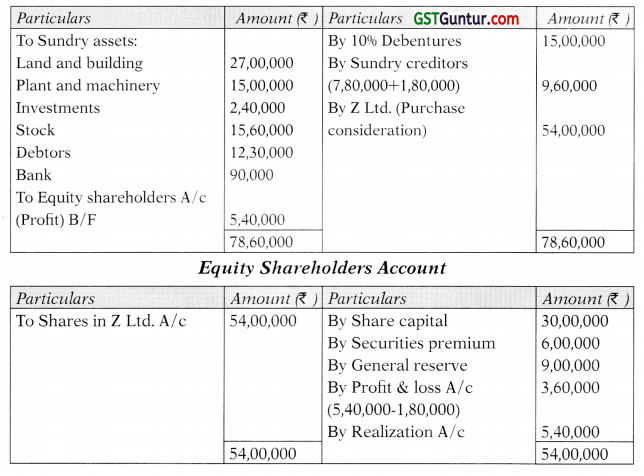

Working Notes:

The purchase consideration was payable as follows:

(i) Payment of liquidation expenses ₹ 5,000 and workmen’s profit sharing fund at 10% premium;

(ii) Issue of equity share of ₹ 10 each fully paid at ₹ 11 per share for every preference share and every equity share of Y Ltd., and a payment of ₹ 4 per equity share in cash.

Calculate the purchase consideration, show the necessary ledger accounts in the books of Y Ltd., and opening journal entries in the books of X Ltd. (Nov 2010) (16 Marks)

Answer:

(i) Computation of purchase consideration

* Question has stated explicitly to consider it as a part of P.C. otherwise it is not a part of P.C.

(ii) In the books of YLtd. Realisation A/c

Bank A/c

Equity shares in X Ltd. A/c

![]()

Question 17.

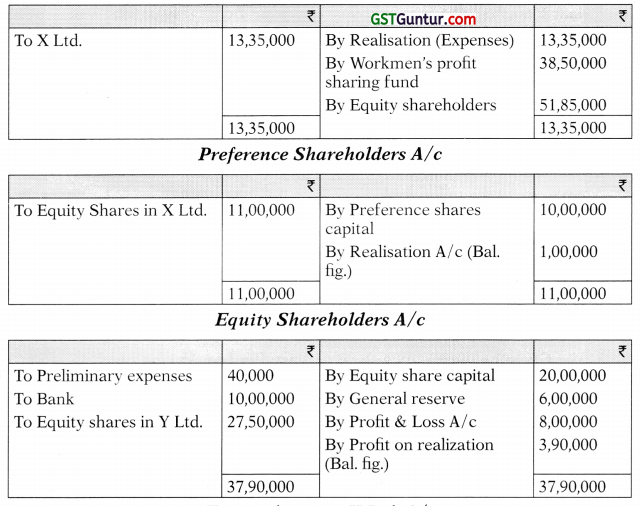

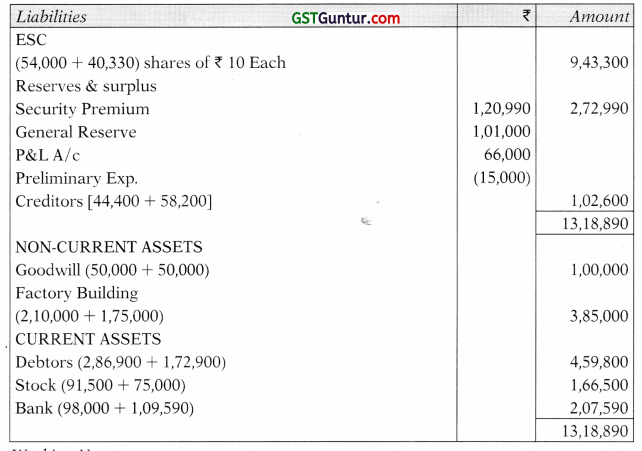

Given below balance sheet of Vasudha Ltd. Vaishali Ltd. as at 31st March, 2012.

Goodwill of the Companies Vasudha Ltd. and Vaishali Ltd. is to be valued at ₹ 75,000 and ₹ 50,000 respectively. Factory Building of Vasudha Ltd. is worth ₹ 1,95,000 and of Vaishali Ltd. ₹ 1,75,000. Stock of Vaishali Ltd. has been shown at 10% above of its cost.

It is decided that Vasudha Ltd. will absorb Vaishali Ltd. without liquidating later, by taking over its entire business by issue of shares at the Intrinsic Value

You are required to draft the balance sheet of the two companies after putting through the scheme. (May 2012) (16 Marks)

Answer:

Balance Sheet of Vasudha Ltd. as on 31st March, 2012

Working Note:

1. Computation of shares issued on the basis of intrinsic values

Hence, Vasudha Ltd. will give its 40,330 shares of ₹ 10 each @ ₹ 13 each to Vaishali Ltd.

Discharge of Purchase consideration

Question 18.

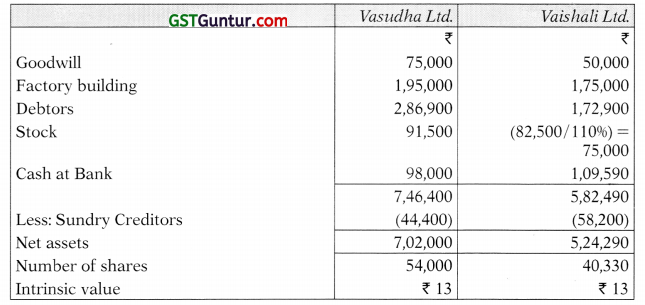

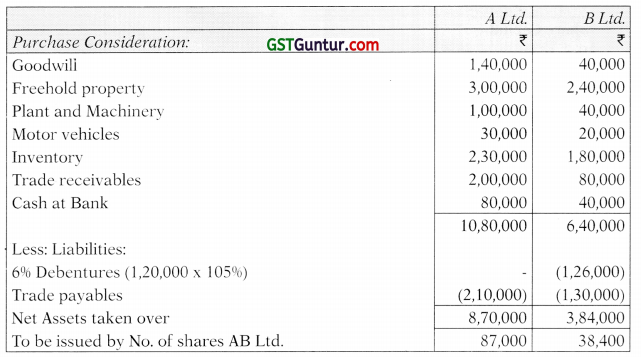

The summarized Balance Sheet of M/s. A Ltd. and M/s. B Ltd. as on 31.03.2014 were is as under:

M/s. A Ltd. and M/s. B Ltd. carry on business of similar nature and they agreed to amalgamate. A new Company, M/s. AB Ltd. is formed to take over the Assets and Liabilities of M/s. A Ltd. and M/s. B Ltd. on the following basis:

Assets and Liabilities are to be taken at Book Value, with the following exceptions:

(a) Goodwill of M/s. A Ltd. and M/s. B Ltd. is to be valued at ₹ 1,40,000 and ₹ 40,000 respectively.

(b) Plant & Machinery of M/s. A Ltd. are to be valued at ₹ 1,00,000.

(c) The Debentures of M/s. B Ltd. are to be discharged, by the issue of 6% Debentures of M/s. AB Ltd., at a premium of 5%.

You are required to:

(i) Compute the basis on which shares in M/s. AB Ltd. will be issued to Shareholders of the existing Companies assuming nominal value of each share of M/s. AB Ltd. is ₹ 10.

(ii) Draw up a Balance Sheet of M/s. AB Ltd. as on 1st April, 2014, when Amalgamation is completed.

(iii) Pass Journal entries in the Books of M/s. AB Ltd. for acquisition of M/s. A Ltd. and M/s. B Ltd. (May 2015) (16 Marks)

Answer:

Computation of Purchase consideration

Balance Sheet AB Ltd. as at 1st April, 2014

Notes to accounts

Journal Entries In the books of AB Ltd.

Assumptions:

- Nominal value of debentures of B Ltd. is ₹ 100 each.

- 6% Debentures of M/s B Ltd. are discharged at premium of 5% by issue of 6% Debentures of M/s AB Ltd. At par.

![]()

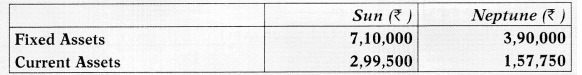

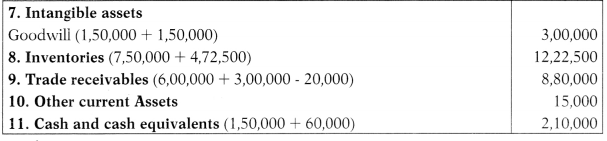

Question 19.

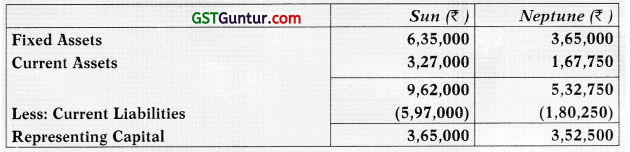

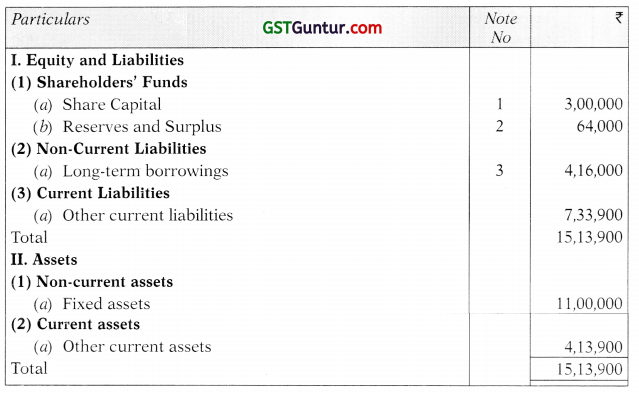

Sun and Neptune had been carrying on business independently. They agreed to amalgamate and form a new company Jupiter Ltd. with an authorised share capital of ₹ 4,00,000 divided into 80,000 equity shares of ₹ 5 each. On 31st March, 2018 the respective Summarised Balance Sheets of Sun and Neptune were as follow:

Additional Information:

(a) Revalued figures of Fixed and Current assets were as follows:

(b) The debtors and creditors include ₹ 43,350 owed by Sun to Neptune. The purchase consideration is satisfied by issue of the following shares and debentures.

(i) 60,000 equity shares of Jupiter Ltd. to Sun and Neptune in the proportion to the profitability of their respective business based on the average net profit during the last three years which were as follows:

(ii) 15% debenture in Jupiter Ltd. at par to provide an income equivalent to 8% return business as on capital employed in their respective business as on 31st March, 2018 after revaluation of assets.

You are required to:

(1) Compute the amount of debentures and shares to be issued to Sun and Neptune.

(2) A Balance sheet of Jupiter Ltd. showing the position immediately after amalgamation. (May 2018) (16 Marks)

Answer:

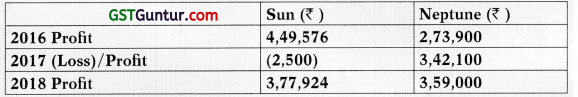

(1) Computation of Amount of Debentures and Shares to be issued:

Sun: 33,000 × \(\frac{100}{15}\) = 2,20,000

Neptune: 29,400 × \(\frac{100}{15}\) = 1,96,000

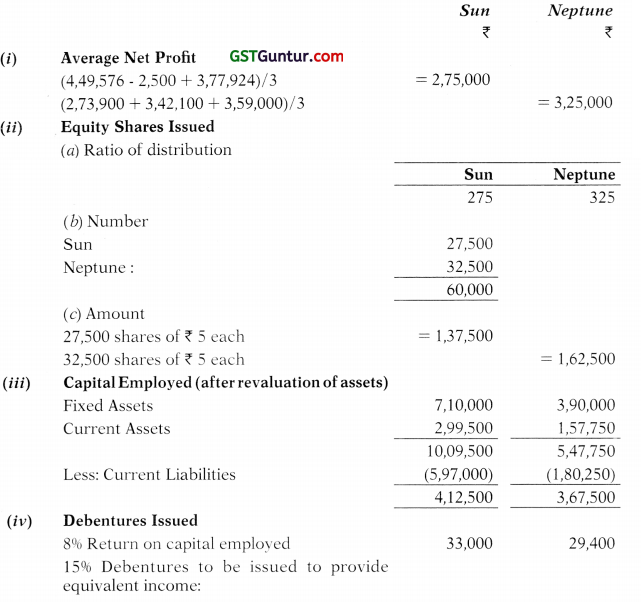

(2) Balance Sheet of Jupiter Ltd. As at 31st March 2018 (after amalgamation)

Notes to Accounts

* 1,57,750 – 43,350 = 1,14,400

** 5,97,000 – 43,350 = 5,53,650

![]()

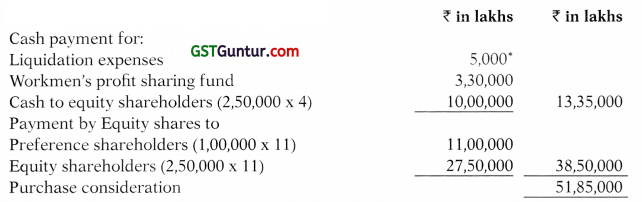

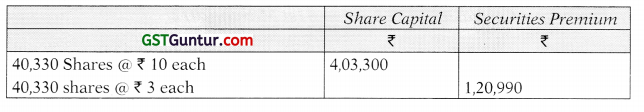

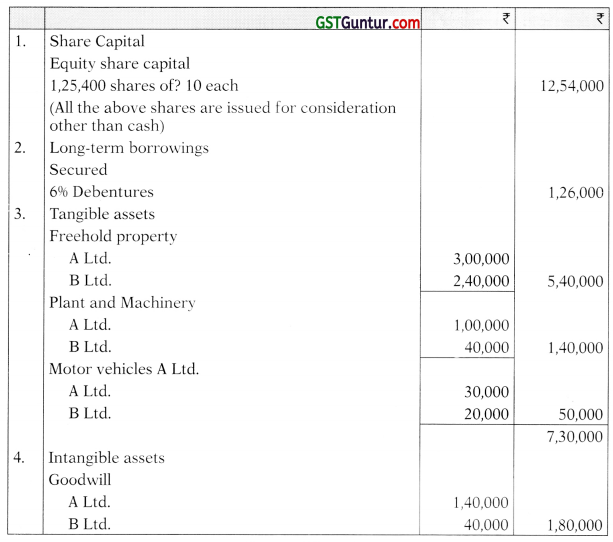

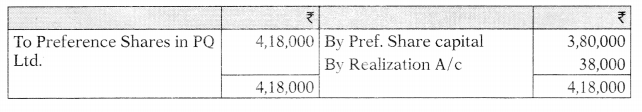

Question 20.

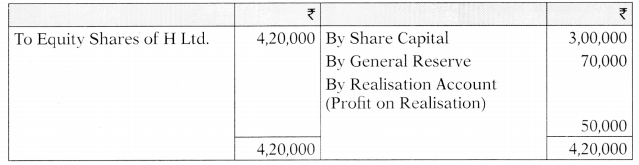

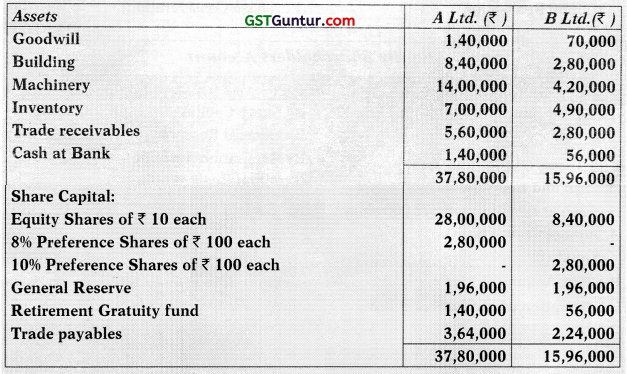

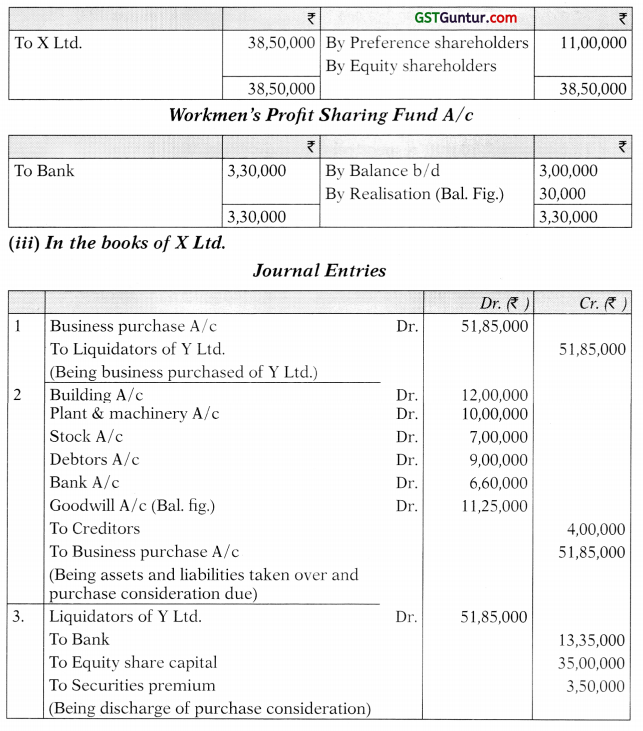

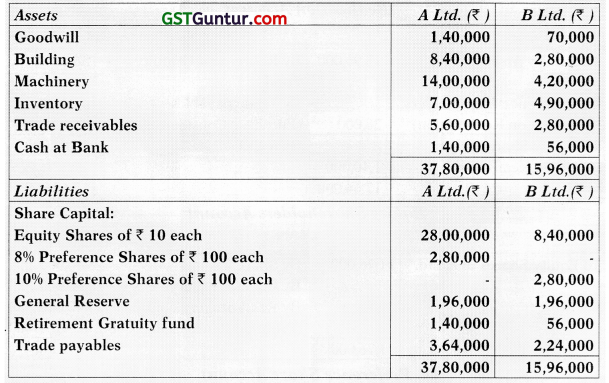

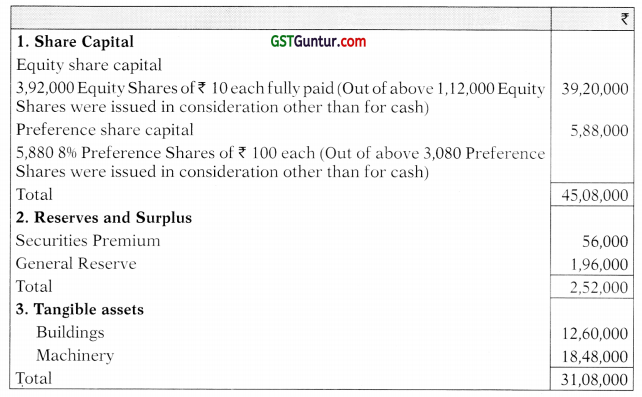

The financial position of two companies A Ltd. and B Ltd. as on 31st March, 2017 was as under:

B Ltd. is absorbed by A Ltd. on the following terms:

(a) 10% Preference Shareholders are to be paid at 10% premium by issue of 8% Preference Shares of A Ltd.

(b) Goodwill of B Ltd. is valued at ₹ 1,40,000, Buildings are valued at ₹ 4,20,000 and the Machinery at ₹ 4,48,000.

(c) Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created @ 7.5%.

(d) Equity Shareholders of B Ltd. will be issued Equity Shares of A Ltd. @ 5% premium.

You are required to:

(a) Prepare necessary Ledger Accounts to close the books of B Ltd.

(b) Prepare the acquisition entries in the books of A Ltd.

(c) Also prepare the Balance Sheet after absorption as at 31 st March, 2017. Internal Reconstruction of a Company

Answer:

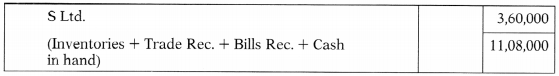

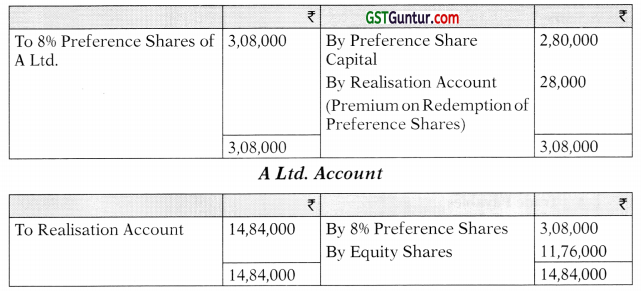

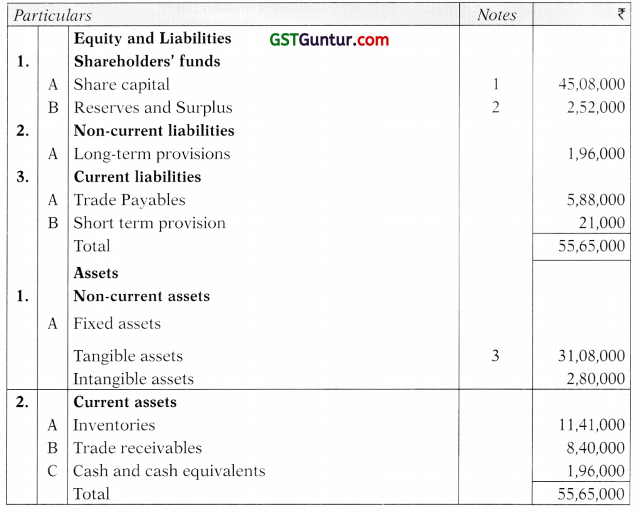

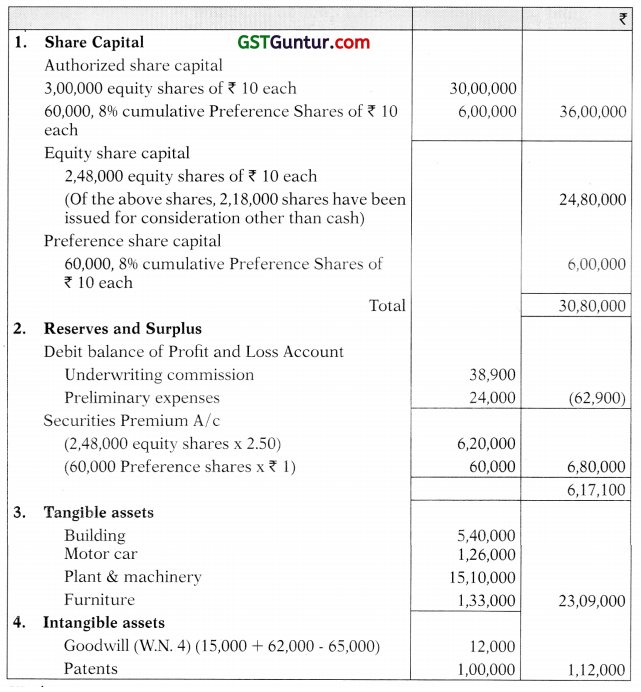

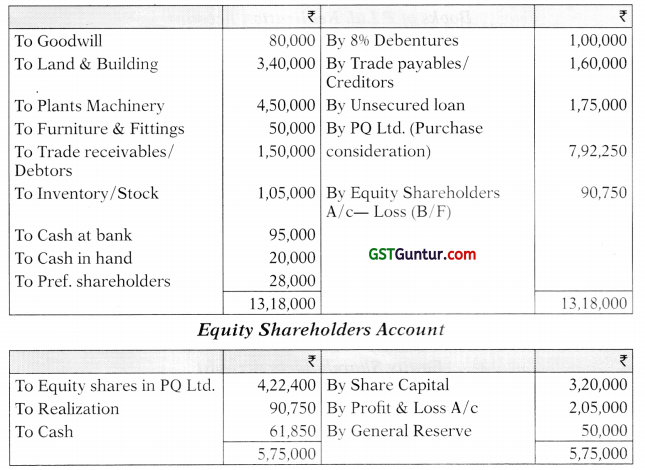

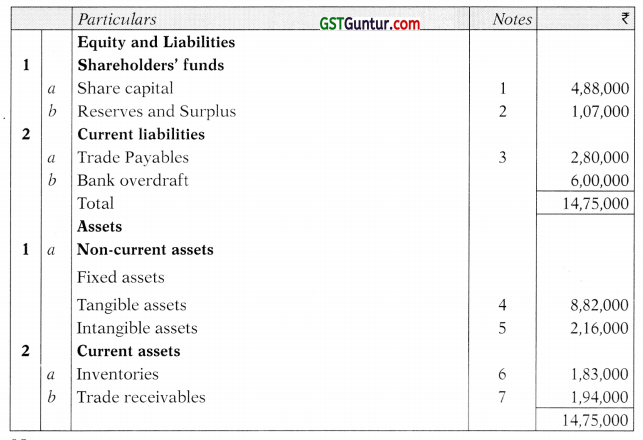

(a) In the Books of B Ltd.

Realisation Account

![]()

A Ltd. Account

(c) Balance Sheet of A Ltd. (after absorption) as at 31st March, 2017

Notes to accounts:

Computation of: Purchase Consideration:

![]()

Question 21.

P Ltd. and 0 Ltd. decided to amalgamate as on 01.04.2016. Their summarized Balance Sheets as on 31.03.2016 were as follows:

From the following information, you are required to prepare the Balance Sheet as on 01.04.2016 of a new company, R Ltd., which was formed to takeover the business of both the companies and took over all the assets and liabilities:

- 50% Debenture are to be converted into Equity Shares of the New Company.

- Investments are non-current in nature.

- Fixed Assets of P Ltd. were valued at 10% above cost and that of 0 Ltd. at 5% above cost.

- 10% of trade receivables were doubtful for both the companies. Inventories to be carried at cost.

- Preference shareholders were discharged by issuing equal number of 9% preference shares at par.

- Equity shareholders of both the transferor companies are to be dis-charged by issuing Equity shares of ₹ 10 each of the new company at a premium of ₹ 5 per share.

Give your answer on the basis that amalgamation is in the nature of purchase.

Answer:

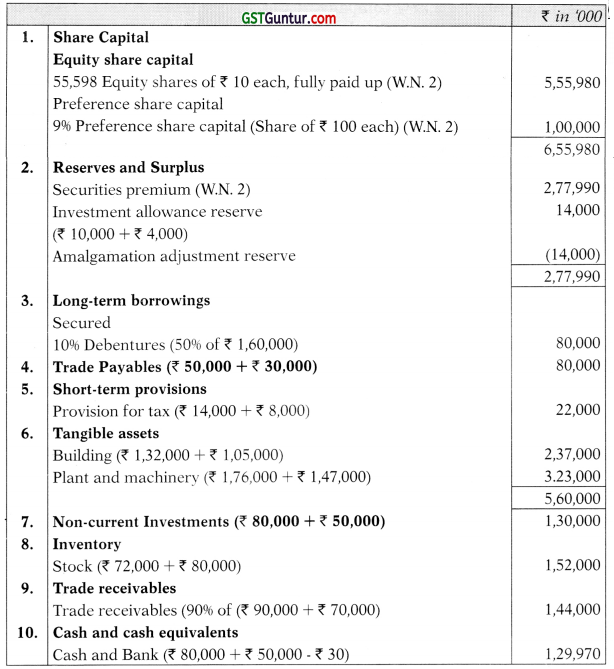

M/s R Ltd.

Balance Sheet as at 1.4.2016

Notes to accounts

Working Notes:

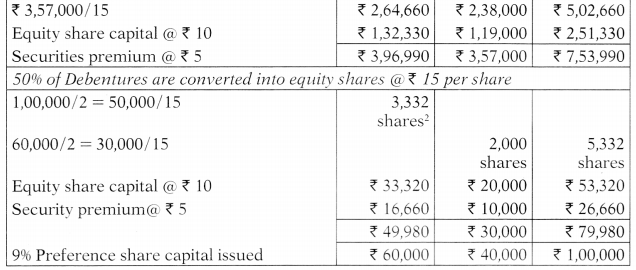

1. Computation of purchase consideration

![]()

Advanced Problems – Purchase

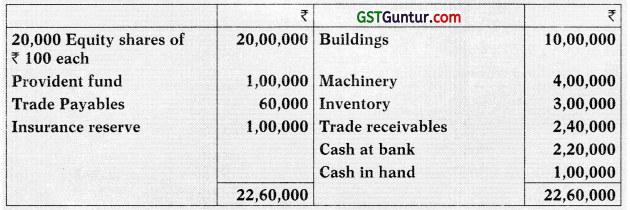

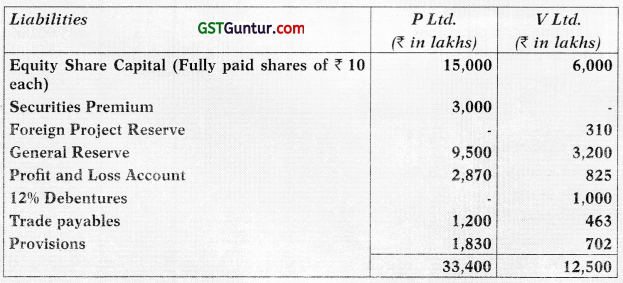

Question 22.

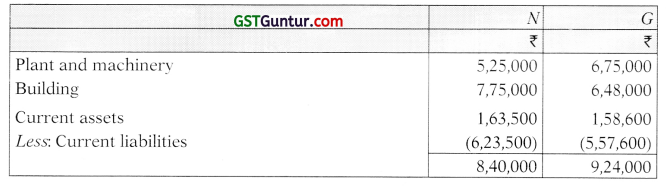

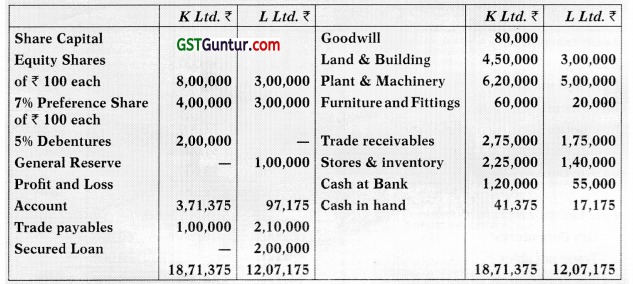

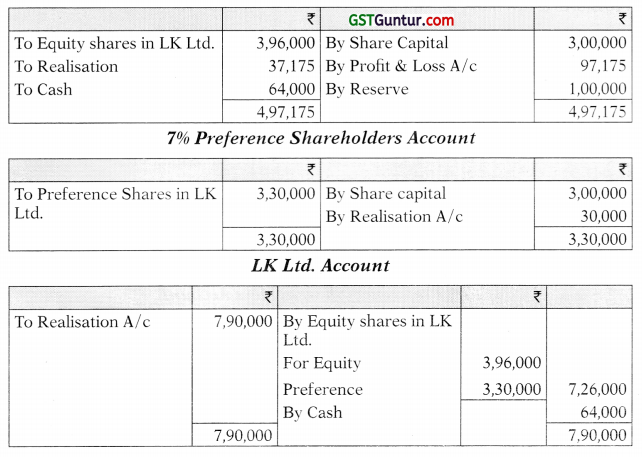

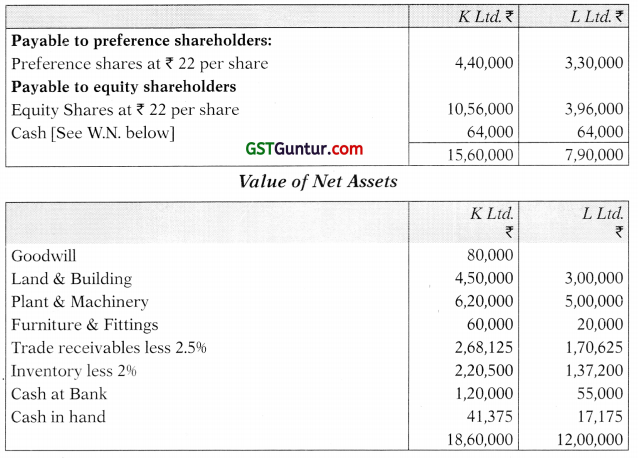

K Ltd. and L Ltd. amalgamate to form a new company LK Ltd. The financial position of these two companies on the date of amalgamation was as under:

The terms of amalgamation are as under:

(A) (1) The assumption of liabilities of both the Companies.

(2) Issue of 5 Preference shares of ₹ 20 each in LK Ltd. @ ₹ 18 paid up at premium of ₹ 4 per share for each preference share held in both the Companies.

(3) Issue of 6 Equity shares of ₹ 20 each in LK Ltd. @ ₹ 18 paid up at a premium of ₹ 4 per share for each equity share held in both the Companies. In addition, necessary cash should be paid to the Equity Shareholders of both the Companies as is required to adjust the rights of shareholders of both the Companies in accordance with the intrinsic value of the shares of both the Companies.

(4) Issue of such amount of fully paid 6% debentures in LK Ltd. as is sufficient to discharge the 5% debentures in K Ltd. at a discount of 5% after takeover.

(B) (1) The assets and liabilities are to be taken at book values inventory and

trade receivables for which provisions at 2% and 2 1/2% respectively to be raised.

(2) The trade receivables of K Ltd. include ₹ 20,000 due from L Ltd.

(C) The LK Ltd. is to issue 15,000 new equity shares of ₹ 20 each, ₹ 18 paid up at premium of ₹ 4 per share so as to have sufficient working capital. Prepare ledger accounts in the books of K Ltd. and L Ltd. to close their books.

Answer:

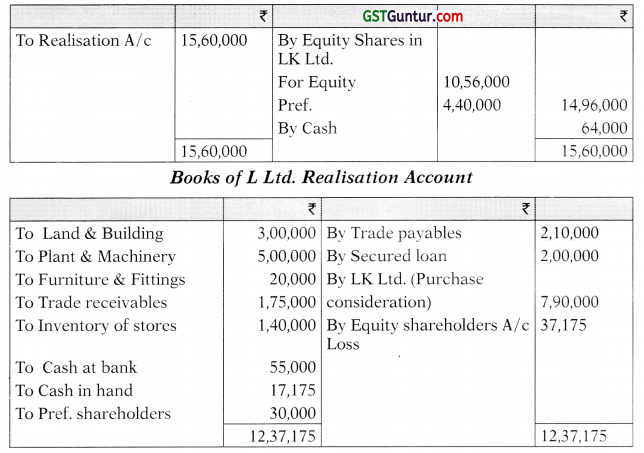

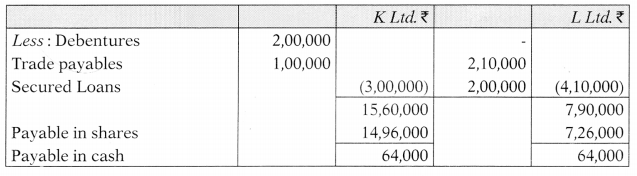

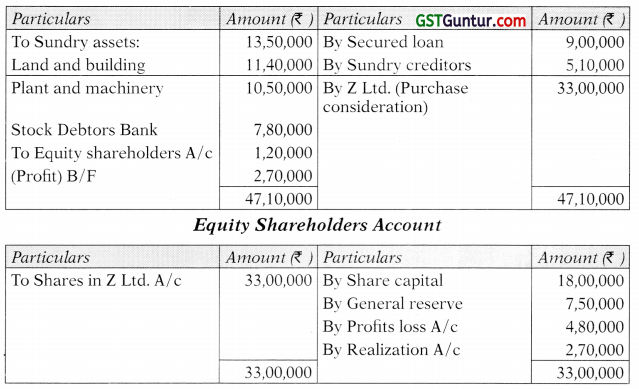

Books of K Ltd. Realisation Account

7% Preference Shareholders Account

LK Ltd. Account

Equity Shareholders Account

Computation and discharge of purchase consideration

![]()

Question 23.

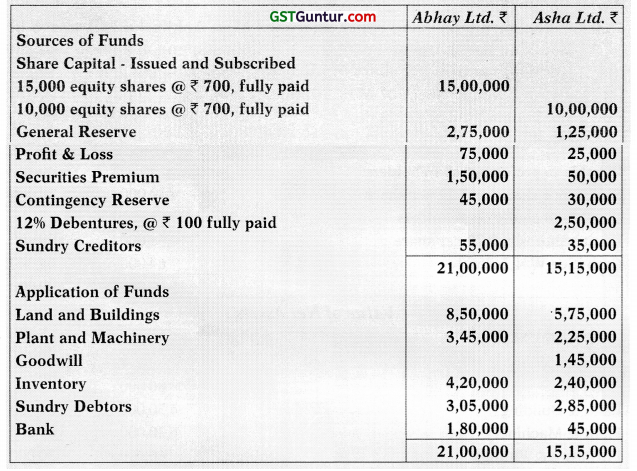

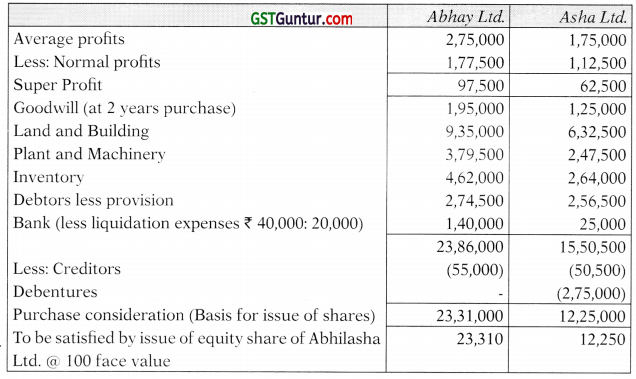

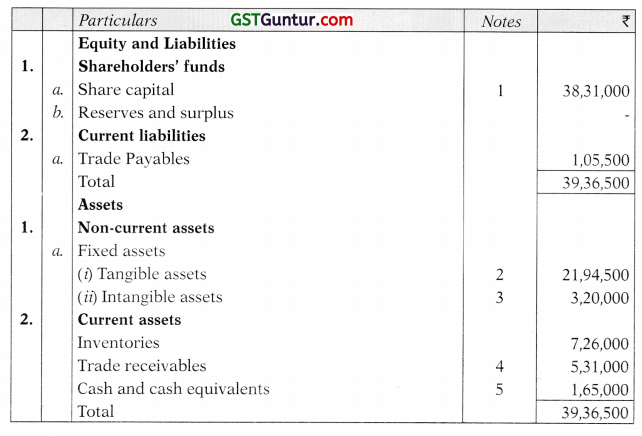

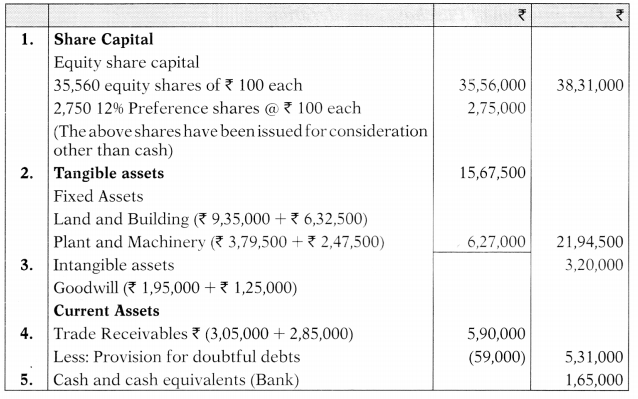

The financial position of two companies M/s. Abhay Ltd. and M/s. Asha Ltd. as on 31-3-2015 is as follows:

Balance Sheet as on 31-3-2015

They decided to merge and form a new company M/s. Abhilasha Ltd. as on 1-4-2015 on the following terms:

(1) Goodwill to be valued at 2 years purchase of the super profits. The normal rate of return is 10% of the combined share capital and general reserve. All other reserves are to be ignored for the purpose of goodwill. Average profits of M/s. Abhay Ltd. is ₹ 2,75,000 and M/s. Asha Ltd. is ₹ 1,75,000.

(2) Land and Buildings, Plant and machinery and Inventory of both companies to be valued at 10% above book value and a provision of 10% to be provided on Sundry Debtors.

(3) 12% debentures to be redeemed by the issue of 12% preference shares of M/s. Abhilasha Ltd. (face value of ₹ 100) at a premium of 10%.

(4) Sundry creditor to be taken over at book value. There is an unrecorded liability of ₹ 15,500 of M/s. Asha Ltd. as on 1-4-2015.

(5) The bank balance of both companies to be taken over by M/s. Abhilasha Ltd. after deducting liquidation expenses of ₹ 60,000 to be borne by M/s. Abhay Ltd. and M/s. Asha Ltd. in the ratio of 2:1.

You are required to:

(i) Compute the basis on which shares of M/s. Abhilasha Ltd. are to be issued to the shareholders of the existing company assuming that the nominal value of per share of M/s. Abhilasha Ltd. is ₹ 100.

(n) Draw Balance Sheet of M/s. Abhilasha Ltd. as on 1 4-2015 after the amalgamation. (May 2015) (16 Marks)

Answer:

(i) Computation of Purchase consideration

(ii) Balance Sheet of Abhilasha Ltd. (After Amalgamation) as on 1-4-2015

Notes to accounts

![]()

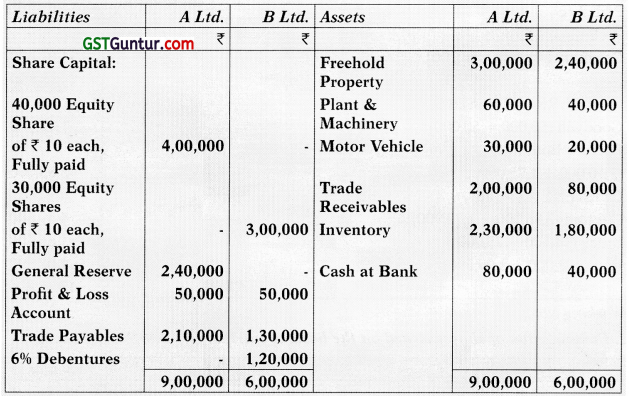

Question 24.

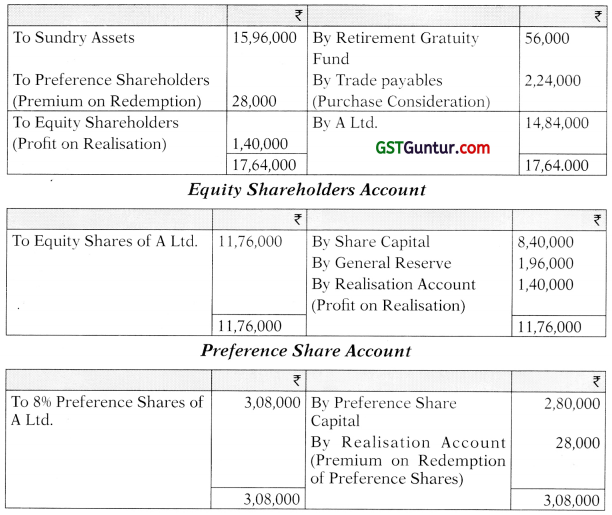

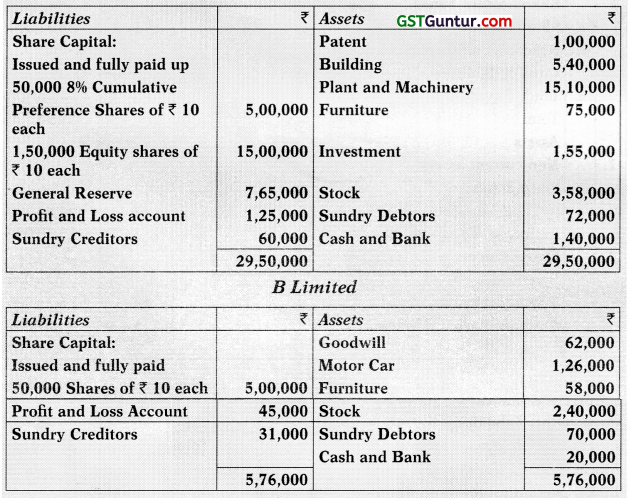

Given below are the Balance Sheet of two companies as on 31st December, 2015.

A Limited

It has been agreed that both these companies should be wound up and a new company AB Ltd. should be formed to acquire the assets of both the companies on the following terms and conditions:

(i) AB Ltd. is to have an authorized capital of ₹ 36,00,000 divided into 60,000, 8% cumulative preference shares of ₹ 10 each and 3,00,000 equity shares of ₹ 10 each.

(ii) AB Ltd. to purchase the whole of the assets of A Ltd. (except cash and Bank balances) for ₹ 28,25,000 to be settled as to ₹ 5,75,000 in cash and as to the balance by issue of 1,80,000 equity shares, credited as fully paid, to be treated as valued at ₹ 12.50 each.

(iii) AB Ltd. is to purchase the whole of the assets of B Ltd. (except cash and bank balances) for ₹ 4,91,000 to be settled as to ₹ 16,000 in cash and as to the balance by issue of 38,000 equity shares, credited as fully paid, to be treated as valued at ₹ 12.50 each.

(iv) A Ltd. and B Ltd. both are to be wound up, the two liquidators distributing the shares in AB Ltd. in kind among the equity shareholders of the respective companies.

(v) The liquidator of A Ltd. is to pay the preference shareholders 12 in cash for every share held in full satisfaction of their claims.

(vi) AB Ltd. is to make a public issue of 60,000, 8% cumulative preference shares at a premium of 10% and 30,000 equity shares at the issue price of ₹ 12.50 per share, all amount payable in full on application.

It is estimated that the cost of liquidation (including the liquidators’ remuneration) will be ₹ 10,000 in case of A Ltd. and ₹ 5,000 in case of B Ltd. and that the preliminary expenses of AB Ltd. will amount to ₹ 24,000- exclusive of the underwriting commission of ₹ 38,900 payable on the public issue.

You are required to prepare the initial Balance Sheet of AB Ltd. on the basis that all assets other than goodwill are taken over at the book value. (May 2016) (16 Marks)

Answer:

Balance Sheet of AB Ltd.

Notes of accounts

Working Notes:

1. Computation of Purchase consideration of A Ltd.

4. Calculation of goodwill/capital reserve of A Ltd. & B Ltd.

Notes:

- As per the information given in the question, only the assets of A Ltd. and B Ltd. are taken over by AB Ltd. Thus the creditors are considered to be paid by the liquidators of the respective companies and hence being not taken over by AB Ltd.

- As per the information given in the second last para of the question, it is stated that the preliminary expenses of AB Ltd. will amount to ₹ 24,000 exclusive of the underwriting commission of ₹ 38,900 payable on the public issue. It has been assumed that ₹ 24,000 has been paid and underwriting commission is still payable in the balance sheet of the amalgamated company.

- Preliminary expenses and underwriting commission have been written off as per the provisions of Accounting standards.

![]()

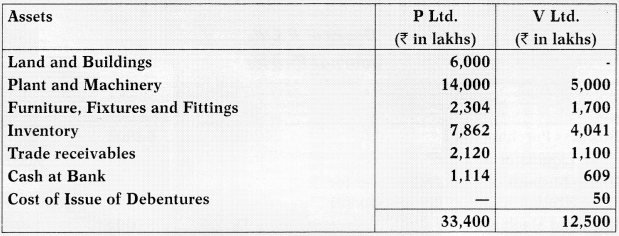

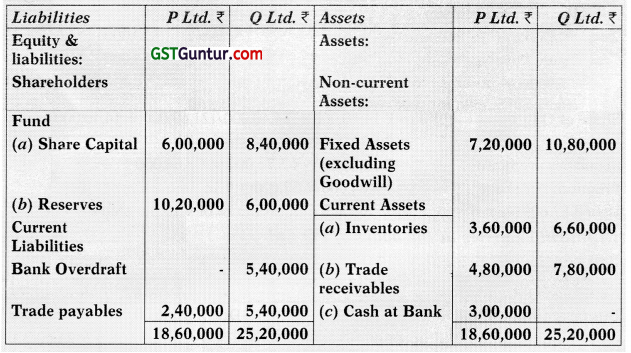

Question 25.

P Ltd. and 0 Ltd. agreed to amalgamate and form a new company called PQ Ltd. The summarized balance sheets of both the companies on the date of amalgamation stood as below:

PQ Ltd. took over the assets and liabilities of both the companies at book value after creating provision @ 5% on Stock and Debtors respectively and depreciating Furniture & Fittings by @ 10%, Plant and Machinery by @ 10%. The debtors of P Ltd. include ₹ 25,000 due from 0 Ltd.

PQ Ltd. will issue:

- 5 Pref. shares of ₹ 20 each @ ₹ 18 paid up at a premium of ₹ 4 per share for each pref. share held in both the companies.

- 6 Equity shares of ₹ 20 each @ ₹ 18 paid up a premium of ₹ 4 per share for each equity share held in both the companies.

- 6% Debentures to discharge the 8% debentures of both the companies,

- 20,000 new equity shares of ₹ 20 each for cash @ ₹ 18 paid up at a premium of ₹ 4 per share.

PQ Ltd. will pay cash to equity shareholders of both the companies in order to adjust their rights as per the intrinsic value of the shares of both the companies.

Prepare ledger accounts in the books of P Ltd. and Q Ltd. to close their books. (May 2017) (16 Marks)

Answer:

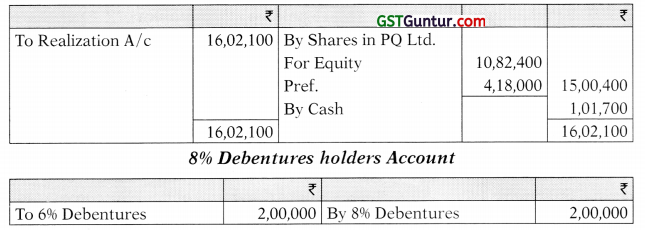

Books of P Ltd. Realization Account

9% Preference Shareholders Account

PQ Ltd. Account

Books of Q Ltd.

Realization Account

9% Preference Shareholders Account

PQ Ltd. Account

W. Note : Value of Net Assets

Note: This cash is paid to equity shareholders of both the companies for adjustment of their rights as per intrinsic value of both companies.

![]()

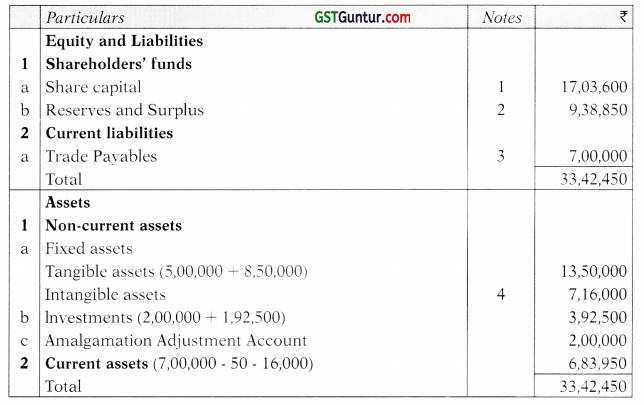

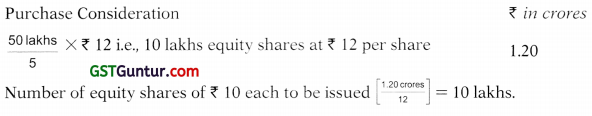

Question 26.

Following are the Balance Sheet of companies as at 31.12.2003:

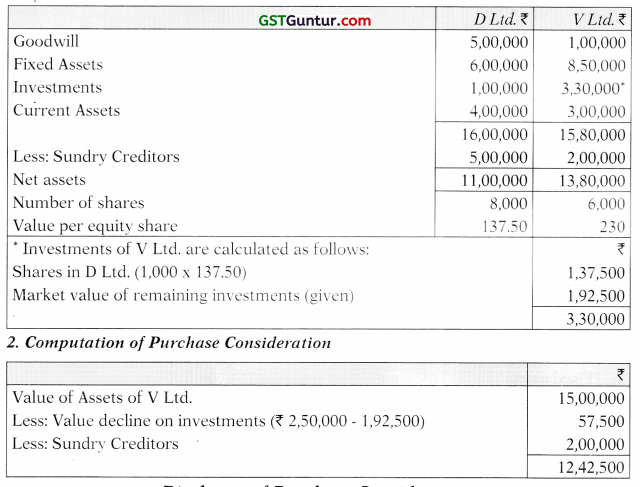

D Ltd. took over V Ltd. on the basis of the respective shares value, adjusting wherever necessary, the book values of assets and liabilities on the basis of the following information:

(i) Investment Allowance Reserve was in respect of addition made to fixed assets by V Ltd. in the year 1997-2002 on which income tax relief has been obtained. In terms of the Income Tax Act, 1961, the company has to carry forward till 2006 reserve of ₹ 2,00,000 for utilization.

(ii) Investments of V Ltd. included 1,000 shares in D Ltd. acquired at cost of ₹ 150 per share. The other investments of V Ltd. have a market value of ₹ 1,92,500.

(iii) The market value of investments of D Ltd. are to be taken at ₹ 1,00,000.

(iv) Goodwill of DLtd. and V Ltd. are to be taken at ₹ 5,00,000and ₹ 1,00,000 respectively.

(v) Fixed assets of D Ltd. and V Ltd. are valued at ₹ 6,00,000 and ₹ 8,50,000 respectively.

(vi) Current assets of D Ltd. included ₹ 80,000 of stock in trade received from V Ltd. at cost plus 25%.

The above scheme has been duty adopted. Pass necessary Journal Entries in the books of D Ltd. and prepare Balance Sheet of D Ltd. after taking over the business of V Ltd. Fractional share to be settled in cash, rest in shares of D Ltd. Calculation shall be made to the nearest multiple of a rupee. (May 2004) (16 Marks)

Answer:

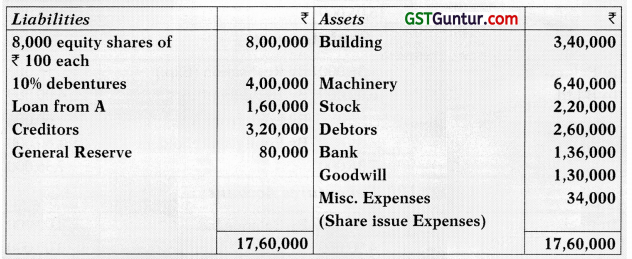

Journal Entries in the Books of D Ltd.

Balance Sheet of D Ltd. as on 31st December, 2003

Notes to accounts

Working Notes:

1. Calculation of net asset value of shares

Discharge of Purchase Consideration

![]()

Question 27.

The following is the summarized Balance Sheet of A Ltd. as at 31st March, 2006:

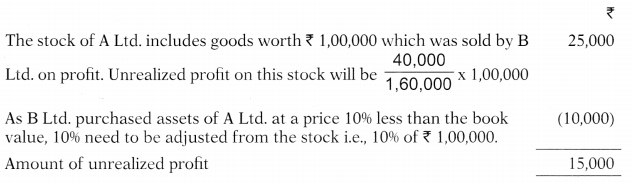

B Ltd. agreed to absorb A Ltd. on the following terms and conditions:

- B Ltd. would takeover alt assets, except bank balance at their book values less 10%. Goodwill is to be valued at 4 year’s purchase of super profits, assuming that the normal rate of return be 8% on the combined amount of share capital and general reserve.

- B Ltd. is to takeover creditors at book value.

- The purchase consideration is to be paid in cash to the extent of ₹ 6,00,000 and the balance in fully paid equity shares of ₹ 100 each at ₹ 125 per share.

- The average profit is ₹ 1,24,400. The liquidation expenses amounted to ₹ 16,000. B Ltd. sold prior to 31st March, 2006 goods costing ₹ 1,20,000 to A Ltd. for ₹ 1,60,000. ₹ 1,00,000 worth of goods are still in stock of A Ltd. on 31st March, 2006. Creditors of A Ltd. include ₹ 40,000 stilt due to B Ltd.

- Show the necessary Ledger Accounts to close the books of A Ltd. and prepare the Balance Sheet of B Ltd. as at 1st April, 2006 after the takeover. (November 2006) (20 Marks)

Answer:

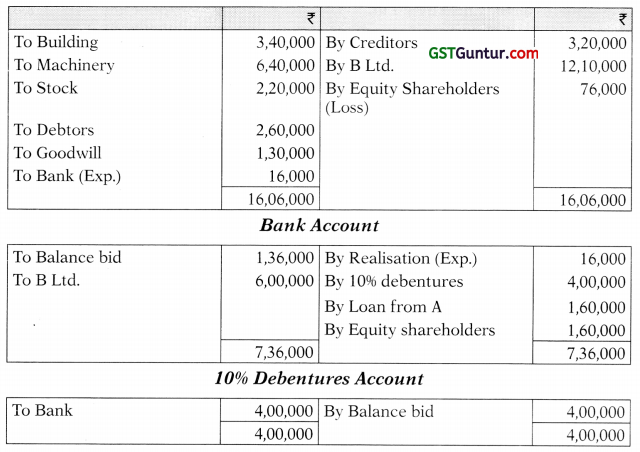

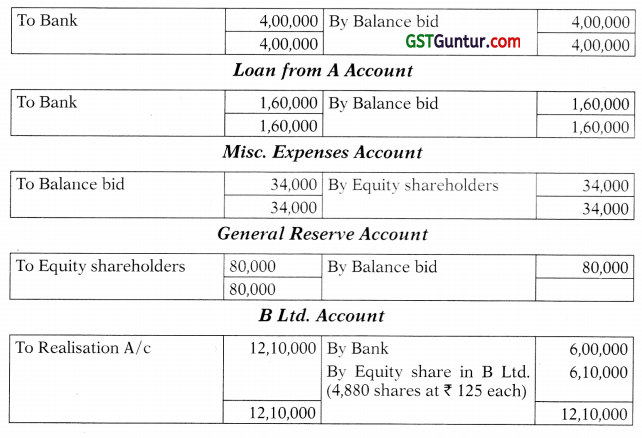

Books of A Limited Realisation Account

Loan from A Account

Equity Shares in B Ltd. Account

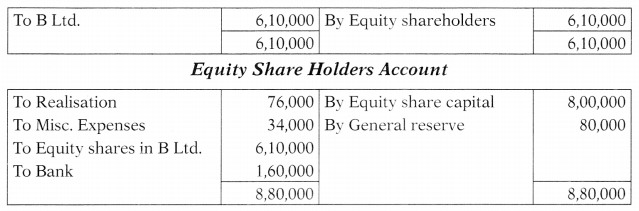

B Ltd.

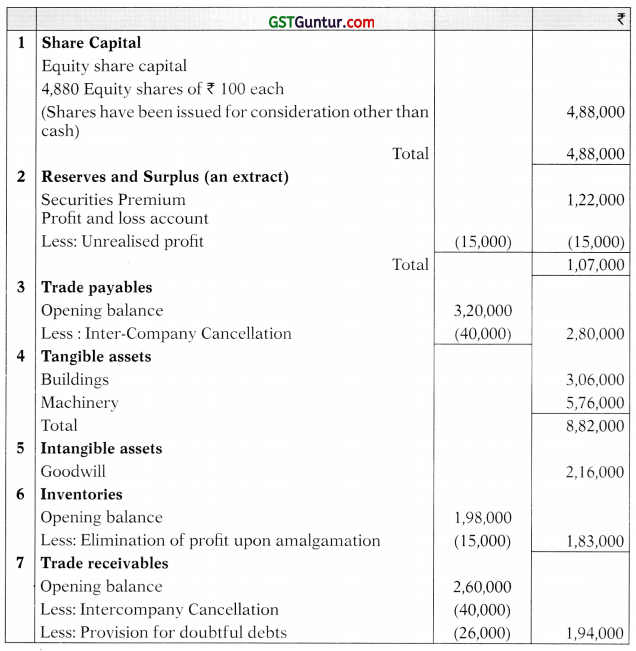

Balance Sheet as on 1st April, 2006 (extract) ‘

Notes to accounts

Working Notes:

Out of this ₹ 6,00,000 is to be paid in cash and remaining i.e., (12,10,000 – 6,00,000) ₹ 6,10,000 in shares of ₹ 125. Thus, the number of shares to be allotted 6,10,000/125 = 4,880 shares.

3. Unrealised Profit on Stock

![]()

Question 28.

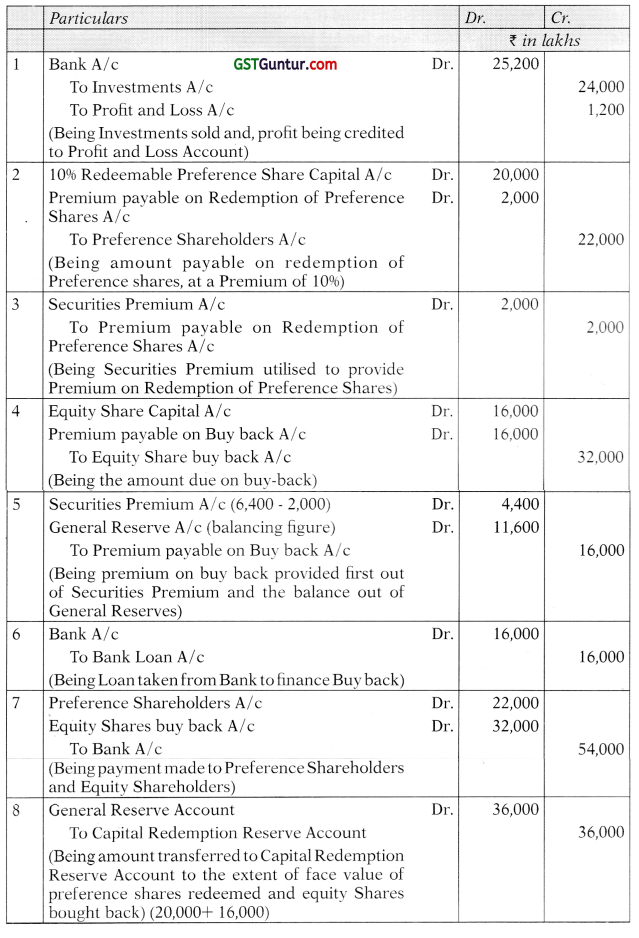

P Ltd. and 0 Ltd. decided to amalgamate as on 01.04.2018 Their summarized Balance Sheets as on 31.03.2018 were as follows:

From the following information, you are required to prepare the Balance Sheet as on 01.04.2018 of a new company, R Ltd., which was formed to takeover the business of both the companies and took over all the assets and liabilities:

- 50% Debenture are to be converted into Equity Shares of the New Company.

- Investments are non- current in nature.

- Fixed Assets of P Ltd. were valued at 10% above cost and that of 0 Ltd. at 5% above cost.

- 10 % of trade receivables were doubtful for both the companies. Inventories to be carried at cost.

- Preference shareholders were discharged by issuing equal number of 9% preference shares at par.

- Equity shareholders of both the transferor companies are to be discharged by issuing Equity shares of ₹ 10 each of the new company at a premium of ₹ 5 per share.

Give your answer on the basis that amalgamation is in the nature of purchase.

Answer:

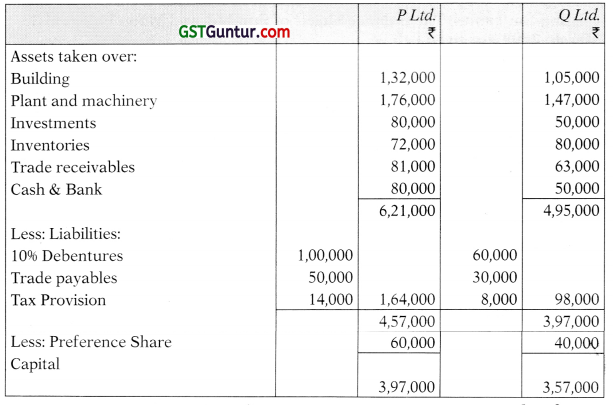

M/s. R Ltd.

Balance Sheet as at 1.4.2018

Notes to accounts

Working Notes:

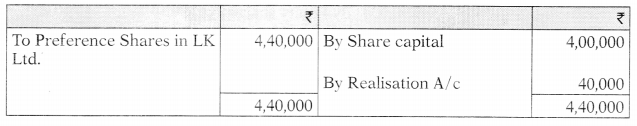

1. Calculation of value of equity shares issued to transferor companies

2. Number of shares issued to equity shareholders, debenture holders and preference shareholders

* Cash paid for fraction of shares = ₹ 3,97,000 less ₹ 3,96,990 = ₹ 10

** Cash paid for fraction of shares = ₹ 50,000 less ₹ 49,980 = ₹ 20

![]()

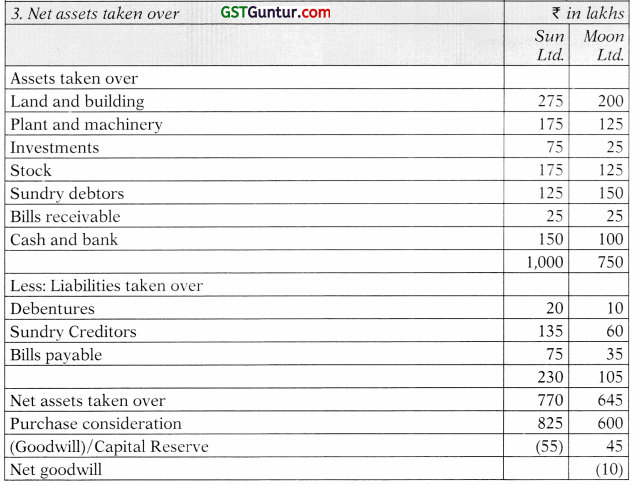

Question 29.

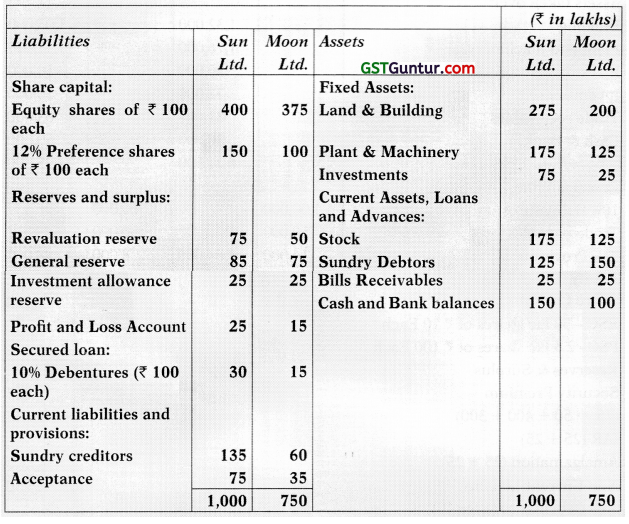

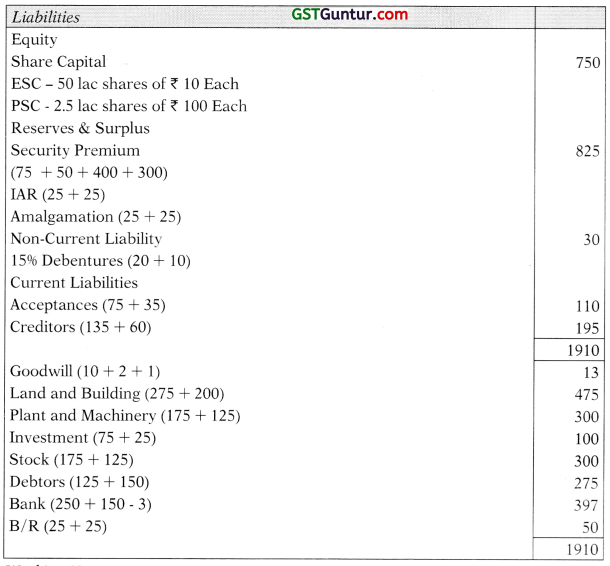

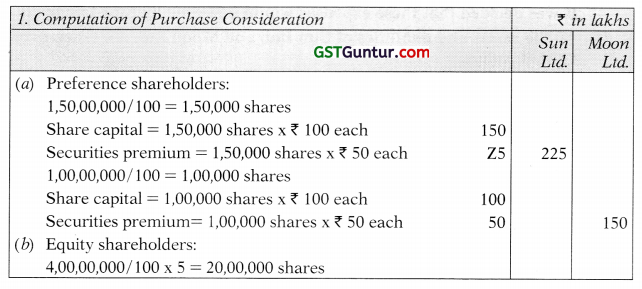

Sun Ltd. and Moon Ltd. were amalgamated on and from 1st April, 2009. A new company Star Ltd. was formed to takeover the business of the existing companies. The Balance Sheets of Sun Ltd. and Moon Ltd. as at 31st March, 2009 are given below:

Additional information:

(a) Star Ltd. will issue 5 equity shares for each equity share of Sun Ltd. and 4 equity shares for each equity share of Moon Ltd. The shares are to be issued @ ₹ 30 each, having a face value of ₹ 10 per share.

(b) Preference shareholders of the two companies are issued equivalent number of 15% preference shares of Star Ltd. at a price of ₹ 150 per share (face value ₹ 100).

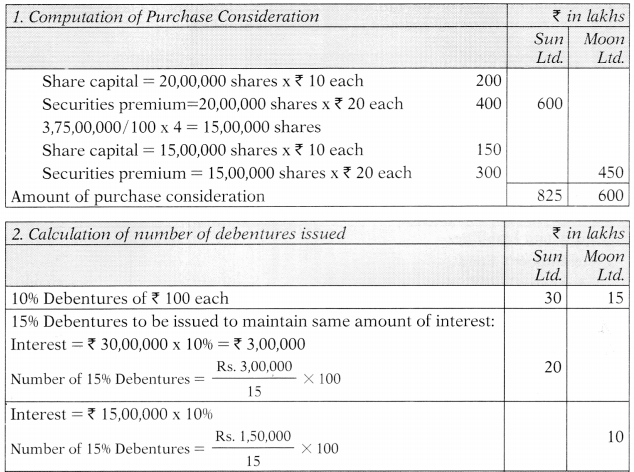

(c) 10% Debenture holders of Sun Ltd. and Moon Ltd. are discharged by Star Ltd., issuing such number of its 15% Debentures of ₹ 100 each so as to maintain the same amount of interest.

(d) Investment allowance reserve is to be maintained for 4 more years.

(e) Liquidation expenses are:

Sun Ltd. ₹ 2,00,000

Moon Ltd. ₹ 1,00,000

It was decided that these expenses would be borne by Star Ltd.

(f) All the assets and liabilities of Sun Ltd. and Moon Ltd. are taken over at book value.

(g) Authorised equity share capital of Star Ltd. is ₹ 5,00,00,000, divided into equity shares of ₹ 10 each. After issuing required number of shares to the Liquidators of Sun Ltd. and Moon Ltd., Star Ltd. issued balance shares to Public. The issue was fully subscribed.

Required:

Prepare the Balance Sheet of Star Ltd. as at 1 st April, 2009 after amalgamation has been carried out on the basis of Amalgamation in the nature of purchase (Nov. 2009) (16 Marks)

Answer:

Balance Sheet of Star Ltd. as at 1st April, 2009

Working Notes:

4. Liquidation expenses of Sun Ltd. and Moon Ltd., ₹ 2 lakhs and ₹ 1 lakhs respectively will be debited to Goodwill account in the books of Star Ltd.

![]()

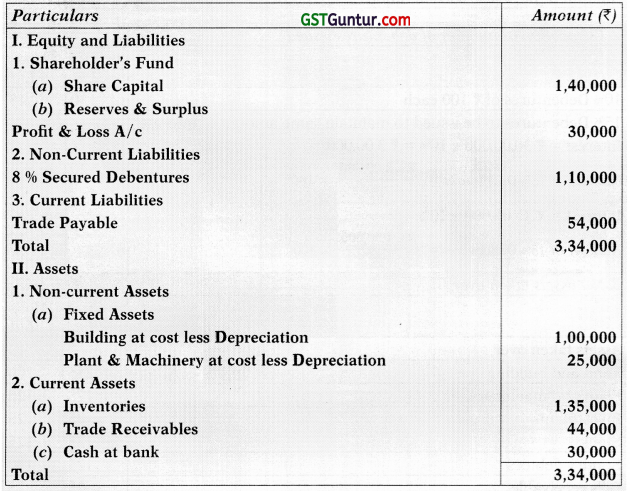

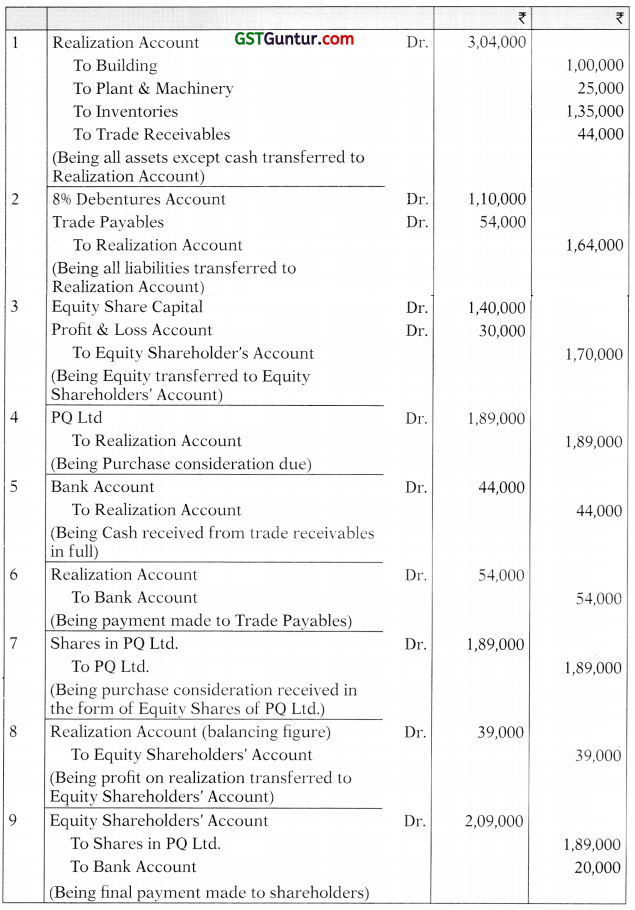

Question 30.

P Ltd. and 0 Ltd. were carrying on the business of manufacturing of auto components. Both the companies decided to amalgamate and a new company PQ Ltd. is to be formed with an Authorized Capital of ₹ 10,00,000 divided into 1,00,000 equity shares of ₹ 10 each. The Balance Sheet of the companies as on 31.03.2014 were as under:

P Limited Balance Sheet as at 31.03.2014

Q Limited

Balance Sheet as at 31.03.2014

The assets and liabilities of the existing companies are to be transferred at book value with the exception of some items detailed below:

- Goodwill of P Ltd. was worth ₹ 50,000 and of 0 Ltd. was worth ₹ 1,50,000.

- Furniture & Fixture of Q Ltd. was valued at ₹ 35,000.

- The debtors of P Ltd. are realized fully and bank balance of P Ltd. are to be retained by the liquidator and the sundry creditors are to be paid out of the proceeds thereof.

- The debentures of P Ltd. are to be discharged by issue of 8% debentures of PQ Ltd. at a premium of 10%.

You are required to:

(/) Compute the basis on which shares in PQ Ltd. will be issued at par to the shareholders of the existing companies.

(ii) Draw up a Balance Sheet of PQ Ltd. as at 1st April, 2014, the date of completion of amalgamation,

(iii) Write up journal entries including bank entries for closing the books of P Ltd. (May 2014) (16 Marks)

Answer:

Computation of Purchase Consideration

PQ Limited Balance Sheet as at 1st April, 2014

Notes to Accounts:

Working Note:

Computation of Securities Premium

Debentures issued by PQ Ltd. to the existing debenture holders of P Ltd. at 1 CPo premium.

Securities Premium = ₹ 1,10,000 × 10% = ₹ 11,000.

In the books of P Ltd. (Journal Entries)

![]()

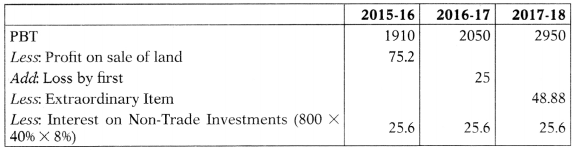

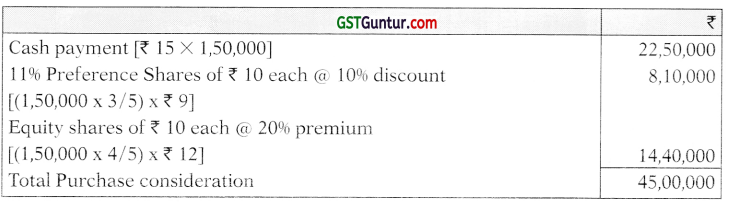

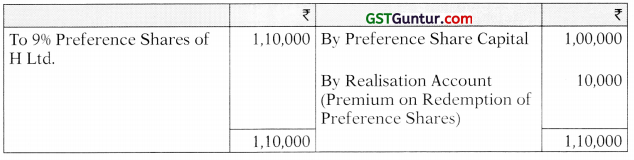

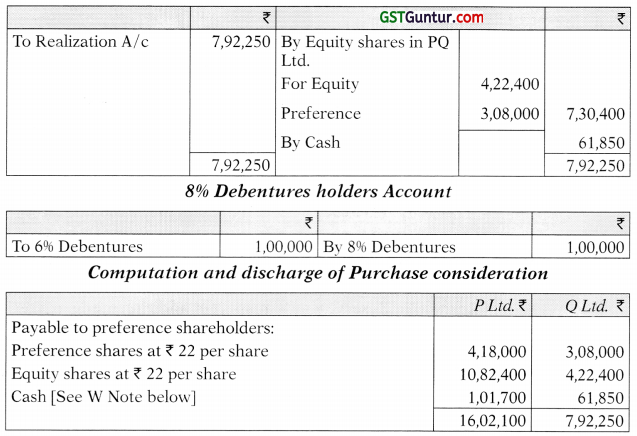

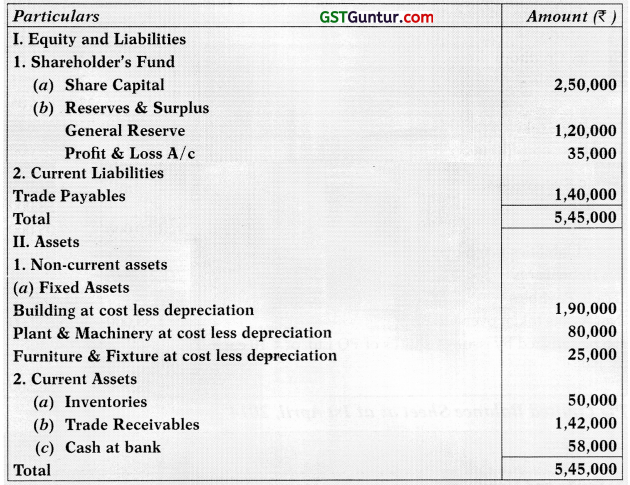

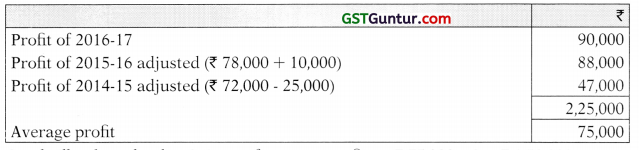

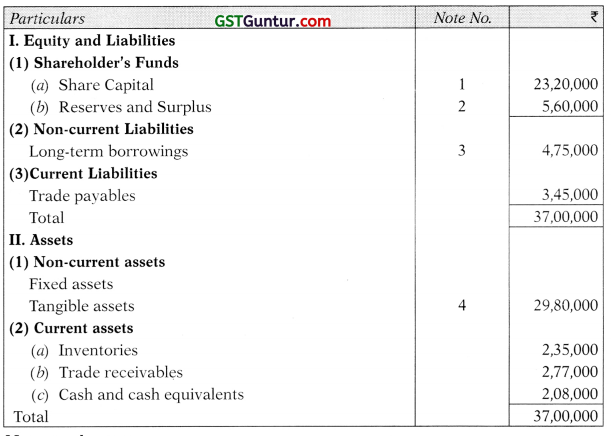

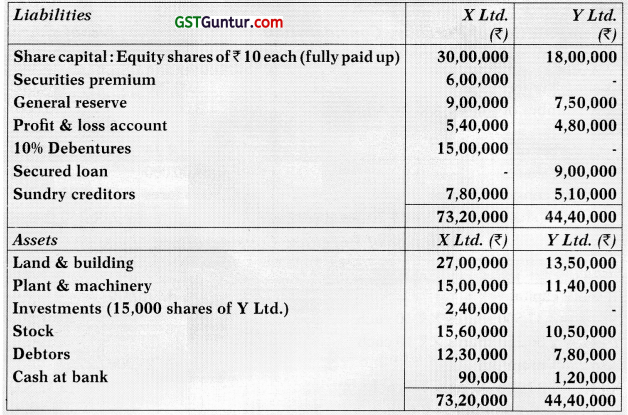

Question 31.

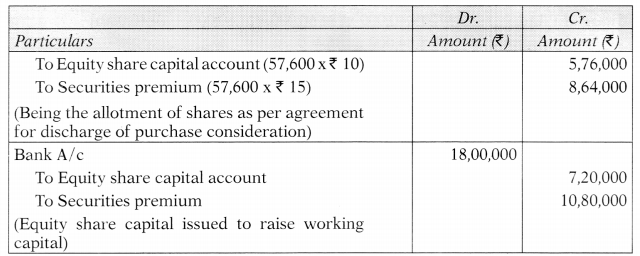

P Ltd. and 0 Ltd. agreed to amalgamate their business. The scheme envisaged a share capital equal to the combined capital of P Ltd. and 0 Ltd. for the purpose of acquiring the assets, liabilities and undertakings of the two companies in exchange for share in PQ Ltd.

The Balance Sheets of P Ltd. and 0 Ltd. as on 31st March, 2017 (the date of amalgamation) are given below:

Summarised balance sheet as at 31-03-2017

The consideration was to be based on the net assets of the companies as shown in the above Balance Sheets, but subject to an additional payment to P Ltd. for its goodwill to be calculated as its weighted average of net profits for the three years ended 31st March, 2017. The weights for this purpose for the years 2014-15, 2015-16 and 2016-17 were agreed as 1, 2 and 3 respectively.

The profit had been:

2014-15 ₹ 3,00,000; 2015-16 ₹ 5,25,000 and 2016-17 ₹ 6,30,000.

The shares of PQ Ltd. were to be issued to P Ltd. and Q Ltd. at a premium and in proportion to the agreed net assets value of these companies.

In order to raise working capital, PQ Ltd. increased its authorized capital by ₹ 12,00,000 and proceeded to issue 72,000 shares of ? 10 each at the same rate of premium as issued for discharging purchase consideration to P Ltd. and Q Ltd.

You are required to:

(i) Calculate the number of shares issued to P Ltd. and Q Ltd.; and

(ii) Prepare the Balance Sheet of PQ Ltd. as per Schedule III after recording its journal entries. (May 2017) (16 Marks)

Answer:

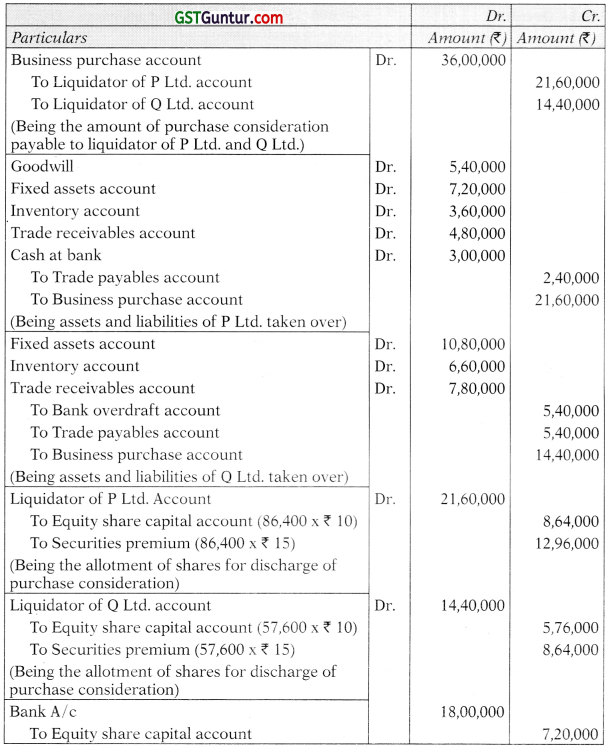

(i) Computation of number of shares issued to P Ltd. and Q Ltd.:

Amoutn of Share Capital as per balance sheet

P Ltd. = ₹ 6,00,000

Q Ltd. = ₹ 8.40.000

= 14.40.000

Share of P Ltd. = ₹ 14,40,000 × [21,60,000/(21,60,000 + 14,40,000)]

= ₹ 8,64,000 or 86,400 shares

Securities premium = ₹ 21,60,000 – ₹ 8,64,000 = ₹ 12,96,000

Premium per share = ₹ 12,96,000/₹ 86,400 = ₹ 15

Issued 86,400 shares @ ₹ 10 each at a premium of ₹ 15 per share

Share of Q Ltd. = ₹ 14,40,000 × [14,40,000/(21,60,000 + 14,40,000)]

= ₹ 5,76,000 or 57,600 shares

Securities premium = ₹ 14,40,000 – ₹ 5,76,000 = ₹ 8,64,000

Premium per share = ₹ 8,64,000/₹ 57,600 = ₹ 15

Issued 57,600 shares @ ₹ 10 each at a premium of ₹ 15 per share

(ii) Journal Entries in the books of PQ Ltd.

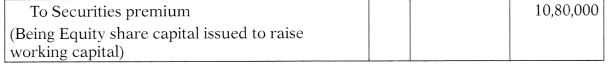

Balance Sheet of PQ Ltd. on 31st March, 2017 after amalgamation

Notes to accounts

Working Notes:

1. Calculation of goodwill

![]()

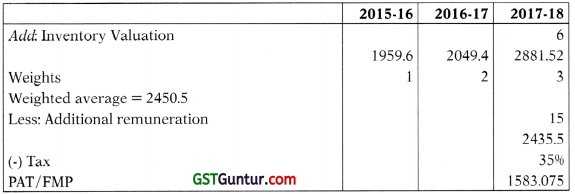

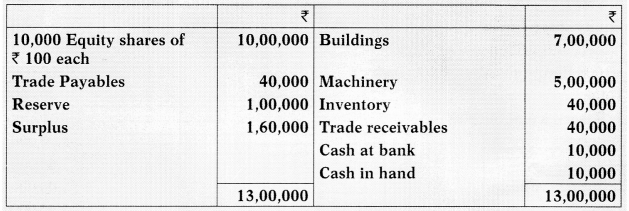

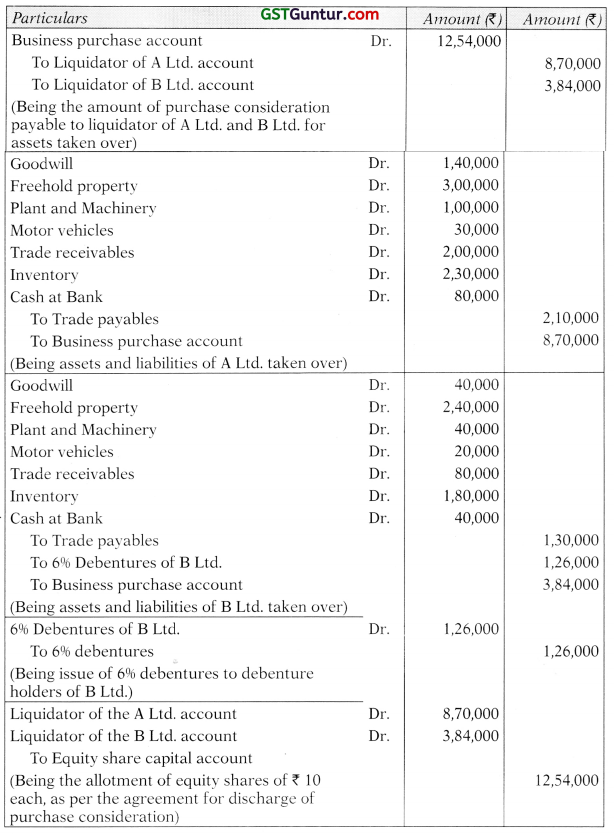

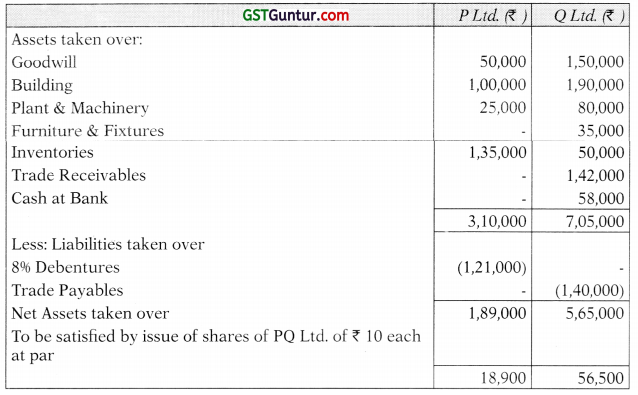

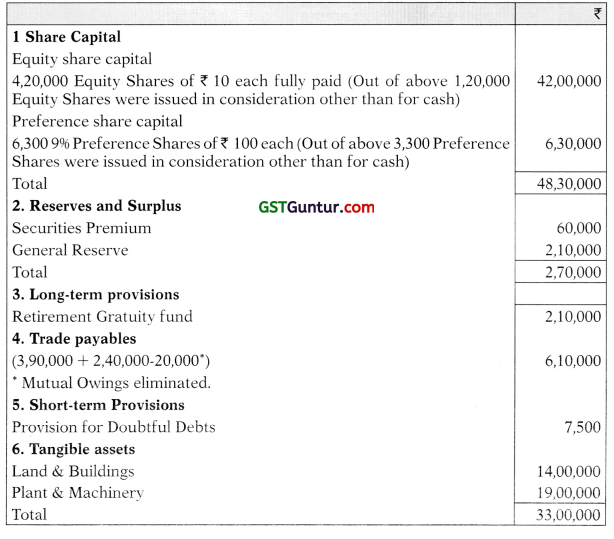

Question 32.

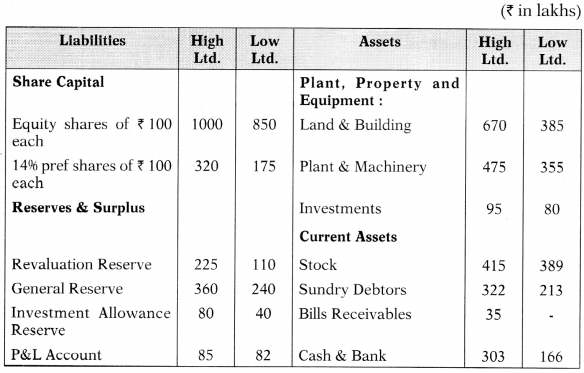

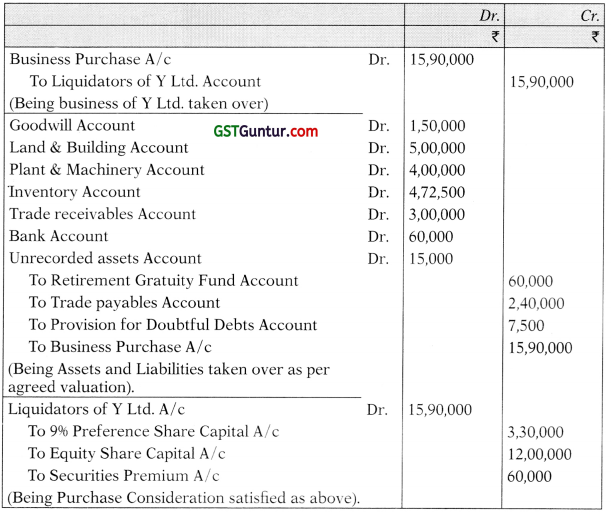

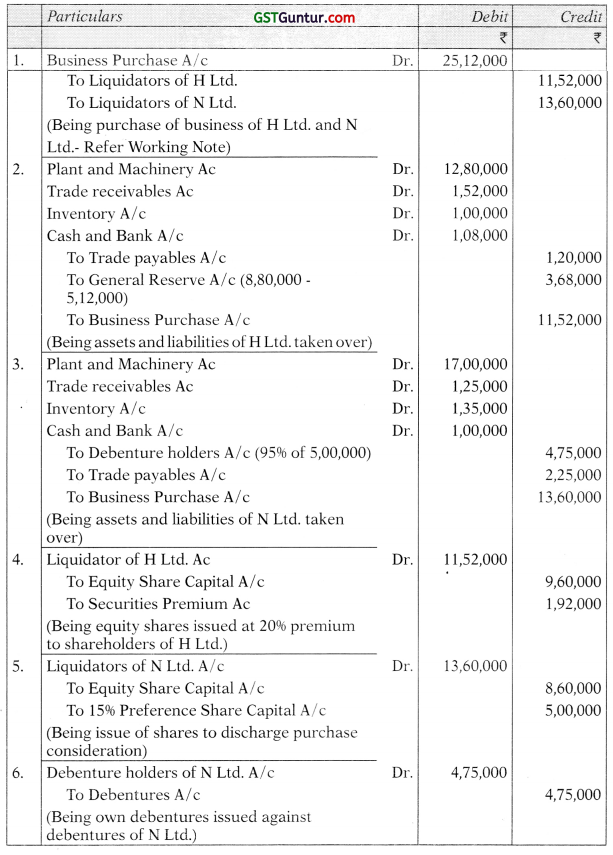

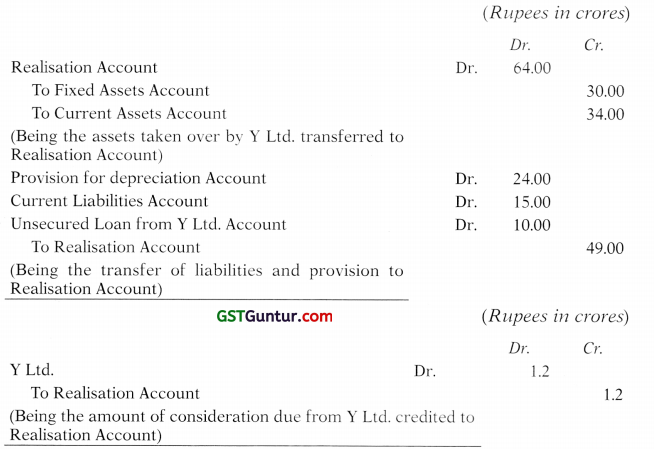

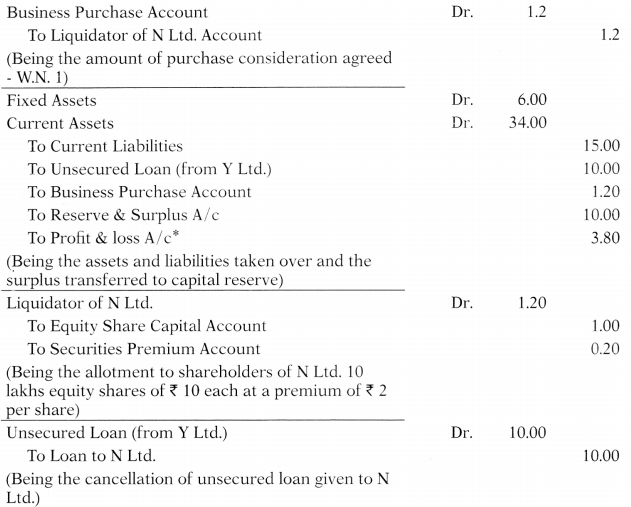

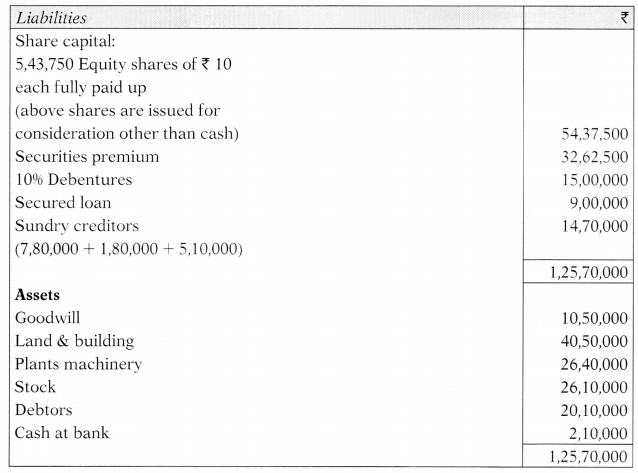

The financial position of X Ltd. and Y Ltd. as on 31st March, 2018 was as under:

X Ltd. absorbs Y Ltd. on the following terms:

(i) 10% Preference Shareholders are to be paid at 10% premium by issue of 9% Preference Shares of X Ltd.

(ii) Goodwill of Y Ltd. on absorption is to be computed based on two times of average profits of preceding three financial years (2016-17: ₹ 90,000; 2015-16: ₹ 78,000 and 2014-15: ₹ 72,000). The profits of 2014 -15 included credit of an insurance claim of ₹ 25,000 (fire occurred in 201314 and loss by fire ₹ 30,000 was booked in Profit and Loss Account of that year). In the year 2015-16, there was an embezzlement of cash by an employee amounting to ₹ 10,000.

(iii) Land & Buildings are valued at ₹ 5,00,000 and the Plant & Machinery at ₹ 4,00,000.

(iv) Inventories are to be taken over at 10% less value and Provision for Doubtful Debts is to be created @ 2.5%.

(v) There was an unrecorded current asset in the books of Y Ltd. whose fair value amounted to ₹ 15,000 and such asset was also taken over by X Ltd.

(vi) The trade payables of Y Ltd. included ₹ 20,000 payable to X Ltd.

(vii) Equity Shareholders of Y Ltd. will be issued Equity Shares @ 5% premium.

You are required to :

(i) Prepare Realisation A/c in the books of Y Ltd.

(ii) Show journal entries in the books of X Ltd.

(iii) Prepare the Balance Sheet of X Ltd. after absorption as at 31st March, 2018. (May 2018 – New Course) (20 Marks)

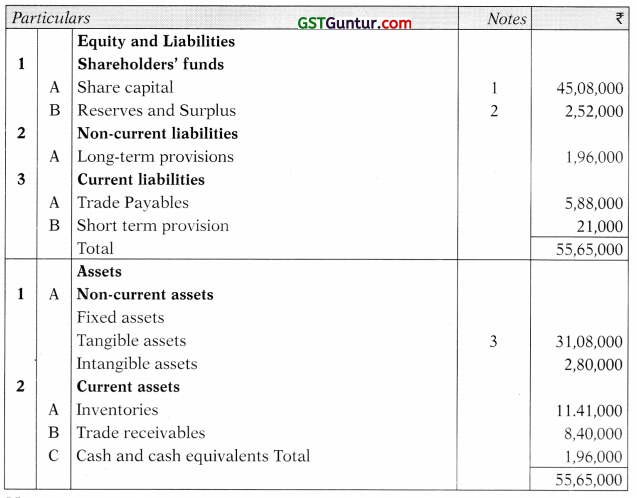

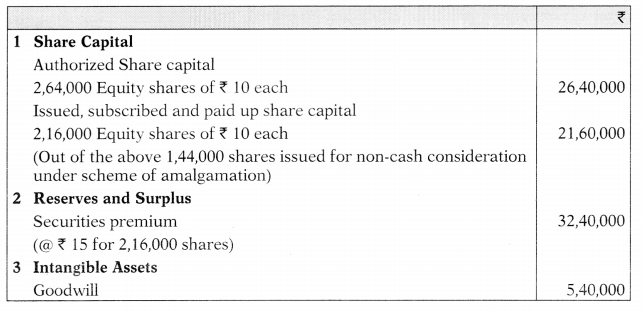

Answer:

In the Books of Y Ltd. Realisation Account

In the Books of X Ltd. Journal Entries

Balance Sheet of X Ltd. (after absorption) as at 31st March, 2018

Notes to accounts

Working Notes:

1. Computation of goodwill

Goodwill to be valued at 2 times of average profits = ₹ 75,000 × 2 = ₹ 1,50,000

2.

![]()

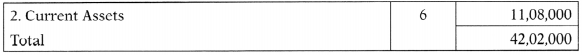

Mix Problems – Merger And Purchase

Question 33.

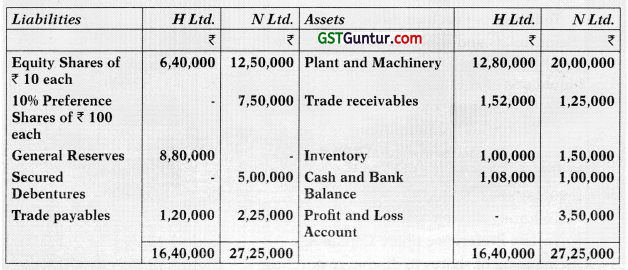

H Ltd. and N Ltd. are to be amalgamated into H N Ltd. The new company is to takeover all the assets and liabilities of the amalgamating companies.

Assets and Liabilities of H Ltd. are to be taken over at book values in exchange of shares in H N Ltd. Three shares in the new company are to be issued at a premium of 20% for every two shares of H Ltd.

The approved scheme for N Ltd. is as follows:

- 10% Preference shareholders are to be allowed two 15% Preference shares of ₹ 100 each in H N Ltd. for three Preference shares held in N Ltd.

- The Debentures of N Ltd. are to be paid off at 5% discount by the issue of debentures of H N Ltd. at par.

- The Equity shareholders of NT Ltd. are to be allowed as many shares at par in H N Ltd. as will cover the balance on their account and for this purpose, plant and machinery is to be valued less by 15% and obsolete stock forming 10% of the overall stock value is to be treated as worthless.

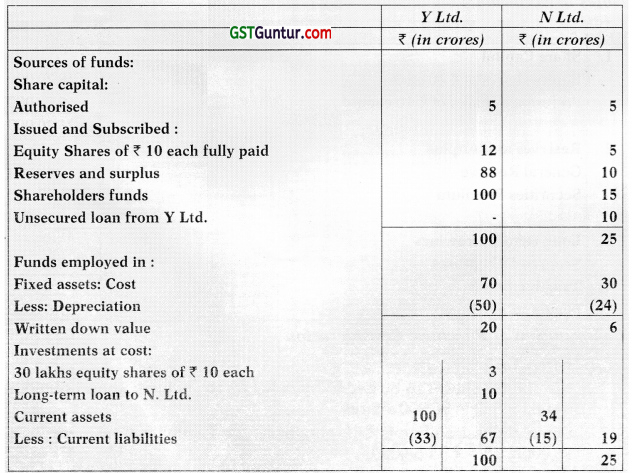

The summarised Balance Sheets of the two companies prior to amalgamation are as follows:

You are required to show the Journal Entries and the Balance Sheet of the amalgamated company immediately after amalgamation.

Answer:

In the books of H N Ltd. (Amalgamated Company)

Journal Entries

Balance Sheet of H NLtd. after amalgamation

Notes to Accounts

Computation of Purchase Consideration

1. For HLtd.

Number of shares to be issued by H N Ltd. for H Ltd.’s shareholders

= 64.0 × 3/2 = 96,000 shares.

Since, the issue price is ₹ 12 per share, the Purchase Consideration is

= 96,000 × 12 = ₹ 11,52,000.

2. For N Ltd.

![]()

Inter Company Holdings

Question 34.

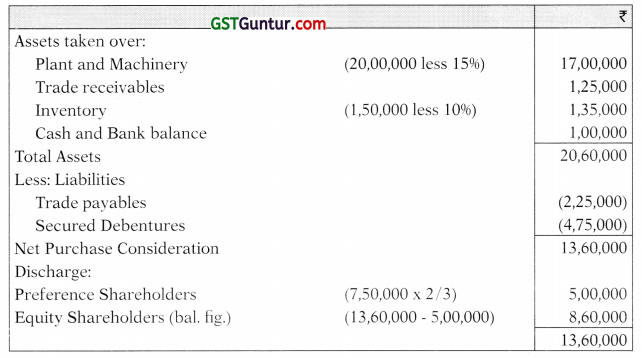

The following are the summarised Balance Sheets of Y Ltd. and N Ltd. as on 31st October, 20X1:

On that day Y Ltd. absorbed N Ltd. The members of N Ltd. are to get one equity share of Y Ltd. issued at a premium of ₹ 2 per share for every five equity shares held by them in N Ltd. The necessary approvals are obtained.

You are asked to pass journal entries in the books of the two companies to give effect to the above.

Answer:

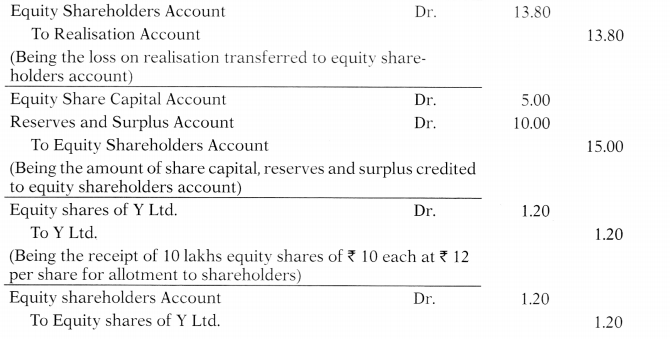

Journal Entries in the books of N Ltd.

![]()

Working Note:

Question 35.

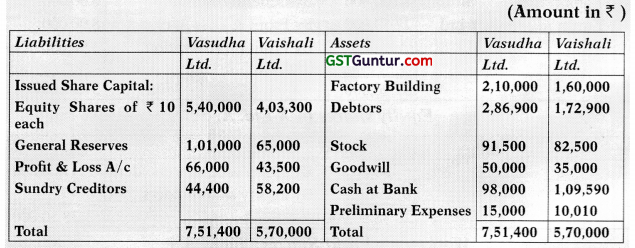

X Ltd. and Y Ltd. were carrying on same business independently. The companies agreed to amalgamate on and from 1-4-2011 and formed a new company Z Ltd. to takeover the assets and liabilities of the existing companies. The Balance Sheets of two companies as on 31-3-2011 are as follows:

Following are the additional information:

- For the purpose of amalgamation, the shares of the existing companies are to be valued as under:

X Ltd. = ₹ 18 per share Y Ltd. = ₹ 20 per share. - A contingent liability of X Ltd. of ₹ 1,80,000 is to be treated as actual existing liability.

- The shareholders of X Ltd. and Y Ltd. are to be paid by issuing sufficient number of shares of Z Ltd. at a premium of ₹ 6 per share.

- The face value of shares of Z Ltd. is to be of ₹ 10 each.

You are required to:

(i) Calculate the purchase consideration (i.e. the number of shares to be issued to X Ltd. and Y Ltd.)

(ii) Prepare Realisation Account and Shareholders Account in the books of X Ltd. & Y Ltd.

(iii) Prepare the Balance Sheet of Z Ltd. after amalgamation. (Nov 2011) (16 Marks)

Answer:

(i) Computation of Purchase Consideration

(ii) (a) In the books of X Ltd.

Realization Account

(b) In the books of YLtd.

Realization Account

![]()

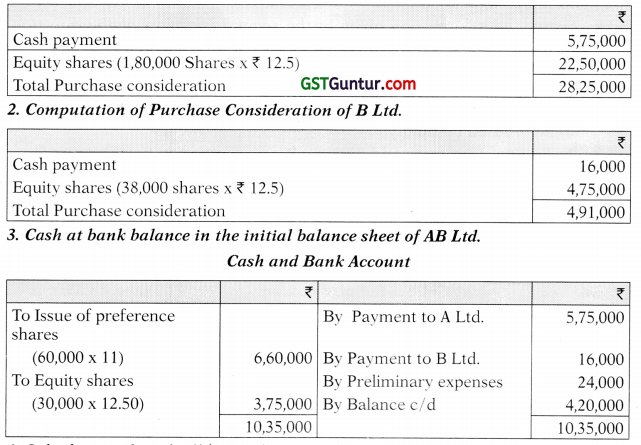

(iii) Balance Sheet of Z Ltd. (After Amalgamation) as on 1st April, 2011

Working Note:

Calculation of Goodwill/(Capital Reserve)