Functional Level Strategies – CA Inter SM Study Material

Functional Level Strategies – CA Inter SM Notes is designed strictly as per the latest syllabus and exam pattern.

Functional Level Strategies – CA Inter SM Study Material

Question 1.

Rohit Bhargava is the Managing Director of Smooth and Simple Pvt Ltd. The company established in 2011, with 35 employees grew very fast to become an organisation with 335 employees in the year 2016. With the increase in size Rohit started facing difficulty in managing things. Many a times he finds that personnel at the functional level are not in sync with the strategies of the top. He felt that strategies need to be segregated into viable plans and policies that are compatible with each other and com-municated down the line.

Why does Rohit need to segregate the strategies into functional plans? Discuss. (RTP Nov. 2018)

OR

ABC Ltd. is a company that has grown eleven times its size in last five years. With the increase in size the company is facing difficulty in manag-ing things. Many a time’s functional level is not in sync with the corporate level. What will you like to advise to the company and why?

(RTP May 2019; RTP May 2020)

OR

Rohit Bhargava needs to break higher level strategies into functional strategies for implementation. These functional strategies, in form of Marketing, Finance, Human Resource, Production, Research and Development help in achieving the organisational objective. (RTP Nov. 2018)

OR

RTP MAY. 19: The higher-level corporate strategies need to be segregated into viable plans and policies that are compatible with each other and communicated down the line. The higher-level strategies need to be broken into functional strategies for implementation. These functional strategies, in form of marketing, finance, human resource, production, research and development help in achieving the organizational objective.

(RTP May 2019)

Answer:

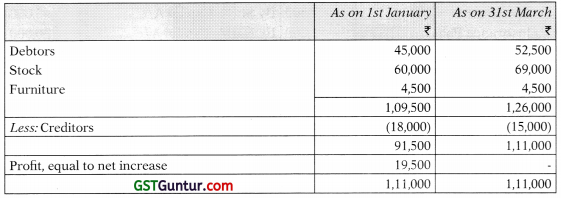

The reasons why functional strategies are needed can be enumerated as follows:

- Functional strategies lay down clearly what is to be done at the func-tional level. They provide a sense of direction to the functional staff.

- They are aimed at facilitating the implementation of corporate strategies and the business strategies formulation at the business level.

- They act as basis for controlling activities in the different functional areas of business.

- They help in bringing harmony and coordination as they are formulated to achieve major strategies.

Similar situations occurring in different functional areas are handled in a consistent manner by the functional managers.

Additional Points:

- Once higher level corporate and business strategies have been de-veloped, management need to formulate and implement strategy for each of the functional areas of business.

- For effective implementation, strategists have to provide direction to functional managers regarding the plans and policies to be adopted.

- Different functional areas of the business are interwoven together and how a functional strategy is synergised with other functional strategies determines its effectiveness.

- Functional strategies are designed to help in the implementation of corporate and business unit level strategies.

- In fact, the effectiveness of strategic management depends critically on the manner in which strategies are implemented.

- Functional strategies play two important roles.

- Firstly, they provide support to the overall business strategy.

- Secondly, they spell out as to how functional managers will work so as to ensure better performance in their respective functional areas.

- Strategies in functional areas including marketing, financial, production, R & D and human resource management are based on the functional capabilities of an organisation.

- For each functional area

- first the major sub areas are identified and

- then for each of these sub areas, content of functional strategies, important factors, and their importance in the process of strategy implementation are identified.

- In terms of the levels of strategy formulation, functional strategies operate below the SBU or business-level strategies.

Question 2.

Explain the term marketing. (May 2018; 5 Marks)

Answer:

- Marketing is an activity performed by all business organizations.

- It is an activity that creates and sustains exchange relationships among those who are willing and able to buy and sell products, services, sat-isfaction and even ideas.

- In the present day business, marketing encompasses all the activities related to identifying the needs of customers and taking such actions to satisfy them in return of some consideration.

- The term marketing constitutes different processes, functions, exchanges and activities that create perceived value by satisfying needs of individuals.

![]()

Question 3.

What are the objectives that must be kept In mind while designing a pricing strategy of a new product? (RTP Nov. 2018)

Answer:

For a new product pricing strategies for entering a market need to be designed.

In pricing a really new product at least three objectives must be kept in mind.

- Making the product acceptable to the customers.

- Producing a reasonable margin over cost.

- Catering to a market that helps in developing market share.

Question 4.

Ronit Roy has started a new business of manufacturing washing powder. Make a plan for him to promote his product. (RTP May 2018)

OR

Explain the marketing mix in the context of modern marketing. (Nov. 2018; 5 Marks)

Answer:

Marketing mix is a set of controllable marketing variables that the firm blends to produce the response that it wants in the target market. Marketing mix consists of everything that the firm can do to influence the demand for its product. The original framework of marketing mix comprises of product, price, place and promotion.

Modern marketing is highly promotional oriented and include personal selling, advertising, publicity and sales promotion.

(After this explain: personal selling, advertising, publicity and sales pro-motion.)

- Promotion stands for activities that communicate the merits of the product and persuade target consumers to buy it.

- Strategies are needed to combine individual methods such as advertising, personal selling, and sales promotion into a coordinated campaign.

- In addition promotional strategies must be adjusted as a product move from an earlier stage from a later stage of its life.

- Modern marketing is highly promotional oriented. Organizations strive to push their sales and market standing on a sustained basis and in a profitable manner under conditions of complex direct and indirect competitive situations.

- Promotion also acts as an impetus to marketing. It is simultaneously a communication, persuasion and conditioning process.

![]()

Question 5.

Briefly explain four major direct promotional methods or tools.

Answer:

(i) Personal selling:

- It is one of the oldest forms of promotion.

- It involves face-to-face interaction of sales force with the prospec-tive customers and provides a high degree of personal attention to them.

- In personal selling, oral communication is made with potential buyers of a product with the intention of making a sale.

- It may initially focus on developing a relationship with the potential buyer, but end up with efforts for making a sale.

- Personal selling suffers from a very high costs as sales personnel are expensive. They can physically attend only one customer at a time. Thus it is not a cost-effective way of reaching a large number of people.

- However, as it is a highly effective method to persuade a potential customer into making a purchase, the personal selling is used in all kind of industries for all products.

(ii) Advertising:

- Advertising is a non-personal, highly flexible and dynamic pro-motional method.

- The media for advertising includes pamphlets, brochures, news-papers, magazines, hoardings, display boards, radio, television and internet.

- Choice of appropriate media is important for effectiveness of the message.

- The media may be local, regional, or national.

- The type of the message, copy, and illustration are a matter of choice and creativity.

- Advertising may be directed towards consumers, middlemen or opinion leaders.

- Advertising is likely to succeed in promoting the sales of an orga-nization but its effectiveness in respect to the expenditure cannot be directly measured.

- A sale is a function of several variables out of which advertising is only one.

(iii) Publicity:

- Publicity is also a non-personal form of promotion similar to advertising.

- However, no payments are made to the media as in case of advertising.

- Organizations skilfully seek to promote themselves and their products without payment.

- Publicity is communication of a product, brand or business by placing information about it in the media without paying for the time or media space directly.

- Thus, it is way of reaching customers with negligible cost.

- Basic tools for publicity are press releases, press conferences, reports, stories, and internet releases. These releases must be of interest to the public.

(iv) Sales promotion:

- Sales promotion is an omnibus term that includes all activities that are undertaken to promote the business but are not specifically included under personal selling, advertising or publicity. [Omnibus means: comprising several items]

- Activities like discounts, contests, money refunds, instalments, kiosks, exhibitions and fairs constitute sales promotion. All these are meant to give a boost to the sales.

- Sales promotion done periodically may help in getting a larger market share to an organization.

![]()

Question 6.

Explain Expanded Marketing Mix in brief.

Answer:

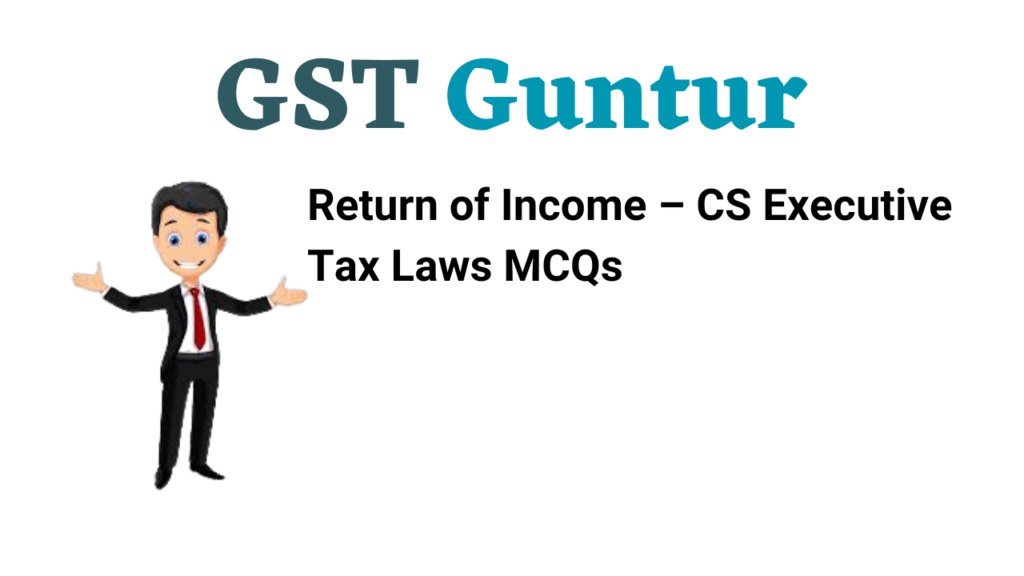

- Typically, all organizations use a combination of 4 Ps in some form or the other.

- However, the above elements of marketing mix are not exhaustive.

- It is pertinent to discuss a few more elements that may form part of an organizational marketing mix strategy.

- They have got more currency in recent years.

- Growth of services has its own share for the inclusion of newer ele-ments in marketing.

- A few Ps included later are as follows:

- People: Allhuman actors who play a part in delivery of the market offering and thus influence the buyer’s perception, namely the firm’s personnel and the customer.

- Process:The actual procedures, mechanisms and flow of activities by which the product/service is delivered.

- Physical evidence:The environment in which the market offering is delivered and where the firm and customer interact.

Question 7.

Explain Strategic Marketing Techniques.

Answer:

- SOCIAL MARKETING

- AUGMENTED MARKETING

- DIRECT MARKETING

- RELATIONSHIP MARKETING

- SERVICES MARKETING

- PERSON MARKETING

- ORGANIZATION MARKETING

- PLACE MARKETING

- ENLIGHTENED MARKETING

- DIFFERENTIAL MARKETING

- SYNCHRO-MARKETING

- CONCENTRATED MARKETING

- DE-MARKETING

SOCIAL MARKETING (MAY 18; 2.5 MARKS):

It refers to the design, implementation, and control of programs seeking to increase the acceptability of a social ideas, cause, or practice among a target group. For instance, the publicity campaign for prohibition of smoking in Delhi explained the place where one can and can’t smoke.

AUGMENTED MARKETING: (NOV. 2018; 2 MARKS)

- It is provision of additional customer services and benefits built around the core and actual products.

- It relate to introduction of hi-tech services like movies on demand, online computer repair services, secretarial services, etc.

- Such innovative offerings provide a set of benefits that promise to elevate customer service to unprecedented levels (never done or known before).

DIRECT MARKETING:

Marketing through various advertising media that interact directly with consumers, generally calling for the consumer to make a direct response. Direct marketing includes catalogue selling, e-mail, telecomputing, electronic marketing, shopping, and TV shopping.

RELATIONSHIP MARKETING:

The process of creating, maintaining, and enhancing strong, value-laden relationships with customers and other stakeholders. For example, Airlines offer special lounges at major airports for frequent flyers. Thus, providing special benefits to select customers to strengthen bonds. It will go a long way in building relationships.

SERVICE MARKETING (MAY 18; 2.5 MARKS):

It is applying the concepts, tools, and techniques, of marketing to services. Services is any activity or benefit that one party can offer to another that is essentially intangible and does not result in the banking, savings, retailing, educational or utilities.

PERSON MARKETING:

People are also marketed. Person marketing consists of activities undertaken to create, maintain or change attitudes and behaviour towards particular person. For example, politicians, sports stars, film stars, etc. ie., market themselves to get votes, or to promote their careers.

ORGANIZATION MARKETING:

It consists of activities undertaken to create, maintain, or change attitudes and behaviour of target audiences towards an organization. Both profit and non-profit organizations practice organization marketing.

PLACE MARKETING:

Place marketing involves activities undertaken to create, maintain, or change attitudes and behaviour towards particular places say, business sites marketing, tourism marketing.

ENLIGHTENED MARKETING:

- It is a marketing philosophy holding that a company’s marketing should support the best long-run performance of the marketing system.

- Its five principles include:

- customer-oriented marketing,

- innovative marketing,

- value marketing,

- sense-of-mission marketing, and

- societal marketing.

DIFFERENTIAL MARKETING:

- It is a market-coverage strategy in which a firm decides to target several market segments and designs separate offer for each.

- For example, Hindustan Unilever Limited has Lifebuoy, Lux and Rexona in popular segment and Dove and Pears in premium segment.

- Differentiation can be achieved through variation in size, shape, colour, brand names and so on.

SYNCHRO-MARKETING:

- When the demand for a product is irregular due to:

- season,

- some parts of the day, or on hour basis, causing idle capacity or overworked capacities, synchro-marketing can be used

- Synchro Marketing find ways to alter the pattern of demand through flexible pricing, promotion, and other incentives.

- It can be done through flexible pricing, promotion, and other incentives.

- For example, products such as movie tickets can be sold at lower price over week days to generate demand.

CONCENTRATED MARKETING:

It is a market-coverage strategy in which a firm goes after a large share of one or few sub-markets.

DEMARKETING:

- It includes marketing strategies to reduce demand temporarily or permanently.

- The aim is not to destroy demand, but only to reduce or shift it.

- This happens when there is overfull demand.

- For example, buses are overloaded in the morning and evening, roads are busy for most of times, zoological parks are over-crowded on Saturdays, Sundays and holidays.

- Here demarketing can be applied to regulate demand.

![]()

Question 8.

A web company initially started as an online marketplace for books. From “biggest E – Bookstore,” its owners wants to expand into an e-com-merce platform selling electronic goods. Implementation of this needs additional funds.

What are the different sources of raising funds and their impact on the financial strategy which you as a financial manager will consider? (RTPNov. 2019)

Answer:

- Successful strategy implementation often requires additional capital. Basic sources of capital are:

- net profit from operations

- sale of assets,

- debt and

- equity.

- Being a financial manager to determine an appropriate mix of debt and equity in a firm’s capital structure can be vital to successful strategy implementation.

Theoretically, an enterprise should have enough debt in its capital structure to boost its return on investment by applying debt to products and projects earning more than the cost of the debt.

In low earning periods, too much debt in the capital structure of an organization can endanger stockholders’ return and jeopardize company survival.- Many debt ridden real estate companies find things very difficult at time of recession.

- Fixed debt obligations generally must be met, regardless of cir-cumstances.

- This does not mean that stock issuances are always better than debt for raising capital.

Some special stock is issued to finance strategy implementation; ownership and control of the enterprise are diluted. - This can be a serious concern in today’s business environment of hostile takeovers, mergers, and acquisitions.

- The maj or factors regarding which strategies have to be made includes:

- capital structure;

- procurement of capital and working capital borrowings;

- reserves and surplus as sources of funds; and

- relationship with lenders, banks and financial institutions.

- Strategies related to the sources of funds are important since they determine how financial resources will be made available for the implementation of strategies.

- Organizations have a range of alternatives regarding the sources of funds. While one company may rely on external borrowings, another may follow a policy of internal financing.

Question 9.

What do you mean by financial strategy of an organization? How the worth of a business is evaluated?

OR

“Evaluating the worth of a business is central to strategy implementation.” In the light of this statement, explain the methods that can be used for determining the worth of a business. (RTP May 2020)

OR

Discuss various approaches for evaluating the worth of a business. (RTP Nov. 2019; 5 Marks)

Answer:

The financial strategies of an organization are related to several finance/accounting concepts considered to be central to strategy implementation. These are: acquiring needed capital/sources of fund, developing projected financial statements/budgets, management/usage of funds, and evaluating the worth of a business.

Various approaches/methods for determining a business’s worth can be grouped Into three main approaches:

1. DETERMINING NET WORTH/STOCKHOLDERS’ EQUITY.

- Net worth is the total assets minus total outside liabilities of an organisation.

- Net worth represents the sum of common stock, additional paid-in capital, and retained earnings.

- After calculating net worth, add or subtract an appropriate amount for goodwill and overvalued or undervalued assets. This total provides a reasonable estimate of a firm’s monetary value.

2. FUTURE BENEFITS TO OWNERS THROUGH NET PROFITS:

- These benefits are considered to be much greater than the amount of profits.

- The worth of any business should be based largely on the future benefits its owners may derive through net profits.

- A conservative rule of thumb is to establish a business’s worth as five times the firm’s current annual profit. A five-year average profit level could also be used.

3. MARKET-DETERMINED BUSINESS WORTH (INVOLVES THREE METHODS).

- Base the firm’s worth on the selling price of a similar company. A potential problem, however, is that sometimes comparable figures are not easy to locate.

- Price-earnings ratio method. To use this method, divide the market price of the firm’s common stock by the annual earnings per share and multiply this number by the firm’s average net income for the past five years.

- Outstanding shares method. To use this method, simply multiply the number of shares outstanding by the market price per share and add a premium. The premium is simply a per-share amount that a person or firm is willing to pay to control (acquire) the other company.

Question 10.

Briefly explain Logistics Strategy.

Answer:

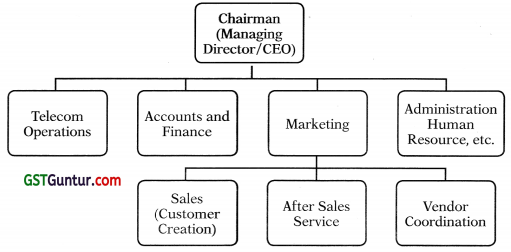

- Management of logistics is a process which integrates:

- the flow of supplies into,

- through and

- out of an organization,

- This helps to achieve a level of service which ensures that the right materials are available at the right place, at the right time, of the right quality, and at the right cost.

- Organizations try to keep the cost of transporting materials as low as possible consistent with safe and reliable delivery.

- For a business organization effective logistics strategy will involve raising and finding solutions to the questions relating to raw material, manufacturing locations, products, transportation and deployment of inventory.

- Improvement in logistics can result in saving in cost of doing business.

- When a company creates a logistics strategy, it is defining the service levels at which its logistics systems are highly effective.

- A company may develop a number of logistics strategies for specific product lines, specific countries or specific customers to address dif-ferent categorical requirements.

![]()

Question 11.

What is supply chain management? Is it same as logistics manage-ment? Discuss.

Answer:

- The term supply chain refers to the linkages between suppliers, man-ufacturers and customers.

- Supply chains involve all activities like sourcing and procurement of material, conversion, and logistics. Planning and control of supply chains are important components of its management.

- Naturally, management of supply chains include closely working with channel partners – suppliers, intermediaries, other service providers and customers. Technological changes and reduction in information communication costs with increase in its speed has led to changes in coordination among the members of the supply chain network.

- Supply chain management is defined as the process of planning, im-plementing, and controlling the supply chain operations.

- It is a cross-functional approach to managing the movement of raw materials into an organization and the movement of finished goods out of the organization toward the end-consumer who are to be satisfied as efficiently as possible.

- It encompasses all movement and storage of raw materials, work- in-process inventory, and finished goods from point-of-origin to point-of-consumption. Organizations are finding that they must rely on the chain to successfully compete in the global market.

- Modern organizations are striving to focus on core competencies and reduce their ownership of sources of raw materials and distribution channels. These functions can be outsourced to other business organizations that specialize in those activities and can perform in better and cost effective manner. In a way organizations in the supply chain do tasks according to their core-competencies.

- Working in the supply chain improve trust and collaboration amongst partners and thus improve flow and management of inventory.

Question 12.

Discuss the major steps in implementing supply chain management system in a business organIzation. (Nov. 2018; 5 Marks)

OR

Implementing supply chain management in a business organization has several steps. Discuss. (RTP Nov.2019)

Answer:

- A successful implementation of supply management system requires a change from managing individual functions to integrating activities into key supply chain processes.

- It involves collaborative work between buyers and suppliers, joint product development, common systems and shared information.

- A key requirement for successfully implementing supply chain will be network of information sharing and management.

- The partners need to link together to share information through elec-tronic data interchange and take decisions in timely manner.

Implementing and successfully running supply chain management system will involve:

1. Procurement: Procurement requires careful resource planning, quality issues, identifying sources, negotiation, order placement, inbound transportation and storage. Organizations have to coordinate with suppliers in scheduling without interruptions. Suppliers are involved in planning the manufacturing process.

2. Product Development: Customers and suppliers must work together in the product development process. Right from the start the partners will have knowledge of all Involving all partners will help in shortening the life cycles. Products are developed and launched in shorter time and help organizations to remain competitive.

3. Manufacturing: Flexible manufacturing processes must be in place to respond to market changes. They should be adaptive to accommodate customization and changes in the taste and preferences. Manufacturing should be done on the basis of just-in-time (JIT) and minimum lot sizes. Changes in the manufacturing process be made to reduce manufacturing cycle.

4. Physical Distribution: Delivery of final products to customers is the last position in a marketing channel. Availability of the products at the right place at right time is important for each channel participant. Through physical distribution processes serving the customer become an integral part of marketing. Thus supply chain management links a marketing channel with customers.

5. Customer Services: Organizations through interfaces with the com-pany’s production and distribution operations develop customer rela-tionships so as to satisfy them. They work with customer to determine mutually satisfying goals, establish and maintain relationships. This in turn helps in producing positive feelings in the organization and the customers.

6. Performance Measurement: There is a strong relationship between the supplier, customer and organisation. Supplier capabilities and customer relationships can be correlated with a firm performance. Performance is measured in different parameters such as costs, customer service, productivity and quality.

7. Outsourcing: Outsourcing is not limited to the procurement of mate-rials and components, but also includes outsourcing of services that traditionally have been provided within an organization. The company will be able to focus on those activities where it has competency and everything else will be outsourced.

![]()

Question 13.

How would you argue that Research and Development Personnel are important for effective strategy implementation? (RTP Nov. 2020)

Answer:

- Research and development (R&D) personnel can play an integral part in strategy implementation.

- These individuals are generally charged with developing new products and improving old products in a way that will allow effective strategy implementation.

- R&D employees and managers perform tasks that include:

- transferring complex technology,

- adjusting processes to local raw materials,

- adapting processes to local markets, and

- altering products to particular tastes and specifications.

- Strategies such as product development, market penetration, and concentric diversification require that new products be successfully developed and that old products be significantly improved. But the level of management support for R&D is often constrained by resource availability.

Question 14.

Describe the Guidelines regarding whether a firm should develop research and development expertise internally or outside to external agencies.

Answer:

A critical question is whether a Finn should develop research and development expertise internall or outside to external agencies. The following guidelines can be used to help make this decision:

- If the rate of technical progress is slow, the rate of market growth is moderate, and there are significant barriers to possible new entrants, then in-house R&D is the preferred solution. The reason is that R&D, if successful, will result in a temporaty product or process monopoly that the company can exploit.

- If technology is changing rapidly and the market is growing slowly, then a major effort in R&D may be very risky, because it may lead to the development of an ultimately obsolete technology or one for which there is no market.

- If technology is changing slowly but the market is growing quickly, there generally is not enough time for in-house development. The prescribed approach is to obtain R&D expertise on an exclusive or non-exclusive basis from an outside firm.

- If both technical progress and market growth are fast, R&D expertise should be obtained through acquisition of a well-established firm in the industry.

![]()

Question 15.

What are the three major R&D approaches for implementing Strat-egies?

Answer:

There are at least three major R&D approaches for implementing strategies:

1. The first strategy is to be the first firm to market new technological products. This is a glamorous and exciting strategy but also a dangerous one. Firms such as 3M and General Electric have been successful with this approach, but many other pioneering firms have fallen, with rival firms seizing the initiative.

2. A second R&D approach is to be an innovative imitator of successful products, thus minimizing the risks and costs of start up. This approach entails allowing a pioneer firm to develop the first version of the new product and to demonstrate that a market exists. Then, laggard firms develop a similar product. This strategy requires excellent R&D per-sonnel and an excellent marketing department.

3. A third R&D strategy is to be a low-cost producer by mass-producing products similar to but less expensive than products recently introduced. As a new product accepted by customers, price becomes increasingly important in the buying decision. Also, mass marketing replaces personal selling as the dominant selling strategy. This R&D strategy requires substantial investment in plant and equipment, but fewer expenditures in R&D than the two approaches described earlier.

Question 16.

State the factors of human resource that Influence on employee’s competence. (RTP May 2018)

Answer:

Human resource management has been accepted as a strategic partner in the formulation of organization’s strategies and in the implementation of such strategies through human resource planning, employment, training, appraisal and reward systems.

The following points should be kept in mind:

- Recruitment and selection: The workforce will be more competent if a firm can successfully identify, attract, and select the most competent applicants.

- Training: The workforce will be more competent if employees are well trained to perform their jobs properly.

- Appraisal of performance: The performance appraisal is to identify any performance deficiencies experienced by employees due to lack of competence. Such deficiencies, once identified, can often be solved through counselling, coaching or training.

- Compensation: A firm can usually increase the competency of its work-force by offering pay and benefit packages that are more attractive than those of their competitors. This practice enables organizations to attract and retain the most capable people.

![]()

Question 17.

Explain the strategic role of Human Resources Manager. (RTP May 2019)

Explain the prominent areas where the Human Resource Manager can play a strategic role. (May 2019; 5 Marks)

Answer:

The prominent areas where the human resource manager can play strategic role arc as follows:

- Building core competency:

-

- A core competence is a unique strength of an organization which may not be shared by others. This may be in the form of human resources, marketing capability, or technological capability.

- If the business is organized on the basis of core competency, it is likely to generate competitive advantage.

- Because of this reason, many organizations have restructured their businesses by divesting those businesses which do not match core competence.

- Organization of business around core competence implies leveraging the limited resources of a firm. It needs creative, courageous and dynamic leadership having faith in organization’s human resources.

2. Creating competitive advantage:

- There are two important ways a business can achieve a competitive advantage over the others.

- cost leadership which means the firm aims to become a low cost leader in the industry.

- differentiation under which the firm seeks to be unique in the industry in terms of dimensions that are highly valued by the customers.

- Putting these strategies into effect carries a heavy premium on having a highly committed and competent workforce.

3. Providing purposeful direction:

- The human resource manager must be able to lead people and the organization towards the desired direction involving people right from the beginning.

- The most important task of a HR manager is to ensure that the objectives of an organization are internalized by each individual working in the organization.

- Objectives of an organization state the very purpose and justification of its existence.

4. Empowerment of human resources:

- Empowerment means authorizing every member of an organization to take up his/her own destiny realizing his/her full potential.

- It involves giving more power to those who, at present, have little control what they do and little ability to influence the decisions being made around them.

5. Managing workforce diversity:

- Workforce diversity can be observed in terms of male and female workers, young and old workers, educated and uneducated workers, unskilled and professional employee, etc.

- Moreover, many organizations also have people of different castes, religious and nationalities.

- The workforce in future will comprise more of educated and self

conscious workers. They will ask for higher degree of participation and avenues for fulfilment. - Money will no longer be the sole motivating force for majority of the z workers. Non-financial incentives will also play an important role in motivating the workforce.

6. Facilitation of change:

- The human resource manager will be more concerned with:

- substance rather than form,

- accomplishments rather than activities, and

- practice rather than theory.

- The HR function will be responsible for furthering the organization not just maintaining it.

- Human resource manager will have to devote more time to promote changes than to maintain the status quo.

7. Development of works ethic and culture:

- Greater efforts will be needed to achieve cohesiveness because employees will have transient commitment to groups.

- As changing work ethic requires increasing emphasis on individuals, jobs will have to be redesigned to provide challenge.

- Flexible starting and quitting times for employees may be necessary. Focus will shift from extrinsic to intrinsic motivation.

- A vibrant work culture will have to be developed in the organizations to create an atmosphere of trust among the employees and to encourage creative ideas by them.

![]()

Question 18.

Mr. Vicky Verma, a Gwalior based entrepreneur, has entered into an exclusive-retail deal with an Italian company selling *Fantasy-3B’, a Hologram LED Fan, which is being used for advertising at public places. Mr. Verma procured a total of 500 units of the product and paid upfront as per the seller’s policy. This resulted in blocking of his working capital significantly and the shipment is expected in a month. Meanwhile his continued efforts of establishing relations with the marketing heads of corporates resulted in a series of meetings, where he demonstrated his specialist product knowledge by changing the hologram images to personalise basis specifications of the customer. The management of a big automative company was impressed with the quality and adaptability of the product, and awarded a contract of 125 units to be displayed in the ; auto-maker’s showrooms. Identify and explain the product promotion strategy adopted by Mr. Verma. (RTP Nov. 2020)

Answer:

Mr. Vicky Verma established personal contacts with potential buyers of the product and persuaded the marketing department over several physical meetings, and was finally able to make sales.

The personal relation establishment and physical demonstration, indicates that Mr. Verma used the Personal Selling method of Promotion.

Modern marketing is highly promotional oriented and include personal selling, advertising, publicity and sales promotion.

Personal selling involves face to face interaction of sales persons with the prospective customers and provides a high degree of personal attention.

It involves working with one customer at a time and hence not cost effective. The intention of oral communication is sale

(RTP)

(RTP)