GST Valuation Goods Services: GST-Goods and service tax will be one tax to subsume all taxes. It will bring in the regime of “One Nation One Tax.” There are many questions in people’s and organizations’ minds as the scheme is an entirely new form of indirect taxation. Any taxes, charges, duties, cess, and fees levied under any act, except GST. If charged separately by the supplier, then the GST Compensation Cess will be excluded. Currently, GST will be imposed on the ‘transaction value.’ Transaction value is the amount actually paid (or payable) for the supply of goods/services within unrelated parties (i.e., payment is the sole consideration).

Valuation At Transaction Value

If the supplier and recipient of Goods/Services are not correlated, then the price actually payable or paid is taken as the value of goods/services. The transaction value shall be received even where the recipient and supplier of supply are associated or Related Persons, provided that the relationship has not determined\affected the price.

Where goods are carried from one station of business to another place of the same business or from the principal to an agent or from an agent to the principal whether or not located in the same State, the transaction value shall be the value of such supply.

Inclusions

The value of goods/services also incorporate the following:-

any taxes, fee, duties, or cesses charged separately by the supplier other than GST itself.

commission or packing and other incidental expenses are charged separately by the supplier.

the expense charged for anything arranged by the supplier at the time of or before delivery of the goods/services. E.g. special packing or gift packing

interest, penalty or late fee charged for postponed payment

subsidies undeviatingly linked to the price excluding subsidies rendered by the State and Central governments.

Exclusions

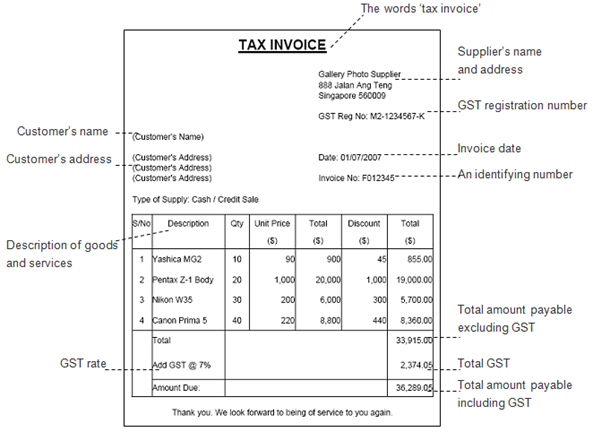

Any discount that is provided shall not be included in the value of the supply:

- such discount shall be mention before or at the time of the supply in the invoice,

- after the supply has been effected, provided that:

- such discount is established entered into before or at the time of such supply in terms of an agreement and associated explicitly with relevant invoices; and

- the recipient of the supply has reversed the input tax credit as is attributable to the discount based on the record issued by the supplier.

The effect of discount provided on transaction value is summarised below-

Type of discount – Effect on transaction value

- If the discount is provided at the time of supply or before and is recorded in the invoice, it can be declared as a deduction from the transaction value.

- Suppose the discount is provided after supply but agreed upon before or at the time of supply and can be specifically linked to relevant invoices. In that case, it can be declared as a deduction from the transaction value.

- If the discount is provided after supply and not comprehended at the time of supply, it cannot be commanded as a deduction from the transaction value.

Circumstances Where The Valuation Consideration Is Not Wholly In Money

In such a circumstance, the valuation will be done at:

- Open market value

- If the open market value is unavailable, then at a ‘total of consideration in money and other consideration’s commensurate money value.

- If the value can-not be resolved with the earlier two methods, then the value of like quality and kind goods or services will be considered as the value.

Examples of circumstances where a value can-not be resolved with the above three methods:-

Where a new laptop is supplied for Rs.40000 along with the exchange of an old laptop and if the price of the new laptop without exchange is Rs.44000, the open market value of the new laptop is Rs 44000.

Where a camera is supplied for Rs.90000 along with a barter of accessories that are manufactured by the recipient and the value of the included accessories known at the time of supply is Rs.9000, but the open market value of the camera is not known, the value of the supply of camera is Rs.99000.

Valuation Of Supplies Between Related Or Distinct Persons Other Than Through An Agent

The value of the supply of services or goods or both between distinct individuals as specified in 25(5) and 25(4) or where the recipient and supplier are associated, other than where the supply is performed through an agent, shall,-

- be the value of open market of such supply;

- if the open market value is unavailable, be the value of supply of goods or services of like quality and kind;

- if the value is not measurable under clause (a) or (b), be the value as concluded by application of rule 4 or rule 5, in that order:

Provided where the beneficiary is qualified for a full input tax credit, the value claimed in the invoice shall be regarded to be the good’s or service’s open market value.

Value Of Supply Of Goods Received Or Made Through An Agent

The agents and their principal and the value of supply of goods between shall-

be ninety per cent of the amount imposed for the supply of goods of like quality and kind, be the open market value of the goods being supplied, or at the option of the supplier, by the recipient to their customer not being a related individual, where the goods are indicated for further supply by the stated recipient.

Illustration: Where a principal supplies walnut to their agent and the agent supplies subsequent walnuts of like kind and quality and supplies at a price of Rs.10000 per quintal on the day of supply. Another independent supplier is supplying groundnuts of similar kind and quality to the said agent at the cost of Rs.9100 per quintal. The principal shall be making the value of the supply of Rs.9100 per quintal, or where he exercises the option, and the value shall be 90% of the Rs.10000, i.e. is Rs.9100 per quintal.

Under clause (a), the value of a supply is not measurable; the same shall be concluded by applying rule 5 or rule 4 in that order.

Rule 4 – Valuation Based On Cost

If the value can not be resolved by any provisions or rules stated above, then the value will be resolved under rule 4. Under rule 4, the value shall be one hundred and ten per cent of the cost of manufacture or production or cost of provision of such services or cost of acquisition of such goods.

Rule 5 – For Determination And Residual Method Of Value Of Supply Of Goods Or Services Or Both

If the value can not be resolved by any provisions or rules specified above and through rule 4, then under rule 5, the value will be defined. Under rule 5, the value shall be resolved using reasonable means uniform with the general and principles provisions of section 15 and these rules.

Granted that the supplier may opt for this rule, disregarding the rule in case of the supply of services.

Meaning of Related Persons

Individuals shall be deemed to be “related persons” if

- such individuals are directors or officers of one another’s businesses;

- such individuals are legally recognised partners in business;

- such individuals are employer and employee;

- any individual directly or indirectly owns, holds or controls twenty-five per cent or more of the outstanding shares or voting stock of both of them;

- one of them indirectly or directly controls the other;

- both of them are indirectly or directly controlled by a third individual;

- together they indirectly or directly control a third individual, or they are affiliates of the same family;

The term “person” also includes legal individuals.

Individuals who are correlated in the business of one another in that one is the sole distributor or sole concessionaire or sole agent, howsoever described, of the other, shall be considered to be related.

Distinct Persons

As per the CGST Act’s Section 25(5):

An individual who is required to obtain or has obtained more than one registration, whether in one Union or State territory or more than one Union or State territory, shall be treated as distinct persons in respect of each such registration for the purposes of this Act.

Where an individual who is required to obtain or has obtained registration in a Union or State territory in respect of an establishment has an establishment in another Union or State territory, then for the purposes of this Act, such establishments shall be conducted as establishments of distinct persons.

The full value in money, excluding the central tax, integrated tax, State tax, Union territory tax and the cess payable by a person in a transaction, is what the open market value of a supply of goods or services or both means where the recipient of the supply and the supplier are not related, and to obtain the supply at the same time, the price is made the sole consideration when the supply being valued.

Any other supply of both or either goods or services are made under similar circumstances that, in respect of the characteristics, functional components, materials, quality, quantity, and reputation of the services or goods or both mentioned before, is the same as, or substantially resembles, or closely that supply of goods or services or both is what the supply of goods or services or both of like kind and quality means.

Valuation In Special Cases

Money Changer: The value in an event when currency is exchanged

From or to Indian Rupees (INR): (Selling rate or buying rate – rate for that currency referred by RBI)* Total units of currency If the quotation rate for any currency is not available, then value = 1% of Indian rupees received or provided by such a money changer.

NOT to or from Indian Rupees (INR): Value is equal to 1% of lesser of the two amounts the individual switching the money would have received by converting any of the two currencies into Indian Rupee at the reference rate on that day granted by RBI.

Life Insurance Business:

the gross premium charged is intimated to the policyholder at the time of supply of service, and such amount get reduced by the amount allocated for savings or investment on behalf of the policyholder;

- a single premium of ten per cent is accredited from the policyholder; in case of single premium annuity policies other than (a), or

- a premium charged twenty-five per cent is charged from the policyholder in the first year for all other cases, and in the subsequent years, twelve and a half per cent from the total premium being charged from the policyholder.

When the entire premium is paid by the policyholder, which contains nothing in this sub-rule, then it only applies towards the risk cover in life insurance.

The Individuals dealing in second-hand goods

The value of supply taken for the GST application is the difference between the purchase price and selling price in the state of an individual who is trading in second-hand goods. Such an amount should be ignored if the difference is negative, and no GST is obligatory on that transaction.

Only when the used goods are sold after minor processing or in the same condition and the nature of the goods is not altered after purchase, then such provision is applicable to such business. Also, if such individuals paid on such transaction, then they should not avail input tax credit.

For example – An individual ventures in second-hand cars. He purchases a car for Rs. 10,00,000. No GST is spent on it. Now for the car’s servicing and repairs, he makes an expense of Rs. 40,000 and then sold it for Rs. 12,00,000. The added Rs. 2,00,000 is the amount on which GST is obligatory.

Pure Agent

A supplier or as a pure agent of the recipient of supply incurs the expenditure or costs which shall be excluded from the value of supply if all the following conditions are satisfied, namely:-

- when the supplier executes payment to the third party on authorisation by such recipient, the supplier serves as a pure agent of the recipient of the supply.

- a separate designation should be mentioned in the invoice issued by the pure agent to the recipient of service while the payment made by the pure agent on behalf of the recipient of supply; and

- the supplies procured by the pure agent are in addition to the services they supply on their own account from the third party as a pure agent of the recipient of the supply.

Explanation:

For the objectives of this rule, “pure agent” means an individual who –

- act as an individual’s pure agent by enrolling into a contractual agreement with the recipient of supply to incur costs or expenditure in the course of supply of both or either goods or services.

- as a pure agent of the supplied recipient, neither intends to hold nor holds any title to the goods or services or both provided so or procured.

- for their own interest, does not use such goods or services so procured or supplied.

- in addition to the amount accepted for supply, the person provides on their own account and receives only the actual amount incurred to procure or supply such goods or services.

Illustration

Corporate services firm X is employed in handling the legal work concerning the incorporation of Company Y. Other than its service fees, and X also recovers registration fee and approval fee for the name of the company paid to the Registrar of the Companies from Y. The fees charged by the Company Registrar’s approval and registration of the name are compulsorily levied on Y. In the payment of those fees, X is merely acting as a pure agent. Therefore, X’s recovery of such expenses not part of the value of supply made by X to Y and is considered as a disbursement.

Option with money changer

Also, with the below-mentioned method, a money changer may execute an option to determine value. Such an alternative, once executed, can not be taken back throughout that financial year.

- for a gross amount up to one lakh rupees, one per cent of the gross amount of currency exchanged, which are subject to a minimum amount of two hundred and fifty rupees.

- for a gross amount exceeding one lakh rupees and up to ten lakh rupees; one thousand rupees and half of a per cent of the total amount of currency is exchanged and

- for an amount exceeding ten lakh rupees, of five thousand rupees and one-tenth of a per cent of the total amount of currency is exchanged subject to a maximum amount of sixty thousand rupees.

Air Travel Agent

In the case of domestic bookings, the value of services provided by the air travel agent is calculated at the rate of 5% of the basic fare and in the case of international bookings, it is determined at the rate of 10% of the basic fare.

The part of the airfare on which commission is normally paid to the air travel agent by the airline is termed as Basic fare.

Goods repossessed from a defaulting borrower

For the goal of recovery of a loan or debt from a defaulting borrower, who is not registered, the purchase value of goods repossessed shall be deemed to be the purchase price of such goods by the defaulting borrower get reduced by five percentage points for every part or quarter thereof, between the date of disposal and the date of purchase by the individual making such repossession.

The value of a token, or a coupon, or a stamp (other than a postage stamp) or a voucher which is redeemable against a supply of both or either goods or services which shall be equal to the money value of both or either of the goods or services redeemable against such token, voucher, stamp or coupon.

For Determination of Value: Rate of Exchange of Currency, other than Indian Rupees

For determination of the value of taxable services or goods or both, the rate of exchange as determined by the Reserve Bank of India shall be the applicable reference rate for that currency on the date when the point of taxation arises in respect of terms of timing of supply provisions of such supply.