GST Bill Format: A GST Invoice is nothing but a bill or receipt which specifies the items supplied or services provided to a customer by a vendor or service provider. In other words, it specifies the total price owed to provide the services/products to the customer. Before CGST and SGST are applied, a GST invoice can be used to calculate the pricing of goods or services. The amount of taxes charged on each good or service that an individual acquires from the seller or provider is also shown on a GST invoicing bill.

The officials of the Central Board of Indirect Taxes & Customs have specified certain rules and formats of this GST Invoice and are advised to follow the same format for issuing the GST invoices. The list of GST invoicing format requirements are explained in detail below.

- GST Invoice Rules 2021-22

- What are the Requirements of GST invoices?

- GST Invoice Format Example

- When a Tax Invoice or a Bill of Supply should be Issued?

- Copy of GST Invoices for Goods Supply

- Copy of GST Invoices for Services Supply

- Revising Invoices Issued Before GST

- When Tax Invoice is not Mandatory?

- FAQ’s on GST Invoice Format and Rules

GST Invoice Rules 2021-22

To understand the specific format of a tax invoice, one must refer to Section 31 of the Central Goods and Services Tax Act of 2017. Section 31 specify the conditions or entries that such an invoice must include in order to be considered an official GST document. The invoice rules specified by the officials is applicable for both electronic and manual bills.

What are the Requirements of GST invoices?

As specified above, the officials of CBIC has specified the GST invoicing format requirements. Out of the GST Invoice rules specifications, the following 3 requirements are mandatory when he/she is issuing the GST bills.

- An input distributor should be the one to send this invoice.

- All additional bills/invoices.

- Any previous revisions to the invoice generated by the supplier.

Apart from these elements, a GST tax invoice must also include the particulars listed below:

- The GSTIN, as well as the name and address of the provider who is submitting the GST invoice

- Bill issued date

- A 16-digit serial number that is unique

- In the event of registered recipients, the bill should additionally include the receiving party’s name, GSTIN, and address

- All services or items provided must be described in detail, including the HSN code

- If certain taxes are eligible for a discount, the amount of the discount must be mentioned

- Amount of tax

- Valuation of invoices

- The rate at which CGST, SGST, and IGST are charged must be specified.

- The billing details and address

- Reverse charge or forward charge details

- Address and information for shipping

- The signature of the tax invoice issuer

GST Invoice Format Example

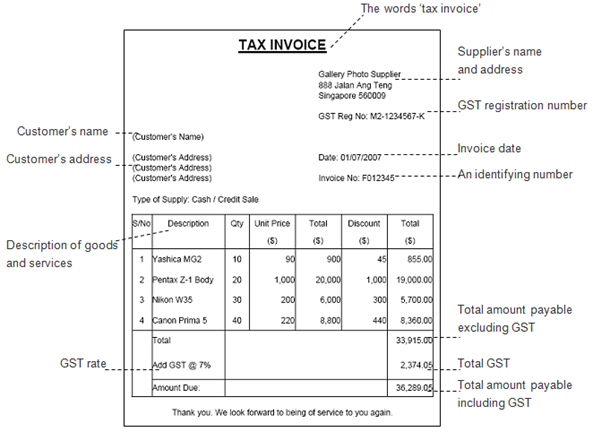

The GST invoice format example is pictured below:

When a Tax Invoice or a Bill of Supply should be Issued?

In some situations, generating a GST invoice as soon as things are dispatched or services are given can be challenging. As a result, the Indian government has established a universal time limit for suppliers to comply with it. But this time frame varies based on the type of goods supplied and they are explained below:

Tax Invoice for Normal Goods

Goods suppliers must create an invoice on or before the date of the products’ disposal. Removal of goods under Section 2 (96) of the CGST Act of 2017 can entail one of two things:

- The goods have been shipped for delivery to the intended recipient.

- The recipient or an authorised person acting on the recipient’s behalf collects goods from the provider.

Tax Invoice on Continous Supply Goods

If the invoice is for a customer with whom the supplier has a regular business relationship, those can issue a GST invoice on or before the account statement is generated or payment is received.

Tax Invoice on Services Provided

In the case of a GST invoice bill for services rendered, the bill must be issued within 30 days of the services being rendered.

GST Invoice on Bank and NBFC Services

The date for issuing a GST receipt for financial services provided by banks and other financial institutions is 45 days from the date of service provision.

Copy of GST Invoices for Goods Supply

If a GST invoice for goods supply is issued, the issuer must prepare three copies for the following parties engaged in the transaction:

- The recipient will receive the original copy.

- The duplicate copy is for personnel in charge of conveying the items from the supplier to the recipient.

- The supplier will benefit from the triplicate copy.

Copy of GST Invoices for Services Supply

Since no transporters are engaged in a service provision, issuers only need to print two copies of the GST invoice bill.

- The service recipient owns the original document.

- The provider keeps the duplicate for internal usage.

Revising Invoices Issued Before GST

Revised tax invoices can be raised against issued invoices under Rule 53 of the CGST Act, 2017. The modification of the GST invoice bill may result in a decrease or increase in the price of the products or services provided. It could also affect the CGST, SGST, and IGST rates that were previously applied to this bill.

The list of details that needs to be mentioned on revised invoices are listed below:

- ‘Revised Invoice’ should be written on the bill

- Supplier’s GSTIN, address, and name should be mentioned

- Bill issue date

- A registered recipient’s name, GSTIN/UIN, and address

- GST invoice’s date and serial number

- Shipping address and information

- Serial number that is unique and not exceeding 16 characters

- The issuer’s or authorised representative’s signature is required

When Tax Invoice is not Mandatory?

A supplier can avoid issuing a GST invoice only under the following two situations:

- The beneficiary in the transaction is unregistered.

- When the recipient declares that he or she does not require an invoice of this nature.

Please note that a supplier must meet both of these criteria in order to avoid the legal requirement of producing a GST invoice. Rather, at the conclusion of each day, the registered provider can produce a consolidated tax invoice for all such supplies.

FAQ’s on GST Invoice Format and Rules

Question1.

Is state code mandatory in GST invoices?

Answer:

Yes, both state code and state name must be mentioned on the GST invoice.

Question 2.

Are there any restrictions on the format of invoices in GST?

Answer:

The length of the GST invoice number should not exceed 16 characters, according to rule 46 of the Central Goods and Service Tax Rules, 2017, which means that the GST invoice number can only be 16 digits long.

Question 3.

What is the GST invoice serial number rules?

Answer:

The GST invoice number rules are:

a. The tax invoice must be numbered in order

b. The total number of characters in a serial number should not exceed 16

c. The serial number should be sequential and contain alphabets, digits, or special characters

d. For a financial year, the sequential serial number should be unique