Difference Between PAN, TAN, And TIN Number 2021

Difference Between TAN and TIN PAN Number: PAN, TAN, and TIN are the common terms which any individual would come across while filing the Income Tax. The term PAN, TAN, and TIN sound more or less similar and this is the reason why most individuals end up confusing themselves. Thus it is important for one to know the meanings of these terms beforehand to simplify the tax filing process. To help you with that, here is a detailed article on what is the difference between TAN, PAN, and TIN. Read on to find out more.

What Is TIN, PAN, and TAN Number?

Before understanding the differences between PAN, TAN, and TIN Numbers, it is important to understand what exactly does the term PAN, TAN, and TIN mean.

What is PAN Number?

PAN Number Full Form: The full form of PAN number is Permanent Account Number. Permanent Account Number comes with a 10 digit alphanumeric unique code. PAN card is issued by the Income Tax Department of India and any taxpayer in India must have the PAN card. PAN card plays a vital role in tax payment, tax returns, tax arrears, and other financial transactions.

What is TAN Number?

TAN Number Full Form: The full form of the TAN number is Tax Deduction and Collection Account Number. TAN Number is a mandatory thing for a tax deduction and collection at source TDS/TCS. TAN Number is allocated to the individuals by Income Tax departments officials which consists of a 10 digit alphanumeric code. The first four digits of code are alphabets, the next 5 digits will be numbers and the last digit ends with an alphabet.

What is TIN Number in India?

TIN Full Form: The full form of TIN number is Taxpayer Identification Number. The TIN number is issued by the officials of the Commercial Tax Department of their respective state government. The TIN number comes with 11 digits unique numeric number which is mandatory for an entity, traders, or dealers who are registered under VAT (Value Added Tax). Any business person who pays VAT should have a TIN Number, which helps the officials easy to track their payments under a single window.

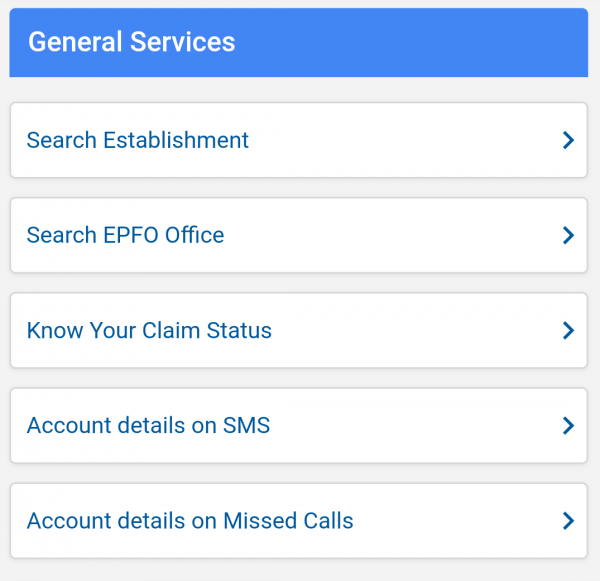

What Is the Difference Between PAN, TIN, and TAN?

Now you are aware of the meaning of PAN, TAN, and TIN. Now let us understand the difference between PAN TAN and TIN number from the table below:

| Description | PAN Number | TAN Number | TIN Number |

| Who Issues | The officials of the Income Tax Department | The officials of the Income Tax Department | The officials of the Commercial Tax Department of their Respective State Government |

| Type of the Code Number | Consists of 10 digit alphanumeric unique code number | Consists of a 10 digit alphanumeric unique code number | Consists of 11 digits numeric code where the first 2 digits represent the state code |

| Code Number Specifications | In PAN number, the first 5 digits are alphabets, the next 4 digits or numerical numbers, and an alphabet | In TAN number, the first 4 digits are alphabets, followed by 5 numerical values and the last digit is the alphabet | In TIN number, all the 11 digits are numerical values. The first 2 numerical values represent the state code |

| Objective | PAN is a universal identification code for tracking income tax and financial transactions | The primary purpose of TAN is to process the deduction and collection of taxes at one source | TIN is mainly used to track VAT-related activities or payments at one single window |

| Who Should Have IT | Each and every taxpayer or income tax assesse should have PAN | Individuals or organizations who are responsible to deduct or collect the tax should have a TAN number | Any dealer, trader, or businessman who is responsible for paying VAT should have a TIN number |

| Account Under Which Law | PAN card issued under Section 139 A of the IT Act of 1961 | TAN is issued under Section 203A of the Income Tax Act of 1961 | Each state has its own act under which the TIN is applicable |

| Penalty Charges | A person who fails to follow the rules will have to pay the penalty fee of Rs 10,000. | A person who fails to follow the rules will have to pay the penalty fee of Rs 10,000. | The penalty charge varies from state to state. |

| Application To Be Submitted Under Form No? | For PAN Card application, individuals will have to submit Form 49A (Indians) or Form 49AA (Foreigners) | For the TAN number application, one will have to fill Form 49B | Form No varies from state to state and it is important for one to check with their state before filling the application form |

| Documents required to apply |

|

No proofs are required. However, if you are filling online application form then you will have to submit the acknowledgment form signed |

|

| No of Persons Can Own | Only One | Only One | Only One |

| Application Charges |

|

Costs Rs.55 plus service tax | Cost varies from state to state |

FAQs On PAN, TAN, and TIN Number

The frequently asked questions on PAN, TAN, and TIN Number are given below:

Q. How to get a TIN Number in India?

A. Any individual who wants a TIN number will have to signup and process the application in their respective state government VAT portal. Upon submitting the application form and necessary documents, the Commerical Tax department of the concerned state allocates the TIN number.

Q. What is the difference between TAN and PAN?

A. The primary purpose of TAN is related to deduct or collect the tax. Whereas PAN is used to track the income tax and other financial transaction details.

Q. What is PAN tax identification number?

A. PAN tax identification number is nothing but the 10 digits alphanumeric number printed on your PAN Card. The main objective of a PAN card is to track the financial transactions which carry taxable components.

Now that you are provided with all the necessary information about PAN, TAN, and TIN numbers and we hope this detailed article is helpful to you. Feel free to ping us through the comment section below if you have any queries about this article or in general about the difference between TAN and TIN, PAN number.

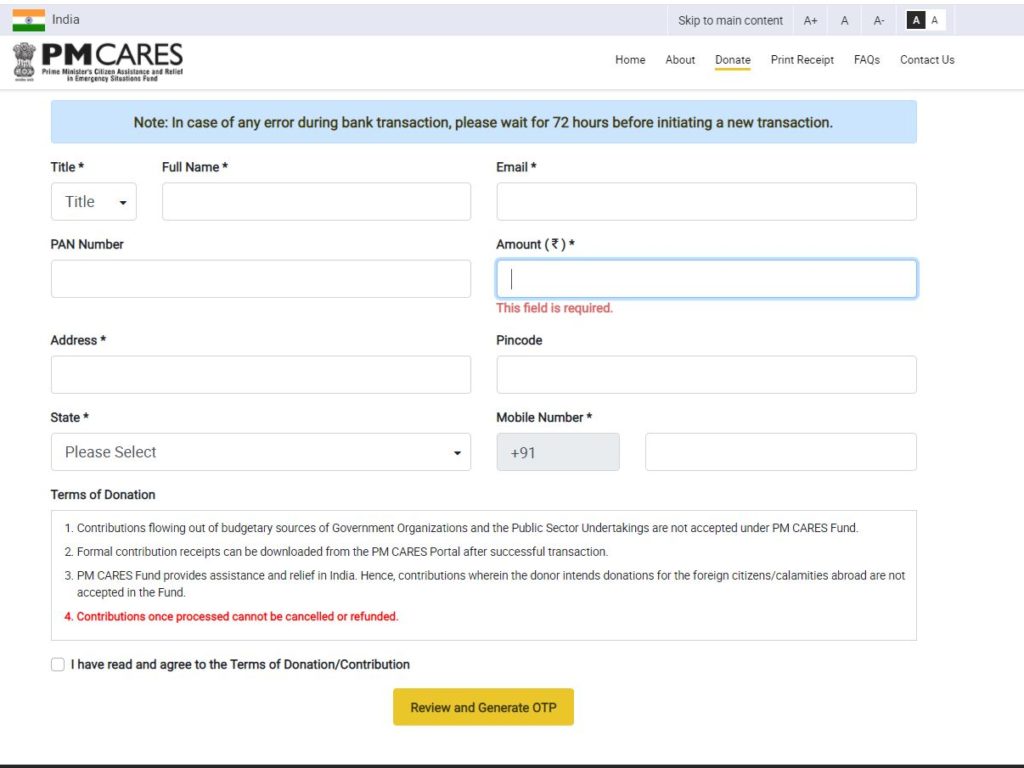

PM CARES Fund

PM CARES Fund