PM CARES Fund 80G: The full form of the PM CARES fund is “Prime Minister’s Citizen Assistance and Relief in Emergency Situations“. PM CARES fund was established on 28th March 2020 and the main objective of this initiative is to deal with economic and health distress caused by the COVID-19. Any individuals or organizations can donate any amount of money to these PM CARES funds and all the funds collected through PM CARES will be used to help the people who are affected with COVID-19.

And to encourage people to donate for PM CARES, the officials of the Income Tax Act have been amended to enable contributions to be tax-deductible under Section 80G. This means that if he/she contributes some amount of money to PM CARES fund, then he/she can claim the tax deduction by submitting the PM CARES fund 80G Certificate of Receipt. In this article, let’s understand how to make donations to PM CARES fund and avail tax exemption. Read on to find more. Know About Income Tax Challan 280

PM Cares Fund Section 80G Tax Deductions

The key points which one will have to keep in mind before making a donation to PM CARES Funds are given below:

- All the contributions which are made to PM care funds will be treated similarly to that of contributions made to PMNRF i.e., Prime Minister’s National Relief Fund.

- Under Section 80G of the Income Tax Act of 1961, If an individual or organization makes donations to the PM CARES fund, then they will be eligible for 100% tax exemption.

- Also one must note that there would be no upper limit on the number of tax deductions available under Section 80G for contributions made to this Fund.

- Under the Companies Act of 2013, Donations made to PM CARES fund would be counted as expenses spent for Corporate Social Responsibility (CSR).

- Donations that are made by individuals from foreign countries will also be exempted from income tax. If any individual or organization based in foreign wants to avail the tax exemption, then they will have to donate under Foreign Contribution Regulation Act (FCRA).

What is Section 80G of the Income Tax Act?

Any individual or organization can avail of the tax benefits by simply making contributions to fund, trusts, and charitable organizations are discussed in Section 80G of the Income Tax Act. It is to be noted that, an individual will be eligible to claim the tax deductions based on the trust, funds or charity to which he/she donated. However, if an individual makes contributions to some government funds will be eligible for a 100 percent tax deduction. But when it comes to monetary donations to some NGOs then he/she can claim only a 50 percent tax deduction.

In addition to this, under Income Tax Act, section 80G, there is an upper limit of tax deduction. The upper limit resembles 10% of your overall gross income. This means that any individual will not able to claim the tax deduction after reaching the certain limit as mentioned above. However one can claim 100% of tax deductions without any upper limit when he/she contributes to PM CARES funds.

How To Contribute for PM CARES Fund Under Section 80G?

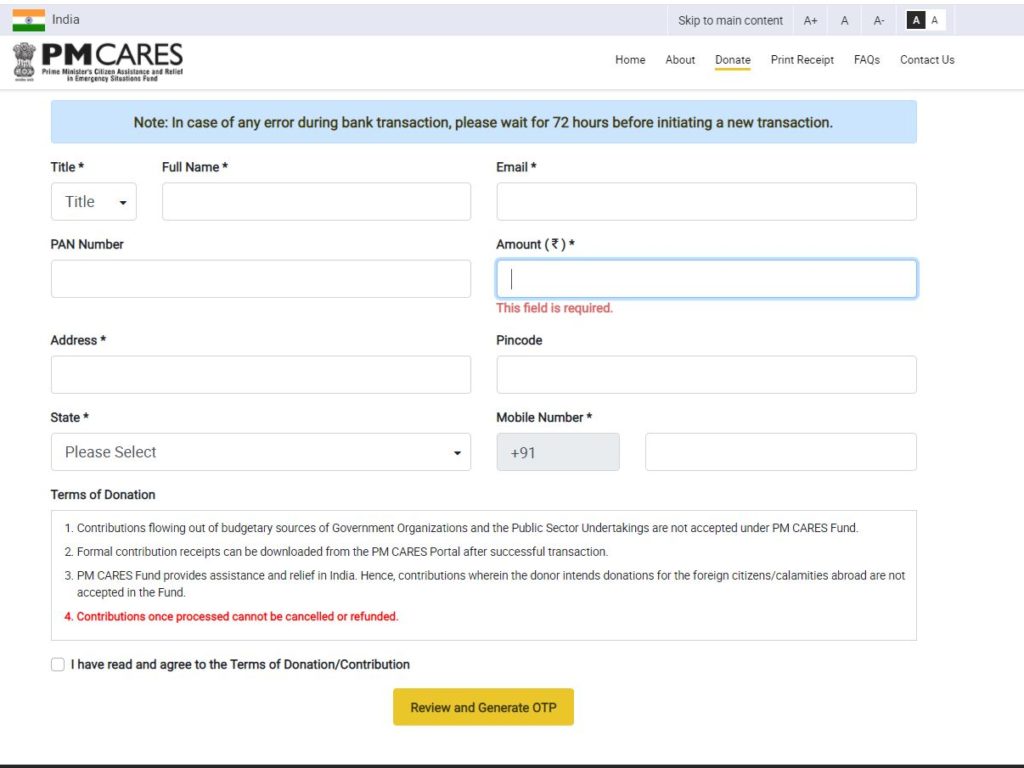

The step by step procedure to contribute to the PM CARES fund has been explained in detail below:

- Step 1: Visit the official website of PM CARES Funds.

- Step 2: Now on the homepage, click on the tab “Donate“.

- Step 3: From the drop-down menu, select the Donation Type you are doing.

- Step 4: Now a new page will open. Enter all the necessary details.

- Step 5: Click on the button “Review & Generate OTP“.

PM CARES Fund

PM CARES Fund

- Step 6: Validate the OTP. Enter the payment method and process your payments.

- Step 7: The acknowledgment page will be displayed on the screen. Take the screenshot for further reference.

PM CARES Fund 80G Certificate or Receipt

To claim the income tax deductions, one will have to submit the necessary proofs. So to claim the deduction under Section 80G of the income tax act, one will have to submit the PM CARES fund 80G receipt. However, if any individual has missed submitting the receipt, then he/she can download the PM CARES donation receipt from the official website by following the steps listed below:

- Visit the official website pmindia.gov.in.

- Now click on “Donation” and select the “Donation Type” you have made.

- A new page will open. Here click on the tab “Print Receipt“.

- Select the medium through which you have donated the funds to PM CARES.

- Based on the medium selected a new page will open.

- Enter your mobile number and Bank reference number.

- Click on the “GET OTP” button.

- Validate the OTP and you can simply download the receipt.

How To Claim Tax Deduction Under Section 80G by Donating To PM CARES Fund?

The officials of the income tax government have approved a 100 percent tax deduction for contributions to the PM CARES Fund under section 80G of the Income Tax Act. All the taxpayers can claim the deduction for the fiscal year 2019-20, if contributions are made between April 1, 2020, and June 30, 2020. However, any individual will be able to avail of the tax deduction only once by donating. For example, if you have claimed the income tax deduction in the financial year of 2019-20, then he/she is not eligible to claim tax deductions for the next financial year that is for the fiscal year 2020-21.

FAQ’s on PM CARES Fund 80G Details

The frequently asked questions on PM CARES Fund 80G are given below:

Question 1.

How can I get an 80G certificate from the PM Cares fund?

Answer:

Any individual will be able to download the 80G certificate or receipt either from the official websites of the PM CARES fund or also can get the receipt by sending an email to pmnrf@gov.in with your details and the donation transaction details.

Question 2.

How many deductions are allowed for donation to Prime Minister Relief Fund?

Answer:

Any individual making a donation to the PM CARES fund can avail of 100% tax deductions without any upper limit.

Question 3.

Is PM cares eligible for 80G?

Answer:

Yes, all contributions made to PM CARES are eligible for Section 80G under Income Tax Act.

Question 4.

Contributions made to PM CARES can be refunded?

Answer:

No, once the contributions are processed, they cannot be canceled or refunded.

Question 5.

How much is the 80G exemption?

Answer:

100% tax exemptions are provided to the individuals who donate to the PM CARES fund. For example, If an individual with an annual income of Rs 10 lakh donates Rs 2 lakh to the PM CARES Fund, the entire donation is tax-deductible under Section 80G, and the taxable income is reduced to Rs 8 lakh.