Challan 280 Meaning: Individuals who wish to pay their income tax can make use of the Challan 280 Form. Form or Challan 280 is available on the official website of Income Tax India and any individual can download it. With the help of Challan 280, an individual will able to pay their tax either online or offline. The best part of Challan 280 is that any individual will be able to pay their taxes directly online without relying on CA or any other sources to pay the Income Tax. Thus any individual who is in search of NSDL Challan 280 online to pay the tax online can refer to this article to know how to fill the Challan 280 NSDL and how to make an e-Payment.

- Income Tax Challan 280 Online Payment

- Important Links Of Challan 280

- How To Pay Income Tax With Challan 280?

- How To Pay Income Tax Using Challan 280 In Offline Mode?

- Income Tax Challan 280 PDF

- Challan 280 Recepit: Proof of Payment

- How To Verify Challan 280 Tax Payment?

- Correction of Information In Challan 280

- FAQs on Challan 280

Income Tax Challan 280 Online Payment

In this section, we have explained how to pay income tax with the help of Challan No 280 online.

Important Links Of Challan 280

How To Pay Income Tax With Challan 280?

The step by step procedure to pay Income Tax through Challan 280 are given below:

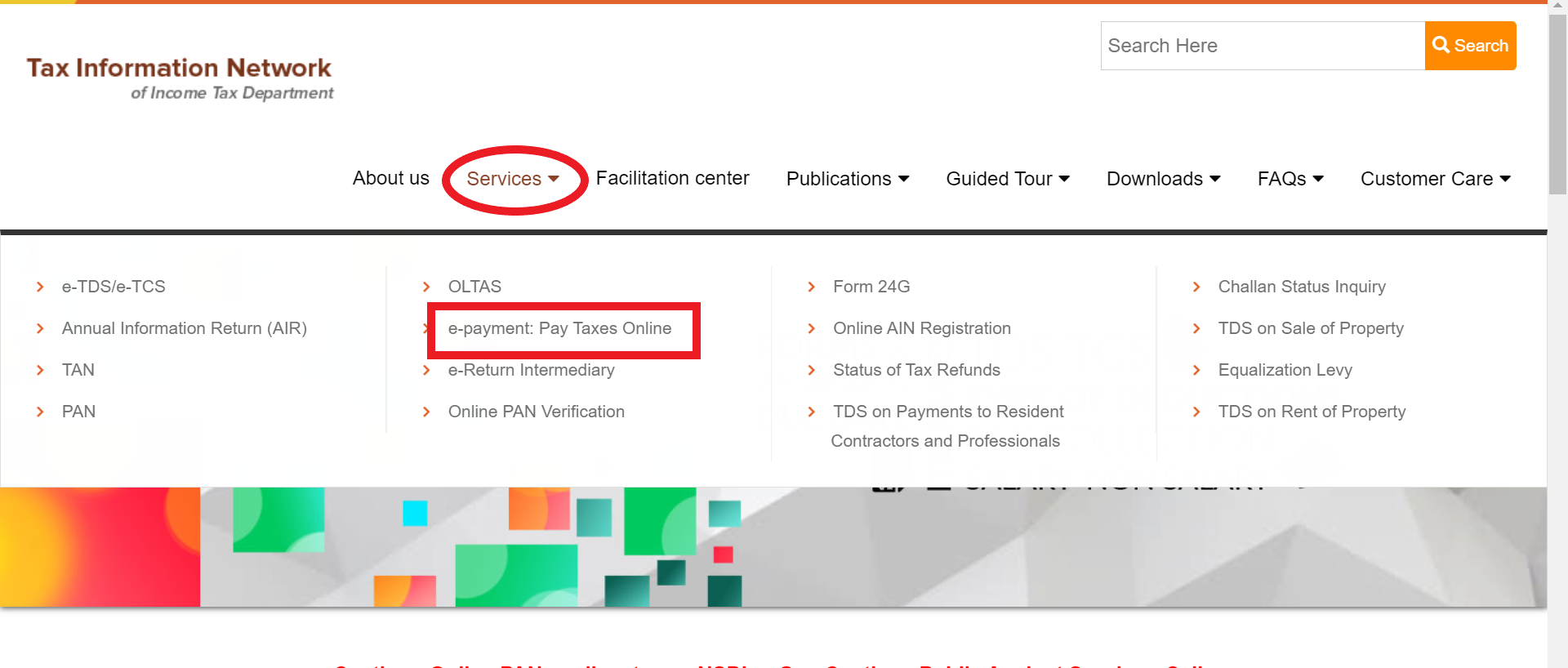

- Step 1: Visit the official website of NSDL – Click Here

- Step 2: On the homepage, click on the “Services” tab and select “e-payment: Pay Taxes Online” from the drop-down menu.

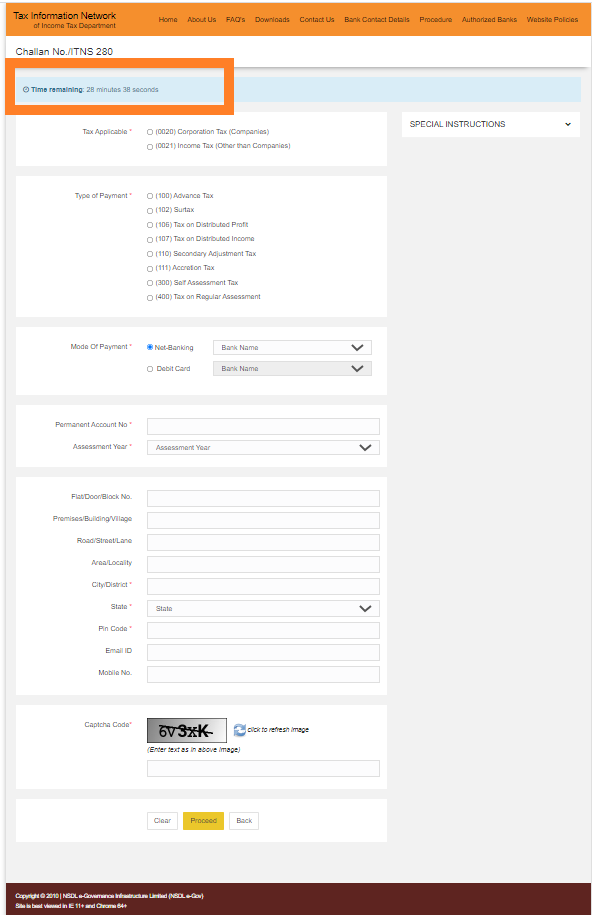

- Step 3: A new page will open. Here choose the “CHALLAN NO./ITNS 280” and click on “Proceed“.

- Step 4: Now a new page will open with the timer. You will be provided 30 Mins within which you will have to fill out the form.

- Step 5: In the form, you will have to enter all the required details. Choose “(0021) Income Tax (Other than Companies)” if you are an individual.

- Step 6: Select your Type of Payment.

- Step 7: Enter the Mode of Payment.

- Step 8: Now enter your PAN number, Address, and Communication Details.

- Step 9: Resolve the Captcha code as displayed on the screen.

- Step 10: Click on “Proceed“.

- Step 11: You will be directed to the “e-Payment” page. Process the Challan 280 online payment and download your Income Tax Challan 280 receipt.

How To Pay Income Tax Using Challan 280 In Offline Mode?

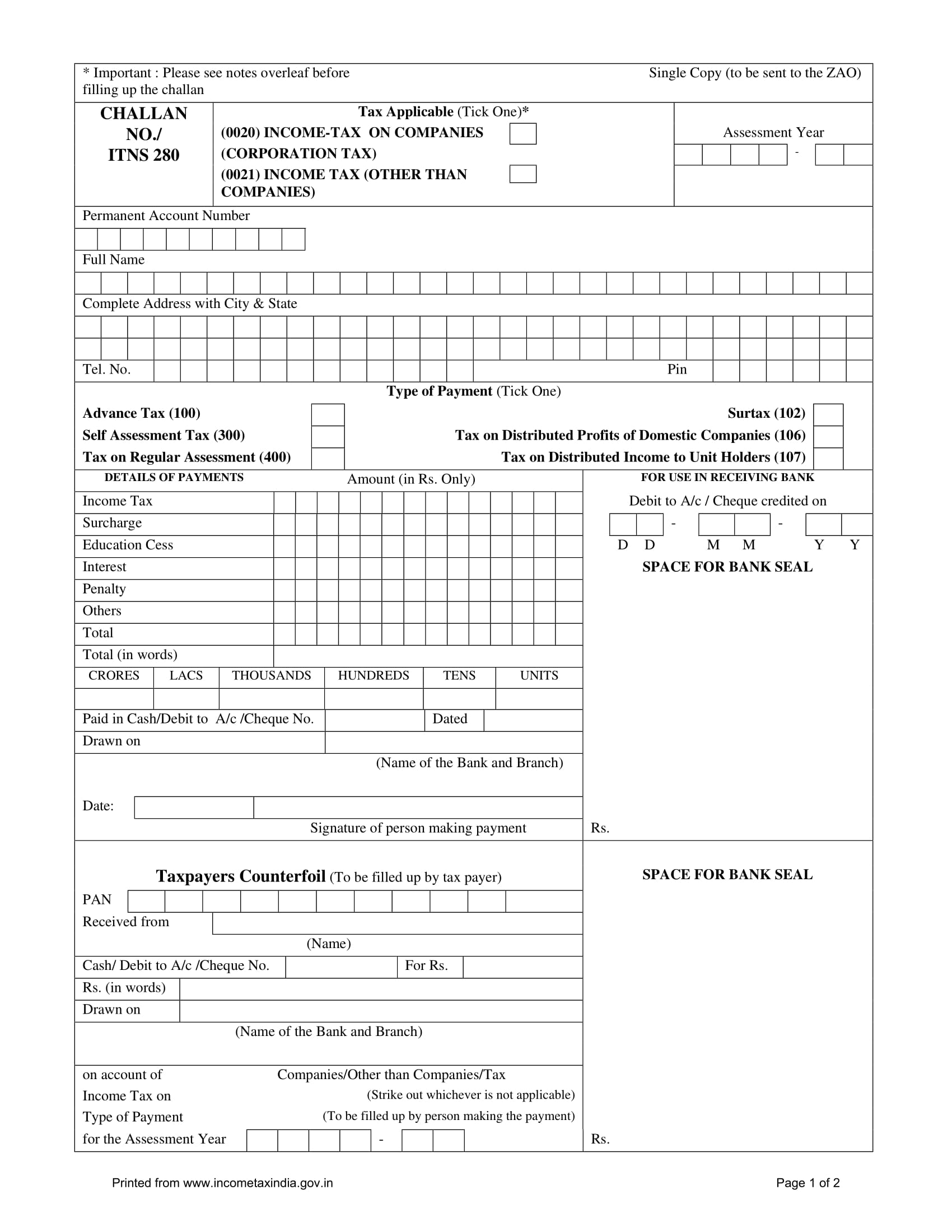

Apart from making income tax e payment online using Challan 280, one can also make the income tax payment offline using Challan 280. The steps to process the Income Tax payment offline using Challan 280 are given below:

Income Tax Challan 280 PDF

- Step 1: Visit the official website of Income Tax India – Click Here

- Step 2: Now click on the tab Form/Downloads and select “Challan” from the drop-down menu.

- Step 3: A new page will open. Here move to the ITNS-280 section and click on the “PDF” icon.

- Step 4: The page will be directed to Challan 280 PDF editable.

- Step 5: Now click on the download icon and Challan 280 will be downloaded to your device.

- Step 6: Also, there is an option where you can download the Challan 280 in Fillable form.

- Step 7: According to your comfort, download the Challan 280 in the required format and enter all the necessary details required.

- Step 8: After entering the details, the individuals will have to head to the bank where he/she is paying the income tax.

- Step 9: Soon after the payment of tax in the concerned bank, individuals must ensure that they are reciving the challan 280 receipts consisting of 7 Digit BSR Code of the Bank Branch, Date of Deposit of Challan, Challan Serial Number.

Challan 280 Recepit: Proof of Payment

After the payment of the income tax amount, a receipt is generated. This receipt will contain all details such as Challan Identification Number (CIN), date, amount of tax paid etc., This CIN receipt is nothing but an acknowledgement that tells that the payment of tax is successful. Individuals should make sure that they are keeping this CIN safe for further references such as e-filing for ITR. Individuals who failed to get the CIN will have to contact their respective banks through which they have processed payments to get the Challan or receipt regenerated.

How To Verify Challan 280 Tax Payment?

Individuals having confusion about the Challan 280 Tax Payment can also verify their tax payment status by following the steps listed below:

- Visit the official website of NSDL website.

- Click on the “Services” and select “Challan 280 Status Enquiry“.

- A new page will open. Move to the “Tax Payers” section.

- Either select “CIN Based View” or “TAN Based View“.

- Based on the selection a new page will open.

- Enter the details in the required fields.

- Solve the “Captcha“.

- Now you can either view the Challan Status or Download the Challan Status.

Correction of Information In Challan 280

It is quite common we tend to enter wrong details in a hurry while filling out the Challan 280. If any individual finds that, some information needs to be modified in the Challan 280, then they can request the bank officials for the same. The list of details that can be modified in Challan 280 are given below:

- Assessment Year

- TAN – Tax Deduction & Collection Number

- PAN – Permanent Account Number

- Nature of the Payment

- Minor Head

- Major Head

- Total Amount

It is to be noted that the bank officials will able to make changes in TAN and PAN, the assessment year, and the total amount only within 7 days from the date of deposit of Challan. For other details, bank officials have a time frame of 3 months where can modify the information.

FAQ’s on Challan 280

The frequently asked questions on Challan 280 are given below:

Q. What is Challan 280?

A. Challan 280 is nothing but a Form through which a tax assessee can pay the Income Tax either online or offline.

Q. How can I download ITNS 280 Challan?

A. If you are paying the Income Tax offline, then you will have to download the ITNS 280 Challan from the official website of Income Tax India or from the link provided on this page.

Q. What is the serial number of Challan 280 in income tax?

A. Challan 280 or Form 280 consists of a challan identification number (CIN) which is unique 7 digits BSR code allocated by the Reserve bank of India to the bank branch where the income tax is deposited. This seven-digit unique BSR code is known as the serial number.

Now that you are provided with all the necessary information about Challan 280 and we hope this detailed article is helpful to you. If you have any queries on Challan form 280 of Income Tax or in general about how to fill out the Challan 280, ping us through the comment box below and we will get back to you as soon as possible.