TDS on Commission or Brokerage Section 194H Of Income Tax Act

TDS on Commission or Brokerage Section 194H: The provision for a tax deduction on earnings as commission or brokerage by a resident individual is underlined in Section 194H of the Income Tax Act. However, the commission collected from insurance sales is not included in this section. A resident individual or HUF required to pay any commission or brokerage (excluding insurance commission) is eligible for a tax deduction under section 194H. TDS must be deducted at the time of payment, whether in cash, by cheque, or by draft. The current TDS rate that applies under section 1194H is 10%. On this page, let’s understand everything about TDS on commission and brokerage for FY 2021-22 in detail.

- What is Section 194H?

- TDS on Commission and Brokerage

- When TDS under Section 194H is Deducted?

- Commission and Brokerage Meaning

- What does TDS on Commission and Brokerage include?

- TDS on Commission and Brokerage Expectations

- Section 194H TDS Rate FY 2020-21

- When TDS under 194H is not Deducted?

- TDS Time Limit for Depositing

- How to Deduct TDS at Lower Rate?

- FAQs on TDS on Commission and Brokerage

What is Section 194H?

- Section 194H is concerned with income tax imposed on any income derived from a brokerage or commission by any person liable to pay a residence.

- Individuals and HUF are required to deduct TDS if they are covered by section 44AB.

- The insurance commission mentioned in section 194H does not exist.

- TDS under Section 194H will be deducted when such income is deposited in the payee’s account or any other provided account.

- It can be paid in cash, cheque, or DD, whether it’s called a suspense account or anything else at the moment of disbursement.

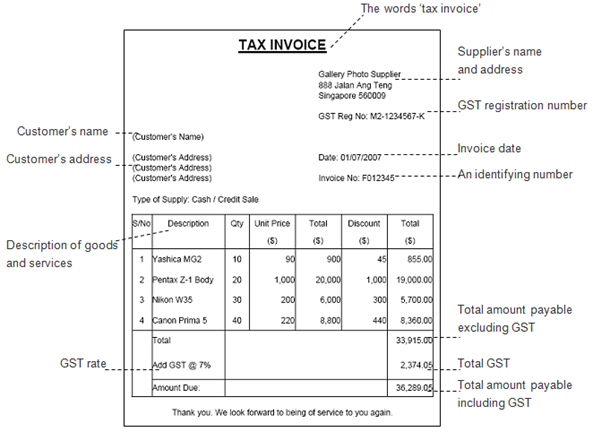

TDS on Commission and Brokerage

TDS on commission or brokerage must be deducted by all types of entities, including individuals and HUFs, that fall under the scope of tax audit under Section 44AB, i.e., whose turnover or annual revenue exceeds 25 lakh and exceeds 1 crore (as applicable according to the income tax slab).

- Over and above the TDS amount at a defined rate, no additional surcharge or education cess is necessary. Thus the TDS is taken at a flat rate of 10%, including service charges (if applicable).

- The number of TDS deducted under section 194H must be submitted with the government prior to the due date of the payment by the entity responsible for TDS deduction.

When TDS under Section 194H is Deducted?

TDS on Commission/Brokerage is needed to be deducted by the individual making the commission or brokerage payment under Section 194H. TDS on commission/broker must be deducted at a rate of 10% at the time of:-

- Making such a payment or

- Crediting such income to the payee’s account in the books of the person who is deducting TDS

whichever comes first.

Commission and Brokerage Meaning

Any payment is considered a commission or brokerage.

- directly or indirectly,

- received or receivable, OR

- by a person acting on behalf of another person

What does TDS on Commission and Brokerage include?

The TDS on commission and brokerage includes:

- For services performed which are not professional

- For services rendered in the process of purchasing or selling a product

- Connection with any transaction involving any asset, valuable article, or thing, except securities

TDS on Commission and Brokerage Expectations

TDS on commission and Brokerage will not be deducted under the following cases:

- During the financial year, the total amount paid or payable does not exceed Rs. 15000. (Limit increased from Rs. 5000 to Rs. 15000 in Budget 2016)

- An employer compensates his employees with a commission. Under Section 192, such commission is liable to be deducted as TDS on salary.

- TDS on the Insurance Commission will not be deducted under this provision because it is particularly addressed in Section 194D.

Section 194H TDS Rate FY 2020-21

TDS is present at a rate of 5%. For transactions between 14 May 2020 and 31 March 2021, the charge is 3.75%. There will be no surcharge, education cess, or SHEC added to the above rates. As a result, the basic rate of tax will be deducted at the source. If the deductee does not quote his or her PAN, TDS will be applied at a rate of 20% in all cases.

When TDS under 194H is not Deducted?

- If the amount or aggregate amounts of such income to be credited or paid during the financial year does not exceed INR 15,000, no deduction will be made under this clause.

- Under section 197, a person can apply to the assessing officer for a tax deduction at a rate of NIL or a lower rate.

TDS Time Limit for Depositing

Taxes deducted from April to February must be deposited on or before the 7th of the following month. Taxes deducted in March must be deposited on or before the 30th of April.

For example, tax deducted on April 25th must be deposited by May 7th, while tax deducted on March 15th must be deposited by April 30th.

How to Deduct TDS at Lower Rate?

The individual whose tax is deducted can apply to the assessing officer under section 197 for a NIL rate or a lower rate of tax deduction.

- Validate the deductee’s PAN by submitting a 197 certificate.

- The Certificate must be valid for the PAN, Section, Rate, and relevant financial year specified in the filed statement.

- Check that the certificate’s threshold limit has not been exceeded in previous quarters.

- The statement should include the correct certificate number. 3XXXAH7X is an example of a correct certificate number.

FAQs on TDS on Commission and Brokerage

Question 1.

What is the limit to deduct TDS u/s 194H?

Answer:

The threshold limit for TDS deduction for commission/brokerage is Rs.15,000 under Section 194H.

Question 2.

What is the TDS rate for brokerage?

Answer:

The TDS rate on commission or brokerage received except for Insurance Commission is 5%.

Question 3.

Who is liable for Tax Deduction At source under Section 194H?

Answer:

Individuals who make money from commissions or brokerage are required to deduct tax at the source under section 194H.