GST Composition Scheme for Service Providers | Rules, Limits, Merits

GST Composition Scheme for Service Providers: The government has implemented a compositional scheme to help small taxpayers and reduce the burden of compliance. A compositional dealer is required to keep fewer accounts/books and not to file monthly returns. Previously, only the suppliers of goods had access to the scheme.

However, it was announced at the 32nd GST Council that the scheme will now also be available to service providers. The scheme is available from 1 April 2019 for service providers. In this article, let’s understand everything about the composition scheme for service providers under GST notification.

Composition Scheme for Service Provider

The taxpayers who offer services of aggregate annual turnover up to Rs. 50 lakh are entitled to pay tax nominally by the composition scheme for service providers. The following service provider can opt for a composition scheme under GST:

- Service provider only

- Goods and services suppliers which means that those suppliers who were not eligible for the composition scheme earlier are now eligible

GST Composition Scheme Rules for Service Provider

The rules for service providers under the GST composition scheme are given below:

- In the previous financial year, the service provider must have had a turnover of less than Rs. 50 lakh.

- The supplier should not supply goods that are not taxable.

- The supplier should not be involved in the production of interstate supplies.

- The supplier should not deliver via an e-commerce provider.

- The supplier should not be a taxable individual or a taxable non-resident.

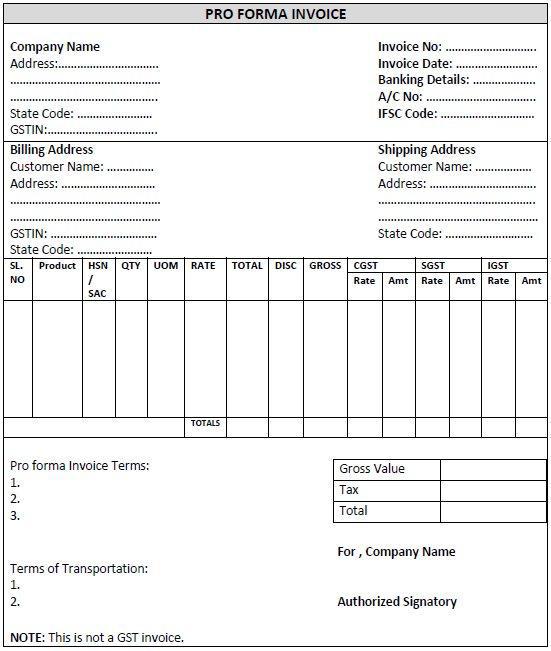

- Instead of a tax invoice, the supplier must issue a letter of supply. The supplier shall mention the word “taxable individual composition” on the supply bill.

- It is impossible for the supplier to charge and collect customer tax.

- The input tax credit cannot be claimed by the supplier.

- For reverse charge supplies, the supplier shall pay regular tax.

- The provider cannot supply ice cream or other manufactured whether or not it contains cocoa, bread masala and tobacco.

What Is The Rate Of Service Tax Under The Composition Scheme?

Compliance with the composition scheme by service providers: The taxpayer should only file one annual declaration with a quarterly tax payment (along with a simple declaration). The rate of service tax under the composition scheme is explained below:

| Business Type | CGST | SGST | Total GST |

| Manufacturers and Traders of Goods | 0.5% | 0.5% | 1% |

| Restaurants | 2.5% | 2.5% | 5% |

| Service Providers | 3% | 3% | 6% |

The value of the provision of exempted services in order to calculate the aggregate annual turnover shall not be taken into account in the continuation of deposits, loans or advancements where the revenue is represented by interest or discount.

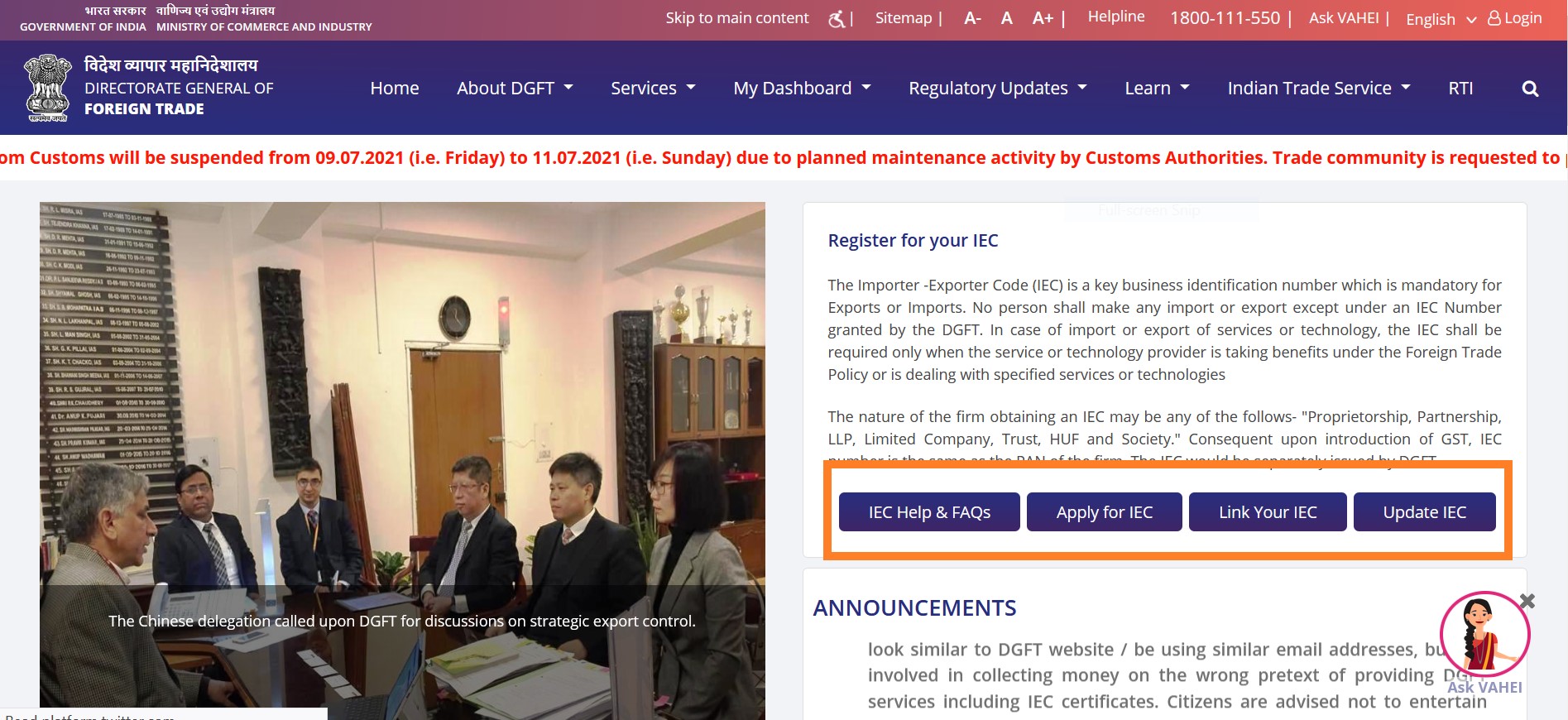

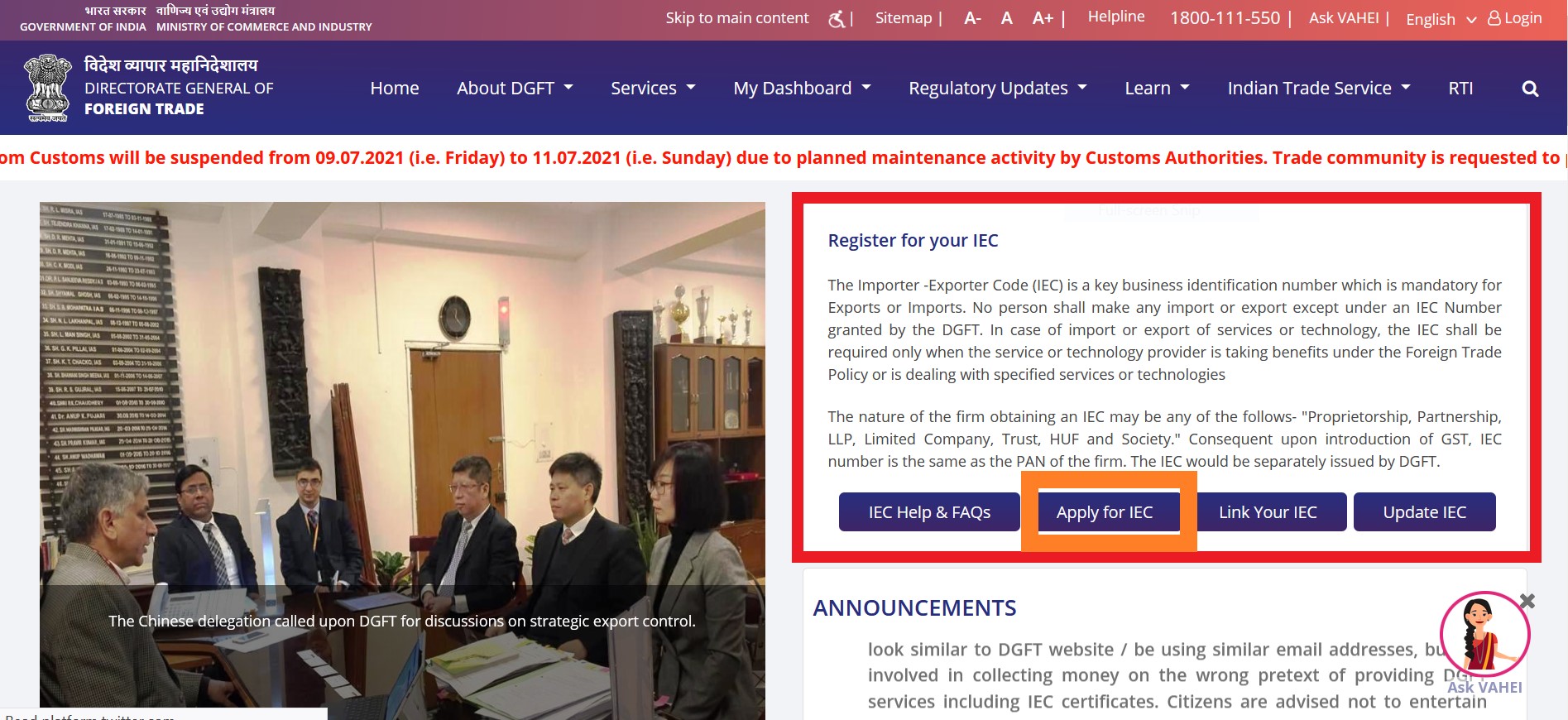

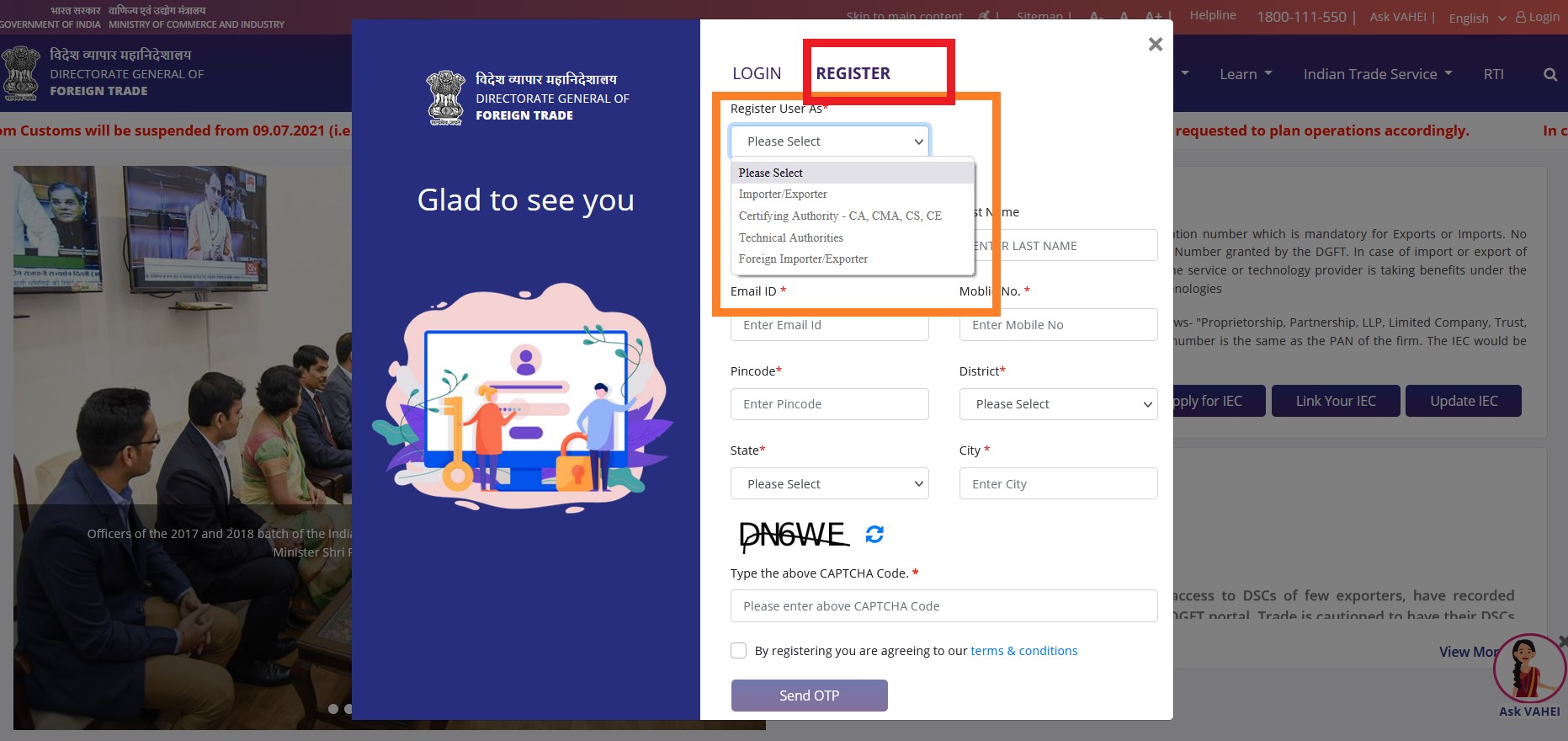

Registration Under Composition Scheme for Service Providers

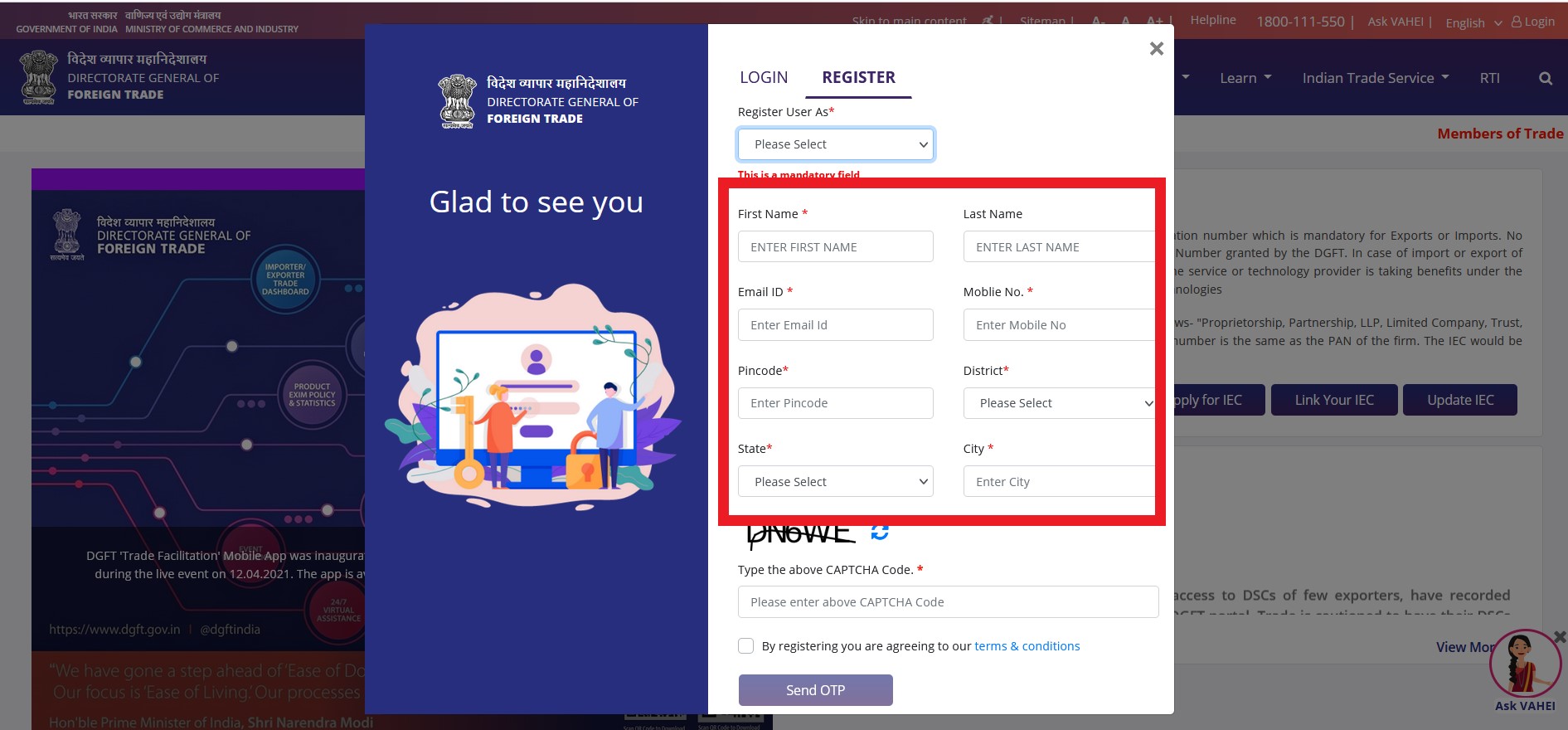

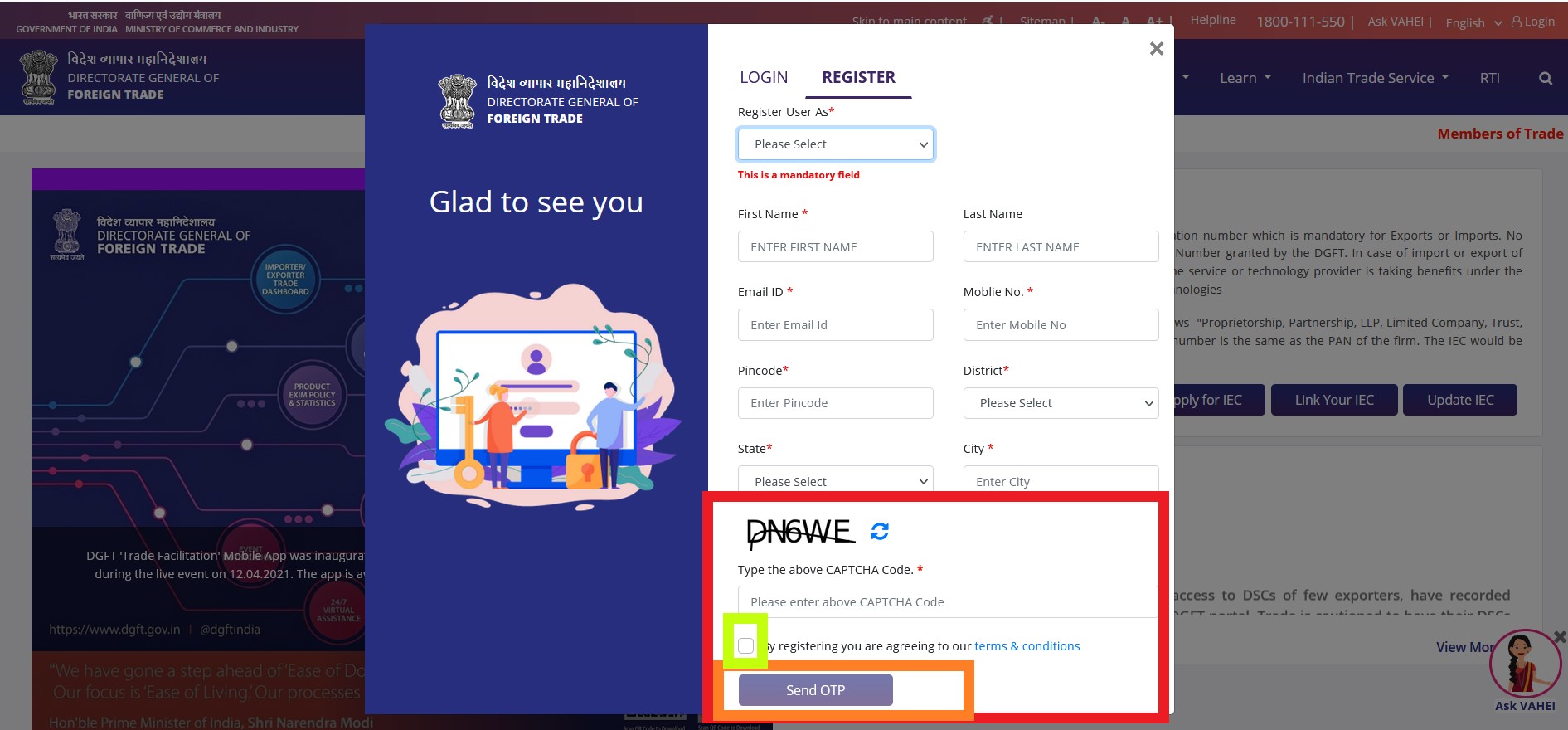

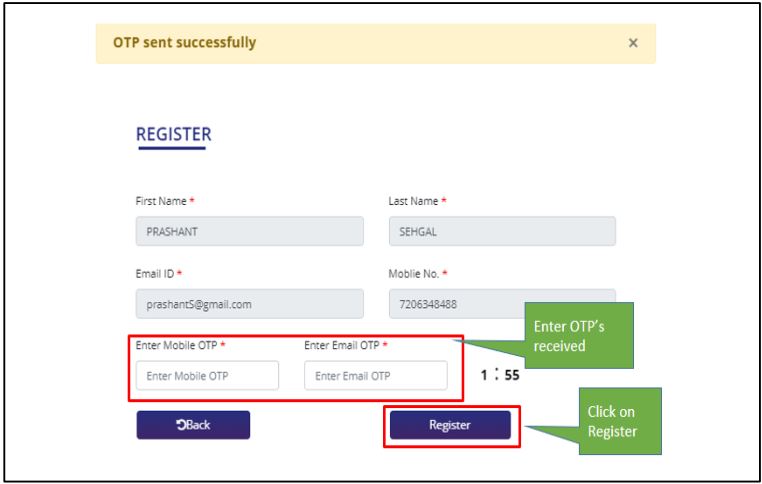

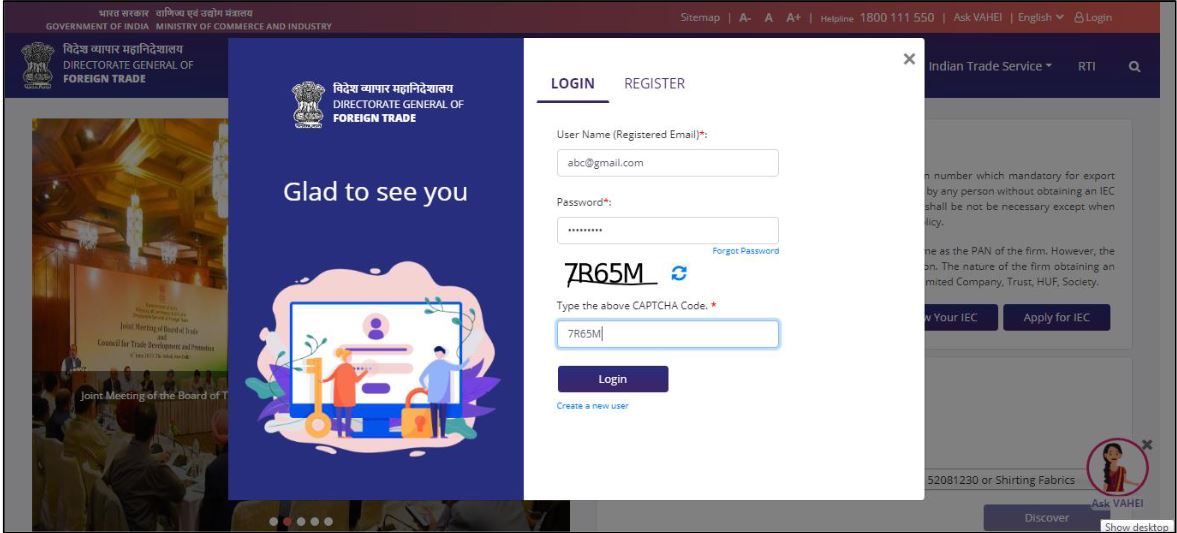

Any service provider (or mixed supplier) who registers for GST for the first time may select an option to pay tax under the composition scheme in Part B of FORM GST REG-01, which will be deemed an intimation to pay tax under the composition scheme. Any notification of a place of business opting for the composition scheme in any State or Union territory is assumed to be a notification for all other places of business registered on the same PAN.

Disadvantages of GST Composition Scheme for Service Providers

The disadvantages of GST Composition schemes for service providers are given below:

- The input tax credit is not available.

- Taxes cannot be charged or collected from customers. As a result, under the plan, a taxpayer is personally liable.

- Exports and interstate transactions are not permitted.

When Can We Opt for GST Composition Scheme?

If someone wants to use the composition scheme, they must do it before the beginning of the financial year. To choose a composition scheme, fill out Form CMP-02. It is not possible to choose a composition scheme in the middle of a financial year. A person who has previously been selected for the scheme is not compelled to do so each year.

GST Returns To Be Filed

For each quarter, the individuals registered under this scheme must file CMP-08. Also, GSTR-4 must be filed for each financial year under GST Returns.

FAQ’s on GST Composition Scheme For Service Providers

Question 1.

Which service provider can opt for a composition scheme under GST?

Answer:

Registered taxpayers who offer services or supply commodities and services may both opt for GST component schemes with aggregate sales of up to 50 Lakhs.

Question 2.

What is the GST limit for service providers?

Answer:

The GST limit for the service provider who falls under normal category states is Rs.20 Lakhs and whereas for Services providers who fall under non-normal category states, the GST limit is Rs. 10 Lakhs.

Question 3.

What is GST composition scheme turnover limit 2020-21?

Answer:

The officials of CBIC has increased the composition scheme turnover limit from Rs 1.0 Crore to Rs. 1.5 Crores. Thus any taxpayer whose turnover is less than Rs. 1.5 crore may opt for the composition scheme of GST.