Leave Travel Concession Section 10(5): The leave travel allowance shall be an allowance granted by an employer for traveling with or without a family in India to his employee. Under certain conditions under Section 10(5) and Rule 2B, the amount received as LTA shall be tax-free under the Income Tax. LTA is sometimes also referred to as leave travel concession (LTC).

- Leave Travel Concession Rules

- Maximum Deduction Under Leave Travel Concession

- LTC or Leave Travel Concession Cash Voucher Scheme

- How To Claim Leave Travel Concession in Income Tax Return?

- FAQ’s on Leave Travel Concession

Leave Travel Concession Rules

There are certain LTC -Leave Travel Concession rules which are set by the officials of Income Tax and they are:

- An exemption from the maximum limits is permitted to the amount paid for travel via air, rail, or bus. The amount paid for other costs like hotel rooms, food, etc. is not permitted.

- The maximum deduction is the allowance received actually.

- Leave Travel Concession is not applicable to accommodation or food costs.

- For two journeys made in a 4 calendar year block the LTA exemption may be claimed (Jan to Dec). This 4-year block is currently between 2014 and 2017. If there is not a claim of two exemptions in a 4-year block then the first year of the following block may receive one exemption.

- Allowance for international travel expenses is not permitted.

- Allowance is permitted only for costs incurred in travelling with himself or family members. There is no exemption if a person pays for the trip of friends and/or distant relatives.

- An exemption is only permitted if the applicant travels as well. Where only families travel, deductions are not permitted.

- Only two surviving children are exempted from this. In the following two cases, however, more than two children are exempted from this requirement.

- All children who have survived born before 1 October 1998

- After the first child, there are multiple births

- If the former employer receives such allowance following the retirement or termination of service, LTA exemption may also be taken.

Maximum Deduction Under Leave Travel Concession

The concession amount in this section does not in any case exceed the amount actually incurred.

- Airways Travel: The airfare is exempt from the shortest route or from the smallest amount spent.

- Travel by Rail: First-class fare on the shorter route or less would be exempted.

- The location and source of the trip are connected by rail, but the journey is completed by a different mode of transport.

- The travel locations are neither partially nor fully connected by rail but are connected by an additional system of public transport.

- Neither the source nor the destination is connected via rail or any other public transport system.

LTC or Leave Travel Concession Cash Voucher Scheme

In October 2020, Finance Minister N.Sitharaman announced the LTC Cash voucher scheme to boost requests in the Indian economy, which was in disorder. During the 2021 Union Budget, it was formally approved. The scheme allows you to claim a tax exemption from LTC without travel if:

- Customers can purchase goods and services worth at least 3 times the LTC price and at least 12% GST.

- The shopping period should be from 12 October 2020 to 31 May 2021 (deadline extended by two months from 31st March 2021)

- Only digital payments should be made with the GST number and the amount paid, which is clearly mentioned on the invoice.

- The maximum exemption per person is Rs. 36,000, which can be claimed.

For example, you should spend at least Rs.180,000 (60,000X3) on a tax discount if you and your family are entitled to an LTC of Rs. 60,000. Although GST would exceed Rs. 2.00,000 by the last invoice value, your baggage costs would be significantly less.

How To Claim Leave Travel Concession in Income Tax Return?

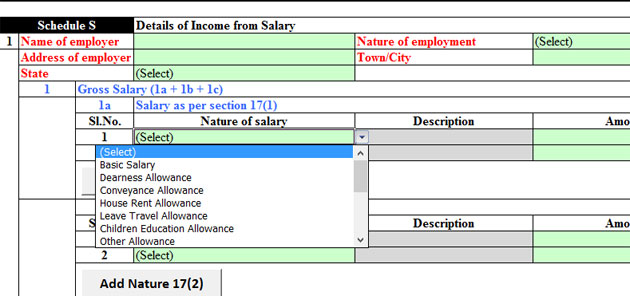

Under Income Tax Returns, in ITR -1, salary income shall be filled in “Salaries income” after all exempt payments have been exempted. Note one must not fill out the details separately. In the case of ITR – 2, 3, 4, in paragraph 2 of the “salary” table the amount of allowance that is exempt and in paragraph 7(i) of the same sheet the amount of LTA that is to be exempt must be filed.

FAQ’s on Leave Travel Concession

Question 1.

What is the difference between LTA and LTC?

Answer:

LTA and LTC are not two different terms. Leave Travel Allowance is otherwise known as Leave Travel Concession which is a tax break that an employee can use to travel to India for self-employed and family members.

Question 2.

How does leave travel concession work?

Answer:

The travel allowance shall be an employer’s allowance for an employee to cover travel costs when the employee is on leave from work. Under the Income Tax Act, the leave travel concession is tax-free. The exemption is only available if certain conditions are satisfied.

Question 3.

What is the new LTC scheme?

Answer:

In October 2020, the Central Government announced the cash voucher system for the LTC (Leave Travel Concession). This scheme allows public employees and employees of the private sector to claim tax benefits in place of LTC, by buying goods and services.