Chapter 11 Valuation of Various Magnitudes of Business Organizations – CS Professional Valuations and Business Modelling Study Material is designed strictly as per the latest syllabus and exam pattern.

Valuation of Various Magnitudes of Business Organizations – CS Professional Valuations and Business Modelling Study Material

Question 1.

Define each of the following terms

Investment Timing Options; (Dec 2009, 5 marks) [CMA Final]

Answer:

Investment timing option

Investment timing options give companies the option to delay a project rather than implement it immediately. This option to wait allows a company to reduce the uncertainty of market conditions before it decides to implement the project. Capacity options allow a company to change the capacity of their output in response to changing market conditions.

![]()

Question 2.

What is Valuation Multiple? Give examples of any four multiples. (June 2015, 4 marks) [CMA Final]

Answer:

Valuation Multiple:

A valuation multiple is the ratio of firm value or equity value to some aspect of the firm’s economic activity, such as cash flow, sales, or EBITDA. The table below lists the most common multiples used to value firms, together with the terminology that is used to describe the multiple.

Multiples Used in Finance

| Quantity | X | Multiple | Terminology = Value |

| Cash Flow | X | Firm Value/Cash Flow of Firm | “Cash flow multiple” =’ Value of Firm |

| EBITDA | X | Firm Value/EBITDA of Firm | “EBITDA multiple” = Value of Firm |

| Sales | X | Firm Value/Sales Value of Firm | “Sales multiple”= Value of Firm |

| Customers | X | Firm Value /Customers | “Customer multiple”= Value of Firm |

| Earnings | X | Price per Share /Earnings | “Price-earnings ratio” = Share Price |

![]()

Question 3.

Aneez Biotech Private Limited is a start-up Venture in Biotech field and expects a Private Equity investment shortly from a Venture Capital investor, lathis scenario the Company has approached you to value its business. As a Valuation Consultant, list out various methods of Valuation of these types of entities and explain a method suitable for Aneez Biotech Private Limited. (Dec 2019, 5 marks)

Question 4.

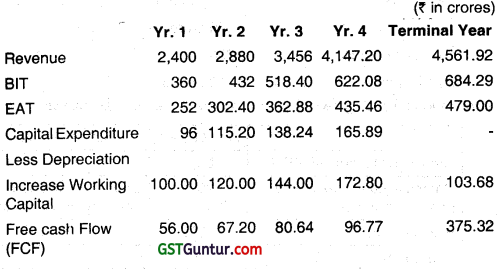

Following information is available in respect of XYZ Ltd. which is expected to grow at a higher rate for four years after which growth rate will stabilize at a lower level: (June 2014, 10 marks) [CMA Final]

Base year information:

Revenues : ₹ 2,000 crores

EBIT : ₹ 300 crores

Capital expenditure : ₹ 280 crores

Depreciation : ₹ 200 crores

Information for high growth and stable growth period is as follows:

| High Growth | Stable Growth | |

| Growth in Revenue & EBIT | 20% | 10% |

| Growth in capital expenditure and depreciation | 20% | Capital expenditure is offset by depreciation |

| Risk free rate | 10% | 9% |

| Equity beta | 1.15 | 1 |

| Market risk premium | 6% | 5% |

| Pre-tax cost of debt | 13% | 12.86% |

| Debt equity ratio | 1:1 | 2:3 |

![]()

For all time, working capital is 25% of revenue and corporate tax rate is 30%. What is the value of the firm? Use rate of discounting @ 13%.

| Year | 1 | 2 | 3 | 4 |

| P.V. Factor @ 13% | 0.885 | 0.783 | 0.693 | 0.613 |

Answer:

High growth phase:

ke = 0.10 + 1.15 × 0.06 = 0.169 or 16.9%.

kd = 0.13 × (1 – 0.3) = 0.091 or 9.1%.

Cost of capital = 0.5 × 0.169 + 0.5 × 0.091 = 0.13 or 13%.

Stable growth phase:

ke = 0.09 + 1.0 × 0.05 = 0.14 or 14%

kd = 0.1286 × (1 – 0.3) = 0.09 or 9%.

Cost of capital = 0.6 × 0.14 + 0.4 × 0.09 = 0.12 or 12%.

Determination of forecasted Free Cash Flow of the Firm (FCFF)

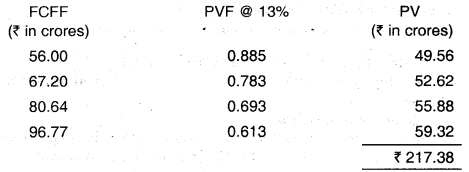

Present value (PV) of FCFF during the explicit forecast period is:

PV of the terminal, value is: \(\frac{375.32}{0.12-0.10}\) × \(\frac{1}{(1.13)^4}\) = ₹ 18.766 Crores × 0.613

= ₹ 11,504 Crores.

The value of the firm is: ₹ 217.38 Crores + ₹ 11,504 Crores = 11,721 Crores.

![]()

Question 5.

Calculate the expected rate of return of the security from the following information: (Dec 2016)

(i) Beta of a security is 0.5; Expected rate of return On portfolio is 15% p.a.; Risk free rate of return is 6% p.a. (3 marks) [CMA Final]

(ii) If another security has an expected rate of return of 18% p.a.; what would be its Beta? (3 marks) [CMA Final]

Answer:

(i) Calculation of expected rate of return of the security:

= 6 + 0.5 (15 – 6)

= 6 + 4.5

= 10.5%

(ii) Calculation of Bjeta of another security whose expected rate of return is 18%

18 = 6 + Beta (15 – 6)

Beta 9 = 18 – 6

Beta = 12/9

= 1.33

![]()

Question 6.

A Registered Valuer has been asked to determine the combined level of valuation discounts for a small equity interest in a private company. The Valuer concluded that an appropriate control premium is 15 percent. A discount for lack of Marketability was estimated at 25 percent. Given these factors, what is the combined discount? (June 2019, 5 marks)

Answer:

The valuation of a small equity interest in a private company would typically be calculated on a basis that it reflects the lack of control and lack of marketability of the interest. The control premium of 15 percent must first be used to provide an indication of a discount for lack of control (DLOC). A lack of control discount can be calculated using the formula Lack of control discount = 1 – [1 / (1 + Control Premium)]

In this case, a lack of control discount of approximately 13 percent is calculated as 1 – [1/(1 + 15%)]. The discount for lack of marketability (DLOM) was specified. Valuation discounts are applied sequentially and are not added.

A combined discount of approximately 35 percent is calculated as 1 – (1 – 13%) × (1 – 25%) = 0.348 or 34.8%.

![]()

Question 7.

Discuss the valuation methods for micro, small and medium enterprise.

Answer:

Valuation Methods for micro, small and medium sized enterprises

Analysts use various approaches for valuing MSMEs ranging from simple to the sophisticated. There are three approaches to valuation, in general terms. The discounted cash flow valuation, relative valuation and contingent claim valuation. Distinct features of SMEs have an impact on the choice of the valuation approach. The following approaches are generally followed to determine the value of the SMEs business depending on the nature of operations:

- The DCF method,

- The relative valuation method,

- Asset based method and

- The mixed method.

Discounted Cash Flow (DCF) method

A small business is valued using all the methods but the Discounted Cash Flow method gives the best picture of the business. DCF method is the most popular method as it arrives at nearly accurate valuation. In this method, the value of the future cash flows of the business is reduced to present.

It also takes inflation into account while calculating the valuation of the business. This method gives a better picture of company’s value at present, and is more relatable for the investors, as well as, the business owners. Most of the companies, however, go for a combination of two or more methods for estimating the enterprise value.

![]()

Comparable Transaction Valuation

Size has consequences for the level of risk and, hence, comparable transaction valuation method of relative valuation approach is also used for small enterprises. Small size naturally increases risk levels and in estimating required rates of return for small and private companies risk premiums for small size will often be incorporated. This method is usually used when the valuation is accepted by the valuer for sale.

Under this method, peer group is compared on similar standards. Similar companies are decided based on industry they belong to as well as the market capitalization for the purpose of valuation. The companies are then assessed on common multiples such as EV/EBITDA, PE ratio, PEG ratio and so on. For fair valuation, the company should be evaluated on more than one standard to ascertain the current and the potential value of the company.

However, this approach has its own set of drawbacks when the historical data of the company is not available. Therefore, this approach is not used solely, but in combination with other approaches. Comparable Transaction Valuation is often used along with Discounted Cash Flow to present fair value of business.

Asset based Approach

Asset based approach is another approach to valuation of SMEs. The valuation here is simply the difference between assets and liabilities taken from the’balance sheet, adjusted for certain accounting principles. Fair market value of assets is arrived to get enterprise value. Patents, goodwill, bad debts, etc. are valued at their book value along with adjustments for inventory undervaluation to arrive at the fair value of the assets.

![]()

This approach is generally used to assess property and investment companies, to cross check for asset based trading companies such as hotels and property developers, under performing trading companies with strong asset base (market value vs. existing use).

Asset Based valuation can be done using three methods. They are Economic Book Value Calculation, Liquidation Value Calculation, and Valuation at Replacement Cost. The valuation of the enterprise is done as per the values arrived from any of the three methods as under:

- Economic Book Value: The accounting book values of the assets are adjusted to their current market value.

- Liquidation Value method: At estimated sale value of assets at liquidation less the cost of liquidation.

- Valuation at Replacement Cost: The cost incurred to get the same assets from scratch is used for valuing assets.

However, the asset-based approach is not an alternative to the above approaches, as this approach itself uses one of the three methods to determine the values. In determining which of these approaches to use, the valuer must exercise discretion as each technique has advantages as well as drawbacks. It is normally considered advisable to employ more than one technique, which must be reconciled with each other before arriving at a value conclusion.

Mixed method (particularly, Anglo-Saxon method with limited capitalization of goodwill): In general, mixed methods mediate between income-based methods and assets-based methods, as the value of an enterprise mostly s. depends on the attitude to produce earnings.

SMEs are shaped by their entrepreneurs and that strongly affect the future perspectives of profit. Therefore, in case of changes in the decision-making owner, perspectives of profit will considerably change, as they particularly depend on the entrepreneur. Thus, it is reasonable to assume that goodwill has a limited duration, in case of changes in ownership arrangement. The method is suitable to define the value of small and medium-sized enterprises and theoretically correct for the specific purpose.

![]()

Question 8.

Discuss the valuation methods for start up.

Answer:

Valuation of Startups

Startup means an entity, incorporated or registered in India:

- Upto a period of seven years from the date of incorporation/registration or upto ten years in case of Startups in Biotechnology sector

- As a private limited company or registered as a partnership firm or a limited liability partnership

- With an annual turnover not exceeding ₹ 25 crore for any of the fnancial years since incorporation/ registration

- Working towards innovation, development or improvement of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation

Features of startups:

The following are some of the key characteristics of start-up companies:

- No past history, operations have not reached the stage of commercial production.

- No or negligible revenue with operational losses.

- Limited promoter’s capital infused and high dependence on external sources of funds.

- Illiquid investments.

![]()

Methods of Valuation

The following are the valuation methods of start-ups as per Indian Valuation Standards Issued by ICAI applicable for the valuation reports issued on or after 1st July, 2018:

- Income approach

- Cost approach

- Venture Capital (VC) method

- First Chicago Method

- Adjusted discounted cash flow method

- Rule of thumb

Income approach : It is a valuation approach that converts maintainable or future amounts (e.g., cash flows or income and expenses) to a single current (i.e., discounted or capitalized) amount. The fair value measurement is determined on the basis of the value indicated by current market expectations about those future amounts.

This approach involves discounting future amounts (cash flows/income/cost savings) to a single present value. The valuer may consider using other valuation approaches instead of income approach or in combination with income approach whenthere is signifcant uncertainty on the amount and timing of income/future cash flows of the start-up companies;

![]()

Cost approach: It is a valuation approach that reflects the amount that would be required currently to replace the service capacity of an asset (often referred to as current replacement cost). A valuer applies cost approach in case income approach cannot be used. The valuer may also consider using other valuation approaches in combination with cost approach, when the asset has not yet started generating income / cash flows (directly or indirectly);

The following are some of the generally acceptable methods of valuation of start- ups:

Venture Capital (VC) method: Venture Capitalist Method is one of the globally acceptable methodologies in estimating the value of start-ups .In this method the valuation of the start-up is done from the venture capitalist point of view. It indicates the value of pre-money ventures by following the process that VCs go through, where they exit an investment within three to seven years. It estimates the expected exit price of a similar mature business venture and discounts it back to present value considering the risks involved.

![]()

Question 9.

Discuss the valuation of small companies.

Answer:

Valuation of Small Companies

Small companies are private in nature and financially less transparent than their publicly traded peers. Though often smaller in size these small private companies have a major importance in the world’s economy. These businesses have noticeably more risk than larger ones.

Size contributes to the discount in the valuation since it replicates the industry. These private company’s owners do not publicly issue shares of their company, instead they keep ownership and associated transactions at low-key.

Valuation of such closely-held private companies can be costly and difficult due to non-availability of exact financial information. Small private companies may be good acquisition targets for larger competitors and publicly-traded counterparts. There are different methodologies and financial tools to evaluate a small private company.

When it comes to small businesses which are private in nature, the following three techniques are most commonly used:

- Comparable Company Trading Multiple Analysis, (also known as “peer group analysis”

- Precedent/Comparable Transaction Analysis, and

- Discounted Cash Flow (“DCF”) Analysis.

![]()

Question 10.

Discuss the valuation of various magnitude of business.

Answer:

Discounted Cash Flow valuation

The method involves forecasting future cash flows and discounting the same to the present point of time using a cost of capital that replicates the firm’s capital structure and business risk. It relates the value of an asset to the present value of expected future cash flows on that asset.

There are several methods of DCF valuation:

Enterprise DCF model: The method values the entire business, with both assets in place (investments already made) and growth assets (investments yet to be made).The cash flows before debt payments and after reinvestment needs are called free cash flows to the frm (FCFFs).

The discount rate that reflects the composite cost of financing from all sources of capital is called the cost of capital (WACC). WACC-based models work best when a company maintains a relatively stable debt-to-value ratio. If a company’s debt-to-value ratio is expected to change, WACC-based models can still yield accurate results but are more difficult to apply.

Value of the firm = Present value of cash flow during an explicit forecast period + Present value of cash flow after the explicit forecast period

Equity DCF model:

The method values the equity stake in the business and is known as equity valuation. The cash flows before debt payments and after re-investment needs are called free cash flows to the equity (FCFs). The discount rate reflects only the cost of equity financing.

![]()

Free cash flow to equity (FCFE)

Another model known as the free cash flow equity model involves forecasting the free cash flow to equity (FCFE). It represents a model where potential or future dividends are discounted rather than actual dividends.

The FCFE model can be used to evaluate publicly traded firms and assumes that there is strong corporate governance system is in practice in the company.Similar to dividend discount model, there are variations in the FCFE model that revolve around assumptions about future growth and reinvestment needs.

Growth Models

Gordon growth model values stock in a stable-growth firm that pays out the shareholders in the form of dividends. The usage of the model is limited to the frms that are growing at a stable rate and at a rate comparable to or lower than the growth rate in the economy. The stable growth rate cannot be more than 0.25 percent to 0.5 percent above the economy growth rate. If the gap between the stable growth rate and growth rate in the economy becomes larger, than using a two -stage or three-stage model to capture the ‘supernormal’ or ‘above average’ growth would be more appropriate.

A two-stage dividend discount model is based on two clearly defined growth stages-high growth and stable growth. It is used when the expected earnings growth rate of the company is superior to the growth rate of the economy. The model is used to value the companies which maintain high growth for a specific time period and the sources of such high growth tend to disappear after some time. The value of a sector or a market can also be estimated using this model.

![]()

Three-Stage dividend discount model is the combination of the features of the two-stage model and the H-model. The model adopts an initial phase of constant high growth, a second phase of declining growth and a third phase of stable low growth that lasts forever. No restrictions on the payout ratio are imposed by the model. The model is suitable for banking companies characterized by high growth initially, followed by declining growth due to competition and lastly maintains a stable low growth because of its nature of business and ownership, specifically the public sector banks in India.

Adjusted present value (APV) model: In case, where a company’s debt-to-value ratio is expected to change adjusted present value (APV) is used as alternative to WACC-based models to get accurate value. APV specifically forecasts and values any cash flows associated with capital structure separately, rather than inserting their value in the cost of capital. Enterprise Value – Value of the unlevered Value of the financing side effects equity free cash flow + Enterprise Value = Current invested capital +Present value of the future economic profit stream

The equity free cash flow of the unlevered firm is same as the free cash flow to the firm. It is discounted at the cost of unlevered equity. For computing the present value the borrowing rate of the firm is used.

Economic profit model: Because of its close link to economic theory and competitive strategy, the discounted economic-profit valuation model is attaining the popularity. Economic profit shows whether a company is earning its cost of capital and how its financial performance is anticipated to change over time. The two models enterprise DCF model and economic profit model yield identical results and have different but complementary benefits. Creating both enterprise DCF and economic-profit models when valuing a company results in accurate value.

Enterprise Value = Current Invested capital + Present value of the future economic stream.

Economic Profit = Invested Capital (ROIC – WACC) .Where ROIC = Return on Invested Capital

Economic profit highlights whether a company is earning its cost of capital and how its financial performance is expected to change over time. The two models enterprise DCF model and economic profit model yield identical results and have different but complementary benefits. It is recommended to create both enterprise DCF and economic-profit models when valuing’ a company.

![]()

Question 11.

Explore the valuation of a bank using equity discounted cash flow method.

Answer:

Valuation of Banks

Financial Institutions like banks and insurance companies are among the most challenging companies to value, particularly for outside analysts as they do not have some crucial information such as asset-liability mismatch about these companies. Further, as these institutions are highly levered, their valuations are remarkably sensitive to small changes in key drivers. Their operations cannot be valued separately from interest income and interest expense, as they are the main components of their income statements.

In valuation of the banks, the focus has to be not on profit growth, but on stability. Therefore, for financial companies which are highly levered, the equity cash flow approach is more appropriate. The equity DCF approach does not tell us how and where a Bank creates value in its operations. Is the bank creating or destroying value when receiving the percentage of interest i.e., for example assume that 6.5 percent on its loans or when paying. 4.3 percent on deposits.

When valuing banks and other financial institutions, where capital structure is an inseparable part of operations, capital cash flow and equity cash flow, valuation models are used.

Discounted cash flow approach

Business valuation models of financial institutions are largely based on discounted cash flow approach (DCF model)and assume some growth stages, which is typical for different growth rates of cash flow or resources for owners. A bank’s cash flows tend to be highly volatile and connected to macroeconomic factors. This makes forecasting cash flows very challenging and prone to mistake. Hence,the calculation of FCFE in banks and financial institutions can be implemented in two basic ways:

![]()

Method 1: FCFE = net income – growth of capital + other income The growth of financial institutions should be followed by an adequate increase in its capital. If the growth is not accompanied by an adequate increase in the capital, it may lead to failure of financial institutions due to lack of solvency. Growth in FCFE lowers the capital, as it means that the bank is introduced into the banking business of profits that would otherwise be paid to owners as dividends.

The Residual Income Valuation Method

An alternative bank valuation model is used based on discounted residual income. Residual Income (Rl) is the difference between operating profits after taxes and the cost of equity capital employed. The latter equals the previous year’s total equity multiplied by the cost of equity according to CAPM.

Second, the terminal value of the bank in perpetuity is estimated by dividing the residual income of the year following the analytical period y with the cost of equity. The two methods theoretically show that both Equity Cash Flow Method and Residual Income (RI) Method produce equivalent equity bank values.

![]()

Question 12.

What is the purpose of valuation?

Answer:

Purpose of Valuation

Value is wanted to be known in a commercial context for the purpose of a transaction of ‘buy or sell’ or to know the ‘worth’ of a possession. Valuations of businesses, business ownership interests may be performed for a wide variety of purposes including the following(as listed by ICAI):

(a) Valuation of financial transactions such as acquisitions, mergers, leveraged buyouts, initial public offerings, employee stock ownership plans (ESOPs) and other share-based plans, partner and shareholder buy-ins or buy-outs, and stock redemptions;

(b) Valuation for dispute resolution and/ or litigation/pending litigation relating to matters such as marital dissolution, bankruptcy, contractual disputes, owner disputes, dissenting shareholder and minority ownership oppression cases, employment disputes, etc;

(c) Valuation for compliance oriented engagements, for example:

- Financial reporting; and

- Tax matters such as corporate reorganizations, purchase price allocations etc.

(d) Valuation for other purposes like the valuation for planning, internal use by the owners etc;

(e) Valuation under Insolvency and Bankruptcy Code.

(f) Valuation for the stake to be divested by public sector undertakings (PSUs).