Chapter 3 International Valuation Standards Overview – CS Professional Valuations and Business Modelling Study Material is designed strictly as per the latest syllabus and exam pattern.

International Valuation Standards Overview – CS Professional Valuations and Business Modelling Study Material

Question 1.

State under what conditions/assumptions the following statements are true (state only one important condition/assumption for each):

Gordon’s Dividend Growth Model provides a good estimate of intrinsic value of a share. (June 2019, 5 marks)

Answer:

Gordon’s Dividend Growth Model provides a good estimate of intrinsic value of a share, for a company having constant dividend pay-out ratio, return on the equity remains constant, cost of equity does not change with time and market is efficient.

Question 2.

(i) What should be the contents of Valuation Report as per International Valuation Standards (IVS) and

(ii) What is the difference between ‘Valuation date’ and ‘date of the Valuation Report’. (June 2019, 5 marks)

Answer:

(i) As per International Valuation Standards (IVS) 103, where the report is the result of an assignment involving the valuation of an asset or assets, the report must convey the following, at a minimum:

(a) the scope of the work performed, including the elements mentioned in the para Scope of Work, to the extent that each is applicable to the assignment,

(b) the approach or approaches adopted.

(c) the method or methods applied,

(d) the key inputs used,

(e) the assumptions made,

(f) the conclusion(s) of value and principal reasons for any conclusions reached, and

(g) the date of the report (which may differ from the valuation date).

(ii) Difference between ‘Valuation date’ and ‘date of the Valuation Report’ As per International Valuation Standards, the valuation date must be stated. If the valuation date is different from the date on which the valuation report is issued or the date on which investigations are to be undertaken or completed then where appropriate, these dates should be clearly distinguished. Valuation date means, ‘the date’ or period for which financials or information is considered.

The date of Valuation Report is the date on which the report is signed. Valuation date must precede the date of Valuation Report and vice versa should not be done.

![]()

Question 3.

‘Different bases of value may require a particular Premise of Value or allow the consideration of multiple Premises of Value’ – Referring International Valuation Standards discuss briefly on different Premises of Valuation. (Dec 2019, 5 marks)

Question 4.

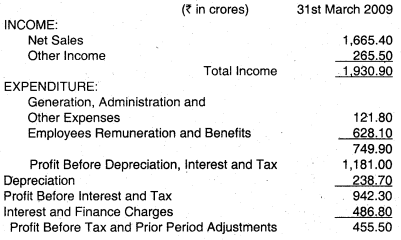

From the annual report 2009 of Precision Tools Limited, the following information has been collected:

Profit and Loss Account of Precision Tools Ltd. for the year ending on 31st March 2009.

Assume that the company follows a ‘Constant Dividend Payout Policy’ and it is committed to maintain the same. Number of shares outstanding as on 31.03.2009 is 5 crores. Net worth of the company as on 31.03.2009 is ₹ 3,100.58 crores and its cost of equity is 15%. Find the value of the equity shares of Precision Tools Limited. Use Constant Growth Model for valuation. (Dec 2009, 9 marks) [CMA Final]

Answer:

Valuation of Equity shares of Precision Tools Ltd. as at 31.3.2009 using the constant Growth Model for Valuation:

Dividend Per Share = ₹ 30 crores/5 crores = ₹ 6.00

Return on Equity = 443.40/3100.58 = 14.30%

Dividend Payout Ratio = (30.00 + 3.10)/443.40 = 7.47%

Retention Ratio = 100% – 7.47% = 92.53%

Growth Rate = 14.30% × 92.53% = 13.23%

Value of Equity Share = (6 × 1.1323)/(15.00% – 13.23%) = ₹ 384.49

Assumption: The company uses a “Constant Dividend Payout Policy”.

Question 5.

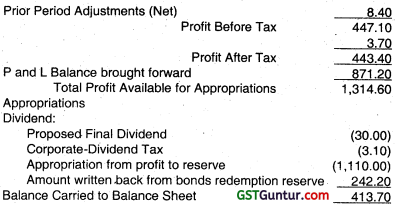

The following information along with other necessary information has been extracted from the Annual Report-2010 of Strongman Limited:

Profit and Loss Account of Strongman Limited for the year ending on March 31, 2010

Other Information:

(i) The company had declared total dividend (interim plus final) of 80% for the year 2009-10 on a share with face value of ₹ 10.

(ii) Net Worth of the company – ₹ 2887-355 million.

(iii) Interest on Risk Free Debt – 7.50%.

(iv) Company’s Beta – 1.15.

(v) Rate of Return on Equity Benchmark Index – 15.50%.

Assuming that the Constant Dividend Growth Model is an appropriate model for determining the value of the company’s share, you are required to use the above information and determine the value of the company’s share.

(Dec 2010, 6 marks) [CMA Final]

Answer:

Strong Man Ltd.

| (₹ millions) | |

| Dividend per share paid during 2009-10 (₹ 10 × 80%) | 8.00 |

| Profit After Tax | 984.663 |

| Net Worth | 2887.355 |

| Return on Equity (ROE)(PAT/Net Worth) | 34.10% |

| Total Dividend Paid including the Corporate Dividend tax | 858.115 |

| Payout Ratio (Total Payout/PAT) | 87.15% |

| Retention Ratio (l-Payout Ratio) | 12.85% |

| Growth Rate (g = ROE × Retention Ratio) | 4.38% |

Calculation of Cost of Equity Using CAPM:

| Risk Free Rate | 7.50% |

| The Company’s Beta | 1.15 |

| Return on Equity Benchmark | 15.50% |

| Index Using CAPM, the cost of Equity is – | 16.70% |

using the Constant Growth Dividend Model, the value of the share will be –

= (₹ 8 × 1.0438)/(16.70% – 4.38%) = ₹ 67.78

Question 6.

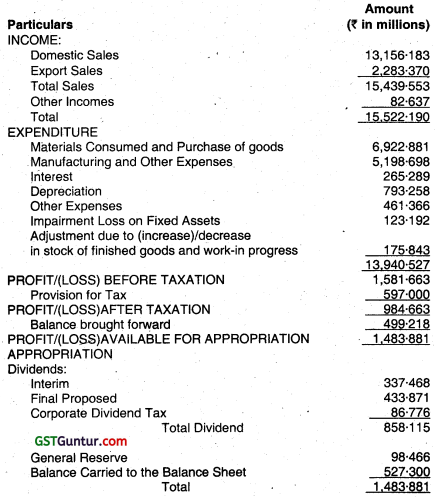

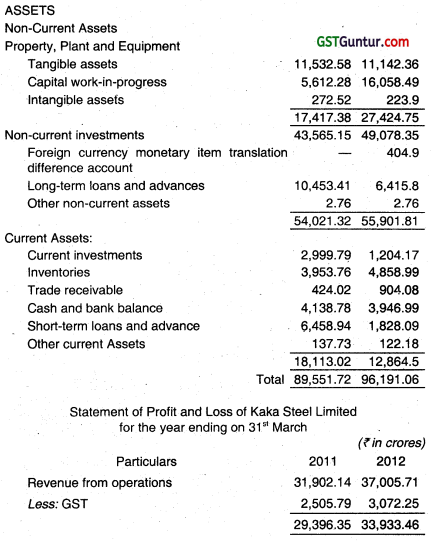

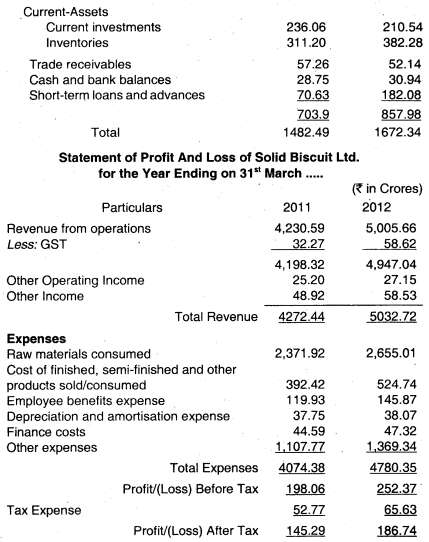

The following financial statements have been extracted from the Annual Report 2011-12 of Kaka Steel:

Balance Sheet of Kaka Steel Limited as at 31st March

EXPENSES

(i) Find the EPS for the period ending on March 31, 2011 and March 31, 2012.

(ii) The face value per share is ₹ 10. Determine Return on Equity (ROE) for the year ending on March 31,2011 and March 31, 2012.

(iii) Using the price of ₹ 471.75, determine the ratio between the market price and the book value as on April 1, 2012.

(iv) Calculate the P/E ratio using the price of ₹ 471.75 and the EPS calculated for the year ending on March 31, 2012.

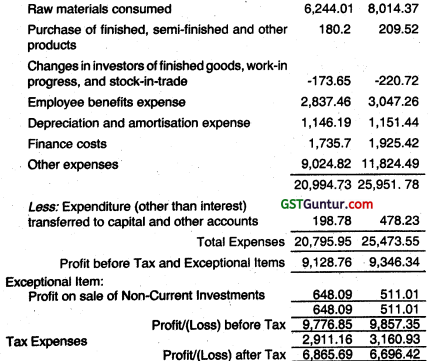

(v) The CFO of Kaka Steels has to make a presentation as a part of due diligence in Merger and Acquisition process. He has requested your help in determining intrinsic value of the shares. Assuming that the intrinsic value of the Kaka Steel Ltd. share can be fairly estimated through the Constant Growth Model, using the information given below, you are required to determine the value of share. Assume the cost of equity as 15%.

(Dec 2012, 4+ 2+ 3 + 1 + 5 = 15 marks) [CMA Final]

Answer:

(i)

| 31-Mar-11 | 31-Mar-12 | |

| 6,868.69 | 6,696.42 | |

| PAT | 959.41 | 971.41 |

| No. of shares | 95.94 | 97.14 |

| EPS | 71.56 | 68.94 |

(ii)

| 31-Mar-11 | 31 Mar-12 | |

| Share Capital | 959.41 | 971.41 |

| Reserves & Surplus | 45,807.02 | 51,649.95 |

| Money received against share warrants | 178.2 | |

| Deferred tax liability | 936.8 | 970.51 |

| 47,881.43 | 53,591.87 | |

| Less: Foreign currency monetary item | 407.9 | |

| 47,881.43 | 53,183.97 | |

| Return on Equity | ||

| Profit After Tax | 6,865.69 | 6,696.42 |

| Return on Equity | 14.34% | 12.59% |

(iii) Net Worth as on 31-03-2012 53,186.97

Share Capital 971.41

No. of Share 97.14

Book Value per share 547.52

Market price on 020412012 471.75

Market price to Book Value Ratio 0.86

(iv) P/E Ratio = EPS/Market Price

= 68.94/471.75

= 6.84

(v)

| Proposed dividend on ordinary shares | 1,165.46 |

| Tax on dividends | 181.57 |

| Total Pay out | 1,347.03 |

| Profit After Tax | 6,696.42 |

| Dividend Pay Out Ratio | 20.12% |

| Retention Ratio | 79.88% |

| Return on Equity | 12.59% |

| Growth Rate ( ROE* Retention Ratio) | 10.06% |

| Dividend Per Share (Proposed Dividend/ No. of Shares) | 12 |

| Cost of Equity | 15.00% |

| Intrinsic Value of Share | 267.17% |

![]()

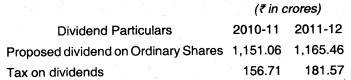

Question 7.

The following financial statements have been extracted from the Annual Report 2011-12 of Solid Biscuit Ltd. Balance Sheet of Solid Biscuits Ltd. as At 31st March —

Miscellaneous Information about the Company

1. Face Value of the Share of the Company : ₹ 2 per share

2. Beta of the Company : 0.90

3. Promoters Holding : 62.59%

4. Dividend History of the Company:

Year ending on March 31, : Dividend Rate (%)

2003 : 100

2004 : 110

2005 : 140

2006 : 150

2007 : 150

2008 : 180

2009 : 400

2010 : 250

2011 : 325

2012 : 425

5. Effective Corporate Dividend Tax Rate = 16.22%

Miscellaneous Information about the Industry lo which the company belongs to:

PIE (Price/Earning Ratio) : 31.68

P/B (Price/Book Value Ratio) : 9.42

Market Capitalization/Enterprise Value : 0.97

Enterprise Value/PB DITA : 19.06

Miscellaneous Information about the Stock Market and Interest Rate:

1. The Market Rate of Return : 15.60%.

2. Risk Free Interest Rate : 7.75%

on the basis of the above, you are required to determine the following:

i. Intrinsic Value of the Share using Constant Growth Model. (June 2013, 5 marks)

ii. Determine the relative valuation of the Company’s Share using

I. P/E Multiple (June 2013, 2 marks)

II. P/B Multiple (June 2013, 4 marks) [CMA Final]

III. Market Capitalization/Enterprise Value (June 2013, 4 marks) (CMA Final)

Answer:

Determination of Intrinsic Value of the Share using constant Growth Model: (‘In Crores)

| Calculation of Net Worth | 31 – Mar -12 |

| Share Capital | ₹ 23.89 |

| Reserves and Surplus | ₹ 496.15 |

| Deferred tax liabilities (Net) | ₹ 8.16 |

| Net Worth | ₹ 528.20 |

| Calculation of return on Equity PAT | ₹ 186.74 |

| Return on Equity | 35.35% |

(₹ in crores)

| Dividend Particulars | 2011 -12 |

| Total share capital | ₹ 23.89 |

| No. of shares (No. in crores ) | 11.945 |

| Dividend per share (‘2* 425%) | ₹ 8.50 |

| Total dividend | ₹ 101.53 |

| Taxon dividends @ 16.22% | ₹ 16.47 |

| Total pay out | ₹ 118.00 |

| PAT (Profit after Tax) | ₹ 186.74 |

| Dividend pay out ratio | 63.19% |

| Retention Ratio | 36.81% |

| Return on Equity (ROE) | 35.35% |

| Growth Rate (ROEx retention rate) | 13.01% |

| Dividend per share | 8.50 |

| Cost of Equity | 14.81% |

| Intrinsic Value of the share | ₹ 533.32 |

Calculation of the cost of Equity using CAPM:

| Risk Free Interest rate | 7.755 |

| Market rate of return | 15.60% |

| Beta of the Company | 0.90% |

| Cost of Equity | 14.81% |

I. Answer:

Valuation as per P/E Multiple

| Industry P/E Multiple | 31.68 |

| PAT | ₹ 186.74 |

| No. of Shares | 11.945 |

| Earning Per share (EPS) | ₹ 15.63 |

| Valuation as per P/E Multiple | ₹ 495.26 |

II. Answer:

Valuation as per P/B Multiple

| Industry P/B Multiple | 9.42 |

| Net worth | ₹ 528.20 |

| No. of Shares | 11.945 |

| Book value Per share (B) | ₹ 44.22 |

| Valuation as per P/B Multiple | ₹ 416.55 |

III. Answer:

Valuation as per market capitalization/Enterprise value

| Industry Market Capitalization/Enterprise value | 0.97 |

| Industry enterprises value/PBDITA | 19.06 |

| PBITA (profit Before Depreciation Interest tax and amortization) = (Profit Before tax + Finance Cost + depreciation and Amortization) | ₹ 337.76 |

| Enterprise value (19.06 * 337.76) | ₹ 6,437.71 |

| Market capitalization as per Industry ratio of Market Capitalization/Enterprise Value | ₹ 6,244.57 |

| No. of Shares | 11.945 |

| Valuation as per Market Capitalization/Enterprise value (in crores) | ₹ 522.78 |

Question 8.

Consider two companies – Alpha Limited and Beta Limited. Both have announced their annual results for 2014-2015 on May 5, 2015 and as per the reported results both are having identical Profit After Tax (PAT) of ₹ 7,125 lakhs and 120 lakhs equity shares outstanding (face value of each share is ₹ 10). Both the companies having same net worth of ₹ 28,500 lakhs.

Alpha Limited has growth plans in future and accordingly, it has decided to have a low payout of 40% as dividend. It is believed that its earnings will increase by present rate of growth every year in perpetuity. Assume that the company is having the required rate of return on equity of 17% a year.

Beta Limited has growth plans in future, but not very ambitious and due to that, it is going to have a dividend payout of 60%. It is believed that its earnings will increase by the present rate of growth every year in perpetuity. Assume that the company is having the required rate of return on equity of 15% a year. Assume that both the companies are identical in all other aspects. Calculate P/E Ratio assuming that Constant Growth Model works. Also explain why a particular company is having higher P/E Ratio. (Dec 2015, 8 + 2 = 10 marks) [CMA Final]

Answer:

(in Lakhs)

| Company | Alpha Ltd. | Beta Ltd. |

| Profit After Tax | 7,125 | 7,125 |

| No. of shares outstanding | 120 | 120 |

| Net Worth | 28,500 | 28,500 |

| Dividend Payout | 40% | 60% |

| Cost of Equity | 17% | 15% |

| ROE [(7,125 ÷ 28,500) × 100] | 25% | 25% |

| Growth Rate [ROE × (1 – Dividend Payout Ratio] | 15% | 10% |

| EPS(PAT ÷ No. of Shares) | ₹ 59.38 | ₹ 59.38 |

| Price per share | ₹ 1365.50 | ₹ 783.80 |

| P/E Ratio | 23 | 13.20 |

| Working Note | Alpha Ltd. | Beta Ltd. |

| 1. Dividend Payout (40% & 60%) | ₹ 2,850 lakhs | ₹ 4,275 lakhs |

| 2. Dividend per share | ₹ 23.75 | ₹ 35.63 |

| 3. Dividend of next period [D0 (1 + g)] | ₹ 27.31 | ₹ 39.19 |

| 4. Difference between Ke and g | 2% | 5% |

| 5. Price of share (3 ÷ 4) | ₹ 1365.50 | 783.80 |

Alpha Ltd. has high P/E Ratio because has high growth rate and it is holding back more profit through low dividend payout ratio to achieve higher growth rate.

Question 9.

Explain the concept of IVS and which committee constitute these standards?

Answer:

The International Valuation Standards Council (IVSC) is an independent, not-for-profit organization committed to advancing quality in the valuation profession. The primary objective of IVSC is to build confidence and public trust in valuation by producing standards and securing their universal adoption and implementation for the valuation of assets across the world. The International Valuation Standards (IVS) is a fundamental part of the financial system with high level of professionalism.

Valuations are widely used and relied upon in financial and other markets, whether for inclusion in financial statements, for regulatory compliance or to support secured lending and transactional activity. The International Valuation Standards (IVS) are standards for undertaking valuation assignments using generally recognized concepts and principles that promote transparency and consistency in valuation practice. IVSC promotes leading practice approaches for proper execution and effective competency of leading professionals.

The IVSC is the body responsible for setting the International Valuation Standards (IVS). The Board has autonomy in the development of its agenda and approval of its publications. In developing the IVS, the Board:

- Follows established due process in the development of any new standard, including consultation with stakeholders (valuers, users of valuation services, regulators, valuation professional organizations, etc) and public exposure of all new standards or material alterations to existing standards,

- Liaises with other bodies that have a standard-setting function in the financial markets,

- Conducts outreach activities including round-table discussions with invited constituents and targeted discussions with specific users or user groups.

The objective of the IVS is to increase the confidence and trust of users of valuation services by establishing transparent and consistent valuation practices. A standard will do one or more of the following:

- identify or develop globally accepted principles and definitions,

- identify and promulgate considerations for the undertaking of valuation assignments and the reporting of valuations,

- identify specific matters that require consideration and methods commonly used for valuing different types of assets or liabilities.

The IVS consist of mandatory requirements that must be followed in order to state that a valuation was performed in compliance with the IVS. Certain aspects of the standards do not direct or mandate any particular course of action, but provide fundamental principles and concepts that must be considered in undertaking a valuation.

![]()

Question 10.

Explain the IVS Framework in detail.

Answer:

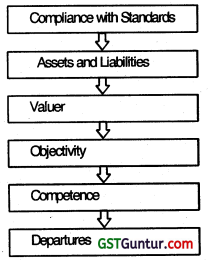

The IVS Framework

This serves as a preamble to the IVS. The IVS Framework consists of general principles for valuers following the IVS regarding objectivity, judgment, competence and acceptable departures from the IVS.

Compliance with Standards

When a statement is made that a valuation will be, or has been, undertaken in accordance with the IVS, it is implicit that the valuation has been prepared in compliance with all relevant standards issued by the IVSC.

Assets and Liabilities

The standards can be applied to the valuation of both assets and liabilities. To assist the legibility of these standards, the words asset or assets have been defined to include liability or liabilities and groups of assets, liabilities, or assets and liabilities, except where it is expressly stated otherwise, or is clear from the context that liabilities are excluded.

Valuer

Valuer has been defined as “an individual, group of individuals, or a firm possessing the necessary qualifications, ability and experience to undertake a valuation in an objective, unbiased and competent manner. In some jurisdictions, licensing is required before one can act as a valuer. Because a valuation reviewer must also be a valuer, to assist with the legibility of these standards, the term valuer includes valuation reviewers except where it is expressly stated otherwise, or is clear from the context that valuation reviewers are excluded.

‘Registered Valuer’ means a person registered as a Valuer under Chapter XVII of the Companies Act 2013.

Registration as Valuers.

(1) For the purposes of sub-section (1) of section 247, the Central Government or any authority, institution or agency, as may be notified by the Central Government, shall maintain a register to be called as the Register of Valuers in which there shall be registered the names, address and other details of the persons registered as valuers in pursuance of section 247.

(2) The following persons shall be eligible to apply for being registered as a valuer:

(a) a Chartered Accountant, Company Secretary or Cost Accountant who is in whole-time practice, or retired member of Indian Corporate Law Service or any person holding equivalent Indian or foreign qualification as the Ministry of Corporate Affairs may recognize by an order; provided that such foreign qualification acquired by Indian citizen.

(b) a Merchant Banker registered with the Securities and Exchange Board of India, and who has in his employment person(s) having qualifications prescribed under (a) above to carry out valuation by such qualified persons;

(c) Member of the Institute of Engineers and who is in whole-time practice;

(d) Member of the Institute of Architects and who is in whole-time practice;

(e) A person or entity possessing necessary competence and qualification as may be notified by the Central Government from time to time.

Provided that persons referred to in (a), (c) and (d) and qualified person in (b) above shall have not less than five years continuous experience after acquiring membership of respective institutions.

Objectivity

The process of valuation requires the valuer to make impartial judgments as to the reliability of inputs and assumptions. For a valuation to be credible, it is important that those judgments are made in a way that promotes transparency and minimizes the influence of any subjective factors on the process. Judgment used in a valuation must be applied objectively to avoid biased analyses, opinions and conclusions.

Competence

Valuation must be prepared by an individual or firm having the appropriate technical skills, experience and knowledge of the subject of the valuation, the market(s) in which it trades and the purpose of the valuation. If a valuer does not possess all the necessary technical skills, experience and knowledge to perform all aspects of a valuation, it is acceptable for the valuer to seek assistance from specialists in certain aspects of the overall assignment, providing this is disclosed in the scope of work (see IVS 101 Scope of Work) and the report (see IVS 103 Reporting).

The valuer must have the technical skills, experience and knowledge to understand, interpret and utilize the work of any specialists.

Departures

A “departure” is a circumstance where specific legislative, regulatory or other authoritative requirements must be followed that differs from some of the requirements within IVS. Departures are mandatory in that a valuer must comply with legislative, regulatory and other authoritative requirements appropriate to the purpose and jurisdiction of the valuation to be in compliance with IVS. A valuer may still state that the valuation was performed in accordance with IVS when there are departures in these circumstances.

The requirement to depart from IVS pursuant to legislative, regulatory or other authoritative requirements takes precedence over all other IVS requirements.

![]()

Question 11.

Explain in detail the IVS Asset Standard under these categories.

(a) IVS 200 Businesses and Business interests

(b) IVS 210 Intangible Assets

(c) IVS 300 Plant and Equipment

(d) IVS 400 Real Property Interests

(e) IVS 410 Development Property

(f) IVS 500 Financial Instruments Answer:

Answer:

(a) IVS 200 Businesses and Business Interests

The definition of what constitutes a business may differ depending on the purpose of a valuation. However, generally a business conducts a commercial, industrial, service or investment activity. Businesses can take many forms, such as corporations, partnerships, joint ventures and sole proprietorships. The value of a business may differ from the sum’of the values of the individual assets or liabilities that make up that business. When a business value is greater than the sum of the recorded and unrecorded net tangible and identifiable intangible assets of the business, the excess value is often referred to as going concern value or goodwill.

When valuing individual assets or liabilities owned by a business, valuers should follow the applicable standard for that type of asset or liability (IVS 210 Intangible Assets, IVS 400 Real Property Interests, etc). Valuers must establish whether the valuation is of the entire entity, shares or a shareholding in the entity (whether a controlling or non-controlling interest), or a specific business activity of the entity. The type of value being provided must be appropriate to the purpose of the valuation and communicated as part of the scope of the engagement (see IVS 101 Scope of Work). It is especially critical to clearly define the business or business interest being valued as, even when a valuation is performed on an entire entity, there may be different levels at which that value could be expressed. For example:

Enterprise value: Often described as the total value of the equity in a business plus the value of its debt or debt-related liabilities, minus any cash or cash equivalents available to meet those liabilities.

Total invested capital value: The total amount of money currently invested in a business, regardless of the source, often reflected as the value of total assets less current liabilities and cash.

Operating Value: The total value of the operations of the business, excluding the value of any nonoperating assets and liabilities.

Equity value: The value of a business to all of its equity shareholders. Valuations of businesses are required for different purposes including acquisitions, mergers and sales of businesses, taxation, litigation, insolvency proceedings and financial reporting. Business valuations may also be needed as an input or step in other valuations such as the valuation of stock options, particular class(es) of stock, or debt.

Answer:

(b) IVS 210 Intangible Assets

An intangible asset is a non-monetary asset that manifests itself by its economic properties. It does not have physical substance but grants rights and/or economic benefits to its owner.

Specific intangible assets are defined and described by characteristics such as their ownership, function, market position and image. These characteristics differentiate intangible assets from one another.

There are many types of intangible assets, but they are often considered to fall into one or more of the following categories (or goodwill):

Marketing-related: Marketing-related intangible assets are used primarily in the marketing or promotion of products or services. Examples include trademarks, trade names, unique trade design and internet domain names.

Customer-related: Customer-related intangible assets include customer lists, backlog, customer contracts, and contractual and non-contractual customer relationships.

Artistic-related: Artistic-related intangible assets arise from the right to benefits from artistic works such as plays, books, films and music, and from non-contractual copyright protection.

Contract-related: Contract-related intangible assets represent the value of rights that arise from contractual agreements. Examples include licensing and royalty agreements, service or supply contracts, lease agreements, permits, broadcast rights, servicing contracts, employment contracts and non-competition agreements and natural resource rights.

Technology-based: Technology-related intangible assets arise from contractual or non-contractual rights to use patented technology, unpatented technology, databases, formulae, designs, software, processes or recipes.

In valuing an intangible asset, valuers must understand different value from customer contracts (those contracts in place on the specifically what needs to be valued and the purpose of the valuation.

As the amount of goodwill is dependent on which other tangible and intangible assets are recognized, its value can be different when calculated for different purposes. For example, in a business combination accounted for under IFRS or US GAAP, an intangible asset is only recognized to the extent that it:

(a) is separable, i.e., capable of being separated or divided from the entity and sold, transferred, licensed, rented or exchanged, either individually or together with a related contract, identifiable asset or liability, regardless of whether the entity intends to do so, or

(b) arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations

While the aspects of goodwill can vary depending on the purpose of the valuation, goodwill frequently includes elements such as:

(a) company-specific synergies arising from a combination of two or more businesses (e.g, reductions in, operating costs, economies of scale or product mix dynamics),

(b) opportunities to expand the business into new and different markets,

(c) the benefit of an assembled workforce (but generally not any intellectual property developed by members of that workforce),

(d) the benefit to be derived from future assets, such as new customers and future technologies, and

(e) assemblage and going concern value.

Intangible asset valuations are performed for a variety of purposes. It is the valuer’s responsibility to understand the purpose of a valuation and whether intangible assets should be valued, whether separately or grouped with other assets, A non-exhaustive list of examples of circumstances that commonly include an intangible asset valuation component is provided below:

(a) For financial reporting purposes, valuations of intangible assets are often required in connection with accounting for business combinations, asset acquisitions and sales, and impairment analysis.

(b) For tax reporting purposes, intangible asset valuations are frequently needed for transfer pricing analyses, estate and gift tax planning and reporting, and ad valorem taxation analyses.

(c) Intangible assets may be the subject of litigation, requiring valuation analysis in circumstances such as shareholder disputes, damage calculations and marital dissolutions (divorce).

(d) Other statutory or legal events may require the valuation of intangible assets such as compulsory purchases/eminent domain proceedings.

(e) Valuers are often asked to value intangible assets as part of general consulting, collateral lending and transactional support engagements.

Answer:

(c) IVS 300 Plant and Equipment

Items of plant and equipment (which may sometimes be categorized as a type of personal property) are tangible assets that are usually held by an entity for use in the manufacturing/production or supply of goods or services, for rental by others or for administrative purposes and that are expected to be used over a period of time.

For Example, For lease of machinery and equipment, the right to use an item of machinery and equipment (such as a right arising from a lease) would also follow the guidance of this standard. It must also be noted that the “right to use” an asset could have a different life span than the service life (that takes into consideration of both preventive and predictive maintenance) of the underlying machinery and equipment itself and, in such circumstances, the service life span must be stated. Assets for which the highest and best use is “in use” as part of a group of assets must be valued using consistent assumptions. Unless the assets belonging to the sub-systems may reasonably be separated independently from its main system, then the sub-systems may be valued separately, having consistent assumptions within the sub-systems. This will also cascade down to sub-sub-systems and so on.

Factors that may need to be considered under each of these headings include the following:

(a) Asset-related:

1. the asset’s technical specification,

2. the remaining useful, economic or effective life, considering both preventive and predictive maintenance,

3. if the asset is not valued in its current location, the costs of

4. the asset’s condition, including maintenance history,

5. any functional, physical and technological obsolescence, decommissioning and removal, and any costs associated with the asset’s existing in-place location, such as installation and re-commissioning of assets to its optimum status,

6. for machinery and equipment that are used for rental purposes, the lease renewal options and other end-of-lease possibilities,

7. any potential loss of a complementary asset, e.g., the operational life of a machine may be curtailed by the length of lease on the building in which it is located,

8. additional costs associated with additional equipment, transport, installation and commissioning, etc, and

9. in cases where the historical costs are not available for the machinery and equipment that may reside within a plant during a construction, the valuer may take references from the Engineering, Procurement, Construction (“EPC”) contract.

(b) Environment-related:

1. the location in relation to the source of raw material and market for the product. The suitability of a location may also have a limited life, eg, where raw materials are finite or where demand is transitory,

2. the impact of any environmental or other legislation that either restricts utilisation or imposes additional operating or decommissioning costs,

3. radioactive substances that may be in certain machinery and equipment have a severe impact if not used or disposed of International Valuation Standards appropriately. This will have a major impact on expense consideration and the environment,

4. toxic wastes which may be chemical in the form of a solid, liquid or gaseous state must be professionally stored or disposed of. This is critical for all industrial manufacturing, and

5. licences to operate certain machines in certain countries may be restricted.

(c) Economic-related:

1. the actual or potential profitability of the asset based on comparison of operating costs with earnings or potential earnings (see IVS 200 Business and Business Interests),

2. the demand for the product manufactured by the plant with regard to both macro and micro economic factors could impact on demand, and

3. the potential for the asset to be put to a more valuable use than the current use (i.e., highest and best use).

Answer:

(d) IVS 400 Real Property Interests

Property interests are normally defined by state or the law of individual jurisdictions and are often regulated by national or local legislation. Before undertaking a valuation of a real property interest, a valuer must understand the relevant legal framework that affects the interest being valued.

A real property interest is a right of ownership, control, use or occupation of land and buildings. There are three main types of interest:

the superior interest in any defined area of land. The owner of this interest has an absolute right of possession and control of the land and any buildings upon it in perpetuity, subject only to any subordinate interests and any statutory or other legally enforceable constraints,

a subordinate interest that normally gives the holder rights of exclusive possession and control of a defined area of land or buildings for a defined period, e.g. under the terms of a lease contract, and/or

a right to use land or buildings but without a right of exclusive possession or control, eg, a right to pass over land or to use it only for a specified activity.

Intangible assets fall outside the classification of real property assets. However, an intangible asset may be associated with, and have a material impact on, the value of real property assets. It is therefore essential to be clear in the scope of work precisely what the valuation assignment is to include or exclude. For example, the valuation of a hotel can be inextricably linked to the hotel brand. In such cases, the valuation process will involve consideration of the inclusion of intangible assets and their impact on the valuation of the real property and plant and equipment assets. When there is an intangible asset component, the valuer should also follow IVS 210 Intangible Assets.

To comply with the requirement to identify the asset to be valued in IVS 101 Scope of Work, the following matters must be included:

(a) a description of the real property interest to be valued, and

(b) identification of any superior or subordinate interests that affect the interest to be valued.

For Examples, Valuations of real property interests for different purposes including secured lending, sales and purchases, taxation, litigation, compensation, insolvency proceedings and financial reporting.

Answer:

(e) IVS 410 Development Property

In the context of this standard, development properties are defined as interests where redevelopment is required to achieve the highest and best use, or where improvements are either being contemplated or are in progress at the valuation date and include:

- the construction of buildings,

- previously undeveloped land which is being provided with infrastructure,

- the redevelopment of previously developed land,

- the improvement or alteration of existing buildings or structures,

- land allocated for development in a statutory plan, and

- land allocated for a higher value uses or higher density in a statutory plan.

Valuations of development property may be required for different purposes. It is the valuer’s responsibility to understand the purpose of a valuation. A non-exhaustive list of examples of circumstances that may require a development valuation is provided below:

(a) when establishing whether proposed projects are financially feasible,

(b) as part of general consulting and transactional support engagements for acquisition and loan security,

(c) for tax reporting purposes, development valuations are frequently needed for ad valorem taxation analyses,

(d) for litigation requiring valuation analysis in circumstances such as shareholder disputes and damage calculations,

(e) for financial reporting purposes, valuation of a development property is often required in connection with accounting for business combinations, asset acquisitions and sales, and impairment analysis, and

(f) for other statutory or legal events that may require the valuation of development property such as compulsory purchases.

When valuing development property, valuers must follow the applicable standard for that type of asset or liability. The residual value or land value of a development property can be very revenue to be derived from the completed project or any of the development costs that will be incurred. This remains the case regardless of the method or methods used or however diligently the various inputs are researched in relation to the valuation date.

This sensitivity also applies to the impact of significant changes in either the costs of the project or the value on completion of the current value. If the valuation is required for a purpose where significant changes in value over the duration of a construction project may be of concern to the user (e.g., where the valuation is for loan security or to establish a project’s viability), the valuer must highlight the potentially disproportionate effect of possible changes in either the construction, costs or end value on the profitability of the project and the value of the partially completed property. A sensitivity analysis may be useful for this purpose provided it is accompanied by a suitable explanation.

Answer:

(f) IVS 500 Financial Instruments

A financial instrument is a contract that creates rights or obligations between specified parties to receive or pay cash or other financial consideration. Such instruments include but are not limited to, derivatives or other contingent instruments, hybrid instruments, fixed income, structured products and equity instruments. A financial instrument can also be created through the combination of other financial instruments in a portfolio to achieve a specific net financial outcome.

Valuations of financial instruments conducted under IVS 500 Financial Instruments can be performed for many different purposes including, but not limited to:

(a) acquisitions, mergers and sales of businesses or parts of businesses,

(b) purchase and sale,

(c) financial reporting,

(d) legal or regulatory requirements (subject to any specific requirements set by the relevant authority),

(e) internal risk and compliance procedures,

(f) tax, and

(g) litigation.

To comply with the requirement to identify the asset or liability to be valued as in IVS 101 Scope of Work, the following matters must be addressed:

(a) the class or classes of instrument to be valued,

(b) whether the valuation is to be of individual instruments or a portfolio, and investigations required to support the valuation must be adequate having

(c) the unit of account.

IVS 102 Investigations and Compliance, provide that the regard to the purpose of the assignment. To support these: investigations, sufficient evidence supplied by the valuer and/or a credible and reliable third party must be assembled. To comply with these requirements, the following are to be considered:

(a) All market data used or considered as an input into the valuation process must be understood and, as necessary, validated.

(b) Any model used to estimate the value of a financial instrument shall be selected to appropriately capture the contractual terms and economics of the financial instrument.

(c) Where observable prices of, or market inputs from, similar financial instruments are available, those imputed inputs from comparable price(s) and/or observable inputs should be adjusted to reflect the contractual and economic terms of the financial instrument being valued.

(d) Where possible, multiple valuation approaches are preferred. If differences in value occur between the valuation approaches, the valuer must explain and document the differences in value.

To comply with the requirement to disclose the valuation approach(es) and reasoning in IVS 103 Reporting, consideration must be given to the appropriate degree of reporting detail. The requirement to disclose this information in the valuation report will differ for different categories of financial instruments. Sufficient information should be provided to allow users to understand the nature of each class of instrument valued and the primary factors influencing the values. Information that adds little to a users’ understanding as to the nature of the asset or liability, or that obscures the primary factors influencing value, must be avoided. In determining the level of disclosure that is appropriate, regard must be had to the following:

(a) Materiality: The value of an instrument or class of instruments in relation to the total value of the holding entity’s assets and liabilities or the portfolio that is valued.

(b) Uncertainty: The value of the instrument may be subject to significant uncertainty on the valuation date due to the nature of the instrument, the model or inputs used or to market abnormalities. Disclosure of the cause and nature of any material uncertainty should be made.

(c) Complexity: The greater the complexity of the instrument, the greater the appropriate level of detail to ensure that the assumptions and inputs affecting value are identified and explained.

(d) Comparability: The instruments that are of particular interest to users may differ with the passage of time. The usefulness of the valuation report, or any other reference to the valuation, is enhanced if it reflects the information demands of users as market conditions change, although, to be meaningful, the information presented, should allow comparison with previous periods.

(e) Underlying instruments: If the cash flows of a financial instrument are generated from or secured by identifiable underlying assets or liabilities, the relevant factors that influence the underlying value must be provided in order to help users understand how the underlying value impacts the estimated value of the financial instrument.

![]()

Question 12.

What are the Indian Valuation Standards issued by ICAI.

Answer:

Indian Valuation Standards (IVSs) issued by ICAI

Valuation Standards Board of ICAI has issued ‘Indian Valuation Standards (IVS 101,102,103, 201,202, 301,302, 303)’. These standards sets out the concepts, principles, practices and procedures to ensure uniformity in approach and quality of valuation output.

Valuation field is gaining importance now and is considered as one of the most critical areas in finance and it plays a key role in many areas of finance such as buy/ sell, solvency, merger and acquisition. It also plays an important role in the Insolvency Resolution regime where Liquidation value has to be ascertained by Resolution professional through the Registered Valuers.

Looking at the importance, The Institute of Chartered Accountants of India has constituted Valuation Standards Board in the year 2017-18. The Valuation Standards Board has been constituted to focus on the release of Indian Valuation Standards, providing Interpretations, Guidance and Technical Materials from time to time and implementation of the Standards. With a vision to promote best practices in this niche area of practice, the Standards lay down a framework for the chartered accountants to ensure uniformity in approach and quality of valuation output. The following Valuation Standards have been issued by ICAI:

- Preface to the Indian Valuation Standards

- Framework for the Preparation of Valuation Report in accordance with the Indian Valuation Standards

- Indian Valuation Standard 101-Definitions

- Indian Valuation Standard 102 – Valuation Bases

- Indian Valuation Standard 103 – Valuation Approaches and Methods

- Indian Valuation Standard 201 – Scope of Work, Analyses and Evaluation

- Indian Valuation Standard 202 – Reporting and Documentation

- Indian Valuation Standard 301 – Business Valuation

- Indian Valuation Standard 302 – Intangible Assets

- Indian Valuation Standard 303 – Financial Instruments

These Indian Valuation Standards will be applicable for all valuation engagements on mandatory basis under the Companies Act 2013. In respect of Valuation engagements under other Statutes like Income Tax, SEBI, FEMA etc, it will be on recommendatory basis for the members of the Institute. These Valuation Standards are effective for the valuation reports issued on or after 1st July, 2018.