Chapter 9 Accounting for Share based Payment (IND AS 102) – CS Professional Valuations and Business Modelling Study Material is designed strictly as per the latest syllabus and exam pattern.

Accounting for Share based Payment (IND AS 102) – CS Professional Valuations and Business Modelling Study Material

Question 1.

Softex Ltd. announced a Stock Appreciation Right (SAR) on 01 -04-07 for each of its employees. The scheme gives the employees the right to claim cash payment equivalent to an excess of market price of company shares on exercise date over the exercise price of ₹ 125 per share in respect of 100 shares, subject to a condition of continuous employment of 3 years. The SAR is exercisable after 31-03-2010 but before 30-06-10.

The fair value of SAR was ₹ 21 in 2007-08, ₹ 23 in 2008-09 and ₹ 24 in 2009-10. In 2007-08 the company estimated that 2% of its employees shall leave the company annually. This was revised to 3% in 2008-09. Actually 15 employees left the company in 2007-08,10 left in 2008-09 and 8 left in 2009- 10. The SAR therefore actually vested in 492 employees on 30-06-2010; when SAR was exercised the intrinsic value was ₹ 25 per share.

Show the provision for SAR account by fair value method. Is this provision a liability or equity ? (Nov 2010, 16 marks) [CA Final]

Answer:

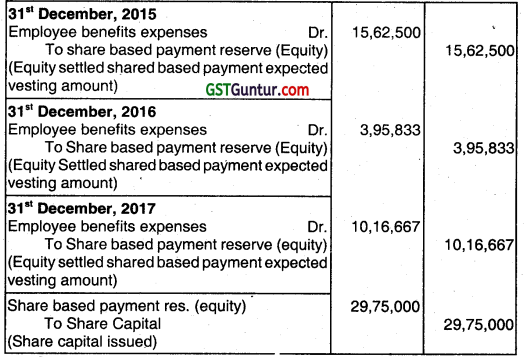

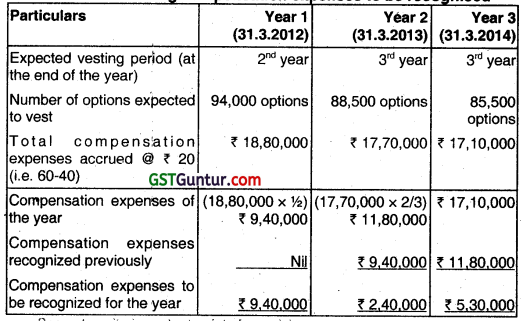

Provision of SARs Account in the books of Softex Ltd.

Note: The Provision for Stock Appreciation Rights (SARs) is a liability. Therefore SARs are settled through cash payment equivalent to an excess of market price of company’s shares over the exercise price on exercise date.

Working Notes:

Year 2007-08

Number of employees to whom SARs were announced (492 + 15 + 10 + 8) = 525 employees

Number of SARs expected to vest = (525 × 0.98 × 0.98 × 0.98) × 100 = 49,413

* SARs expected to lies years 2007-08 and 2008-09.

It can also be worked out by rounding off the number of employees.

Fair value of SARs = 49,413 SARs × 21 = 10,37,673

Vesting period = 3 years

Value of SARs recognised as expense in year 2007 – 08 = 10,37,673 / 3 years = 3,45,891.

![]()

Question 2.

2011 – Nov [1] {C} (c)

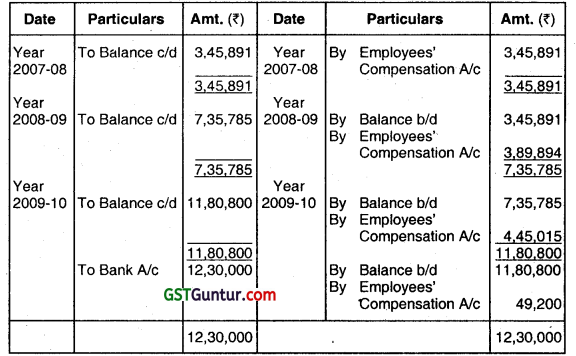

On 1st April, 2010, A company offered 100 shares to each of its 500 employees at ₹ 50 per share. The employees are given a month to decide whether or not to accept the offer. The shares issued under the plan (EPP) shall be subject to lock-in on transfers for three years from grant date. The market price of shares of the company on the grant date is ₹ 60 per share. Due to post-vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 56 per share.

On 30th April, 2010, 400 employees accepted the offer and paid ₹ 50 per share purchased. Nominal value of each share is ₹ 10.

Record the issue of shares in the book of the company under the aforesaid plan. (5 marks) [CA Final]

Answer:

Fair value of an EPP = ₹ 56 – ₹ 50 = ₹ 6

Number of shares issued = 400 employees × 100shares/employee = 40,000 shares

Fair value of EPP which will be recognized as expenses in the year 2010-11 = 40,000

Shares × ₹ 6 = ₹ 2,40,000

Vesting period = 1 month

Expenses recognized in 2010-11 = ₹ 2,40,000

![]()

Question 3.

Answer the following :

Goodluck Limited grants 180 share options to each of its 690 employees. Each grant containing condition on the employees working for Goodluck Ltd. over the next 4 years. Goodluck Ltd. has November 2, 2012 estimated that the fair value option is ₹ 15. Goodluck Ltd. also estimated that 30% of employees will leave during four year period and hence forfeit their rights to the share option. If the above expectations are correct, what amount of expenses to be recognised during vesting period? (Nov 2012, 4 marks) [CA Final]

Answer:

Expense to be recognized during 4 years’ vesting period

| Year | Calculation | Expenses for the period ₹ | Cumulative expenses ₹ |

| 1 | 690 employees × 180 options × 70% × ₹ 15 × 1/4 | 3,26,025 | 3,26,025 |

| 2 | [690 employees × 180 options × 70% × ₹ 15 × 2/4 years]- ₹ 3,26,025 | 3,26,025 | 6,52,050 |

| 3 | [690 employees × 180 options × 70% × ₹ 15 × 3/4 years] – ₹ 6,52,050 | 3,26,025 | 9,78,075 |

| 4 | [690 employees × 180 options × 70% × ₹ 15 × 4/4 yearsl – ₹ 9,78,075 | 3,26,025 | 13,04,100 |

![]()

Question 4.

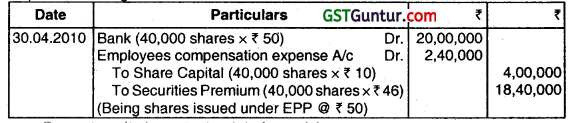

On 1st April, 2012, A company offered 100 shares to each of its employees at ₹ 40 per share. The employees are given a month to decide whether or not to accept the offer. The shares issued under this plan will be subject to each in transfer for throe years from the grant date. The market price on the grant date is ₹ 50 per share. However the fair value of shares issued under this plan is estimated at ₹ 48 per share. On 30-04-2012, 400 employees accepted the offer and paid ₹ 40 per share. Nominal value of each share is ₹ 10.

Record the issue of shares in the books of the company under the aforesaid plan. (May 2013, 4 marks) [CA Final]

Answer:

Journal Entries

Note:

- Guidance Note on “Employee Share Based Payments” states that if the shares granted vest immediately, the employee is not required to complete a specified period of service before becoming unconditionally entitled to those instruments.

- In such a case, the enterprise presumes the services rendered by the employee as consideration received for the instruments granted.

- Accordingly, in this case, because there is no vesting period the enterprise should recognise the expense of ₹ 3.20,000 immediately.

Working Note:

Fair value of an Employee Share Purchase Plan (EPP) = ₹ 48 – ₹ 40 = ₹ 8

Number of shares issued 400 employees × 100 share per employee = 40,000 shares

Fair value of EPP which wifl be recognized as expense in the year 2012-13

= 40,000 shares × ₹ 8 = ₹ 3,20,000

![]()

Question 5.

Kush Ltd. announced a Share Based Payment Plan for its employees who have completed 3 years of continuous service, on 1st of April, 2010. The plan is subject to a 3 year vesting period. The following information is supplied to you in this regard :

(i) The eligible employees can either have the option to claim the difference between the exercise price of ₹ 144 per share and the market price in respect of the share on vesting date in respect of 5,000 shares or such employees are entitled to subscribe to 6,000 shares at the exercise price.

(ii) Any shares subscribed to by the employees shall carry a 3 year lock in restriction. All shares carry face Value of ₹ 10.

(iii) The Current Fair Value of the shares at (ii) above is ₹ 60 and that in respect of freely tradeable shares is higher by 20%.

(iv) The Fair Value of the shares not subjected to lock in restriction at the end of each year increases by a given % from its preceding value as under:

![]()

You are required to draw up the following accounts under both options:

(i) Employee Compensation Account

(ii) Provision for Liability Component Account

(iii) ESOP Outstanding Account (Nov 2013, 10 marks) [CA Final]

Answer:

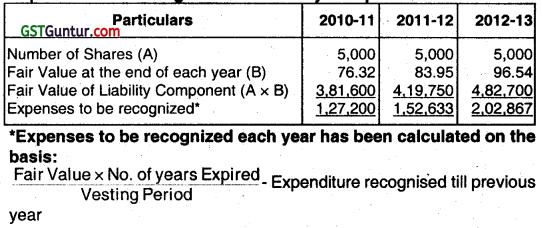

Working Notes:

1. Computation of Fair Values

Fair value of shares subject to lock in as on 1st April, 2010 : ₹ 60.00

% of increase in fair value of shares not subjected to Lock in : 20%

Fair Value as on 1st April, 2010 of Shares not subjected to lock in (60 + 20%) : ₹ 72.00

% increase over previous value in respect of Fair Value on 31.03.2011 : 6%

Fair value of shares not subjected to lock in restriction on 31.03.2011(72 + 6%) : ₹ 76.32

% increase over previous value in respect of Fair Value on 31.03.2011 : 10%

Fair Value of Shares not subjected to lock in restriction on 31.03.2012(76.32 + 10%) : ₹ 83.95

@ increase over previous value in respect of Fair Value on 31.03.2012 : 15%

Fair Value of Shares not subjected to Lock in restriction on 31.03.2013(83.95 + 15%) ₹ 96.54

![]()

2. Expense to be recognized in respect of Equity Component

Fair Value under Equity Settlement Option (6,000 × ₹ 60/-) : 3,60,000

Less: Fair Value under Cash Settlement (Liability Component) option (5,000 × ₹ 72) : 3,60,000

Equity Component : Nil

Expenses to be recognized each year for Equity Component : Nil

3. Expenses to be recognized for Liability Component

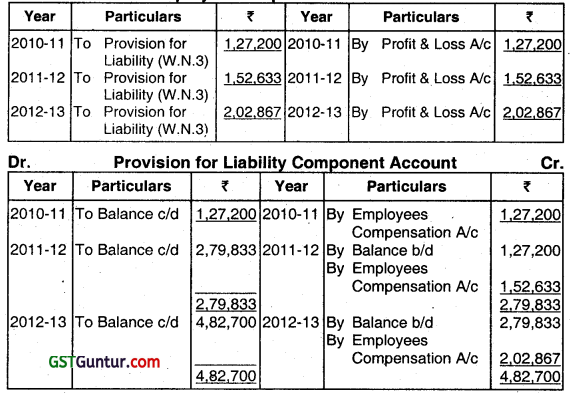

Employee Compensation Account

If Employee opts for Cash Settlement

Provision for Liability Component Account

| Year | Particulars | ₹ | Year | Particulars | ₹ |

| 2013-14 | To Bank (5000 × ₹ 96.54) | 4,82,700 | 2013-14 | By Balance b/d | 4,82,700 |

![]()

If Employee opts for Equity Settlement

Provision for Liability Component Account

| Year | Particulars | Year | Particulars | ₹ | |

| 2013-14 | To ESOP outstanding A/c | 4,82,700 | 2013-14 | By Balance b/d | 4,82,700 |

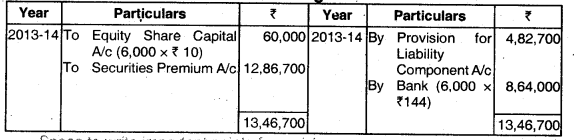

ESOP Outstanding Account

![]()

Question 6.

Quittle Ltd. announced a Stock Appreciation Rights (SAR) Scheme to its employees on 1st April, 2011. The salient features of the scheme is given below :

- The scheme will be applicable to employees who have completed three years of continuous service with the company .

- Each eligible employee can claim cash payment amounting to the excess of Market Price of the company’s shares on exercise date over exercise price in respect of 60 (sixty) shares.

- The exercise price is fixed at ₹ 75 per share.

- The option to exercise the SAR is open from 1st April, 2014 for 45 days and the same vested on 975 employees.

- The intrinsic value of the company’s share on date of closing (15th May, 2014) was ₹ 30 per share.

- The fair value of the SAR was ₹ 20 in 2011-12; ₹ 25 in 2012-13 and ₹ 27 in 2013-14.

- In 2011 -12 the expected rate of employee attrition was 5% which rate was doubled in the next year.

- Actual attrition year wise was as under:

2011- 12 35 employees of which 5 had served the company for less than 3 years.

2012- 13 30 employees of which 20 employees served for more than 3 years.

2013- 14 20 employees of which 5 employees served for less than 3 years.

You are required to show the Provision for Stock Appreciation Rights Account by Fair Value Method. (May 2014, 8 marks) [CA Final]

Answer:

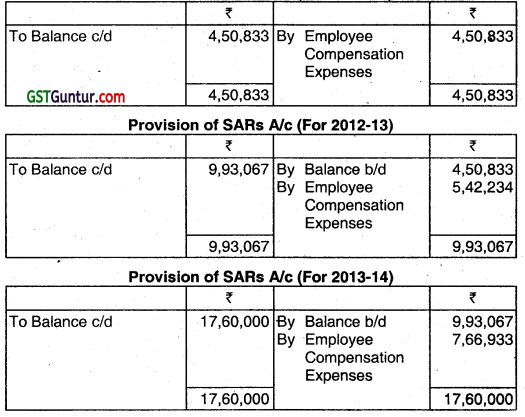

Provision for SAR’s Account

Working Notes :

1. No. of eligible employees = 975 + 35 – 5 + 20 + 20 – 5 = 1,040

2. Expenses to be recognized each year:

| 2011-12 | 2012-13 | 2013-14 | |

| No. of SARS to Vest | 1040 × 0.95 × 0.95 × 0.95 × 60 = 53,500 | 1040 – (35-5) × 0.90 × 0.90 × 60 = 49,086 | 1040 – (35 -5 ) – 20 – (20 – 5) × 60 = 58,500 |

| Fair Value of SAR | 20 | 25 | 27 |

| Total Fair Value Expenses to be recognized each year | 10,70,000 10,70,000 × 1/3 = 3,56,667 |

12,27,150 12,27,150 × 2/3 – 3,56,667 = 4,61,433 |

15,79,500 15,79,500 – (3,56,667 + 4,61,433) = 7,61,400 |

3. Expenses to be recognized in the year 2014-15.

Total intrinsic Value of SARs less expense recognized till date.

= (975 × 60 ×30) – 15,79,500 = 1,75,500

![]()

Question 7.

Virtual Limited granted on 1st April, 2011, 1,00,000 Employees’ Stock Options at ₹ 40, when the market price was ₹ 60/-. These options will vest at the end of year 1, if the earning of Virtual Limited is more than 15% or it will vest at the end of the year 2, if the average earning of two years is more than 12% or lastly it will vest at the end of third year, if the average earning of 3 years will be 9% or more. 6000 unvested options lapsed on 31st March, 2012. 5500 unvested options lapsed on 31st March, 2013 and finally 3000 unvested options lapsed on 31st March, 2014.

The earnings of Virtual Limited was as follows:

Year ended on – Earning in %

31.3.2012 – 13%

31.3.2013 – 9%

31.3.2014 – 7%

Employees exercised for 85,000 stock options which vested in them at the first opportunity and the balance options were lapsed. Pass necessary journal entries and show the necessary working. (Nov 2014, 12 marks)

Answer:

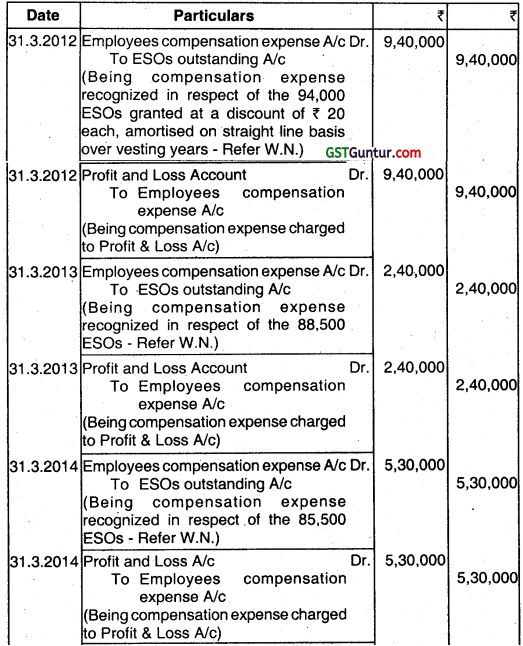

Journal Entries

![]()

Working Note :

Statement showing compensation expenses to be recognised

Question 8.

A company announced a Stock Appreciation Right (SAR) on 01/04/2011 for each of its 600 employees. The scheme gives the employees the right to claim cash payment equivalent to excess on market price of company’s shares, on exercise date, over the exercise price ₹ 130 per share in respect of 100 shares, subject to the condition of continuous employment of 3 years. The SAR is exercisable after 31/03/14 but before 30/06/14.

| Particulars | 2011-12 | 2012-13 | 2013-14 |

| Fair value of SAR | 25 | 28 | 32 |

| Actual no. of employees left | 25 | 15 | 10 |

| Company estimation for left employee | 3% | 5% | – |

On 30/06/2014 when SAR was exercised, the intrinsic value per share was ₹ 35 per share. Show Provision for SAR account by fair value method. (Nov 2015, 8 marks) (CA Final]

Answer:

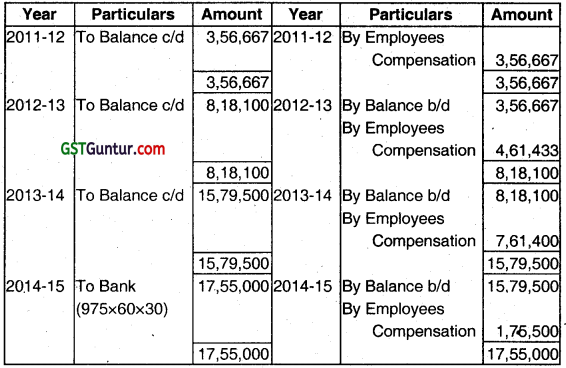

Note: The solution given below is by rounding off the number of employees and then the number of SARs has been calculated.

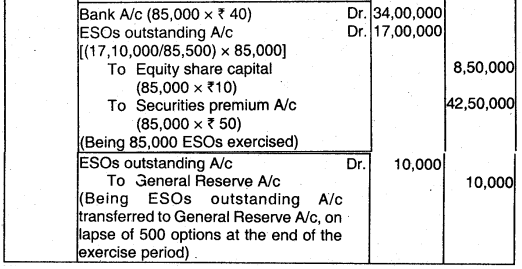

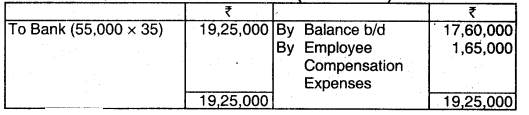

Provision of SARs A/c (For 2011-12)

Provision of SARs A/c (For 2014-15)

![]()

Working Notes:

Year 2011-12

Number of employees to whom SARs were announced = 600 employees

Total number of employees after three years, on the basis of the estimation in 2011-12

= [(600 – 25) × .97 × .97) = 541 employees (approx.)

Total estimated SARs, to be vested at the end of the vesting period

= 541 employees × 100 SARs = 54,100 SARs

Fair value of SARs = 54,100 SARs × ₹ 25 = ₹ 13,52,500

Vesting period = 3 years

Value of SARs to be recognized as an expense in 2011-12 = ₹ 13,52,500/3

years = ₹ 4,50,833

Year 201 2-13

Total number of employees after three years, on the basis of the estimation

in 2012-13 = [(600 – 25 – 15) × 0.95] = 532 employees

Total estimated SARs, to be vested at the end of the vesting period

= 532 employees × 100 SARs = 53,200 SARs

Fair value of SARs = 53,200 SARs × ₹ 28 = ₹ 14,89,600

Vesting period = 3 years and No. of years expired = 2 years

Cumulative value of SARs to recognize as expense = 14,89,600/3 × 2 = ₹ 9,93,067

Value of SARs to be recognized as an expense in 201 2-13 = ₹ 9,93,067 – ₹ 4,50,833 = ₹ 5,42,234

Year 2013-14

Fair value of SARs = ₹ 32

SARs actually vested = (600 – 25 – 15-10) employees × 100 SARs

= 550 employees × 100 = 55,000 SARs

Fair value = 55,000 SARs × 32 = ₹ 17,60,000

Cumulative value to be recognized = ₹ 17,60,000

Value of SARs to be recognized as an expense = ₹ 17,60,000 – ₹ 9,93,067 = ₹ 7,66,933

Year 2014-15

Cash payment of SARs = 55,000 SARs × ₹ 35 = ₹ 19,25,000

Value of SARs to be recognized as an expense in 2014-15 = ₹ 19,25,000 – ₹ 17,60,000 = ₹ 1.65,000

![]()

Question 9.

On 1st April, 2015, Krishna Limited offered 50 shares to each of its 1000 employees at ₹50 per share. The employees are given a month time to decide whether or not to accept the offer. The shares issued under the plan (ESPP) shall be subject to lock-in transfer for three years from grant date.

Other information:

(1) The market price of shares of the company on the grant date is ₹ 60 per share.

(2) Due to post vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 56 per share.

(3) On 30th April, 2015,800 employees accepted the offer and paid ₹ 50 per share purchased.

(4) The nominal value of each share is ₹ 10 each.

You are required to record the issue of shares in the books of the company under aforesaid plan. (May 2016, 4 marks) [CA Final]

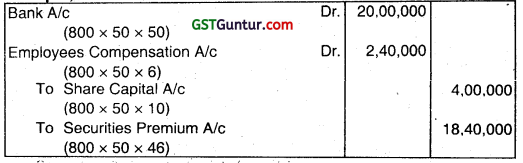

Answer:

Fair Value of ESPP = (800 × 50) × (56 – 50)

= 2,40,000

Vesting Period = one month

Expenses recognised = 2,40,000

30th April, 2015:

![]()

Question 10.

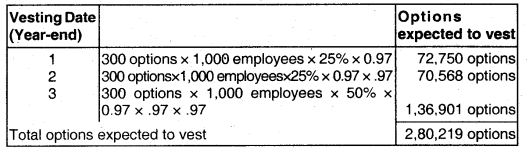

At the beginning of year 1, an enterprise grants 300 options to each of its 1,000 employees. The contractual life of option granted is 6 years. Other relevant information is as follows:

Vesting Period – 3 years

Exercise Period – 3 years

Expected Life – 5 years

Exercise Price – ₹ 50

Market Price – ₹ 50

Expected forteitúres per year – 3%

The option granted vest according to a graded schedule of 25% at the end of the year 1,25% at the end of the year 2, and the remaining 50% at the end of the year 3.

You are required to calculated total compensation expenses for the options expected to vest and cost and cumulative cost to be recognised at the end of all the 3 years assuming that expected forfeiture rate does not change during the vesting period when,

(i) The fair value of these options, computed based on their respective expected lives, are ₹ 10, ₹ 13, ₹ 15 per options, respectively.

(ii) The intrinsic value of the options at the grant date is ₹ 6 per options. (Nov 2016, 10 marks) [CA Final]

Answer:

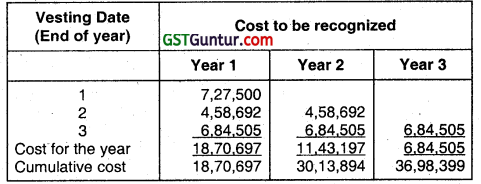

(i) Based on Fair Value Method.

1. Since the options granted have a graded vesting schedule, the enterprise segregates the total plan into different groups, depending upon the vesting dates and treats each of these groups as a separate plan.

2. The enterprise determines the number of options expected to vest under each group as below:

3. Total compensation expense for the options expected to vest is determined as follows:

| Vesting Date (Year-end) | Expected Vesting (No. of Options) | Fair Value per Option (₹) | Compensation Expense (₹) |

| 1 | 72,750 | 10 | 7,27,500 |

| 2 | 70,568 | 13 | 9,17,384 |

| 3 | 1,36,901 | 15 | 20,53,515 |

| 2,80,219 | 36,98,399 |

![]()

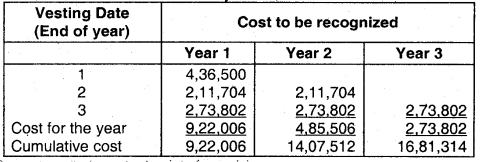

4. Compensation expense, determined as above, is recognised over the respective vesting periods. Total compensation expense of ₹ 36,98,399, determined at the grant date, is attributed to the years 1, 2 and 3 as below:

(ii) Based on Intrinsic Value Method

In case of intrinsic value method, total compensation expense for the options expected to vest would be:

| Vesting Date (End of year) | Expected Vesting (No. of Options) | Value per Option (₹) | Compensation Expense (₹) |

| 1 | 72,750 | 6 | 4,36,500 |

| 2 | 70,568 | 6 | 4,23,408 |

| 3 | 1,36,901 | 6 | 8,21,406 |

| 2,80,219 | 16,81,314 |

The compensation expense of ₹ 16,81.314. determined at the grant date, would be attributed to the years 1, 2 and 3 as below:

![]()

Question 11.

ABC Limited issued 20,000 Share Appreciation Rights (SARs) that vest immediately to its employees on 1st April 2015. The SARs will be settled in cash. At that date it is estimated using an option pricing model, that the fair value of a SAR is ₹ 95. SAR can be exercised any time up to 31st March 2018. At the end of period on 31st March 2016 it is expected that 95% of total employees will exercise thé option, 92%, of total employees will exercise the option at the end of next year and finally 89% will be vested only at the end of the 3rd year. Fair values at the end of each period have been given below:

| Fair value of SAR | ₹ |

| 31st March 2016 | 110 |

| 31st March 2017 | 107 |

| 31st March 2018 | 112 |

Discuss the applicability of Cash Settled Share based payments under the relevant md AS and pass the journal entries. (May 2018, 10 marks) (CA Final)

Answer:

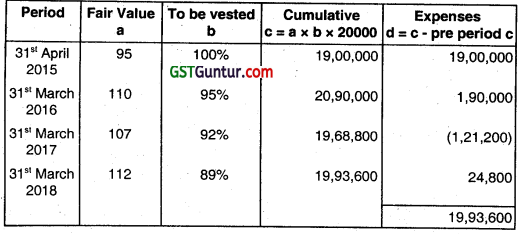

Calculation of expenses recognised during the year on account of change in fall value of SARs

Journal Entries

![]()

Question 12.

Beetel Holding Inc. grants 100 shares to each of its 300 employees on 1st January, 2015. The employees should remain in service during the vesting period. The shares will vest at the end of the

First year if the company’s earnings increase by 13%

Second year if the company’s earnings increased by more than 21 % over the two-year period.

Third year if the entity’s earning increased by more than 23% over the three-year period

The fair value per share at the grant date is ₹ 125.

In 2015, earnings increased by 9% and 20 employees left the organization. The company expects that earnings will continue at a similar rate in 2016 and expects that the shares will vest at the end of the year 2016. The company also expects that additional 30 employees will leave the organization in the year 2016 and that 250 employees will receive their shares at the end of the year 2016.

At the end of 2016, company’s earnings increased by 19%. Therefore, the shares did not vest. Only 20 employees left the organization during 2016. Company believes that additional 25 employees will leave in 2017 and earnings will further increase so that the performance target will be achieved in 2017.

At the end of the year 2017, only 22 employees have left the organization. Assume that the company’s earnings increased to desired level and the performance target has been met.

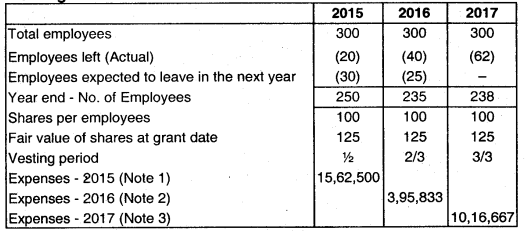

Determine the expense for each year and pass appropriate journal entries. (May 2019, 8 marks) [CA Final]

Answer:

Since the earnings of the entity is non-market related, hence It will not be considered in fair value calculation of the shares given. However, the same will be considered while calculating number of shares to be vested.

Workings:

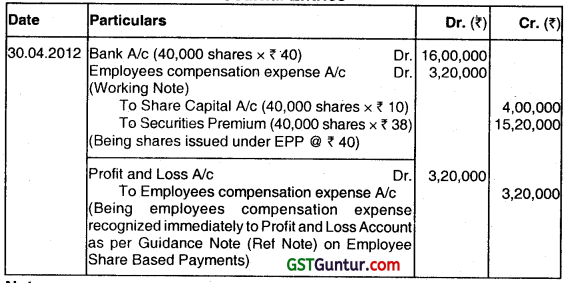

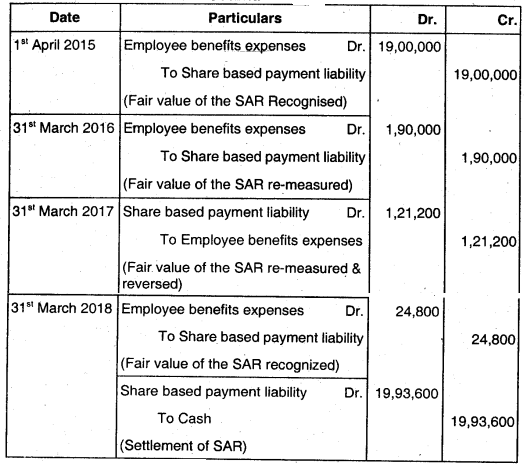

![]()

Note: 1

Expense for 2015 = No. of employees × shares per employee × Fair value

of share × Proportionate vesting period

= 250 × 100 × 125 × 34

= 15,62,500

Note: 2

Expenses for 2015 = (No. of employees × shares per employee × Fair value of share x Proportionate vesting period) – Expense recognised in year 2015

= (235 × 100 ( 125 × 2/3) – 15,62,500

= 3,95,833

Note: 3

Expenses for 2017 = (No. of employees × shares per employee × Fair Value of share × Proportionate vesting period) – Expense recognised in year 2015 and 2016

= (238 × 100 × 125 × 3/3) – (15,62,500 + 3,95,833)

= 10.16,667

![]()

Journal Entries