Types of Financing – CA Inter FM Question Bank is designed strictly as per the latest syllabus and exam pattern.

Types of Financing – CA Inter FM Question Bank

Question 1.

Write short notes on following:

Bridge Finance. (May 2006, Nov 2011, Nov 2016, 3, 2, 2 each marks)

Answer:

Bridge Finance:

Meaning

bridge finance ¡s a short-term loan taken by a firm from commercial banks to disperse loans sanctioned by financial institutions.

Importance or Need for Bridge Finance

Bridge finance as the name suggests bridges the time gap between the date of sanctioning of a term loan and its disbursement.

The reason for such delay is due to procedure formalities.

Such delays result in cost overrun of the project.

Thus, to avoid such cost overruns, firms approach commercial banks for short-term loans for a period for which delay may occur:

- In India Bank of Baroda has introduced a scheme called ‘Bridge Loan’ for top rated corporate clients against expected equity flows/issues.

- Bank can also extend bridge loans against the expected proceeds of Non-Convertible Debentures, External Commercial Borrowings, Global Depository Receipts, and/or funds in the nature of Foreign Direct Investments, provided the borrowing company has already made firm arrangements for raising the aforesaid resources/funds.

- This facility would be available for a period not exceeding 12 months.

Characteristics of Bridge Finance

- It is a short-term loan.

- It bridges the gap between the date of sanctioning the loan and the final disbursement of loan.

- The rate of interest on such loan is usually high.

- These loans are usually repaid as and when term loans are disbursed.

Advantage

- It helps in avoiding the cost overruns.

- Such loans are useful to implement the projects on time.

Disadvantage

1. The rate of interest on such loans is very high.

Question 2.

Explain the term ‘Ploughing back of Profits’. (May 2007, Nov 2009,2 marks,15 marks)

Answer:

Meaning: Ploughing back of profit is an internal source pt finance. It is a phenomenon under which the company does not distribute all the profit earned but retains a part of it, which is re-invested in the business for its development. It is thus known as Retained Earnings. Long-term funds can be provided by accumulating the profits of the company and ploughing them back into business. Such funds belong to the ordinary shareholders and increase the net worth of the company.

A public limited company must plough back a reasonable amount of its profits each year for 2 reasons:

(i) keeping in view the legal requirements in this regard and (II) its own expansion plans.

Question 3.

Answer the following:

Discuss the advantages of preference share capital as an instrument of raising funds. (May 2008, 2 marks)

Answer:

Meaning of Preference Share

As the name suggests, Preference shares are the shares which enjoys certain preferential rights over the equity shares in regards to:

- Payment of dividends at a fixed rate.

- Repayment of capital on the winding up of the company.

Advantages

- It provides a long-term capital to the company.

- There is no dilution of EPS.

- As it bears a fixed charge, there is a leveraging advantage.

- It can be redeemed after a specified time period.

- It does not carry voting rights hence, there is no dilution of control.

- It enhances the creditworthiness of the company.

Question 4.

Answer the following:

Financing a business through borrowing is cheaper than using equity. Briefly explain. (Nov 2012, 4 marks)

Answer:

- When only equity shares are issued the company cannot take advantage of trading on equity.

- There is a danger of over-capitalisation as equity shares cannot be redeemed.

- During prosperous period higher profit leads to higher dividends to the shareholders which increases the market value of the share and also the possibility of speculation.

- The cost of equity shares is high as the shareholders are paid profit after tax and preference shareholders.

![]()

Question 5.

Distinguish between the following:

Preference Shares and Debentures (Nov 2015, 2 marks)

Answer

Preference Shares:

Preference shares are the share to which the right to recover money is given prior to the equity shareholders. Shareholders are not owners of the company. A certain percentage of dividends given preference shareholders on shares.

Debentures:

Debentures are the liability of the company. Debenture holders are entitled to receive a fix rate of interest on value. Debentures can be redeemed and having prior right to receive funds than preference shareholders in case of liquidation.

Question 6.

What are Masala Bonds? (May 2018,2 marks)

Answer:

- Masala (means spice) bond is an Indian name used for rupee-denominated bond that Indian corporate borrowers can sell to investors in overseas markets.

- These bonds are issued outside India but do-nominated in Indian rupees.

- NTPC raised 2,000 more via masala bonds for its capital expenditure in the year 2016.

Question 7.

Explain in brief the following bonds:

(i) Callable Bonds

(ii) Puttable Bonds (Jan 2021, 2 marks)

Question 8.

Write a note on Venture Capital Financing. (Nov 2002, May 2005, 3 marks)

OR

What is meant by Venture capital financing” (Nov 2008, 3 marks)

Answer:

Venture Capital Financing

Venture capital financing refers to financing of a new high risky venture promoted by qualified entrepreneurs who lack experience and funds to give shape to their ideas.

The European Venture Capital Association describes venture capital as risk finance for entrepreneurial growth-oriented companies. It is an investment for the medium or long term seeking to maximize the return.

In a broad sense, under venture capital financing, venture capitalist makes investment to purchase debt or equity from inexperienced entrepreneurs, who undertake highly risky ventures with potential of success.

Features

1. It is a long-term investment In growth-oriented but small and new high-risk venture.

2. It’s in form of equity finance.

3. The investors also provide support in form of sales strategy, business networking, etc.

Methods

- Equity financing

- Conditional loan

- Income note

- Participating in debenture.

Question 9.

Answer the following:

Explain the methods of venture capital financing. (Nov 2007, 3 marks)

OR

What is meant by venture capital financing? State its various methods. (Nov 2015, 4 marks)

OR

Explain In brief the methods of Venture Capital Financing. (Nov 2020, 4 marks)

Answer:

Please refer 2002. Nov (7) (b) on page no. 39

1. Equity financing: Usually venture capital financing takes form of equity financing as equity financing is a long-term financing.

2. Income Note: It is a type of hybrid financing in which the entrepreneur has to pay both interest and royalty on sales but at a low rate.

3. Conditional Loan: It is a type of financing whereby conditional loan is repayable in the form of a royalty after the venture capital is also to generate sales. No interest is paid on such loans.

4. Participating Debenture: It is a type of financing where security carrier charges in three distinct phases:

- Start-up phase: No interest is charged

- 2nd Phase: A low rate of interest is charged up to a particular level of operation

- 3rd Phase: After reaching a particular level of operation high rate of interest.

Question 10.

Discuss factors that a venture capitalist should consider before financing risky project. (May 2012, 4 marks)

OR

Answer the following:

What is venture capital financing? State the factors which are to be considered in financing any risky project. (May 2013, 4 marks)

Answer:

Venture Capital Financing:

Venture capital financing refers to financing of a new high risky venture promoted by qualified entrepreneurs who lack experience and funds to give shape to their ideas. The European Venture Capital Association describes venture capital as risk finance for entrepreneurial growth-oriented companies. It is an investment for the medium or long term seeking to maximize the return.

In a broad sense, under venture capital financing, venture capitalist makes investment to purchase debt or equity from inexperienced entrepreneurs. who undertake highly risky ventures with potential of success.

Features

1. It is a long-term investment in a growth-oriented but small and new high-risk venture.

2. It is in form of equity finance.

3. The investors also provide support in form of sales strategy, business networking, etc.

Factors to be considered before Financing any Risky Project by Venture Capitalist:

- The technical feasibility of the new product/service should be considered.

- Research must be carried Out to ensure that there is a market for the new product.

- Since the risk involved in investing in the company is quite high, venture capitalists should ensure that the prospects for future profits compensate for the risk.

- The quality of the management team is a very important factor to be considered. They are required to show a high level of commitment to the project.

- The technical ability of the team is also vital. They should be able to develop and produce a new product/service.

Question 11.

What is Debt Securitisation? Explain the basic Debt securitization process. (Nov 2004, 6 marks)

OR

Write Short Notes of Debt Securitisation (May 2006, 3 marks)

OR

Explain the concept of Debt securitization. (May 2008, 3 marks)

OR

What is debt securitization? And also state its advantages. (May 2013, 4 marks)

OR

State advantages of Debt Securitisation. (Nov 2016, 4 marks)

Answer:

Debt Securitisation

Meaning

Debt securitization is a method of recycling of funds. It is a process whereby loans and other receivables are underwritten and sold in form of assets. It is thus a process of transforming the assets ola lending institution into a negotiable instrument for generation of funds.

Process of debt securitization The process of debt securitization is as follows:

- The loans are segregated into relatively homogeneous pools.

- The basis of pool is the type of credit, maturity pattern, interest rate, risk etc.

- The asset pools are then transferred to a trustee.

- The trustee then Issues securities which are purchased by investors.

- Such securities (asset pool) are sold on the undertaking without recourse to seller.

Function of debt securitization

it is a method of recyding of funds. It is especially beneficial to financial intermediaries to support the lending volumes. The basic debt securitization process can be classified in the following three functions:

- The Origination Function

- The Pooling Function

- The Securitisation Function.

1. The origination function

Whenever a bank, financial institution, leasing company, Hire Purchase Company, credit card company, housing finance company, etc. lends money (whether directly of indirectly) to a borrower, there comes into existence an asset in the books of bank. This creation of financial asset is called the origination function.

2. The pooling function

Similar loans or receivables are clubbed together to create an underlying pool of assets. This pool is transferred in favour of a SPV (Special Purpose Vehicle), which acts as a trustee for the investor. This pooling of assets is SPy’s portfolio is called the pooling function.

3. The securitization function

Once the assets are transferred, SPy issues its securities (Called Pass-through certificates) to the investor, This issue of securities is called the securitization function. In this way, we see that conversion of debts to securities is known as debt securitization.

Advantages of Debt Securitisation

- The asset is shifted off the Balance Sheet, thus giving the originator recourse to oft Balance Sheet funding.

- It converts liquid assets to liquid portfolios.

- If facilitate better balance sheet management assets are transferred off balance sheet facilitating satisfaction of capital adequacy norms.

- The originator’s credit rating enhances.

![]()

Question 12.

Answer the following:

Discuss the benefits to the originator of Debt Securitisation. (May 2009, 2 marks)

Answer:

The benefits to the originator of debt securitization are es follows:

- The assets are shifted oft the balance sheet, thus giving the originator recourse to off-balance sheet funding.

- It converts illiquid assets to liquid portfolios.

- It facilitates better balance sheet management as assets are transferred off balance sheet facilitating satisfaction of capital adequacy norms.

- The originator’s credit rating enhances.

Question 13.

What is the process of Debt Securitisation? (May 2019, 4 marks)

Answer:

The basic debt securitization process can be classified in the following three functions:

1. The Origination Function

2. The Pooling Function

3. The Securitisation Function

1. The origination function:

Whenever a bank, Financial institution, leasing company, Hire Purchase Company, credit card company, housing finance company etc. lends money (whether directly of indirectly) to a borrower, there comes into existence an asset in the books of bank. This creation of financial asset is called the origination function.

2. The pooling function

Similar loans on receivables are dubbed together to create an underlying pool of assets. This pool is transferred in favour of a SPV (Special Purpose Vehicle), which acts as a trustee for the investor. This pooling of assets is SPy’s portfolio is called the pooling function.

3. The securitization function

Once the assets are transferred, SPy issues its securities (Called Pass-through certificates) to the investor. This issue of securities is called the securitization function. In this way we see that conversion of debts to securities is known as debt securitization.

Question 14.

Explain the concept of leveraged lease. (Nov 2007, 2 marks)

OR

Explain what do you mean by Leveraged Lease (May 2016, 2 marks)

Answer:

Leveraged Lease

Meaning

A lease agreement that is partially financed by the lessor through of third-party financial institution. Under a leverage lease transaction, the leasing company (called the equity participant) and a lender (called the loan participant) jointly fund the Investment with assets to be leased to the lessee.

Mechanism

In this form of lease agreement, the lessor undertakes to finance only a part of the money required to purchase the asset. The major part of the finance is arranged with a financier to whom the title deeds for the asset as well as the lease retails are assigned. There are usually three parties involved, the lessor, the lessee, and the financier. The lease agreement is between the lessee and lessor as in any other case. But it is supplemented by another separate agreement between the lesser and the financier who agrees to provide a major part say 80% of the money required.

Such lease agreement which will enable the lessor to undertake and expand volume of lease business with a limited amount of capital and hence it is called leverage leasing.

Question 15.

Distinguish between Operating lease and financial lease. (Nov 2011, 4 marks)

OR

Distinguish between Operating Lease and ‘Financial Lease’. (Nov 2014, 4 marks)

OR

Distinguish between operating lease and finance lease. (May 2016, 4 marks)

Answer:

Difference between Operating Lease and Financial Lease

| Basis of Difference | Financial Lease | Operating Lease |

| 1. Lease Term | Lease term Is for the major part of the economic lite of the assets. | Lease term is significantly less than the economic life of the assets. |

| 2. Risk and Rewards transferred | Under finance lease the Lessor transfers substantially all the risk and rewards incidental to ownership of an asset to the Lessee. | Under operating lease,the lessor does not transfer substantially all the risks and rewards incidental to ownership of an assets to the Lessee. |

| 3. Beerer of Risk of obsolescence | The risk of obsolescence falls on the Lessee. | The risk of obsolescence falls on the Lessor. |

| 4..Continuation of Lease | Continuation of lease is reasonably certain, | Continuation of lease is not reasonably certain. |

| 5. Cancellation | Finance Leases are generally non-cancellable unless contract provides otherwise. | Operating leases are generally cancellable unless contract provides otherwise. |

Question 16.

State the main elements of leveraged lease. (Nov 2013, 2 marks)

Answer:

Main elements of Leveraged Lease:

- A third-party lender is involved besides lessor and lessee who agreed to provide a major part of the money required.

- The lessor borrows a part of purchase cost from lender (third party)

- The asset is held as security.

- The lender is paid off by lessee from the lease rental.

![]()

Question 17.

Explain Sales and Lease Back’. (May 2015, 4 marks)

Answer:

Sale and Lease Back: Under this type of lease, the owner of an asset sells the asset to a party (the buyer), who in turn leases back the same asset to the owner ¡n consideration of a lease rentals. Under this agreement, the asset is not physically exchanged but it all happens in records only. The main advantage of this method is that the lessee can satisfy himself

completely regarding the quality of an asset and after possession of the asset convert the sale into a lease agreement.

An operating lease is particularly attractive to companies that continually update or replace equipment and want lo use equipment without ownership, but also want to return equipment at lease end and avoid technological obsolescence.

Question 18.

Discuss the Advantages of Leasing. (Nov 2018, 4 marks)

Answer:

Advantages of Leasing:

- Flexibility

- The leasing company may finance 100% cost of the equipment

- Leasing is time-saving and involves quick documentation.

- Operating lease safeguards lessee against obsolescence.

- Leasing does not affect the borrowing capacity of the lessee.

- Leased equipment is an off-the-balance sheet asset being economically used by the lessee and does not affect the debt position of lessee.

- Sale and lease back’ arrangement helps lessee overcomes a financial crisis immediately.

- Leasing is convenient for small equipments where debt financing is impracticable.

- Tax benefits may also sometimes accrue to the lessee depending upon his tax status.

Question 19.

Give any two limitations of leasing. (May 2019, 2 marks)

Answer:

Limitations of leasing:

1. The lease rentals become payable soon after the acquisition of assets and no moratorium period is permissible as in case of term loans from mandal institutions. The lease arrangement may, therefore, not be suitable for setting up of the new projects as it would entail cash outflows even before the project comes into operation.

2. The leased assets are purchased by the lessor who is the owner of equipment. The seller’s warranties for satisfactory operation of the leased assets may sometimes not be available to lessee.

3. Lessor generally obtains credit facilities from banks etc. to purchase the leased equipment which are subject to hypothecation charge in favour of the bank. Default in payment by the lessor may sometimes result In seizure of assets by banks causing loss to the lessee.

4. Lease financing has a very high cost of interest as compared to interest charged on term loans by financial institutions/banks.

Question 20.

Loft Ltd. is considering an investment in new technology that will reduce operating costs through increasing efficiency. The new technology will cost ₹ 5,00,000 and have a tour year life at the end of which it will have a residual value of ₹ 50,000.

An annual license fee of ₹ 52,000 is payable to operate the machine. The purchase can be financed by 10% loan payable in equal installments at the end of each of tour years. The depreciation is to be charged as per reducing balance method. The rate of depreciation is 25% per annum. Alternatively, Loft Ltd. could lease the new technology. ‘The Company

would pay four annual lease rentals 0f ₹ 1,90,000 per year. The annual lease rentals include Ihe cost of license lee. Tax rate is 30%. Compute the incremental cash flows under each option. What would be the appropriate rate at which these cash flows have to be discounted Discount the incremental cash flows under each option and decide which option is better – buy or lease? (Nov 2019, 10 Marks)

Answer:

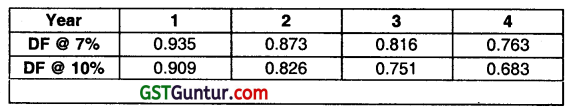

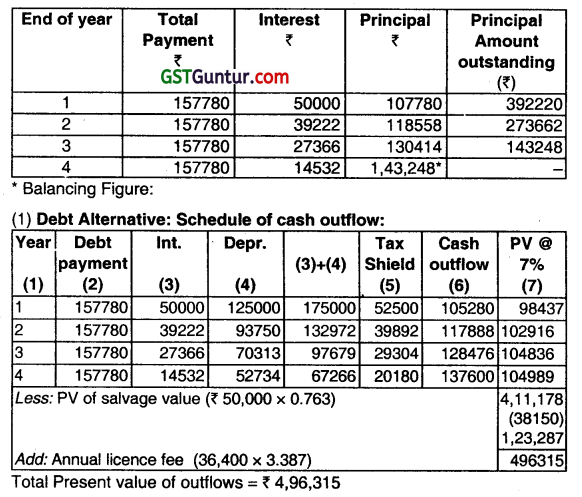

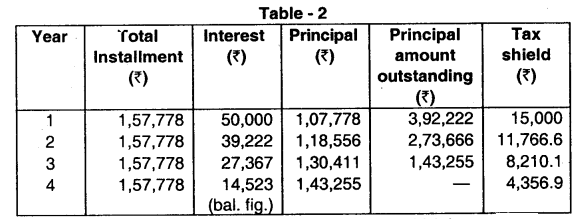

The PVAE at the rate of 10% for4 year is 3.169, the amotint payable will be Annual Payment = \(\frac{₹ 5,00,000}{3.169} \) = ₹ 1,57,780 (Rounded)

Schedule for Debt Repayment

(2) Lease Alternative:

After-Tax Lease Rent = ₹ 1,90,000 × 0.7

= ₹ 1,33.000

So, outflow = ₹ 1,33,000 × 3.387

= ₹ 4,50,471

Since PV of outflow Is lower in the leasing option loti lid, should prefer leasing option of the new technology.

Note:

Preferable discount rate will be after-tax rate of interest i.e. 7% [10% – (30% of 10%)]

Alternate Answer:

1. The buy or lease decision means computation of NPV arising from lease decision i.e. computation of valuation advantage of lease over buy. If the value is positive then we go for lease, otherwise, we buy.

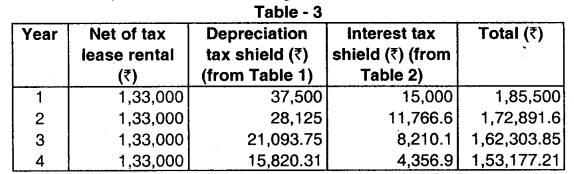

2. The valuation process involves – (a) finding incremental cash flow of lease over buy, and then, (b) discounting the incremental cash flow by net of tax interest rate of equivalent loan (to purchase the asset in question).

If we go for lease, there would be cash outflow in the form of net of tax lease rent from year 1104. Net of tax lease rent per annum = ₹ 1,90,000

x (1 – 30) = ₹ 1,33,000.

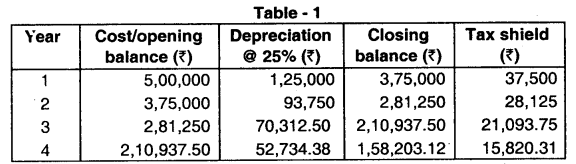

Again, if the equipment had been purchased there would have been tax savings of depreciation = Depreciation x tax rate. Here, the tax saving or tax shield is available for 4 years. But under lease, the benefit accrues to lessor. For lessee, it is a negative cash flow as advantage is not available to him under lease arrangement as lessor is considered the legal owner of the asset for claiming depreciation under Income tax law. The depreciation schedule and tax shield on depreciation are given in Table 1.

3. Further, if the equipment had been purchased there would have been tax saving of interest on loan = interest on loan x tax rate. Here, the tax saving or tax shield is available for 4 years. For lessee, it is a negative cash flow as advantage is not available to him under lease arrangement.

The loan amount would have been repayable together with the interest at the rate of 10% in equal installments at the end of each year. The PVAF at the rate of 10% for 4 years is 3.169(0.909 + 0.826 + 0.751 + 0.683). the amount payable would have been – Annual Installment = \(\frac{₹ 5,00,000}{3.169}\) = ₹ 1,57,778 (approx,)

The interest expense schedule and tax Shield on interest expense are given in Table 2.

4. After 4 years the equipment is sold for ₹ 50,000 which is a cash outflow due to lease over buy Loss on sale = ₹ (1,58,203.12 – 50,000)

= ₹ 1,08,203.12

Tax savings on loss = 30% of ₹ 1,08,203.12 = ₹ 32,460.94

This further tax shield has to be accounted for in the year 4.

5. If the equipment is taken on ease, the cash outflow on a/c of lease rental, and depreciation tax shields given in table 3.

Since, NPV or value of the lease is positive, the equipment should be taken on lease.

Question 20.

What are the sources of short-term financal requirements of the company? (May 2018,4 marks)

Answer:

Source of short-term financial requirements of the company

- Trade credit

- Accrued expenses and deferred income

- Short-term loans like working capital loans form commercial banks

- Fixed deposits for a period of 1 year or less

- Advances received from customers

- Various short-term provisions.

Question 21.

Briefly describe any four sources of short-term finance. (Nov 2019, 4 marks)

Answer:

There are various sources available to meet short-term needs of finance.

The different sources are discussed below:

1. Trade Credit

It represents credit granted by suppliers of goods, etc. as an incident of sale. The usual duration of such credit is 15 to 90 days. it generates automatically in the course of business and is common to almost all business operations. It can be in the form of an open account or bills payable.

Trade credit is preferred as a source of finance because it is without any explicit cost and till a business is a going concern it keeps on rotating. Another very important characteristic of trade credit is that it enhances automatically with the increase in the volume of business.

2. Commercial Paper

A commercial paper is an unsecured money market instrument issued in the form of a promissory note. The Reserve Bank of India introduced the commercial paper scheme in the year 1989 with a view to enabling highly rated corporate borrowers to diversify their sources of short-term borrowing and to provide an additional instrument to investors. Subsequently in addition to the corporate, primary Dealers and All India Financial Institutions have also been allowed to issue commercial papers.

All eligible issuers are required to get the credit rating from Credit Rating Information Services of India Ltd. (CRISIL), or the Investment Information and Credit Rating Agency of India Ltd. (ICRA) or the Credit Analysis and Research Ltd. (CARE) or the FITCH. Ratings India Pvt. Ltd. or any such other credit rating agency as is specified by the Reserve Bank Of India.

3. Bank Advances

Banks receive deposits from public for different periods at varying rates of interest. These funds are invested and lent in such a manner that when required, they may be called back. Lending results in gross revenues out of which costs, such as interest on deposits, administrative costs, etc, are met and a reasonable profit is made. A bank’s lending policy is not merely profit-motivated but has to also keep in mind the socioeconomic development of the country.

4. Treasury Bills

Treasury Bills are a class of Central Government Securities. Treasury bills, commonly referred to as T- Bills are issued by the Government of India to meet short-term borrowing requirements with maturities ranging between 14 to 364 days.

![]()

Question 22.

Write short note on Seed capital assistance. (May 2005, 3 marks)

OR

Answer the following:

Briefly discuss the concept of Seed Capital Assistance. (May 2010, 2 marks)

Answer:

Seed Capital Assistance

Scheme designed by

The seed capital assistance scheme is designed by the IDBI for professionally or technically qualified entrepreneurs who lack financial resources.

Project Cost

The project cost should not exceed 2 crores. The maximum assistance under this scheme will be:

(a) 50% of the promotors required contribution, or

(b) ₹15 lacs, whichever is lower

Interest

The assistance is initially interest-free but carries a service Rate charge of 1% pa. for the five years and at an increasing rate thereafter.

However, IDBI will have option to charge interest at such rate as may be determined by it on loan if financial position and profitability of the company so permit during the duration of the loan.

Repayment Schedule

The repayment schedule Is fixed depending upon the repaying capacity of the unit with an initial moratorium of up to 5 years.

Question 23.

Answer the following:

Discuss the features of Deep Discount Bonds. (Nov 2007, 2 marks)

OR

Answer the following:

Write a short note on Deep Discount Bonds. (Nov 2008, May 2012, 2 marks)

Answer:

Deep Discount Bond:

Deep discount bonds are a form of zero-interest bonds.

These bonds are sold at a discounted value and on maturity face value is paid to the investor’ In such bonds, there is no interest payout during lock-in period. When such bonds are sold in the stock market, the difference realised between face value and market price is the capital gain.

IDBI was the first to issue deep discount bonds in India in January 1992. For a deep discount price of ₹ 2,700/- in IDBI the investor got a bond with the face value of ₹ 1,00,000. The bond appreciates to its face value over the maturity period of 25 years. Alternatively, the investor can withdraw from the investment periodically after 5 years. The capital appreciation is charged to tax at capital gains rate which is lower than normal income tax rate. The deep discount bond is considered a safe, solid, and liquid instrument and assigned the best rating by CRISIL.

Question 24.

Answer the following:

Discuss the features of Secured Premium Notes (SPNs). (May 2008, 2 marks)

Answer:

Features of Secured Premium Notes (SPNs).

- A secured premium Note is issued along with a detachable warrant and is redeemable after a notified period of 4 to 7 years.

- The conversion of detachable warrants into equity shares will have to be done within time period notified by the company.

- The warrant attached to SPNs gives the holder the right to apply for and get allotment of equity shares as per the conditions within the time period notified by the company.

Question 25.

Answer the following:

Explain the concept of Indian depository receipts. (Nov 2007, 2 marks)

Answer:

Indian Depository Receipts

Meaning of IDR

An IDR is an Instrument denominated in Indian Rupees in the form of a depository receipt created by a Domestic Depository (custodian of securities registered with the Securities and Exchange Board of India) against the underlying equity cA issuing company to enable foreign companies to raise funds from the Indian Securities Markets.

Legislations governing IDRs

Central Government notified the Companies (Registration of Foreign Companies) Rules, 2014(IDR Rules) pursuant to the Section 390 of the Companies Act. 2013. SEBI issued guidelines for disclosure with respect to (IDRs and notified the model listing agreement to be entered between exchange and the foreign issuer specifying continuous listing requirements.

Question 26.

Answer the following:

Explain briefly the features of External Commercial Borrowings. (ECB) (May 2008, 3 marks)

Answer:

External Commercial Borrowings (ECS):

- ECB is an instrument used in India to facilitate the access to foreign money by Indian corporations and PSUs.

- ECBs include commercial loans (in the form of bank loans, buyers’ credit, suppliers’ credit, and securitized instruments (eg. floating rate notes and fixed rate bonds) availed from non-resident lenders with minimum average maturity of 3 years.

- Borrowers can raise ECBs through internationally recognised sources like (a) International banks, (b) international capital markets (c) multilateral financial institutions such as the IFC, ADB etc, (d) export credit agencies (e) suppliers of equipment, (f) foreign collaborators and (g) foreign equity holders.

- External Commercial Borrowings can be accessed under two routes viz (a) Automatic route (b) Approval route.

- Under the Automatic route, there is no need to take the RBI! Government approval whereas such approval Is necessary under the Approval route.

- Company’s registered under the Companies Act and NGOs engaged In microfinance activities are eligible for the Automatic Route whereas Financial Institutions and Banks dealing exclusively in infrastructure or export finance and the ones which had participated in the textile and steel sector restructuring packages as approved by the government are required to take the Approval Route.

Question 27.

Answer the following:

Name the various financial Instruments dealt with in the international market. (Nov 2008, 2 marks)

OR

Name any four financial instruments, which are related to international financial market. (May 2014, 2 marks)

OR

Answer the following:

Explain in brief following Financial instruments:

(i) Euro Bonds

(ii) Floating Rate Notes

(iii) Euro Commercial paper

(iv) Fully Hedged Bond (Nov 2018, 1 x 4=4 marks)

Answer:

Some of the various financial Instruments dealt with in the International market are discussed below:

1. Euro Issue

An Euro issue is a issue listed on a foreign stock exchange. It Is an instrument which raises foreign currency in the international market. through the issue of:

- Depository Receipts-ADR & GD

- Foreign Currency convertible bonds.

2. Euro Bonds

Euro bonds are long-term loans raised by entities enjoying an excellent credit rating.

These are debt instruments which are not denominated in the currency of the country In Which they are issued. These are issued in a bearer form rather than as registered bond and in such cases they do not contain investor’s name or the country of their origin.

3. Foreign Bonds

Foreign Bonds are debt instruments denominated in a currency which is foreign to the borrower and Is sold In the country of that currency.

4. Fully Hedged Bonds

Fully hedged bonds are the foreign bonds devoid of the risk of currency fluctuation. It eliminates the risk by selling the entire streams of principal and interest payment the forward market.

5. Floating Rate Note

The Floating Rate Notes provide foreign currency at a rate lower than foreign loans. They are Issued for a period up to 7 years. The interest rates are adjusted to reflect the prevailing exchange rate.

6. Euro Commercial Paper

Euro commercial papers are promissory notes with a maturity period of less than one year. These are unsecured instruments issued by a corporate body. The main investors are banks, insurance companies, fund managers, etc. They are usually designated in US Dollars.

7. Foreign Currency option

Foreign currency option is the right to buy or sell spot, future or forward, a specified foreign currency. It provides a hedge against financial and economic risks.

8. Foreign Currency Futures

A foreign currency future is a right to buy or sell a sum of foreign currency at a fixed exchange rate on a specific future date. It is an alternative to forward contract for hedging of exchange risk.

Question 28.

Discuss the concept of American Depository Receipts. (May 2009, 2 marks)

Answer:

American Depository Receipt:

Meaning

A deposit receipt issued by an Indian company in USA is known as American depository receipt (ADRs).

How Issued Such receipts have to be issued in accordance with the provisions stipulated by the security and Exchange Commission of USA.

Created by

An ADR is generally created by the deposit of the securities of an outsider company with a custodian bank in the country of incorporation of issuing company. The custodian bank informs the depository in USA that the ADRs can be issued. ADRs are dollar-denominated and are traded in the same way as are security of U.S. company.

Mode of Trading

ADRs can be traded either by trading existing ADRs or purchasing the shares in the issuer’s home market and having new ADRs created, based upon availability and market conditions. When trading in existing ADRs, the trade is executed on the secondary market on the New York Stock Exchange through Depository Trust Company (DTC) without involvement from foreign brokers or custodians.

![]()

Question 29.

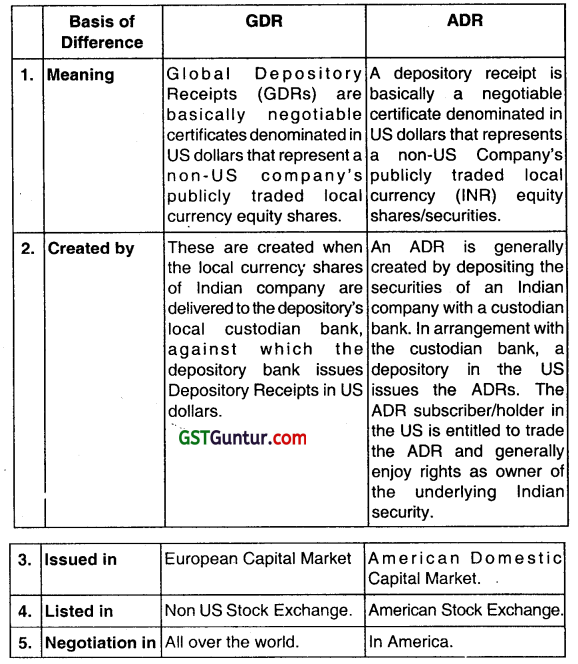

Distinguish between the following:

Global Depository Receipts and American Depository Receipts. (Nov 2010, 4 marks)

OR

State the main features of Global Depositary Receipts (GDRs) and American Depositary Receipts (ADRs). (May 2014, 4 marks)

OR

Answer the following:

Explain GDR and ADR. (May 2017, 4 marks)

Answer: