Financing Decisions Capital Structure – CA Inter FM Question Bank is designed strictly as per the latest syllabus and exam pattern.

Financing Decisions Capital Structure – CA Inter FM Question Bank

Question 1.

Answer the following:

What is Optimum Capital Structure? Explain. (Nov 2007, 2 marks)

OR

Answer the following:

Discuss the concept of ‘Optimál Capital Structure.” (Nov 2008, 2 marks)

Answer:

Capital structure is optimum when the value of the firm is maximum and Cost of capital (debts & equity) is minimum and so market price per share is maximum, Which leads to the maximization of the value of the firm.

An optimal capital structure should possess the following features:

- Maximization of profitability: by using leverage minimum cost.

- Flexibility: structure should be flexible so that company may be able to raise fund or reduce fund whenever ¡t is required.

- Control: It should reduce the risk of dilution of control.

- Solvency: Excessive debt may threaten the solvency of the company.

According to this:

- If a company takes on debt, the value of the firm increases up to a certain point. Beyond that value of the firm will start to decrease.

- If the company is unable to pay the debt within the specified period then it will affect the goodwill of the company in the market. Hence, company should select appropriate capital structure with due consideration of all factors.

Question 2.

Answer the following:

What do you understand by Capital structure? How does it differ from Financial structure? (May 2010, 2 marks)

Answer:

Meaning of Capital Structure and Its Difference from Financial Structure: Capital Structure refers to the combination of debt and equity which a company uses to finance its long-term operations. It is the permanent financing of the company representing long-term sources of capital. owner’s equity and long-term debts but excludes current liabilities. Whereas, Financial Structure is the entire left-hand side of the balance sheet which represents all the long-term and short-term sources of capital. Thus, capital structure is only a part of financial structure.

Question 3.

What do you mean by capital structure? State its significance in financing decisions. (Nov 2013, 4 marks)

Answer:

Capital Structure refers to the composition of long-term sources of funds, such as debentures, long-term debt, preference share capital, and ordinary share capital including reserves and surplus (retained-earning). It is the permanent financing of the firm, represented by long-term debt, preferred stock, and net worth. Thus, capital structure ordinarily implies the proportion of debt and equity in the total capital of a company. Since a company may tap any one or more of the different available sources of funds to meet its total financial requirement. The total capital of a company may, thus, be composed of all such tapped sources.

The capital structure should be planned generally keeping in view the interests of the equity shareholders and the financial requirements of a company. An optimum capital structure can be defined as a financial plan having an appropriate debt-equity mix which minimises overall cost of capital of the firm and maximizes the market price per share or the total value of the firm. Hence, the optimal capital structure is concerned with the two important variables at one time – the minimization of cost as well as maximization of worth.

![]()

Question 4.

State three assumptions of Modigliani and Miller’s approach to Cost of Capital. (Nov 2002, 3 marks)

Answer:

The Theory: Franco Modigliani and Meron H. Miller developed a hypothesis which is actually an extension of net operating income approach. “According to the theory, in absence of corporate tax, cost of capital and the market value of equity share is independent to the changes in capital structure or degree of leverage.”

Explanation: The M-M hypothesis gave two propositions, which are as follows:

Proposition I: The market value of the firm (V) and the cost of capital (ko) are independent of its capital structure.

Proposition II: The firm’s cost of equity increases to offset the use by cheaper debt capital. In other words, the firm’s use of debt increases its cost of equity as well.

Assumptions:

- The investors are free to buy and sell the securities is the securities are traded in perfect market.

- The expectations of investors are same and homogenous.

- The firms can be classified into homogeneous dass.

- The dividend payout ratio is 100%

- There are no corporate taxes.

Question 5.

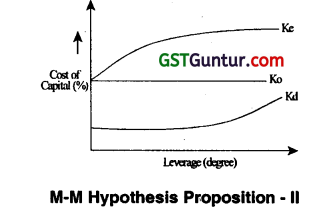

Discuss the relationship between the cost of equity and financial leverage in accordance with MM Proposition II. (May 2004, 3 marks)

Answer:

Proposition II: The firm’s cost of equity increase to offset the use by cheaper debt capital. In other words, the firms use of debt increases its cost of equity as well. The cost of capital k0 is equal to sum of constant average cost of capital k0 and a premium for financial risk

Thus k0 = k0 + Risk premium

Where,

Risk premium = (k0 – ke) D/s

∴ Ke = k0 + (k0 – ke) D/s

The proposition II presumes a linear relationship between k and debt-equity ratio (D/s).

Graphical representation:

Assumptions:

- The investors are tree to buy and sell the securities ¡s the securities are traded in the perfect market.

- The expectations of investors are same and homogenous.

- The firms can be classified into homogeneous class.

- The dividend payout ratio is 100%

- There is no corporate taxes.

Question 6.

Explain in brief the assumptions of Modigliani-Miller theory. (Nov 2007, 2 marks)

Answer:

The Theory: Franco Modigliani and Meron H. Miller developed a hypothesis which is actually an extension of net operating income approach. “According to the theory, in absence of corporate tax, cost of capital and the market value of equity share ¡s independent to the changes in capital structure or degree of leverage.”

Explanation: The M-M hypothesis gave two propositions, which are as follows:

Proposition I: The market value of the firm (V) and the cost of capital (ko) are independent of its capital structure.

Proposition II: The firm’s cost of equity increases to offset the use by cheaper debt capital. In other words, the firm’s use of debt increases its cost of equity as well.

Assumptions:

- The Investors are free to buy and sell the securities is the securities are traded in perfect market.

- The expectations of investors are same and homogenous.

- The firms can be classified into homogeneous class.

- The dividend payout ratio is 100%

- There are no corporate taxes.

Question 7.

Explain the assumptions of Net Operating Income approach (NOI) theory of capital structure. (Nov 2007, 3 marks)

Answer:

The Theory

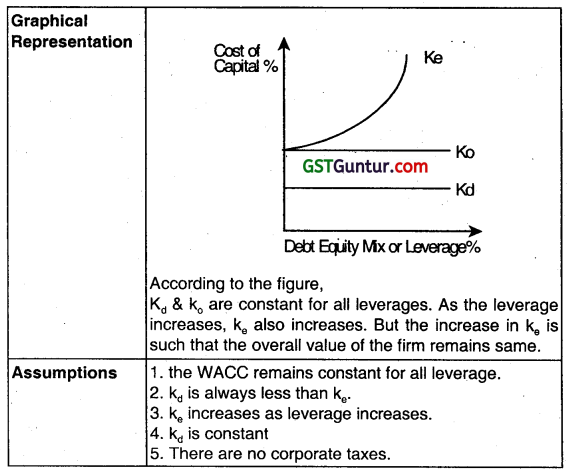

According to the net operating income approach, the market value of the firm depends upon the net operating profit or EBIT and the WACC. The financing mix or capital structure is irrelevant and does not affect the value of the firm.

Explanation

The market value of the firm is not affected by the capital structure changes. For a given value of EBIT, the value of the firm remains the same irrespective of the capital composition. It however depends upon the WACC.

Question 8.

What is Net Operating income theory of capital structure? Explain the assumptions on which the NOl theory is based. (May 2012, 4 marks)

Answer:

Net Operating Income (NOI) Theory of Capital Structure

There is no relationship between the cost of capital and value of the firm. Under Net Operating Income (NOI) the value of the firm is independent of the capital structure of the firm.

Assumptions of NOI Approach:

- There are no taxes.

- The overall cost of capital remains same for all degrees of debt-equity mix.

- The market capitalizes the value of the firm as a whole. Thus the split between debt and equity is not important.

- The increase in proportion of debt in capital structure leads to change in risk perception of the shareholders i.e. increase in cost of equity (Ke). The increase in cost of equity is such as completely offsets the benefits of using cheaper debt.

Question 9.

There are two firms P and Q which are identical except P does not use any debt in its capital structure while Q has ₹ 8,00,000, 9% debentures in its capital structure. Both the firms have earnings before interest and tax of ₹ 2,60,000 p.a. and the capitalization rate is 10%. Assuming the corporate tax of 30%, calculate the value of these firms according to the MM Hypothesis. (Nov 2009, 3 marks)

Answer:

Calculation of value of firms P and Q according to MM Hypothesis Market value of firm P (Unlevered)

Vu = \(\frac{E B I T(1-t)}{K_e}\)

= \(\frac{2,60,000(1-0.30)}{10 \%}\)

= \(\frac{₹ 1,82,000}{10 \%}\) = ₹ 18,20,000

Market Value of Firm Q (Levered)

VE =Vu +DT

= ₹ 18,20,000 + (8,00,000 × 0.30)

= ₹ 18,20,000 + 2,40,000 = ₹ 20,60,000

Question 10.

RES Ltd. is an all-equity financed company with a market value of ₹ 25,00,000 and cost of equity, ke =21%. The company wants to buy back equity shares worth ₹ 5,00,000 by issuing and raising 15% perpetual debt of the same amount. Rate of tax may be taken as 30%. After the capital restructuring and applying MM Model (with taxes), you are required to

calculate:

(i) Market value of RES Ltd.

(ii) Cost of Equity ke

(iii) Weighted average cost of capital and comment on it. (May 2012, 5 marks)

Answer:

Computation of Market Value, Cost of Equity and WACC of RES Ltd.

Market Value of Equity = 25,00,000

Ke = 21%

\(\frac{\text { Net income }(\mathrm{NI}) \text { for equity holders }}{\mathrm{K}_e} \) = Market Value of Equity

\(\frac{\text { Net income }(\mathrm{NII}) \text { for equity holders }}{0.21}\) = 25,00,000

Net income for equity holders = 5,25,000

EBIT = 5,25,000/0.7 = 7,50,000

| Particulars | All Equity | Debt and Equity |

| EBIT | 7,50,000 | 7,50,000 |

| Interest to debt-holders | – | 75,000 |

| EBT | 7,50,000 | 6,75,000 |

| Taxes (30%) | 2,25,000 | 2,02,500 |

| Income available to equity shareholders | 5,25,000 | 4,72,500 |

| Income to debt holders plus income available to shareholders | 5,25,000 | 5,47,500 |

Present value of tax-shield benefits = 5,00,000 x 0.30 = 1,50,000

(i) Value of Restructured firm

= 25,00,000 + 1,50,000 = 26,50,000

(ii) Cost of Equity (Ke)

Total Value = 26,50,000

Less: Value of Debt = 5,00,000

Value of Equity = 21,50,000

Ke = \(\frac{4,72,500}{21,50,000}\) = 0.219 = 22%

(iii) WACC

Cost of Debt (after tax) = 15% (1- 0.3) 0.15 (0.70) = 0.105 = 10.5%

| Components of Costs | Amount | Cost of Capital | Weight | Weighted COC |

| Equity | 21,50,000 | 0.22 | 0.81 | 0.178 |

| Debt | 5,00,000 | 0.105 | 0.19 | 0.020 |

| 26,50,000 | 0.198 |

WACC =19.8%

Comment: At present, the company is all equity financed. So, Ke = Ko i.e. 21%. However, after restructuring, the Ko would be reduced to 19.81% and Ke would increase from 21% to 21.98%. Reduction in Ko and increase in Ke is good for the health of the company.

![]()

Question 11.

‘A’ Ltd. and ‘B’ Ltd. are identical in every respect except capital structure. ‘A’ Ltd. does not employ debts in its capital structure whereas ‘B’ Ltd. employs 12% Debentures amounting to ₹ 10 lakhs. Assuming that:

(i) All assumptions of M-M model are met.

(ii) Income-tax rate is 30%;

(iii) EBIT is ₹ 2,50,000 and .

(iv) The Equity capitalization rate of ‘A’ Ltd. is 20%.

Calculate the value of both the companies and also find out the Weighted Average Cost of Capital for both the companies. (Nov 2014, 5 marks)

Answer:

(i) Calculation of Value of Firms ‘A Ltd.’ and ‘B Ltd.’ according to MM Hypothesis Market Value of ‘A Ltd.’ (Unlevered)

Vu = \(\frac{E B / T(1-t)}{K_e} \)

= \(\frac{2,50,000(1-0.30)}{20 \%}\)

= \(\frac{1,75,000}{20 \%} \) = ₹ 8,75,000.

Market Value of ‘B Ltd.’ (Levered)

VE =Vu × DT

= 8,75,000 + (10,00,000 × 0.30)

= 8,75,000 + 3,00,000 = ₹ 11,75,000

(ii) Computation of Weighted Average Cost of Capital (WACC)

WACC of ‘A Ltd. = 20% (Ke= Ko)

WACC of ‘B Ltd.’

kd = 12% (1- 0.3) = 12% × 0.7 = 8.4%

WACC = 14.90%.

Question 12.

PNR Limited and PXR Limited are identical in every respect except capital structure. PNR Limited does not employ debts in its capital structure whereas PXR Limited employs 12% Debentures amounting to ₹ 20,00,000. The following additional information are given to you:

(i) Income tax rate is 30%

(ii) EBIT is ₹ 5,00,000

(iii) The equity capitalization rate of PNR Limited is 20% and

(iv) AH assumptions of the Modigliani-Miller Approach are met.

Calculate:

(i) Value of both the companies,

(ii) Weighted average cost of capital for both the companies. (May 2017, 8 marks)

Answer:

Calculation of Value of Firms PNR Ltd. and PXR Ltd. according to MM Hypothesis:

(a) Market velue of Firm PNR (Unlevered)

Vu = \(\frac{E B \mid T(1-t)}{Ke} \)

Vu = \(\frac{5,00,000(1-0.3)}{0.20} \)

Vu = 17,50,000

(b) Market value of Firm PXR (Levered)

VE = VU+DT

VE = 17,50000 + (20,00,000 × 0.30)

VE = 23,50,000

2. Weighted Average Cost of Capital (According to M-M)

(a) WACC for PNR = 20% (Same as given in Que. Since only equity in capital)

(b) WACC for PXR

| EBIT (-) Interest (12%) |

5,00,000 (2,40,000) |

| EBT (-) Tax @ 30% |

2,60,000 (78,000) |

| PAT | 1,82,000 |

| Value of Firm (-) Value of Debt |

23,50,000 (20,00,000) |

| Value of Equity | 3,50,000 |

∴ Ke = \(\frac{\text { PAT }}{\text { Value of Equity }}=\frac{1,82,000}{3,50,000}\) = 52%

| Weighted Average Cost of Capital | ||||

| Capital | Amount | Weight | Cost | W x C |

| Equity | 3,50,000 | 0.1489 | 52% | 7.75% |

| Debt | 20,00,000 | 0.8511 | 8.40% | 7.15% |

| 23,50,000 | WACC | 15% | ||

Question 13

A Limited and B Limited are identical except for capital structures. An Ltd. has 60 percent debt and 40 percent equity, whereas B Ltd. has 20 percent debt and 80 percent equity. (All percentages are in market-value terms.) The borrowing rate for both companies is 8 percent in a no-tax world, and capital markets are assumed to be perfect.

(a)

(i) If X, owns 3 percent of the equity shares of A Ltd., determine his return if the Company has net operating income of ₹ 4,50,000 and the overall capitalization rate of the company, (K0) is 18 percent.

(ii) Calculate the implied required rate of return on equity of A Ltd.

(b) B Ltd. has the same net operating income as A Ltd.

(i) Calculate the implied required equity return of B Ltd.

(ii) Analyse why does it differ from that of A Ltd. (Jan 2021, 10 marks)

Question 14.

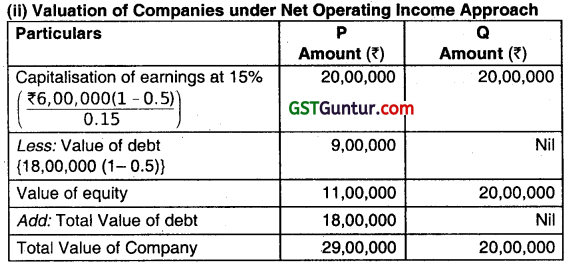

Company P and Q are identical in all respects including risk factors except for debt/equity, company P having issued 10% debentures of ₹ 18 lakhs while company Q is uníevered. Both the companies earn 20% before interest and taxes on. their total assets of ₹ 30 lakhs. Assuming a tax rate of 50% and capitalization rate of 15% from an all-equity company.

Required:

CALCULATE the value of companies’ P and Q using (i) Net Income Approach and

(ii) Net Operating Income Approach.

Answer:

(i) Valuation under Net Income Approach

| Particulars | P Amount (₹) |

Q Amount (₹) |

| Earnings before Interest & Tax (EBIT) (20% of 30,00,000) |

6,00,000 | 6,00,000 |

| Less: Interest (10% of 18,00,000) | 1,80,000 | |

| Earnings before Tax (EBT) | 4,20,000 | 6,00,000 |

| Less: Tax @ 50% | 2,10,000 | 3,00,000 |

| Earnings after Tax (EAT) (available to equity holders) |

2,10,000 | 3,00,000 |

| Value of equity (capitalized @ 15%) | 14,00,000 (2,10,000 × 100/15) |

20,00,000 (3,00,000 × 100/15) |

| Add: Total Value of debt | 8,00,000 | Nil |

| Total Value of Company | 32,00,000 | 20,00,000 |

Question 15.

Discuss the major considerations in Capital structure planning. (Nov 2003, 6 marks)

OR

Discuss the major considerations in Capital Structure Planning. (May 2006, 6 marks)

Answer: –

The major considerations in Capital Structure Planning are:

1. Risk

2. Cost of capital

3. Control

1. Risk: Risk is a situation wherein the possibility of happening or non-happening of an event can be measured. With reference to capital structure planning, risk may be defined as the variability in the actual return from an investment and the estimated return as forecasted at the time of capital structure planning. While designing the capital structure the firm tries to keep the risk at minimum.

2. Cost of Capital: The cost of capital is the minimum rate of return that a firm must earn or, its investment to satisfy its various investors. Cost is thus, an important consideration ¡n capital structure planning.

3. Control: The decisions relating to capital structure are taken after keeping the control factor in mind. For e.g. when equity shares are issued the company automatically dilutes its controlling.

![]()

Question 16.

List the fundamental principles governing capital structure. (Nov 2012, 4 marks)

OR

State the principles that should be followed while designing the capital structure of a company. (May 2016, 4 marks)

Answer:

Fundamental Principles Governing Capital Structure

1. Cost Principle

According to this principle, an ideal pattern of capital structure is one that minimises cost of capital structure and maximises earnings per share (EPS).

2. Risk Principle

According to this principle, reliance is placed more on common equity for financing capital requirements than excessive use of debt. Use of more and more debt means higher commitment in form of interest payout. This would lead to erosion of shareholders’ value in unfavorable business situations.

3. Control Principle

While designing a capital structure, the finance manager may also keep in mind that existing management control and ownership remains undisturbed.

4. Flexibility Principle

It means that the management chooses such a combination of sources of financing which it finds easier to adjust according to changes in need of funds in future too.

5. Other Considerations

Besides above principles, other factors such as nature of industry, timing of issue, and competition in the industry should also be considered.

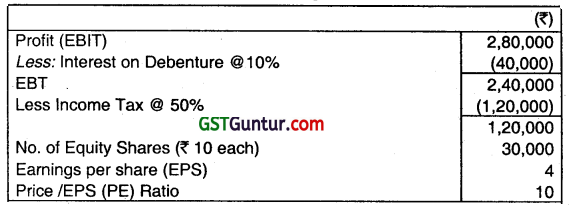

Question 17.

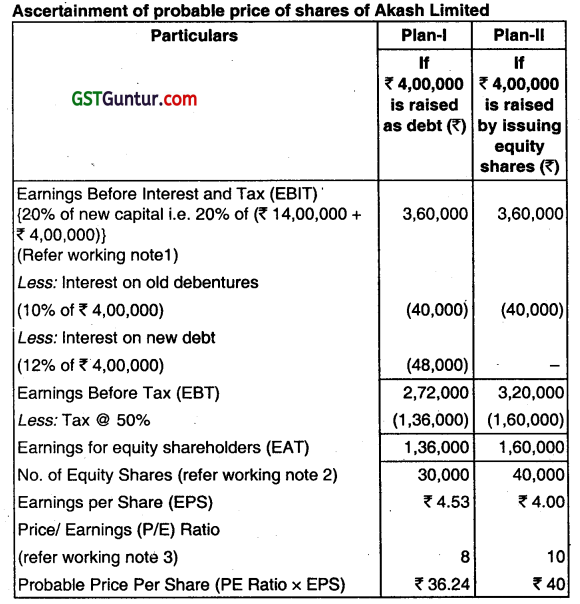

Akash Limited provides you the following information:

The company has reserves and surplus of ₹ 7,00,000 and required ₹ 4,00,000 further for modernization. Return on Capital Employed (ROCE) is constant. Debt (Debt/Debt + Equity) Ratio higher than 40% will bring the PIE Ratio down to 8 and increase the interest rate on additional debts to 12%. You are required to ASCERTAIN the probable price of the share.

(i) If the additional capital are raised as debt; and

(ii) If the amount is raised by issuing equity shares at the ruling market price.

Working Notes:

1. Calculation of existing Return of Capital Employed (ROCE):

2. Number of Equity Shares to be issued In Plan-II:

= \(\frac{₹ 4,00,000}{₹ 40}\) = 10,000 shares

Thus, after the issue total number of shares = 30,000 + 10,000 = 40,000 shares

3. Debt/Equity Ratio if ₹ 4,00,000 is raised as debt:

= \(\frac{₹ 8,00,000}{₹ 18,00,000} \times 100\) = 44.44%

As the debt-equity ratio is more than 40% the PIE ratio will be brought down to 8 in Plan-I.

Question 18.

Discuss the concept of Debt-Equity or EBIT-EPS indifference point, while determining the capital structure of a company. (May 2009, 2 marks)

Answer:

Concept of Debt-Equity or EBIT-EPS Indifference Point while Determining the Capital Structure of a Company The determination of the optimum level of debt 1h the capital structure of a company is a formidable task and is a major policy decision. It ensures that the firm is able to service its debt as well as contain its interest cost. Determination of optimum level of debt involves equalizing between return and risk.

EBIT-EPS analysis is a widely used tool to determine level of debt in a firm. Through this analysis, comparison can be drawn for various methods of financing by obtaining indifference points. It is point to the EBIT level at which EPS remain unchanged irrespective of debt level equity mix. For example indifference point for the capital mix (equity share capital and debt)

can be determined as follows:

\(\frac{\left(E B I T-I_1\right)(1-T)}{E_1}=\frac{\left(E B I T-I_2\right)(1-T)}{E_2} \)

Where,

EBIT = Indifference point

E1 = Number of equity shares in Alternative 1

E2 = Number of equity shares ¡n Alternative 2

I1 = Interest charged in Alternative 1

I2 = Interest charged in Alternative 2

T = Tax-rate

Alternative 1 = All equity finance

Alternative 2 = Debt-equity finance.

Question 19.

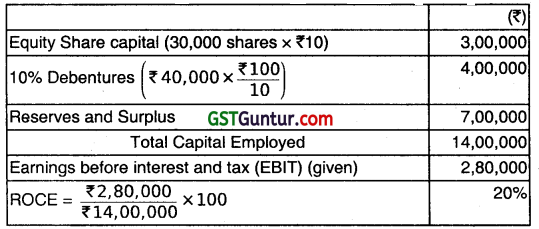

The management of Z Company Ltd. wants to raise its funds from market to meet out the financial demands of its long-term projects. The company has various combination of proposals to raise its funds. You are given the following proposals of the company.

(ii) Cost of debt – 10%

Cost of preference shares – 10%

(iii) Tax rate – 50%

(iv) Equity shares of the face value of ₹ 10 each will be issued at a premium of ₹ 10 per share.

(v) Total investment to be raised ₹ 40,00,000.

(vi) Expected earnings before interest and tax ₹ 18,00,000.

From the above proposals the management wants to take advice from you for appropriate plan after computing the following:

Earning per share

Financial break-even-point

Compute the EBIT range among the plans for indifference. Also, indicate if any of the plans dominate. (May 2011, 12 marks)

Answer:

(ii) Computation of Financial Break-even Points

Proposal ‘P’ = 0

Proposal ‘Q’ = ₹ 2,00,000 (Interest charges)

Proposal R’ = Earnings required for payment of preference share dividend i.e.

₹ 2,00,000 ÷ 0.5 (Tax Rate) = ₹ 4,00,000

(iii) Computation of indifference Point between the Proposals

The indifference point

\(\frac{\left(E B I T-1_1\right)(1-T)}{E_1}=\frac{\left(E B I T-1_2\right)(1-T)}{E_2} \)

Where,

EBIT = Earnings before interest and tax

11 = Fixed Charges (Interest) under Proposal ‘P’

12 = Fixed char3jinterest) under Proposal ‘Q’

T = Tax Rate’

E1 = Number of Equity shares in Proposal P

E2 = Number of Equity shares in Proposal Q

Combination of ProposaIs

(A) Indifference point where EBIT of proposal “P” and proposal ‘‘Q’’ is equal \(\frac{(EBIT-0)(1-0.5)}{2,00,000}=\frac{(E B I T-2,00,000)(1-0.5)}{1,00,000}\)

5 EBIT (1,00,000) = (.5 EBIT -1 ,00,000) 2,00,000

5 EBIT= EBIT – 2,00,000

EBIT = ₹ 4,00,000

(B) indifference point where EBIT of proposal ‘P’ and Proposal ‘R’ is equal:

\(\frac{(E B I T-1)(1-T)}{E_1}=\frac{(E B I T-12)(1-T)}{E_2} \) – Preference Share dividend

\(\frac{(E B I T-0)(1-.5)}{2,00,000}=\frac{(E B I T-0)(1-.5)-2,00,000}{1,00,000}\)

\(\frac{5 \mathrm{EBIT}}{2,00,000}=\frac{.5 \mathrm{EBIT}-2,00,000}{1,00,000} \)

25 EBIT = 0.5 EBIT – 2,00,000

EBIT = 2,00,000 ÷ 0.25

= ₹ 8,00,000

(C) Indifference point where EBIT of proposal ‘Q’ and proposal ‘R’ are equal \(\frac{(EBIT-2,00,000)(1-0.5)}{1,00,000}=\frac{(E B I T-0)(1-0.5)-2,00,000}{1,00,000} \)

0.5 EBIT – 1,00,000 = 0.5 EBIT – 2,00,000

There is no indifference point between proposal ‘Q’ and proposal ‘R’ Analysis:

It can be seen that Financial proposal ‘Q’ dominates proposal ‘R’, since the financial break-even point of the former is only ₹ 2,00,000 but in case of latter, it is ₹ 4,00,000.

Question 20.

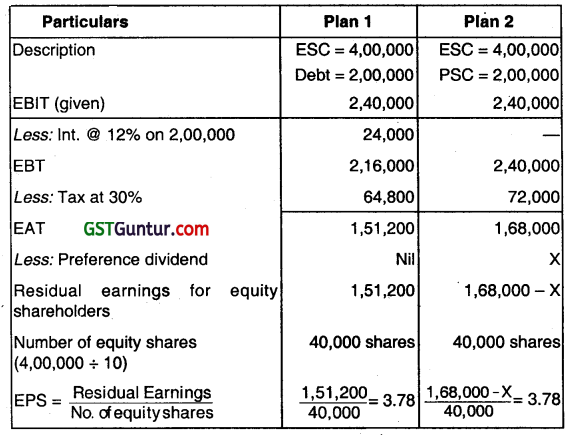

X Ltd. is considering the following two alternative financing plans:

| Particulars | Plan-I ₹ | Plan-II ₹ |

| Equity shares of ₹ 10 each | 4,00,000 | 4,00,000 |

| 12% Debentures | 2,00,000 | – |

| Preference Shares of ₹ 100 each | – | 2,00,000 |

| 6,00,000 | 6,00,000 |

The indifference point between the plans is ₹ 2,40,000. The corporate tax rate is 30%. Calculate the rate of dividend on preference shares. (Nov 2013, 5 marks)

Answer:

For indifference between the above alternatives, EPS should be equal.

So \(\frac{1,51,200}{40,000 \text { shares }}=3.78=\frac{1,68,000-X}{40,000 \text { shares }}\)

Or 40,000 × 3.78 = 1,68,000 – X

Or X=16,800

So, Rate of Preference Dividend = \(\frac{16,800}{2,00,000} \) = 8.4%.

![]()

Question 21.

Alpha Limited requires funds amounting to ₹ 80 lakhs for its new project. To raise the funds, the company has following two alternatives:

(i) to issue Equity Shares (at par) amounting to ₹ 60 lakhs and borrow the balance amount at the interest of 12% p.a.; or

(ii) to issue Equity Shares (at par) and 12% Debentures in equal proportion.

The Income-tax rate is 30%.

Find out the point of indifference between the available two modes of financing and state which option will be beneficial in different situations. (Nov 2014, 5 marks)

Answer:

(i) Let the par value of equity share is be ₹ 1oo

Amount = ₹ 80 Lakhs

Plan I = Equity of ₹ 60 lakhs + Debt of ₹ 20 lakhs

Plan II = Equity of ₹ 40 Iakhs + Debentures of ₹ 40 Lakhs.

Plan I: Interest Payable on Loan

0.12 x 20,00,000 = 2,40,000

Plan II: Interest Payable on Debentures

= 0.12 x 40,00,000 = 4,80,000

Computation of Point of In difference

\(\frac{(E B I T-I)(I-t)}{E_1}=\frac{\left(E B I T-I_2\right)(I-t)}{E_2} \)

\(\frac{(E B I T-2,40,000)(1-0.3)}{60,000}=\frac{(E B I T-4,80,000)(1-0.3)}{40,000} \)

2 (EBIT- 2,40,000) =3 (EBIT – 4,80000)

2 EBIT – 4,80,000 = 3 EBIT – 14,40,000

2 EBIT -3 EBIT = -14,40,000 + 4,80,000

EBIT = 9,60,000

Comment: In situation A, when expected EBIT is less than the EBIT at indifference point then, Plan I is more viable as it has higher EPS. The advantage of EPS would be available from the use of equity capital and not debt capital.

Comment: Situation, when expected EBIT is more than the EBIT at indifference point then, Plan II is more viable as ¡t has higher EPS. The use of fixed costs. source of funds would be beneficial from the EPS viewpoint. In this case, financial leverage would be favourable.

(Note: The problem can also be computed by assuming any other figure of EBIT which is more than 9,60,000 and any other figure less than 9,60,000. Alternatively, the answer may also be based on the factors/governing the capital structure like the cost, risk, control, Principles, etc.)

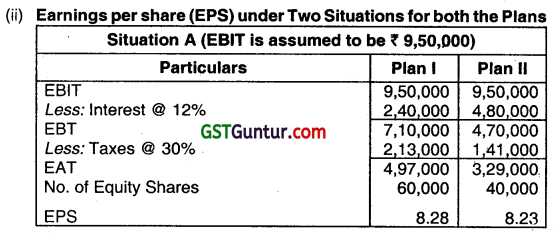

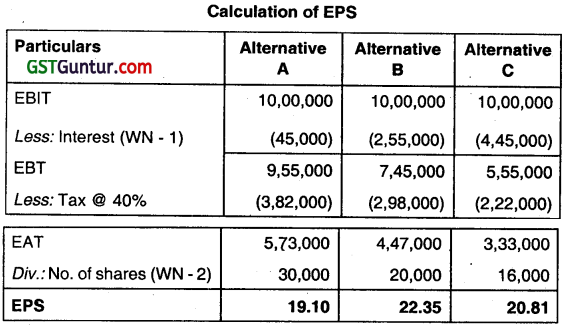

Question 22.

India Limited requires ₹ 50,00,000 for a new Plant. This Plant is expected to yield earnings before interest and taxes of ₹ 10,00,000. While deciding about the financial plan, the company considers the objective of maximizing earnings per share. It has three alternatives to finance the project – by raising debt of ₹ 5,00,000 or ₹ 20,00,000 or ₹ 30,00,000 and the balance, in each case, by issuing equity shares. The company’s share is currently selling at ₹ 150 but is expected to decline to ₹ 125 in case the funds are borrowed in excess of ₹ 20,00,000. The funds can be borrowed at the rate of 9 percent up to ₹ 5,00,000, at 14 percent over ₹ 500,000 and upto ₹ 20,00,000, and at 19 percent over₹ 20,00,000. The tax rate applicable to the company is 40 percent. Which form of financing should a company choose? Show EPS Amount up to two decimal points. (Nov 2016, 8 marks)

Answer:

Financing Alternatives B (i.e. Raising debt of ₹ 20 lakhs and issue of equity share capital of ₹ 30 lakhs) is the option which maximizes the earnings per share.

Working Notes (WN):

1. Calculation of interest on Debt.

Note: Instead of slab, the relevant interest rate can be applied on total amount.

2. Number of equity shares to be issued

Alternative A: $\frac{₹ 45,00,000}{₹ 150 \text { (Market Price of Share) }}=30,000$ shares

Alternative B: $\frac{₹ 30,00,000}{₹ 150 \text { (MarketPrice of Share) }}=20,000$ shares

Alternative C: $\frac{₹ 20,00,000}{₹ 125 \text { (RevisedMarketPrice of Share) }}=16,000$ shares

Question 23.

The X Ltd. is willing to raise funds for its new project which requires an investment of ₹ 84 lakhs. The company has two options:

Option I: To issue Equity Shares ( 10 each) only

Option II: To avail term loan at an interest rate of 12%. But in this case, as insisted by the financing agencies, the company will have to maintain a debt-equity proportion of 2: 1. The corporate tax rate is 30%. Find out the point of indifference for the project. (Nov 2017, 5 marks)

Answer:

Indifference point is EBIT Level where EPS from two options remains same

Let x be the EBIT Level

Indifference point

\(\frac{x(1-T)}{N_1}=\frac{(x-1)(1-T)}{N_2} \)

T = Tax Rate 30%

I = interest

N1 = No. of Equity share in option II

\(\frac{84,00,000}{10} \) = 8,40,000 shares

N2 = No. of Equity in option II

Debt Equity Ratio = 2:1

Amount to be raised by Debt.

84,00,000 × 2/3 = 56,00,000.

Amount to be raised by Equity.

84,00,000 × 1/3 = 28,00,000

N2 = \(\frac{28,00,000}{10}\) = 2,80,000 shares.

∴ \(\frac{x(1-30)}{8,40,000}=\frac{(x-6,72,000)(1-30)}{2,80,000} \)

∴ \(\frac{7 x}{3}=\frac{7 x-4,70,400}{1}\)

∴ 1.4 x = 14,11,200

x = \(\frac{14,11,200}{1.4} \) = 10,08,000.

Question 24.

Sun Ltd. is considering two financing plans.

Details of which are as under.

(i) Fund’s requirement – ₹ 1oo Lakhs

(ii) Financial Plan

| Plan | Equity | Debt |

| I | 100% | – |

| II | 25% | 75% |

(iii) Cost of debt – 12% p.a.

(iv) Tax Rate – 30%

(v) Equity Share ₹ 10 each, issued at a premium of ₹ 15 per share

(vi) Expected Earnings before Interest and Taxes (EBIT) ₹ 40 Lakhs You are required to compute:

(i) EPS in each of the plan

(ii) The Financial Break Even Point

(iii) Indifference point between Plan I and II (May 2018, 5 marks)

Answer:

(ii) Calculation of Financial Break-even point

The financial break-even point is the earnings which are equal to the fixed finance charges

Plan – I:

Under this plan there is no interest payment, hence the Financial Break-evèn point will be zero.

Plan – II:

Under this plan there is an interest payment of ₹ 9,00,000, hence, the financial Break-even point will be ₹ 9,00,000 (Interest charges)

(iii) Computation of Indifference point between the plans

The indifference between two alternative methods of financing is calculated by applying the following formula.

\(\frac{\left(E B I T-I_1\right)(1-T)}{E_1}=\frac{\left(E B I T-I_2\right)(1-T)}{E_2}\)

Where,

EBIT = Earnings before interest and tax

I1 = Fixed charges (interest) under Alternative

I2 = Fixed charges (interest) under Alternative

T=Tax rate

E1 = No. of equity shares in Alternative 1

E2 = No. of equity shares in Alternative 2

Now, we cari calculate indifference point between different plans of financing.

\(\frac{(E B I T-0)(1-0.3)}{4,00,000}=\frac{(E B I T-9,00,000)(1-0.3)}{1,00,000}\)

2.8 EBIT – 25,20,000 = 0.7 EBIT

Or 2.1 EBIT = 25,20,000

EBIT = 12,00,000

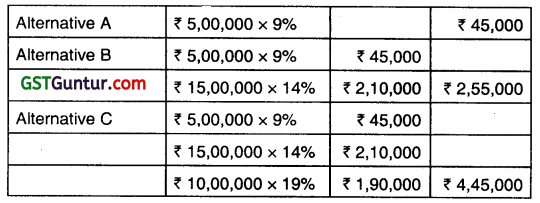

Question 25.

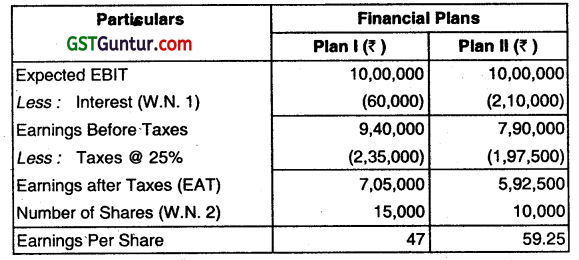

Y Limited requires ₹ 50,00,000 for a new project. This project is expected to yield earnings before interest and taxes of ₹ 10,00,000. While deciding about the financial plan, the company considers the objective of maximizing earnings per share. It has two alternatives to finance the project – by raising debt ₹ 5,00,000 or ₹ 20,00,000 and the balance, in each case, by issuing Equity Shares. The company’s share is currently selling at ₹ 300, but is expected to decline to ₹ 250 in case the funds are borrowed in excess of ₹ 20,00,000. The funds can be borrowed at the rate of 12 percent upto ₹ 5,00,000 and at 10 percent over ₹ 5,00,000. The tax rate applicable to the company is 25 percent. Which form of financing should the company choose? (Nov 2018, 5 marks)

Answer:

Plan I = Raising Debt of ₹ 5 lakhs + Equity of ₹ 45 lakhs

Plan II = Raising Debt of ₹ 20 lakhs + Equity of ₹ 30 lakhs

Calculation of Earnings Per Share (EPS):

Financial Plan II (i.e. Rising Debt of ₹ 20 lakhs and issue of equity share capital of ₹ 30 lakhs) is the option which maximises the earnings per share.

Working Notes:

1. Calculation of interest on Debt:

| Plan I | (₹ 5,00,000 x 12%) | ₹ 60,000 | |

| Plan II | (₹ 5,00,000 x 12%) (₹ 15,00,000 x 10%) |

₹ 60,000 ₹ 1,50,000 |

₹ 2,10,000 |

2. Number of Equity Shares to be issued:

Plan I = \(\frac{₹ 45,00,000}{₹ 300 \text { (Market Price of Share) }}\) = 15,000 Shares

Plan II = \(\frac{₹ 30,00,000}{₹ 300} \) = 10,000 Share.

![]()

Question 26.

RM Steels Limited requires ₹ 10,00,000 for construction of a new plant.

It is considering three financial plans:

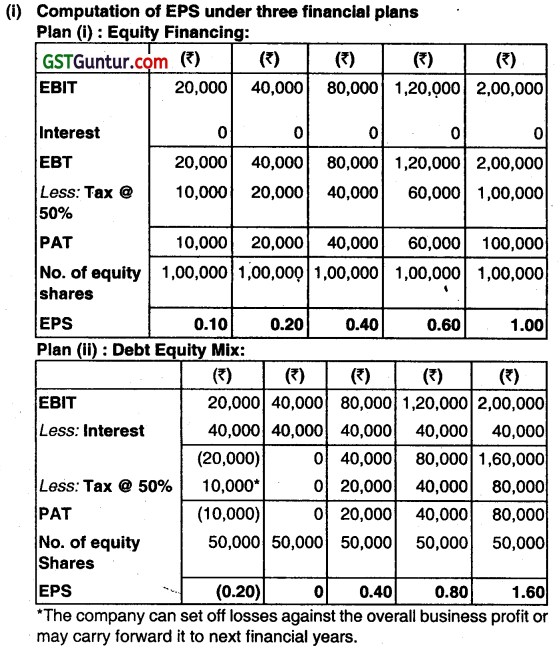

(i) The company may issue 1,00,000 ordinary shares at ₹ 10 per share;

(ii) The company may išsue 50,000 ordinary shares at ₹ 10 per share and 5000 debentures of ₹ 100 denominations bearing a 8 percent rate of interest; and

(iii) The company may issue 50,000 ordinary shares at ₹ 10 per share and 5,000 preference shares at ₹ 100 per share bearing a 8 percent rate of dividend.

If RM Steels Limited’s earnings before interest and taxes are ₹ 20,000;

₹ 40,000; ₹ 80,000; ₹ 1,20,000 and ₹ 2,00,000, you are required to compute the earnings per share under each of the three financial plans?

Which alternative would you recommend for RM Steels and why? Tax rate is 50%. (May 2019, 10 marks)

Answer:

In case of Preference shares, the company has to pay dividends to preference shareholders. Here, preference shares are assumed to be cumulative.

(ii) From the above EPS calculations tables under the three financial plans we can see that when EBIT is ₹ 80,000 or more, Plan (ii) i.e., Debt-equity mix is preferable over the Plan (i) and Plan (iii), as rate of EPS is more under this plan.

On the other hand, an EBIT of less than ₹ 80,000, Plan (i), Equity financing has higher EPS than Plan (ii) and Plan (iii) Plan (iii) :

Preference share-Equity mix is not acceptable at any level of EBIT, as EPS under this plan is lower. The choice of the financing plan will depend on the performance of the company and other macroeconomic conditions. If the company is expected to have higher operating profit plan (ii): A debt-equity mix is preferable. Moreover, debt financing gives more benefits due to

availability of tax shield.

Question 27.

J Ltd. is considering three financing plans. The key information is as follows:

(a) Total investment to be raised ₹ 4,00,000.

(b) Plans showing the Financing Proportion:

| Plans | Equity | Debt | Preference Shares |

| X | 100% | – | – |

| Y | 50% | 50% | – |

| Z | 50% | – | 50% |

(c) Cost of Debt 10%

Cost of preference shares 10%

(d) Tax Rate 50%

(e) Equity shares of the face value of ₹ 10 each will be issued ata premium of ₹ 10 per share.

(f) Expecte1 EBIT is ₹ 1,00,000.

You are required to compute the following for each plan:

(i) Earnings per share (EPS)

(ii) Financial break-even point

(iii) Indifference Point between the plans and indicate if any of the plans dominate. (Nov 2020, 10 marks)

Question 28.

What is Over capitalization? State its causes and consequences. (Nov 2013, 4 marks)

Answer:

Over Capitaflsetion

Meaning

When a firm has consistently been unable to earn the prevailing rate of return on its capital employed, the situation is termed as Over Capitalisation. In simple words, it means the existence of excess capital as compared to the level of activity and requirement.

Parameters

1. When Actual Rate of Earning < Current Rate of Earning.

2. Real Value of Business < Book Value of Business.

Causes of Over-Capitalisation

1. Under-estimation of the Capitalisation Rate: If the rate of capitalisation is underestimated, it will lead to a situation of over-capitalisation.

2. Over-Issue of Capital: Sometimes, while floating a new company, the promoters overestimate the financial requirements, and as a result, they raise more capital than what is actually needed, resulting in over-capitalization.

3. High Promotion Expreses: Incurring high promotional expenses, excessive preliminary expenses etc. may lead i.e over-capitalization.

4. Liberal Dividend Policy: The company might have followed the lenient dividend policy without bothering much about building up the reserves. As a result, the retained profits of the company may be adversely affected.

5. Inadequate Depreciation: An adequate provision might not have been made for depreciation on the assets. As such, the real value of the assets is less than the book value of the assets.

6. Formation of the Company during Inflationary Period:

If a company is floated under the conditions of inflation, it requires a large fund for acquiring its necessary assets. But when depression sets in, naturally, the prices of the assets fall which ultimately leads to over-capitalisation.

Consequences of Over-Capitalisation

1. Poor Creditworthiness: Reduced earnings of an over-capitalized concern affect its credit worthiness and as a result, it becomes difficult for it to get loans or credit at cheaper rates of interest.

2. Difficulties In Obtaining Capital: For a company faced with a situation of over-capitalization, it is very difficult to obtain further capital for its growth and expansion programmes. it is so because the investors have already lost confidence in the company.

3. Loss of Goodwill: In an over-capitalised company, there is a reduced earning capacity resulting in the fall of market price of its shares and thereby shaking up the investor’s confidence. A company whose shares sell below the face value may find it difficult to improve its goodwill in the market.

4. Loss of Market: Over-capitalised companies fail to produce goods at competitive costs and, hence, often lose their market to competitors.

5. Liquidation of Company: An over-capitalized company goes into liquidation unless drastic steps are taken to re-organize the whole capital structure, and re-organization would itself lead to a lot of problems.