Financing Decisions Leverages – CA Inter FM Question Bank is designed strictly as per the latest syllabus and exam pattern.

Financing Decisions Leverages – CA Inter FM Question Bank

Question 1.

What do you understand by Business Risk and Financial Risk? (Nov 2009, 2 marks)

Answer:

Business Risk

It refers to the risk associated with the firm’s operations. It is uncertainty about the future operating income. That is, how well can the operating income be predicted? It can be measured by standard deviation of basic earning power ratio.

Financial Risk

It refers to the additional risk placed on firms shareholders as a result of debt used in financing. Companies that issue more debt instruments would have higher financial risk than companies financed mostly by equity. Financial risk can be measured by ratios such as firms financial leverage multiplier, total debt to assets ratio etc.

Question 2.

Distinguish between business risk and financial risk. (Nov 2012, Nov 2014, 4 marks each)

Answer:

| Basis | Business Risk | Financial Risk |

| 1. Meaning | It refers to the risk associated with the firm’s operations. It is uncertainty about the future operating income. That is, how well can the operating income be predicted? | It refers to the additional risk placed on firm’s shareholders as a result of debt used in financing. Companies that issue more debt instruments would have higher financial risk than companies financed mostly by equity. |

| 2. Measured by | It can be measured by standard deviation of basic earning power ratio. | Financial risk can be measured by ratios such as firm’s financial leverage multiplier, total debt-to-assets ratio etc. |

Question 3.

Operating risk is associated with cost structure, whereas financial risk is associated with capital structure of a business concern.” Critically examine this statement. (May 2013, 4 marks)

Answer

Operating risk is associated with cost structure whereas financial risk is associated with capital structure of a business concern”. Operating risk refers to the risk associated with the firm’s operations. It is represented by the variability of earnings before interest and tax (EBIT).

The variability in turn is influenced by revenues and expenses, which are affected by demand of firm’s products, variations In prices and proportion of fixed cost in total cost.

If there is no fixed cost, there would be no operating risk. Whereas financial risk refers to the additional risk placed on firm’s shareholders as a result of debt and preference shares used in the capital structure of the concern.

Companies that issue more debt instruments would have higher financial risk than companies financed mostly by equity.

![]()

Question 4.

Discuss the impact of financial leverage on shareholders’ wealth by using return-on-assets (RCA) and return-on-equity (ROE) analytic framework. (May 2003, 3 marks)

Answer:

ROA = \(\frac{\text { NOPAT }}{\text { Sales }} \times \frac{\text { Sales }}{\text { Capital Employed }}\)

ROE = \(\frac{\text { Earning available for Equity shareholders }}{\text { Equity fund Employed }} \)

Also ROE = RCA + \(\frac{\text { Debt }}{\text { Equity }}\) (RCA — Kd)

Where RCA = Return-on-Asset

NOPAT = EBIT – Tax

Capital Employed = Shareholder’s fund + Loan fund

ROE = Return-on-Equity

Kd = Cost of debt

Since ROE = RCA + \(\frac{D}{E} \) (RCA – Kd)

Therefore it is evident that when ROA is high ROE will also be high and the financial leverage will be favourable.

However if Kd> ROA then the leverage wiH work in the opposite direction. Therefore, in order that equity shareholders gain wealth from debt fund the cost of debt should be less than ROA.

Question 5.

Discuss the Return on assets (ROA) and Return on Equity (ROE) by bringing out clearly the impact of financial leverage. (May 2004, 4 marks)

Answer:

Return on assets (ROA) measures the profitability of the firm in terms of asset employed. It is represented as:

ROA = \(\frac{\text { PAT(Profit after tax) }}{\text { Sales }} \times \frac{\text { Sales }}{\text { Assets }}\)

Whereas,

Return on Equity (ROE) i.e. earning per share (EPS) measures the return on shareholders’ funds. This ratio represents how profitability of the shareholder’s funds have been utilized by the firm. It is represented as:

ROE = ROA+ \(\frac{\mathrm{D}}{\mathrm{E}} \)[ROA-i(1-t)]

Where,

i = rate of interest on debt.

D = debt capital utilized.

E = Equity capital utilized.

t = corporate tax rate.

Interpretation: The impact of financial leverage on ROE is favorable, if cost of debt (after tax) is less than ROA and vice versa.

Explanation with the help of an example: If Debt/Equity ratio is 1:3 cost of debt is 10%, tax rate 30%. Show the impact of the financial leverage on ROE if RCA is (i) 16% and (ii) 5%.

(i) ROE = 16% + \(\frac{1}{3}\) [16% – 10% (1 – 30%)]

=16%+ \(\frac{1}{3}\) (16 – 10 × 0.70 )

=19%

In this case, ROA > cost of debt, impact on financial leverage is favorable on return on equity.

(ii) ROE =5% + \(\frac{1}{3}\) [5%-10% (1 -70%)]

= 5% + \(\frac{1}{3}\) [5%-7%]

= 5%-0.667%

=4.333%

If this case when ROA < cost of debt, impact of financial leverage is unfavourable on return on equity.

Question 6.

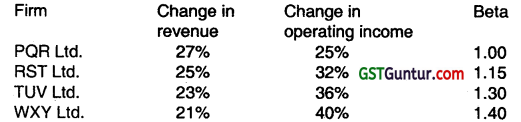

The following summarizes the percentage changes in operating income, percentage changes in revenues, and betas for four pharmaceutical firms.

Required:

(i) Calculate the degree of operating leverage for each of these firms. Comment also.

(ii) Use the operating leverage to explain why these firms have different beta. (Nov 2004, 3+3=6marks)

Answer:

(ii) Beta is an indicator of an investment, systematic risk. It measures systematic risk associated with an investment in relation to total risk associated with market portfolio.

Relation between operating leverage and beta: Increase in operating leverage indicates increase in operating risk & this leads to high beta.

Question 7.

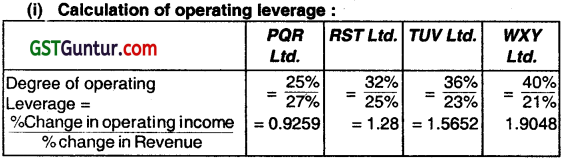

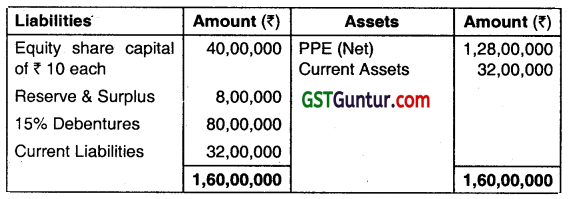

A Company had the following Balance Sheet as on March 31, 2006:

Required:

Calculate the following and comment:

(i) Earnings per share

(ii) Operating Leverage

(iii) Financial Leverage

(iv) Combined Leverage. (Nov 2006, 8 marks)

Answer:

Total asset turnover Ratio = 2.5

2.5 = \(\frac{\text { Sales }}{\text { Total assets }}\)

Sales = 2.5 × 40,00,00,000

= 1,00,00,00,000

Variable operating cost Ratio 1,00,00,00,000 × 65% = 65,00,00,000

(i) Earning per shares = \(\frac{14,40,00,000}{1,00,00,000}\) = ₹ 14.40/- Share

(ii) Operating leverage = \(\frac{\text { Contribution }}{\text { EBIT }} \)

= \(\frac{35,00,00,000}{27,00,00,000}\) = 1.30.

(iii) Financial leverage = \(\frac{\text { EBIT }}{\text { EBT }}\)

= \(\frac{35,00,00,000}{27,00,00,000} \)

= 1.13

(iv) Combined leverage = OL × FL

= 1.3 × 1.13

= 1.47.

Operating, Financial, and Combined Leverage are the measurements of risk, where Combined leverage studies the choice of fixed cost in cost structure and choice of debts in capital structure and also studies how sensitive the change in EPS is changes with change in sales.

Question 8.

The following details of RST Limited for the year ended 31 March 2006 are given below:

Operating leverage 1.4

Combined leverage 2.8

Fixed Cost (Excluding interest) ₹ 2.04 lakhs

Sales ₹ 30.00 lakhs

12% Debentures of ₹ 100 each ₹ 21.25 lakhs

Equity Share Capital of ₹ 10 each ₹ 17.00 lakhs

Income tax rate 30 per cent

Required:

(i) Calculate Financial leverage

(ii) Calculate PN ratio and Earnings per Share (EPS)

(iii) If the company belongs to an industry, whose assets turnover is 1.5, does it have a high or low assets leverage?

(iv) At what level of sales the Earning before Tax (EBT) of the company will be equal to zero? (May 2007, 8 marks)

Answer:

Financial leverage

(i) Combined Leverage = Operating Leverage (OL) × Financial

Leverage (FL)

2.8 = 1.4 × FL

FL = 2

Financial Leverage = 2

(ii) PN Ratio and EPS

PN ratio = \(\frac{\mathrm{C}}{\mathrm{S}}\) × 1 00

2. Operating leverage = x 100

1.4 = \(\frac{\mathrm{C}}{\mathrm{C}-2,04,000} \)

1.4 (C – 2,04,000) = C

1.4 C – 2,85,600 = C

C = \(\frac{2,85,600}{0.4}\)

C = 7.14,000

PN = \(\frac{7,14,000}{30,00,000} \times 100\) = 23.8%

Therefore, PN Ratio = 23.8%

EPS = \(\frac{\text { Profit after tax }}{\text { No. of equity shares }} \)

EBT = Sales – V – FC – Interest

= 30,00,000 – 22,86,000 – 2,04,000 – 2,55,000

= 2,55,000

PAT = EBT – Tax

= 2,55,000- 76,500 = 1,78,500

EPS = \(\frac{1,78,500}{1,70,000}\) = 1.05

3. Assets turnover

Assets turnover = \(\frac{\text { Sales }}{\text { Total Assets }}=\frac{30,00,000}{38,25,000} \) = 0.784

0.784 < 1.5 means lower than industry turnover.

4. Zero EBIT means 100% reduction in EBT, because combined leverage is 2.8 and sales have to be dropped by 100/2.8= 35.71%. Therefore, new sales will be

30,00,000 × (100 – 35.71) = 19,28,700.

Hence at 19,28,700 level of sales, the Earnings before Tax of the company will be equal to zero.

Question 9.

A firm has Sales of ₹ 40 lakhs; Variable cost of ₹ 25 lakhs; Fixed cost of ₹ 6 lakhs; 10% debts of ₹ 30 lakhs; and Equity Capital of ₹ 45 lakhs.

Required:

Calculate operating and financial leverage. ( Nov 2007, 2 marks)

Answer:

Combined Leverage = Operating Leverage x Financial Leverage

= \(\frac{\text { Contribution }}{\mathrm{EBIT}} \times \frac{\mathrm{EB} I \mathrm{~T}}{\mathrm{EBT}}=\frac{\text { Contribution }}{\mathrm{EBT}} \)

Where, contribution = EBIT + Fixed Cost

= ₹ 10 Lacs + ₹ 20 Lacs

= ₹ 30 Lacs

= \(\frac{\text { Contribution }}{\text { EBT }}=\frac{30 \text { Lacs }}{8 \text { Lacs }} \) = 3.75

It shows that for every change ¡n contribution there will be a more than proportionate change on earnings of shareholders i.e., EBT.

![]()

Question 10.

A company operates at a production level of 1 ,000 units. The contribution is ₹ 60 per unit, operating leverage is 6, combined leverage is 24. If tax rate is 30%, what would be its earnings after tax? (Nov 2008, 3 marks)

Answer:

Contribution = 1,000 units @ 60 per unit

= ₹ 60,000

Operating leverage = 6

Operating leverage = \(\frac{\text { Contribution }}{\mathrm{EBIT}} \)

6 = \(\frac{60,000}{\mathrm{EBIT}}\)

EBIT = \(\frac{60,000}{6}\) = ₹ 10,000

combined leverage = 24

Combined leverage = Operating leverage × Financial leverage

24 = 6 × FL

Financial leverage = 4

Financial Leverage = \(\frac{\text { EBIT }}{\text { EBT }}\)

4 = \(\frac{10,000}{\text { EBT }} \)

∴ EBT = ₹ 2,500

Earnings before tax = ₹ 2,500

(-)tax@30% = ₹ 750

Earnings after tax (EAT) = ₹ 1,750

Question 11.

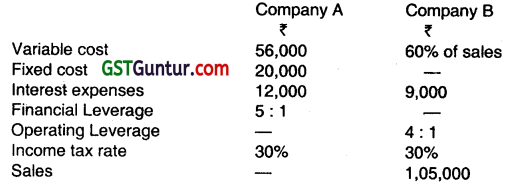

From the following Financial data of Company A and Company B:

Prepare their Income statements.

(Nov 2009, 8 Marks)

Answer:

Working Notes:

Company A

(i) Financial Leverage = \(\frac{\text { EBIT }}{\text { EBIT-Interest }}\)

5 = \(\frac{\text { EBIT }}{\text { EBIT }-12,000}\)

5(EBIT-12,000) = EBIT

4 EBIT = 60,000

∴ EBIT = ₹ 15,000

(ii) Contribution = EBIT + Fixed Cost

Contribution = 15,000 + 20,000

∴ Contribution = ₹ 35,000

(iii) Sales = Contribution + Variable Cost

Sales = 35,000 + 56,000

∴ Sale = ₹ 91,000

Company B

(i) Contribution = 40% of Sales (as variable Cost is 60% of Sales)

= 40%of 1,05,000

= ₹ 42,000

(ii) Operating Leverage = \(\frac{\text { Contribution }}{\mathrm{EBIT}} \)

4 = \(\frac{42,000}{E B I T} \)

Hence EBIT = \(\frac{42,000}{4}\) = ₹ 10,500

(iii) Fixed Cost = Contribution – EBIT

= 42,000 – 10,500 = ₹ 31,500

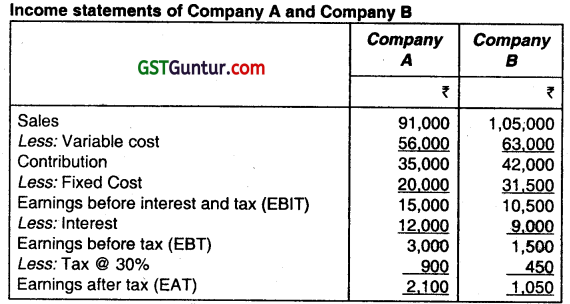

Question 12.

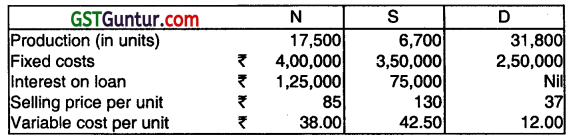

Calculate the degree of operating leverage, degree of financial leverage and the degree of combined leverage for following firms and interpret the results:

(Nov 2010, 4 Marks)

Answer:

Question 13.

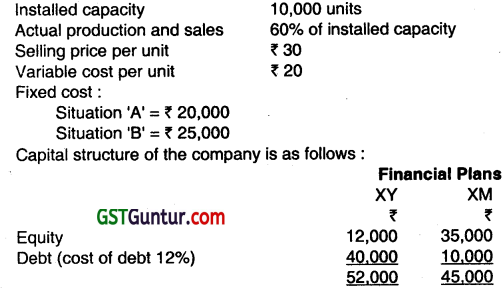

You are given two financial plans of a company which has two financial situations. The detailed information are as under:

You are required to calculate operating leverage and financial leverage of both the plans. (May 2011, 5 marks)

Answer:

Computation of Operating and Financial Leverage

Actual Production and Sales:

(60% of 10,000 = 6,000 units)

Contribution per unit:

₹ 30 – ₹ 20 = ₹ 10

Total Contribution:

6,000 × ₹ 10 = ₹ 60,000

Question 14.

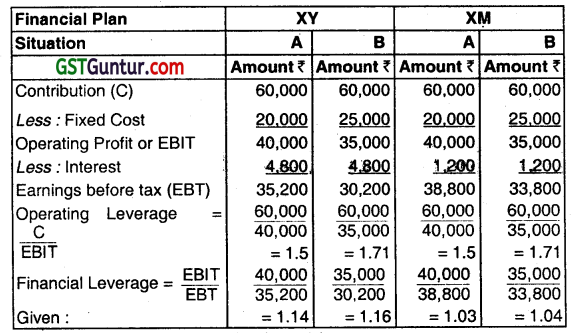

Alpha Ltd. has furnished the following Balance Sheet as on March 31, 2011:

Additional informations:

1. Annual Fixed Cost other than Interest 28,00,000

2. Variable Cost Ratio 60%

3. Total Assets Turnover Ratio 2.5

4. Tax Rate 30%

You are required to calculate:

(i) Earning Per Share (EPS), and

(ii) Combined Leverage. (Nov 2011, 8 marks)

Answer:

Total Assets = ₹ 48,00,000

Total Assets Turnover Ratio = 2.5

Total Sales = 48,00,000 x 2.5 = ₹ 1,20,00,000

(i) EPS = \(\frac{\text { PAT }}{\text { No. of EquityShare }}=\frac{11,60,000}{1,00,000} \) = ₹ 11.06

(ii) CL = Operating leverage x Financial leverage

= \(\frac{\text { Contribution }}{\mathrm{EBIT}} \times \frac{\mathrm{EBIT}}{\mathrm{PBT}} \) Or = \(\frac{\text { Contribution }}{\text { PBT }} \)

= \(\frac{48,00,000}{15,80,000}\) = 3.04

Question 15.

The capital structure of JCPL Ltd. is as follows:

Additional Information:

Profit after tax (tax rate 30%) ₹ 1,82,000

Operating expenses (including depreciation ₹ 90,000) being 1.50 times of EBIT

Equity share dividend paid 15%.

Market price per equity share 20.

Required to calculate:

(i) Operating and financial leverage.

(ii) Cover the preference and equity share dividends.

(iii) The earning yield and price earning ratio.

(iv) The net fund flow. (May 2012, 8 marks)

Answer:

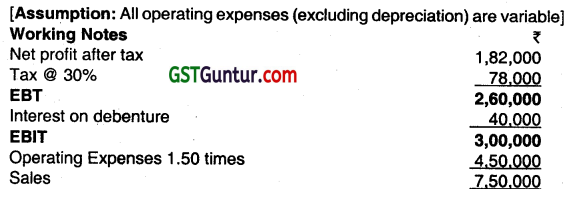

[Assumption: All operating expenses (excluding depreciation) are variable]

(i) Operation Leverage = Contribution/EBIT

= (7,50,000 – 3,60,000)13,00,000

= 3,90,000/3,00,000 = 1.30 times.

Financial Leverage = EBIT/EBT = 3,00,000/2,60,000

= 1.15 times

OR

FL = \(\text { EBIT / EBT – }\left(\frac{\text { Pret. Dividend }}{1-t}\right)\)

= \(\frac{3,00,000}{2,60,000-\left(\frac{50,000}{1-0.3}\right)} \)

= \(\frac{3,00,000}{2,60,000-(71,429)} \)

= \(\frac{3,00,000}{1,88,571} \) = 1.59 = 1.6

(ii) Preference Dividend Cover = PAT/Preference share Dividend

= 1,82,000/50,000 = 3.64 times

Equity dividend cover = PAT – Prof. div/Equity dividend

= 1,82,000 – 50,000/1,20,000

= 1. 10 times

(iii) Earning yield = EPS/market price x 100 i.e.

= 1,32,000/80,000 = 1.65/20 = 8.25%

Price Earning Ratio = Market price/EPS = 20/1.65

= 12.1 Times

(iv) Net Funds Flow

Net Funds flow = Net profit after tax + depreciation – Total dividend

= 1,82,000+ 90,000- (50,000 + 1,20,000)

= 2,72,000 – 1,70,000

Net funds flow = 1,02,000

![]()

Question 16.

X Limited has estimated that for a new product, its break-even point is 20,000 units if the item is sold for ₹ 14 per unit and variable cost ₹ 9 per unit. Calculate the degree of operating leverage for sales volumes 25,000 units and 30,000 units. (Nov 2012, 5 marks)

Answer:

Computation of Degree of Operating Leverage

Selling Price = ₹ 14/ unit

Variable Cost = ₹ 9/ unit

Fixed Cost = BEP × (Selling price – Variable cost)

= 20,000x(14- 9)= 20,000 × 5

= 1,00,000

Question 17.

The following information related to XL Company Ltd. for the year ended 31st March 2013 are available to you:

Equity share capital of ₹ 10 each ₹ 25 lakh

11% Bonds of ₹ 1,000 each ₹ 18.5 lakh

Sales ₹ 42 lakh

Fixed cost (Excluding Interest) ₹ 3.48 lakh

Financial leverage 1.39

Profit-Volume Ratio 25.55%

Income Tax Rate Applicable 35%

You are required to calculate:

(I) Operating Leverage;

(ii) Combined Leverage; and

(iii) Earning Per Share. (May 2013, 6 marks)

Answer:

Profit – Volume Ratio = \(\frac{\text { Contribution }}{\text { Sales }} \)

25.55 = \(\frac{\text { Contribution }}{42,00,000} \times 100 \)

Contribution = 10,73,100

(i) Operating Leverage = \(\frac{\text { Contribution }}{\text { Contribution – Fixed Cost }}\)

= \(\frac{10,73,100}{10,73,100-3,48,000}\)

= \(\frac{10,73,100}{7,25,100} \)

= 1.48

(ii) Combined Leverage = Operating Leverage × Financial Leverage

= 1.48 × 1.39 = 2.06

(iii) Earnings Per Share (EPS)

Number of Equity Shares = 2,50,000

Earnings Before Tax (EBT) = Sales – Variable Cost – Fixed Cost – interest

EBT = 4200,000 – 31,26,900 – 3,48,000 – 2,03,500 = 5,21,600

Profit After Tax (PAT) = EBT – Tax

= 5,21,600 – 1,82,560

= 3,39,040

EPS = \(\frac{3,39,040}{2,50,000}\) = 1.3561

EPS = 1.36

Question 18.

Calculate the degree of operating leverage, degree of financial leverage and the degree of combined leverage for the following firms:

(Nov 2013, 5 Marks)

Answer:

Question 19.

A company had the following Balance Sheet as on 31st March 2014:

The additional information given is as under:

Fixed Cost per annum (excluding interest) ₹ 4 crores

Variable operating cost ratio 65%

Total assets turnover ratio 2.5

Income Tax rate 30%

Required:

Calculate the following and comment:

(i) Earnings Per Share

(ii) Operating Leverage

(iii) Financial Leverage

(iv) Combined Leverage (May 2014, 8 marks)

Answer:

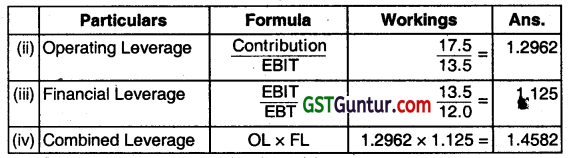

(i) Calculation of Earning Per Share:

| Particulars | Amt. (₹ In crores) |

| Sales (W.N.1) | 50.00 |

| Less: Variable cost @ 65% | 32.50 |

| Contribution | 17.50 |

| Less: Fixed cost | 4.00 |

| EBIT | 13.50 |

| Less: Interest on Debenture @ 15% | 1.50 |

| EBT | 12.00 |

| Less: Tax @ 30% | 3.60 |

| EAT (Earning After Tax) | 8.40 |

| ÷ No. of Equity Shares | 0.50 |

| EPS | ₹ 16.80 |

Working Note 1:

Calculation ot Sales:

Total Asset Turnover Ratio = \(\frac{\text { Sales }}{\text { TA }} \)

∴ Sales = 2.5 × 20 = 50 (Crores)

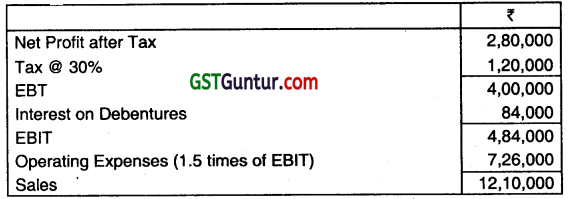

Question 20.

The Capital structure of RST Ltd. is as follows:

Additional Information:

Profit after tax (Tax Rate 30%) are ₹ 2,80,000

Operating Expenses (including Depreciation ₹ 96,800) are 1.5 times of EBIT

Equity Dividend paid is 15%

The market price of Equity Share is ₹ 23 Calculate:

(i) Operating and Financial Leverage

(ii) Cover for preference and equity dividend

(iii) The Earning Yield Ratio and Price Earning Ratio

(iv) The Net Fund Flow

Note: All operating expenses (excluding depreciation) are variable. (Nov 2014, 8 marks)

Answer:

(i) Operating Leverage

= \(\frac{\text { Contribution }}{\mathrm{EBIT}} \)

= \(\frac{(12,10,000-6,29,200)}{4,84,000} \)

= \(\frac{5,80,800}{4,84,000}\) = 1.2 times

Financial Leverage = \(\frac{\mathrm{EBIT}}{\mathrm{EBT}}\)

= \(\frac{4,84,000}{4,00,000}\) = 1.21 times

Or

Financial Leverage = \(\frac{\text { EBIT }}{\text { EBT }-\left(\frac{\text { Preference Dividend }}{1-t}\right)}\)

= \(\frac{4,84,000}{4,00,000-\left(\frac{50,000}{1-0.30}\right)} \)

= \(\frac{4,84,000}{4,00,000-71,428.57}\)

= \(\frac{4,84,000}{3,28,571}\) = 1.47 times

(ii) Cover for Preference Dividend

= \(\frac{\text { PAT }}{\text { Preference Share Dividend }} \)

= \(\frac{2,80,000}{50,000} \) = 5.6 times

Cover for Equity Dividend

= \(\frac{(\text { PAT }- \text { Preference Dividend })}{\text { Equity Share Dividend }} \)

= \(\frac{(2,80,000-50,000)}{1,20,000} \)

= \(\frac{2,30,000}{1,20,000} \) = 1.92 times

(iii) Earning Yield Ratio

= \(\frac{\text { EPS }}{\text { MarketPrice }} \times 100\)

= \(\left(\frac{\frac{2,30,000}{80,000}}{23} \times 100\right)\)

= \(\frac{2.875}{23} \times 100 \) = 12.5%

Price – Earnings Ratio (PE Ratio)

= \(\frac{\text { Market Price }}{\text { EPS }}=\frac{23}{2.875} \)

(iv) Net Funds Flow

= Net PAT + Depreciation – Total DMdend

=2,80,000+96,800- (50,000 + 1,20,000)

= 3,76,800 – 1,70,000

Net Funds Flow = 2,06,800

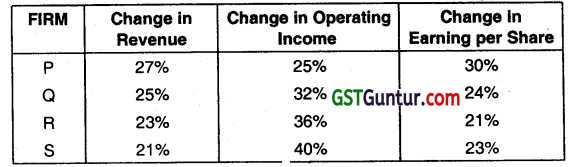

Question 21.

Following information are related to four firms of the same industry:

Find out:

(i) degree of operating leverage, and

(ii) degree of combined leverage for all the firms. (May 2015, 5 marks)

Answer:

(i) Degree of operating leverage:

Degree of operating leverage =

![]()

P = \(\frac{25 \%}{27 \%}\) = 0.926 times

Q= \(\frac{32 \%}{25 \%}\) = 1.280 times

R = \(\frac{36 \%}{23 \%}\) = 1.57 times

S = \(\frac{40 \%}{21 \%}\) = 1.905 times

(ii) Degree of combined leverage:

Degree of combined leverage = \(\frac{\text { Percentage change in EPS }}{\text { Percentage change in sales }} \)

P = \(\frac{30 \%}{27 \%}\) = 1.1 1 times

Q = \(\frac{24 \%}{25 \%}\) = 0.960 times

R = \(\frac{21 \%}{23 \%} \) = 0.913 times

S = \(\frac{23 \%}{21 \%}\) = 1.095 times

![]()

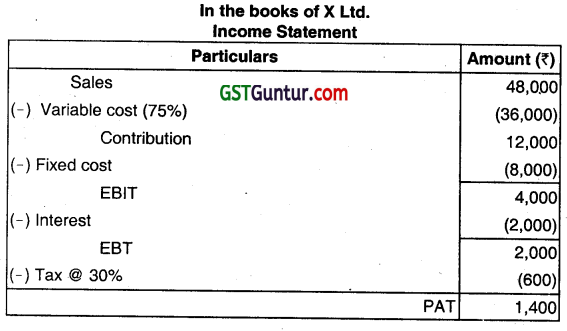

Question 22.

From the following details of X Ltd., prepare the Income Statement for the year ended 31st December 2014:

Financial Leverage 2

Interest ₹ 2,000

Operating Leverage 3

Variable cost as a percentage of sales 75%

Income tax rate 30% (Nov 2015, 5 marks)

Answer:

Working Note:

Calculation for EBIT:

Financial Leverage = \frac{\text { EBIT }}{\text { EBT }}\(\)

2 = \(\frac{\text { EBIT }}{\text { EBIT – Interest }} \)

2 = \(\frac{\text { EBIT }}{\text { EBIT }-2,000}\)

2 EBIT – 4,000 = EBIT

EBIT = 4,000

2. Calculation for Contribution:

Operating Leverage = \(\frac{\text { Contribution }}{\text { EBIT }} \)

3 = \(\frac{\text { Contribution }}{4,000} \)

Contribution = ₹ 12,000

3. Calculation for Sales & Variable Cost:

Variable cost as a percentage of sales = 75%

So, contribution is 25% of sales

Sales = \(\frac{\text { Contribution }}{25 \%} \)

= \(\frac{12,000}{25 \%}\)

Sales = 48,000

Variable Cost = ₹ 48,000 × 75%

Variable Cost = ₹ 36,000

4. Fixed Cost:

Fixed Cost = Contribution – EBIT

= 12,000 – 4,000

= ₹ 8,000

Question 23.

A company had the following balance sheet as on 31st March 2015.

The additional information given is as under:

Fixed cost per annum (excluding interest) ₹ 32,00,000

Variable operating cost ratio 70%

Total assets turnover ratio 2.5

Income tax rate 30%

Calculate the following:

(i) Operating Leverage

(ii) Financial Leverage

(iii) Combined Leverage

(iv) Earning per share (May 2016, 5 marks)

Answer:

– Operating Leverage

\(\frac{\text { Contribution }}{\text { EBIT }}=\frac{1,20,00,000}{88,00,000}\) = 1.364

– Financial Leverage

\(\frac{\text { EBIT }}{\text { EBT }}=\frac{88,00,000}{76,00,000}\) = 1.158

– Combined Leverage

Operating Leverage × Financial Leverage

(1.364 × 1.158) = 1.58

Question 24.

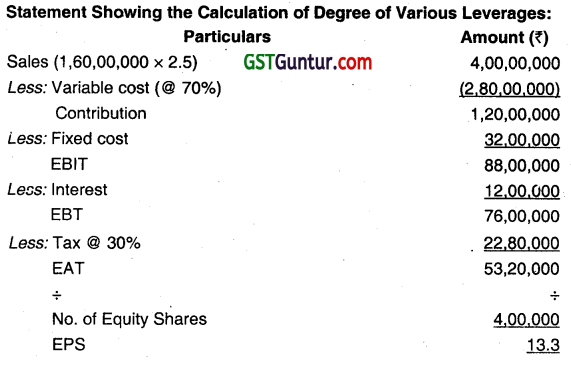

The following information is related to YZ Company Ltd. for the year ended 31st March, 2016:

Equity is are capital (of ₹ 10 each) ₹ 50 lakhs

12% Bonds of ₹ 1000 each ₹ 37 lakhs

Sales ₹ 84 lakhs

Fixed cost (excluding interest) ₹ 6.96 lakhs

Financial leverage 1.49

Profit-volume Ratio 27.55%

Income Tax Applicable 40%

You are required to câlculate:

(i) Operating Leverage;

(ii) Combined leverage; and

(iii) Earnings per share.

Show calculations upto two decimal points. (Nov 2016, 5 marks)

Answer:

(i) Calculation of Operating leverage:

Degree of operating leverage = \(\frac{\text { Contribution }}{\mathrm{EBIT}}\)

= \(\frac{₹ 23,14,200(\mathrm{WN}-1)}{₹ 16,18,200(\mathrm{WN}-2)} \)

= 1.43.

Working Notes:

1. Calculation of Contribution PN Ratio = \(\frac{\text { Contribution }}{\text { Sales }} \)

27 55% = \(\frac{\text { Contribution }}{₹ 84,00,000}\)

∴ Contribution = 84,00,000 × 27.55%

= ₹ 23,14,200.

2. Calculation of EBIT:

EBIT = Contribution – Fixed Cost (Excluding Interest)

= ₹ 23,14,200 – ₹ (6,96,000)

= ₹ 16,18,200.

(ii) Calculation of Combined leverage:

Degree of combined leverage = Operating Leverage x Financial Leverage

= 1.43 × 1.49

= 2.13.

Question 25.

You are given the following information of 5 firms of the same industry:

| Name of the Firm | Change in Revenue | Change In Operating income | Change Earning per in Share |

| M | 28% | 26% | 32% |

| N | 27% | 34% | 26% |

| P | 25% | 38% | 23% |

| Q | 23% | 43% | 27% |

| R | 25% | 40% | 28% |

You are required to calculate:

(i) Degree of operating leverage and

(ii) Degree of combined leverage for all firms. (May 2017, 5 marks)

Answer:

Question 26.

The following details of a company for the year ended 31st March, 2017 are given below:

Operating leverage, 2:1

Combined leverage 2:5:1

Fixed Cost excluding interest ₹ 3.4 lakhs

Sales ₹ 50 lakhs

8% Debentures of ₹ 100 each ₹ 30.25 lakhs

Equity Share Capital of ₹ 10 each ₹ 34 lakhs

Income Tax Rate 30%

Required:

(i) Calculate Financial Leverage

(ii) Calculate PN ratio and Earning per Share (EPS)

(iii) If the company belongs to an industry, whose assets turnover is 1.5 does it have a high or low assets turnover?

(iv) At what level of sales, the Earning before Tax (EBT) of the company will be equal to zero? ( Nov 2017, 8 marks)

Answer:

(i) Financial Leverage

Combined Leverage = Operating Leverage × Financial Leverage

∴ 2.5 = 2 × FL

∴ FL = \(\frac{2.5}{2}\) = 1.25

(ii) PN Ratio and EPS

P/V Ratio = \(\frac{\text { Contribution }(\mathrm{c})}{\text { Sales }(\mathrm{s})} \times 100 \)

OL = \(\frac{\text { C }}{\text { C-Fixed Cost }}\)

2 = \(\frac{C}{C-3,40,000}\)

2C – 6,80,000=C

∴ C = 6,80,000

P/V Ratio = \(\frac{6,80,000}{50,00,000} \times 100\) = 13.6%

EPS = \(\frac{\text { Profit after tax }}{\text { No. of Equity Shares }}\)

EBT = Sales – V- FC- Interest

50,00,000 – 432O,OOO – 3,40,000 – 2,42,000 = 98,000

PAT=EBT-Tax

= 98,000 – 29,400 = 68,600

EPS = \(\frac{68,600}{3,40,000}\) = 0.201 76.

(iii) Assets Turnover = \( \frac{\text { Sales }}{\text { Total Assets }}\)

= \(\frac{50,00,000}{64,25,000}\) = 0.778

0.778 < 1.5 Means lower than industry turnover.

(iv) EBT zero means 100% production in EBT since combined Leverage 2.5 sales have to be dropped by 100/2.5 = 40. Hence, new sales will be 50,00,000 × [100% – 40%] = 30,00,000. Therefore, at 30,00,000 level of sales, the EBT of company Will be equal to zero.

![]()

Question 27.

The following data have been extracted from the books of LM Ltd:

Sales – ₹ 100 lakhs Interest Payable per annum – ₹ 10 lakhs

Operating leverage – 1.2

Combined leverage – 2.16

You are required to calculate:

(i) The financial leverage

(ii) Fixed cost and

(iii) P/V ratio. (May 2018, 5 marks)

Answer:

(i) The financial leverage: Combined Leverage = Operating Leverage x Financial Leverage 2.16 = 1.2 x FL Financial Leverage (FL) = 1.8

(ii) Fixed Cost: Financial Leverage = \(\frac{\text { EBIT }}{\text { EBT }}\) Financial Leverage = \(\frac{\mathrm{EBIT}}{\mathrm{EBIT}-\text { Interest }}\) 1.8 = \(\frac{\text { EBIT }}{\text { EBIT }-10,00,000}\) 1.8 EBIT- 18,00,000 = EBIT 0.8 EBIT = 18,00,000 EBIT = ₹ 22,50,000 Operating Leverage = \(\frac{\text { Contribution }}{\mathrm{EBIT}} \) Operating Leverage = \(\frac{\text { EBIT + FixedCost }}{\text { EBIT }}\) 1.2 = \(\frac{22,50,000+\text { FixedCost }}{22,50,000}\) 27,00,000 = 22,50,000 + Fixed Cost Fixed Cost = ₹ 4,50,000

(iii) P/V ratio = Contribution = EBIT + Fixed Cost = 22,50,000 + 4,50,000 = 27,00,000 P/V ratio = \(\frac{\text { Contribution }}{\text { Sales }} \times 100\) = \(\frac{27,00,000}{1,00,00,000} \times 100\) P/V ratio = 27%

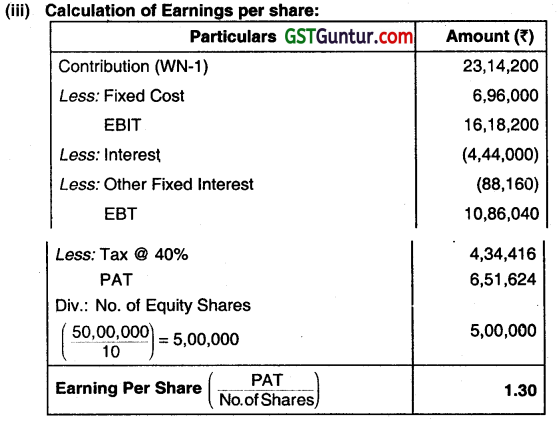

Question 28.

Following is the Balance Sheet of Soni Ltd. as on 31st March, 2018:

Additional Information:

(i) Variable Cost is 60% of Sales.

(ii) Fixed Cost p.a. excluding interest ₹ 20,00,000.

(iii) Total Asset Turnover Ratio is 5 times.

(iv) Income Tax Rate 25%.

You are required to:

(1) Prepare Income Statement

(2) Calculate the following and comment:

(a) Operating Leverage

(b) Financial Leverage

(c) Combined Leverage. (Nov 2018, 10 marks)

Answer:

1. Income Statement: Total Assets 1,00,00,00 Total Asset Turnover Ratio = 5 times Hence, Total Sales = ₹ 1,00,00,000 × 5 = 5,00,00,000

EPS = \(\frac{\text { PAT }}{\text { No. of Equity Shares }}=\frac{₹ 1,30,50,000}{2,50,000}\) = ₹ 52.50

2. (a) Operating Leverage: Operating Leverage = \(\frac{\text { Contribution }}{\text { EBIT }}=\frac{₹ 2,00,00,000}{₹ 1,80,00,000}\) = 1.111

It indicates the choice of technology and fixed cost in cost structure. It is level-specific. When firm operates beyond operating break-even level, then operating leverage is low, It indicates sensitivity of earnings before interest and tax (EBIT) to change in sales at a particular level.

(b) Financial Leverage: . Financial Leverage = \(\frac{\text { EBIT }}{\text { PBT }}=\frac{₹ 1,80,00,000}{₹ 1,74,00,000}\) = 1.034 The financial leverage is very comfortable since the debt service obligation is small vis-a-vis EBIT.

(c) Combined Leverage: Combined Leverage = \(\frac{\text { Contribution }}{\mathrm{EBIT}} \times \frac{\mathrm{EBIT}}{\mathrm{PBT}}\) Or, = Operating Leverage x Financial Leverage = 1.111 × 1.034 = 1.149

The combined leverage studies the choice of fixed cost in cost structure and choice of debt in capital structure. It studies how sensitive the change in EPS is vis-a-vis the change in sales. The leverages – operating, financial, and combined are measures of risk.

Question 29.

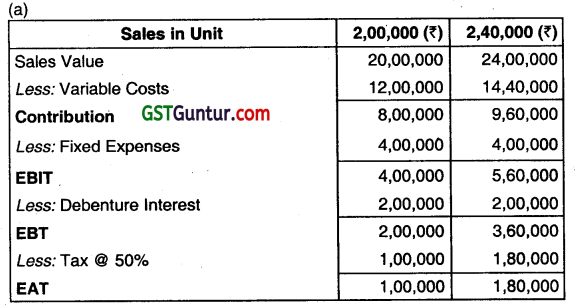

The capital structure of the Shiva Ltd. consists of equity share capital of ₹ 20,00,000 (Share of ₹ 100 per value) and ₹20,00,000 of 10% Debentures, sales increased by 20% from 2,00,000 units to 2,40,000 units, the selling price is 10 per unit; variable costs amount to 6 per unit and fixed expenses amount to ₹ 4,00,000. The income tax rate is assumed to be 50%.

(a) You are required to calculate the following:

(i) The percentage increase in earnings per share;

(ii) Financial leverage at 2,00,000 units and 2,40,000 units.

(iii) Operating leverage at 2,00,000 units and 2,40,000 units.

(b) Comment on the behaviour of operating and Financial leverages in relation to increasing in production from 2,00,000 units to 2,40,000 units. (May 2019, 10 marks)

Answer:

(i) Earning per share (EPS) = \(\frac{₹ 1,00,000}{20,000} \) = ₹ 5 \(\frac{₹ 1,80,000}{20,000} \) = ₹ 9

(ii) Financial Leverage = \(\frac{E B T}{\text { EBT }}\) \(\frac{₹ 4,00,000}{₹ 2,00,000} \) = 2 \(\frac{₹ 5,60,000}{₹ 3,60,000}\) = 1.56

(iii) Operating Leverage= \(\frac{\text { Contribution }}{\text { BiT }} \frac{₹ 8,00,000}{₹ 4,00,000} \) = 2 \(\frac{₹ 9,60,000}{₹ 5,60,000}\) = 1.71

(b) Financial leverage is represented by organization ability to recover interest component of debt. Here, with the every increase in unit sales, Financial leverage comes down as interest on debenture would remain the same. Operating leverage indicates fixed cost in cost structure. Since, the fixed cost remains the same, every increase in sales volume will decrease the value of operating leverage.

Question 30.

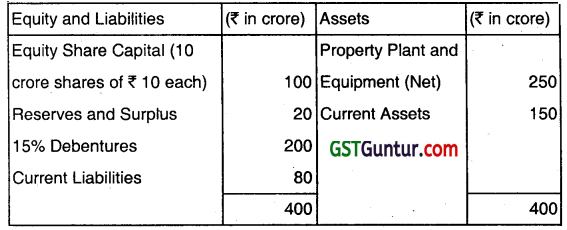

The Balance Sheet of Gita shree Ltd. is given below:

The company’s total asset turnover ratio is 4. Its fixed operating cost is ₹ 2,00,000 and its variable operating cost ratio is 60%. The income tax rate is 30%. Calculate: (i) (a) Degree of Operating leverage. (b) Degree of Financial leverage. (C) Degree of Combined leverage. (ii) Find out EBIT it EPS is (a) ₹ 1 (b) ₹ 2 and (c) ₹ 0. (N0v 2019, 10 marks) Answer: Total Assets = ₹ 6,00,000 Total asset Turnover Ratio = 4 Hence, Total Sales = ₹ 6,00,000 × 4 = ₹ 24,00,000

Question 31.

The information related to XYZ Company Ltd. for the year ended 31st March 2020 are as follows: Equity Share Capital of ₹ 100 each ₹ 50 Lakhs 12% Bonds of ₹ 1000 each ₹ 30 Lakhs Sales ₹ 84 Lakhs Fixed Cost (Excluding Interest) ₹ 7.5 Lakhs Financial Leverage 1.39 Profit – Volume Ratio 25% Market Price per Equity Share ₹ 200 Income Tax Rate Applicable 30% You are required to compute the following:

(i) Operating Leverage

(ii) Combined Leverage

(iii) Earning per share

(iv) Earning Yield (Jan 2021, 10 marks)

Question 32.

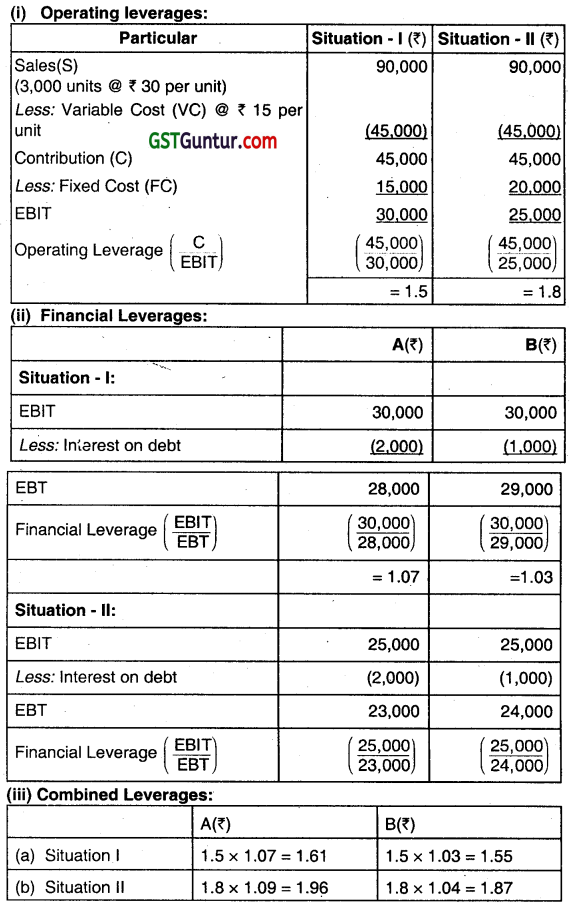

Calculate the operating leverage, financial leverage, and combined leverage from the following data under Situation I and II and Financial Plan A and B;

Installed Capacity 4,000 units

Actual Production and Sales 75% of the Capacity

Selling Price ₹ 30 per unit

Variable Cost ₹ 15 per unit

Fixed Cost:

Under Situation – I ₹ 15,000

Under Situation – II ₹ 20,000

Capital Structure: Financial Plan A (₹) B (₹)

Equity 10,000 15,000

Debt (Rate of Interest at 20%) 10,000 20,000

5,000 20,000

Answer:

Question 33.

Financial Leverage is a double-edged sword Discuss.

Answer:

Financial leverage (FL) is defined as the use of funds with a fixed cost in order to increase earnings per share. It is the use of company funds on which it pays a limited return. Financial leverage involves the use of funds obtained at a fixed cost in the hope of increasing the return to common stockholders.

Financial Leverage (FL) = \(\frac{\text { Earnings before interest and tax }(\mathrm{EBIT})}{\text { Earnings before tax (EBT) }} \)

Financial Leverage is a double-edged sword. When cost of fixed cost fund’ is less than the return on investment financial leverage will help to increase return on equity and EPS. The firm will also benefit from the saving of tax on interest on debts etc.

However, when cost of debt will be more than the return it will affect return of equity and EPS unfavorably and as a result firm can be under financial distress. This is why financial leverage is known as “double-edged sword.”

Effect on EPS and ROE:

When, ROI> Interest – Favourable – (Advantage)

When, ROI> Interest – Unfavourable – (Disadvantage)

When, ROI> Interest -Neutral- (Neither advantage nor disadvantage)

Question 34.

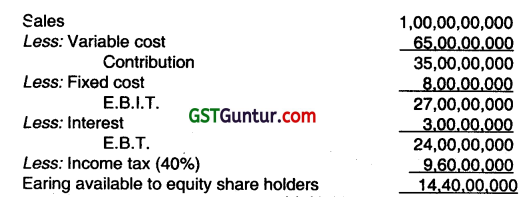

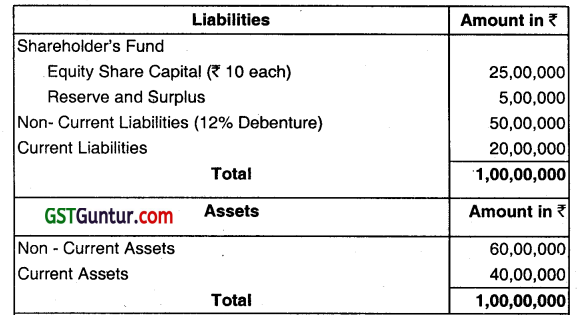

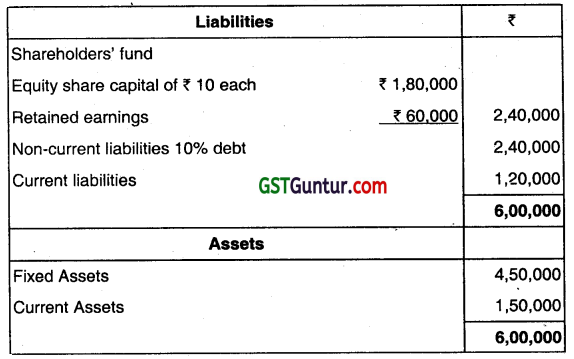

A Company had the following Balance Sheet as on March 31, 2019:

The additional information given is as under:.

Fixed Costs per annum (excluding interest) ₹ 80 crores

Variable operating costs ratio 65%

Total Assets turnover ratio 2.5

Income-tax rate 40%

Required:

CALCULATE the following and comment:

(i) Earnings per share

(ii) Operating Leverage

(iii) Financial Leverage

(iv) Combined Leverage.

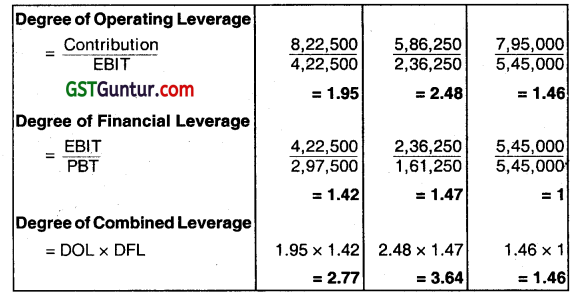

Answer:

Total Assets = ₹ 400 crores

Asset Turnover Ratio = 2.5

Hence, Total Sales = 400 x 2.5 = ₹ 1,000 crores

(i) Earnings per share (EPS)

∴ EPS = \(\frac{₹ 144 \text { crores }}{10 \text { crore equity shares }}\) = 14.40

(ii) Operating Leverage

Operating leverage = \(\frac{\text { Contribution }}{\text { EBIT }}=\frac{350}{270} \) = 1.296

It indicates the sensitivity of earnings before interest and tax (EBIT) to changes in sales at a particular level.

![]()

(HI). Financial Leverage

Finance Leverage = \(\frac{\mathrm{EBIT}}{\mathrm{EBT}}=\frac{270}{240} \) =1.125

The financial leverage is very comfortable since the debt service obligation is small vis-a-vis EBIT.

(iv) Combined Leverage

Combined Leverage = \(\frac{\text { Contribution }}{\mathrm{EBIT}} \times \frac{\mathrm{EBIT}}{\mathrm{EBT}} \)

Or, Operating Leverage × Financial Leverage =1.296 × 1.125=1.458

The combined leverage studies the choice of fixed cost in cost structure and the choice of debt in capital structure. It studies how sensitive the change ¡n EPS is vis-a-vis change in sales.